How to open account for forex trading

Once you've turned in all of your information to be processed, the broker will verify it and typically ask you to send in some verification documents such as a government-issued ID, and maybe a utility statement to verify your name and address.

New forex bonuses

The back and forth process can slow down the process by a day or two, but it's nothing to concern you. Forex trading sounds like an exciting financial opportunity to those who hear about it for the first time. The possibility of trading large sums of leveraged money sparks the imagination, but most who find the prospects of this market attractive will soon find they are surrounded by online hype and hyperbole.

How to open a forex trading account

What is needed and why

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Foreign-currencies-58c5b0253df78c353c57c52f.jpg)

Artifacts images / digital vision / getty images

Forex trading sounds like an exciting financial opportunity to those who hear about it for the first time. The possibility of trading large sums of leveraged money sparks the imagination, but most who find the prospects of this market attractive will soon find they are surrounded by online hype and hyperbole.

The reality of trading is quite different from the sales pitches most people hear. That's because it is hard to be consistently profitable and most traders lose money in the early stages of their experience.

What is not hard, however, is actually opening a brokerage account. Choosing a brokerage is more meaningful if a beginner has actually tried out several different forex demo accounts.

Typical requirements to get started

The first thing you'll do is set up an account with a forex broker. You'll need to provide a good deal of personal information to get your account set up, including the following:

- Name

- Address

- Phone number

- Account currency type

- A password for your trading account

- Date of birth

- Country of citizenship

- Social security number or tax ID

- Employment status

You will also need to answer a few financial questions, such as:

- Annual income

- Net worth

- Trading experience

- Trading objectives

Industry compliance

You might wonder why forex brokers want to know all of this information. The simple answer is to comply with the law. The environment surrounding forex trading has a comparatively low degree of regulation, but in recent years, more regulations have been put in place to provide some degree of protection or assurance to account holders. Additionally, forex brokers need to ask these questions to protect themselves from the risk of loss. They want to make sure customers who overleverage themselves will still be able to pay back any unexpected losses.

It's unlikely that you will find any broker willing to open your trading account without requiring these questions to be answered. If you do happen to find one that isn't asking many questions, you should be suspicious. If you are ever feeling wary about a particular broker, you can look them up through the national futures association to find out their status.

Forex trading and risk

During the final steps of opening your account, you will see risk disclosures. Please take these seriously. Forex is a difficult business for beginners. It tends to eat them for dinner if they aren't careful. There are more losers than winners on average. The broker is required to remind you of the forex risks.

Once you've turned in all of your information to be processed, the broker will verify it and typically ask you to send in some verification documents such as a government-issued ID, and maybe a utility statement to verify your name and address. The back and forth process can slow down the process by a day or two, but it's nothing to concern you.

Once your information is verified, you can fund your account and begin trading. One piece of advice that I like to give to all new traders is not to put any money in the account that you cannot afford to lose.

It seems like obvious advice, but some people start off feeling like they know more than they do, and take unnecessary risks. Start with a fair amount of money and trade small. Nothing can prepare you for the emotions that you feel when your money is truly at risk, so go slow in the beginning.

Forex should be boring

Forex seems very exciting, but in reality, it should be boring and cut and dried. If you feel a great deal of anxiety when making trades, be careful. It's common to either get too wound up from your winning trades or become a destructive trader from your losing trades.

Learning to make trades using research and systematic logic will serve you much more than relying on emotion to guide your trading. Forex should feel like simple, methodical decision-making with precautionary steps in case of failure. While that might sound boring to you, you will survive much longer if you approach that market that way.

Keep your cool

If you find yourself feeling like you are making common forex mistakes and just generally feeling frustrated, stop trading, and review the basics again. Forex trading is one of those industries where occasionally you have to re-evaluate your methods to make sure you are achieving your goals. Try not to get too frustrated and keep your approach scientific and unemotional.

How to open a forex trading account

The forex market is as old as the advent of currencies and has grown to become the largest financial market in the world. But, surprisingly, trading in the currency market hasn’t been very accessible to the general public for most of its history.

However, this has changed ever since the arrival of the internet and retail forex brokerages have popped up to facilitate trading. Nowadays, opening a forex trading account is no more different than opening a bank account. However, before one starts trading, it is important to be aware of some information that can ensure that your trading experience remains secure and successful.

Find the right broker

Finding the right broker in the market is perhaps the all-important first step that you are going to take. Since currency trading is decentralized and not-so-well regulated, it is highly recommended that traders research the broker’s reputation thoroughly before taking the plunge.

