No deposit bonus forex malaysia

New traders are afraid of risking their money which is not an issue with a free bonus such as no deposit bonus.

New forex bonuses

The traders are just required to register with the broker for an account and become a member. Forex brokers often provide such bonuses in order to get the clients familiarized with their services and also add to their potential clients. Entering the world of forex trading can be a little disconcerting for the newcomers of the market. So, what better way than using a вђњno deposit bonus forexвђќ for the malaysian traders to get over the uneasiness?

No deposit bonus forex 2021 malaysia

Entering the world of forex trading can be a little disconcerting for the newcomers of the market. So, what better way than using a вђњno deposit bonus forexвђќ for the malaysian traders to get over the uneasiness?

New traders are afraid of risking their money which is not an issue with a free bonus such as no deposit bonus. The traders are just required to register with the broker for an account and become a member. Forex brokers often provide such bonuses in order to get the clients familiarized with their services and also add to their potential clients.

As the name suggests, forex no deposit bonus requires no pre-funding on your part; you just receive the bonus and start trading. Plus, any profits you manage to earn will be yours fully, provided that you fulfill the terms and conditions of the bonus. All in all, itвђ™s a win-win, there is no version of this in which you can lose your money; additionally, youвђ™ll get more proficient in your trading while earning some extra bucks. So, think of it as a practice in the real market using real money!

Below you can find the list of forex brokers that offer вђњforex no deposit bonusвђќ to their malaysian clients.

The malaysian clients should bear in mind that there are quite a few forex no deposit bonuses out there, but not all of them are a good choice for trading and must be approached carefully. Therefore, the clients should develop a keen eye for spotting the ones that could be beneficial.

The no deposit bonus that you choose ought to be considered from different perspectives such as:

The legitimacy of the broker - in terms of their background, reputation, and whether or not theyвђ™re well-regulated by prominent regulatory authorities.

The pre-requisites and conditions of the promotions - you should know what you agree to by clicking that вђњacceptвђќ button. For example, how many lots youвђ™re required to trade, how much time you have, and how limited your options are. So read the terms it in depth until you understand them fully.

The bonus amount should give you enough room to trade - at least an amount above $20, so you can maneuver in your trades.

And lastly a leverage amount (usually 1:100 - 1:500 depending on the broker) that can help you make bigger trades and gain more profits while engaging in fewer trades.

Forex no deposit bonus in malaysia and how to profit from it?

As a first-time trader in malaysia, entering into the forex market which primarily speaks the currency of USD may seem like a risky prospect due to the high exchange rate from MYR to USD. Besides a demo account, what are the other ways you can trade with? The way we malaysians can do it is with a no deposit bonus, which is no pre-funding required by the broker, offering traders a certain amount for free to trade.

How forex no deposit bonus works in malaysia?

For most of the brokers, you only must register an account and start using their platform for them to start giving you a free bonus to try out. This is usually a strategy that many brokers use to attract people to try their platform and then turn them into a client. The bonus that you’ve received from the brokers, the profits that you’ve traded with it will go to you if you’ve satisfied the platform’s terms and conditions.

How to trade with the no deposit bonus account?

1. Try out the platform

Similarly to using a demo account, the no deposit bonus is a way for you to test the functionality of the platform. The benefit from this is that you directly experience the movements of the market as you are trading with real money. Before you deposit extra into the platform, test a few other platforms at the same time to make sure it is the right one for you and it suits your trading needs.

2. Patience and confidence

Although it is a no deposit bonus, build a mindset as if you’re trading with your own money. Trading requires patience and not an overnight success, so remember to use the bonus to make calculated trades and improve upon your strategy. This not only to improve your skill sets but also your confidence as every trade you’re executing, it has to be a trade that you believe in.

How to choose the best broker that offers no deposit bonus in malaysia?

A note to malaysians, the forex brokers that offer the best bonuses doesn’t mean it is the best platform available, which is why do compare the forex broker side by side to make sure it is what you’re looking for. To choose the best broker, there are a few criteria to evaluate:

1. Regulations

A platform may offer you a bigger no deposit bonus, but all will go into waste if the platform is an illegal forex scheme, and your deposits and profits made later on will all be gone. To prevent this, make sure the broker is regulated by a governing body. Locally, there is the bank negara malaysia (BNM), and internationally there are those such as financial conduct authority (FCA), the cyprus securities & exchange commission (cysec), and more.

