Xm broker login

XM ultra low account offers 6 base currencies. The contract size varies from 1000 to 100,000 in one lot.

New forex bonuses

Spreads range from 0.6 pips. The minimum trading volume is 0.1 - 0.01 lots. Just like in previous accounts, there is an option for hedging and islamic account. The minimum deposit is $50. The first account provides 11 basic currencies for trading. There are 1,000 units in one lot. The minimum deposit is 5 dollars. Leverage is from 1:1 to 1:888. Spread on major instruments is at least 1 pip. The account does not charge any commissions and the minimum trading volume is 0.01 lot for MT4 and 0.1 lot for MT5. Therefore the account is perfect for beginners and traders with very small initial budgets.

XM indonesia login - types of accounts and accounts

XM indonesia login is a very simple operation in just a few minutes. Let's figure out together how to get a profile on an international brand platform.

To register an account, click on members login at the top of the official website. You will see the XM forex login form in your personal cabinet. If you don't already have a profile, scroll down to see the buttons:

The first one allows a demo account with broker XM login for 100,000 virtual dollars. Thanks to this amount, a beginner will practice all the skills necessary for trading for free and learn all the features of world markets. Also, the free account will help you to form a strategy to increase your chances of profit without expenses.

Types of accounts for beginners

The second button allows XM indonesia login account for real money. You can choose 1 of 4 basic account types for XM's login:

The first account provides 11 basic currencies for trading. There are 1,000 units in one lot. The minimum deposit is 5 dollars. Leverage is from 1:1 to 1:888. Spread on major instruments is at least 1 pip. The account does not charge any commissions and the minimum trading volume is 0.01 lot for MT4 and 0.1 lot for MT5. Therefore the account is perfect for beginners and traders with very small initial budgets.

Standard XM login account uses 11 base currencies. The contract amount of 1 lot is 100,000 units. The same leverage and spread as in the previous account type. There are no commissions for trading volume, and the minimum trading volume is 0.01 lot. Here too, the minimum deposit is 5 dollars. The account is suitable for traders with little experience.

XM ultra low account offers 6 base currencies. The contract size varies from 1000 to 100,000 in one lot. Spreads range from 0.6 pips. The minimum trading volume is 0.1 - 0.01 lots. Just like in previous accounts, there is an option for hedging and islamic account. The minimum deposit is $50.

6 asset classes - 16 trading platforms - over 1000 instruments.

Trade forex, individual stocks, commodities, precious metals, energies and equity indices at XM.

Stock trading XM indonesia

Share account uses only 1 base currency - dollar. The contract size is 1 share. Here, accordingly, there is no leverage. Spread is determined by the base exchange. There is a commission - its size is specified in the broker's policy. Minimum trading volume - 1 lot, minimum deposit - 10,000 dollars.

By registering one XM indonesia login, you get access to all types of accounts. Every client of the broker is entitled to an XM broker login of 8 trading accounts plus 1 stock account. Creating a personal area XM login gives you a lot of advantages!

6 asset classes - 16 trading platforms - over 1000 instruments.

Legal: this website is operated by XM global limited with registered address at no. 5 cork street, belize city, belize, CA.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, and trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (cysec) (licence number 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (license number IFSC/60/354/TS/19).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: forex and CFD trading involves a significant risk to your invested capital. Please read and ensure you fully understand our risk disclosure.

Restricted regions: XM global limited does not provide services for the residents of certain countries, such as the united states of america, canada, israel and the islamic republic of iran.

XM account login

Broker XM.Com was introduced in the year 2013 and instantly became famous for traders, as the company at that time already had a wealth of experience in financial markets; however, under a different name. The last name of the forex broker, under which he began his thorny journey to win the trust of clients - xemarkets. Both of these brands are owned by a holding corporation registered in cyprus. It is trading point holdings ltd which was established in 2009 by two greek ex-dealers. Having gained a wealth of experience, so to speak, "from the inside", they tried to take into account all the moments that are important for a trader, which provided the company with a reasonably easy start and today the broker XM.Com is already well known on the world stage.

XM broker singapore login: fund protection

Since the most important for each trader when choosing a broker is the issue of security of the invested funds, it is worth paying the most attention to this point. It is necessary to start with the fact that XM broker's head office is located in cyprus, so the parent company's activities are subject to cysec - cyprus securities commission, as well as european legislation with its stringent rules, which are prescribed in special EU directives for the operation of companies providing access to financial markets (mifid).

