Jp markets reviews 2021

The company only has one license, the one provided by the FSCA, also known as the FSB.

New forex bonuses

The FSB is the south african financial regulatory body that is responsible for making sure that forex brokerages are working with their clients responsibly. The license was given in the year 2016, the founding year of the company and it seems the company has operated without issue since then. It would be better to see the company get some more licensing form other regulatory bodies, but this will not be happening until the company decides to move out of their borders and into other regions. So far, with all the investigation we have done into the company, we would like to say that yes, we think there is enough evidence to support this claim. They seem to provide a pretty good service which, while limited, seems to be on track to becoming one of the better south african forex brokers. The only qualms have against the company are the possible scam allegations brought up by a few users and the lack of comprehensive online education tools. Other than that the company has done well and is on the right track to becoming one of the better brokers in the area. Though until they lower their spread and have a longer track record of faithful service, they will remain at the silver lion.

JP markets – why do we think that is not the best option?

Minimum deposit

Bonus

Maximum leverage

Year founded

Regulation

Trading platform

Zaargh doesn’t recommend this broker!

I do not trust this broker and do not recommend you to sign up with it.

JP markets is a very interesting broker that, despite some issues with their services, does their utmost best to provide as much information and as good a service to their clients. This includes comprehensive information regarding their offers, what promotions they have going on, some educational resources as well as a decent contact scheme. It is a pleasure to see a south african doing so much to advance their business and to help their clients. So let us get into the JP markets review and talk about all of the things they have done right up to this very point.

Though we are still going to give you a fair warning before we get into the details. The experience you have with the company might be very different from what the other users have, so do not expect to get the 100% best trading experience from them that you go in expecting.

The page

The page

The website the JP markets has to offer to clients seems very simple at first look. The simple black and grey color scheme, with a very simplistic design, are something of a red flag when going to a new website, especially a website related to forex and another financial trading. In the past, when seeing such a website, we have warned against a potential nefarious scheme being part of the company’s plans. Fortunately, we do not believe that a JP markets scam is possible. The website has a very simplistic approach to showcasing information and is rather easy and quick to navigate. The fact that it is ugly is an unfortunate reality that we have to deal with if we want to deal with a good south african forex broker. Sometimes a good broker will just not want to pimp their website, and that too is ok, as long as the service remains good and the information provided on the website is useful and concise. So what is the information provided?

Navigation

Navigation

Thankfully, the information is full and detailed. The navigation bar that is front and center of the website allows the client, potential or already seasoned, to travel to any part of the website and receive any information needed in a couple of clicks only. Whether it is the FAQ page, the training page or the page talking about the economic calendar, the user will be able to end up there within seconds if they want to. The nav bar also provides easy access to information for first-time visitors, easy registration.

Communication

Communication

The communication with the company is not obvious when you first enter the webpage. The online chat and live support located on the bottom right of the page is simply shaped like a large, red dot that you wouldn’t suspect was online chat unless you knew so. Even then, the chat is mostly offline. It is possible to get in touch with the company offices from the contact page or send an email, though not everybody enjoys these two options as the live chat support option. Alas, you can’t have everything.

Education

The education page of the JP markets FX brokerage is extremely limited. They simply provide a number of definitions that only a person entirely oblivious to the forex industry will have not known. This is unfortunate, as we believe that a good forex broker will support their traders with any resource they have, especially educational ones. Though on the other hand, it seems that the company offers some training opportunities for their traders, and what is great is that this training does not need to be paid for clients, but need to be paid for if you are not already a client. The company offers regular training and workshops for clients and non-clients that a person can register for from the website.

Background

Background

The company does not have a long history of existence, but what it does have is an impressive track record. The company over the past years of existence has expressed its ambitions to move onto working globally, but so far has remained confined to the south african market. It seems that what is getting in the way of JP markets forex broker most is their own reported problems with certain individuals they have worked with. There have been some accusations of the company trading against their own clients, though there are not too many of them. Still, does this provide evidence for a JP markets scam? Let’s take a closer look.

License

License

The company only has one license, the one provided by the FSCA, also known as the FSB. The FSB is the south african financial regulatory body that is responsible for making sure that forex brokerages are working with their clients responsibly. The license was given in the year 2016, the founding year of the company and it seems the company has operated without issue since then. It would be better to see the company get some more licensing form other regulatory bodies, but this will not be happening until the company decides to move out of their borders and into other regions.

Promotions

Promotions

The company seems to run a lot of promotions. While this might seem like a good thing, we tend to get suspicious of such things. While a fast growing company might be interested in investing some money into promotional events and marketing, the possibility of these were simply words to gain more followers is not excluded. Whether it is JP markets fraud schemes or true, a high number of promotions is not something we would suspect a new company to be able to run, unless they are making enough profit to support them. Still, we are not going to cause this to lower our scoring of the company by too much. Though the fact that there are opportunities to get a bunch of JP markets bonus deals is a great thing.

Accusations

Accusations

It seems like the company has been accused several times of making the life of their clients hard. There are a number of small youtube videos, as well as a couple of facebook posts and other online forum posts regarding the company not being an honest one. Though the outcry against these is usually high from the supporters of the company and JP markets reviews these themselves and tries to get in touch with those who have had a bad experience with them. A respectable trait that redeems the company and makes us wonder whether these “bad” reviews are simply the results of the occasional bug or human error.

Software: is JP markets trustworthy?

Let us now take a look at the software and other offers that the company has for their clients. The platform options are rather limited, with the company offering online one: the meta trader 4. This platform is the most used one across the world with most brokers and is easily recognizable to most. The JP markets MT4 provides users with a relatively easy and simple interface to use, while also allowing a large amount of customization for the personal tastes and preferences of most users. The basic nature of the MT4 also allows even the most beginner users to easily get adjusted and start working with the platform. Though, the limited choice of platforms might be a bit of a problem for some – people like diversity in their choices and more advanced or interesting platforms are able to provide better service to more advanced traders. Maybe in the future, JP markets will be adding some options.

