Best leverage for $50

Your margin leverage will be 50:1 (50,000/1,000). Forex trading with high leverage means a starting deposit in a account can give you control of a much larger amount based on how much leverage is applied.

New forex bonuses

Best leverage for $50

US forex brokers with high leverage

US forex brokers with high leverage

In this article you will find US forex brokers with high leverage listed below. You will also find out why super high leverage brokers do not exist within the united states. Find out why you may need to open an account offshore to get the leverages of 100:1 and beyond.

Make sure you check out our 2020 list of US forex brokers with high leverage down below!

What is forex leverage?

Leverage is loaning out a certain amount of the money needed to invest in something, ie a stock, currency pair etc.

In forex trading money is borrowed from a broker.

Forex trading with high leverage means a starting deposit in a account can give you control of a much larger amount based on how much leverage is applied.

If you deposit 2% of the total transaction value as margin (same as saying as the amount deposited in your account) and you wanted to trade one standard lot of USD/EUR, which is equivalent to US$50,000, the margin required would be US$1,000.

Your margin leverage will be 50:1 (50,000/1,000).

For a margin requirement of 0.5%, the margin leverage will be 200:1

Take a look at these ratio and percentage examples.

| Margin as a ratio | margin required (percentage) |

| 500:1 | 0.2% |

| 200:1 | 0.50% |

| 100:1 | 1.00% |

| 50:1 | 2.00% |

List of US forex brokers with high leverage in 2020.

| Broker type | ECN |

| regulations | IFSC |

| min deposit | $100.00 |

| account base curreny | USD, EUR, GBP, AUD, CAD, bitcoin, gold, bitcoin cash, litecoin, ethereum and XRP |

| max leverage | 200:1 |

| trading platforms | metatrader 4/5 |

| Broker type | market maker |

| regulations | NFA, CFTC, RFED, FCM |

| min deposit | $50.00 |

| account base currency | USD CAD GBP |

| max leverage | 50:1 |

| trading platforms | forextrader, metatrader 4 |

| Broker type | market maker |

| regulations | IIROC, CIPF, NFA, FCA, CFTC, ASIC, MAS |

| min deposit | $1.00 |

| account base currency | AUD CAD EUR GBP HKD JYP SGD CHF USD |

| max leverage | 50:1 |

| trading platforms | web trading, metatrader 4, oanda desktop trading platform |

Can US residents get more than 50:1 leverage?

The short answer is no. 50:1 leverage is the maximum amount of leverage aloud within the united states.

This is because the US regulation forbids forex brokers in the united states to offer leverage above 50:1 or 2%

Forex trading in the USA is regulated by the NFA (national futures association) and the CFTC. Some of the regulations that have to be met are:

- Limits leverage to 50:1 on the major currencies.

- Limits leverage of 20:1 on minor currencies.

- First-in-first-out (FIFO) rule.

- US residents are only allowed to trade with US forex brokers under NFA regulations.

- Money owed by the forex broker to the client should be held at one or more qualifying institutions in the US.

- Retail forex trading brokers in the united states must maintain minimum capital of at least $20 million and 5% of the amount by which liabilities to retail forex customers exceed $10 million. Making it tough for any new comer to the business as it take a lot of capital just to get started.

- Provide weekly financial statements to the NFA to ensure that all financials are in order.

- No hedging allowed.

What does this all mean?

It means most forex brokers do not offer clients from the USA high leverage above 50:1, because of the strict requirements set out by the regulators, NFA and CFTC.

How much leverage is right for you in forex trades

Understanding how to trade foreign currencies requires detailed knowledge about the economies and political situations of individual countries, global macroeconomics, and the impact of volatility on specific markets. But the truth is, it isn’t usually economics or global finance that trip up first-time forex traders. Instead, a basic lack of knowledge on how to use leverage is often at the root of trading losses.

Data disclosed by the largest foreign-exchange brokerages as part of the dodd-frank wall street reform and consumer protection act indicates that a majority of retail forex customers lose money. The misuse of leverage is often viewed as the reason for these losses. this article explains the risks of high leverage in the forex markets, outlines ways to offset risky leverage levels, and educates readers on ways to pick the right level of exposure for their comfort.

Key takeaways

- Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone.

- Forex traders often use leverage to profit from relatively small price changes in currency pairs.

- Since leverage, can amplify both profits as well as losses, choosing the right amount is a key risk determination for traders.

- Leverage in the forex markets can be 50:1 to 100:1 or more, which is significantly larger than the 2:1 leverage commonly provided on equities and the 15:1 leverage provided in the futures market.

The risks of high leverage

Leverage is a process in which an investor borrows money in order to invest in or purchase something. In forex trading, capital is typically acquired from a broker. While forex traders are able to borrow significant amounts of capital on initial margin requirements, they can gain even more from successful trades.

In the past, many brokers had the ability to offer significant leverage ratios as high as 400:1. This means, that with only a $250 deposit, a trader could control roughly $100,000 in currency on the global forex markets. However, financial regulations in 2010 limited the leverage ratio that brokers could offer to U.S.-based traders to 50:1 (still a rather large amount). this means that with the same $250 deposit, traders can control $12,500 in currency.

So, should a new currency trader select a low level of leverage such as 5:1 or roll the dice and ratchet the ratio up to 50:1? Before answering, it’s important to take a look at examples showing the amount of money that can be gained or lost with various levels of leverage.

Example using maximum leverage

Imagine trader A has an account with $10,000 cash. He decides to use the 50:1 leverage, which means that he can trade up to $500,000. In the world of forex, this represents five standard lots. There are three basic trade sizes in forex: a standard lot (100,000 units of quote currency), a mini lot (10,000 units of the base currency), and a micro lot (1,000 units of quote currency). Movements are measured in pips. Each one-pip movement in a standard lot is a 10 unit change.

Because the trader purchased five standard lots, each one-pip movement will cost $50 ($10 change / standard lot x 5 standard lots). If the trade goes against the investor by 50 pips, the investor would lose 50 pips x $50 = $2,500. This is 25% of the total $10,000 trading account.

Example using less leverage

Let’s move on to trader B. Instead of maxing out leverage at 50:1, she chooses a more conservative leverage of 5:1. If trader B has an account with $10,000 cash, she will be able to trade $50,000 of currency. Each mini-lot would cost $10,000. In a mini lot, each pip is a $1 change. Since trader B has 5 mini lots, each pip is a $5 change.

Should the investment fall that same amount, by 50 pips, then the trader would lose 50 pips x $5 = $250. This is just 2.5% of the total position.

How to pick the right leverage level

There are widely accepted rules that investors should review before selecting a leverage level. The easiest three rules of leverage are as follows:

- Maintain low levels of leverage.

- Use trailing stops to reduce downside and protect capital.

- Limit capital to 1% to 2% of total trading capital on each position taken.

Forex traders should choose the level of leverage that makes them most comfortable. If you are conservative and don’t like taking many risks, or if you’re still learning how to trade currencies, a lower level of leverage like 5:1 or 10:1 might be more appropriate.

