Tickmill welcome bonus review

Minimum deposit: $100 the most advantageous of all is the VIP account.

New forex bonuses

You only pay a commission of $ 1.6 per lot. However, the minimum deposit for this account is $ 50,000. Tickmill also offers personal multi account manager. With the MAM program, professional money managers are assigned to act on behalf of their clients. In this way, a money manager can perform block trades on all accounts with his master account effectively.

Forex brokers lab

BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : FCA, FSA, CYSEC

Cryptocurrencies: YES

Minimum deposit: $100

Maximum leverage: 1:500

Spreads: low

My score: 7.9

First thing I can say about tickmill forex broker is that it is one of the fastest growing brokers in the world. Thanks to the company’s aggressive growth policy, tickmill succeeded in reaching thousands of forex traders from a wide range of different countries in a very short period of time. The website has more than a million visitors a month. In this tickmill review, you will find information on tickmill spreads, regulations, account types, deposit and withdrawal methods. Are you wondering is tickmill scam or legit? I would definitely recommend reading this review before opening an account with tickmill.

Tickmill regulation and investor protection

One of the most crucial issues in the forex system is regulation. Because when you have problems with your broker, the regulators help you to solve the problems. Think about; you wanted to withdraw but the broker could not let this. In this situation, the regulator moves in and protects your rights. We can duplicate samples like this. Let’s see what tickmill offers us.

There are two different companies behind the tickmill brand name. One of them is tmill UK limited and the other is tickmill limited. Tmill UK limited regulated by FCA (register number: 717270) in the UK FCA while tickmill limited regulated by FSA in seychelles.

Clients of the UK broker are protected by financial services compensation scheme-FSCS as well as FCA. If the forex broker goes bankrupt, the investors’ money is under the FSCS guarantee. The institution pays investor’s money up to £50,000. This shows your money is in safe if the broker goes bankrupt.

In addition, vipro markets, which operates in cyprus with CYSEC-licenced, joined the tickmill group in 2017. Before joining the tickmill group, this company also had more than 500,000 visitors per month. If a broker wants to have a cysec license, it must keep at least €1,000,000 to prove to clients that they can make a payment. I think it is a reassuring feature for prospective clients who are suspected of not taking their money.

In order to keep your money safe, you must trade with a broker who has a license. Watchdogs allow the brokers to act in accordance with the rules. They periodically inspect the brokers and if the brokers do not obey the rules, they may cancel the licenses.

The tickmill forex broker has grown rapidly in a short period of time and currently serves forex and CFD trading in asia, the middle east and africa.

Tickmill spreads and account types

Tickmill offers customers 4 different account types as follows:

| account type | minimum deposit | maximum leverage | spreads (& commission) | swap free |

|---|---|---|---|---|

| classic | $100 | 1:500 | from 1.6 pips | yes |

| pro | $100 | 1:500 | 0.2 pips + $4 / lot (round turn) | yes |

| VIP | $50.000 | 1:500 | 0.0 pips + $3.2 / lot (round turn) | yes |

In all of these 4 account types, you can trade on 85 trading instruments and use USD, EUR, GBP, PLN as base currency of the account. The maximum leverage in the accounts is 1:500.

Classic account is more suitable for newbie investors. Minimum deposit for classic account is $100. It can be called an average deposit. There is no commission, but spreads start from 1.6 pips on EURUSD. If I compare it with fxpro, I can say that spreads are higher in the classic account in tickmill. However, the pro account that we can see as ECN account is quite advantageous compared to other brokers’ ecns.

In the pro account, the minimum deposit is same with classic account and it is $100. You only pay a commission of $ 2 per lot and $ 4 per round turn. I can easily say that this commision is quite low. If we compare with other brokers, tickmill offers better commission fee. For example FXPRO offers $ 3 per lot and $ 4.5 per round turn.

The most advantageous of all is the VIP account. You only pay a commission of $ 1.6 per lot. However, the minimum deposit for this account is $ 50,000. Tickmill also offers personal multi account manager. With the MAM program, professional money managers are assigned to act on behalf of their clients. In this way, a money manager can perform block trades on all accounts with his master account effectively.

If you are an investor with islamic belief and do not want to earn or pay interest, you can apply for a swap free account for all these account types. Tickmill offers the same terms and conditions as their regular account types to its clients who want to use islamic accounts. The only difference is that there are no swaps. Tickmill may ask you to document your belief. It also has the right to reject your application.

Trading products

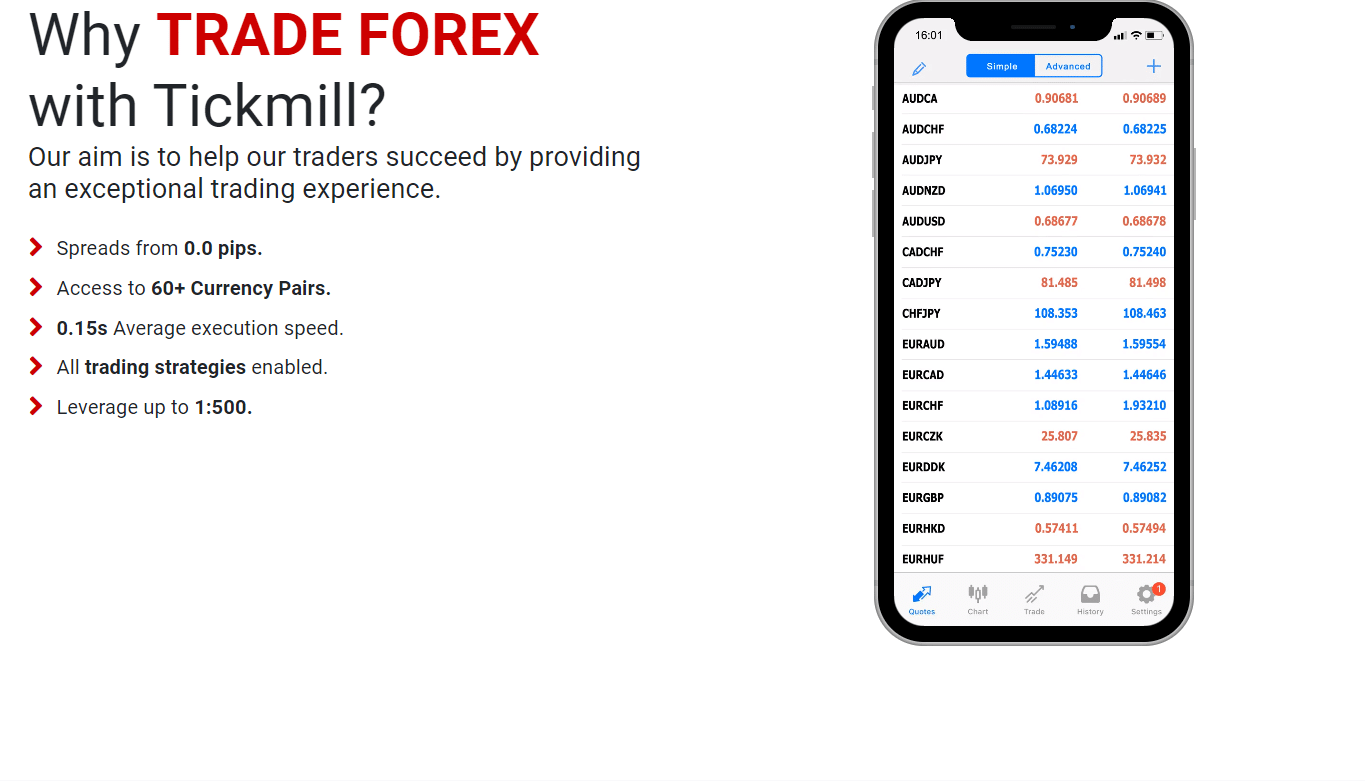

Tickmill offers to trade cfds on currency pairs, precious metals, crude oil, stock indices, bonds and cryptocurrencies. The broker includes only BTC on cryptos. This is a disadvantage for tickmill. And also, +60 pairs of forex pairs available.

