Online free trading account

Whether you're a beginner investor or have been playing the market since before the last recession, free stock trading platforms and apps provide a great opportunity to maximize your returns and keep trading easy and simple.

New forex bonuses

Schwab also has no-transaction-fee mutual funds, with around 4,000 available. Their regular trades will set you back around $5 apiece. There is no minimum balance requirement (although normal accounts typically come with a $1,000 minimum).

7 best free stock trading platforms

Thanks to the rise of fintech, investors now have the option to buy and sell stocks online or through mobile apps - and often free of charge.

There are dozens of trading apps and platforms that allow investors to invest cash in a variety of securities with minimal to no fees. With the increase in choices, here are the best free stock-trading platforms and how they compare.

7 best free stock trading platforms

Whether you're a beginner investor or have been playing the market since before the last recession, free stock trading platforms and apps provide a great opportunity to maximize your returns and keep trading easy and simple.

These investment platforms are top-notch.

1. E*TRADE

Although E*TRADE (ETFC) - get report accounts aren't always free, there are some promotions and accounts that allow investors to invest for free. Currently, E*TRADE is having a promotion when you open a new account. The promotion offers 60 days of commission-free trading for up to 500 trades with a minimum deposit of $10,000 or more.

The site offers 24/7 customer service, easy mobile trading, data and research information, and has trading vehicles that range from etfs to options. And while E*TRADE's commissions usually hit just under the $7 mark for normal (nonpromotional) trades, the site is still very popular for its ease of use and retirement services.

2. Robinhood

The free stock trading app has seen a meteoric rise in popularity in recent years, accumulating 6 million users in 2019 - and with good reason. Robinhood seems to be the darling of commission-free trading - as a fintech startup founded by baiju bhatt and vlad tenev in 2013 with their free stock trading model.

Although there has been some speculation over how robinhood makes money (given their free trading model), the app is very popular for its easy, free trading and variety of investment vehicles - including options and even cryptocurrency.

To get started, you simply have to submit an application to robinhood and meet a few basic requirements (although if you are planning to participate in options trading, additional requirements are necessary) - with no account minimum. As a bonus, there are no maintenance fees.

As somewhat of a drawback, robinhood doesn't currently allow fractional investing (you can only buy whole shares). But for its cost-efficiency and easily-accessible app format, robinhood is clearly a crowd favorite for a reason.

3. Charles schwab

Ideal for investors looking to get into etfs, charles schwab (SCHW) - get report has an impressive array of 200 etfs to choose from, all commission-free. And, as a bank and stockbroker all-in-one, the schwab app is a great one-stop-shop for investors.

Schwab also has no-transaction-fee mutual funds, with around 4,000 available. Their regular trades will set you back around $5 apiece. There is no minimum balance requirement (although normal accounts typically come with a $1,000 minimum).

Because of their wide selection of the commission-free etfs and mutual funds, schwab is a strong contender for free stock trading.

4. Acorns

If you're a beginner investor looking to make money in stocks, acorns is the perfect introductory stock trading app.

Acorns specializes in micro-investing - that is, investing your spare change in stocks. There is no minimum to create an account, but there is a $5 minimum to start investing.

The app takes the spare change you've got from linked debit or credit cards to invest in commission-free etfs. There are no fees for inactivity.

5. Vanguard

Boasting around 1,800 commission-free etfs (just shy of robinhood's 2,000,) vanguard offers a wide selection of free trading options. The platform offers over 3,000 transaction-free mutual funds to boot - including S&P 500 index funds.

The trading platform doesn't have a minimum account requirement, but they do charge $20 a year for a service fee.

6. TD ameritrade

Much like E*TRADE, TD ameritrade (AMTD) - get report offers a free trading promotional if you open an account. You can get up to 60 days of commission-free trading for options, etfs and other equities, as well as up to $600 if you deposit $3,000 or more.

And even when the 60 days runs out, trades average about $6.95 a trade - on par with several other competitors. But TD ameritrade also offers over 300 commission-free etfs, and hundreds of transaction-fee-free mutual funds to choose from.

As one of the biggest online trading platforms, TD ameritrade offers a variety of top-notch services including research, data, and information on stocks as well as cash management, among others.

7. M1 finance

M1 finance does things a bit differently (think: customization.)

In addition to being completely commission-free and fee-free, M1 finance allows investors to invest in fractional shares as small as one penny. And, what makes M1 finance different is it allows users to create "pies" - that is, pie graphs that are comprised of a variety of etfs, stocks, and bonds. The app also allows users to choose different kinds of pies based on their investment needs and risk tolerance.

Although there is a $100 minimum for investing, the app allows for total customization of your own portfolio, and offers different kinds of "pies" from moderate to "ultra-aggressive" or "market cap 100."

For a completely free, zero-commission stock trading app, M1 finance seems to offer a pretty good deal for the DIY investor.

The bottom line

So, which free stock trading platform is best for you?

While some platforms like TD ameritrade and E*TRADE only offer short-term free stock trading services through promotions or new accounts, they do offer some industry-leading services that may be worth the extra cost you'll incur when your trial run ends.

However, for the investor who wants a truly free stock trading experience, robinhood, acorns and M1 finance offer a formidable range of services and offerings - even including cryptocurrency and options. And, as trading is increasingly becoming mobile, these app-focused companies are optimized to provide a solid, easy-to-use trading experience from the comfort of your ios or android-enabled device.

Still, as always, it is important to examine your personal investment goals and be realistic about how much you are willing to pay for extra services (if you do opt for one of the bigger brokerage names). But thanks to the surge of fintech companies in recent years, there are plenty of investment options that offer free stock trading services that can help grow your returns - all with the touch of a button.

Free trading demo account review

Are you looking for a free and unlimited trading demo account? – then this page is for you. In more than 7 years of experience in online trading, we have tested many providers and present you in the lower table in our top 3. Additionally, you will learn on this page why a demo account with virtual credit is so important for beginners and advanced traders.

| Broker: | review: | spreads: | advantages: | open account: |

|---|---|---|---|---|

1. IQ option  | ➜ read the review | starting 1.0 pips | + FX & options + best platform + start with $10 |

Criteria for a good trading demo account:

Not every trading demo account is optimal for the private trader. That’s why there are different criteria that make a good trader. All in all, however, it can be said that nowadays almost every online broker offers a free demo account. Sometimes, however, there are runtime restrictions or other functions that are limited.

