New forex brokers

Trade cfds on a wide range of instruments, including popular FX pairs, futures, indices, metals, energies and shares and experience the global markets at your fingertips.

New forex bonuses

Trade the CFD market on the go with our mobile application and benefit from ultra-low latency trading infrastructure, award-winning order execution and deep liquidity.

Trade on the go,

like a pro.

Welcome to fxpro, the world’s #1 broker! 1

With 15+ years of excellence and innovation, we provide high-quality access to financial markets, through our advanced execution model. Discover the world of online trading with cfds on 260+ instruments in 6 asset classes.

Invest in #US30 (dow jones industrial average), EURUSD , gold and apple from a single account

Trade cfds on a wide range of instruments, including popular FX pairs, futures, indices, metals, energies and shares and experience the global markets at your fingertips.

Trade on mobile

Trade the CFD market on the go with our mobile application and benefit from ultra-low latency trading infrastructure, award-winning order execution and deep liquidity.

Available for ios and android devices.

Secure fxpro wallet MT4, MT5 & ctrader accounts variety of payment methods latest economic events

Multiple payment options

We provide our clients with a wide range of flexible payment options including bank transfer, credit/debit cards, E-wallets and more 2 . Detailed information is available on our funding page.

Tight spreads and no commission

Tap into the world's markets and explore endless trading opportunities with the world's best broker 1 - all with tight spreads and no commission 3 .

Browse the full rangeof platforms

At fxpro we understand that different clients have different needs. Therefore, we offer a wide selection of trusted, award-winning platforms and account types to choose from.

New forex brokers

- Language support: bengali, chinese, english, hindi, indonesian, malay, portuguese, spanish, thai

- Create trading accounts, modify leverage, enable swap-free options, edit and restore passwords

- Make deposits and withdrawals using the most popular payment options

- View your detailed overall or account operation history, apply convenient filters to it and cancel your previous deposit

- Start trading in a compatible trading platform app

- Top up your demo account

- View contest statistics and access your contest accounts

- Activate bonuses and view statistics on active and completed bonuses

get it on

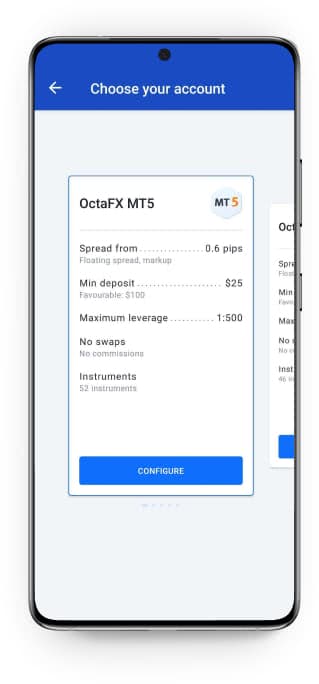

Forex trading accessibility for everyone

Octafx - one of the best forex brokers on the market, for traders all round the world. Octafx offers access to CFD trading, commodity trading and indices trading with award-winning forex trading conditions. As well as access to the forex market, octafx offers a variety of promotions that can help you:

50% bonus on deposit

Negative balance protection

Why choose forex trading with octafx

Octafx forex broker ensures reliable forex trading conditions to provide traders of all skill levels with an opportunity to earn more. This is possible due to:

- No commissions on deposits and withdrawals

- No swaps

- No slippage

- No delays

Best forex brokers in new zealand 2021

If you live in new zealand and want to trade currencies one of the key things to know is how to choose the broker you will trade with. We have conducted research into the very best brokers for new zealand traders based on service, product quality and reliability.

The brokers below represent the best brokers in new zealand

Trading forex and cfds involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions. General advice warning the information in this website is of a general nature only and the advice has been prepared without taking account of your objectives, financial situation or needs. Accordingly, before acting on the advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, and after considering the legal documents.

Trading forex and cfds involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions. General advice warning the information in this website is of a general nature only and the advice has been prepared without taking account of your objectives, financial situation or needs. Accordingly, before acting on the advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, and after considering the legal documents.

76.4% of retail CFD accounts lose money

ASIC, cysec, FCA, FSB, ISA, MAS

76.4% of retail CFD accounts lose money

Moneta markets

Headquarters : 4th floor the harbour centre, 42 N church st, george town, cayman islands

Trading forex and cfds involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions. General advice warning the information in this website is of a general nature only and the advice has been prepared without taking account of your objectives, financial situation or needs. Accordingly, before acting on the advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, and after considering the legal documents.

Moneta markets was founded in 2020 and is a trademark of vantage international group limited which is authorised and regulated by the cayman islands monetary authority (CIMA).

