Global 360 bonus

IMPORTANT INFORMATION: all FICO ® score products made available on myfico.Com include a FICO ® score 8, and may include additional FICO ® score versions.

New forex bonuses

Your lender or insurer may use a different FICO ® score than the versions you receive from myfico, or another type of credit score altogether. Learn more

Global 360 bonus

Heck yes it's worth and the real deal. As long as you haven't opened a 360 account with capital one since january 2018 I believe you're eligible and it's easy peasy to get. More info about the bonus here. I actually meant to post this yesterday but slipped my mind

So I have a question on this.

Is it 2 DD's that have to be $1,000 EACH? Or is it 2 DD's that could be $500 each, totaling $1,000? The wording is slightly confusing, that's why I ask.

- Mark as new

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS feed

- Permalink

- Email to a friend

- Report inappropriate content

Heck yes it's worth and the real deal. As long as you haven't opened a 360 account with capital one since january 2018 I believe you're eligible and it's easy peasy to get. More info about the bonus here. I actually meant to post this yesterday but slipped my mind

So I have a question on this.

Is it 2 DD's that have to be $1,000 EACH? Or is it 2 DD's that could be $500 each, totaling $1,000? The wording is slightly confusing, that's why I ask.

I read it as two direct deposits of $1000 or more EACH. I got the same offer but switching direct deposits for my work is a PITA, so I'm passing on this one.

- Mark as new

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS feed

- Permalink

- Email to a friend

- Report inappropriate content

Is it 2 DD's that have to be $1,000 EACH? Or is it 2 DD's that could be $500 each, totaling $1,000?

The second one. The wording is "totaling $1,000." someone confirmed it with a capital one customer service rep.

- Mark as new

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS feed

- Permalink

- Email to a friend

- Report inappropriate content

Is it 2 DD's that have to be $1,000 EACH? Or is it 2 DD's that could be $500 each, totaling $1,000?

The second one. The wording is "totaling $1,000." someone confirmed it with capital one customer service rep.

Yeah, "at least 2 dds totaling $1k" is pretty clear, I'm planning on 3 payroll dds totaling just over $1k.

Products

Learn

Company

Get our app

Follow us

Credit education

- Credit scores

- What is a FICO score?

- FICO score versions

- How scores are calculated

- Payment history

- Amount of debt

- Length of credit history

- Credit mix

- New credit

- Credit reports

- What's in your report

- Bureaus

- Inquiries

- Errors on your report?

- Calculators

- Know your rights

- Identity theft

- FAQ

- Glossary

Copyright © 2001- fair isaac corporation. All rights reserved.

IMPORTANT INFORMATION:

All FICO ® score products made available on myfico.Com include a FICO ® score 8, and may include additional FICO ® score versions. Your lender or insurer may use a different FICO ® score than the versions you receive from myfico, or another type of credit score altogether. Learn more

FICO, myfico, score watch, the score lenders use, and the score that matters are trademarks or registered trademarks of fair isaac corporation. Equifax credit report is a trademark of equifax, inc. And its affiliated companies. Many factors affect your FICO scores and the interest rates you may receive. Fair isaac is not a credit repair organization as defined under federal or state law, including the credit repair organizations act. Fair isaac does not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating. FTC's website on credit.

Opentext execute360

Content, workflow, and process management capabilities that integrate with your existing data processing systems

Opentext™ execute360 provides an end-to-end document lifecycle management solution for the capture, process management, and storage of information assets. Execute360 is a powerful and highly scalable solution designed to deliver content-enabled process management solutions for small departmental applications or for enterprise-wide distributed systems that serve thousands of users. You can use the execute360 software suite to:

- Define workflows to manage business processes; ensure work is completed efficiently and processes are in compliance, lowering the cost of processing

- Report on processing activities, workloads and trends

- Manage content lifecycle; collection, validation and long-term storage and retention; prevent the loss of business-critical information and ensure document regulatory retention requirements are met

- Capture content from multiple sources including scanned documents, fax, email, and MQ series messaging systems

- Seamless integration and fully customized interfaces to tie systems and information together, providing an effective solution that helps maximize end user productivity

- Rapid deployment with customizable, out-of-the-box software to create business-tailored user interfaces

- Integration of execute360 services and features with other business systems to provide a tightly coordinated solution to the business community

Opentext execute360 is designed for and proven in high-volume, high-availability environments where 24x7 operations are critical. System performance metrics and behavior are readily available to enable reliable performance and expedite system administration and management.