Minimum deposit, account type

Minimum deposit, account type

The JP markets rating is definitely affected by the fact that there are no real account types to talk about, other than the ones dedicated to a specific currency. It is both a good and a bad thing. It means that all accounts get treated the same, but the fact that you can’t pay for additional support from the company means that they haven’t grown enough to start offering different types of accounts to their clients. The minimum deposit for JP markets is 3500 ZAR, which is pretty low as compared to the rest of the FSB registered forex brokers.

Spread

Spread

The spread that JP markets FX broker to their clients even on the most basic currency pairs is a little higher than the industry average. This is probably caused by the recent foundation of the company and a relatively small client base. This will possibly be changing in the future when the company will be able to capture a larger share of the market. Though today, large spreads are causing people to conduct trades that are a little more profitable simply to keep themselves afloat, with small-time bidders having a hard time staying with the broker. This is unfortunate, but the fact that it keeps commissions on different money transfers and trades away from JP markets is a good thing.

Withdrawal

Withdrawal

The JP markets withdrawal process is relatively easy. It is possible to withdraw your profit through a bank deposit, wire transfer, in a platform request or even a whatsapp request. Though watch out, not all of these possible withdrawals are as safe as the others. It seems like some ways of funds withdrawal are faster than others, such as the one where you make a request through the client, which can take less than a day. This makes the broker much more trustworthy in our opinion.

Is JP markets broker legit?

So far, with all the investigation we have done into the company, we would like to say that yes, we think there is enough evidence to support this claim. They seem to provide a pretty good service which, while limited, seems to be on track to becoming one of the better south african forex brokers. The only qualms have against the company are the possible scam allegations brought up by a few users and the lack of comprehensive online education tools. Other than that the company has done well and is on the right track to becoming one of the better brokers in the area. Though until they lower their spread and have a longer track record of faithful service, they will remain at the silver lion.

Zaargh doesn’t recommend this broker!

I do not trust this broker and do not recommend you to sign up with it.

JP markets review

User review

JP markets is an international online broker that started operating in 2016. Although the company has been around for just a few years, it has already built a relationship of trust with its clients. It began as a small company with a small office and a few workers, but today, it has offices in several countries across the globe.

• negative balance protection

• sophisticated trading platforms

• safe and secure

• excellent customer support

• no promotions

• users only trade cryptocurrencies but don’t own them.

The founder of jpmarkets is a south african entrepreneur called justin paulsen. He has a major in finance and economics at the university of cape town. Paulsen got the opportunity to interact with a number of asset managers, hedge fund managers, forex traders, and portfolio managers while working for a leading forex broker in south africa.

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Reasons to sign up at JP markets for south african traders

Here are six stout reasons for south african investors and traders to sign up at JP markets:

- Negative balance protection – you will never end up owing JP markets any money because it uses a risk management system and an automated transaction management system to prevent a client’s account from turning negative.

- Sophisticated trading platforms – JP markets offers adequate and fast trading platforms. Since there are no lags and requotes, clients get exactly what they want.

- Safe and secure – the forex broker maintains client funds separately from its own funds.

- Free deposits and withdrawals – the broker does not charge clients for processing deposits and withdrawals.

- Fast payment methods – the deposits are instantly credited to traders’ accounts. And customers can instantly withdraw their profits from their accounts. They simply do not have to wait long for the transactions to go through.

- Excellent customer support – the customer support agents are friendly, helpful, and prompt. You can get in touch with the FX broker through live chat, email, or phone.

Is JP markets reliable forex broker?

South african investors can definitely rely on JP markets as it is the biggest forex broker in africa and south africa. During the last few months, the company has experienced tremendous growth and has expanded into bangladesh, pakistan, and kenya.

The broker operates on a license issued by the financial services board of south africa. You can view a copy of the license on the JP markets website.

You can contact JP markets through the telephone number +27-010-590-1250, the email address [email protected], or the facebook account www.Facebook.Com/jpmarketssa. JP markets has offices in johannesburg, pretoria, cape town, swaziland, and polokwane.

Create an account to start trading

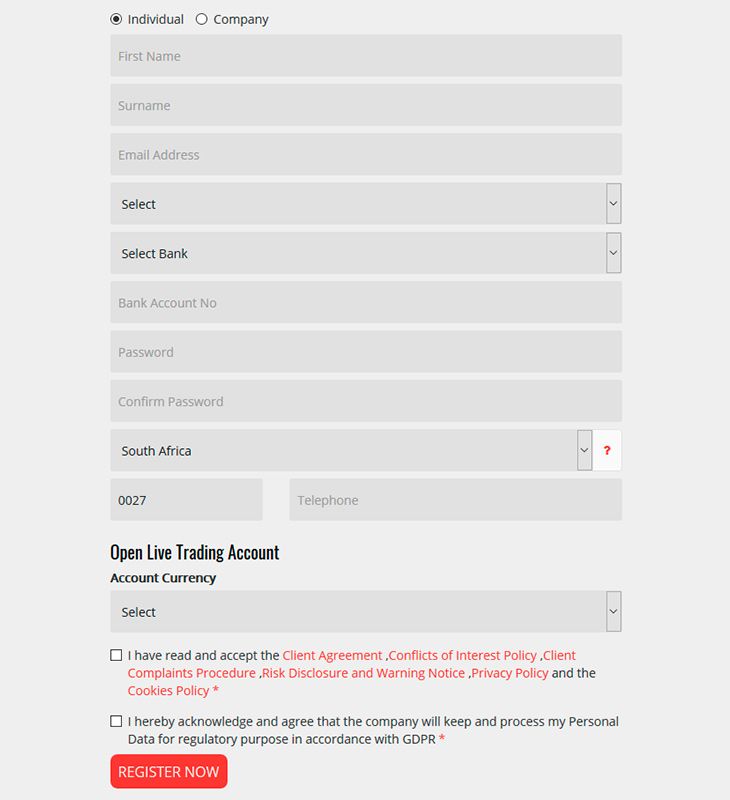

You can open a live trading account at JP markets in three simple steps:

- Complete the online registration form.