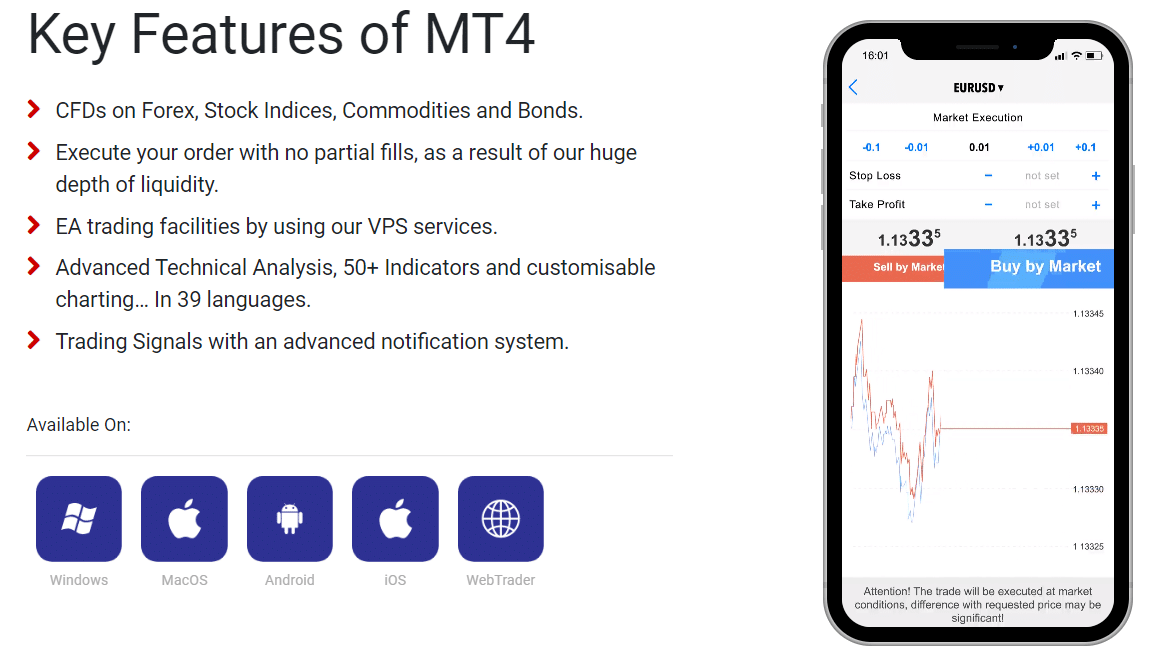

Trading platforms

You can trade with tickmill on desktop or tablet, browser or on-the-go with your smartphone. Metatrader 4 and web trader are available. MT4 is considered to be the world’s most popular forex trading platform because it is easy to use, offers a variety of graphics and indicators, a variety of expert advisors (eas) and most importantly supports the MQL language.

- Cfds on forex, stock indices, WTI, commodities, bonds and cryptocurrencies

- EA trading facilities

- Micro lots available

- No partial fills

Promotions

Tickmill offers three promotions to its clients. One of them is ‘trader of the month’ : each month, tickmill selects the best and highest performance among its talented clients and rewards it with a $ 1,000 award. They take into account not only good profits, but also money and risk management skills when selecting the winner. I would say that this promotion enables competition among clients. Available to clients of tickmill ltd (FSA SC regulated) only.

The second one is ‘tickmill’s NFP machine’. This promotion is also available to clients of tickmill ltd (FSA SC regulated) only. During every NFP week, they choose one instrument and challenge you to guess its price in their MT4 platform at 16:00, exactly 30 minutes after the NFP release. A perfect hit will bring you $500 to your trading account. If no one breaks the bank by an exact figure, the trader with the closest prediction will cash in a $200 prize.

And the last one is ‘$30 welcome account’. Available to clients of tickmill ltd (FSA SC regulated) only. If you open a new account tickmill gives you $30 welcome bonus.

All promotions have terms and conditions.

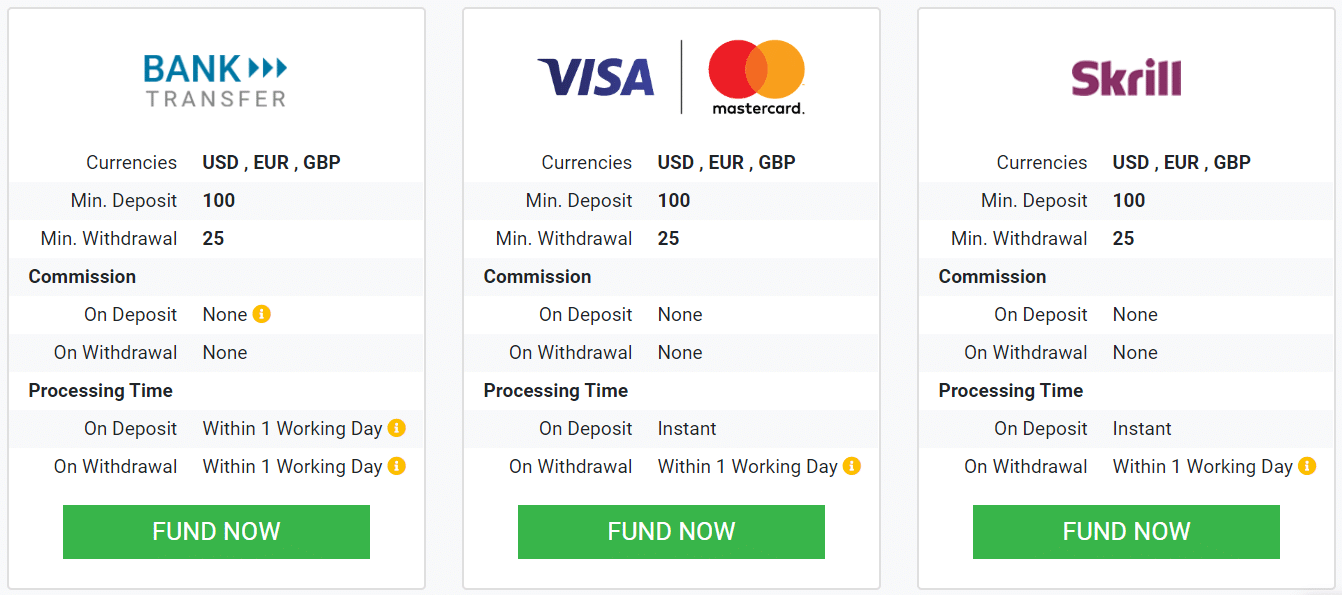

Deposit and withdrawal methods.

Tickmill has a wide range of funding and withdrawal methods. These are wire transfer, credit/debit card, skrill, neteller, fasapay and unionpay. I can say that this is enough but unfortunately, there is no BTC. Also, you do not pay any fees thanks to the zero fees policy of the company. Tickmill offers deposit and withdrawal methods as follows:

I did not have any problems with withdrawing and depositing money during my transactions. When depositing money I preferred to deposit with a credit card. When withdrawing money, they deposit the money in the same day.

Final thoughts

Tickmill is a fast-growing broker. A few years ago, nobody knew tickmill. But now all investors on the forex market know tickmill. If this growth continues fast, I can not imagine what will happen in a few years. They have a good designed website and you can find all information about trading.

FCA license and FSCS registration are two of the broker’s strongest features. The broker has cysec license too. There is no doubt that tickmill is a reliable broker. Tickmill offers enough account types to its clients. The classic account has advantages about minimum deposit and spreads. The pro account also offers a highly advantageous and competitive spread. If you are going to use a pro account, I recommend you open an account at tickmill. Finally, tickmill is a reputable broker who has various product portfolio and effective trading conditions.

Tickmill review

Tickmill is forex broker. Tickmill offers the MT4 and MT4 webtrader trading currency platforms. Tickmill.Com offers over 60 currency pairs, gold, sliver, bonds and cfds for your personal investment and trading options.