Execute360 works out-of-the-box with other opentext technologies, including:

Capital one 360 new account bonus: up to $400 cash for checking account

Updated january 14, 2021

Some links below are from our sponsors.

This blog has partnered with cardratings for our coverage of credit card products. This site and cardratings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author's alone and have not been reviewed, endorsed or approved by any of these entities.

As an amazon associate, I earn from qualifying purchases. More information

Capital one is one of the most recognizable names in the financial world and capital one 360 is their online banking arm. If you’re thinking about opening an account and want to know if they have any bonus offers – you’re in the right place.

They offer up to $400 cash bonus for opening a 360 checking account. There are several offers – the top one requires a direct deposit but there are two more, for less money, that only require you to spend a certain amount using the debit card.

Bank of america $100 new checking account bonus

Bank of america will give you a $100 cash bonus if you open a new account by june 30th, 2021 and receive at least 2 qualifying direct deposits of $250 or more within the first 90 days. The monthly fee is easy to get waived.

Let’s see how you can get this capital one 360 bonus:

How to get $400 for a capital one 360 checking account

This latest bonus for a capital one 360 checking account is super simple.

Just open a capital one 360 checking account by 1/26/2021 and then receive 2 direct deposits totaling $1,000 or more within 60 days of account opening. If you can’t meet the direct deposit requirement, there are two other offers that are based on spending (but they’re for less money).

There is, unfortunately, no bonus for the 360 performance savings account, just the checking.

How to get up to $250 for a capital one 360 checking account

If you don’t have a direct deposit that meets the requirements for the $400 offer, they also have two offers with a spending requirement.

If you think you can spend over $500 on your debit card in the first 90 days, you’ll want to open a 360 checking account with the promotion code UPTO250.

Spend over $500 on your debit card within the first 90 days and you’ll get $150 into your account.

Spend over $1,500 on your debit card within the first 90 days and you’ll get $250 into your account.

Bonus is deposited 60 days after the 90-day spend period ends.

If you cannot spend more than $500, then the next tier is at $300 in spending. Open a 360 checking account by january 26, 2021 with the promotion code BANK100.

Then, use your debit card and spend at least $300 within 90 days of opening that account. You’ll get $100 in the account 60 days after your 90-day spend period ends.

These offers are less generous than the one listed above BUT it has no direct deposit requirement.

About capital one 360

It only felt like yesterday that the term “online bank” felt like a novelty. ING direct was still doing silly ads where people didn’t know how to pronounce “ING” (I still say the individual letters). They were acquired by capital one in 2011 and turned into capital one 360 – the bank we’re talking about today.

Capital one 360 is FDIC insured as capital one bank USA (FDIC #33954) and if you want a deeper dive into the bank’s offering – our capital one 360 review does a good job outlining it all.

Just as an aside – even without the bonus, capital one 360 is a pretty good online bank. They have great rates, practically no fees, and one of the nice features is that you can open separate savings accounts for different savings goals. You can do it all online pretty quickly and each one will have its own account number, so you can set up automatic transfers to help with savings. It’s a good way to do envelope budgeting without actual envelopes.

So it’s a case where you come for the bonus but stay for the bank’s other features.

Any fees or gotchas?

You are not eligible for this bonus if you’ve had or had an open 360 checking account (as primary or secondary) on or after january 1, 2018.

Otherwise, no other things to watch out for – the account has no monthly fees, no minimum balance, and no gotchas to speak of. I’ve had an account at capital one 360 for over ten years (it started as an ING direct account) and have yet to pay a fee.

Plus it earns an interest rate of 0.40% APY, as of .

Capital one quicksilver cash rewards credit card – $200

You also get 1.5% cashback on every purchase, it’s a solid cash back card with no annual fee.

How does this bonus compare?

It’s a pretty solid offer because a bonus of $400 for just is great.

For example, chase bank has a competitive bonus too where you can get up to $350 for opening a new checking AND savings account. For their offer, you will have to set up a direct deposit to a chase total checking account AND transfer in $10,000+ in new money to the total savings account. This nets you a $200 bonus for the checking and $150 for the savings.

