Jp markets copy trade

There are a few steps one should take in order to successfully copy trade. With avatrade you can trade on leading platforms for copy trading:

New forex bonuses

Copy trading

Open a trading account and receive

free trading training in 1 minute!

What is copy trading

Copy trading enables traders, experienced and new alike, to take part in the financial markets, by having their trades executed by experienced and seasoned traders with proven track records. This form of trading offers a unique solution for people who wish to trade and invest money with the aim of increasing their initial capital, however lack the time or experience to invest by themselves. For this reason brokers offer the possibility of copy trading. There are multiple platforms which offer copy trading, and while some are manual, other are automated or semi-automated, and all offer different variations of copy trading.

The rise of copy trading

To begin we need to establish that there are two main types of traders, those who attend seminars, attempt to compile strategies, follow all market trends, and enjoy ‘expert-trading-fees’. Then you have the other group that want to make money with as little input and effort as possible.

For the latter, mirror or copy trading was created and has suited many as the perfect solution.

The growth in the past 5 years of copy trading has been exponential, for its main reason is that many traders ‘trust’ this system, and have a comforting feeling that they are not trading alone. Avatrade offers you popular signal providers that are the best in the business.

Copy trading is not only for the unexperienced, a lot of expert traders use copy trading as a means of market research, it saves time and could be part of a new strategy that could be implemented and profitable.

Advantages of copy trading

There are many advantages to copy trading, and as such it has earned its place amongst traders:

- Allows first time traders to familiarize themselves with the financial markets and gain confidence to trade. Enables experienced traders to take part in the market even when they are too busy, and cannot invest the valuable time and research needed in order for them to trade.

- Copy trading can be employed on various instruments, including forex trading online, stocks trading, commodities and much more.

- Creates a community of traders, beginners traders and experienced alike, who can exchange ideas, strategies and improve their trades together.

Register today and get a welcome bonus of up to $10,000.

How to successfully copy trade

There are a few steps one should take in order to successfully copy trade.

Find the right broker

look no further – selecting a trusted and regulated broker, with which the funds and client’s details are completely safe, is imperative. Avatrade ensures that the funds of our clients are kept in segregated accounts within international banks. In additions, we are a regulated broker with 5 international regulations.

Select a suitable account

it is time to open an account on an automated trading platform. We have the zulutrader as well as the duplitrade and MQL5 signal services, which are readily available to all traders that wish to take part in automated trading.

Pick your signal providers

after the account is active, the platform generates a list of signal providers, from which the trader can choose the best one for them.

When following these steps, a few guidelines are important to remember. During each step one can choose from a large variety – there are many brokers, multiple platforms and plenty of signal providers. It is important to narrow down the choices of each to the ones that are suitable to the trader and his needs.

Subjects such as the goals the trader wants to achieve, the instruments he wishes to trade, the amount of capital he can invest, to name a few – should all be figured out before commencing to trade, and once done choosing the broker, the platform and the signal provider trading should be much easier.

Copy trade with avatrade

Avatrade offers you a variety of direct and indirect copy trading opportunities, and collaborates with leading signal providers to ensure that you can opt to follow traders from around the world.

With avatrade you can trade on leading platforms for copy trading:

- Zulutrade – with a large variety of signal providers to choose from

- MLQ5 signal service – sends signals to MT5 AND MT4, a world leading trading platform

- Duplitrade – easily and conveniently copy trades from multiple signal providers

The combination of avatrade’s global reputation with the best signal providers, gives traders the security in knowing that their trades are in the safe hands of some of the best traders.

Copy trading main faqs

If your plan is only to follow and copy other traders there is no experience required, although it can be helpful in analysing and selecting a good trader to copy. In reality it is often the traders with no experience who like to use copy trading. It can be a good way to begin growing an account, and if you take the time to analyse the trades being made by those you follow it can also be a very good way to learn about trading too. If you’re a new trader and are worried about losing money with copy trading you could always try it with a demo account first before funding your account.

If you take the time to identify good traders to copy you aren’t taking any more risk than when trading your own account. That is to say trading is inherently risky, and there is always the possibility that you will lose money. Also note that the past performance of a trader is no guarantee of their future performance, so even if they’ve been profitable for three years running, they could have their first losing week right after you decide to follow them. As always, never invest more than you can afford to lose.

While it might seem tempting to copy the trader with a 300% annual return, in general these traders are taking on far too much risk and eventually will blow up. Instead look for traders who have at least 1-year trading history and a return somewhere between 10% and 30%. The trader should also be active enough that they are placing a minimum of one trade per week. This ensures that they are trying to grow their trading base rather than just locking your money in a single trade. If you want to spread out your risk you can spread out your copy trading between 2-4 different traders.

Open your copy trading account with avatrade today!

Alpari copytrade

Sit back and watch your potential profits grow with copy trade service

Want to trade forex but don’t know where to start? Experience all the excitement of the most liquid market in the world when you copy the trades of a suitable strategy manager.

How alpari copytrade works

Alpari copytrade allows you to copy the trading positions of another trader, called the strategy manager. The beauty is that you don’t need any advanced knowledge of forex trading to get started. These strategy managers usually have a wealth of experience in the markets, with tried-and-tested strategic trading decisions. Once you decide whom to follow, they do the trading that could lead to potential increases in your capital.

