How does xm bonus work

Getting the 30 USD no deposit bonus on XM is pretty easy. The only thing you need, except for the wish to trade forex, is to go through XM registration, get your account, and confirm your phone number via SMS.

New forex bonuses

As for the bonus, within the maximum of 24 hours (but usually in around 30 minutes), you will get the money credited to your account and you will be able to trade currencies online with XM without making a deposit. Once the questionnaire is complete, the user is very close to getting the bonus. All that is left to do is to confirm the email. The notification will be generated and the user will be asked to check the inbox of the indicated email address. Through the link provided in the email, the user will be able to confirm the transaction.

XM no deposit 30 USD bonus – read an honest review

Platform

Min. Volume

Action

XM forex broker is a great place to get started for a next FX professional. This broker gives you access to XM no deposit 30 USD bonus campaign and allows you to use metatrader4 and MT5. This is one of the only brokers that makes MT4 live trading available to you without making a deposit. You should certainly try this XM no deposit bonus, as metatrader 4 is the platform you will most likely have to change to eventually and this promo campaign lets you test drive the platform without any deposits.

XM free 30 USD no deposit bonus description

Getting the 30 USD no deposit bonus on XM is pretty easy. The only thing you need, except for the wish to trade forex, is to go through XM registration, get your account, and confirm your phone number via SMS. As for the bonus, within the maximum of 24 hours (but usually in around 30 minutes), you will get the money credited to your account and you will be able to trade currencies online with XM without making a deposit.

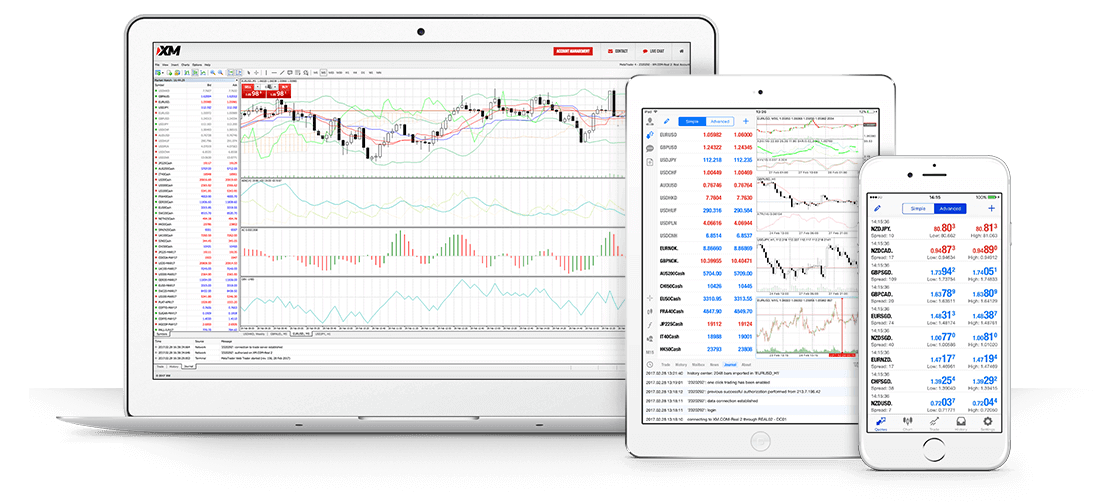

XM free trial available platforms

When it comes to FX trading online, the choice of available trading platforms becomes quite important. Most of the traders end up on MT4 or MT5 platform and this is certainly an advantage of XM. With XM FX broker, traders using mac laptops and desktops will find a hustle way to trade since they offer native access to metatrader 4 for mac OS. Also, the MT4 web platform is also available with XM, this trading terminal could be used for windows and other operating systems too. Like most of the brokers, XM account also enables you to trade on your smartphone.

XM 30$ bonus terms and conditions

XM no deposit 30 USD bonus is unavailable for withdrawals, however, every cent from the profit is yours. You can take your time and only make relevant trades that get you great money on the XM no deposit bonus.

XM free account critics

Many traders have been complaining about this promotion and XM broker in general, this is why forex trading bonus team would strictly advise against it. You may, of course, try your luck and see how fast you can triple your initial balance, however, some traders did have their accounts removed without any prior notification.

We decided to check this bonus on our own. We have to admit, we were positively surprised by the quality of services and web platform from XM. This is why we recommend you try XM trading bonus!

How to get XM $30 no deposit bonus?

XM is a quickly growing international investment firm with over 2.5 million users and 300 professionals. The company offers a trustworthy and convenient trading environment and is one of the few brokers who will allow MT4 live trading without making any deposits. After getting their XM global login, users will be rewarded with $30 no deposit bonus that is available for trading right away. It shouldn’t take longer than a day for the funds to show up in the account.

Steps for getting the no deposit XM bonus:

Getting the bonus is fairly simple. A user only has to register on the platform and activate the account. The registration procedures are very easy to follow. On any page on XM’s website, in the top right corner, there is a green button titled “open an account”. Clicking the button will start the registration process.

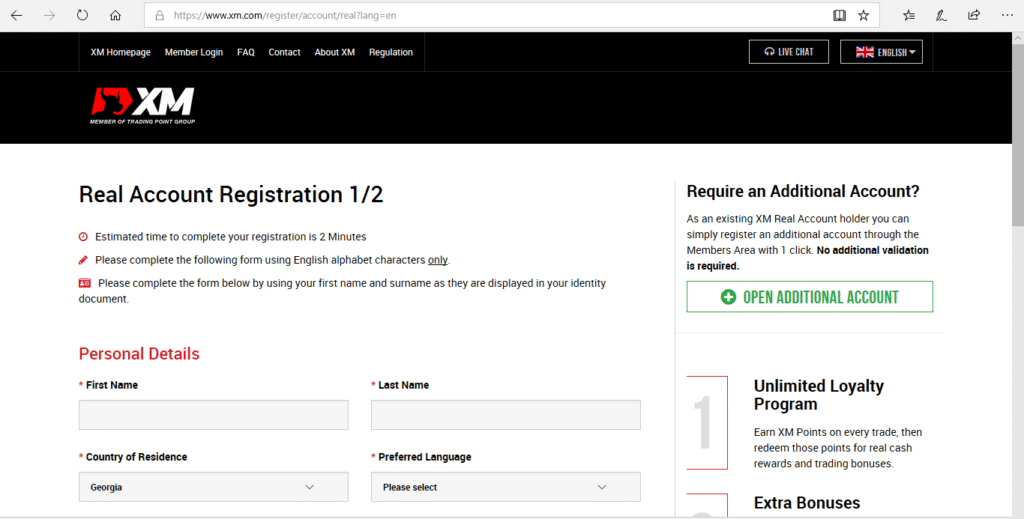

The registration includes filling out a standard questionnaire. The first part of it is depicted on the screen below. In this section, the user is asked to fill out some details like name, country of residence and a phone number. A user will also get to choose an account type and trading platform type on this page.

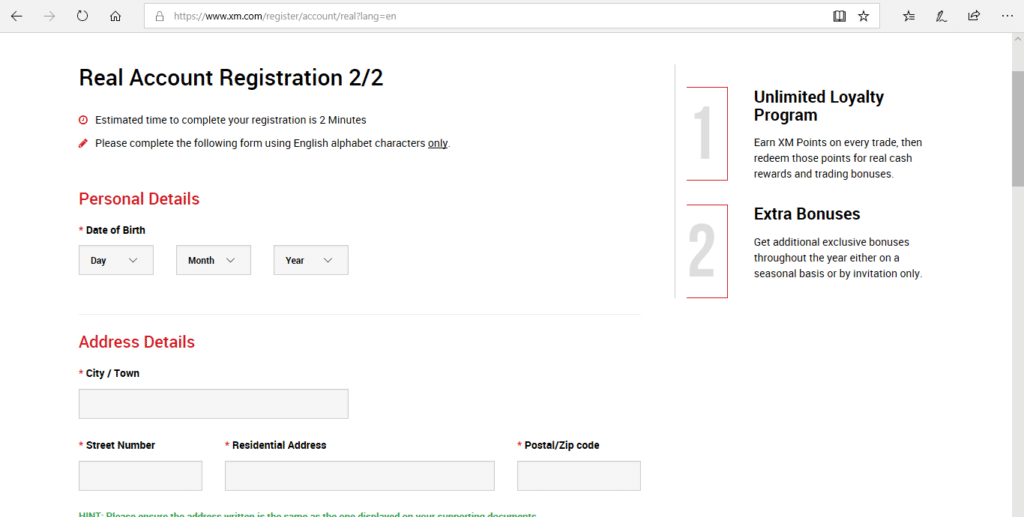

After this information is filled out, the second part of the questionnaire will load. Here, the user is asked to provide some additional details, like the date of birth and address.