Users can trade on more than 300+ financial CFD instruments covering forex, commodities, indices, cryptocurrencies and shares on the custom-built moneta markets web trader platform which provides an all-in-one account opening, funds management and trading solution. Users can also trade from the moneta markets apptrader for android and ios.

Plus500

Regulated by: ASIC, cysec, FCA, FSB, ISA, MAS

Headquarters : building 25, MATAM, haifa, israel

76.4% of retail CFD accounts lose money

Plus500 is a leading CFD trading platform with support for stocks, indices, cryptocurrencies, and forex. This commission-free brokerage charges very low spread-rates and offers fast trades on a great platform. Plus500 supports complex trades, includes negative balance protection, and makes trading an educational and hopefully profitable venture.

You can start with a free demo account to test the platform and any trading strategy. Real money accounts offer leverage of up to 300:1. This broker is based in israel and regulated by the financial conduct authority (FCA) in the UK.

How to choose a broker as a new zealand trader

First and foremost, you want to use a broker who is regulated in your country. An unregulated broker does not account to anybody, so you can never know whether your money is safe or he will take it and disappear one day without notice. Int his case an FMA regulated broker should be your choice.

Secondly, a trading platform is something you want to check with your broker. It is your tool to trade, so if it is too complicated or non user friendly we would suggest finding another one.

Commission and spreads come next. You want to find broker with the lowest spreads and no hidden fees.

A good broker will offer you at least a few types of accounts to choose from. Whether you come with 50$ or with 50000$ service provider should offer a type that suits your interests and possibilities best.

Customer care and service is another thing you should look into when you are in search of a broker. Brokers that do not respond to their customer requests in a timely manner should be avoided altogether.

General regulation and new zealand regulation

As forex is a vast global market it will have different legal authorities regulating it in a specific country or even region. US and europe are two good examples. FX brokers in US are regulated by NFA and CFTC. Those are very strict regulators and they will take severe legal actions against brokers who are not registered under them. Current capital requirement for US brokers is 20 million $ and a lot of small companies cannot afford them, so the number of players in FX market is not that big. Leverage that is allowed would be between 50:1 to 20:1 depending on currency pairs traded.

In europe, on the other hand, requirements for FX companies are more loose and the leverage can be 200:1. In europe forex trading was harmonised so a broker that has a licence in one member state can legally function in any other one. Each european country will have its local regulator, some like in UK (FCA) more strict ones and some like in cyprus (CYSEC) more loose ones.

Forex brokers in new zealand are regulated by FMA (financial markets authority). It is quite a strict regulator that was given regulation powers in 2011 after the securities commission of new zealand was dismissed as an incompetent regulator that failed to curb fraud, price manipulation, excessive risk trading by local market operators and inside trading that ultimately led to huge losses for individual investors. More strict rules and regulations apply now for those who offer financial services in the country. Lots of brokers lost their licenses and new ones coming to offer their services have to comply with new rules, open their books for regular audits and share whatever requested information is needed. So, trading with FMA regulated broker is pretty safe now.

Trading platform & software

It is only natural to expect that a good broker will offer you to test their trading platform on a demo version before you start trading on a real money account. Their platform should be user friendly and easy to use, but also offer you a lot of other features and options that you might need for analysis and application of your specific trading strategies: various charts with indicators, the ability to draw and write notes, a large variety of time frames, the possibility of opening multiple windows and be able to study them separately, incorporated news feed, strategy tester, the possibility to copy other traders and etc.

Most brokers will offer you a downloadable software for metatrader (MT 4) platform that you can launch right from your desktop and trade after logging in or they will offer you an online platform, which does not have to be downloaded, but can be used straight from your browser. Social trading platforms are also a good choice, because you will be able to use social investing platform by copying traders that are successful and make profits. Lastly, this is the age of mobile phones, so a good broker will probably have a mobile application and you will be able to trade currencies on the go on your mobile phone.

Commissions & spreads

Most forex brokers are compensated by spreads, which is the difference between the bid and ask price. Some companies use fixed, some variable spreads. As an example, a broker that has a fixed spread would probably offer 1-3 pips for the most popular forex pair eur/usd. For a variable spread this range can be smaller. Under normal market conditions, where no news is expected or released the spread for the pair can be 0.2-0.5 pip. However, when news comes variable spread can increase to 10-30 pips for the pair and much more for less popular currency pairs such as gbp/jpy or eur/cad.

