Fbs deposit methods

The FBS cent account is one that offers great value particularly to new traders, trading in cents.

New forex bonuses

This account type is available worldwide and has a very reasonable minimum deposit of 10 EUR within the EU or just $1 USD when trading outside of europe. This account has been also featured in our forex brokers with low minimum deposit guide.

FBS minimum deposit guide (2021)

If you have read our FBS review then it is already very likely that you know a great deal about what this major forex broker has to offer.

Here though we take the opportunity to hone in on some specifics.

These specifics are the various funding methods made available at FBS and particularly the FBS minimum deposit and how this can change depending on the choices you make.

Table of contents

74-89% of retail CFD accounts lose money

FBS account base currency

The FBS base currencies are limited. If you are trading from within europe, you can only access euro as your base currency and deposit in euro only. You also cannot convert other currencies into euro through FBS.

If you are trading from another location within the international market then you will have access to two base currencies in the form of euro and USD. In this case, if you find the account with another currency, it is possible you will incur a conversion fee.

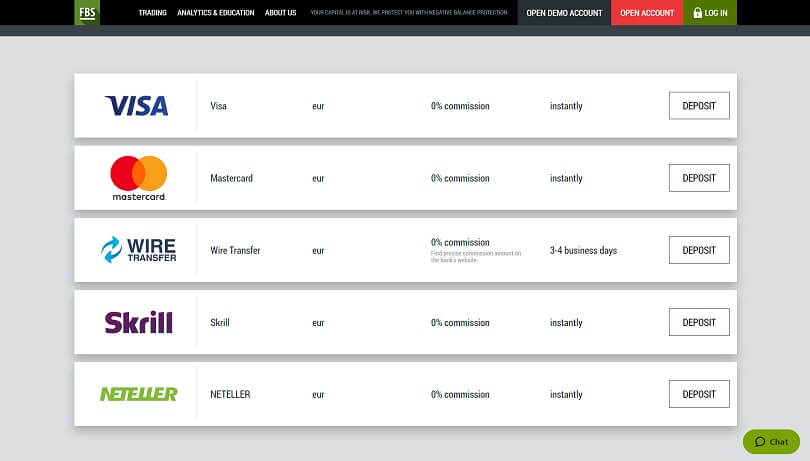

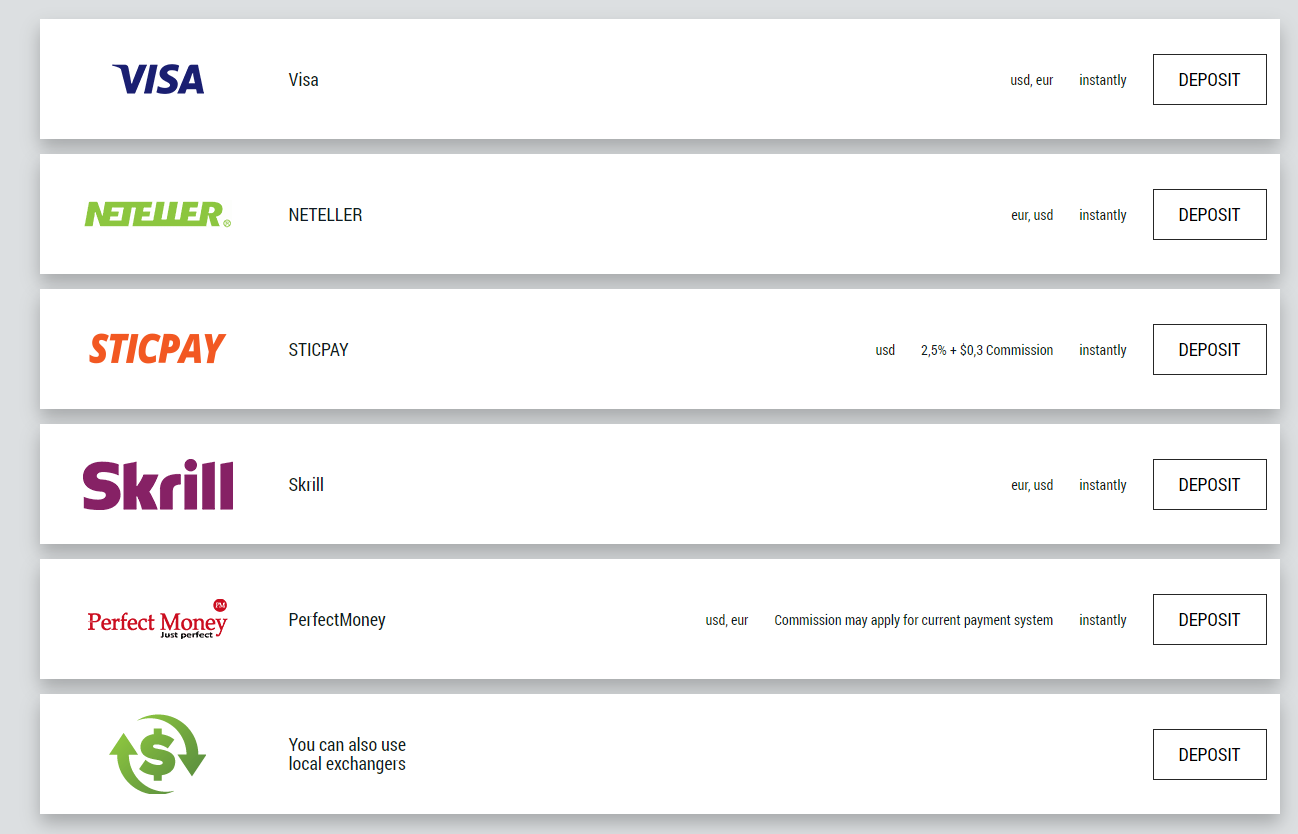

FBS funding and deposit methods

As a major forex broker, FBS makes a wide number of options available for you to choose from when funding your account. We have detailed these below and the FBS fees which are associated with each method.

Wire transfer

FBS deposit by wire transfer funding is available around the world and comes with no fees attached at all. With this said, you will want to double-check your bank’s policy of wire transfers since it is possible to incur a fee from their side, but never from the broker side in the case of FBS.

This deposit method takes 3-4 business days in order to be processed and available for trading.

Credit/debit cards

FBS credit and debit card deposits are of course also available. In this situation, visa and mastercard are both accepted although mastercard is only available within europe, while visa deposits are available around the world.

Deposits made through this method are instant and immediately available to trade within your FBS account. There are also no fees associated with this form of deposit.

Ewallets

FBS ewallet deposits are an increasingly popular way to fund your trading account. For that reason, the broker makes both neteller, and skrill available worldwide for funding.

Perfectmoney is another ewallet service which is available for FBS traders outside of europe only. Bitcoin deposits are also not permitted within the EU.

The ewallet deposits will not encounter any type of FBS fee and are also instantly available to trade with.

Deposits from indonesia

With FBS there are special exceptions made when it comes to deposits from indonesia. Indonesian traders can benefit from a fixed-rate currency exchange of 10,000 IDR for 1 USD. This means that you will not be impacted at all by currency fluctuation when making your FBS deposit.