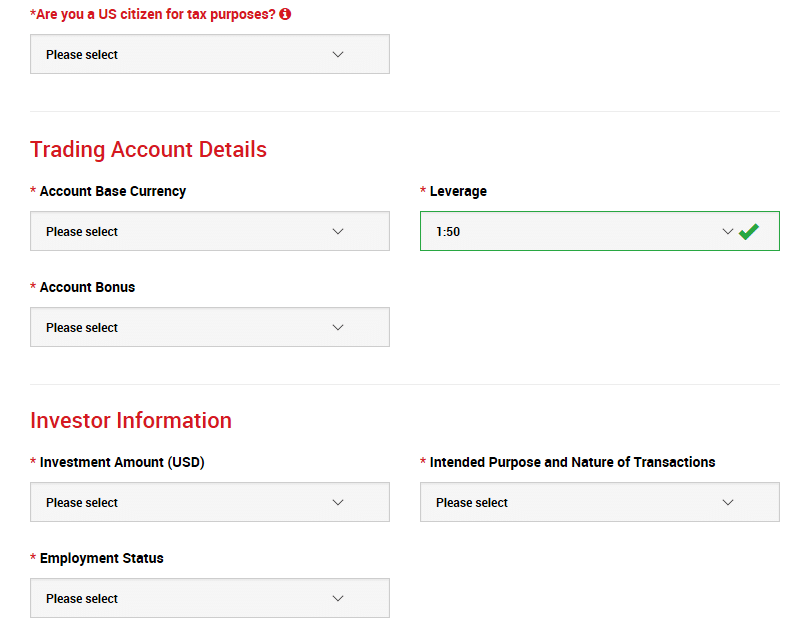

The website will also ask whether the user is a US citizen or not, as well as some additional questions to determine the purpose of the client. Once, this information is filled out, the user will set the password, agree to the terms and conditions as well as some other policies that can be viewed through the links and will click the button “open a real account”, and with that, you XM signup will be complete. Don’t stress out, your free XM bonus is almost here!

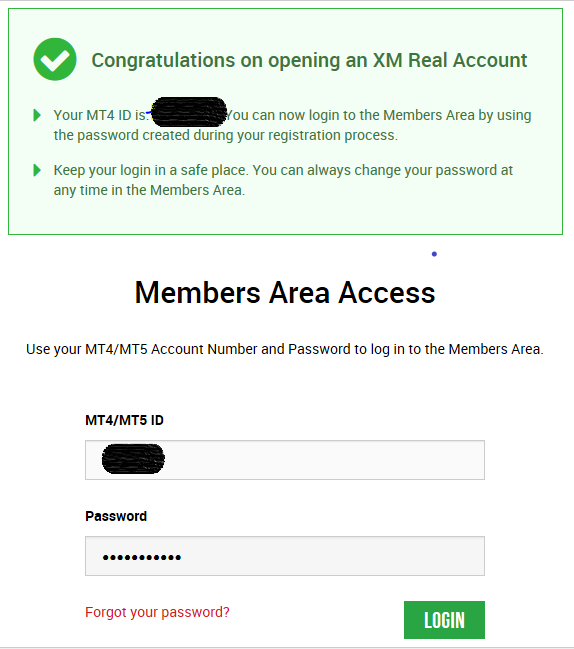

Once the questionnaire is complete, the user is very close to getting the bonus. All that is left to do is to confirm the email. The notification will be generated and the user will be asked to check the inbox of the indicated email address. Through the link provided in the email, the user will be able to confirm the transaction.

After confirming the transaction the user will finally get to log into the system using their XM members login . They will also be assigned an MT4 ID, which functions as a username when logging into the platform.

The XM no deposit bonus should show up on the account within a day after completing the registration process. The $30 no deposit bonus from XM cannot be withdrawn but can be used to trade in the system. It is a great feature to test the platform and get acquainted with it. It is an especially good feature for beginners, who might not want to risk their own funds while figuring out the basics of trading.

Trade forex and cfds on stock indices,

oil and gold.

78.04% of retail investor accounts lose money when trading cfds with this provider.

You should consider whether you can afford to take the high risk of losing your money. Risk disclosure

- Trade with a regulated broker

- Zero commissions

- Trade on desktop, mobile and tablet

- No hidden fees

Trade on 16 platforms from 1 account

MT4 and MT5, both available for desktop, tablet and mobile devices

78.04% of retail investor accounts lose money when trading cfds with this provider.

You should consider whether you can afford to take the high risk of losing your money. Risk disclosure

Why choose XM?

There is a reason why over 3.5 million clients have chosen XM for trading forex and cfds on stocks

stock indices, commodities, metals and energies.

Licensed and regulated

Trading with XM means trading with a licensed and regulated broker.

Up to 30:1 leverage

XM offers its clients up to 30:1 leverage with negative balance protection and no changes in margin overnight or at weekends.

24-hour support

At XM you can enjoy 24/5 support in over 30 languages by live chat, email and phone.

Over 1000 instruments

XM offers trading in over 1000 instruments ranging from forex and cfds on stock indices, oil and gold.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

XM live chat

By clicking the "enter" button, you agree for your personal data provided via live chat to be processed by trading point of financial instruments limited, as per the company's privacy policy, which serves the purpose of you receiving assistance from our customer support department.

If you do not give your consent to the above, you may alternatively contact us via the members area or at support@xm.Com.

All incoming and outgoing telephone conversations, as well as other electronic communications (including chat messages or emails) between you and us will be recorded and stored for quality monitoring, training and regulatory purposes.

Please enter your contact information. If you already have an XM account, please state your account ID so that our support team can provide you with the best service possible.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

XM sign up bonus review south africa – revealed ( 2021 )

XM sign up bonus

A first time XM sign up bonus of $30 is offered by XM.

Traders who register a real account with XM are offered first time sign up bonus which is equivalent to that of a no deposit bonus.

The first time sign up is not subjected to any prior deposits and serves as a welcome bonus as well, and the $30 is automatically credited to the account of the trader. Although, traders should be aware that the deposit itself cannot be withdrawn.

Should traders make any profits on the bonus amount, the profits can be withdrawn at any time.

Traders should see this bonus as a start-up boost to start trading before investing their own capital, but traders should acknowledge that it might be lower than margin requirements on some trades.

The purpose of this bonus is to provide traders with a demo-account type of experience but with the added advantage that it is applied to a real account and it does not require any additional sign-up apart from real account registration.

This deposit is only available to new clients who have not previously registered a real account with XM, or whose information is not contained on XM’s data base in addition to the registering of a demo account not being eligible for this bonus.

In addition, traders who register a XM ultra low account will not be considered eligible either. Fortunately, XM has an array of other accounts that traders can register for that will be considered eligible.

In addition, XM also provides traders with a 100% deposit bonus of up to $500 along with an additional 20% deposit bonus, with a cumulative amount of maximum $4,500 or currency equivalent.

Brokers often offer these broker bonuses to new traders in an effort to draw in more customers in addition to encouraging trading activities. These bonuses are some of the best ways in which to assure traders that they will receive some cash back.

Bonuses such as these also serve as extra credit that traders can use to trade without risking their own funds and of which the profits, not the actual bonus, can be withdrawn.

This is an imperative notion for brokers as traders are more likely to register a real account with brokers that offer such bonuses as it helps increase the chance of gains without putting traders at more risk to lose their own capital.

Referral bonus

XM does not currently offer referral bonuses to new or existing traders who make use of the products and services offered by XM.

Referral bonuses are offered by brokers to traders in an attempt to draw in new clients and expand their customer base.

Often these types of bonuses have strict criteria that will have to be fulfilled before the trader can benefit from referring a friend or family member.

