Can you make money with forex

As the name suggests, copy trading is a form of forex trading where you copy or replicate the trading patterns of other traders.

New forex bonuses

This is a trend that emerged in the early 2000’s and has over the years proved to be a real savior for inexperienced traders. With copy trading, also known as mirror trading or sometimes social trading, you can make profits as a forex trader even with minimum skills. Sometimes followers can be fabricated. That is why you should critically analyze the followers to ensure that they are real humans. Another reason for this is to ensure that the follower base is consistently growing. If the number of traders copying your potential professional grows and suddenly drops, it may mean a drop in good performance. However, if the followers are ever increasing, you should add that investor to your list.

Fxdailyreport.Com

For beginners, the forex market can be hard to navigate. There is a lot of jargon that you have to wrap your head around in order to be able to make any reasonable profits. The problem is, it takes a lot of time to master all the crucial skills that are required to qualify as a professional. Often times, many novice traders give up without making a dime.

But do you really have to trade to make money on forex? What if there was a way to invest profitably without actually having to trade? The good news is, there is a way. It is called forex copy trading.

What is copy trading ?

As the name suggests, copy trading is a form of forex trading where you copy or replicate the trading patterns of other traders. This is a trend that emerged in the early 2000’s and has over the years proved to be a real savior for inexperienced traders. With copy trading, also known as mirror trading or sometimes social trading, you can make profits as a forex trader even with minimum skills.

The only skills you require is to understand the whole concept of copy trading, that is mostly, how to choose a good trader to follow. You should, however, keep in mind that forex trading, in general, is risky and high returns are not guaranteed. Although copy trading gives you an opportunity to make profits without investing in research and having to understand the ins and outs of forex, the risk is still there and a lot of caution is required.

In most cases, forex copy trading can backfire because of a poor choice of traders to follow. That is why it is important that you carefully analyze your potential “masters” using the stats provided by the copy trading platform of your interest to make good money.

Below are a few tips on how to find a good trader to follow.

How to find A good trader to follow

The following tips will help you land the perfect trading pro:

- Discover the most followed traders

The number of followers often point to the credibility and prowess of that particular trader. If a potential professional is followed or copied by many traders, it usually means that they have consistently recorded outstanding performance.

- Analyze their followers/copiers

Sometimes followers can be fabricated. That is why you should critically analyze the followers to ensure that they are real humans. Another reason for this is to ensure that the follower base is consistently growing. If the number of traders copying your potential professional grows and suddenly drops, it may mean a drop in good performance. However, if the followers are ever increasing, you should add that investor to your list.

- Should have consistent monthly performance

Your search for the perfect trader should not end with the most followed. Sometimes, they might have a lot of traders copying them, but the balance between profits and losses is not promising. That is why it pays to dig deeper and unearth trading gurus who have posted good and consistent monthly performance.

- Number of trades and time on a platform

Traders who have been on the platform for a long are most preferred. They are usually more experienced and know their way around trading. The number of trades conducted is also another indicator. The person you wish to follow should have done a good number of trades with consistent profits.

You might not find the perfect trader to follow, but as you gain more useful skills, you will be able to make more constructive analysis and choose wisely. The type of copy trading platform you choose also matters. A lot of seasoned traders use credible forex brokers and you will hardly see them on new platforms or those with a bad reputation.

Benefits of forex copy trading

Copy trading presents a lot of good opportunities for both those who copy others and those who are copied.

- You gain invaluable trading skills from professionals you follow

- There is a lot of transparency as the trading history of the trader is publicly disclosed to followers

- You can make passive income without actively trading

- You don’t have to understand all the aspects of forex trading

With forex copy trading, you can make good money without having to actively trade. The point is to choose the right trader to follow by carefully analyzing their profiles and utilizing the stats provided by the various platforms.

How much money can I make forex day trading?

:strip_icc()/how-much-money-can-i-make-forex-day-trading-1031013_color-332300f659374e4b897904a35b4d64ae.gif)

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

4 ways to make money through forex trading

The forex market size is almost $1.93 quadrillion, which means the market is 2.5X larger than the global GDP.

Nearly 5.3 trillion dollars are traded every day in the forex market. It shows the enormous amount traded on this market to make money. But is it for real or just a fad?

Forex trading is seen as a real currency generator if you are a skilled currency trader. However, if there is excessive leverage in the forex market, then it can lead to losses. Traders need to have the right market strategy to gain an edge over the forex market.

Placing a trade in this market is quite simple, and the financial mechanics found are similar to that of the stock market. People who possess good experience in trading will pick the trading quite quickly. Go through these important ways to know how you can make a good amount through forex trading.

Make money through right trading strategies

You can be a veteran trader or a beginner, just starting with trading. But, be abreast with the right forex trading ways. It is not sensible to put your money at stake without studying the forex market. Now, let’s see a few ways to make money through forex trading.

Study the currency pair-up

You must pick a base currency or a home currency when you get a chance to register as a forex broker. After depositing the amount in your account, you can either choose your home currency or opt for the worldwide currencies. Like, if you possess a US dollar trading account. Here, you can trade the string currencies like euro and UK pound as well. The present-day forex trading does not restrict the currency pairing up for the traders.