Account types

Depending on your capital size most brokers will offer you a number of choices for an account. The most popular structure is micro (with micro lot size 1000$), mini (with mini lot size 10000$) and standard (with standard lot size 100k $). So, if you have only 100 $ you may apply for a micro account and start trading having gone through verification process. The same is true with other account types. Other brokers may even offer you up to 9 types of accounts. So, be sure to check them when you visit your broker‘s website and choose the one that fits your needs best.

Customer service

Good customer service is a feature of a reliable broker. Most good new zealand brokers will definitely have a customer service line where you can ask a question, have a query, send a complaint and get an answer 24/7. More serious complaints should also be solved by a customer care department between 24-72 hours. If you ask a question and wait for a week for a response from your broker, do not even think about opening an account with them. Trading involves a lot of risk and you need a broker whom you can trust and who deals with your problems responsibly.

Additional services

Extra services that you would expect a broker to offer would be education and those should be free of charge. They should offer you materials explaining basics of currency trading, fundamental and technical analysis, central banks‘ policy, interest rates, risks, trends and etc. You would also expect webinars on various educational topics ranging from beginner to advanced traders. Look through a brokers website to find out what they offer to see for yourself.

Conclusion

As you may see the choice of a good broker relies on a number of factors explained in the article. We have created a list based on all of these factors showing the most recommended brokers. If you trust your broker you will be able to concentrate on your trading and trade with a peace of mind without worrying whether your broker will implement some manipulative scheme against you or not. Confidence and trust will help you to make more rational decisions that will ultimately contribute to you becoming a more successful trader.

New forex brokers

- Language support: bengali, chinese, english, hindi, indonesian, malay, portuguese, spanish, thai

- Create trading accounts, modify leverage, enable swap-free options, edit and restore passwords

- Make deposits and withdrawals using the most popular payment options

- View your detailed overall or account operation history, apply convenient filters to it and cancel your previous deposit

- Start trading in a compatible trading platform app

- Top up your demo account

- View contest statistics and access your contest accounts

- Activate bonuses and view statistics on active and completed bonuses

get it on

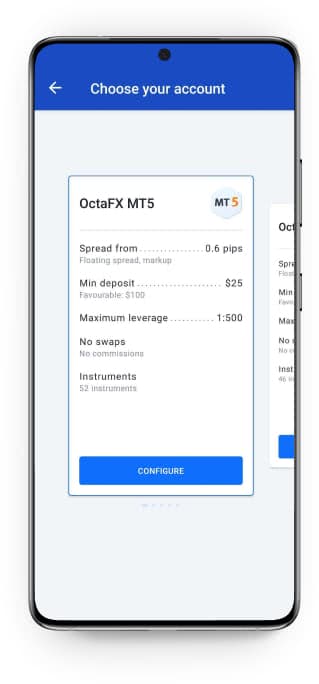

Forex trading accessibility for everyone

Octafx - one of the best forex brokers on the market, for traders all round the world. Octafx offers access to CFD trading, commodity trading and indices trading with award-winning forex trading conditions. As well as access to the forex market, octafx offers a variety of promotions that can help you:

50% bonus on deposit

Negative balance protection

Why choose forex trading with octafx

Octafx forex broker ensures reliable forex trading conditions to provide traders of all skill levels with an opportunity to earn more. This is possible due to:

- No commissions on deposits and withdrawals

- No swaps

- No slippage

- No delays

Best forex brokers in new zealand 2021

If you live in new zealand and want to trade currencies one of the key things to know is how to choose the broker you will trade with. We have conducted research into the very best brokers for new zealand traders based on service, product quality and reliability.

The brokers below represent the best brokers in new zealand

Trading forex and cfds involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions. General advice warning the information in this website is of a general nature only and the advice has been prepared without taking account of your objectives, financial situation or needs. Accordingly, before acting on the advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, and after considering the legal documents.

Trading forex and cfds involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions. General advice warning the information in this website is of a general nature only and the advice has been prepared without taking account of your objectives, financial situation or needs. Accordingly, before acting on the advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, and after considering the legal documents.

76.4% of retail CFD accounts lose money

ASIC, cysec, FCA, FSB, ISA, MAS

76.4% of retail CFD accounts lose money

Moneta markets

Headquarters : 4th floor the harbour centre, 42 N church st, george town, cayman islands

Trading forex and cfds involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions. General advice warning the information in this website is of a general nature only and the advice has been prepared without taking account of your objectives, financial situation or needs. Accordingly, before acting on the advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, and after considering the legal documents.

Moneta markets was founded in 2020 and is a trademark of vantage international group limited which is authorised and regulated by the cayman islands monetary authority (CIMA).