Let’s say you invest $1000. You start following and copying the trades of a strategy manager who makes a $200 profit on his next successful trade. Through alpari copytrade’s system, the strategy manager earns an extra 10% of this profit, while you add $180 to your initial investment for a total of $1180. Without as much as lifting a finger, you’ve earned a tidy sum. Not bad, right?

Join alpari copytrade today…

…with as little as $/€/£100!

Straightforward

No need for any advanced forex trading experience or deep knowledge

Stay in control

You choose the most suitable strategy manager for you and how much you want to invest

Safe and secure

Your account is only visible to you and is completely protected

Up-to-the-minute updates

Monitor your account in real-time

Accessible from anywhere

Stay connected on our website or wherever you are in the world

Easy to manage

Manage your funds the way you want to – withdraw, invest and pay your strategy manager only if you profit

While past strategy manager results do not guarantee future returns, and the likelihood for losses is always present, the key is that everyone has the possibility to profit from alpari copytrade.

Join today and find out how.

- Fill in the form above and register your account

- Choose the most suitable strategy manager from hundreds of choices

- Verify your account

- Deposit funds, sit back and watch that strategy manager trade for you!

Top 3 strategy managers

Capitalfirst

MFT-TEAM-KH

Stable1

Past performance does not guarantee future results.

Grow your portfolio

Trading conditions

About us

Policies & regulation

Promotions

Trading guides, articles & insights

ALPARI INTERNATIONAL is the business name of exinity limited which is regulated by the financial services commission of the republic of mauritius with an investment dealer license bearing license number C113012295.

Registered address: 5th floor, 355 NEX tower, rue du savoir, cybercity, ebene 72201, mauritius.

Card transactions are processed via FT global services ltd, reg no. HE 335426 with registered address at tassou papadopoulou 6, flat/office 22, ag. Dometios, 2373, nicosia, cyprus. Address for cardholder correspondence: [email protected]

Risk warning: trading forex and leveraged financial instruments involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. It is the responsibility of the client to ascertain whether he/she is permitted to use the services of the alpari international based on the legal requirements in his/her country of residence.

Regional restrictions: alpari international does not provide services to residents of the USA, mauritius, japan, canada, haiti, suriname, the democratic republic of korea, brazil, puerto rico, the occupied area of cyprus. Find out more in the regulations section of our faqs.

Copy trading: trade like etoro’s top traders

Copytrader™, etoro’s most popular feature, allows you to view what real traders are doing in real time and copy their trading automatically

Etoro’s award-winning copytrader technology is a game changer in the industry, enabling anyone to trade like a top trader.

When they trade, you trade

Whether you’re a beginner learning the basics or you simply don’t have time to watch the markets, now it’s easy to leverage other traders’ expertise. With etoro’s copytrader, you can automatically copy top-performing traders, instantly replicating their trading in your own portfolio.

Top traders work for you — without management fees

Sign up for etoro and start copying other traders at no extra charge. There are no management fees or other hidden costs involved. View our complete pricing policy here.

The traders you copy get paid directly as part of our popular investor program. To learn more about earning income by being copied on etoro, click here.

Not just a copy trading platform, but a community

For those looking to improve their trading, etoro offers so much more than just a copy trading platform. You’ll be joining a leading collaborative community of traders and investors — a place to connect, share, and learn. View millions of other traders’ portfolios, stats, risk scores, and more. Chat with them, discuss strategies and benefit from their knowledge.

We are only as GOOD

As our clients say WE ARE

Ready to start copy trading?

Copytrader is so simple and user-friendly. Once you’ve spotted a trader you like, just click and let the copy trading begin

How to copy traders on etoro

Search for traders by performance, assets, risk score, and more

Choose a total amount for the copy — the proportions are calculated automatically

Click the “copy” button to start automatically copying the trader’s positions

Meet some of etoro’s most profitable popular investors

| gain in last 12M. | AVG risk score | ||

|---|---|---|---|

| | 12.1% | 4 | copy |

| | 21.66% | 3 | copy |

| | 12.38% | 3 | copy |

| | 26.02% | 5 | copy |

| | 46.39% | 5 | copy |

| | 21.36% | 3 | copy |

You’re in control

When you use copytrader, you still retain full control over managing your portfolio. Choose one trader to copy, or up to 100 simultaneously. You can stop the copy, pause it, and add or remove funds at any time. For more details on how copy trading works, click here.

Take it for a test drive

Want to try copytrader without risking any capital? Try it in demo mode. Every etoro account includes a free $100,000 virtual portfolio for you to practice with.

Ready to start copy trading?

We’ll help answer your questions so that you can get started copy trading today

There is no additional charge for copying another trader or traders. You will still be charged spreads on the trading and/or transaction fees where applicable. To view our complete pricing policy, click here.

The minimum amount required to copy a trader is $200.

Please note that there is a minimum amount for each copied position of $1. Positions not meeting the $1 minimum will not be opened.

Setting up your copy trading is simple. Choose the user that you’d like to copy, input the amount you’d like to allocate, and click COPY. You’ll be duplicating their positions automatically in real time and direct proportion.