Broker details

| established: | 2015 |

| address: | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| contact: | support@tickmill.Com, +852 5808 2921 |

| regional offices: | |

| regulators: | cysec #278/15, FSA-S #SD 008, FCA #717270 |

| prohibited countries: |

| deposit methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

| withdrawal methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

Live discussion

Join live discussion of tickmill.Com on our forum

Tickmill.Com profile provided by tickmill, nov 10, 2016

Tickmill is an award-winning global ECN broker, authorized and regulated by the FCA of the united kingdom and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data center. Our team members have trading experience that goes back to 1989 and we have successfully traded all major financial markets from asia to north america.

In june 2016, tickmill recorded a monthly trading volume of $49.1 billion, followed by a record-high trading volume of $51.7 billion in july, which makes it one of the largest retail forex brokers in the world.

Video

Your company video here? Contact ad sales

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

I have been with tickmill over 5 years and they are my experience with them is excellent.

They provide direct market trading with minimal commission and almost no slippage.

Deposits and withdrawals are fast if using skrill or neteller even faster.

They do have a client outreach and communicate with you occasionally on promotions or events they hold.

I have had no qualms' with them at all.

Commendable and one of the best. Keep up the good work.

Length of use: over 1 year

Tickmill threatens with legal action against me because I expose truth on social media how they refuse to pay me my funds, $35 966! Funds are not paid for more then 6 months already, and they now even threaten with legal action against me. I fight this SCAM company hard with regulators and I am going also to bring my case on court. This unjustice and fraudulent behavior must be stopped!

I strongly advise everyone to stay away from tickmill. This is SCAM company and I kindly ask forexpeacearmy to mark this company with SCAM label and their ratings erased to 0.

Aug 17, 2020 - 1 star this is SCAM company and it should be put where it belongs, to SCAM brokers. Their ratings erased.

Their price at the moment is on 24.10 $. Also straight forward crippled price action. While at same time december futures 2020 contract price which they claim they follow is on 43.22 $ with very much visible dips during upside movement. Something which we do not see in tickmill's price action!

For situation to be even worse, they charge insane swap for long positions of more then 14 points! Total SCAM! This must be punished!

Tickmill continues their fraudulent activity by offering imaginary, fake, and wrong spot WTI price. Price which has nothing to do with reality, or with any futures contract price. Random number they transmit.

I am in close contact with FSA regulator which works on my case, and hopefully this week there will be some real progress regarding my case, and my funds paid in full.

Tickmill must pay me funds they owe me, $35 966 must be paid to my trading account # 3033967.

For more information about my case, you can follow it here: scam - scam alerts - tickmill SCAM! Offers invalid WTI price in close only mode, wrong price execution for all bigger trades.

May 11, 2020 - 1 star I am going to describe 2 problems I ran into with tickmill. My trading account # 3033967.

First and main problem is fake and imaginary WTI CFD price they offer in the moment. Their price currently is at 9.64$ for barrel, while true WTI CFD price is 26$ for barrel, it can be checked with any other broker, or simply by looking at CME futures prices for WTI, all contracts are above 25$ for barrel. Tickmill have applied close only mode on WTI, and since I have 3 long positions I am not able to close my positions with significant profit of 26 000$, and trader can not open new long positions on that absurd, fake, low price they offer because it is only close only mode applied. I would have no problems with their close only mode if they offer true WTI CFD price, instrument I was trading with. Their excuse is that they follow movement of december 2020 futures price, which is also invalid since price for december futures is over 30$ for barrel, and also price movement is completely different. They refuse to pay my winnings after weeks of annoying conversations and invalid arguments they try to provide. I am experienced trader who has account with over 10 brokers, and what they say is completely absurd and not acceptable! Difference in their price from true price is almost 300%, no LP can justify that. There is only one true WTI CFD price and it is between 26$ and 27$ for barrel at the moment I am writing this review.

Second problem I encountered with wrong price execution for trades bigger then 1 lot size. This applies for all FX pairs and metals. Order is executed on price NOT SHOWN in MT4, but on price worse for client by 1-2 points. This happens every time, for manually opened positions and pending positions. They stole from me on over 500 trades these 1-2 point. It is not slippage, it is wrong price execution! I brought this issue also to them, and gave them chance to refund what they were stealing from me for years, but they refused with no true explanation provided, only fake arguments which has nothing to do with reality. Experienced trader like me can not be fooled or tricked like that.

I am going to continue to fight with them with these two problems and claim my funds via court if necessary if they continue to refuse to pay what they owe me.

Everyone can feel free to contact me directly here on FPA if further details about tickmill are wanted.

Reply by tickmill submitted may 15, 2020 hi deltoid88,

We have provided all necessary clarifications and have assisted with detailed explanation in regards to your trades.

If you have any additional concerns, you can reach out to our support team.

Welcome account

Experience one of the best trading environments in the industry risk-free with our $30 welcome account.

A special welcome to the world of trading

and our superior services

Jump-start an exciting trading journey with tickmill and explore our world-class services with the $30 welcome account.

New clients have the opportunity to trade with free trading funds, without having to make a deposit. The welcome account is very easy to open and the profit earned is yours to keep.

Enjoy a seamless trading experience with lightning-fast execution, while getting access to award-winning trading tools and resources.

Your perfect start

with tickmill

NO RISK

PROFITABLE

- The “welcome account” campaign is held by tickmill ltd (FSA SC regulated).

- The welcome account is for introductory purposes and only for new clients from non-restricted countries, who are interested in opening a live trading account with tickmill ltd (FSA SC regulated).

- The welcome account is not available in algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, lebanon, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, san marino, south africa, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

- European union citizens cannot apply for a welcome account.

- Expert advisors (eas) are not allowed on welcome accounts.

- Existing clients cannot apply for a welcome account.

- Each client can open only one welcome account.

- The welcome account has identical trading conditions to the live pro account type.

- The client has the option to either raise or lower the leverage on the welcome account.

- The welcome account is available for trading for 60 days from the day of opening. Once 60 days have passed, trading will be disabled but the welcome account will still be accessible for an additional 14 days to claim the earned profit.

- The welcome account is available in the USD currency.

- The welcome account is created automatically after the client completes the registration form on the web page and the application has been approved. Login details will be sent automatically to the email address provided in the registration form. Please note that these credentials may only be used to create a welcome account, not to access the client area.

- A 30 USD initial complimentary deposit is added automatically to the welcome account.

- Tickmill reserves the right to reject a bonus request or block the welcome account, if there is a partial or complete match of IP address or other signs of welcome accounts belonging to the same person.

- The initial deposit cannot be withdrawn or transferred from the welcome account.

- A minimum of 30 USD and a maximum of 100 USD of profit can be transferred from the welcome account to a live MT4 trading account (classic, pro or VIP account type) with tickmill ltd (FSA SC regulated).

- Each client can make only one request to transfer profit from the welcome account to a live MT4 trading account.

- In order to make a transfer of profit from the welcome account to a live MT4 account, the client must:

- Register a client area account, using the same information provided during the welcome account registration (name, surname, email, date of birth, etc.);

- Provide the necessary identification documents required to validate the client area account;

- Open a live MT4 trading account inside the client area and deposit a minimum of $100 (or equivalent in other currencies);

- New live MT4 trading account should not be connected to any other promotions (e.G. Rebate campaign).

- After a deposit is made to a live MT4 account, the client should send an email to funding@tickmill.Com and request a transfer of profit from the welcome account to the live MT4 account. Transfer of profits should be requested to the same trading account where an initial deposit was made.

- If initial deposit was made to rebate promotion trading account, transfer of profit should be requested to another live account which is not designated for the rebate promotion.

- It is not allowed to make third party deposits and tickmill reserves the right to cancel bonus at any time upon detecting third party payment.

- Once the profit transfer is completed, the welcome account will be disabled and no further trading will be possible.

- The profit of the welcome account will be added to the balance of the live trading account with tickmill ltd (FSA SC regulated) and can be withdrawn immediately by using any of the available withdrawal options available in the client area.

- All profits earned and transferred from the welcome account campaign are deemed to be null and void, if the welcome account or live MT4 tickmill ltd account holder (FSA SC regulated) has provided incorrect, false or misleading information during the registration process.

