Tickmill server time

A VPS (virtual private server) is your own private server hosted in the cloud or on the internet – being on 24/7 and constantly online.

New forex bonuses

It runs it’s own copy of an operating system (OS), but isn’t hosted on your computer, so your PC can operate freely, even when you’re not there. Clients must be at least 18 years old to use the services of tickmill.

TICKMILL VPS

Keep your MT4 eas and signals running, even when you’re offline.

What is a VPS?

A VPS (virtual private server) is your own private server hosted in the cloud or on the internet – being on 24/7 and constantly online. It runs it’s own copy of an operating system (OS), but isn’t hosted on your computer, so your PC can operate freely, even when you’re not there.

A VPS allows you to run automated algorithmic strategies or ‘expert advisors’ (eas) around the clock on a remote server, independently from your own computer and without any efforts from your side.

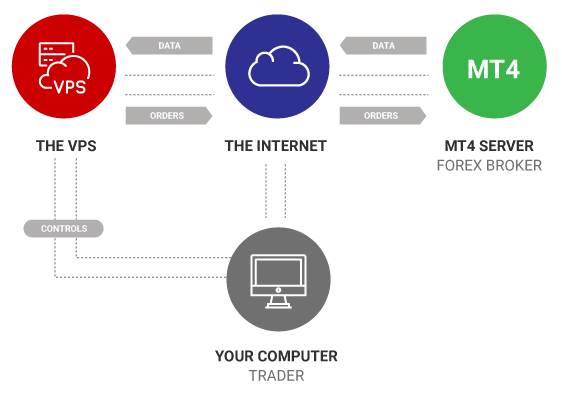

How does a VPS work?

The technology that enables a VPS is where one very powerful server is divided into multiple sections. Although the server as a whole is shared, your part of the virtual private server is only for your use, so you won't have to share CPU, RAM or any other data! Due to the fact that it doesn’t have any interference from other external sources, you’re able to have a continual connection.

The map below explains how the connectivity between your computer, the VPS and the MT4 trading server gives you constant access.

Why choose tickmill’s

VPS by beeksfx?

20% discount on all packages. Quick setup and a 24/7 live chat and email support. Negligible latency due to VPS servers’ adjacent location to tickmill. 100% uptime guarantee. No shared resources, and increased control.

Get tickmill VPS

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Forex broker server time (GMT offset)

When it comes to MT4 charts, not all brokers are created equally. Depending on the MT4 broker’s server time, the charts or the candlesticks on the charts are calculated differently. For example, most GMT brokers tend to have an additional candlestick such as sunday candlesticks as well. While this might seem to be not much of an issue, when making use of pivot points (especially daily pivots that are used on the intraday charts) the pivot values vary quite differently.

Besides the aspect of the different in pivot points, even the indicators such as moving averages or oscillators such as stochastics or RSI are also calculated differently in comparison to regular GMT+2 or +3 brokers.

The first chart below gives one such example. In the chart below, we make use of a GMT broker, where the ‘sunday’ candlestick is shown on the chart.

GMT broker with sunday candles

The next chart below illustrates the same GBPJPY daily chart but without ‘sunday’ candlesticks and based off GMT+2 (or +3).

GMT+3 broker without sunday candlesticks

GMT+2 (or +3 during european summer DST): forex brokers whose servers are based off GMT+2 (or +3) server time usually tend to offer 5 candlesticks during a week, representing 5 days of trading sessions in the week. Typically, GMT+2(+3) brokers follow the GMT timings of 5PM EST as the open and close of a new day’s trading session.

GMT: the GMT brokers tend to offer 6 days of candlesticks during a week, where the sunday candlestick is also included. As can be understood, the GMT brokers have an additional trading session (i.E: sunday) for the week. Of course, some brokers tend to offer GMT server time but exclude the sunday candlestick in order to maintain a uniform, 5 day trading week.

GMT or GMT+2 broker, which is more ideal?

Technically speaking, the only difference between these two types of broker server times is the difference on the way the daily candlesticks are calculated. However, if you shift to a lower time frame, the hourly and lower charts tend to be uniform as far as the candlesticks are concerned. However, the differences are noticeable when you focus on the daily or H4 chart time frame candlestick patterns.