- Verify their account by clicking on a link in the FX brokers’ first email.

- Load their trading accounts and start trading.

Traders can open accounts as individuals or companies.

We strongly recommend reading the client agreement form, client complaints procedure, privacy policy, cookies policy, risk disclosure and warning notice, and conflicts of interest policy carefully before registering an account.

Making deposits and withdrawals at JP markets

South african traders can choose a bank from the given list of banks to make a deposit. They can use their MT4 account number for reference. It may take up to 24 hours for the funds to be credited to traders’ accounts. If they want the funds to be credited faster, they have to email payment proofs to [email protected]

- ABSA

- Standard bank

- Nedbank

- Snapscan

- First national bank

- Mpesa

- Online gateways

There are three ways to make withdrawals at JP markets:

- Client portal – you can quickly and easily request payout through their client portal.

- Online platform – you can withdraw through the platform using payfast/skrill or local bank transfers. JP markets processes payout requests from monday to friday, between the hours of 9:00 a.M. And 5:00 p.M. You will receive a verification call from the broker for purposes of security.

- Whatsapp – you can send your payout request to 079-604-4252 and include your MT4 account number and the amount you would like to withdraw. When it receives the request, the company verifies the details and credit payouts in 24 hours after the completion of the verification procedure.

However, withdrawal through whatsapp is available only from 10:00 a.M. To 4:00 p.M. From monday to friday.

Types of trading platforms

Traders can choose from the following platforms at JP markets:

MT4 for windows

Customers can download MT4 for windows, android, and ios and enjoy features such as no rejections, no requotes, and flexible leverage in the range of 1:1 to 500:1. This platform is suitable for traders of different skill levels.

The MT4 platform is popular for its user-friendly interface, technical analysis tools, automated trading capabilities, advanced charting features, and automated trading capabilities. JP markets’ MT4 platform supports multiple currencies such as PLN, SGD, GBP, EUR, and USD. Also, it is available in 30 languages.

MT4 for mac

Traders can use wine, a free software program that enables systems based on unix to run applications developed for MS windows. Unfortunately, wine is not fully stable. So the application may not work as intended.

JP markets recommends playonmac, a free wine-based application that can be used to easily install windows applications on devices that run on the mac operating system.

MT4 for linux

Users of linux computers can use wine to install MT4 on their systems. However, they must understand that the application may not work properly.

Account types

JP markets offers different types of accounts to meet the requirements of different types of customers.

- USD, GBP, and ZAR based accounts

- Accounts that charge commissions

- Accounts that charge spreads as costs

Each type of account gives clients direct access to the market. The orders flow directly to the market, ensuring that traders get the best market prices without any slippage, price manipulation, and lag.

There are micro as well as mini accounts, but the forex broker doesn’t discriminate between the two.

Unique features of JP markets

Here are some features that make jpmarkets unique and set it apart from the other forex & CFD brokers in the industry:

JP markets mastercard

Registered traders at JP markets can apply for the JP markets mastercard and become a VIP mastercard client. They can use their card to make payments and withdraw money at atms. Also, they can use it to manage their profits easily.

To qualify for a JP markets mastercard, customers have to create a trading account and maintain a minimum balance of R5000. The holders of this card can use it only in south africa, not in any other country. This card has been designed to enable JP markets to pay profits to its clients; so traders cannot load any money in it. However, they can apply for a total of three JP markets mastercards.

To check their balance, clients have to log in to www.Whatsonmycard.Com. They should note that they cannot use their card to store any money and accrue interest on it. They have to use their card to either make purchases or withdraw their money at an ATM. They cannot withdraw the funds on their card at any bank.

Copy trading

Customers can earn profits by copying the trades of professional traders at JP markets. They will just be investing funds and a copy master will manage their funds for them. Any professional trader can become a copy master at JP markets. They can do so by following these steps:

- Visit jpmarkets.Co.Za/copy-trader and complete the online application form.

- An account manager will contact them and give them some paper work.

- Visit copytrader.Jpmarkets.Co.Za and open an account.

- When the company approves your fund manager or professional trader status, you can log into your account at copytrader.Jpmarkets.Co.Za

Welcome bonus

You get a welcome bonus of up to 100% just for opening a live trading account and making a deposit. You have to deposit at least R3,000 to qualify.

JP markets offers 25% bonus on deposits in the range of R3000 to R30,000; 40% bonus on deposits in the range of R30,001 to R60,000; 60% bonus on deposits in the range of R60,001 to R100,000; 80% bonus on deposits in the range of R100,001 to R125,000; and 100% bonus on a deposit of $125,000.

JP markets FAQ

Q1: how much should I deposit in my trading account?

A: JP markets doesn’t set any deposit limits for its clients. So you can deposit any amount you wish. However, JP markets recommends a minimum deposit of R3000, especially if you are a new trader in need to training.

Q2: do clients have to pay for the trading education at JP markets?

A: JP markets offers excellent forex trading absolutely free of charge to holders of live trading accounts. The forex broker offers classes at some of its offices in south africa. Also, it offers video courses and online courses for traders who wish to learn at their own pace. Those interested can send an email to [email protected] for more information.

Q3: can I use bitcoin to load my trading account?

A: you can use bitcoin, but only through skrill. You can use bitcoin to load your skrill wallet and then transfer the money to your trading account.

