Jp markets withdrawal

In complying with this, amidst several other strict rules and regulations, all client funds must be kept separate from the broker account, and it can only be used by traders to conduct trading activities.

New forex bonuses

You can make use of the following payment methods to deposit or withdraw funds:

JP markets minimum deposit

JP markets minimum deposit

The JP markets minimum deposit amount that JP markets requires is ZAR3,000.

The minimum deposit amount of ZAR3,000 when registering a live account is equivalent to USD 170,38 at the current exchange rate between south african rand and the US dollar on the day that this article was written.

JP markets is a south african-based broker which is authorized and regulated by one of the strictest and most demanding regulating entities namely FSCA, and as a regulated broker, one of the requirements is that client funds be kept in segregated accounts.

In complying with this, amidst several other strict rules and regulations, all client funds must be kept separate from the broker account, and it can only be used by traders to conduct trading activities.

In addition to ensuring client fund security through segregated accounts, regulated brokers such as JP markets are required to be a member of a compensation scheme or fund which pays out a certain amount to eligible clients in the case of company insolvency.

Deposit fees and deposit methods

JP markets does not charge any fees when deposits are made into the trader’s account, and traders can deposit the minimum deposit amount by using any of the following methods:

- Bank transfer (ABSA, FNB, nedbank)

- Credit/debit cards

- Skrill

- I-pay

- Payfast

- Transfers from atms, and

- Snapscan, and

- Mpesa

JP markets supports a variety of deposit currencies in which traders can fund their accounts including:

- USD

- GBP

- ZAR

- KWD

Step by step guide to deposit the minimum amount

Once the trader has completed the process of registering on the website, the trader can make the initial minimum deposit by taking down the banking details provided to transfer funds via EFT, or traders can follow these steps for other payments:

- Navigate to the JP markets website and log into the client portal.

- Select the deposit option, the payment method and amount.

- Follow the instructions and additional prompts to deposit the minimum amount.

Traders should take note that with making deposits by using bank wire transfer, the transactions may take a certain amount of time depending on the method, time of the day, and day of the week.

Bank wire transfers take anything from a day to a few business days depending on the time the payment was made during the day along with the day of the week.

Pros and cons

| PROS | CONS |

| 1. Deposit fees and withdrawal fees are not charged | 1. Small variety of deposit methods supported |

| 2. Only a few deposit currencies supported |

What is the minimum deposit for JP markets?

Interactive brokers does not have a specified minimum deposit.

Professional accounts, however, have certain minimum deposits depending on the account that the professional trader opens.

How do I make a deposit and withdrawal with JP markets?

You can make use of the following payment methods to deposit or withdraw funds:

- Bank wire transfer

- US automated clearing house (ACH) transfer initiated at interactive brokers

- Cheques

- Direct debit/electronic money transfer

- Canadian electronic funds transfer, or EFT

- Single euro payment area (SEPA)

- BACS/GIRO/ACH

Does JP markets charge withdrawal fees?

The first withdrawal is free, thereafter traders will be charged per withdrawal depending on the size of the withdrawal and the method of payment.

End of the road for JP markets as court orders final liquidation

By sizwe dlamini

JOHANNESBURG – JP markets, the platform and technology for clients to trade forex in the international financial markets, is now under final liquidation as per the order of the gauteng high court.

The global forex powerhouse, as JP markets describes itself on its website, was accused of not paying out client withdrawals, not posting client’s deposits to their trading accounts and even manipulating data feeds.

The liquidation application was granted on september 7, after the financial sector conduct authority (FSCA) had filed an urgent application with the high court to liquidate JP markets and its bank accounts frozen.

In a statement on tuesday, the FSCA said this was the first time that the statutory power in section 38B of the FAIS act had been used by the FSCA. The section allows the authority to launch liquidation proceedings if it considers that the interests of the clients of a financial services provider or of members of the public so require.

The FSCA said it would work with the liquidators to do everything in its power to ensure that clients of JP markets recovered as much as possible of their funds. It said due to its intervention more than R2.58 billion was preserved in the numerous bank accounts held by JP markets.

JP markets, which was established in 2016 by founder and chief executive justin paulsen, has a domestic presence in johannesburg, polokwane, bloemfontein, cape town and pretoria, as well as an international presence in eswatini, kenya, pakistan and bangladesh.

The investigation against JP markets and paulsen, who is the only director and shareholder, has been completed, according to the authority. “the FSCA has given notice of its intention to debar paulsen from the industry,” it said. “on liquidation, the licence of JP markets was automatically withdrawn.”

The FSCA said it was preparing to hand the matter over to the national prosecution authority (NPA) for further investigation and possible criminal prosecution.

“the FSCA has taken these steps because of the substantial risk to the public in instances where entities and individuals act as issuers of derivative products (product providers) without having the adequate financial reserves, risk management system and knowledge, and as an on-going effort to remove financial service providers (fsps) who are prepared to act outside the law from the financial industry,” it said.

The FSCA has several other on-going investigations into forex platform operators.

Justice gilbert, who heard the application, appointed corné van den heever and tebogo malatjie as JP markets’ joint liquidators in terms of the financial advisory and intermediary services (fais) act.

“the respondent is placed under final winding-up in the hands of the master of the high court, johannesburg in terms of the fais act. The applicant’s costs, including any previously reserved costs, are costs in the winding-up of the respondent,” he said.

Justice gilbert pointed out that JP markets only filed its application for a licence on the eve of the FSCA’s liquidation application, while it had 16 months to do so.

He also said: “every FSP is, in terms of the fais act, required to have a key individual who oversees and manages the activities of the FSP relating to the rendering of financial services. Paulsen is the chief executive officer and the key individual of the respondent.”

The FSCA reminded consumers that forex derivative trading was a high-risk investment only suitable for investors with the required knowledge, skills and experience. “the public should carefully consider whether trading in such financial instruments is suitable for them. As forex derivative platforms are a very popular space for scammers and fraudsters to ply their trade, additional care should be taken when dealing with any platform.”