You can start or stop copying a user at any time. You may also set a stop loss for the copy, add or remove funds, or pause the copy. For more details on how copy trading works, click here.

Trades are typically executed in less than a second from the instant the trader you copy executes their own trades.

Yes, other traders on etoro can copy you if your profile is public. However, only users approved to participate in etoro’s popular investor program are eligible to receive monthly earnings. For more information about becoming a popular investor, click here.

Ready to start copy trading?

- Top instruments

- Bitcoin (BTC)

- Ripple (XRP)

- Amazon shares

- Apple shares

- Gold (commodity)

- NSDQ100 index

- Support

- Help center

- How to deposit

- How to withdraw

- How to open an account

- How to verify your account

- Customer service

- Learn more

- How copytrading works

- Responsible trading

- Avoid scam

- What is leverage & margin

- Buy and sell explained

- Market research

Find us on

- Top instruments

- Bitcoin (BTC)

- Ripple (XRP)

- Amazon shares

- Apple shares

- Gold (commodity)

- NSDQ100 index

- Support

- Help center

- How to deposit

- How to withdraw

- How to open an account

- How to verify your account

- Customer service

- Learn more

- How copytrading works

- Responsible trading

- Avoid scam

- What is leverage & margin

- Buy and sell explained

- Market research

- About us

- About

- Etoro reviews

- Careers

- Our offices

- Privacy and regulation

- Etoro cookie policy

- Privacy policy

- Regulation & license

- General risk disclosure

- Terms & conditions

- Partners and promotions

- Invite a friend

- Affiliate program

- Etoro club

- Partner copyportfolios

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money.

The purchase of real/cryptoassets is an unregulated service and is not covered by any specific european or UK regulatory framework (including mifid). In the event that cryptoassets are purchased on a real/physical basis and not traded in the form of a CFD you will not benefit from the protections available to clients receiving mifid regulated investment services, such as access to the cyprus investor compensation fund (ICF)/the financial services compensation scheme (FSCS) and the financial ombudsman service for dispute resolution.

Etoro (europe) ltd., a financial services company authorised and regulated by the cyprus securities exchange commission (cysec) under the license # 109/10.

Etoro (UK) ltd, a financial services company authorised and regulated by the financial conduct authority (FCA) under the license FRN 583263.

Etoro AUS capital pty ltd. Is authorised by the australian securities and investments commission (ASIC) to provide financial services under australian financial services license 491139.

Past performance is not an indication of future results.

General risk disclosure | terms & conditions

You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before you decide to trade. Under no circumstances shall etoro have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to cfds or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Trading with etoro by following and/or copying or replicating the trades of other traders involves a high level of risks, even when following and/or copying or replicating the top-performing traders. Such risks includes the risk that you may be following/copying the trading decisions of possibly inexperienced/unprofessional traders, or traders whose ultimate purpose or intention, or financial status may differ from yours. Past performance of an etoro community member is not a reliable indicator of his future performance. Content on etoro's social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of etoro - your social investment network.

Copyright © 2006-2021 etoro - your social investment network, all rights reserved.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money.

Etoro is in the process of registering as a crypto service provider with de nederlandsche bank NV (DNB). Until the application is decided upon, etoro will no longer be able to provide crypto services to users in the netherlands.

The purchase of real/cryptoassets is an unregulated service and is not covered by any specific european or UK regulatory framework (including mifid). In the event that cryptoassets are purchased on a real/physical basis and not traded in the form of a CFD you will not benefit from the protections available to clients receiving mifid regulated investment services, such as access to the cyprus investor compensation fund (ICF)/the financial services compensation scheme (FSCS) and the financial ombudsman service for dispute resolution.

Etoro (europe) ltd., a financial services company authorised and regulated by the cyprus securities exchange commission (cysec) under the license # 109/10.

Etoro (UK) ltd, a financial services company authorised and regulated by the financial conduct authority (FCA) under the license FRN 583263.

Etoro AUS capital pty ltd. Is authorised by the australian securities and investments commission (ASIC) to provide financial services under australian financial services license 491139.

Past performance is not an indication of future results.

General risk disclosure | terms & conditions

You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before you decide to trade. Under no circumstances shall etoro have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to cfds or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Trading with etoro by following and/or copying or replicating the trades of other traders involves a high level of risks, even when following and/or copying or replicating the top-performing traders. Such risks includes the risk that you may be following/copying the trading decisions of possibly inexperienced/unprofessional traders, or traders whose ultimate purpose or intention, or financial status may differ from yours. Past performance of an etoro community member is not a reliable indicator of his future performance. Content on etoro’s social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of etoro – your social investment network.

Copyright © 2006-2021 etoro – your social investment network, all rights reserved.

JP markets review

User review

JP markets is an international online broker that started operating in 2016. Although the company has been around for just a few years, it has already built a relationship of trust with its clients. It began as a small company with a small office and a few workers, but today, it has offices in several countries across the globe.

• negative balance protection

• sophisticated trading platforms

• safe and secure

• excellent customer support

• no promotions

• users only trade cryptocurrencies but don’t own them.