The demo account is intended to simulate real money trading. Therefore, it is essential to choose a reputable provider. With brokers with an official regulation and financial license, there are no differences in the demo and real money trading from our experience.

- Free demo account

- Unlimited demo account

- There is no difference between the demo account and real money trading

- The account can be recharged with virtual money as desired

- All functions are available

Why is a demo account so important for beginners and advanced users?

A trading demo account is an account filled with virtual credit (play money). It simulates real money trading. Traders can therefore trade real market situations without risk. The account is particularly suitable for beginners who want to start trading. The first experiences can be collected in the demo account.

In general, it is about getting to know the trading platform of the broker better. In our experience, most beginners find it very complex to trade on the financial markets at first. After a few explanations and tests, however, one realizes that it is not so difficult. In addition to the trading platform, the broker can also test the trading conditions.

The spread and trading commission in the demo account is the same as in the real money account. New markets should also first be tested in virtual mode, especially in the short-term area (day trading). Beginners and advanced traders can benefit from this. In addition, trading strategies can be tried out or developed. In summary, the rule is that you should trade in the demo account until you are profitable and make progress.

Facts about the demo account:

- Trading in the demo account is risk-free and simulates real money trading

- Test the trading platforms sufficiently

- Learn online trading and control order execution

- Test the broker’s fees

- Test and develop new trading strategies

Free and unlimited demo account

In general, a demo account is always free of charge. From our experience, 99% of online brokers offer this service. Some few providers require a minimum deposit. From such offerers is urgently to be advised against, because these are often unserious. In addition, the account should have an unlimited duration.

Some providers have fixed expiration times for the test account. By a message to the support, this problem can be solved however and the running time was extended from my experiences up to now always. In summary, beginners and advanced traders have the opportunity to test open trading platforms and brokers. A demo account like the real money account should always be ready to trade.