Some of the criteria includes, but is not limited to:

- The referral has to register a real account with the broker using a unique referral link so that the registration can be traced back to the trader.

- The referral bonus is only applicable should referrals register a real account as these bonuses are not available when using a demo account.

- A certain minimum deposit amount has to be made by the referral.

- The referral may be required to execute a certain number of trades on the new account before the trader becomes eligible to receive the referral bonus

Referral bonuses may also have a limited time in which they can be utilized by traders, perhaps in a given month that brokers see a decrease in activity and attempts to counter it by providing such bonuses.

Additional broker bonuses, promotions and rewards

XM offers trading bonuses to active traders and loyal customers through the XM loyalty program where traders are rewarded with special seasonal bonuses during specific calendar events and occasions.

In addition, XM provides traders with an additional 10-year anniversary promotion to the value of $1,000,000 where a random account will be chosen every month, providing traders with the chance of winning various prizes until 30 june 2021.

The lucky draw consists of a $80,000 prize pool and a total of 50 winners per month. To sign up for the draw, traders will have to adhere to the following criteria:

- The trader will have to be in possession of a MT4 or MT5 real account which has been validated through the relevant channels, and

- There must be a $500, or currency equivalent, account balance in the trader’s account.

There have already been numerous winners as follows:

- 1 winner of $10,000

- 1 winner of $8,000

- 1 winner of $7,000

- 1 winner of $6,000

- 1 winner of $4,000

- 10 winners of $2,000

- 15 winners of $1,000, and

- 20 winners of $200.

The funds that these traders have won are credited either in USD, or currency equivalent, to their XM MT 4 and/or MT5 live, and active, trading accounts.

Pros and cons

| PROS | CONS |

| 1. First time sign up bonus provided which serves as a welcome bonus and no deposit bonus | 1. No referral bonus offered |

| 2. Trading bonuses offered through XM loyalty program for active traders and loyal customers |

Conclusion

XM caters extensively and comprehensively for new traders who register a real account, existing traders, and loyal customers through its array of bonuses and rewards in addition with its competitive trading conditions.

These trading bonuses offer traders a chance to use the funds credited to their accounts as a boost for trading as the funds cannot be withdrawn, but the profit made from it can be withdrawn.

Brokers who offer such bonuses often see an influx in new traders registering for real accounts eligible for the bonus and it is the best way through which brokers can expand their client base in addition to increasing trading volumes.

Such bonuses, especially trading bonuses, ensure that there is constant trading volume, in addition to increases during times when these bonuses are active, and it is the best way through which loyal customers and active traders can be rewarded. XM offers some of the lowest spreads and fees.

ALL YOU NEED TO KNOW ABOUT XM 30$ BONUS

XM is one of the best forex brokers in the world and now they even offer an XM 30$ bonus for all new clients. Can you believe that? Now, you may be wondering how come XM gives you this promotion or what their conditions are. This article today will answer all your questions so that you can really understand this trading bonus.

What type of bonus is XM 30$ bonus?

Normally, there are three types of forex bonuses. They are welcome bonus, deposit bonus, and lot back bonus.

Welcome bonus, just like its name, is a bonus brokers give traders as a “thank you” for their registration at them. Traders usually use this bonus as a means to test the broker to see if they want to work for long term with this broker.

Deposit bonus is a sum of money offered to traders when they first make a deposit. The amount of this bonus is decided based on the total deposit the traders make. This is a way to encourage traders to deposit more in the first time.

Finally, lot back bonus is like a loyalty program. The procedure can be put simply as when you finish one trade, a rebate will be given to your account automatically from the broker. The more you trade, the more you get rebated. This bonus program encourages traders to trade more with that broker.

The XM 30$ bonus is a welcome bonus. Whenever there is a new client on the platform, XM will reward this new register with $30 for trading. This bonus is for first time sign-up only. Welcome bonus is actually very good for forex beginners. You’re new to forex, so you’re advised to not deposit too much at first, because more than 90% of new traders lose everything at the beginning. So with this extra $30, you have more than enough money to try trading forex. You can check the execution quality, the platform, the speed, spread and commission, the slippages, swaps, or requotes of XM without losing any of your own money. What a good deal for a beginner.

A quick notice: you must claim this bonus in 30 days since you open an account or the bonus will be unavailable.

Conditions for withdrawal

When you finish making money with this XM 30$ bonus, you will want to withdraw your profit, right? This is when the tricky part appears. Just like all other types of bonus and broker, the withdrawal conditions of this bonus is quite complicated. I will try to make it the most simple as possible.

The profit you make from this bonus can be withdrawn anytime. However, everytime you withdraw your funds, the amount of this bonus will be reduced 40%. Also, you have to withdraw at least 40% of your funds. For example, you make $200 from this XM 30$ bonus. Therefore, when you withdraw, you have to take at least $80 (40% of $200). Then, the amount of the bonus will be reduced $12 (40% of $30). So you have withdrawn, for instance, $80, and you have a total of $138 left in your account ($120 profit + $18 bonus).

How to get this XM 30$ bonus

You can easily acquire this bonus simply by following these steps:

- Open a real account at XM.

- Log in to your member area.

- Validate your account.

- There will be a button saying “claim your bonus” on the screen.

- Complete the SMS verification by following the instructions there.

Now what are you waiting for? Claim your XM 30$ bonus here.

Why should you get this bonus?

$30 is not much for trading. However, when you convert it to pip, it's 0.3 pip. So when you look at it the other way, this bonus is a great way to reduce your trading cost when you trade with XM. The normal XM spread is about 1 to 1.2 pips. With the 0.3-pip discount, you have cut your trading cost down to 0.7 - 0.9 pip, which is among the lowest spread in the market. So you can see that this bonus is not meant for trading. It is for cost reduction.

Other XM bonus programs

Right now, XM is having very good bonus programs that are super beneficial to traders:

- XM 15% welcome bonus: this is a welcome bonus program that reward you 15% of your first deposit. The maximum amount you can get rewarded is up to $500. More details here.

- XM loyalty program: as you trade, you will earn XM points which can be redeemed at any time for credit bonus rewards in the members area. In the members area you can also monitor your balance of XMP at any time, including the equivalent value of your XM points as credit bonus. The bonus adds funds to your trading account but it is intended for trading purposes only. The amount of bonus is a third of your total XM points. More details here.

Those 2 programs are just as good as the XM 30$ bonus program. You can obviously see that trading at XM can be very cheap thanks to all those bonus programs.

Mario draghi

Hey, I’m mario draghi. I’m a writer currently resided in thailand. For my forex experience, I have been working with brokers and trading for 5 years. Hope that you'll enjoy my articles about all forex-related matters.

South asian airlines are about to launch blockhain payment

South asian airlines are about to launch blockhain payment

XM sign up bonus review south africa – revealed ( 2021 )

XM sign up bonus

A first time XM sign up bonus of $30 is offered by XM.

Traders who register a real account with XM are offered first time sign up bonus which is equivalent to that of a no deposit bonus.

The first time sign up is not subjected to any prior deposits and serves as a welcome bonus as well, and the $30 is automatically credited to the account of the trader. Although, traders should be aware that the deposit itself cannot be withdrawn.

Should traders make any profits on the bonus amount, the profits can be withdrawn at any time.

Traders should see this bonus as a start-up boost to start trading before investing their own capital, but traders should acknowledge that it might be lower than margin requirements on some trades.

The purpose of this bonus is to provide traders with a demo-account type of experience but with the added advantage that it is applied to a real account and it does not require any additional sign-up apart from real account registration.

This deposit is only available to new clients who have not previously registered a real account with XM, or whose information is not contained on XM’s data base in addition to the registering of a demo account not being eligible for this bonus.

In addition, traders who register a XM ultra low account will not be considered eligible either. Fortunately, XM has an array of other accounts that traders can register for that will be considered eligible.

In addition, XM also provides traders with a 100% deposit bonus of up to $500 along with an additional 20% deposit bonus, with a cumulative amount of maximum $4,500 or currency equivalent.

Brokers often offer these broker bonuses to new traders in an effort to draw in more customers in addition to encouraging trading activities. These bonuses are some of the best ways in which to assure traders that they will receive some cash back.

Bonuses such as these also serve as extra credit that traders can use to trade without risking their own funds and of which the profits, not the actual bonus, can be withdrawn.