Additional methods of deposit which are available to indonesian traders include local bank deposits from BCA, BNI, BRI, and more local banks in the country. This should make it very easy and fast to deposit.

Every deposit method offered in this case is fee-free with the exception of stic pay which charges a minimal commission. Both fasapay and perfectmoney are available without any fees.

The only point to note is that bank deposits will also still incur a commission based on your bank and their policy. All the methods noted, allow for an instant deposit to your account. The exception again here is banks which can take up to 24-hours.

Other methods

There are other FBS deposit methods available aside from what we have mentioned. This is particularly the case outside of the EU in areas such as the middle east and asia. Bitwallet is one such method available only in japan.

When it comes to other methods, the minimum deposit for FBS may vary along with some fees.

74-89% of retail CFD accounts lose money

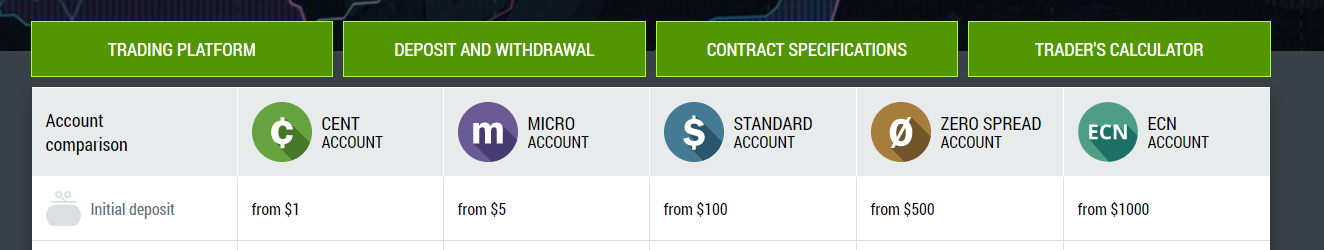

FBS minimum deposits

Having looked at the various funding methods available, let’s look closer at the FBS account types, of which there are many, and the minimum deposit FBS applies in each case.

Cent account

The FBS cent account is one that offers great value particularly to new traders, trading in cents.

This account type is available worldwide and has a very reasonable minimum deposit of 10 EUR within the EU or just $1 USD when trading outside of europe. This account has been also featured in our forex brokers with low minimum deposit guide.

FBS islamic accounts are also available.

Standard account

The FBS standard account is again one that the broker makes available to traders around the world.

Islamic accounts are always available should you require one, and the minimum deposit here stands at 100 EUR within the EU or $100 if you are trading under international regulation.

Micro account

The FBS micro account is only available to those trading from outside europe and it trades with micro lots. The account type offers excellent value again with a minimum deposit of just $5 to trade, and FBS islamic accounts available on request.

Zero account

Another account that is available only outside europe is the FBS zero account. This account makes zero spread trading available although there are commissions in place.

The FBS minimum deposit on these accounts will set you back $500 with the option of an islamic account again available if needed.

ECN account

Continuing the trend of only being available outside europe, the FBS ECN account provides for fast, effective ECN execution of your trades at the best prices and with the lowest spreads. Commissions are charged though, and only forex trading is available.

The ECN account features a minimum deposit of $1,000.

Copytrading account

The final FBS account type to take a look at is the copytrading account. This is again only available to those trading from outside europe and you can choose to be a signal provider or an investor.

If you choose to be a signal provider, you should be aware that you will only be allowed to open standard or micro account types and so you will be subject to those conditions and minimum deposits associated with those accounts.

As an investor, also known as a copytrader, you can open any account type and start to copy trade once your account is verified and you have a balance of more than $100. So, in the end, the FBS copy trade minimum deposit is 100$.

Related guides:

74-89% of retail CFD accounts lose money

FBS deposit bonus

Lastly, after all the FBS broker minimum deposit variables, we will take a look at the FBS bonus conditions and criteria. This will help ensure that you do not miss out on an FBS bonus if one is available to you.

No deposit bonus

An FBS no deposit bonus of $100 is available to you as a trader under certain conditions. Among these conditions are that you cannot withdraw the money immediately. So, as such, you cannot withdraw this base FBS bonus. What you can do though is withdraw the profits you make on the bonus in the event that you successfully trade at least 5 lots within a 30-day timeframe.

$123 no deposit bonus

The FBS 123 bonus is one that used to be available. It is no longer available however and has since been replaced with the no deposit bonus which we mentioned above. This still represents a positive FBS bonus deal for the majority of traders.

100% deposit

An FBS deposit bonus is also available on request and under certain conditions. This means that you can effectively double your FBS deposit depending on the circumstances up to a limit.

FBS pro challenge

The final FBS bonus we will take a look at is the FBS pro challenge. In fact, this is not a direct type of deposit bonus, but it is a special type of contest event which is periodically opened to FBS traders to participate in.

With this type of challenge, you typically get to trade with a $10,000 FBS demo account on 100:1 leverage. If you are successful in making the most profit among your fellow competitors on this demo account over a 2-week period, then you will receive an FBS bonus amount of $450.

74-89% of retail CFD accounts lose money

FBS fee for deposit and withdrawal

FBS is one of the top foreign exchange (forex) trading websites with millions of users worldwide in almost all countries. Since forex traders are depositing, withdrawing large amounts in or from their forex account and have slim margins, one of the considerations while choosing the deposit or withdrawal method is the FBS fee for each method. Traders should be aware that FBS is offering users more than 50 different methods for depositing or withdrawing money from their account for the convenience of the forex traders from different countries. For some payment methods, the trader is also reimbursed part of the amount deposited. Hence the FBS fees for some of the more popular payment/withdrawal methods are discussed.

If the trader deposits money via credit card, FBS doesn’t charge any fee. FBS fee for credit card deposit is zero dollars. For each withdrawal, the FBS fee is $1. So FBS charges $1 for 1 withdrawal attempt using a credit card.

A credit or debit card is another popular option for depositing and withdrawing money from an FBS forex account. Only cards from visa, mastercard, and maestro can be used. FBS does not charge any fee for the deposit and also does not reimburse any amount. The amount deposited is immediately credited to the forex account and can be used for trading. FBS will charge a fee of US $1 for each withdrawal request to the credit card. Time taken typically for processing the request is again 15-20 minutes; if there is any further delay, there may be a problem with the bank, and the user should check with the credit/debit card issuer.

Neteller, webmoney & okpay

Neteller is one of the most popular deposit methods on FBS since the trader is reimbursed 3.9% of the amount deposited. The amount is credited to the account immediately. For withdrawal, the fees vary from $1 to $30, and processing time for the withdrawal is usually 15 to 20 minutes, though it may take up to 48 hours for the withdrawal to be processed in some cases. Webmoney is another popular method for deposit/withdrawal at FBS since its reimbursement is 0.8%, and the account is credited immediately. The withdrawal fees are also 0.8%. FBS offers reimbursement of 0.5% on deposits and charges a fee of 0.5% on withdrawals. Like neteller, the deposits are immediately credited, and withdrawals take 15-20 minutes.