Q4: how much money can I make at JP markets?

A: it all depends on how well you trade. You should learn to make informed decisions using a wide range of trading tools. Also, you should learn how to manage your risks well.

Q5: are my funds safe at JP markets?

A: yes, your money is 100% safe at JP markets. This is because the online broker holds clients’ money in separate accounts and never mixes it with its own funds. In addition, it has professional indemnity insurance to protect clients’ funds.

Should you open an account at JP markets?

If you reside in africa, you certainly should. JP markets is not only licensed and regulated in south africa, but also supports ZAR and offers products designed for african traders. In addition, it has several offices across africa and is founded by a well-known african entrepreneur.

JP markets is not only a safe, secure, and well-regulated online trading platform, but also an excellent educator. If you have never traded before, you can easily learn how to trade at jpmarkets.

JP markets review

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Setschedule reviews hot housing markets for 2021

It’s the time of year where everyone starts making their predictions for the next 12 months, and the real estate industry is no exception. Experts are already predicting which markets will be hot in 2021, based on current trends and recent news. In this article, real estate tech company setschedule reviews some of the hottest markets for 2021.

Priced out of miami? Consider tampa

Let’s start out close to home. Many experts are looking at the rising prices in miami and realizing that the market is becoming unsustainable for some buyers. Those looking to move to south florida may consider smaller towns, but on the metro level, it looks like tampa is the most likely beneficiary of miami’s current success.

Tucson becomes a bedroom community for phoenix

With about 100 miles between them, tucson and phoenix are too far apart for most commuters. However, with more and more companies eyeing the possibilities of work-from-home, phoenix-based employees are expected to turn their sights to tucson. Close enough to allow for visits to the office for important meetings, tucson offers lower housing prices, slightly lower temperatures, and a vibrant restaurant scene. Setschedule reviews of tucson also suggest that the city could be a good location to purchase rental properties to serve university of arizona students looking for off-campus housing.

Seattle continues to be hot, among other WA cities

While many cities are seeing an exodus to the suburbs, seattle’s housing market has remained strong in 2020 and is expected to continue trending upwards. However, setschedule reviews of various expert opinions also show that other WA cities are trending. South of seattle, tacoma is experiencing a renaissance as restaurateurs, brewers, and other small businesses who have been priced out of seattle relocate. This town could prove to be a new hotspot for young couples and families, and entrepreneurs looking for a vibrant community. Spokane, in the eastern half of the state, is also expected to be hot in 2021.

Will austin, TX be the new silicon valley?

With several recent announcements of companies relocating to austin from the bay area, many experts have turned their eyes to TX. Austin was already a happening city, with a great food and arts scene and the SXSW festival. Now, with an influx of tech jobs, it’s expected that some buyers will be priced out of this market. Both san antonio and killeen are predicted to potentially take some of the overflow from austin.

Setschedule reviews agree with the experts: 2021 is going to be big!

Although vaccines are rolling out and there’s an expectation that life will return to “normal” sometime in 2021, experts still expect that the coronavirus will continue to boost the housing market as more people seek the security of homeownership. Low interest rates are making mortgages appealing, and some people are using the freedom of working from home to buy land out in suburban or even rural areas to build custom homes.

Some experts are calling for 2021 to be even bigger than 2020. Perhaps those who didn’t feel comfortable buying a house during the pandemic will feel safer home shopping once they’ve received the vaccine, and they may feel more financially secure once the worst of the pandemic has passed and they’re less worried about their job future.

There’s no doubt, 2020 was a tumultuous year, but many are looking to 2021 with hope in their eyes, and plans for a beautiful new home. Setschedule reviews suggest these hot markets won’t be the only ones to see a boost in home sales and new home construction!

Markets enter 2021 with both chaos and optimism

Markets are seemingly fighting a tug of war between optimism and pessimism every week. On one hand, the democrats won control of the senate which means more stimulus could be coming. Vaccines are also now officially in circulation. On the other hand, the capitol was raided by insurgent trump loyalists, the economic recovery could be sputtering, and the pandemic continues to rage onwards with a disorganized vaccine roll-out. Although last week investors largely overlooked the headwinds and sent stocks surging to fresh records, this week has opened with stocks selling off and cooling down. Although the short-term could be a bumpy road, the general outlook for the second half of 2021 is positive. A good way to manage these short-term risks and add diversity to your portfolio is through investing in etfs. Q.Ai’s deep learning algorithms have identified several etfs to look out for this week based on their fund flows over the last 90-days, 30-days, and 7-days. We have identified two top buys, one attractive, two neutrals, two unattractives, and one top short this week.

Sign up for the free forbes AI investor newsletter here to join an exclusive AI investing community and get premium investing ideas before markets open.

Top buy

Financial select sector SPDR fund (XLF)

The financial select sector SPDR fund XLF is our first top buy for the week. This ETF is considered a benchmark ETF for exposure to banks and other financials, and seeks to effectively represent the S&P 500’s financial sector. The ETF has $28,809,081,988.51 AUM and has seen positive fund flows coinciding with optimism on further stimulus. The ETF has a 90-day fund flow of $6,432,224,106.30, 30-day fund flow of $3,629,098,189.30, and 1-week fund flow of $2,616,307,481.15. Its net expense ratio of .13% is also fairly attractive.

Simple moving average of financial select sector SPDR fund

3energy select sector SPDR fund (XLE)

The energy select sector SPDR fund XLE is our only other top buy for this week. This ETF aims to give investors broad exposure to S&P 500 energy stocks. While still undervalued, energy stocks have seen a nice recovery as of late. The ETF is on the smaller side with $15,701,960,962.98 AUM. The ETF has also seen consistently positive fund flows with a 90-day fund flow of $3,415,566,423.35, 30-day fund flow of $1,426,495,735.10, and 1-week fund flow of $672,239,740.00. With a net expense ratio of .13%, this ETF is fairly attractive as well.