Users can trade on more than 300+ financial CFD instruments covering forex, commodities, indices, cryptocurrencies and shares on the custom-built moneta markets web trader platform which provides an all-in-one account opening, funds management and trading solution. Users can also trade from the moneta markets apptrader for android and ios.

Plus500

Regulated by: ASIC, cysec, FCA, FSB, ISA, MAS

Headquarters : building 25, MATAM, haifa, israel

76.4% of retail CFD accounts lose money

Plus500 is a leading CFD trading platform with support for stocks, indices, cryptocurrencies, and forex. This commission-free brokerage charges very low spread-rates and offers fast trades on a great platform. Plus500 supports complex trades, includes negative balance protection, and makes trading an educational and hopefully profitable venture.

You can start with a free demo account to test the platform and any trading strategy. Real money accounts offer leverage of up to 300:1. This broker is based in israel and regulated by the financial conduct authority (FCA) in the UK.

How to choose a broker as a new zealand trader

First and foremost, you want to use a broker who is regulated in your country. An unregulated broker does not account to anybody, so you can never know whether your money is safe or he will take it and disappear one day without notice. Int his case an FMA regulated broker should be your choice.

Secondly, a trading platform is something you want to check with your broker. It is your tool to trade, so if it is too complicated or non user friendly we would suggest finding another one.

Commission and spreads come next. You want to find broker with the lowest spreads and no hidden fees.

A good broker will offer you at least a few types of accounts to choose from. Whether you come with 50$ or with 50000$ service provider should offer a type that suits your interests and possibilities best.

Customer care and service is another thing you should look into when you are in search of a broker. Brokers that do not respond to their customer requests in a timely manner should be avoided altogether.

General regulation and new zealand regulation

As forex is a vast global market it will have different legal authorities regulating it in a specific country or even region. US and europe are two good examples. FX brokers in US are regulated by NFA and CFTC. Those are very strict regulators and they will take severe legal actions against brokers who are not registered under them. Current capital requirement for US brokers is 20 million $ and a lot of small companies cannot afford them, so the number of players in FX market is not that big. Leverage that is allowed would be between 50:1 to 20:1 depending on currency pairs traded.

In europe, on the other hand, requirements for FX companies are more loose and the leverage can be 200:1. In europe forex trading was harmonised so a broker that has a licence in one member state can legally function in any other one. Each european country will have its local regulator, some like in UK (FCA) more strict ones and some like in cyprus (CYSEC) more loose ones.

Forex brokers in new zealand are regulated by FMA (financial markets authority). It is quite a strict regulator that was given regulation powers in 2011 after the securities commission of new zealand was dismissed as an incompetent regulator that failed to curb fraud, price manipulation, excessive risk trading by local market operators and inside trading that ultimately led to huge losses for individual investors. More strict rules and regulations apply now for those who offer financial services in the country. Lots of brokers lost their licenses and new ones coming to offer their services have to comply with new rules, open their books for regular audits and share whatever requested information is needed. So, trading with FMA regulated broker is pretty safe now.

Trading platform & software

It is only natural to expect that a good broker will offer you to test their trading platform on a demo version before you start trading on a real money account. Their platform should be user friendly and easy to use, but also offer you a lot of other features and options that you might need for analysis and application of your specific trading strategies: various charts with indicators, the ability to draw and write notes, a large variety of time frames, the possibility of opening multiple windows and be able to study them separately, incorporated news feed, strategy tester, the possibility to copy other traders and etc.

Most brokers will offer you a downloadable software for metatrader (MT 4) platform that you can launch right from your desktop and trade after logging in or they will offer you an online platform, which does not have to be downloaded, but can be used straight from your browser. Social trading platforms are also a good choice, because you will be able to use social investing platform by copying traders that are successful and make profits. Lastly, this is the age of mobile phones, so a good broker will probably have a mobile application and you will be able to trade currencies on the go on your mobile phone.

Commissions & spreads

Most forex brokers are compensated by spreads, which is the difference between the bid and ask price. Some companies use fixed, some variable spreads. As an example, a broker that has a fixed spread would probably offer 1-3 pips for the most popular forex pair eur/usd. For a variable spread this range can be smaller. Under normal market conditions, where no news is expected or released the spread for the pair can be 0.2-0.5 pip. However, when news comes variable spread can increase to 10-30 pips for the pair and much more for less popular currency pairs such as gbp/jpy or eur/cad.

Account types

Depending on your capital size most brokers will offer you a number of choices for an account. The most popular structure is micro (with micro lot size 1000$), mini (with mini lot size 10000$) and standard (with standard lot size 100k $). So, if you have only 100 $ you may apply for a micro account and start trading having gone through verification process. The same is true with other account types. Other brokers may even offer you up to 9 types of accounts. So, be sure to check them when you visit your broker‘s website and choose the one that fits your needs best.