This is an imperative notion for brokers as traders are more likely to register a real account with brokers that offer such bonuses as it helps increase the chance of gains without putting traders at more risk to lose their own capital.

Referral bonus

XM does not currently offer referral bonuses to new or existing traders who make use of the products and services offered by XM.

Referral bonuses are offered by brokers to traders in an attempt to draw in new clients and expand their customer base.

Often these types of bonuses have strict criteria that will have to be fulfilled before the trader can benefit from referring a friend or family member.

Some of the criteria includes, but is not limited to:

- The referral has to register a real account with the broker using a unique referral link so that the registration can be traced back to the trader.

- The referral bonus is only applicable should referrals register a real account as these bonuses are not available when using a demo account.

- A certain minimum deposit amount has to be made by the referral.

- The referral may be required to execute a certain number of trades on the new account before the trader becomes eligible to receive the referral bonus

Referral bonuses may also have a limited time in which they can be utilized by traders, perhaps in a given month that brokers see a decrease in activity and attempts to counter it by providing such bonuses.

Additional broker bonuses, promotions and rewards

XM offers trading bonuses to active traders and loyal customers through the XM loyalty program where traders are rewarded with special seasonal bonuses during specific calendar events and occasions.

In addition, XM provides traders with an additional 10-year anniversary promotion to the value of $1,000,000 where a random account will be chosen every month, providing traders with the chance of winning various prizes until 30 june 2021.

The lucky draw consists of a $80,000 prize pool and a total of 50 winners per month. To sign up for the draw, traders will have to adhere to the following criteria:

- The trader will have to be in possession of a MT4 or MT5 real account which has been validated through the relevant channels, and

- There must be a $500, or currency equivalent, account balance in the trader’s account.

There have already been numerous winners as follows:

- 1 winner of $10,000

- 1 winner of $8,000

- 1 winner of $7,000

- 1 winner of $6,000

- 1 winner of $4,000

- 10 winners of $2,000

- 15 winners of $1,000, and

- 20 winners of $200.

The funds that these traders have won are credited either in USD, or currency equivalent, to their XM MT 4 and/or MT5 live, and active, trading accounts.

Pros and cons

| PROS | CONS |

| 1. First time sign up bonus provided which serves as a welcome bonus and no deposit bonus | 1. No referral bonus offered |

| 2. Trading bonuses offered through XM loyalty program for active traders and loyal customers |

Conclusion

XM caters extensively and comprehensively for new traders who register a real account, existing traders, and loyal customers through its array of bonuses and rewards in addition with its competitive trading conditions.

These trading bonuses offer traders a chance to use the funds credited to their accounts as a boost for trading as the funds cannot be withdrawn, but the profit made from it can be withdrawn.

Brokers who offer such bonuses often see an influx in new traders registering for real accounts eligible for the bonus and it is the best way through which brokers can expand their client base in addition to increasing trading volumes.

Such bonuses, especially trading bonuses, ensure that there is constant trading volume, in addition to increases during times when these bonuses are active, and it is the best way through which loyal customers and active traders can be rewarded. XM offers some of the lowest spreads and fees.

XM review and tutorial 2021

XM.Com offer a range of account types and a low minimum deposit to appeal to all levels of trader. With 1000+ markets and low spreads they offer a great service.

XM.Com deliver ultra low spreads across a huge range of forex markets. Flexible lot sizes, and micro and XM zero accounts accommodate every level of trader.

XM review; touted as the next generation broker for online forex and commodity trading, XM global webtrade is suitable for beginner and seasoned traders alike. Traders can get started with the trading software real account, or test the waters with a demo account platform with $100,000USD of virtual currency.

Highlights of this particular broker service include auto trading, no hidden fees or commissions and fast order executions, with 99.35% taking place in under 1 second.

Company details

XM group (XM) is a group of regulated online brokers. Trading point of financial instruments was established in 2009 and is regulated by the cyprus securities and exchange commission (cysec 120/10).

Trading point of financial instruments pty ltd was established in 2015 and is regulated by the australian securities and investments commission (ASIC 443670).

XM global was established in 2017 and is regulated by the international financial services commission (000261/106).

The platform boasts over 1.5 million clients with traders in 196 countries. The XM ethos is all about being big, fair and human. The company prides itself on things like excellent customer service and a personalised approach for every client, no matter their investment goals.

XM trading platform

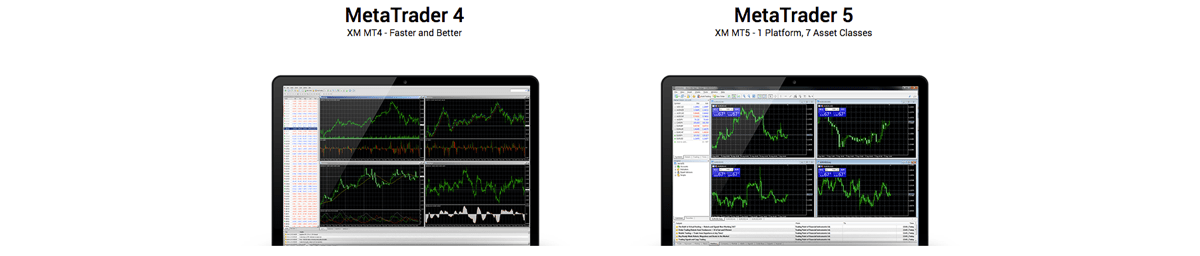

XM offers 2 trading platforms which are accessible from both real and demo accounts. The multi-award winning metatrader 4 is predominantly a forex trading platform that supports stop, limit, market and trailing orders.

The metatrader 5 platform is a multi-asset trading platform which also offers access to stocks, stock indices and precious metals. Both platforms are available on apple and android devices, which makes for a smooth and easy-to-use mobile trading experience.

The trading area offers additional, optional tools, such as economic calendar or trade volume stats.

Assets / markets

This broker has more than 1000 financial instruments which can be traded on the MT4/MT5 platforms and this includes forex trading, stocks cfds, commodities cfds, equity indices cfds, precious metals cfds and energies cfds.

Forex trading is available on over 55 pairs, including the major USD, GBP, EUR and JPY pairs.

XM does not offer binary options or futures.

Spreads & commission

Spreads vary depending on the kind of account opened. It’s possible to open a micro account, standard account and XM zero account. The minimum spread across all accounts is 0.1 pips, and the average spread for a major pair such as EUR/USD is 0.1 pips.

XM operates a strict “no hidden fees or commission” policy. As such, commission is only given for XM zero accounts. XM covers all transfer fees and same-day withdrawals are guaranteed.

Leverage

Depending on the instrument, the leverage can range from 2:1 to 30:1. This is completely flexible and XM offers its clients the chance to manage their own leverage risk. Margin requirements remain constant throughout the week and never widen at weekends or at night.

This leverage applies to clients registered under the EU regulated entity of the group.

XM mobile apps

XM is available on a number of android and apple devices, including apple iphone, apple ipad and android tablets and android phones. Login is super-easy and can be done via fingerprint. You can download their apps from the apple app store or the google play store.

They are both fully functional and allow for monitoring and trading on-the-go. The desktop platforms for PC and mac both support one-click trading.

Payment methods

In line with conventional KYC regulations, users need to provide a colour copy of an official identification document such as a passport or a driver’s license. They also need to provide a recent utility bill dated within the last three months as proof of address.

Once registered, the minimum deposit amount is $5 for micro and standard accounts, while zero accounts require a minimum deposit of $100.

Deposits can be made using most major credit cards, electronic payment methods, wire transfer, local bank transfer and more.

Deposits can be made in any currency and it will be automatically converted into the currency you select as your base currency when opening the account.

All withdrawals are processed in 24 hours and there are no fees to take your money out of your ewallet.

Demo account

XM excels in its demo account offering. Users can set up a demo account with just a few details and then get trading with a virtual balance of $100,000USD. The XM demo account is unique in that it offers exactly the same trading conditions as the real thing.

There are no time limits on how long you can use your demo account.

Bonus deals and promotions

XM also offers a free VPS (virtual private server) service to help increase the speed of trades. This VPS is accessible from anywhere and available 24/7. They claim to eliminate downtime and are available across the globe.

