Trading account with free money

- Trading in the demo account is risk-free and simulates real money trading

- Test the trading platforms sufficiently

- Learn online trading and control order execution

- Test the broker’s fees

- Test and develop new trading strategies

New forex bonuses

From our experience, a period of one month is suitable here. If you make a good profit week after week, you can slowly dare to trade real money.

Free trading demo account review

Are you looking for a free and unlimited trading demo account? – then this page is for you. In more than 7 years of experience in online trading, we have tested many providers and present you in the lower table in our top 3. Additionally, you will learn on this page why a demo account with virtual credit is so important for beginners and advanced traders.

| Broker: | review: | spreads: | advantages: | open account: |

|---|---|---|---|---|

1. IQ option  | ➜ read the review | starting 1.0 pips | + FX & options + best platform + start with $10 |

Criteria for a good trading demo account:

Not every trading demo account is optimal for the private trader. That’s why there are different criteria that make a good trader. All in all, however, it can be said that nowadays almost every online broker offers a free demo account. Sometimes, however, there are runtime restrictions or other functions that are limited.

The demo account is intended to simulate real money trading. Therefore, it is essential to choose a reputable provider. With brokers with an official regulation and financial license, there are no differences in the demo and real money trading from our experience.

- Free demo account

- Unlimited demo account

- There is no difference between the demo account and real money trading

- The account can be recharged with virtual money as desired

- All functions are available

Why is a demo account so important for beginners and advanced users?

A trading demo account is an account filled with virtual credit (play money). It simulates real money trading. Traders can therefore trade real market situations without risk. The account is particularly suitable for beginners who want to start trading. The first experiences can be collected in the demo account.

In general, it is about getting to know the trading platform of the broker better. In our experience, most beginners find it very complex to trade on the financial markets at first. After a few explanations and tests, however, one realizes that it is not so difficult. In addition to the trading platform, the broker can also test the trading conditions.

The spread and trading commission in the demo account is the same as in the real money account. New markets should also first be tested in virtual mode, especially in the short-term area (day trading). Beginners and advanced traders can benefit from this. In addition, trading strategies can be tried out or developed. In summary, the rule is that you should trade in the demo account until you are profitable and make progress.

Facts about the demo account:

- Trading in the demo account is risk-free and simulates real money trading

- Test the trading platforms sufficiently

- Learn online trading and control order execution

- Test the broker’s fees

- Test and develop new trading strategies

Free and unlimited demo account

In general, a demo account is always free of charge. From our experience, 99% of online brokers offer this service. Some few providers require a minimum deposit. From such offerers is urgently to be advised against, because these are often unserious. In addition, the account should have an unlimited duration.

Some providers have fixed expiration times for the test account. By a message to the support, this problem can be solved however and the running time was extended from my experiences up to now always. In summary, beginners and advanced traders have the opportunity to test open trading platforms and brokers. A demo account like the real money account should always be ready to trade.