JP markets review

JP markets is among the many forex markets that are increasing in popularity. It gives its clients a single type of account with variable spreads, as well as additional benefits. However, the site does not allow the use of (EA) automated strategies, scalping and hedging.

Who is behind JP markets?

Established in 2016, JP markets is a forex broker that has its base in south africa, and happens to be the leading african and south african forex broker, with services expanding into other countries such as bangladesh, swaziland, kenya and pakistan.

The company operates under approval from the financial services board (FSB), south africa, FSP 46855. This gives the technology and platform allowing african-based clients to trade successfully in forex markets around the world.

JP markets focuses on assisting clients at a localized level through customer service as well as tools that can assist in succeeding on that front. The company prides itself on being the only brokerage worldwide that gives interest on trading accounts (this is subject to a specific minimum balance), as well as other industry firsts and benefits to various clients.

The founder is a south african entrepreneur, justin paulsen. He has extensive knowledge on the financial sector, having obtained a degree in economics and finance from the university of cape town. He has also worked with several brokers and forex agencies before setting up the company.

Trading services offered

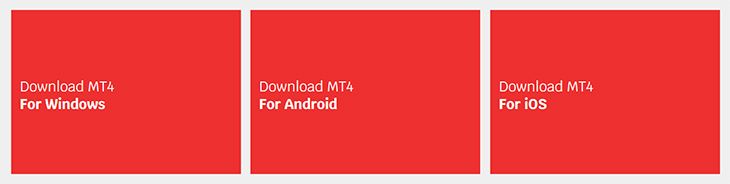

You can trade up to 30 forex pairs, other cfds, gold, stock indices and oil on the site, which uses the MT4 (metatrader 4) platform.

You may wonder why the base is in south africa. One reason is that many investors view south africa as a country with great potential, since it is among the most developed countries on the continent. The regulator, FSA, has enforcing powers that allow it to deal with breaches in forex brokerage, while it also runs the office of the omud for financial services providers, which is a customer complaints service.

Regulation within the country is not among the best in the world, though there is some level of reliability in the sector. If you are a local broker with a trading license, you need to keep all your client funds in recognized banks in the country within segregated accounts.

Advantages of MT4 trade platform

As the industry standard platform, MT4 lends itself to various traders as an easier alternative, thanks to the richness of its features. It places itself among the leading platform in online trading due to its foreign exchange agency model implementation, unconventional organization of trading, as well as competitive assessments.

You can use algorithmic traders as well as expert advisors (eas), which automate your exchange and make the process easier for you. MT4 allows you to see the marketplace you are dealing with, all within real time, highly accurate and impeccably judge all your exits and entrances.

Accounts available on the platform

Clients have a single account type to choose, and this account comes with no commission fees imposition, fixed spreads, STP (straight through processing) market execution and leverage that reaches a maximum of 1:500. You can get PAMM services as well.

Straight through processing

This service means that the forex broker will send the customer’s order directly to larger brokers or banks without the order passing through a dealing desk. That implies that there are no delays in the process and the processing of transactions is faster.

It has several advantages, which include:

STP brokers make their money through addition of small commissions, which are markups to the spreads

The losses of the client are not the profits of the broker

When the trader loses or wins, the exact markup will go to the broker, so this eliminates conflict of interest

A related aspect to STP is NDD (no dealing desk), which gives brokers access to the inter-bank forex markets. In addition, this eliminates conflict of interest, filling orders and re-quotes.

Deposit and withdrawal options

The platform does not offer a wide range of deposit options. The bank option is ned bank, with the deposit details. Keep in mind that the south african reserve bank (SARB) will always convert international payments to their base rate. Other options include bitcoin, credit and debit cards, neteller and skrill.

You need an initial deposit minimum of R3500, and this is a reasonable amount especially when you compare it to other south african brokers. In addition, allocations of payments can take a maximum of 24 hours on business days (from monday to friday).

An interesting aspect to JP markets is the allowance for sending withdrawal requests through whatsapp, which is unseen on other platforms. The withdrawals are easy and fast to process (the process takes about 24 hours), and you can do the process on official working days from 9am to 5pm.

The platform uses secure and safe ways to send you your money, while all transactions undergo rigorous processing to ensure your money stays safe.

The option is through local bank transfer, as the site does not allow e-wallets or any other mediums of withdrawal. The time it takes to receive funds depends on the bank you use. For instance, standard bank, ABSA, nedbank and FNB allow you to get your money within the same day, while other banks could take up to two days.

As with any other withdrawal process, you need to have proof of documentation before you submit your withdrawal request. This includes scanned copies of your ID, bank statements and proof of address, all confirming your details as per regulations from the FSB.

Keep in mind that all withdrawals that you make through credit cards have an extra fee of R50. For the case of bank transfers, there are no charges for withdrawals, but you are liable for any fees that the individual bank charges in the transaction, including the use of intermediaries.

Commissions, leverages and spreads

The maximum amount of leverage you can get is 1:500, which many investors consider high, even with other brokers offering higher or similar rates.

Note that with higher leverage comes higher risks of losses, and this is the reason many jurisdictions set caps on leverage rates.

Any promotional bonuses?

There are a few promotions that the company offers, which include:

30% welcome on deposit bonus, and this is valid for 60 days

Currently, the minimum amount that qualifies you for any bonus is R3000. There is also not much information regarding bonuses.

The platform does not charge you extra commission fees, which may be a good thing. However, we do not like the spreads, as we find them too wide to be competitive – they are 2.4 pips on average for USD/EUR.

Even though fixed spreads are wider than floating ones generally, many other brokers will offer you a better deal.