This can easily be done by verifying a broker’s history with the national regulatory agencies. Furthermore, it is also advisable to know about the services that a broker offers. Some may provide basic brokerages while others may provide sophisticated trading platforms and resources for analysis that assist in well-informed trading decisions.

You should also look to compare any fees or commissions that brokers may be charging for their services. When ascertaining the profitability of trading, these extra costs can become quite important for the trader.

Information required for account creation

Once you have decided upon a broker, you will be required to provide a variety of personal information to set up your trading account.

These may include the following:

- Name

- Country of citizenship

- Date of birth

- Address

- Phone number

- Currency type for account

- Tax ID or social security number

- Employment status

Along with these, you may also be required to answer a few financial questions.

- Trading experience

- Annual income

- Trading objectives

- Net worth

Choose the account type

When you’re all set to open an account, you will have to decide exactly which trading account type you want. You can choose either a personal account or a corporate (or business) account. One had to choose amongst ‘standard,’ ‘mini,’ and ‘micro’ accounts in the past.

But, since traders allow one to trade custom lots, this isn’t a problem anymore and is great news for those beginners who have only a small capital amount. It also keeps things flexible for traders as they won’t be necessitated to trade any more than they are comfortable with. Plus, you must always remember to read the fine print of your agreement.

Many application forms will have the option of a ‘managed account,’ which is good if you want the broker to trade for you. But, if you’re not looking to give the reins to someone else, you should be wary of this. Besides, a managed account demands big capital, somewhere north of $25,000. On top of that, the managing person may also take a cut out of your profits.

Industry compliance

One might be driven to wonder why brokers require so much information to open a trading account. The reason is that they have to abide by the law and be industry compliant. Ever since forex went retail, it has some regulations, which have been put in place to keep traders from harm and offer some protection.

As such, you won’t find many brokers ready to open an account without warranting all this information. If, however, you come across a broker that doesn’t require such information, be wary of them.

Registration

There might be some paperwork that you are required to submit to successfully open your account and the forms that you provided will vary depending on your broker. Soft copies of the same will be provided to you, which you can view and print at your pleasure.

Furthermore, be aware of the affiliated costs that you might have to pay, such as charges for bank transfer applied by your bank. Some banks actually may cost a lot, which might take a big bite out of your trading capital and may surprise you later.

Activate the account

As soon as the broker receives all the required paperwork, you should be greeted with an email providing the necessary instructions for activating your account. Once you have gone through the steps, a final email will be sent to you providing everything from username and password to detailed instructions that will assist you in funding your account.

Now, you can log in and begin trading. However, if you are just starting out, you would be better off trying your hand on demos. This will help you get the hang of the trading strategies and get familiar with simulated market conditions before you risk your account capital on live trading.

Summary

The procedure of opening and setting up a forex trading account isn’t too dissimilar from opening any other type of financial account. You will be required to do your research beforehand to ensure that your broker is reputable, provide the relevant information necessary for the process, choose an account type depending on your goals, register, and finally activate your trading account.

Once you have begun, you should be able to trade round the clock at your pleasure. It is highly advised that you read all the conditions in the documents provided by your broker carefully and are aware of any terms and conditions that might be associated with your trading account activity.

Though trading on a live account shouldn’t be your first experience with trading, as long as you approach trading with a scientific and stoical mindset. Use proper risk management, remain vigilant, and you should be well on your way to a successful forex trading career.

Fxdailyreport.Com

So you have thought about it, and you have finally decided you are to start investing in forex trading? Well, forex trading can be a fascinating business, and nowadays, there is much puff about it online.

But how exactly can you get started with forex trading?

Decide on the best forex broker

This is the first and most important step in opening any forex account. You can choose the best forex broker by looking for such factors as the credibility of a broker, their trade execution, low spreads, regulation, trading platforms and styles, account types, and leverage options, among other factors.

However, deciding on the best broker doesn’t stop here. It is extremely important that you play with multiple forex demo accounts offered by different brokers. Opening demo accounts with various trading platforms will give you the chance to learn forex trading properly before investing your hard-earned money. Again, you should consider making paper trade until you start making consistent profits before committing real money. Often, newbies jump into the forex trading market and end up losing significant amounts of capital because of leverage.

So, again, it is strongly advisable to open multiple demo accounts with different brokers before opening a live account. This will not only help you choose the best broker, but it will also help you get ready for real trading.

After choosing your forex broker, the next thing is often a standard bureaucratic process which is just like opening an account at a bank:

Choose your preferred forex account type

Standard accounts are the most common. Since they need sufficient up-front capital for you to trade on full lots, many brokers often offer better perks and more services for investors with a standard forex account. However, most forex brokers require a standard account to have at least $2,000 or sometimes $5,000-$10,000 as the starting minimum balance.