The founder of jpmarkets is a south african entrepreneur called justin paulsen. He has a major in finance and economics at the university of cape town. Paulsen got the opportunity to interact with a number of asset managers, hedge fund managers, forex traders, and portfolio managers while working for a leading forex broker in south africa.

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Reasons to sign up at JP markets for south african traders

Here are six stout reasons for south african investors and traders to sign up at JP markets:

- Negative balance protection – you will never end up owing JP markets any money because it uses a risk management system and an automated transaction management system to prevent a client’s account from turning negative.

- Sophisticated trading platforms – JP markets offers adequate and fast trading platforms. Since there are no lags and requotes, clients get exactly what they want.

- Safe and secure – the forex broker maintains client funds separately from its own funds.

- Free deposits and withdrawals – the broker does not charge clients for processing deposits and withdrawals.

- Fast payment methods – the deposits are instantly credited to traders’ accounts. And customers can instantly withdraw their profits from their accounts. They simply do not have to wait long for the transactions to go through.

- Excellent customer support – the customer support agents are friendly, helpful, and prompt. You can get in touch with the FX broker through live chat, email, or phone.

Is JP markets reliable forex broker?

South african investors can definitely rely on JP markets as it is the biggest forex broker in africa and south africa. During the last few months, the company has experienced tremendous growth and has expanded into bangladesh, pakistan, and kenya.

The broker operates on a license issued by the financial services board of south africa. You can view a copy of the license on the JP markets website.

You can contact JP markets through the telephone number +27-010-590-1250, the email address [email protected], or the facebook account www.Facebook.Com/jpmarketssa. JP markets has offices in johannesburg, pretoria, cape town, swaziland, and polokwane.

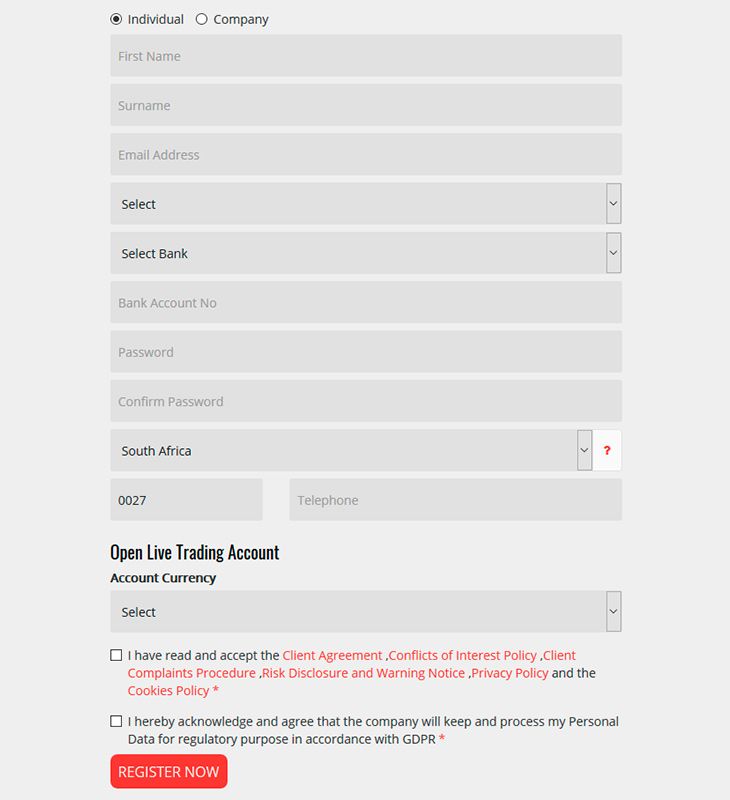

Create an account to start trading

You can open a live trading account at JP markets in three simple steps:

- Complete the online registration form.

- Verify their account by clicking on a link in the FX brokers’ first email.

- Load their trading accounts and start trading.

Traders can open accounts as individuals or companies.

We strongly recommend reading the client agreement form, client complaints procedure, privacy policy, cookies policy, risk disclosure and warning notice, and conflicts of interest policy carefully before registering an account.

Making deposits and withdrawals at JP markets

South african traders can choose a bank from the given list of banks to make a deposit. They can use their MT4 account number for reference. It may take up to 24 hours for the funds to be credited to traders’ accounts. If they want the funds to be credited faster, they have to email payment proofs to [email protected]

- ABSA

- Standard bank

- Nedbank

- Snapscan

- First national bank

- Mpesa

- Online gateways

There are three ways to make withdrawals at JP markets:

- Client portal – you can quickly and easily request payout through their client portal.

- Online platform – you can withdraw through the platform using payfast/skrill or local bank transfers. JP markets processes payout requests from monday to friday, between the hours of 9:00 a.M. And 5:00 p.M. You will receive a verification call from the broker for purposes of security.

- Whatsapp – you can send your payout request to 079-604-4252 and include your MT4 account number and the amount you would like to withdraw. When it receives the request, the company verifies the details and credit payouts in 24 hours after the completion of the verification procedure.

However, withdrawal through whatsapp is available only from 10:00 a.M. To 4:00 p.M. From monday to friday.