2. Bonuses

Although the bonuses are not the most important, it should at least be $20 (around RM85) so that you still have a sizable amount to do some trading.

Take this quick quiz to help us find the best path for you

3. Terms and conditions

Most platforms will lure you with good bonuses, but it is also important to understand the terms and conditions before you sign up for it. For example, a broker may offer you $50 as a no deposit bonus, however, the profits that you make from the $50 can only be withdrawn if you deposit another $200 from your pocket. So do make sure you’ve done your research before you jump into the platform.

Best forex brokers in malaysia that offer A no deposit bonus:

Tickmill: $30 no-deposit bonus

XM: $30 no-deposit bonus

The selection of these brokers is based on the recommendations stated above:

1. TICKMILL

- TICKMILL is a top 3 rated broker, it is highly rated for its wide varieties of asset classes to be traded such as forex, commodities, and more. One of the reasons is due to its regulation. It is regulated by the seychelles financial services authority (FSA), financial conduct authority (FCA), and the cyprus securities and exchange commission (cysec).

- TICKMILL offers a $30 no deposit bonus. For malaysian clients, all you are required to do is to open a trading account with the broker and provide the necessary information, then you will receive your no deposit bonus.

- The broker supports metatrader 4 (MT4), an electronic trading platform that is popular among malaysian traders, the platform can be used via web or phone. Malaysians also get to enjoy using the platform in bahasa melayu, with customer support in malay as well!

- To withdraw the profits made from the $30 no deposit bonus, malaysian clients will need to deposit $100 into the MT4 trading account, so that you can withdraw the profits made. The no deposit bonus also can only be used for trading.

2. XM forex

- XM forex is a well-known broker due to its low minimum deposits. It is well regulated by a few international regulating bodies. It is regulated by the international financial services commission (IFSC), cyprus securities and exchange commission, and the australian securities and investments commission (ASIC).

- XM forex offers a $30 no deposit bonus. For malaysian clients, all you need to do is to register an account with XM forex and register then verify your phone number, then you will be receiving your $30 no deposit bonus within 24 hours. With XM forex, malaysians also get to enjoy customer support in malay and also the platform in bahasa melayu as well!

- To withdraw, XM forex has its own terms and conditions as well. For the client that has registered, you can only receive the no deposit bonus once. The no deposit bonus can only be used for trading purposes. Take note that you can only withdraw the profits on the condition that you trade at least 0.1 standard lot or 10 micro-lots in 5 round turntables.

Conclusion and thoughts

Forex no deposit bonuses have its pros and cons, it is important to utilize it in a way that can be beneficial to your trading journey. To fellow malaysians, never get drawn up to greed to all of these bonuses and open new accounts nonstop, it is more important to build consistency with a platform that yields the best results for you. Remember, brokers that offer a large amount of money may be too good to be true, so always beware and go through the few evaluation criteria stated above. As always, have fun trading!

PEOPLE WHO READ THIS ALSO VIEWED:

- Best forex brokers

- Best brokerage fee in malaysia

- Forex trading in malaysia

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage . 75 % of retail investor accounts lose money when trading cfds with this provider . You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money .

Welcome to mitrade

- English

- Demo account

- Create account

- Log in

- 简体中文

- 繁体中文

- English

- ไทย

- Tiếng việt

- Bahasa melayu

- Markets

- Tools

- Trading platform

- Support

- Learn

- About us

- English

- Forexindicescommoditiessharescryptocurrencies

- Trading analysisforecasteconomic calendarnewsmarket datasentimentrisk management

- Faqhelp centrecontract specifications

- Basicseducationinsights

- About mitradeour awardsclient money protectionfees & chargesmitrade propromotionscontact us

- 简体中文繁体中文englishไทยtiếng việtbahasa melayu

Online trading forex, gold bitcoin and more

- 100+ popular financial markets

- Competitive spreads

- Relevant regulatory bodies regulated

- Zero commissions

Delving into the world of trading can be nerve-wracking and confusing for newcomers. Luckily, many forex brokers offer new members an initial bonus without a deposit, which can be used to start trading right away. You may have some questions, such as: how can I get a no deposit bonus to start trading? Which brokers can I trust with my money? And how can I be sure it’s not a scam?

