Ewallet number

Can you reverse an ewallet transaction? FNB and standard banks permit free money withdrawals at specified retailers.

New forex bonuses

The receiver of the money must know the validity of the ewallet PIN which is normally 30 days for absa and standard bank and 7 days for nedbank. In case the recipient fails to withdraw the cash in the given period, the money is reversed back to the account of the sender.

- Select send money then choose ewallet.

- Insert the mobile phone number of the person you wish to make the transfer to. Double-check to ensure that the digits are correct.

- Next, select if the app should offer the recipient a PIN or not, then type in the amount you wish to send.

- Lastly, confirm and submit the transaction.

How to reverse ewallet payment in 2021?

In this digital era, sending money across the globe has been made so much easier. Ewallet FNB is one of the simplest, efficient, and cheapest ways to transfer cash to friends and family in south africa. The best part is that you can transfer such funds from your bank account to any registered mobile number all over the country and not necessarily another bank account. In addition, the recipient can access the money instantly at any of the FNB atms. But what happens if you make an error with the recipient's mobile phone or bank information? Here is how to reverse ewallet payment in 2021.

Image: canva.Com (modified by author)

source: UGC

Can I reverse ewallet transaction? In case you send money via this option to the wrong recipient, you need to reverse it and resend it to the right person. Therefore, it is essential to know how to reverse such payments, and here is what you ought to do in case you are caught up in such a situation.

How to reverse ewallet transfer?

How do I reverse FNB ewallet when sent to the wrong recipient? You just noticed that the money has gone to the wrong recipient, and cannot help but panic. Do not worry, as there is an alternative to reversing the transaction. The only way to cancel an already complete transaction is to contact FNB call centre and request for the procedure to be done manually from their end. So, how do you contact FNB call centre on how to reverse ewallet sent to the wrong number manually?