In view of this confusion, a trader might often wonder whether they want to follow the candlestick patterns on the GMT broker or the GMT+2 broker. From a technical analysis perspective, traders should simply follow the sentiment offered by the candlestick patterns as they exhibit market sentiment irrespective of whether your broker’s server time is GMT or GMT+2.

In other words, a bullish engulfing on a GMT time zone based chart exhibits the same bullish sentiment as it appears on the GMT+2 time zone as well.

How to find out server time your broker

When in doubt as to which server time your MT4 broker is following, a simple and easy way to find out is to click on the ‘view’ from the main menu and select ‘market watch’ or click ‘ctrl+M’ to display the market watch window. On the top of this window, the broker show’s their server time.

The picture below shows a GMT+3 broker whose server time is shown on top of the market watch window.

MT4 – market watch tab, broker’s server time

To compare the broker’s time to your time zone or to GMT time, the following resources could be helpful.

How to find out GMT offset your broker? – see difference between server time and GMT

Timezone MT4 indicator

The following free indicator for MT4 platform can be used to display the different time zones and the broker’s server time on the chart. (download from here)

MT4 time zone indicator

From the above article, traders should be able to easily find out what time zone their broker is following and also be able to understand the differences between the GMT and GMT+2 candlesticks.

Tickmill

In a FAST-MOVING market, choose a STABLE BROKER

Access the global markets with a dynamic broker. Trade 62 currency pairs on forex. Get access to major international stock indices and oil. Speculate on the movements of gold and silver against the US dollar and diversify your trading portfolio. Take advantage of the inverse relationship between interest rates and bond prices and leverage the stability of government treasuries. This is available for tickmill UK ltd traders. A company location is england and wales under number 09592225. Principal and registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ. Authorized and regulated by the financial conduct authority. FCA register number: 717270. Risk warning: the complex instruments provided by this broker come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Where are tickmill servers located?

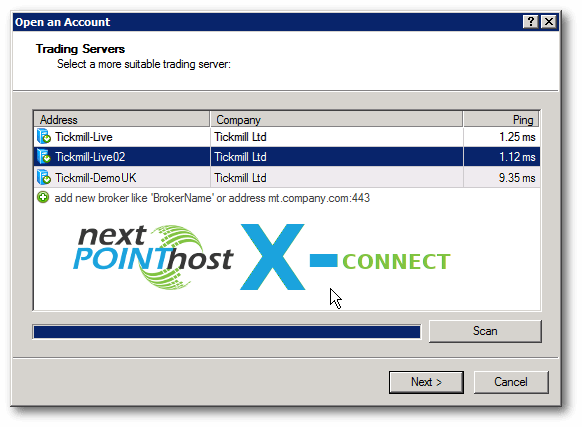

Nextpointhost X-connect - guaranteed ultra-low latency without slippage.

Servers are situated in london, UK inside one of the many nextpointhost top data centers. We know the exact location, but due to security reasons will keep it secret. It's very important to know that location of the tickmill broker head office is different from the location of their trading servers. At the moment of writing this article, tickmill owns these metatrader-4 servers:

- Tickmill-live

- Tickmill-live02

- Tickmill-demouk

The first ones are used by real traders, who trade in live markets. The last one (as the name shows) is for paper trading. It is an electronic market simulator that allows investors to practice buying and selling without risking real money. As you can see on the picture without matter from server name - nextpointhost X-connect gives a strong competitive advantage over all other participants in the forex market, who have slower connections and higher latency. It will drastically improve the chances of your trades to executed by broker's servers in front of other traders who are competing for the same price.

Why TRADE with nextpointhost X-connect to tickmill?

We appreciate traders desire in their aim to buy or sell at profitable price. In fact market is moving unstoppable. Just because you are seeing good deal on the screen doesn't mean that you will be able to close the possition with profit. Due to physically distance of your location tickmill broker need time to receive, process and execute your trade. Delay in these steps can cost you a lot of money in lost if the position is closed at different price than expected. We are talking about hundreds, even thousands of dollars. In this way your winning strategy can not achieve best possible results. Nextpointhost X-connect servers are great solution of this major problem. They provide direct cross connection between the tickmill's servers and your forex vps server. This means you will be at the same place, the same data center where metatrader servers of tickmill are situated. You will not losing time! You'll have a strong competitive advantage before all other participants on the market. Your trades will be executed before trades of others who use standard location internet connection. X-connected servers totally eliminate the slippage. They increase trading profits.