Trailing or limit stops provide investors with a reliable way to reduce their losses when a trade goes in the wrong direction. By using limit stops, investors can ensure that they can continue to learn how to trade currencies but limit potential losses if a trade fails. These stops are also important because they help reduce the emotion of trading and allow individuals to pull themselves away from their trading desks without emotion.

The bottom line

Selecting the right forex leverage level depends on a trader’s experience, risk tolerance, and comfort when operating in the global currency markets. New traders should familiarize themselves with the terminology and remain conservative as they learn how to trade and build experience. Using trailing stops, keeping positions small, and limiting the amount of capital for each position is a good start to learning the proper way to manage leverage.

Low leverage allows new forex traders to survive

As a trader, it is crucial that you understand both the benefits AND the pitfalls of trading with leverage.

Using a ratio of 100:1 as an example means that it is possible to enter into a trade for up to $100 for every $1 in your account.

This gives you the potential to earn profits on the equivalent of a $100,000 trade!

It’s like a super scrawny dude who has a super long forearm entering an arm-wrestling match.

If he knows what he’s doing, it doesn’t matter if his opponent is arnold schwarzenegger, due to the leverage that his forearm can generate, he’ll usually come out on top.

When leverage works, it magnifies your gains substantially. Your head gets BIG and you think you’re the greatest trader that has ever lived.

But leverage can also work against you.

You’ll be broke faster than mike tyson can chew your ear off.

Here’s a chart of how much your account balance changes if prices move depending on your leverage.

| Leverage | % change in currency pair | % change in account |

|---|---|---|

| 100:1 | 1% | 100% |

| 50:1 | 1% | 50% |

| 33:1 | 1% | 33% |

| 20:1 | 1% | 20% |

| 10:1 | 1% | 10% |

| 5:1 | 1% | 5% |

| 3:1 | 1% | 3% |

| 1:1 | 1% | 1% |

Let’s say you bought USD/JPY and it goes up by 1% from 120.00 to 121.20.

If you trade one standard 100k lot, here is how leverage would affect your return:

| Leverage | margin required | % change in account |

|---|---|---|

| 100:1 | $1,000 | +100% |

| 50:1 | $2,000 | +50% |

| 33:1 | $3,000 | +33% |

| 20:1 | $5,000 | +20% |

| 10:1 | $10,000 | +10% |

| 5:1 | $20,000 | +5% |

| 3:1 | $33,000 | +3% |

| 1:1 | $100,000 | +1% |

Let’s say you bought USD/JPY and it goes down by 1% from 120.00 to 118.80.

If you trade one standard 100k lot, here is how leverage would affect your return (or loss):

| Leverage | margin required | % change in account |

|---|---|---|

| 100:1 | $1,000 | -100% |

| 50:1 | $2,000 | -50% |

| 33:1 | $3,000 | -33% |

| 20:1 | $5,000 | -20% |

| 10:1 | $10,000 | -10% |

| 5:1 | $20,000 | -5% |

| 3:1 | $33,000 | -3% |

| 1:1 | $100,000 | -1% |

The more leverage you use, the less “breathing room” you have for the market to move before a margin call.

You’re probably thinking, “I’m a day trader, I don’t need no stinkin’ breathing room. I only use 20-30 pip stop losses.”

Example #1

You open a mini account with $500 which trades 10k mini lots and only requires .5% margin.

You buy 2 mini lots of EUR/USD.

Your true leverage is 40:1 ($20,000 / $500).

You place a 30-pip stop loss and it gets triggered. Your loss is $60 ($1/pip x 2 lots).

You’ve just lost 12% of your account ($60 loss / $500 account).

Your account balance is now $440.

You believe you just had a bad day. The next day, you’re feeling good and want to recoup yesterday losses, so you decide to double up and you buy 4 mini lots of EUR/USD.

Your true leverage is about 90:1 ($40,000 / $440).

You set your usual 30-pip stop loss and your trade losses.

Your loss is $120 ($1/pip x 4 lots).

You’ve just lost 27% of your account ($120 loss/ $440 account).

Your account balance is now $320.

You believe the tide will turn so you trade again.

You buy 2 mini lots of EUR/USD. Your true leverage is about 63:1.

You’ve just lost almost 19% of your account ($60 loss / $320 account). Your account balance is now $260.

You’re getting frustrated. You try to think about what you’re doing wrong. You think you’re setting your stops too tight.

The next day you buy 3 mini lots of EUR/USD.

Your true leverage is 115:1 ($30,000 / $260).

You loosen your stop loss to 50 pips. The trade starts going against you and it looks like you’re about to get stopped out yet again!

But what happens next is even worse!

You get a margin call!

Since you opened 3 lots with a $260 account, your used margin was $150 so your usable margin was a measly $110.

The trade went against you 37 pips and because you had 3 lots opened, you get a margin call. Your position has been liquidated at market price.

The only money you have left in your account is $150, the used margin that was returned to you after the margin call.

After four total trades, your trading account has gone from $500 to $150.

A 70% loss!

Congratulations, it won’t be very long until you lose the rest.

| Trade # | starting account balance | # lots of used | stop loss (pips) | trade result | ending account balance |

|---|---|---|---|---|---|

| 1 | $500 | 2 | 30 | -$60 | $440 |

| 2 | $440 | 4 | 30 | -$120 | $320 |

| 3 | $320 | 2 | 30 | -$60 | $260 |

| 4 | $260 | 3 | 50 | margin call | $150 |

A four-trade losing streak is not uncommon. Experienced traders have similar or even longer streaks.

The reason they’re successful is that they use low leverage.

Most cap their leverage at 5:1 but rarely go that high and stay around 3:1.

The other reason experienced traders succeed is that their accounts are properly capitalized!

While learning technical analysis, fundamental analysis, sentiment analysis, building a system, trading psychology are important, we believe the biggest factor on whether you succeed as a forex trader is making sure you capitalize your account sufficiently and trade that capital with smart leverage.

Your chances of becoming successful are greatly reduced below a minimum starting capital. It becomes impossible to mitigate the effects of leverage on too small an account.

Low leverage with proper capitalization allows you to realize losses that are very small which not only lets you sleep at night, but allows you to trade another day.

Example #2

Bill opens a $5,000 account trading 100k lots. He is trading with 20:1 leverage.

The currency pairs that he normally trades move anywhere from 70 to 200 pips on a daily basis. In order to protect himself, he uses tight 30 pip stops.

If prices go 30 pips against him, he will be stopped out for a loss of $300.00. Bill feels that 30 pips are reasonable but he underestimates how volatile the market is and finds himself being stopped out frequently.

After being stopped out four times, bill has had enough. He decides to give himself a little more room, handle the swings, and increases his stop to 100 pips.

Bill’s leverage is no longer 20:1. His account is down to $3,800 (because of his four losses at $300 each) and he’s still trading one 100k lot.

He decides to tighten his stops to 50 pips. He opens another trade using two lots and two hours later his 50 pip stop loss is hit and he losses $1,000.

He now has $2,800 in his account. His leverage is over 35:1.