Types of trading platforms

Traders can choose from the following platforms at JP markets:

MT4 for windows

Customers can download MT4 for windows, android, and ios and enjoy features such as no rejections, no requotes, and flexible leverage in the range of 1:1 to 500:1. This platform is suitable for traders of different skill levels.

The MT4 platform is popular for its user-friendly interface, technical analysis tools, automated trading capabilities, advanced charting features, and automated trading capabilities. JP markets’ MT4 platform supports multiple currencies such as PLN, SGD, GBP, EUR, and USD. Also, it is available in 30 languages.

MT4 for mac

Traders can use wine, a free software program that enables systems based on unix to run applications developed for MS windows. Unfortunately, wine is not fully stable. So the application may not work as intended.

JP markets recommends playonmac, a free wine-based application that can be used to easily install windows applications on devices that run on the mac operating system.

MT4 for linux

Users of linux computers can use wine to install MT4 on their systems. However, they must understand that the application may not work properly.

Account types

JP markets offers different types of accounts to meet the requirements of different types of customers.

- USD, GBP, and ZAR based accounts

- Accounts that charge commissions

- Accounts that charge spreads as costs

Each type of account gives clients direct access to the market. The orders flow directly to the market, ensuring that traders get the best market prices without any slippage, price manipulation, and lag.

There are micro as well as mini accounts, but the forex broker doesn’t discriminate between the two.

Unique features of JP markets

Here are some features that make jpmarkets unique and set it apart from the other forex & CFD brokers in the industry:

JP markets mastercard

Registered traders at JP markets can apply for the JP markets mastercard and become a VIP mastercard client. They can use their card to make payments and withdraw money at atms. Also, they can use it to manage their profits easily.

To qualify for a JP markets mastercard, customers have to create a trading account and maintain a minimum balance of R5000. The holders of this card can use it only in south africa, not in any other country. This card has been designed to enable JP markets to pay profits to its clients; so traders cannot load any money in it. However, they can apply for a total of three JP markets mastercards.

To check their balance, clients have to log in to www.Whatsonmycard.Com. They should note that they cannot use their card to store any money and accrue interest on it. They have to use their card to either make purchases or withdraw their money at an ATM. They cannot withdraw the funds on their card at any bank.

Copy trading

Customers can earn profits by copying the trades of professional traders at JP markets. They will just be investing funds and a copy master will manage their funds for them. Any professional trader can become a copy master at JP markets. They can do so by following these steps:

- Visit jpmarkets.Co.Za/copy-trader and complete the online application form.

- An account manager will contact them and give them some paper work.

- Visit copytrader.Jpmarkets.Co.Za and open an account.

- When the company approves your fund manager or professional trader status, you can log into your account at copytrader.Jpmarkets.Co.Za

Welcome bonus

You get a welcome bonus of up to 100% just for opening a live trading account and making a deposit. You have to deposit at least R3,000 to qualify.

JP markets offers 25% bonus on deposits in the range of R3000 to R30,000; 40% bonus on deposits in the range of R30,001 to R60,000; 60% bonus on deposits in the range of R60,001 to R100,000; 80% bonus on deposits in the range of R100,001 to R125,000; and 100% bonus on a deposit of $125,000.

JP markets FAQ

Q1: how much should I deposit in my trading account?

A: JP markets doesn’t set any deposit limits for its clients. So you can deposit any amount you wish. However, JP markets recommends a minimum deposit of R3000, especially if you are a new trader in need to training.

Q2: do clients have to pay for the trading education at JP markets?

A: JP markets offers excellent forex trading absolutely free of charge to holders of live trading accounts. The forex broker offers classes at some of its offices in south africa. Also, it offers video courses and online courses for traders who wish to learn at their own pace. Those interested can send an email to [email protected] for more information.

Q3: can I use bitcoin to load my trading account?

A: you can use bitcoin, but only through skrill. You can use bitcoin to load your skrill wallet and then transfer the money to your trading account.

Q4: how much money can I make at JP markets?

A: it all depends on how well you trade. You should learn to make informed decisions using a wide range of trading tools. Also, you should learn how to manage your risks well.

Q5: are my funds safe at JP markets?

A: yes, your money is 100% safe at JP markets. This is because the online broker holds clients’ money in separate accounts and never mixes it with its own funds. In addition, it has professional indemnity insurance to protect clients’ funds.

Should you open an account at JP markets?

If you reside in africa, you certainly should. JP markets is not only licensed and regulated in south africa, but also supports ZAR and offers products designed for african traders. In addition, it has several offices across africa and is founded by a well-known african entrepreneur.

JP markets is not only a safe, secure, and well-regulated online trading platform, but also an excellent educator. If you have never traded before, you can easily learn how to trade at jpmarkets.

JP markets review

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Jp markets copy trade

Discover financial markets with

investments from 100 USD.

Thousands of participants

Join a huge community of traders

and investors.

Multifunctional control

Control every stage investments

and allocation of funds.

Minimum investments

Discover financial markets with

investments from 100 USD.

Thousands of participants

Join a huge community of traders

and investors.

Multi-functional control

Control every stage investments

and allocation of funds.

How to become a successful investor with prixo?