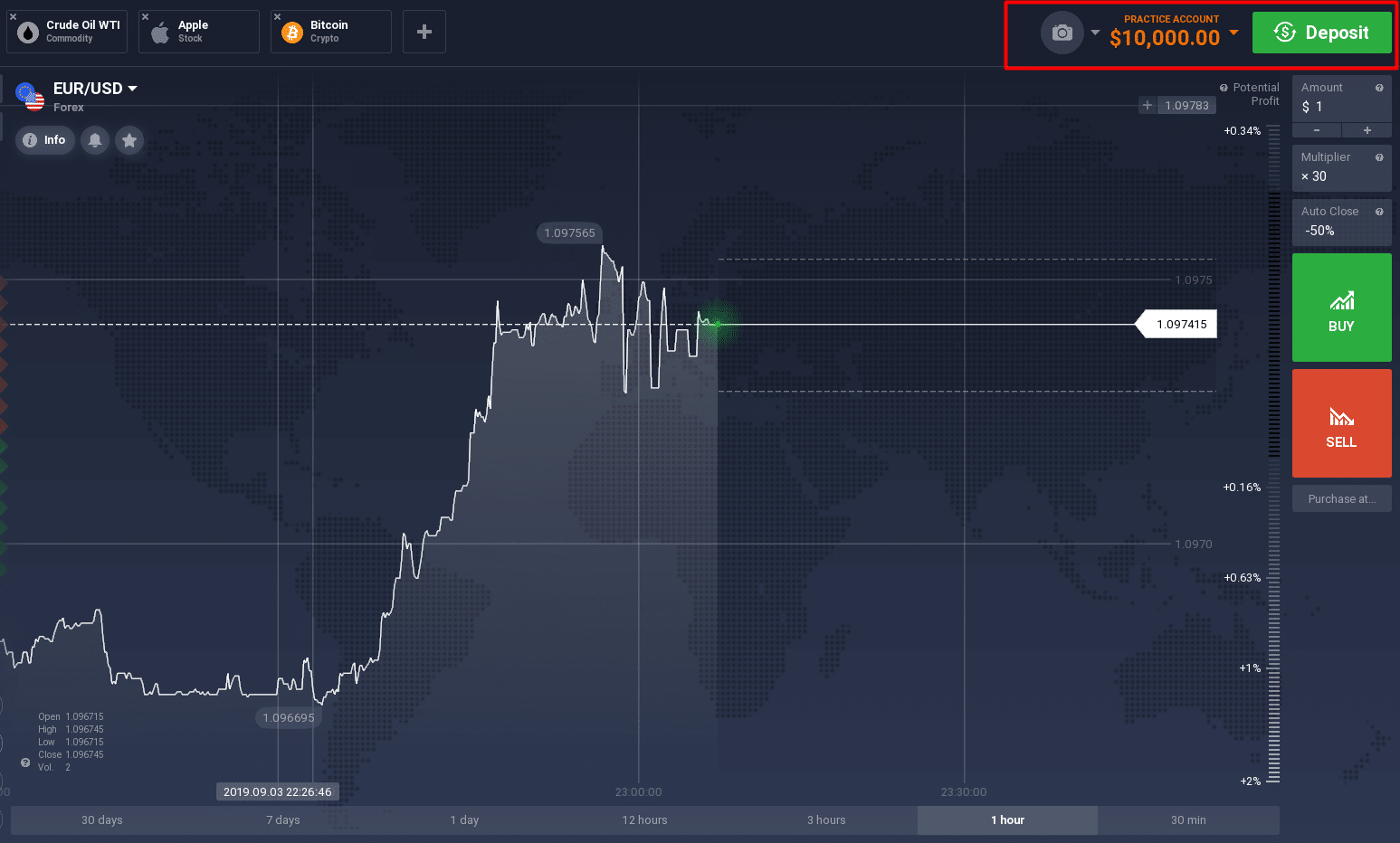

IQ option trading demo account

No difference between real money and virtual credit

With good brokers there is no difference between demo and real money trading. The price movements and executions are the same. Gladly, the trader can also check this himself. With regulated providers you do not have to worry. Therefore, be sure to obtain an official license from a financial supervisory authority.

The top recommended brokers all have an official license and are even regulated several times. Also, the trading fees and/or the spread has no difference in the demo account to the real money trade. With these accounts, you can simulate real money trading 1 to 1.

- Choose a reputable provider for your trading demo account as well

- You trade in both accounts under the same conditions

Account recharge is quite simple

With the demo account, there is the possibility to recharge the credit as desired. Since it is a test account, the credit can shrink quickly. But this is no problem at all. Because over the web page of the broker one can recharge the account very simply in few clicks. If you have any questions you can contact the support.

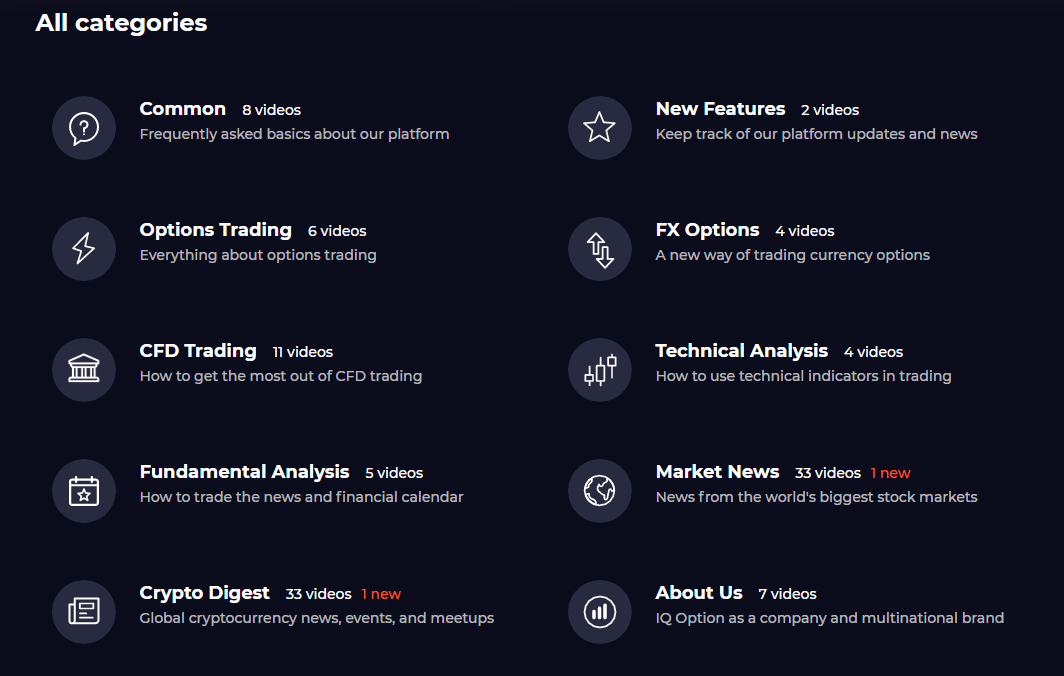

Further training for traders

Especially many beginners trade in the demo account and this is also absolutely necessary for a newcomer. The brokers offer concrete training material. The offer ranges from trade tutorials to free-market analyses and webinars. The demo account is the best way to expand your knowledge.

In addition, you can gain personal experience in various market situations. Professionals generally talk about the fact that it takes several thousand hours of screening time to act successfully. Read also our 10 trading tips.

Education center (videos and more)

How long should I practice in a demo account?

From our experience, one should practice in the demo account until one has made demonstrably the first profits over a longer period of time. From our experience, a period of one month is suitable here. If you make a good profit week after week, you can slowly dare to trade real money.

It is important that you keep a statistic about your trades. The trading platform, however, already shows this very transparently. Alternatively, further tools can be added. It is best not to rush into anything. Trading a week longer in a demo account is better than losing real money because you don’t feel safe enough.

Conclusion: the demo account is the best way to learn online trading

The trading demo account is suitable for any trader and should be used before trading real money. It has many advantages which we have described to you on this page.

In addition, the creation of such an account is done in a few minutes. Online brokers meanwhile offer very easy access to the trading platform. Should he feel sure that a trader is safe enough for real money trading, he can start it directly.

In summary, the demo account is one of the most important tools of a trader, because with this account you can try many things about real market situations for free and without risk.

Good luck with your trading.

A demo account is necessary for each type of trader. You can try to trade the markets without risk.

Free real money forex no deposit

Among forex brokers, there is a tough competition going on as to who will get the most number of novice traders. The race for new clients is so important to forex brokers that they are willing to sponsor their new clients by giving them access to take part in live forex trades without making any deposit. This is called the fore no deposit account.

With this development, it is now possible to actually trade the forex market without making any financial commitments at all. The normal trend was to sign up with a broker and make some deposits in your real account before you can start trading the forex market, but things has changed and broker have devised new ways of getting new clients every day. Once you sign up with the broker, you get real money in your account with which you can trade the forex market with.

