Broker for forex

Market maker: licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately.

New forex bonuses

All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

1. Bdswiss  | ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

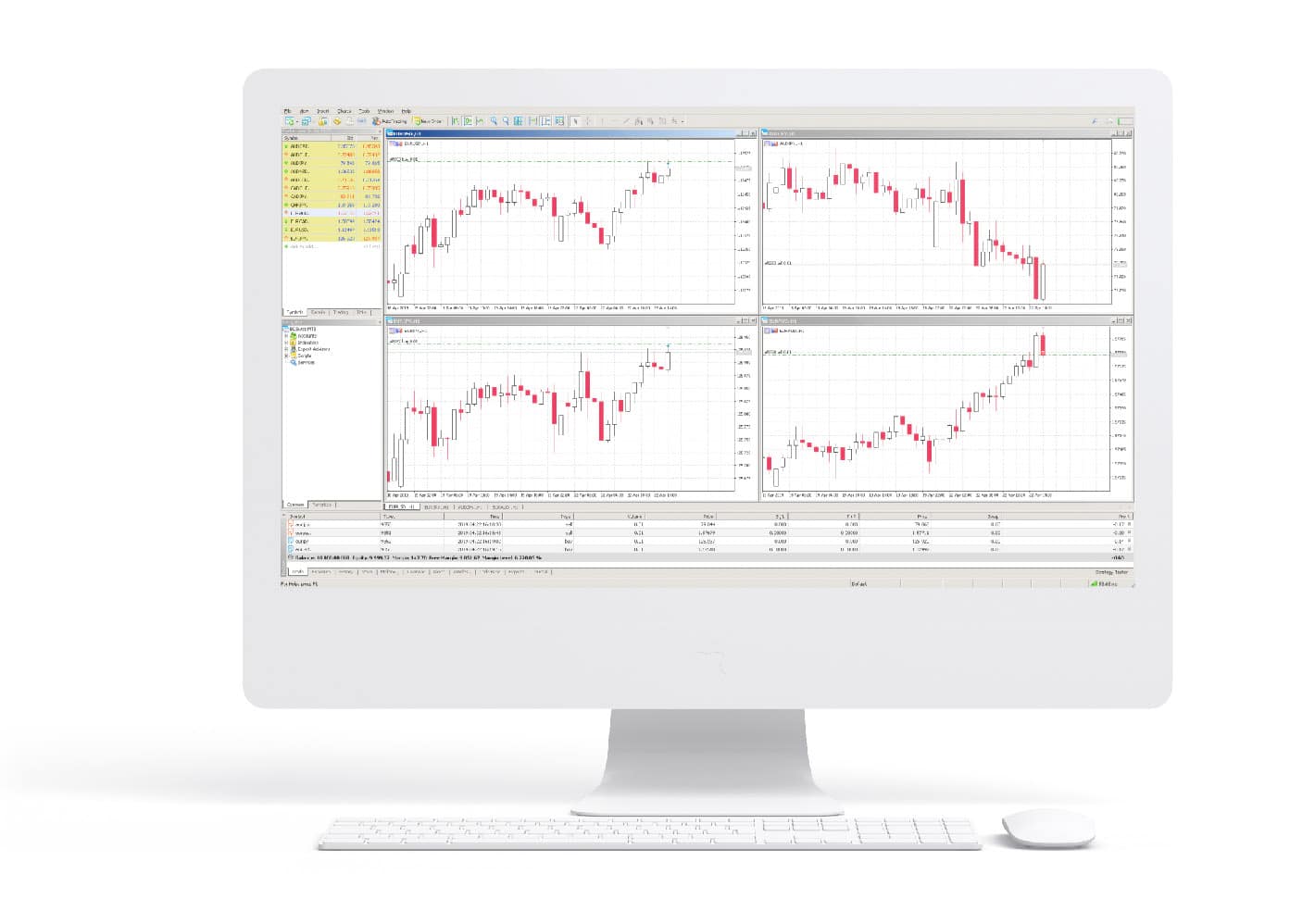

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

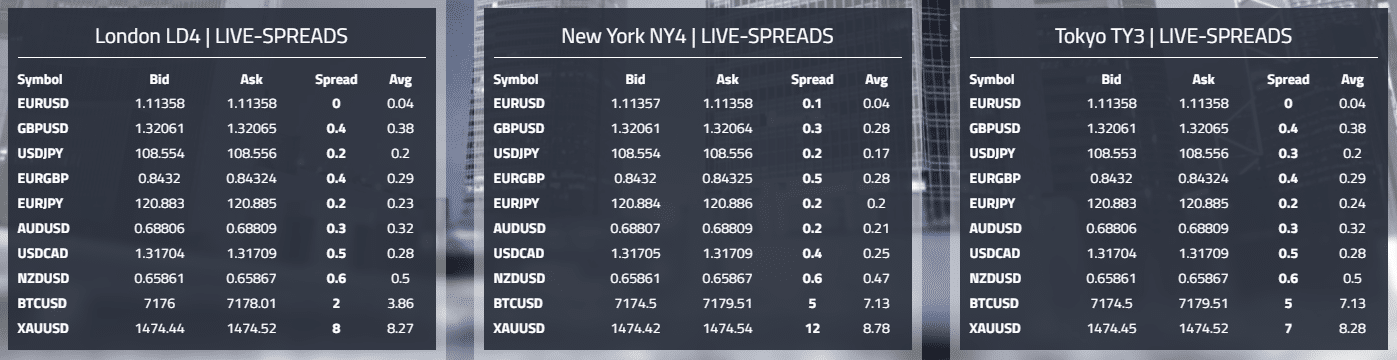

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.