Also, if you want to get $400 from wells fargo (this offer is currently not available, we just include it as a reference), you’ll have to open an everyday checking account and receive a total of $4,000 or more in qualifying direct deposits into the new checking account within 90 days from account opening within 90 days. It requires just a $25 minimum deposit so the dollar amount is quite low but you’ll have to adjust your financial system so this account gets a direct deposit, likely from your full-time job.

As you can see, this capital one 360 bonus account is easier because it requires a relatively small direct deposit. Not all offers are this simple, review our guide on bank account bonuses to see what other banks typically require as a comparison.

Capital one savings bonus: up to $500

It's difficult to ignore the allure of free cash. If you are seeking a cash bonus for your savings account, then capital one's offer of up to $500 is worth taking a closer look at.

You will have to open a new bank account and deposit $50,000 to get the biggest bonus, but capital one offers tiered deals on balances of $10,000 and above for new customers. The bank also provides opportunities for existing customers to earn a bonus. The online bank pays savers a competitive yield.

Here's everything you need to know about the offer to see if it's the right fit for you.

The details

A deal like that might sound too good to be true. Let's take a closer look at the details.

New customers can score up to $500

Capital one is offering cash bonuses of $100 per every $10,000 you deposit and maintain in your account, up to $500 for $50,000. In order to secure this offer, you will have to open a 360 performance savings account through capital one using a promo code (SCORE500).

According to capital one, it should only take you about five minutes to open your new account. However, receiving the promised bonus will take several months.

Existing customers can score up to $450

If you already have an existing capital one 360 performance savings account, don't worry. You won't miss out on the chance to score a cash bonus from capital one.

As an existing account holder, you can earn a $450 bonus if you deposit $50,000 or more. If you don't have that much on hand, then you can still score a $150 bonus if you deposit between $20,000 and $49,999.99 in your existing capital one 360 savings account.

What's the catch?

Nothing in life is perfect and there are some limitations for this cash bonus.

Importantly, the offer has some specific time requirements for both existing and new customers. In order to secure the bonus, you will need to make your deposit before may 31, 2020. For new customers, you will also need to deposit money into the account within 10 days of opening it.

Simply transferring the money into your capital one account will not lead to a bonus, however. In addition to an initial deposit, you have to maintain the daily balance until aug. 29, 2020 if you're an existing customer, or for 90 days if you are a new customer. The daily balance must stay at the level you have chosen if you want to see the expected bonus hit your account. Otherwise, you may miss out on some of -- or all of -- your cash bonus.

For example, let's say you open a new account with $10,000; however, your daily balance drops below that initial deposit at some point in the first 90 days. If your daily balance drops below the initial deposit, you won't qualify for the cash bonus. But if you deposited $50,000 into a new account and your daily balance dropped to $30,000 in the first 90 days, then you would still see a $300 cash bonus as a new customer.

If you are able to maintain your account balance for 90 days or until aug. 29, 2020, you'll receive the appropriate cash bonus within 60 days. If you don't see the cash bonus by oct. 28, 2020, then you should call capital one to see what the delay is.

Is this a good deal for you?

This capital one 360 savings account bonus is something to consider if you have enough cash to deposit. A bonus is not the only factor you should think about, however. The key features to look for in any savings account are: APY, the fees associated with the account, and any bonus offerings.

First, the APY offered by the capital one 360 performance savings account is relatively high. Although the APY on the savings account is not the highest on the market, it is still very competitive. For example, marcus by goldman sachs offers a slightly higher APY; however, you would miss out on the cash bonus opportunity.

Capital one’s savings account doesn't charge monthly account maintenance fees either, so you'll also be able to watch your savings continue to grow without fees leaching away your earning potential.

Finally, the bonus offered by the capital one 360 performance savings account is attractive when compared to other bank deals. But you'll need to park a substantial amount of your savings in this account for an extended period of time in order to receive the cash bonus. If you have ample cash reserves on hand, then this could be a good opportunity to score a worthwhile cash bonus. However, you'll need to be comfortable with the idea of leaving your savings untouched for the foreseeable future. If you are unable to do that, then you may want to consider a bank with a higher APY to help your savings grow faster until you need to access it.

