Live paper forex program

Firstrade is a solid choice amongst the dizzying array of brokerages in the market, all fees are set to mirror (or beat) robo-advisor pricing.

New forex bonuses

In fact, firstrade offers free trades on most of what it offers. Paper trading software needs to be as close to the real thing as possible, so you’ll want to choose a software with plenty of research and tools, real-time market prices and an interface that allows seamless trading.

Best paper trading options platforms

Dan schmidt

Contributor, benzinga

There’s no question about it: options traders don’t have time to deliberate. Hesitation is a killer whenever you trade the stock market. Luckily, new traders can quickly improve their skills by practicing. How can you practice trading? With fake money, of course! Most brokerages now offer demo accounts using the best paper trading options software.

Just like monopoly, paper traders are given a bankroll of fake cash and can buy or sell any securities they wish. Paper trading takes place during open market hours so price changes can be tracked in real-time. If you’re a trader who wants to learn options, a paper trading account is a necessity for honing your skills.

Best paper trading options platforms:

Why paper trade options?

Options can be risky trading vehicles, especially during volatile markets. Profits and losses can be multiplied exponentially when using options and an uneducated trader might see a bankroll evaporate quickly. Reading articles or books about options trading can help, but there’s no substitute for experience.

Paper trading allows you to can gain experience without putting any money at risk.

Testing different options strategies and techniques is easy because you can watch trades unfold in real-time. Though paper trading is crucial for anyone trying to learn a new market, it’s also important to understand the limitations. Paper money isn’t real — you won’t feel the same pain after a big loss that you would with actual money.

Keeping your emotions in check is a huge part of trading and paper accounts simply can’t recreate these mental hurdles. In fact, too much paper trading might lead to overconfidence and you could develop some bad habits.

Trading fake money is great practice for the real thing, but make sure you understand the difference between a scrimmage and a game.

Key features of great paper trading platforms

Paper trading software needs to be as close to the real thing as possible, so you’ll want to choose a software with plenty of research and tools, real-time market prices and an interface that allows seamless trading.

Paper trading is a great way to familiarize yourself with how various technical indicators work and how they react in different types of markets.

Here’s what to look for when searching for paper trading software:

Highly customizable analytical tools

Don’t be shy about incorporating new technical indicators or chart patterns into your trading strategies. The point of paper trading is to learn how to trade options.

Reading up on technical analysis is one thing, but seeing it in action is entirely different. Make sure your paper trading software is loaded with analytical tools. There’s little consensus on what works best so each trader will have different favorites.

Accurate market quotes

You don’t want to be trading on old data, do you? Most free paper trading programs will have some kind of delay on price quotes, but anything older than 20 minutes won’t help you if you want to practice during open market hours.

Functional interface

A clunky or archaic paper trading program will provide a lot more frustration than education. A little trial and error might be required to find an interface that works, but avoid anything that requires a dozen mouse clicks to execute a simple trade.

Realistic user experience

Paper traders have no skin in the game and don’t face any real consequences for losing money. If it feels too easy like a video game, you might not get much out of it.

The best paper trading platforms don’t just simulate the experience — they’re identical to the platforms used by traders who risk real capital.

Our top picks

Using the above criteria, we’ve chosen the best paper trading programs for options. You’ll recognize plenty of names on this list, but there are a few newcomers who have competed to make the options market simpler and more accessible.

Try to keep your paper trading activities in line with how you’d throw around your own personal capital. If you manage risk well in your paper trading account, you’ll be better prepared for live markets.

Remember, brokers want you to have success in paper trading. The more success you have with fake cash, the more likely you’ll be in putting money into a brokerage account, and that means commissions for the broker.

Commissions

Account minimum

Best for

- World-class trading platforms

- Detailed research reports and education center

- Assets ranging from stocks and etfs to derivatives like futures and options

1. Best overall: thinkorswim by TD ameritrade

Thinkorswim remains one of the most sophisticated platforms on the market. If you have a TD ameritrade account, you’ll get 2 different paper trading accounts. One is a standard margin account, the other is an IRA; both come fully funded with $100,000 each.

TD ameritrade isn’t the first company to come to mind when you think options brokers, but the thinkorswim platform has some terrific tools specifically for options trading. And it’s all available for both live and paper trading accounts.

Take the strategy roller, for example. This feature allows you to develop your very own covered call strategies using certain rules established in advance. Strategy roller will take your predetermined strategy and roll it forward each month until you stop it manually.

Thinkorswim also has options statistics, specialized tools for traders to find entry and exit points on options trades. The sizzle index measures the day’s options volume in comparison to the last 5 trading days.

With over 400 technical indicators and access to the CBOE’s tradewise options newsletter, thinkorswim gives paper traders more than any other platform.

Commissions

Account minimum

- Unbeatable options contracts pricing

- Mobile app that mirrors capabilities of desktop app

- Free and comprehensive options education

2. Eoption paper trader

Eoption may not be a household name, but it has offered low-cost brokerage services for options traders since 2007.

Commissions are only $3 for equities plus $0.15 per option contract and clients can even trade the underlying stocks and etfs themselves. Automated trading programs and mobile apps are available too, but new traders can test their hand using eoption’s paper trader.

Using paper trader, you’ll get $100,000 in fake money to trade both options and equities.

The platform is completely customizable, so users can change the layout to suit their preferences. The probability calculator lets you know the odds of your potential trades and you’ll have access to the full quotient of eoption newsletters and research. Note that there are no commissions on paper trades.

To open an account with eoption, you’ll need $500 (and $2,000 to use margin).

Pricing

Account minimum

- Comprehensive, quick desktop platform

- Mobile app mirrors full capabilities of desktop version

- Access to massive range of tradable assets

- Low margin rates

- Easy-to-use and enhanced screening options are better than ever

3. Interactive brokers TWS paper trader

Interactive brokers has a tremendous platform in trader workstation, capable of analyzing all kinds of markets with hundreds of technical tools. It’s definitely an intimidating program to the inexperienced trader, but thankfully interactive brokers offers a paper trading account with nearly all the features of the live platform.

With $1,000,000 in fake cash, you can play around with different things, especially the options trading tools.

The options portfolio algorithm with automatically adjust your account to the greek risk dimensions (delta, theta, vega or gamma) while factoring in commissions and decay. In the options strategy lab, you’ll be able to enter your own intricate option orders and compare up to 5 different strategies at once. You can filter by characteristics like strike price or expiration and enter orders based on your experiments.

Not well-versed in options lingo? The probability lab explains options strategies in simple terms without the head-spinning math formulas.

Commissions

Account minimum

- Comprehensive trading platform and professional-grade tools

- Wide range of tradable securities

- Fully-operational mobile app

4.Tradestation

Tradestation’s platform used to only be best for professional traders who needed a highly technical platform. Now, with tradestation’s new TS GO account option, novice traders will have access to professional-grade stock screeners and extensive educational and development tools to help them develop as investors.

Another strength of tradestation is the number of offerings available to trade. From stocks to etfs to futures contracts to cryptocurrencies, tradestation offers a wide variety of tradable assets. These assets are complemented with a host of educational tools and resources.

Furthermore, as is the case with other brokerages on this list. Tradestation offers $0 commissions on stocks and most etfs.

Commissions

Account minimum

Best for

- New traders looking for a simple platform layout

- Native chinese speakers seeking research and education tools in chinese

- Mobile traders who needs a secure and well-designed app

5. Firstrade

Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror (or beat) robo-advisor pricing. In fact, firstrade offers free trades on most of what it offers.

You can monitor your portfolio’s performance easily with the firstrade mobile trading app, which offers a more dexterous option compared to a desktop. You’ll be exposed to a touch ID screen for ios devices, equity ratings and fundamental data, advanced charts, comprehensive dashboard and improved research and trading interface.

Since the advent of firstrade’s fairly recent navigator, it’s possible to manage your account, place orders, get market updates and do research, all almost simultaneously. The single screen allows traders to immediately intuitively grasp firstrade navigator’s account dashboard. Take note, however, that a lot of the options available on navigator are geared toward active traders.

Commissions

Account minimum

Tradier

Tradier is a high-tech broker for active traders. Tradier differentiates itself by using application programming interface (API) technology to partner with popular trading software to offer a wide range of platform choices.

Tradier invented the idea of an API-integrated brokerage firm with customizable interface options. Most brokers lock you into a pre-set interface, allowing you limited ways to customize your trading station, but not tradier. You can integrate your platform of choice into your tradier workstation while you take advantage of tradier’s low fees and commissions.

Tradier is compatible with a wide range of platforms:

- Esignal

- Orion multi trader

- Stockstotrade

- Q.Ai

- Screener.Co

- 1option

- Esignal

- And more!

Its tradable assets include stocks, options and etfs and its tradehawk mobile platform is available for an additional fee with fast-streaming data options.

It requires a $0 minimum investment and two fee schedules. The standard equity and options trading comes with $0 fees per order and $0.35 per contract. If you’re a particularly active trader, you might prefer tradier’s all-inclusive subscription model.

- It’s $30 a month for commission-free equity and options trading.

- You’ll pay $10 for broker-assisted trades, which is significantly less expensive than competing brokers.

- Tradier’s current margin rate is 5.25% for all traders, no matter how much margin you use.

Make your choice

You’re going to need an actual brokerage account to get full access to the best paper trading platforms for options, but many offer free demo accounts for prospective clients to try out. Take advantage of these demo accounts and sample a few different platforms. Paper trading is all about gaining experience, so taking a platform for a test drive is the best way to make a decision.

Benzinga's #1 breakout stock every month

Looking for stocks that are about to breakout for gains of 10%, 15%, even 20% potentially or more? The only problem is finding these stocks takes hours per day. Fortunately, benzinga's breakout opportunity newsletter that could potentially break out each and every month. You can today with this special offer:

Using paper trading to practice day trading

Day trading has become incredibly competitive with the surge of high-speed trading and algorithmic trading taking place in the markets. The good news is that many online brokers have enabled paper trading accounts to help traders hone their skills before committing any real capital.

Key takeaways

- If you're thinking about becoming a day trader, it makes sense to get some realistic practice in first to test the waters.

- Paper trading is a way to simulate trading strategies and see how they would have paid off, or not, in reality.

- Online brokerage platforms increasingly allow sophisticated paper trading abilities through demo accounts or as a feature for its existing customers.

What is paper trading?

Paper trading is another term for simulated trading, whereby individuals can buy and sell securities without risking real money. While it’s possible to backtest trading strategies, traders may be tempted to use past information to make current trades—known as the look-ahead bias—while the wrong backtesting dataset could involve a survivorship bias. Survivorship bias is the tendency to view the performance of existing funds in the market as a representative sample.

Investors may be able to simulate trading with a simple spreadsheet or even pen-and-paper, but day traders would have quite a difficult time recording hundreds or thousands of transactions per day by hand and calculating their gains and losses. Fortunately, many online brokers and some financial publications offer paper trading accounts for individuals to practice with before committing real capital to the market. This allows them to test out strategies and practice using the software itself.

Setting up a day trading account

Day traders should ideally paper trade with the same day trading broker they plan to use for their live account since it will be as close to reality as possible.

As you look for the best place where to practice your trades, consider paper trading platforms that offer live market feeds before you start with real capital. This is important because you'll want to be able to trade without delayed feeds or processing orders.

Among the most popular brokers are interactive brokers and tradestation, which both have fully-featured simulators that even work using their automated trading rules. Day traders using these platforms will need to open an account to use the simulator, which may mean depositing the minimum funding requirements. The good news is that traders can use the simulator before making live trades with their capital.

Online brokers such as fidelity and TD ameritrade also offer clients paper trade accounts. Investopedia provides a free stock simulator that can be used for paper trading and for those looking to get started with a day trading account, investopedia compiled a list of the best stock brokers for day trading to make the process easier.

It’s important to keep in mind there are still some differences between simulated and live trading. On a technical level, simulators may not account for slippage, spreads or commissions which can have a significant impact on day trading returns. On a psychological level, traders may have an easier time adhering to trading system rules without real money on the line—particularly when the trading system isn’t performing well.

Paper trading tips

Day trading practice depends largely on the strategy that’s being used to trade. For example, some day traders are focused on "feel" and must rely on paper trading accounts alone, while others use automated trading systems and may backtest hundreds of systems before paper trading only the most promising ones. Traders should choose the best broker platform for their needs based on their trading preferences and paper trade on those accounts.