- No deposits can be made to the welcome account.

- Tickmill reserves the right to disqualify any user, if there is a suspicion of misuse or abuse of fair rules.

- Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse.

- Using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse.

- Tickmill reserves the right to change the terms of the campaign or cancel it at any time.

- Any disputes or likely misunderstandings that may occur as a result of the campaign terms will be resolved by the tickmill management in a way that presents the fairest solution to all parties involved. Once such a decision has been made, it shall be regarded as final and/or binding for all parties.

- Clients agree that information provided during the registration process may be used by the company both within the context of the welcome account campaign and for any other marketing purposes.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Conta de boas-vindas

Experimente, sem risco, um dos melhores ambientes de negociação da indústria e usufrua da nossa conta de boas-vindas de $30.

Boas-vindas especiais ao mundo das negociações

e aos nossos serviços de topo

Inicie uma empolgante jornada ao negociar com a tickmill e explore os serviços de classe mundial com a conta de boas-vindas de $ 30.

Os novos clientes têm a oportunidade de negociar com fundos de negociação gratuitos, sem efetuar qualquer tipo de depósito. A conta de boas-vindas é muito simples de abrir e o lucro obtido fica para si .

Desfrute de uma experiência de negociação incrível, com rápida execução, enquanto obtém, acesso a ferramentas premiadas e outros recursos.

O seu inicio perfeito

com a tickmill

GRATUITO

ISENTO DE RISCO

LUCRATIVO

- A “conta de boas-vindas” está disponível somente para clientes da tickmill ltd (regulamentado pela FSA SC).

- A conta de boas-vindas é para fins introdutórios e apenas para novos clientes de países não restritos, que estão interessados em abrir uma conta de negociação com a tickmill ltd (regulamentado pela FSA SC).

- A conta de boas-vindas não está disponível na argélia, armênia, austrália, azerbaijão, bielorrússia, bulgária, colômbia, geórgia, hong kong, islândia, israel, cazaquistão, líbano, liechtenstein, macau, moldávia, marrocos, noruega, palestina, suíça, taiwan, tunísia, yemen, coreia do norte, irão, EUA, indonésia, venezuela, vietname, lesoto, paquistão, bangladesh, gana, egito, rússia, san marino, áfrica do sul, ucrânia, uzbequistão, quirguistão, tajiquistão, turquemenistão e quênia.

- Os cidadãos da união europeia não poderão aplicar para uma conta de boas-vindas.

- Expert advisors (eas) não são permitidos nas contas de boas-vindas.

- Cada cliente pode abrir apenas uma conta de boas-vindas.

- A conta de boas-vindas tem condições de negociação idênticas ao tipo da conta pro.

- O cliente tem a opção de aumentar ou diminuir a alavancagem na conta de boas-vindas.

- A conta de boas-vindas está disponível para negociação por 60 dias, a partir do dia de abertura. Após passar esse prazo, a negociação da conta será desativada, mas a conta ainda está acessível por mais 14 dias, para assim poder reivindicar o lucro por obtido.

- A conta de boas-vindas está disponível em USD.

- A conta de boas-vindas é criada automaticamente após o cliente concluir o formulário de inscrição na página web e que a aplicação seja aprovada. Os detalhes do acesso serão enviados de forma automática para o endereço de email que foi fornecido no formulário de inscrição. Observe que essas credenciais só podem ser usadas para criar uma conta de boas-vindas e não para acessar na área de cliente.

- Um depósito inicial de 30 USD será adicionado automaticamente na sua conta de boas-vindas.

- A tickmill reserva o direito de rejeitar uma solicitação para um pedido de bónus ou bloquear a conta de boas-vindas, se existir uma correspondência parcial ou completa do endereço IP ou outros sinais de contas de boas-vindas pertencentes à mesma pessoa.

- O depósito inicial não poderá ser levantado ou transferido através da conta de boas-vindas.

- Um montante mínimo de 30 USD e um montante máximo de 100 USD de lucro, podem ser transferidos da conta de boas-vindas para uma conta de negociação MT4 (classic, pro ou VIP) com a tickmill ltd (regulamentado pela FSA SC).

- Cada cliente poderá fazer apenas um pedido de transferência do lucro, através da conta de boas-vindas para a uma conta de negociação MT4.

- Para fazer a transferência de lucro da conta de boas-vindas para uma conta de negociação MT4, o cliente deverá:

- Registrar-se na área de cliente, usando as mesmas informações fornecidas durante o registo da conta de boas-vindas (nome, apelido, email, data de nascimento, etc.);

- Providenciar os documentos necessários para validar a sua área de cliente;

- Abrir uma conta de negociação MT4 através da sua área de cliente e depositar no mínimo $100 (ou o equivalente em outras moedas);

- A nova campanha de trading live MT4 não deverá ser associada a quaisquer outras promoções (por exemplo, campanha de reembolso).

- Depois que um depósito for feito em uma conta MT4 ativa, o cliente deverá enviar um e-mail para funding@tickmill.Com e solicitar a transferência de lucro da conta de boas-vindas para a conta MT4 ativa. A transferência do lucro deve ser solicitada para a mesma conta de negociação em que foi feito um depósito inicial.

- Se o depósito inicial tiver sido realizado para uma conta de trading de promoção de reembolso, a transferência do lucro deverá ser realizada para outra conta mais que não esteja designada para a promoção de reembolso.

- Não é permitido fazer depósitos de terceiros e a tickmill reserva o direito de cancelar o bónus a qualquer momento ao detetar um pagamento de terceiros.

- Uma vez que a transferência do lucro é concluída, a conta de boas-vindas será desativada e não será possível efetuar mais nenhuma negociação.

- O lucro da conta de boas-vindas será adicionado ao saldo da conta de negociação da tickmill ltd (regulamentado pela FSA SC) e poderá ser levantado imediatamente, usando qualquer uma das opções de levantamento, disponíveis na área de cliente.

- Todos os lucros obtidos e transferidos da campanha da conta de boas-vindas são considerados nulos, se a conta de boas-vindas ou o titular da conta de negociação MT4 da tickmill ltd (regulado pela FSA SC), fornecerem informações incorretas, falsas ou enganosas durante o processo de registro.

- Não podem ser efetuados depósitos na conta de boas-vindas.

- A tickmill reserva o direito de desqualificar qualquer titular, se existir suspeita de uso indevido ou abuso das regras.

- As posições de negociação em hedge feitas internamente (usando outras contas de negociação mantidas com a tickmill) ou externamente (usando outras contas de negociação mantidas por outras corretoras) para, assim evitar o risco de mercado, são consideradas abusivas.

- Usar as falhas no fluxo de cotações para obter lucros garantidos ou qualquer outra forma de atividade fraudulenta, são consideradas abusivas.

- A tickmill reserva o direito de alterar os termos da campanha ou cancelá-la a qualquer momento.

- Qualquer disputa ou suspeita de mal-entendidos que possam decorrer no desenrolar dos termos do concurso, serão resolvidos pela gestão da tickmill, de forma a apresentar a solução mais justa para todas as partes envolvidas. Uma vez que tal decisão tenha sido tomada, deve ser considerada como final e/ou obrigatória para todas as partes envolvidas.

- Os clientes concordam que as informações fornecidas durante o processo de registo, podem ser usadas pela empresa, tanto no contexto da campanha da conta de boas-vindas, como para qualquer ouro propósito de marketing.

INSTRUMENTOS PARA NEGOCIAR

CONDIÇÕES DE NEGOCIAÇÃO

CONTAS DE NEGOCIAÇÃO

PLATAFORMAS

EDUCATIVO

FERRAMENTAS

PARCERIAS

PROMOÇÕES

SOBRE NÓS

SUPORTE

Tickmill é o nome comercial do grupo de empresas tickmill.