Customer service

Good customer service is a feature of a reliable broker. Most good new zealand brokers will definitely have a customer service line where you can ask a question, have a query, send a complaint and get an answer 24/7. More serious complaints should also be solved by a customer care department between 24-72 hours. If you ask a question and wait for a week for a response from your broker, do not even think about opening an account with them. Trading involves a lot of risk and you need a broker whom you can trust and who deals with your problems responsibly.

Additional services

Extra services that you would expect a broker to offer would be education and those should be free of charge. They should offer you materials explaining basics of currency trading, fundamental and technical analysis, central banks‘ policy, interest rates, risks, trends and etc. You would also expect webinars on various educational topics ranging from beginner to advanced traders. Look through a brokers website to find out what they offer to see for yourself.

Conclusion

As you may see the choice of a good broker relies on a number of factors explained in the article. We have created a list based on all of these factors showing the most recommended brokers. If you trust your broker you will be able to concentrate on your trading and trade with a peace of mind without worrying whether your broker will implement some manipulative scheme against you or not. Confidence and trust will help you to make more rational decisions that will ultimately contribute to you becoming a more successful trader.

New forex brokers

Deposit bonus – A bonus on funding a live account. The bonus credited on percentage of the deposit amount.

No deposit bonus – free bonus on account registration for the new clients to trade live without any risk.

Tradable bonus: A deposit bonus that can be lost and traded as the part of your trading equity.

Volume bonus – most common type of deposit bonus, it allows you to increase your trading volume. Often the bonus can be cashed on trading lot requirement.

Forex gift – A gift for the clients for completing certain requirements, everything from bonus to latest gadget

Freebies – free stuff by forex brokers like ebook, courses, trading materials etc.

Rebate – cash-back withdrawable bonus on each lot traded.

Demo contest – contests held on demo account, win cash/tradable money with no-risk involve!

Live contest – contest held on live account, deposit requires. Win bigger cash/prizes.

Refer – a-friend– refer your friend to your broker, when your friend deposit you will get a special bonus

Free signals – get free trading signals from the broker.

Free VPS – get access to an optimized forex virtual private server for free on maintaining a certain amount of trading balance.

Binary options – binary bets trading on forex instruments

Forum posting: get a small trading bonus for each of your post in forms.

3 affiliate IB: receive a commission from your fellow traders, specially design for the marketers.

Draw bonus: the winners chosen by a draw

Seminars webinars: find the schedule to participate in the online/offline events.

Expos events: inviting to attend the forex events & expos globally.

New forex brokers

You are using an outdated browser. Please upgrade your browser to improve your experience and security.

You are using an outdated browser. Please upgrade your browser to improve your experience and security.

Forex recent information

Forex featured brokers

Forex is the most popular currency exchange market. It becoming more popular day by day. Currently averaged $6.6 trillion currency traded per day from april 2019.

But, this industry is technical and more professional. So, to make it interesting and easy forex broker offers bonuses and contests for traders.

At forexnewbonus.Com we published all types of bonuses and contests. Here you will get all the latest forex news, bonuses, contests, broker comparison, guide, etc. Mostly forex no deposit bonus and forex deposit bonus.

What is forex no deposit bonus?

Forex broker offers no deposit bonus to start live trading free. This bonus is completely free, broker provides free credit to a live trading account.

You can trade currencies, cfds, stock, indices, metals, gold, silver, oil, commodity, and more. This is a very good opportunity to risk free trading.

What is forex deposit bonus?

Very interesting bonus from brokers. You will fund your account for trading and the broker will give you some free money to enjoy it. This bonus increase trading funds and leverage.

All deposit bonuses are tradable as the offer conditions. Sometimes broker offers deposit bonus include loyalty VIP bonus.

How to find the best forex bonus?

Finding the best bonuses is important for traders. You can visit on the web, read reviews and broker platforms. But this is difficult, so we made it easy for traders.

To finding the best bonus check our website regularly. We publish new and a lot of bonuses offered by brokers.

Forex demo trading brokers

Congratulations, you are ready to test out forex trading and looking for a forex broker to do it with. The best way to do this is to open a free demo account with one of the forex demo trading brokers listed below. In this article we’ll explain the things you need to know about to choose a forex demo account and how to get the most out of this risk-free benefit.

The difference between a forex demo and real account

A demo account allows a new trader, or experienced trader who wants to test out a new forex broker, a way to trade without risk. This is sometimes referred to as ‘paper-trading’ as opposed to real money trading.