He tries again with two lots. This time the market goes up 10 pips. He cashes out with a $200 profit. His account grows slightly to $3,000.

He opens another position with two lots. The market drops 50 points and he gets out. Now he has $2,000 left.

He thinks “what the hell?!” and opens another position!

The market proceeds to drop another 100 pips.

Because he has $1,000 locked up as margin deposit, he only has $1,000 margin available, so he receives a margin call and his position is instantly liquidated!

He now has $1,000 left which is not even enough to open a new position.

He lost $4,000 or 80% of his account with a total of 8 trades and the market has only moved 280 pips. 280 pips! The market moves 280 pips pretty darn easy.

Are you starting to see why leverage is the top killer of forex traders?

As a new trader, you should consider limiting your leverage to a maximum of 10:1. Or to be really safe, 1:1. Trading with too high a leverage ratio is one of the most common errors made by new forex traders. Until you become more experienced, we strongly recommend that you trade with a lower ratio.

Best high leverage forex brokers

Dan schmidt

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Currency traders have a few advantages over traders of other types of securities. The market stays open 24 hours a day during the work week and the best forex broker commissions are often a fraction of what online stock brokers charge. But the biggest edge is margin requirements and leverage. You don’t need a big infusion of capital to begin a career as a forex trader, just the right tools and the right broker.

Best high leverage forex brokers:

- Best overall: FOREX.Com – open an account

- HYCM

- Avatrade

- IC markets

- Pepperstone

Best for

Overall rating

Best for

1 minute review

IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. The broker only offers forex trading to its U.S.-based customers, the brokerage does it spectacularly well. Novice traders will love IG’s intuitive mobile and desktop platforms, while advanced traders will revel in the platform’s selection of indicators and charting tools. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface.

Best for

- New forex traders who are still learning the ropes

- Traders who prefer a simple, clean interface

- Forex traders who trade primarily on a tablet

- Easy-to-navigate platform is easy for beginners to master

- Mobile and tablet platforms offer full functionality of the desktop version

- Margin rates are easy to understand and affordable

- Access to over 80 currency pairs

- U.S. Traders can currently only trade forex

- Customer service options are lacking

- No 2-factor authentication on mobile

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

FOREX.Com is a one-stop shop for forex traders. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX.Com is an excellent choice for brokers searching for a home base for their currency trading. New traders and seasoned veterans alike will love FOREX.Com’s extensive education and research center that provides free, informative forex trading courses at multiple skill levels. While FOREX.Com is impressive, remember that it isn’t a standard broker.

Best for

- Impressive, easy-to-navigate platform

- Wide range of education and research tools

- Access to over 80 currencies to buy and sell

- Leverage available up to 50:1

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

Though australian and british traders might know etoro for its easy stock and mobile trading, the broker is now expanding into the united states with cryptocurrency trading. U.S. Traders can begin buying and selling both major cryptocurrencies (like bitcoin and ethereum) as well as smaller names (like tron coin and stellar lumens).

Etoro offers traders the opportunity to invest their assets into premade portfolios or cryptocurrencies, similar to services offered by robo-advisors through traditional brokers. Though etoro isn’t a one-stop-shop for everything an investor needs, its easy-to-use platform and low spreads is a great way to enter the cryptocurrency market.

Best for

- International forex/CFD traders

- New cryptocurrency traders looking for an easy-to-use platform

- Traders who want to buy and sell cryptocurrencies on-the-go

- Simple platform that is easy to master

- Copytrader feature that allows new traders to copy the same strategies used by professionals

- Virtual dummy account that gives you $100,000 to practice trades

- U.S. Traders currently limited to cryptocurrencies

- Only 15 major coins available to trade

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

HYCM is 1 of the world’s leading forex brokers, offering investors access to over 69 unique currency pairs. However, forex isn’t the only thing the broker offers — HYCM also offers high rates of leverage, stock and ETF trading, commodity investing and much more. Getting started with HYCM is quick and easy, and most investors can open an account in as little as 10 minutes.

HYCM offers a varying fee structure, which allows investors to choose the spread option that’s best for them. A wide range of educational and investing tools are available, which can be equally beneficial to both experienced and novice traders. Though HYCM isn’t currently available in the united states, it can be a great choice for residents of the other 140 countries where it offers service.

Best for

- Investors who want a customizable fee schedule

- Traders comfortable using the metatrader platform

- Islamic traders who need swap-free accounts that don’t build interest

- Wide range of currency pairs available

- Excellent selection of educational tools

- $0 deposit and withdrawal fees

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

A fully regulated broker with a presence in europe, south africa, the middle east, british virgin islands, australia and japan, avatrade deals with mainly forex and cfds on stocks, commodities, indexes, forex, cryptocurrencies, etc. This brokerage is headquartered in dublin, ireland and began offering its services in 2006. It offers multiple trading platforms and earns mainly through spreads.

Best for

- Beginners

- Advanced traders

- Traders looking for a well-diversified portfolio

- Controlled by regulatory agencies of multiple countries

- Choice offered in terms of trading platforms

- Support available in 14 languages and trading platforms in 20 languages

- Practice/demo account available for trying out

- Breadth of trading assets

- Does not accept customers from the U.S. As it isn’t regulated in the U.S.

- Transferring funds to the account may take up to five days; withdrawals could take up to 10 days

What’s leverage and margin in forex trading?

Traditional stock brokers in the united states often offer margin trading to their clients. The broker will lend money to the client for additional stock purchases and then make money in interest when the loan is repaid. Margin rates vary, but most online brokers charge clients between 5% and 9% to borrow money, depending on the amount. Why would clients want to borrow money for the stock market from their brokers?

They want to crank up the leverage on trades.

Leverage refers to how much borrowed money is involved in a trade. In most stock brokerages, investors can get 2:1 leverage, which means they need $50 in their account to trade $100 in capital. Obviously, leverage adds risk to any trade. Since you don’t just lose your capital if it goes bad, you owe your broker money.

Excessive leverage has killed many financial firms, including lehman brothers and long term capital management. But when it’s used properly, you can generate tremendous profits with little upfront capital.

In forex trading, leverage can often be as high as 500:1. Since currencies move incrementally compared to stocks, using leverage doesn’t carry the same risks. When trades are measured in fractions of a penny, 500:1 leverage doesn’t seem excessive. Forex brokers use margin requirements to determine how much leverage currency traders can use per trade. This is expressed as a percentage, such as USD/EUR trades that require a 2% margin.

United states limitations

Forex trading is subject to stricter regulations in the united states than most countries in the world. Europe and australia have no aversion to leverage as high as 500:1, but U.S. Law limits forex brokers to 50:1 leverage.

Additionally, many forex brokers offer contracts for difference (cfds) on indices, bonds, commodities and even cryptocurrencies. These products are highly speculative and banned entirely in the U.S., which means metatrader 5 has practically no uptake.

What to look for in A high leverage forex broker

Choosing a forex broker depends not only on your trading preferences but also the country you live in. United states forex traders won’t be able to use the highest available leverage or use popular trading programs like metatrader 5. When you pick a broker, here are a few things to pay attention to:

- Margin requirements: in the united states, margin requirements are limited to 2% (50:1 leverage). Internationally, you can lever trades up to 500:1 on most major currencies. You don’t need to use high leverage on all trades, but make sure to pick a broker with limits that work for you.