Skrill/bank transfer

Skrill is widely used in europe, and FBS does not charge for skrill deposits in the FBS account. However, its withdrawal fee is lower at 1% + $0.32, making it more affordable for forex traders trading in smaller amounts. The deposit and withdrawal times are similar to those for other electronic payment methods with an instant deposit, 15-20 minutes withdrawal. Bank transfer is an option for forex traders in all countries. However, the fees are usually higher at 30 euro for deposit and withdrawal. The time taken for the amount deposited to get credited to the FBS account is also longer at 5-7 days.

Other methods

Depending on the popularity in a particular country, forex traders can opt for other methods like safecharge, perfectmoney, yuupay, zaw forex services, sahib exchange, unionpay, fasapay, filspay, maypay, yandex money, yandex terminal, moneta RU, and 1pay. If multiple options are available, it is advisable to check the amount reimbursed and fees before choosing a particular method.

FBS withdrawal rate

FBS withdrawal rate is $1 for credit cards. FBS withdrawal rate for skrill is 1% + $0.32; for neteller 3.9%, for wire transfer from $25 till $50 (different for each country).

FBS review and tutorial 2021

FBS is a top online broker offering MT4 & MT5 trading across a range of instruments.

Trade on nearly 50 leveraged forex pairs.

FBS is an online broker that offers financial market trading in forex and cfds. Our review in 2021 takes a thorough look at the broker’s legitimacy, leverage offering, spreads, and minimum deposits. Sign up for an FBS account and start trading.

History & headlines

FBS is a global broker founded in 2009. In the EU, FBS is operated by tradestone ltd and regulated by the cyprus securities and exchange commission (cysec). The global branch is run by FBS markets inc and regulated by the international financial services commission of belize (IFSC).

FBS has a head office location in cyprus and claims to have over 15 million active traders across more than 190 countries, from malaysia and indonesia to south africa, pakistan and the EU.

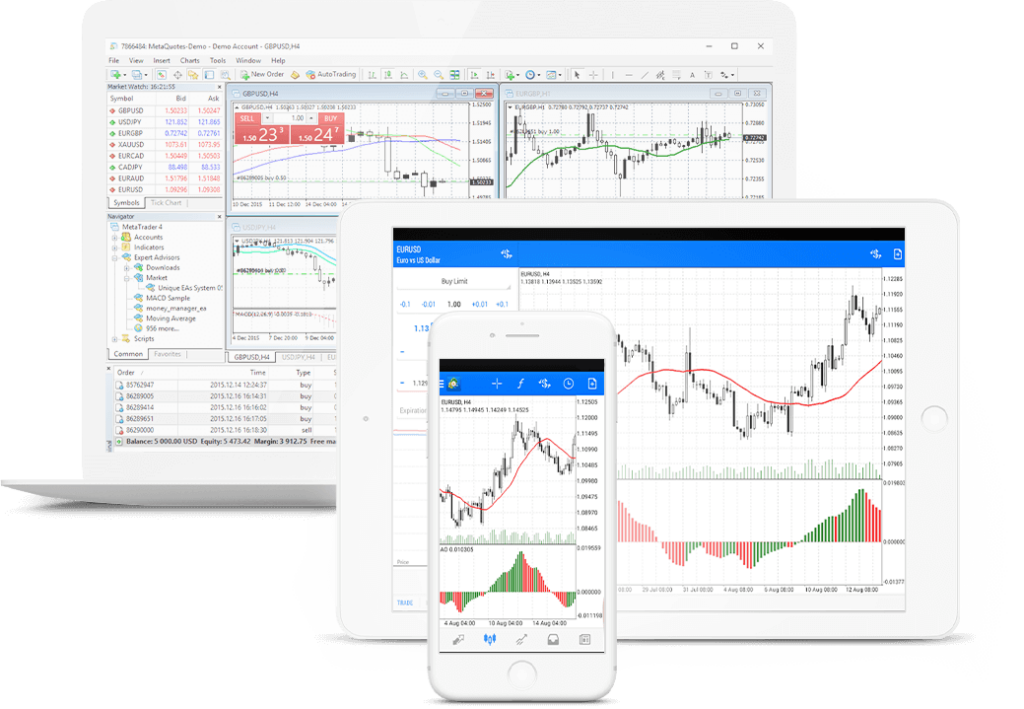

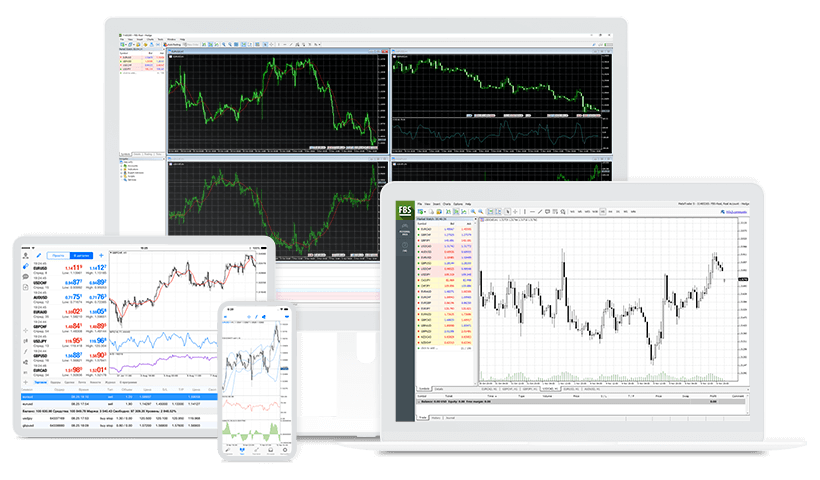

Trading platforms

FBS uses a non-dealing desk (NDD) system with STP for rapid order execution. After registration and login clients have a choice of two platforms to access the markets.

Metatrader 4

MT4 is a market-leading platform that FBS clients can download for PC. The trading platform includes a range of features:

- One-click execution and copy-trading

- Expert advisors (EA) service and apis

- Wide range of technical indicators and charting tools

- Support for clients using a virtual private server (VPS)

The global branch of FBS also offers MT4 multiterminal, which allows clients to operate multiple accounts simultaneously.

Metatrader 5

This broker recently added MT5 integration to its portfolio. This platform is a recent update to MT4 with greater versatility that offers the following:

- Hedging & netting

- Market depth view

- More technical indicators

- More order types and timeframes

MT4 and MT5 are also both available without a download via any browser through the webtrader solution. This service works across all operating systems and has all the features of the original software.