Keep an eye on the financial market

The investors, forex traders, organizations, and government agencies transact in the open market to meet their financial needs. Many corporate users might change their currency pairing, watching the rise in other currencies. When you investin the forex market, you need to keep an eye on rising and falling prices. Choose an optimal price before exiting from the financial market.

You must be aware of different financial markets and instruments like indices, commodities, and shares. Learn about the varied types of catalyst approach and market analysis to master the fiancés move in your country’s financial market.

Take broker’s leverage services

A few brokers provide leverage like 1:30, 1:50, 1:100, and it moves accordingly. The leverage may not help you make that much money, but it helps boost profit if used wisely. This technique helps even small forex traders to make money with a nominal amount.

Let’s understand the leverage with this example. You have £100 with no leverage, so if the price moves just 3%, then you will make a £3 profit over this currency. On the other hand, if you have procured leverage services, you will open with a value of £5,000. Here, a 3% move ‘in your favor’ will get you £150.

One thing worth noting here is that you may increase your profits when you use leverage or margin trading but can lose money too. So, choose wisely or opt for it for lesser time.

Go for demo account first

Now, you are aware of the financial market, commodities, indices, etc. The time has come to open a forex account to invest money and start trading to make profits. The veteran traders can begin with a real-money account if they are abreast of new financial rules and trends.

However, beginners must opt for the demo account first. Reputable forex brokers in the united kingdom offer both demo and real-money accounts. But, beginners must start trading with paper money. The market scenario is similar to a real-money account. The prices will be close to real-money accounts.

With a demo account, you will access educational material and forecasts rendered to real-money account traders. You must only switch to a real-money account from the demo account when you feel you are ready. The reason being it involves real capital.

Conclusion

Forex market is not a cakewalk but includes many strategies to understand the performance of the financial market. You cannot invest your hard-earned money landing in losses. The beginners must take the services from reputed brokers.

It will help them learn the fundamental and technical aspects of forex trading. You must get access to the broker who provides enough material and forecasts. It is better to learn on the demo account rather than risking your real money. These are a few ways to make money through forex, but you can hire a good broker to get insightful details.

4 ways to make money through forex trading

The forex market size is almost $1.93 quadrillion, which means the market is 2.5X larger than the global GDP.

Nearly 5.3 trillion dollars are traded every day in the forex market. It shows the enormous amount traded on this market to make money. But is it for real or just a fad?

Forex trading is seen as a real currency generator if you are a skilled currency trader. However, if there is excessive leverage in the forex market, then it can lead to losses. Traders need to have the right market strategy to gain an edge over the forex market.

Placing a trade in this market is quite simple, and the financial mechanics found are similar to that of the stock market. People who possess good experience in trading will pick the trading quite quickly. Go through these important ways to know how you can make a good amount through forex trading.

Make money through right trading strategies

You can be a veteran trader or a beginner, just starting with trading. But, be abreast with the right forex trading ways. It is not sensible to put your money at stake without studying the forex market. Now, let’s see a few ways to make money through forex trading.

Study the currency pair-up

You must pick a base currency or a home currency when you get a chance to register as a forex broker. After depositing the amount in your account, you can either choose your home currency or opt for the worldwide currencies. Like, if you possess a US dollar trading account. Here, you can trade the string currencies like euro and UK pound as well. The present-day forex trading does not restrict the currency pairing up for the traders.

Keep an eye on the financial market

The investors, forex traders, organizations, and government agencies transact in the open market to meet their financial needs. Many corporate users might change their currency pairing, watching the rise in other currencies. When you investin the forex market, you need to keep an eye on rising and falling prices. Choose an optimal price before exiting from the financial market.

You must be aware of different financial markets and instruments like indices, commodities, and shares. Learn about the varied types of catalyst approach and market analysis to master the fiancés move in your country’s financial market.

Take broker’s leverage services

A few brokers provide leverage like 1:30, 1:50, 1:100, and it moves accordingly. The leverage may not help you make that much money, but it helps boost profit if used wisely. This technique helps even small forex traders to make money with a nominal amount.

Let’s understand the leverage with this example. You have £100 with no leverage, so if the price moves just 3%, then you will make a £3 profit over this currency. On the other hand, if you have procured leverage services, you will open with a value of £5,000. Here, a 3% move ‘in your favor’ will get you £150.

One thing worth noting here is that you may increase your profits when you use leverage or margin trading but can lose money too. So, choose wisely or opt for it for lesser time.

Go for demo account first

Now, you are aware of the financial market, commodities, indices, etc. The time has come to open a forex account to invest money and start trading to make profits. The veteran traders can begin with a real-money account if they are abreast of new financial rules and trends.

However, beginners must opt for the demo account first. Reputable forex brokers in the united kingdom offer both demo and real-money accounts. But, beginners must start trading with paper money. The market scenario is similar to a real-money account. The prices will be close to real-money accounts.

With a demo account, you will access educational material and forecasts rendered to real-money account traders. You must only switch to a real-money account from the demo account when you feel you are ready. The reason being it involves real capital.

Conclusion

Forex market is not a cakewalk but includes many strategies to understand the performance of the financial market. You cannot invest your hard-earned money landing in losses. The beginners must take the services from reputed brokers.

It will help them learn the fundamental and technical aspects of forex trading. You must get access to the broker who provides enough material and forecasts. It is better to learn on the demo account rather than risking your real money. These are a few ways to make money through forex, but you can hire a good broker to get insightful details.

