Octafx malaysia

Octafx forex broker ensures reliable forex trading conditions to provide traders of all skill levels with an opportunity to earn more.

New forex bonuses

This is possible due to: octafx - one of the best forex brokers on the market, for traders all round the world. Octafx offers access to CFD trading, commodity trading and indices trading with award-winning forex trading conditions. As well as access to the forex market, octafx offers a variety of promotions that can help you:

Octafx malaysia

- Language support: bengali, chinese, english, hindi, indonesian, malay, portuguese, spanish, thai

- Create trading accounts, modify leverage, enable swap-free options, edit and restore passwords

- Make deposits and withdrawals using the most popular payment options

- View your detailed overall or account operation history, apply convenient filters to it and cancel your previous deposit

- Start trading in a compatible trading platform app

- Top up your demo account

- View contest statistics and access your contest accounts

- Activate bonuses and view statistics on active and completed bonuses

get it on

Forex trading accessibility for everyone

Octafx - one of the best forex brokers on the market, for traders all round the world. Octafx offers access to CFD trading, commodity trading and indices trading with award-winning forex trading conditions. As well as access to the forex market, octafx offers a variety of promotions that can help you:

50% bonus on deposit

Negative balance protection

Why choose forex trading with octafx

Octafx forex broker ensures reliable forex trading conditions to provide traders of all skill levels with an opportunity to earn more. This is possible due to:

- No commissions on deposits and withdrawals

- No swaps

- No slippage

- No delays

Octafx review 2021

Octafx is a low cost cysec regulated forex broker that is popular in malaysia. Their trading fees is low & support is good too, but have limited number of trading instruments. Read our review to decide if you should choose them or not?

Regulated by: cysec, FSA

Headquarters: st. Vincent and grenadine

Foundation year: 2011

Octafx is a popular STP forex broker that has been operating since 2011 & accepts traders from malaysia. More than 1.5 million trading accounts have been registered with them globally.

Octafx offers three different kinds of trading accounts and the fees that it charges depends on the type of account. Users have the option of using the metatrader 4, metatrader 5, or ctrader trading platforms. Octafx is relatively less regulated than other comparable brokers and holds licenses from tier-2 cysec and offshore regulator st. Vincent & grenadine authorities.

Compared to other brokers, octafx offers limited range of instruments including 28 currency pairs & 10+ cfds on commodities, cryptocurrencies, indices. But they offer copytrading feature.

In this octafx malaysia review, we’ve compared every pros & cons, and everything you need to know about octafx before choosing them.

- Octafx is a STP broker, and they charge low fees overall without any hidden fees.

- Negative balance protection is available at octafx malaysia

- Chat support available in bahasa malay & english.

- Offers choice between MT4, MT5 and ctrader trading platforms for mobile, desktop & web.

- Islamic account is available at octafx.

- Not well-regulated. Only with 1 top tier regulator cysec.

- There is no local phone number for support in malaysia.

- Fewer currency pairs, and very few CFD trading instruments offered compared to other competing brokers.

Octafx malaysia – A quick look

| �� our verdict | #1 forex broker in malaysia |

| �� broker name | octafx malaysia |

| �� typical EURUSD spread | 0.7 pips (with micro MT4 account) |

| �� year founded | 2011 |

| �� website | https://www.Octafxmy.Com/ |

| �� minimum deposit | $100 |

| ⚙️ maximum leverage | 1:500 |

| ⚖️ regulation | cysec, FSA |

| ��️ trading instruments | 28 currency pairs, 10+ cfds on indices. Cryptos, metals |

| �� trading platforms | MT4, MT5, ctrader for desktop, web & mobile |

Is octafx malaysia safe?

Octafx is regulated by one tier-2 financial regulator which is less trusted than other comparable brokers. However, being licensed to operate by fewer financial authorities does not automatically mean that octafx is not a safe broker. They have been operating since 2011 and have a proven track record.

Octafx is regulated and authorized under following regulators:

Octafx is registered with the cysec of cyprus under name ‘octa markets cyprus ltd’ – which is authorized and regulated by cysec with license no. 372/18.

Is octafx a safe forex broker for malaysian traders? Yes, would be our short answer.

It is also worth mentioning that octafx also maintains other security procedures to enhance the safety of traders. These practices include segregation of funds, anti-money laundering policies, and negative balance protection.

Octafx is less well-regulated than other comparable brokers, however, they have been in operation since 2011 and are trusted by thousands of users worldwide.

Octafx malaysia fees

The fees and commission that a trader is charged at octafx depend on a variety of factors – such as which type account is being used, when the trade is being made, and which instrument is being traded.

However, traders can get an idea of how much fees octafx malaysia charges by using a few benchmark examples.

Here is a breakdown of trading fees at octafx malaysia:

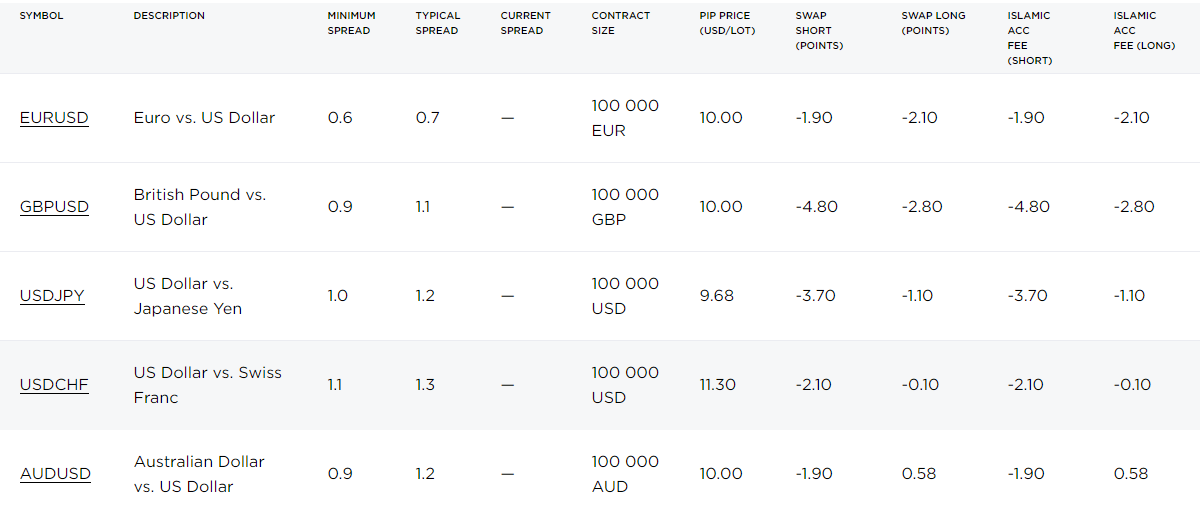

Low typical spread – the minimum spread that is charged at octafx is the lowest for those trading through the ECN ctrader account. However, the average or typical spread that is charged is nearly the same for all three accounts.For a trader using the micro MT4 account, the typical spread charged for trading the benchmark EURUSD currency pair is 0.7 pips.