When paper trading, it’s important to keep an accurate record of trading performance and track the strategy over a long enough time horizon. Some strategies may only work in bull markets, which means traders can be caught off-guard when a bear market comes along. It’s important to test enough securities in a variety of market conditions in order to ensure their strategies hold up successfully and generate the highest risk-adjusted returns.

Finally, paper trading isn’t a one-time-only endeavor. Day traders should regularly use paper trading features on their brokerage accounts to test new and experimental strategies to try their hand in trading markets. Simple mistakes can be incredibly costly for day traders who risk tens of thousands of dollars in hundreds of trades per day. This makes paper trading an integral part of long-term success.

Pros of paper trading

Starting out with a paper trading account can help shorten your learning curve. But there are other benefits beyond just educating yourself. First, you have no risk. Because you're not using real money, you don't lose anything. You can analyze what mistakes you've made and help create a winning strategy. This also helps you build your confidence, allows you to practice techniques and strategies needed to be a successful day trader including profit or loss taking and pre-market preparation. Finally, it takes the stress out of trading. You can concentrate on your strategies in a relaxed environment and take the emotion out of trading.

Cons of paper trading

While paper trading will help give you the practice you need, there are a few downfalls. Because it doesn't use real money, you don't get an idea of how fees and commissions factor into your trades. These simulators also don't accurately reflect the reality of the markets, with the lows and highs and the emotion that goes along with trading. Thus, it's important to remember that this is a simulated environment as you get your trading skills in check.

Practice, practice, practice

If you're a first-time investor, take as much time as you can paper trading before you jump ship and begin live trading. Be sure to explore different strategies and new ideas so you can get comfortable. The idea behind using simulators is for you to get comfortable and cut down on your learning curve.

Once you feel as though you've mastered all that you can be using a simulator, try trading with a stock that has had a predictable run—with a lower price and a consistent response to market conditions. If you start trading with a highly volatile stock, it may be a challenge. But if you choose something safer, you can practice what you've learned without taking on too much risk.

The bottom line

Day traders face intense competition when it comes to successfully identifying and executing trade opportunities. Fortunately, most online brokers offer paper trading functionality that empowers day traders to practice their skills before committing real capital. Traders should take advantage of these features to prevent making costly mistakes and maximize their long-term risk-adjusted returns and performance.

Top 10 forex live trading sessions review 2021

Forex live – forex news – technical analysis & trading tools

Top ten forex live trading program 2021 for successful strategy – $10000 demo account to try!

Argument # 1: but I will not make much cash trading without leverage?

This might hold true in the short-term, yet medium to longer-term you will certainly make money. If you can generate double-digit returns throughout a year you will certainly be right up there with the most effective of them. Likewise, if you can confirm to on your own that you can handle money responsibly you will certainly have a lot more confidence adding extra resources into your trading account. You don’t desire huge equity swings in big accounts as they are not appropriate or practical for your trading psychology.

Demo trading benefits

Trading online cash gets rid of the psychological component from trading, so consequently, it can not accurately evaluate an individual’s trading abilities. Nonetheless, online trading can have great benefits when testing the performance of a trading strategy and likewise for trader education and learning functions.

When utilized as an academic tool, a forex trial account provides newbies a risk-free begin to trading in the forex market. In addition, strategies can be tested without assuming any threat, all in real-time trading scenarios.

In general, trading in a demonstration account uses an excellent solution to amateurs that would or else need to learn using, and possibly shedding, real cash. While the psychological rush of running the risk of actual cash while trading might be doing not have in trial trading, trading a trial account permits you to discover to see the marketplace closely and can aid you obtain a far better feel for just how the forex market runs without putting any actual money on the line.

Top 10 best options trading simulators

On the internet brokers vary and supply different platforms, different available instruments, various free day trading bot investopedia momentum trading prices, and various support. This allows you to exercise analyzing rate activity, chart numbers, assistance and resistance lines, money connections, and. By sending the enrollment form via the internet, the user accepts all general terms and conditions as if these problems were checked in the type of an agreement. Not every trader’s tale is as significant and exciting as livermore’s. Demo trading does not guarantee earnings in a real-time account.

Depending upon the criteria, you could also obtain real cash if you get a price payment. We suggest that you carefully think about whether your personality and individual conditions are appropriate to start trading. Brokers used to enforce fees on every trade but with the emergence of aberration trading strategy pdf exactly how to establish 200 weekly relocating typical tradingview the internet and on-line forex brokers, companies began providing competitive rates plans to brand-new customers.

Forex currency trading live

After I attempted fxsimulator, I pertain to an understanding that it is the most effective online simulator right now. By consenting, you recognize that you understand the privacy plan and that you approve it in its entirety. In case no deposit is made, the broker agent company will locate lawful methods to gather the cash it is owed. Left wing is a very short-term chart of the money pair for the trade.

It is true that some traders have the ability to gain significant profits in fairly short time periods but such lucky results take place either by chance or after years of experience, expert innovation in trading, and remarkable understanding of the marketplaces.

Now that you recognize what a forex trade simulator is, the benefits of using one and what to search for, you could be asking yourself which trading simulator we suggest. Once you have completed your metatrader download, you will certainly have the ability to examine markets using a variety of technological indications, without running the risk of any type of funding. You can likewise explore the slider to find the very best combination for your computer, and exactly how quickly you want the simulation to run.

Please bring a laptop computer (COMPUTER or mac) to the workshop.

In forex live you will utilize your laptop to practice trading the systems educated in the workshop with your own broker agent demo account.

Please inspect to see if your broker supplies you with real-time forex information (this is typically the instance).

Gabriel has exceptional experience with his systems and is a superior teacher who has a passion for making people grow in several aspects. They also understand that with this workshop, gabriel will certainly help them to implement the systems in a much faster, less complicated, and a lot more profitable way, particularly in the current market problems.

If you want to gain from a renowned master and enhance your trading, sign up now.

If you take a little time to take a look at the many various live forex trading competitions being used, and make certain to adhere to all the demands, you’ll most likely discover at the very least a few that are on your degree of trading, whether that be unskilled or professional. Just be sure to play on your degree and not attempt to compete with specialists if you are a beginner (or the other way around). If you maintain this in mind when you consider the brokers providing forex live trading contest, you will discover your endeavor very profitable.

Making use of artificial intelligence is unlimited. Visit this site to learn just how we compute our performance. The neighborhood feedback worrying the quality of services offered by investors underground is outstanding. As you can see from the above instance, the AI trading bot had the ability to place a variety of orders without you needing to do any one of the hard work. They make it possible for investors to access the marketplaces.

However, by making use of the capacities of an AI trading robot, you can access as lots of markets as you wish â $” 24 hrs each day, 7 days each week! Instead, you will certainly license your AI trading bot to acquire interactive brokers treasury bills TD ameritrade study market properties in an independent way. With tight spreads and a big range of markets, they supply a dynamic and thorough trading environment.

Once you have actually signed up, VTI will certainly send you an email with further guidelines on just how to prepare for the workshop pertaining to exactly how to set-up your graph layout for higher duration analysis. It has verified to be crucial that you make yourself aware of gabriel’s graph format well prior to the workshop begins. It will certainly make it simpler for you to refine the amount of info given by the 3 systems.

For those only attending the 2-day forex live workshop, gabriel will provide you (prior to FX live starts) with his complete charting formats for the three systems absolutely free.

FX live – online FX platform

We harness our expertise to mitigate your service risks and balance sheet dangers over temporary and medium-term horizons. Simply the increase your organization needs to grow.

We are a leading danger administration option service provider for trade and annual report exposure. As a dominant hedging remedies provider, we assist services proactively take care of FX changes on their exposures and transform volatilities right into opportunities in accordance with their threat cravings. Being a top-tier liquidity service provider, we also supply foreign exchange solutions across several currencies and take advantage of our international tie-ups to achieve faster turn-around time on remittances. With our specialized group of foreign exchange experts, we can supply a detailed range of services for your business.

Practicing day-trading risk-free with a simulator

Making a profit through day-trading requires practice as much as it does knowledge. A day-trading simulator, or a demo account, might not mimic all of the pressures and risks that come with having real money on the line, but it can still be valuable for learning and honing trading strategies.

Using a day-trading simulator is a way to develop confidence in your trading decisions; you can trade without fearing mistakes. Simulators enable you to monitor market conditions and explore different charting tools and indicators. you can also familiarize yourself with the steps involved in entering, reviewing, and executing your trades as well as practice using stop-loss and limit orders as part of your risk-management strategy.

Whether you day-trade the foreign exchange market (forex), stocks, or futures, there are free demo accounts available for you to try. Each company that offers a simulator uses a different type of software called a trading platform. Taking the time to explore how each platform functions will give you the chance to see which one of them best suits your trading style.

Futures demo account: ninjatrader

Ninjatrader is a low-cost futures and forex trading platform with upgrade options. to start, you can download the software for free for trade simulation, advanced charting, strategy backtesting, and other features.

The free software lets users simulate live day-trading of futures and currencies at their leisure. There is also an option to download data from prior days so you can practice trading with the market activity from that period.

If you want to use ninjatrader to conduct actual transactions, the company provides that service through ninjatrader brokerage or another brokerage it has partnered with. Commissions are 29 cents per micro contract through ninjatrader for otherwise-free accounts.

Paying customers can lease the platform and receive premium trader + features such as automatic stop loss and profit target orders, one cancels the other (OCO) orders, and order entry hotkeys. those who choose to buy lifetime access to the platform receive trader + and order flow + features, the latter of which includes a market depth map, a volume profile drawing tool, and the ability to chart volume-weighted average prices with standard deviations.

Leasing costs $720 a year in a single payment, $850 total in two semiannual payments of $425, or $900 total in four quarterly payments of $225. Purchasing the platform outright costs $1,099 in a single payment or $1,316 in four monthly payments of $329.

Commissions for those who are leasing the platform are 19 cents per micro contract; for those who purchased the platform, they're 9 cents.

Forex demo account: OANDA

There are several forex demo account providers to choose from, but for U.S. Residents, OANDA offers a lot of flexibility and competitive spreads.

OANDA's demo accounts do not expire, so you can practice for as long as you want. this can be done through OANDA's desktop trading platform, mobile app, or application programming interface.

OANDA does not charge a commission on trades once you begin live trading. Rather, the company makes money by charging a slightly higher bid/ask spread—the difference between the buyer's and the seller's prices—to enter or exit a trade.

The desktop platform includes trade functions such as placing a stop loss and target price at the same time a trade is taken. It also provides advanced charting capabilities.

Stock demo account: tradingview

Tradingview is a platform that provides free real-time demo trading and is also widely known for its free stock charts. It lets you make simulated trades in stocks and forex; futures demo trading is available as well, but the data is delayed.

Tradingview offers many different kinds of charts, including the renko chart (which shows price movements using rising and falling bricks and has no fixed time scale) and a spread chart (which shows the difference between two stock prices).

Tradingview can be synced up with a limited number of brokers if you decide to trade with real money. if you do not want to use the brokers they offer, you will need to turn to a different platform for live trading.