How much money can you make from forex trading – 2020 guide

Millions of people across the globe are trading to earn higher profits. If you are a trader, then forex trading is a common term for you. It is the best way to make vast amounts of money by trading in foreign exchange. The most significant advantage of forex is low fees as compared to others. Both beginners and experienced traders can buy or sell currencies with high profits.

No doubt that you can earn an ample amount of money through trading forex. It is important to learn how to make it. If you want to achieve significantly, then you must trade hard. Check out forexstore to start forex trading. In the following write-up, know the amount of money you can earn via trading forex exchange. There are many factors to earn and calculate money won in trading forex. Let’s begin.

1. Trade more

Many individuals are addicted to trading, like gambling. They buy and sell foreign exchange frequently to earn profits. If you think of trading once and get plenty of amounts, then you are wrong. You have to trade more to collect a significant amount. Now, you might be thinking that there are also chances of failure. Is it best to invest money repeatedly? You must invest more to trade more.

Due to higher chances of wins, you can risk your shares again and again in trading forex. When you trade more, the winning probability is quite high. A beginner can risk with time and circumstances, but an experienced trader must not lose the opportunity at all.

2. Managing risk

Risking huge amounts is one of the trading schemes to get high returns. Remember one thing that there are also possibilities of losing massive amounts. You must trade carefully because it eventually affects your account of trading. Before trading forex, you need to create a strategy with positive output.

Suppose if you are getting $10,000 in your account per year by trading $1000, then it will not be the same each year. You can earn more considerably than expected. Try to trade more in some years to get higher profits. It will not affect your account, and in the end, a trader can count on his massive earned money.

3. Money extraction from your trader’s account

You can operate your trading account for buying or selling foreign exchange. The amount will be stored in your account, and you can either trade more, withdraw or keep it there for adding more interest. Every person earns money to enjoy a satisfying life with luxuries and comfort. Make sure that you debit the required money from your account.

It is essential to keep a certain amount as savings for more trading. The added compound will generate more amount, and later, you can get more money out of it. Therefore, it is a good deal of saving amount for the future. Many traders prefer to do such things for better money management.

4. Determine your expectancy

Trading is about risking money. You can determine the expectancy factor by analyzing your performance while trading. Suppose if you are continuously risking your money, and you are getting profits 2 or 3 times, then you are not a good trader. But sometimes, you have an excellent winning rate by getting profits in the initial trading session.

You need to join the winning and losing rate together to know about your future profits and loss. You can easily create different methods for trading if you determine your rate of expectancy. It will help you in earning money via forex trading efficiently.

5. Trading risk is dependent on currency pairs

An experienced trader is aware of different currency pairs. You can lose some amount while trading a currency pair. A trader must know the current currency rate and then buy or sell it. You need to estimate the winning and losing trade to get enough profits. If we calculate the win rate of the trader, then you must find out the difference between the profitable and loser trades.

The win rate is quite less in case of no or fewer commissions. There is a considerable return on the profit without affecting any previous records. The profit from trading on various currency pairs is different. Make sure that you analyze the current rate before investing your money.

6. Calculate profit from forex trading

There is one way to know the amount of earning money by trading forex. You can calculate all the potential earnings. Before that, you must know certain things about your yearly profits, trading amount, earnings, buying, and selling currency assumptions. It is easy to evaluate the profits if you know how exactly you trade and what strategies you must adopt.

Determining all the factors and calculating profits are the best ways to know the amount of money you can make through trading forex. You can also calculate the average rate of profit that you will earn in an entire year.

The bottom line

Trading forex exchange is not a one-day task to earn a considerable amount. You need to invest and experiment a lot to become a good forex trader. There is no doubt that you can make much money from forex trading. But you have to focus on your performance to prevent yourself from massive loss.

Make sure that you come up with highly-effective trading strategies to get profits frequently. Millions of people worldwide are trading, but not everyone is getting the same results. You must calculate everything from your trading performance to future profits from forex. It will ensure that you are on the correct path or not. After analyzing everything, there will be a scope of improvement in your trading performance.

Make sure that you keep the above things in your mind for better results. Try to start trading by investing a small amount to prevent huge losses. It is better to understand your skills before trading enough money on different exchange currencies.

Can you really make money trading forex

Actually, can you make money trading forex?

First, we invite the experts and beginners in the forex to read this until the end and learn how can you really make money trading forex.

The usage of online sources to earn money is a popular method in this century. Do you know the professional online money makers are also there in the world? They usually practiced one or more methods to earn money. But the reality is you cannot expect to earn as displays in the ads or hosting sites. Even it is not as easy as they are explaining.

Especially, if you are going to make money with forex trading it is a complex task.

However, once you practiced well, it is an art. So, we must know the basic strategies. It means certain mathematical usages are there to use in order to have two-three times of profit from the investment. Hence, let’s look at possible ways to earn a big amount of money through a small investment.

What is the most vital metric to make money from forex trading?

You may be familiar with two metrics known as a risk to reward and win rate. The experts are saying they are using these two metrics in certain ways to increase their profit. So, the newcomers used to use their strategies as it. They think that is the best way to earn more.

However, do you think that you can copy someone’s technology including what’s in their brains? No! This practice is somewhat problematic in the field of forex.