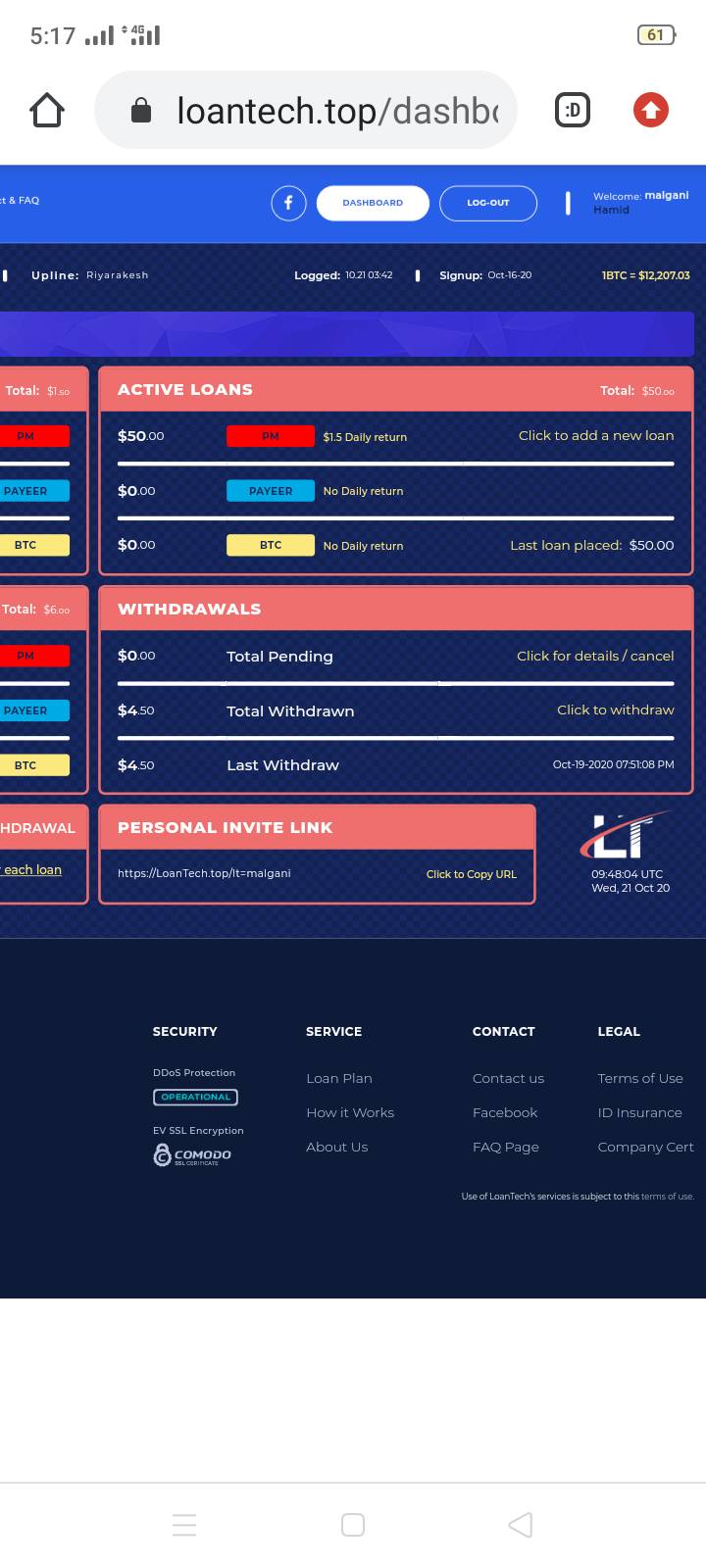

Below screenshot of table from their website shows the fees with their metatrader 4 account.

The spread that they charge quite competitive when compared to other similar brokers like exness & XM.

In addition to a spread, octafx also charges swap rates. But there is no commission with islamic account, although the overall fees that they charge for islamic accounts is similar to the other types of accounts.

Overall, octafx does not charge a any hidden fees that we noticed. Plus they have an option to open islamic account for swap free trading. We found that octafx are an affordable forex broker.

Octafx bonus

For new account openers, octafx offers a 50% deposit bonus & this offer is available to traders in malaysia.

But to withdraw the bonus funds, you need to trade half the number of standard lots equal to the bonus that you receive.

Octafx deposit and withdrawal

Octafx offers a variety of deposit and withdrawal methods for traders in malaysia.

The following deposit funds options are available at octafx malaysia

- Local bank deposit: traders in malaysia can make a deposit through their local bank in their octafx account. Normally the funds are tracked & added within the same business day.

- Credit/debit card: they also have the option of making deposits through their debit or credit cards.

- Ewallets: additionally, a variety of payment wallets are also accepted for making deposits and withdrawals. Octafx accepts deposits via ewallets like skrill & netteller. The funds added using this method are added within few minutes.

- Bitcoin: octafx also allows you to make your deposit using cryptocurrencies like bitcoin.

Octafx does not charge any deposit or withdrawal fees which makes it highly attractive to open an account with them.

Octafx account types

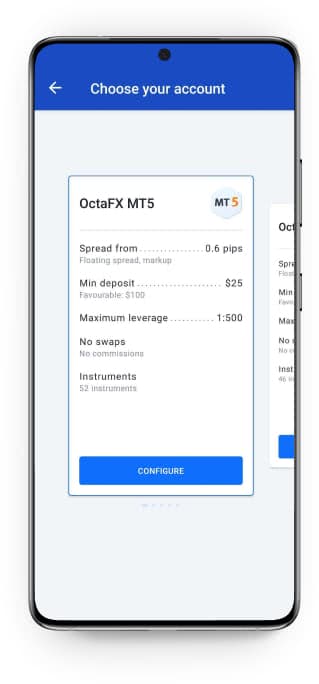

Octafx offers 3 different types of accounts and each of them are suitable for different kinds of traders. They recommend the micro MT4 account for beginner or novice traders, the pro MT5 for experienced traders, and the ECN ctrader account for progressive traders.