- Commissions and fees: forex brokers make money in two ways: from commissions or from the spread. Many brokers have spread-only and commission accounts available, and commission accounts get reduced spreads. Brokers have fee charts on their websites. Make sure you understand all charges before you open an account.

- Support for trading software: many forex brokers have their own proprietary trading software, but also offer popular platforms like metatrader 4 and ctrader. If you like to trade using metatrader 4, make sure the broker you choose supports it!

- Account and trade minimums: capital required to open an account varies by the broker, as does the amount needed to complete a trade. Some brokers may have no account minimum, but all will have trade minimums.

The best high leverage forex brokers

Using the above criteria, benzinga has identified the best high leverage forex brokers on the market today. High leverage in the united states is limited to 50:1, but for international brokers to qualify, they must offer 500:1 leverage for at least a few major pairs.

The best leverage to use when trading with a $500 forex account

What the best leverage to use when trading with a $500 forex account?… the usual leverage used by professional forex traders is 100:1. What this means is that with $500 in your account you can control $50K. 100:1 is the best leverage that you should use .

The most important thing is how much of your account equity you are willing to lose on a trade. If you are willing to lose 2% of your account equity on a trade this translates into a $10 for a $500 account, $20 for a $1000 account and $200 for a $10K account. This is known as the percentage risk that you are willing to take.

RISK and LEVERAGE

RISK and LEVERAGE are different things . Most people confuse leverage with risk. In the answers below someone said leverage is not important it is the lot size that is important. This is partly true. Actually what is important is the risk percentage that you choose for your account. Then you translate that risk percentage into lot size using the leverage that you had chosen for your account plus what is your account equity. Let me explain how.

When we open a trade we decide how much risk we are willing to take. Lot size is determined by the stop loss size. Suppose you have a trade setup. The stop loss is 30 pips. We need to translate this 30 pips into the lot size.

This depends on how much risk you are willing to take. Suppose you are ready to lose 2% of your account equity on this trade. This means if you lose 2% of $500 you will lose $10, so you will end up with $490 in your account in case of a loss.

If you are willing to lose $10 on this trade you choose 2% risk level. So you will trade with a lot size of 0.03. With this lot size if you lose 30 pips, you will lose $9. And if you trade with a lot size of 0.04, losing 30 pips means you are going to lose $12. So the lot size should be somewhere between 0.03 and 0.04. Metatrader 4 does not allow 0.035 lot size. So either choose 0.03 or choose 0.04.

How you are going to calculate the lot size:

$risk= %risk*account equity/100

Lot size= $risk/(pipvalue*SL)

In this formula, %risk is the risk percentage that you chose which was 2%. $risk is this risk translated into dollar terms. So with the first formula you calculate $risk. We have %risk as 2% and account equity as $500. So:

$risk=2*500/100=$10

Our stop loss is 30 pips. Pipvalue for a 100:1 leverage account is 1 pips is equal to $10. So pipvalue is 10. Now we use the second formula and calculate the lot size:

Lot size= 10/10*30=0.033

As said above metatrader allows either 0.03 or 0.04. So choose either 0.03 in which your $risk will be $9 or choose 0.04 in which case your $risk will be $12.

Now suppose your leverage is 50. In this case $risk will be:

$risk=2*500/50=$10

This is same as before. %risk and $risk does not depend on leverage at all. It only depends on your account equity. You must have understood it by now. Pipvalue will be $5 as 1 pip will be equal to $5 now. So pip value is what depends on the leverage that you choose. Now lot size will be:

Lot size=10/(5*30)=10/150=0.0 666

So we can choose either 0.06 lot or 0.07 lot now. You must have observed now that by reducing the leverage you have doubled the lot size. But the net effect is the same. Whether you choose 100:1 leverage or 50:1 leverage, you are going to lose $10. So it doesn’t matter what leverage you choose . It all depends on the risk percentage that you are willing to lose. From that risk percentage you calculate the lot size which depends on the leverage that you chose for your account.

Now this pip value thing depends on the currency pair you choose to trade.

For pairs with USD as the base currency like GBPUSD, EURUSD, NZDUSD, AUDUSD it is easy to calculate. It is $10 for 100:1 leverage. If you half the leverage pip value also gets halved like $5 for 50:1 leverage. If you double the leverage to 200:1, it will double to $20. But for cross pairs like GBPNZD, EURGBP, AUDJPY, NZDJPY it is different. You should use an online pip value calculator for these pairs.

The leverage itself is less important. It’s the lot size that matter.

With such a small account I would go for the maximum available leverage. And would be trading either nano or micro lots (0.001-0.05)

It is essential to always keep the possible margin call in mind. The smaller the leverage you will be using (let’s say – 1:10) the faster you will get the margin call. With such a leverage you would be able to open $5000 worth of position that is a maximum 0f 5 micro lots (0.05) but in such a case even only a couple of pips in the losing direction will get your positions closed as there will be no more available margin.

If you are using a leverage of at least 1:100 – you are will be able to control $50 000.

And this next sentence is very important.

With this kind of leverage, you still open a max of 0.05 lots, otherwise it’s going to be the same case as with the smaller leverage – you’ll simply get margin called really fast.

This way you can still open a lot of different trades/set-ups and you will still have enough margin left.

Leverage 1:50 forex brokers

But what is it exactly? The term is widely used in finance and it refers to various techniques that use borrowed funds or debt rather than owned capital for making an investment. When trading with leverage, one has the opportunity to trade volumes larger than what would be possible with their own capital. In short, by taking advantage of the leverage offered by forex brokers, traders “borrow funds” from them to multiply the potential profits from a successful transaction.

Best forex brokers for united states

This may sound like an attractive offer because successful trades bring more than a decent profit. However, higher leverage constitutes a higher risk and if a deal goes bad, traders would lose more money than they would have lost without leverage. This is why they should carefully select a forex broker and always pay close attention to the conditions they are offered.

What is financial leverage?

Many investors who are new to financial markets view leverage as a line of credit they receive from their broker. But that is not true at all. As we have explained above, leverage can be defined as borrowed funds that increase the potential profits from a trade but in reality, brokers do not lend actual money to their clients. Instead, they extend leverage to retail traders by borrowing from banks, clearing agents, and liquidity providers.

To better understand how financial leverage is used in trading, we need to know the basics of it. In essence, most forex and CFD brokers are broker-dealers, acting as intermediaries between their clients and the market. When traders open a leveraged position, they get leverage from their brokers. In other words, they borrow capital that is multiple of their own funds – 2, 5, 10 or 100 times the equity on their account. The amount of leverage is displayed as the ratio of the clients’ funds to the capital borrowed from the broker – 1:2, 1:5, 1:10 or 1:100.