Bottom line

When you are looking for the right savings account to safely store your money in, it can be difficult to find the right fit. You want an account with a high APY and no fees. But you also want a little something extra for doing your banking with a particular institution. Many banks under-deliver on these desires, but capital one's 360 performance savings account doesn't disappoint. Overall, the bonus offered by capital one is worth considering.

Even if you don't choose to work with capital one, you should take advantage of one of the savings accounts with a higher APY to help you reach your savings goal sooner, and potentially, to also earn a cash bonus to further increase your savings.

Capital one $400 checking bonus

Offer at a glance

- Maximum bonus amount: $400

- Availability: nationwide

- Direct deposit required:yes, two direct deposits totaling $1,000+

- Additional requirements: use promo code

- Hard/soft pull:soft (overdraft protection no longer being offered)

- Chexsystems:mixed. EWS sensitive according to the comments

- Credit card funding: none

- Monthly fees: none

- Early account termination fee: none

- Household limit: none listed

- Expiration date: january 26, 2021

The offer

- Capital one is offering a checking bonus of up to $400 when you open a new checking account with promo code BONUS400 (make sure this is added as it’s not automatically applying for everybody). To receive bonus you must two or more direct deposits totaling $1,000+ within 60 days of account opening

The fine print

- Here’s the full scoop on how to earn your $400 bonus:

- Open a 360 checking account between 12:00 a.M. ET on november 9, 2020, and 11:59 p.M. ET on january 26, 2021. When you open your account, enter your promotional code—BONUS400.

- Receive at least 2 direct deposits totaling $1,000 or more to your 360 checking account within 60 days of account opening. A qualifying direct deposit is an automated clearing house (ACH) credit, which may include payroll, pension or government payments (such as social security) by your employer or an outside institution.

- This account is subject to approval. This offer cannot be combined with any other 360 checking account opening offers. Only one promotional code is accepted. Bonus is only valid for one new 360 checking account.

- If you have or had an open 360 checking account as a primary or secondary account holder with capital one on or after january 1, 2018, you will be ineligible for the bonus. If your account is in default, closed or suspended, or otherwise not in good standing, you will not receive the bonus.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding fees

Monthly fees

This account has no monthly fees to worry about

Early account termination fee

There is no early account termination fee

Our verdict

There was just a $250 bonus released, but that didn’t require a direct deposit. Bit annoying for people that already signed up for that deal or even the previous $100 offer if they can easily do a direct deposit (or use one of the methods that has worked before). Obviously a great bonus and one we will be adding to the best bank bonus page.

Global 360 bonus

Is it 2 DD's that have to be $1,000 EACH? Or is it 2 DD's that could be $500 each, totaling $1,000?

The second one. The wording is "totaling $1,000." someone confirmed it with capital one customer service rep.

Yeah, "at least 2 dds totaling $1k" is pretty clear, I'm planning on 3 payroll dds totaling just over $1k.

Has anyone that is self-employed found an effective way to set up dds that are ACH deposits? I've seen the list on the doctor of credit website, but was also looking for an alternative to charles swaab and fidelity. Thanks!

- Mark as new

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS feed

- Permalink

- Email to a friend

- Report inappropriate content

First horizon sent me a $400 offer too. Must be bank switching season lol

- Mark as new

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS feed

- Permalink

- Email to a friend

- Report inappropriate content

Has anyone that is self-employed found an effective way to set up dds that are ACH deposits? I've seen the list on the doctor of credit website, but was also looking for an alternative to charles swaab and fidelity. Thanks!

If you want it to code as a payroll DD, you' probably have to sign up for 3rd party service then have them DD your check?

- Mark as new

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS feed

- Permalink

- Email to a friend

- Report inappropriate content

- Mark as new

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS feed

- Permalink

- Email to a friend

- Report inappropriate content

Has anyone that is self-employed found an effective way to set up dds that are ACH deposits? I've seen the list on the doctor of credit website, but was also looking for an alternative to charles swaab and fidelity. Thanks!

If you want it to code as a payroll DD, you' probably have to sign up for 3rd party service then have them DD your check?