Pros of the JP markets platform

The FSB regulates its activities

MT4 is available on the site

Same day deposits and withdrawals are possible

You can trade in rand, other than USD or EUR

There is a limited choice of trading platforms

The spreads are too wide

You cannot use eas, hedging or scalping techniques on the platform

Final thoughts

JP markets is a CFD south african broker and forex company that the FSA regulates actively. They support the MT4 platform, making them easy to use for many traders. However, the spreads are higher than the average, and this unfortunately places many restrictions on trade.

Leave a reply cancel reply

������top broker 2020 SA������

General risk warning: the financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose. For more infomation, read our disclaimer.

JP markets minimum deposit

JP markets minimum deposit

The JP markets minimum deposit amount that JP markets requires is ZAR3,000.

The minimum deposit amount of ZAR3,000 when registering a live account is equivalent to USD 170,38 at the current exchange rate between south african rand and the US dollar on the day that this article was written.

JP markets is a south african-based broker which is authorized and regulated by one of the strictest and most demanding regulating entities namely FSCA, and as a regulated broker, one of the requirements is that client funds be kept in segregated accounts.

In complying with this, amidst several other strict rules and regulations, all client funds must be kept separate from the broker account, and it can only be used by traders to conduct trading activities.

In addition to ensuring client fund security through segregated accounts, regulated brokers such as JP markets are required to be a member of a compensation scheme or fund which pays out a certain amount to eligible clients in the case of company insolvency.

Deposit fees and deposit methods

JP markets does not charge any fees when deposits are made into the trader’s account, and traders can deposit the minimum deposit amount by using any of the following methods:

- Bank transfer (ABSA, FNB, nedbank)

- Credit/debit cards

- Skrill

- I-pay

- Payfast

- Transfers from atms, and

- Snapscan, and

- Mpesa

JP markets supports a variety of deposit currencies in which traders can fund their accounts including:

- USD

- GBP

- ZAR

- KWD

Step by step guide to deposit the minimum amount

Once the trader has completed the process of registering on the website, the trader can make the initial minimum deposit by taking down the banking details provided to transfer funds via EFT, or traders can follow these steps for other payments:

- Navigate to the JP markets website and log into the client portal.

- Select the deposit option, the payment method and amount.

- Follow the instructions and additional prompts to deposit the minimum amount.

Traders should take note that with making deposits by using bank wire transfer, the transactions may take a certain amount of time depending on the method, time of the day, and day of the week.

Bank wire transfers take anything from a day to a few business days depending on the time the payment was made during the day along with the day of the week.

Pros and cons

| PROS | CONS |

| 1. Deposit fees and withdrawal fees are not charged | 1. Small variety of deposit methods supported |

| 2. Only a few deposit currencies supported |

What is the minimum deposit for JP markets?

Interactive brokers does not have a specified minimum deposit.

Professional accounts, however, have certain minimum deposits depending on the account that the professional trader opens.

How do I make a deposit and withdrawal with JP markets?

You can make use of the following payment methods to deposit or withdraw funds:

- Bank wire transfer

- US automated clearing house (ACH) transfer initiated at interactive brokers

- Cheques

- Direct debit/electronic money transfer

- Canadian electronic funds transfer, or EFT

- Single euro payment area (SEPA)

- BACS/GIRO/ACH

Does JP markets charge withdrawal fees?

The first withdrawal is free, thereafter traders will be charged per withdrawal depending on the size of the withdrawal and the method of payment.

End of the road for JP markets as court orders final liquidation

By sizwe dlamini

JOHANNESBURG – JP markets, the platform and technology for clients to trade forex in the international financial markets, is now under final liquidation as per the order of the gauteng high court.

The global forex powerhouse, as JP markets describes itself on its website, was accused of not paying out client withdrawals, not posting client’s deposits to their trading accounts and even manipulating data feeds.

The liquidation application was granted on september 7, after the financial sector conduct authority (FSCA) had filed an urgent application with the high court to liquidate JP markets and its bank accounts frozen.

In a statement on tuesday, the FSCA said this was the first time that the statutory power in section 38B of the FAIS act had been used by the FSCA. The section allows the authority to launch liquidation proceedings if it considers that the interests of the clients of a financial services provider or of members of the public so require.

The FSCA said it would work with the liquidators to do everything in its power to ensure that clients of JP markets recovered as much as possible of their funds. It said due to its intervention more than R2.58 billion was preserved in the numerous bank accounts held by JP markets.

JP markets, which was established in 2016 by founder and chief executive justin paulsen, has a domestic presence in johannesburg, polokwane, bloemfontein, cape town and pretoria, as well as an international presence in eswatini, kenya, pakistan and bangladesh.

The investigation against JP markets and paulsen, who is the only director and shareholder, has been completed, according to the authority. “the FSCA has given notice of its intention to debar paulsen from the industry,” it said. “on liquidation, the licence of JP markets was automatically withdrawn.”

The FSCA said it was preparing to hand the matter over to the national prosecution authority (NPA) for further investigation and possible criminal prosecution.

“the FSCA has taken these steps because of the substantial risk to the public in instances where entities and individuals act as issuers of derivative products (product providers) without having the adequate financial reserves, risk management system and knowledge, and as an on-going effort to remove financial service providers (fsps) who are prepared to act outside the law from the financial industry,” it said.

The FSCA has several other on-going investigations into forex platform operators.

Justice gilbert, who heard the application, appointed corné van den heever and tebogo malatjie as JP markets’ joint liquidators in terms of the financial advisory and intermediary services (fais) act.

“the respondent is placed under final winding-up in the hands of the master of the high court, johannesburg in terms of the fais act. The applicant’s costs, including any previously reserved costs, are costs in the winding-up of the respondent,” he said.

Justice gilbert pointed out that JP markets only filed its application for a licence on the eve of the FSCA’s liquidation application, while it had 16 months to do so.

He also said: “every FSP is, in terms of the fais act, required to have a key individual who oversees and manages the activities of the FSP relating to the rendering of financial services. Paulsen is the chief executive officer and the key individual of the respondent.”