With a leverage of 1:50 and an investment of only $100, traders can open positions worth $5,000. If the trade turns a profit, this profit is not paid by the broker – it comes from the other party in the trade, the losing party (this could be another trader, a bank, or the broker). If traders lose, the lost funds are debited from the traders’ account balance. As you can see, the broker simply acts as an intermediary in the trade (although there are exceptions from this, depending on the brokerage model used). In any case, the 1:50 leverage amplifies both profits and losses – by a factor of 50 times compared to profits/ losses resulting from trading without leverage.

How does leverage work in forex?

The reason is that the foreign exchange market is the largest market in the world in terms of trading volume and the typical transactions in the interbank market range from hundreds of thousands to millions of dollars. In april 2019, trading in the forex markets averaged $6.6 trillion per day according to the bank for international settlements. The participants in these trades are mostly banks, international corporations, and hedge funds, which suggests that the sizeable transaction volumes are simply too huge for the majority of private, retail investors.

At the same time, the foreign exchange market has become accessible to individuals in the past few decades due to the emergence of fully digital trading systems and real-time online platforms. To trade on the decentralized forex market, retail traders simply register with a forex broker who transmits their orders to the market. The use of leverage, however, is a fundamental part of this process since it allows individuals to trade huge volumes while providing only a portion of the transaction value.

The process is quite simple – forex brokers require a certain deposit to be made to provide their clients with leverage of 10, 50 or 100 times their capital. The deposit is referred to as “required margin” and its purpose is to cover the potential losses in the event of a failure. The leverage enables the client to realize transactions much higher than he or she could normally afford. So, for instance, if you are using the services of a broker with leverage of 1:50, you will be required to invest only $2,000 in order to open a position worth $100,000.

In this case, the margin required is $2,000 or 2% of the total value of the transaction. If the trade is closed on a profit, the profit is based on the total value, which means that traders can realistically earn several thousand dollars with a deposit of $2,000. However, if the trade is not successful, the client will lose the same amount as a result of the leverage. This is why leverage is often described as a double-edged sword – it can multiply both profits and losses.

Is 1:50 leverage suitable for you?

To determine whether levels of 1:50 are suitable for you, you need to take into account your knowledge and skill in forex trading, your broader understanding of the financial markets, your starting capital, and your tolerance for risk. Moreover, most traders adjust the leverage ratio they will use to their trading style and the strategy they apply – there are day traders, scalpers, swing trader, position trader, algorithmic trader, and event-driven trader who can use even more strategies.

Regulation

The maximum allowed leverage in the US, for instance, is 1:50, while retail traders in the EU can use up to 1:30 leverage on major pairs. The rest of the restrictions introduced by the european securities and markets authority (ESMA) are as follows:

- 20:1 for non-major currency pairs, gold and major indices;

- 10:1 for commodities other than gold and non-major equity indices;

- 5:1 for individual equities and other reference values;

- 2:1 for cryptocurrencies

Initial capital

Of course, a standard lot of 100,000 currency units will then be out of reach for such clients, which is why brokers may allow opening positions with a 0.01 lot, worth $1,000. With a leverage of up to 1:50, the trader can control volumes of $2,500 and using even lower leverage of 1:20 would be enough to open such a trade. Those who choose the 1:50 level, however, will be maximizing the potential profits from the transaction. At the same time, they will be trading at the highest risk possible.

Trading strategy

This is why leverage of 1:50, which is quite high for novices, is preferred by day traders and scalpers. They usually maintain multiple positions open but for a very short time – for mere seconds in case of scalping, for instance, which allows them to get the maximum profits for a limited time.

Advantages of 1:50 leverage in forex

Another great benefit of using 1:50 leverage is that successful traders can make good, stable profits even they lose some of their initial capital. Losses are to be expected, after all. As we have explained above, leverage amplifies the potential profits as long as it is applied carefully and in combination with certain risk management techniques. Of course, traders should understand that leverage may act as a line of credit but it does not come with interest, which typically arises from credit.

Risks of using 1:50 leverage

The main risk of using 1:50 leverage is, of course, associated with the possibility to lose a lot of money. In fact, it is possible to lose more than you have deposited in your account when using excessive leverage without any stop losses or other tools for fund protection. This could happen when sharp, unexpected market movements occur and the time for reaction is mere minutes. To avoid huge losses, traders who use high leverage (anything above 1:20) should apply various measures to protect their account balance.

Leverage in forex trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/foreign-currency-804917648-5ae5ef29ff1b780036736d7c.jpg)

Leverage is the ability to use something small to control something big. Specific to foreign exchange (forex or FX) trading, it means you can have a small amount of capital in your account, controlling a larger amount in the market.

Stock traders will call this trading on margin. In forex trading, there is no interest charged on the margin used, and it doesn't matter what kind of trader you are or what kind of credit you have. If you have an account and the broker offers margin, you can trade on it.

The apparent advantage of using leverage is that you can make a considerable amount of money with only a limited amount of capital. The problem is that you can also lose a considerable amount of money trading with leverage. It all depends on how wisely you use it and how conservative your risk management is.

You have more control than you think

Leverage makes a rather boring market incredibly exciting. But when your money is on the line, exciting is not always good, and that is what leverage has brought to FX.

Without leverage, traders would be surprised to see a 10% move in their account in one year. However, a trader using leverage can easily see a 10% move in one day.

But typical amounts of leverage tend to be too high, and it is important for you to know that much of the volatility you experience when trading is due more to the leverage on your trade than the move in the underlying asset.

Leverage amounts

Leverage is usually given in a fixed amount that can vary with different brokers. Each broker gives out leverage based on their rules and regulations. The amounts are typically 50:1, 100:1, 200:1, and 400:1.

- 50:1: fifty-to-one leverage means that for every $1 you have in your account, you can place a trade worth up to $50. As an example, if you deposited $500, you would be able to trade amounts up to $25,000 on the market.

- 100:1: one-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth up to $100. This ratio is a typical amount of leverage offered on a standard lot account. The typical $2,000 minimum deposit for a standard account would give you the ability to control $200,000.

- 200:1: two-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth up to $200. The 200:1 ratio is a typical amount of leverage offered on a mini lot account. The typical minimum deposit on such an account is around $300, with which you can trade up to $60,000.

- 400:1: four-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth $400. Some brokers offer 400:1 on mini lot accounts but beware of any broker who offers this type of leverage for a small account. Anyone making a $300 deposit into a forex account and trying to trade with 400:1 leverage could be wiped out in a matter of minutes.

Professional traders and leverage

Professional traders usually trade with very low leverage. Keeping your leverage lower protects your capital when you make trading mistakes and keeps your returns consistent.

Many professionals will use leverage amounts like 10:1 or 20:1. It's possible to trade with that type of leverage regardless of what the broker offers you. You have to deposit more money and make fewer trades.

No matter what your style, remember that just because the leverage is, there does not mean you have to use it. In general, the less leverage you use, the better. It takes the experience to really know when to use leverage and when not to. Staying cautious will keep you in the game for the long run.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.

Leverage ratios

What are leverage ratios?