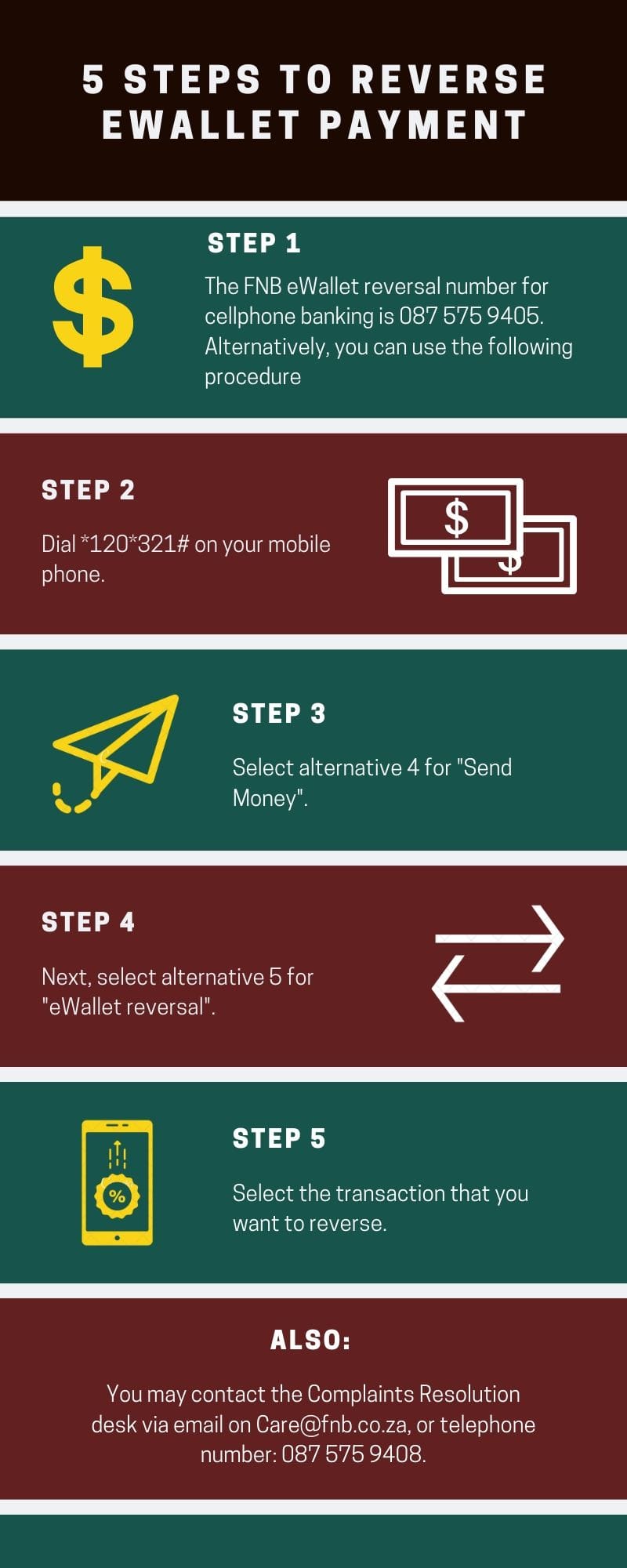

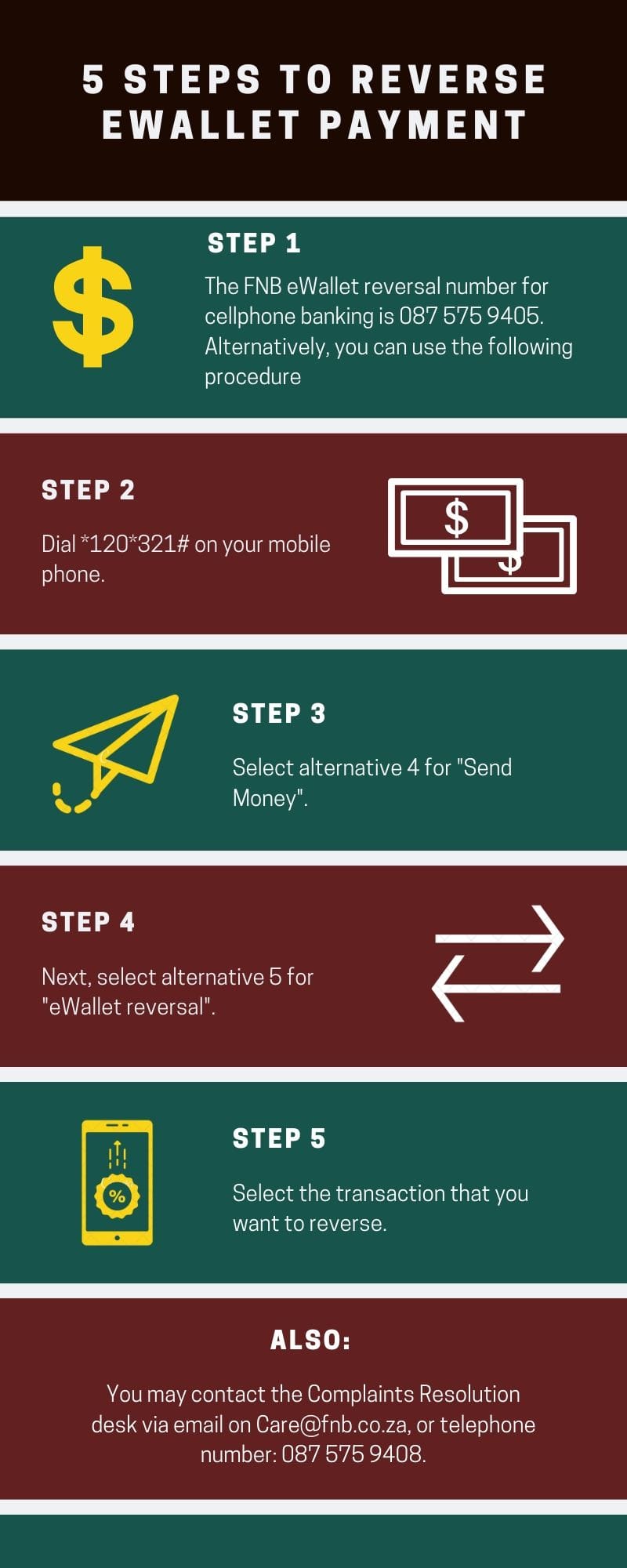

- The FNB ewallet reversal number for cellphone banking is 087 575 9405. Alternatively, you can use the following procedure:

- Dial *120*321# on your mobile phone.

- Select alternative 4 for "send money".

- Next, select alternative 5 for "ewallet reversal".

- Select the transaction that you want to reverse.

- You may also contact the complaints resolution desk via email on care@fnb.Co.Za, or telephone number: 087 575 9408 (option one).

How do I reverse ewallet on FNB app? In case of any inquiries with regards to how to reverse ewallet on app, call 087 575 0362. And for queries on FNB ewallet reversal online, contact 087 575 0000.

Other important details on ewallet reversal

Can you reverse an ewallet transaction? FNB and standard banks permit free money withdrawals at specified retailers. The receiver of the money must know the validity of the ewallet PIN which is normally 30 days for absa and standard bank and 7 days for nedbank. In case the recipient fails to withdraw the cash in the given period, the money is reversed back to the account of the sender.

In case you receive payments wrongly, do not withdraw the cash and the FNB reverse payment will automatically revert to the sender after the PIN expires. The ewallet PIN for FNB is valid for four hours. Upon its expiration, the recipient can opt for FNB ewallet new pin request at any given period by dialing *130*277#.

How long does it take to reverse ewallet?

If you send money to the wrong recipient and call the company's team, the reversal should take up to 4 business days. On the other hand, money is returned to the sender within 15 business days if the recipient's number does not work.

How much does it cost to reverse an ewallet?

Kindly note that you will be charged about R50 as fee to get back the money sent to the wrong number. Also according to FNB, this procedure is not really guaranteed. For a better experience, ensure to double-check the cell phone of the receiver as well as the amount to be sent and this will save you the hassle of making an FNB ewallet reversal. Here is a quick reminder on how to correctly use this platform to send money.

How to correctly send money and avoid reversal inconveniences

Image: fnb.Co.Za

source: UGC

Ewallet FNB is very convenient because one can use it in four different platforms which are mobile banking, ATM, mobile app, or online banking. After selecting your preferred option of making the transfer:

- Select send money then choose ewallet.

- Insert the mobile phone number of the person you wish to make the transfer to. Double-check to ensure that the digits are correct.

- Next, select if the app should offer the recipient a PIN or not, then type in the amount you wish to send.

- Lastly, confirm and submit the transaction.

The recipient gets an instant message after the money has been deposited into their account. To withdraw the cash, go to any of the nearby FBN ATM or selected retailers.

- Select FNB card less services in the screen then tap in the ewallet services.

- Insert your mobile number and press the proceed button.

- Type in the ATM PIN included in the message received and input the amount you wish to withdraw.

- After taking the money, ensure that the transaction has completed, or choose ‘cancel’ before departing from the ATM.

- In case you do not wish to withdraw the money, then you can use your FNB ewallet to purchase airtime, data, and electricity as well as pay for goods and services.