In as much as this is basically to encourage people to trade the forex market, it is also important t know that there are terms and conditions attached to the forex no deposit accounts. These terms and conditions help the forex broker stay safe and not exposed to huge risks seeing as they are the ones sponsoring their new clients with their no deposit accounts. Some of the terms and conditions are

1. The trader must register with the broker and trade with the platform offered by the broker. This is the main reason why brokers go as far as offering traders the opportunity to trade the forex market without any deposit.

2. Once the client registers with the broker and is set to trade, the broke gives the trader access to an account with a certain amount of real money with which the trader can trade the live forex market on the condition that the trader does not withdraw the money. The money is there and can be traded with but the trader does not have the ability to make withdrawals from the no deposit account until some conditions are met.

3. For the trader to withdraw some real money from his or her no deposit account, the trader must have accumulated some trade points and made some profits. Form the profit made, the trader is expected to make some deposit to his account, which will serve as a trade capital, after which the trader can freely withdraw the rest of the profit made.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

Forex trading without deposit | no deposit bonus explained

It’s no surprise that one regular lot is equal to 100,000 currency units – forex trading is definitely an expensive endeavor. However, there are still some ways in which you can start trading forex while maintaining some sort of profitability without spending hundreds of thousands of dollars.

No deposit bonus in a glance

In forex trading you can, in fact, start trading with no money of your own or even making a deposit. With free no deposit bonus offered by the top forex brokers, you can start forex trading without deposit with a good boost.

There is no sense in hiding the fact that FX trading is risky, especially if you are trading without proper knowledge and at least minimal experience. In an attempt to prevail over the risk of losing your money and to stay safe, it is undoubtedly better to start trading with a free forex account or no deposit bonus offered by various FX brokers. Especially if such deals are not so rare at this time and even best forex brokers sometimes offer such deals.

It is always better to preview all conditions that offer you an option to trade without money of your own. So, be sure to start forex trading without a deposit now and get yourself a good and reliable deal!

But let’s say that although you’ve learned how to start deposit free forex trading, it’s still too risky for you. Thankfully, there is an alternative. One way to start trading with a broker is by opening a free forex demo account for beginners. A demo account will allow you to try your hand at trading on the real market without ever touching real money. One of the best brokers to try a free demo account with would be FXTM. If you don’t want to be working with FXTM and want access to a reliable forex broker that offers its services around the globe, alpari offers a similar service, including forex trading demo accounts. If you are a US citizen that wants to trade with local brokers, then you should go for forex.Com, who offer their services within the US and are known to be one of the best brokers in the world.

Transparent pricing and fast, reliable trade executions on over 80 currencies

Start trading with the largest forex broker in the US

How to start forex trading without deposit: tips & recommendations

As a matter of fact, a lot of brokers worldwide try to offer their clients those no deposit deals, and we’ve even seen some trading apps without deposit popping up here and there. Do not perceive this as an act of generosity though, those bonuses serve as a sort of protection for them also. But still, this is good for you if you want to start forex trading without a deposit.

Here are some of the main considerations that can help you spot a decent no deposit bonus:

- If you somehow dislike conditions and terms offered by the broker – simply skip the promotion. Let’s investigate the ways that may help you find the best bonus in FX. First of all, bonuses must be easy to understand and transparent in general conditions. If you see non-explicit information presented, avoid the promotion or ask the broker for clarification.

- If you wish to take part in the particular promotion and start forex trading without investment, then do not overlook terms and conditions. Even the smallest detail must be in your sight. A free bonus is actually not always 100% free. Some brokers may ask you to deposit some money in order to collect your profits. Indeed, such promotions are scams.

- Be attentive, because some forex brokers can demonstrate a good opportunity with their no deposit bonus, however it may ask to complete the trading volume requirement. Stay away from the bonus that asks to complete more than 1 lot for $10 to further unlock the profits and balance.

- Bonuses can vary in terms of geographical location requirements. Therefore, ensure that FX bonus accounts of the broker are given in your country as well if you desire to start forex trading without investment. Furthermore, there can be account restrictions. This means that no deposit bonuses may not always be available for every account at a particular broker. Thus, check whether you applied for a correct account.

- In addition, make sure what instruments can be traded to withdraw your profit before you begin trading as sometimes FX bonus accounts are not available for some of them. As for the withdrawal, some forex bonus brokers limit the maximum profit available to withdraw from the account. So, do not miss this field before you start trading on your no deposit FX bonus account.

- Bonuses are frequently represented only in 1 currency equivalent. However, there are many no deposit bonuses that evaluate a similar amount in your local currency, so doing your research in order to figure out how to join forex trading without making any deposits is a good way for ensuring success in the long run.

Not ready for live trading? Try IQ option demo account!

Practice your trading skills with free $10,000 practice account!

How to start forex trading without a deposit?

How to start forex trading without a deposit?

As one of the cases, no deposit bonus may come with SMS verification. It is recommended to make sure that you have the right phone number prior to start applying for the bonus.

One of the last tips that can help you find a trustworthy no deposit bonus, or at least help you get through a scammer, is to save the terms and conditions document as a .Pdf file. Do this even if you deal with the best no deposit forex bonus account. You can use the help of your account manager and ask him to confirm all the statements of the bonus promotion in which you participate.

Start forex trading without deposit: introduction to best no deposit bonuses

Although there are very good no deposit bonuses offered by industry leaders and most proficient brokers, you should understand one fact: FX bonuses without a deposit are most frequently offered by bad brokers. That is the very reason why you should be very careful not to get entangled with a scammer.

All this leads to us stressing how important it is to be attentive at all times, so be attentive to details when researching how to start trading with no deposit bonuses. Fortunately, we have examples of the best brokers/investment firms.

Start forex trading without investment: XM forex broker

To begin with, XM is recognized by the united kingdom-based organization – investors in people for its powerful efforts in developing individuals to realize their entire potential and achieve both individual and corporate goals. We should also admit that this organization provides a huge amount of proven tools and resources specially designed to complement its unique framework with an aim to boost performance and indeed maximize sustainability. XM achieves this standard by showing that it is a driving force in the online trading sector and is committed to the provision of services and products of the best quality. How to start forex trading without money? If you are interested, you can claim the XM 30 USD no deposit bonus!