The minimum deposit at octafx malaysia is $100 with their micro metatrader 4 account. The base currency of all types of accounts can be either EUR or USD for all types of accounts for malaysian traders.

In this section, we will be discussing the different account types as applicable to malaysian traders since the terms and conditions may differ from jurisdiction to jurisdiction.

1. Octafx micro account – the trading platform that is available for this type of account is metatrader 4. The floating spread for this type of account starts at 0.4 pips. They do not charge a commission when trading through this type of account.

A trader has the option of choosing between 28 currency pairs, gold and silver, 5 cryptocurrencies, and different indices. For currencies, a trader gets a leverage of 1:500. Swaps are optional.

2. Octafx pro account – pro users can trade through the metatrader 5 trading platform. The floating spread starts from 0.2 pips. They do not charge a commission. The recommended minimum deposit is USD 500.

You can trade between 28 currency pairs, gold and silver, 2 energy, 10 indices, and 5 cryptocurrencies. For currencies, they offer a leverage of 1:200. This account type does not offer swaps.

3. Octafx ECN account – ECN account users can trade through the ctrader trading platform. The floating spread starts at 0.4 pips. They charge a commission when trading through an ECN account. The recommended minimum deposit is USD 100.

Traders have the option of trading between 28 currency pairs and gold and silver. The instruments available is quite limited for an ECN account. Traders can get a leverage of 1:500 for trading currency pairs and 1:200 for trading gold and silver. No swaps are available.

Octafx trading instruments

The availability of instruments depends on the type of account that is being used. The pro MT5 account type offers the wides range of instruments to trade while the ECN ctrader account offers the least number of options.

Through octafx, you have the option of trading 28 currency pairs, gold and silver, 2 energy instruments, 10 different indices, and 5 different cryptocurrencies.

The leverage that is offered depends on the type of account and the type of instrument that is being traded.

Octafx trading platforms

With octafx, you can trade using your mobile, web browser, or desktop regardless of the trading platform. FXTM uses popular third-party software to allow you to conduct your trades.

For micro account users, metatrader 4 is available.

For pro account users, metatrader 5 is available.

For ECN account users, ctrader is available.

Web trading platform – their web trading platform be used if you want to trade through your internet browser. This offers a quick and convenient way for you to access the trading platform. The web trading platform supports all popular web browsers.

Mobile platform – you can enjoy a user-friendly trading experience straight from your mobile phone. If you’re on-the-go or have a long commute then using a mobile platform can be the best choice for you.

Desktop trading platform – this is functionally and design-wise similar to the web trading platform. In the desktop version, you are offered greater functionality than the web version.

Overall, FXTM offers a standard trading experience thanks to its use of the MT4, MT5, and ctader trading platforms. They do not have a proprietary trading platform of their own, which can be an advantage if you are used to using these third-party platforms.

Octafx customer support

Octafx offers support via 3 mediums to traders in malaysia, including chat support, email or via telegram. But the best way to reach customer support for octafx is to use the live chat that is available on their website.

- Good live chat support: live chat is available in bahasa malay and english. Their live chat option was found to be highly responsive and helpful in answering our questions.

Their english chat support is available for 5 days in a week, for 24 hours. But their malay chat support is only available during day time in malaysia. - Email support is okay: in addition to live chat, you can reach out to octafx by filling the contact form on their contact page or emailing [email protected] we received a response from their team within 4 hours, which is great compared to other brokers.

- Telegram: octafx also offers option to contact them via telegram app. We did not test this support channel.

Overall, we found octafx’s malaysian support to be good. We like the fact that they have operators offering support in local language too.

Do we recommend octafx malaysia?

Yes, we do recommend octafx to traders in malaysia.

There are both pros and cons to trading through octafx, but there are more positives than negatives.

The overall fees that octafx charges is lower than most other brokers, which makes than an attractive choice for traders looking for a low-cost broker. They also do not charge any hidden fees.

The customer support offered through live chat is quick and helpful, and also available in local language. Plus, you can request a callback too.

But, many traders will find that the instruments that they offer is quite limited compared to other brokers. Also, octafx is less well-regulated than comparable brokers and is only regulated by a single tier – 1 regulator.

However, octafx has a good track record and is trusted by users across many jurisdictions. They also have separation of funds and anti-money laundering policies in place.

Overall, we believe it is safe to trade forex & cfds with octafx if you are a trader based in malaysia.

Increase your income

As an introducing broker (IB) with octafx.

Smooth daily

commission payouts

Favourable trading conditions

Transparent program with no hidden restrictions

Best market compensation

- Competitive payouts up to 12 USD/lot

- Granted flat-rate commission for all assets

- Accelerated withdrawals and transfers to clients

- Worthwhile prizes, including new cars, macbooks, fancy gala dinners, and VIP events

Superior growth

- Individualised partnerships that fit your style

- Rewarding ‘master IB program’ for further advancement

- Frequent IB contests for continued prosperity

- Award-winning trading conditions bringing larger profit through a more active client base

World-class support

- Valued manager guidance

- Accessible regional representatives

- Quality assistance 24/7

- A superb staff that speaks your language

See how much you can earn with octafx

Less than 5 active clients

Receive 1 USD/lot traded through referred clients

Commission obtained every 24 hours

Withdraw the funds or transfer it to your trading balance

From 5-14 active clients

Receive 3 USD/lot traded through referred clients

Able to enrol in our monthly reward program

From 15-29 active clients

Receive 6 USD/lot from referred clients

Earn even more additional income via our monthly reward program

From 30-59 active clients

Receive 9 USD/lot from referred clients

Up to 2,000 USD in additional monthly rewards

More than 60 active clients

More advantageous conditions

Customisable plans to help maximise profit

Understand how to thrive as an octafx IB

Join the octafx IB family by following these easy steps.

Share your

referral link

Once clients start trading, you profit daily

Check out our octafx IB community on facebook

Octafx malaysia

To win a prize you need to achieve the highest results possible across all three categories before the prize drop arrives. The traders performing best will win the main prizes. When the winners are determined, all results are reset, and all participants can start competing for the next drop.

Regardless when you enter the race, you can win.

New deposits made to your contest account do not negatively affect your current gain, can positively affect your future gain, and increase your chances in the traded volume category!

