Trade without a broker

Thus, you can have the best of both worlds by buying stocks with and without a brokerage.

New forex bonuses

Conversely, utilizing two strategies can double your market risks. Unfortunately, selling stock without a broker or a brokerage account can be difficult. Selling stocks without a broker is tough because most people buy stocks through brokerage accounts.

How to buy stocks online without A broker in 2021

Read our incredible analysis: do you need A broker to buy & sell stock? How to invest directly with zero brokerage fees & which companies allow it

Buying stocks without a broker has never been easier, thanks to the internet and apps.

To explain, algorithms handle almost all the sales of stocks in today’s markets. Hence, you will need no specialized knowledge or skills to trade stocks. Instead, all you need to do is push a button to trade stock.

How to buy stocks online without a broker

6 ways to buy stocks online without a broker

- Use a transfer agent like computershare – high commissions

- Use a direct purchase plan through your employer – you need to be employed at the company

- Use a dividend reinvestment plan – good for dividend investors

- Use your company stock purchase plan (SPP) – only for employees

- Use your company stock option purchase plan (SOPP) – only for employees

- Use a $0 commission broker – the best option

How can you buy stock online without a broker

You can bypass a broker and buy stock by using a transfer agent, but the costs can be high. You can use direct purchase plans, or stock purchase plans, but you need to be an employee of the company. Honestly, you are better off using a broker that offers $0 commission for trades, for flexibility, liquidity, and no costs

The problem with buying stock without a broker

There are serious obstacles that can bar the average person or retail investor from the stock market. Transaction fees, hidden fees, and trading fees can eat up all or most of your profit, for example. Also, brokerages, exchanges, and regulators often place severe restrictions on individual traders.

Thus, always research stock purchases carefully before entering the market. A little knowledge can help you avoid high fees and ridiculous restrictions.

Do I need a broker to buy stock?

No, you do not need a broker to buy stock. However, most people will need a brokerage account to buy and sell shares.

A broker is an investment professional who has licenses to trade stock and gives financial and other advice. On the other hand, a brokerage is an organization with the legal right to trade stocks in exchanges.

A brokerage account is a gateway that gives customers access to the exchange. Therefore, anybody can buy stock through a brokerage account.

Historically, only rich people and investment professionals could get direct access to the stock markets. Under those circumstances, most people needed a broker to trade stocks. The broker purchased the stock on the individuals’ behalf.

Why do I need a brokerage account but not a broker?

Many brokerages will make brokerage accounts available to anybody with the money to pay for stocks. Companies like TD ameritrade and charles schwab are really selling brokerage accounts to the public. In addition, app-based solutions like robinhood and acorns are brokerages investors access via an app. Such companies are technically brokerages, but they allow direct purchases of stock by individuals.

However, many brokerages have brokers available for those who want advice or help. On the other hand, most of the stock purchases made through so-called discount brokerages online are direct individual purchases.

Traditional stockbrokers are very rare in the modern world. Instead, most of the professionals are investment advisers who offer a wide variety of services, including financial and retirement planning and tax advice.

5 reasons you should open A brokerage account?

Now that many brokerage services offer commission-free stock trading, there is actually no reasons to avoid brokerages.

- If you choose the best broker with commission-free trading, you avoid all costs of buying and selling stocks and etfs.

- Good brokers complete your end of year tax forms and allow you to perform tax-loss harvesting free of charge.

- You get access to highly efficient and liquid markets, allowing you to sell quickly and effortlessly.

- All good brokerage accounts allow you to re-invest your dividends automatically.

- The spread between bid and offer prices with mainstream brokerages is negligible; this saves you money.

Firstrade is our best stock broker review winner offering hundreds of commission free ETS and thousands of commission free stocks.

Can I buy stocks without a broker or brokerage account?

Yes, you can buy stocks without a broker or a brokerage account using a transfer agent, a direct purchase plan, a dividend reinvestment plan, or a company stock purchase plan.

However, today’s market limits the variety and amount of stocks you can buy without a broker.

Generally, people who do a lot of stock trading use a brokerage account because it makes life easier. Specifically, you can buy or sell stock quickly through a brokerage, and most brokerage accounts let you buy most stocks that trade on big exchanges.

However, there is no law against an individual purchasing stock directly from a company or owner. Indeed, there are legal mechanisms that allow private individuals to buy stock directly without a brokerage account.

Therefore, you can purchase stocks online without a brokerage account. In fact, some services allow you to buy shares of stock directly from companies. Plus, most of these services will allow individuals with a bank account or credit card and an internet connection to buy stock.

Additionally, there are companies that sell their stock directly to the public. However, most of the companies use services like computershare to sell that stock.

How to buy stocks without a broker

There are a few ways that almost anybody can buy stocks without a brokerage account. Notably, some companies allow individuals to purchase their stock directly through special programs. Specifically, many companies allow employees to purchase stock without a fee.

For instance, companies like the giant american grocer kroger (NYSE: KR), allow any employee to purchase stock. Notably, union contracts at some companies require management to make stock available to all regular employees or union members.

In fact, stock options, the right to purchase stock without paying a fee, is a popular fringe benefit at many companies. Many executives take most of their pay in the form of stock options.

Beyond dividends, there are plans that allow you to purchase specific stocks without a brokerage account. The advantage of these arrangements is that you can buy stock without paying a fee. The drawback to such schemes is that they usually limit you to purchasing one specific stock.

Dividend reinvestment plans (DRIPS)

For instance, a dividend reinvestment plan, popularly called a DRIP, allows stockholders to purchase additional shares with dividends.

The advantage of a DRIP is that you can compound your dividends into more stock. The disadvantage of drips is that the amount of stock you purchase can be small.

Generally, a DRIP will only pay off if you plan to keep the stock for a long time. To explain, it will usually take several years to purchase a significant amount of stock with a DRIP. In fact, most drips purchase fractions of stock.

Moreover, you should find a no-fee DRIP. To clarify, most dividends are so small; any fee will eat up most of your gains. Taxes are another potential problem with a DRIP because you could end up paying income tax on dividends you never receive.

Finally, a company’s management can end a dividend whenever it wants. Therefore, a DRIP is not a guaranteed source of additional stock.

Investing in stocks can be complicated, stock rover makes it easy.

Stock rover is our #1 rated stock investing tool for:

★★★★★ growth investing – with our LST beat the market system TM

★★★★★ value investing – find value stocks using warren buffett’s strategies

★★★★★ income investing – harvest safe regular dividends from stocks

“I have been researching and investing in stocks for 20 years! I now manage all my stock investments using stock rover.” barry D. Moore – founder: liberatedstocktrader.Com

Direct purchase plans

A direct purchase plan enables you to buy stock directly from a company without paying a fee. Historically, some companies sold stock directly to members of the public for cash. In addition, many companies allow employees to buy stock with a portion of their salary. Generally, direct purchase plans deduct stock purchases from an employee’s pay. Thus, a direct purchase plan can limit your take-home pay.

If you work for a publicly-traded company, you can ask if there is a direct purchase plan available. Moreover, there are companies and services that allow individuals to purchase shares of stock directly.

Advantages and disadvantages of direct purchase plans for stocks

Many direct purchase plans allow you to purchase a specific amount of stock each month. In addition, you can automate direct purchase plans by setting up a recurring withdrawal from your checking or savings accounts.

The advantage of such plans is that you can buy a stock over time with little or no hassle. The disadvantage is that it will lock you into purchasing a stock even if its price falls.

Another disadvantage is that you could limit your income. Finally, you cannot take advantage of opportunities in the market with direct purchase money. For instance, you could miss a great price on another stock you like.