We’re here to quash your fears and give you confidence in your upcoming trades. Continue reading to learn more about our research on certain forex brokers with a no deposit bonus for malaysian traders in 2020.

Let’s start with the most important question: which forex brokers have a no deposit bonus for malaysian traders?

* kindly note that this information is accurate but these characteristics might change in the future. For details, please refer to the latest update on their official websites. *wikifx is a global forex broker regulatory inquiry app.

1. Mitrade

Mitrade’s main office is located in australia and holds a number of awards for innovation and mobile accessibility. They provide a unique trading platform, easily accessible on the web or mobile devices. If you’re new to the world of trading forex in malaysia, they offer a demo account that’s valid for 90 days.

The minimum deposit at mitrade is $50 and they offer negative balance protection, ensuring your account won’t go below 0. At mitrade there is a very low threshold amount, the minimum size per trade is as low as 0.01 lots for many markets.

The leverage amount is up to 1:200 and they offer clients competitive spreads, zero commissions, as well as articles to help first-time traders understand the scope of forex in malaysia.

Regulated by

Australian securities and investment commission (ASIC)

Forex no deposit bonus 2020

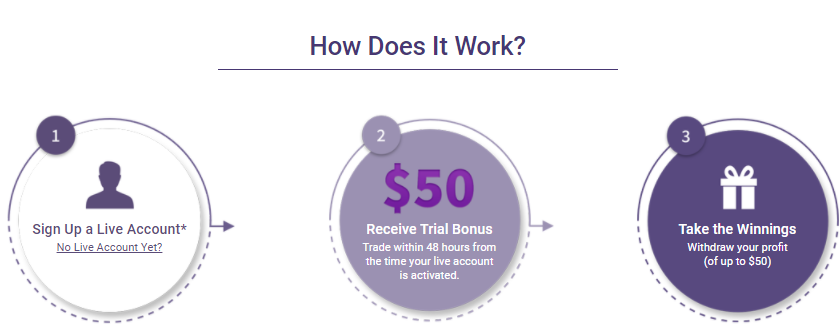

Sign up easily on the website for a live account. Within 48 hours of your account being activated, you’ll be transferred the no deposit bonus ( trial bonus for new clients). The bonus is limited to 300 eligible customers each day.

This no deposit bonus has an expiry, which is 48 hours from activation of the bonus. If you want to withdraw your earnings up to a $50 profit, do so within this timeframe. After the 48 hour event, you can submit regular withdrawal/deposit requests for your account.

Open live account, and apply this trial bonus!

XM group (XM) is said to be a suitable forex broker choice for beginners as well as vets in the trading industry. At XM you have the choice of 2 trading platforms: metatrader 4, an award-winning platform that is mostly used for forex trading, and metatrader 5, a multi-asset platform for traders.

Regulated by

Cyprus securities and exchange commission (cysec)

International financial services commission (IFSC)

Financial conduct authority (FCA)

Australian securities and investment commission (ASIC)

Forex no deposit bonus 2020

For details, please refer to the latest update on their official website.

3. Tickmill

Tickmill is based in london but operates in many countries across the world. Their MT4 platform is easily navigable and provides 50+ indicators, charting tools, and EA trading, among other features. Forex traders can benefit from 60+ currency pairs, and open a demo account to test their platform before committing. The downside is they do not have MT5 integration.

Regulated by

Seychelles financial services authority (FSA)

Financial conduct authority (FCA)

Cyprus securities and exchange commission (cysec)

Forex no deposit bonus 2020

For details, please refer to the latest update on their official website.

Fxopen operates on MT4 and MT5 trading platforms, with a web-based option available, and a range of CFD instruments. The broker allows trade of over 50 currency pairs. Spreads vary depending on the pairs.

Regulated by

Financial conduct authority (FCA)

Australian securities and investment commission (ASIC)

Forex no deposit bonus 2020

For details, please refer to the latest update on their official website.