A tickmill.Com pertence e é operada dentro do grupo de empresas tickmill. Tickmill group é composto por: tickmill UK ltd - regulada pela financial conduct authority (FCA) do reino unido (número de licença: 717270 e sede: 3rd floor, 27 - 32 old jewry, londres EC2R 8DQ, inglaterra), tickmill europe ltd - regulada pela cyprus securities and exchange commission (número da licença: 278/15 e sede: kedron 9, mesa geitonia, 4004 limassol, chipre), tickmill south africa (PTY) LTD, FSP 49464, regulada pela financial sector conduct authority (FSCA) (sede: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd - regulada pela financial services authority de seychelles (número da licença: SD008 e sede: 3, F28- F29 eden plaza, eden island, mahe, seychelles) e sua subsidiária 100% proprietária procard global ltd (número de registro: 09592225 e sede social: 3rd floor, 27 - 32 old jewry, londres EC2R 8DQ, inglaterra), tickmill asia ltd - regulada pela financial services authority de labuan malásia (número da licença: MB/18/0028 e sede social: unidade B, lote 49, 1º andar, bloco F, lazenda warehouse 3, jalan ranca-ranca, 87000 FT labuan, malásia).

Os clientes devem ter pelo menos 18 anos para usar os serviços da tickmill .

Aviso de alto risco: negociar contratos por diferença (cfds) acarreta um alto nível de risco e pode não ser adequado para todos os investidores. Antes de decidir negociar contratos por diferença (cfds), você deverá considerar cuidadosamente os seus objetivos de negociação, nível de experiência e apetite ao risco. É possível que você sustente perdas que excedam o seu capital investido e, portanto, você não deve depositar dinheiro que não pode perder. Por favor, certifique-se que entende completamente os riscos e que toma os cuidados necessários para gerir o risco.

Este website não deverá ser considerado como um meio de publicidade ou de solicitação ,mas sim um canal de distribuição de informação. Nada neste website deverá ser considerado como um anúncio, oferta ou solicitação para o uso dos nossos serviços.

O website contem links para websites oferecidos e controlados por terceiros. A tickmill não inspeccionou e, por este meio, nega a responsabilidade por qualquer informação ou material publicado em qualquer um dos websites vinculados a este website. Ao criar um link para um website de terceiros, a tickmill não confirma, nem recomenda quaisquer produtos ou serviços oferecidos nesse website. A informação contida neste website destina-se somente para fins informativos, portanto não deverá ser considerada como uma oferta ou solicitação a qualquer pessoa, em qualquer jurisdição, em que tal oferta ou solicitação não seja autorizada ou a qualquer outra pessoa a quem seria ilegal fazer tal recomendação ou solicitação, nem considerada como recomendação para comprar, vender ou lidar com qualquer moeda em particular ou negociação de metais preciosos. Se você não tem a certeza de qual é a sua moeda local e quais os regulamentos para a negociação me metais preciosos, então você deverá deixar este website imediatamente.

Será fortemente aconselhável, antes de proceder com a negociação de moedas ou metais preciosos, obter aconselhamento financeiro, jurídico e fiscal de forma independente. Nada neste website deverá ser lido ou interpretado com um conselho por parte da tickmill, ou de qualquer um dos seus afiliados, diretores e colaboradores.

Os serviços da tickmill e as informações contidas neste website, não são dirigidas a cidadãos/residentes dos estados unidos da américa e, não se destinam a ser distribuídos ou, usados por qualquer pessoa, em qualquer país ou jurisdição, onde tal distribuição ou uso, contrariam as leis ou regulamentos locais.

Tickmill – $30 welcome bonus

Tickmill

Promotion name: welcome bonus

Note: this promotion is available to clients of tickmill ltd (FSA SC regulated) only.

How to get:

1. Start registering your client area at tickmill.

2. Tick the “yes” box to the welcome account question.

3. Click the validation link you’ll receive via email.

4. Enjoy trading on your welcome account.

Withdrawal requirements:

you can withdraw 30-100 USD of profits after you pass verification process and make at least $100 deposit.

More information:

welcome bonus is not available in algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan, kenya and european union countries. This no-deposit promotion is available to new clients. Hedging trading is prohibited.

Information about the broker:

tickmill is a forex broker operated by tickmill ltd. Located in seychelles and regulated by the financial services authority of seychelles. Tickmill is also a trading name of tmill UK limited a company regulated by the financial conduct authority (FCA). Broker offers classic, ECN pro and VIP accounts. The minimum starting deposit is $€£100, spreads start from 0.0 pips, maximum leverage is 1:500. Broker review.

Forex brokers lab

BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : FCA, FSA, CYSEC

Cryptocurrencies: YES

Minimum deposit: $100

Maximum leverage: 1:500

Spreads: low

My score: 7.9

First thing I can say about tickmill forex broker is that it is one of the fastest growing brokers in the world. Thanks to the company’s aggressive growth policy, tickmill succeeded in reaching thousands of forex traders from a wide range of different countries in a very short period of time. The website has more than a million visitors a month. In this tickmill review, you will find information on tickmill spreads, regulations, account types, deposit and withdrawal methods. Are you wondering is tickmill scam or legit? I would definitely recommend reading this review before opening an account with tickmill.

Tickmill regulation and investor protection

One of the most crucial issues in the forex system is regulation. Because when you have problems with your broker, the regulators help you to solve the problems. Think about; you wanted to withdraw but the broker could not let this. In this situation, the regulator moves in and protects your rights. We can duplicate samples like this. Let’s see what tickmill offers us.

There are two different companies behind the tickmill brand name. One of them is tmill UK limited and the other is tickmill limited. Tmill UK limited regulated by FCA (register number: 717270) in the UK FCA while tickmill limited regulated by FSA in seychelles.

Clients of the UK broker are protected by financial services compensation scheme-FSCS as well as FCA. If the forex broker goes bankrupt, the investors’ money is under the FSCS guarantee. The institution pays investor’s money up to £50,000. This shows your money is in safe if the broker goes bankrupt.

In addition, vipro markets, which operates in cyprus with CYSEC-licenced, joined the tickmill group in 2017. Before joining the tickmill group, this company also had more than 500,000 visitors per month. If a broker wants to have a cysec license, it must keep at least €1,000,000 to prove to clients that they can make a payment. I think it is a reassuring feature for prospective clients who are suspected of not taking their money.

In order to keep your money safe, you must trade with a broker who has a license. Watchdogs allow the brokers to act in accordance with the rules. They periodically inspect the brokers and if the brokers do not obey the rules, they may cancel the licenses.

The tickmill forex broker has grown rapidly in a short period of time and currently serves forex and CFD trading in asia, the middle east and africa.

Tickmill spreads and account types

Tickmill offers customers 4 different account types as follows:

| account type | minimum deposit | maximum leverage | spreads (& commission) | swap free |

|---|---|---|---|---|

| classic | $100 | 1:500 | from 1.6 pips | yes |

| pro | $100 | 1:500 | 0.2 pips + $4 / lot (round turn) | yes |

| VIP | $50.000 | 1:500 | 0.0 pips + $3.2 / lot (round turn) | yes |

In all of these 4 account types, you can trade on 85 trading instruments and use USD, EUR, GBP, PLN as base currency of the account. The maximum leverage in the accounts is 1:500.

Classic account is more suitable for newbie investors. Minimum deposit for classic account is $100. It can be called an average deposit. There is no commission, but spreads start from 1.6 pips on EURUSD. If I compare it with fxpro, I can say that spreads are higher in the classic account in tickmill. However, the pro account that we can see as ECN account is quite advantageous compared to other brokers’ ecns.

In the pro account, the minimum deposit is same with classic account and it is $100. You only pay a commission of $ 2 per lot and $ 4 per round turn. I can easily say that this commision is quite low. If we compare with other brokers, tickmill offers better commission fee. For example FXPRO offers $ 3 per lot and $ 4.5 per round turn.

The most advantageous of all is the VIP account. You only pay a commission of $ 1.6 per lot. However, the minimum deposit for this account is $ 50,000. Tickmill also offers personal multi account manager. With the MAM program, professional money managers are assigned to act on behalf of their clients. In this way, a money manager can perform block trades on all accounts with his master account effectively.

If you are an investor with islamic belief and do not want to earn or pay interest, you can apply for a swap free account for all these account types. Tickmill offers the same terms and conditions as their regular account types to its clients who want to use islamic accounts. The only difference is that there are no swaps. Tickmill may ask you to document your belief. It also has the right to reject your application.