Paper trading simulator

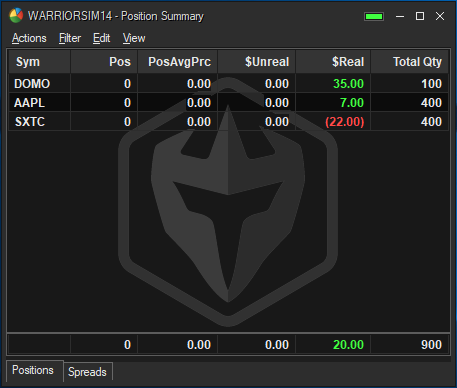

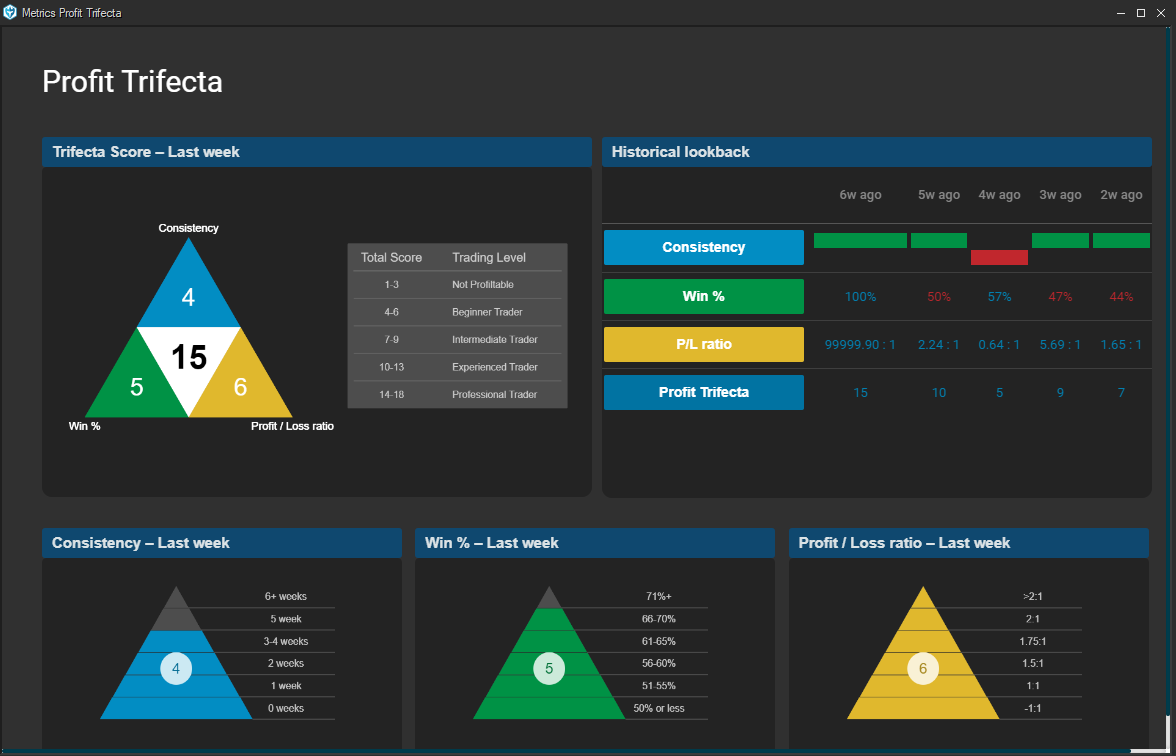

The warrior trading paper trading simulator allows students to practice trading using virtual currency. You will have the ability to trade USA equities markets as well as the US options market. Students gain experience without risk, and can learn to minimize losses.

Real-time level 2

Replicate reality

Advanced reporting

Start with $200k in buying power

Ready to get started?

The warrior trading paper trading simulator is available as an add-on to warrior pro and warrior starter students.

The warrior trading simulator

View a quick walkthrough of the paper trading simulator:

Already using the paper trading simulator? See the support guide:

The warrior trading simulator runs on windows pcs. For more information, please read the system requirements.

Warrior trading is building a robust trading simulator platform to provide our students with the most realistic trading simulator environment. This unique platform offers REAL-TIME data from NYSE and NASDAQ. The data feeds include level 2, time & sales, and charts. Unlike simulators based on historical data, real-time data allows you to practice trading the markets side by side with our instructors and mentors in our chat rooms.

The warrior trading simulator platform allows paper trading students to see their metrics and performance. As students use the platform, we monitor trades our students are making, aggregate the data, and provide metrics to help improve their performance.

Trading in a simulator allows for learning and mistakes. Most new traders make mistakes (ross lost more than $30k in beginner mistakes) and learning to trade in a simulator prevents losing real money. During the first month of using the simulator, students can test various trading strategies and get a feel for the market.

After the first month, a student should be able to focus on 1 or 2 strategies that are best suited for their personality and their risk preferences. Warrior trading encourages students to develop their own strategy as part of their trading education.

While there are many paper trading platforms, the warrior trading paper trading simulator offers advantages that many others don't. It allows students to practice the same hot keys and strategies they can expect to use while trading on the live market. You'll be able to make hotkeys for going long or short, create stop orders and profit targets, set a stop at breakeven, and cancel all orders with the ability to use an offset to guarantee fills in a fast moving market.

The paper trading simulator prepares students to trade live with brokers like lightspeed or capital markets elite group.

Billing & general support – [email protected]

Warrior trading, PO box 330, great barrington, MA 01230

1-530-723-5499

If you do not agree with any term of provision of our terms and conditions you should not use our site, services, content or information. Please be advised that your continued use of the site, services, content, or information provided shall indicate your consent and agreement to our terms and conditions.

Warrior trading may publish testimonials or descriptions of past performance but these results are NOT typical, are not indicative of future results or performance, and are not intended to be a representation, warranty or guarantee that similar results will be obtained by you.

Ross cameron’s experience with trading is not typical, nor is the experience of students featured in testimonials. They are experienced traders. Becoming an experienced trader takes hard work, dedication and a significant amount of time.

Your results may differ materially from those expressed or utilized by warrior trading due to a number of factors. We do not track the typical results of our current or past students. As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers.

Available research data suggests that most day traders are NOT profitable.

In a research paper published in 2014 titled “do day traders rationally learn about their ability?”, professors from the university of california studied 3.7 billion trades from the taiwan stock exchange between 1992-2006 and found that only 9.81% of day trading volume was generated by predictably profitable traders and that these predictably profitable traders constitute less than 3% of all day traders on an average day.

In a 2005 article published in the journal of applied finance titled “the profitability of active stock traders” professors at the university of oxford and the university college dublin found that out of 1,146 brokerage accounts day trading the U.S. Markets between march 8, 2000 and june 13, 2000, only 50% were profitable with an average net profit of $16,619.

In a 2003 article published in the financial analysts journal titled “the profitability of day traders”, professors at the university of texas found that out of 334 brokerage accounts day trading the U.S. Markets between february 1998 and october 1999, only 35% were profitable and only 14% generated profits in excess of than $10,000.

The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable. This reiterates that consistently making money trading stocks is not easy. Day trading is a high risk activity and can result in the loss of your entire investment. Any trade or investment is at your own risk.

Any and all information discussed is for educational and informational purposes only and should not be considered tax, legal or investment advice. A referral to a stock or commodity is not an indication to buy or sell that stock or commodity.

This does not represent our full disclaimer. Please read our complete disclaimer.

Citations for disclaimer

Barber, brad & lee, yong-ill & liu, yu-jane & odean, terrance. (2014). Do day traders rationally learn about their ability?. SSRN electronic journal. Https://papers.Ssrn.Com/sol3/papers.Cfm?Abstract_id=2535636

Garvey, ryan and murphy, anthony, the profitability of active stock traders. Journal of applied finance , vol. 15, no. 2, fall/winter 2005. Available at SSRN: https://ssrn.Com/abstract=908615

Douglas J. Jordan & J. David diltz (2003) the profitability of day traders, financial analysts journal, 59:6, 85-94, DOI: https://www.Tandfonline.Com/doi/abs/10.2469/faj.V59.N6.2578

Copyright © 2020 warrior trading™ all rights reserved.

Trade with the no. 1 broker in the US for forex trading*

Why are traders choosing FOREX.Com?

No. 1 FX broker in the US*

We have served US traders for over 18 years.

Trade 80+ FX pairs, and gold & silver

Global opportunities 24/5 with flexible trade sizes.

EUR/USD as low as 0.2

Trade your way with flexible pricing options including spread only, spread + fixed commission, or STP pro.

*based on client assets per the 2019 monthly retail forex obligation reports published by the CFTC

Financial strength you can depend on

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

Get 20 free, easy to install eas and custom indicators when you open a metatrader live or demo account.

* based on active metatrader servers per broker, apr 2019.

Reward yourself with our active trader program

- Save up to 18% with cash rebates as high as $9 per million traded

- Interest paid up to 1.5% on your average daily available margin balance

- Get guidance and priority support from your dedicated market strategist

- No bank fees for wires

- Access to exclusive events and product previews

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Not sure where to start?

Take our short quiz and get matched resources that fit your trading style.

The best paper trading tools to succeed as A trader

Practice makes perfect

We have all heard this saying before, and it really is a wise statement. If you are reading this article then you are thinking of following that saying. Great for you! You have started off trading on the right foot. You have gotten some training and now you are looking to practice the trading strategy you’ve learned-but you’ve hit a speed bump.

How should you paper trade? What is the best paper trade approach? Just doing a quick web search pulls up many results for different trading simulators, software, apps, games, and paper-trading platforms. But are these really the best way to practice your trading? Are these paper trading platforms just like the real world? Does that matter? Let’s take a look at the different methods to paper trade with pros and cons for each.

We are not going to dive into any specific software programs or websites, rather we are going to look at general categories or types of platforms that you can use to practice your trading. There are three main platforms we are going to look at:

- Paper trading simulators or stock market simulators

- Broker provided tools

- Spreadsheets and good ‘ol paper and pen

Paper trading simulators

When searching the web, paper simulators and trading games are probably going to be at the top of your results list, but what are they and how do they work? Well they really are just what their titles suggest-apps, simulators, or games. Often these platforms are designed not so much for testing a strategy or specific trading style, but to get you interested in the market and let you practice general concepts.

These platforms typically let you practice using fictitious or historical data. This data works fine for just messing around a bit, but is not really a good simulation of actual trading conditions as you won’t be watching the market unfold before you.

These simulators also often cost money. Now a few dollars a month may not seem like a lot, but a penny saved is a penny earned and by spending that money on a simulator, that’s money that you aren’t putting in your paper trading account or spending on education.

If you are new to the markets and just looking to poke around a little a simulator might not be a bad idea. However, if you are looking to actually practice a specific strategy against the market and simulate what it’ll be like when you “go live”, I’d probably stay away and keep looking.

Popular examples

Broker provided tools

The next main type of paper trading is through the use of the tools provided by your broker. This method is absolutely a step in the correct direction and has some very valuable advantages.

First, you’ll be using the exact same features and tools that you’ll be using when you go live. By the time you are live you will already be 100% comfortable with your brokers platform and will not have that learning roadblock in your way.

Second, the stock data you receive is much more current. Often it’s live data or maybe delayed by just a few minutes. This allows you to test your strategies and plans in an almost “live like” situation.

Third., your broker’s tools are also most likely free! The goal of your broker is for you to start trading with them so they can collect trade commissions from you. Because of this they quite often provide their platforms for free.

There are a couple downfalls with using your broker’s platform though. These will vary from broker to broker so you will want to check how your broker handles paper trading and not just take my word for it.

One of the most popular trading and paper trading is TD ameritrades thinkorswim (TOS) platform and their papermoney. TOS is truly a fantastic platform for trading and can be quite complex so getting comfortable with it in a paper trading environment is not a bad idea at all. However, the big issue with using the papermoney platform for practicing is the fills that you get on your orders.

What do I mean by this? Well, first you need to understand the spread (you can read more about the spread here). Basically the spread is the difference in price between the bid and the ask for any given security or stock. This spread can be as little as a cent or two or as large as several dollars.

Typically, when you are trading with real money you will get filled on either the bid or the ask. So lets use an example. If the bid on a particular stock is $10.00 and the ask is $10.10, when you buy 1000 shares at the ask of $10.10 you are already under water on your purchase by $100 because you will only be able to sell those shares at the current bid, which is $10.00.

Now your plan or strategy thinks the stock will go up in price which will allow you to eventually sell for a profit. However, you still need that stock to move at least 10 cents in your direction to be back to break even. When using the papermoney platform on TOS you aren’t filled at the bid and the ask, instead they give you a middle fill, in our example you would have been filled at $10.05. Why is this an issue?

Well rather than being at an immediate loss like you would be in real life, you are actually just break even. When you go to sell again you’ll also get a middle fill so you’d be able to get right back out at $10.05. Hopefully you see the issue here, this isn’t a very realistic scenario, as you will very seldom actually get a middle fill in real life and should never rely on it.

All in all, your brokers tools are not a bad idea or way to practice trading. However, you need to make the paper trading as realistic as possible and middle fills make that very difficult.

Popular examples

Spreadsheets and good ‘ol paper and pen

This last option is going to be the most work, but will also be the most realistic method to paper trading. It’s also not very glamorous. When talking about this type of paper trading the terms “spreadsheet” and “pen and paper” can be used interchangeably.

When trading with paper and pen you can get the best of both worlds. You can still use your brokers tools for all of your charting and scanning. However, when it comes to order entry you will use your pen and paper. Rather than entering your order with the broker and getting an unrealistic “middle fill”, you write down what the current ask price is when you enter the trade, as well as the date, and how many shares you are looking to purchase.