5. Just2trade

Just2trade offers traders a multitude of accounts to choose from before advancing with their trades, depending on each person’s needs. They connect their clients via the whotrades social network app.

Spreads and commissions are low at just2trade, and depending on the plan chosen, there may or may not be monthly fees for your account.

Regulated by

Cyprus securities and exchange commission (cysec)

Forex no deposit bonus 2020

For details, please refer to the latest update on their official website.

FBS broker services are based in belize, and have been on market for 2-5 years. They’re licensed for MT4 and MT5 trading platforms. FBS offers negative balance protection, giving you some security.

Regulated by

Cyprus securities and exchange commission (cysec)

International financial services commission (IFSC)

Forex no deposit bonus 2020

For details, please refer to the latest update on their official website.

Forex bonus scams are not a new problem. In review news sites you can get hundreds of forex bonus schemes, some of which even record up to thousands of dollars in bonuses with no conditions attached.

In asia there are a number of brokers operating under ponzi schemes (unsustainable multi-level operations), attracting traders through huge bonus programs. These exchanges launch huge bonuses but then the trader has no way to withdraw money, or encounters a banking system error. So, as a forex trader, how do you know which no deposit bonus is a scam?

How can you be sure a forex broker with no deposit bonus isn’t a scam?

The rule of thumb here is common sense. If a no deposit bonus looks too good to be true, it probably is. As you can see from our list, a typical amount is around $30 to $50 for a no deposit bonus. I’ve seen offers for 250$ or even 1,000$, which is way more than the usual amount.

The simplest, most reliable way is to choose forex no deposit bonus programs from certified brokers serving malaysia that have been on the market for at least 3-5 years. With reputable forex brokers, the bonus will be appropriate and support many future benefits.

A couple of tips to keep your money safe:

Watch out for unlicensed brokers. If a broker is legitimate, they won’t hesitate to tell the world about how safe your money will be in their hands, with proof.

Also keep an eye out for false advertising. This means that the no deposit bonus they’re advertising should align with the terms and conditions on their page. If there’s a discrepancy, be wary of the opportunity.

Lastly, take a look at the terms and conditions to see if they are published with transparency. Transparency equals honesty: brokers offering scams have something to hide and do so with strangely-worded terms and loopholes.

Is the no deposit bonus a scam?

No. As we’ve outlined above, scams do exist, but if you pay attention to the details you will be able to spot a scam from a mile away.

Can I withdraw a no deposit bonus?

This depends on the broker. Certain terms and conditions state you can’t directly withdraw it, but you can withdraw earnings made from the forex bonus. Oftentimes you’ll have to profit a certain amount, or turnover x number of lots, before being qualified to withdraw. Check the broker’s terms to find out.

Why do forex brokers provide no deposit bonuses?

Forex no deposit bonus is a way for brokers to get your business, and for you to start trading without requiring your own start-up capital. The bonus is enticing for people who are just starting out, or who want to try out a service without investing immediately in the malaysian market.

If you find a quality broker with a forex no deposit bonus in 2020, it’s a win-win, as the broker wants you to make money through their business and you don’t have to risk your own equity!

The content presented above, whether from a third party or not, is considered as general advice only. This article does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Mitrade does not represent that the information provided here is accurate, current or complete. Mitrade is not a financial advisor and all services are provided on an execution only basis. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. *CFD trading carries a high level of risk and is not suitable for all investors. Please read the PDS before choosing to start trading.

On-the-go trading on mobile app and web

Provide a full range of quality column content for global investors

Risk warning:

Mitrade does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products.

All of our products are over-the-counter derivatives over global underlying assets. Mitrade provides execution only service, acting as principle at all times.

Mitrade does not issue, buy or sell any cryptocurrencies nor is it a cryptocurrency exchange.

This website is owned and operated by mitrade global pty ltd ABN 90 149 011 361, AFSL 398528. This AFSL authorises us to carry on a financial services business in australia. Contact mitrade at cs@mitrade.Com.

The information on this site is not intended for residents of the united states, canada, japan, new zealand or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For certain jurisdictions, card processing service is provided by mitrade services ltd (a company registered in england and wales under number 11804044 with registered address at 27 old gloucester street, london, WC1N 3AX, united kingdom). Mitrade services ltd is wholly owned subsidiary of mitrade global pty ltd.