Get your 30 USD no deposit bonus with XM, and start trading today

Sign up with top tier broker and get the best no deposit deal on the market

*clients registered under the EU regulated entity of the group are not eligible for the bonus

No deposit bonus as an alternative – is it worth it?

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself? Will you get any significant benefit from it?

The answer to that question is subjective; some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

As for other traders, they often prefer spending their own money, which gives them more incentive to be more careful in the market – after all, it’s their own money they’re risking.

So, suffice to say no deposit bonuses have their time and place; one just has to seize that exact moment.

Forex trading without deposit | no deposit bonus explained

It’s no surprise that one regular lot is equal to 100,000 currency units – forex trading is definitely an expensive endeavor. However, there are still some ways in which you can start trading forex while maintaining some sort of profitability without spending hundreds of thousands of dollars.

No deposit bonus in a glance

In forex trading you can, in fact, start trading with no money of your own or even making a deposit. With free no deposit bonus offered by the top forex brokers, you can start forex trading without deposit with a good boost.

There is no sense in hiding the fact that FX trading is risky, especially if you are trading without proper knowledge and at least minimal experience. In an attempt to prevail over the risk of losing your money and to stay safe, it is undoubtedly better to start trading with a free forex account or no deposit bonus offered by various FX brokers. Especially if such deals are not so rare at this time and even best forex brokers sometimes offer such deals.

It is always better to preview all conditions that offer you an option to trade without money of your own. So, be sure to start forex trading without a deposit now and get yourself a good and reliable deal!

But let’s say that although you’ve learned how to start deposit free forex trading, it’s still too risky for you. Thankfully, there is an alternative. One way to start trading with a broker is by opening a free forex demo account for beginners. A demo account will allow you to try your hand at trading on the real market without ever touching real money. One of the best brokers to try a free demo account with would be FXTM. If you don’t want to be working with FXTM and want access to a reliable forex broker that offers its services around the globe, alpari offers a similar service, including forex trading demo accounts. If you are a US citizen that wants to trade with local brokers, then you should go for forex.Com, who offer their services within the US and are known to be one of the best brokers in the world.

Transparent pricing and fast, reliable trade executions on over 80 currencies

Start trading with the largest forex broker in the US

How to start forex trading without deposit: tips & recommendations

As a matter of fact, a lot of brokers worldwide try to offer their clients those no deposit deals, and we’ve even seen some trading apps without deposit popping up here and there. Do not perceive this as an act of generosity though, those bonuses serve as a sort of protection for them also. But still, this is good for you if you want to start forex trading without a deposit.

Here are some of the main considerations that can help you spot a decent no deposit bonus:

- If you somehow dislike conditions and terms offered by the broker – simply skip the promotion. Let’s investigate the ways that may help you find the best bonus in FX. First of all, bonuses must be easy to understand and transparent in general conditions. If you see non-explicit information presented, avoid the promotion or ask the broker for clarification.

- If you wish to take part in the particular promotion and start forex trading without investment, then do not overlook terms and conditions. Even the smallest detail must be in your sight. A free bonus is actually not always 100% free. Some brokers may ask you to deposit some money in order to collect your profits. Indeed, such promotions are scams.

- Be attentive, because some forex brokers can demonstrate a good opportunity with their no deposit bonus, however it may ask to complete the trading volume requirement. Stay away from the bonus that asks to complete more than 1 lot for $10 to further unlock the profits and balance.

- Bonuses can vary in terms of geographical location requirements. Therefore, ensure that FX bonus accounts of the broker are given in your country as well if you desire to start forex trading without investment. Furthermore, there can be account restrictions. This means that no deposit bonuses may not always be available for every account at a particular broker. Thus, check whether you applied for a correct account.

- In addition, make sure what instruments can be traded to withdraw your profit before you begin trading as sometimes FX bonus accounts are not available for some of them. As for the withdrawal, some forex bonus brokers limit the maximum profit available to withdraw from the account. So, do not miss this field before you start trading on your no deposit FX bonus account.

- Bonuses are frequently represented only in 1 currency equivalent. However, there are many no deposit bonuses that evaluate a similar amount in your local currency, so doing your research in order to figure out how to join forex trading without making any deposits is a good way for ensuring success in the long run.

Not ready for live trading? Try IQ option demo account!

Practice your trading skills with free $10,000 practice account!

How to start forex trading without a deposit?

How to start forex trading without a deposit?

As one of the cases, no deposit bonus may come with SMS verification. It is recommended to make sure that you have the right phone number prior to start applying for the bonus.

One of the last tips that can help you find a trustworthy no deposit bonus, or at least help you get through a scammer, is to save the terms and conditions document as a .Pdf file. Do this even if you deal with the best no deposit forex bonus account. You can use the help of your account manager and ask him to confirm all the statements of the bonus promotion in which you participate.

Start forex trading without deposit: introduction to best no deposit bonuses

Although there are very good no deposit bonuses offered by industry leaders and most proficient brokers, you should understand one fact: FX bonuses without a deposit are most frequently offered by bad brokers. That is the very reason why you should be very careful not to get entangled with a scammer.

All this leads to us stressing how important it is to be attentive at all times, so be attentive to details when researching how to start trading with no deposit bonuses. Fortunately, we have examples of the best brokers/investment firms.

Start forex trading without investment: XM forex broker

To begin with, XM is recognized by the united kingdom-based organization – investors in people for its powerful efforts in developing individuals to realize their entire potential and achieve both individual and corporate goals. We should also admit that this organization provides a huge amount of proven tools and resources specially designed to complement its unique framework with an aim to boost performance and indeed maximize sustainability. XM achieves this standard by showing that it is a driving force in the online trading sector and is committed to the provision of services and products of the best quality. How to start forex trading without money? If you are interested, you can claim the XM 30 USD no deposit bonus!