XM are also offering commission and fee free withdrawals and deposits.

As an EU regulated brand, XM comply with the ESMA ban on bonuses, and the $30 deposit bonus is no longer available to EU traders.

Regulation and licensing

As noted above, XM group has a range of brands covered by different regulators.

XM group (XM) is a group of regulated online brokers. Trading point of financial instruments was established in 2009 and is regulated by the cyprus securities and exchange commission (cysec 120/10).

Trading point of financial instruments pty ltd was established in 2015 and is regulated by the australian securities and investments commission (ASIC 443670).

XM global was established in 2017 and is regulated by the international financial services commission (000261/106).

Additional features

One of the biggest perks available on the XM platform is the wealth of training and educational materials available. The platform hosts regular webinars aimed at newcomers and seasoned professionals alike.

The platform is inherently social, encouraging users to learn from their team of instructors. The company also published research and technical analysis.

XM account types

There are four levels of trading account, micro, standard and zero. All accounts allow up to 200 open/pending positions per client.

- Micro accounts: micro accounts can use USD, EUR, GBP, CHF, AUD, JPY, HUF and PLN as the base currency and can get started with a minimum deposit of $5USD. 1 micro lot is 1,000 units of the base currency.

- Ultra low accounts: XM ultra low accounts, can use EUR, USD, GBP, AUD, ZAR, SGD as the base currency and traders will require a minimum deposit of $50 USD. 1 standard ultra lot is 100,000 units of the chosen base currency, whereas, 1 micro ultra lot is 1,000 units of the base currency. XM ultra low accounts are not applicable to all entities of the group.

- Standard: standard accounts can use USD, EUR, GBP, CHF, AUD, JPY, HUF and PLN as the base currency and traders can get started with just $5USD. 1 standard lot is 100,000 units of the chosen base currency.

- Zero accounts: zero accounts can use USD, JPY and EUR as the base currency and traders will require a minimum deposit of $10USD. Like the standard account, 1 standard lot is 100,000 units of the chosen base currency.

Benefits

XM offers a full-service education package on forex, ideal for those making their first steps into trading.

However, this isn’t at the expense of the more seasoned professional, who also have access to expert analysis and unparalleled tracking tools. As a company that prides itself on solid customer service, their users are well-served with support available in many different languages.

Drawbacks

While the support may be strong, some users dislike that customer support is only available monday to friday. Another disadvantage is the lack of diversity between the different account types makes for a less personalised feel.

Other brokers offer more a distinct offering in their accounts, but the micro, standard and zero accounts are almost identical. And finally, paypal deposits are not currently supported, which can be problematic for some.

Traders from certain regions are also forbidden to open an account due to licensing laws, these include canada and the united states.

Trading hours

In line with worldwide forex market hours, XM is available 24 hours a day. For phone trading, the XM trading hours are sunday 22:05 GMT through to friday at 21:50 GMT.

Contact details / customer support

The easiest way to contact XM is through their live chat feature found on the contact page of their website.

You can also email support on: support@xm.Com

Or call on +357 25029933.

Safety and security

There are no obvious security concerns with the website. Users are required to confirm their email address in order to open a demo account but signing up for email updates is not a requirement. In order to open a trading account, identification documents are required.

According to the company privacy policy, XM has organisational procedures in place to ensure that personal data is kept secure.

Overall verdict

XM offers a comprehensive broker service to traders of all levels. Whether you are just starting out and learning the ropes, or if you’re a seasoned trader looking for a reliable and efficient platform, XM is a solid choice.

Despite the shortcomings with the different account options, the platform is easy to use and simple to navigate.

Accepted countries

XM accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use XM from united states, canada, israel, iran, portugal, spain.

Betfair cross matching (XM) – explained

Nobody will remember now, but a very long time ago in a galaxy far far away.

Well the first big was accurate at least, but there was a time when cross matching on betfair didn’t exist. Cross matching is often truncated into the intitials XM. Just to confuse things you also have cross market, cross matching so you can also have XMXM, a concept we will touch on later in the blog.

Betfair introduced cross matching in 2008. I remember it very well because, overnight, a number of bet angel users started reporting that some of their strategies had started to perform badly and they wondered why. So a bit of detective work led us to the reason and soon after, betfair formally announced the change.

So what is cross matching, what is the background to it and what impact does it have on a betting market?

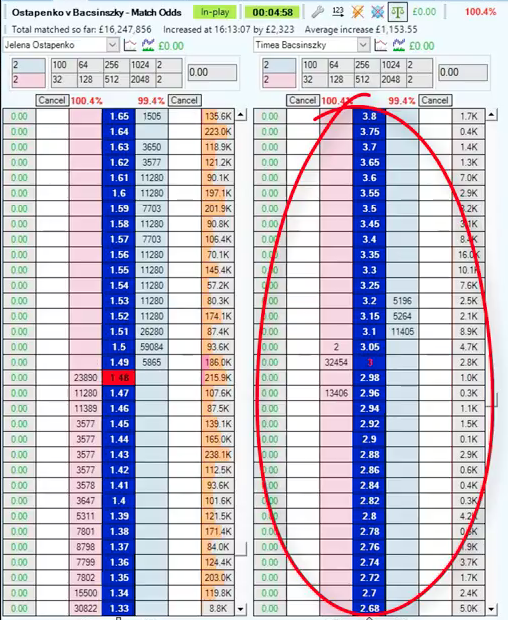

What is cross matching (XM)?

When this concept was introduced on the betfair exchange it wasn’t available via the API. So at bet angel we had to work it all out and put it in bet angel as an option. That option still exists.

So if you want to understand the concept and see it in action, you access the virtual bet display via the settings menu. You can toggle it on and off while looking at a ladder, for example, to understand its impact.

Cross matching, or virtual bets as they are often described on the betfair API documentation, are odds on offer in the market that were not offered by any particular individual.

If you are new to this concept, you may wonder who is actually offering these bets into the betfair betting exchange, the answer is the betfair cross matcher. Betfair themselves are putting these offers into the market.

The concept is that if you offer a bet on one side or one selection within a market then the same bet gets offered at reciprocal odds by betfair elsewhere. If there was a two runner horse race with both horses at decimal odds of 2.00 then backing one runner at these odds is effectively the same as laying the other runner with the at the same odds.

So what the betfair cross matcher does, in essence. Is look at what bet you have placed on the betfair betting exchange and then take that unmatched bet and place it at reciprocal points elsewhere in the market. In layman’s terms, it duplicates your bet and puts it elsewhere. You are probably not even aware that it is happening.

I explained the concept about cross matching in a video here, but more specifically you can see it live on a tennis match on this video. In the illustration you see below all the unmatched bets on the right ladder in this tennis match, are completely virtual, they don’t exist. Watch the video if you want to see that for yourself.

Why was it introduced?

The concept that betfair posited was that it would help betfair customers, by increasing liquidity. But I’ve always been pretty suspicious of it. You will learn why in a bit, but fundamentally speaking there was nothing wrong with the way the market was working before it was introduced.

Sometimes a large order would hit the market and send a price way off its touch price, but the market would eventually soak it up that order and find it’s correct price. After cross matching the market always ‘hugged’ a 100% book and therefore a large order wouldn’t move the price, just spike in the direction of the order and send everything else out in the opposite direction. Not a true reflection of the market at all.

However, I knew from betfair’s conference calls that creating a more competitive market where neither side on the exchage dominates each other leads to a higher gross yield for betfair. If nobody wins too much, then betfair wins more. I always felt this was a stronger case for implementation.

Cross matching controversy

Shortly after cross-matching was introduced it hit some controversy.

Of course, a lot of people were upset at the fact that the strategies didn’t seem to work the way that they should do. But the key issue surrounding its controversy was two fold. The first, it was positioned that it would be beneficial to liquidity.

But when it was later introduced on horse racing. I noticed that the fill rate had changed. I wasn’t getting my orders matched as frequently as I used to.

The upshot was that I had to adjust what I was doing and had to re-invent some strategies to survive the change. When you are used to a certain type of activity and it shifts, if you don’t know why you may be headed for the poorhouse.