A leverage ratio is any kind of financial ratio financial analysis ratios glossary glossary of terms and definitions for common financial analysis ratios terms. It's important to have an understanding of these important terms. That indicates the level of debt incurred by a business entity against several other accounts in its balance sheet balance sheet the balance sheet is one of the three fundamental financial statements. These statements are key to both financial modeling and accounting , income statement income statement the income statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or , or cash flow statement cash flow statement A cash flow statement (officially called the statement of cash flows) contains information on how much cash a company has generated and used during a given period. It contains 3 sections: cash from operations, cash from investing and cash from financing. . These ratios provide an indication of how the company’s assets and business operations are financed (using debt or equity). Below is an illustration of two common leverage ratios: debt/equity and debt/capital.

List of common leverage ratios

There are several different leverage ratios that may be considered by market analysts, investors, or lenders. Some accounts that are considered to have significant comparability to debt are total assets, total equity, operating expenses, and incomes.

Below are 5 of the most commonly used leverage ratios:

- Debt-to-assets ratio = total debt / total assets

- Debt-to-equity ratio = total debt / total equity

- Debt-to-capital ratio = today debt / (total debt + total equity)

- Debt-to-EBITDA ratio = total debt / earnings before interest taxes depreciation & amortization ( EBITDA EBITDA EBITDA or earnings before interest, tax, depreciation, amortization is a company's profits before any of these net deductions are made. EBITDA focuses on the operating decisions of a business because it looks at the business’ profitability from core operations before the impact of capital structure. Formula, examples )

- Asset-to-equity ratio = total assets / total equity

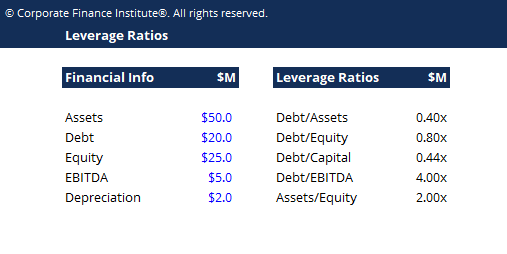

Leverage ratio example #1

Imagine a business with the following financial information:

- $50 million of assets

- $20 million of debt

- $25 million of equity

- $5 million of annual EBITDA

- $2 million of annual depreciation expense

Now calculate each of the 5 ratios outlined above as follows:

- Debt/assets debt to asset ratio the debt to asset ratio, also known as the debt ratio, is a leverage ratio that indicates the percentage of assets that are being financed with debt. = $20 / $50 = 0.40x

- Debt/equity finance CFI's finance articles are designed as self-study guides to learn important finance concepts online at your own pace. Browse hundreds of articles! = $20 / $25 = 0.80x

- Debt/capital = $20 / ($20 + $25) = 0.44x

- Debt/EBITDA debt/EBITDA ratio the net debt to earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio measures financial leverage and a company’s ability to pay off its debt. Essentially, the net debt to EBITDA ratio (debt/EBITDA) gives an indication as to how long a company would need to operate at its current level to pay off all its debt. = $20 / $5 = 4.00x

- Asset/equity = $50 / $25 = 2.00x

Download the free template

Enter your name and email in the form below and download the free template now!

Leverage ratio example #2

If a business has total assets worth $100 million, total debt of $45 million, and total equity of $55 million, then the proportionate amount of borrowed money against total assets is 0.45, or less than half of its total resources. When comparing debt to equity, the ratio for this firm is 0.82, meaning equity makes up a majority of the firm’s assets.

Importance and usage

Leverage ratios represent the extent to which a business is utilizing borrowed money. It also evaluates company solvency and capital structure. Having high leverage in a firm’s capital structure can be risky, but it also provides benefits.

The use of leverage is beneficial during times when the firm is earning profits, as they become amplified. On the other hand, a highly levered firm will have trouble if it experiences a decline in profitability and may be at a higher risk of default than an unlevered or less levered firm in the same situation.

Finally, analyzing the existing level of debt is an important factor that creditors consider when a firm wishes to apply for further borrowing.

Essentially, leverage adds risk but it also creates a reward if things go well.

What are the various types of leverage ratios?

1 operating leverage

An operating leverage ratio refers to the percentage or ratio of fixed costs to variable costs. A company that has high operating leverage bears a large proportion of fixed costs in its operations and is a capital intensive firm. Small changes in sales volume would result in a large change in earnings and return on investment. A negative scenario for this type of company could be when its high fixed costs are not covered by earnings because the market demand for the product decreases. An example of a capital-intensive business is an automobile manufacturing company.

If the ratio of fixed costs to revenue is high (i.E., >50%) the company has significant operating leverage. If the ratio of fixed costs to revenue is low (i.E., property, plant, and equipment PP&E (property, plant and equipment) PP&E (property, plant, and equipment) is one of the core non-current assets found on the balance sheet. PP&E is impacted by capex, (PP&E).

What are the risks of high operating leverage and high financial leverage?

If leverage can multiply earnings, it can also multiply risk. Having both high operating and financial leverage ratios can be very risky for a business. A high operating leverage ratio illustrates that a company is generating few sales, yet has high costs or margins that need to be covered. This may either result in a lower income target or insufficient operating income to cover other expenses and will result in negative earnings for the company. On the other hand, high financial leverage ratios occur when the return on investment (ROI) does not exceed the interest paid on loans. This will significantly decrease the company’s profitability and earnings per share.

Coverage ratios

Besides the ratios mentioned above, we can also use the coverage ratios coverage ratio A coverage ratio is used to measure a company’s ability to pay its financial obligations. A higher ratio indicates a greater ability to meet obligations in conjunction with the leverage ratios to measure a company’s ability to pay its financial obligations debt capacity debt capacity refers to the total amount of debt a business can incur and repay according to the terms of the debt agreement. .

The most common coverage ratios are:

- Interest coverage ratio interest coverage ratio interest coverage ratio (ICR) is a financial ratio that is used to determine the ability of a company to pay the interest on its outstanding debt. : the ability of a company to pay the interest expense interest expense interest expense arises out of a company that finances through debt or capital leases. Interest is found in the income statement, but can also (only) on its debt

- Debt service coverage ratio: the ability of a company to pay all debt obligations, including repayment of principal and interest

- Cash coverage ratio: the ability of a company to pay interest expense with its cash balance

- Asset coverage ratio: the ability of a company to repay its debt obligations with its assets

Additional resources

This leverage ratio guide has introduced the main ratios, debt/equity, debt/capital, debt/EBITDA, etc. Below are additional relevant CFI resources to help you advance your career.

- Coverage ratios coverage ratio A coverage ratio is used to measure a company’s ability to pay its financial obligations. A higher ratio indicates a greater ability to meet obligations

- Valuation multiples multiples analysis multiples analysis involves valuing a company with the use of a multiple. It compares the company’s multiple with that of a peer company.