The term ‘paper-trading’ comes from the pre-digital era. Before computer trading, investors would test their ideas by writing on a piece of paper their ‘imaginary’ purchase of an asset – in most cases an equity share or commodity – at a certain price, time and date they made ‘their purchase’. Then they would monitor the market’s price movements by checking the daily prices in the newspaper.

The investor would later decide when they wanted to “sell” the asset by marking the time and date they wanted to exit the position. This allowed traders to hone their skills and get a sense of the markets though ‘paper-trading’, which carried no risk but allowed them to learn. Real money trading should only occur when you are ready to deposit real money into a live account with a broker. This carries a burden of risk, meaning you can lose your deposited money if you make losing trades. However, real money trading also rewards the prepared investor with actual profits when trading is going well and decisions are on the correct side of financial market momentum.

A demo account is a great way to learn how to trade and discover how a new broker’s platform works. However, it is important to keep in mind that an asset on a demo account may carry a different spread between the bid and ask prices compared to what the same broker offers in a real money live account. Most brokers restrict the amount of time your demo account will remain open, with a maximum period of one month being typical. Of course, if you have a few email addresses, there is nothing to stop you re-registering once your demo account expires. That being said, graduating to a real money trading account can be a good thing as spending too long trading only a demo account can hinder your development as a trader.

While it is sometimes an difficult step for new traders to switch from a demo to a real money live account, it is also a necessary step. Your use of the demo account will teach you to practice the art of opening positions and closing them, and also reinforce the necessary traits of practicing risk management which will always be important.

Best all-around: high floating leverage + fast execution

Best all-around: high floating leverage + fast execution

ECN trading with leverage up to 1:500

Deposit $500 and trade with $1000!

ECN trading with leverage up to 1:500

Highly regulated, choice of fixed or floating spreads

Mifid, central bank of ireland, FSA, ASIC, BVI, FFAJ, FSCA, ADMG - FRSA

Highly regulated, choice of fixed or floating spreads

Wide range of cfds + trailing stop losses

Cysec, FCA, ASIC, FMA, FSB, MAS

Wide range of cfds + trailing stop losses

Best broker for social traders and crypto traders : 75% of retail CFD accounts lose money

Best broker for social traders and crypto traders : 75% of retail CFD accounts lose money

How to use a forex demo account

Today, with high speed computers and trading apps, traders practice their ‘paper-trading’ on free demo accounts offered by most forex / CFD brokers. This gives you an opportunity to learn more about the financial markets and get a taste for what live ‘real money’ trading will feel like. A demo account allows you to trade assets at no risk. You cannot lose real money with a demo account. This is because your broker’s demo account allocates you a certain amount of ‘paper’ money which is for demonstration purposes only, and allows you to trade this ‘paper’ money to practice what it will feel like in a live ‘real money’ environment.

A forex demo account can also give a very good primary grasp about what your chosen broker offers regarding with assets can be traded, which types of trade orders are permitted, plus a dynamic sense of ‘market feel’. Another important use of a demo account is in testing the broker’s trading platform’s capability to handle software which places trades at a high frequency and/or automatically . You will need to check with your broker to see what trading software can be used on their trading platforms. For example, brokers using the metatrader 4 trading platform often accept trading with algos and robots.

You should be aware that some brokers won’t allow the use of algos or robots because their servers and platforms are not developed for this type of trading. If you do not tell your broker you are using trading mandates and software such as algos or robots the broker may have a right to cancel the outcome of your trading on a live account – in a demo account of course, it does not matter. If you are trading a live account with real money, be sure to communicate with your chosen broker directly to make sure you can fully test your desired tools on their demo account.

Are forex demo accounts accurate?

In a forex demo account, you can open a position which allows you to buy or sell in the marketplace depending on your choice of market direction. Your demo account allows you to experience the natural speed of the market, the pace at which assets change value, and the ability to choose position sizes - to put full trades on at market prices to execute trades which carry no risk.

Checking out what the spreads are is important, but it is equally important to learn if a certain asset carries overnight trading costs known as swaps, plus the fundamentals of trade execution and the kind of mistakes that are easy to make so you can tell how to best avoid them in the future. Using a demo account allows you to practice choosing your assets to trade, and the buy and sell status; size of position wanted allows you to become accustomed to these needed inputs to make your transactions. When you switch from a demo to a real money environment you will feel more comfortable with the needed decision-making processes and its effect on the outcome of your trades because of your practice with the forex demo account.