Ewallet account can hold a maximum of R5,000 at any point in time. The limit per day when transferring via the mobile app or online banking is R3,000 while the limit for cellphone banking and atms is R1,500. Additionally, FNB ewallet will only charge you a fee of R10.95 per transaction making it the most affordable way to send money in south africa. Ewallet withdraw fees will vary depending on the amount withdrawn.

With the above guide, you now know how to reverse ewallet payments if you incorrectly send the cash. So, if you make the mistake of sending money to the wrong person, do not panic but simply follow the steps and options to reverse the transaction.

DISCLAIMER: this article is intended for general informational purposes only and does not address individual circumstances. It should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility! We are not responsible for any loss, damages, etc. That may occur if the information contained turns out to be inaccurate/incorrect.

Ewallet number

How can we help?

Browse through our frequently asked questions or search for your specific concern

How can I add funds into ewallet?

You have multiple ways to add funds to your ewallet account

How do I pay a merchant?

Ewallet supports both physical and online merchants. To make a payment to a merchant, follow the steps below:

○ physical merchants:

At the time of payment, open your app and display your QR code. The merchant will scan your QR code and send the bill to your app, whereby you will then be expected to confirm the amount. Simply enter your PIN or scan your fingerprint (or face ID where applicable) and the payment is processed within a fraction of second. A transaction success notification will be sent to your app and via SMS.

○ online merchants

: when you are ready to check out, select the ewallet icon under the payment options and enter your mobile number in full format (for example +971 XX XXX XXXX). You will receive a request for payment in your app for you to confirm the amount. Simply enter your PIN or scan your fingerprint (face ID where applicable) and the payment is processed within a fraction of second. A transaction success notification will be sent to your app and via SMS.

Why can’t I perform some transactions?

Some transactions may be limited due to your status. Upgrade your account status from digital KYC to physical KYC to enjoy the full suite of ewallet services.

How can I withdraw from ewallet?

You have multiple ways to withdraw from your ewallet account

- Bank cash out: simply open the app, select the cash out option in the menu and fill the required details

- Agent cash out

- Kiosk/ATM cash out

Ewallet number

This is your third and last login attempt available.

Your profile will be blocked if you fail to enter your login details correctly.

Oh no!

We've noticed that you've tried to login more than 3 times.

You might have blocked your online banking profile.

In order to unblock your profile, reset your username and password.

Cellphone banking

- Dial *130*321#

- Select send money

- Select the account you want to send money from

- Key in the cellphone number you want to send to

- Enter the amount you want to send

- Confirm that all is correct (make sure you entered the right cellphone number)

To send money using FNB cellphone banking you need to be registered for cellphone banking.

To register for cellphone banking, dial *130*321#

Online banking

- Log into FNB online banking

- Select the payments tab

- Enter your one time PIN (OTP)

- Select send money

- Select the account you want to send money from

- Select the amount you want to send

- Key in the cellphone number you want to send money to

- Click on finish

You need to register for online banking to send money via the internet

FNB ATM

- Insert your card and enter your PIN

- Select more options

- Select buy it/pay it

- Select send money. Read the terms and conditions and then select proceed

- Key in the cellphone number you want to send money to and select proceed

- Key in the amount you want to send money to and select proceed

- Confirm that all the details are correct and select proceed

- Remember to take your card

No registration or application is necessary if you send money via an FNB ATM

| fee (BWP) | |

|---|---|

| send money | P9.40 |

| withdrawal (you get 1 free withdrawal with every wallet send without exceeding maximum of 4 free withdrawals in the wallet) | FREE |

| dormant ewallet (up to 6 months) | FREE |

| dormant ewallet (after 6 months) | FREE |

Standard network operator rates apply when using your cellphone.

You have access to ewallet

If you are an FNB client with an active transactional account, you already have access to the ewallet service.

Login to online banking, cellphone banking or visit your nearest ATM and select send money to make use of this safe and convenient way to send money to anyone.

Ewallet

Send money anywhere, any time

The ewallet allows FNB customers to send money to anyone with an active cell number. Money is transferred instantly. Recipients can use the money in the ewallet to buy airtime, send money to other cellphones and more.

How it works

Instantly send money or make payments

- You can send money to friends and family members or make a payment to anyone simply and hassle free

- Money can be sent to anyone who has a valid botswana cellphone number and the recipient does not need to have a bank account

- Any GSM cellphone model can be used to send money or to receive money

- Money is instantly available in the ewallet

- Money will be stored in an ewallet. Recipients will be able access the money immediately at an FNB ATM without needing a bank card and without filling in any forms

- Recipients will get all of the money sent as there are no ATM charges to withdraw money

- Recipients don't have to withdraw all the money at once

- Recipients can also check the balance, get a mini statement, buy prepaid airtime, send money on to someone else's cellphone

- You can send money at any time of the day or night via cellphone banking, FNB online banking, FNB app or at an FNB ATM

What's hot

It's for everyone

Send money to anyone with a valid botswana cellphone number

It's simple

The recipient does not need a bank account or bank card

It's convenient

Money can be sent anytime, anywhere, from the comfort and safety of your own home

It's fast

The money is sent immediately and the recipient can access the funds immediately

It's free of bank charges

Pay no bank charges when you send money via ewallet

Ways to send

Send the way you want to

As an FNB customer you can use one of FNB's convenient digital channels to send money to anyone with a valid cellphone number on any network.