@janus thank you for your feedback. According to the website and a representative, I will be able to meet the requirement using an ACH from an outside institution. However, I'd much rather have a payroll DD and will look into some other ideal alternatives.

- Mark as new

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS feed

- Permalink

- Email to a friend

- Report inappropriate content

Not the biggest cap one fan - but I just opened a checking account for this - haha.

- Mark as new

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS feed

- Permalink

- Email to a friend

- Report inappropriate content

Just tried to redeem this offer and..

It ran into an error it displayed "sorry, we hit a snag please try again later"

Am wondering if this has to due with the cards and auto loan I filed bankruptcy on. My chexsystems is clear

- Mark as new

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS feed

- Permalink

- Email to a friend

- Report inappropriate content

Just tried to redeem this offer and..

It ran into an error it displayed "sorry, we hit a snag please try again later"

Am wondering if this has to due with the cards and auto loan I filed bankruptcy on. My chexsystems is clear

Capital one doesn't use chex, they use EWS, early warning service. Is your BK currently in process? If so that would likely be a problem for them.

Opened my checking account yesterday. If you have a cap one login for ccs/loans click that - super easy, fills out all your personal info, just need to confirm SS# and dob. Be sure to chose fund the account, that's were it brings up the BONUS400 promo code & confirms eligibility. For me it brought up my bank accounts for my cap one CC payments, you can fund with as little as $20.

- Mark as new

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS feed

- Permalink

- Email to a friend

- Report inappropriate content

I'm definitely getting this. I just got my SUB from wells fargo in september for 400. I'll be closing that account and switch to cap1. I already have a cap1 savings, quicksilver CC and a savor one CC.

- Mark as new

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS feed

- Permalink

- Email to a friend

- Report inappropriate content

I opened mine last week and set up $500 biweekly dd just in case my job takes a few weeks to apply the change. If the account is opened this month, we get the bonus end of march. This is the best one I've seen. And I'm working on a few others. ����

Products

Learn

Company

Get our app

Follow us

Credit education

- Credit scores

- What is a FICO score?

- FICO score versions

- How scores are calculated

- Payment history

- Amount of debt

- Length of credit history

- Credit mix

- New credit

- Credit reports

- What's in your report

- Bureaus

- Inquiries

- Errors on your report?

- Calculators

- Know your rights

- Identity theft

- FAQ

- Glossary

Copyright © 2001- fair isaac corporation. All rights reserved.

IMPORTANT INFORMATION:

All FICO ® score products made available on myfico.Com include a FICO ® score 8, and may include additional FICO ® score versions. Your lender or insurer may use a different FICO ® score than the versions you receive from myfico, or another type of credit score altogether. Learn more

FICO, myfico, score watch, the score lenders use, and the score that matters are trademarks or registered trademarks of fair isaac corporation. Equifax credit report is a trademark of equifax, inc. And its affiliated companies. Many factors affect your FICO scores and the interest rates you may receive. Fair isaac is not a credit repair organization as defined under federal or state law, including the credit repair organizations act. Fair isaac does not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating. FTC's website on credit.

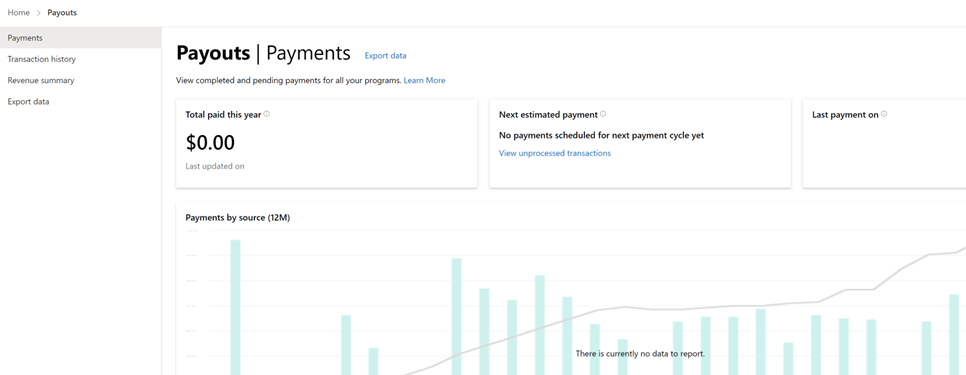

View your incentives program details

Applies to

Appropriate roles

- Incentive administrator

- Incentive user

- Incentive read-only viewer

- Global admin

- MPN partner admin

This article explains how to access the my incentives overview page, which shows the overall status of your incentive programs, as well as the status of each program at each location. It also gives the different enrollment statuses.