Like differentials in spreads which can exist between a demo and a real money account, differentials can also exist regarding the time you have to place a trade before the quote requotes or even expires. Demo accounts sometimes allow you more time within the trade decision making process. Real money time parameters for selecting trades can fluctuate due to live market price action, while in a demo account they usually will not. Also note that while spreads will sometimes be different on a demo account compared to a real money account, the price quotes for assets are frequently accurate. You can check this by watching the live market and looking at the prices for assets being provided at the same time by your demo account. However, it is important to note that the prices in the ‘live’ market you are often looking at are delayed depending on your source. This is because live quotes to the financial markets are considered valuable tools. You should ask your broker if you are seeing live market prices or if they are on a delay. Accurate pricing is crucial to understand the real feel of the marketplace and most demo accounts provide live quotes.

Forex trading demo account for beginners

Brokers are happy to have you trade on their demo accounts to learn and become an informed trader, but they do not want you to stay in the demo environment forever because they want you to open a live account eventually and deposit some funds. Demo accounts are also a burden on the broker’s computer servers, which is another reason they don’t want traders to use them for too long. The psychological aspects of trading are important and demo accounts give a new trader the ability to ‘feel’ the marketplace. It is important to note the effect on a traders psyche when they are placing a trading. There is an impact emotionally when carrying a position for any length of time and the decision making process becomes affected due to the nature of the markets which can be fast and sometimes volatile. A demo account allows you to become accustomed to the financial markets and the pace at which assets change values. Forex pairs, and ? Cfds offering indexes, equities and commodities will be available to examine and grow accustomed to, regarding the manner and rules with which each of them are treated by the broker.

While making money is a fundamental goal of every trader, a demo account allows you to trade with the goal of learning and not worrying about losing real money. Understanding the capabilities your broker offers and taking the opportunity to become fully accustomed to the real money trading environment is very important for new traders, and there’s no better way to do this than with a forex demo account. The widespread appeal of the forex demo account means that almost every forex broker offers one and you can sign up quite easily on the broker’s website.

How to create a demo account for forex trading

When you find a broker you like, you will usually see an offer in their website for a ‘free online demo account’. You will probably be asked to register your name, email address, and a few more personal details when you register for the account. After you have completed that process you will be prompted to either open an account or ‘get started’ – it is the second option which will activate your demo account. You will receive a username and a password along with a few instructions about using the demo account and you can then begin to “paper trade” immediately. The forex demo account allows you to test your chosen broker’s platform(s) and learn. They will usually contact you by email or phone if you provided your telephone number as part of the registration process to check on your progress and introduce themselves further in order to help you.

Top 7 of best US forex brokers for 2021

Top rated:

Are you searching for the best US forex brokers?

Luckily, our team of professional forex broker reviewers can take care of your every need.

Let alone the best forex broker in USA, our team realizes it is tough to find any broker which offers a trustworthy, and still value for money proposition when you want to trade forex in the USA. Forex brokers accepting US clients may be few and far between, but we have combined years of experience to narrow your selection down to the top five brokers.

These five are among the best forex brokers USA has to offer.

In fact, they are some of the best forex brokers for residents of any country. These brokers will ensure you feel safe, secure, and still have the ability to prosper in your trading career. They have been selected as the best US forex brokers for a variety of reasons.

Among these reasons are the amount of trading support they offer you, they wide range of markets and instruments that are available for trading, and the very competitive pricing and fee structure offered by these top forex brokers.

Table of contents

Is forex trading legal in the USA?

As a forex trader in the US, one of the most important questions you may be asking yourself from the outset surrounds the legality of forex trading in the US. Well, we are pleased to tell you that yes, forex trading is legal in the US. In fact, the US has several top financial regulators providing the best protection to you as a trader. These bodies are FINRA, the SEC, CFTC, and NFA with the latter two being the main regulators when it comes to forex trading and trading in derivatives such as futures. Remember also that cfds trading in the US is not permitted.

How to trade forex in the USA

The process of getting started with a forex broker in the US is typically similar to that of any other country. With any top broker you will usually be asked for the following information:

- Proof of identity. A passport is typically best for this purpose.

- Proof of residence, usually in the form of a bank statement at your current address.

Once these documents are uploaded and verified, a process that takes most forex brokers just a few minutes, you will be free to get started trading forex.

Top 7 forex brokers in the USA listing for 2021

Here’s our list of the best US forex brokers:

1. Forex.Com

When it comes to US forex brokers, forex.Com has to be an immediate consideration for opening your forex trading account in the USA. They are CFTC licensed and NFA regulated (#0339826) and provide a selection of flexible and accessible account types with low spreads starting from 0.2 pips, including their direct market access account. This offers some of the most unbeatable spreads among any of the forex trading brokers USA. They also provide extensive trading options in all of the top forex currency pairs, metals including gold and silver, as well as futures trading. When it comes to forex brokers accepting US clients, forex.Com certainly offers among the most comprehensive range of services to their US-based traders.