Online banking

View how to send money via online banking

Cellphone banking

View how to send money via cellphone banking

View how to send money via FNB ATM

Ways to use

Withdraw, buy + spend

When you receive an SMS notifying you that money has been sent to your cellphone, you can do the following

- Send a portion of the money in the ewallet to another ewallet in exactly the same way

- Withdraw all or some of the money from the ewallet at an FNB ATM without needing a bank card. The rest of the money can be withdrawn at a later stage

- Buy prepaid airtime from the ewallet

- Check the ewallet account balance or get a mini statement

- How to receive money

How to receive money

Turn your phone into a wallet

Once you've received an SMS telling you that you have been sent money

- Dial *130*392# to access the ewallet

- Set a secret 5-digit PIN for the ewallet

- Select 'withdraw cash' and then 'get ATM PIN'

- You'll receive an SMS with an ATM PIN

- Go to an FNB ATM

- At the ATM press the green button (enter/ proceed) and then wallet services

- Key in your cellphone number and ATM PIN

- Choose the amount of money to withdraw. Make sure that either your transaction has ended or that you press 'cancel' before leaving the ATM

If you have been sent money but you have no airtime , dial *103*392# to buy airtime with the money that has been sent to you. Then dial *130*321# .

How to reverse ewallet payment in 2021?

In this digital era, sending money across the globe has been made so much easier. Ewallet FNB is one of the simplest, efficient, and cheapest ways to transfer cash to friends and family in south africa. The best part is that you can transfer such funds from your bank account to any registered mobile number all over the country and not necessarily another bank account. In addition, the recipient can access the money instantly at any of the FNB atms. But what happens if you make an error with the recipient's mobile phone or bank information? Here is how to reverse ewallet payment in 2021.

Image: canva.Com (modified by author)

source: UGC

Can I reverse ewallet transaction? In case you send money via this option to the wrong recipient, you need to reverse it and resend it to the right person. Therefore, it is essential to know how to reverse such payments, and here is what you ought to do in case you are caught up in such a situation.

How to reverse ewallet transfer?

How do I reverse FNB ewallet when sent to the wrong recipient? You just noticed that the money has gone to the wrong recipient, and cannot help but panic. Do not worry, as there is an alternative to reversing the transaction. The only way to cancel an already complete transaction is to contact FNB call centre and request for the procedure to be done manually from their end. So, how do you contact FNB call centre on how to reverse ewallet sent to the wrong number manually?

- The FNB ewallet reversal number for cellphone banking is 087 575 9405. Alternatively, you can use the following procedure:

- Dial *120*321# on your mobile phone.

- Select alternative 4 for "send money".

- Next, select alternative 5 for "ewallet reversal".

- Select the transaction that you want to reverse.

- You may also contact the complaints resolution desk via email on care@fnb.Co.Za, or telephone number: 087 575 9408 (option one).

How do I reverse ewallet on FNB app? In case of any inquiries with regards to how to reverse ewallet on app, call 087 575 0362. And for queries on FNB ewallet reversal online, contact 087 575 0000.

Other important details on ewallet reversal

Can you reverse an ewallet transaction? FNB and standard banks permit free money withdrawals at specified retailers. The receiver of the money must know the validity of the ewallet PIN which is normally 30 days for absa and standard bank and 7 days for nedbank. In case the recipient fails to withdraw the cash in the given period, the money is reversed back to the account of the sender.

In case you receive payments wrongly, do not withdraw the cash and the FNB reverse payment will automatically revert to the sender after the PIN expires. The ewallet PIN for FNB is valid for four hours. Upon its expiration, the recipient can opt for FNB ewallet new pin request at any given period by dialing *130*277#.

How long does it take to reverse ewallet?

If you send money to the wrong recipient and call the company's team, the reversal should take up to 4 business days. On the other hand, money is returned to the sender within 15 business days if the recipient's number does not work.

How much does it cost to reverse an ewallet?

Kindly note that you will be charged about R50 as fee to get back the money sent to the wrong number. Also according to FNB, this procedure is not really guaranteed. For a better experience, ensure to double-check the cell phone of the receiver as well as the amount to be sent and this will save you the hassle of making an FNB ewallet reversal. Here is a quick reminder on how to correctly use this platform to send money.

How to correctly send money and avoid reversal inconveniences

Image: fnb.Co.Za

source: UGC

Ewallet FNB is very convenient because one can use it in four different platforms which are mobile banking, ATM, mobile app, or online banking. After selecting your preferred option of making the transfer:

- Select send money then choose ewallet.

- Insert the mobile phone number of the person you wish to make the transfer to. Double-check to ensure that the digits are correct.

- Next, select if the app should offer the recipient a PIN or not, then type in the amount you wish to send.

- Lastly, confirm and submit the transaction.

The recipient gets an instant message after the money has been deposited into their account. To withdraw the cash, go to any of the nearby FBN ATM or selected retailers.

- Select FNB card less services in the screen then tap in the ewallet services.

- Insert your mobile number and press the proceed button.

- Type in the ATM PIN included in the message received and input the amount you wish to withdraw.

- After taking the money, ensure that the transaction has completed, or choose ‘cancel’ before departing from the ATM.

- In case you do not wish to withdraw the money, then you can use your FNB ewallet to purchase airtime, data, and electricity as well as pay for goods and services.

Ewallet account can hold a maximum of R5,000 at any point in time. The limit per day when transferring via the mobile app or online banking is R3,000 while the limit for cellphone banking and atms is R1,500. Additionally, FNB ewallet will only charge you a fee of R10.95 per transaction making it the most affordable way to send money in south africa. Ewallet withdraw fees will vary depending on the amount withdrawn.

With the above guide, you now know how to reverse ewallet payments if you incorrectly send the cash. So, if you make the mistake of sending money to the wrong person, do not panic but simply follow the steps and options to reverse the transaction.