- EV/EBITDA EV/EBITDA EV/EBITDA is used in valuation to compare the value of similar businesses by evaluating their enterprise value (EV) to EBITDA multiple relative to an average. In this guide, we will break down the EV/EBTIDA multiple into its various components, and walk you through how to calculate it step by step

- Financial modeling guide free financial modeling guide this financial modeling guide covers excel tips and best practices on assumptions, drivers, forecasting, linking the three statements, DCF analysis, more

Financial analyst training

Get world-class financial training with CFI’s online certified financial analyst training program FMVA® certification join 350,600+ students who work for companies like amazon, J.P. Morgan, and ferrari

Gain the confidence you need to move up the ladder in a high powered corporate finance career path.

Learn financial modeling and valuation in excel the easy way, with step-by-step training.

Best leverage for $50

US forex brokers with high leverage

US forex brokers with high leverage

In this article you will find US forex brokers with high leverage listed below. You will also find out why super high leverage brokers do not exist within the united states. Find out why you may need to open an account offshore to get the leverages of 100:1 and beyond.

Make sure you check out our 2020 list of US forex brokers with high leverage down below!

What is forex leverage?

Leverage is loaning out a certain amount of the money needed to invest in something, ie a stock, currency pair etc.

In forex trading money is borrowed from a broker.

Forex trading with high leverage means a starting deposit in a account can give you control of a much larger amount based on how much leverage is applied.

If you deposit 2% of the total transaction value as margin (same as saying as the amount deposited in your account) and you wanted to trade one standard lot of USD/EUR, which is equivalent to US$50,000, the margin required would be US$1,000.

Your margin leverage will be 50:1 (50,000/1,000).

For a margin requirement of 0.5%, the margin leverage will be 200:1

Take a look at these ratio and percentage examples.

| Margin as a ratio | margin required (percentage) |

| 500:1 | 0.2% |

| 200:1 | 0.50% |

| 100:1 | 1.00% |

| 50:1 | 2.00% |

List of US forex brokers with high leverage in 2020.

| Broker type | ECN |

| regulations | IFSC |

| min deposit | $100.00 |

| account base curreny | USD, EUR, GBP, AUD, CAD, bitcoin, gold, bitcoin cash, litecoin, ethereum and XRP |

| max leverage | 200:1 |

| trading platforms | metatrader 4/5 |

| Broker type | market maker |

| regulations | NFA, CFTC, RFED, FCM |

| min deposit | $50.00 |

| account base currency | USD CAD GBP |

| max leverage | 50:1 |

| trading platforms | forextrader, metatrader 4 |

| Broker type | market maker |

| regulations | IIROC, CIPF, NFA, FCA, CFTC, ASIC, MAS |

| min deposit | $1.00 |

| account base currency | AUD CAD EUR GBP HKD JYP SGD CHF USD |

| max leverage | 50:1 |

| trading platforms | web trading, metatrader 4, oanda desktop trading platform |

Can US residents get more than 50:1 leverage?

The short answer is no. 50:1 leverage is the maximum amount of leverage aloud within the united states.

This is because the US regulation forbids forex brokers in the united states to offer leverage above 50:1 or 2%

Forex trading in the USA is regulated by the NFA (national futures association) and the CFTC. Some of the regulations that have to be met are:

- Limits leverage to 50:1 on the major currencies.

- Limits leverage of 20:1 on minor currencies.

- First-in-first-out (FIFO) rule.

- US residents are only allowed to trade with US forex brokers under NFA regulations.

- Money owed by the forex broker to the client should be held at one or more qualifying institutions in the US.

- Retail forex trading brokers in the united states must maintain minimum capital of at least $20 million and 5% of the amount by which liabilities to retail forex customers exceed $10 million. Making it tough for any new comer to the business as it take a lot of capital just to get started.

- Provide weekly financial statements to the NFA to ensure that all financials are in order.

- No hedging allowed.

What does this all mean?

It means most forex brokers do not offer clients from the USA high leverage above 50:1, because of the strict requirements set out by the regulators, NFA and CFTC.

Best leverage for $50

Low minimum deposit forex brokers

After spending weeks of examining and reviewing many brokers, I found some of the best low minimum deposit forex brokers with micro accounts below $10.

Here’s a list of the best legit and regulated low minimum deposit forex brokers with small micro accounts:

You can find reviews and more brokers with micro accounts in the table at the bottom of this post.

You'll see in this article:

Why forex micro accounts?

There are a few reasons that people look for the forex brokers with low minimum deposit or forex micro accounts but I think the main reason is that you are a new trader and you want to get your feet wet before plunging into the ocean.

Well, that’s a wise thing to do and fortunately, there are several forex brokers offering low minimum deposit accounts so not only do you have a chance to begin with a few bucks but also you have a wide range of brokers that you can pick from.

There are some factors that you can pay heed to when choosing a low minimum deposit account. Some of them might not be as important while picking brokers for a larger size account, like educational material, and some should be treated differently such as leverage.

There might be other reasons for the traders to search for the forex brokers with low minimum deposits like having a strategy, especially a scalping one, with aggressive money management or dividing your capital into several small portions and keeping it out of your account for psychology issues or any other reasons.

Either way, you are probably interested in knowing some information about the brokers in this category so that you can make a more reliable decision.

What to search in low minimum deposit forex brokers?

There are several sections that I’ve designed for the table but some of them are more important especially if you are new to trading so I’ll explain them to some extent.

These are some of the factors that I think are important to consider when searching for low minimum deposit forex brokers.

I looked into these metrics precisely when I was searching for micro accounts brokers so that I can write a fair review and provide useful information for everyone that reads this post.

Ok, now let’s see what you should look at when seeking brokers with small accounts.

Regulation

Brokers’ regulation is always important however it’s crucial when you trade with large size accounts. With a low minimum deposit, you don’t need to scout out for a highly regulated broker with the authorization of several financial bodies in different parts of the world.

On the other hand, choosing a broker with no regulation is not a wise decision either because they have no obligatory conditions that watch their probable wrongdoings and make them accountable if they do something illegal.

Not regulated brokers have tempting conditions in some cases such as lower spreads but you can find those situations, and even better, in some regulated brokers as well — you just need to dig deeper.

Not all unregulated brokers are scam and you may find a good one every now and then but I prefer to look for the best ones among regulated brokers.

I think having one regulation in this case suffices. That’s why I’ve chosen the brokers in this list from the ones that are authorized by one regulatory body at the least.

If you want to know more about the method that I used for scoring them, you can see this post that I explain about that.

Spread

With low minimum deposit accounts, you get the worst spreads of brokers most of the time. This is definitely not the strong suit of micro or mini accounts but if this is your priority, for example if you are a scalper, there are still some brokers in the list that have lower spreads.

You will defiantly have problems if you’re a scalper with a 3 to 4 pip tp/sl unless you have an impressive win rate.

On the other hand, there are plenty of options to pick from if you have something like a 10-pip target or stop loss.

If you are a longer-term trader like a day trader, the condition is better and you can pay attention to the other aspect of the brokers as well.

The spread section of the list is based on the lowest spread (from) you get for EUR/USD, which normally has the lowest spread among all the available currency pairs.

If you trade a specific pair or pairs or even other trading instruments like metals, cfds, cryptocurrencies, and etc; you can find the typical or minimum spreads for them on the website of the brokers.