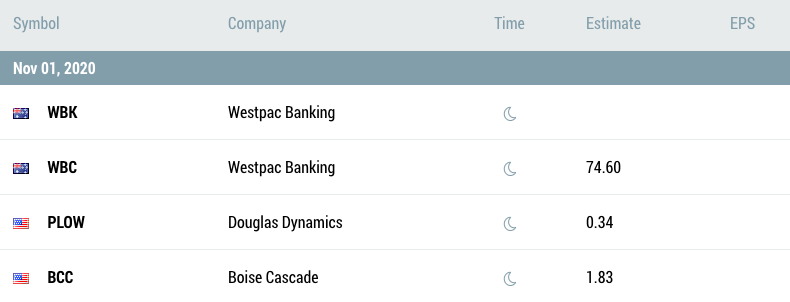

Markets

Clients can access a wide range of assets for trading:

- Forex – 28 standard pairs plus 16 exotics

- Metals – four precious metals

- Energies – WTI and brent crude oil

- Stocks (global only) – 40 company shares

- Indices – four indices including the NASDAQ

Unfortunately trading on the FTSE100 is not offered and neither is cryptocurrencies, such as bitcoin.

Trading fees

Spreads offered by FBS vary by account type and region. For EURUSD, the global firm offers a spread of 3.0 pips on its micro account, 1.1 on its standard and cent accounts and zero pip spreads on its zero and ECN accounts. In the EU the same spread is 0.7 pips with both the standard and cent accounts. Our review was pleased to see competitive spreads with the zero and ECN accounts.

The global branch charges a fixed rate commission of $20 per lot on the zero spread account and $6 on the ECN account. It also charges $3 for stock trades and $25 for CFD trading.

FBS charges overnight rollover fees (swap-free is available) and a cancellation fee of €5 for transactions that have taken advantage of price latency. Accounts dormant for 180 days are charged a €5 monthly fee.

FBS leverage

The maximum leverage available depends on account type and branch. In the EU the broker provides leverage up to 1:30 on standard and cent account types. Globally it offers up to 1:1000 on the cent account, 1:500 on the ECN account, and 1:3000 on other account types.

FBS has a margin call of 40% and lower, whereafter it is entitled to close a client’s position.

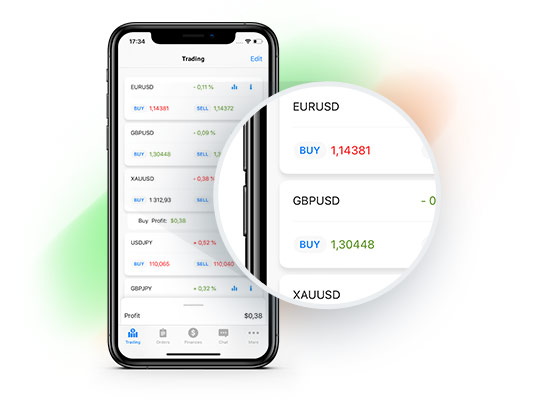

Mobile apps

FBS trader app

The owner and CEO have ensured that FBS trader is a free and fully-featured trading app. It can be downloaded to android (APK) devices from google play. Outside the EU it’s also available on ios. The broker’s downloadable app offers forex and top instruments for trading, alongside real-time stats and easy management.

MT4 & MT5 apps

Both metatrader platforms are also available as mobile apps from the app store and google play. The apps have the main features of the native platforms including technical analysis with the convenience of one-click trading on-the-go.

Payments

The minimum deposit at the online forex broker is different for each account type and trading region. The EU firm requires an initial deposit of €10 on the cent account and €100 on the standard. The global branch offers minimum deposits of $1, $5, $100, $500, and $1000 for the cent, micro, standard, zero spread, and ECN accounts respectively. Our review was pleased to see the low minimum deposit offering.

Several deposit and withdrawal methods are available including wire transfer (EU only), visa, and electronic payment systems, such as skrill and neteller. Deposits are instant for all methods bar wire transfer and withdrawals take up to 48 hours. Commission fees apply to withdrawals at the global FBS firm and identifying documents may be requested.

Demo account review

FBS offers demo versions of the cent and standard accounts in the EU. MT4 and MT5 integration are available and a range of instruments are offered to practice trading with zero deposit requirement. Once comfortable with the broker’s services, you can then sign up for a live account.

Trading bonuses

FBS has a wide selection of promotions and bonuses advertised on its global website. For example, the broker offers a trade $100 bonus with no deposit necessary. The broker credits clients with $100 and if the client has 30 active trading days with 5 lots traded, the bonus can be withdrawn. FBS also offers a 100% deposit bonus, which doubles the deposit available for trading, and many contests.

Licensing

FBS is a legitimate broker with regulations from respected authorities. The company that owns the EU branch of FBS is regulated by the cyprus securities and exchange commission (cysec). The global branch is regulated by the international financial services commission of belize (IFSC).

In the EU, the broker also offers negative balance protection to retail clients. Overall, we’re happy FBS is not a scam.

Note, traders from the USA cannot register for an account, though clients from most other countries are accepted, including canada, india and nigeria.

Additional features

The FBS website has an analysis section with resources including forex-related news, market updates, and a forex TV feature that displays informational videos, weekly insights, and trading plans. This broker also provides an economic calendar and forex calculators alongside extensive educational materials such as live webinars and tutorials.

Copy trading

The copytrade solution from FBS lets beginners replicate the success of top traders with secure, flexible trading tools. Clients can use the user-friendly mobile app to compare traders, allocate funds and create a unique trading portfolio.

Trading accounts

New clients have the option of several live account types. In the EU, the broker offers the standard and cent accounts. The global branch additionally offers the micro, zero spread, and ECN account. Order volumes are the same across account types. The ECN account has no trading limits and market execution is by ECN, unlike the other accounts which use STP. In general, the more you can deposit the higher the account tier and the more competitive the trading requirements.

When opening an account, you’ll need to submit documents to verify your name, address and the country you’re registering from.

Pros and cons

Benefits

Advantages of trading with FBS include:

- MT4 and MT5 integration

- Ultra-low minimum deposits

- Competitive zero-pip spreads

- Range of promotions & deposit bonuses

Drawbacks

Bad areas flagged in our review include:

- Fewer account and trading options in the EU

- Commissions payable on many trade types at the global firm

Trading hours

The FBS broker website is available at all times. Opening hours for each asset depends on the market and timezone, but forex runs 24 hours a day on weekdays. The broker also provides a virtual private server (VPS) service, which allows the client to keep their trading platform on a virtual machine 24/7.

Customer support

Customer support is available in english, spanish, portuguese, french, german and italian:

- Email – info@fbs.Eu

- Live chat – logo in bottom right

- Contact number – +357 25313540

- Address – vasileos georgiou A 89, office 101, potamos germasogeias 4048, limassol, cyprus

Global

Contact options including live chat, callback, and whatsapp are available on the global website.

Trader safety

FBS ensure client personal information and privacy is safeguarded. Transactional information is also protected using transport layer security (TLS). The metatrader platforms also offer dual-factor authentication at the login stage for added security.

FBS verdict

FBS is an international forex broker that offers low minimum deposits and a variety of trading accounts with MT4 and MT5 integration, alongside the FBS trader app. Spreads are competitive, and both novice and advanced traders will feel at home with this broker.

Accepted countries

FBS accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use FBS from united states, japan, canada, myanmar, brazil, israel, iran.

Where is FBS regulated?

This broker is regulated in the EU by the cyprus securities and exchange commission (cysec) and elsewhere by the international financial services commission of belize (IFSC).