Get your 30 USD no deposit bonus with XM, and start trading today

Sign up with top tier broker and get the best no deposit deal on the market

*clients registered under the EU regulated entity of the group are not eligible for the bonus

No deposit bonus as an alternative – is it worth it?

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself? Will you get any significant benefit from it?

The answer to that question is subjective; some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

As for other traders, they often prefer spending their own money, which gives them more incentive to be more careful in the market – after all, it’s their own money they’re risking.

So, suffice to say no deposit bonuses have their time and place; one just has to seize that exact moment.

Trading account

Invest for a better future with our award-winning everyday investing and trading account. Start today for only £9.99 a month.

Please remember, investment value can go up or down and you could get back less than you invest.

Benefits of our trading account

More opportunities

Over 40,000 UK and global stocks to choose from across 17 stock exchanges. Invest directly in shares, etfs, funds, investment trusts and more.

Cut your costs

Reduce your FX costs by managing your money in up to nine currencies across the world's leading exchanges, including US dollars, euros and sterling.

Always in control

Buy and sell investments, check your portfolio and fund your account anytime with our ios and android apps.

Stay in the know

Get the award-winning quotestream, level 2 streaming prices and real-time portfolio management for a low fixed price of £20 +VAT per month.

Get started today for only £9.99 a month.

Get the best investment choice and insight around

A fair flat fee of £9.99 a month. Our charges stay the same as your investment grows, giving you better value in the long term.

One free trade per month. We give you back £7.99 credit every month to buy or sell any investment.

Commission rates: only £7.99 for all UK and US trades. Regular investing is free.

Our fixed fee covers you for multiple accounts (add a SIPP today and pay no SIPP fee for six months. Then just £10 a month extra).

Looking for a general investment account?

The ii trading account is the ideal choice for investors looking for flexibility and uncapped investment options. It is our most flexible investment account and has the widest choice of investment options in the market, including funds, shares, investment trusts and etfs.

With our impartial expert ideas and analysis, you will have all the tools you need to be a confident investor. Plus you can access your money whenever you like and trade securely at any time, using our ios and android apps.

Get started today for only £9.99 a month.

Looking for a joint trading account?

The ii joint trading account is the ideal choice for a secure investment account with shared ownership. It offers simplified portfolio management and is easy for both parties to access. The joint trading account allows you to hold a wide range of investments, with holdings registered in both names.

Trading account with free money

Get our monthly newsletter from advisory desk

Investments in securities market are subject to market risk, read all the related documents carefully before investing.

We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services. We do not sell or rent your contact information to third parties. Please note that by submitting the above mentioned details, you are authorising us to call/SMS you even though you may be registered under DND. We shall call/SMS you for a period of 12 months.

Exchange disclaimer:"the bombay stock exchange/national stock exchange of india ltd is not in any manner answerable, responsible or liable to any person or persons for any acts of omission or commission, errors, mistakes and/or violation, actual or perceived, by us or our partners, agents, associates etc, of any of the rules, regulations, bye-laws of the bombay stock exchange, national stock exchange of india ltd, SEBI act or any other laws in force from time to time.

The bombay stock exchange/national stock exchange of india ltd is not answerable, responsible or liable for any information on this website or for any services rendered by us, our employees, and our servants.

If you do not agree to any of the terms and conditions mentioned in this agreement, you should exit the site."

Risk:"investments in securities market are subject to market risk, read all the related documents carefully before investing.

We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services.

We do not sell or rent your contact information to third parties.

Please note that by submitting the above mentioned details, you are authorizing us to call/SMS you even though you may be registered under DND. We shall call/SMS you for a period of 12 months."

Attention to investors:"no need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorize your bank to make payment in case of allotment. No worries for refund as the money remains in the investor's account.

Prevent unauthorized transactions in your demat account ; update your mobile number with your depository participant. Receive alerts on your registered mobile for all debit and other important transactions in your demat account directly from CDSL on the same day

Prevent unauthorised transactions in your account; update your mobile numbers/email ids with your stock brokers. Receive information of your transactions directly from exchange on your mobile / email at the end of the day "

1. Stock brokers can accept securities as margin from clients only by way of pledge in the depository system w.E.F. September 1, 2020.

2. Update your mobile number & email id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

3. Pay applicable upfront margin of the transaction value to trade in cash market segment.

4. Investors may please refer to the exchange's frequently asked questions (faqs) issued vide circular reference NSE/INSP/45191 dated july 31, 2020 and NSE/INSP/45534 dated august 31, 2020 & vide notice no. BSE 20200731-7 dated july 31, 2020 and BSE 20200831-45 dated august 31, 2020 and other guidelines issued from time to time in this regard.

5. Check your securities /MF/ bonds in the consolidated account statement issued by NSDL/CDSL every month."

World investor week november 23-29, 2020 being celebrated under the aegis of IOSCO and SEBI.

Trading account

Invest for a better future with our award-winning everyday investing and trading account. Start today for only £9.99 a month.

Please remember, investment value can go up or down and you could get back less than you invest.

Benefits of our trading account

More opportunities

Over 40,000 UK and global stocks to choose from across 17 stock exchanges. Invest directly in shares, etfs, funds, investment trusts and more.

Cut your costs

Reduce your FX costs by managing your money in up to nine currencies across the world's leading exchanges, including US dollars, euros and sterling.

Always in control

Buy and sell investments, check your portfolio and fund your account anytime with our ios and android apps.

Stay in the know

Get the award-winning quotestream, level 2 streaming prices and real-time portfolio management for a low fixed price of £20 +VAT per month.

Get started today for only £9.99 a month.

Get the best investment choice and insight around

A fair flat fee of £9.99 a month. Our charges stay the same as your investment grows, giving you better value in the long term.

One free trade per month. We give you back £7.99 credit every month to buy or sell any investment.

Commission rates: only £7.99 for all UK and US trades. Regular investing is free.