That was nothing however compared to the fury that enveloped various communities when it turned out that betfair was not calculating reciprocal stakes in the same manner that you would expect given reciprocal odds. This meant that there was a small rounding error, in betfair’s favour of course. That meant for each bit of cross-matching that they did, they were getting a small amount of margin.

It was tricky to quantify exactly how much was being taken off the table, but obviously wasn’t something that was expected or wanted. Needless to say, this ‘error’ wasn’t accepted by the wider betfair community, who suddenly had reason to question the incentive for introducing XM.

How much did betfair make from cross matching?

Before long, betfair terms were amended, see further down, to include the process of cross matching. It also acknowledged that there was the possibility of rounding in their favour. This brought up the question of just how much was betfair making from cross matching and was there a financial incentive for them?

Of course, getting more bets matched would generate more commission and therefore there was a direct incentive. But it was the residual amount that was what most people were interested in.

Long since forgotten was that betfair set up a new company specfically to be the counter party for this ‘service’. The would give us an answer as they would have to publish accounts publically to show how the company performaned. The name of the company was listed in the terms alongside an explanation as to why betfair was acting as counter party to some bets.

The first set of accounts of betfair general betting limited showed a profit of £272k for the year ending 2008. This rose to £1.2m the year after then rose to £1.7m in 2010. The betfair exchange turns over tens of billions a year, so even a tiny rounding error would yield substantial amounts. It reminded me of that sequence in superman the movie, where a simple clerk also finds a rounding error.

It’s difficult to completely trace or assess the amount earned by betfair through these rounding errors as there is nowhere that betfair provides this data. But the thing that always concerned me is that there was no incentive to stop them or make them more efficient. The interesting thing was that in australian the licensing body demanded that these amounts be returned to customers.

This was done a broad basis and not by turnover. I should have received a much greater rebate because of my turnover. But no doubt the deal that was done which meant that it was easier for betfair just to divided up a giant pot than assignment it accurately. When betfair sold their interest in australia, that process stopped.

Cross market cross matching (XMXM)

By 2014 betfair had expanded cross matching to a variety of sports, including the tricky horse racing markets. They went further in july of that year to introduce the concept of cross market, cross matching.

This meant that not only would your virtual bet appear on the same market. But if a parallel related market existed, think football here, they it also appeared in that market. So, as betfair would put it, that means that you get more chances to get matched. Nothing to do with an even wider margin of error on the round at all of course!

This added another bit of distortion to the market. This is why we called the position in queue feature on bet angel, the ‘estimated’ position in queue. We have worked hard to make it as accurate as possible and uniquely include cross matching in the calculation. But this only works on the primary market.

Cross matching can get confusing!

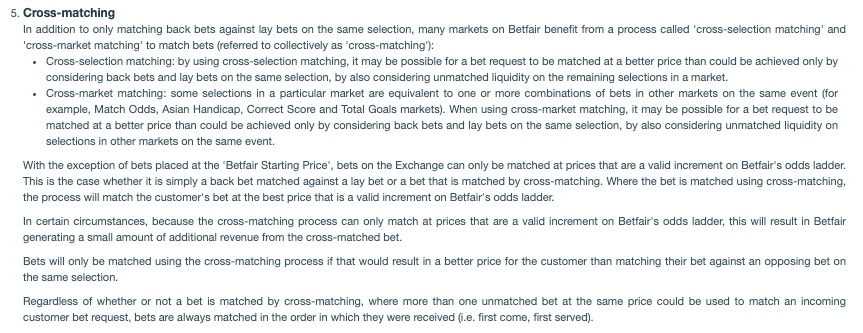

But to round off this blog, here is a detailed description of exactly how cross matching works. You should find it useful to understand exactlly how it could influence your betting or trading strategy: –

A detailed description of the cross matching process

If you visit betfair terms and conditions it does lay out the cross matching process. But’s it’s not particulary helpful in terms of working out exactly how it functions: –

However, betfair kindly wrote to me recently to clarify some key points around cross-matching. This explains how cross matching works in general, but also how orders are specifically matched.

It’s easier to focus on a two runner market to explain cross matching as it gets more complicated when you go above this value.

Two runner cross-matching

Conceptually cross matching is very simple. If you want to back a selection in a 2-runner market, there are two ways that we can get your bet matched: against a layer of that same selection, or with a backer of the other selection. For example, backing djokovic at 1.5 is identical to laying murray at 3.0.

When you place a bet, instead of considering just one of the sets of unmatched bets with which betfair could match you, we consider both. If you place a bet that isn’t immediately matched, we advertise it to other customers both ways that we could match it.

There are two ways we could match you, so we display both on the site to give you the best chance of getting matched. These bets can be matched in exactly the same way as any other bet.

How bets are matched

Betfair confirmed to me that when bets arrive on the exchange they will be matched in the following manner: –

(1) price

(2) where prices are the same, lay bets against back bets in preference to cross matches

(3) by bet ID (i.E. In time order)

In other words, every time you place a bet we look at the regular match (back vs. Lay), and cross-matching only comes into play if that would get you a better price than a regular match (or if it matches a bet that would otherwise remain unmatched).

Reciprocal pricing

To answer what happens at odds which don’t have a direct reciprocal on the odds ladder, an example would be useful.

If you attempt to back djokovic at 1.98 for £50 and your bet is initially unmatched, then we can show that to other customers in two different ways: £50 available to lay djokovic at 1.98 of course, but we could also show it as available for murray backers.

2.02 is the best price on our ladder that we could offer, for a stake of £49.01. So we could match a djokovic backer for £50 at 1.98 with a djokovic layer for £50 at 1.98, or we could match a djokovic backer for £50 at 1.98 with a murray backer for £49.01 at 2.02.

If you go back to the matching order answer above, you’ll see that matching lay bets against back bets in preference to cross matches means that if we have the choice of a cross-match that makes us a penny or a regular match that doesn’t, we always do the latter.

7 REASONS TO TRADE AT XM. XM REVIEW 2021

Having tried out tons of different brokers over my years of trading, I find that none of them is even close to XM in terms of services and trading conditions. It’s actually quite surprising that not that much traders know how great XM services and trading conditions are. That is why today I will be writing this article to give you a throughout XM review – one of the best forex brokers of 2021.

Founded in 2009, XM now has over 1,500,000 clients from 196 countries which is an impressive enough number for us to trust. XM has also personally visited over 120 countries to meet with their clients and partners and hosted hundreds of seminars around the world to educate traders, enabling them to make better trading decisions. Below, I’m going to review XM based on many different criteria such as regulations, trading conditions and trading costs, trading platform , paying system and types of accounts.

Regulations of XM review

Regulation, commonly, is one of the most important things in forex market, which could indicate how reliable a broker is. Moreover, it is not easy to obtain a license of the regulation. Therefore, the brokers having the license are often trustworthy and reliable.

There are now still discussions on regulations between US&UK brokers and other brokers in the forex market. Most traders have chosen US&UK regulated brokers because they believe in US/UK financial management system. As a result, US and UK regulations are considered very good. Brokers which can acquire one of these regulations often have the best trading platforms, techniques, financial health and management systems… accordingly, XM broker is one of the best regulated brokers as it has a regulation from UK, which is FCA . It also obtains cysec from cyprus, ASIC from australia and FSB from south africa in order to serve the traders in these areas. With these regulations, XM is the most reliable broker which could protect traders in many countries from all over the world. Therefore, I can say that you can trust XM.

CLICK TO SEE XM REGULATIONS.

Trading costs and trading benefits of XM review

Trading cost

Cost of transactions is one of the most considerations of traders while joining into the forex market. Apparently, traders often prefer the brokers which have reasonable and low cost of transactions, especially scalpers who have many transactions at a time.

Accordingly, XM has the low spreads like FXCM and forex.Com, US and UK brokers. The spread is 1.7 pip for a EUR/USD for trading regular accounts. And 6$ commission for trading ECN account (other brokers charge around $7 for trading ECN account). Moreover, XM has the loyalty program. It will rebate an amount of money to your account automatically when you finish a lot/transaction. The rebated amount depends on your trading currencies, account types and trading time. This program is mostly preferred by the professional traders as it could minimize the transaction cost effectively.

Trading benefits

In forex system, XM lots back $3 (0.3 pip) to 10$ (1 pip) for each completed transaction and the rebated amount will increase by time for each trading lot. After the lot-back bonus, cost of transactions is now lower than FXCM and forex.Com brokers and spreads are decreased down to only 1 to 1.4 pips.