Just few steps of the registration procedure are between you and a brand new level of trading. Every participant of the platform will surely find all tools and instruments that are necessary for success, whether they are an exceptional trading strategy, which is attractive to subscribers, or the most promising trader to copy transactions from. Prixo allows you to benefit from both of these opportunities in order to increase your trading efficiency.

3 step to start investing

Register prixo markets

Complete a simple registration procedure of prixo members area and investment account. It allows you to venture into the world of finances.

Specify the investment

Decide on the amount of money you want to invest together with prixo and deposit it to your account using prixo available payment systems.

Start working

Copy transactions or offer strategies to others to copy them. The choice is yours! Specify conditions and create subscriptions in prixo members area.

How to become a successful investor with prixo?

Just few steps of the registration procedure are between you and a brand new level of trading. Every participant of the platform will surely find all tools and instruments that are necessary for success, whether they are an exceptional trading strategy, which is attractive to subscribers, or the most promising trader to copy transactions from. Prixo allows you to benefit from both of these opportunities in order to increase your trading efficiency.

How to become a successful investor with prixo?

Just few steps of the registration procedure are between you and a brand new level of trading. Every participant of the platform will surely find all tools and instruments that are necessary for success, whether they are an exceptional trading strategy, which is attractive to subscribers, or the most promising trader to copy transactions from. Prixo allows you to benefit from both of these opportunities in order to increase your trading efficiency.

3 simple step to start investing

Create prixo account

Complete a simple registration procedure of prixo members area and investment account.It allows you to venture into the world of finances.

Specify the investment

Decide on the amount of money you want to invest together with prixo and deposit it to your account using prixo available payment systems.

Start working

Copy transactions or offer strategies to others to copy them. The choice is yours! Specify conditions and create subscriptions in prixo members area.

Live chat

Contact us

Contact us

Disclaimer: prixo markets ltd is compensated by the spread. Leverage may increase gains or losses. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. You should make sure you understand the risks involved, seeking for independent advice if necessary.

Prixo markets ltd – regulated by the financial services of seychelles license number: 221576

ATTENTION: prixo markets ltd does not solicit residents of japan, USA and canada to open trading accounts. Citizens of mentioned countries (regardless of residence) are not accepted. Residents and citizens of the UN-sanctioned countries are also not accepted.

Disclaimer: prixo markets ltd is compensated by the spread. Leverage may increase gains or losses. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. You should make sure you understand the risks involved, seeking for independent advice if necessary.

Prixo markets ltd – regulated by the financial services of seychelles license number: 221576

ATTENTION: prixo markets ltd does not solicit residents of japan, USA and canada to open trading accounts. Citizens of mentioned countries (regardless of residence) are not accepted. Residents and citizens of the UN-sanctioned countries are also not accepted.

© 2020 | prixo markets | all rights reserved

© 2020 | prixo markets | all rights reserved

Alpari copytrade

Sit back and watch your potential profits grow with copy trade service

Want to trade forex but don’t know where to start? Experience all the excitement of the most liquid market in the world when you copy the trades of a suitable strategy manager.

How alpari copytrade works

Alpari copytrade allows you to copy the trading positions of another trader, called the strategy manager. The beauty is that you don’t need any advanced knowledge of forex trading to get started. These strategy managers usually have a wealth of experience in the markets, with tried-and-tested strategic trading decisions. Once you decide whom to follow, they do the trading that could lead to potential increases in your capital.

Let’s say you invest $1000. You start following and copying the trades of a strategy manager who makes a $200 profit on his next successful trade. Through alpari copytrade’s system, the strategy manager earns an extra 10% of this profit, while you add $180 to your initial investment for a total of $1180. Without as much as lifting a finger, you’ve earned a tidy sum. Not bad, right?

Join alpari copytrade today…

…with as little as $/€/£100!

Straightforward

No need for any advanced forex trading experience or deep knowledge

Stay in control

You choose the most suitable strategy manager for you and how much you want to invest

Safe and secure

Your account is only visible to you and is completely protected

Up-to-the-minute updates

Monitor your account in real-time

Accessible from anywhere

Stay connected on our website or wherever you are in the world

Easy to manage

Manage your funds the way you want to – withdraw, invest and pay your strategy manager only if you profit

While past strategy manager results do not guarantee future returns, and the likelihood for losses is always present, the key is that everyone has the possibility to profit from alpari copytrade.

Join today and find out how.

- Fill in the form above and register your account

- Choose the most suitable strategy manager from hundreds of choices

- Verify your account

- Deposit funds, sit back and watch that strategy manager trade for you!

Top 3 strategy managers

Capitalfirst

MFT-TEAM-KH

Stable1

Past performance does not guarantee future results.

Grow your portfolio

Trading conditions

About us

Policies & regulation

Promotions

Trading guides, articles & insights

ALPARI INTERNATIONAL is the business name of exinity limited which is regulated by the financial services commission of the republic of mauritius with an investment dealer license bearing license number C113012295.

Registered address: 5th floor, 355 NEX tower, rue du savoir, cybercity, ebene 72201, mauritius.

Card transactions are processed via FT global services ltd, reg no. HE 335426 with registered address at tassou papadopoulou 6, flat/office 22, ag. Dometios, 2373, nicosia, cyprus. Address for cardholder correspondence: [email protected]

Risk warning: trading forex and leveraged financial instruments involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. It is the responsibility of the client to ascertain whether he/she is permitted to use the services of the alpari international based on the legal requirements in his/her country of residence.