Secured by SSL. © mitrade copyright, all rights reserved.

$50 no deposit bonus вђ“ superforex malaysia

The superforex broker, regulated by IFSC, presents a $50 no deposit bonus to its newly joined malaysian clients who completely verify a real trading account. This bonus program comes with no time limit, so trade as much as you can!

The traders are to register a real standard trading account with the company and provide the required info to claim the bonus amount. This bonus is for trading purposes only, but your profits can be withdrawn after completing 1 standard lot for every dollar of the profits.

Regulated by cysec, FCA, IFSC

Regulated by cysec, IFSC

Regulated by cysec, ASIC, FCA, IFSC

Regulated by cysec, IFSC

Here's how you can apply for the superforex $50 no deposit bonus:

Log into your personal area at the broker website, register a real standard trading account and submit the necessary information including name, address, phone number, and email. After reading the bonus agreement and submitting the вђњget the no deposit bonusвђќ youвђ™ll receive the bonus amount within 2 days. Use the bonus for making profit and withdraw the result of your effort upon meeting the conditions!

Superforex $50 bonus conditions:

each client can participate in this program only once, even those with several trading accounts.

You cannot use this promotion in conjunction with other promos such as the 40% welcome bonus, 60% energy bonus, and 120% hot bonus.

Meet the required number of lots to withdraw your profits.

$100 no deposit bonus (malaysia) – FBS inc

Get $100 on your account and start your forex career smartly. The goal of the trade 100 bonus is to give traders a chance to study the basics of successful and effective trading.

Available to : all clients .

End date : limited time.

How to get :

1. Register an account, if you don’t have one already.

2. Open a new $100 bonus with an MT5 account.

3. Request the bonus.

Withdraw : the conditions that need to be fulfilled in order to withdraw the profit

- The required number of active trading days is 30 (active trading day is a day when the order was opened or closed);

- Positive pips difference (the total number of pips from profitable orders has to be bigger than the total number of pips from losing orders);

- Client should have at least 5 lots traded in the period of 30 active trading days

- The conditions of the bonus should be fulfilled in 50 days in order to withdraw the profit;

More info –

1. General terms and conditions apply.

2. The promotion can be changed any time without previous notice.

3. Please ask their support for more information .

Please follow this link for more details about the rules : terms and conditions

| Bonus name | NO DEPOSIT BONUS |

| maximum leverage | 1:500 |

| bonus type | monthly bonus |

| minimum funding | no funding is allowed |

| top up | not allowed |

| country restriction | malaysia and indonesia only |

| eligibility | new client ONLY |

| bonus start date/time | 4 th of january 2021 00:00:00 GMT +8 |

| bonus end date/time | 29 th january 2021 11:59:59 GMT +8 |

| withdrawable profit | minimum withdrawal USD30 maximum withdrawal USD100 *based on the T&C below |

| withdrawal profit period | until 29th january 2021 23:59:59 GMT +8 or until all the amount USD100,000 has been fully withdrawn by our clients. |

Bonus terms & conditions:

This NO DEPOSIT BONUS (hereinafter the “bonus account”) is open for new clients ONLY will be able to claim USD 30 as a “credit” into their live trading account with profitto.

NO DEPOSIT BONUS is subject to the terms and conditions contained in the present document and subject to all existing profitto terms and conditions. The date and time which stated below are according to GMT +8.

General

- The bonus period starts from 4th of january 2021 00:00:00 until 29th of january 2021 11:59:59 GMT + 8 (ending time subject to change).

- By registering, opening a NO DEPOSIT BONUS account, and or accepting the terms and conditions within the applicable landing pages and/or client member’s area, the trader is acknowledging that they have read, understood and agree to be bound by the terms and conditions of this bonus.

- This bonus is eligible for new clients ONLY and they will be able to redeem USD30 as a “credit” into their “NO DEPOSIT BONUS” trading account, and who traded with any currencies pair, precious metals and exotic pairs ONLY.

- This is a NO DEPOSIT BONUS.

- No employees of the company should participate in this bonus.

- The maximum leverage with this bonus is 1:500.