Work that speaks | ad reviews | 11 to 17 jan 2021

Brands that cut through: jos alukkas, cadbury, laadli, pampers, dabur, future generali, unwanted 21 days, pee buddy, cars24

By gokul krishnamoorthy

Jos alukkas | shine on, girl

“model? Waste of time.” that’s how this leading actor across south film industries, trisha krishnan, is dismissed early on in her career (according to this spot). Krishnan has been the face of the brand for a few years now but this film is not just about her rise to stardom. As the teaser promises, this is also the story of many ‘everyday stars’. The message is that others shouldn’t be telling women what they should be doing – and that they should decide for themselves. All the protagonists here do just that, including the film star. Krishnan’s story is one of several that add up to make the point emphatically. Jos alukkas shines on with this piece of work.

Cadbury dairy milk | #scoopintochocolateheaven

Another signature cadbury dairy milk ‘kiss me’ spot. But this one literally packs some magic into the customary playful exchange between the young boy and girl. Keeps it interesting, delivers the ‘scoop’.

Population first (laadli) | stop WFH harassment

With work going virtual, the issue of harassment at work could well follow. Pressure to keep one’s job is real in several industries and as we all know, it could be the trigger for predatory superiors. This spot from the NGO working on gender issues captures this challenge of today’s work reality and the attendant pain of vulnerable employees. It also manages to end on a positive note, staying true to its campaign line of #changeforpositive.

Pampers | dads for virat

One might have dismissed this as an opportunistic moment in marketing but for the fact that the brand has championed #ittakes2 in the past. Staying the course, pampers uses its right to the space to good effect, offering some timely advice from other dads to the new celebrity dad virat kohli.

Dabur honey | heroes of honey

Honey brands were in the news for all the wrong reasons and here’s a case of a brand using content to make its point on purity. In this well-executed film, the brand tells the story of those on the honey trail in the beautiful but dangerous sunderban forest. As a part of the honeycomb falls into the casket of the collector, so does a drop of honey into a tea cup. That visual device using the magic of film allows the brand to make its claim of purity, smoothly.

Future generali general insurance | #healthinsideout

A stress ball, a vase and a pillow speak volumes of what they go through, thanks to their masters with mental health issues. A largely unaddressed theme gets the spotlight here in a manner that doesn’t stifle conversations on it further. On the contrary, the brand manages to spell out the symptoms without adding to the stigma. It also manages to clearly state that its health insurance plan also covers mental health.

Unwanted 21 days | #shhnotokplease

Another topic that is all hushed up is contraception and here’s a brand that’s trying to open up the category. It manages to deliver the message of ‘plan your pregnancy’ with a #shhnotokplease song and dance, because a sermon wouldn’t have worked. In a country where people expect a couple getting married to deliver (a baby) in a year or less, it’s time to say it’s not okay.

Pee buddy | #shitsmellsbad #notanymore

A new category is opening up and one that most will relate to. When the product proposition is clear, it helps craft the communication with clarity. Rather than go the “hygiene-plus-odour removal” route, the brand has smartly picked the bad odour approach. The hygiene element is pitched as an added benefit in the context of public restrooms. Rather than play in an overcrowded hygiene space, it makes sense to address the universal #shitsmellsbad problem with a #notanymore promise.

Cars24 | bhogi car melam

Bhogi, the day preceding the main pongal festival, is a day when the old is symbolically discarded (traditionally, burnt) and one ushers in the new. It is also a day when the traditional drums (melam) is played. Cars24 has attempted to ride this, to ask people if it’s time to get rid of their old car. It’s nice to see national brands pay attention to regional festivals and the nuances therein. There’s a lot, lot more that can be done in this direction, across india.

Top stocks to buy today as headwinds keep markets sideways

Stocks for the second straight day failed to stage a large recovery after monday’s losses. After hitting record highs last week, the indices have largely traded sideways. Investors are becoming concerned about inflation, political uncertainty and the pandemic. The dow jones fell 31 points, or 0.1%, the S&P 500 traded flat, and the nasdaq NDAQ gained 0.2%. The U.S. Consumer price index rose 0.4% in december, which was largely in line with the dow jones’s estimate. Meanwhile, all eyes are on washington, as the house is expected to vote to impeach president trump for the second time. The U.S. Is also recording at least 248,650 new covid-19 cases per day and at least 3,223 covid-related deaths per day. For investors looking to make the most of this market, the deep learning algorithms at Q.Ai have crunched the data to give you a set of top buys. Our artificial intelligence ("AI") systems assessed each firm on parameters of technicals, growth, low volatility momentum, and quality value to find the best long plays.

Sign up for the free forbes AI investor newsletter here to join an exclusive AI investing community and get premium investing ideas before markets open.

Boise cascade co (BCC)

Boise cascade co BCC is our first top buy today. Boise cascade manufactures wood products and is also a wholesale distributor of building materials. With a weak dollar to coincide with low interest rates, boise cade could have a strong 2021. Our AI systems rated the company B in technicals, A in growth, A in low volatility momentum, and A in quality value. The stock closed down 0.58% to $49.66 on volume of 376,993 vs its 10-day price average of $49.25 and its 22-day price average of $48.61, and is up 3.91% for the year. Revenue grew by 9.93% in the last fiscal year and grew by 15.17% over the last three fiscal years, operating income grew by 106.7% in the last fiscal year and grew by 95.33% over the last three fiscal years, and EPS grew by 101.51% in the last fiscal year and grew by 95.81% over the last three fiscal years. Revenue was $4643.4M in the last fiscal year compared to $4431.99M three years ago, operating income was $133.2M in the last fiscal year compared to $140.95M three years ago, EPS was $2.06 in the last fiscal year compared to $2.12 three years ago, and ROE was 11.78% in the last year compared to 13.22% three years ago. The stock is also trading with a forward 12M P/E of 14.42.