Is FBS a good broker?

FBS is a legitimate broker and not a scam. It is licensed by respected financial authorities and has positive online reviews.

Does FBS offer any bonuses?

The global branch of FBS offers 100% deposit bonuses and promotions where no deposit is required. This broker also offers trader contests and a VPS service.

What is the minimum deposit at FBS?

Clients can open an account with $1 at the global branch and $10 in the EU. The greater the initial deposit, the tighter the spreads and more advanced the trading tools.

What platforms does FBS offer?

FBS has both MT4 and MT5 platforms, which are available on any browser and as mobile apps. This broker also offers FBS trader, an in-house mobile application.

Does the FBS broker have trading on nas100?

Yes, clients can trade on the NASDAQ and three other major indices, including the S&P 500, dax30, and dow jones.

Review

Introduction

FBS is an international online trading brokerage that was launched out of belize back in 2009. Since their establishment, FBS have expanded their trading services to over 190 countries around the world and now service 8,000,000 traders and 315,000 partners across the globe and supports 17 different languages. The brokerage provides a simple and easy trading experience with a selection of trading platforms and wide array of tradeable instruments.

FBS is obviously a successful online trading brokerage and have won countless awards since their establishment in 2009. Some of their most notable awards include; best FX IB program, best FX broker indonesia, best forex broker southeast asia, best forex broker thailand, and best international forex broker. As well, FBS has won many other awards for various reasons.

Not only has the FBS brokerage seen great success, but they also provide safe and reliable online trading services to their clients. FBS is licensed and regulated by the international financial services commission (IFSC) of belize with license number IFSC/60/230/TS/18.

Trading conditions

The FBS online trading brokerage is very accepting and supportive of nearly every type of trader. FBS offers their clients the choice between 6 different trading accounts, each with slight differences to better suit their needs. Overall, the trading conditions outlined in these accounts vary but are very favourable. See the trading accounts and their trading conditions overviewed below.

- Deposit from $1.00

- Floating spreads

- Zero commission trading

- Up to 1:1000 leverage

- Market execution

- Deposit from $5.00

- Fixed spreads

- Zero commission trading

- Up to 1:3000 leverage

- Market execution

- Deposit from $100

- Floating spreads

- Zero commission trading

- Up to 1:3000 leverage

- Market execution

- Deposit from $500

- Fixed spreads

- Zero commission trading

- Up to 1:3000 leverage

- Market execution

- Deposit from $500

- Floating spreads

- Zero commission trading

- Up to 1:500 leverage

- Market execution

- Deposit from $1000

- Floating spreads

- Zero commission trading

- Up to 1:500 leverage

- ECN execution

Products

The FBS trading brokerage features a wide array of tradeable instruments across the global markets for their clients to trade. For instance, traders can participate in the trading of over 35 forex currency pairs, 4 precious metals, 3 cfds, and 4 cryptocurrency cfds. While the extent of tradeable assets offered is rather small compared to some brokers, the range of markets available to trade in are wide.

Regulation

FBS is not widely regulated even though they are an international online trading brokerage. The only regulatory authority governing the FBS trading brokerage is the international financial services commission (IFSC) with license number IFSC/60/230/TS/18. FBS is an offshore trading brokerage and therefore is not as reliable as some brokers. FBS’s headquarters are located at no.1 orchid garden street, belmopan, belize, C.A.

Platforms

The FBS online trading brokerage provides their clients with the choice between two of the most highly sought-after trading platforms, the metatrader 4 (MT4) and the metatrader 5 (MT5) trading platforms. Both these platforms are highly advanced and sophisticated while at the same time very user-friendly and easy to use.

The metatrader platforms offered by FBS consist of both the webtrader platforms and the downloadable platforms. All platforms are fully compatible with windows, mac, and linux operating systems as well as multiple web browsers for the web-based versions.

All in all, both the MT4 and MT5 trading platforms offered are relatively the same. The main difference between the two is that the MT5 trading platform has an upgraded trading interface, a few additional features, and is more suitable for the trading of all financial assets other than forex. Therefore, traders looking to participate solely in the forex markets will choose the MT4 platform and traders more focused on a wider variety of markets will choose the MT5 platform.

Both platforms feature auto trading functionality with expert advisors (eas) as well as a sophisticated charting package with three chart types, over 50 technical indicators, and a variety of drawing and analysis tools.

Mobile trading

Both the MT4 and MT5 trading platforms offered by FBS feature downloadable mobile trading applications for both ios and android mobile devices. The mobile trading app can be downloaded from the apple app store and the google play store for free. The trading apps are fully optimized for the mobile screen and feature all the same functionality as the desktop platforms. As well, traders wanting to use the FBS website on a mobile device can, as it has been optimized to work on mobile devices too.

Pricing

The FBS trading brokerage is accepting of all experience levels of traders and therefore provides trading accounts with minimum deposits from as low as $1.00 and professional ECN trading accounts with minimum deposits from $1,000. As for the available spreads, FBS provides floating spreads as low as 0.2 pips, fixed spreads as low as 3 pips, and trading without spread, but with a commission starting from $20. All in all, the spreads and commissions offered by FBS are quite favourable and competitive with the industry standards.

Deposits & withdrawals

FBS provides their traders with an extensive array of deposit and withdrawal options with a total of 72. All methods of deposit are free of charge and withdrawals have varying commissions depending on the method used.

Deposits via the most popular e-wallets and credit cards are instant, and all other methods take between 15 – 20 minutes or a maximum of 48 hours to complete. Withdrawals generally take between 15 – 20 minutes or a maximum of 48 hours to complete and come with a small commission for most methods.

See below, a list of the most popular deposit and withdrawal methods.

- Visa/mastercard

- Neteller

- Skrill

- Bitcoin by skrill

- Perfectmoney

- Mybitwallet

- OKPAY

- Astropay

Customer support

The level of customer care and support provided by FBS is truly phenomenal. Traders can reach support representatives 24 hours a day, 7 days a week via email, live chat, telegram, wechat, and telephone with multiple international numbers. Also, clients can schedule a call back if they prefer not to wait. However, support representatives are generally quick to respond and friendly with their responses. Additional methods of support include an extensive FAQ page and interaction via various social media channels.

Research & education

FBS provides their traders with a comprehensive education and research centre that’s packed with educational resources and content. For instance, traders have access to market analytics such as forex news, daily market analysis, and forex tv. They also have access to trader tools including an economic calendar, central bank rates, and forex calculators. As for educational material, traders are provided with a forex guidebook, tips for traders, webinars, video lessons, seminars, and a glossary. All in all, we were very impressed with the extent of educational content and market research resources.

Noteworthy points

The FBS trading brokerage is highly successful and has an excellent reputation in the online trading industry. Therefore, the brokerage has various noteworthy points worth mentioning. For instance, FBS stands above the rest of online trading brokerages in the following areas.

- Extent of deposit and withdrawal options.

- Variety of educational content and resources.

- Exceptional selection of trading platforms.