Hence, we invite you to build your own method. But, how can you do it? First of all, think about how much you are going to invest. The profit may depend upon that. So, you cannot expect exactly what experts earn. Next, look at the profit by considering our first matrix. It is calculating losing chances. Or else, you can go through win rate.

However, nowadays the validated method is using one matrix that made through the above mentioned two matrices. It is known as the expectancy. A small equation is there to get this value. So, you will be able to increase your profit through it.

Do you want to win more with forex? Then play more!

You may have heard the statement that saying try and try one day you can fly. Even though the trading is not only a try, this statement is somewhat matching with the forex. It means you can enhance winning chances by playing frequently. This is the same scenario we can see in the casinos.

Once you try to play more, your winning rate may increase. That is why the experts have selected this as their permanent career. But, the part-timers are also there.

Use trading for your business

Nowadays, we expect to have quick money within a shorter period of time. However, this concept can be a bad practice in forex. So, follow a method to gradually increase your profit. It will be a consistent solution for your economic status. Later it will become your business.

The conclusion

Finally, what is the answer to ” can you really make money trading forex? ” definitely, you can make money with forex trading. But, it is a complex task. If you do not follow the strategies in the field, you will lose. So, it is better to give proper training with a beginner account before investing real money. We hope to provide more info in this during the next few days. Hence, you can check updates frequently to collect extra facts.

Can you make money with forex trading? Understanding the rewards, risks, and realities

I don’t usually talk about high-risk investments on this blog but I think it’s important to explore all avenues in the world of making money online and to be well-prepared when the time comes. Inside today’s topic – can you make money with forex trading – we shall explore the rewards, the risks, and the realities of this rather captivating market. So, let’s dive right in.

Forex trading 101

If you’ve traveled overseas and spent on foreign currencies, you’ve done a forex transaction before. And that’s what the process is all about, exchanging one currency for another in the hope to make a profit from the price difference.

The foreign exchange market, also called FOREX or FX, is a globally renowned market for currency trade. It has a daily transaction volume of more than $5 trillion, making it the biggest and most exciting financial market in the world compared to stocks and commodities trading.

Forex’s popularity attracts foreign-exchange traders of all levels, from beginners to the experienced and there are the four key players you need to know;

- Central banks

- Foreign exchange banks

- Brokers

- Clients (this is the pool you’ll likely join as a trader)

The advantage of trading

- The forex market is open 24 hours a day, 5 days a week (from friday evening to sunday evening). That means you can trade all day long and still get some rest over the weekend.

- You can create a free demo account with the brokers to ‘test the water’ and learn the day-to-day trading scenarios while polishing your knowledge about the terminology and movements of the market. When you are ready to trade with real money, you can start with a minimum deposit of $100 to $200.

- There are plenty of resources for leverage, also known as funds that can be loaned to amplify profit returns. This volume can carry a high margin, some up to 50 times more than the amount of capital you put toward a trade.

- Due to the fast-moving and deep liquidity nature of the market, profit can be made quickly compared to other trading markets.

- Unlike other trading markets that are influenced by private information, the currency market is more transparent and thus, less subjective to any form of manipulation.

- Forex is well integrated with automated trading systems. Where such technology is available to the users, one can instruct the platform to trade on specific price movements or market conditions without having to keep an eye on the latest changes all the time.

The disadvantage of trading

- Forex is a highly volatile market and changes according to socioeconomics situations across regions. This unpredictable nature can put your investment at risks and that’s why you are always advised not to trade more than what you can afford to lose. Such warnings are clearly printed in many financial services sites, as can be seen with this one;

- The lack of central regulations means that the market is easily subjected to insecurities like shady brokerage companies or investment fraud schemes. That’s why it is common to see many forex scams online and new ones popping up all the time.

- The art of currency exchange can be foreign to many beginners and it can take a few months just to understand the theory alone and a few more years to fully master the trade. That’s why it’s recommended to use a demo account first while learning the skills.

5 ways to make money with forex

Thanks to the rapid use of the internet, there are actually a few ways to monetize from currency exchange. Let’s start with the one that we are most familiar with first.

1 – day trading

Forex trades 24 hours a day and can only be done through a broker. A legit broker should be registered with the futures commission merchant (FCM) and regulated by the commodity futures trading commission (CFTC). There are always free trials available to test different trading platforms and once you’ve decided, you will open an account with one of these companies and an account number will be sent to your email after verification.

Each company has its minimum deposit so find out what that is before transferring any funds into your account. Inside the trading platform, you will also get access to real-time charts, live price feeds, technical analysis tools, regional news as well as support to help you speculate each trading activity.

The amount of money you make is very much dependant on your capital investment. It’s always recommended to start with minimal risk first such as 1% or less. That means you don’t want to lose any more than $10 on a single trade in which you invested $1000. Of course, if you put in more money and willing to take higher risks, the earning potential would be a lot more.

2 – forex affiliate programs

Affiliate marketing is a business model that lets you earn from online sales referrals . In the forex niche, we are mostly talking about brokerage services and trading platforms. These merchants provide you with affiliate links in the form of text or images to be used on articles, blogs or videos.

While there are no hard and fast rules about who can join as an affiliate, it makes sense to say that active traders and individuals with a keen interest in financial investment are most suited for these programs.