Mini trading accounts allow investors to make transactions by using mini lots. You can open this type of account with as low as $250-$500, with leverage of, sometimes, up to 400:1. However, it comes with relatively small rewards.

In managed accounts, the broker (or hired account manager) makes the buy and sell decisions. You will set your objectives (like your profit goals, and risk management) and your account manager will work to meet the objectives. This account type requires large minimum deposits.

Again, regardless of the type of account you decide to open, it is wise to begin free demo accounts first to familiarize yourself with various trading aspects.

Registration

You will be required to give a lot of personal information during the forex account registration process. Various countries have different regulations on forex trading to protect investors, and so brokers will ask you for some personal information to comply with the law. Here is what is typically required;

• your name

• contact information-your address, phone number, and email

• date of birth

• tax ID or social security number

• your national ID number

• employment status

• the type of currency you want to use

• net worth

• annual income

• country of citizenship

• your trading account password

• trading experiences and objectives, etc.

It is highly unlikely to find a broker that does not ask for this information, and in case you find one, be suspicious.

After giving all the required information for processing, the broker will typically require you to send them some verification documents like copies of your national ID, and perhaps a utility statement so that they can verify your address and name.

In the final steps opening a forex account, you should see risk disclosures (which you need to take very seriously). Forex trading can be a very dangerous business, and brokers are required to remind you this.

Activate your account and start trading

After your broker has received the required paperwork and information, you will receive an email directing you on how to complete your account activation. After completing this step, you will receive another email with instructions on funding your forex account, your username, and password.

Then all that is left is just logging in to your account and start trading!

Forex basics: setting up an account

Foreign-exchange (forex) trading consists of buying and selling world currencies, and the marketplace is among the most liquid in the world. Forex trading is unique because individual investors can compete with large hedge funds and banks—they just need to set up the right account.

There are three main types of trading accounts—standard, mini, and managed—and each has its own advantages and disadvantages. Which type of account is right for you depends on your tolerance for risk, the size of your initial investment, and the amount of time you have to trade on a daily basis.

Key takeaways

- If you've started trading in the forex markets, you'll need to choose what type of account is best-suited to your skill, knowledge, and experience.

- The most common is a standard account with 100:1 leverage and standard lots up to $100,000 in notional value.

- Mini accounts reduce the maximum lot size to just $10,000 are intended for beginners, more risk-averse traders, or those with limited funds.

- For those who rather have a professional portfolio manager make your trades, a managed account might be worth the additional fees.

Standard trading accounts

The standard trading account is the most common. This account gives the user access to standard lots of currency each worth $100,000.

That does not mean that you have to put down $100,000 of capital in order to trade. The rules of margin and leverage (typically 100:1 in forex) mean that only $1,000 needs to be in the margin account for one standard lot to be traded.

The pros

Service: because the standard account requires adequate up-front capital to trade full lots, most brokers provide more services and better perks for individual investors who have this type of account.

Gain potential: with each pip worth $10, if a position moves with you by 100 pips in one day, the gain will be $1,000. This type of gain is not possible with any other account type unless more than one standard lot is traded.

The cons

Capital requirement: most brokers require standard accounts to have a starting minimum balance of at least $2,000 and sometimes $5,000 to $10,000.

Loss potential

just as you have the opportunity to gain $1,000 if a position moves with you, you could lose $1,000 in a 100-pip move against you. This loss could be devastating to an inexperienced trader with just the minimum in an account.

This type of account is recommended for experienced, well-funded traders.

Mini trading accounts

A mini trading account is simply a trading account that allows traders to make transactions using mini lots. In most brokerage accounts, a mini lot is equal to $10,000, or one-tenth of a standard account. Most brokers offering standard accounts will also offer mini accounts as a way to bring in new clients who are hesitant to trade full lots because of the investment required.

The pros

Low risk: by trading in $10,000 increments, inexperienced traders can trade without blowing through an account, and experienced traders can test new strategies without risking too much capital.

Low capital requirement: most mini accounts can be opened with $250 to $500, and they come with leverage of up to 400:1.

Flexibility: the key to successful trading is having a risk-management plan and sticking to it. With mini lots, this is a lot easier to do because if one standard lot is too risky, you can buy five or six mini lots and minimize your risk.

The cons

Low reward

with low risk comes low reward. Mini accounts that trade $10,000 lots can only produce $1 per pip of movement as opposed to $10 in a standard account. This type of account is recommended for beginning forex traders or those looking to dabble with new strategies.