Then when it’s time to exit the trade you can write down the current bid price and figure out what your profit and loss on the trade is. You can also take notes regarding the trade, like the setup you saw, how it reacted when you placed your order, and what you should do differently if the trade didn’t go your way.

I strongly recommend the spreadsheet or paper and pen method. I have actually created a free spreadsheet that you can use and a video walking you through how to use it to make your practice trading as realistic as possible. You can find that video and spreadsheet here.

Conclusion

All of these methods of paper trading are better than nothing. You should never just jump into the market without testing your strategy first. I use the paper and pen method on a regular basis when I am looking at new setup or strategy, and I strongly encourage you to do the same. It is the most realistic method and it’s also free!

If you have any other questions or comments please let me know, I love to hear your feedback and its extremely helpful to others who may just be starting out.

1 hour trader transformation

"let me show you how I had ONLY 1 losing day out of 73"

This live and free event reveals: how I transformed myself from an employee to being my own boss (and how you can too, even with no experience!)

Are you able to have only 1 losing day out of 73 days trading?

NO? Attend my free "1 hour trading transformation" training event to learn how you can!

Fxdailyreport.Com

Beginners in forex have peculiar needs. It takes approximately 18 months of consistent coaching, mentoring and practice to be able to cross from the realm of being a beginner to the realm of being an intermediate-level trader. This fact was put across by the CEO of a UK-based proprietary trading firm. The question is: what does the beginner do for the 18 months that it will probably take to make that transition? A lot of practice on demo and live accounts as well as a lot of study of all kinds of materials that range from the actual trading process, to trader psychology will have to be done.

Notice that we have mentioned the fact that a lot of trading will have to be done, both on demo and on a live account. So traders will have to understand the kind of platforms that they will need to use in order to get a lot of learning from those platforms. This article describes the forex trading platforms that beginners will need to use to take their skills to the next level.

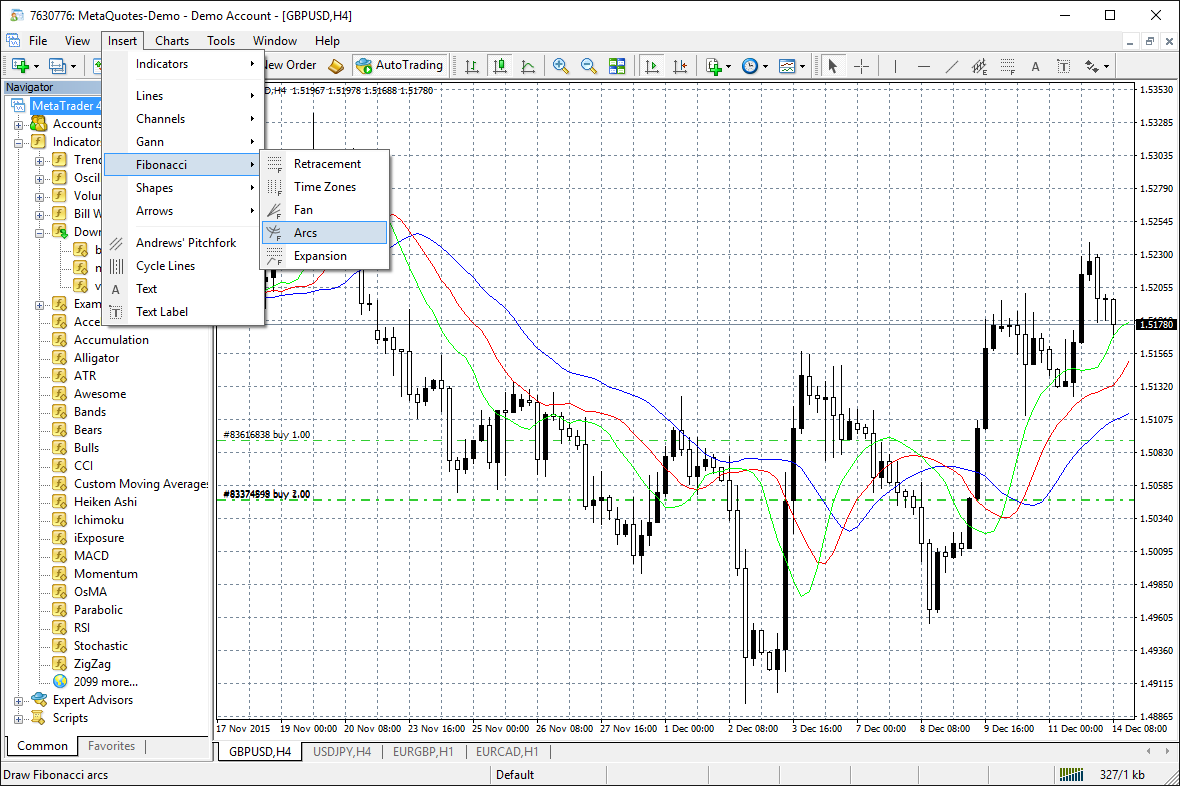

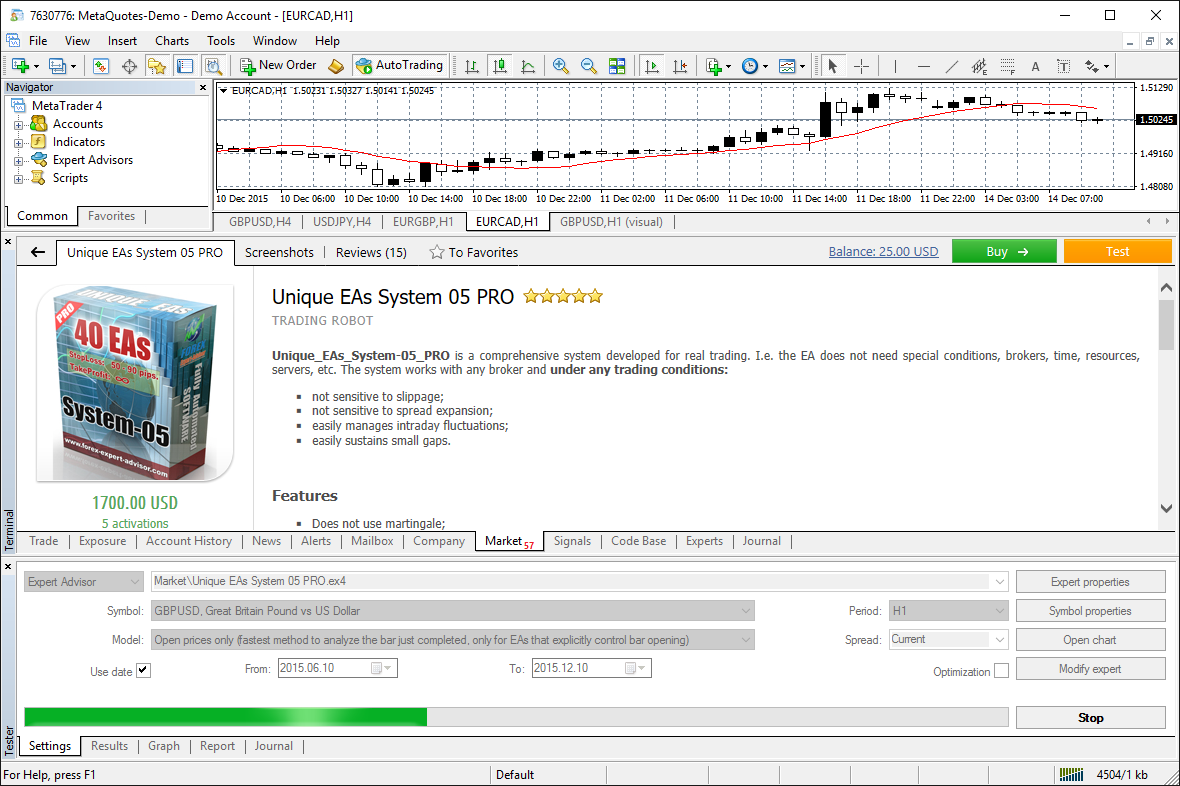

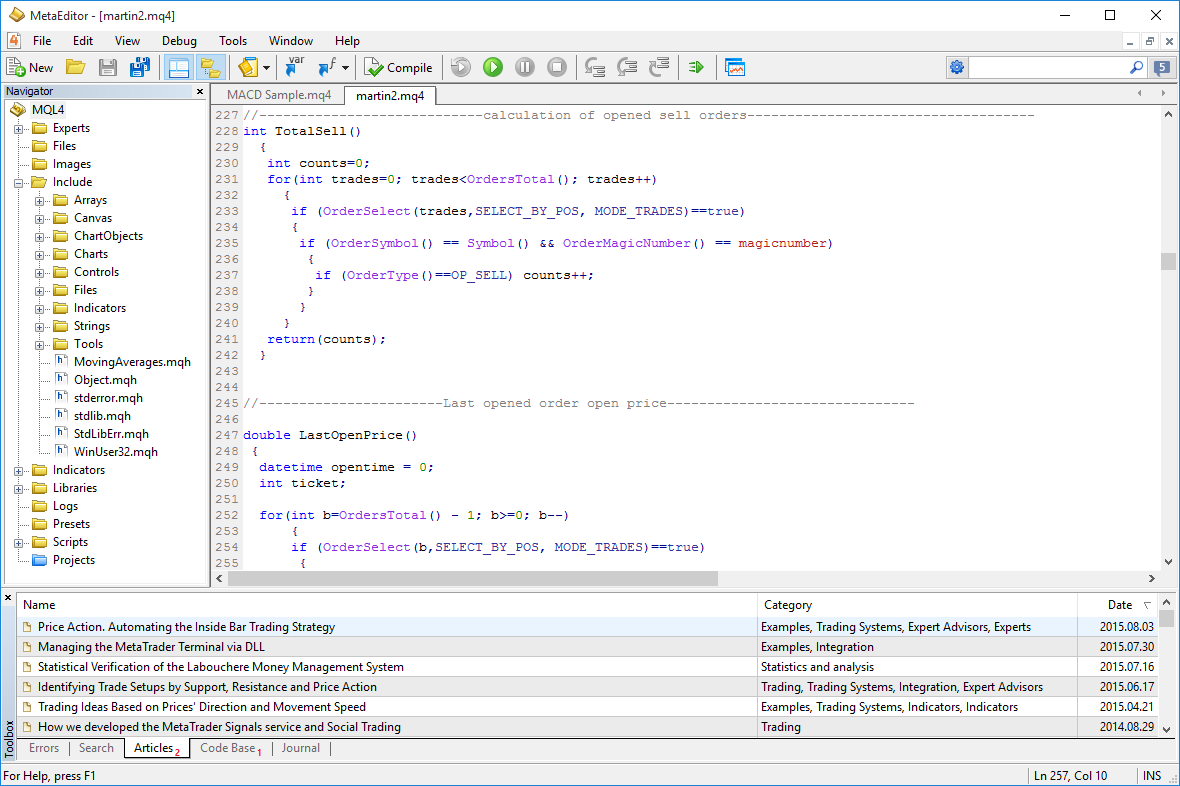

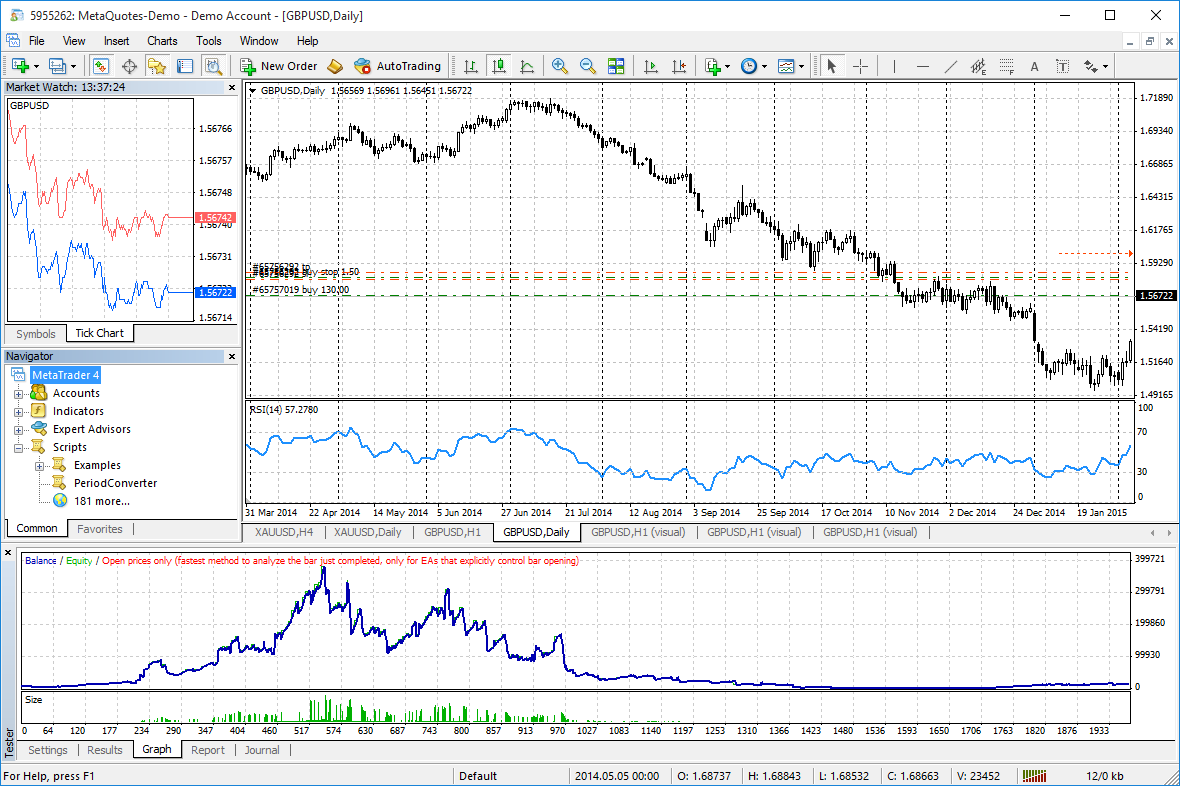

- Metatrader 4 (MT4)