That’s because when you speak and write from a user experience point of view, it is much more convincing to advocate about a particular product to an online audience. While forex trading is the core skill here, affiliate marketing will also equip you with other internet marketing knowledge such as SEO , keyword research and social media.

When combining the two together, it elevates your authority in the niche, gets more traffic to your site or youtube channel and improves the click-through rate of your affiliate links. Sounds like a lot to master, right?

Well, it is but when done right, an affiliate site can generate a stream of passive income which is the total opposite from the unpredictable nature of trading forex. With so many people looking to enter the forex market, you are putting yourself in one of the best positions by joining the following affiliate programs;

- Admiral markets – earn up to $600 per referred client

- Just forex – earn up to 65% per trade

- Libertex affiliates – earn up to 60% of the broker’s gross revenue

- Octa FX – earn up to $12 per lot

- XM – earn up to $25 per lot

- Vantagefx – earn up to $800 CPA

3 – become a broker

A broker is someone who provides traders with access to the forex trading platforms and they make money mainly through charging commissions per trade or earning from money loaned to clients in the form of leverage.

The straightforward method is to join a brokerage firm and that usually requires you to have a degree qualification in business and economics and also experiences in selling financial products.

Alternatively, you can set up your own brokerage by registering for a company and hiring a team of qualified individuals. You also need to purchase a trading software that can cost anywhere between $1000 to $100,000.

It’s a lucrative career to consider because, with skills and experience, you can choose to work from home while operating your business worldwide.

4 – become a forex tutor

Once you gain plenty of trading experience and qualifications under your belt, teaching forex online is something to consider as there are always people seeking to learn more and wanting to improve on their trading activities.

For example, inside the udemy teaching platform , we can already see many forex tutors offering various topics in this niche. Students just need to pay a fee and they will get immediate access to the courses as well as downloadable learning materials.

Udemy is a great entry point for teaching any subject due to the high number of online traffic to the site and the amount of on-going promotion. In exchange, they do take a small cut of revenue share from the sales of your course.

If you want to make a bigger profit from teaching, then I would recommend creating your own course through platforms like teachable and sell through your own site. In fact, it’s possible to become a forex tutor AND an affiliate marketer at the same time if you truly trade currency for a living.

5 – forex MLM

Yes, you read that right. There actually exists an MLM component inside forex that lets you earn from selling AND recruiting. The products aren’t associated with brokerage services but more on providing tools and education to assist people in their trading activities.

Like most network companies, each has its own negative feedback from users due to the lack of transparency and monthly membership commitment that don’t offer as much product values as expected. Some are also considered illegal operations in certain countries.

Imarketslive and quest markets are two companies that use MLM to make money with forex. There are massive online reviews outlining the efficacy of their business and if you are still interested to join, proceed with caution.

So, is forex trading profitable?

The short answer is yes. It’s certainly not a scam and all of its economics can be viewed in real-time. However, it’s not easy either because exchange rates fluctuate frequently according to the changes in the global markets.

Those who have a knack for speculating price movements will convince you it’s a rewarding career, but others will warn that you need to have a gut of steels to make profits in the long term. Since losing money is inevitable, this form of trading may not be everyone’s cup of tea.

With good education and constant practice (on a demo account that is), trading forex can become less of a daunting task and more of a calculated investment strategy. So consider starting with that first.

There are other ways to make money online if you feel jittery about the whole trading thing. One that is less risky and more suited to your own level of knowledge and scope of interest. Find out from my recommended training platform how you can get started by simply creating a blog and I shall guide you from there.

Can you make real money out of forex trading?

Follow these top tips and increase your chances of achieving success in forex markets

A lot of people get into forex hoping to make a quick fortune and only end up being disappointed. The truth is that forex trading is not a get-rich-quick scheme. But can you make some real money out of it?

The short answer is yes. This article will lay bare some important things you must know and should do if you are interested in maximising your chances of making some serious money out of forex trading.

Be in the know

If you have been thinking that luck alone can make you a tidy sum in forex, you will be disappointed. While it is good to have a hot hand, it will take far more than that to be a successful trader.

Unfortunately, some people do not understand that FX and gambling are two different things. Gambling is a game of chance, while success in forex is mainly dependent on a person’s actions or inactions.

As such, you must have a great understanding of how the industry works. Start by identifying a reliable source of information such as forex academy to have a grounding. The good thing about this website is that it contains almost everything you need to know about forex.

You must also be interested in political or economic events happening around the world because these may have a profound effect on the market.

Keep the emotions out

If there is one thing that could be the ruin of any trader, it is greed. But it isn’t just greed alone - fear can be just as dangerous.

Fear could make you close out a trade before the optimal point, without having realised a reasonable profit, and greed could make you hold on for too long, which could see you suffer a huge loss in the process.

Every decision you make should be guided by reason or knowledge. A common mistake that people make is to count how much they have made and use that as a basis of whether to close out or not. Instead, check out real market signals to determine the direction your trade is likely to take.

For example, if there are new highs being made on consecutive days in an uptrend, it would be advisable to maintain an open position, utilising a trailing stop which would allow the market to automatically close the trade for you when certain parameters are met. On the other hand, if a trend starts to flatten out, it makes sense to exit. However, you should not do so blindly as there are other considerations to make.