X-connect important facts

- Executing trades 10000 times faster than your 4G mobile network.

- 250 times faster than you can blink.

- Guarantee lightning-fast connectivity to tickmill 24/7!

HOW-TO use nextpointhost X-connect competitive advantage?

It's simple and fast to start!

All you have to do is REGISTER. Then you'll receive your X-connect in few minutes! High-performance, dedicated connectivity with increased reliability and lowest possible latency is the gold standard for us. No further action is required on your part. This unique feature comes included by default. Trading is more accessible than ever. No matter of your current location. It’s the same MT4 platform that you’re used to, but now is available directly everywhere. Nextpointhost's solid online platform provides access to your tickmill’s metatrader 4 anywhere from any kind of device. No matter do you use windows, or apple's devices, or android. The platform is compatible with all vendors. Gives quick and easy access to the market. No need for additional software, downloads, and installations. Fully compatible with existing expert advisors, indicators, or already made presets. Whole existing trading can be migrated fully automatically and absolutely secured via encrypted connections. Try our X-connect and trade more easily, calm, and profitable!

Start trading now

Tickmill competitors

This online broker comparison is designed to bring more clarity to your broker selection. You can compare online brokerages side by side across many categories that save you hours of research. There is no single best investment platform for everybody. The financial market is competitive. Players compete by offering different pricing models, market niches, and location. Take an informed decision! All materials are created with an informative purpose. Don't treat them as advice or advertisement to open an account with a specific broker.

Tickmill review

Tickmill is forex broker. Tickmill offers the MT4 and MT4 webtrader trading currency platforms. Tickmill.Com offers over 60 currency pairs, gold, sliver, bonds and cfds for your personal investment and trading options.

Broker details

| established: | 2015 |

| address: | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| contact: | support@tickmill.Com, +852 5808 2921 |

| regional offices: | |

| regulators: | cysec #278/15, FSA-S #SD 008, FCA #717270 |

| prohibited countries: |

| deposit methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

| withdrawal methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

Live discussion

Join live discussion of tickmill.Com on our forum

Tickmill.Com profile provided by tickmill, nov 10, 2016

Tickmill is an award-winning global ECN broker, authorized and regulated by the FCA of the united kingdom and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data center. Our team members have trading experience that goes back to 1989 and we have successfully traded all major financial markets from asia to north america.

In june 2016, tickmill recorded a monthly trading volume of $49.1 billion, followed by a record-high trading volume of $51.7 billion in july, which makes it one of the largest retail forex brokers in the world.

Video

Your company video here? Contact ad sales

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

I have been with tickmill over 5 years and they are my experience with them is excellent.

They provide direct market trading with minimal commission and almost no slippage.

Deposits and withdrawals are fast if using skrill or neteller even faster.

They do have a client outreach and communicate with you occasionally on promotions or events they hold.

I have had no qualms' with them at all.

Commendable and one of the best. Keep up the good work.

Length of use: over 1 year

Tickmill threatens with legal action against me because I expose truth on social media how they refuse to pay me my funds, $35 966! Funds are not paid for more then 6 months already, and they now even threaten with legal action against me. I fight this SCAM company hard with regulators and I am going also to bring my case on court. This unjustice and fraudulent behavior must be stopped!

I strongly advise everyone to stay away from tickmill. This is SCAM company and I kindly ask forexpeacearmy to mark this company with SCAM label and their ratings erased to 0.

Aug 17, 2020 - 1 star this is SCAM company and it should be put where it belongs, to SCAM brokers. Their ratings erased.

Their price at the moment is on 24.10 $. Also straight forward crippled price action. While at same time december futures 2020 contract price which they claim they follow is on 43.22 $ with very much visible dips during upside movement. Something which we do not see in tickmill's price action!

For situation to be even worse, they charge insane swap for long positions of more then 14 points! Total SCAM! This must be punished!

Tickmill continues their fraudulent activity by offering imaginary, fake, and wrong spot WTI price. Price which has nothing to do with reality, or with any futures contract price. Random number they transmit.