All customer accounts are kept with barclay, a world-class bank. The scheme of work of the broker completely excludes access to funds from his side.

XM broker login and registration

To pass the registration process on the official website of XM brokerage company, you do not need to spend much time and effort. It is enough to make a few simple steps to achieve this goal, namely:

Go to the page of the official site of XM brokerage company;

In the corner of the start page, find the registration column and click on it;

Fill in the registration form with all the data correctly;

Send personal data to the administration of the XM brokerage website;

Verify and confirm your identity by uploading passport scans.

After that, you will be able to trade and earn money with XM brokerage company without any problems.

6 asset classes - 16 trading platforms - over 1000 instruments.

Trade forex, individual stocks, commodities, precious metals, energies and equity indices at XM.

Trading conditions

The XM.Com broker offers three account types:

Micro for those who want to experiment on forex, but are not ready to invest large sums of money in it yet;

The standard is suitable for more experienced traders who have already seen the reality of making money in forex and want to increase their capital;

It will appeal to severe traders and fund managers, as it provides additional convenience.

The minimum deposit size for micro and standard is only $5. However, for standard - it is frankly not enough and will not allow working comfortably, and for executive will need more than $ 100 thousand. If you wish, you can work with the method of "islamic accounts" on any of the above.

The size of the leverage can be increased up to 1:888, but for executive, it is limited to 1:200. Spread is floating for all accounts - from 1 point.

Clients of XM broker can work with more than 100 assets, among which besides currency pairs, there are precious metals, stock indices, energy resources and so on.

6 asset classes - 16 trading platforms - over 1000 instruments.

Legal: this website is operated by XM global limited with registered address at no. 5 cork street, belize city, belize, CA.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, and trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (cysec) (licence number 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (license number IFSC/60/354/TS/19).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: forex and CFD trading involves a significant risk to your invested capital. Please read and ensure you fully understand our risk disclosure.

Restricted regions: XM global limited does not provide services for the residents of certain countries, such as the united states of america, canada, israel and the islamic republic of iran.

Xm broker login

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

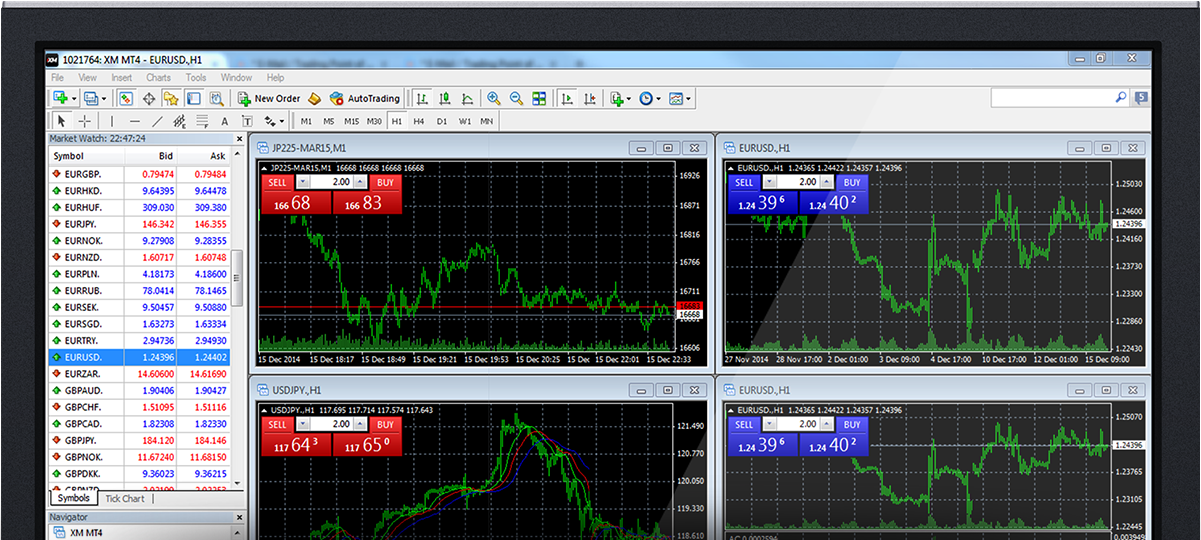

Metatrader 4 (MT4)

Why XM MT4 is better?