Find a reputable broker

While it is indeed possible to trade without a broker, it is not a recommended option, especially for a novice trader. Brokerage firms connect traders with the money market, offer valuable advice and handle withdrawal requests. They also protect their user’s accounts from unauthorized access and address trade disputes.

However, brokers aren’t all cut from the same cloth. Unfortunately, it is not unheard of for a broker to go bankrupt, shutdown or refuse to honour withdrawals, and if you are working with an unregulated brokerage firm you have a slim chance of recouping your investment.

It is therefore imperative to do your due diligence before establishing a relationship with a broker. As the bare minimum, they must be regulated by the FCA . You should also be interested in establishing their withdrawal and funding procedures and ensure that their customer service is excellent.

Practice makes perfect

Mistakes are costly when it comes to forex trading. A single miscalculation can possibly blow out your account. In 1998, george soros - one of the most successful investors in history - made a wrong move and lost $2 billion .

While this might sound scary to new traders, the truth is that forex involves a significant amount of risk. But, thanks to demo accounts, you can learn without losing real cash.

These accounts simulate the real marketplace and allow you to trade just like a conventional trader would. The only difference is that you will not be investing any real money. This will give you the chance to get a taste of how forex trading works and can help you develop a trading strategy.

Again, you will learn the ins and outs of using the software so that you won’t be fidgeting with things when the actual trading is taking place.

Lucrative venture

Forex trading can be a lucrative venture if you take the right approach. Granted, it may seem complicated when you are starting out, but in reality, it doesn't have to be overbearingly difficult.

Find a reliable source of trading education such as forex academy, and you will significantly boost your chances of success.

Can you make money with forex

Put an end to your quest of hunting for forex courses or coaches, there will be a new one popping out every other week. If you are looking for the “guru’s guru” “the best in the industry” “one of the world’s best forex trader” – as testified by my students.

Let me ask you a question.

Why do forex traders trade?

I mean how many people who’ve started trading actually love the art of trading and don’t just do it to make money?

I’ll admit I do love trading. The art of trading. The beauty of reading charts especially price action trading and the different forex trading strategies. The satisfaction I get when I see the market moving in the intended direction.

It’s just like playing a game. The main difference is that, when you win this game, you are rewarded in material terms. Not in achievements or kudos, but in actual cash that you can use in the real world.

Would you like to play this game? Working your way through it and ensuring you understand as much as possible on how to win?

If this piques your interest, then, yes, forex trading or trading of any sort may suit you.

Contents

Can you get rich by trading forex?

But ezekiel… I hear, how much money can you make trading forex? Can I become rich from it?

“I would like to put in capital of $1000. And if I trade diligently, is it realistic to make $2k a month from trading… say after one year?”

“if I put in $10,000, can I make $100,000 from it in a year? Or… can I make like $10k a month from it?”

You see, being a forex trading coach and mentor, these are the types of questions I get pretty often.

If you want a straight answer to whether you are able to become rich through forex trading, then the answer is yes.

But… is it simple? Not really.

Can trading make you rich?

How can I turn $10,000 into $100,000?

Want to know a method akin to gambling for how you can get rich through trading?

Take a look at this example:

If, let’s say, you put in $10,000 and you want to grow it to $100,000 in a year.

So that’s 10x growth in 12 months.

Or 1000% growth in 12 months.

Now, do you know of any vehicle that gives you that? Not really.

But is it possible in forex trading? Yes it is.

I mean… you could simply enter a trade with a 100% risk. Meaning you go all-in on one trade risking your entire $10k.

And if that trade runs a risk reward ratio of 1:10.

Then there you go… you just made $100k in a trade.

How can I turn $10,000 into $1 million?

Here’s another example of how to “get rich through forex trading”:

You can go all-in at $10k for one trade.

To put it in simple terms, the chances of you winning are 50% and losing are 50%.

So, if it goes up your way, you could have made (let’s not aim so high… but just a risk reward ratio of 1:1) a 100% profit.

So your $10k becomes $20k.

Now, let’s say you now put in your $20k (at the same 100% risk) and you win your next trade.

And then you put your $40k into the next trade, you make $80k.

Woo-hoo! Three wins in a row and you just turned $10k into $80k.

The fourth win will make you $160k!

And so you went in with high hopes thinking that, in a couple more trades, you will turn that $160k into $320k, then the $320k into $640k and then into $1.28 million!!

Just four more wins and you will be a millionaire! Fantastic!

But of course, things get in the way and fantasies like this are shattered in no time.

Because you lost the next trade and your $80k account is now busted!

Does the above scenario sound familiar? Because it’s stories like this that we hear all too often.

This above scenario is just like gambling isn’t it? The gambler will tell you how much he won and then he’ll lose it all. And then go on to tell you he will make it back and more the next time because he has “learnt” what not to do.

If you follow that specific method, then I’m pretty sure the next set, and the set after that, will turn out the same.

Because you can get lucky in one trade, in two trades, maybe even in three trades… but how long can you stay lucky that way? It’s not really realistic isn’t it.

Now… let me bring you back down to earth. Because that was fantasy island. ;)

So is it not possible to turn $10k into $100k?

But we have to do it the “slow and steady way”.

How much can you make trading forex?