DISCLAIMER: this article is intended for general informational purposes only and does not address individual circumstances. It should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility! We are not responsible for any loss, damages, etc. That may occur if the information contained turns out to be inaccurate/incorrect.

How to reverse ewallet payment

In this digital era, sending money across the globe has been made so much easier. Ewallet FNB is one of the simplest, efficient, and cheapest ways to transfer cash to friends and family in south africa. The best part is that you can transfer such funds from your bank account to any registered mobile number all over the country and not necessarily another bank account. In addition, the recipient can access the money instantly at any of the FNB atms. But what happens if you make an error with the recipient’s mobile phone or bank information? Here is how to reverse ewallet payment.

Can I reverse ewallet transaction? In case you send money via this option to the wrong recipient, you need to reverse it and resend it to the right person. Therefore, it is essential to know how to reverse such payments, and here is what you ought to do in case you are caught up in such a situation.

How to reverse ewallet transfer?

How do I reverse FNB ewallet when sent to the wrong recipient? You just noticed that the money has gone to the wrong recipient, and cannot help but panic. Do not worry, as there is an alternative to reversing the transaction. The only way to cancel an already complete transaction is to contact FNB call centre and request for the procedure to be done manually from their end. So, how do you contact FNB call centre on how to reverse ewallet sent to the wrong number manually?

Do the *120*321# cellphone banking thing as if you’re about to send another ewallet. The option for reversal will come up

- The FNB ewallet reversal number for cellphone banking is 087 575 9405. Alternatively, you can use the following procedure:

- Dial *120*321# on your mobile phone.

- Select alternative 4 for “send money”.

- Next, select alternative 5 for “ewallet reversal”.

- Select the transaction that you want to reverse.

Guys pin this for yourselves just in case:

FNB ewallet reversal : *120*321#

choose option 4 (send money)

thereafter option 5 (ewallet reversal)

then choose to high transaction you want to reverse.

It’s cheaper to use cellphone banking than it is to call them.

- You may also contact the complaints resolution desk via email on care@fnb.Co.Za, or telephone number: 087 575 9408 (option one).

How do I reverse ewallet on FNB app? In case of any inquiries with regards to how to reverse ewallet on app, call 087 575 0362. And for queries on FNB ewallet reversal online, contact 087 575 0000.

Other important details on ewallet reversal

Can you reverse an ewallet transaction? FNB and standard banks permit free money withdrawals at specified retailers. The receiver of the money must know the validity of the ewallet PIN which is normally 30 days for absa and standard bank and 7 days for nedbank. In case the recipient fails to withdraw the cash in the given period, the money is reversed back to the account of the sender.

In case you receive payments wrongly, do not withdraw the cash and the FNB reverse payment will automatically revert to the sender after the PIN expires. The ewallet PIN for FNB is valid for four hours. Upon its expiration, the recipient can opt for FNB ewallet new pin request at any given period by dialing *130*277#.

How long does it take to reverse ewallet?

Is there no function though on internet banking that allows one to do this instead of calling the call centre?

You have to phone the ewallet team. The reversal takes 4 working days.

If you send money to the wrong recipient and call the company’s team, the reversal should take up to 4 business days. On the other hand, money is returned to the sender within 15 business days if the recipient’s number does not work.

OK thank u. I will do that! For how long though?

If an ewallet has not been activated within 13 days, the money will be returned to the sender.

How much does it cost to reverse an ewallet?

Kindly note that you will be charged about R50 as fee to get back the money sent to the wrong number. Also according to FNB, this procedure is not really guaranteed. For a better experience, ensure to double-check the cell phone of the receiver as well as the amount to be sent and this will save you the hassle of making an FNB ewallet reversal. Here is a quick reminder on how to correctly use this platform to send money.

How to correctly send money and avoid reversal inconveniences

Ewallet FNB is very convenient because one can use it in four different platforms which are mobile banking, ATM, mobile app, or online banking. After selecting your preferred option of making the transfer:

- Select send money then choose ewallet.

- Insert the mobile phone number of the person you wish to make the transfer to. Double-check to ensure that the digits are correct.

- Next, select if the app should offer the recipient a PIN or not, then type in the amount you wish to send.

- Lastly, confirm and submit the transaction.

The recipient gets an instant message after the money has been deposited into their account. To withdraw the cash, go to any of the nearby FBN ATM or selected retailers.

- Select FNB card less services in the screen then tap in the ewallet services.

- Insert your mobile number and press the proceed button.

- Type in the ATM PIN included in the message received and input the amount you wish to withdraw.

- After taking the money, ensure that the transaction has completed, or choose ‘cancel’ before departing from the ATM.

- In case you do not wish to withdraw the money, then you can use your FNB ewallet to purchase airtime, data, and electricity as well as pay for goods and services.

Ewallet account can hold a maximum of R5,000 at any point in time. The limit per day when transferring via the mobile app or online banking is R3,000 while the limit for cellphone banking and atms is R1,500. Additionally, FNB ewallet will only charge you a fee of R10.95 per transaction making it the most affordable way to send money in south africa. Ewallet withdraw fees will vary depending on the amount withdrawn.

Guys I almost peed on myself today. I mistakenly sent ewallet of R3000 to the wrong number. When I realised, I was like…

Thank god for ewallet reversal, @FNBSA after today I am became a fan.

With the above guide, you now know how to reverse ewallet payments if you incorrectly send the cash. So, if you make the mistake of sending money to the wrong person, do not panic but simply follow the steps and options to reverse the transaction.