XM pioneered offering an MT4 platform with trading execution quality in mind. Trade on MT4 with no re-quotes, no rejection of orders and with leverage ranging from 1:1 – to 30:1.

XM MT4 features

- Over 1000 instruments including forex, cfds and futures

- 1 single login access to 8 platforms

- Spreads as low as 0 pips

- Full EA (expert advisor) functionality

- 1 click trading

- Technical analysis tools with 50 indicators and charting tools

- 3 chart types

- Micro lot accounts (optional)

- Hedging allowed

- VPS functionality

XM MT4, faster and better.

Gain access to the world’s financial markets.

- Download the terminal by clicking here. (.Exe file)

- Run the XM.Exe file after it has downloaded

- When launching the program for the first time, you will see the login window

- Enter your real or demo account login data

- Works with expert advisors, built-in and custom indicators

- 1 click trading

- Complete technical analysis with over 50 indicators and charting tools

- Built-in help guides for metatrader4 and metaquotes language 4

- Handles a vast number of orders

- Creates various custom indicators and different time periods

- History database management, and historic data export/import

- Operating system: microsoft windows 7 SP1 or higher

- Processor: intel celeron-based processor, with a frequency of 1.7 ghz or higher

- RAM: 256 mb of RAM or more

- Storage: 50 mb of free drive space

- STEP 1: click start → all programs → XM MT4 → uninstall

- STEP 2: follow the on-screen instructions until the uninstall process finishes

- STEP 3: click my computer → click drive C or the root drive, where your operating system is installed → click program files → locate the folder XM MT4 and delete it

- STEP 4: restart your computer

How can I find my server name on MT4 (PC/mac)?

Click 'file' -> click "open an account" which opens a new window, "trading servers" -> scroll down and click the + sign at "add new broker", then type 'XM' and click "scan".

Once the scanning has been done, close this window by clicking "cancel".

Following this, please try to log in again by clicking "file" -> "login to trading account" in order to see if your server name is there.

How can I gain access to the MT4 platform?

To start trading on the MT4 platform you need to have an XM MT4 trading account. It is not possible to trade on the MT4 platform if you have an existing XM MT5 account. To download the MT4 platform click here.

Can I use my MT5 account ID to access MT4?

No, you can’t. You need to have an XM MT4 trading account. To open an XM MT4 account click here.

How do I get my MT4 account validated?

If you are already an XM client with an MT5 account, you can open an additional MT4 account from the members area without having to re-submit your validation documents. However, if you are a new client you will need to provide us with all the necessary validation documents (i.E. Proof of identity and proof of residency).

Can I trade stock cfds with my existing MT4 trading account?

No, you can't. You need to have an XM MT5 trading account to trade stock cfds. To open an XM MT5 account click here.

What instruments can I trade on MT4?

On the MT4 platform you can trade all the instruments available at XM including stock indices, forex, precious metals and energies. Individual stocks are only available on MT5.

Metatrader 4, commonly nicknamed MT4, is a widely used electronic trading platform for retail foreign exchange, developed by the russian software company metaquotes software corp, which is currently licensing the MT4 software to almost 500 brokers and banks worldwide. Released in 2005, the MT4 trading software became extremely popular with retail forex traders especially for its easy to use features and the ability to even facilitate automated trading by allowing users to write their own trading scripts and trading robots (commonly known as expert advisors). For most online traders and investors, whether they are trading forex or cfds (contracts for difference on various financial instruments), metatrader 4, is undoubtedly a household name today.

Not only is MT4 considered to be the most popular online trading platform to access the global markets but it is also regarded as the most efficient software for retail foreign exchange trading (i.E. Especially developed for individual online traders). Online (or electronic) trading platforms are computer-based software programs used to place trading orders for various financial instruments through a network with financial institutions (e.G. Brokerage companies) that operate as financial intermediaries (i.E. Facilitate online transactions between buyers and sellers by executing their trades). Online investors can trade on live market prices being streamed by trading platforms, as well as enhance their profit potential with some additional trading tools provided by these platforms such as trading account management, live news feeds, charting packages and can even use trading robots, also called expert advisors.