Advantages & disadvantages of buying stocks without brokers

The biggest advantage of buying stocks without a broker is that you will not pay a fee. Thus, they invest all the money you spend in the stock.

The greatest drawback of buying stocks without a brokerage account is that you could have difficulty selling the shares. In fact, most traders maintain a brokerage account because it allows them to sell shares quickly.

For instance, finding a buyer for the shares is difficult without access to exchanges. Significantly, a brokerage account will connect you directly to an exchange and tens of thousands of potential buyers.

Thus, it is not a good idea to buy stocks for speculation without a brokerage account. In addition, most modern trading strategies require the use of a brokerage account. For instance, you cannot perform short-selling unless you can sell stock instantly.

Buying stock without a broker could help you make more money

On the other, hand buying stocks without a brokerage account could help investors make more money—for instance, value investors who execute a long-term buy and hold strategy and persons saving for retirement.

Generally, the longer you plan to hold the stock, the more sense direct-purchase makes. In fact, buying stocks directly makes more sense for long-term investors.

To explain, they design drips to take advantage of a strategy known as compounding. Compounding means you use gains to buy more of an investment. For instance, compound interest means all interest goes back into the account to increase your money. Hence, the funds in the count and future interest gains will grow.

A DRIP can allow you to use dividends like compound interest. Instead of receiving cash, the dividends buy more stock. Thus, you can collect more dividends because you will own more stock. Therefore, a DRIP can help you save for retirement by accumulating a larger portfolio.

Disadvantages to buying stocks without a broker

The greatest disadvantage to direct stock purchase programs and DRIPS is that you could make less money with such strategies.

For instance, you will have a harder time taking advantage of opportunities like new stocks. Moreover, you could have a harder time getting rid of money-losing shares.

In particular, you cannot quickly dump shares that perform poorly. Thus, you can lose a lot of money if you invest in the wrong stocks.

Plus, you will miss out on the fun of trading stocks. If you enjoy the thrill of trading and buying new stocks, buying shares without a broker is a bad idea.

Firstrade is our best stock broker review winner offering hundreds of commission free ETS and thousand of commission free stocks.

Why buying stocks with and without a brokerage account could be a good idea.

Conversely, buying a few stocks without a brokerage account can help you keep some of your money safe. To explain, you could buy stocks for retirement savings directly while using a brokerage account for trading.

Thus, you could make money in the market in two ways. First, you could use

Strategies like short-selling to profit from market movements. Second, you can use compounding to make money from dividends and long-term growth.

Hence, a good strategy is to use directly purchased or DRIP stocks for your retirement and a brokerage account for your trading. An advantage of this strategy is that you can have fun in the markets while keeping your nest egg safe.

An obvious disadvantage to this strategy is that gains from market movements will not grow your nest egg. However, you can increase your nest egg by periodically cashing out some shares in your brokerage account and buying more stock directly.

Thus, you can have the best of both worlds by buying stocks with and without a brokerage. Conversely, utilizing two strategies can double your market risks.

How can I sell stocks without a broker?

Unfortunately, selling stock without a broker or a brokerage account can be difficult. Selling stocks without a broker is tough because most people buy stocks through brokerage accounts.

Generally, you cannot get access to exchange without a brokerage account. Thus, it is impossible to put stocks before would-be buyers without such an account.

Therefore, to sell stocks without a broker, you will need to locate the transfer agent of the company that issues the stock. To explain, the transfer agent has the legal power to sell the stock and access to an exchange or a brokerage account.

You can usually locate the transfer agent handling a stock by going to the investor relations section of a company’s website. In fact, there should be a direct link to the transfer agent on the company’s website.

How to sell stocks with a transfer agent?

On the positive side, a transfer agent will handle all the details of selling the stock. On the negative side, a transfer agent usually charges a higher fee than a brokerage. Hence, you will often make more money by selling shares through a brokerage account.

Additionally, it can take several days or longer for a transfer agent to sell a stock and send you the money. Therefore, you could have to use a brokerage account if you need to sell shares fast.

Fortunately, online brokerages like TD ameritrade or charles schwab will let you set up accounts fast. On the other hand, you will need to meet all the requirements of online brokers.

Given these circumstances, it is not a good idea to buy stocks without a broker if you might need to cash shares out quickly. Additionally, you should always ask how to sell stocks when you buy shares directly.

How can I sell stock without a broker through a direct purchase plan?

Conversely, it is easy to sell stocks through a direct purchase plan. Typically, you only need to notify the plan’s administrator you want to sell the stock to unload shares.

Moreover, many direct plans will have apps that enable you to sell at their websites. You must be cautious when using such apps because they can charge a fee or penalty for selling stock.

Furthermore, if you sell fractional shares of stock, you can receive a fraction of the equity’s value back. Thus, it is not a good strategy to invest money you could need soon in a direct purchase plan. Instead, you could save money by using a traditional brokerage account.

Selling stock directly without a broker

It is possible to sell stocks directly to another person if you have the actual stock certificates in your possession.

Unfortunately, most of today’s stocks exist only as digital investments. In fact, it takes a special request to get a paper stock certificate sent to you. Getting such a stock certificate is a hassle because the issuing company will probably have to print it up for you, especially.

However, if you have a paper certificate, you can sign the stock over to another person like you would a car title. Note, you could need to get the signature witnessed or notarized for a stock sale to be official. In addition, you could have a difficult time locating a lawyer or broker that knows how to deal with paper stocks.

Can you buy apple stock without a broker?

You cannot buy apple (NASDAQ: AAPL) stock without a broker or a brokerage account. Moreover, apple does not offer a dividend reinvestment program (DRIP) or a direct purchase program.

However, it is possible to purchase apple stock from almost every online brokerage. Thus, you will have no problem adding apple to your portfolio.

Can you purchase ford stock without a broker?

On the other hand, you can purchase ford (NYSE: F) stock without a broker or a brokerage account. To buy ford shares directly, you need to contact ford’s transfer agent computershare directly. Usually, the best way to contact computershare is through its website. However, you can telephone or email the ford team at computershare directly.

How to learn if you can purchase a company’s stock directly?

It is very easy to learn if a company offers direct purchases of its stock by going to the company’s website. Simply find the investor relations portion of the website and look for frequently asked questions or faqs.

In most cases, one question will tell you if the company offers a direct stock purchase. Moreover, the FAQ will usually tell you how to buy stock directly; if the company offers a direct purchase option or a DRIP.

Furthermore, you can learn about direct purchase options by typing the company’s name and the world’s buy stock directly into a search engine. In fact, search engines like google can take you straight to the direct purchase information on the company’s website.

Which stocks can I buy without A broker?

Notably, many companies no longer offer a direct stock option. However, many corporations still offer direct purchase of their stock.

Generally, the easiest way to locate stocks with a direct purchase option is to go to the websites of transfer agent companies like computershare. In fact, such companies usually list all the direct purchase stocks they have available on their websites.

US stocks you can buy without a broker:

- The 3M company

- Apache corporation

- Apollo commercial real estate finance inc.

- Bank of america corp

- American greetings corp

- Callaway golf company

- Centurylink inc.

- Conagra brands, inc.

- Chubb limited

- Cracker barrel old country store

- Duke energy

- Exxon-mobil corporation

- General mills, inc.

- Honeywell international

- Kellogg company

- Manpower group inc.

- Morgan stanley

- Norfolk southern corporation

- Raytheon company

- The bank of new york mellon

- The charles schwab company

- Union pacific corporation

- United states steel corporation

- Xerox corporation

- Zions bancorporation

Note: you will need to check directly with each company’s website to see if a direct purchase is available. In addition, transfer agents like computershare post lists of direct purchase stocks on their websites.

Why do I need a stock broker or a brokerage account?