Trading products

Tickmill offers to trade cfds on currency pairs, precious metals, crude oil, stock indices, bonds and cryptocurrencies. The broker includes only BTC on cryptos. This is a disadvantage for tickmill. And also, +60 pairs of forex pairs available.

Trading platforms

You can trade with tickmill on desktop or tablet, browser or on-the-go with your smartphone. Metatrader 4 and web trader are available. MT4 is considered to be the world’s most popular forex trading platform because it is easy to use, offers a variety of graphics and indicators, a variety of expert advisors (eas) and most importantly supports the MQL language.

- Cfds on forex, stock indices, WTI, commodities, bonds and cryptocurrencies

- EA trading facilities

- Micro lots available

- No partial fills

Promotions

Tickmill offers three promotions to its clients. One of them is ‘trader of the month’ : each month, tickmill selects the best and highest performance among its talented clients and rewards it with a $ 1,000 award. They take into account not only good profits, but also money and risk management skills when selecting the winner. I would say that this promotion enables competition among clients. Available to clients of tickmill ltd (FSA SC regulated) only.

The second one is ‘tickmill’s NFP machine’. This promotion is also available to clients of tickmill ltd (FSA SC regulated) only. During every NFP week, they choose one instrument and challenge you to guess its price in their MT4 platform at 16:00, exactly 30 minutes after the NFP release. A perfect hit will bring you $500 to your trading account. If no one breaks the bank by an exact figure, the trader with the closest prediction will cash in a $200 prize.

And the last one is ‘$30 welcome account’. Available to clients of tickmill ltd (FSA SC regulated) only. If you open a new account tickmill gives you $30 welcome bonus.

All promotions have terms and conditions.

Deposit and withdrawal methods.

Tickmill has a wide range of funding and withdrawal methods. These are wire transfer, credit/debit card, skrill, neteller, fasapay and unionpay. I can say that this is enough but unfortunately, there is no BTC. Also, you do not pay any fees thanks to the zero fees policy of the company. Tickmill offers deposit and withdrawal methods as follows:

I did not have any problems with withdrawing and depositing money during my transactions. When depositing money I preferred to deposit with a credit card. When withdrawing money, they deposit the money in the same day.

Final thoughts

Tickmill is a fast-growing broker. A few years ago, nobody knew tickmill. But now all investors on the forex market know tickmill. If this growth continues fast, I can not imagine what will happen in a few years. They have a good designed website and you can find all information about trading.

FCA license and FSCS registration are two of the broker’s strongest features. The broker has cysec license too. There is no doubt that tickmill is a reliable broker. Tickmill offers enough account types to its clients. The classic account has advantages about minimum deposit and spreads. The pro account also offers a highly advantageous and competitive spread. If you are going to use a pro account, I recommend you open an account at tickmill. Finally, tickmill is a reputable broker who has various product portfolio and effective trading conditions.

Tickmill forex broker review – min deposit, welcome bonus and spreads!

Regulators: FCA, FSA, CYSEC

The first thing I will say concerning tickmill forex broker is it really is among the quickest growing brokers on earth. Because of the company’s competitive growth policy, tickmill triumphed in reaching tens of thousands of forex traders from the vast array of various nations a really brief time period. The web site has a lot more than a thousand people monthly. Inside this tickmill review, you’ll discover advice on tickmill propagates, regulations, account types, withdrawal and deposit procedures. Are you currently wondering why tickmill scam or untrue? I’d recommend reading this review before launching a merchant account together with tickmill.

Tickmill regulation and investor protection

One of the most important problems from the forex strategy is regulation. Because if you have difficulties with the broker, the authorities enable one to address the issues. Think of; you desired to draw however, the broker couldn’t make this. Within this circumstance, the regulator goes and protects your rights. We are able to duplicate samples similar to this. Let’s find out what tickmill offers.

There are two unique businesses behind the tickmill name. Certainly one of these will be tickmill UK limited and another is tickmill limited. Tickmill UK limited controlled by FCA (register number: 717270) from the UK FCA while tickmill restricted regulated by FSA at seychelles.

Clients of the UK broker are protected by financial services compensation scheme-FSCS in addition to FCA. In case the forex broker goes bankrupt, then the shareholders ‘ money is under the FSCS guarantee. The institution pays investor’s money up to 50,000. This shows your money is in safe if the broker goes bankrupt.

In addition, vipro markets, which operates in cyprus with CYSEC-licenced, joined the tickmill group in 2017. Before joining the tickmill group, this company also had more than 500,000 visitors per month. If a broker wants to have a cysec license, it must keep slightly 1,000,000 to prove to clients that they can make a payment. I think it is a reassuring feature for prospective clients who are suspected of not taking their money.

In order to keep your money safe, you must trade with a broker who has a license. Watchdogs allow the brokers to act in accordance with the rules. They periodically inspect the brokers and if the brokers do not obey the rules, they may cancel the licenses.

The tickmill forex broker has grown rapidly in a short period of time and currently serves forex and CFD trading in asia, the middle east and africa.

Tickmill spreads and account types

Tickmill offers customers 4 different account types as follows:

| Account type | minimum deposit | maximum leverage | spreads (& commission) | swap free |

|---|---|---|---|---|

| classic | $100 | 1:500 | from 1.6 pips | yes |

| pro | $100 | 1:500 | 0.2 pips $4 / lot (round turn) | yes |

| VIP | $50.000 | 1:500 | 0.0 pips $3.2 / lot (round turn) | yes |

In all of these 4 account types, you can trade on 85 trading instruments and use USD, EUR, GBP, PLN as base currency of the account. The maximum leverage in the accounts is 1:500.

Classic account is more suitable for newbie investors. Minimum deposit for classic account is $100. It is called an average deposit. There is no commission, but spreads start from 1.6 pips on EURUSD. If I compare it with fxpro, I can say that spreads are higher in the classic account in tickmill. However, the pro account that we can see as ECN account is quite advantageous compared to other brokers’ ecns.

In the pro accounts, the deposit the similarly with the classic account plus it really is $100. You simply pay a percentage of 2 a bunch and $ 4 each round turn. I can quickly say this commission is quite lower. When we equate to different brokers, tickmill offers a higher commission fee. As an instance FXPRO offers $5 a lot and $ 4.5 per return.

The very valuable is your VIP account. You simply pay out a commission of 1.6 a lot. Nevertheless, the deposit for that account is currently $50,000. Tickmill also supplies private multi-level accounts manager. With all the MAM application, professional money managers have been delegated to do something with respect to their clientele. This manner, a money manager may do block trades to all reports along with his master accounts effortlessly.

If you’re an investor having an islamic belief and don’t want to pay or earn attention, you are able to make an application for swap-free accounts fully for these accounts types. Tickmill delivers similarly stipulations and requirements because their routine account types for the customers who wish to make use of islamic accounts. The sole distinction is there aren’t any swaps. Tickmill will request that you record your own opinion. Additionally, it gets got the right to reject the application.

Trading products

Tickmill offers to trade cfds on money pairs, gold and silver coins, crude petroleum, share indices, bonds and cryptocurrencies. The broker comprises just BTC on cryptos. That really is a drawback for tickmill. And additionally, 60 pairs of forex monies out there.

Trading platforms

You are able to trade tickmill on tablet or desktop, on-the-go or browser along with your own smartphone. Metatrader 4 and also web trader are all readily available. MT4 is considered to become the environment ‘s popular forex trading platform since it’s not difficult to use, provides various indicators and graphics, an assortment of expert advisors (eas) and also above all supports the MQL terminology.

- Cfds online forex, share indices, WTI, commodities, bonds and crypto currencies

- EA trading centers

- Micro lots accessible

- No semi fills

Promotions

Tickmill provides three promotions on to its customers. One is ‘trader of the month’: each calendar month, tickmill chooses the greatest and greatest performance one of its talented customers and advantages it with a $ 1000 award. They think about not just fantastic benefits, but also risk and money management skills when choosing the winner. I’d say this promotion enables rivalry among customers. Open to customers of tickmill ltd (FSA SC regulated) just.