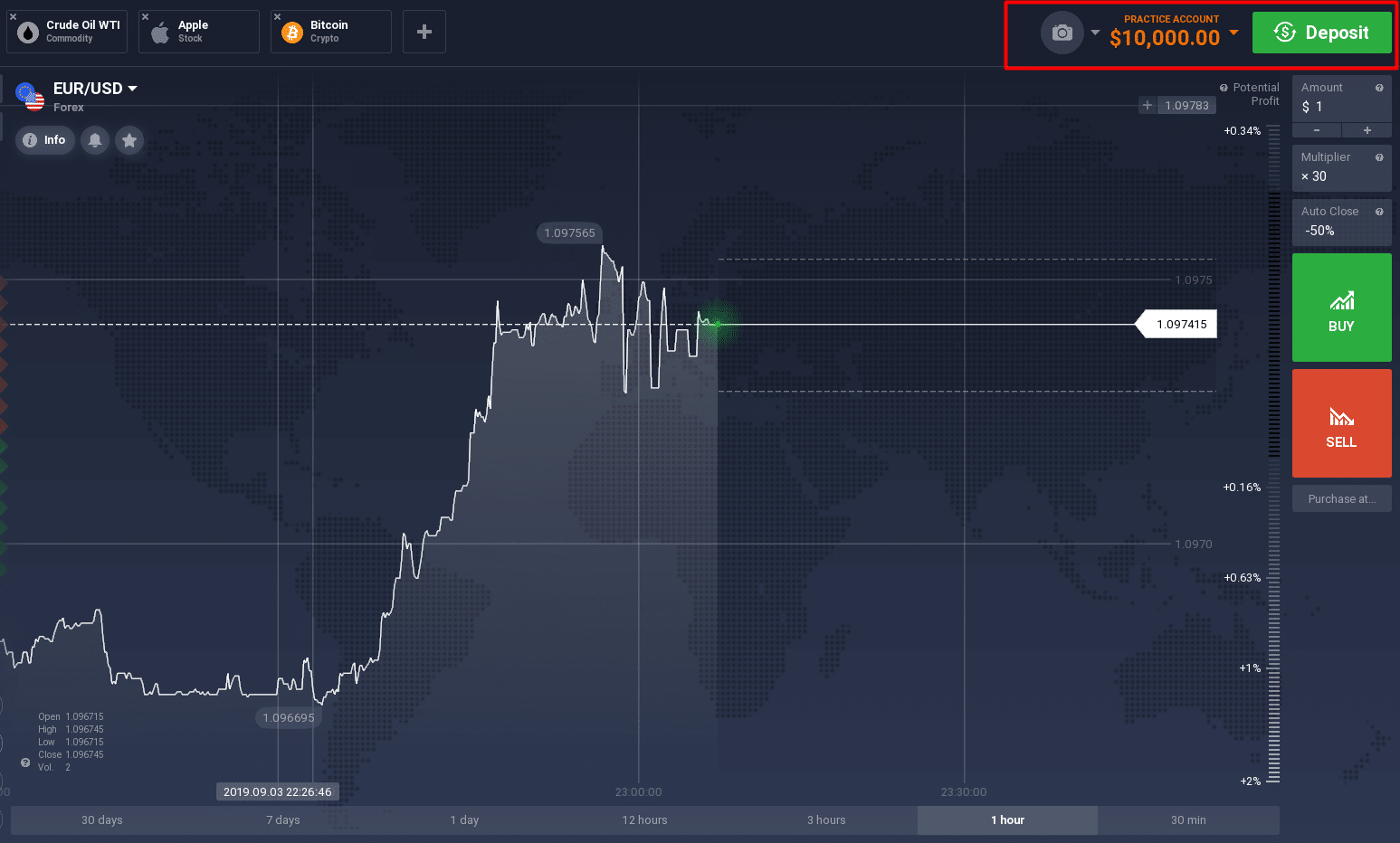

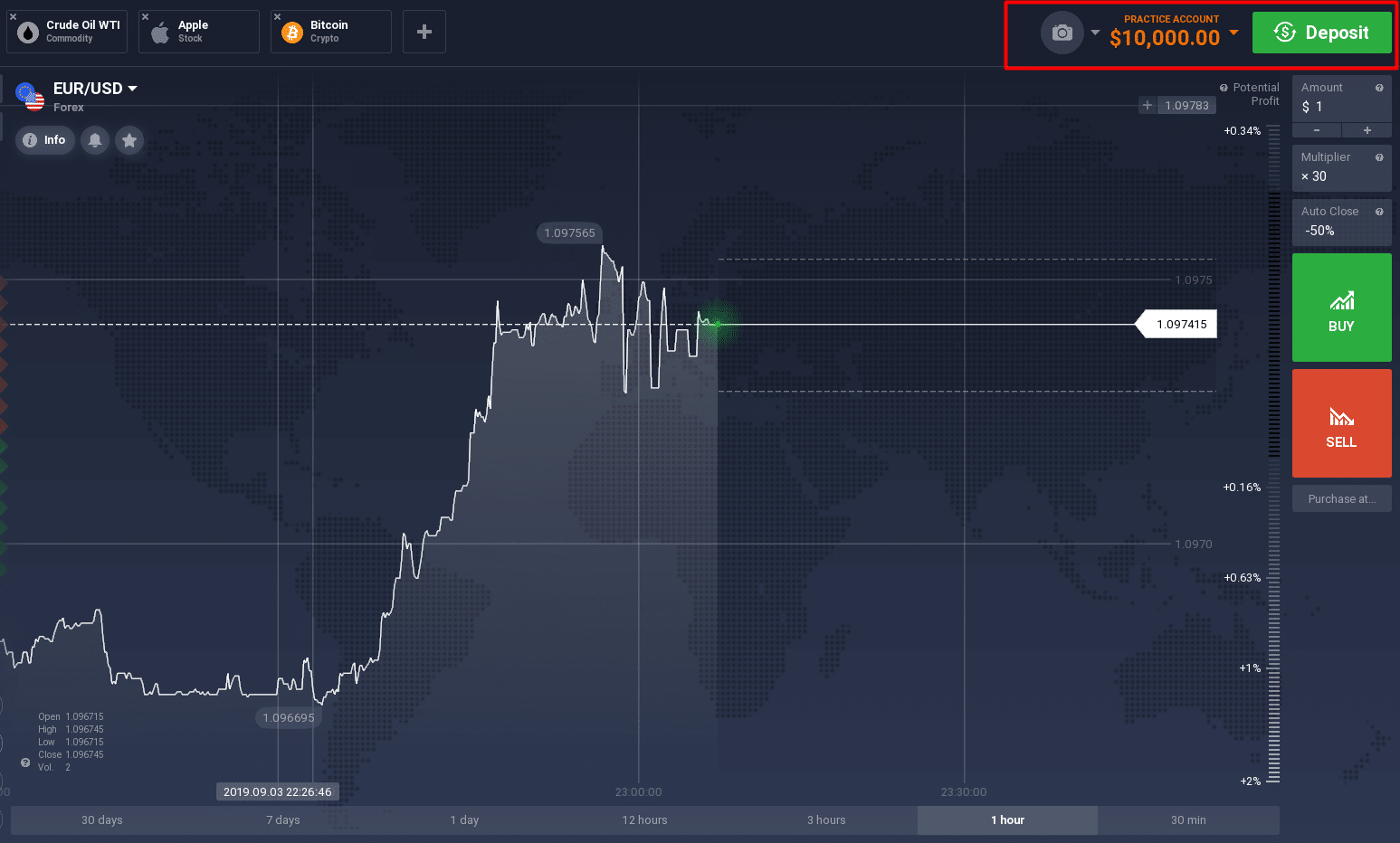

IQ option trading demo account

No difference between real money and virtual credit

With good brokers there is no difference between demo and real money trading. The price movements and executions are the same. Gladly, the trader can also check this himself. With regulated providers you do not have to worry. Therefore, be sure to obtain an official license from a financial supervisory authority.

The top recommended brokers all have an official license and are even regulated several times. Also, the trading fees and/or the spread has no difference in the demo account to the real money trade. With these accounts, you can simulate real money trading 1 to 1.

- Choose a reputable provider for your trading demo account as well

- You trade in both accounts under the same conditions

Account recharge is quite simple

With the demo account, there is the possibility to recharge the credit as desired. Since it is a test account, the credit can shrink quickly. But this is no problem at all. Because over the web page of the broker one can recharge the account very simply in few clicks. If you have any questions you can contact the support.