Successful forex trading requires a good and reliable broker. In this review, we showed you the top 23 secure forex brokers. Now you can choose your professional trading partner.

Broker for forex

How to decide which one is best for you?

One of the main aspects of choosing a forex broker that does. Need keeping in mind is that you will be looking for a broker that will of course allow you to sign up based on where it is you live in the world. But also you will want to be able to fund your trading account in your own home currency. By locating a forex broker that will offer multi currency options. To their new traders when registering a new account. You are then not going to be forced to pay currency exchange rate fees. When you make a deposit into your forex trading account. Nor will you lose out via currency exchange rate fees and charges when making a withdrawal either!

Bonus awarding forex best brokers

Looking in the best value is what every forex trader will be looking to do on every single trade. Or as many trades that they place as is possible. One way which you are going to be able to do just that. Is by making use of some of the plethora of different bonus offers. That will be on offer to you. With that in mind please take a good look through the individual forex broker reviews. As by doing. So you are then going to discover which forex broker is going to be offering you the best value and the highest valued bonus offers. Both as a first time trader at those brokers and on an ongoing basis too.

- What banking options will be available to me?

- You are going to find the easiest way to move money. Both into and out of any online or mobile forex trading account.

Will be by you using a debit card linked up to your bank account. As by using such a card all deposits will be made in real time and will reflect in your account instantly.

However, do keep in mind that if you would prefer not to use a debit card linked up to your bank account. There are lots of different options that you can choose to use including credit cards. Web wallets and even prepaid vouchers so plenty of banking options will be available to you.

- Accessing a demo trading account

You are not going to know whether you actually like the design and service offered at any forex brokers. Until you actually test out those brokers. Trading platforms either online or via a mobile trading app. And with that in mind you should initially open up a demo trading account. By opening up a demo trading account which by the way you can easily do in a matter of minutes at any of our feature forex brokers. You can then test out their individual trading platforms and get a true feel for the way that they all work and operate. But in a no-risk trading environment.

The way in which all of our featured forex brokers have designed their mobile trading apps. Is such that no matter what types and kinds of forex trade you are looking to place you are always going to find. Then being offered to you via those apps. All of the different trades you can place via an online forex trading platform will be available to you via a trading app. And you will of course have access to just as many bonus offers and promotional offers. When using a forex trading app as you will when using an online trading platform. So they are certainly worth utilizing.

- Are there any additional fees and charges?

By looking over the trading platforms and making a note of the financial gains that can be make on every single trading opportunity available to you. Then when you place those trades you will not have to pay any additional fees and charges. When you place those types of trades or when you have made a profit on them. However, do keep in mind there may be some additional fees and charges that you will have to pay in regards to sign some banking options. However those charges are not usually levied upon you via the forex broker but by the operator of those banking options. Such as when you using a web or e-wallet those companies will have some nominal fees and charges that you will have to pay for using their services.

The world’s first true ECN forex broker

IC markets true ECN trading environment allows you to trade online on institutional grade liquidity from the worlds leading investment banks and dark pool liquidity execution venues, allowing you to trade on spreads from 0.0 pips. You can now trade along side the worlds biggest banks and institutions with your order flowing straight into our true ECN environment.Trade in a true ECN environment with no dealing desk or price manipulation. IC markets is the online forex broker of choice for high volume traders, scalpers and robots.

FX choice also for USA & CANADA.

From all corners of the globe, thousands of traders have already benefited from fxchoice unbeatable trading conditions and rock-solid service. Join us today and benefit from:

- Tight spreads from 0.1 pips

- Minimum trade size of 0.01 lots

- Leverage up to 1:200

- Forex, cfds & spot metals

- Rapid market execution

- No conflict of interest through NDD technology

- Competent and friendly client support 24/5

- Price improvements on all order types

Forex: largest, most liquid market for trading currencies

Educational materials and demo contests for beginners

Trading blog forex

Regularly updated and carefully selected learning materials and forex strategies, described by professional traders.

Demo contest for beginners

Monthly contest BEST OF THE BEST

Become the best in trading forex,cfds, shares, indices, gold, oil, and other commodities and win up to $4000 on your live ECN account for trading

Optimal choice for opening a forex account

Provided for any category of traders, including professional ECN accounts with floating spreads and unlimited trading strategies

CLASSIC

Trading platforms

Most popular professional trading platforms metatrader 4 and metatrader 5 and their mobile and web versions

Some of the lowest spreads in the forex market

And over 145 tools for successful trading

Variety of deposit/withdrawal methods

The latest analytical materials are at your command as well.

The art of analysis from claws&horns

Experienced experts at claws&horns master the art of analysis as no one else. All sorts of analysis, latest forecasts, unique reviews, expert opinions and many other analytical materials that are indispensable to trading success are now freely available to liteforex's clients.

The material published on this page is produced by the claws&horns company jointly with liteforex and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC; furthermore it has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Traders' social network for forex copy trading

Are you a beginner?

- Communicate with traders worldwide

- Copy successful traders' trades

- Step up the level of your trading!

Are you a pro?

- Find investors in a social network

- Let others copy trades from your accounts

- Earn extra commissions from your investors

Discover new trading prospects with the social trading platform.

Top 3 traders in the past month

Past performance is not an indication of future results.

Affiliate programs at liteforex

Exquisite cooperation opportunities with the leader of the forex industry

become liteforex's partner and make money from our 3 programs

Revenue share

Regional representative

Promote liteforex’s brand in your region and manage liteforex’s local office

Company's news

Risk warning: trading on financial markets carries risks. Contracts for difference (‘cfds’) are complex financial products that are traded on margin. Trading cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved and taking into account your investment objectives and level of experience. Click here for our full risk disclosure.

The website is owned by liteforex group of companies.

Liteforex investments limited registered in the marshall islands (registration number 63888) and regulated in accordance with marshall islands business corporation act. The company’s address: ajeltake road, ajeltake island, majuro, marshall islands MH96960. Email:

Liteforex investments limited does not provide service to residents of the EEA countries, USA, israel, and japan.

Brokers

Regulated forex brokers

When viewing the forex broker or a trading platform, it is the paramount priority to choose from the hundreds the most reliable one and the best forex provider, as it will determine the whole trading experience. Indeed, doing research and compare the vast number of forex brokers with many aspects to consider, maybe not an easy choice, as well time-consuming. So here we are ready to assist your selection and answer the most common questions.

Can I trade forex without a broker?

This may be the first question you would ask, as indeed forex market, FX or currency market is the largest global non-centralized exchange where trading process performed electronically via networks. While main forex participants are international banks and financial institutions operating huge volumes through a need to exchange currencies, presented as currency pairs, and assist international business with the conversion which is known as the interbank market.

Therefore, in order to trade fx you should be authorized dealer to do so, as well as operate a quite sufficient amount so before forex brokers were introduced to retail traders and global community it was not possible for trade markets. For this reason, forex trading brokers are the companies or agent if you like that gives retail forex traders access through its platform to operate forex market and trade various markets including commodity futures, indices, bonds, etc.

Do I need license to trade forex?

So this is another pleasant and great opportunity which is given by forex brokers, as you may access trading without financial or dealer license. Moreover, there are hundreds of opportunities with a relatively small investment which allows you to trade forex, do technical analysis and analyze markets almost instantly.

Are forex brokers regulated?

And now we will check the most crucial question if forex broker can be regulated, since the market is decentralized, and is it safe to trade forex? Obviously, this is the biggest trump you may fall as a retail trader if you choose a non-reliable, mainly non-regulated or offshore firm without a proper license you may easily fall into a scam and lose money.

So due to increasing demand and mainly that traders got no easy access to trading or financial education, the world countries established particular organizations or authorities in order to oversee the market proposals and regulate forex broker firms. So yes, forex brokers are regulated while holding a license from a local authority alike world known FCA in the UK, ASIC in australia, commodity futures trading commission CFTC in the USA, MAS in singapore and more.

What does a regulated broker mean?

The whole concept of regulation is to oversee forex business in a particular country or region, protect clients and ensure safe conditions while trading forex. So in simple words, regulated broker means a safe and legit broker that is compliant to various rules and criteria set by the international authority with the purpose to provide secure trading and good customer service. So its trading environment and provided services like technical analysis, education and tools are also aligned to the best practices.

In addition to its constant check on the service providing, authorities protecting clients throughout compensation schemes and other security checks, however, these conditions may vary from the regulator to another.

How do I know if my forex broker is regulated?

In order to check if broker is regulated or not, you should verify this information through the official brokers’ website first, as regulated companies always provide its licenses. And the next step is to verify a license through the official regulatory website. However, in our forex broker review you will find all the necessary information and license check as well.

It is a fact, unscrupulous brokers may easily fake information and assure you of its license while its not true, so always verify information through the official source. As well, adhere to trade with brokers regulated in serious jurisdictions, not the offshore once, as they luck of strong regulation, requirements and necessary safety measures. Read more by the link why avoid brokers from st vincent & the grenadines.

How to choose best forex broker?

Security of funds is always first in forex trading, for that reason, we recall your attention to open an account with regulated brokers only. Making it simple, regulated broker means that you will trade forex with proper security of funds and investment itself, so first of all good broker is a sharply regulated broker.

Further on, you should also check the necessary conditions and select offer suitable for you and trading strategy you deploy.

For this reason, we assist your selection and provide an assortment of efficient regulated brokers with updated on a weekly basis in-depth forex broker list. A professional detailed analysis with trading fees account overview, platform breakdowns while sorted by regulation, country or trading conditions, along with traders comments so smarter decision is easier now.

Forex trading: understanding A forex broker

A forex broker refers to an individual or firm that plays the role of an intermediary between the trader and the interbank system. The interbank system, on the other hand, refers to the bank networks trading with each other in the forex market.

If you want to trade, the forex broker provides you with actual prices of the banks having access to forex liquidity and lines of credit. Many FX brokers will use multiple banks to offer their clients pricing, and in the end, they will offer them the best available prices.

Forex trading risks

Forex trading can be a complex and risky investment. Unfortunately, the forex instruments aren’t standardized, and the interbank market has different regulations. Forex trading is usually unregulated; therefore, you have to be cautious when investing in this field.

The interbank market has many banks that trade with each other globally. So, these banks are the ones to determine and accept credit and sovereign risks. Fortunately, they have already come up with internal processes that help them stay safe all the time. However, it is a safe industry for the banks because the regulations are usually imposed, which will help protect each bank that will participate.

Understanding the forex broker

There are many forms of trading, but for the forex exchange market, it is a 24-hour market operating globally. Among the clients include retail currency traders. They have to use the platforms to know the direction of their currencies. Moreover, the other clients are large financial services firms who will trade on behalf of their customers or investment banks.

If you want to trade individually, you’ll only handle a small portion considering the overall foreign exchange market.

The forex broker plays different roles in the foreign exchange market. In this market, the transactions occur between paired currencies. And for these currencies, they are only from ten countries that can afford to make up to G10. So, these nations and their currencies are; euro (EUR), U.S. Dollar (USD), japanese yen (JPY), sterling pound (GBP), new zealand dollar (NZD), australian dollar (AUD), swiss franc (CHF) and canadian dollar (CAD).

However, other forex brokers allow you to trade using other currencies, especially in the emerging markets.

If you’re using a forex broker, you have to open a trade, and to do so; you have to buy a currency pair. While closing the trade, you will have to sell the same pair. You can decide to change euros to USD; for example, with this, you will buy the EUR/USD pair. And to do that, it means you will buy euros but with U.S. Dollars. When you want to close your trade, you will sell the pair, which is the same as buying U.S. Dollars but using euros.

When you are closing your trade, if the exchange rate will be higher, that’s how you will make a profit. On the other hand, if not, that leads to a loss.

How to choose an FX broker

- Security

The first characteristic of considers is a secure trading platform. After all, you can’t hand over your hard-earned money to any platform because it claims to be legit.

An added advantage is that it is now easy to check the credibility of any forex broker. In each country, there are regulatory bodies responsible for separating fraudulent forex brokers from trustworthy. If you’re new, consider checking this list of best forex brokers.

Depending on your geographical region or country, here is a list of some corresponding regulatory bodies:

- United states – CFTC ( commodity futures trading commission) and NFA ( national futures association).

- Australia – ASIC (australia securities & investment commission)

- United kingdom – PRA (prudent regulation authority) and FCA (financial conduct authority).

- Switzerland – SFBC (swiss federal banking commission)

- France – AMF (autorité des marchés financiers)

- Germany – bafin (bundesanstalt für finanzdienstleistungsaufsicht)

It is, therefore, essential to think before you invest in an FX broker. Depending on your geographical region, make sure that the forex broker you choose is a member of regulatory bodies.

- Deposit and withdrawal

An excellent type of FX broker is one allowing you to deposit and withdraw hassle-free. There is no concrete reason that should make it hard for you to deposit and withdraw your profits. The only reason they can hold funds is when facilitating trading.

The broker, therefore, will hold your money, ensuring your trading experience is more effortless. So, don’t expect other reason that can make them give you a hard time to withdraw your earnings. Choose a force broker who ensures your withdrawal process is smooth and speedy.

- Transaction costs

With transaction costs, it does not matter with your currency because, in the end, you’ll experience transaction costs.

Any time you enter to trade, there are charges such as spread or commission to be subjected. So, the best broker’s trading platform is the one offering cheap rates and most affordable.

However, there are times that you can sacrifice low transactions to get a reliable broker. And in such a case, look for a way to balance between low transaction cost and security of your money.

- Trading platform

If you’re to trade online, most of the trading activities will be on your broker’s platform. Therefore, consider a broker with a stable and user-friendly platform.

Before you sign and deposit your money in a broker’s system, check the trading platform to confirm what it offers. For example, the free needs feed technical and charting tools, and how it presents the information you need to trade. After the review, you can now make your decision.

The bottom line

Before you make a step to register with a forex broker, take time to look for the best forex broker. It will help you avoid making the wrong decision that might cost you. Nevertheless, choosing a top broker provides you with robust resources, access to the worldwide banking systems, and trade at a low cost. You will have nothing to worry about; your money will be safe. Besides, you can also open a small account and make a fortune with your trading skills.

What does forex trading cost in 2020?

Would you like to know what forex trading fees may apply? – then you have come to the right place. We show you from our experiences the costs, which can come up to you and describe to you, why these results to you. In addition, we will show you options for how you can trade most cost-effectively.

These costs can be charged in forex trading:

- Spreads

- Commission

- Swap (financing fees of the position)

Additional costs of the forex broker:

- Account fees

- Fees for deposits and withdrawals

Example of forex trading fees

In the following texts, we will discuss the trading fees in detail and show you how to pay the lowest fees.

The forex trading costs are depending on the broker

The forex trading broker determines the fees that a trader must pay when opening a position. There are cheap and expensive providers. The costs have a decisive effect on a trader’s profits. The cheaper the fees are, the higher your profit will logically be.

In many cases, 2 different account models are offered. The only difference here is how the forex broker earns his money. A distinction is made between a spread and a commission account. From my experience, the commission account is much cheaper and offers more advantages.

Often there are 2 fee models for traders:

- Spread model: you pay an additional spread when a position is opened (this may depend on the market situation).

- Commission model: you pay a minimum spread (often 0.1 points or less) and you pay a fixed commission per 1 lot traded (100,000 of the underlying).

How the forex broker earns money from the spread?

Definition of the spread: the spread is a difference between the buy and sells price.

This spread can always fluctuate due to the market situation because there are not always enough buyers and sellers on one price (this rarely happens). This phenomenon is often seen with very strong price fluctuations (high volatility). The forex broker also adds a spread to the market spread to earn money.

In principle, the trader thus gets an execution on a worse price in the market. The difference between the order opening and the current market price is the broker’s profit.

Facts about the spread:

- The forex broker earns money through an additional spread

- The spread depends on the market situation

The commission fees explained

Some forex brokers offer the commission model for forex trading. First of all, I have to say from my experience that a commission account is always cheaper after my test. Instead of an additional spread, you get the direct market spread for your order execution. The forex provider now charges a commission per lot traded.

The size 1 lot describes 100,000 units of the underlying of the forex pair. For example, in the EUR/USD 1 lot exactly would be 100.000€. A fixed commission is charged depending on the trading volume. The average value is between 5$ and 10$ per 1 lot traded. If you trade a smaller size than 1 lot then the commission is of course also smaller.

Facts of the commissions:

- The commission is a fixed amount and depends on the trading volume

- Traders do not pay an additional spread but the commission

- Commission based account models are the cheapest accounts

Financing of your trading position: the swap for leveraged forex

The swap, also known as an interest rate swap, is incurred when trading in leveraged derivatives. It can also be described as the financing fee for a position. Forex trading is carried out with a lever and the trader borrows money from the forex broker for his position. This, in turn, borrows the money from a bank and lends the money to you at higher interest rates.

The difference in interest is the broker’s profit. The position is therefore financed. This fee only applies to longer-term positions that are held overnight. The amount of the swap depends on the current interest rates of the currency pair and is also dependent on the broker. The swap usually occurs after the market closes at 23:00 hrs.

Advantage: the swap can be positive in forex trading

The swap can also be positive. For example, trade the EUR/USD with a short position, invest in the USD and sell the euro. Interest rates in USD are much higher than in EUR. So you even get one credit per day. This is also called carry trade.

Carry trade example:

The interest rate of the EURO is 0% and the interest rate in the USD. Now you buy the USD and sell the EUR. This means short the currency pair EUR/USD. Now there is a huge difference between these 2 interest rates and you borrow money for the position. You get credited with the interest difference to your trading account.

Facts about the swap:

- The swap occurs because forex trading is leveraged

- The fee is only for positions which are opened overnight

- The swap can be positive or negative

- The swap depending on the forex broker and the interest rates

Pay fewer fees with a good forex broker

A good forex broker is essential for success in trading. When making your choice, you should make sure that the provider is officially regulated, has good support and offers good conditions for trading.

In the table below you will find our top forex brokers, which are self-tested. They are the best and cheapest on the market. With over 7 years of experience in forex trading, we have compared a total of hundreds of providers. Bdswiss, tickmill, and XM has the best forex trading conditions in the world. You can already trade from 0.0 pips spread and pay a maximum commission of 2$.

| Broker: | review: | spreads: | advantages: | open account: |

|---|---|---|---|---|

1. Bdswiss  | ➔ read review | starting 0.0 pips | + individual offers + trading signals + personal service |

Additional fees which can occur for traders

In our experience, many forex brokers do not charge these fees in order to gain a market advantage over other providers. However, it often happens that there are account maintenance fees for inactivity. If the trader has not opened a position after up to 3 – 12 months, a fee of up to 50€ may apply. This is however dependent on the offerer.

Further costs are possible with the payment of customer money. There are usually no fees for the deposit. But also with the disbursement, many providers do not charge any fees. Should this still be the case, you can view it transparently in the button.

Conclusion: rarely there are additional costs.

Conclusion: the fees are very low in forex trading

On this page, we have shown you which costs you may incur when trading. Due to the competition among online brokers, the fees have become very low, but you should still look for the cheapest providers to make bigger profits. We have again all the important points of this page for you structured:

Forex brokers offer different fee models:

- There is the spread model

- There is the commission model

- Swap fees may apply overnight

- Find yourself a cheap forex broker

- As a rule, all fees should be transparently visible to the forex broker

Forex trading fees are very important. The fees are critical for your profit and loss. So choose a trusted and cheap forex broker.

Best online brokers for forex trading in january 2021

Advertiser disclosure

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

How we make money.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Editorial disclosure.

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

Share

At bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here’s an explanation for how we make money.

Editorial integrity

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.Com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, bankrate does not include information about every financial or credit product or service.

Trillions in currency are zipping around the world, 24 hours a day, five days a week, making the foreign exchange (also known as forex or fx) markets the world’s most active. Fortunes can be won and lost quickly, as brokers routinely let traders borrow heavily to finance their speculations.

If you’re looking to get in on this action, you’ll need a broker who deals in currency, and many of the big names in stock trading simply don’t offer this feature. Because the markets are so different, you’ll also need to evaluate a forex broker on different criteria from what you would use on a stock broker.

Below are some top forex brokers, including a couple that allow customers to trade cryptocurrencies.

Here are the best online brokers for forex trading in 2021:

What to consider when choosing a forex broker

While you may be familiar with many of the brand-name online stock brokers, only some of them deal in forex trading. Instead, a plethora of more specialized niche brokers populate the space, and they may cater to high-volume currency traders looking for every possible edge.

But regardless of which kind of broker you’re targeting, you’ll want to focus on at least a few features that are common to any forex broker:

- Pricing: forex brokers have two ways to price their services: by baking the price into the buy-sell spread or on a commission basis. Spreads are often quoted in pips, or one ten-thousandth of a point.

- Leverage: how much leverage will the broker let you assume? In general, traders are looking for a higher amount of leverage to magnify the moves in the currency market. The level may differ on the liquidity of the currency.

- Currency pairs: A handful of major pairs dominate trading, but how many other pairs (minors, exotics) does the broker offer? The most popular currencies include the U.S. Dollar, the euro, the japanese yen, the U.K. Pound and the swiss franc.

- Spreads: how wide are the broker’s spreads for trades? The larger the spread, the less attractive the trade. Of course, brokers who charge a spread markup will tend to have wider spreads because that’s how they get paid.

Investors looking to buy cryptocurrency may be able to do so through some of the traditional stock brokers such as TD ameritrade or robinhood. These have been noted below, though the trading works differently from regular forex trading as described above.

One downside for american traders is that many top forex brokers are based in the U.K. And simply won’t accept them because of their citizenship. The brokers below are all fine for americans, however.