Regional restrictions: alpari international does not provide services to residents of the USA, mauritius, japan, canada, haiti, suriname, the democratic republic of korea, brazil, puerto rico, the occupied area of cyprus. Find out more in the regulations section of our faqs.

Services

85% win rate

Fixed lot sizes

Working on smart phones

Result statement

01 – 30th october

Performance

LIVE myfxbook

$5000 account – 0.01lot size

Copy trading plans

1 month subscription $75 was $110

• auto trade opening

• auto closing trades

• above 84% profit rate

• if use VPS (recommended) mobile access. No PC required.

• enjoy profits with zero work.

• receive the signals directly to your MT4

• 85% accurate signals

• 16% drowdown

• 50% return monthly

• trades sent directly to your MT4

• never miss a trade again

3 month subscription $220

• you can start with $200

• auto trade opening

• auto closing trades

• above 84% profit rate

• if use VPS (recommended) mobile access. No PC required.

• enjoy profits with zero work.

• receive the signals directly to your MT4

• 85% accurate signals

• 16% drowdown

• 50% return monthly

• trades sent directly to your MT4

• never miss a trade again

You can start with even $ 200 MICRO account.

For STANDARD account we recommend minimum $500.

��we recommend you a trusted broker. |

for best results with our copy trading service ✔️

http://bit.Ly/df_broker

http://bit.Ly/df_broker

To run on mobile you need a VPS. A VPS is like a PC on the cloud 24/7 so you do not have to run the copy trading software(autobot) on your PC all the time to capture all the signals.

⚠️ we strongly recommend you to use a VPS with autobot.

This is not an auto trading bot, this only does copying our premium account to your MT4 platform without any of your interaction. You need a stable internet connection to get optimal results from the EA. If you are not able to connect your PC always to the internet, you can do this with help of service called “VPS server”.

All positions we open from our platform will open on your platform and any positions we modify or close from our platform will modify on your platform in real-time so you don’t need to worry about anything. In addition, you can also in control of following,

❑ min lot size per trade ❑ max lot size per trader ❑ max simultaneous trades ❑ lot sizing mode, etc.

FP markets launches copy-trading offering with autotrade

We are pleased to announce that we have added autotrade to FP markets’ wide range of trading tools. Autotrade is a service provided through myfxbook.

It provides traders the opportunity to copy a wide selection of trades from any system into their FP markets MT4 trading account .

Autorade offers the following benefits:

– no need to waste time searching for winning systems

– you can add and remove systems at any time

– trade mirroring is completely automated

– incentives are given to signal providers only for profitable trades

– real data with accurate statistics

– no additional software needed

To get started, just log into our secure client portal and select ‘open A new live account‘. Once your account has been opened you will need to link it to myfxbook autotrade and send an email to [email protected] with your new account number to link to myfxbook autotrade.

As always, you can contact our 24/5 customer support now to find out more information.

Articles

Views

AUTHOR

FP markets

FP markets is an australian regulated broker established in 2005 offering access to cfds across forex, indices, commodities, stocks & cryptocurrencies on consistently tighter spreads in unparalleled trading conditions. FP markets combines state-of-the-art technology with a huge selection of financial instruments to create a genuine broker destination for all types of traders.

Start trading with a global broker

Archives

Archives

Categories

Categories

- Brexit

- Company news

- Company updates

- Currency point

- Daily analysis

- Daily report

- Featured posts

- Forex 101

- Forex news

- Fundamental analysis

- Market insights

- Market news

- Platforms & tools

- Popular posts

- Press releases

- Products & services

- Recent posts

- Technical analysis

- Technical report

- Trading

- Trading knowledge

- Trending now

- US elections

- Webinars

Global fundamental analysis 20/01/2021

January 20th 2021: USD lower ahead of the US presidential inauguration day

January 19th 2021: greenback concludes off best levels; forms daily shooting star pattern

Evaluating commodity markets in the post-COVID-19 era

Global fundamental analysis 18/01/2021

Open an account now

By supplying your email you agree to FP markets privacy policy and receive future marketing materials from FP markets. You can unsubscribe at any time.

Markets

Tools & platforms

Trading info

Regulation & licence

About us

Quick start & resources

Markets

Tools & platforms

- Metatrader 4 (MT4)

- Metatrader 5 (MT5)

- Mobile trading app

- Iress

- Webtrader

- VPS

- Autochartist

- Myfxbook

- MAM/PAMM

- Traders toolbox

Trading info

- Iress account types

- MT4/5 account types

- Deposit funds

- Withdraw funds

- Margin table

- Forex spreads

- Forex swap rates

- Leverage

- MT4/5 fees & charges

- Iress fees & charges

- Trading hours

About us

Regulation & licence

- Metatrader 4 (MT4)

- Metatrader 5 (MT5)

- Mobile trading app

- Iress

- Webtrader

- VPS

- Autochartist

- Myfxbook

- MAM/PAMM

- Traders toolbox

- Iress account types

- MT4/5 account types

- Deposit funds

- Withdraw funds

- Margin table

- Forex spreads

- Forex swap rates

- Leverage

- MT4/5 fees & charges

- Iress fees & charges

- Trading hours

DISCLAIMER: this material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for difference (cfds) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading cfds you do not own or have any rights to the cfds underlying assets

Get inspired by the reliable social trading feature

Copytrading will let you clone orders opened by a more experienced trader and imprint them within your trading account. It indeed is a great way to learn the world of forex. Foloow the best trademasters and profit from their decisions!