Our fixed fee covers you for multiple accounts (add a SIPP today and pay no SIPP fee for six months. Then just £10 a month extra).

Looking for a general investment account?

The ii trading account is the ideal choice for investors looking for flexibility and uncapped investment options. It is our most flexible investment account and has the widest choice of investment options in the market, including funds, shares, investment trusts and etfs.

With our impartial expert ideas and analysis, you will have all the tools you need to be a confident investor. Plus you can access your money whenever you like and trade securely at any time, using our ios and android apps.

Get started today for only £9.99 a month.

Looking for a joint trading account?

The ii joint trading account is the ideal choice for a secure investment account with shared ownership. It offers simplified portfolio management and is easy for both parties to access. The joint trading account allows you to hold a wide range of investments, with holdings registered in both names.

Forex trading accounts

To trade online, you need to open a forex trading account. When you sign up, you will likely have to choose among several account types. The best forex trading accounts are those that suit your personal needs perfectly. On this page, we look at the forex trading account options you have. We also discuss ways in which these account options will impact your trading performance. You will learn:

- Which is the best forex trading account?

- Account types. What is a standard account, a funded account, a mini/micro account, a managed account, etc?

- Geographic account type considerations.

Below are the best forex trading accounts in your location:

The top 5 forex trading accounts in the united kingdom

Opening a forex trading account

What do you need to consider when opening a new forex trading account?

- The brokerage firm. Is it reputable or is it a known scammer?

- The services the brokerage firm offers.

- Costs and incentives involved.

- The account type that best suits your needs.

Once you have gotten these issues sorted, there is 3 step process for opening an account:

- Fill out the application forms and provide the information your broker requires.

- Fund your account.

- Start looking for investment opportunities.

When you select a brokerage firm, you take all these factors into account. You need to know whether your would-be broker is a trustworthy destination for traders. Though fewer these days, rogue operations still exist. Creating a real money account with such a broker is flushing money down the toilet.

You also need to know what incentives your broker offers. Match up these incentives with the costs. The broker has to support the account type you prefer and it has to give you access to a proper suite of services. You may even have a preferred account funding method. The broker may or may not accept/support that method.

Services-wise, you are looking for:

- Proper trading platforms, with solid technical analysis tools.

- Access to education and research.

- Trading foreign markets.

- Special features you may want.

- Convenience. Some brokerage firms offer face-to-face guidance. Others do not. It always makes sense from the perspective of trust, to prefer an operator with physical offices close by.

As far as incentives go, some brokers offer commission-free trading. Others may even reward you for certain achievements as a trader. You may even want to keep your savings with the broker if it rewards you for it.

Make sure you read and understand the full pricing schedule/policy of your broker.

Determining the right trading account type to meet your needs depends on what kind of trader you are, and what your objectives are.

When you fill out your application forms, be aware that you will have to provide information on your employment status, investable assets, and net worth. Some find such probing on the part of the broker quite intrusive.

You also have to provide a copy of your ID/driver’s license. If you want to trade options or gain access to margin, you may have to provide additional information.

Brokers accept several account-funding methods.

- Various e-wallets. (neteller, paypal, skrill etc)

- Bank transfer.

- Electronic funds transfer.

- Checks.

Some may accept asset transfers and even paper stock certificates.

Which is the best forex trading account?

As mentioned, the best account type for you is the one that best suits your needs and personal profile. The factors you should consider in this regard fall into two main categories.

Your investment objectives.

The type of trader you are.

Choosing a forex trading account based on your investment objectives

– most “casual” traders invest with a relatively near-term goal. The “make some money” mantra is the main driver behind such efforts. If this mantra describes your investment objectives, you likely need a traditional brokerage account. Such accounts do not offer any tax advantages. On the other hand, they do not tie up your investments long-term either.

You may also be able to trade on margin with such an account. Trading on margin involves borrowing money from the broker. The assets in your account will serve as collateral in this case. Trading on margin carries some obvious risks.

– if your goal is to secure your nest-egg for your retirement, an IRA (individual retirement account) is your option. All IRA options, such as traditional IRA, roth IRA, and rollover IRA offer you tax benefits. On the downside, you will not be able to touch this money before you are old.

Choosing a forex trading account based on what type of investor you are

- – you are an absolute beginner. And as such, not much of an investor. What you need at this stage is education. Possibly some good trading signals as well. In a word, you need an account, through which the broker can hold your hand. It could be that your ambitions are not high. Still, you need to know why you are doing what you are doing. Customer service and user interface are important factors in your account selection.

- – you are a “value” investor. Such investors buy and hold assets, to sell them when they appreciate. Such investors are not active traders. If you are a value investor, you value fundamental analysis. You have little use for charting and fancy technical indicators, however.

- – passive investing. Those who invest in index funds passively do not require much from their broker. Unlike beginners, such traders don’t need their hands held either. They just need access to index funds, and good tradable asset selection within this category.

- – high frequency trader. Active traders do not hold their positions long-term. They buy and sell with high frequency. Thus, they need all the bells and whistles their broker can offer them. They want good trading platforms with superb charting. Outstanding reporting and a highly functional interface are also musts. Technical analysis is the bread and butter of this trader category. Trading costs are also very important for active traders.

Forex trading account types

There are four basic account type categories: standard, funded, mini and managed. We will look at each in turn.

Within these categories, there are a few additional variants, such as the micro accounts. There are a handful of special account types as well, such as islamic accounts, demo accounts, and VIP accounts. Every one of these account options carries some advantages and some disadvantages.

Standard trading accounts

The name of this account option stems from the standard lots to which it gives traders access. A standard currency lot is worth $100,000. Such a lot size seemingly places this account type out of the reach of average traders.

You do not have to have $100,000 in your account to trade, however. The existence of margin and leverage means that you only have to have $1,000 to trade a standard lot.

Leverage varies based on many things. In the EU, forex leverage is capped at 1:30. In other places, brokers may offer leverage up to 1:500 even on standard accounts.

Brokers offer full services for the holders of standard accounts. Such accounts require upfront capital, so these are all depositing traders. The profit potential of this account type is significant as well.