The forex.Com minimum deposits starting form $1000 on standard, and commission accounts, and $25,000 on DMA accounts with demo accounts available. There are also a range of other great benefits such as cash rebates and reduced or no fees for active traders.

2. IG markets

With over 40-years in the industry, IG markets is a true pioneer of the industry, and among the most long standing forex brokers accepting US clients. The broker has evolved continually, keeping the requirements of US-based traders as a top priority. These can be traded on MT4, the mainstay trading platform for top US forex brokers and traders from all around the world as well as being both CFTC licensed, and NFA regulated (#0509630). IG markets offers one type of account to all traders and this has a minimum deposit requirement of $250.

Accessibility with IG is also excellent, you can engage with a number of top professional charting packages using your desktop, phone, or other smart device. Beyond the USA, IG markets also featured in our top 10 largest forex brokers australia. This showcases their global appeal to traders. This appeal is further enhanced by a great cost of trading on more than 90 forex pairs with spreads starting at 0.8 pips.

3. Interactive brokers

You will very often find interactive brokers among our lists of top forex brokers. This is also true when it comes to our choice of top US forex brokers. This is thanks to a number of positive aspects which the longstanding broker uses to attract clients around the world. These include an excellent proprietary trading platform which offers some of the most advanced trading tools available on any market, and a widespread list of products which are available at highly competitive rates. These products include currencies, options, metals, and indices within a list which is ever increasing. IB are a FINRA member and regulated by both the CFTC and NFA (#0392970), as well as the SEC (#8-47257).

They have two account types, you can choose the IBKR lite, or IBKR pro both at no minimum deposit though the pro account has a $10 maintenance fee. As mentioned the product range is excellent as is the trading cost with spreads from 0.1 pips on 105 forex pairs. All of these features make IB a top choice particularly for experienced traders.

4. Oanda

Oanda is also making progress toward becoming the best forex broker in the USA. The industry leader is making progressive inroads in the US market, and now offers trading in more than 70 diverse forex currency pairs. This is more than enough for you to trade successfully. Added to this, you can also benefit from the powerful educational and research infrastructure oanda provides. This includes marketpulse, a selection of news, technical analysis, and research resources which are provided by the in-house oanda team. This can combine perfectly with our own online investment guides and educational content. Oanda are also well-regulated by both the CFTC, and NFA (#325821) offering traders two account types.

The standard account type is attractive thanks to the fact it has no minimum deposit, while the premium account requires a $2,000 minimum deposit but has benefits like lower spreads and other costs. An unlimited oanda demo account is also available. The broker also use the much respected MT4 trading platform for trading in all 70 forex pairs and more at a very competitive spread starting from 0 pips. All traders but particularly newer ones, seem to fit well within oanda.

So, let's see, what we have: fxpro offers cfds on currency pairs and five other asset classes. Start trading forex online with the world’s best forex broker. At new forex brokers

Contents of the article

- New forex bonuses

- Trade on the go, like a pro.

- Invest in #US30 (dow jones industrial average),...

- Trade on mobile

- Browse the full rangeof...

- New forex brokers

- Forex trading accessibility for everyone

- Why choose forex trading with octafx

- Best forex brokers in new zealand 2021

- Moneta markets

- Plus500

- How to choose a broker as a new zealand trader

- General regulation and new zealand regulation

- Trading platform & software

- Commissions & spreads

- Account types

- Customer service

- Additional services

- Conclusion

- New forex brokers

- Forex trading accessibility for everyone

- Why choose forex trading with octafx

- Best forex brokers in new zealand 2021

- Moneta markets

- Plus500

- How to choose a broker as a new zealand trader

- General regulation and new zealand regulation

- Trading platform & software

- Commissions & spreads

- Account types

- Customer service

- Additional services

- Conclusion

- New forex brokers

- New forex brokers

- Forex recent information

- Forex featured brokers

- What is forex no deposit bonus?

- What is forex deposit bonus?

- Forex demo trading brokers

- The difference between a forex demo and real...

- How to use a forex demo account

- Are forex demo accounts accurate?

- Forex trading demo account for beginners

- How to create a demo account for forex trading

- Top 7 of best US forex brokers for 2021

- Is forex trading legal in the USA?

- How to trade forex in the USA

- Top 7 forex brokers in the USA listing for 2021

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.