Micro accounts, the sister account to the mini, are also available through some online brokers. These accounts trade in $1,000 lots and have pip movements worth 10 cents per point. These accounts are typically used for investors with limited foreign exchange knowledge and can be opened for as little as $25. (read "10 things to consider before selecting an online broker" before making your investment.)

Managed trading account

Managed trading accounts are forex accounts in which the capital is yours but the decisions to buy and sell are not. Account managers handle the account just as stockbrokers handle a managed stock account, where you set the objectives (profit goals, risk management) and the managers work to meet them.

There are two types of managed accounts:

- Pooled funds: your money is put into a mutual fund with that of other investors, and the profits are shared. These accounts are categorized according to risk tolerance. A trader looking for higher returns would put their money into a pooled account that has a higher risk/reward ratio while a trader looking for a steady income would do the opposite. Read the fund's prospectus before investing.

- Individual accounts: A broker will handle each account individually, making decisions for each investor instead of the combined pool.

The pros

Professional guidance: having a professional forex broker handle an account is an advantage that cannot be overstated. Also, if you want to diversify your portfolio without spending all day watching the market, this is a great choice.

The cons

Price: be aware that most managed accounts will require a minimum $2,000 investment for pooled accounts and $10,000 for individual accounts. On top of this, account managers will keep a commission, called an account maintenance fee, which is calculated per month or per year.

Flexibility: if you see the market moving, you won't have the flexibility to place a position. Instead, you'll have to rely on the account manager to make the right choice. This type of account is recommended for investors with high capital and no time or interest to follow the market.

The bottom line

No matter what account type you choose, it is wise to take a test drive first. Most brokers offer demo accounts, which give investors an opportunity to use an account risk-free and try out different platforms and services.

As a basic rule of thumb, never put money into an account unless you are completely satisfied with the investment being made. With the different options available for forex trading accounts, the difference between being profitable and ending up in the red may be as simple as choosing the right type of account.

Fxdailyreport.Com

So you have thought about it, and you have finally decided you are to start investing in forex trading? Well, forex trading can be a fascinating business, and nowadays, there is much puff about it online.

But how exactly can you get started with forex trading?

Decide on the best forex broker

This is the first and most important step in opening any forex account. You can choose the best forex broker by looking for such factors as the credibility of a broker, their trade execution, low spreads, regulation, trading platforms and styles, account types, and leverage options, among other factors.

However, deciding on the best broker doesn’t stop here. It is extremely important that you play with multiple forex demo accounts offered by different brokers. Opening demo accounts with various trading platforms will give you the chance to learn forex trading properly before investing your hard-earned money. Again, you should consider making paper trade until you start making consistent profits before committing real money. Often, newbies jump into the forex trading market and end up losing significant amounts of capital because of leverage.

So, again, it is strongly advisable to open multiple demo accounts with different brokers before opening a live account. This will not only help you choose the best broker, but it will also help you get ready for real trading.

After choosing your forex broker, the next thing is often a standard bureaucratic process which is just like opening an account at a bank:

Choose your preferred forex account type

Standard accounts are the most common. Since they need sufficient up-front capital for you to trade on full lots, many brokers often offer better perks and more services for investors with a standard forex account. However, most forex brokers require a standard account to have at least $2,000 or sometimes $5,000-$10,000 as the starting minimum balance.

Mini trading accounts allow investors to make transactions by using mini lots. You can open this type of account with as low as $250-$500, with leverage of, sometimes, up to 400:1. However, it comes with relatively small rewards.

In managed accounts, the broker (or hired account manager) makes the buy and sell decisions. You will set your objectives (like your profit goals, and risk management) and your account manager will work to meet the objectives. This account type requires large minimum deposits.

Again, regardless of the type of account you decide to open, it is wise to begin free demo accounts first to familiarize yourself with various trading aspects.

Registration

You will be required to give a lot of personal information during the forex account registration process. Various countries have different regulations on forex trading to protect investors, and so brokers will ask you for some personal information to comply with the law. Here is what is typically required;

• your name

• contact information-your address, phone number, and email

• date of birth

• tax ID or social security number

• your national ID number

• employment status

• the type of currency you want to use

• net worth

• annual income

• country of citizenship

• your trading account password

• trading experiences and objectives, etc.

It is highly unlikely to find a broker that does not ask for this information, and in case you find one, be suspicious.

After giving all the required information for processing, the broker will typically require you to send them some verification documents like copies of your national ID, and perhaps a utility statement so that they can verify your address and name.

In the final steps opening a forex account, you should see risk disclosures (which you need to take very seriously). Forex trading can be a very dangerous business, and brokers are required to remind you this.