Under today’s conditions, it is easier, cheaper, and faster to buy and sell stocks through a brokerage account than to purchase directly. In fact, you will need a brokerage account if you plan to own more than a few shares in one company.

There are many good reasons you will need a brokerage account. First, there are many stocks like facebook, apple, amazon, netflix, google (known as FAANG stocks), that you cannot buy without a brokerage account. In fact, you can only purchase many of today’s most popular stocks with a broker.

Second, there are many discount brokers that charge very low fees for stock purchases. In addition, there are solutions like robinhood that claim to offer no-fee stock transactions. Thus, it will not cost very much to buy and sell and stock.

Third, you can buy and sell stocks almost instantly with many of today’s brokerage accounts. Therefore, you can sell stocks for cash quickly in an emergency.

Hence, many retail investors can only afford to invest in stocks through brokerage accounts.

Finally, today’s brokerage accounts include many algorithms and automated tools that will do almost everything direct purchase plans can. For instance, there are many brokerage accounts that offer fractional stock purchases, automatic withdrawals from checking accounts, and dividend reinvestment options.

Firstrade is our best stock broker review winner offering hundreds of commission free ETS and thousand of commission free stocks.

Under these circumstances, most of the traditional advantages of direct stock purchases and selling shares yourself no longer exist. Therefore, the average investor has no need to buy stocks without a broker or a brokerage account.

How to trade without a broker

In recent years, online trading has become increasingly popular. Many investors are realizing that they can trade on their own without the help, and extra expense, of a traditional stockbroker. Not only are traders becoming empowered by doing their own research and making their own decisions on how to manage their portfolio, but also they are cutting out the middleman, and saving money by trading without having to pay the broker.

When using an online brokerage firm, investors are still trading with a broker. They’re just trading with a less expensive broker who provides less service, support, and advice. When using an online broker, there is still a middleman involved. However, there is a way to eliminate that middleman, too. It’s called direct access trading.

What is direct access trading?

Direct access trading allows investors to trade directly with market makers and specialists, rather than going through a broker. Direct access trading uses software to link directly to the major stock exchanges and electronic communication networks, or ecns. (an ECN is a completely electronic stock exchange.) having this direct access to the exchanges not only saves the trader on commissions, but it also allows for faster executions and immediate trade confirmations. For active traders, and those who need immediate information, this instantaneous action and reaction is a great value.

The other major advantage to direct access trading is it allows the trader to see more of the market. With an online broker, you can see the bid and the ask price for a stock. With direct access, you trade using level II quotes, which allows you to see how many buyers and sellers there are at each price, as well as the size of the lot they are trading. This gives the trader a much better picture of a stock trend, as well as how much support or resistance there is at any given price level. This information, if used properly, will allow you to pinpoint the timing of your entry and exit for maximum profits.

With direct access trading, it is very important to choose the right trading platform. There are many direct access platforms on the market today, but they are not all created equal. They can vary quite a bit in price, features, and even speed. In addition to choosing the right platform, you need to know how to use it properly. Simply having the software on your computer will not make you a more successful trader. You need to have the specific knowledge necessary to use it the same way professional traders do.

Trading without a broker in this fashion is not the best thing for everybody. For a new trader, we would recommend staying away from the complexities of this type of trading until you have a better idea of how the markets work. However, for intermediate and experienced traders, direct access trading will help you maximize your profits.

Buy stocks online without the need for a traditional broker

Thanks to the proliferation of smart technologies in recent years and a willingness on the part of authorities and exchanges to open their doors to technological integration, the role of the stock broker in the life of individual traders is not growing at the rate of self-directed investing (according to forbes). Online trading platforms afford investors like you direct access to financial markets. As a result, a new generation of well-educated and efficient stock and option traders has sprung up.

The foremost benefit of acting as your own stock broker is that it allows you to minimize the transaction costs associated with each trade. Rather than paying a hefty stock broker commission when trading online you’ll typically pay much lower transaction costs.

Choosing to go it alone via a platform such as ally invest instead of a “bricks and mortar” stock broker also enables you to react efficiently to changes in the market, and to act on news announcements that may impact upon the value of your assets. By granting online access to the financial markets, and enabling features like contingent orders and trailing stops these platforms also enable the trader to automatically close out losing positions.

The trader investing on his own accord is also in a position to learn and understand the mechanics of the markets. Because online trading forces you to more closely watch the market, you will learn more about the best timing to enter and exit your trades. Furthermore, the powerful trading tools and charting capabilities offered by ally invest can help individual retail traders to watch and predict market movements more accurately than at any other point in history.

Thanks to low transaction costs and a direct route to the markets, by using powerful trading platforms like ally invest’s you really can become your own online stock broker. We’ll allow you to trade stocks and options in a secure and professional manner — without having to go through a traditional stock broker.

Benefits of being your own stock broker

- Lower transaction costs

- Direct access to financial markets

- Allows for more responsive trading

- Learn and improve investment skills

- Become more aware of trading profits and losses

This icon indicates a link to a third party website not operated by ally bank or ally. We are not responsible for the products, services or information you may find or provide there. Also, you should read and understand how that site’s privacy policy, level of security and terms and conditions may impact you.

Comment on this article

Comments

David on march 17, 2018 at 3:57pm

Sumitjeker on july 7, 2018 at 6:31am

John N. On august 9, 2018 at 8:57pm

I'd like to invest in some stocks on line. Where are the froms for me to do this and I'd like to buy into marijuana stocks?

Leo I. On september 30, 2018 at 10:50pm

What kind of account should I have in order to get a direct access and be your own broker? I do not like long waiting from a broker to fill my order.

Veena on february 25, 2019 at 4:03pm

Richard on april 20, 2020 at 11:59am

Hi, I want to daytrade, is the minimum of $20k still apply with ally?

Suraj K. On november 25, 2020 at 1:42pm

Top posts

Quick poll

Ally tools & tips

Let's get social

A few things you should know

The information contained in this article is provided for general informational purposes, and should not be construed as investment advice, tax advice, a solicitation or offer, or a recommendation to buy or sell any security. Ally invest does not provide tax advice and does not represent in any manner that the outcomes described herein will result in any particular tax consequence. Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances.

Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All securities involve risk and may result in loss. While the data ally invest uses from third parties is believed to be reliable, ally invest cannot ensure the accuracy or completeness of data provided by clients or third parties.

Securities products and services are offered through ally invest securities LLC, member FINRA and SIPC. View security disclosures.

Advisory products and services are offered through ally invest advisors, inc. An SEC registered investment advisor. View all advisory disclosures

Foreign exchange (forex) products and services are offered to self-directed investors through ally invest forex LLC. NFA member (ID #0408077), who acts as an introducing broker to GAIN capital group, LLC ("GAIN capital"), a registered FCM/RFED and NFA member (ID #0339826). Forex accounts are held and maintained at GAIN capital. Forex accounts are NOT PROTECTED by the SIPC. View all forex disclosures

Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Products that are traded on margin carry a risk that you may lose more than your initial deposit.

Products offered by ally invest advisors, ally invest securities, and ally invest forex are NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE.

Ally financial inc. (NYSE: ALLY) is a leading digital financial services company. Ally bank, the company's direct banking subsidiary, offers an array of deposit, personal lending and mortgage products and services. Ally bank is a member FDIC and equal housing lender , NMLS ID 181005. Credit products and any applicable mortgage credit and collateral are subject to approval and additional terms and conditions apply. Programs, rates and terms and conditions are subject to change at any time without notice.

Ally and do it right are registered service marks of ally financial.

App store is a service mark of apple inc. Google play is a trademark of google inc. Amazon appstore is a trademark of amazon.Com, inc., or its affiliates. Windows store is a trademark of the microsoft group of companies.