DISCLAIMER: this article is intended for general informational purposes only and does not address individual circumstances. It should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility! We are not responsible for any loss, damages, etc. That may occur if the information contained turns out to be inaccurate/incorrect.

Ewallet

How paynetics adds value:

redefining mobile payments on a digital banking platform

Introduction

The paynetics ewallet is a digital platform which provides seamless user experience which enables consumers to make payments directly from their phones either online or in-store. Our interoperable ewallet connect shoppers with merchants creating value for both parties. For the consumer, spending analytics, payment notifications, full card control, cashback and digitalization of loyalty cards, vouchers and coupons all offer huge benefits. For the merchants, a customizable app for vouchers and loyalty cards can drive repeat business and generate increase demand.

All in one

Our ewallet proposition combines software as a service with payments as a service, significantly reducing time to market for our partners

Secure

New technologies ensure safe flow of payment information, money is held securely and transferred in multiple ways

Efficient

Lower fraud risk, reduced transaction fees, and an effective instrument for businesses to reach new customers

Some of our clients

What we offer to our partners

With consumers using smartphones for all aspect of their lives, the ewallet solution and payment app is becoming the ‘go-to’ secure and convenient method of payment. Merchants therefore need to support these payment methods as part of providing customers with a secure online payment journey and experience. For consumers, the ewallet is fast-becoming a “must-have” in any digital payment offer.

However, launching a financial or banking service is very laborious and time consuming process, requiring providers to overcome a number of hurdles:

- Regulatory - need to get through the tough licensing processes and strictly comply with all the regulation, incurring high upfront investment cost

- Technology - need to build great user experience matching best of class fintechs, while keeping bank grade security, regulatory compliance and connection to financial infrastructure providers

- Team - need to get the right people from the industry with deep domain knowledge

- Time - need to plan 24-36 months to go live

Through our white label ewallet solution, we empower our partners to offer digital banking and financial services in a short period of time – we have implemented a commercial ewallet solution from a client within just three months of signing a contract.

Features of the paynetics digital banking platform

Our platform has evolved from a pure ewallet solution to a full digital banking infrastructure, offering a wide range of functionality. A key feature of our approach is that we work with easy to integrate modular services, meaning that we can scale quickly and easily with our customers.

We offer full support for IBAN accounts management and money transfers. On our platform, our partners can:

- Create and manage IBAN account via simple API

- Enable your customers to easily send instant P2P, SEPA and SWIFT bank transfers

- Allow customers to top-up funds via any credit/debit card or through bank transfers

- Issue and control virtual and physical mastercard payment cards

- Use a back-office portal for customer support purposes

And since we offer card acquiring services, we provide a wealth of additional features for our clients and partners:

- Tap to pay just by using your phone (supports apple pay and android MDES)

- Multiple virtual cards, including single use cards

- Full card management - order and control payment cards from the phone

- Plastic cards on demand

As we strive to remove friction in the payment process, our ewallet platform offers QR payments as a viable alternative method, driving customer engagement, reducing costs and helping merchants offer the broadest range of payment options to their clients:

- Lower fees: merchants accepting QR payments benefit from much lower transaction costs via an easy to integrate API

- Flexible UX: merchant-initiated or user-initiated - users can scan a QR code to pay or generate their QR code which can be scanned to authorize the transaction

- Merchants web portal allows digital onboarding and business account management like transaction tracking, refunds, reconciliation, cash-out and executing bank transfers

In order to deliver additional value to both merchants and consumers we have integrated a sophisticated loyalty and rewards module, offering:

- Digitised loyalty cards: users no longer need to carry plastic cards

- Customer analytics: help merchants to understand their customers’ behavior based on real purchase data across various market verticals

- Digital vouchers: enable merchants to attract new customers and drive repeat business from existing customers with 100% measurable digital vouchers, delivered via a superior user experience

- Cashback system: empower merchants with flexible cashback program designed to drive repeat visits while decreasing discount cost. Coalition between retailers enabled.

The power of interoperability

The paynetics digital banking platform is built to support multiple instances and allow them to be interoperable, creating its own payment infrastructure. We are able to do that as we offer both software as a service and payment as a service. It creates enormous additional value for all participants – for our partners, for the merchants and for the consumers. As all white label solutions are interoperable, the reinforce each other:

- Free peer to peer for customers of all wallets

- Close loop QR payments within the network lowering costs

- Advanced merchant services for retailers boarded on the various wallets

- Next generation marketing engine, based on coherent and actionable data

Security is the guiding principle

Our ewallets effectively remove inputting payment card information from the process when making online (and offline) transactions. It is a more secure way to pay, as no actual payment data is used to process the transaction (read more about our payment tokenization).

In-person transactions are also more secure. It reduces the risk of losing cash or a payment card, having it stolen, as well as the threat of skimming.

The ewallet solution has benefits for merchants as well. Transactions via our ewallet solution keep sensitive payment card data secure reducing PSI DSS scope and costs. At paynetics we also use dynamic authentication methods to reduce payment fraud, protecting both customers and merchants from fraudulent activity.

Ewallet number

Register as a new user on our system

It only takes a few minutes to set up an ewallet account. Simply follow onscreen instructions.

Billing and additional information

Accept payments on your site using a simple HTML form and IPM notifications

FAQ's and support

Buy goods and pay for services, and if something goes wrong, we will refund money

Learn more about:

Creating an account

♦ note: you must be at least 18 years old to create an ewallet account.