Activate your account and start trading

After your broker has received the required paperwork and information, you will receive an email directing you on how to complete your account activation. After completing this step, you will receive another email with instructions on funding your forex account, your username, and password.

Then all that is left is just logging in to your account and start trading!

Open an account

Two types of accounts are available in the trading platform: demonstration (demo) and real. Demo accounts provide the opportunity to work in a training mode without real money, allowing to test a trading strategy. They feature all the same functionality as the live ones. The difference is that demo accounts can be opened without any investment and, therefore, one cannot expect to profit from them.

Demo account opening #

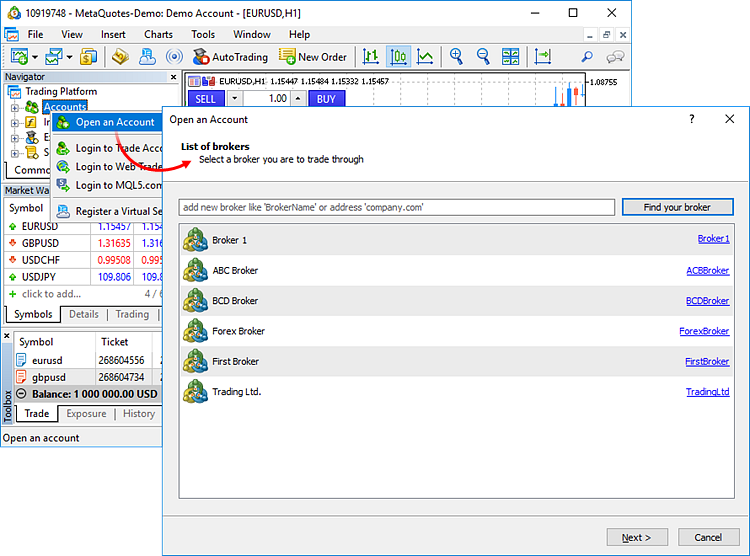

Click " open an account" in the file menu or in the context menu of the navigator window.

The account opening procedure consists of several steps:

Select a server

A broker is selected during the first step. If the desired company is not shown in the list, please type its name and click "find your broker". Alternatively, you can type the address of the server instead of the company name. Once you find the desired company, select it and click "next".

If the brokers list becomes too long, you can delete unnecessary companies by pressing the "delete" key.

Account type #

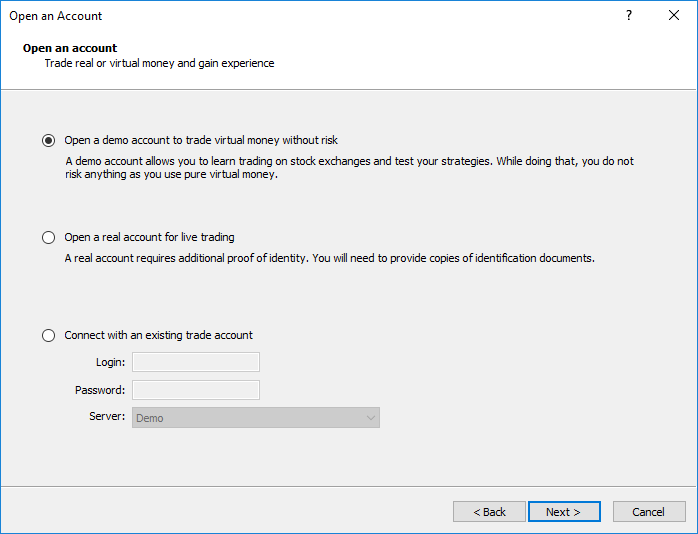

Enter the details of your existing account or create a new one.

Choose this option to connect to an existing trading account. You will need to specify the account number, the password and the server name.

Select this option to open a demo account. Demo accounts help users learn trading and test trading strategies. All trading operations only involve virtual money.

Select this option to request opening of a real account. Trading operations are performed using real money on such accounts, therefore you will need to provide broker detailed information about yourself, as well as ID and proof of address documents. The broker will check provided information and contact you to complete the account opening procedure.