The FSCA reminded consumers that forex derivative trading was a high-risk investment only suitable for investors with the required knowledge, skills and experience. “the public should carefully consider whether trading in such financial instruments is suitable for them. As forex derivative platforms are a very popular space for scammers and fraudsters to ply their trade, additional care should be taken when dealing with any platform.”

JP markets review

User review

JP markets is an international online broker that started operating in 2016. Although the company has been around for just a few years, it has already built a relationship of trust with its clients. It began as a small company with a small office and a few workers, but today, it has offices in several countries across the globe.

• negative balance protection

• sophisticated trading platforms

• safe and secure

• excellent customer support

• no promotions

• users only trade cryptocurrencies but don’t own them.

The founder of jpmarkets is a south african entrepreneur called justin paulsen. He has a major in finance and economics at the university of cape town. Paulsen got the opportunity to interact with a number of asset managers, hedge fund managers, forex traders, and portfolio managers while working for a leading forex broker in south africa.

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Reasons to sign up at JP markets for south african traders

Here are six stout reasons for south african investors and traders to sign up at JP markets:

- Negative balance protection – you will never end up owing JP markets any money because it uses a risk management system and an automated transaction management system to prevent a client’s account from turning negative.

- Sophisticated trading platforms – JP markets offers adequate and fast trading platforms. Since there are no lags and requotes, clients get exactly what they want.

- Safe and secure – the forex broker maintains client funds separately from its own funds.

- Free deposits and withdrawals – the broker does not charge clients for processing deposits and withdrawals.

- Fast payment methods – the deposits are instantly credited to traders’ accounts. And customers can instantly withdraw their profits from their accounts. They simply do not have to wait long for the transactions to go through.

- Excellent customer support – the customer support agents are friendly, helpful, and prompt. You can get in touch with the FX broker through live chat, email, or phone.

Is JP markets reliable forex broker?

South african investors can definitely rely on JP markets as it is the biggest forex broker in africa and south africa. During the last few months, the company has experienced tremendous growth and has expanded into bangladesh, pakistan, and kenya.

The broker operates on a license issued by the financial services board of south africa. You can view a copy of the license on the JP markets website.

You can contact JP markets through the telephone number +27-010-590-1250, the email address [email protected], or the facebook account www.Facebook.Com/jpmarketssa. JP markets has offices in johannesburg, pretoria, cape town, swaziland, and polokwane.

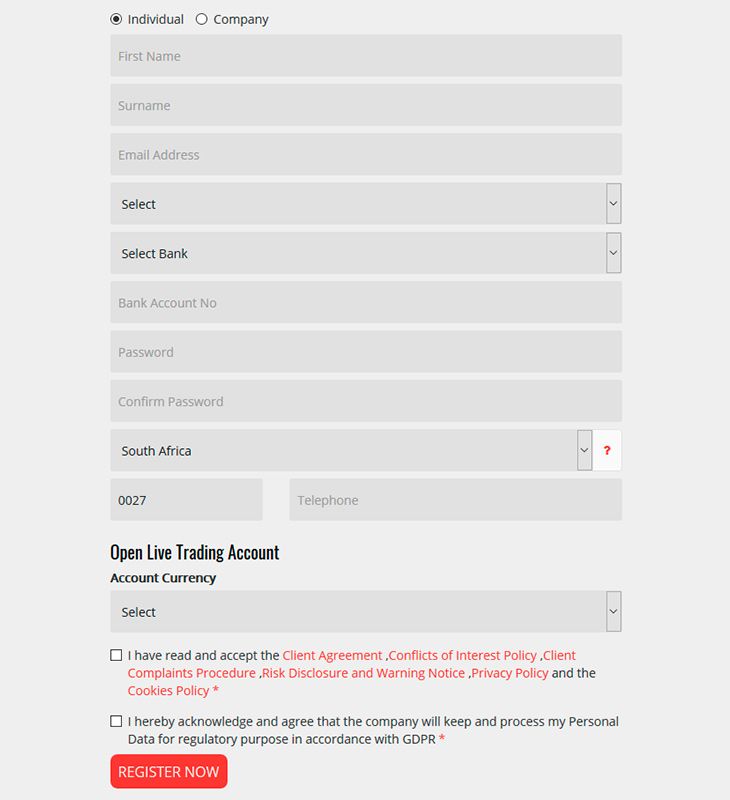

Create an account to start trading

You can open a live trading account at JP markets in three simple steps:

- Complete the online registration form.

- Verify their account by clicking on a link in the FX brokers’ first email.

- Load their trading accounts and start trading.

Traders can open accounts as individuals or companies.

We strongly recommend reading the client agreement form, client complaints procedure, privacy policy, cookies policy, risk disclosure and warning notice, and conflicts of interest policy carefully before registering an account.

Making deposits and withdrawals at JP markets

South african traders can choose a bank from the given list of banks to make a deposit. They can use their MT4 account number for reference. It may take up to 24 hours for the funds to be credited to traders’ accounts. If they want the funds to be credited faster, they have to email payment proofs to [email protected]