As compared with today’s online trading platforms used for trading a series of financial instruments such as currencies, equities, bonds, futures and options, the very first such software versions were almost exclusively associated with stock exchange. Until the 1970s, financial transactions between brokers and their counterparties were still being processed manually, and traders did not have the possibility to access the global financial markets directly but only through an intermediary. It was also was during this time that electronic trading platforms started being applied to carry out at least a part of these transactions. The first such platforms were mainly used for stock exchange and known as RFQ (request for quote) systems, in which clients and brokers placed orders that were only confirmed later. Starting from the 1970s, e-trading platforms that did not provide live streaming prices were gradually replaced by more developed software with near instant execution of orders, along with live price streaming and more enhanced client user interface.

How MT4 developed

The very first generation of internet-based foreign exchange (forex) trading platforms emerged in 1996, making it possible for foreign exchange to develop at a much faster pace and for customer markets to expand. As a result, web-based retail foreign exchange allowed individual customers to access the global markets and trade on currencies directly from their own computers. Although the first generation of such electronic trading platforms was basic software downloadable to computers and still lacking user-friendly interfaces, gradually new features such as technical analysis and charting tools were added, resulting in more enhanced attributes and also the option for these programs to be used as web-based platforms and on mobile devices (e.G. Smartphones, tablets) compatible with automated tools such as trading robots.

Along with the introduction of online trading platforms, a rapidly growing segment of the foreign exchange market had also emerged, which involved individuals who could access the global markets and trade online through brokers and banks: retail forex. This market segment allowed even small investors to access the markets and trade with smaller amounts. The demand for technically more sophisticated trading platforms kept growing, in particular for retail forex trading, and the need grew for individuals to trade the global markets directly. Released in 2005, the metatrader 4 online trading platform was just the kind of software that made it possible for a great number of retail forex traders to speculate and invest in currency exchange and other financial instruments from virtually every spot of the world.

Usage of metatrader (MT4)

Currently, over half a million retail traders are using the MT4 platform in their daily trading practices, benefitting from its wide range of features that facilitate their investment decisions such as automated trading, mobile trading, one-click trading, news feed streaming, built-in custom indicators, the ability to handle a vast number of orders, an impressive number of indicators and charting tools. Suitable for both beginner and seasoned traders with versatile investment skills and practices, MT4 can be regarded today’s ultimate trading software in virtually every spot of the globe.

MT4 and automated trading

Automated trading is well known to online investors as a helpful tool to automatically process trade orders with extremely fast reaction time and according to a series of pre-determined trading rules (such as entries and exits) set up by traders by using the MQL programming language of metatrader4. Also known by the name of system trading, automated trading has another great advantage: as it carries out trades mechanically and based on the settings of traders, it excludes the emotional factor from trading, which may very often affect investment decisions negatively. Thus it has the ability to handle trading on investors’ behalf, along with all the analytical processes involved in the trading process.

The cutting-edge technology of the MT4 platform provides automated trading as its fully integrated feature, executing repetitive trading orders at a speed otherwise impossible with manual trading. For many investors this saves up a considerable amount of time from the routine of market watch as well as trade execution.

Backtesting (i.E. Testing trading strategies on prior time periods) is yet another advantage of automated trading in that it applies trading rules to historical market data and so it helps investors assess the efficiency of several trading ideas. On applying proper backtesting, traders can easily evaluate and fine-tune trading ideas, which they can later apply in their own trading practices for better results. Effective as it is, automated trading is also a sophisticated method to trade the markets and as such it, mainly for beginner traders, it is advisable to start with small sizes during the learning process.

Additionally, potential mechanical failures can also affect the outcome of trades carried out by the automated system, and many traders with poor internet connection are compelled to also manually monitor trades being handled by automated trading. In order to exclude any negative factors such as slow internet connectivity, computer failures, or unexpected power cuts, the optical fibre connectivity based free MT4 VPS (virtual private server) service of XM ensures smooth operations of automated trading and expert advisors at all times by allowing clients to connect to the MT4 VPS and enjoy seamless trading.