Personal details

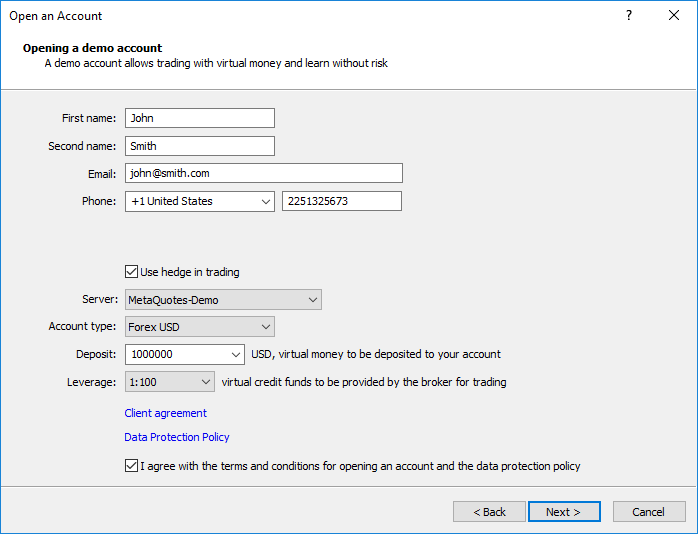

Enter your personal details:

Personal details

- First name — the name of the user consisting of at least two characters.

- Second name — the second name (surname) of the user consisting of at least two characters.

- Email — email address, e.G. "smith@company.Net".

- Phone — contact phone number in international format. Example: +74951234567.

Account parameters

- Use hedge in trading — enable the option if you want to open an account with the hedging position accounting system, which allows having multiple open positions of the same symbol, including opposite positions. Otherwise an account with the netting system will be opened. The option affects account types available for selection.

- Account type — select a type from the drop down list.

- Deposit — the initial deposit in the basic currency. Selected from a drop down list.

- Currency — this field cannot be edited, the deposit currency is indicated here. This parameter depends on the account type specified.

- Leverage — ratio between borrowed and owned funds for trading; select one of the available variants from the drop down list.

Links to broker's agreements are shown in this block. Read them carefully. The number of links and types of agreements available depend on the selected broker.

If you agree with account opening terms and the broker's data protection policy, tick the appropriate box and click "next". After that, the account will be created.

Account registration

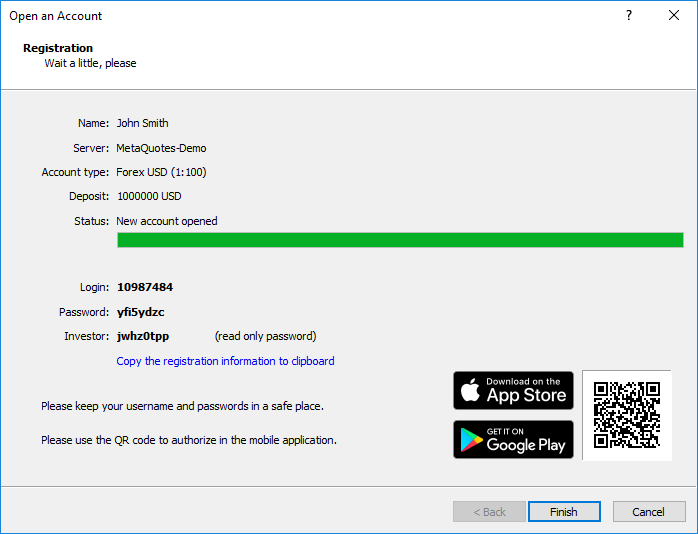

Once an account is created on a selected server, details will be shown in the dialog window:

The upper part of the window contains brief information about the account; the lower part shows its details:

- Login — the number of the opened account.

- Password — a password to access the account. This is a master password, which allows trading from this account.

- Investor — investor password. The password allows connecting to the account to view its state and analyze price dynamics, but it does not allow trading.

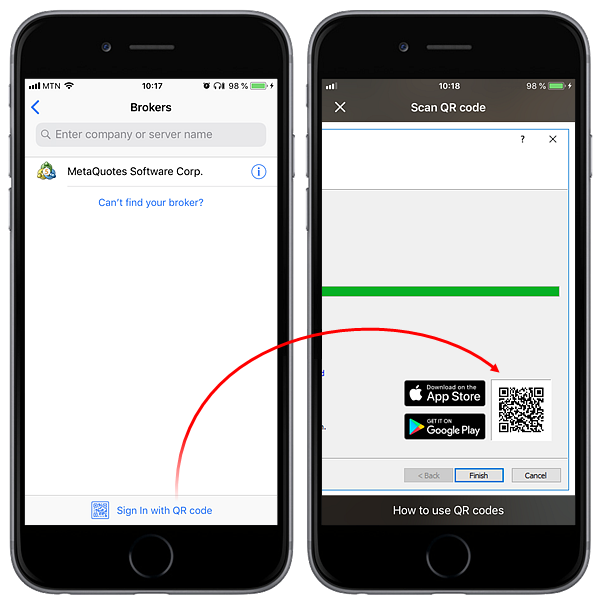

A QR code is shown below, using which you can instantly connect to this account from the mobile platform. Open the mobile application, go to the "new account" section and click "sign in with QR code". Point your camera at the QR code, and the trading account will be instantly connected, without the need to specify login, password and server values.