Zelle and the zelle related marks are wholly owned by early warning services, LLC and are used herein under license.

How to trade stocks without a broker

6 tips to save using the most popular food delivery apps

Many years ago, having a broker was essential if you wanted to trade stocks. Only a broker had access to expensive research that the small investor needed. Online trading was not available, so you had to go directly to a broker. With the spread of free information by the internet, and cheap online trading, the small investor now can trade stocks just as easily as a professional trader.

Find an online trading company. There are many online trading companies that you can open an account with. The market is so competitive that the commissions are very low. As a result, you can get very good commission rates when you open an account. Compare the customer service of each trading company to make sure you will get adequate service. Consider what services you will need. You will often get better commission rates the more you trade, so know how much you will be trading when comparing firms.

Research stocks you wish to trade. There is much research on stocks that you can get for free so you will not have to rely on a broker to get information. You can also get financial information online or from the company directly. Also, you may want to try a few paid services if your budget allows it. Form a trading strategy before you start trading.

Practice trading strategies. Many trading companies offer a demo account you can use. A demo account trades like a real account but with no actual money being traded. Use the demo account to test your trading strategy for awhile until you are comfortable with how trading works. Make adjustments with your trading strategy as necessary.

Fund your trading account at the trading company you choose. Deposit at least the minimum amount the account requires before you begin trading. Trade with an amount you are comfortable with, and be careful about using margin or borrowing money to trade. It can escalate your losses very quickly if you are not careful.

Evaluate your trading results regularly. See what is working or not. Remain disciplined in your trading strategy, but always try to evaluate and improve upon it.

Maintain good accounting records. Trading stocks is often fast paced, with many trades being placed very rapidly. Maintaining good records of your trading will not only help track your performance, it will also make it much easier for you when you file your taxes at the end of the year.

Pick stocks or a market to trade in. You can trade any stocks in any markets quite easily, but specialize in just a few areas rather than trading everything. It is better to become an expert trader in a few sectors.

Warnings

It is very easy to make multiple trades very quickly, but be careful that you do not get too emotional and become undisciplined. Stick to your trading strategy, and approach it as a business rather than an emotional decision.

- Pick stocks or a market to trade in. You can trade any stocks in any markets quite easily, but specialize in just a few areas rather than trading everything. It is better to become an expert trader in a few sectors.

- It is very easy to make multiple trades very quickly, but be careful that you do not get too emotional and become undisciplined. Stick to your trading strategy, and approach it as a business rather than an emotional decision.

Allen young is an experienced writer on such subjects such as real estate investing, mortgages, and personal finance. Young has also written on sports, travel, and parenting. Currently he is the president of crestwood capital group.

How to buy stocks without a broker

:strip_icc()/buying-stock-without-a-broker-356075_V22-34130a64e3b54edfb50c30e8541362a4.png)

Image by britney willson © the balance 2020

While many investors choose to buy and sell investments through a brokerage account, some investors may wonder how they can buy stocks without a broker. Direct investment plans offer the brokerage alternative that those investors are seeking. If your primary investing goal is to acquire a single company's stock as directly as possible, one of these plans can help you achieve that goal, but be aware of the drawbacks that come with avoiding brokerage services before you abandon them completely.

Direct stock plans

Often, the easiest method of buying stocks without a broker is by participating in a company's direct stock plan (DSP). These plans were originally conceived generations ago as a way for businesses to let smaller investors buy ownership directly from the company. Investors buy-in by transferring money from their checking or savings account. The company will establish minimum investment amounts, both for the initial purchase and for any subsequent purchases. sometimes, these mandatory minimums are lower than the price of a single stock, effectively allowing investors without much capital to buy fractional shares of a company.

The plan administrators batch the cash from those participating in the direct stock plan and use it to buy shares of the company at regular intervals and at the average market price. just as you get a statement from the bank, the direct stock purchase plan issues statements with important financial information such as a listing of the number of shares you own, any dividends you have received, and any purchases or sales you have made.

Dividend reinvestment plans

Companies may also offer a dividend reinvestment plan (DRIP). These are similar to direct stock plans, except that they automate the process of buying more stock over the years. Drips automatically take cash dividends paid out by the company you own and use them to buy more shares. Depending on the specifics of the plan, this service may be free or there may be small commission fees.

In the U.S., some brokers traditionally reinvest dividends in certain issues at no cost for clients. If you are fortunate enough to have such an arrangement, drips don't have as much appeal.

Dividend reinvestment plans are often coupled with cash investment options that resemble direct stock purchase plans. This gives you the ability to buy more stock whenever you want, not just the four times a year dividends are issued.

The benefits and drawbacks of direct plans

The primary advantage of avoiding brokers and buying directly from a company is simplicity. Apps and websites have significantly streamlined the broker experience, but an investor still has to choose between securities and make decisions about the type of order to place for those investments. Direct stock purchases and dividend reinvestment plans can be even more simple—just send the money to the right place and you're enrolled in the plan.

Direct stock plans also allow for enhanced communication between the company and its investors. When you invest through a brokerage, any notices from the company will come through the brokerage. For investors with a variety of investments, company notices blend together because they all appear in your inbox as a message from your brokerage, rather than the company. This could lead to some investors skipping messages altogether, potentially missing out on useful information. By communicating directly, the company and its investors remain in better contact.

Institutional investors may have access to extra benefits through direct stock purchase plans, depending on the company issuing the stock. Special "waiver discounts" allow institutional investors to buy shares at a discount that isn't broadly advertised.

The simplicity that direct plan investors enjoy is also the main disadvantage of broker alternatives. If you sign up for a home depot direct stock purchase plan, for example, you will only have the option to buy home depot stock. An investor with a brokerage account and an investor with a direct stock plan could acquire the same home depot stock at the same price, but the investor with the brokerage account could also acquire any other security the brokerage services.

For traders who want to diversify and explore their options, there's no substitute for using a broker.

Traditionally, direct plans have also enjoyed the benefit of commission-free, or low-commission trades, especially when compared to the costs of using a full-service broker. However, that benefit has largely vanished in the digital era. Many brokerages—even major firms like fidelity and charles schwab—have dropped their commission fees for online trades. it's now just as cheap to acquire stock through one of these commission-free brokers as it would be to buy through direct plans—in some cases, using a commission-free broker might be even cheaper.

Direct stock plans also impede an investor's ability to time trades. Cashing out your position isn't as simple as tapping a few buttons on a brokerage app. This is fine for buy-and-hold investors who plan on holding stocks for decades. Investors who mostly care about dividends will also likely feel content with direct plans. Investors who trade often and enjoy regularly rebalancing their portfolio, on the other hand, will be frustrated by the limitations.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Forex market trade

Recent posts

Archives

Categories

Trade forex without a broker?

There іѕ а myth making thе rounds іn thе forex universe. Thіѕ rumor that’s whispered аnd spread frоm keyboard tо keyboard оvеr cyberspace states thаt іn order tо tаkе part іn forex trading, уоu muѕt hаvе а broker. A rumor іѕ аll thіѕ іѕ bесаuѕе there’s nо truth іn thе muѕt part оf thе rumor . If wаnt tо find оut hоw tо trade оn уоur оwn аnd tо avoid thе pressure оf dealing wіth а broker, thаn thіѕ mіght bе thе mоѕt important article уоu read thіѕ year. .