On the downside, the same goes for loss potential. For this reason, you should only trade through a standard account if you are an experienced trader.

Funded trading accounts

Some brokers/other financial organizations fund certain traders. They provide them with starting capital, in exchange for a share of their future profits.

How does such a setup work?

Would-be funded account owners need to pass an evaluation program. If the broker’s analysts consider them to be good candidates, they grant them a funded account.

Funding can run into millions of dollars. Profit splits are in the 50% range. Funded accounts carry monthly profit targets. Traders who fulfill these targets can gain additional funding.

The broker pays out the profits periodically.

What do you need to do to secure such a funded account?

- Your first step is to sign up for the evaluation program.

- Trade through the evaluation account and reach the targets.

- Earn a proper funded account and start making money for you and the account provider.

Mini and micro trading accounts

A standard account features $100,000 lots. For traders who cannot afford to trade in that league, despite margin and leverage, mini accounts offer an alternative. A mini account supports mini lots. These lots are worth $10,000 each. Mini accounts usually accompany standard accounts and they target new traders.

Micro accounts take this approach a step further. They support micro-lots of $1,000. Such accounts are even more affordable than the mini ones. Like the minis, micro accounts target beginners as well.

The main advantage of mini and micro accounts resides in risk-reduction. For a mere $250-$500, you can open such a trading account. Trading in lower increments stretches your funds longer as well. This is one of the reasons why professional traders like to use such accounts. They can test their strategies in a low-risk, real-money environment.

In addition to the inherent risk-minimization benefits, mini and micro accounts let you spread your funds thinner. Thus, you can better micro-risk-manage them.

The obvious downside is that risk/loss minimization reduces profit potential as well. Such accounts are, therefore, hardly suited to cover the profit needs of professional/advanced traders.

Managed trading accounts

Forex trading account management works like this, A managed account is one that holds your funds but excludes you from decision-making. You make your deposit, and someone else – usually a broker-side expert – does the trading for you. You may be able to set objectives, however.

Why would you want to give up control through such a trading account?

– you are not an expert and you feel that the manager will do a better job than you ever could. Thus you let the manager handle your individual trading account.

– you feel that pooling your money with the funds of other investors offers you a degree of protection. Such managed accounts work like mutual funds. Managers handle the trading and they distribute the profits.

Managers rank these pooled accounts according to risk tolerance. Those looking for higher profits opt for more risky accounts. Those with a lower risk tolerance play it safer, earning less.

The main advantage of a managed account is that it allows you to cash in on the skills of a forex professional. Furthermore, you get to do it hands-off.

The disadvantage is that this forex expert will cut a commission from your profits. Managed accounts require larger deposits than regular ones. Individual accounts may require as much as $10,000. Pooled accounts are slightly cheaper at around $2,000.

Islamic trading accounts

Islam holds trading to be haram (not permitted). There are ways to turn it into halal (permitted), however.

All trading activity has to adhere to the principles of islamic finance.

- There must not be any interest (riba) involved.

- Exchanges involved in trading have to be immediate.

- No gambling is allowed.

- Risks, as well as benefits, have to be distributed.

Islamic accounts are swap-free accounts, through which transactions and the payments of costs associated with them, happen instantly. In the context of islamic trading accounts, the margin, commissions and administrative fees are not riba.

VIP accounts

Brokers reserve their VIP accounts to their most privileged clients. A VIP account holder enjoys special benefits, such as superior trading conditions. Forex brokerages often invite VIP traders to special events, treating them to special rewards.

What do you have to do to gain access to such an account?

You normally need to deposit an unusually large amount of money (often upward of $100,000). You will also need to trade frequently and perhaps meet certain trade volume requirements.

Demo accounts

A demo account is the “play money” simulation of a real account. It allows traders to test the platform and trading conditions. Some may also use such accounts to test-run certain strategies.

When you sign up for a demo account , the broker credits your account with a set amount of virtual funds. Some demo accounts offer the same functionality as a standard/mini/micro account. Others limit their users’ access to certain features.

Geographic considerations

Sometimes, your geographic location should play a role in your account type selection. Some jurisdictions may limit certain trade types. In the US, there is no CFD trading. The practice is against US securities laws.

Leverage varies greatly between EU regulated countries, the UK for example, and other parts of the world. In the EU forex margin is limited to 1:30 by ESMA, the european regulator.

In other parts of world, india and south africa for example, leverage can be offered up to 1:1000 (though 1:400 or 1:500 is more typical)

The taxes you have to pay on your profits also vary from one jurisdiction to another. Read our taxes page for more on that.

How to make up to £100 by depositing £1 into A trading 212 account

When I first read about trading 212 on another money blog, I was suspicious. The blog said if I created an account with trading 212 using a referral link and deposited just £1, I’d receive one free share and within just a few days I’d be able to sell that share and withdraw a sum of money up to the value of £100.

I was skeptical. It seemed too good to be true. Nevertheless, I decided to give it a go to see whether there was any truth in this money making trick or whether money bloggers were only promoting it because of its generous referral scheme.

TL;DR: turns out trading 212 is a legit website (as in, regulated by the FCA & your funds will be covered by the FSCS) and by following the steps I share below, you can receive a free share worth up to £100.

For many, trading 212’s free share offer is an opportunity to get some free money before never using the website again.

For others, this could be an accessible way into the world of investing. Since using the trading 212 sign up offer, I’ve begun investing myself and now have more than £1,000 in my trading 212 account spread across companies such as nike, NIO, astra zeneca and asana.

Click here to create a free trading 212 account and get your free share up to the value of £100 today.

What is trading 212?

“trading 212 is a london based fintech company that democratises the financial markets with free, smart and easy to use apps, enabling anyone to trade equities, forex, commodities and more.

“we disrupt the stock brokerage industry by offering the first zero commission stock trading service in the UK and europe, unlocking the stock market for millions of people.

“our mobile app has more than 14 000 000 downloads, which makes it one of the most popular trading apps in the world.”