Moreover, XM also has the deposit bonus, which allows you to get money depending on how much you deposit it. This deposit bonus program can reduce your trading costs even more. You can get up to $5000 from their deposit bonus program, with the maximum deposit rate being 100%.

In short, it can be said that the original spread and commission are similar with other brokers. However, in fact, the actual cost is much lower after many completed transactions thanks to the lot-back bonuses and the deposit bonus. And there you have it, a broker with high-quality regulation (UK) yet has low transaction cost.

CLICK TO SEE XM SPREADS.

XM markets is one of the best in europe

According to finance magnates, brokers now have to compete with each other to build a good percentage of customers with good profit/loss ratio to support marketing and advertisement. To do this, brokers must provide many good resources for customers, while improving customer training. Brokers who use tricks to market, attract new customers, ignorant customers . Are currently having difficulty operating in europe because of the new ESMA law. Based on a survey conducted by finance magnates, XM markets is currently in the top 5 brokers with most profited customers in europe. Clients of XM markets lose money less than hundreds of other brokers in the world and they certainly make more profits.

Trading platforms of XM review

XM has the best up-to-date trading platform with automatic transfer system. Their trading platform can be used either on PC, smartphone or tablet and still doesn’t lose it performance. Personally, I find XM trading platform to be generally great with nothing to be complaining about. XM simply offers you all the tools that you’d need in order to make profits.

Payment system of XM review

In common, traders are usually not concerned about the payment system. This is a rookie mistake but understandable. They can only realize the importance of the payment system when they start depositing or withdrawing their win money. Most trusted forex brokers are overseas so when they transfer money, it can cost you some money to transfer. Some countries are very strict in order to transfer money over sea. It's even illegal to transfer money to forex brokers. Some payment methods are costly. In asia, if you make payment over sea by credit card, they will charge you around 1.7 - 4% in total. So, that why traders must choose brokers which have local payment methods to save deposit/withdrawal cost.

A good payment system will be really helpful for traders and it should be fast, free, and unlimited. These standards below are also the most common of the good payment systems:

- Fast deposit and withdrawal

- Local payment supported

- Low or even free-of-charge fee for deposit or withdrawal

- High minimum withdrawal limitations

It could be said in person that XM broker has the best payment system in asian countries such as china, thailand, indonesia. They allow traders to deposit through many free different international payment methods like: credit/debit cards, neteller, skrill, webmoney, perfectmoney, bitcoin, alipay, nganluong wallet. They have local banks such as: bank central asia, bank mandiri, bank negara indonesia, bank CIMB NIAGA, bank rakyat (indonesia), bangkok bank, bank of ayudhya, kasikorn bank, krung thai bank, siam commercial bank, kbank mobile banking (thailand).

Customer support of XM review

BRKV - needless to say, customer support is among one of the most important criteria for choosing a broker. It is obvious that the field of forex is very complicated, so traders will need as much help as possible. From my experience, there is nothing to complain about XM’s customer services since it’s been a smooth journey for me with no technical errors or any discomfort. If your native language isn’t english, it shouldn’t really be a problem for you as XM offers supports for well over 30 languages. Languages such as thai, chinese, indonesian, vietnamese, etc. Are always supported 24/7 and those countries also have local banking supports as well.

CLICK HERE XM OFFICES.

Account types of XM review

There are currently 3 account types offered by XM: micro, standard and zero, each designed to different trading needs. Micro account is always popular among new traders and beginners. Standard account is more suitable for regular uses and zero account is specifically for experts only.

XM micro account

The micro account is suitable for beginners with commission-free and the low spread . The minimum deposit is just $5, but the leverage is up to 1:888, which is relatively high. All accounts allow 200 orders at a time, and pending positions are included, with the negative balance protection from XM.

Check XM micro account here.

XM standard account

The standard account is for the experienced traders. The condition is similar to the micro account, but there are still notable differences: the offered contract size is a hundred time bigger - 100,000 for 1 lot. The minimum trading lots are equal for both MT platforms, and the lot restriction per ticket is 50 - a half compared to the micro account.

Check XM standard account here.

XM ultra low account

XM’s newest account, the ultra low account, is the total game changer. It offers trader the lowest spreads ever in XM (which is 0.7 pip) and even no commission. The base currency options are EUR, USD, GBP, AUD, ZAR, and SGD. You can choose the contract size as both micro and standard account. The highest leverage is 1:888.

Check XM ultra low account here.

There is also the XM islamic account for clients who follow the muslim faith. They are the free-swap type of account for islam traders.

Check XM islamic account here.

XM trading assets

Sometimes, people don't just trade currency pairs. When the market is too volatile because of big news or important events, you shouldn't trade forex. As a result, traders will look for other trading assets. A good forex broker must be able to provide a wide range of trading products for their clients. Let's take a look at all trading assets of XM:

- 50+ currency pairs

- Stock cfds

- Commodities such as cocoa, coffee, soy beans, or wheat.

- Equity indices

- Precious metals: gold and silver

- Energies

- Shares

XM trading advices

All in all, it’s in my opinion that XM is a great broker that should be recognized more. At first, their trading conditions seem to be just as good as the other US/UK brokers. But they also offer many different and beneficial bonus programs to help you reduce your trading costs. Together with other great features, they are surely one of the top best forex brokers . Moreover, XM has been around the forex market since 2009 and still, they haven’t got caught up in any shady business rumors. Their customers are always satisfied with their services and trading conditions and have no reason to ever leave their service. I myself am a long-time customer of XM as well so I can safely say that you can’t really go wrong trading with XM. In case any of you are still confused, I have a little advice below that are based on my experiences and time with XM broker:

- Micro account is a great trading environment if you want to learn more about the forex market.

- Cryptocurrency trading conditions are the best. Take advantage of it.

- XM should support payments via your local bank so if your local bank is supported, you should always utilize it since it doesn’t cost any fee.

- Day time spread in XM is always lower than night time’s spread. Thus, trading in daytime seems like a more sensible decision.

XM trading experience

Having traded forex for 5 years now and 2 years of that with XM, I think I would like to share my XM trading experience. XM is a great broker. It is certainly reliable, just as I mentioned before. What I find most wonderful about XM is that they have really low prices. With the ultra low account, you can easily cut down your trading cost and keep your trades cheap. Moreover, XM hostes great educational seminars. I attended some, actually. They can help you so much in forex trading.

Fanara filippo

Hey, I’m fanara filippo. I’m the founder of this site. I'm currently living in bangkok, thailand. I have been trading forex for more than 5 years. You can read my articles about the best forex brokers on this page. Let’s review brokers today.

South asian airlines are about to launch blockhain payment

South asian airlines are about to launch blockhain payment

XM no deposit bonus

Platform

Min. Volume

Action

Forex trading is one of the most multifaceted and complex forms of financial activity in the world. It involves analyzing a bunch of asset price movements, economic and political developments, volatility channels, and whatnot. In short, you have to be constantly aware of various market forces to never miss the chance.

One of the ways the brokers try to make this complexity a bit more bearable is by offering different bonus promotions. Whether it’s deposit bonuses, refer-a-friend bonuses, or no deposit bonuses, the main goal with these promotions is to help you take your trading game to the next level.

With that being said, however, you need to make sure that you’re getting the service from the most trustworthy broker possible. Otherwise, its bonus will be yet another lure that attracts you and leads you to your eventual demise.

XM forex broker has already proven that it is one of the best choices for a south african trader. Besides that, they are one of the only brokers that offer a no deposit bonus for their customers. The brokerage offers trading on the popular metatrader 4 and metatrader 5 platforms with their free XM no deposit bonus of 30 USD (420 ZAR). The beauty of the offers is the fact that you do not have to deposit anything. What this means is that as soon as you sign up you are immediately eligible for that 420 ZAR. This is one of the best ways to start off in forex trading as it lets you taste the market, without having to pay your own money.

In the following review of XM no deposit bonus, our team of expert reviewers at topforexbrokers will help you understand what makes this bonus so unique, as well as trustworthy.