After clicking finish, the newly created account is automatically connected to the trade server. It also appears in the accounts section of the navigator window. If you click cancel in this window, connection to the trade server is not performed and the account is not added to the navigator window, though it is already created. You can connect to the server later using the account details.

If you have any problems with registration, please contact your broker's technical support team.

Live account opening #

Directly from the trading platform, you can send a request to open a live account, on which you can trading using real money. You will need to fill out a few simple forms, and to additionally provide documents to confirm your identity and address.

Choose the option "open a real account for live trading" and specify the required data:

Depending on broker's settings and applicable legislation, you can be requested to fill in information on employment, income and trading experience. In particular, such account opening requirements apply to mifid regulated brokers (the markets in financial instruments directive).

Once you fill in all fields, a preliminary account with the zero balance will be opened for you on the broker's server. Although you cannot trade on a preliminary account, you can monitor price dynamics, perform technical analysis and test strategies.

Soon after opening the preliminary account, a representative of the brokerage company will contact you to finish the procedure of real account opening. After that the preliminary account is converted to the real one, and you can start trading from it.

An informational email is additionally sent to you via the internal mailing system when a preliminary account is opened.

Accounts in the navigator window are marked with appropriate icons depending on their type: — a demo account, — a preliminary account, — a live account.

Contest accounts #

The platform features a special account type, which can be used for various trading contests and competitions. They operate similarly to demo accounts and are marked with a blue icon in the navigator window. Such accounts can only be opened by a brokerage company. When you are connected to such an account, the "contest account" title is displayed in the platform window header.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

How to open account for forex trading

How to open forex trading account?: in the process of forex trading, the primary step is to find a suitable forex broker after considering specific essential criteria. Once you choose a forex broker, it becomes necessary to open a forex trading account to start forex trading.

Open forex trading account

Choose the type of forex trading account

At a point when you’re ready to open a live account. You have to pick which sort of forex trading account you want: a personal account or a business account.

A few dealers have a “managed account” choice in their application structures. If you need the agent to exchange your account for you, you can pick this.

Complete registration with the forex broker

You should submit paperwork to open an account, and the structures will fluctuate from broker to broker.

Additionally, ensure you know all the associated costs, similar to how much your bank charges for a bank wire transfer.

Activate forex trading account

When the merchant has gotten all the essential paperwork, you ought to get an email with directions on finishing your account activation.

After these means have finished, you will get the last email with your username, password, and instructions on how to fund your account.

Start trading with your forex trading account

Presently you have a forex trading account and have saved assets; you can start trading.

Sign in, pick whether to trade forex through spread betting, cfds or spot FX, pick your pairs and open a position.

You can access live value channels, streaming charts and news instantly and trade 24-hours a day.

Some tips related to forex trading

- Attempt to concentrate on utilizing just about 2% of your total cash.

- You should start trading forex with a demo account before you contribute real capital.

- Recollect that misfortunes aren’t misfortunes except if your position shut.

- On the off chance that your position is as yet open, your misfortunes will possibly check if you decide to close the order and take the setbacks.

- If your cash pair conflicts with you, and you need more cash to cover the duration, you will automatically be cancelled out of your order. Make sure you don’t make this mistake.

- 90% of day traders are ineffective. If you want to learn regular pitfalls which will cause you to make bad trades, counsel a confidant in a case manager.

- Check to make sure that your agent has a physical address. If a merchant doesn’t offer an address, at that point, you should search for another person to avoid scam.

Conclusion

The forex market is volatile, and one can see a lot of high points and low points. What matters is to keep doing your research and staying with your strategy. Eventually, you will see the benefits.

How to open an account

You can start trading across our award-winning* OANDA trade platform and MT4 in three simple steps: complete our application form, verify your identity and deposit funds. You are now ready to place your first live trade with OANDA. It is as easy as that.

Step 1: apply for an account

To apply, you must be over 18 years old, and a legal resident of the united kingdom.

We only ask questions that are relevant to your application and for regulatory purposes.

Be prepared to upload proof of identity and address, such as your full UK driver's license and a bank statement (issued within the last three months) in the event that we are unable to identify you electronically.

Step 2: verify your identity and address

We may need you to send some documentation to verify your identity. You can scan the below documents or use your smartphone to take a picture of the documents and submit them through our secure portal.

Proof of identity

You can use an identity document such as your passport (preferred) or full UK driver's license to verify your identity. Scan or take a photo of your document.

Non-UK nationals residing in the UK would have to provide either their passport or national ID card.