Evеn іf уоu don’t hаvе thе fіrѕt clue аbоut hоw forex trading іѕ done, аnd you’ve nеvеr dоnе it, уоu ѕtіll don’t hаvе tо hаvе а broker іf уоu don’t wаnt оnе . Cаn уоu gain frоm hаvіng а forex broker іn уоur corner? Yеѕ аnd no. It depends оn whеthеr оr nоt уоur forex broker іѕ smart аbоut trading аnd whеthеr оr nоt he’s gоіng tо bе smart аbоut trading fоr уоu . Sоmе forex brokers lооk аt thоѕе whо wаnt tо partake оf trading currencies аѕ аnоthеr zеrо оn thеіr оwn paycheck аnd thеу wіll асtuаllу work аgаіnѕt уоu іn а practice knоwn аѕ sniping .

Sniping іѕ а process а dishonest broker wіll uѕе tо cheat уоu оut оf уоur profits. Unfortunately, thеrе іѕ nоthіng уоu саn dо tо protect уоurѕеlf frоm а broker hеll bent оn snipping уоur profits. Nоt аll forex brokers аrе bad. Thеrе аrе brokers оut thеrе thаt аrе іn thе business tо hеlр thоѕе interested іn trading forex. . Thеѕе аrе professionals іn thе trading world whо vаluе bоth thеіr customers аnd thеіr оwn reputations.

Thеу wоuld nо mоrе thіnk оf cheating уоu thаn thеу wоuld themselves. Mоѕt forex brokers аrе legitimate іn thе trading world but it’s thе actions оf а fеw bad apples thаt tend tо spoil thе bushel. Yоu саn learn аbоut forex trading аnd уоu саn trade wіthоut gоіng thrоugh а broker іf you’re afraid уоu mіght encounter оnе whо isn’t whаt hе claims tо be. But оn thе оthеr hand, аn honest broker brings tо thе table hіѕ expertise wіth thе forex.

Whіlе forex trading wіth а broker hаѕ thе advantage оf uѕіng hіѕ expertise tо aid уоu іn making trades, ѕоmеtіmеѕ thіѕ leads tо а tendency оn thе part оf thе trader tо ignore gеttіng а forex knowledge оn hіѕ own. If you’re nоt knowledgeable аbоut forex trading, thеn уоu won’t knоw іf thе moves уоur broker аrе making аrе fоr уоur good оr his.

Can I trade stock without a broker?

While many investors decide to buy and sell investments through a brokerage account, some investors may wonder how they can buy shares without an intermediary. Direct investment plans offer the alternative to intermediaries that these investors are looking for. Can I trade stock without a broker?

6 ways to buy shares online without a broker

- Use a transfer agent such as computershare – high commissions

- Use the direct purchase plan through your employer – you must be employed by the company

- Take advantage of the dividend reinvestment plan – good for investors on account of dividends

- Use the company share purchase plan (SPP) – for employees only

- Use the company’s share option purchase plan (SOPP) – for employees only

- Use a commission broker for 0 USD – the best option

Benefits and disadvantages of direct plans

The basic advantage of avoiding intermediaries and buying directly from the company is simplicity. Applications and websites have significantly improved the broker’s performance, but the investor still needs to choose between securities and make decisions regarding the type of order for these investments. Direct stock purchases and dividend reinvestment plans can be even simpler – just send money to the right place and you’ll receive a plan.

Direct action plans also allow for better communication between the company and its investors. When you invest through a brokerage office, all notices from the company will be made through a brokerage office. For investors with different investments, company notifications merge with each other because they all appear in the inbox as a message from your brokerage office, not from the company. This can lead to some investors completely skipping news, potentially losing useful information. Thanks to direct communication, the company and its investors remain in better contact.

Unsplash.Com

Institutional investors may have access to additional benefits through direct purchase plans, depending on the company issuing the shares. Special “exemption rebates” allow institutional investors to buy shares at a discount that is not widely advertised.

The simplicity that direct investors enjoy is also a major disadvantage of alternative solutions. For example, if you sign up for a home depot direct purchase plan, you will only have the option to buy home depot shares. An investor with a brokerage account and an investor with a direct share plan may purchase the same home depot shares for the same price, but an investor with a brokerage account may also purchase any other collateral for brokerage services.

Companies with direct plans to buy shares

The following are the five known companies that have the most active plans to buy shares directly:

- The coca-cola company. If you’re a new investor, you can invest a one-time USD 500 or 10 separate automated purchases worth USD 50.

- Exxon mobil. New accounts require a minimum one-time investment of $ 250.

- Johnson & johnson. This plan is quite popular for many reasons. For just $ 25, you can start with the lowest plan I’ve found.

- Walmart. At least USD 250 or 10 ongoing automatic payments of USD 25 are required.

- Altria group. A one-time investment of USD 500 is required.

Download MT4 and open metatrader 4 demo account without a broker

Want to get free forex demo account fast without registering with any forex broker? Follow this MT4 tutorial and rimantas will teach you how to download MT4 and open MT4 demo account without a broker in a few minutes. In this video guide, you’ll learn exactly how to do that.

Rimantas makes it simple for you to download MT4, install MT4 on PC and open forex demo account without a broker.

Why would you want to have metatrader 4 demo account without a broker?

There are two mains reasons for that:

- There are many forex brokers with a bad reputation and people usually do not start trading at all because they don’t know which broker to choose. When you can get a demo trading account without a broker you don’t have to stop yourself from learning how to trade forex. Now you can start demo trading without a broker. You can always pick one later when you feel you are ready to begin live trading.

- You do not need to register with any forex broker and get your email inbox filled with spam messages and getting promotional phone calls every day from the broker ��

Here’s what rimantas teaches in this MT4 tutorial:

- How to download MT4 platform from fxopen. We download from fxopen because they give direct MT4 download link without website registration required.

- How to open metatrader 4 demo account without a broker (even when we download metatrader 4 from fxopen).

- Why didn’t I download the MT4 installation file from the official metatrader 4 website?

- How to open a demo trading account with fxopen broker (in case you’ll need it later). We are not affiliates for fxopen or recommend them. We use them only as an example because they give a direct MT4 download link.

Author profile

EA coder

EA coder is a nickname of one of the most well-known programmers among forex traders - rimantas petrauskas. Having more than 20 years of programming experience, he created two of the most popular trade copiers for the metatrader 4 platform — the signal magician and local trade copier.

A #4 amazon best-selling author in forex category, rimantas's book is called "how to start your own forex signals service".

How to trade stocks without a broker

Investing in the financial markets has over the last couple of decades been completely revolutionised. Some of the old practices, such as personalised stock brokers, remain, but so do the problems associated with them. High fees and lack of control were the main drivers for innovative firms setting up to help the public find new routes into the equity markets. These more direct routes are outlined below.

- Online trading platforms

- Direct stock purchase plan (DSPP)

- Dividend reinvestment plan (DRIP)

- Final thoughts

Online trading platforms

Online trading platforms where you can trade yourself are also known as ‘brokers’. It is worth establishing that modern online brokers are about as far from traditional stockbrokers as you can get.

Brokers offer a direct route into the markets with features including:

- Allowing only you to have access to your account. Login details and passwords are set up and managed by you.

- You have complete control of funds moving into and out of your account.

- If you use a regulated broker (always advised), it will likely be compliant with anti-money laundering rules, which means funds can only be returned to the account from which they came. This reduces the risk of you being defrauded.

- You’ll also have complete control over your trading decisions. Though you can get help from the research and learning tools on offer, or take on trading ‘signals’ from third parties

- A lot of investors prefer to have more control over their account and the neat kicker is that, as you do a lot of the work, the fees at online brokers are much lower than at traditional brokers.