I am in close contact with FSA regulator which works on my case, and hopefully this week there will be some real progress regarding my case, and my funds paid in full.

Tickmill must pay me funds they owe me, $35 966 must be paid to my trading account # 3033967.

For more information about my case, you can follow it here: scam - scam alerts - tickmill SCAM! Offers invalid WTI price in close only mode, wrong price execution for all bigger trades.

May 11, 2020 - 1 star I am going to describe 2 problems I ran into with tickmill. My trading account # 3033967.

First and main problem is fake and imaginary WTI CFD price they offer in the moment. Their price currently is at 9.64$ for barrel, while true WTI CFD price is 26$ for barrel, it can be checked with any other broker, or simply by looking at CME futures prices for WTI, all contracts are above 25$ for barrel. Tickmill have applied close only mode on WTI, and since I have 3 long positions I am not able to close my positions with significant profit of 26 000$, and trader can not open new long positions on that absurd, fake, low price they offer because it is only close only mode applied. I would have no problems with their close only mode if they offer true WTI CFD price, instrument I was trading with. Their excuse is that they follow movement of december 2020 futures price, which is also invalid since price for december futures is over 30$ for barrel, and also price movement is completely different. They refuse to pay my winnings after weeks of annoying conversations and invalid arguments they try to provide. I am experienced trader who has account with over 10 brokers, and what they say is completely absurd and not acceptable! Difference in their price from true price is almost 300%, no LP can justify that. There is only one true WTI CFD price and it is between 26$ and 27$ for barrel at the moment I am writing this review.

Second problem I encountered with wrong price execution for trades bigger then 1 lot size. This applies for all FX pairs and metals. Order is executed on price NOT SHOWN in MT4, but on price worse for client by 1-2 points. This happens every time, for manually opened positions and pending positions. They stole from me on over 500 trades these 1-2 point. It is not slippage, it is wrong price execution! I brought this issue also to them, and gave them chance to refund what they were stealing from me for years, but they refused with no true explanation provided, only fake arguments which has nothing to do with reality. Experienced trader like me can not be fooled or tricked like that.

I am going to continue to fight with them with these two problems and claim my funds via court if necessary if they continue to refuse to pay what they owe me.

Everyone can feel free to contact me directly here on FPA if further details about tickmill are wanted.

Reply by tickmill submitted may 15, 2020 hi deltoid88,

We have provided all necessary clarifications and have assisted with detailed explanation in regards to your trades.

If you have any additional concerns, you can reach out to our support team.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill

Olalobere

Recruit

There are so many issue about price being earlier reported but each complain and/or explanation always reported have made me always look like fool, because i the meta4 chart would have been corrected, capture page will not be accessible at meta4 data base and i was not able to access attached document; as a prove from my e-mail account no. Minor news, i now see spread of close to 20 pips most especially on limit and

stop orders. What make things worse is the fact that the contact person will not be logical in their presentation and/or argument; and there is no way you can win illogical argument, so, i waited patiently to get them red handed.

Here are the trade orders in contention, all in nzdusd that i opened.

35927640 2015.09.17 20:39:29 sell 0.18 nzdusd 0.63381

35605254 2015.09.09 23:55:24 buy 0.10 nzdusd 0.64013

The trades with the ticket numbers 35605254 and 35927640 as reflected in daily confirmation dated thu, 17 sep 2015 15:15:40 -0700 the meta4 used adopted GMT+2. I closed the trade with the ticket no 35605254 at 11.33.23 am (GMT+2)

16 dollar profit but to my surprise, account was deducted with -63.20 dollar and looking at my account history this is what i see these closed trades.

35605254 2015.09.09 23:55:24 buy 0.10 nzdusd 0.64013 0.00000 0.00000 2015.09.18 11:33:25 0.63381 -0.26 0.00 3.06 -63.20

35927640 2015.09.17 20:39:29 sell0.00 nzdusd 0.63381 0.00000 0.00000 2015.09.18 11:33:25 0.63381 0.00 0.00 0.00 0.00

Additionally, in my open trades i now have this entry which i know did not trade as reflected in daily confirmation of 17 of september with the trade entry reflected.