The next one is ‘tickmill’s NFP machine’. This promotion is available to customers of tickmill ltd (FSA SC regulated) just. Throughout every NFP week they choose one particular tool and challenge one to suppose its own cost inside their MT4 platform at 16:00, thirty seconds after the NFP release. A complete hit provides you 500 to your own trading accounts. In case nobody breaks down the financial institution by a specific amount, the trader with the nearest forecast will profit a $200 prize.

And the previous one is ‘$30 welcome account’. Open to customers of tickmill ltd (FSA SC regulated) just. If you start a brand new account tickmill provides you a 30$ as welcome bonus.

All promotions include provisions and requirements.

Deposit and withdrawal methods.

Tickmill features a large assortment of withdrawal and funding procedures. All these are cable transfer, credit/debit card, skrill, neteller, fasapay along with unionpay. I am able to say this is enough but regrettably, there’s not any BTC. Additionally, you don’t cover any penalties because of this zero fees policy of the provider. Tickmill provides withdrawal and deposit techniques the following:

| Payment option | currencies | minimum deposit | minimum withdrawal | deposit processing time | withdrawal processing time |

|---|---|---|---|---|---|

| USD, EUR, GBP, PLN | 25 | 10 | throughout 1 day time | throughout 1 day time |

| USD, EUR, GBP, PLN | 25 | 10 | immediately | throughout 1 day time |

| USD, EUR, GBP, PLN | 25 | 10 | immediately | throughout 1 day time |

| USD, EUR, GBP, PLN | 25 | 10 | immediately | throughout 1 day time |

| USD, IDR | $25 or 250,000 rp | $10 or 100,000 rp | 1 2 hours | throughout 1 day time |

| CNY | 150 | 50 | immediately | throughout 1 day time |

| VND | 500,000 | 200,000 | throughout 1 day time | throughout 1 day time |

| USD, RUB, EUR | 25 | 10 | immediately | throughout 1 day time |

I didn’t need any issues with depositing and withdrawing money throughout my trades. After depositing money I chose to deposit using credit card. When withdrawing money they deposit the amount at a similar moment.

Final thoughts

Tickmill can be really a fastgrowing broker. A number of decades back, no one knew tickmill. However today traders on the forex store understand tickmill. Whether this growth continues fast, I can’t imagine what’s going to transpire in a couple of decades. They’ve an excellent designed web site and also you may get all details relating to trading.

FCA permit and FSCS enrollment are just two of those broker’s most important features. The broker needs cysec permit too. There’s not any doubt that tickmill is still a dependable broker. Tickmill presents enough account types for its clientele. The timeless accounts include the advantages of minimum spreads and deposits. The pro accounts also supplies an extremely valuable and competitive disperse. If you’re likely to make use of an account, I advise that you start a free account in tickmill. Finally, tickmill is just a respectable broker with various merchandise portfolio and also efficient trading requirements.

A comprehensive tickmill review – is this broker trustworthy?

Minimum deposit

Bonus

Maximum leverage

Year founded

Regulation

Trading platform

When setting out to start trading forex, stocks, or other tradable assets, one of the first things every trader should think about is a broker. The internet is full of scam brokerages that you absolutely need to stay away from, however, given how skilled they are at tricking potential customers, it may not be as easy to spot hidden flaws under their platform.

But it doesn’t mean that you have no means of distinguishing legitimate brokers from fraudulent ones. It just takes a little effort and research into the broker’s offerings to assess their credibility and make the right decision.

On forex trading bonus, we’re trying to make the broker selection process a little bit easier by offering our comprehensive reviews about them. And today, we’ll do the same for the tickmill forex broker.

In order to determine whether tickmill is a trustworthy broker or a scam, we will take a look at its website and software support, then move to the licensing, and finish off by talking about the actual trading conditions. So, let’s get started.

Initial overview

Tickmill is a forex broker established in 2015 in seychelles. The broker brings together a team of professional traders whose experience in this field has started off back in the 80s, therefore, the new clients of tickmill are already in good hands.

While the main focus of tickmil forex broker can be gathered from what we’ve just said – forex trading, the broker also offers many other instruments to its traders: stocks, indices, commodities, and bonds. But before we delve deeper into these instruments and what the actual conditions on them are, let’s do a brief overview of everything we’ll talk about in this article.

A brief tickmill.Com review

When you go to tickmill’s website, the first thing you’re going to notice is how slender and simplistic the interface looks. One image here or there, several visual effects, and very decent font make up a visual that is hardly ever distracting the visitor from getting the information.

And information is certainly there. We have seen websites with decent thematic separation but what we saw on tickmill was something else: the broker has divided the website into the sections that answer all the questions effortlessly. For instance, want to know the conditions for spreads? Go to the spreads & swaps section and find out everything about it.

This level of simplicity is definitely an advantage that we will take into account when making a final tickmill rating.

We were also pretty pleased when we came across 5 different account types on the website. All of them are designed for specific users and make trading a once-in-a-lifetime experience for them.

As for trading platforms, tickmill definitely doesn’t invent a bicycle here: it uses metatrader 4 and webtrader for all the trading executions. And to be fair, it doesn’t need to be original because these pieces of software have proven to be the most effective and efficient in this industry.

The license

Next up, we will take a look at the broker’s licensing material. This is the part that actually reveals a lot about the broker’s code of conduct and its legitimacy issues.

So, the very first line that you read when entering the website is this: “authorised and regulated: FSA SC, FCA UK, cysec.” this means that the broker has regulatory obligations to three separate countries and their financial institutions.

And actually going through these institutions can reveal a lot. For instance, when seeing that one of the main regulators of tickmill is the UK’s financial conduct authority, all the tickmill scam suspicions or suggestions are instantly dissipated for us. There’s just no way of being a scam and having this level of regulatory oversight monitoring your activities.

We will talk about this section more further down below.

Actual tickmill promotions

At last, we’ll discuss every important trading condition available on tickmill. We’ll start with the leverage and spreads. On the broker’s website, we can see that the maximum leverage ratio that the traders can use is 1:500, which is definitely a lucrative offering.

As for spreads, the broker offers two different levels of bid-ask price differences on forex pairs: 1.6 pips for classic account and 0 pips for pro and VIP accounts. Both conditions are pretty decent, although, as you can imagine, the 0-pip offering is far more attractive.

As for the tickmill bonus, the broker offers multiple promotions to its clients, ranging from the $30 welcome account, trader of the month, and many more. These bonuses give additional trading funds to the lucky winners who also can withdraw the bonus money to their personal account.

Finally, we’ll take a look at the minimum deposit requirement, as well as how you can make that deposit, as well as withdrawal. On tickmill, the minimum amount you need to deposit in order to set up a classic account is $100. As for financial platforms, the broker supports bank wire, credit/debit cards, as well as many e-wallets like neteller, skrill, etc.

In short, we think that tickmill is a trustworthy brokerage that offers quite impressive trading conditions to its clients. Now, let’s review each of the above-mentioned points more closely.

What’s the software experience like on tickmill?

As per usual, we’ll begin with the website. As we noted earlier, the visual side of the website is pretty spot-on: it’s not overburdened with unnecessary imagery or transition effects; everything is used moderately and adequately. What this achieves is it makes the navigation through the website much easier.

When it comes to finding the actual information on this website, it’s safe to say that all you need is one mouse click to go where you want. The website is separated into six different sections: trading, platforms, clients tools, promotions, partnerships, and about us. Within those sections, you can find anything about the broker’s regulatory measures, trading numbers, platforms, and payment methods.

As for the account types, there are five different packages that fulfill the demand coming from every type of trader: there are three live accounts (classic, pro, and VIP), one islamic, and one demo account. And all of them are special in their own way; some have lower spreads but higher minimum deposit requirements, some come with no swaps, etc. All in all, these accounts are perfect for specific users.

The last point of this section is trading software. Instead of going all fancy and offering proprietary trading software, tickmill chose a safer and more trustworthy route and gone with metatrader 4. MT4 is a well-tested and widely-used platform that has proven to be the most effective software across the board. What’s more, the broker also offers the MT4-based webtrader that works on all major web browsers.