- ABSA

- Standard bank

- Nedbank

- Snapscan

- First national bank

- Mpesa

- Online gateways

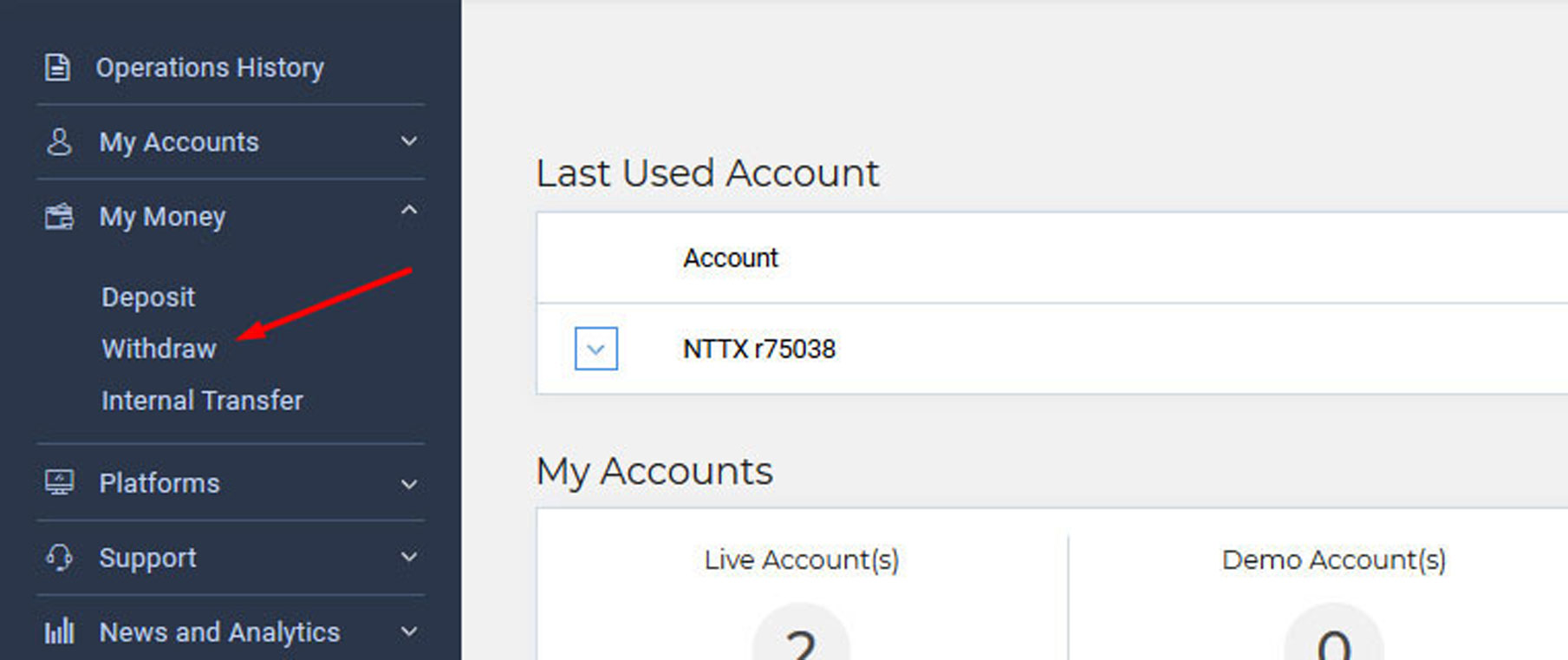

There are three ways to make withdrawals at JP markets:

- Client portal – you can quickly and easily request payout through their client portal.

- Online platform – you can withdraw through the platform using payfast/skrill or local bank transfers. JP markets processes payout requests from monday to friday, between the hours of 9:00 a.M. And 5:00 p.M. You will receive a verification call from the broker for purposes of security.

- Whatsapp – you can send your payout request to 079-604-4252 and include your MT4 account number and the amount you would like to withdraw. When it receives the request, the company verifies the details and credit payouts in 24 hours after the completion of the verification procedure.

However, withdrawal through whatsapp is available only from 10:00 a.M. To 4:00 p.M. From monday to friday.

Types of trading platforms

Traders can choose from the following platforms at JP markets:

MT4 for windows

Customers can download MT4 for windows, android, and ios and enjoy features such as no rejections, no requotes, and flexible leverage in the range of 1:1 to 500:1. This platform is suitable for traders of different skill levels.

The MT4 platform is popular for its user-friendly interface, technical analysis tools, automated trading capabilities, advanced charting features, and automated trading capabilities. JP markets’ MT4 platform supports multiple currencies such as PLN, SGD, GBP, EUR, and USD. Also, it is available in 30 languages.

MT4 for mac

Traders can use wine, a free software program that enables systems based on unix to run applications developed for MS windows. Unfortunately, wine is not fully stable. So the application may not work as intended.

JP markets recommends playonmac, a free wine-based application that can be used to easily install windows applications on devices that run on the mac operating system.

MT4 for linux

Users of linux computers can use wine to install MT4 on their systems. However, they must understand that the application may not work properly.

Account types

JP markets offers different types of accounts to meet the requirements of different types of customers.

- USD, GBP, and ZAR based accounts

- Accounts that charge commissions

- Accounts that charge spreads as costs

Each type of account gives clients direct access to the market. The orders flow directly to the market, ensuring that traders get the best market prices without any slippage, price manipulation, and lag.

There are micro as well as mini accounts, but the forex broker doesn’t discriminate between the two.

Unique features of JP markets

Here are some features that make jpmarkets unique and set it apart from the other forex & CFD brokers in the industry:

JP markets mastercard

Registered traders at JP markets can apply for the JP markets mastercard and become a VIP mastercard client. They can use their card to make payments and withdraw money at atms. Also, they can use it to manage their profits easily.

To qualify for a JP markets mastercard, customers have to create a trading account and maintain a minimum balance of R5000. The holders of this card can use it only in south africa, not in any other country. This card has been designed to enable JP markets to pay profits to its clients; so traders cannot load any money in it. However, they can apply for a total of three JP markets mastercards.

To check their balance, clients have to log in to www.Whatsonmycard.Com. They should note that they cannot use their card to store any money and accrue interest on it. They have to use their card to either make purchases or withdraw their money at an ATM. They cannot withdraw the funds on their card at any bank.

Copy trading

Customers can earn profits by copying the trades of professional traders at JP markets. They will just be investing funds and a copy master will manage their funds for them. Any professional trader can become a copy master at JP markets. They can do so by following these steps:

- Visit jpmarkets.Co.Za/copy-trader and complete the online application form.

- An account manager will contact them and give them some paper work.

- Visit copytrader.Jpmarkets.Co.Za and open an account.