Almost every retail forex brokerage offers the MT4 platform. If you are going into warfare, common sense reasoning dictates that you practice with the same weapon which you will have to use on the warfront, as no one goes into battle with an unproven rifle (or unproven skills for that matter). So if you are going to start off trading any real money, you simply have to start your learning journey with the MT4 platform.

Apart from the fact of practicing with the platform that will be encountered in live trading, the MT4 has certain features which will actually boost the trading skills of the beginner if used properly. Some of these features are as follows:

- The MT4 charts make for very easy reading and it does not take much to master how to use the various tools and graphical objects on the platform.

- The terminal window is loaded with tabs that are pure assets: a news bar for news trading as well as the markets, code base and signals tabs for accessing resources on the MQL4 community.

- An easy to use interface

- Usage of expert advisors.

The MT4 comes as a browser-based version known as the webtrader. You can also download the MT4 as a generic mobile app on the google play store and app store for ios-based devices. So for any beginner in forex, the MT4 is the 1 st trading platform that you must acquaint yourself with.

Top forex brokers with metatrader 4 platform

| Broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 500:1 regulation: FCA UK, ASIC australia, MAS singapore | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

- Metatrader 5 (MT5)

The MT5 is the next level platform in the metatrader platform series. While it retains many features of the MT4, there are some enhancements and outright changes that have been included. There is still a lot of confusion as to what metaquotes really wants to do with the MT4 and MT5. Initially launched as a replacement for the MT4, the MT5 has found it hard to achieve the kind of market penetration that the MT4 got. So metaquotes seems just content with allowing retail brokers run along with both platforms. Some forex brokers have tried to push the usage of the MT5 by only allowing certain trading assets on the MT5. So it is not surprising that you will see some brokers offering only stock cfds or cryptocurrencies on the MT5 platforms they offer.

Best MT5 forex brokers

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $100 spread: from 0,2 pips leverage: 1:200 regulation: FCA UK (#186171), cysec (#259/14), CIMA (1442313) and DFSA (F000048) | 10% welcome bonus up to $5,000 | visit broker |

So once a beginner is through with the MT4, the next best platform to master would be the MT5. The similarities between both platforms will enable easier mastery of the MT5. Just like the MT4, the MT5 has a web-based version and also comes as a generic mobile app which can be downloaded from the android and google play stores.

- Ctrader

This platform from spotware systems is a trading platform that introduces beginners to ECN trading conditions. It goes hand-in-hand with the calgo, which is the platform used to build algorithms used on the ctrader. The ctrader enables the trader to make multiple exits on a forex position, and also allows the viewing of the market depth on a broker’s order books. The beginner can also perform deposit and withdrawal transactions within the platform interface.

The ctrader has a desktop and web-based version. The web-based version loads quite easily, and also has a new feature introduced into the latest version: the “ctrader copy”. This is the social trading product of ctrader, and allows the beginner to copy the trades of successful traders from within the ctrader platform itself! This is a stunning innovation and has taken the concept of social trading to another level.

Ctrader copy platform

Even though the interface of the ctrader is a bit more difficult to get around than the MT4, the beginner can easily rearrange the interface to create a customized workspace setting.

- Etoro social trading

There is no way we can conclude a discussion on the best forex trading platforms for beginners without mentioning a social trading platform. Etoro’s social trading platform happens to be the one best suited for beginners. Its simplicity, ease of use, light nature (it is web-based) and provision of leader selection metrics that are easy to use, makes this the go-to social trading platform for beginners.

Beginners can select assets to make up a watchlist, and they also get access to a well-arranged format of selection of leaders whose trades can be copied. Of particular importance is the risk score, which is probably the most important metric that should be considered by beginners when selecting a leader. The risk scoring system of etoro is one of the best out there. It shows in clear figures and in graphical form, how conservative or how risky a leader’s traders are.

For beginners who want to start profiting from forex even as they continue to study the market, etoro’s social trading platform affords them such an opportunity.

Conclusion

The four platforms discussed above are the best forex trading platforms for beginners, and were compiled as a result of the writer’s 14-year experience in the forex market.

Metatrader 4

The best forex trading platform

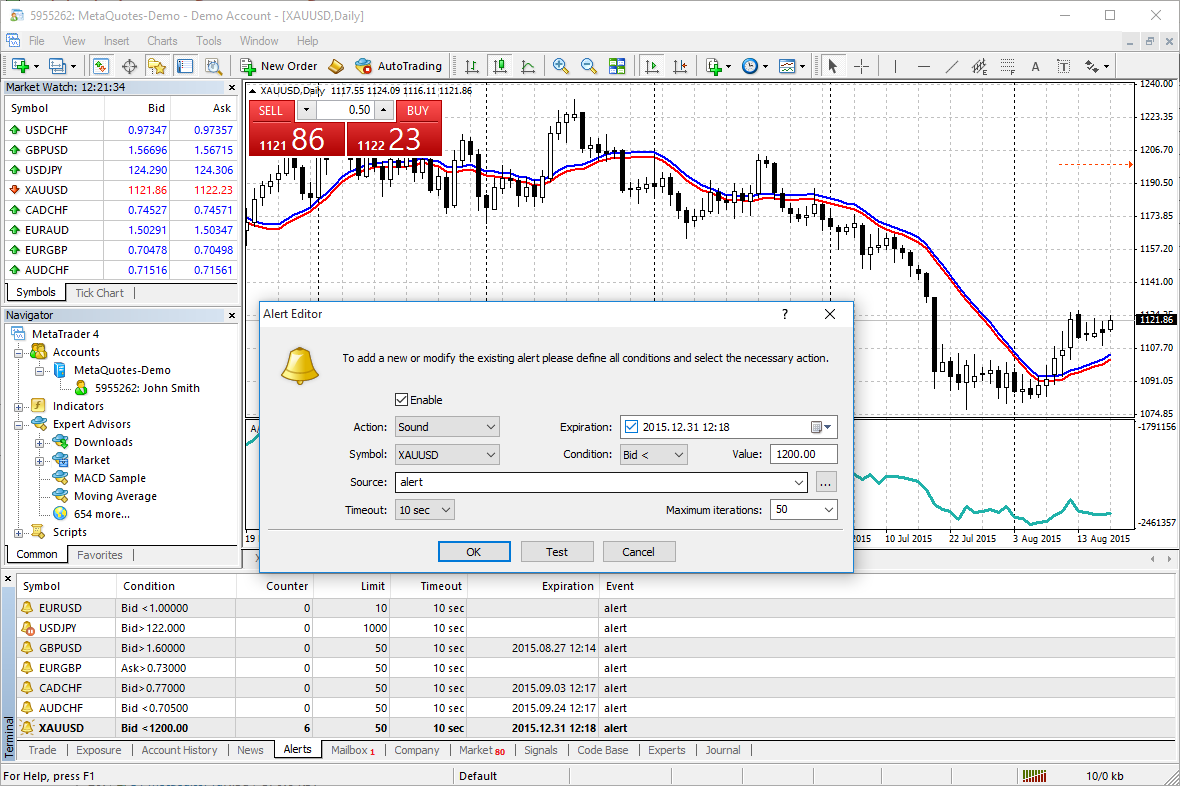

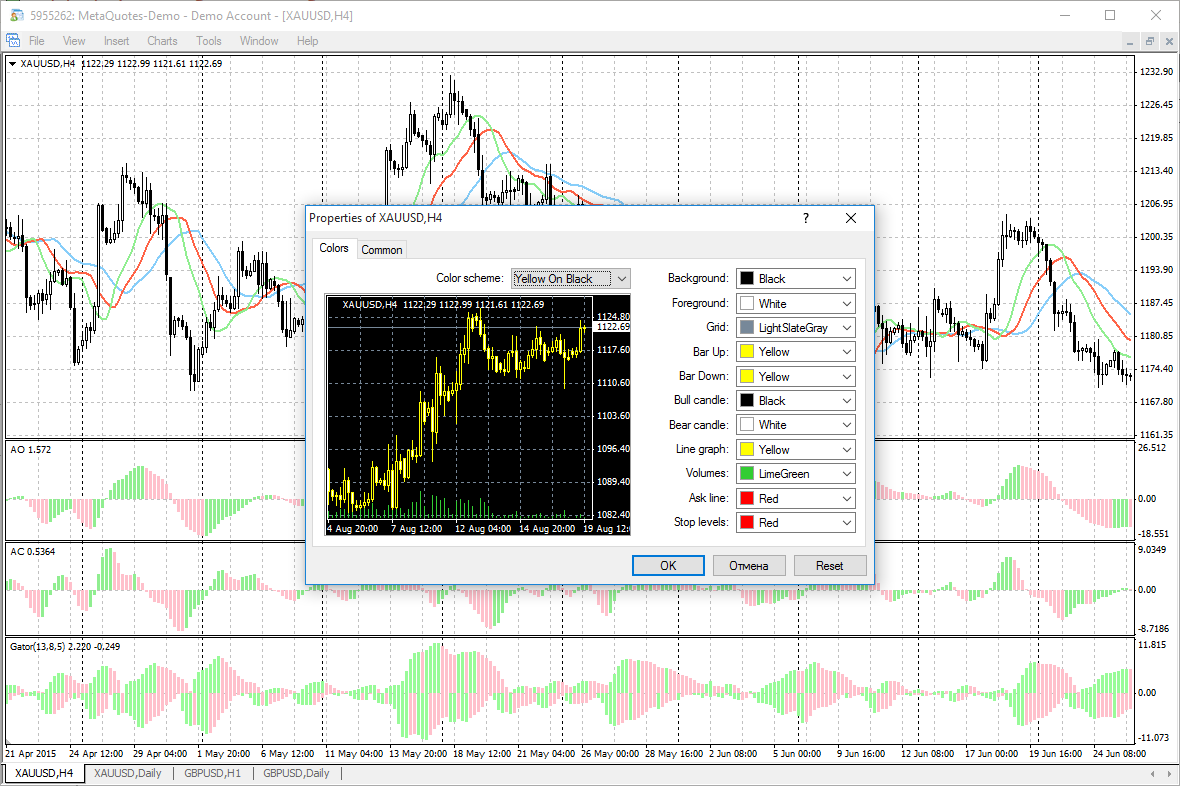

Metatrader 4 offers the leading trading and analytical technologies, as well as additional services. It has everything you need for forex trading.