To win in the gain or profit factor categories, you need to trade well. Every profitable trade will increase your ranking. To win in the traded volume category, the amount of your balance is what mostly matters. The higher your balance, the more orders you can close and more lots you can trade.

But remember, that to win, you need to be as close to the top as possible in all three categories.

Gain = (personal funds + amount withdrawn – personal funds when deposited) / personal funds when deposited × 100%

In this equation, personal funds are the contest account’s current equity excluding bonuses, amount withdrawn is the total amount of money withdrawn from the contest account after its checking in for the prize dop or making a deposit to it, personal funds when deposited is equity of the contest account (bonus funds not included) at the moment of making a deposit to it.

If you make several deposits when competing for one prize drop, the total gain is calculated as a sum of separate gains for all timespans between deposits: gain sum = gain 1 (from initial deposit to deposit 2) + gain 2 (from deposit 2 to deposit 3) + gain N (after deposit N).

Whenever you make a new deposit to your contest account, we fix the gain that has already been made in this account before the deposit (gain 1) and then start to calculate the gain after the deposit (gain 2), until the current drop finds its winners or another deposit is made.

Example: you invested 100 USD into your contest account and claimed a 50% bonus to it (50 USD). While trading, you withdraw 50 USD to support your margin on your other account, but as you trade profitably, at the end of the day, your balance ends up to be 250 USD (including the bonus amount). In the next few weeks, you did not make any withdrawals but added 100 USD more to this account and then raised your balance to 650 USD (including the 50 USD bonus claimed to your first deposit) by the moment of summarising the results.

In this case, your gain will be calculated as a sum of four steps; bonus funds to not affect the calculations.

Step 1. You withdrew 50 USD in the course of trading, and your balance, without bonuses, is now 50 USD. Gain #1 = 0.

Step 2. You made a profit of 150 USD, you also had 50 USD of your funds + 50 USD of bonus funds on your balance. Gain #2 = 150 (profit) × 100% / 50 (your funds) = 300%.

Step 3. You added 100 USD to your balance, which became equal to 300 USD without bonuses. Gain #3 = 0%.

Step 4. You made a profit of 300 USD, you also had 300 USD of your funds on your balance. Gain #4 = 300 (profit) × 100% / 300 (your funds) = 100%.

So, your overall gain is calculated as follows: gain = 0% + 300% + 0% +100% = 400%

Profit factor = profit from trades (in USD) / loss from trades (in USD)

If you have equal results with another participant, your ranking is determined by the volume of your profitable trades—if you have greater volume, you win. If these volumes also match, you win if you obtained this profit with fewer trades.

Traded volume = total volume of all trades made during competing for one drop.

The volume of trades opened before signing up for the contest is counted in your statistics for the first prize drop you compete for.

Overall ranking = the sum of your places across all three categories in the yearly ranking - the higher the place, the smaller the number.

The winner is determined by their overall ranking being the smallest number.

If the participants have equal overall ranking, the winner is determined as follows:

1. The participant with the lowest sum of places taken in the profit factor and traded volume categories wins.

2. The participant with the highest gain wins. (if the sum of places across profit factor and traded volume matches.)

If you have spoiled your contest statistics with several unsuccessful trades, you can make a recharge and increase the odds for winning. The recharge is a reset of all previously achieved results in order to start participating in the contest anew.

In order to perform a recharge, you need to log in to your personal area, view your personal statistics, click the recharge button, and make sure the trading account’s personal funds (equity excluding bonuses) is at least 50 USD or EUR and therefore qualified for joining the contest (otherwise deposit the required amount to qualify). All previous data regarding the balance, trades, traded volume, deposits, withdrawals, losses, and profits associated with this account will stop being counted in the contest statistics after the recharge is made (this does not affect the account itself or trades being opened). The recharge does not affect your previous results, i.E. The ranking you achieved when competing for the previous drops will not reset even if a winner makes the recharge. You are entitled to use the recharge any number of times.

This will take a little time. We will contact you within seven business days after determining the winners.

Keep in mind that we run a background check on the winners, their legitimacy, information validity, and possible violations. You'll need to provide a full set of original documents (passport or other ID certifying your residence) before being able to take the prize. Your ID must be valid.

Then we will send you your prize or appoint a date and time for the prize award ceremony.

That depends on the place you take. You can win prizes from every drop, but only until you win a car and become an absolute winner. Absolute winners cannot compete for other drops.

For instance, if you are placed third when the first drop arrives, you win a macbook air and can compete for other prizes in the next three-month run, but if you win a car after that, you won’t be able to participate and fight for the third prize drop.

Create a dedicated contest account. Sign up or log in to your personal area, create a new real account, and check the box sign up this account for octafx 16 cars. Make sure your first deposit amounts at least 50 USD or EUR.

Assign your existing real account for the contest. Sign up or log in to your personal area, pick a metatrader 4 account you are willing to sign up for the contest in the my accounts list at the bottom of the page, press this account and select assign as contest account. Make sure your first deposit amounts at least 50 USD or EUR.

Keep in mind that you can sign up several accounts for the contest if you want to.

Yes, you can. You only need to register your real account once, and it will automatically participate in all subsequent runs as long as its personal funds (equity excluding bonuses) amount to 50 USD (EUR) or more. If your personal funds drop below 50 USD (EUR) when a new drop arrives, the account will not qualify for this run until you replenish the personal funds to at least 50 USD (EUR).

I registered an account for the contest, but I'm not in the rankings and I did not receive a link to the contest statistics. Why is that?

Simply registering an account for the contest is not enough to participate. Your account will be activated for the contest and its performance will be counted in the ranking only after you top up your balance by enough that its current equity excluding bonuses becomes at least 50 USD (EUR).

You don't need to register in advance. Just sign up your real account for the contest at any moment and start trading when the prizes appear on the contest page.

We’ll close registration seven days prior to the contest end date.

You just need to create a metatrader 4 (micro) account and check this account as a contest account, or assign your existing metatrader 4 (micro)account, and make sure that your account’s personal funds (equity excluding bonuses) are 50 USD (or its equivalent in EUR) or above.

To register, press join contest on the contest page or go to your personal area, pick a metatrader 4 account you are willing to sign up for the contest in the my accounts list at the bottom of the page, press this account and select assign as contest account.

Top 9 best forex brokers in malaysia for 2021

Top rated:

Searching for a trading broker in malaysia?