Another good side of regulated brokers is that they publish some information like their spreads on their websites, however, according to my experience, the information released by high regulated brokers are more reliable.

Leverage

This is probably the most important factor for micro accounts. It makes it possible to trade with a low budget in general. Without that there’s no such a thing as a low minimum deposit account.

As a general rule, the higher leverage in small size accounts the better and the lower in large-size accounts the safer, so it’s kind of a double-edged sword.

It’s very hard to trade with as low as 5 or 10 dollars normally even with high leverage like 1.2000, now imagine you have to trade when you have 1:300 with min lot size of 0.01 — it’s kind of impossible to open more than one trade at a time.

In a nutshell, with a 1:300 leverage and 0.01 lot size and a $10 account, we can have roughly 2 trades at a time so if you have a strategy that generates lots of signals, you should pick the highest leverage or larger lot size or even both.

For example, with a lot size of 0.001, you can have 20 trades with the same leverage (1:300) and even larger tp/sl.

If you just open one trade at a time even 1:200 will be enough. In this case, you can put stress on other aspects of the broker you want to pick.

Min lot size

Minimum lot size is the next crucial factor for minimum deposit accounts. The combination of this and the leverage determines your freedom in trading with micro accounts.

As we saw, the larger leverage the better for micro accounts. It’s the opposite for min lot size, the smaller the better.

One standard size for example for EUR/USD is worth $10. 0.1 lots are worth $1 and 0.01 lots are worth 10 cents.

With a $10 account, considering you use a large leverage like 1:1000, you almost have 100 pips which makes it possible to have lots of small trades with a for example 5-pip tp/sl.

Imagine how many trades you can have with 0.001 or even 0.00001 lot size. It’s very helpful for scalpers with a lot of simultaneous trades.

There are some brokers in the list that provides such lot sizes, so if opening lots of positions at the same time is in your trading style, they would be a great fit for you.

Education

This section is not necessarily important if you are not new to trading but it’s a helpful element to consider if you are a newbie.

You have to be well-equipped before even think of trading a small account, but since micro accounts can be an alternative to the demo accounts, you can start with a few dollars right away instead of fake money.

There are some advantages to that. First of all, there are some differences between demo and live accounts.

For example, you may not see problems like slippage (getting a worse price than the one you order), or at least not as frequent, in demo accounts.

So when you trade with a live account especially if you rip a few number of pips like scalpers, you might get into trouble and stumble upon situations you’ve never seen before.

Another issue that you might come across when trading with live accounts is psychology. You can trade with fake money and win or lose big amounts but nothing changes inside you.

You trade fearlessly and don’t care about your trades so you wouldn’t get back and analyze them to find the flaws. It’s different in real money even if it’s not much.

Anyway, if you’re a complete beginner, choosing a broker with educational material can serve you well in the early stage of your trading career.

You’ll probably need more, especially in terms of experience, but even basics can prevent you from jumping into many unreasonable trades or losing your money soon.

I went through all the educational materials of the brokers listed here so that I can be a better reviewer. I didn’t want to just see the headlines of education sections on the brokers’ websites to figure out if they have any material but I examined each of them thoroughly so that I can give meaningful scores.

The scores are from A+ which includes the educations that have useful articles, videos webinars, seminars with high-standard quality, to B which means the broker only provides some basics.

If you are a rather experienced trader, you can skip this section and pay attention to other parts but if you are a beginner, consider this factor as one of your choosing criteria.

Bonus

I chose this factor for the brokers with low minimum deposit because it can increase your initial money so that you can trade with a chubbier account, however, it might not be beneficial to you if you don’t know these kinds of bonuses well.

First of all, you should know that there’s nothing like free money in this case. It means no broker gives you a bonus with no string attached. You need to trade and redeem the bonus.

In other words, the brokers take back their money when you trade and give them spreads or commission which are the revenue stream of the legit brokers.

For example, for withdrawing a bonus, you need to trade a rather high number of lots compare to the size of your account. It’s even worse when they give you no deposit bonus.

For example, if you get a $50 bonus, you need to trade 50 standard lots so that you can withdraw that $50. In other words, you have to be a hell of a trader with lots of trades in a day because in most cases you have a limited time for redeeming the money too.

It can lead to overtrading and growing other bad trading habits which are fatal to the future of your trading especially if you are a newbie.

If you decide to use these types of bonuses, you can find them on the table or on this post that I wrote about them here.

Just make sure to read the terms and conditions of the bonus so you don’t break the bonus’ rules and waste your time.

There are reviews both on the above link and on the links inside the table that explain the conditions thoroughly.

Support

Since online trading creates an opportunity for people from all over the world, brokers try to provide service in different languages.

It comes in handy for the traders who don’t speak english or english is not their native language because there might be some terms and conditions that people ignore because they don’t understand them correctly.

Brokers’ website is the primary source of the clients to find everything they need to know about their brokers and become more familiar with different parts of them.

Moreover, it’s very helpful for those who want to take advantage of educational materials. If the broker’s website offers their languages, the learning process becomes more productive.

Supporting different languages on a website doesn’t necessarily mean that they have customer service or support in those languages.

Some websites support lots of languages but they only have english customer service agents. On the other hand, there are some brokers in the list that have agents for most of the languages that their site supports.

Hotforex, FXTM, FBS, robo forex are some of them.

You can find whether they speak in your language or not by either having a look at their contact page or asking them via online chat.

So, let's see, what we have: find US forex brokers with high leverage that offer 50:1 to as much as 200:1. Open an account offshore to get the leverages of 100:1 and beyond. At best leverage for $50

Contents of the article

- New forex bonuses

- Best leverage for $50

- List of US forex brokers with high leverage in...

- How much leverage is right for you in forex trades

- The risks of high leverage

- Example using maximum leverage

- Example using less leverage

- How to pick the right leverage level

- The bottom line

- Low leverage allows new forex traders to survive

- Example #1

- Example #2

- Best high leverage forex brokers

- Best high leverage forex brokers:

- Best for

- Overall rating

- Best for

- 1 minute review

- 1 minute review

- 1 minute review

- 1 minute review

- 1 minute review

- What’s leverage and margin in forex trading?

- United states limitations

- What to look for in A high leverage forex broker

- The best high leverage forex brokers

- The best leverage to use when trading with a $500...

- Leverage 1:50 forex brokers

- Best forex brokers for united states

- What is financial leverage?

- How does leverage work in forex?

- Is 1:50 leverage suitable for you?

- Advantages of 1:50 leverage in forex

- Risks of using 1:50 leverage

- Leverage in forex trading

- You have more control than you think

- Leverage amounts

- Professional traders and leverage

- Leverage ratios

- What are leverage ratios?

- List of common leverage ratios

- Leverage ratio example #1

- Download the free template

- Leverage ratio example #2

- Importance and usage

- What are the various types of leverage ratios?

- What are the risks of high operating leverage and...

- Coverage ratios

- Best leverage for $50

- List of US forex brokers with high leverage in...

- Best leverage for $50

- Low minimum deposit forex brokers

- Why forex micro accounts?

- What to search in low minimum deposit forex...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.