- Maximum bonus account that can be created for each client is up to 1 NO DEPOSIT BONUS trading account for each client’s profile.

- Please be informed that we will close PROFITTO MALAYSIA DAY account on 30th january 2021 00:00:00.

- Minimum profit can be withdrawn is USD30 and maximum profit will be USD100 with minimum lot size traded is 2 standard lots and transactions amount to 10 trades or above (closed trades). Once withdrawal has been requested and approved, the credit bonus will be taken out.

- There is no IB commission will be paid for all trading coming from NO DEPOSIT BONUS account.

- Please be informed that once you have withdrawn your profit, the credit bonus will be taken out.

- Please be informed that the last date to withdraw your profit is until 29th of january 2021 23:59:59 GMT +8.

- Please be informed that maximum withdrawable profit is up to USD100,000. We will announce once all the amount have been fully claimed by our clients.

Procedure of participation

- Register an account with us start from 25th of december 2020 will be eligible for NO DEPOSIT BONUS. Credit bonus will be given start from 4th of january 2021 00:00:00 until 29th of january 2021 23:59:59 GMT + 8.

- Login to cabinet area, submit your KYC for approval.

- In the cabinet area, click on open live account and select “NO DEPOSIT BONUS” trading account.

- Claim your NO DEPOSIT BONUS by sending us an email or open helpdesk ticket from your cabinet.

- Trade on ANY CURRENCIES PAIRS, METALS and EXOTIC PAIRS ONLY.

No deposit bonus forex malaysia

Deposit bonus – A bonus on funding a live account. The bonus credited on percentage of the deposit amount.

No deposit bonus – free bonus on account registration for the new clients to trade live without any risk.

Tradable bonus: A deposit bonus that can be lost and traded as the part of your trading equity.

Volume bonus – most common type of deposit bonus, it allows you to increase your trading volume. Often the bonus can be cashed on trading lot requirement.

Forex gift – A gift for the clients for completing certain requirements, everything from bonus to latest gadget

Freebies – free stuff by forex brokers like ebook, courses, trading materials etc.

Rebate – cash-back withdrawable bonus on each lot traded.

Demo contest – contests held on demo account, win cash/tradable money with no-risk involve!

Live contest – contest held on live account, deposit requires. Win bigger cash/prizes.

Refer – a-friend– refer your friend to your broker, when your friend deposit you will get a special bonus

Free signals – get free trading signals from the broker.

Free VPS – get access to an optimized forex virtual private server for free on maintaining a certain amount of trading balance.

Binary options – binary bets trading on forex instruments

Forum posting: get a small trading bonus for each of your post in forms.

3 affiliate IB: receive a commission from your fellow traders, specially design for the marketers.

Draw bonus: the winners chosen by a draw

Seminars webinars: find the schedule to participate in the online/offline events.

Expos events: inviting to attend the forex events & expos globally.

Best no deposit bonus forex brokers 2021

The brokers below represent the best no deposit bonus forex brokers.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.27% and 73.32% of retail investor accounts lose money when trading cfds with tickmill UK ltd and tickmill europe ltd respectively. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Cysec, FCA, FSA(SC), FSCA, labuan-fsa

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.27% and 73.32% of retail investor accounts lose money when trading cfds with tickmill UK ltd and tickmill europe ltd respectively. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Trading derivatives and leveraged products carries a high level of risk, including the risk of losing substantially more than your initial investment. It is not suitable for everyone. Before you make any decision in relation to a financial product you should obtain and consider our product disclosure statement (PDS) and financial services guide (FSG) available on our website and seek independent advice if necessary.

Trading derivatives and leveraged products carries a high level of risk, including the risk of losing substantially more than your initial investment. It is not suitable for everyone. Before you make any decision in relation to a financial product you should obtain and consider our product disclosure statement (PDS) and financial services guide (FSG) available on our website and seek independent advice if necessary.

Your capital is at risk

Ctrader, MT4, MT5, proprietary

Dealing desk, ECN, market maker, no dealing desk, STP

Your capital is at risk

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Note: not all forex brokers accept US clients. For your convenience we specified those that accept US forex traders as clients.