2. Enter your username, email address, first and last name, password, and repeat the password. You have to check: I'm not a robot and to click - register

3. You will receive an email to confirm your new account.

4. After the confirmation, you can log in with your username or email address and your password.

Simple registration, login, password reset

A set of features to support users

Google captcha

The script uses googles API service recaptcha to log in, register and reset the account password. This excludes the brute force of passwords and unauthorized attempts to log into your account.

Two-factor authorization

User can use two-factor authorization when signing in to the account. One-time input tokens can be sent in sms message, email message or accessible through a special mobile application.

Hold balance

The amount of disputed transactions is held on the user's banal and is not available for transactions until the problem is resolved. An administrator can block any transaction

Ticket support system

The ticketing system for customer support will provide the necessary assistance for any user. The user can create a ticket, reply in the ticket and close it if the problem is solved.

Feedback form

A special form for communication for unregistered users allows you to contact the administrator even without an account.

Billing and additional information

Ewallet supports a multicurrency account for money transfer, exchange and payments online and instore

Profile settings

Set your email address, name, family name, language, and password.

Verification

3 levels of verification. The user can enter information about himself and upload documents for receiving funds and making use of deposit methods and withdrawing methods

Billing settings

Set your billing details for easy deposit, transfer, payment online and withdrawal money

No checking

You do not need to enter a token at the time of authorization in your account

Two-factor authentication

You need to enter a token via mobile application at the time of authorization in your account

SMS or email authentification

You need to enter a token via SMS or email message at the time of authorization in your account

Transaction history

User-friendly interface for tracking all your transactions even linking your bank account

Set of tools for receiving payments

Receiving payments in the system ewallet or integration with the user's site

Shop and payment

Users can create stores and digital or physical products that are sold in a special section within the ewallet or web site

Invoices

Invoices between users allow me to pay for goods, services, work

HTML form plugin

Simple integration with third-party sites for receiving payments

Amazing tools to accept payments online and offline

POST notification on server and send user selected receipt

Selling using ewallet cart and orders

Offline stores and service providers can now become a dominating force online " ewallet has built the most amazing future for retail and service providers. An in-sync system by using your everyday ewallet as a selling tool get started today by registering for a merchant account first, after approval by admin, this then allows you to instantly upload and publish your offline products for sale to an online shop within minutes, more impressive is that the items that are sold online or offline are in sync amazing innovation from ewallet all online and offline orders can be tracked in the same wallet you are selling from and getting paid too one wallet does it all

Protect your client's purchases

If the goods are not received or are not as what was described in the sale the user can open a dispute and open an investigation and have the funds returned including crypto this is a FIRST for CRYPTO CURRENCIES "ABILITY TO REFUND " EWALLET PATENT PENDING " please visit resolution center

IPN service

The platform will send POST notification to the user's server with the details of the completed transaction

Low risks

The purchase is paid from the balance account - not directly through a third-party gateway

Popular methods for deposit and withdrawing money

Built-in methods are suitable for most countries

Automatic deposits

Users will instantly receive money to their account balance after the deposit is successful, except for methods of bank transfers and large crypto transactions

Manual withdrawals

Requests for withdrawal of funds are handled by the administrator in manual mode

Operation limits

The administrator can set the minimum and maximum limit for each currency

Verification requirement

Set a minimum level of verification to use the deposit method and withdraw of funds method