Trading 212 is authorised and regulated by the financial conduct authority (FCA). All clients’ funds are kept separately in segregated bank accounts and are covered by the financial services compensation scheme, FSCS (trading 212 UK ltd.) and the investors compensation fund, ICF bulgaria (trading 212 ltd).

Can I make money by depositing £1 into my trading 212 account?

Yes! I made £88.83 by creating a trading 212 account using a referral link and depositing £1 into my trading 212 account.

It took about 10-15 minutes to create my account and deposit £1. The next day I received an email to say I’d been given a share worth £88.83.

I then had to sell the share (which took a matter of seconds once I found the sell share button by hovering under the price section at the bottom of the dashboard).

30 days after the share had initially been given to me, I was able to withdraw it to my bank account.

How do I get my free share from trading 212?

Here’s a brief step-by-step guide to getting your free stock from trading 212.

- Sign up for trading 212 using this link

- Deposit £1 into your trading 212 invest account – emphasis on the word ‘invest’. There are a few different types of account. You must select the invest option to be eligible for the free share

- Sign in the following business day to find your free share

- Sell the share for its current value. You can usually do this straight away

- 30 days after you first received the share you can withdraw its value back into your bank account

Create a trading 212 invest account using this link and we both get a free share!

Will everyone make the same amount from signing up to trading 212?

While I ‘won’ big from trading 212, others won’t be quite as lucky.

I was so excited after making £88 from just minutes of work that I encouraged my boyfriend to sign up too. Unfortunately, he wasn’t quite so successful and came away with a share for under armour worth just £8.

When I recommended trading 212 to my instagram followers, many signed up using my referral link and messaged me afterwards to tell me how they’d done.

Many received an £8 under armour share but there were others receiving £19 bank of america shares, £25 uber shares, £75 starbucks shares and even £90 astrazeneca. All this for just a few minutes of typing your details into the trading 212 website!

What information will I needed to share with trading 212?

Trading 212 will ask for pretty standard details from you such as your date of birth and address.

Don’t be surprised if it goes a little deeper, though. You’re likely to also be asked for your salary and national insurance number.

Should I continue trading with trading 212 after I’ve made money from my free stock?

This one is completely up to you. When I first wrote this blog post I was in no hurry to deposit more of my own money into my trading 212 account until I knew more about it.

However, I’ve since done tons of research into how the platform works and have used it as my entryway into the world of stock market investing.

There are lots of people who use trading 212 as an alternative to more traditional investment platforms – mostly because unlike other platforms, trading 212 doesn’t charge you commission and you can invest with as little as £1.

I’ve really enjoyed playing around with the app and exploring the website to watch how various companies are performing. It’s interesting to see how a modestly priced share at a particular company could have grown over the years. Perhaps you’ll find yourself investing in the next big thing!

As with any product or service I talk about on can’t swing a cat, please carry out your own research before leaping in and committing much larger amounts of your own money to trading 212. I’m by no means a financial expert and since I have no formal finance qualifications, I’m in no position to offer financial advice to anyone.

Click here to create a free trading 212 account and get your free share up to the value of £100 today.

I’ve already gotten my free trading 212 share. What now?

Refer a friend

If you have a partner or friend who would also like to sign up to trading 212, log into your account, click your email in the top right hand corner of the screen (on desktop) and hit ‘get free shares’. You’ll then be able to send this link to your friend and when they sign up and deposit £1 into their account, you’ll each get a free share.

Play around with the app and get a feel for how investing works

If you’re new to the world of investing, trading 212 could give you an opportunity to dip your toe in the water and get a feel for the world of investing, in a hands-on and easy-to-understand way. I’d recommend watching some of trading 212’s tutorials and video guides to learn more.

Please note this post includes affiliate links. This means that if you create an account after clicking one of the links in this post, I may make a small commission at no extra cost to you.

So, let's see, what we have: 3 best trading demo account for practise 2021 ✔ open for free ✔ reliable online brokers ✔ tips & tricks ➜ read more about it now at trading account with free money

Contents of the article

- New forex bonuses

- Free trading demo account review

- Criteria for a good trading demo account:

- Why is a demo account so important for beginners...

- Free and unlimited demo account

- No difference between real money and virtual...

- Account recharge is quite simple

- Further training for traders

- How long should I practice in a demo account?

- Conclusion: the demo account is the best way to...

- Free real money forex no deposit

- Forex trading without deposit | no deposit bonus...

- No deposit bonus in a glance

- How to start forex trading without deposit: tips...

- Start forex trading without deposit: introduction...

- No deposit bonus as an alternative – is it worth...

- Forex trading without deposit | no deposit bonus...

- No deposit bonus in a glance

- How to start forex trading without deposit: tips...

- Start forex trading without deposit: introduction...

- No deposit bonus as an alternative – is it worth...

- Trading account

- Benefits of our trading account

- More opportunities

- Cut your costs

- Always in control

- Stay in the know

- Get started today for only £9.99 a month.

- Get the best investment choice and insight around

- Looking for a general investment account?

- Looking for a joint trading account?

- Trading account with free money

- Trading account

- Benefits of our trading account

- More opportunities

- Cut your costs

- Always in control

- Stay in the know

- Get started today for only £9.99 a month.

- Get the best investment choice and insight around

- Looking for a general investment account?

- Looking for a joint trading account?

- Forex trading accounts

- The top 5 forex trading accounts in the united...

- Which is the best forex trading account?

- Forex trading account types

- Standard trading accounts

- Funded trading accounts

- Mini and micro trading accounts

- Managed trading accounts

- Islamic trading accounts

- VIP accounts

- Demo accounts

- Geographic considerations

- How to make up to £100 by depositing £1 into A...

- What is trading 212?

- Can I make money by depositing £1 into my trading...

- How do I get my free share from trading 212?

- Will everyone make the same amount from signing...

- What information will I needed to share with...

- Should I continue trading with trading 212 after...

- I’ve already gotten my free trading 212 share....

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.