Conclusion

The FBS online trading brokerage is a widely used international forex and cfds trading brokerage that features an array of tradeable assets across the global markets. FBS is an offshore trading brokerage which raises some concerns, however, they have an excellent reputation and are licensed and regulated by the IFSC. FBS is supporting of all types and experience levels of traders and offers them favourable trading conditions and low commissions and fees. Traders at FBS have an excellent selection of trading platforms to choose from and can trade a variety of financial assets with all the tools and features necessary to succeed. All in all, FBS is a solid online trading brokerage and could be the right broker for you.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

Use this guide to deposit your FBS account via perfect money in a flash

Discover the easiest way to deposit your FBS account and get quick withdrawal with perfect money

For sure, you can deposit your FBS account using a credit card, but bank systems in its modern interpretation is too conservative and slow, and also greatly influenced by the political situation in the world, which impacts the speed of transactions.

Follow the detailed instruction below to deposit your account safely and easily via perfect money:

1. Log in to your FBS ‘personal area’ and select the ‘deposit funds’ option in ‘financial operations’ section.

2. Choose ‘perfect money’ from the list of displayed payment methods and proceed to deposit details.

3. Enter your account number and the amount of your deposit. Select EUR or USD for the currency - this is the currency of your perfect money account. Then click ‘deposit account’.

4. You will be redirected by the secured connection of “perfect money” payment system. To proceed with your deposit, select ‘perfect money account’ and click on ‘make payment’ to authorize the payment, enter your perfect money member ID, password and captcha. Then click on ‘preview payment’.

5. Perfect money will send you a PIN code to authorize your payment. The PIN code will be sent to your e-mail or phone, depending on your settings. Enter the PIN code in the provided slot and click ‘confirm’.

6. On the next page, review the deposit details and click ‘confirm payment’. You’re all set!

Special bonus for traders in myanmar. FBS will add 5% to each deposit made with perfect money.

FBS broker minimum deposit tutorial and payment methods

FBS is an international forex and CFD broker that serves clients from over 190 countries. Since 2009, it has proven and demonstrated excellence as evidenced in its numerous prestigious awards and the number of partnerships and endorsements the broker has been able to bag. It has its main headquarters in belize and other headquarters in cyprus as well as in the marshall islands.

This means that it is a european broker. Being a european derivatives broker subjects a broker to thorough regulation and supervision by designated authorities. In just a short time of operations, FBS has been able to bag numerous awards – over 40 to be precise. Particularly, it has been awarded for transparency and great customer service. It has also been noted to be one of the most beloved brands in the forex brokerage space.

In this article, we want to discuss the minimum deposit when opening an account with FBS. We will show you all the details and payment methods.

FBS broker deposit methods

Facts about the FBS minimum deposit:

- The minimum deposit is at least $ 1

- The minimum deposit is depending on the account type

- Multiple payment methods are available

- Instant deposits

- No fees for deposits

(risk warning: your capital can be at risk)

Payment methods for the minimum deposit

To deposit funds into a live trading account, FBS offers a range of the most convenient payment options, featuring over 100 payment systems. The payment systems are depending on your country of residence. For example, people in europe can not use unionpay but chinese people can do it. They are neatly grouped into:

- Wire transfer

- E-wallets such as skrill and neteller.

- Bank cards such as mastercard and visa.

However, this might be applicable for FBS international only, since the EU regulator puts in place a strict money transfer policy.

The most popular deposit methods with FBS:

- Credit cards

- Neteller

- Sticpay

- Skrill

- Perfect money

- Bank transfer

Are there fees for minimum deposits?

FBS does not charge any fees when you are depositing money. Most payment methods are for free. From our research, sticpay is the only method where fees of 2,5% + $0.3 commission apply.

What is the FBS minimum deposit?

FBS offers multiple account types. For the live account, we have the cent account and the standard account. Each has its own features and perks. As for the minimum deposit amount, FBS allows trading through cent account only with 10$ at the start, which is a fantastic option for beginner traders. Standard account, on the other hand, requires a deposit of 100$ initial deposit.

- Cent account – $ 1 minimum deposit – best for beginners with small amounts of money

- Micro account – $ 5 minimum deposit – best for beginners

- Standard account – $ 100 minimum deposit – average trading account

- Zero spread account – $ 500 minimum deposit – best for news trading

- ECN account – $ 1000 – best trading account overall

On our page FBS account types, we compared the trading accounts in detail. You should visit it before signing up.

(risk warning: your capital can be at risk)

FBS regulation and safety of customer funds

As mentioned, being a european broker subject a trader to some thorough regulation that they have to adhere to. As such, FBS is a heavily licensed and regulated broker – and it is registered under numerous jurisdictions. It is licensed by the cyprus securities and exchange commission (cysec), one of the most prominent and trusted regulators of derivatives brokers which has been known to be thorough in its supervisory activities with forex, cfds, and binary options brokers.

It is as well registered under the international financial service commission, which is the financial regulatory authority of belize. By far, the most important point in this is the fact that by being a european broker, FBS is subjected to the markets in financial instruments directive (mifid). The mifid is the european union (EU) regulation that oversees and supervises the work of financial brokers. Mifid puts brokers under heavy regulation to comply with strict guidelines and rules.

For one, under no circumstance can the broker breach any terms of agreement against the trader. If they do so and the broker makes that known to the authorities, not only will the broker be fined, but it also has to compensate the trader. Such compensation can be very heavy at times. Furthermore, one of the regulations is that the broker must keep the funds deposited by traders separate from its own internal running funds. In fact, authorities expect that brokers keep such funds with third parties. Hence, if there is an issue with the broker, especially as regards insolvency or bankruptcy, the traders will not be affected. Nothing will happen to the traders’ funds. In fact, mostly they will have their funds given back to them.

If these do not convince anyone, one fact that proves the credibility of FBS is the partnerships that it has developed. FBS is the official trading partner of the barcelona football club. Popularly referred to as FC barca, barcelona FC is one of the biggest football clubs not only in spain and europe but in the entire globe. Both on the pitch and away from the pitch, barcelona FC is huge. It features some of the world’s very best players. It is also one of the richest clubs. All these confirm the authenticity of FBS as a broker.

FBS is FC barcelona sponsor

However, some facts are notable. One of the downsides to trading with FBS is that it operates in the form of a double entity. This means that it somewhat offers different services to different people. The services that FBS offers to traders in the EU area are also somewhat different from the ones that it offers to traders in other parts of the world. As such, it appears we have FBS europe and FBS international. However, this is not due to any faults of the broker. Signing up to be an EU-registered broker makes them liable to a lot of regulations. They have a lot of restrictions as to which type of services they can offer to traders. Many of such offers, however, cannot offer to traders from other parts of the world.

What you get when you trade with FBS

FBS offers traders a lot of premium services that you may not find with other brokers. They include:

- Better and much bigger leverage

Leverage is one of the most wonderful concepts in forex trading. In forex trading, it means borrowing to add to your trading account so that you can take more risks and take more trading positions. Normally, entering positions and trading in the financial markets is quite expensive. It is not for the average individual trader. For instance, investing in a stock like amazon might require a trader putting up at least $2,400 per share.