Automated trading and MQL

Automated trading is undoubtedly one of the most popular features of metatrader 4. It is remarkable data in itself that since 2014, over 75% of the united states stock share trades, including NASDAQ and the new york stock exchange, have been carried out through automated trading system orders. The fact that today automated trading on the MT4 software is also available for retail traders and investors is a huge plus, allowing trading not only on stocks but also on foreign exchange (forex), futures and options. The MT4 platform uses MQL4, a proprietary scripting language for implementing trading strategies, which helps traders to develop their own expert advisors (i.E. Trading robots), custom indicators and scripts, as well as to test and optimize their eas with the MT4 strategy tester.

MQL4 encompasses a great number of functions that enable traders to analyse previously received and current quotes, follow price changes by means of built-in technical indicators and not just manage but continuously control their trading orders. Over 30 custom technical indicators are at traders’ disposal on the MT4 software and available on various financial instruments besides forex, which helps investors identify price dynamics patters, market trends and also to determine possible entry and exit points, as well as to manage trading signals.

The trading programs written in the MQL4 programming language serve different purposes and present traders with various features. Expert advisors, which are linked to specific charts, provide valuable information to online investors about possible trades and can also perform trades on their behalf, sending the orders directly to the trading server. Along with this, by using MQL4, investors can write their own custom indicators and use them in addition to those already available on the MT4 client terminal. MQL4 also includes scripts, but unlike expert advisors, these do not execute any pre-determined action on traders’ behalf and are meant to handle the single execution of certain trading activities.

Mobile trading and MT4

Metatrader4 was designed by taking into account all the requirements of the 21st century technology and thus it ensures flexibility at its very best, the core of this being mobility. This is exactly why the MT4 mobile trading option allows investors to also access the trading platform, apart from their windows and mac operating system based pcs, directly from their smartphones and tablets. Trading portfolio as well as multiple trading account management and/or monitoring is thus possible practically speaking on the go. Having the ability to manage multiple trading accounts from one interface and from portable devices like smartphones, pocket and tablet pcs gives investors a definite edge in trading, while the software’s compatibility with the IOS operating system allows mac users to follow up with market changes 24 hours a day and place trades directly from iphone, ipad or ipod touch.

The MT4 mobile trading makes it extremely easy for online investors to follow the global markets at any time and from anywhere, place and execute orders instantly and of course manage their accounts even when away from their home pcs. Additionally, mobile trading also provides a wide array of analytical options and the graphical display of quotes for proper account management. Since the MT4 mobile trading options are exactly the same for smartphones and tablets as for trading from table pcs, online investors can perform their trading activities at the same speed and with the same trading tools for best results.

Review

Introduction

XM was first started back in 2009 in london and now they have an offering of more than 400 different instruments.

This includes over 350 cfds, as well as 57 currency pairs and 5 cryptocurrency cfds. XM is regulated by the FCA in the united kingdom and they have european passports with the mifid, as well as being regulated by the cysec in cyprus, as well as being regulated in australia as an ASIC entity.

They offer more than 30 language options for their users and they cater for any and all levels of trader. One of the recent awards they have received is being named as the best FX broker in europe in 2018 by the world finance magazine.

- Over 30 supported languages

- Numerous esteemed awards

- Regulated by well-respected authorities

Trading conditions

XM offer three different types of account for their users. The micro account is best suited to beginners, with the standard account being ideal for flexible traders. The XM zero account generally is best suited for regular traders or those who place significant trades.

Depending on the specific instrument, for each of the account types you will be dealing with leverage ranging from 1:1 up to 30:1. While there are seven base currency options available with micro and standard accounts, you can only deal with USD and EUR when you have a XM zero account.

You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission. Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

XM always have a range of promotions they are running at any given time. They have a 100% deposit bonus up to $5,000, they have free VPS services and there are no fees on both deposits and withdrawals.

- Wide ranging promotions

- Commission free account options

- 3 different account types

Products

In total, there are 356 different cfds offered by XM, with five of these being cryptocurrency cfds. There are 57 currency pairs on offer and they don’t offer any ETF products.

- 356 CFD options

- No ETF products

- 57 currency pairs

Regulation

Having been around since 2009, XM are regulated by a number of trusted authorities. They are authorised in the european union, as well as being regulated by the FCA in the united kingdom. They have the necessary approval from the cysec in cyprus as well as being a ASIC regulated entity in australia.