For more information about incentives and incentive features in partner center, see partner investments and incentives (sign-in required).

Access the incentives overview page

Select incentives, then overview from the menu.

View the earnings and payments summary at the top of the page and further details in the table below. You can also sort, group, and expand the accompanying table:

- To sort by column, select the column name.

- To group by program, select the by program tab above the table.

- To group by location, select the by location tab above the table.

- To view more detail about enrollments within a specific group, select the chevron symbol at the end of a given row. This chevron expands your view.

If further action is required to enroll in a program, this information will appear in the status column. In this case, select the chevron symbol to learn about next steps you need to take.

Enrollment status

The following table explains the different enrollment states shown in the status column.

If the status is ineligible, then the partner does not meet the current eligibility requirements for the program; selecting the see eligibility requirements link beneath the enrollment status will show the requirements for eligibility and which of these requirements have been met.

See your payment information

Select the payout icon in the upper-right corner of the screen to access these different summaries:

- Transaction history

- Payments

- Export data

This information includes total incentive earnings and payments since you enrolled in incentive programs. Also included on this page are earnings and payments by location or program as well as any further actions you might need to take to enroll in a program at a specific location.

You can also use the partner payout API to connect and obtain payout transaction and payment data directly. See payout statements to learn more.

Top perks and benefits of delta 360 status

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our advertising policy, visit this page.

Update: some offers mentioned below are no longer available. View the current offers here.

In 2009, delta announced a new top-tier status for its most loyal flyers: diamond medallion. But that’s not the actual top of the heap. In addition to published top tiers, like american’s executive platinum, delta diamond and united premier 1K, all three carriers offer an even higher level of status, reserved specifically for the biggest spenders.

Delta 360 is delta’s version of an invite-only, hyper-exclusive service tier. It compares to american airlines’ concierge key and united’s global services. Here’s the official description from delta: “delta 360° is an annual, invitation-only program for our top skymiles members, offering an exclusive suite of benefits and services even beyond diamond medallion status. An invitation into delta 360° is based on your overall investment with delta. If you’re selected to join, we’ll contact you directly.”

Intrigued? Let’s dive in and see what this exclusive status is all about.

In this post

How to earn delta 360 status

I caught up with a current delta 360 member to get a feel for what it took to trigger their invitation and how they’re looking to maintain it in 2019. One detroit-based member, who hasn’t received word on whether he’ll re-qualify for 2019, received this year’s 360 invite via email in early february. He’s presently sitting at just over 240,000 MQM (with 86,000 of those rolling over from 2017), which were accrued over 43 segments. His MQD count is just north of $42,000. He’s taken six international business trips this year, is a delta million miler and puts “a fairly significant sum” on his platinum delta skymiles® credit card from american express.

Despite delta 360 offering (arguably) the weakest set of perks among the three major invite-only programs, it generally requires the most to get in. A spate of delta loyalists at flyertalk have recently chimed in, with one NYC-based flyer having nearly $90,000 in spend but still lacking a 360 invite. Another based near huntsville (HSV) has spent nearly $50,000 year-to-date and is also looking in from the outside. A few added data points show that in saturated delta markets, such as new york and atlanta, you may need to hit six figures in annual spend to be in the mix for an invitation.

A separate poster explains that delta looks at more than just overall spend, including how much control you have over corporate contracts that could funnel vast sums of money into delta’s coffers.

For those who do get the invite, you can look forward to a few extra perks.

Delta sky club executive membership

If you frequently travel with family or colleagues, or want the ability to spontaneously guest someone into the sky club after sparking a conversation on a flight, this is a significant perk. Delta sky club executive membership includes unlimited club access for the member and up to two guests per visit.

If you wanted to pony up for executive sky club membership, you’d need to pay $845 annually, part ways with 84,500 skymiles or pay $75 for 12 monthly installments.