With this collection of the best forex brokers the country has to offer. Here you are sure to find one that fits your trading needs.

Making your malaysia forex broker search as easy as possible starts with choosing from one of these top choices, any of which can be opened both quickly and easily.

Table of contents

Is forex trading legal in malaysia?

This is a very valid question and concern since not very long ago forex trading in malaysia was not legal.

Now however, the rules are changing.

You will find that officially within malaysia, the only legal regulation is that people can only register with a financial services company that is regulated within malaysia and compliant with the laws of the country.

With that said, given that forex trading is relatively new to malaysia, there are not yet any brokers that are regulated by the SCM (securities commission of malaysia).

With that said, trading as a malaysian forex trader is still not illegal and some of the forex brokers that we have listed provide the very best in terms of regulatory oversight from top-tier bodies such as cysec, the FCA, or ASIC.

How to trade forex in malaysia

If you want to trade forex within malaysia then the process is in fact quite straightforward since the regulations are still quite new and allow for no particular restrictions in terms of what a forex trader can do or what a broker can offer.

The only key steps beyond choosing the correct malaysian forex broker for you is to submit the relevant documents to begin trading. These will typically include your proof of ID and residency.

From there, you are ready to begin trading.

Top 10 best forex brokers in malaysia

Here is our collection of what we feel are the best malaysia broker choices for you as a forex trader:

1. Instaforex

Starting our list of the best forex brokers in malaysia is instaforex. They are a well-known and award winning broker particularly within asia having won more than 19 awards and counting related to being the “best broker in asia”.

Beyond this, they are also very well regulated by multiple regulatory bodies including the FCA, ASIC, and cysec. When it comes to account types you will have a total of 6 to choose from. Instaforex minimum deposits here range from a bargain $1 up to $1,000 depending on account type. The account types available include 2 cent accounts, a standard account, 2 ECN accounts, and a scalping account.

You can deposit MYR through wire transfer within local banks and you can also utilize a fully functioning demo account to try out the broker. This is ideal, in combination with really low-risk cent accounts to help new forex traders get to know the market.

Finally, an islamic account type is available though there is an additional fee that replaces the swap fee. Instaforex also offers 4 bonuses to traders. This includes a 100% first deposit bonus.

XM is renowned as one of the best forex brokers in the world and is available to malaysian forex traders. They are again regulated by some of the foremost authorities in the industry in the form of FCA, cysec, and ASIC. They were also awarded the “best forex broker in australasia” award along with numerous others.

Opening an XM account, you will be faced with a wide choice of 6 account types. Minimum deposits on these account types range from $5-$100 depending on account, or you can also opt for a shares account with a minimum deposit of $10,000. These deposits can be made through wire transfer, credit card, or ewallet although no MYR deposits are facilitated.

If you would like to try out the broker, you can avail of their full demo account. This, together with the XM micro account offers a great path to get into forex trading in malaysia and around the world.

Spreads at XM can start from as little as 0 pips in many cases, and the XM islamic account follows all of the same conditions of the regular accounts with no mark-ups, higher spreads, or additional commissions.

3. Octafx

Next in our collection of the top malaysian forex brokers is octafx. They are also regulated by two highly trusted regulatory bodies in the form of both the FCA in the UK and cysec in europe. They are reputed within the industry as offering some of the best swap-free services around. In fact, in 2015 they were recognized byb forextraders.Com as the “best forex islamic account” providers.

To that end, micro, ECN, and pro accounts are available with minimum deposits starting at $100 and reaching $500 for a pro account. It is also worth noting that every account is available as a swap-free account. The accounts utilize the top trading platforms of MT4, MT5, and ctrader.

MYR deposits are accepted and can be made through local banks, billplz, and help2pay services with an excellent exchange rate of 3 MYR per $1 USD available. Spreads also start from a highly competitive 0 pips across the board and the trading conditions feature no changes at all when it comes to islamic account trading.

In terms of octafx bonus offers, a 50% deposit bonus is made available on each deposit.

4. Hotforex

Hotforex is another globally recognized forex broker and top choice for you as a malaysian trader. They are well regulated by both cysec and ASIC and offer a wide choice of 6 forex account types to choose from.

Again here, this includes a micro trading account with a minimum deposit of only $5 ideal for new traders, a premium account with a $100 minimum, a zero spread account, and an auto trading account you can try for a minimum deposit of $200. If you are interested in copytrading this is available through hfcopy with a minimum of $100 deposit to copy, or $300 if you want others to copy your trades.

When it comes to deposits, MYR is available through local bank transfer. In other cases, you can use your major credit card or ewallet methods. Either way, a fully realistic demo account is accessible as is an islamic account where needed.

Spreads here start from a competitive 0 pips across the board although some additional fees may apply on islamic accounts. You can offset these through cash rebates, 100% bonuses, and the higher leverage that hotforex try to offer along with many real prize winning trading contests.

5. FBS

Next on the list of the best malaysian forex brokers is FBS. As with all of our brokers they are well-trusted and fully regulated by both cysec and the IFSC. This is an excellent broker with 5 account choices including a great cent account offering that may be just perfect for new traders. These account types also include an ECN account.

Minimum deposits with the broker start from just $1 reaching up to $1,000 depending on your account choice and although MYR deposits are unavailable, funding via wire transfer, credit card, and ewallet are all available. Every account can also be made swap-free where needed.

Although FBS do add an additional admin fee if you hold a position for more than 2 days with a swap-free account, this can be somewhat balanced by the fact they have a comprehensive bonus offering that includes a 100% deposit bonus and contests including some particularly aimed at islamic traders during ramadan.

6. Oanda

Oanda is one of the few brokers to be regulated in the USA by the CFTC as well as the NFA, and globally through the FCA, MAS, ASIC, and IIROC. A who’s who of top regulators for a much trusted broker.

They offer just one account type but it is available with no minimum deposit at all. Perfect if you are new to the forex trading market. Another suitable point here is you can open positions for as low as just one currency unit ($1 or equivalent base currency), although no MYR deposits are available.

With that said, deposits can be made through wire transfers, major credit cards, and ewallets. Fully operational oanda demo accounts are available to try as are islamic accounts on request.

Spreads with this broker are low, starting from just 1 pips and trading is through MT4 trading platform. .

You may find that some additional fees are placed on the islamic account in place of the swap fee, and at the moment there is unfortunately no bonus offering in place.

7. Pepperstone

Pepperstone are another of the standard bearing top brokers offering service to malaysian forex traders. They are regulated by the top authorities of FCA and ASIC and are one of the most chosen ECN brokers around.