- When the company approves your fund manager or professional trader status, you can log into your account at copytrader.Jpmarkets.Co.Za

Welcome bonus

You get a welcome bonus of up to 100% just for opening a live trading account and making a deposit. You have to deposit at least R3,000 to qualify.

JP markets offers 25% bonus on deposits in the range of R3000 to R30,000; 40% bonus on deposits in the range of R30,001 to R60,000; 60% bonus on deposits in the range of R60,001 to R100,000; 80% bonus on deposits in the range of R100,001 to R125,000; and 100% bonus on a deposit of $125,000.

JP markets FAQ

Q1: how much should I deposit in my trading account?

A: JP markets doesn’t set any deposit limits for its clients. So you can deposit any amount you wish. However, JP markets recommends a minimum deposit of R3000, especially if you are a new trader in need to training.

Q2: do clients have to pay for the trading education at JP markets?

A: JP markets offers excellent forex trading absolutely free of charge to holders of live trading accounts. The forex broker offers classes at some of its offices in south africa. Also, it offers video courses and online courses for traders who wish to learn at their own pace. Those interested can send an email to [email protected] for more information.

Q3: can I use bitcoin to load my trading account?

A: you can use bitcoin, but only through skrill. You can use bitcoin to load your skrill wallet and then transfer the money to your trading account.

Q4: how much money can I make at JP markets?

A: it all depends on how well you trade. You should learn to make informed decisions using a wide range of trading tools. Also, you should learn how to manage your risks well.

Q5: are my funds safe at JP markets?

A: yes, your money is 100% safe at JP markets. This is because the online broker holds clients’ money in separate accounts and never mixes it with its own funds. In addition, it has professional indemnity insurance to protect clients’ funds.

Should you open an account at JP markets?

If you reside in africa, you certainly should. JP markets is not only licensed and regulated in south africa, but also supports ZAR and offers products designed for african traders. In addition, it has several offices across africa and is founded by a well-known african entrepreneur.

JP markets is not only a safe, secure, and well-regulated online trading platform, but also an excellent educator. If you have never traded before, you can easily learn how to trade at jpmarkets.

JP markets review

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Withdrawals

Key to markets offers several withdrawal methods.

Clients’ funds are held on segregated accounts, which are separate from key to markets own corporate accounts.

Please note that withdrawal is returned to the same source your trading account was funded from.

Payments to third parties are strictly forbidden .

The conditions of each withdrawal method are as follows:

Key to markets is always at your side.

We work hard to provide you with the best technology and trading conditions available on the market.

Safety is your as well as our priority. Your funds are kept in a segregated account separate from the company accounts.

FCA (UK) regulated license number 527809.

FSC (mauritius) regulated license number GB19024503.

Key to markets has a worldwide presence with offices in london (UK), port louis (mauritius) and auckland (NZ).

KEY TO MARKETS INTERNATIONAL limited, 1/F river court, 6 st denis street – port louis 11328 – mauritius, is a company incorporated in mauritius, under company number 169425 and regulated by the financial services commission of mauritius as an investment dealer, licence number GB19024503. Key to markets international limited is a payment processor for non-EU clients using skrill and neteller wallets.

KEY TO MARKETS (UK) limited, vicarage house – 58-60 kensington church street – london, W8 4DB – united kingdom, is a company registered in the united kingdom and regulated by the financial conduct authority (FCA register number 527809).

KEY TO MARKETS NZ limited, level 10, 21 queen street – auckland, 1010 – new zealand, is a company registered in new zealand under number 4472148 KEY TO MARKETS NZ limited is wholly-owned and controlled by KEY TO MARKETS (UK) limited. Key to markets NZ limited is the provider of the MT4 platform.

All of the above KEY TO MARKETS companies do not offer any services to residents of the USA, iran, new zealand, north korea and other countries where restrictions apply. For the full list of restricted countries please contact us.

Risk warning and disclosure:

Trading in margined foreign exchange carries a high level of risk to your capital and is subject to rapid and unexpected price movements. A key risk of leveraged trading is that if a market moves against your position you can incur additional liabilities far in excess of your initial margin deposit. Only speculate with money you can afford to lose. The products listed on this website may not be suitable for all customers, therefore ensure you fully understand the risks involved and seek independent financial advice if necessary. Nothing on key to markets’ websites, emails or any other form of communication or advertisement is intended to be a recommendation to buy or sell in any financial derivative markets. No representation, implicit or explicit, has been made that any account will or is likely to realize any particular profit or loss. Please read our full: risk and disclosure notice.

Jp markets withdrawal

Deposit and withdrawal policy

Trading in any investment opportunity that may generate profit requires marketsuk customers to deposit money on their online account. Profits may be withdrawn from the online account.

Deposits and withdrawals are regulated by this WD policy as well as the generally applicable terms and conditions.

You, the client, have to perform all the deposits from a source (e.G. Single bank account). If you want to start trading, you should make sure this account is in your country of residence and in your name. In order to certify that a SWIFT confirmation is authentic, it has to be sent to marketsuk to confirm the origin of the money which will be used for trading. If you don’t comply with this WD policy, you may be prevented from depositing the money via bank/wire transfer. If you did not login and traded from your account within six (6) months (“dormant account”), your dormant account will be subject to a deduction of 10 % each month (the “dormant fee”).

Funds appearing on clients’ account may include agreed or voluntary bonuses and incentives, or any other sums not directly deposited by the client or gained from trading on account of actually deposited funds (“non-deposited funds”). Please note unless otherwise explicitly agreed, non-deposited funds are not available for withdrawal. Further, due to technical limitations, non-deposited funds may be assigned to client’s account in certain occasions (for example, for the technical purpose of allowing the closing of positions or an indebted account).

Without derogating from the abovementioned, bonuses issued to client by marketsuk may only be withdrawn subject to execution of a minimum trading volume of 25 times the deposit amount plus the bonus issued (“minimum trading volume“).