To trade gold (XAU/USD), you need to put up a similar amount. This is just for one single unit. Most traders cannot put up with this amount to trade. The concept of leverage however comes to their rescue. In essence, their broker assists them by helping them increase the power of their trading capital via leverage. FBS provides its traders in the EU with leverage as high as 1:30 for trading major currencies. Although this is small, it is entirely due to caps placed by EU regulators.

However, the case is entirely different for international traders. FBS offers leverage as high as 1:1000 and even 1:3000 in some cases. This gives traders all the space in the world to carry out trades and take up risks which can lead to more bountiful profits. However, as high leverage can benefit a trader, it can also hurt a trader’s account substantially.

- Social trading

Social trading involves copying the trades of other experienced and veteran traders directly. Social trading was one of FBS’s creations to help traders start earning from the day they start trading by copying others. It saves them a lot of stress and time that would have been spent learning.

Trading platforms

FBS provides traders access to trading via multiple channels. They include the popular metatrader4 and its more advanced version, the metatrader5. However, traders can also choose to go for the proprietary trading software known as the FBS trader.

All the above platforms are accessible via web trading and mobile apps on the google play and apple app stores.

FBS online trading platform

Web trading

Web trading is very comfortable since you don’t need to download or install any software. You simply login online through a browser and you start to trade instantly. You can access both the MT4/MT5 and the FBS trader via web trading.

MT4/MT5

MT4 delivers a wealth of features, advanced charting, and customization along with auto-trading capabilities while being available for PC/ mac, android, and ios devices. In addition to the stellar features and functions of the MT4, you can enjoy daily technical and fundamental analysis data that is made available in the news section. Other features include over 50 technical indicators, one-click trading, the possibility to create and use eas with no limitations, and even trade with VPS service support.

Moreover, in case you will be trading with FBS international, you will be offered access to the upgraded version, the metatrader5. This comes with more capabilities, features, and opportunities.

FBS trader

FBS trader functions as a copytrade app for social trading platform. It allows the following trading professionals or strategies, which is a great option for beginner traders to learn and earn.

Available markets

FBS gives you access to many markets to trade cfds. However, the range of instruments is still rather limited as there are around 40 currency pairs including exotic ones that are offered and 6 indices based on CFD trading, along with metals and energies. If you prefer trading stocks, futures, or many other instruments, FBS does not provide those.

FBS customer support

We have to note that FBS provides top-notch customer support services. Highlights of their customer support services include 24/7 accessibility via any of live chat, international phone lines, email, or even social media. FBS customer support gives relevant and quick answers to questions and concerns and they are definitely client-oriented.

Conclusion on the FBS minimum deposit

FBS is undoubtedly one of the best online brokers out there and one that you would really want to do business with. We have to note that its minimum required deposit, especially for the cent account, is a very trader-friendly one, when you consider the services offered. It is one of the lowest you find amongst quality forex brokers.

(risk warning: your capital can be at risk)

Trade for glory

FBS - official trading partner of FC barcelona

- Transparent registration conditions

- Daily analytics and free educational materials

- Multiple methods for deposits and withdrawals

- Easy trading options both for beginners and experts

Over 10 years of expertise

We share experience and educate clients

We solve your issues and collect feedback

Increased leverage 1:500 for professionals

Fast deposit and withdrawal

Join to work your money fast and easy

Open account

For experienced market players making their way to forex heights

For beginners who want to trade real funds without risking too much.

Perfectly suits those who are starting their way to success on forex

For cautious traders who want to test their trading skills and tools on small virtual funds

Your capital is at risk. We protect you with negative balance protection.

Choose your payment system

Be armed with the latest news

Trading schedule changes due to martin luther king, jr. Day

FBS acquired the FBS banking trademark

Cable takes another peek above 1.3700

USD/CHF: a bullish breakthrough

Risk-on momentum remains strong

Lots and lots of pmis on friday

Market outlook for this week

Risk warning: 74% of retail accounts lose money when trading ᏟᖴᎠs with this provider. ᏟᖴᎠ's are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how ᏟᖴᎠ's work and whether you can afford to take the high risk of losing your money. Please refer to our risk acknowledgement and disclosure

The website is owned and operated by tradestone limited (address: 89, vasileos georgiou street, 1st floor, office 101, potamos germasogeias, 4048 limassol, cyprus), registration number HE 353534, authorized by cyprus securities and exchange commission, license number 331/17.

Trade forex, cfds, stocks and metals with honest broker

For newbies, risks are 100 times lower

Highest honest leverage on market

Wide payment systems geography

Feel free to choose any account type you like!

For experienced market players making their way to forex heights

Perfectly suits those who are just starting on their way to success on forex

Ideal for those who want to calculate their profit precisely

Designed for those who prefer trading at the fastest speed

For those who want to feel the full power of trading with ECN technologies

To grow your confidence, train your trading skills on a demo account.

Deposit with your local payment systems

Be armed with the latest news

FBS new year promo results

FBS runs a christmas charity event in brazil

Dreams come true winner gets a motorcycle to help him and his students commute

Cable takes another peek above 1.3700

USD/CHF: a bullish breakthrough

Should you buy apple in 2021?

Lots and lots of pmis on friday

Market outlook for this week

FBS at social media

Contact us

- Zopim

- Wechat

- Fb-msg

- Viber

- Line

- Telegram

The website is operated by FBS markets inc.; registration no. 119717; FBS markets inc is regulated by IFSC, license IFSC/000102/124; address: 2118, guava street, belize belama phase 1, belize

The service is not provided in the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran

Payment transactions are managed by НDС technologies ltd.; registration no. HE 370778; address: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

For cooperation, please contact us via support@fbs.Com or +35 7251 23212.

Risk warning: before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the internet resources of any materials from this website is possible only upon written permission.

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

Review

Introduction

FBS is an international online trading brokerage that was launched out of belize back in 2009. Since their establishment, FBS have expanded their trading services to over 190 countries around the world and now service 8,000,000 traders and 315,000 partners across the globe and supports 17 different languages. The brokerage provides a simple and easy trading experience with a selection of trading platforms and wide array of tradeable instruments.

FBS is obviously a successful online trading brokerage and have won countless awards since their establishment in 2009. Some of their most notable awards include; best FX IB program, best FX broker indonesia, best forex broker southeast asia, best forex broker thailand, and best international forex broker. As well, FBS has won many other awards for various reasons.

Not only has the FBS brokerage seen great success, but they also provide safe and reliable online trading services to their clients. FBS is licensed and regulated by the international financial services commission (IFSC) of belize with license number IFSC/60/230/TS/18.

Trading conditions

The FBS online trading brokerage is very accepting and supportive of nearly every type of trader. FBS offers their clients the choice between 6 different trading accounts, each with slight differences to better suit their needs. Overall, the trading conditions outlined in these accounts vary but are very favourable. See the trading accounts and their trading conditions overviewed below.