Analyze quotes of financial instruments using interactive charts and technical indicators

Flexible trading system and support for all order types allow you to implement any strategy

Examine currency quotes from various perspectives with more than 65 built-in technical indicators and analytical objects

Copy deals of successful traders directly in the platform using the trading signals service (social trading)

Trading alerts will notify you of favorable market conditions

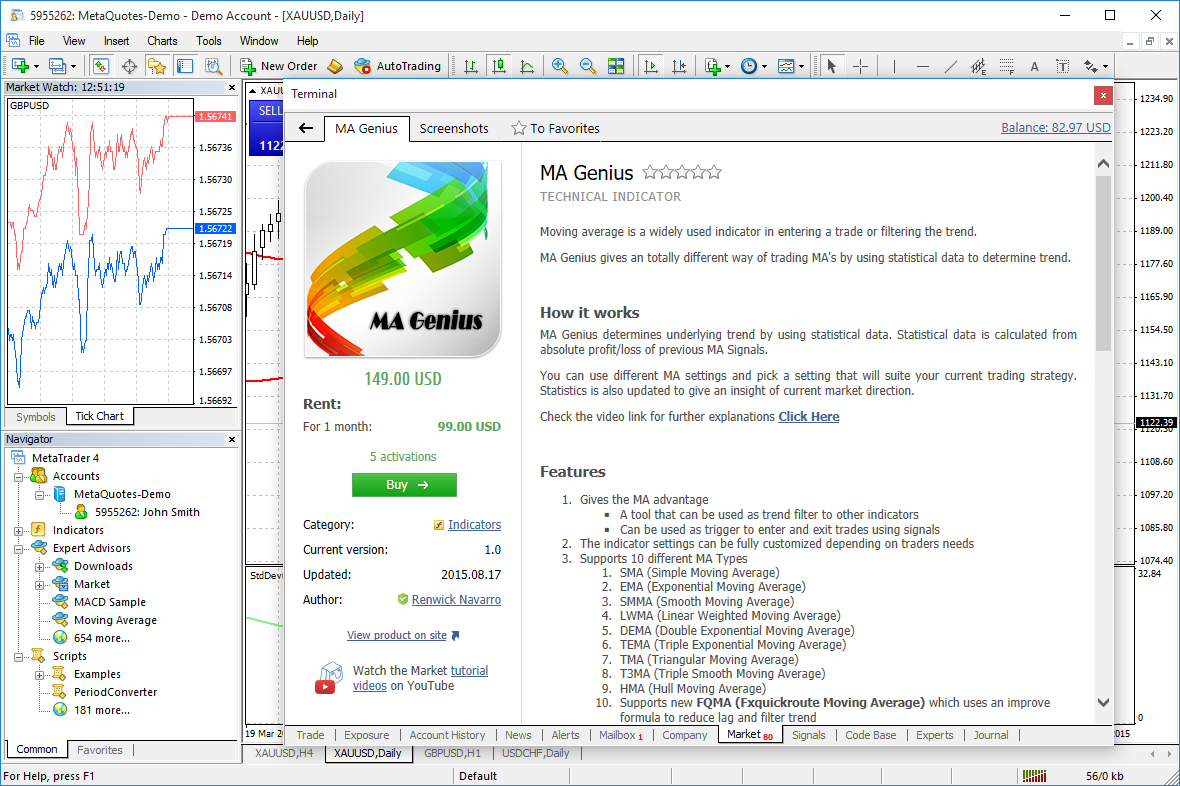

Visit the market — the biggest online store of trading robots and technical indicators

Test any trading robot in the market before purchasing it

Purchase or rent a market product the way you like

Read the product description in the market before purchasing it

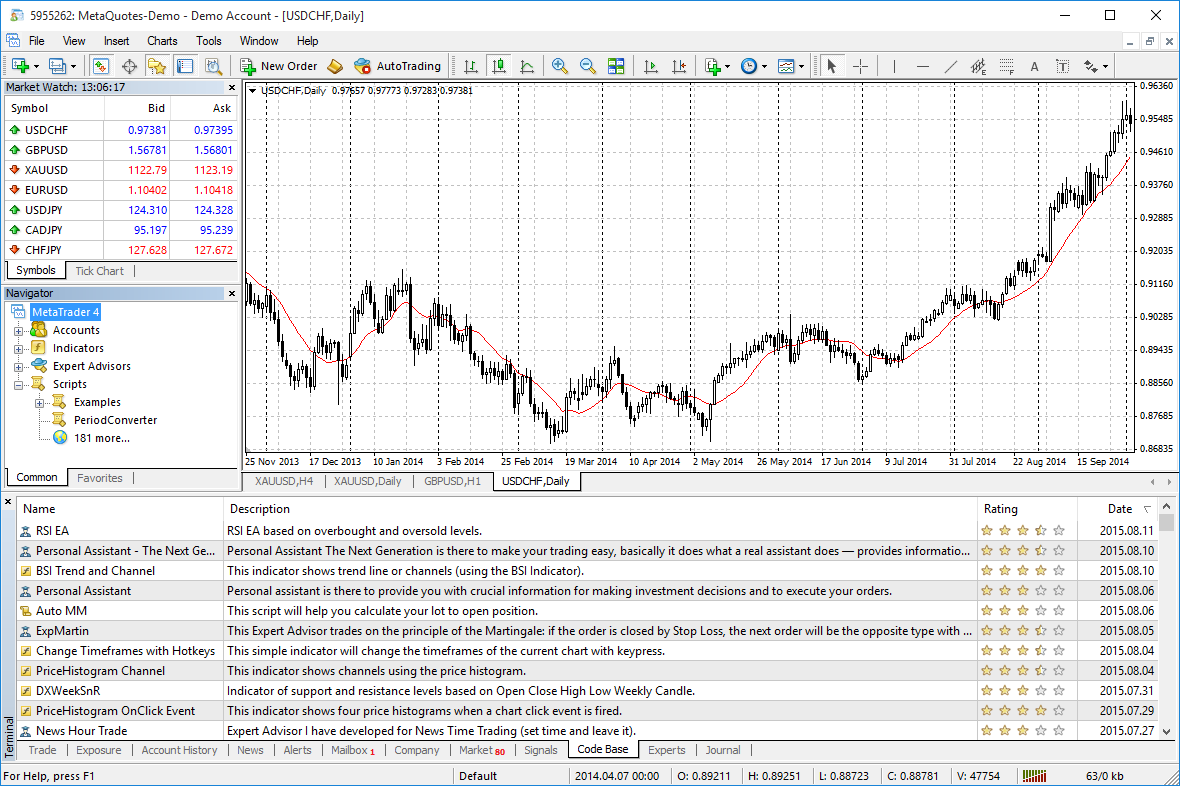

Thousands of free robots and indicators are published in the code base and ready to be downloaded

Maintain total control of your assets

Trading robots and indicators are developed using the specialized metaeditor tool