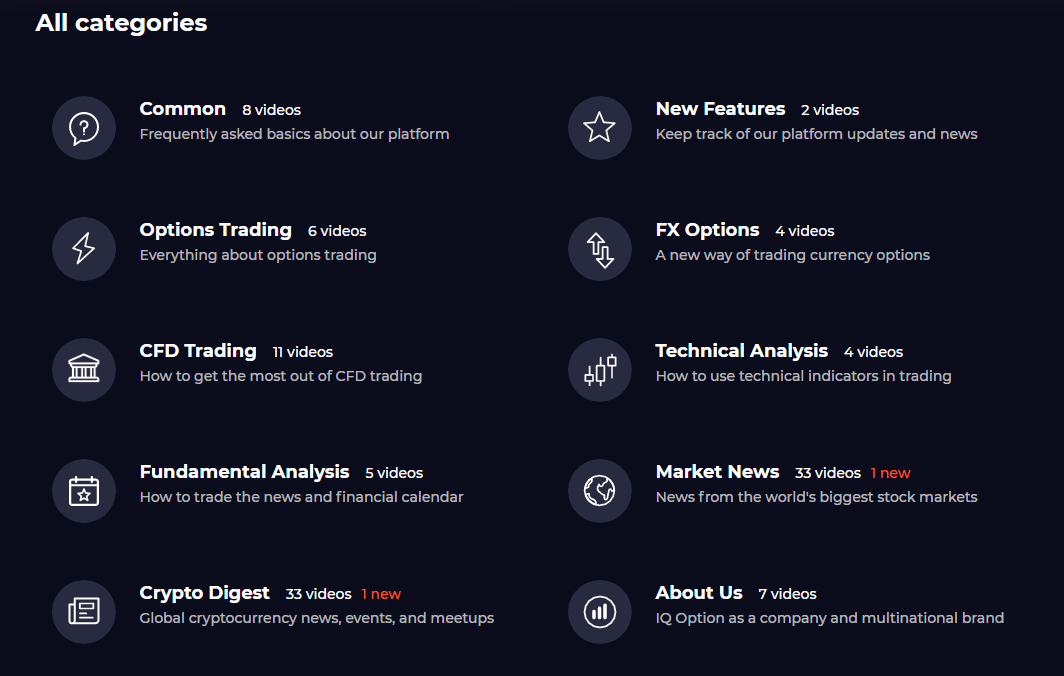

Further training for traders

Especially many beginners trade in the demo account and this is also absolutely necessary for a newcomer. The brokers offer concrete training material. The offer ranges from trade tutorials to free-market analyses and webinars. The demo account is the best way to expand your knowledge.

In addition, you can gain personal experience in various market situations. Professionals generally talk about the fact that it takes several thousand hours of screening time to act successfully. Read also our 10 trading tips.

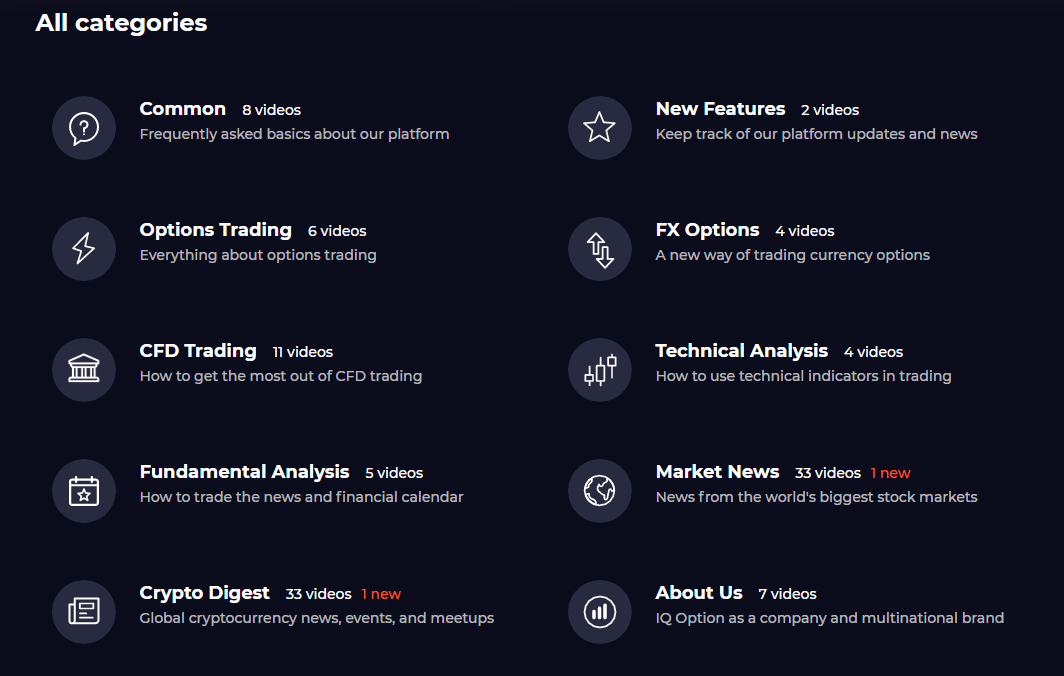

Education center (videos and more)

How long should I practice in a demo account?

From our experience, one should practice in the demo account until one has made demonstrably the first profits over a longer period of time. From our experience, a period of one month is suitable here. If you make a good profit week after week, you can slowly dare to trade real money.

It is important that you keep a statistic about your trades. The trading platform, however, already shows this very transparently. Alternatively, further tools can be added. It is best not to rush into anything. Trading a week longer in a demo account is better than losing real money because you don’t feel safe enough.

Conclusion: the demo account is the best way to learn online trading

The trading demo account is suitable for any trader and should be used before trading real money. It has many advantages which we have described to you on this page.

In addition, the creation of such an account is done in a few minutes. Online brokers meanwhile offer very easy access to the trading platform. Should he feel sure that a trader is safe enough for real money trading, he can start it directly.

In summary, the demo account is one of the most important tools of a trader, because with this account you can try many things about real market situations for free and without risk.

Good luck with your trading.

A demo account is necessary for each type of trader. You can try to trade the markets without risk.

Open trading account

OPEN YOUR FREE TRADING ACCOUNT WITH EASE

Open trading account online with arihant capital & start trading with our best hassle-free process.

We're glad you chose to start your investment journey with arihant capital. Opening a paperless trading account and getting started is easy, just choose from one of the following 3 options and take control of your financial future.

Fill your information in the below form for an online trading account opening

Get a call back

Arihant ekyc

Now you can use ease way to open an online account through arihant ekyc with no paperwork.

Arihant ekyc is a paperless know your customer( KYC) process, wherein the identity and address of the subscriber are verified electronically through aadhaar authentication.

Download and print

A SMARTER WAY TO MANAGE YOUR INVESTMENTS

When it comes to investments we don't want you to leave anything to chance. We have the tools, resources, and personalized support to help you make the right investment decisions.

TOOLS & SUPPORT

Whether you are looking for self-assisted or broker-assisted trading, you get access to our expert investment advisors and powerful trading tools

GET IDEAS

Investment education and tools that will make it really simple for you to plan your investments

DIVERSIFY

Get the benefit of diversification with our full range of investment options , free research and innovative tools

1. How long does it take to open an account?

Once we receive your signed forms and proper documents, your account will be opened within 24 working hours, assuming everything is in order. At any point of time you can check the status of your account by e-mailing us or calling us and any of your queries will be responded promptly.

2. What documents do you need?

You need to submit the following in order to open an account with us along with the application form (for individuals):

- PAN card (compulsory)

- Address proof (ration card / passport / driving license, electricity/telephone bill)

- Bank statement

- Demat account statement or slip (if any)*

- Latest passport size photograph (one)

*if you do not have a demat account, you would also be required to open a demat account to start trading.