The only other way to procure executive sky club membership for free is to burn two choice benefits for delta’s diamond medallion members. Given that diamond members only receive three choice benefits, that’s a steep price to pay.

Dedicated phone line with best-in-class agents

While each of delta’s published elite tiers (silver, gold, platinum and diamond) receive priority phone treatment, with increasingly skilled agents assigned to higher tiers, delta 360 members are able to dial up what amounts to a personal assistant. Based on feedback from current and former delta 360 members, the dedicated VIP phone line gives them 24/7 access to the crème de la crème.

These agents are given extra autonomy to cut through red tape and do whatever is necessary to get delta 360 members out of jams when it comes to irregular operations (IROPS) and weather-related delays/cancellations. They’re also more likely to bend the published rules when members need to make schedule changes or add legs to itineraries.

Greater chance of a porsche gate-to-gate airport transfer

Delta carefully monitors the travels of its diamond medallion members, and if it detects that a member may miss a critical connection agents will work hard to position a porsche at their arriving gate in order to expedite their transfer to the connecting gate. This service is primarily found at delta’s large hubs, such as atlanta (ATL), detroit (DTW), minneapolis (MSP), los angeles (LAX), salt lake city (SLC) and seattle (SEA).

When it comes to delta 360 members, however, this monitoring is taken to entirely new heights. They are given porsche priority when the fleet is at max utilization, and are more likely to receive a courtesy porsche transfer even when it’s not necessary to make a tight connection.

A fancy champagne gift

You can enjoy a glass of bubbly in delta one and delta first class — not to mention the premium cabins of most other airlines — but delta also has been known to send its 360 members a magnum of louis roederer champagne and tiffany & co. Flutes. It’s not a travel benefit per se, but who wouldn’t be happy to receive this package in the mail?

Higher upgrade priority on delta flights

Delta 360 doesn’t appear to offer any significant advantage over its highest published status (diamond medallion) when it comes to upgrades, but at least members get the same priority. That said, reports indicate that when members do receive complimentary upgrades, they tend to clear on the same day of the flight — rarely as early as five days out.

Of course, chances are quite good that these travelers are booked into paid first class as it is, so any upgrade perks may not be applicable.

Bottom line

One could expect that the dedicated individuals employed to service delta 360 members would also go above and beyond when flight plans are thwarted due to schedule changes, weather delays or IROPS, but on paper you’ll see a more robust set of exclusive perks when achieving american airlines concierge key and united global services.

In fact, one delta 360 member told me that he hasn’t felt a huge difference since being elevated from diamond medallion, which can be looked at one of two ways: either delta isn’t doing enough to celebrate its 360 members, or its top published tier (diamond) delivers truly exceptional service, making the differentiation between the two tougher.

As a diamond medallion myself, I’d say the truth likely lies somewhere in between. I’m consistently impressed with how well I’m treated, particularly giving my relatively small diamond spend ($17,000 mqds for 2018), but I’d be angling for a few more global and regional upgrade certificates at the very least if I ever hit a point where 360 was a possibility.

In some ways, this is good news to other delta medallion elites who might feel like they’re missing out — since in reality top-tier diamond medallion members largely get similar customer service and a comparable overall experience flying delta.

If you’re currently working toward status on this carrier, make sure to check out the top cards that can help you earn mqms and offer a variety of elite-like perks.

- Gold delta skymiles® credit card from american express earn 30,000 bonus miles after you use your new card to make $1,000 in purchases within your first 3 months and a $50 statement credit after you make a delta purchase with your new card within your first 3 months. Terms apply.

- Gold delta skymiles® business credit card from american express earn 30,000 bonus miles after you use your new card to make $1,000 in purchases within your first 3 months and a $50 statement credit after you make a delta purchase with your new card within your first 3 months. Terms apply.

- Platinum delta skymiles® business credit card from american express earn 5,000 medallion® qualification miles (mqms) and 35,000 bonus miles after you spend $1,000 in purchases on your new card in your first 3 months. Plus, earn a $100 statement credit after you make a delta purchase with your new card within your first 3 months. Terms apply.

- Delta reserve for business credit card earn 40,000 bonus miles and 10,000 mqms after you spend $3,000 in purchases on your new card in your first 3 months. Terms apply.

Are you a delta 360 member? Share your experience in the comments below!