Trading the safer way

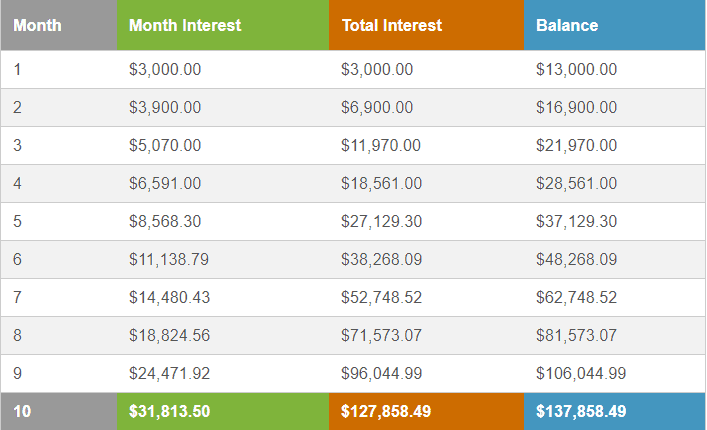

Now let’s say we follow the general rules of risking 1-3% a trade. For this example, let’s put it at 3%.

If your risk reward ratio is, on average, at 1:2…

You will win $600 each trade, and, if you lose, you lose $300.

Let’s say you have a win rate of just 50%.

Therefore, out of 20 trades, you lost 10, meaning you lost $300 * 10 = $3000.

And you won 10 trades, 10 * $600 = $6000.

Out of 20 trades, you made $6000 – $300 = $3000.

So now your capital is at $10,000 + $3000 = $13,000.

Meaning your next trade will be 3% of $13,000 = $390.

Now that’s compounding in action.

Let’s put the above scenario into a compounding calculator.

Assuming you take 20 trades a month…

How long do you need to make $100k?

That’s 9 months.

Now of course, it may also seem unrealistic that you are making 30% a month. Because you made $3k out of $10k in a month.

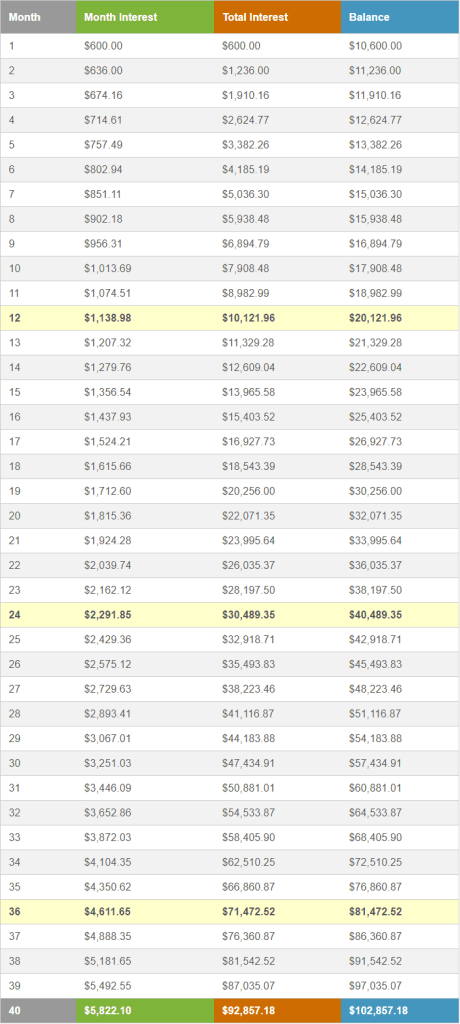

Let’s tone it down a little.

Let’s say out of 10 trades, you won four and lost six. So you have just a win rate of 40%.

And you now only take 10 trades a month, not 20.

Therefore, out of 10 trades, you lost 6, meaning you lost $300 * 6 = $1800.

And you won 4 trades, 4 * $600 = $2400.

Out of 10 trades, you made $2400 – $1800 = $600.

So now your capital is at $10,000 + $600 = $10,600.

Meaning your next trade will be 3% of $10,600 = $318.

Let’s put it into compounding…

You will reach $100k at month 40. Which is around 3 year 4 months.

Now it may seem way longer. But turning $10k into $100k in 3+ years is still really good, right?

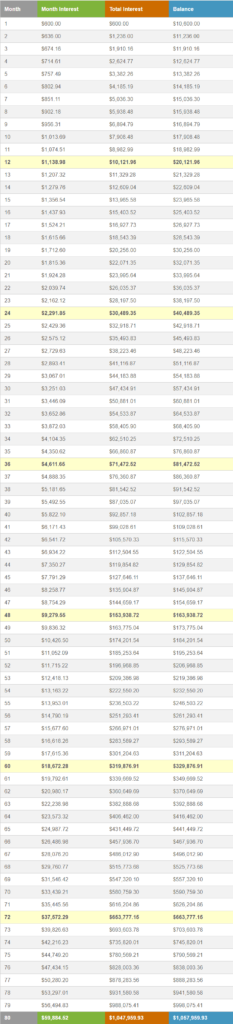

How about if we wait a bit longer…

By month 80, you would have turned it into $1 million dollars!

So is forex really profitable?

Can you get rich by trading forex?

This is the power of compounding put into trading.

Can you make a living trading forex?

As much as it’s possible to do. I don’t want any new traders to be jumping into this game thinking that they can get rich instantly.