Simple moving average of boise cascade co

Extra $300 unemployment payments to begin this week in some states

5 student loan changes for 2021

IRS says you can now check the status of your stimulus check with get my payment tool

Charter communications inc (CHTR)

Telecom and mass media giant charter communications CHTR is our next top buy. Charter communications, also known as charter spectrum is the second-largest cable operator in the united states by subscribers, and the third-largest pay TV operator right behind comcast CMCSA and AT&T T . Our AI systems rated the company rated C in technicals, B in growth, A in low volatility momentum, and C in quality value. The stock closed down 3.06% to $621.49 on volume of 1,695,525 vs its 10-day price average of $641.49 and its 22-day price average of $646.4, and is down 3.95% for the year. Revenue grew by 3.21% in the last fiscal year and grew by 13.6% over the last three fiscal years, operating income grew by 18.67% in the last fiscal year and grew by 74.42% over the last three fiscal years, and EPS grew by 69.29% in the last fiscal year. Revenue was $45764.0M in the last fiscal year compared to $41581.0M three years ago, operating income was $6545.0M in the last fiscal year compared to $4453.0M three years ago, EPS was $7.45 in the last fiscal year compared to $34.09 three years ago, and ROE was 4.8% in the last year compared to 20.66% three years ago. Forward 12M revenue is expected to grow by 4.63% over the next 12 months, and the stock is trading with a forward 12M P/E of 31.71.

Simple moving average of charter communications inc

Mettler-toledo intl inc (MTD)

Mettler-toledo is our third top buy for the day. The manufacturer operates in a very unique and distinct niche, and is the largest provider of the scales and weighing instruments for use in laboratory, industrial, and food retailing applications. Our AI systems rated the company C in technicals, B in growth, A in low volatility momentum, and B in quality value. The stock closed down 1.97% to $1220.48 on volume of 124,049 vs its 10-day price average of $1187.09 and its 22-day price average of $1158.83, and is up 5.13% for the year. Revenue grew by 9.77% over the last three fiscal years, operating income grew by 3.61% in the last fiscal year and grew by 23.74% over the last three fiscal years, and EPS grew by 5.88% in the last fiscal year and grew by 67.07% over the last three fiscal years. Revenue was $3008.65M in the last fiscal year compared to $2725.05M three years ago, operating income was $733.19M in the last fiscal year compared to $613.91M three years ago, EPS was $22.47 in the last fiscal year compared to $14.24 three years ago, and ROE was 111.02% in the last year compared to 76.56% three years ago. Forward 12M revenue is expected to grow by 6.69% over the next 12 months, and the stock is trading with a forward 12M P/E of 44.38.

Simple moving average of mettler-toledo intl inc

Progress software corp (PRGS)

Progress software corp PRGS is our fourth top buy. Progress software is a tech company that deploys business applications such as adaptive user experiences, mobility and serverless cloud, cognitive services, data connectivity and integration, and web experience management. Our AI systems rated the company C in technicals, C in growth, B in low volatility momentum, and A in quality value. The stock closed up 0.7% to $47.7 on volume of 251,836 vs its 10-day price average of $46.09 and its 22-day price average of $44.59, and is up 7.22% for the year. Revenue grew by 5.69% in the last fiscal year and grew by 12.24% over the last three fiscal years, operating income grew by 56.83% in the last fiscal year and grew by 33.67% over the last three fiscal years, and EPS grew by 117.26% in the last fiscal year and grew by 110.02% over the last three fiscal years. Revenue was $413.3M in the last fiscal year compared to $389.15M three years ago, operating income was $72.17M in the last fiscal year compared to $84.68M three years ago, EPS was $0.58 in the last fiscal year compared to $0.6 three years ago, and ROE was 8.07% in the last year compared to 7.42% three years ago. Forward 12M revenue is expected to grow by 12.02% over the next 12 months, and the stock is trading with a forward 12M P/E of 14.97.

Simple moving average of progress software corp

T-mobile US inc (TMUS)

T-mobile is our second communications company today, and our final top buy. T-mobile is a big international telecom company with numerous subsidiaries around the globe. T-mobile has a combined total of around 230 million subscribers worldwide, and is the fourth-largest multinational telecom company after the UK's vodafone, india's airtel, and spain's telefónica. Our AI systems rated T-mobile C in technicals, B in growth, A in low volatility momentum, and B in quality value. The stock closed down 3.19% to $128.69 on volume of 5,368,541 vs its 10-day price average of $132.69 and its 22-day price average of $131.84, and is down 2.82% for the year. Revenue grew by 33.19% in the last fiscal year and grew by 47.61% over the last three fiscal years, and operating income grew by 32.2% in the last fiscal year and grew by 80.18% over the last three fiscal years. Revenue was $44998.0M in the last fiscal year compared to $40604.0M three years ago, operating income was $6342.0M in the last fiscal year compared to $4653.0M three years ago, EPS was $4.02 in the last fiscal year compared to $5.2 three years ago, and ROE was 12.96% in the last year compared to 22.24% three years ago. Forward 12M revenue is expected to grow by 15.24% over the next 12 months, and the stock is trading with a forward 12M P/E of 41.7.

Simple moving average of T-mobile US inc

Liked what you read? Sign up for our free forbes AI investor newsletter here to get AI driven investing ideas weekly. For a limited time, subscribers can join an exclusive slack group to get these ideas before markets open.

Stocks drop from record highs; dollar strengthens: markets wrap

SHARE THIS ARTICLE

U.S. Stocks fell for the first time in five sessions as investors started the week in a cautious mood with equity prices near all-time highs.