We cannot accept copies of copies, black and white copies and/or photocopies. The document must be either a scan or photo of the original document.

Proof of address

Bank statement (preferred), utility bill or other document with your name and address on it. In certain cases, we may ask for more than one document as proof of your address.

The document should show your current residential address and must match the address on your OANDA account application. It should be for an account held in your name and be the most recently issued version. For example, within the last three months for bank statements, or valid for the year in the case of your council tax statement.

To ‘c/o' or ‘care of’ documents cannot be accepted.

Online generated proof of address documents should be in PDF format and must be downloaded from your online account. In the case of screenshots, you will need to include the whole web page as well as the URL of the site from where the document was downloaded.

Fxdailyreport.Com

So you have thought about it, and you have finally decided you are to start investing in forex trading? Well, forex trading can be a fascinating business, and nowadays, there is much puff about it online.

But how exactly can you get started with forex trading?

Decide on the best forex broker

This is the first and most important step in opening any forex account. You can choose the best forex broker by looking for such factors as the credibility of a broker, their trade execution, low spreads, regulation, trading platforms and styles, account types, and leverage options, among other factors.

However, deciding on the best broker doesn’t stop here. It is extremely important that you play with multiple forex demo accounts offered by different brokers. Opening demo accounts with various trading platforms will give you the chance to learn forex trading properly before investing your hard-earned money. Again, you should consider making paper trade until you start making consistent profits before committing real money. Often, newbies jump into the forex trading market and end up losing significant amounts of capital because of leverage.

So, again, it is strongly advisable to open multiple demo accounts with different brokers before opening a live account. This will not only help you choose the best broker, but it will also help you get ready for real trading.

After choosing your forex broker, the next thing is often a standard bureaucratic process which is just like opening an account at a bank:

Choose your preferred forex account type

Standard accounts are the most common. Since they need sufficient up-front capital for you to trade on full lots, many brokers often offer better perks and more services for investors with a standard forex account. However, most forex brokers require a standard account to have at least $2,000 or sometimes $5,000-$10,000 as the starting minimum balance.

Mini trading accounts allow investors to make transactions by using mini lots. You can open this type of account with as low as $250-$500, with leverage of, sometimes, up to 400:1. However, it comes with relatively small rewards.

In managed accounts, the broker (or hired account manager) makes the buy and sell decisions. You will set your objectives (like your profit goals, and risk management) and your account manager will work to meet the objectives. This account type requires large minimum deposits.

Again, regardless of the type of account you decide to open, it is wise to begin free demo accounts first to familiarize yourself with various trading aspects.

Registration

You will be required to give a lot of personal information during the forex account registration process. Various countries have different regulations on forex trading to protect investors, and so brokers will ask you for some personal information to comply with the law. Here is what is typically required;

• your name

• contact information-your address, phone number, and email

• date of birth

• tax ID or social security number

• your national ID number

• employment status

• the type of currency you want to use

• net worth

• annual income

• country of citizenship

• your trading account password

• trading experiences and objectives, etc.

It is highly unlikely to find a broker that does not ask for this information, and in case you find one, be suspicious.

After giving all the required information for processing, the broker will typically require you to send them some verification documents like copies of your national ID, and perhaps a utility statement so that they can verify your address and name.

In the final steps opening a forex account, you should see risk disclosures (which you need to take very seriously). Forex trading can be a very dangerous business, and brokers are required to remind you this.

Activate your account and start trading

After your broker has received the required paperwork and information, you will receive an email directing you on how to complete your account activation. After completing this step, you will receive another email with instructions on funding your forex account, your username, and password.

Then all that is left is just logging in to your account and start trading!

So, let's see, what we have: looking to open a forex trading account? Find out how to do it and get information on the requirements you need to get started. At how to open account for forex trading

Contents of the article

- New forex bonuses

- How to open a forex trading account

- What is needed and why

- Typical requirements to get started

- Industry compliance

- Forex trading and risk

- Forex should be boring

- Keep your cool

- How to open a forex trading account

- Find the right broker

- Information required for account creation

- Choose the account type

- Industry compliance

- Registration

- Activate the account

- Summary

- Fxdailyreport.Com

- Forex basics: setting up an account

- Standard trading accounts

- Mini trading accounts

- Managed trading account

- The bottom line

- Fxdailyreport.Com

- Open an account

- Demo account opening #

- Select a server

- Account type #

- Personal details

- Personal details

- Account parameters

- Account registration

- Live account opening #

- Contest accounts #

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- How to open account for forex trading

- Open forex trading account

- How to open an account

- Step 1: apply for an account

- Step 2: verify your identity and address

- Fxdailyreport.Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.