The fact is that most new forex traders leave the game after just two years.

And only 10% of traders make money.

It’s because successful trading takes discipline that is incorporated into a solid forex trading system to put the above into action.

Few forex traders want to put in the hard work but only want to get rich.

That’s why there are always gimmicks out there and get-rich-quick schemes which people will always fall into.

Final thoughts

After trading for two decades and seeing the stories of thousands of traders, I can say that I know quite a lot on this subject matter.

So here’s my take away if you want to become successful in this field.

Don’t go into trading with a mindset of wanting to make a million out of a thousand. Instead, go in with the mindset that you are here to learn and hone this skill into a finely crafted tool. Mastering any skill takes time, and nothing is ever achieved without a lot of hard work and practice.

Most people jump into the game and put in loads of money right at the start. On the contrary, in the first six months to a year, you should spend your time learning and practicing with very little money involved. Only when you are ready, and by being ready, I mean that your account is growing steadily, can you then decide to put in more capital.

Try picking up any new sport, e.G. Soccer, basketball, badminton, etc. Were you good at it right from the start? No, everyone who has ever become good at anything has put countless hours into practicing and honing their craft. Working on their weakness and strengthening their game.

The same goes for forex trading. Don’t expect to make big bucks within the first few months of trading. If you somehow manage this, it’s pure luck. Instead, spend time practising and working on your trading game. And this time and effort you put into honing trading into an art will reward you going forward.

Questions:

How much do forex traders make a day?

This will depend on the number of trades you take in a trade. If your trading style is scalping, then you can probably take 20 trades a day. And by scalping, I mean that you are trading in a timeframe such as one minute.

And if that is your preferred way of trading, the math formula will be:

Your win rate: e.G. You win 6 out of 10 trades = 60% win rate.

Your risk reward ratio: e.G. 1:2.

Your risk percentage: e.G. 2%.

So 20 trades * 60% win rate = 12 wins.

Risk per trade is: 2% * $1k = $200.

12 wins * $400 (risk reward ratio 1:2) = $4800.

Total profit: $4800 – $1600 = $3200.

And the above estimation is based on the above scenario.

But what if scalping is not your style and you prefer mid- to longer-term trading?

So perhaps, you will have just one to three trades a day.

Do the math and you will have the answer.

How much to invest in forex trading to make a living?

Using the formula of calculating your win rate, your risk percentage, your risk reward ratio – the number of trades will give you an estimate of how much you can make a month.

And if your living expenses are $3.2k a month, and if you trade 20 trades a month based on the above example, then $10k capital is needed.

Can you make a living day trading forex?

Yes, aside from your daily trades with wins that have a risk reward ratio of 1:2, there are also trades that can go as high as 1:15 or 1:25. These are what I call a bonus for us forex traders.

Imagine you have a trade with a risk percentage of 3%. And you made a successful trade with a risk reward ratio of 1:25.

You’ve just made a 75% gain of your capital in a single trade with just a risk of 3%.

If your capital is $10k, you would have made $7.5k in a single trade…

And if your capital is $100k, you made $75k profit on that trade.

So apart from your day-to-day trades with the standard risk to reward ratio – these are our salary –the big trades are our big payday. Our bonus.

So, let's see, what we have: fxdailyreport.Com for beginners, the forex market can be hard to navigate. There is a lot of jargon that you have to wrap your head around in order to be able to make any reasonable profits. At can you make money with forex

Contents of the article

- New forex bonuses

- Fxdailyreport.Com

- What is copy trading ?

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- 4 ways to make money through forex trading

- The forex market size is almost $1.93...

- Make money through right trading strategies

- Study the currency pair-up

- Keep an eye on the financial market

- Take broker’s leverage services

- Go for demo account first

- Conclusion

- Make money through right trading strategies

- 4 ways to make money through forex trading

- The forex market size is almost $1.93...

- Make money through right trading strategies

- Study the currency pair-up

- Keep an eye on the financial market

- Take broker’s leverage services

- Go for demo account first

- Conclusion

- Make money through right trading strategies

- How much money can you make from forex trading –...

- 1. Trade more

- 2. Managing risk

- 3. Money extraction from your trader’s account

- 4. Determine your expectancy

- 5. Trading risk is dependent on currency pairs

- 6. Calculate profit from forex trading

- The bottom line

- Can you really make money trading forex

- Actually, can you make money trading...

- What is the most vital metric to make...

- Do you want to win more with forex? Then...

- Use trading for your business

- Can you make money with forex trading?...

- Forex trading 101

- The advantage of trading

- The disadvantage of trading

- 5 ways to make money with forex

- 1 – day trading

- 2 – forex affiliate programs

- 3 – become a broker

- 4 – become a forex tutor

- 5 – forex MLM

- So, is forex trading profitable?

- Can you make real money out of forex trading?

- Be in the know

- Keep the emotions out

- Find a reputable broker

- Practice makes perfect

- Lucrative venture

- Can you make money with forex

- Contents

- Can you get rich by trading forex?

- How can I turn $10,000 into $100,000?

- How can I turn $10,000 into $1 million?

- How much can you make trading forex?

- Can you make a living trading forex?

- Final thoughts

- How much do forex traders make a day?

- How much to invest in forex trading to make a...

- Can you make a living day trading forex?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.