35985061 2015.09.17 20:39:29 sell 0.08 nzdusd 0.63381 0.00000 0.00000 0.64476 -0.20 0.00 0.00 -87.60

As reflected in my attached account details. And my doubt were confirmed by daily confirmation sent from ticmill

After my complaint to tickmill (copy of e-mail is attached) the phantom nzdusd 0.8 that was open, now closed.

What my investigation reveals.

I have two nzdusd , one 0.1 lots at 0.63381 and 0.18 lots 0.64013 which are 6332 points (4 digit platform), i close 35605254 at

+160 points, and i suppose to have my account added with

16 dollars it was deducted with 63.20 dollar and my trade 35927640 of 0.18 lots was partially (not by me because this exist on tickmill mt4 platform). And after my complaint, the partial closed trade was close (not by me)and appended with another ticket no..

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Visit broker

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill

About me tickmill is a new way of trading with extremely low market spreads, no requotes, absolute transparency and innovative trading technology. Tickmill is a trading name of tmill UK limited (FCA register no. 717270) and tickmill ltd. (FSA license no. SD008)

Price is facing bearish pressure from our first resistance, in line with our 50% fibonacci retracement, horizontal pullback resistance and 127.2% fibonacci extension where we could see a reversal below this level. Our 20 period EMA and ichimoku cloud are showing signs of bearish pressure as well.

Price is facing bearish pressure from our first resistance, in line with our 100% fibonacci extension, 23.6% fibonacci retracement and horizontal pullback resistance where we could see a further drop below this level. Ichiomku cloud and 20 period EMA are showing signs of bearish pressure as well.

USDCAD dropped nicely from our 1st resistance and might go below the downside confirmation where the 38.2% fib retracement is. Price could drop further from downside confirmation towards 1st support if it manages to close below downside confirmation. EMA is also showing that more bearishness is likely to come.

USDCAD dropped nicely from our 2nd resistance and might go up to retest the 1st resistance where the 61.8% fib retracement is. Price could reverse from 1st resistance towards 1st support where the 100% fib extension is. EMA is also showing that more bearishness is to come.

EURJPY reversed off our first resistance at 122.74 (61.8% fibonacci extension,23.6% fibonacci retracement, horizontal pullback resistance) where it could potentially drop to its support at 122.12 (horizontal swing low support, 100% fibonacci extension). Trading cfds on margin carries high risk. Losses can exceed the initial investment so please ensure you fully.

USDJPY is approaching our first support at 109.49 (horizontal swing low support, 61.8% fibonacci extension, 76.4% fibonacci retracement ) where a strong bounce might occur pushing the price up to our major resistance at 110.69 (horizontal swing high resistance, ,50%&78.6% fibonacci retracement, 100% fibonacci extension). Stochastic is also approaching support.

XAGUSD reversed off our first resistance at 14.66 (61.8% fibonacci extension,78.6% fibonacci retracement, horizontal pullback resistance) where it could potentially drop to its support at 14.36(horizontal swing low support, 61.8% fibonacci extension, 78.6% fibonacci retracement). Trading cfds on margin carries high risk. Losses can exceed the initial.

XAUUSD reversed off our first resistance at 1291.78 (61.8% fibonacci extension,61.8% fibonacci retracement, horizontal swing high resistance) where it could potentially drop to its support at 1266.86(horizontal swing low support, 61.8% fibonacci extension, 50% fibonacci retracement). Trading cfds on margin carries high risk. Losses can exceed the initial.

NZDUSD is approaching our first resistance at 0.7304 (horizontal overlap resistance, 76.4% fibonacci retracement, 100% fibonacci extension) which coincides with our long term descending resistance line. A strong reaction might occur at this level pushing price down to our major support at 0.7230 (50% fibonacci retracement, horizontal swing low support). A breakout.

USDJPY broke out of its horizontal resistance-turned-support level at 105.60 (horizontal overlap support, breakout level). A strong bounce could occur at this level pushing price up to our major resistance at 106.67 (horizontal swing high resistance, 76.4% fibonacci retracement, 100% fibonacci extension) which coincides with the long term descending resistance.

NZDUSD is approaching our first support at 0.7260 (horizontal overlap support, 23.6% fibonacci retracement, breakout level). A strong bounce might occur at this level, pushing price up to our major resistance at 0.7323 (100% fibonacci extension, horizontal overlap resistance, 78.6% fibonacci retracement). A breakout of our intermediate resistance level at 0.7279.