Advantages of copy trading at eagles markets

• allows first time traders to familiarise themselves with the financial markets and gain the confidence to trade

• helps new traders to learn how to trade, by watching the actions of other, sometimes more experienced traders.

• enables more experienced traders to take part in the market, even when they are too busy, and not able to invest the time and research they should normally devote to trading

• you can copy trade on various instruments including foreign exchange, stocks, commodities and more.

• creates a community of traders, beginners and experienced alike, who can exchange ideas, strategies and endeavour to improve their trades together.

How to increase chances for successful copytrading?

• copy more than one trademaster to diversify portfolio and decrease the risk

• stay away from newbies who have less than 12-month trading records

• copy lower risk traders according to the risk score given by eagles markets

• diversify into more assets. Apart from stocks and forex, bitcoin and ethereum become upcoming markets, offering potentials for big gains

• don't be afraid to stop if things just don't feel right.

Risk control

• risk control settings

maximum trade volume as well as the peak number of simultaneously copied orders can be preset. Consequently, copytrading will stop if your predefined trading volume is exceeded.

• maximum drawdown

copytrading will stop if the drawdown exceed preset values

• push notifications for all copytraded orders opening and closing

• trademasters commission is separated from your trading balance

in a misfortunate case of the trademaster's severe loss, their commission will serve as compensation and to a certain extent will cover the losses of the followers

Start

Environment

Supports

Agreements

Markets

Eagles markets

Contact

High risk warning: forex trading is a high-risk investment and may not be suitable for all traders. Prudent consideration should be given to your investment assets, anticipated benefits, financial conditions, relevant knowledge and experience in participating in the market environment. Traders should acknowledge and learn all risks related to margin trade to avoid overwhelming losses. All the contents available on this website shall not be interpreted as guidance contents for trading. Forex/CFD products are only suitable for clients who fully understand market risk. Information given on this website, as well as general advice, does not take into account your investment objectives, financial position or needs. The contents of this website should not be construed as personal advice. The operator of this website kindly recommends that you seek the advice of an independent financial advisor before placing orders and depositing funds.

So, let's see, what we have: learn to automate your trading by following the leading trading signals ✅ copy trades of successful traders ✅ get your bonus today ➤ join NOW ! At jp markets copy trade

Contents of the article

- New forex bonuses

- Copy trading

- What is copy trading

- The rise of copy trading

- Advantages of copy trading

- How to successfully copy trade

- Copy trade with avatrade

- Alpari copytrade

- Sit back and watch your potential profits grow...

- How alpari copytrade works

- Join alpari copytrade today… …with as...

- Straightforward

- Stay in control

- Safe and secure

- Up-to-the-minute updates

- Accessible from anywhere

- Easy to manage

- While past strategy manager results do not...

- Join today and find out how.

- Copy trading: trade like etoro’s top traders

- When they trade, you trade

- Top traders work for you — without management fees

- Not just a copy trading platform, but a community

- How to copy traders on etoro

- Meet some of etoro’s most profitable popular...

- You’re in control

- Take it for a test drive

- Find us on

- JP markets review

- Reasons to sign up at JP markets for south...

- Is JP markets reliable forex broker?

- Create an account to start trading

- Making deposits and withdrawals at JP markets

- Types of trading platforms

- Account types

- Unique features of JP markets

- JP markets FAQ

- Should you open an account at JP markets?

- Jp markets copy trade

- Thousands of participants

- Multifunctional control

- Minimum investments

- Thousands of participants

- Multi-functional control

- How to become a successful investor with prixo?

- 3 step to start investing

- How to become a successful investor with prixo?

- How to become a successful investor with prixo?

- 3 simple step to start investing

- Contact us

- Contact us

- Alpari copytrade

- Sit back and watch your potential profits grow...

- How alpari copytrade works

- Join alpari copytrade today… …with as...

- Straightforward

- Stay in control

- Safe and secure

- Up-to-the-minute updates

- Accessible from anywhere

- Easy to manage

- While past strategy manager results do not...

- Join today and find out how.

- Services

- Result statement

- Performance

- LIVE myfxbook $5000 account –...

- Copy trading plans

- FP markets launches copy-trading offering with...

- FP markets

- Archives

- Categories

- Global fundamental analysis 20/01/2021

- January 20th 2021: USD lower ahead of the US...

- January 19th 2021: greenback concludes off best...

- Evaluating commodity markets in the post-COVID-19...

- Global fundamental analysis 18/01/2021

- Open an account now

- Quick start & resources

- Markets

- Tools & platforms

- Trading info

- About us

- Regulation & licence

- Get inspired by the reliable social trading...

- Advantages of copy trading at eagles markets

- How to increase chances for successful...

- Risk control

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.