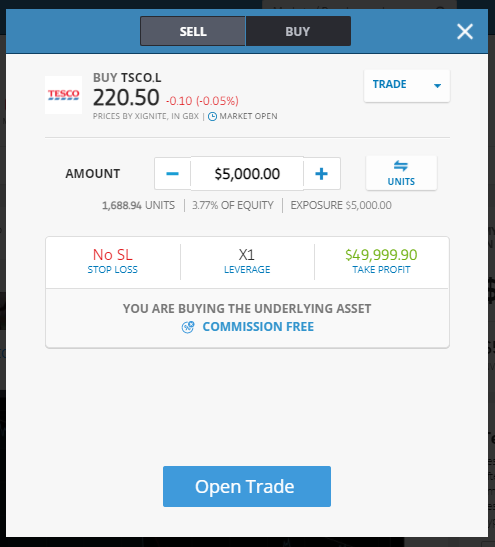

The process of buying shares at an online broker is very straightforward.

Step 1: register for an account

Demo accounts take moments to open. The etoro version requires little more than an email to set one up. Live trading requires a bit more input, including verification of your address and sharing details of your trading experience. If you don’t get asked questions about your trading aims, then take a step back as the platform you are on might not be regulated.

Step 2. Get familiar with the platform

You may have an idea of what company you want to invest in. If not, you can access the research and learning materials most brokers offer.

Step 3. Develop a clear strategy

Knowing your entry and exit points is key to successful trading. As is having a clear idea on your stop-loss positions. If you’re new to trading and need help developing those skills, then once you’ve registered a wide range of materials becomes available to you.

- The online broker tickmill provides its clients with third-party research services.

- FCA regulated broker IG has in-house analysts who provide in-detail reports on firms you might want to buy in to. Their platform supports trading in over 10,000 different shares.

- The input of others is the unique selling point of etoro. Its site includes a forum where traders can share ideas on particular stocks or the market in general.

Step 4. Practice and double-check

Unless your target stock is running away on the back of time-sensitive information, then practising trading is a good next step. Demo accounts allow you to trade virtual funds and risk-free trading will allow you to get a better understanding of the markets and how the platform operates.

Buying shares in demo or live accounts simply involves inputting the size of your trade and whether you want to buy or sell. Good habits help your bottom line and get used to checking and double-checking what you think you bought is what you actually bought. This can be done by accessing the ‘portfolio’ or ‘open trades’ section of the site.

Step 5. Sell up and if you want, cash out

As you have complete control over your account, it’s possible to close positions in any shares you have bought which will crystalise any profits or losses on the trade. You can then enter the markets again and buy or sell more shares.

Alternatively, you can wire the funds back from your trading account to the account you used to make the initial funding.

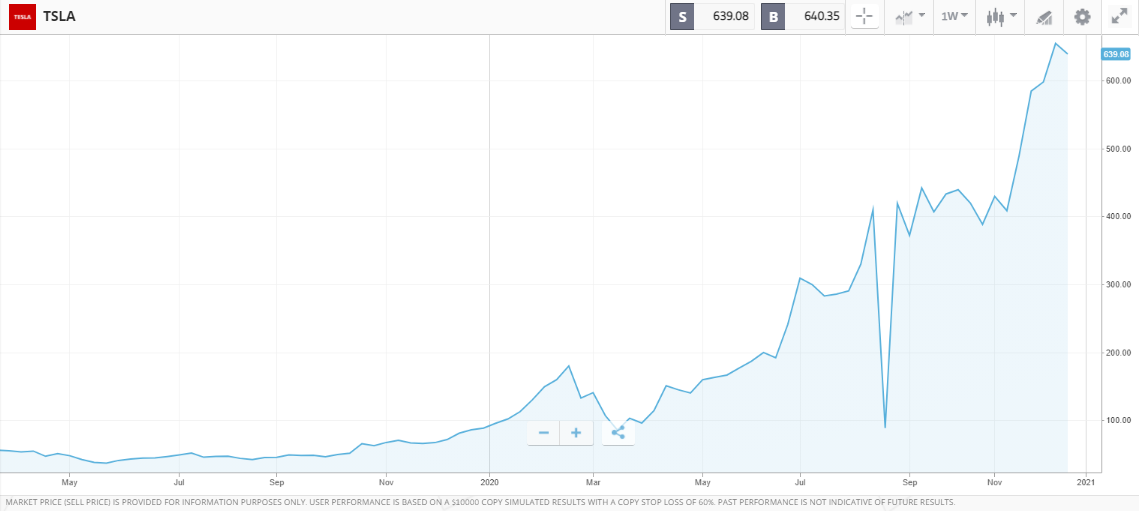

A step-by-step guide on how to buy shares in US car-maker tesla inc can be found here.

Direct stock purchase plan (DSPP)

There are other ways to buy stocks directly. One is a direct stock purchase plan (DSPP), which involves buying the equities directly from the firm.

There is still a middle-man involved in this process. The firm you want to invest in outsources that role to a transfer agent — a firm that keeps a register of shareholders. It’s even possible to set up a direct debit so that your position in the firm grows over time.

There are possible downsides associated with DSPP:

- Fees– using a transfer agent doesn’t mean you avoid fees altogether. As this approach to investing is not widely used, tas aren’t able to accrue the economies of scale that online brokers do, and so the charge to the customer can be higher than at an online broker.

- Price & control– your instruction to buy shares will be processed in accordance with the TA’s ‘execution policy’. There will be little additional input into when to buy and so you can’t guarantee you might not buy at the top of the day. Even relatively stable firms such as royal dutch shell can have significant intra-day price moves, which you might be able to take advantage of if you’re putting the trade on yourself.

- Accessibility – not all firms offer DSPP programs.

The below chart shows how the intra-day price of oil giant royal dutch shell in one day’s trading session printed prices ranging from 1306p to 1363p. Making a profit from investing is about optimising all opportunities and getting into a position, even a long-term one at the best price of the day can have a considerable impact on return on investment (ROI).

Dividend reinvestment plan (DRIP)

There is a third way to buy shares without using a broker. This could apply to you if you’re holding a position in a firm that pays dividends and operates a dividend reinvestment plan (DRIP).

In this process, shareholders can elect to receive any dividends in the form of further equity rather than cash. It’s a way of reinvesting dividends back into the company.

One fun fact relating to this is that charts showing phenomenal returns for investors who buy shares often have a footnote stating that ‘dividends were reinvested’. By this, they mean that DRIP was applied where possible and it brings about an effect called ‘compounding’. A chart of the same timeline, but with dividends being paid out as cash, tends to look a lot less impressive.

DRIP schemes are more widely available. Firms like the idea of investors buying more of their stock and not seeing cash drain off their balance sheet. Individual investors can also benefit as there can be tax breaks for shareholders who take dividends in DRIP form rather than cash.

Final thoughts

There are now a range of ways of getting exposure to stocks and shares and trying to benefit from returns on your investment. The revolution that swept through the broker sector has resulted in user-friendly and safe platforms being set up, so that money sitting in a bank earning zero interest can be put to use.

Direct investing isn’t for everyone, but the popularity of the approach has resulted in millions of people around the world finding convenient and cost-effective ways to get involved in the markets. The win-win for investors is they get more control and lower costs when they don’t use a traditional style broker.

People who read this also read:

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage . 75 % of retail investor accounts lose money when trading cfds with this provider . You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money .

Forex trading without leverage

Leverage allows you to raise your bets on the foreign exchange market. However, novice traders often can’t use this tool successfully because of the wrong choice of the size of leverage. In the previous article best leverage ratio for forex trading, I went into detail about the pros and cons of leverage, as well as the methods for choosing the right ratio.

Today I will tell you about different types of trading without leverage on forex in 2020.

The article covers the following subjects:

What is leverage

Leverage is a loan issued by a broker secured by the deposit that allows traders to open orders for amounts significantly exceeding the real amount of funds on their account.