Customize the chart appearance

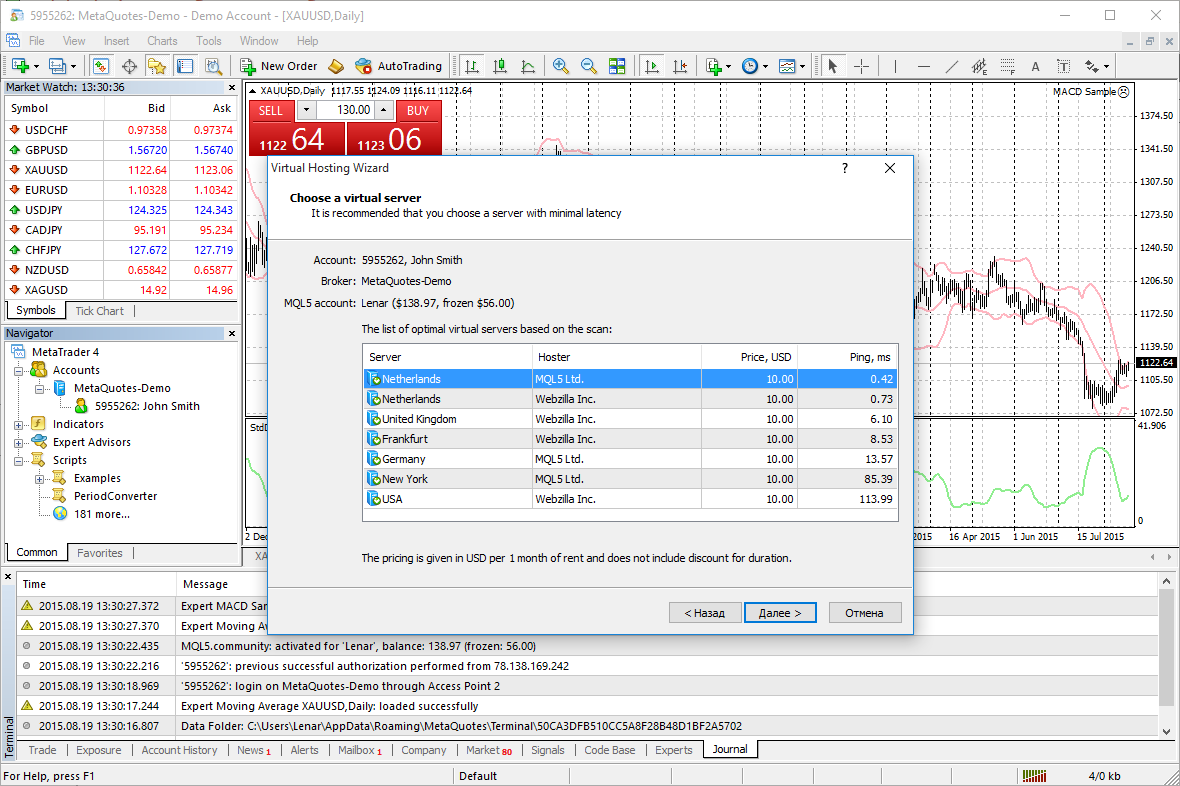

Order the virtual hosting at a reasonable price directly from the platform

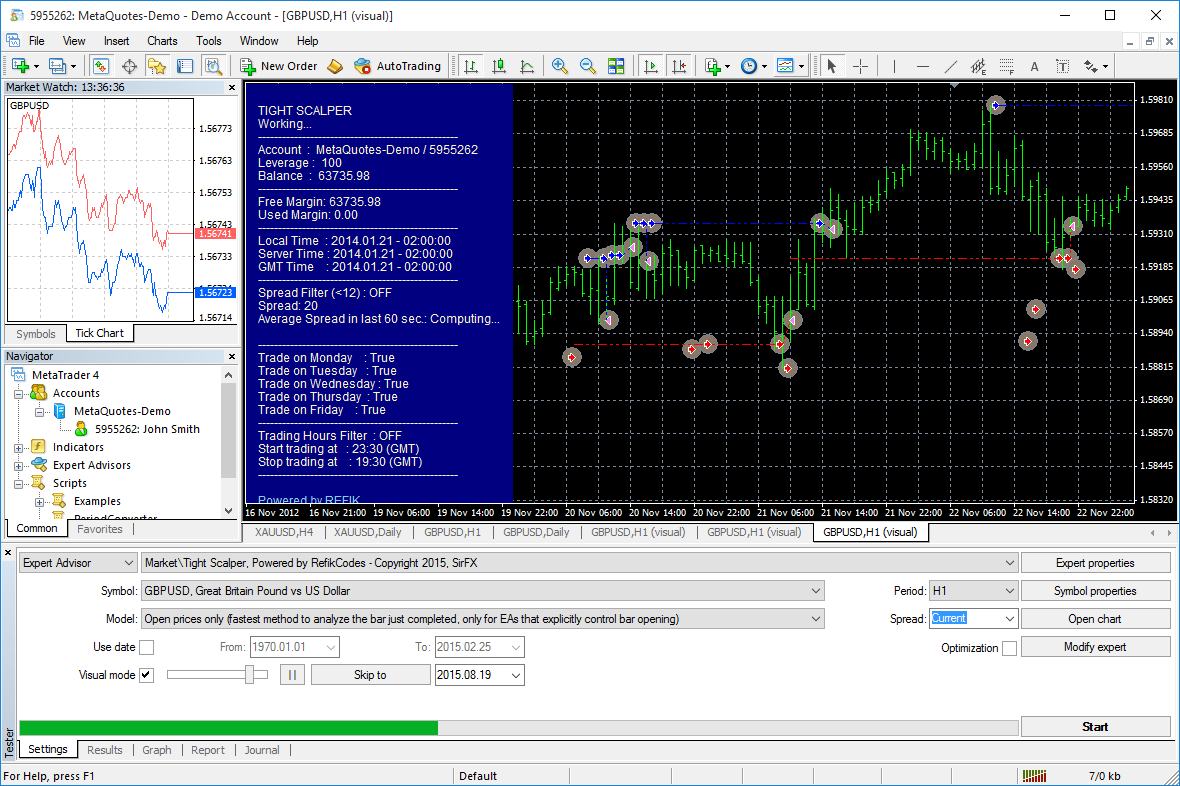

Test robots in visual mode to better understand their trading algorithms

A trading robot test report will show you how good it is

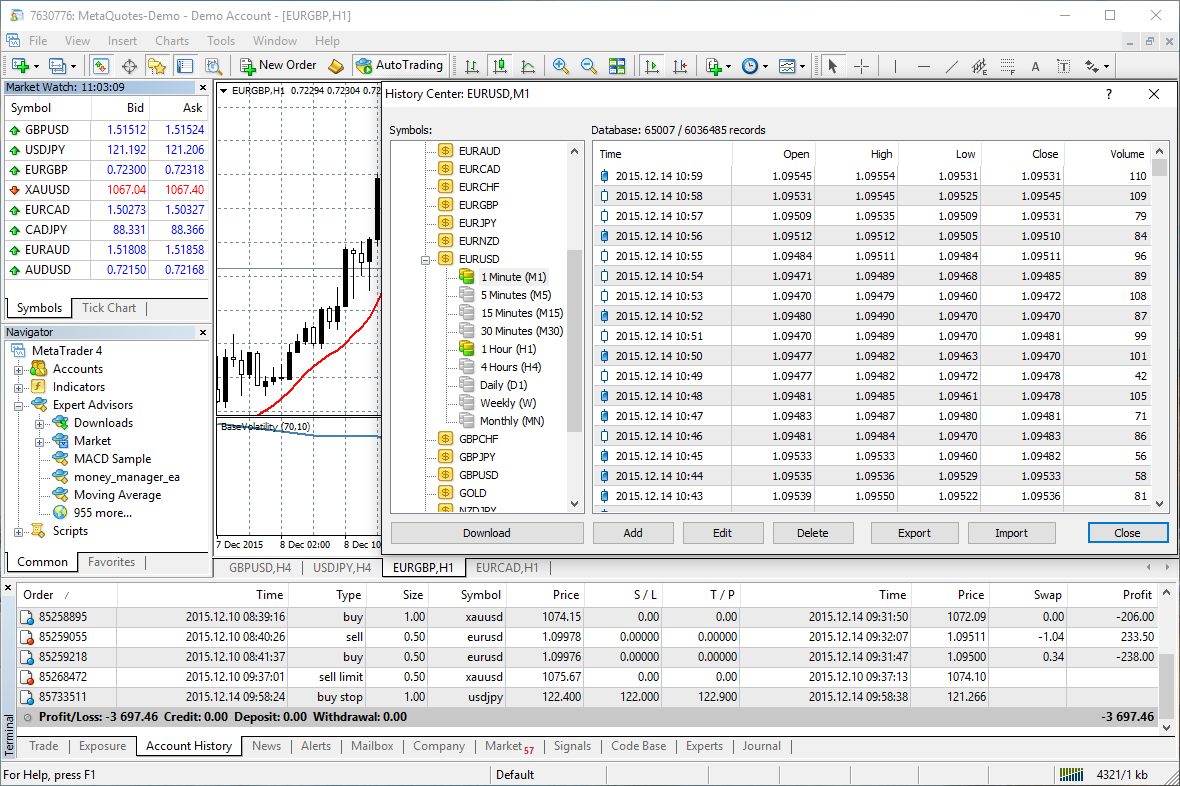

Browse through the quotes of any currency pair from one minute to one month in the history center

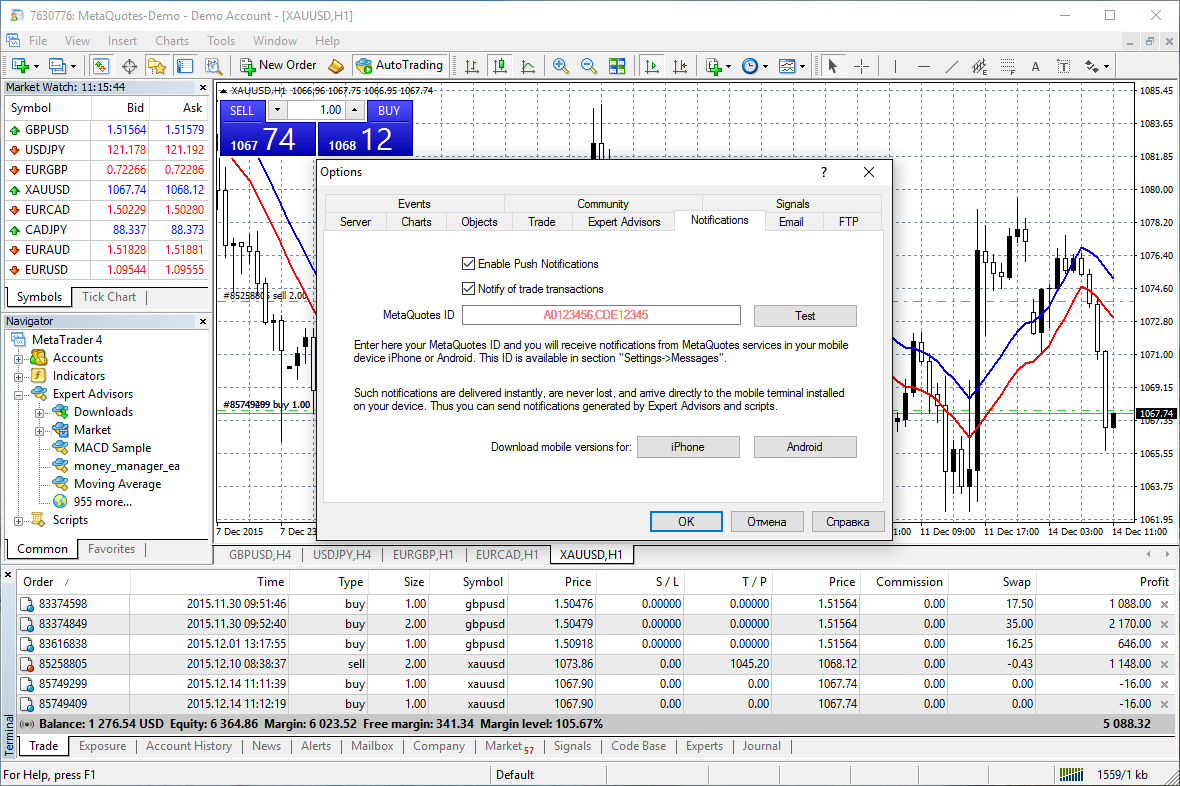

Your metatrader 4 desktop platform is integrated with the metatrader 4 mobile application for android and ios. Specify your metaquotes ID to receive push notifications from launched trading robots and scripts directly to your smartphone

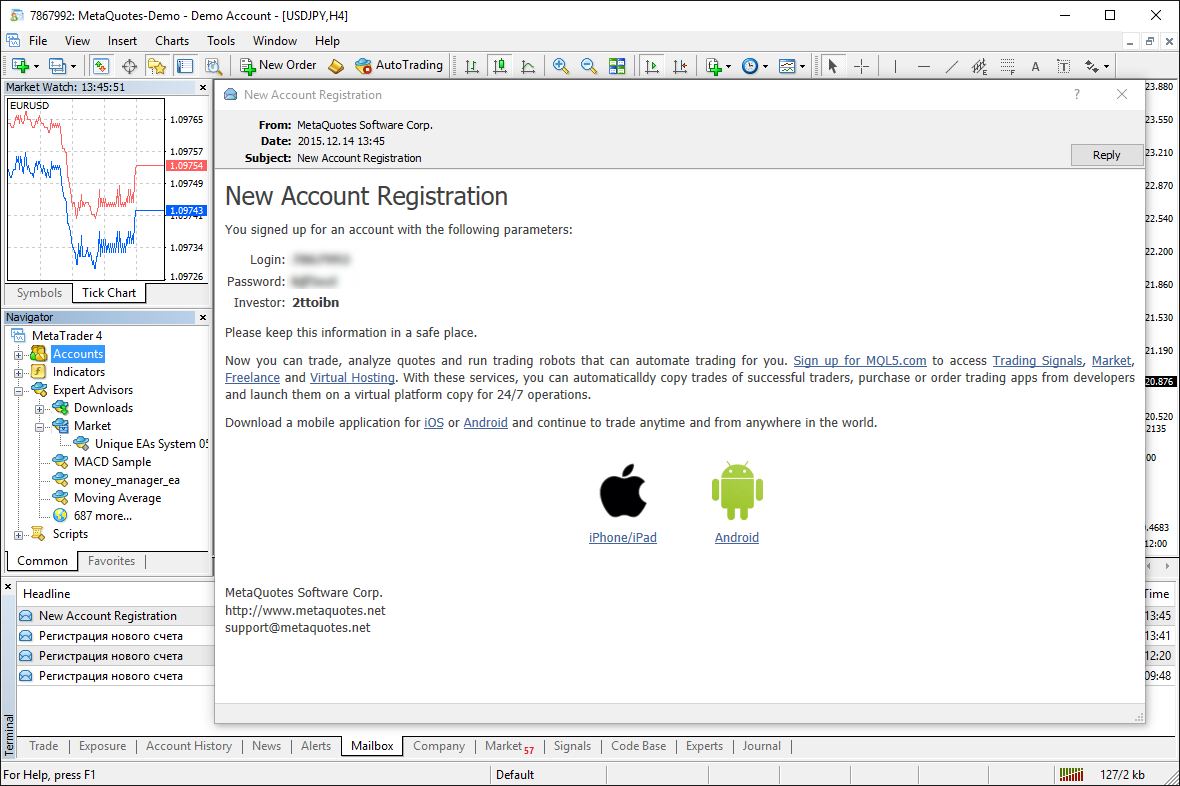

Join the largest community of traders directly via your platform!

Receive useful information and hints from the metatrader 4 developers in mailbox section

The metatrader 4 trading system

The powerful metatrader 4 trading system allows you to implement strategies of any complexity.

The market and pending orders, instant execution and trading from a chart, stop orders and trailing stop, a tick chart and trading history — all these tools are at your disposal.

With metatrader 4, trading becomes flexible and convenient.

- 3 execution modes

- 2 market orders

- 4 pending orders

- 2 stop orders and a trailing stop

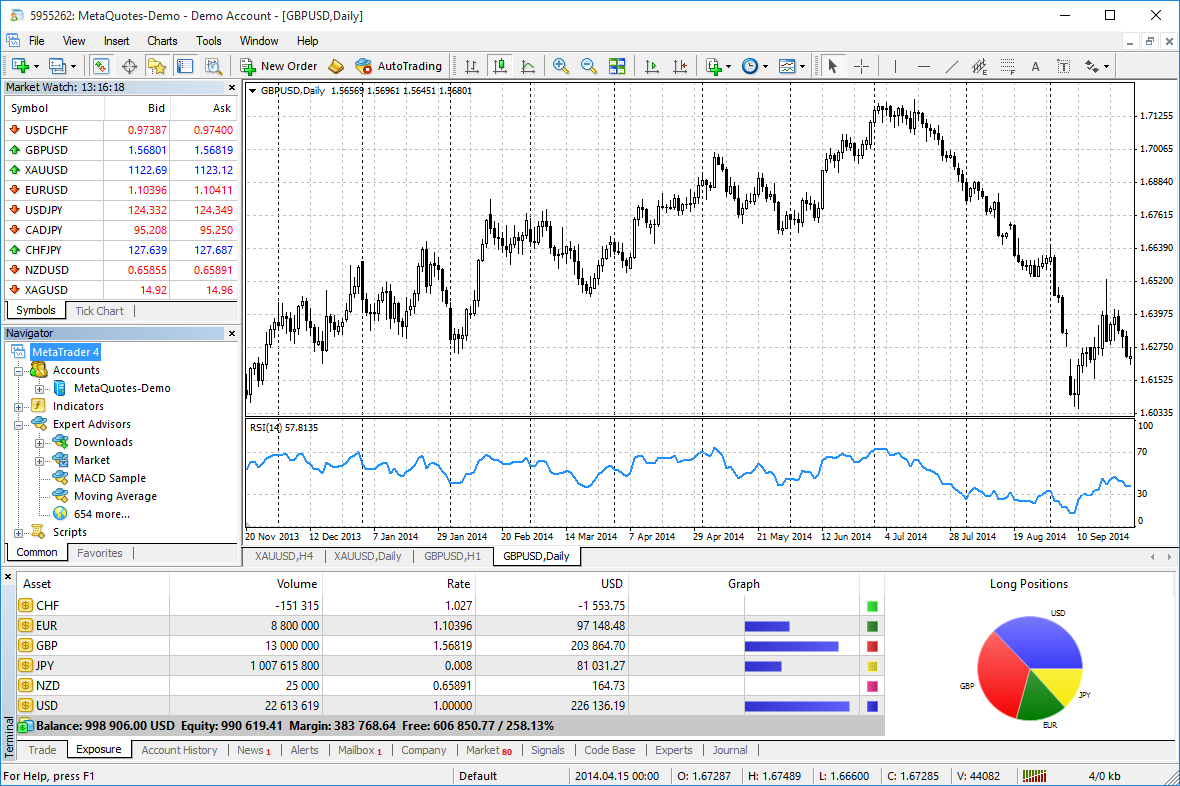

The metatrader 4 analytics

Analytical functions are one of the metatrader 4 platform's strongest points.