Platforms

The only platform that is offered by XM is metatrader, which is an industry standard trading platform. They offer both metatrader 4 and metatrader 5 and they have tweaked them slightly to suit the specific needs of their users.

You have access to virtual trading, but those using mac desktop computers will not be able to run this trading platform optimally. There are 51 different trading indicators available to you and there are 31 charting tools you can utilise.

- Metatrader is the only trading platform available

- 51 trading indicators

Mobile trading

As a result of being a metatrader only platform, you will able to utilise the platforms on ios and android devices, whether it is through the MT4 or mt5 apps which can be downloaded straight away from either the app store or the android play store.

There are 30 trading charting indicators available on the mobile apps and you have the full range of trading instruments to choose from with these apps.

Pricing

With XM the amount of fees and commission that you have to pay will be dependent on what sort of account you have with them. There are three different account types in total. You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission.

Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

Lower overall spreads can be achieved by XM as they are the sole dealer in every single trade.

- Competitive spreads thanks to XM being the sole dealer

- Varying commissions and fee levels depending on account type

Deposits & withdrawals

With the micro and standard account types, you are not subject to a minimum deposit, but usually you will have to deposit at least $5 due to system requirements. There is a minimum required deposit of $100 for the XM zero account type.

All of the usual forms of deposit and withdrawal are available with XM, such as neteller moneybookers, debit and credit cards and skrill. Most of the deposit options will allow you to have your deposit processed instantly. Bank transfers will take between 2 and 5 business days to process though.

When it comes to withdrawing from XM, most options will have your withdrawal processed within 24 hours without having a minimum required withdrawal. If you are withdrawing via a bank transfer, then you will have to wait between 2 and 5 business days for it to be processed and there is a minimum withdrawal of $200 in place.

- Variety of banking options

- Quick processing times

Customer support

More than 14 languages are catered for through the customer support service at XM. You can reach them no matter what time of day it may be through their live chat feature.

You can also give them a call or send them an email, with the team working on weekdays only.

- 14 languages catered for

- 24/5 customer support

Research & education

There is a library of free educational materials for XM users including the likes of week interactive webinars and video tutorials. They always have the latest news from the world of forex as well as providing regular market analysis from the team of experts at the platform. They also have a range of tools and calculators that provide everything a trader needs when making certain calculations.

Noteworthy points

As a whole XM is a trusted broker that has a solid and unspectacular offering for their users. They look after the needs of their clients through quality customer support and they have regular promotions such as a free VPS service.

As they are completely reliant on metatrader platforms, those familiar with the sector can easily utilize the broker as it is similar to a lot of other offerings out there.

Catering for 30 languages and having received numerous awards in recent years, including being named as the best FX broker in europe in 2018 by the world finance magazine, they hold a reputable place in the sector.

- 30 languages catered for

- Free VPS service

- Best broker in europe 2018 – world finance magazine

Conclusion

XM is a broker that has been around since 2009 and now employs more than 300 people. They have a diverse offering of instruments, which caters for the needs of their users in an adequate manner.

As they are reliant on metatrader for the trading software, you are not going to be surprised by anything on this front. They have a decent welcome bonus, matching your first deposit 100% up to a max bonus of $5,000.

They have a wide ranging section for education, including free weekly webinars that are interactive. It is an ideal learning ground for beginner traders and with three different account types, they cater for all kinds of traders depending on what their specific needs may be.

If you are looking for a platform that is easy and straightforward to use and that looks after their users, XM could be the right option for you.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

XM broker

XM broker review explained by professional forex trading experts, all you need to know about XM broker login, for more information about XM.Com broker you can also visit XM review by forexsq.Com currency trading website, the top forex broker ratings fx brokers website and the fxstay.Com online investing company and get all information you need to know about XM trading forex broker.

XM broker review

XM broker‘s trading platforms is too diversify, maximum forex brokers offer an industry-leading platform such as MT4 and combine this with a good mobile app. XM,com provides 9 platforms, five of which are keen to desktop computers and 4 that are keen to mobile traders. They really do not leftover any chance to live up to the right of “valuing trading competence” and provide for traders of all levels and necessities. These stages are below defined in brief detail.