- Deposit from $1.00

- Floating spreads

- Zero commission trading

- Up to 1:1000 leverage

- Market execution

- Deposit from $5.00

- Fixed spreads

- Zero commission trading

- Up to 1:3000 leverage

- Market execution

- Deposit from $100

- Floating spreads

- Zero commission trading

- Up to 1:3000 leverage

- Market execution

- Deposit from $500

- Fixed spreads

- Zero commission trading

- Up to 1:3000 leverage

- Market execution

- Deposit from $500

- Floating spreads

- Zero commission trading

- Up to 1:500 leverage

- Market execution

- Deposit from $1000

- Floating spreads

- Zero commission trading

- Up to 1:500 leverage

- ECN execution

Products

The FBS trading brokerage features a wide array of tradeable instruments across the global markets for their clients to trade. For instance, traders can participate in the trading of over 35 forex currency pairs, 4 precious metals, 3 cfds, and 4 cryptocurrency cfds. While the extent of tradeable assets offered is rather small compared to some brokers, the range of markets available to trade in are wide.

Regulation

FBS is not widely regulated even though they are an international online trading brokerage. The only regulatory authority governing the FBS trading brokerage is the international financial services commission (IFSC) with license number IFSC/60/230/TS/18. FBS is an offshore trading brokerage and therefore is not as reliable as some brokers. FBS’s headquarters are located at no.1 orchid garden street, belmopan, belize, C.A.

Platforms

The FBS online trading brokerage provides their clients with the choice between two of the most highly sought-after trading platforms, the metatrader 4 (MT4) and the metatrader 5 (MT5) trading platforms. Both these platforms are highly advanced and sophisticated while at the same time very user-friendly and easy to use.

The metatrader platforms offered by FBS consist of both the webtrader platforms and the downloadable platforms. All platforms are fully compatible with windows, mac, and linux operating systems as well as multiple web browsers for the web-based versions.

All in all, both the MT4 and MT5 trading platforms offered are relatively the same. The main difference between the two is that the MT5 trading platform has an upgraded trading interface, a few additional features, and is more suitable for the trading of all financial assets other than forex. Therefore, traders looking to participate solely in the forex markets will choose the MT4 platform and traders more focused on a wider variety of markets will choose the MT5 platform.

Both platforms feature auto trading functionality with expert advisors (eas) as well as a sophisticated charting package with three chart types, over 50 technical indicators, and a variety of drawing and analysis tools.

Mobile trading

Both the MT4 and MT5 trading platforms offered by FBS feature downloadable mobile trading applications for both ios and android mobile devices. The mobile trading app can be downloaded from the apple app store and the google play store for free. The trading apps are fully optimized for the mobile screen and feature all the same functionality as the desktop platforms. As well, traders wanting to use the FBS website on a mobile device can, as it has been optimized to work on mobile devices too.

Pricing

The FBS trading brokerage is accepting of all experience levels of traders and therefore provides trading accounts with minimum deposits from as low as $1.00 and professional ECN trading accounts with minimum deposits from $1,000. As for the available spreads, FBS provides floating spreads as low as 0.2 pips, fixed spreads as low as 3 pips, and trading without spread, but with a commission starting from $20. All in all, the spreads and commissions offered by FBS are quite favourable and competitive with the industry standards.

Deposits & withdrawals

FBS provides their traders with an extensive array of deposit and withdrawal options with a total of 72. All methods of deposit are free of charge and withdrawals have varying commissions depending on the method used.

Deposits via the most popular e-wallets and credit cards are instant, and all other methods take between 15 – 20 minutes or a maximum of 48 hours to complete. Withdrawals generally take between 15 – 20 minutes or a maximum of 48 hours to complete and come with a small commission for most methods.

See below, a list of the most popular deposit and withdrawal methods.

- Visa/mastercard

- Neteller

- Skrill

- Bitcoin by skrill

- Perfectmoney

- Mybitwallet

- OKPAY

- Astropay

Customer support

The level of customer care and support provided by FBS is truly phenomenal. Traders can reach support representatives 24 hours a day, 7 days a week via email, live chat, telegram, wechat, and telephone with multiple international numbers. Also, clients can schedule a call back if they prefer not to wait. However, support representatives are generally quick to respond and friendly with their responses. Additional methods of support include an extensive FAQ page and interaction via various social media channels.

Research & education

FBS provides their traders with a comprehensive education and research centre that’s packed with educational resources and content. For instance, traders have access to market analytics such as forex news, daily market analysis, and forex tv. They also have access to trader tools including an economic calendar, central bank rates, and forex calculators. As for educational material, traders are provided with a forex guidebook, tips for traders, webinars, video lessons, seminars, and a glossary. All in all, we were very impressed with the extent of educational content and market research resources.

Noteworthy points

The FBS trading brokerage is highly successful and has an excellent reputation in the online trading industry. Therefore, the brokerage has various noteworthy points worth mentioning. For instance, FBS stands above the rest of online trading brokerages in the following areas.

- Extent of deposit and withdrawal options.

- Variety of educational content and resources.

- Exceptional selection of trading platforms.

Conclusion

The FBS online trading brokerage is a widely used international forex and cfds trading brokerage that features an array of tradeable assets across the global markets. FBS is an offshore trading brokerage which raises some concerns, however, they have an excellent reputation and are licensed and regulated by the IFSC. FBS is supporting of all types and experience levels of traders and offers them favourable trading conditions and low commissions and fees. Traders at FBS have an excellent selection of trading platforms to choose from and can trade a variety of financial assets with all the tools and features necessary to succeed. All in all, FBS is a solid online trading brokerage and could be the right broker for you.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

So, let's see, what we have: discover the FBS minimum deposit needed to open an account, and the best way to do it, depending on base currencies, funding methods and bonuses. At fbs deposit methods

Contents of the article

- New forex bonuses

- FBS minimum deposit guide (2021)

- FBS account base currency

- FBS funding and deposit methods

- FBS minimum deposits

- FBS deposit bonus

- FBS fee for deposit and withdrawal

- FBS review and tutorial 2021

- History & headlines

- Trading platforms

- Markets

- Trading fees

- FBS leverage

- Mobile apps

- Payments

- Demo account review

- Trading bonuses

- Licensing

- Additional features

- Trading accounts

- Pros and cons

- Trading hours

- Customer support

- Trader safety

- FBS verdict

- Accepted countries

- Where is FBS regulated?

- Is FBS a good broker?

- Does FBS offer any bonuses?

- What is the minimum deposit at FBS?

- What platforms does FBS offer?

- Does the FBS broker have trading on nas100?

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- Use this guide to deposit your FBS account via...

- FBS broker minimum deposit tutorial and payment...

- Payment methods for the minimum deposit

- Are there fees for minimum deposits?

- What is the FBS minimum deposit?

- FBS regulation and safety of customer funds

- What you get when you trade with FBS

- Trading platforms

- Web trading

- MT4/MT5

- FBS trader

- Available markets

- FBS customer support

- Conclusion on the FBS minimum deposit

- Trade for glory

- Open account

- Choose your payment system

- Be armed with the latest news

- Trade forex, cfds, stocks and metals with honest...

- Feel free to choose any account type you like!

- Deposit with your local payment systems

- Be armed with the latest news

- Data collection notice

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.