The S&P 500 was led lower by the real estate and consumer discretionary sectors, while energy companies were the biggest gainers in the benchmark index. Eli lilly & co. Lifted heath-care shares. The dollar strengthened against all its major peers, with demand supported by elevated treasury yields.

Weighing on the minds of investors are worries that equities are running too hot and valuations are stretched at a time when major parts of the world are grappling with the worst of the covid-19 pandemic.

“keep in mind though, after big runs like we saw last week, it’s natural for the market to take a breather,” said chris larkin, managing director of trading and investing product at E*trade financial. “traders looking for new opportunities may be wise to look beyond behemoth tech stocks.”

Benchmark treasury yields topped 1% last week on bets that democratic lawmakers will enact big spending packages to drive the economic recovery out the pandemic. The move reset expectations for a range of asset classes and sparked debate over whether higher yields might jeopardize the current environment of easy financial conditions.

Ten-year U.S. Yields climbed to almost 1.14% on monday, the highest level since march.

“ultimately it goes back to the 10- year,” wrote KC rajkumar and jahanara nissar of lynx equity strategies. A higher yield “points to higher inflation down the road -- which is negative for stocks. We are not there yet, but as the 10-year inches higher -- the closer we get.”

Twitter inc. Fell after the social media platform permanently banned president donald trump after a mob invaded the capitol building last week. Mirabaud securities analyst neil campling said the ban shows the company is making editorial decisions, and opens the door to more regulation of social media under the next administration.

Shares of facebook inc., which also suspended trump’s account, also declined. Meanwhile, house democrats monday introduced a resolution to impeach trump for a second time, setting up a vote this week unless vice president mike pence uses his constitutional authority to remove the president.

Bitcoin tumbled, with prices sliding as much as 20% on monday. Some investors have said the digital currency’s recent gains defy logic and the U.K.’s financial watchdog issued a statement that consumers in crypto should be prepared to lose all their money. The token traded down about 14% at $32,835.

Elsewhere in markets, the MSCI asia pacific index slipped. Commodities were broadly lower on the back of the stronger dollar, with west texas intermediate oil trading near $52 a barrel.

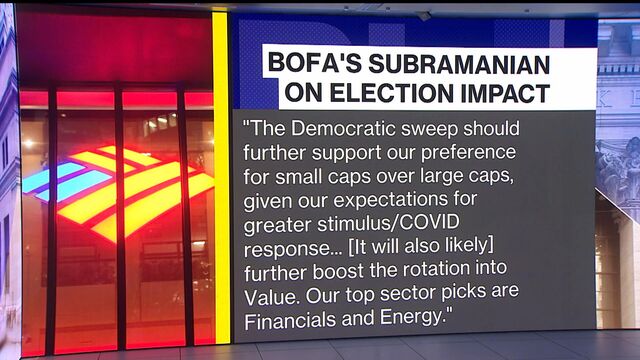

Savita subramanian, bank of america head of U.S. Equities and quantitative strategy, talks about how a democratic controlled washington could impact markets and equities.

Here are some key events coming up:

- Jpmorgan chase & co., citigroup inc. And wells fargo & co., as well as firms ranging from taiwan semiconductor manufacturing co. To infosys ltd., are among those due to report earnings.

- EIA crude oil inventory report is due wednesday.

- European central bank’s christine lagarde speaks at an online conference wednesday.

- U.S. Consumer-price inflation figures are due wednesday.

- Biden plans to lay out proposals for fiscal support on thursday.

- Fed chair jerome powell takes part in a webinar on thursday.

- U.S. Initial jobless claims data are due thursday.

- U.S. Retail sales, industrial production, business inventories and consumer sentiment figures are due friday.

These are some of the main moves in markets:

Stocks

Currencies

Bonds

Commodities

— with assistance by claire ballentine

Condo why OCR condos might dominate rental markets in 2021

- By ryan J ong

- January 5, 2021

- 7 min read

A short while ago we pondered whether the singapore rental market could stay its course. Given the impact of covid-19, our rental market has held up remarkably well; at this point simply maintaining rental income / yields can be considered fortunate.

However, not every segment of the rental market faces an equal challenge. While the core central region (CCR) condos face higher risks of vacancies or falling rental income, the outside of central region (OCR) may be the safe port in the storm for property investors; at least for 2021 and the near term:

Where is the OCR?

By OCR, we refer to all districts from 16 to 19, and then all districts from 21 through to 28.

The latest health check on singapore’s rental market

According to 99.Co, these are the rental rates up to the latest available date (october 2020):

Rental rates in the CCR fell from $4.19 to $4.14 psf, while rates in the RCR were more or less flat; from $3.50 to $3.49 psf.

Only the OCR managed to see a slight increase, from $2.81 to $2.85 psf.

This coincides with a recent business times report, when savills singapore predicted a further decrease of three to five per cent in CCR rental rates for 2021.

(note: savills singapore also estimated a much deeper drop in CCR rental rates than the chart above, calling a two to three per cent drop in 2020).

What’s supporting rental rates of OCR condos?

- Fewer prospective tenants

- Tenants downgrading

- Less preference for shared spaces

- Ongoing decentralisation

- Singapore’s transport infrastructure

1. Fewer prospective tenants

It’s foreign workers, not locals, who are seeing the highest rates of job loss. This is intentional, with initiatives such as the jobs support scheme aimed at protecting singaporeans first. From january to september last year, it was foreigners who made up nine in 10 job losses.

In singapore, these foreign workers – many of whom are now heading home – made up the majority of prospective tenants in areas like the CCR.

Locals who need to rent, such as when they’re waiting for their home to be built, almost always pick fringe regions such as jurong, tampines, woodlands, etc., for simple reasons of affordability.

As such, the OCR has experienced a smaller reduction in its tenant pool, compared to more expensive areas.

Renting will singapore’s rental market maintain its resilience in 2021?