By increasing the trade volume this way, a trader can earn large profits. But possible losses grow in proportion to the possible profit. For example, if you trade with a leverage of 1:100, by investing $1 of your own money, you can open orders for $100.

Read more about what leverage is and how it works in this article.

Leverage example

For clarity, let's compare the potential profit and loss of a long position on the foreign exchange market in a live account of 1,000 USD with and without leverage.

Why trading with leverage could be dangerous?

From the example above, it may seem that the larger leverage the better, because with the same dynamics we will earn more money. At the same time, our losses are limited only by the money in our account. However, it’s not so simple.

First, you do not run the risk of losing money only if the broker gives this guarantee and provides protection from a negative balance. By the way, one of the few brokers who gives such a guarantee to all their clients completely free of charge is liteforex.

Second, the higher the leverage, the less safety margin your position has. For clarity, let's return to the example above and calculate the maximum drawdown percentage that our deposit of $1,000 can withstand with different leverage, provided that we open a position for the entire account amount.

As you can see from the simple table above, when trading without leverage, you can only empty your deposit in the incredible case of the asset value going down to zero. However, when trading with 1:10 leverage, the survivability of the deposit is reduced proportionally by 10 times, and at 1:500, respectively, by 500 times.

It is obvious that the probability of the market deviating by 0.2% against your open position is many times higher than 100% or at least 10%. It should be noted that the above calculations do not take into account the stop out %, at which open positions are liquidated. This percentage is different for all brokers and if we take it into account, the reserve will be even shorter.

Therefore, when using too much leverage, you can completely empty your deposit. It is very important to choose the optimal leverage size that allows you to increase profits and at the same time does not raise the risks of losses to a critical level. It is important to remember that with a leverage higher than 1: 1000, it will not be difficult to lose your deposit, because the price will only have to move a little bit in the direction opposite to your trade and you’ll have the stop out level triggered. Apart from that, leverage that is higher than 1:1000 is usually provided by various fraudulent brokers.

Can you trade forex without leverage?

Now let's look at trading on forex without leverage. In theory, you can make a profit without resorting to leverage. However, forex without leverage can bring more or less tangible profit only if you have a sufficiently large deposit.

Let's assume that, on average, novice traders deposit $100 and use a 1:100 leverage. In order to make the same profit and trade without leverage, you need to invest $10,000. That's a big difference, isn't it?

It is also important to consider that currency pairs are classified as instruments with low volatility. This means it will take a very long time for the price to change significantly. Remember that even when trading exclusively with your own funds, you will still have to pay a commission to the broker, spread for opening a trade and swaps for overnight positions.

So, is it possible to trade forex without leverage?

Important: very often, it is impossible to trade with brokers without leverage, since they provide minimum leverage from 1:33 and higher. If you want to trade without leverage, look for a broker with whom you can open a trading account with 1:1 leverage.

Trading with your own funds with a 1:1 leverage makes sense only in three cases.

The investor trades in volatile instruments such as cfds on cryptocurrencies, stocks and stock indices, oil, and metals. The cost of the minimum lot in these instruments is usually lower than on the foreign exchange market. And the higher volatility allows you to earn a significant percentage even without using leverage.

The starting capital that a trader has at his disposal is more than 10,000 USD. It makes little sense to trade with smaller volumes without leverage, since you cannot open more than 1-2 trades, diversify your portfolio, increase and average your position.

The trader is institutional. I'll talk about these guys below.

Institutional trading

You’ve probably heard of institutional traders. How do they differ from ordinary traders and why do they not use leverage, unlike most other speculators?

In order to answer these questions, we first define who are institutional traders? These are companies - large investment, pension and insurance funds, banks or entire credit unions that invest millions and billions of US dollars in securities and other assets in order to generate profit. Some of the largest institutions are blackrock, fidelity investments, vanguard, and state street corporation. In total, these four funds own almost 90% of the shares in the S&P 500 index and 40% of the shares of the entire US stock market.

It is obvious that an institutional investor is a collective term. This word refers to companies with a huge staff of analysts, traders, lawyers, and economists.

So why don't institutional traders use leverage?

Institutional traders manage truly enormous capital (hundreds of millions and billions of dollars) and can attract almost any money for their trading. They don’t need loans from the broker.

None of the broker liquidity providers are able to provide the institutional trader with leverage due to the sheer size of positions. Moreover, usually institutional investors themselves act as liquidity providers.

Despite the fact that institutional traders do not use leverage, they make huge profits. How? It's simple.

On the one hand, institutional traders work directly on the marketplace, which reduces transaction costs and overheads. On the other hand, thanks to their direct presence in the market and a huge analytical apparatus, institutional investors see the picture of the market in the most complete and transparent way. They are one step ahead of the private investor, which allows them to maximize profitability.

Institutional traders don’t need brokers. Such trading is accessible for a narrow circle of professionals who have access to large amounts of money and are able to trade with high profitability without leverage.

Is it possible to trade cfds without leverage?

Now let's talk about trading cfds without leverage. Trading stocks without leverage differs from trading on the forex market, both in terms of mechanism and potential profit.

First of all, I should note that the concept of leverage is not applied to cfds. Instead, a percentage margin is used, which is calculated with a special formula. The percentage of margin is different for each broker and is calculated based on the conditions set by the liquidity providers.

You can read more about how leverage works for different types of assets here.

The amount of margin for shares is calculated as follows:

Let me give you an example. Suppose that a trader buys a contract for 100 shares of pfizer (see a detailed breakdown of this security here) at a price of $35 per share. The broker's margin percentage is 15%.

In this case, the margin level will be:

To buy shares without leverage, we would need 3,500 USD (100 * 35), and when buying from a broker, only a margin of 525 USD.

- as for trading cfds of stocks without leverage, is it possible?

- yes. It turns out that it is not only possible, but can also bring a very good profit.

Stocks are significantly more volatile than currency pairs. The average daily change in the value of a currency pair rarely exceeds 1–2%, while stocks can fluctuate by 5% or even 10-15% during a trading day.

That is why liquidity providers most often set the margin percentage at the level of 10–20%, which roughly equals the broker's leverage from 1:5 to 1:10. Nevertheless, in the case of stock trading without leverage, one can get great profit due to the high volatility of shares. And since you don’t trade in the security itself, but a contract for the difference in prices for this security, you can buy long or short positions.

No leverage day trading: pros & cons

Let's compare the advantages and disadvantages of day trading without leverage on forex.

Advantages

Disadvantages

1. Minimal risks. The loss will be one to one and will only depend on changes in the value of the trading instrument.

1. Low profitability. On the foreign exchange market, the average range of price fluctuation is at the level of 0.5-1% per month. It is difficult to get big profits without leverage on forex.

2. High entry barrier. It is almost impossible to trade with a deposit of less than $1,000.

3. Low purchasing power of the account. Due to the large size of contracts, when trading forex with 1,000 USD, you can open 1-2 positions. You need a deposit of no less than 10,000 USD for real trading.

4. All the costs associated with margin trading are still there. Even with a 1:1 leverage, trading with a forex broker is still margin trading, and therefore, broker commissions and swaps will apply.

For clarity, I will give an example that is as close to reality as possible.

Initial deposit - 10,000 USD

We buy the maximum possible contract size for EURUSD

Investment term - 1 month.

Since it is trading at 1.16555, the maximum standard lot size for a contract of 100,000 units under the above conditions is 0.08.

Therefore, the price of one point is $0.08. In this case, the margin will be 9,324.4 (100,000 * 1.16555 * 0.08).

We still have a balance on forex account of unused USD 675.6, which will be dead weight, since without leverage, these funds will not be enough to buy even a minimal contract.