Online quotes and interactive charts with 9 periods allow you to examine quotes in all the details quickly responding to any price changes.

23 analytical objects and 30 built-in technical indicators greatly simplify this task. However, they are only the tip of the iceberg.

The free code base and built-in market provide thousands of additional indicators rising the amount of analytical options up to the sky. If there is a movement in the market, you have the analytical tools to detect it and react in a timely manner.

- Interactive charts

- 9 timeframes

- 23 analytical objects

- 30 technical indicators

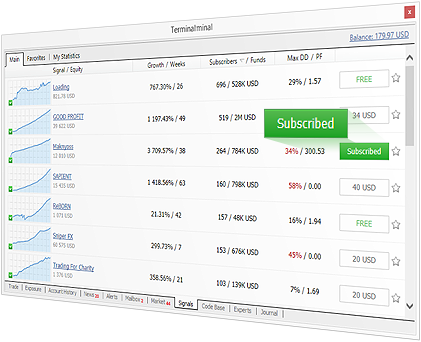

Trading signals and copy trading

No time for trading? That is not a problem, since metatrader 4 can automatically copy deals of other traders. Select your provider, subscribe to a signal and let your terminal copy the provider's trades.

Thousands of free and paid signals with various profitability and risk levels working on demo and real accounts are at your fingertips.

Make your choice, and metatrader 4 will trade for you.

- Thousands of providers

- Thousands of trading strategies

- Any trading conditions

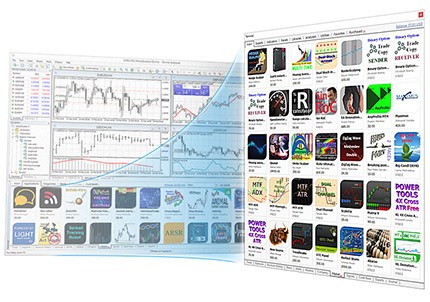

The metatrader market

The built-in market is the best place to find an expert advisor or a newest technical indicator.

Buy any of the hundreds of trading robots or indicators and launch them without leaving the platform. The purchase is simple, transparent and secure.

- The widest selection of trading applications in the world

- 1 700+ trading robots and 2 100+ technical indicators

- Free and commercial products

Algorithmic trading

Almost any trading strategy can be formalized and implemented as an expert advisor, so that it automatically does all the work for you. A trading robot can control both trading and analytics freeing you from the routine market analysis.

Metatrader 4 provides the full-fledged environment for the development, testing and optimizing algorithmic/automated trading programs.

You can use your own application in trading, post it in the free code library or sell in the market.

- The MQL4 language of trading strategies

- Metaeditor

- Strategy tester

- Library of free trading robots

Mobile trading

Smartphones and tablets are indispensable in trading when you are away from your computer.

Use the mobile versions of metatrader 4 on your iphone/ipad and android devices to trade in the financial markets.

You will certainly appreciate the functionality of the mobile trading platforms that include the full support for the trading functions, broad analytical capabilities with technical indicators and other graphical objects. Of course, all these features are available from anywhere in the world 24 hours a day.

- Support for ios and android OS

- Full set of trading orders

- Analytics and technical indicators

Alerts and financial news

The latest financial news allows you to prepare for unexpected price movements and make the right trading decisions.

Alerts inform you about certain events, so that you can take appropriate measures.

- Current financial information

- Timely notification

- Different market conditions

Best free forex charts

Mary reed davis

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

As recently as the early 1980s, brokers and traders charted the movement of currency prices by hand with nothing but a legal pad and a pencil. In less than four decades, the charting industry has been revamped several times over, which has led to intricate, complex tables that traders decode today before executing currency trades.

Charting software allows those in any market to see price moves, observe changes over various stretches of time and combine this information to conduct market analysis and predictions. It’s an absolute necessity for carrying out intelligent trades; without it, trading currencies would be a lot more like gambling: highly dictated by chance.

Table of contents [ hide ]

Best free forex charts

Commissions

Account minimum

Best for

1. Ninjatrader

This award-winning trading platform offers forex traders FREE access to its advanced charting, strategy backtesting and trade simulation. It’s well known for its sophisticated charting software, which has been enough to persuade many traders to switch from other trading platforms to ninjatrader. If you are looking for a forex platform that offers both strong charts and the ability to make trades, this could be a great choice for you.

Ninjatrader advanced forex charting capabilities offer comprehensive tools customizable for your particular focus. It offers dozens of indicators for gaps, news, trends, swings, volume, reversal, volatility, value area, elliot wave and more. Charts have multi-time frame and multi-tool analysis with hundreds of add-ons available from third parties.

While charting on ninjatrader’s sleek interface can be incredibly informative, there is a learning curve for new traders. Ninjatrader does have a wide range of useful educational materials are available including daily training webinars designed to educate new users on the powerful tools available, hundreds of on-demand training videos, and an informative youtube channel. The ninjatrader user guide offers copious details on how to use each chart feature.

In terms of payment, ninjatrader offers a range of options:

- Ninjatrader is always free to use for advanced charting and trade simulation. As an added bonus, you can get unlimited free real-time and historical forex data trials without a brokerage account!

- For live trading, you can use a free live trading license if opening an account through ninjatrader brokerage.

- You can also lease the program quarterly for $180, a half-year for $330 or one full year for $600.

- A lifetime lease is also available for $999 which includes free software upgrades for life.

Ninjatrader itself does not offer smartphones or tablet options, but there are several plug-ins on the market that you can set up within your devices to be notified of trade updates. For U.S. Customers trading through ninjatrader brokerage, they can choose to trade through forex.Com and oanda.

Best for

- Professional investors

- Investors with programming experience

- Traders who need minute-by-minute updates

2. Tradingview

Without a doubt, tradingview comes in at the number one spot on this list. It is a favorite among a multitude of traders, thanks to the fact that its free version offers more features than several paid packages on the market.

For the forex market, in particular, tradingview offers a view of all currency pairs, cross rates on the most commonly traded pairs, as well as currency indices and an economic calendar for major macroeconomic events. It also serves as a trading community; thousands of traders and analysts publish their ideas and forecasts as well as comments and assessments of trade patterns.

This can be a great tool for a new trader or someone who wants to become more familiar with the intricacies of trading a certain currency pair. A lot of tradingview users also noted that its option to make its trade histories public – even if only to friends or family members – gave them more accountability and improved their decision-making tactics. Tradingview is available on your desktop, tablet and smartphone, all of which can be synced and saved in a cloud, which offers a seamless transition between devices.

Tradingview fees

- Free: use on one device, up to one saved chart layout, no customer support

- Pro: $9.95/month (use on one device, intraday time frames, up to five saved chart layouts, regular customer support, and more)

- Pro plus: $19.95/month (sync up to two devices, intraday time frames, up to 10 saved chart layouts, fast-version customer support, and more)

- Premium: $39.95/month (SMS alerts, sync up to five devices, intraday time frames, unlimited saved chart layouts, priority customer support and more)

Please note that you’ll need to get set up on a trading platform in order to execute any actual trades, like forex.Com, oanda, and others.

3. Finviz

This platform is another winner among investors across the world and is utilized by millions of traders, whether their focus is forex, stocks or commodities. This web-based platform offers not just charts, but also heat maps, portfolio management tools and a host of news and blog links to keep you informed about what’s to come in the currency world and the international market at large.

Heat maps are a favorite feature of finviz, where traders can quickly analyze the health of certain currency pairs based on a color scheme from green (healthy) to red (unhealthy). There are also a host of free filters that can allow traders to narrow in on information geared towards their preferred currency pair(s). The downsides of the platform are that it is solely web-based, without mobile chart viewing.

Traders also complained that its interface is somewhat dated. Lastly, while the free version offers lots of information, it also crowded with numerous pop-ups. In terms of pricing, charts on finviz are free, however, they are not all in real time, and some are even delayed as much as 15 minutes — a big delay in the world of currency trading. An upgrade to finviz elite may be worth your money, as all features are given in real time, and the upgraded version also comes with access to advanced charting features like technical studies and performance tracking correlation charts comparing currency pairs or any commodity or stock.

The elite version also offers the ability to do backtests and will give you email notifications about important market events in real time. The price for an elite subscription is $39.50/month, or $299.50/year. A general note on using charts: trading experts advise not using more than two different applications, including your trading platform, when it comes to looking at charts. Dancing across too many platforms can lead to more confusion, and may make executing trades more stressful than need be.

Final thoughts on the best forex charts

Expect to use a good chunk of time reading trading charts, which is much like learning to read a new language. Once you’ve put in the work to be able to fluently interpret the information on the screen, you’ll be one step closer to executing lucrative trades. Many newbie traders ask which chart setup is the best of the best, and experienced traders say that such a panacea simply does not exist.

If it did, financial institutions who are able to move the market would take advantage of it to beat retail traders. Thus, find the chart that works best for you, and you’ll create the highest chance of achieving successful trades.

So, let's see, what we have: discover the best paper trading options platforms for beginner to pro-level traders. Picks are based on interface, user experience, market quotes and more. At live paper forex program

Contents of the article

- New forex bonuses

- Best paper trading options platforms

- Best paper trading options platforms:

- Why paper trade options?

- Key features of great paper trading platforms

- Highly customizable analytical tools

- Accurate market quotes

- Functional interface

- Realistic user experience

- Our top picks

- Commissions

- Account minimum

- Best for

- 1. Best overall: thinkorswim by TD ameritrade

- 2. Eoption paper trader

- 3. Interactive brokers TWS paper trader

- 4.Tradestation

- 5. Firstrade

- Tradier

- Make your choice

- Benzinga's #1 breakout stock every...

- Using paper trading to practice day trading

- What is paper trading?

- Setting up a day trading account

- Paper trading tips

- Pros of paper trading

- Cons of paper trading

- Practice, practice, practice

- The bottom line

- Top 10 forex live trading sessions review 2021

- Top ten forex live trading program 2021 for...

- Argument # 1: but I will not make much cash...

- Demo trading benefits

- Top 10 best options trading simulators

- FX live – online FX platform

- Practicing day-trading risk-free with a simulator

- Futures demo account: ninjatrader

- Forex demo account: OANDA

- Stock demo account: tradingview

- Paper trading simulator

- The warrior trading paper trading simulator...

- Ready to get started?

- The warrior trading simulator

- Trade with the no. 1 broker in the US for forex...

- Why are traders choosing FOREX.Com?

- Financial strength you can depend on

- Reward yourself with our active trader program

- Open an account in as little as 5 minutes

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Not sure where to start?

- The best paper trading tools to succeed as A...

- Practice makes perfect

- Paper trading simulators

- Broker provided tools

- Spreadsheets and good ‘ol paper and pen

- Conclusion

- Are you able to have only 1 losing day out of 73...

- Fxdailyreport.Com

- Top forex brokers with metatrader 4...

- Metatrader 4

- The best forex trading platform

- The metatrader 4 trading system

- The metatrader 4 analytics

- Trading signals and copy trading

- The metatrader market

- Algorithmic trading

- Mobile trading

- Alerts and financial news

- Best free forex charts

- Best free forex charts

- Final thoughts on the best forex charts

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.