3. Will you send someone to my house?

We try to make it convenient for you to open an account. I fyou cannot come to our office, we can try to send someone at your place to help you with the documentation process. However at certain locations we may not be able to send an advisor to distance or unavailability of staff. In such instance we can schedule a video chat on a convenient date and time, wherein our advisor will help you with the form and also conduct the mandatory in-person verification (IPV) to verify that your identity proof match yourself.

4. Why do you need these documents and an IPV?

As per SEBI regulations the know your customer (KYC) formalities that includes the documentation and in-person verification (IPV) are mandatory for every client. Being a financial services company we are subject to strict laws and regulations just like banks. These processes allow us to identify who you are, how to contact you and your general profile and also prevents any potential frauds.

5. Can a foreign national invest in india?

Yes. Foreign citizens can invest in equity markets under foreign portfolio investors regulations, 2014 by registering themselves with a designated depository participant. For more details please write to us at contactus@arihantcapital.Com .

Trade your way

Online, mobile, on the phone, trade the way you want, from where you want

How it works

Have a query?

PRODUCTS AND SERVICES

MEDIA CENTER

OTHER LINKS

Connect with us on

ATTENTION INVESTORS :- a) prevent un authorised transactions in your account. Update your mobile numbers/email ids with your stock brokers. Receive information of your transactions directly from exchange on your mobile/email at the end of the day; b) KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, mutual fund etc.), you need not undergo the same process again when you approach another intermediary; c) prevent unauthorized transactions in your demat account. Update your mobile number with your depository participant. Receive alerts on your registered mobile for all debit and other important transactions in your demat account directly from NSDL / CDSL on the same day. (issued in the interest of investors). Please read the risk disclosure document and do's & dont's prescribed by the exchanges carefully before investing.

Arihant group companies are registered broker and dealer. SEBI registration number for NSE & BSE :- INZ000180939; NSDL - IN-DP-127-2015 DP ID-IN301983; CDSL DP ID-43000; NCDEX - 00080; MCX - 10525; AMFI - ARN 15114; SEBI merchant banking regn. No. - MB INM 000011070; SEBI research analyst regn. No. - INH000002764. Arihant capital markets ltd provides services with respect to commodities derivatives trading through its group company arihant futures and commodities ltd. Please carefully read the risk disclosure document as prescribed by SEBI & FMC and do's & don'ts by NCDEX. Existing customers can send in their grievances to compliance@arihantcapital.Com. And for DP related queries & complaints please write us to depository@arihantcapital.Com if you want to register your complaints through SEBI score portal please click here.

ARIHANT CAPITAL IFSC LIMITED | SEBI regid. No. : INZ000157539

address: unit no. 424, 4 th floor, the signature building, block 13B, road 1C, zone 1, GIFT SEZ, GIFT city, gandhinagar, gujarat - 382355. | tel: 079-40701700

Disclaimer: arihant capital markets limited and arihant futures & commodities limited are engaged in client based and proprietary trading on various stock and commodity exchanges. Arihant capital IFSC limited is engaged in proprietary trading in NSE IFSC stock exchange and india INX stock exchange.

#1011 solitaire corporate park, andheri ghatkopar link road, chakala, andheri (E), mumbai - 4000093. Email: contactus@arihantcapital.Com

Copyright © 2021 arihant capital markets ltd. All rights reserved.

COVID-19 important update: we are experiencing high call volumes and we appreciate your continued patience. We strongly encourage you to use our digital tools for self-servicing. You can download arihant mobile or trade online through invest ease (web trading) or ari trade speed (ODIN) and access your backoffice reports through client login dashoboard or arihant backoffice mobile app

Demo trading account

Develop your trading skills on thousands of markets, and master our award-winning platform for free. 1

Practise trading with £10,000 virtual funds

Get exclusive educational content on IG academy

Test strategies on the go with our free mobile apps

Open a demo trading account

Develop your trading skills on thousands of markets, and master our award-winning platform for free. 1

What is a demo trading account?

A demo account is a simulated market environment offered by a trading provider that aims to recreate the experience of ‘real’ trading as closely as possible. This is so that you can get a feel for how different products and financial markets work. The main difference is you won’t be at risk of losing any money, so you can explore and experiment with confidence.

When you open a demo account with us, you’ll get immediate access to a version of our online platform, along with a pre-set balance of £10,000 in virtual funds to practise with.

Why use a trading simulator?

You can use a trading simulator, such as a demo account, to enable you to get to grips with a platform, build your strategy and grow in confidence, without having to risk any real money.

Trading simulators aren’t just for newcomers. As an experienced trader, you can use demo accounts to try out new strategies, tools or ideas, safe in the knowledge that your experiments won’t result in any real-world losses.

You’ll often see demo accounts described as ‘paper trading’, which is the term to describe simulated securities trading. With an IG demo trading account, you’ll gain access to over 17,000 markets, including:

As well as a range of other markets including bonds, rates and options.

A demo account will enable you to see the financial markets available with IG, and get used to how they behave. You’ll be able to set alerts on markets you want to keep an eye on, so you can react instantly to any price volatility. The demo account will also help you get used to the IG platform, ensuring that you can read and analyse price charts, fill in the deal ticket and monitor open positions.

If you’re interested in using more advanced software, you can also get an MT4 demo account with us. This enables you to build your understanding of the metatrader4 online trading platform in a risk-free environment.

Yes, you can practise stock trading and forex trading for free with an IG demo account. No need to create a separate forex demo account or stock demo account – you can trade both markets via a single login.

With an IG demo account, you can practise CFD trading and spread betting risk-free. These two products both use leverage, which enables you to gain full market exposure for just a small initial deposit. While this can magnify your returns, it can also magnify your risk – so it’s important to get to grips with how they work before you start to trade on live markets.

There is no difference between a demo trading account, trading simulator or paper trading account. All of these terms are just synonyms for the same type of simulated trading platform.

For your country of residence, you may wish to use <

Sorry we cannot open an account for clients with your country of residence through this site. Instead, please visit <

1 awarded ‘best multi platform provider’ and ‘best finance app’ at the ADVFN international financial awards 2020

Markets

IG services

Trading platforms

Learn to trade

Contact us

Spread bets and cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and cfds with this provider. You should consider whether you understand how spread bets and cfds work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, etfs and etcs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG markets ltd, spread betting provided by IG index ltd. IG is a trading name of IG markets ltd (a company registered in england and wales under number 04008957) and IG index ltd (a company registered in england and wales under number 01190902). Registered address at cannon bridge house, 25 dowgate hill, london EC4R 2YA. Both IG markets ltd (register number 195355) and IG index ltd (register number 114059) are authorised and regulated by the financial conduct authority.

The information on this site is not directed at residents of the united states, belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Open and test drive our demo trading account

By opening this demo account you confirm your acceptance of our demo account terms and conditions and privacy policy.

Learn to trade with a demo account

Trading with city index

Technical analysis

Fundamental analysis

Financial markets

Demo trading support service

We provide detailed information about every aspect of our service with ongoing account support for every client.

Platform walkthroughs

Ongoing support

Live account upgrade

A demo account cannot always reasonably reflect all of the market conditions that may affect pricing, execution and margin requirements in a live trading environment. Margin and leverage settings may vary from time to time between your demo account and a live account due to live account setting changes imposed as a result of elevated market volatility or other factors.

Demo accounts are intended to enable you to familiarise yourself with the tools and features of our trading platforms. Success or failure in simulated trading bears no relation to probable future results with any live trading that you may choose to engage in, and you should not expect any success with the demo account to be replicated in actual live trading.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

* spread betting and CFD trading are exempt from UK stamp duty. Spread betting is also exempt from UK capital gains tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

† 1 point spreads available on the UK 100, germany 30, france 40 and australia 200 during market hours on daily funded trades and cfds (excluding futures).

‡ voted “best trading platform”, “best mobile application” and “best spread betting provider” at the OPWA awards 2019. Voted “best professional trading platform” and “best spread betting provider” at the 2019 shares awards. Voted “best CFD provider” at the ADVFN international financial awards 2020.

City index is a trading name of GAIN capital UK limited. Head and registered office: devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is a company registered in england and wales, number: 1761813. Authorised and regulated by the financial conduct authority. FCA register number: 113942. VAT number: GB 887 937 443. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

City index and city trading are trademarks of GAIN capital UK ltd.

The information on this website is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

OPEN DEMAT ACCOUNT

All it takes is 15 minutes for quick demat account opening

Open demat account online for free

HOW TO OPEN DEMAT ACCOUNT?

What is demat account?

Demat account allows an investor to hold securities in an electronic form rather than physical form which has made the whole trading, investing, holding and monitoring of securities convenient and quick. For stock market trading it is utmost important to hold a demat account. It works same as a bank account, when shares are purchased your money gets deducted and vice versa. There are two depositories who manage demat account:

- National securities depository limited (NSDL)

- Central depository services limited (CDSL)

To trade in share market, all you need is to hold a bank account, demat account and a trading account. Demat account helps you reduce risks, save cost, save transaction time and also increases liquidity. Under demat account, your share certificates are converted from physical form to electronic form so as to increase their accessibility. The facilities offered by demat account are:

- Transfer of shares

- Loan facility

- Dematerialization & rematerialization

- Multiple access options

- Corporate actions

- Speed e-facility

A demat account holds all the investments an individual makes in shares, exchange-traded funds, bonds and mutual funds, etc. In one place. It has become a necessary thing in case you want to invest in stock markets. It makes the entire process of share trading easy, secure and speedy. Demat account allows you to buy shares and safely store them. A good note is you can open a demat account without possessing any shares and can maintain a zero balance in your account.

How to open demat account?

The procedure to open a demat account is easy and quick. Below are the steps to guide on how to open a demat account.

- Firstly, choose a depository participant to open a demat account

- Complete the account opening procedure and as required attach the documents. Remember to carry original documents during verification

- Further in-person verification will be done for which a representative will be assigned

- On successful processing, the client will receive a client ID from DP, these details will be required to access demat account online

- On becoming a demat account holder, you would be required to pay AMC for maintenance of account. Also, transaction fee would be charged for conducting trade transaction. In case you hold physical shares, the DP may charge you a separate fee for dematerialization of the shares

- Benefit of demat account is you can open it without having any shareholdings and there’s no mandate to maintain a minimum balance

Documents required for opening a demat account:

- Aadhaar card

- PAN

- Canceled personalized cheque

- Passport size photograph

WHY OPEN A DEMAT ACCOUNT with KARVY ONLINE ?

Karvy has a rich experience of over 30 years in the industry. You can avail the following benefits of demat account on opening account with us:

Cutting-edge technology and platforms to support trade

Assisted trading through advisory and support desk services

Extended research expert assistance

Award-winning performance and customer services

One of top 10 broking houses in india

One of the largest retail brokers with a pan india presence

Additional benefits:

Quickest ways to open the best demat account in india: demat account opening can be done in just 15 minutes. You can have free trading account too as there is no separate procedure for free trading account opening

Enjoy brokerage reversal: open demat account online with us and get rs. 5500 brokerage reversal

High speed trading platforms: highly reliable, and easy to use trading platforms

Top botch advisory: experts offer personalized and tangible investment solutions

FEATURES & BENEFITS OF DEMAT ACCOUNT

Ask the expert

Expert research analysts resolve all trade related queries

Advisory desk

Customised advice for balanced portfolio and assistance in trade

Live chat

Chat sessions with experts for trading support and service desk

Ways to reach us

Secured and quicker access by call N trade, trade via SMS, whatsapp and skype from your registered mobile / email

Locate us

Wide network of over 258 branches providing service to over 70 million individual investors and 600 corporate houses

Book A demo

One stop solution for queries related to equity trading and trading platforms

PRODUCTS TO TRADE USING DEMAT ACCOUNT

Karvy’s combined account facility helps you capitalize on the following investment opportunities

- Equity: companies sell a portion of ownership to the public in order to raise capital for further expansion. This portion of ownership is commonly known as shares, stocks, or equity. It is a market where buyers and sellers of stocks meet. The securities traded here can be either public stocks, which are those listed on the stock exchange, or privately traded stocks.

- Mutual fund: mutual fund, a sort of financial intermediary, pools money from several investors to invest the collected funds in other financial instruments. It is professionally managed by fund managers who thoroughly track the market and trace the winning stocks and appropriate times to buy and sell.

- Future and options: future contracts are the best hedging tools and are used to limit the risk exposure faced by an investor. Whereas, options allow more flexibility as the buyer has no obligation to fulfill the contract.

- Currency: currency is very powerful hedging and investment tool. It’s a contract wherein two currencies can be exchanged at a future date at a specific rate.

- Commodity: commodity trading is a common tool used by an investor to hedge prices, take speculative positions and explore arbitrage opportunity. Access to multiple commodity exchanges: karvy holds membership of the leading commodity exchanges like MCX, NCDEX, NMCE, and ACE.

- Ipos: opportunity to invest in quality stocks: utilize this IPO route and take advantage of investing in quality stocks at the lowest price.

Investing for growth with revolut trading

Enjoy commission-free stock trading within your monthly allowance

Buying and selling stocks with revolut is accesible for all вђ“ comission-free within your monthly allowance

Metal enjoy unlimited commission-free trades a month, premium enjoy 8 and standard get 3

Buy and sell shares in global companies

Get access to over 750+ stocks, from apple to zoom

Trade in fractional shares, (a small portion of a stock thatвђ™s less than one full share), from as little as $1

Stay informed in real time

Enjoy real time market graphs so you can make informed trading decisions

Keep track of the companies youвђ™re interested in with our in-app global market news

Common questions

Please remember that stock trading puts your capital at risk. The performance of stocks can go down as well as up.

How to get into stock trading?

Itвђ™s easy to get started to trade with revolut, if you're not already. Youвђ™ll need to complete a few additional steps before you can get going - you might need to have your local tax ID handy. Once the red tape is dealt with, you can start trading!

What is stock trading?

Stock trading with revolut means being able to invest in the companies you love, enabling you to buy stocks as part of a diversified portfolio. So just as you might put ВЈ100 into a savings account each month - youвђ™ll be able to do the same, only with stocks. So investing for your future can finally become an attainable reality.

What are fractional shares?

A fractional share is just that: a fraction of a whole share. Companies issue whole units of stocks, called shares, which are then traded on the public market for investors вђ“ like you вђ“ to buy. If you buy a fractional share that means youвђ™re buying a little piece of a companyвђ™s stock вђ“ a fraction of it.

Join revolut for free

Manage your everyday spending with powerful budgeting and analytics, transfer money abroad, spend easily in the local currency, and so much more. Join 12M+ already using revolut.

Explore other popular features

Trade in crypto

Trade commodities

Capital at risk.

This stock trading platform is facilitated by revolut trading. Neither revolut nor revolut trading provides investment advice and individual investors should make their own decisions or seek professional independent advice if they are unsure as to the suitability/appropriateness of any investment for their individual circumstances or needs. The value of investments can go up as well as down and you may receive less than your original investment or lose the value of your entire initial investment. Past performance is not a reliable indicator of future results. Currency rate fluctuations can adversely impact the overall returns on your original investment. Any trades outside of your monthly allowance are charged ВЈ1 per trade вђ“ see our trading FAQ for your equivalent. An annual account management fee of 0.01% is charged on your assets monthly. Learn more by reading our full risk disclosure and our trading FAQ.

Revolut trading ltd (FRN 832790) is an appointed representative of resolution compliance ltd which is authorised and regulated by the financial conduct authority. Revolut trading ltdвђ™s registered address is: 7 westferry circus, canary wharf, london, england, E14 4HD.

Free trading demo account review

Are you looking for a free and unlimited trading demo account? – then this page is for you. In more than 7 years of experience in online trading, we have tested many providers and present you in the lower table in our top 3. Additionally, you will learn on this page why a demo account with virtual credit is so important for beginners and advanced traders.

| Broker: | review: | spreads: | advantages: | open account: |

|---|---|---|---|---|

1. IQ option  | ➜ read the review | starting 1.0 pips | + FX & options + best platform + start with $10 |

Criteria for a good trading demo account:

Not every trading demo account is optimal for the private trader. That’s why there are different criteria that make a good trader. All in all, however, it can be said that nowadays almost every online broker offers a free demo account. Sometimes, however, there are runtime restrictions or other functions that are limited.

The demo account is intended to simulate real money trading. Therefore, it is essential to choose a reputable provider. With brokers with an official regulation and financial license, there are no differences in the demo and real money trading from our experience.

- Free demo account

- Unlimited demo account

- There is no difference between the demo account and real money trading

- The account can be recharged with virtual money as desired

- All functions are available

Why is a demo account so important for beginners and advanced users?

A trading demo account is an account filled with virtual credit (play money). It simulates real money trading. Traders can therefore trade real market situations without risk. The account is particularly suitable for beginners who want to start trading. The first experiences can be collected in the demo account.

In general, it is about getting to know the trading platform of the broker better. In our experience, most beginners find it very complex to trade on the financial markets at first. After a few explanations and tests, however, one realizes that it is not so difficult. In addition to the trading platform, the broker can also test the trading conditions.

The spread and trading commission in the demo account is the same as in the real money account. New markets should also first be tested in virtual mode, especially in the short-term area (day trading). Beginners and advanced traders can benefit from this. In addition, trading strategies can be tried out or developed. In summary, the rule is that you should trade in the demo account until you are profitable and make progress.

Facts about the demo account:

- Trading in the demo account is risk-free and simulates real money trading

- Test the trading platforms sufficiently

- Learn online trading and control order execution

- Test the broker’s fees

- Test and develop new trading strategies

Free and unlimited demo account

In general, a demo account is always free of charge. From our experience, 99% of online brokers offer this service. Some few providers require a minimum deposit. From such offerers is urgently to be advised against, because these are often unserious. In addition, the account should have an unlimited duration.

Some providers have fixed expiration times for the test account. By a message to the support, this problem can be solved however and the running time was extended from my experiences up to now always. In summary, beginners and advanced traders have the opportunity to test open trading platforms and brokers. A demo account like the real money account should always be ready to trade.

IQ option trading demo account

No difference between real money and virtual credit

With good brokers there is no difference between demo and real money trading. The price movements and executions are the same. Gladly, the trader can also check this himself. With regulated providers you do not have to worry. Therefore, be sure to obtain an official license from a financial supervisory authority.

The top recommended brokers all have an official license and are even regulated several times. Also, the trading fees and/or the spread has no difference in the demo account to the real money trade. With these accounts, you can simulate real money trading 1 to 1.

- Choose a reputable provider for your trading demo account as well

- You trade in both accounts under the same conditions

Account recharge is quite simple

With the demo account, there is the possibility to recharge the credit as desired. Since it is a test account, the credit can shrink quickly. But this is no problem at all. Because over the web page of the broker one can recharge the account very simply in few clicks. If you have any questions you can contact the support.

Further training for traders

Especially many beginners trade in the demo account and this is also absolutely necessary for a newcomer. The brokers offer concrete training material. The offer ranges from trade tutorials to free-market analyses and webinars. The demo account is the best way to expand your knowledge.

In addition, you can gain personal experience in various market situations. Professionals generally talk about the fact that it takes several thousand hours of screening time to act successfully. Read also our 10 trading tips.

Education center (videos and more)

How long should I practice in a demo account?

From our experience, one should practice in the demo account until one has made demonstrably the first profits over a longer period of time. From our experience, a period of one month is suitable here. If you make a good profit week after week, you can slowly dare to trade real money.

It is important that you keep a statistic about your trades. The trading platform, however, already shows this very transparently. Alternatively, further tools can be added. It is best not to rush into anything. Trading a week longer in a demo account is better than losing real money because you don’t feel safe enough.

Conclusion: the demo account is the best way to learn online trading

The trading demo account is suitable for any trader and should be used before trading real money. It has many advantages which we have described to you on this page.

In addition, the creation of such an account is done in a few minutes. Online brokers meanwhile offer very easy access to the trading platform. Should he feel sure that a trader is safe enough for real money trading, he can start it directly.

In summary, the demo account is one of the most important tools of a trader, because with this account you can try many things about real market situations for free and without risk.

Good luck with your trading.

A demo account is necessary for each type of trader. You can try to trade the markets without risk.

FOREX trading accounts

Choose an account type that best suits your trading style.

FOREX.Com account

- Advanced trading platforms with customizable interfaces

- Trade forex, equities and more, all on one account

- Fast, reliable trade executions

Metatrader account

- Dedicated FX trading platform

- Exclusive in-platform market news and analysis

- Trades execute at the best available price

DMA account

- Trade on prices as low as 0.1 on all major FX pairs

- Get commission discounts as low as $20/m traded

- Split the spread and place orders within the top of book spreads

What information do I need when opening an account?

We will need you to provide us with your name and address to establish your identity. Typically, we can verify your identity instantly. For more information, see our account document faqs.

What markets does FOREX.Com offer?

You can trade over 80 currency pairs at FOREX.Com. View our full range of markets.

When is forex market open for trading?

You can trade forex at FOREX.Com 24 hours a day, five days a week. For details, read our forex trading times article.

Is there a charge for central clearing?

We provide central counterparty clearing through an omnibus segregated clearing account (OSCA) free of charge as standard to all clients. If you wish to open an individual segregated clearing account (ISCA), fees apply:

- For an individual these charges are: £13,000 account opening fee, plus account maintenance and transaction charges

- For a corporate entity these charges are: £200,000 account opening fee, plus account maintenance and transaction charges

Try a demo account

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

Try a demo account

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

It's your world. Trade it.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

So, let's see, what we have: you can now trade stocks online or through apps - and often for free. But, what are the best free stock trading platforms? At online free trading account

Contents of the article

- New forex bonuses

- 7 best free stock trading platforms

- 7 best free stock trading platforms

- The bottom line

- Free trading demo account review

- Criteria for a good trading demo account:

- Why is a demo account so important for beginners...

- Free and unlimited demo account

- No difference between real money and virtual...

- Account recharge is quite simple

- Further training for traders

- How long should I practice in a demo account?

- Conclusion: the demo account is the best way to...

- Open trading account

- OPEN YOUR FREE TRADING ACCOUNT WITH EASE

- Get a call back

- Arihant ekyc

- Download and print

- A SMARTER WAY TO MANAGE YOUR INVESTMENTS

- TOOLS & SUPPORT

- GET IDEAS

- DIVERSIFY

- 1. How long does it take to open an account?

- 2. What documents do you need?

- 3. Will you send someone to my house?

- 4. Why do you need these documents and an IPV?

- 5. Can a foreign national invest in india?

- Trade your way

- How it works

- Have a query?

- Demo trading account

- Open a demo trading account

- What is a demo trading account?

- Why use a trading simulator?

- Open and test drive our demo trading account

- Learn to trade with a demo account

- Demo trading support service

- OPEN DEMAT ACCOUNT

- All it takes is 15 minutes for quick demat...

- Open demat account online for free

- HOW TO OPEN DEMAT ACCOUNT?

- WHY OPEN A DEMAT ACCOUNT with KARVY ONLINE ?

- FEATURES & BENEFITS OF DEMAT ACCOUNT

- PRODUCTS TO TRADE USING DEMAT ACCOUNT

- Investing for growth with revolut trading

- Enjoy commission-free stock trading within your...

- Buy and sell shares in global companies

- Stay informed in real time

- Common questions

- Join revolut for free

- Explore other popular features

- Trade in crypto

- Trade commodities

- Common questions

- Free trading demo account review

- Criteria for a good trading demo account:

- Why is a demo account so important for beginners...

- Free and unlimited demo account

- No difference between real money and virtual...

- Account recharge is quite simple

- Further training for traders

- How long should I practice in a demo account?

- Conclusion: the demo account is the best way to...

- FOREX trading accounts

- Try a demo account

- Try a demo account

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.