Submitting A withdrawal request

In order to process your withdrawal request, you must:

• open a withdrawal request from client area.

• print the [withdrawal.Pdf] form. Client will log in to his account through the website, click on withdrawal, fill up the information and fill up the withdrawal form.

• sign the printed form.

• all compliance documentation must have been received and approved by marketsuk compliance officer in order to proceed with the withdrawal.

• beneficiary name must match the name on the trading account. Requests to transfer funds to third party will not be processed.

IMPORTANT: ACCOUNT HOLDER IS REQUIRED TO MONITOR ACCOUNT REGULARLY, AND ENSURE THAT AVAILABLE MARGIN EXISTS IN THE ACCOUNT PRIOR TO SUBMITTING THIS REQUEST, AS SUCH WITHDRAWAL MAY HAVE AN IMPACT ON EXISTING OPEN POSITIONS OR TRADING STRATEGY USED.

Typical withdrawal processing time

The time it takes for the money to reach your credit card or bank account that has been used to deposit funds may vary (usually up to five business days). Note that it might take longer for withdrawals to bank accounts due to the additional security procedures in force.

The request will generally be processed by marketsuk within 2 to 5 working days of receipt. In order to avoid any delays please review your information carefully before submitting your request. Marketsuk assumes no responsibility for errors or inaccuracies made by the account holder. Corresponding withdrawals will take 3 to 5 working days to process. Marketsuk cannot monitor and is not responsible in any way for the client’s credit card company or bank’s internal procedures. Client must follow up with the credit card or respective bank independently.

Funds are released to your credit account once your credit card merchant has debited the funds from our account. This process may take up to 2-14 working days or more to reflect on your credit card account balance. If you do not have online access to your credit card, it should appear on the next billing statement(s) depending on your card’s billing cycle.

Please note clearly that we are not committed to any time frame and that any additional charges imposed by third parties shall be deducted from the deposit or the withdrawal, as applicable.

Additional charges: if the receiving bank uses an intermediary bank to send/receive funds, you may incur additional fees charged by the intermediary bank. These charges are usually placed for transmitting the wire for your bank. Marketsuk is not involved with and nor has any control over these additional fees. Please check with your financial institution for more information.

For credit card deposits, when you choose an account in a different currency than USD (united states dollar), your credit card will be debited properly in accordance with amount deposited and the applicable exchange rates. In addition to the exchanged sum deposited, additional credit cards fees may apply (as a result, in such cases you may notice discrepancies between the sum of deposit and the sum charged on your credit card). Customers must accept these slight variations that can occur and won’t try to charge this back.

If you have used a credit card to deposit money, performed online trading and decide to cash in on your winnings, the same credit card must be used.

Amount of withdrawal per credit card is only allowable to an equal amount of money deposited per credit card or less. Greater amounts must be wire-transferred to a bank account.

Your account may comprise of different currencies. These will be subject to the following conditions:

we may accept payments into the account in different currencies and any payments due to or from us and any net balances on the account shall be reported by us in the respective currency; the account is maintained in US dollars, euro or GB pounds (“base currencies”) and any other currency will be converted at the exchange rate existing at the point of conversion (“exchange rate”); if the client send funds in another currency than his account’s currency, we will apply an exchange rate to our discretion.

We will generally settle trades or perform any required setoffs and deductions in the relevant currency where the account comprises such currency ledger, save that where such currency balance is insufficient, we may settle trades in any currency using the exchange rate.

Additional conditions

please note this policy cannot be exhaustive, and additional conditions or requirements may apply at any time due to regulations and policies, including those set in order to prevent money laundering. Please note any and all usage of the site and services is subject to the terms and conditions, as may be amended from time to time by marketsuk , at its sole discretion.

For queries concerning policy matters, please contact us anytime.

Refund and return policy

The refund policy has been developed for the purpose of reducing the company’s financial and legal risks of the company, as well as observing principles of anti-money laundering and counter terrorist activity.

The company has the right to unilaterally block the access to the secure client area, suspend trading activity of any accounts held by the trader, cancel a request for transfer/ withdrawal, or make a refund, if the source of funds or the client’s activities contradict the anti-money laundering and counter terrorist financing policy.

The company does not cancel the implemented trade transactions, therefore the company has the right to return the funds to the remitter, if within one month from the date of recharge, no trading activity has been recorded on the trading accounts.

The company has the right, under certain objective reasons and, if it is necessary, to make a refund of funds received via any payment system including credit/debit cards. Furthermore, the refund will be made to electronic wallets and bank details, which have been used by the client when paying in the funds.

Should the company classify the activities of the client as inappropriate or contradicting the usual purpose of the company’s services usage, where there is a direct, or indirect, illegal or dishonest intent, the company reserves the right to act within the framework of this document, without informing the client in advance. All direct or indirect losses; expenses connected with transfer of funds are reimbursed to the company from the client’s funds.