Tickmill

Regulated by: cysec, FCA, FSA(SC), FSCA, labuan-fsa

Headquarters : 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.27% and 73.32% of retail investor accounts lose money when trading cfds with tickmill UK ltd and tickmill europe ltd respectively. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill was founded in 2014 and is regulated by the UK financial conduct authority (FCA), the cyprus securities and exchange commission (cysec) and the seychelles financial services authority (FSA).

The broker provides more than 80+ CFD instruments to trade on covering forex, indices, commodities and bonds through three core trading accounts called the pro account, classic account and VIP account. They also offer a demo trading account and islamic swap-free account.

GO markets

Regulated by: ASIC, cysec

Headquarters : level 22, 600 bourke street, melbourne, VIC 3000, australia

Trading derivatives and leveraged products carries a high level of risk, including the risk of losing substantially more than your initial investment. It is not suitable for everyone. Before you make any decision in relation to a financial product you should obtain and consider our product disclosure statement (PDS) and financial services guide (FSG) available on our website and seek independent advice if necessary.

Australian brokers are definitely making a name for themselves in the trading arena as some of the most reliable, intuitive and forward thinking firms around. This broker is no different with a wide variety of tools, assets and reasonable trading conditions.

GO markets pty ltd an ASIC regulated broker has been in operation since 2006. The head office is located in melbourne, australia. With over a decade of experience, GO markets has grown to become a leading broker with a huge client base from over 150 countries. GO markets offers forex, share cfds, indices, metals and commodities for trading on the MT4 and MT5 trading platforms.

Roboforex

Headquarters : 2118 guava street, belama phase 1, belize city, belize

Your capital is at risk

The roboforex brand is operated by the roboforex group, and is located in belize. Roboforex began operations in 2009 and has grown in size and capacity. The brand offers over multiple trading instruments which include forex, stocks, indices, etfs, commodities, energies, metals and cryptocurrencies.

They also offer cutting edge platforms. Roboforex boasts of over 800,000 clients from 169 countries. They are both a dealing desk and non dealing desk broker offering ECN and STP trading accounts through their platforms. This means a different payment model to you the trader eg. Lower spreads for ECN accounts with some commissions to pay.

*leverage depends on the financial instrument traded and on the client’s country of residence.

Axiory

Headquarters : no.1 corner of hutson street and marine parade belize city, belize

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Axiory was founded in 2012 and is a trading name of axiory global ltd which is authorised and regulated by the international financial services commission (IFSC) of belize. The broker segregates client funds from their own and offers negative balance protection. The company is also audited by pricewaterhousecoopers and is a member of the financial commission.

Users can choose from three types of trading accounts called nano, standard and max to trade on 80 different markets covering forex and cfds on indices, energies, stocks and metals. Axiory offers maximum leverage of up to 1:500 and also provides access to islamic swap-free accounts and a demo trading account. Users can also access data regarding execution times and slippage distribution for even more transparency.

What is a no deposit forex bonus?

A no deposit forex bonus is a cash award that is deposited by the broker into the forex trader’s account, without requiring an initial deposit into the trading account by the trader.

Just like the deposit bonuses in forex (which require you to deposit first), the no-deposit bonus is used strictly for trading purposes and can only be withdrawn from the account on fulfillment of the broker’s trade volume requirements.

Typically, the no-deposit forex bonuses are not as large as the deposit bonuses. They range from between $10 and $200, depending on the broker. They are actually meant to introduce new traders into the world of real money trading and are not meant to be used for profit-oriented trading. Think of it as a form of live, real money practice account where you keep all the gains. If you lose money, you have lost nothing.

What should I do to get my bonus?

Most of the no-deposit forex bonuses in the market can be obtained as exclusive offers through affiliate partners of the forex brokers that offer them. The forex brokers who award the no-deposit forex bonuses directly are typically in the minority.

What is the difference between no deposit bonuses and deposit bonuses?

No-deposit forex bonuses do not require an initial deposit into the trading account before they are awarded. This factor distinguishes the no-deposit forex bonus from deposit bonus, which like the name implies, requires a deposit from the trader before it is awarded.

No-deposit forex bonuses are smaller in size as they mostly serve for live account practice.

What other bonus and promotion types do brokers offer?

Other bonuses and promotions may be given out by brokers occasionally.