XM no deposit bonus review

The registration for the bonus is very easy. The only thing you will need to indicate is your email and phone number. The number will not be used for those pesky telemarketing campaigns, and will only serve as a confirmation method when utilizing the broker’s feature. The XM no deposit bonus is very fast to be credited. The moment you apply for it the process begins and could last 24 hours tops, however it usually takes no more than 30 minutes. After those 30 minutes, you will get your XM bonus account and will be ready to start trading without hassle.

To give you a more detailed description of the registration process for XM no deposit bonus, here’s the list of steps you need to take:

- Open a live trading account at XM – before anything else, you need a live account to be eligible for the no deposit bonus at XM. And as our XM no deposit bonus review shows, it literally takes just a couple of minutes to set up that account with this broker. You need to provide your basic details, such as your full name, date and place of birth, residence address, and employment details for the KYC procedure. After that, you need to verify that information by uploading your national ID/passport/driver’s license and bank statement/utility bill. Once that’s done too, you can go ahead and apply for the no deposit bonus itself.

- After you create your very-first account at XM, you need to head over to the member’s area where you need to opt for the no deposit bonus offered by XM.

- Then you need to verify your claim. You can do this either by the SMS or voice verification. And once that’s done too, you’re pretty much good to go; your $30 XM no deposit bonus is ready to be used in your forex trading endeavors.

XM trading platforms

Although there is software that is superior to the MT4 and MT5, we still believe that these two are some of the best available ones still. Sure they may be a bit outdated but they get the job done, and there is not too much you can improve a trading software with. The simple design of the software that XM forex broker uses is definitely a very big plus to the whole experience.

The best thing about the whole ordeal is that XM understands the hectic lifestyle of today’s society, therefore they also offer an option to trade on your smartphone.

XM no deposit bonus withdrawals

The fact is that the same policy is applied to the XM no deposit withdrawals as to their regular accounts. As our review of XM no deposit bonus shows, there are no related fees, everything you make is pure profit and can be withdrawn. However, there is one setback, which is pretty much the industry standard. You cannot withdraw the bonus or the profits until you reach a certain amount of trades. For example, the broker may require that for the $30 bonus you would have to make at least $5,000 ( 70,000 ZAR) trades. This is no setback, however, as over time, you will learn enough and use the leverage, by which point reaching that mark will not be hard at all.

XM no deposit bonus guide

As already mentioned the XM bonus is quite easy to get. Over 1.5 million of its users have the opportunity to utilize it, this should already give you an idea about the size of this brokerage. Now with all of the reassurance about the forex broker, let’s dive into the detailed guide on how to get the bonus.

- Go to the XM website, choose south africa and then click on the green button that says “open an account”;

- Fill out all of the personal information, no need to worry, all of that info will be safely encrypted and stored;

- Choose which software you would like to use, it can only be either MT4 or MT5;

- Choose an account type, you can find more detailed info about the accounts in our XM review;

- Confirm all of your emails, log-in your account and apply for the bonus after filling in the payment methods, this is where all of your profits will go;

- Wait for 30 minutes to an hour and your bonus will be transferred;

- Start trading;

As you can see from our XM no deposit bonus review, this process is extremely simplified, therefore there are no complications with it. The XM no deposit bonus is probably one of the easiest to get out of all the brokers so far.

So you don’t deposit anything?

That’s right! You have already noticed that there was no segment dedicated as to how you deposit. Well, you don’t have to, it’s indicated in the name, XM no deposit bonus. You may think that this is a terrible business model, but in all honesty, this bonus is what got most of the customers to remain or even find XM. There are also other types of bonuses to go around, such as the XM loyalty deposit bonus and the XM deposit bonus, but that is a story for another day.

The reality is that the funds that are given to you when you register, is solely covered by the company. The only thing you need to know is that you cannot withdraw that 420 ZAR, you will have to wait until you have made at least some kind of profits before you are eligible.

Naturally, making your millions with just 420 ZAR is going to be hard, so don’t expect too much very quickly. All I can suggest is that you keep at it, work your way up and if need be, boost your portfolio with a deposit once you get acquainted with the platform.

It’s also important to note that XM is fully regulated in south africa, so no matter what your funds will be protected by the FSCA. So what’s holding you back? The free XM bonus may not be here forever.

Help to buy isas explained

You can no longer open a new help to buy isa, but existing account-holders can continue to save towards buying their first home and earn a bonus from the government.

What is a help to buy isa?

Help to buy isas are savings accounts which allow first-time buyers to save for a mortgage deposit and then claim a government bonus when they buy their first home.

As with other isas, any savings deposited in a help to buy isa aren't taxed.

For every £200 you save, the government will pay you a £50 bonus towards the purchase price of a property. This means the government will effectively give you a 25% top-up on savings of up to £12,000, so you could earn a maximum tax-free bonus of £3,000.

The help to buy isa scheme has now closed to new applicants. Savers with existing help to buy isas can continue to use them (and benefit from the 25% bonus) until december 2030.

Video: help to buy isas explained

Watch our short video below to find out how help to buy isas work, and who is eligible to open one.

How much can I pay into a help to buy isa?

You can pay £200 per calendar month into your isa. When you first open the account, you're allowed to make an additional contribution of £1,000, meaning you can save £1,200 in the first month.

You can withdraw money if you need to, but your deposit allowance won't change. This means that if you contribute £200 at the start of the month and then withdraw it (or some of it), you won't be able to pay anything else in until the next calendar month.

As well as the government contribution, cash in a help to buy isa will earn interest from the bank in the same way as it would in any other isa.

This interest will count towards the balance the government bonus is based on.

Who can use a help to buy isa?

Any UK resident can have a help to buy isa - but to qualify for the bonus, you need to:

- Use the money to buy your first home; and

- Buy a home costing a maximum of £250,000, or £450,000 in london.

Unlike help to buy equity loans, the help to buy isa isn't limited to those buying new-build homes.

The government bonus will only be paid when you buy a property, though, so you won’t get the 25% top-up if you use the money for something else.

If you're saving up to buy a house with another person, you can both open separate help to buy isas, meaning you could potentially get £6,000 extra from the government.

If the person you're buying with is not a first-time buyer, you can open an account and will still qualify for the government bonus on your part of the deposit, but they won't be able to do so for their share.

The property you're buying must be mortgaged in order to qualify for the government bonus.

Help to buy isa account holders can take out any kind of residential mortgage (but not a buy-to-let mortgage) and you don't have to get your mortgage from the bank you hold your isa with.

How does the bonus get paid?

If you've saved up for your mortgage deposit using a help to buy isa and are ready to buy a property, whatever you do, don't just withdraw the money - there's a process you need to follow in order to claim your bonus:

Step 1: tell the bank that you're ready to buy and would like to close the account. You'll then receive a closing letter from the isa manager.

Step 2: give the closing letter to your property solicitor or conveyancer. They will use the letter to apply for your government bonus.

Step 3: the bonus will be transferred to your solicitor.

Step 4: your solicitor will complete the purchase of your home using the full bonus amount in addition to your deposit.

The bonus will be calculated based on the total amount of money in your help to buy isa at the time of closing, including any interest you've earned from the bank.

Not all of your deposit needs to be held in your help to buy isa, just the amount that you want to be taken into account when the bonus is calculated.

You can only use your help to buy isa bonus for the purchase of the property itself, not other costs such as conveyancing fees. The bonus is paid on completion so can't be put towards the exchange deposit (see below).

Paying an exchange deposit

You'll probably have to pay an exchange deposit of 10% when you exchange contracts with the seller (the point at which you legally commit to buying the property).

You won't be able to put the government bonus towards this, as the bonus is only paid on completion.

If you're taking out a 95% or 90% mortgage and need the bonus as part of your deposit, tell your conveyancer as early on in the process as possible. They should usually be able to negotiate a lower exchange deposit for you.

What if the sale falls through?

If your home purchase doesn't go through after the solicitor has received your government bonus, you can reopen a help to buy isa.

You'll need to ask your solicitor for a 'purchase failure notification' and show it to a bank or building society, who will open an account for you.

In this situation, you'll be able to deposit the full amount you've saved as a lump sum – so if you'd saved £12,000, you can put it all into the help to buy isa at once.

Is there anything else I should know?

For anyone saving up for a mortgage deposit, a help to buy isa is a very attractive option.

However, there are some restrictions: