How to trade 5 lots in 30 days

Let’s use another example when your leverage is set at 200:1. We will use the same example above to understand how the leverage will affect your margin level.

New forex bonuses

Your account will show the following our calculations in this sector are when your base currency is the USD. We will provide three different examples.

The principles behind lots trading and pips calculation

What you will learn:

- Lot definition

- Different lot sizes explained

- USD and EUR practical illustrations

- The correlation between margin and leverage

- Understanding the intrigues in margin call calculation

What is a lot size in forex?

In forex trading, a standard lot refers to a standard size of a specific financial instrument. It is one of the prerequisites to get familiar with for forex starters.

Standard lots

This is the standard size of one lot which is 100,000 units. Units referred to the base currency being traded. When someone trades EUR/USD, the base currency is the EUR and therefore, 1 lot or 100,000 units worth 100,000 eurs.

Mini lots

Now, let’s use smaller sizes. Traders use mini lots when they wish to trade smaller sizes. For example, a trader may wish to trade only 10,000 units. So when a trader places a trade of 0.10 lots or 10,000 base units on GBP/USD, this means that he trades 10,000 british pounds.

Micro lots

There are many beginners or small investors who wish to use the smallest possible lots sizes. In contrary to the mini lots that refer to 10,000 units, traders are welcome to trade 1,000 units or 0.01. For example, when someone trades USD/CHF with a micro lot the trader basically trades 1,000 usds.

Pip value

Now that we understand what lots are, let’s take one step further. We need to calculate the pip value so we can estimate our profits or losses from our trading.

The simplest way to calculate the pip value is to first use the standard lots. You will then have to adjust your calculations so you can find the pip value on mini lots, micro lots or any other lot size you wish to trade.

USD base currency

Our calculations in this sector are when your base currency is the USD. We will provide three different examples.

USD quote currency of the currency pair. You’re trading 1 standard lot (100,000 base units) that the quote currency is the USD such as EUR/USD. The pip value is calculated as below:

100,000*0.0001 (4th decimal)=$10

USD base currency of the currency pair. You’re trading 1 standard lot (100,000 base units) and the base currency is the USD such as USD/JPY. The pip value is calculated as below:

The USD/JPY is traded at 99.735 means that $1=99.73 JPY 100,000*0.01 (the 2nd decimal) /99.735≈$10.03. We approximated because the exchange rate changes, so does the value of each pip.

Finding the pip value in a currency pair that the USD is not traded. You’re trading 1 standard lot (100,000 base units) on GBP/JPY.

The GBP/JPY is traded at 153.320. Because the value changes in the quote currency times the exchange rate ratio as

The pip value => 100,000*0.01JPY*1GBP/153.320JPY = 6.5 GBP

Because the base currency of the account is the USD then we need to take into account the GBP/USD rate which let’s assume that is currently at 1.53560.

6.5 GBP/(1 GBP/1.53560 USD)= $9.98

EUR base currency

Now let’s make our examples when the base currency of our account is the EUR

EUR base currency of the currency pair. You’re trading 1 standard lot (100,000 base units) on EUR/USD. The pip value is calculated as below

The EUR/USD is traded at 1.30610 means that 1 EUR=$1.30 USD so

100,000*0.0001 (4th decimal)/1.30610 ≈7.66 EUR

Finding the pip value in a currency pair that the EUR is not traded. You’re trading 1 standard lot (100,000 base units) on GBP/JPY. From our example before, we know that the value is 6.5 GBP. Now, we need to take into account the EUR/GBP rate in order to calculate the pip value. Let’s assume that the rate is currently at 0.85000. So:

6.5GBP/(1GBP*0.85 EUR)= (6.5 GBP/1 GBP)/0.85 EUR≈7.65 EUR

Leverage – how it works

You are probably wondering how can I trade with lot sizes of 100,000 base units or even 1,000 base units. Well, the answer is very simple. This is available to you from the leverage you have in your account. So let’s assume that your account’s leverage is set at 100:1. This means that for every $1 used, you’re actually trading $100 in the forex market. In order for you to trade a position of $100,000 then the required margin to open such a position will be $1,000. As for any losses or gains these will be deducted or added to the remaining balance in your account.

If your account’s leverage is set at 200:1 this means that for every $1 you use you’re actually trading $200. So for a trade of $100,000 you will require a margin to be at $500.

Margin call – what you should know

Now looking at the examples above regarding the leverage you’re probably thinking that is the best to work with the highest possible leverage. However, you need to take into consideration your margin requirements as well as the risks associated with higher leverages.

Let’s just say that you have deposited first $5,000 to your trading account that the leverage is set at 100:1. Your nominated currency is the USD. The first time you will login to your MT4 trading account you will notice that the balance and the equity is $5,000 and this is due to the fact that you did not place any trades yet.

Now, you have decided to open a position on the USD/CHF of the 1 standard lot which means that you will require use a margin of $1,000. The floating P/L is at -9.55. The account will show the following

| balance | equity | margin | free margin | margin level |

|---|---|---|---|---|

| 5,000 | 4,990.45 (5,000-9.55) | 1,000 | 3,990.45 (4,990.45-1000) | 499.05% (4990.45/1000)*100 |

If your forex broker margin call level is set at 100% this means that when the margin level reaches this percentage it will notify you to add more funds. As you can understand from the example above, the P/L, and your margin will affect your margin level. Now, if your broker sets the stop out level at 50% this means that your position will be closed by the broker when the margin level reaches that level.

Let’s use another example when your leverage is set at 200:1. We will use the same example above to understand how the leverage will affect your margin level. Your account will show the following

By looking at the numbers above, you will prefer to use a higher leverage for your account. However, let’s assume that the market goes against you and you have bought 9 lots of USD/CHF but the pair falls. When you open your position you will have the following numbers:

As we explained above, the broker will give you a margin call when you have 100% margin level. This means that you will receive a margin call when the USD/CHF falls 5 pips only. On the other hand, if you had a leverage set at 100:1 the would not allow you to enter into such a position from the first place and you would have saved your equity.

How to determine position size?

Choosing the volume of a trade is a big challenge for beginner traders. Let’s sort it through!

There are several ways to choose the size of your position.

1. Fixed lot size

The idea here is that a trader uses the same trade volume in lots for every trade. This way is simple to understand for those who have only recently started trading. It’s recommended to choose small trade sizes. It’s possible to change the position size if the size of your account significantly changes. The pip value will be the same for you all the time.

You have $500 on your account. With 1:100, this amount will be enough to make 50 trades of 0.01 lot each. Each trade will require $10 margin.

If you use the same lot size every time, your account can show stable growth. This is a good option for those who can’t easily adjust to the exponential growth of their trade sizes because of higher stress levels which are associated with it. More experienced traders, however, may want to have an approach with greater flexibility and bigger potential account expansion.

2. Percentage of equity

In this case, you choose the size of your position as the percentage of your equity. If your equity increases, so do your position sizes. This, in turn, can lead to geometric growth of your account. At the same time, it’s necessary to remember that the declines of your account after losing trades will be bigger as well.

The recommendation is not to use more than 1-2% of your deposit for one trade. This way even if some of your trades aren’t successful, you won’t lose all your money and will be able to keep trading.

Here’s a formula of the position size in lots:

Lots to trade = equity * risk(%) / contract size * leverage

You have $500 and decide that the acceptable risk level is 2% of your account. With 1:100 leverage, your need to choose ($500 * 0.02) / 100,000 * 100 = 0.01 lots.

With $1000 on your account, you will be able to trade ($1000 * 0.02) 100,000 * 100 = 0.02 lots.

This approach is not the best option for smaller accounts. It may happen that if you have a large loss, the risked percentage will be too small to act as a margin even for the smallest lot size. As a result, you will be forced to break your risk management rules and allocate more money to keep trading. Moreover, as this approach doesn’t take into account what’s happening on the price chart, the size of stop loss it allows may be too big.

As the position size depends on equity, the loss will make position size smaller, so that it will be harder for a trader to recover the account after a drawdown. At the same time, if the account becomes too big, the size of each trade way turn to be uncomfortably big as well.

3. Percentage of equity with a stop loss

Here you base your position size not only on the predetermined percentage risk per trade but also on your stop loss distance. Let’s break this process in 3 steps.

Step 1. The recommendation stays the same: don’t risk more than 1-2% of your deposit/equity for one trade.

If your equity is $500, 2% risk will cost you $10.

Step 2. Establish where the stop loss should be for a particular trade. Then measure the distance in pips between it and your entry price. This is how many pips you have at risk. Based on this information, and the account risk limit from step 1, calculate the ideal position size.

If you want to buy EUR/USD at 1.1100 and place a stop loss at 1.1050, your trade risk is 50 pips.

Step 3. And now you determine position size based on account risk and trade risk. In other words, you need to determine the number of lots to trade that will give you the risk percentage you want with the stop distance that fits your trading system.

The important thing is to adjust your position size to meet the desired stop loss and not the other way round. Your risk will be the same in every trade, but the position size may be different because stop loss distances may vary.

Remember that a 1,000-unit lot (micro) is worth $0.1 per pip movement, a 10,000-unit lot (mini) is worth $1, and a 100,000-unit lot (standard) is worth $10 per pip movement. This applies to all pairs where the USD is listed second, for example, the EUR/USD. If the USD is not listed second, then these pip values will vary slightly. Note that trading on a standard lot is recommended only for professional traders.

Lots to trade = equity * risk% / (stop loss in pips * pip value) / 100

As it turns out, you will be able to trade $500 * 0.02 / (50 * $0.1) = $10/$5 = 2 micro lots. The outcome is in micro lots because the pip value used in the calculation was for a micro lot.

Your next trade may only have a 20 pip stop. In this case, your position size will be $10/(20x$1) = $10/$20 = 0.5 mini lots, or 5 micro lots.

If you use this method, your position sizes will increase proportionally to the increase in your account (the opposite will happen if your equity decreases) and will be adjusted for the situation on the charts. As with the simple equity percentage technique, however, this option may also leave little room for maneuver if your account is small. In addition, this method won’t suit you if your trading strategy doesn’t involve knowing the exit levels in advance.

So, what is our ultimate recommendation for choosing a position size? It’s actually that you should pick the option you feel most comfortable with. As you can see, all techniques have their advantages and drawbacks, so the method that works well for one trader may not suit another. Much will depend on your trading strategy: does it imply big profit but the risk of big drawdowns as well or does it offer multiple opportunities of smaller profit? That will matter for your decision.

Although all these calculations related to position sizing may seem unpleasant, it’s in your best interest to get to the bottom of them. Knowing how to choose the right position size will make you a more disciplined trader and provide you with sound risk management. This is the way to maximizing your profit and minimizing your loss!

How to determine lot size for day trading

Risk management talking points:

- Trade size is an important factor of risk management

- Larger lots increase profits and losses per pip

- Use a simple ‘cost per pip’ formula to identify your position size

One of the important steps when day trading, is deciding how big your position should be. Position size is a function of leverage and while trading a large position may multiply a win, it can exponentially increase the value of a potential loss. This is why traders should always consider position size in trading. If too much leverage is incorporated in any given position, there could be unnecessarily devastating affects to one’s account balance. To help, today we will review how to determine the correct lot size for your trading.

Determine your risk

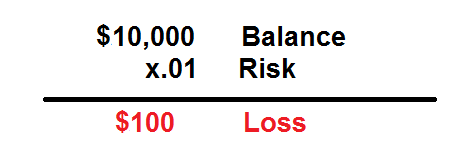

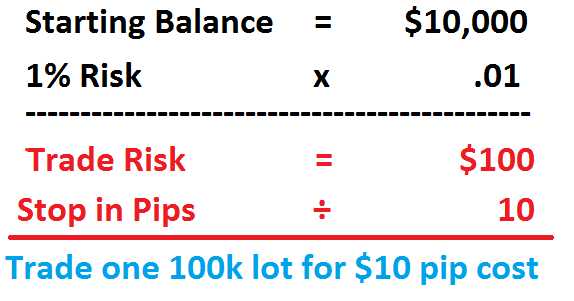

Before you can select an appropriate lot size, you need to determine your risk in terms of percentages. Normally, it is suggested that traders use the 1% rule. This means in the event that a trade is closed out for a loss, no more that 1% of the total account balance should be at risk. For example, if your account balance totals $10,000, you should never risk losing more than $100 on any position. The math is fairly self-explanatory, and you will find the basic equation used below. Once you have a risk percentage in mind , we can move to the next step in determining an appropriate position size.

Find your stop

As with any open position, a stop should be set to determine where a trader wishes to exit a trade in the event the market moves against them. There are virtually countless ways stops can be placed. Normally traders will use key lines of support and resistance for order placements. Traders can use price action, pivots, fibonacci, or other methods for finding these values. The idea is with whatever method you decide, count the number of pips from your open price to your stop order. Keep this value in mind as we move to the last step of the process.

Pip cost & lot size

The last step in determining lot size, is to determine the pip cost for your trade. Pip cost is how much you will gain, or lose per pip. As your lot size increases, so does your pip cost. Conversely if you trade a smaller lot size, your profit or loss per pip will decrease as well. Which leaves the final question, how big should your trade size be?

First, take your total trade risk (1% of your account balance), and then divide that calculated value out by the number of pips you are risking to your stop order. The total at this point is the amount per pip you should be risking. In the example above, if you are placing a trade on a $10,000 account you should only be risking about $100. On a 10 pip stop, this equates to a risk of $10 a pip. On pairs like the EURUSD, this means trading a 100k lot!

Most traders are right on a majority of their trades, yet their trading account is unprofitable over time. We've researched and answered this phenomenon on page 5 of our traits of a successful trader guide.

How much can you make as a day trader?

How much money does the average day trader make? The question is impossible to answer. Few day traders disclose their results to anyone but the internal revenue service. Moreover, results vary widely given the myriad of trading strategies, risk management practices and amounts of capital available for day trading.

To be sure, losing money at day trading is easy. A research paper from university of california researchers brad barber and terrance odean found that many individual investors hold undiversified portfolios and trade actively, speculatively and to their own detriment. day traders can also incur high brokerage fees, so picking the best broker and creating a manageable trading strategy with proper risk management is essential.

Key takeaways

- Day traders rarely hold positions overnight and attempt to profit from intraday price moves and trends.

- Day trading is risky but potentially lucrative for those that achieve success.

- Several factors come into play in determining potential upside from day trading, including starting capital amount, strategies used, the markets you are active in, and luck.

- Experienced day traders tend to take their job seriously, remaining disciplined, and sticking with their strategy.

What day traders do

Day traders typically target stocks, options, futures, commodities or currencies, holding positions for hours or minutes before selling again. Day traders enter and exit positions within the day, hence the term day traders. They rarely hold positions overnight. The goal is to profit from short-term price movements. Day traders can also use leverage to amplify returns, which can also amplify losses.

Setting stop-loss orders and profit-taking points—and not taking on too much risk—is vital to surviving as a day trader. Professional traders often recommend risking no more than 1% of your portfolio on a single trade. If a portfolio is worth $50,000, the most at risk per trade is $500. The key to managing risk is to not allow one or two bad trades to wipe you out. If you stick to a 1% risk strategy and set strict stop-loss orders and profit-taking points, you can limit your losses to 1% and take your gains at 1.5%, but it takes discipline.

How to get started in day trading

Getting started in day trading is not like dabbling in investing. Any would-be investor with a few hundred dollars can buy shares of a company and keep it for months or years. However, the financial industry regulator authority (FINRA) sets rules for those they define as pattern day traders. These rules require margin traders who trade frequently to maintain at least $25,000 in their accounts, and they cannot trade if their balance drops below that level. this means day traders must have sufficient capital on top of the $25,000 to really make a profit. And because day trading requires focus, it is not compatible with keeping a day job.

Pattern day trading rules apply to stock and stock options trading, but not other markets such as forex.

Most day traders should be prepared to risk their own capital. In addition to required balance minimums, prospective day traders need access to an online broker or trading platform and software to track positions, do research and log trades. Brokerage commissions and taxes on short-term capital gains can also add up. Aspiring day traders should factor all costs into their trading activities to determine if profitability is attainable.

Earning potential and career longevity

An important factor that can influence earnings potential and career longevity is whether you day trade independently or for an institution such as a bank or hedge fund. Traders working at an institution don't risk their own money and are typically better capitalized, with access to advantageous information and tools. Meanwhile, some independent trading firms allow day traders to access their platforms and software, but require traders to risk their own capital.

Other important factors that impact a day trader's earnings potential include:

- Markets you trade: different markets have different advantages. Stocks are generally the most capital-intensive asset class. Individuals can start trading with less capital than with other asset classes, such as futures or forex.

- How much capital you have: if you start with $3,000, your earnings potential is far less than someone who starts with $30,000.

- Time: few day traders achieve success in just a few days or weeks. Profitable trading strategies, systems and approaches can take years to develop.

Example of a day trading strategy in action

Consider a strategy for day trading stocks in which the maximum risk is $0.04 and the target is $0.06, yielding a reward-to-risk ratio of 1-to-1.5. A trader with $30,000 decides their maximum risk per trade is $300. Therefore, 7,500 shares on each trade ($300 / $0.04) will keep the risk within the $300 cap (not including commissions).

Here's how such a trading strategy might play out:

- 60 trades are profitable: 60 x $0.06 x 7,500 shares = $27,000.

- 45 trades are losers: 45 x $0.04 x 7,500 shares = ($13,500).

- The gross profit is $27,000 - $13,500 = $13,500.

- If commissions are $30 per trade, the profit is $10,500, or $13,500 - ($30 x 100 trades).

The maximum that rules permit a pattern day trader to trade in excess of the $25,000 maintenance margin.

Of course, the example is theoretical. Several factors can reduce profits. A reward-to-risk ratio of 1.5 is used because the number is fairly conservative and reflective of the opportunities that occur all day, every day, in the stock market. The starting capital of $30,000 is also just an approximate balance to start day trading stocks. You will need more if you wish to trade higher-priced stocks.

The bottom line

Day trading is not a hobby or occasional activity if you are serious about trading to make money. While there is no guarantee you will make money or be able to predict your average rate of return over any period of time, there are strategies you can master to help you lock in gains while minimizing losses.

It takes discipline, capital, patience, training and risk management to be a successful day trader. If you're interested, review the best stock brokers for day trading, as the first step is to choose the right broker for your needs.

How to calculate lot size in forex? – lot size calculator

How to determine position size when forex trading

For a foreign exchange (forex) trader, the trade size or position size decides the profit he makes more than the exit and entry points while day trading forex. Even if the trader has the best forex trading strategy, he takes too little risk or too much risk if the trade size is very small or huge. Traders should avoid taking too much risk since they will lose all their money. Some tips on how the trader should determine position size are provided.

Lot size in forex trading

What is lot size in currency trading?

What is a lot in forex? Lot in forex represents the measure of position size of each trade. A micro-lot consists of 1000 units of currency, a mini-lot 10.000 units, and a standard lot has 100,000 units. The risk of the forex trader can be divided into account risk and trade risk. All these factors are considered to determine the right position size, irrespective of the market conditions, trading strategy, or the setup.

Now let us define a standard lot.

What is the standard lot size in forex?

The standard forex size lot is 100,000 units of currency. Usually, brokers represent forex lot size with currency units. For example, 5 lots are 500 000 currency units.

In this video, we will see lot size forex trading example:

How to calculate lot size in forex?

Forex lot size can be calculated using input values such as account balance, risk percentage, and stop loss. In the first step, the trader needs to define a risk percentage for trade and then define stop loss and a dollar per pip. A trader needs to determine lot size (number of units) for currency pair in the last step.

Determine the risk limit for each trade

Most traders consider specifying the dollar amount or percentage limit risked on each trade as the most crucial step in determining the forex position’s size. Lot size forex calculation is simply because professional and experienced traders will usually risk a maximum of 1% of their account in trade; usually, the amount is lower. While the other trading variables may change depending on the trade, most traders will keep the percentage they risk on the trade constantly, though the amount risked for the trade may be reduced if it exceeds the 1 percent limit.

(max risk per trade position should be 1%-2%)

Determine dollar per pip

A pip is an abbreviation for price interest point or the percentage in point, which is the lowest unit for which the currency price will change. When currency pairs are considered, the pip is 0.0001 or one-hundredth of a percent. However, if the currency pair includes the japanese yen, the pip is one percentage point or 0.01. Some brokers show prices with an additional decimal place, and this fifth decimal place is called a pipette. In the case of the japanese yen, the third place is the pipette. M the pip risk for each trade is calculated as the difference between the point where the stop-loss order is placed and the entry point.

A stop-loss will close a trade when it is losing a specified amount. Traders use this to ensure that their loss does not exceed the account’s loss risk. The stop-loss level also depends on the pip risk for a specific trade. The volatility and strategy are some factors that determine pip risk. Though traders would like to ensure that their stop loss is as close to the entry point as possible, keeping it too close may end the trade before the expected forex rate movement occurs.

Determine forex lot size position

In a currency pair that is being traded, the second currency is called the quote currency. If the trading account is funded with the quote currency, the pip values for various lot sizes are fixed at 0.0001 of the lot size. Usually, the forex trading account is funded in US dollars. So if the quote currency is not the dollar, the pip value will be multiplied by the exchange rate for the quote currency against the US dollar.

What information do we need to make a forex position size calculator formula?

Let us repeat all steps once time more:

Account currency: USD

account balance: $5000 for example

risk percentage: 1% for example

stop loss: 200 pips, for example

currency: EURUSD

How to find a lot of size in trading? In the first step, we need to calculate risk in dollars, then calculated dollars per pip, and in the last step, calculate the number of units.

Step 1: calculate risk in dollars.

Calculate risk percentage from account balance: 1% for $5000 is : $5000/100=$50.

$50 is 1% of $5000.

Step 2: calculate dollars per pip

(USD 50)/(200 pips) = USD 0.25/pip

Step 3: calculate the number of units

USD 0.25 per pip * 10 000 = 2,500 units of EUR/USD

For 5 digits brokers, we use 10 000 as a multiplicator.

2.5 micro lots or 0.25 mini lots is the final answer. Technically, it is 2 micro lots because most brokers do not allow trading less than micro-lots.

In the end, here, you can use the position size calculator.

Lot size calculator

The lot size forex calculator is represented below. You can use to calculate forex lot position size:

The risk you can define either using % or either using risk in dollars.

What is a lot size in forex?

In this article we will see what a lot in forex is and how a lot size in forex can be classified.

For instance there are different lot sizes in forex, each of them with a different value.

When trading, each selected lot size in forex involves a different amount of money.

This can range from a micro lot which is equal to 0.01, to a standard lot (1).

What is a lot in forex?

A lot represents a unit of measure in a forex transaction. Thanks to this it’s possible to know how much money a trader needs to use for a single trade.

The smallest lot size in forex is called a microlot and it’s worth 0,0. There’s then the minilot which is 0,1 and it’s the medium size.

However, there’s no limit to the highest amount – even if some brokers set a maximum of 20 lots for every single trade position.

A standard lot size forex (1) represents 100.000 units, but this doesn’t mean that a trader should have $100.000 in their account.

Let’s explain this better with an example.

Example of lot size in forex

In forex trading, a very important factor is the leverage.

In fact, if the chosen leverage is 1:200, it’s just necessary to have $500 to open a position of 1 lot.

We know that this concept can sound a bit complicated, but to keep it simple when trading just remember what the starting leverage is.

Once you have the starting leverage, you just need to divide 1 lot (so 100.000) for the leverage (200 in this case). The result represents the amount of money you’re going to invest for that position if you decide to open 1 lot.

So this would be $500 in our example.

If $500 is too much for a single investment, it’s possible to select a lower amount of lots, for example 0,1 lot and invest just $50.

How to set up the lot size on metatrader 4

When trading on the MT4 or metatrader 4, setting up the size is essential.

To trade, it’s necessary to press the F9 button and the trading window will open.

There in the volume window (as you can see in the picture), it’s possible to set up the desired lot size.

Finally, to complete the trade, you just need to enter the stop loss and take profit values. You must also decide if you want to sell or buy.

Each forex broker platform will have a different trading window layout. So you can take your time getting to know all the features and how to set up the stop loss etc.

Many brokers offer free forex demo account versions, so new clients can practice trading for free with a set amount of virtual funds. This practice can include opening positions and trying out different combinations of lot sizes and leverage.

How to set up the lot size in a forex platform

The minimum lot size which can be selected is the microlot, so 0.01 lots. To set up the lot size, you need to open up the trading window on your selected forex platform.

Some brokers offer you the chance to trade whilst deciding directly the amount of money you wish to invest in each position.

This might be a big help for beginners who have some difficulties understanding the amount of money invested on lots.

Another big help some trading platforms offer, is the margin call.

What is the margin call

The margin in forex represents a minimum quantity of money which must be in the trading account before a trade can be opened.

Every broker has a different margin requirement, usually between the 1% and 2%.

This means that to open a position with 1 lot (100.000 units) a trader needs to have at least $1000 funded in their account.

Because the 1% of 100.000 units are 1.000 units which represent $1000.

An alternative for the trader can be to open a position with 0.01 which is exactly 1.000 units.

A margin call will happen in the case the trader does not have enough money in their forex account to trade.

If this happens the broker will send a message or an email asking for a new deposit. Alternatively they could also stop the trade automatically.

Click here to learn more about how to trade forex: https://tradingonlineguide.Com/what-is-forex-trading/how-to-trade-forex/

Author of this article and founder of tradingonlineguide.Com

My aim is to help you increase your trading knowledge with helpful content. I come from an economic background and have a strong passion for forex trading. With more than 6 years in the online trading world, I want to share my financial knowledge so that anyone can develop their investment skills.

In my spare time I enjoy cooking and travelling.

Here you can learn more about our review methodology.

How mini lot trading minimizes risk

Why a big market allows small trades

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/stock-marketht-573fd43b3df78c6bb05255ba.jpg)

A mini lot is a lot of 10,000 units of a country's base currency. It is called a mini lot because it is only 1/10th of the size of a 100,000 unit standard lot. For instance, if you're trading on an account using U.S. Dollars, a mini lot would be a trade worth $10,000 of USD. A mini lot is a common trade size used in a forex mini account.

Why people use mini lots

Mini lots may not be exciting in terms of price change on a trade, but they have many practical purposes. Because of this, even experienced traders like to use mini lots to finely tune their exposure to a market.

With the increase of algorithmic trading, trade size is rarely done in full blocks because the risk exposure from 500,000 to 600,000 is rather large when you can easily move from 500,000 to 510,000.

Traders use mini lots to learn and to limit risk

Mini lots are also excellent for traders just learning how to trade forex. A common misconception many traders have is that they can get appropriate feedback on their trading strategy and how well they'll be able to manage risk live by using a practice account.

While entries and exits and risk management can be refined through a virtual money practice account, traders typically don't understand how they will react to big moves in the market until real money is on the line.

To the rescue is mini lots, which help traders get comfortable with how the equity in their account fluctuates based on market moves. Traders know that the larger the trade size, the larger the account equity swings on an absolute basis. An example of incrementally adapting to a situation is the need to use the shallow end of a swimming pool before jumping into the deep end when learning how to swim.

Another reason to use mini lots is to limit risk and to test the market. Limiting risk is done through tighter trade sizes based on quantitative models. You do not have to have a quantitative model to trade the foreign exchange market, but they are common.

Testing the market is something that mini lot traders like to do because it allows them to "load into a trade." for example, instead of a trader opening their fully planned trade size at once, they'll break up their trade into chunks of three. If they were going to originally trade 30,000 on an idea, they might start with 10,000 and see how it goes. If the trade does well they might add another 10 or go ahead and drop the entire 20 on the market. The mini lot way of trading allows them to test their idea with limited risk and therefore is a useful tool for trades of all sizes.

How to find consistently volatile stocks for day trading (video tutorial)

Do this once to find a handful of volatile stocks you can day trade throughout the week. The whole process takes about 20 minutes, and your homework is done for the week. No more researching for volatile day trading stocks every day, such as flipping through new highs and lows or a biggest movers list. By watching a handful of these stocks you always have big moves to day trade…especially in the mornings, which is when day traders should be most active anyway.

In the video below, I show you how to find volatile day trading stocks which are likely to see big percentage movements each day over the course of the next week, based on average historic volatility.

This is the method I use to update the day trading stocks picks each week (the picks include some stocks found using a different method as well).

Watch, learn, enjoy. Resources mentioned in the video are discussed below.

Resources for finding volatile stocks

Volatile day trading stock picks are based on the method(s) described in the video, screened for on stockfetcher.Com.

Reasons I like this screening method is covered in consistent high volatility stock screen for day traders. Here is a sample screen/filter you can copy and paste into stockfetcher.Com:

Show stocks where the average day range (100) is above 4.5%

and price is between $5 and $150

and average volume (30) is greater than 4000000

and exchange is not amex

add column average volume (30)

add column average day range (30)

What this filter is asking the research engine to do is find stocks that typically move at least 4.5% per day. That’s quite a bit of movement. We are also asking the research to only produce stocks that have a 100 day over 4.5%. So the stocks that show up on this list likely didn’t just move a bunch one day…they tend to move a lot every day. If they have moved, on average, over 4.5% for 100 days, they will probably move a fair bit this week as well. Then next week will run the filter again.

The price filter gets rid of penny stocks, which I don’t like, but you can adjust this filter to find stocks in a price range you like.

The volume criteria make sure that the stock has ample volume for us to trade. On lower-priced stocks often 2 million is enough volume. As the price increases, typically we will want more volume to keep the spreads tight and be able to get in and out with ease. I typically like to trade stocks with 4 million or more in average volume.

The criterion “exchange is not amex” excludes etfs from the results. If you want to include etfs, delete this line of code.

The add column functions show us how much the average volume and volatility is over the last 30 days.

If you’re a do-it-yourself type person, and like to look for stocks that are moving a lot each day, look into a finviz elite subscription. Use it to see what’s moving in the pre-market and during the day, see what stocks are gapping, and run technical filters for stocks breaking out of chart patterns. This is for people who don’t like waiting around for trades, and instead like actively seeking out trades all day long.

Volatile stock day trading strategies

The above screening method doesn’t tell us how to trade or which direction these stocks are moving. The screen/filter just tells us that these are the stocks that consistently move a lot. As for how to trade, for that we need a trading strategy. For strategies that work well with these types of stocks, see:

Day trading volatile stocks isn’t for everyone. Have a plan for how you will trade them, and test out your strategies before trading with real capital. Slippage is possible in these stocks. This isn’t an endorsement for the stocks that show up on the list. Pick a handful that move in a way you like, then trade them all week. Run a new scan each week. Typically I find the same stocks stay on the list week after week…which is a good thing because it shows the scan is producing consistently volatile stocks.

This method is just one option for finding volatile stocks for day trading if you don’t want to be constantly researching.

The 10 things you should do in the first 30 days of a new job

Authored by paul petrone

Focused on connecting all professionals to economic opportunity

The first month of a new job is often a nerve-wracking experience.

There are new people. New customs. Abbreviations you don’t know. And, the whole time you are wondering if you are making a good impression, if you are doing the right things and if your boss really likes you.

Well, we are here to help. In her linkedin learning course what to do in the first 90 days of a new job, instructor aimee bateman dedicates the most time on what to do in the first 30. She describes that first month as the “absorb” month, where you absorb a plethora of information: who the key partners are, what the culture is like, what the kpis are, etc.

In your first month of a new job, bateman lists 10 things you should do. Use her suggestions as a roadmap, as following them will ensure you make a good impression with your colleagues and set yourself up for future success.

Linkedin learning instructor aimee bateman explains what you should do in your first month of starting a new job.

The 10 things you should in your first month of a new job

Bateman suggests doing these 10 things in your first 30 days of a new job:

1. Talk about your “why.”

When you introduce yourself to new colleagues, don’t just focus on the what – as in, what you previously did and what you do now. Instead, include the why.

Talk about why you chose this job, or why you are passionate about the company or the field. This will automatically make introductions more engaging and leave a positive and lasting imprint in people’s minds.

2. Ask people what they expect from you.

The first few weeks of the job are generally spent meeting with a variety of key partners. In these meetings, ask this critical question: “what do you expect from me?”

This will help you build a close relationship with each partner and crystallize how you can meet expectations.

3. Understand how your manager is measured.

A key to being successful in any job is managing your manager. And, to do this well, you need to understand what they are being measured on.

Maybe there’s one metric they are held to. Or, perhaps it’s more about internal sentiment around their team’s performance or collaboration. Whatever it is, if you can understand what your manager cares about most, you’ll drastically increase your chances of forming a stronger relationship with them.

4. Ask a lot of questions.

A lot of questions. If there’s any doubt, ask a question.

Most people will appreciate this, as it shows you have a strong willingness to learn. And you should have a strong willingness to learn – you need to understand the business quickly and it’s usually pretty complicated.

So, if you are in doubt, ask a question. It’ll get you up to speed much faster than trying to figure it out on your own.

5. Memorize the org chart.

People really like it when you know their name and what they do. But, when you start you often spend so much time meeting so many people, it can be easy to forget.

Take some time to memorize your broader team's org chart. This way, you’ll know people’s names, their roles and you’ll have a good sense of who you need to partner with.

6. Create and learn your pitch.

You are going to meet a lot of people in your first two weeks. In that time, create and perfect your elevator pitch on who you are and what you do.

Remember the message from the first point on this list – keep in the why. So, yes, in your first month you should be able to quickly articulate what you do. But also, if you can, throw in a line about why you are passionate about your job.

7. Learn as much as you can about the organization.

The first month on the job is often less busy than when you get into the heat of the position. Use that downtime wisely by learning as much as you can about the organization.

That means attending every all-hands and department meeting you can, as well as any optional cultural ones. Read the company’s annual report. Watch previous presentations of your company’s CEO.

Once the pace of your job picks up, it’s easy to get lost in the shuffle of the day-to-day. Building that foundational understanding of your organization’s philosophy and goals early will empower you to act more strategically throughout your tenure at the organization.

8. Learn about your customers.

Regardless of what you do in your organization, your ultimate job is to fix the problems of your organization's customers. So, do what you can to learn about them as much as possible, as early as possible.

At the very least, meet with the sales team and look at market research in your first month. Even better, see if you can listen in on some sales calls or speak directly with customers, so you have a clear understanding of their mindset and needs.

9. Learn about the company’s culture.

It’s important to understand the culture of your organization in your first 30 days for a variety of reasons. First off, it’ll help you comply with the organization’s norms. And second, big picture, it’ll help you understand if this job is really a long-term fit for you.

Ask colleagues what’s really rewarded at the organization and how promotions are determined. Go to any company cultural activities, if there are any. Notice if people are expected to stay until 6 p.M. Each day, or if hours are flexible so long as you get your job done. Learn who the real influencers are within your organization.

10. Understand your performance metrics.

Last but certainly not least – you need to fully understand how you are being judged. What are the biggest metrics you'll be judged on? What does your boss and your boss’s boss care most about?

Here, edge on the side of overcommunication. If there’s any doubt in your mind how you’ll be judged, ask your boss. The clearer it is in your mind, the better chance you’ll have of succeeding in your role.

If your new role is a management position, check out our article 7 things every new manager should do in their first month on the job.

Want to learn what to do in the second and third months of a new job? Watch aimee bateman’s full course, what to do in the first 90 days of a new job.

Other linkedin learning courses you might be interested in are:

5 reasons to trade with forex nano lots

If you don't know why you should start trading with nano lots, this post will fill you in. I believe that they are essential for people who are just getting started in forex trading. Nano lots allow you take the correct amount of risk, no matter what your account size is. Get all the details here.

If you have not heard of nano lots before, then this post is for you. Even if you have heard of nano lots, you may not know all of the benefits of using them in your forex trading.

I will first start by explaining what they are, then I will give you five good reasons to start using them in your trading.

What are forex nano lots?

Forex is a great market to trade because there is so much flexibility in the position size that you can take in your trades. Other markets don't have nearly as much flexibility.

For example, if you trade futures and want to trade the S&P 500, the smallest lot size that you can trade is a mini contract. That means that the smallest move in this futures contract will equal $12.50.

Your account could fluctuate hundreds or even thousands of dollars a day, just trading the minimum contract size. In addition, the margin (or “good faith” deposit that you put up to enter the trade) is $4,758, at the time of this post.

So much for starting with a small account.

Forex lot sizes explained

In foreign exchange however, there are many more options. These are the lot sizes that you can trade, depending on the broker that you have.

- Standard lot: 100,000 currency units

- Mini lot: 10,000 currency units

- Micro lot: 1,000 currency units

- Nano lot: 1 currency unit

The cost of one currency unit will fluctuate, depending on the currencies you are trading. But if we use the EUR/USD as an example, this is what you might expect the cost per pip to be with the above lot sizes.

- Standard lot: $10 per pip

- Mini lot: $1 per pip

- Micro lot: $0.10 per pip

- Nano lot: $0.0001 per pip

As you can see, one nano lot can give you tremendous flexibility to trade even the smallest account. The cost per pip will depend on your broker, so be sure to check with them first.

But the per pip values for the EUR/USD listed above are pretty common among forex brokers.

Now that you understand how a nano lot works, let's get into why you might want to start using them in your trading.

5 reasons to trade nano lots

1. You can start small

Regardless if you know that forex trading is for you, or if you are just trying this trading thing out, it is vital that you keep your risk low in the beginning. Would you learn to be a pilot by starting in a fighter jet? Would you learn to ride a motorcycle on the biggest harley that you can find?

You will start on something small. Forex trading is no different. Nano lots allow you to start with a very small account and still take the proper amount of risk when trading.

An added benefit to starting with a small account comes into play if you are trying to convince your spouse or other family members to support you in your trading. Starting with a very small account is the best way that I know of to convince them to let you give it a shot.

Even if you only have yourself to answer to, starting with a small account is a great way to keep your losses small while you are learning. Only after you have proven yourself on a small account, should you start risking more money.

2. Reduce stress

However, sometimes people will get into forex with an account that is less than $1,000 and choose a broker that only provides micro lots as the smallest lot size. Well, that presents a problem that may not be so obvious at the time that they open their account.

Let's say that you open a $500 account and micro lots are your smallest lot size option. As a beginner, you should be risking only 1% at most, and probably a lot less than that.

However, to make the numbers easy, let's say that you risk 1% on every trade. That means that you can only risk $5 per trade.

If you use the cost per pip in our EUR/USD example, then you can only risk 50 pips on any trade. That is pretty limiting.

There may be times when the trade calls for the stop loss to be set at 75 pips, or even 100 pips. Being limited by the number of pips that you can risk means that you will probably be stopped out more often than necessary.

Risk more than the maximum 1% and you will start to really worry about your trades.

By utilizing the power of nano lots, you can custom tailor your lot size to the individual trade you are taking. You can set a stop loss that makes sense, based on the trade that you are taking an not because of the size of your account.

Using the same scenario above, but using nano lots instead of micro lots, you could risk up to 50,000 pips if you only traded 1 nano lot. I have never heard of anyone needing a 50k pip stop loss, but the point is that it is there if you need it.

3. Find out if A system works for you

I believe that backtesting and demo trading are great ways for you to figure out if a system has a chance of being profitable. But as you know, there is no way to tell for sure, until you actually start putting some real money behind it.

You may find that a system backtests well and you are able to demo trade it profitably. But when even the smallest amount of money is on the line, you choke.

By risking a small amount of money, instead a lot of money, you can figure out if a trading system is something that you can actually trade in real life conditions. You might be surprised at what you discover.

4. It's good practice

Even if you graduate to larger lot sizes, you will probably hit a few rough patches in your trading. That just the way that trading works.

When that happens to you, it can be very discouraging and it can make you afraid to pull the trigger on your next trades. Going back to nano lots can help you get back into the flow and give you time to get your mojo back.

5. You can always go bigger

Don't let nano lots fool you, if you need to trade bigger sizes, you can. Need to trade a full sized lot one day?

No problem, just enter 100,000 nano lots. The key is the flexibility and nano lots give you just that.

Conclusion

So which brokers allow you to trade these microscopic lot sizes? There aren't to many out there.

The only nano lot broker that I have traded forex nano lots with is oanda. So that is the only broker that I can recommend. They also provide a great risk calculator on the order entry screen, which is handy. But there are other brokers that give you these options too.

Even if you become successful enough to start trading with standard sized lots and move on to another broker, it is useful to keep a small account open with a nano lot broker. You can use it in the future for testing or getting back on the horse after a bad streak.

Whatever the case may be, I believe that the option to trade nano lots should be in every forex trader's field kit.

Do you agree that trading forex nano lots is beneficial when you are starting out? Let me know in the comments below.

So, let's see, what we have: details of lot sizes, how pips are calculated, how leverage work, dangers of margin calls and how to calculate everything with major base currencies. At how to trade 5 lots in 30 days

Contents of the article

- New forex bonuses

- The principles behind lots trading and pips...

- What you will learn:

- What is a lot size in forex?

- Standard lots

- Mini lots

- Micro lots

- Pip value

- USD base currency

- 100,000*0.0001 (4th decimal)=$10

- The pip value => 100,000*0.01JPY*1GBP/153.320JPY...

- 6.5 GBP/(1 GBP/1.53560 USD)= $9.98

- EUR base currency

- Leverage – how it works

- Margin call – what you should know

- How to determine position size?

- How to determine lot size for day trading

- Risk management talking points:

- Determine your risk

- Find your stop

- Pip cost & lot size

- How much can you make as a day trader?

- What day traders do

- How to get started in day trading

- Earning potential and career longevity

- Example of a day trading strategy in action

- The bottom line

- How to calculate lot size in forex? – lot size...

- Lot size in forex trading

- Lot size calculator

- What is a lot size in forex?

- What is a lot in forex?

- Example of lot size in forex

- How to set up the lot size on metatrader 4

- How to set up the lot size in a forex platform

- What is the margin call

- How mini lot trading minimizes risk

- Why a big market allows small trades

- Why people use mini lots

- Traders use mini lots to learn and to limit risk

- How to find consistently volatile stocks for day...

- The 10 things you should do in the first 30 days...

- The 10 things you should in your first month...

- 1. Talk about your “why.”

- 2. Ask people what they expect from you.

- 3. Understand how your manager is measured.

- 4. Ask a lot of questions.

- 5. Memorize the org chart.

- 6. Create and learn your pitch.

- 7. Learn as much as you can about the...

- 8. Learn about your customers.

- 9. Learn about the company’s culture.

- 10. Understand your performance metrics.

- 5 reasons to trade with forex nano lots

- What are forex nano lots?

- Forex lot sizes explained

- 5 reasons to trade nano lots

- 1. You can start small

- 2. Reduce stress

- 3. Find out if A system works for you

- 4. It's good practice

- 5. You can always go bigger

- Conclusion

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.