XM broker account types

There are 4 types of XM.Com broker trading account types:

XM.Com broker zero account

XM zero accounts provide spreads as little as 0 on 56 currency pairs, silver and gold and the leverage up to 500:1.

XM broker micro trading account

This kind of account is suitable for those who need to accept a low risk approach near investing. This trading account essentials a really low minimum initial deposit of just 5 dollars.

XM.Com broker standard trading account

The standard trading account is more suitable for the expert and more skilled traders. Though the profits are the similar as micro trading accounts, traders with standard trading accounts can trade with greater contract size.

XM.Com broker managed forex accounts

Customers who don’t have the involvements or time to trade for they can also trust on the extra services provided by XM through the method of managed accounts. An expert account manager will help customers’ with their trades and also assistance to manage their assets for them.

XM broker islamic account

Knowing that the forex market is a universal marketplace, it also make payments for those traders who request to trade in accord with their spiritual belief. The islamic trading permits traders to bearing trades based on sharia ideologies.

XM broker demo account

Through the XM forex trading demo account, traders can trial out their trading approaches without having to risk real money. Every demo account is providing with 100,000 dollars in virtual money so traders can attempt to simulate real trading situations.

XM broker deposit and withdrawal methods

They take the most normally used banking approaches today comprising electronic payments, credit cards, local bank transfers, bank wire transfers, western union and moneygram. Their coverage is fairly extensive and enhances more suppleness on adding assets into the account.

XM broker login

To do XM broker login you can visit the broker website and after sign up with the broker you can check your email and do XM broker login.

XM broker review conclusion

However the XM.Com broker is regulated but invest the amount you can afford to lose it as online trading contains risk of losing your money.

By this XM forex review now you know all about XM trading platform, there is other XM broker review on the internet to know about XM MT4, XM login and XM download, if you like this XM forex broker review then share it please and help other currency traders to know about this XM trading review.

Akses ke member area

Gunakan akun riil MT4/MT5 dan kata sandi untuk masuk pada login anggota.

Baru di XM?

Legal: situs ini dioperasikan oleh XM global limited dengan alamat terdaftar no. 5 cork street, kota belize, belize, CA.

Trading point holdings ltd adalah perusahaan induk dari trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd dan trading point MENA limited.

Trading point of financial instruments limited diotorisasi dan diregulasi oleh komisi sekuritas dan bursa siprus (cysec) (nomor lisensi 120/10).

XM global limited diotorisasi dan diregulasi oleh komisi jasa keuangan internasional (IFSC) (nomor lisensi 000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd diotorisasi dan diregulasi oleh komisi investasi dan sekuritas australia (AFSL 443670).

Trading point MENA limited diotorisasi dan diregulasi oleh otoritas jasa keuangan dubai (DFSA) (dibawah nomor F003484).

Peringatan resiko: trading forex dan CFD melibatkan risiko yang signifikan terhadap dana investasi anda. Mohon untuk membaca dan memastikan bahwa anda telah paham dengan pengungkapan risiko kami.

Wilayah terbatas: XM global limited tidak menyediakan layanan untuk warga negara di beberapa negara tertentu, seperti amerika serikat, kanada, israel dan iran.

Kami menggunakan cookies untuk memberikan anda pengalaman terbaik di website kami. Baca lebih lanjut atau ubah pengaturan cookie anda.

Peringatan resiko: modal anda berisiko. Produk dengan leverage mungkin tidak cocok untuk semua orang. Mohon pertimbangkan pengungkapan risiko kami.

Website ini menggunakan cookies

Dengan mengeklik “lanjutkan”, anda setuju dengan pengaturan awal cookie di website kami.

XM menggunakan cookies untuk memastikan bahwa kami memberikan anda pengalaman terbaik saat mengunjungi website kami. Beberapa cookies dibutuhkan untuk memberikan fitur-fitur esensial seperti sesi login, dan tidak bisa dinon-aktifkan. Cookies lainnya membantu kami meningkatkan performa website dan pengalaman anda melalui konten yang dipersonalisasi, memberikan fitur media sosial dan menganalisa traffic anda. Cookies seperti ini juga termasuk cookies pihak ketiga, yang mungkin merekam penggunaan website anda. Anda bisa mengubah pengaturan cookies kapanpun.

Pelajari lebih lanjut atau ubah pengaturan cookies. Anda

Pengaturan cookies anda

Apakah itu cookie ?