How does ewallet work

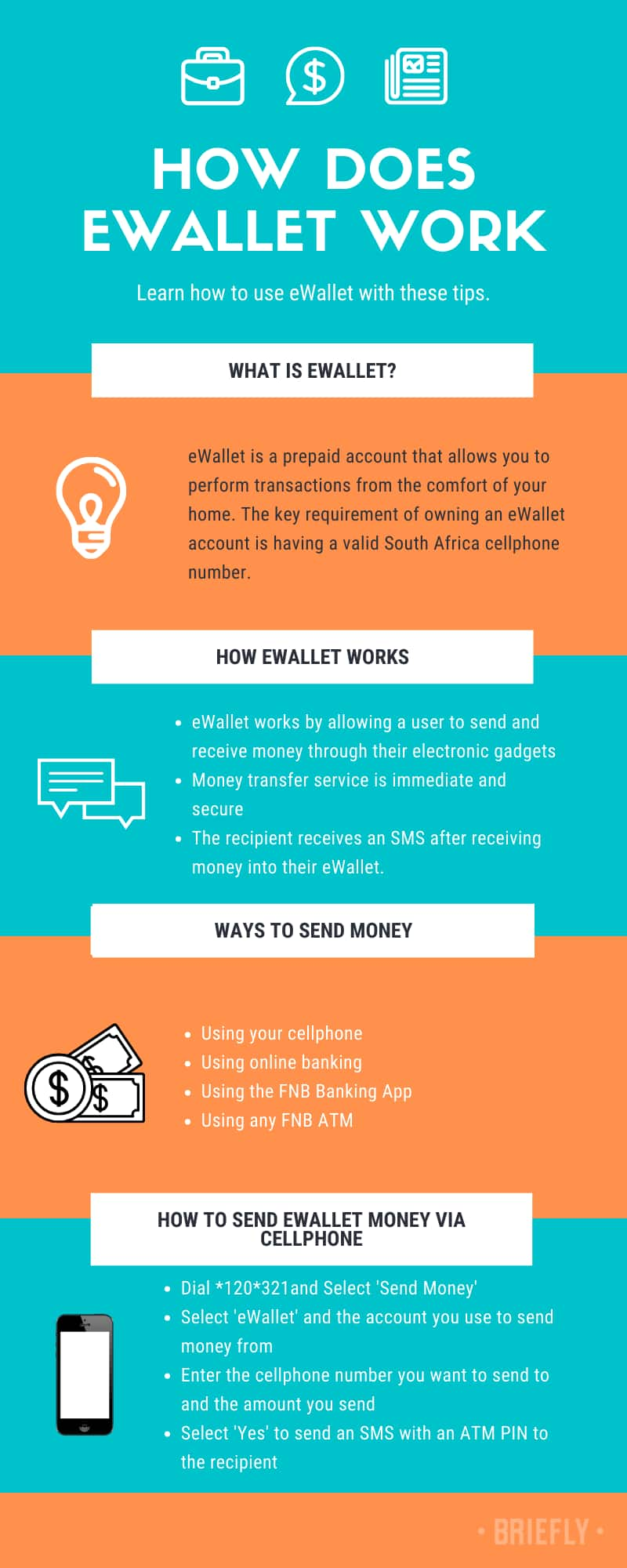

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

Image: canva.Com (modified by author)

source: original

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user's account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user's bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient's account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Image: instagram.Com, @fnbsa

source: UGC

READ ALSO: how to apply and use PEP money transfer

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the 'send money' option and clicking okay

- Selecting the 'ewallet' option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

Image: facebook.Com, @fnbsa

source: UGC

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the "ewallet services" on the screen.

- Enter your valid south african phone number on the keypad and select the "proceed" option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

- Verify that you have completed the transaction before leaving the ATM. In case you do not approve the transaction, you can select the " cancel" option to stop the transaction.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the "get retail PIN" option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the "withdraw cash" at checkout option.

- The following screen will ask you to "withdraw cash from ewallet."

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

READ ALSO: how does standard bank instant money transfer work

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

READ ALSO:

- FNB reverse payment - how can you reverse an EFT payment FNB with ease?

- How to send money to zimbabwe cheap, fast and securely

- How to reverse ewallet payment in 2020?

Ewallet number

As you may have heard, a major security vulnerability; dubbed "heartbleed," was recently discovered in openssl. Openssl enables SSL and TLS encryption, which governs HTTPS — the secure communications…

Looking to switch from ewallet GO!® (GO) to full ewallet® on your android, ios, mac, or PC but need to import your data? We've got links for each platform below. Import instructions import GO data into…

When registering your software, make sure of the following when inputting the name and key: you are entering the name and key exactly as they appear in your registration email - the name and key are case-sensitive.…

There are a few ways you can lock your wallet, the simplest being simply pressing the lock button within ewallet. You might prefer something a bit more automatic though and we have a couple of options…

The following terms and conditions apply to using this software. Unless you have a different license agreement signed by ilium software, your use of this software indicates your acceptance of the terms…

If ewallet says that a wallet file is in use or read-only, then it isn't able to write to the file. Here are the reasons why: your wallet file is already open in another instance of ewallet. Try closing…

Ewallet starts you out with a set of sample cards. You can look through them for examples of the kinds of cards you can make and use, then delete them and create your own. Just choose the new button to…

Ewallet comes with a sample wallet to demonstrate its features. This sample wallet does not use a password. We strongly recommend setting a password before entering any of your own information into this…

Ewallet is licensed per operating system platform. If you are replacing your desktop computer with one of the same type (operating system platform), you can use your existing license for the new computer.…

Ewallet is licensed per operating system platform. If you are replacing your device with one of the same type (operating system platform), you can use your existing ewallet license for that device. Just…

so, let's see, what we have: sent money to the wrong recipient and wondering⭐HOW TO REVERSE EWALLET⭐ payment? Here is a detailed guide that will help you reverse the transaction. Read more. At ewallet number

Contents of the article

- New forex bonuses

- How to reverse ewallet payment in 2021?

- How to reverse ewallet transfer?

- Other important details on ewallet reversal

- How long does it take to reverse ewallet?

- How much does it cost to reverse an ewallet?

- How to correctly send money and avoid reversal...

- Ewallet number

- How can we help?

- How can I add funds into ewallet?

- How do I pay a merchant?

- Why can’t I perform some transactions?

- How can I withdraw from ewallet?

- Ewallet number

- Cellphone banking

- Online banking

- FNB ATM

- You have access to ewallet

- Send money anywhere, any time

- Instantly send money or make payments

- What's hot

- Send the way you want to

- Withdraw, buy + spend

- Turn your phone into a wallet

- How to reverse ewallet payment in 2021?

- How to reverse ewallet transfer?

- Other important details on ewallet reversal

- How long does it take to reverse ewallet?

- How much does it cost to reverse an ewallet?

- How to correctly send money and avoid reversal...

- How to reverse ewallet payment

- How to reverse ewallet transfer?

- Other important details on ewallet reversal

- How long does it take to reverse ewallet?

- How much does it cost to reverse an ewallet?

- How to correctly send money and avoid reversal...

- Ewallet

- Introduction

- Some of our clients

- What we offer to our partners

- Features of the paynetics digital banking platform

- The power of interoperability

- Security is the guiding principle

- Ewallet number

- Creating an account

- Simple registration, login, password reset

- A set of features to support users

- Google captcha

- Two-factor authorization

- Hold balance

- Ticket support system

- Feedback form

- Billing and additional information

- Ewallet supports a multicurrency account for...

- Profile settings

- Verification

- Billing settings

- No checking

- Two-factor authentication

- SMS or email authentification

- Transaction history

- Set of tools for receiving payments

- Amazing tools to accept payments online and...

- POST notification on server and send user...

- Popular methods for deposit and withdrawing money

- Built-in methods are suitable for most countries

- Automatic deposits

- Manual withdrawals

- Operation limits

- Verification requirement

- How does ewallet work

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- Ewallet number

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.