2. Tenants downgrading

During a downturn, companies often cut costs by shrinking expatriate benefits packages. One element of this is housing allowance; tenants may seek shorter leases, and constantly be on the look-out for cheaper alternatives. We already saw a gradual exodus from the CCR to heartland areas, around the middle of 2020. More expats have also lost confidence over job prospects, and may be hesitant about committing to long, expensive leases.

That said, we should point out feedback from real estate agents has been a little bit different. While most we spoke to agree on an exodus from the CCR, their observation is that tenants who work in areas like marina bay financial centre, robinson road etc. Tend to move to the RCR, rather than OCR. For example, an expat might consider a move to bugis, but not as far out as, say, bedok.

(this may explain why the RCR has managed to better maintain its rates.)

3. Less preference for shared spaces

Also from word on the ground, agents have told us the recent circuit breaker has changed attitudes; they are seeing more tenants avoid shared units.

While they may have been happy to live with several unrelated tenants before, the experience became unbearable once they were all stuck in the same unit. Some are also wary of health issues, and don’t want to live in close proximity to others right now.

Renting an entire unit on your own is much more expensive, which often rules out CCR and RCR properties. Based on the numbers above, however, the average 500 sq.Ft. An OCR unit would only cost $1,425 a month.

4. Ongoing decentralisation

Singapore is making active efforts to decentralise the CBD. This is the reason for creating separate business hubs, such as jurong east, changi business park, the upcoming woodlands north corridor, etc.

As foreigners increasingly find employment in these areas, rather than the traditional CBD, condos in the OCR become more attractive (e.G. If you were to work in changi business park, you would have better access by renting in tanah merah than in newton).

Note that this also applies to amenities – the new business hubs are often also retail hubs, which makes living in fringe areas almost as convenient as the CBD.

5. Singapore’s transport infrastructure

In the current downturn, newer expats and tenants are likely to expand their search to find cheaper alternatives. This is when they’ll realise an inherent truth: singapore is so small and well-connected, that they are not punished for seeking cheaper rent on the outskirts.

Unlike other countries where “fringe region” might mean a two-hour bus ride to work, most parts of singapore are at most an hour from the city centre. “fringe” also doesn’t mean a serious lack of amenities, as almost every neighbourhood has its own mall, eateries, recreational areas, etc.*

Expats who cast their net wider this year – and we suspect they will – are soon to discover that a $2,700 per month shoebox in the CBD may not offer much more convenience than a $1,425 per month shoebox in the OCR.

Six of the top 10 condos for rental yield are currently in the OCR

The following is from square foot research, and is based on the past 12 months:

| District | development | rent (psf) | leasing volume | est. Rental yield |

| 21 (OCR) | the hillford* | $4.67 | 118 | 4.8% |

| 1 (CCR) | people’s park complex | $3.27 | 82 | 4.2% |

| 18 (OCR) | melville park | $2.30 | 322 | 4.1% |

| 25 (OCR) | northoaks | $1.94 | 107 | 3.9% |

| 5 (RCR) | viva vista | $5.06 | 93 | 3.9% |

| 27 (OCR) | euphony gardens | $2.14 | 23 | 3.9% |

| 25 (OCR) | woodsvale | $1.92 | 122 | 3.8% |

| 17 (OCR) | hedges park condominium | $2.90 | 122 | 3.8% |

| 14 (RCR) | the octet | $3.93 | 29 | 3.8% |

| 12 (RCR) | skysuites 17 | $4.53 | 53 | 3.8% |

*rental yield is high due to the unusually low quantum; this is a 60-year leasehold property

Note that admiralty / woodlands (district 25) is the only district to have two condos on the top 10 list for rental yields.

But please don’t take this as a suggestion that OCR condos are next year’s “definite goldmine”

We’re only saying OCR rental properties tend to be less affected by the covid-19 downturn; not that they’re some kind of golden ticket.

In the broader sense, 2021 – and likely the next few years after – will be characterised by more remote-location work, and fewer foreigners coming through our borders. This will make it tough for landlords as a whole; and if there’s a light at the end of this tunnel, it will be past 2021 before we glimpse it.

In the meantime, check out stacked for in-depth reviews on new and resale condos alike; and follow us so we can keep you updated on the latest news. If you need help specific to your property, you can also drop us a note on facebook.

So, let's see, what we have: is the JP markets forex broker in south africa trustworthy? Let's conduct a research and define the JP markets overall ranking together. At jp markets reviews 2021

Contents of the article

- New forex bonuses

- JP markets – why do we think that is not the best...

- Software: is JP markets trustworthy?

- Is JP markets broker legit?

- JP markets review

- Reasons to sign up at JP markets for south...

- Is JP markets reliable forex broker?

- Create an account to start trading

- Making deposits and withdrawals at JP markets

- Types of trading platforms

- Account types

- Unique features of JP markets

- JP markets FAQ

- Should you open an account at JP markets?

- Setschedule reviews hot housing markets for 2021

- Priced out of miami? Consider...

- Tucson becomes a bedroom community for...

- Seattle continues to be hot, among other...

- Will austin, TX be the new silicon...

- Setschedule reviews agree with the...

- Markets enter 2021 with both chaos and optimism

- Top buy

- Work that speaks | ad reviews | 11 to 17 jan 2021

- Brands that cut through: jos alukkas, cadbury,...

- Top stocks to buy today as headwinds keep markets...

- Boise cascade co (BCC)

- Extra $300 unemployment payments to begin this...

- 5 student loan changes for 2021

- IRS says you can now check the status of your...

- Charter communications inc (CHTR)

- Mettler-toledo intl inc (MTD)

- Progress software corp (PRGS)

- T-mobile US inc (TMUS)

- Stocks drop from record highs; dollar...

- SHARE THIS ARTICLE

- Condo why OCR condos might dominate rental...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.