Is tickmill legit?

Moving on, let’s talk about how legit the broker is based on its licensing materials. As we have already mentioned earlier, there are three separate regulatory pieces that monitor and even direct the broker’s financial activities, and all of them are pretty significant.

These licenses include: FSA from seychelles, FCA from the UK, and cysec from cyprus. Now, if there only was the FSA license, we would at least acknowledge the legitimacy of the tickmill scam suspicions. That’s because for some traders, seychelles isn’t the country with the biggest political or economic prowess to hold the broker accountable for its actions.

However, when we see the licensing materials from the UK and cyprus, all the suspicions are instantly dissipated. Just take a look at the FCA from the UK. Do you think that any brokerage would engage in fraudulent activity and be forgiven by this institution? We certainly don’t think that.

And then there’s the cysec license as some sort of cherry topping as it’s also a very strong licensing material from within the EU. In short, all three of the licenses make sure that the broker abides by the strictest financial rules.

Trading terms and conditions

Finally, let’s talk about what the actual offerings on tickmill are. As noted earlier, the leverage goes as high as 1:500, which is a very impressive and lucrative offering. With it, traders can increase their initial deposits by x500 times, increasing profits by the same multiplication rate.

As for the spreads, the bid-ask price difference for forex pairs is different on different account but the minimum spread can go as low as 0 pips, meaning there’s no actual price difference and traders can buy the same amount of assets as they sell.

When it comes to the bonuses, tickmill FX brokerage offers at least five different promotions: the trader of the month, tickmill’s NFP machine, $30 welcome account, IB contest, and rebate promotion. All of them offer money prizes to the traders, making the experience on tickmill so much better.

And finally, let’s talk about the minimum deposit requirements and financial platforms backing those deposits. On tickmill, the least amount of money you can deposit to your account is $100. This means that even the beginner traders can fire off their career on tickmill without breaking the bank.

The payment platforms that drive those deposits, as well as withdrawals, are also very attractive: the broker offers both traditional (bank wire, debit/credit cards) and e-wallet platforms (neteller, skrill, fasapay, etc). As for tickmill withdrawals, the same platforms can be used for taking out the money you have earned. And transactions are secured with the SSL protocol, which is the highest security standard in the industry.

Should you trade with tickmill?

So, what is our final tickmill opinion? Should you use its services and platforms to trade forex, stocks, and commodities?

Judging from what we’ve just said in this review, it is safe to say that the broker offers some of the most exciting trading conditions you can find on the market right now. Whether you want to leverage large trading positions with fewer of your own money, shallow spreads, or sophisticated financial mechanisms, you can never go wrong by choosing tickmill.

Besides, the broker has three separate licensing materials that ensure that there’s no tickmill fraud going on. In short, we freely recommend this broker with all its offerings and requirements.

Tickmill $30 welcome account

Platform

Min. Volume

Action

In forex, you can find tons of different promotional bonuses offered by brokers. The market is full of deposit bonuses, rebate programs, and affiliate promotions, and they promise quite lucrative offers.

But one major similarity between all of them is that they require a financial commitment from you, the client. For instance, a deposit bonus only activates when you make a deposit to your account. In the case of a rebate program, you only get cashbacks if you trade with your own money.

But there’s one particular class of bonuses that don’t require any deposit from you, and their name is quite straightforward as well – no deposit bonuses. Today, we’ll take a look at yet another no deposit bonus from tickmill, called the $30 welcome account, and show you all its merits.

Why should you get to know tickmill first?

Now, while the idea behind no deposit bonuses sounds enticing, it should be noted that not all no deposit bonuses are trustworthy. On the one hand, there aren’t too many brokers that offer this bonus. On the other hand, if you even manage to find one, there’s no guarantee that it’s going to be trustworthy.

Many scam brokers offer welcome/no deposit bonuses to enhance the appeal of their platforms without featuring any kind of significant trading features. Therefore, you need to be able to tell scammers from reliable brokers.

In the case of the tickmill welcome account, what should be your course of action? Should you trust it and receive the bonus? Well, let’s find out.

When you check out the broker’s website, the very first sentence you’ll read is the following: “authorised and regulated: FSA SC, FCA UK, cysec, LFSA, FSCA.” therefore, the broker is monitored by five different regulators, and from those five, two are from europe – financial conduct authority (FCA) of the UK and cyprus securities and exchange commission (cysec).

Now, what this means is that whenever you apply for the $30 welcome account, tickmill won’t have a chance to even think about scamming you. And if it does try to do that, the above-mentioned regulators will wipe it out from its existence, which in itself guarantees that you’re trading with a reliable brokerage.

On to the no deposit bonus itself

So, since we’ve established the reliability of tickmill, why don’t we take a look at its $30 welcome account and why it’s such an exciting offer?

As the broker elaborates, its welcome account is a risk-free promotion that doesn’t request anything from you. The only thing you need to do is register with the broker and start trading with the bonus money. And, as noted earlier, you don’t need to deposit money on your newly-created account.

Furthermore, it’s extremely easy to create the welcome account, and as soon as you’re done, tickmill will immediately credit $30 to your account balance – it’s that easy to claim the bonus money.

Here are some of the main terms and conditions of the tickmill $30 welcome account:

- Only the first-ever clients of tickmill are eligible for the welcome account;

- You don’t need to deposit any funds to get the bonus;

- All the profits you earn stay with you;

- Welcome account is only available within the jurisdiction of the FSA seychelles. Non-supported countries are: algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, lebanon, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, san marino, south africa, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan, kenya, as well as all EU countries;

- You have 60 days from the opening of the account to use the bonus money.

As for how to withdraw the profits you generated, you can use debit/credit cards, bank wire, and skrill.

Is tickmill welcome account what you’re looking for?

After everything we’ve just mentioned about this promotion, should you apply for the tickmill welcome account bonus? Is a $30 reward worthwhile of your time and effort?

Well, considering that it’s coming from a tightly-regulated broker and it has pretty flexible conditions, there’s no reason why you should deny the offer. Besides, it actually is free money and you’re not risking anything.

So, let's see, what we have: check out my deatiled tickmill forex broker review minimum deposits, spreads, and account types.Don't open account before read this tickmill review! At tickmill welcome bonus review

Contents of the article

- New forex bonuses

- Forex brokers lab

- Tickmill regulation and investor protection

- Tickmill spreads and account types

- Deposit and withdrawal methods.

- Final thoughts

- Tickmill review

- Broker details

- Live discussion

- Tickmill.Com profile provided by tickmill, nov...

- Video

- Traders reviews

- Welcome account

- A special welcome to the world of...

- Your perfect start with...

- NO RISK

- PROFITABLE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Conta de boas-vindas

- Boas-vindas especiais ao mundo das...

- O seu inicio perfeito com...

- GRATUITO

- ISENTO DE RISCO

- LUCRATIVO

- INSTRUMENTOS PARA NEGOCIAR

- CONDIÇÕES DE NEGOCIAÇÃO

- CONTAS DE NEGOCIAÇÃO

- PLATAFORMAS

- EDUCATIVO

- FERRAMENTAS

- PARCERIAS

- PROMOÇÕES

- SOBRE NÓS

- SUPORTE

- Tickmill – $30 welcome bonus

- Tickmill

- Forex brokers lab

- Tickmill regulation and investor protection

- Tickmill spreads and account types

- Deposit and withdrawal methods.

- Final thoughts

- Tickmill forex broker review – min deposit,...

- Tickmill regulation and investor protection

- Tickmill spreads and account types

- Trading products

- Trading platforms

- Promotions

- Deposit and withdrawal methods.

- Final thoughts

- A comprehensive tickmill review – is this broker...

- Initial overview

- What’s the software experience like on tickmill?

- Is tickmill legit?

- Trading terms and conditions

- Should you trade with tickmill?

- Tickmill $30 welcome account

- Why should you get to know tickmill first?

- On to the no deposit bonus itself

- Is tickmill welcome account what you’re looking...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.