USDJPY is approaching our first resistance at 105.27 (horizontal overlap resistance, 23.6% fibonacci retracement, 61.8% fibonacci extension). A strong reaction might occur at this level, pushing price down to our major support at 104.63 (100% fibonacci extension, horizontal swing low support). RSI (34) is also approaching our major resistance line at 54%, in.

GBPUSD is approaching our first support at 1.4126 (horizontal overlap support, breakout level) which coincides with our short term ascending support line. A strong bounce might occur at this level, pushing price up to our major resistance level at 1.4281 (horizontal swing high resistance, 61.8%, 100% fibonacci extension, elliot wave structure). A breakout of our.

USDJPY is now testing major resistance at 109.76 (fibonacci retracement, horizontal swing high resistance) and a strong reaction could occur at this level to push price down to 108.33 support (fibonacci extension, horizontal swing low support). Our next level of resistance is at 110.36 (above multiple fibonacci retracements, above pullback resistance). Stochastic.

Ripple has dropped strongly and is now approaching major support at 0.8224 (fibonacci extension, elliott wave structure, horizontal swing low support, bullish divergence) and a strong bounce could occur at this level to push price up to at least 1.1511 resistance (fibonacci retracement, horizontal overlap resistance). Stochastic (34,5,3) is seeing major support.

Talking points: - investors prefer not to take risks before the decision of the bank of japan, fix profits; - democrats and republicans can not agree on financing the government, investors are slow to sell the dollar - because the consequences for the economy are not obvious. The senate will vote on monday; - OPEC excites the market with a statement that.

Minutes of the fed meeting from the minutes of december FOMC meeting it became clear that the tax reform left inflation front under the sign of question for the fed. Although it was noted that tax discounts would spur consumer spending, the regulator said that it will continue to follow gradual rate hiking path, while maintaining risks in the tradeoff between GDP.

The crypto currency boom opened a new chapter on monday with the start of trading bitcoin futures on the CBOE chicago stock exchange. The price for a contract with the delivery in january started from $15.460, but soon it soared to almost $ 19,000. The volume of contracts almost reached 3000 at the time of writing the article. The pricing of futures proved to be.

$500 bonus NFP machine – tickmill

Get $500 bonus NFP machine on exact prediction for june US non-farm payroll figure. Connect with the facebook page of tickmill and put your prediction in the comment before the next NFP release. Participate NFP machine campaign and make your chance to win $500 for an exact match or $200 for the closest guess.

Join $500 bonus NFP machine

Joining link: NFP-competition

Ending date: december 04, 2020

Offer is applicable: all clients with tickmill ID

How to apply:

- Like the official page of tickmill

- Put your prediction along with your tickmill ID

- Place your prediction before 16:00 (server time)

- Get $500 for exact prediction OR

- Get a $200 prize for the closest prediction to a live account.

Bonus cash out:

- The bonus is for trading purposes only.

- Need to trade one standard lot of reach $5 bonus

Terms & conditions – tickmill bonus NFP machine

General terms and conditions apply.

The account needs to verify before making any withdrawal.

This offer may be terminated anytime without such notice

so, let's see, what we have: access low latency networks where your expert advisors can truly thrive, with tickmill’s forex VPS. 100% uptime guarantee with increased control. At tickmill server time

Contents of the article

- New forex bonuses

- TICKMILL VPS

- What is a VPS?

- How does a VPS work?

- Why choose tickmill’s VPS by...

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Forex broker server time (GMT offset)

- GMT or GMT+2 broker, which is more ideal?

- How to find out server time your broker

- Tickmill

- In a FAST-MOVING market, choose a STABLE BROKER

- Where are tickmill servers located?

- Why TRADE with nextpointhost X-connect to...

- HOW-TO use nextpointhost X-connect competitive...

- Start trading now

- Tickmill competitors

- Tickmill review

- Broker details

- Live discussion

- Tickmill.Com profile provided by tickmill, nov...

- Video

- Traders reviews

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Tickmill

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Tickmill

- $500 bonus NFP machine – tickmill

- Join $500 bonus NFP machine

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.