They have two available account types that can be opened with a minimum deposit of $200. These are the standard and ECN razor account types which are also both available as islamic accounts. For account deposits, wire transfers, credit cards, and ewallets are all accepted methods of funding although no MYR deposits are available.

Spreads with pepperstone start from 0 pips and trading is available through MT4, MT5, or ctrader and you are welcome to try the pepperstone demo account first.

On the islamic accounts, an admin fee will be applied on positions held for more than 10 days and no pepperstone bonus amount is currently available.

8. IC markets

IC market regulated by cysec and ASIC represent another of the best malaysian forex broker choices for any traders. They offer 2 account types in their standard and raw spread accounts, both of which can be opened with no minimum deposit.

These accounts can be easily funded through wire transfers, major credit cards, or ewallet methods although no MYR deposits are accepted. On the minimum deposit, although there is none in place, the broker do recommend depositing at least $200.

Spreads with IC markets start from the bottom at 0 pips and with the option of trying a demo account and opting for an islamic account through MT4, MT5, or ctrader platforms. Within this islamic account most conditions remain the same. The only change is an admin fee added on positions open for more than one day.

At this time IC markets does not provide for any kind of bonus offering.

9. Etoro

Last but not least on our listing of top malaysian broker choices is etoro. Known the world over, they are regulated well by cysec, FCA, and ASIC. They are well known of course as a top broker for social trading and a particularly good fit if you are new to the sector.

One account type is offered that can also be made swap-free though in this case the minimum deposit would increase from $200 to $1,000 with trading available through the brokers own user-friendly trading platform.

Spreads at etoro typically start from 1 pip though they can be higher. Deposits are catered for through wire transfer, credit card, and ewallets, though no MYR deposit option is available.

You will be glad to know that while there are no bonus offerings, trading conditions remain the same on islamic accounts.

Malaysian trader? Here’s what to look for in a forex broker

Although there are currently no particular set of stringent rules in place from the SCM and everything is routinely left at the discretion of the trader and broker in terms of what is offered in bonus, leverage, and account type terms, there are still a few things that you should try and look out for when choosing the best forex broker to deal with.

1. Stick with regulated brokers

Always try to choose a regulated forex broker like any of the top brokers listed above. The SCM have not yet officially regulated any themselves, but you can very much trust the listed brokers regulated by some of the top bodies worldwide like cysec, ASIC, and the FCA.

It is good practice to deal with these and any who are also ESMA compliant for the most trusted experience and to avoid offshore regulated or non-regulated brokers where you can.

2. Look for the best islamic account

The muslim population in malaysia is more than 50%. This, along with the fact that islam is the official religion mean there is always big demand for malaysian islamic forex trading accounts.

Since swap or overnight broker fees are considered haram when it comes to sharia law, you should be looking to open an islamic account that will not feature any of these fees in order to be fully compliant.

If you are unsure or interested to learn more about this topic, you can read our best islamic forex brokers guide for more information.

3. Choose the broker before choosing the bonus

One of the biggest final things to be sure of is that, since forex broker bonuses are legal in malaysia, that you do not get blinded by that fact.

This means choosing a broker that best suits your trading needs above considering what types of bonus they offer.

Being tempted by a big bonus offer can leave you dissatisfied in other areas when it comes it future trading and so. You should really not base your broker decision on that. Also, always make sure you read the terms and conditions first.

Finally, you should take advantage of any no deposit bonus opportunities offered by a broker as a great chance to see what they can offer.

How to verify if a forex broker is regulated in malaysia

Although there are not any forex broker officially regulated by the SCM as yet, this may well be possible in the future. In that case, you should take the opportunity to check this page for any further developments.

Checking registration with the other top regulatory bodies can also be as simple as a couple of clicks and a search of the following links:

Keep in mind if you are wondering about ESMA regulation, this depends on the country, but if they have registered in a european country, they will typically be ESMA compliant.

Is forex trading taxable in malaysia?

The simple answer to this question is yes.

Forex trading in malaysia is taxable. That is because all revenues should be declared through your ITN (income tax number) and these are unique to each person and issues by the IRBM (inland revenue board of malaysia).

More information on the precise filing processes can be found here.

With that said, since forex trading is new to malaysia, there is still a considerable grey area related to revenues and capital gains taxes, particularly is the broker you trade with is located outside of malaysia.

[disclaimer: we are not accountants, we have done internet research. Due to these grey areas, we strongly suggest you contacting malay local authorities before proceeding]

Octafx malaysia

ANI

29 dec 2020, 21:37 GMT+10

New delhi [india], december 29 (ANI/newsvoir): octafx, a forex broker that provides online trading services worldwide has come up with an exclusive list of top events that affected the market in 2020.

Rising of coronavirus casesinvestors were watching the spread of the then-unknown disease in china closely earlier this year. How a leading east asian country is handling this problem was of crucial importance. It turned out later that the newly titled coronavirus would not only affect china but soon the entire world. The rising numbers of people in the united states and europe being infected with and dying from this horrific virus led investors to panic, which impacted the currency, stock, and commodities markets.

OPEC and OPEC agree on the largest output cut in historyone of the first assets that experienced the impact of the pandemic was crude oil. On 8 january 2020, the price of 'black gold' already fell from the level of 70.75 dollars per barrel of brent down to 64.38 dollars per barrel, which is almost 9% in a single day. However, the most severe collapse in the entire history of the oil market occurred transitioning from march to april.

Approval of a stimulus package for the U.S. Economyafter the oil, the stock market followed suit spiralling down soon after. Hence, in the period from 20 february to 23 march this year, one of the most popular stock indices in the world, the SPX500, fell to the level of 2,172 USD. This amounts to an almost 36.5% decrease. As a reminder, SPX500 includes 505 selected public companies traded on american stock exchanges with the largest capitalisation.

Gold reaches all-time highsthe gold market struggled immensely at the beginning of the year. Although, since the second half of march, the precious metal has shown steady growth, starting from the level of 1,450 to 2,080 dollars per ounce by the beginning of august, which amounts to almost 43% in gains.

Second coronavirus wave enters the stageat the end of august, disturbing reports flooded the headlines with an ongoing epidemic that followed what seemed to be a calm summer. The total daily increase of infected people in september throughout october exceeded the peak in may by two or three times. In november, several european countries, such as the united kingdom, france, germany, italy, and greece, again announced regional lockdowns and began applying strict sanitary measures.