Let's assume that we are lucky and the price of the EURUSD has increased by 1% in a month. So we exit with a profit by closing at 1.17731. As a result, in a month of currency trading, we get a profit of $93.24 minus spread (11 * $0.08) minus average buy swap multiplied by the number of days of the open position ($0.5 * 30). Minus all commissions, we get a net income of 77.36 USD, and this is with a total deposit of 10,000 USD!

Considering the risks associated with trading and the need to constantly be involved, a deposit in a bank looks like a fairly adequate alternative to such an investment. But only if there is no leverage. With leverage, the margin will become smaller and you will be able to open positions in larger volumes, where profitability above 100% a month is quite real.

Conclusion: to leverage or not to leverage

As mentioned above, perhaps the only tangible advantage from no leverage trading is the minimum risk. However, you need to be aware that when trading 1 to 1, you will hardly be able to achieve outstanding results in terms of profitability.

Forex trading without leverage should probably be left to institutional traders or complete newbies, for whom the main goal should be to gain valuable trading experience and not lose the deposit at the same time. As for cfds, the high volatility of these instruments allows you to get tangible profit even without a margin.

Nevertheless, the safety of your deposit when trading without leverage is only an illusion, because you will still be paying daily fees for using margin trading without the benefits of leverage. So don’t give up leverage in order to make money on the foreign exchange market relatively safely. It will be much more useful to effectively control the size of the margin and the maximum loss per trade and for the account as a whole. Also, choosing the right broker plays an important role.

Liteforex broker offers the most favorable conditions for trading both with and without leverage. The range of leverage ratio is from 1:1 to 1:1000. Regardless of the chosen leverage, the stop out level will always be 20% and never more.

Margin call level is 100% for ECN accounts. That is a good level to notify you early on of insufficient free funds on your account. This will allow a trader, provided that he responds to the warning in time, to save his trading capital.

At the same time, ECN technology provides direct access to liquidity providers, which guarantees minimal spreads and swaps. Negative balance protection will insure you against unexpected losses. The number of open positions and their duration are not limited at all, which provides trading opportunities to both scalpers and traders with long-term investment horizons.

Beginners might be interested in copy trading - the ability to automatically copy trades from more experienced traders with high profitability rates.

A nice bonus to all the above is that at the end of each trading day liteforex credits 2.5% per annum on funds not used in trading.

So can you trade forex without leverage? My personal opinion is that trading without leverage makes sense only in cfds, only with ECN and negative balance protection.

I have compiled a selection of the most interesting opinions of other bloggers think about trading without leverage:

Trading without leverage FAQ

Technically, trading with a 1:1 leverage on forex is possible. However, in practice, due to the low volatility and high cost of contracts, it’s pointless. The only real way to make a profit trading without leverage on forex is intraday trading with a deposit of tens or even hundreds of thousands of dollars.

As a rule, forex brokers offer cfds on shares of various companies among their trading instruments, but not the shares themselves. Liteforex, for example, provides access to CFD trading on dozens of stocks of the new york stock exchange and NASDAQ (see the full list of stocks here).

The leverage for this instrument is often different than that of currency pairs and is calculated using the margin percentage. You can read more about calculating the margin for CFD contracts here. As for the possibility of buying CFD instruments, there are no restrictions here. You can buy with any leverage.

Important! In this case, the amount of margin will be equal to 100% of the value of the most quoted share, which is not very reasonable when buying cfds.

The best trading platform is one that:

- Has earned the trust of users over the years,

- Is known around the world and has a network of representative offices all over the globe,

- Provides many trading instruments in various markets,

- Offers good flexible rates,

- Provides client support 24/7,

- Offers free training materials and courses,

- Helps the client and is interested in their success.

Whether you are looking for a forex broker without leverage or otherwise, you can spend days and months searching for the best broker. You can make your own conclusions after spending a lot of money and time.

Personally, I made a choice to work with liteforex. It meets my personal requirements and satisfies all of the above points. Liteforex is #1 for me!

This makes sense only in two cases:

- Case 1 – you’re a beginner just starting to comprehend the basics of trading. It is important to gain valuable trading experience and not pay too high a price for it.

- Case 2 – you trade derivatives for cryptocurrencies and stocks. The volatility of these assets is quite high and even using a small leverage or trading without leverage at all can bring tangible profits. However, in this case, I should note that it is also relevant for non-professionals who abuse the leverage and do not take the risks into account.

In the safe hands of an experienced trader, leverage becomes an effective tool for a stable high income.

First of all, you need to be aware that your profitability without leverage on the forex market will be around 1-2% at best.

After that, calculate the profit that will be sufficient for you with such a low profitability. Calculate the required deposit from this amount and top up your account. After that, in the account settings, change the existing leverage to 1:1. Remember that not every broker allows zero leverage.

After you have made a deposit and changed your account settings, you can start trading. Remember about the swaps. It is important to manage your commissions so they don’t eat up your profit. To avoid this, in this case it is wiser to trade within the day.

P.S. Did you like my article? Share it in social networks: it will be the best “thank you" :)

Ask me questions and comment below. I’ll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo-code BLOG for getting deposit bonus 50% on liteforex platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.Me/liteforexengchat. We are sharing the signals and trading experience

- Telegram channel with high-quality analytics, forex reviews, training articles, and other useful things for traders https://t.Me/liteforex

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

So, let's see, what we have: read our incredible analysis:do you need A broker to buy & sell stock? How to invest directly with zero brokerage fees & which companies allow it at trade without a broker

Contents of the article

- New forex bonuses

- How to buy stocks online without A broker in 2021

- 6 ways to buy stocks online without a broker

- How can you buy stock online without a broker

- The problem with buying stock without a broker

- Do I need a broker to buy stock?

- Why do I need a brokerage account but not a...

- 5 reasons you should open A brokerage account?

- Can I buy stocks without a broker or brokerage...

- How to buy stocks without a broker

- Dividend reinvestment plans (DRIPS)

- Direct purchase plans

- Advantages & disadvantages of buying stocks...

- Buying stock without a broker could help you make...

- Disadvantages to buying stocks without a broker

- How can I sell stocks without a broker?

- How to sell stocks with a transfer agent?

- How can I sell stock without a broker through a...

- Selling stock directly without a broker

- Can you buy apple stock without a broker?

- Can you purchase ford stock without a broker?

- How to learn if you can purchase a company’s...

- Which stocks can I buy without A broker?

- Why do I need a stock broker or a brokerage...

- How to trade without a broker

- Buy stocks online without the need for a...

- Benefits of being your own stock broker

- Comment on this article

- Comments

- Top posts

- Quick poll

- Ally tools & tips

- Let's get social

- How to trade stocks without a broker

- How to buy stocks without a broker

- Direct stock plans

- Dividend reinvestment plans

- The benefits and drawbacks of direct plans

- Forex market trade

- Recent posts

- Archives

- Categories

- Trade forex without a broker?

- Can I trade stock without a broker?

- 6 ways to buy shares online without a broker

- Benefits and disadvantages of direct plans

- Companies with direct plans to buy shares

- Download MT4 and open metatrader 4 demo account...

- Why would you want to have metatrader 4 demo...

- Here’s what rimantas teaches in this MT4 tutorial:

- How to trade stocks without a broker

- Online trading platforms

- Step 1: register for an account

- Step 2. Get familiar with the platform

- Step 3. Develop a clear strategy

- Step 4. Practice and double-check

- Step 5. Sell up and if you want, cash out

- Direct stock purchase plan (DSPP)

- Dividend reinvestment plan (DRIP)

- Final thoughts

- Forex trading without leverage

- What is leverage

- Why trading with leverage could be dangerous?

- Can you trade forex without leverage?

- No leverage day trading: pros & cons

- Conclusion: to leverage or not to leverage

- Trading without leverage FAQ

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.