Capital one 360 promo codes & coupons january 2021

Capital one 360 coupons and promo codes for january 2021 are updated and verified. Today's top capital one 360 promo code: $25 bonus for opening new account.

Capital one 360 promo codes january 2021

Top online capital one 360 coupons and promo codes for january 2021. You can find some of the best capital one 360 discounts for save money at online store.

Take $25 reward for launching new accounts

Get $25 reward for opening up new bank account

Take $5 away initial 5 uber rides

Get $5 off of very first 5 uber trips

Special offer! $25 bonus when you open new checking or savings account

Get $25 benefit when you open brand-new checking or savings account

Extra $20 bonus when you open an account

Get an added $20 bonus when you open an account

Get $25 bonus for opening new account

Get $25 bonus for opening new account

Take $25 bonus for opening new account

Get $25 bonus offer for opening up new account

Up to $50 added bonus on your own order

Wake up to $50 added bonus on the purchase

$25.00 bonus for opening up A new orange bank account for first time people.

$25.00 added bonus for opening up a whole new orange savings account for first time members.

Special offer! $10 away from

Get $10 once you open a whole new bank account!

Get $50 free of charge attention making banking account

Get $50 free of charge fascination getting bank checking account

$1,250 funds reward with new sharebuilder accounts

Wide open a fresh sharebuilder profile and you will receive up to a $1,250 funds bonus

Share the gift of monetary satisfaction & get $40

Share the gift of economic assurance and have $40 for every buddy that effectively starts a capital one particular 360 account

Cost-cost-free and no minimum requirements looking at

360 examining is payment-totally free, has no minimums & generates interest

Take $25 bonus for opening up A fresh savings account with $250

Get $25 bonus for opening a brand new bank account with $250

Take $25 added bonus 360 savingssm $25 added bonus youngsters savings account $25 added bonus funds credit account for teens

Get $25 bonus 360 savingssm $25 bonus youngsters savings account $25 bonus dollars credit make up young adults

Obtain $25 bonus 360 savingssm, $25 bonus kids savings account & $25 bonus MONEY debit account for teens

Get $25 bonus 360 savingssm, $25 bonus kids savings account & $25 bonus MONEY debit account for teens

so, let's see, what we have: hi! Came across the below offer on my capital one app, seems too good to be true. Has anyone does this one before? Does opening the account - 6184103 at global 360 bonus

Contents of the article

- New forex bonuses

- Global 360 bonus

- Opentext execute360

- Content, workflow, and process management...

- Capital one 360 new account bonus: up to $400...

- How to get $400 for a capital one 360 checking...

- How to get up to $250 for a capital one 360...

- About capital one 360

- Any fees or gotchas?

- Capital one quicksilver cash rewards credit card...

- How does this bonus compare?

- Capital one savings bonus: up to $500

- The details

- What's the catch?

- Is this a good deal for you?

- Bottom line

- Capital one $400 checking bonus

- The offer

- The fine print

- Avoiding fees

- Our verdict

- Global 360 bonus

- View your incentives program details

- Access the incentives overview page

- Enrollment status

- See your payment information

- Top perks and benefits of delta 360 status

- In this post

- How to earn delta 360 status

- Delta sky club executive membership

- Dedicated phone line with best-in-class agents

- Greater chance of a porsche gate-to-gate airport...

- A fancy champagne gift

- Higher upgrade priority on delta flights

- Bottom line

- Capital one 360 promo codes & coupons january 2021

- Capital one 360 promo codes january 2021

- Take $25 reward for launching new accounts

- Take $5 away initial 5 uber rides

- Special offer! $25 bonus when you open new...

- Extra $20 bonus when you open an account

- Get $25 bonus for opening new account

- Take $25 bonus for opening new account

- Up to $50 added bonus on your own order

- $25.00 bonus for opening up A new orange bank...

- Special offer! $10 away from

- Get $50 free of charge attention making banking...

- $1,250 funds reward with new sharebuilder accounts

- Share the gift of monetary satisfaction & get $40

- Cost-cost-free and no minimum requirements...

- Take $25 bonus for opening up A fresh savings...

- Take $25 added bonus 360 savingssm $25 added...

- Obtain $25 bonus 360 savingssm, $25 bonus kids...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.