How to withdraw funds from the account

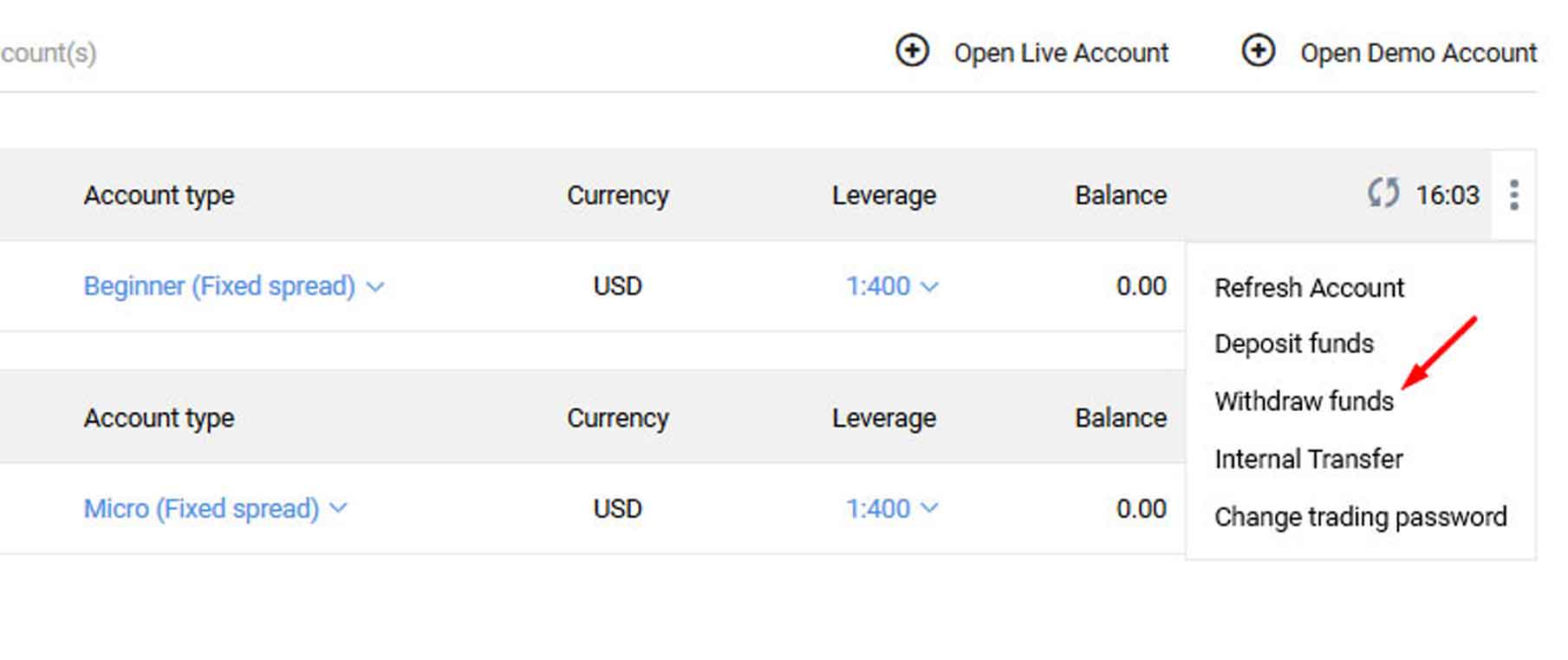

You can withdraw funds from your live trading account through the withdrawal dialog in your private area. You can access this dialog in the following ways:

- Click "withdraw" in the "my money" section.

- Select the line with the needed account from the “live accounts” list, click the “ellipsis” icon (. ), and choose the “withdraw funds” function.

The first page of the “choose a withdrawal method” dialog contains a list of available withdrawal methods for you, such as the basic ones - bank transfer, debit/credit bank card, bitcoin transfer, etc., as well as additional ones, available for transfers from some countries and regions of the world. Each withdrawal method is characterized by three main parameters - terms of withdrawal, processing time (from a few minutes to 2-3 business days), transfer fees.

You can choose the line with the preferred withdrawal method and click the "withdraw" button on it - a dialog box will open with a form for filling in the withdrawal amount and payment details of your account either in a bank or in the selected payment system. After filling in all the required fields of the form, click the "next" (or "withdraw") button.

The company’s back office will consider your application during its worktime (monday - friday, from 07:00 to 19:00 (CET)). You will get a message to your email about the receipt of the request. If your withdrawal request has been rejected, please, contact the customer support service.

You can track the status of your requests in the "my requests" section, as well as by clicking "view all requests" - the parameters of your request are in the "details" column (the “view” button).

And also, in the "my money" section of the "operations history" page, you can see the withdrawal transactions from your accounts with the main details and current status. The main status types are as follows:

- Active - request is accepted but not yet processed

- Processing - request is being considered

- Cancelled - request has been canceled by the account holder

- Rejected - request has been rejected

- Performed - request has been executed

- Pending - request is awaiting the new payment option verification

- Error - error in the request

You can cancel any request while its status is “active”. You can see the results of the withdrawal request on the "operations history" page, where you can view the withdrawal parameters (bank transfer transaction number, webmoney protection code, the request refusal reason, and other information) in the "details" column. After clicking the “status” button, you can filter your requests in the drop-down list.

So, let's see, what we have: an up to date actionable broker summary of JP markets minimum deposit, methods to fund your trading account, withdrawal fees. Make an informed trading decision. At jp markets withdrawal

Contents of the article

- New forex bonuses

- JP markets minimum deposit

- JP markets minimum deposit

- Deposit fees and deposit methods

- Step by step guide to deposit the minimum amount

- Pros and cons

- What is the minimum deposit for JP markets?

- How do I make a deposit and withdrawal with JP...

- Does JP markets charge withdrawal fees?

- End of the road for JP markets as court orders...

- JP markets review

- Who is behind JP markets?

- Trading services offered

- Accounts available on the platform

- Deposit and withdrawal options

- Commissions, leverages and spreads

- Pros of the JP markets platform

- Final thoughts

- Leave a reply cancel reply

- ������top broker 2020 SA������

- JP markets minimum deposit

- JP markets minimum deposit

- Deposit fees and deposit methods

- Step by step guide to deposit the minimum amount

- Pros and cons

- What is the minimum deposit for JP markets?

- How do I make a deposit and withdrawal with JP...

- Does JP markets charge withdrawal fees?

- End of the road for JP markets as court orders...

- JP markets review

- Reasons to sign up at JP markets for south...

- Is JP markets reliable forex broker?

- Create an account to start trading

- Making deposits and withdrawals at JP markets

- Types of trading platforms

- Account types

- Unique features of JP markets

- JP markets FAQ

- Should you open an account at JP markets?

- Withdrawals

- Jp markets withdrawal

- How to withdraw funds from the account

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.