- The cashback is the commonest bonus which a trader can get. Although this requires that some previous deposit would have been made by the trader, cashbacks are a good way to earn back any money that has been lost in previous trades. These are provided by brokers automatically without requiring further deposits.

- Trade contest awards do not require a previous deposit. You can participate in various trade contests on broker platforms for a share of the prizes. Cash prizes are usually awarded to traders as a no-deposit bonus. All you need is to ensure your account KYC documents are in place and you can claim your award if you win.

- Some brokers provide traders with tools they need to trade with on fulfillment of certain conditions such as attaining certain trade volumes within a specified time frame.

Conclusion

Are you looking for the best no deposit bonus forex brokers for 2017? Here we show a list of these brokers which we have compiled after careful evaluation of various candidates. Ensure you use the no-deposit forex bonus wisely and use it to enhance your live account trading experience.

Forex trading in malaysia

Forex trading in malaysia! Since the law is very grey here, there is a risk of getting into trouble with the government, if you are trading with a brokerage that is not on the list of licensed institutions and then risking everything you do being examined closely as well. That being said, most people who are trading from malaysia with their own funds and an overseas broker will never have a problem.

Is forex trading legal in malaysia?

The short answer to this question is yes, but only with a registered and approved financial institution. The official ruling is that you are only allowed to trade currency legally in malaysia with licensed institutions, of which there are several. There are some that say that this rule only applies to physical currency and retail forex trading, especially online, does not fall into that category because online, you trade theoretical currency. That is why this is considered a tricky question requiring explanation and not just a simple yes or no. The easiest way to trade forex in malaysia legally is to use one of the approved institutions, and maintain an islamic account. Forex trading in malaysia

Investing overseas is legal forex trading in malaysia and there are many opinions that say that retail forex trading with an offshore brokerage can be easily considered foreign investment. The main issues that the nation has with forex is that they are a developing country that wants to control the value of their currency to some degree. Since most forex trading even in malaysia does not involve their own currency, they tend to overlook the many ways that forex can be traded using other currencies.

The idea here is that the laws are written in favor of the government being able to act if they see fit. Meaning, that it is extremely unlikely that you will be arrested in malaysia for trading forex because there are ways to do it legally but the government reserves the right to have some control over what is happening. The law does strictly prohibit forex trading with the funds of others and soliciting funds to trade. This is pretty clear and will get anyone who transgresses these regulations into a heap of trouble. Forex trading in malaysia

There are many laws on the books that people do not comply with and they are not even aware of the law in the first place. This means that most of the time, you can go on your merry way and not have any problems with the law, but the minute you do something that crosses the authorities or brings your offenses to the attention of the authorities, you can be penalized for everything that you are doing wrong, even the ones you didn’t know about. Forex trading in malaysia is a pretty good example. It is likely that if you are trading your own funds, not bothering anyone and not being very public about it, nothing will happen to you at all. If you do something that angers the authorities, they can then come after you for every little law that you are breaking including this one.

So, let's see, what we have: no deposit bonus forex 2021 in malaysia! Forex brokers with free forex welcome bonus, find newest forex no deposit bonuses now! At no deposit bonus forex malaysia

Contents of the article

- New forex bonuses

- No deposit bonus forex 2021 malaysia

- Forex no deposit bonus in malaysia and how to...

- How forex no deposit bonus works in malaysia?

- How to trade with the no deposit bonus account?

- How to choose the best broker that offers no...

- Take this quick quiz to help us find the best...

- Best forex brokers in malaysia that offer A no...

- Tickmill: $30 no-deposit bonus

- XM: $30 no-deposit bonus

- 1. TICKMILL

- 2. XM forex

- Conclusion and thoughts

- Welcome to mitrade

- $50 no deposit bonus вђ“ superforex malaysia

- $100 no deposit bonus (malaysia) – FBS inc

- No deposit bonus forex malaysia

- Best no deposit bonus forex brokers 2021

- Tickmill

- GO markets

- Roboforex

- Axiory

- What is a no deposit forex bonus?

- What should I do to get my bonus?

- What is the difference between no deposit bonuses...

- What other bonus and promotion types do brokers...

- Conclusion

- Forex trading in malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.