Overview: top online forex brokers in january 2021

TD ameritrade

TD ameritrade offers a range of tradable products, and currency really rounds out its portfolio. Currency traders are able to use the broker’s highly regarded thinkorswim trading platform, and can also trade on a couple of mobile apps.

The broker uses spread pricing and offers 50:1 leverage, which is the legal maximum permitted in the U.S. It offers more than 70 currency pairs, providing plenty of options. TD ameritrade also allows clients to trade bitcoin futures, though you’ll need to get approval to trade futures, and pricing uses the broker’s futures scheme.

(charles schwab has purchased TD ameritrade, and will eventually integrate the two companies.)

Pricing: spread

Maximum leverage: 50:1 on major currencies; 20:1 on minors

Currency options: 73 pairs

Forex.Com

Like its name suggests, forex.Com specializes in currency trading (though it trades in metals and futures, too) and it offers a plethora of attractive features. Clients can select the pricing structure that suits them best: spread or commission, or the broker’s STP pro pricing, where prices come from global banks and others with no additional markup.

Forex.Com also gives traders access to more than 80 currency pairs, and its success with clients has the broker declaring that it’s the no. 1 forex broker in the U.S., in terms of assets held with the broker.

Pricing: spread and commission, depending on account type

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Ally invest

Ally invest is better known as a low-cost stock broker (and for its especially good prices on options trades), but currency trading really adds some breadth to its offerings. Ally is a good choice for traders just starting out, and it offers more than 80 currency pairs and easy-to-use charting software, including a mobile app.

Ally also allows you to open a $50,000 practice account so that you can see how currency trading works, even if you don’t intend to actually trade. Given the difficulty of forex trading, that’s a great resource for beginners to try it out.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

IG

IG is a more specialized broker focused on forex, and it’s open to american investors. It’s a high-powered broker that nevertheless offers many features, such as a demo account, that may help novice traders. The broker offers a web platform, a mobile app and access to metatrader4 and prorealtime platforms.

IG allows spreads as low as 0.8 pips, and says that its pricing is up to 20 percent lower on the euro-dollar pair than the top two U.S. Brokers. The broker also provides an extensive range of charting capabilities across its platforms.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Robinhood

Robinhood doesn’t offer traditional currency trading, but it does bring the slick, easy-to-use interface it’s known for to the crypto space. Here clients can trade a range of cryptocurrencies, including some of the most popular. Tradable currencies include bitcoin, ethereum, litecoin and dogecoin, among a total of seven types of cryptos. You’ll also be able to get quotes on 10 other digital currencies.

Like its core brokerage that offers free trades on stocks and options, crypto trading is also gratis (free) on robinhood.

Forex: largest, most liquid market for trading currencies

Educational materials and demo contests for beginners

Trading blog forex

Regularly updated and carefully selected learning materials and forex strategies, described by professional traders.

Demo contest for beginners

Monthly contest BEST OF THE BEST

Become the best in trading forex,cfds, shares, indices, gold, oil, and other commodities and win up to $4000 on your live ECN account for trading

Optimal choice for opening a forex account

Provided for any category of traders, including professional ECN accounts with floating spreads and unlimited trading strategies

CLASSIC

Trading platforms

Most popular professional trading platforms metatrader 4 and metatrader 5 and their mobile and web versions

Some of the lowest spreads in the forex market

And over 145 tools for successful trading

Variety of deposit/withdrawal methods

The latest analytical materials are at your command as well.

The art of analysis from claws&horns

Experienced experts at claws&horns master the art of analysis as no one else. All sorts of analysis, latest forecasts, unique reviews, expert opinions and many other analytical materials that are indispensable to trading success are now freely available to liteforex's clients.

The material published on this page is produced by the claws&horns company jointly with liteforex and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC; furthermore it has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Traders' social network for forex copy trading

Are you a beginner?

- Communicate with traders worldwide

- Copy successful traders' trades

- Step up the level of your trading!

Are you a pro?

- Find investors in a social network

- Let others copy trades from your accounts

- Earn extra commissions from your investors

Discover new trading prospects with the social trading platform.

Top 3 traders in the past month

Past performance is not an indication of future results.

Affiliate programs at liteforex

Exquisite cooperation opportunities with the leader of the forex industry

become liteforex's partner and make money from our 3 programs

Revenue share

Regional representative

Promote liteforex’s brand in your region and manage liteforex’s local office

Company's news

Risk warning: trading on financial markets carries risks. Contracts for difference (‘cfds’) are complex financial products that are traded on margin. Trading cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved and taking into account your investment objectives and level of experience. Click here for our full risk disclosure.

The website is owned by liteforex group of companies.

Liteforex investments limited registered in the marshall islands (registration number 63888) and regulated in accordance with marshall islands business corporation act. The company’s address: ajeltake road, ajeltake island, majuro, marshall islands MH96960. Email:

Liteforex investments limited does not provide service to residents of the EEA countries, USA, israel, and japan.

Guide: how to choose a forex broker

With hundreds of forex brokers to choose from, selecting the right one can be both challenging and time consuming. To ease the process, we’ve tested and reviewed dozens of the top forex brokers and compiled our findings into thorough forex brokers reviews. But don’t just take our word for it – each forex broker review also includes feedback from real traders, so that you can make a comfortable, informed decision.