All this significantly affected bitcoin, which has risen from the levels of 9,700-10,500 USD to a historic record high of 19,920 USD since the beginning of september, before going even further in december by reaching 24,000 USD.

Coronavirus vaccine discoveryin august, mass media reported that authorities in russia registered the first coronavirus vaccine. Positive news like this led to a sharp decline in the prices of gold, which previously reached the earlier mentioned unheard-of high of 2,080 dollars per ounce. This would make sense since gold is usually purchased when critical situations occur in the world, such as an uncontrolled pandemic, large-scale war, or political uncertainty.

In merely two days, from 11 august to 12 august, the yellow metal lost almost 8.3% in value, sinking its price to 1,862 dollars per ounce. Subsequently, in november, the three largest companies in pfizer (together with biontech), moderna and astrazeneca announced the successful final phases of testing their coronavirus vaccines.

United states presidential electionthe 2020 U.S. Presidential election, held on 3 november, is recognised as the most controversial in history. As usual, two candidates emerged in the final race. Donald trump again represented the U.S. Republican party in hopes for a second term in office. His democratic counterpart, former vice president and U.S. Senator joe biden, was challenging trump's re-election.

The OPEC / OPEC december agreementthe approval of new parameters within the OPEC / OPEC deal was a significant reason for optimism in the oil market in early december. According to the previous agreement, which the member countries accepted amidst the price collapses taking place almost a year ago, they expected the quota for their oil production to increase by almost 2 million barrels per day from 1 january 2021.

The brexit trade dealthe E.U. And the U.K. Have pledged to sign a deal on trade and security that will finalise the U.K. Leaving the european union by 31 december 2020. According to a study by the german economic institute IFO, the U.K. Will suffer more financial losses as a result of brexit than the E.U. Currently, both sides are focused on an agreement to develop a mechanism to ensure that neither side can distort trade by undermining european standards. Up to that point, negotiations on the post-brexit trade deal between london and brussels have been stalling for several months.

2020 has become a great challenge for millions of people on the planet. However, from the trader's point of view, the crisis gives great opportunities for making money, too.

In hindsight, the value of almost all FOREX trading instruments has fallen significantly over this year. Most currency pairs and commodities have updated their historic lows and are still experiencing high volatility, which, with the right approach, can be exploited to make a profit. From the viewpoint of fundamental and technical analysis, the upcoming 2021 will be the year of recovery for the global economy. In turn, traders will have numerous opportunities to make lots of profitable orders.

This story is provided by newsvoir. ANI will not be responsible in any way for the content of this article. (ANI/newsvoir)

Indonesia, malaysia and octafx

We love our partners, and they love us in return. That’s why our visit to indonesia and malaysia was so anticipated.

Since we have been working with those countries for about 8 years, this trip was filled with meetings with our old friends, as well as new faces who wished to start a productive partnership with us, and we couldn’t be more grateful for such a warm welcome.

We have spent 1 week in indonesia and were able to travel all around java. Besides impressive mountain landscapes, ancient temples and breathtaking views of business centres, the cities we visited greeted us with enthusiasm and willingness to share our common love for forex trading.

Discussions were dedicated to our mutual plans for the future, as well as the hard work our partners have done. The most interesting topics were:

Prospects of opening offline education for our clients

Development of copytrading

Courses available for our clients to help them become professional traders and simply learn more about the things they really enjoy.

During our visit, there was an inspiring seminar organised by our partners octafx explorer. More than 200 people gathered to share their experience and knowledge, encourage new traders and see the impressive results of those experienced in trading, uniting traders from our big community all around indonesia.

Malaysia welcomed us with even more enthusiasm. We were glad to meet our old friends and enhance relations with those who want to join our team. Our malaysian partners are numerous, but we are always glad to see new faces and establish new connections. Our goal is to provide you with the possibility to fulfil your desire to make a living out of forex, bring clients and improve your business.

The most memorable event was the discussion of swaps and commissions cancellation. This amazing news became the result of those meetings with our partners, and we are grateful for their feedback that helped us reach this mutually beneficial conclusion.

Not only was our trip dedicated to business questions, but also gave us the possibility to participate in a charity event. Our partnership with our dear friends from bali sports foundation lasts for a long time, and as the result of ramadan charity collection, we donated $6,000 to support their goals.

We would like to thank everyone who greeted us on this memorable trip, we hope to come back soon to make our partnership even better!

Octafx malaysia

The wikifx score of this broker is reduced because of too many complaints! The wikifx score of this broker is reduced because of too many complaints! The wikifx score of this broker is reduced because of too many complaints!

Licenses

Overview

Country/area of registry:

Customer service email address:

Customer service phone number:

Wikifx APP!

Global forex broker regulatory inquiry APP!

Warning: this platform is a ponzi scheme. Please stay away!

Previous detection: 2021.01.20 risk: 4 item

- This broker bas been verified to be illegal and all of its licences have been expired, and it has been listed in wikifx's scam brokers list; please be aware of the risk!

- The platform is a ponzi scheme, which refers to the use of "principle of value multiplication". In the form of rolling or static fund circulation, it uses the money of next member to pay to the present one, which is essentially a pyramid scheme with the distinction of hidden, deceptive and socially harmful. By calling common person's desire for money, fraudsters in the platform begin raising funds underground. Since this kind of platform mostly will abscond after 1 or 2 years, the fund-raising mode just can exist less than 3 years.

- The number of the complaints received by wikifx have reached 15 for this broker in the past 3 months, please be aware of the risk and the potential scam!

- The cypruscysec regulatory (license number: 372/18) claimed by this broker is a suspicious clone, please be aware of the risk!