The basic criteria to use in choosing a broker are few and simple. Without doubt, your number one priority should be ensuring the safety of your funds. Firstly, this means making sure that the broker you choose will not steal your deposit. You can best take care of this by making sure that you only use a broker based in and regulated by a financial authority in a respected financial center. Secondly, you need to make sure that even if the broker operates honestly, but goes bankrupt for any reason, that you will be able to recover your deposit. One measure that can be taken here is to only deposit with brokers whose regulators offer deposit protection for clients (such as regulated brokers in the U.K. Or australia, for example). This means that even if your broker goes broke, the government will bail you out by paying back your funds up to a certain amount, although it might take some time. Beyond that, try to choose a broker with a healthy financial situation and a good reputation. Once you have taken these precautions, you can look at what your potential brokers offer in terms of range of available assets to trade, spreads and commissions, overnight financing charges, and speed and reliability of trade execution – and make your choice accordingly.

Use the below links to navigate through the guide:

Things to consider when choosing a broker

Regulation, safety of funds & legal issues

Regulation and compliance are - beyond the shadow of a doubt - the most important things to consider when choosing a broker. An unregulated broker can essentially do as it pleases with its traders' funds. Such a broker might be nothing more than an online scam, so it worth being extremely wary of any unregulated brokers.

Regulatory compliance

The activity of a trustworthy broker should always be governed by an official regulator designed to protect and promote the integrity of brokerage operations. All types of abusive practices linked to the sale of futures and options should be out of the question, as traders should be protected against fraud as well as manipulation. A US broker must be registered with the US commodity futures trading commission (CFTC) as a merchant and retail forex dealer. It also must be a member of the NFA (national futures association). These credentials are usually listed in the about us section of the broker's website. Equivalents of these trade associations and regulatory bodies are present in nearly every country in the world. Depending on where their broker is based, traders should always research and look for these credentials. In this respect, it's also worth researching the year when the broker obtained its license as this might carry some significance as well, in regards to the overall reputation and operational history of the broker.

Safety of funds

Regulated brokers must comply with a set of rules that are meant to safeguard investor assets. This is the primary reason why regulation is so important. Every regulated broker is subject to a "net capital rule" which prescribes a minimum amount of capital to be kept in liquid form. This way investors are protected with a 'safety net' in the event that a broker is forced to close. In addition to the requirement of maintaining minimum capital requirements, regulated brokers in most jurisdictions are required to keep all client funds separated in segregated accounts so that client funds won't accidentally (or purposely) be used for any reasons other than to execute the client's trades. Some nations, such as the united kingdom, even offer government-backed deposit insurance for its regulated brokers so that clients can recover part or all of their funds even if the broker manages to misappropriate them.

Select a forex broker by the type of trading platform :

Broker types

The type of broker used can have an impact on one's overall trading performance and results.

Dealing desk vs. ECN brokers

Dealing desk brokers work similarly to the dealing desks provided by various financial institutions and banks. A forex broker who uses a dealing desk and is registered as a retail foreign exchange dealer and futures commission merchant (or equivalent in another country) can offset trades. The no dealing desk system on the other hand offsets positions automatically and then transmits them to the interbank market. Brokers working through a dealing desk system do not work directly with market liquidity providers, therefore only one liquidity provider remains in the equation, and that gives birth to a fundamental conflict of interest.

An ECN broker on the other hand, offers its traders direct access to the other market participants through an electronic communications network. Why is an ECN broker the superior of a dealing desk one spreads-wise? Simple: because it deals with price quotations from several trading entities, it can offer much better bid/ask spreads.

The business model of an ECN broker is an entirely fair one, as it eliminates a major conflict of interest: because it matches trades between various traders, it cannot become the sole market-maker, thus it cannot trade against its own clients. Another advantage of the ECN is that because of the lower spreads it offers, such brokers can charge a fixed commission on every transaction.However, you should not see ECN brokers as a panacea. Under certain conditions, their liquidity can dry up completely, creating much greater slippages than dealing desk brokers’ client might be suffering. Another sad reality is that many brokers describe themselves as of the ECN type, but have an element of dealing desk within their operation, so are not “true” ecns.

Top rated forex brokers

Fees & commissions

This brings us to the third most important brokerage selection factor: costs

Brokerage fees - price isn’t everything

Brokerage fees are fees that the broker charges for the services it offers, which are services focused on facilitating transactions between buyers and sellers. The amount of these fees depends on the broker type, and the type of service to which the trader signs up. For the purposes of retail traders, the situation is best summarized by saying the dealing desk brokers charge spreads only, while ECN brokers charge spreads as well as commissions.

Commissions & spreads (fixed or non-fixed)

The key difference between fees and commissions that all traders need to understand, is that fees represent a flat charge, while commissions vary depending on the delivered financial product and the size of the transaction.

Premium services offered by the broker?

Full service brokers offer all sorts of additional perks and premium features, some of which are indeed extremely useful. Such services do cost extra though. In this respect, what you should be looking for is a broker who includes as many premium services as possible, as cheaply as possible. In the premium service category, we have features like advice and research covering a wide range of traded assets, retirement advice, tax planning etc. You need to carefully weigh whether you need such services or not. If you're only looking to execute trades, there's no point in getting embroiled in any premium-service intricacies. Discount is probably the way to go then.

Does the broker credit or debit daily rollover?

Another factor to consider is daily rollover. The daily rollover is interest credited or debited to the entity holding a forex position overnight, depending on the relative interest rates of the currencies involved in the trade. Positions which are kept open past 5PM EST are considered positions held overnight. In such cases the broker will consider which national currency the trader bought relative to the other national currency of the pair. If the interest-rate difference favors the bought currency, the trader will have rollover interest credited: in theory, at least. If it's the other way around, the interest will be debited. The problem is that most brokers make sure their clients pay for holding most positions overnight, and there is nothing to stop them doing this beyond the true market cost.