External chain proportion

Unable to withdraw I wasn't able to withdraw my money back and they told me that it's the best broker

I wasn't able to withdraw my money back and they told me that it's the best broker

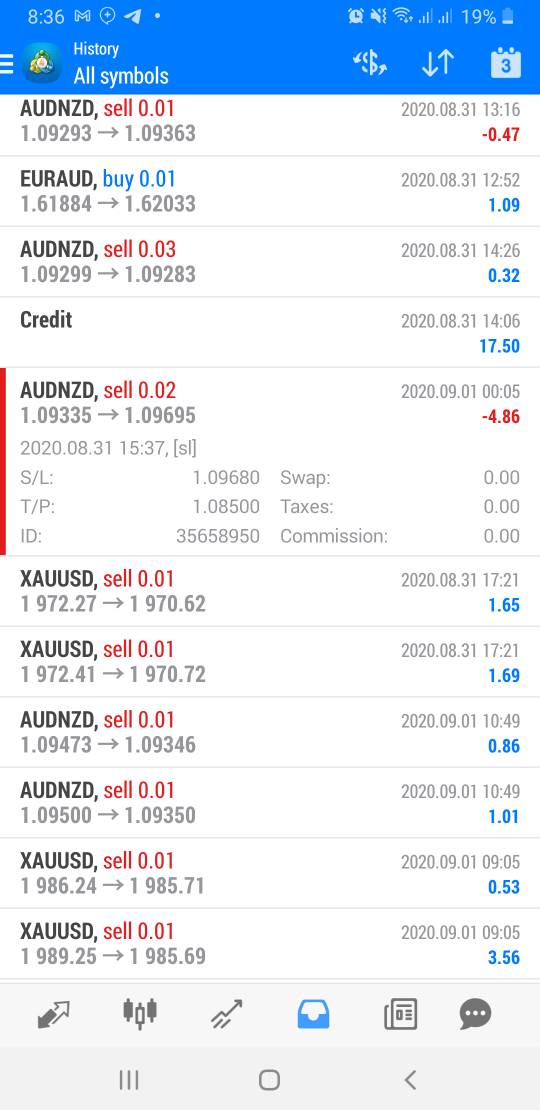

Others fake stop lose

31 august 2020 open sell with stop lose 1.09680 (picture no 1 history open) 1 september 2020 in morning i got stop lose (picture no 2 grafik candle bearish and never touched 1.09680 note : already check other platform (tradingview.Com, FBS, icmarkets, oanda, etc) at 1 september 2020 never touch 1.09680

Unable to withdraw octafx would not want to withdrew the profit and it did not send me the message that money was successful sent to my bank account

Octafx must withdraw the profit I made and must immediately send a message of successful approving the withdrawal

Scam did not recieved withdrawn

Did not recieved withdrawn. The post is written withdrawn succesful but did not recieved dollars yet since 30 hours

Scam the trick of the fraud

I showed the information of the fraud in order that you can avoid being cheated by him.The process of the scam is so dramatic, he used many different identities to induce others to invest and made other people reach the point of no return. The so-called teacher in the stock group focuses on customers who made a loss and recommend shares, futures or other investments to you. That’s a scam. The teacher has many different QQ in the name of analysis teacher, investment consultant of future, businessman or top operator. Let you profit, then let you lose money again and again.Torment you by inch. And you will lose all the money in the end without noticing the scam.Please polish your eyes, don’ be cheated like me, my whole family has been ruined.

Cyprus securities and exchange commission (CYSEC)

The cyprus securities and exchange commission (cysec) was established in accordance with section 5 of the securities and exchange commission (establishment and responsibilities) law of 2001 as a public legal entity. It is an independent public supervisory authority responsible for the supervision of the investment services market, transactions in transferable securities carried out in the republic of cyprus and the collective investment and asset management sector. It also supervises the firms offering administrative services which do not fall under the supervision of ICPAC and the cyprus bar association.

Market making(MM)

Regulated in country/area

Octafx malaysia

Licenses

Overview

Octa markets cyprus ltd.

Country/area of registry:

Customer service email address:

Customer service phone number:

Wikifx APP!

Global forex broker regulatory inquiry APP!

Scam scam investors

I lost my funds. The broker can manipulate their market.

Unable to withdraw I lost my money in OCTAFX. They asked me to pay more money to withdraw my account balance.

I lost my money in OCTAFX. They asked me to pay more money to withdraw my account balance.

Cyprus securities and exchange commission (CYSEC)

The cyprus securities and exchange commission (cysec) was established in accordance with section 5 of the securities and exchange commission (establishment and responsibilities) law of 2001 as a public legal entity. It is an independent public supervisory authority responsible for the supervision of the investment services market, transactions in transferable securities carried out in the republic of cyprus and the collective investment and asset management sector. It also supervises the firms offering administrative services which do not fall under the supervision of ICPAC and the cyprus bar association.

Market making(MM)

Regulated in country/area

Email address of licensed institution :

Website of licensed institution :

Address of licensed institution :

Strovolou 47, KYROS TOWER, 5th floor, nicosia 2018

Phone number of licensed institution :

Licensed institution certified documents :

Most visited countries/areas

The data are from

This broker's score is relatively low.

Please choose wisely! Please avoid unnecessary loss

OCTAFX · choose VR

So, let's see, what we have: trade with reliable broker and best conditions: low spreads, no swaps, no commissions. Claim and withdraw 50% deposit bonus! At octafx malaysia

Contents of the article

- New forex bonuses

- Octafx malaysia

- Forex trading accessibility for everyone

- Why choose forex trading with octafx

- Octafx review 2021

- Octafx malaysia – A quick look

- Is octafx malaysia safe?

- Octafx malaysia fees

- Octafx bonus

- Octafx deposit and withdrawal

- Octafx account types

- Octafx trading instruments

- Octafx trading platforms

- Octafx customer support

- Do we recommend octafx malaysia?

- Increase your income

- Best market compensation

- Superior growth

- World-class support

- See how much you can earn with octafx

- Less than 5 active clients

- From 5-14 active clients

- From 15-29 active clients

- From 30-59 active clients

- More than 60 active clients

- Understand how to thrive as an octafx IB

- Octafx malaysia

- Top 9 best forex brokers in malaysia for 2021

- Is forex trading legal in malaysia?

- How to trade forex in malaysia

- Top 10 best forex brokers in malaysia

- Malaysian trader? Here’s what to look for in a...

- 1. Stick with regulated brokers

- 2. Look for the best islamic account

- 3. Choose the broker before choosing the bonus

- How to verify if a forex broker is regulated in...

- Is forex trading taxable in malaysia?

- Octafx malaysia

- Indonesia, malaysia and octafx

- Octafx malaysia

- Licenses

- Overview

- Wikifx APP!

- Unable to withdraw I wasn't able to withdraw my...

- Others fake stop lose

- Unable to withdraw octafx would not want to...

- Scam did not recieved withdrawn

- Scam the trick of the fraud

- Cyprus securities and exchange commission (CYSEC)

- Octafx malaysia

- Licenses

- Overview

- Wikifx APP!

- Cyprus securities and exchange commission (CYSEC)

- This broker's score is relatively low.

- OCTAFX · choose VR

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.