Most brokers roll over open positions automatically. It is important to know that the rollover interest (whether it's debited or credited) is calculated on the full amount involved in the trade and not on the margin alone. Another important thing regarding the rollover interest is that it represents a separate revenue stream from the capital gains and as such, it will be taxed separately too, as interest income.

Trading terms

Time to shed some light on the expressions and terms you may have come across within this guide but that haven’t been fully explained until now.

Select a forex broker by country/region

Margin

Through a margin account, the investor essentially borrows from the broker, with the intention of controlling larger positions than he'd be able to control based solely on his own invested capital. There are special margin accounts that traders can use for this purpose. The margin percentage is set to 1-2% in the case of accounts which trade in 100,000 currency units. What this means is that in order to control a $100,000 position, a trader needs to deposit $1,000. Margin accounts come with their own risks, and special operating procedures meant to reduce risk for the trader as well as for the broker.

The difference between margin and leverage is simple. Let’s say a broker requires a deposit of $1,000 to make trades worth up to $100,000. The leverage is the factor by which the deposit is multiplied to reach the maximum trade value: in this case, 100, so the leverage is 100 to 1. The margin is simply the amount of deposit required as a percentage of the maximum trade value. Here, it is 1%. It is just the flip side of the earlier calculation.

Leverage = maximum trade value / deposit

Colloquially, “margin” is often used to refer to the cash deposited with a broker.

Initial deposit

The initial deposit is the first deposit a trader makes with a broker. This deposit may be subject to special rewards, such as bonuses.

Bonuses & promotions

Bonuses and promotions are marketing tools used by the broker to "sweeten" its offer, and thus to attract more business. You might want to consider whether a really top-quality broker would feel the need to offer such incentives.

Customer service

Customer service is very important for new traders and experienced investors alike. Whenever one runs into any sort of trouble with his or her broker, it is the duty of the customer service agent to iron everything out. As such, the expertise, skills and availability of the customer service staff should be a factor within the broker selection balance.

Availability

Funds deposited into trader accounts through third party checks typically take some time to clear. Once they do, they become "available". Availability hinges on the bank from where the check originates, and the availability schedule of the broker.

Trading platforms

The trading platform is the gate between the retail trader and the markets. It is also the tool through which the trader performs his trading. A proper, simple, fast and user-friendly trading platform is critical in trading successfully.

Ease of deposit & withdrawal

Being able to make deposits and to withdraw money from your broker quickly and easily is highly important. This all depends on the type of withdrawal and deposit options your broker supports. The selection of these payment solutions needs to be as large and as diverse as possible. It is also a good idea to check the withdrawal time, as many traders complain that it can take up to a week to withdraw, when they wanted their funds available quicker.

Minimum balances

The term "minimum balance" refers to the amount of money the trader needs to keep in his/her account to keep the account open and to receive the services he/she has signed up for. Obviously, the smaller this amount is, the better it is for the trader.

Instruments

In the context of forex trading, an instrument is defined as a tradable asset, and any asset underlying a derivative. Commodities, stocks, indices and currency pairs are all trading instruments, because through them, value is held and/or transferred.

So, let's see, what we have: how reliable are the best 23 forex brokers? ✅ trusted list of reviews for traders | leading trading conditions ➜ read more at broker for forex

Contents of the article

- New forex bonuses

- List of the best 23 forex brokers | trusted...

- Strict criteria for the forex broker review

- How does a forex broker work?

- Warning: only trade with regulated and...

- How risky is forex trading?

- How to deposit and withdrawal money:

- Not every country is available for forex trading

- Review conclusion: start trading with a reliable...

- Broker for forex

- How to decide which one is best for you?

- The world’s first true ECN forex...

- FX choice also for USA & CANADA.

- Forex: largest, most liquid market for...

- Optimal choice for opening a forex...

- Trading platforms

- Some of the lowest spreads in the forex...

- The latest analytical materials are at your...

- Traders' social network for forex copy...

- Top 3 traders in the past month

- Affiliate programs at liteforex

- Brokers

- Regulated forex brokers

- Can I trade forex without a broker?

- Do I need license to trade forex?

- Are forex brokers regulated?

- What does a regulated broker mean?

- How do I know if my forex broker is regulated?

- How to choose best forex broker?

- Forex trading: understanding A forex broker

- What does forex trading cost in 2020?

- The forex trading costs are depending on the...

- How the forex broker earns money from the spread?

- The commission fees explained

- Financing of your trading position: the swap for...

- Pay fewer fees with a good forex broker

- Best online brokers for forex trading in january...

- Advertiser disclosure

- How we make money.

- Editorial disclosure.

- Share

- Editorial integrity

- Key principles

- Editorial independence

- How we make money

- Here are the best online brokers for forex...

- What to consider when choosing a forex broker

- Overview: top online forex brokers in january 2021

- Forex: largest, most liquid market for...

- Optimal choice for opening a forex...

- Trading platforms

- Some of the lowest spreads in the forex...

- The latest analytical materials are at your...

- Traders' social network for forex copy...

- Top 3 traders in the past month

- Affiliate programs at liteforex

- Guide: how to choose a forex broker

- Things to consider when choosing a broker

- Regulation, safety of funds & legal issues

- Broker types

- Fees & commissions

- Brokerage fees - price isn’t everything

- Commissions & spreads (fixed or non-fixed)

- Premium services offered by the broker?

- Does the broker credit or debit daily rollover?

- Trading terms

- Margin

- Initial deposit

- Bonuses & promotions

- Customer service

- Availability

- Trading platforms

- Ease of deposit & withdrawal

- Minimum balances

- Instruments

- Regulation, safety of funds & legal issues

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.