Cookie adalah berkas data kecil. Ketika anda mengunjungi situs web, situs web ini mengirimkan cookie ke komputer anda. Komputer anda menyimpannya dalam berkas yang terletak di dalam browser web anda.

Cookie tidak mentransfer virus atau malware ke komputer anda. Karena data dalam cookie tidak berubah ketika ia bolak-balik, juga tidak memiliki cara untuk memengaruhi cara komputer anda berjalan, namun, mereka bertindak seperti log (yaitu merekam aktivitas pengguna dan mengingat informasi lengkap) dan mereka diperbarui setiap kali anda mengunjungi situs web.

Kami akan mendapat informasi tentang anda dengan mengakses cookies yang dikirimkan oleh situs kami. Beberap tipe cookies menulusuri beragam aktifitas. Sebagai contoh, session cookies digunakan ketika seseorang secara aktif menjelajah suatu situs. Seketika anda meninggalkan situs, session cookie akan hilang.

Apa gunanya cookies ?

Kami menggunakan cookie fungsional untuk menganalisis bagaimana pengunjung menggunakan situs web kami, serta melacak dan meningkatkan kinerja dan fungsi situs web kami. Ini memungkinkan kami untuk memberikan pengalaman pelanggan berkualitas tinggi yang dengan cepat mengidentifikasi dan memperbaiki masalah apa pun yang mungkin timbul. Misalnya, kami mungkin menggunakan cookie untuk melacak halaman situs web mana yang paling populer dan metode penautan mana di antara halaman situs web yang paling efektif. Ini juga membantu kami melacak, apakah anda dirujuk ke kami oleh situs web lain dan meningkatkan kampanye iklan kami di masa mendatang.

Penggunaan lain dari cookie adalah untuk menyimpan sesi login anda, yang berarti bahwa ketika anda masuk ke login anggota untuk menyetor dana, "cookie sesi" diatur sedemikian, sehingga situs web dapat mengingat bahwa anda sudah masuk. Jika situs web tidak mengatur cookie ini, anda akan diminta untuk login dengan kata sandi di setiap halaman baru, saat anda melakukan proses pendanaan.

Selain itu, cookie fungsional, misalnya, digunakan untuk memungkinkan kami mengingat preferensi anda dan mengidentifikasi anda sebagai pengguna, memastikan informasi anda aman untuk beroperasi lebih andal dan efisien. Misalnya, cookie menghemat pengetikan nama pengguna anda setiap kali anda mengakses platform trading kami, juga mengingat preferensi anda, seperti bahasa apa yang ingin anda lihat ketika anda masuk.

Berikut adalah ikhtisar dari beberapa fungsi yang diberikan cookie kami:

- Memverifikasi identitas anda dan mendeteksi negara anda saat ini

- Memeriksa tipe browser dan piranti anda

- Menelusuri dari situs mana pengguna berasal

- Memungkinkan pihak ketiga untuk merubah konten

Situs web ini menggunakan google analytics, layanan analitik web yang disediakan oleh google, inc. ("google"). Google analytics menggunakan cookie analitis yang ditempatkan di komputer anda, untuk membantu situs web menganalisis penggunaan situs web oleh pengguna. Informasi yang dihasilkan oleh cookie tentang penggunaan situs web anda (termasuk alamat IP anda) dapat dikirimkan dan disimpan oleh google di server mereka. Google dapat menggunakan informasi ini untuk mengevaluasi penggunaan situs web anda, untuk menyusun laporan tentang aktivitas situs web dan untuk menyediakan layanan lain yang terkait dengan aktivitas situs web dan penggunaan internet. Google juga dapat mentransfer informasi ini kepada pihak ketiga, jika diharuskan untuk melakukannya oleh hukum, atau di mana pihak ketiga tersebut memproses informasi atas nama google. Google tidak akan mengaitkan alamat IP anda dengan data lain yang dimiliki. Dengan menggunakan situs web ini, anda memberikan persetujuan anda kepada google untuk memproses data tentang anda dengan cara dan untuk tujuan yang ditetapkan di atas.

Atur perubahan

Silahkan pilih tipe cookies yang anda ingin simpan dalam perangkat anda.

Xm broker login

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Extraordinary underwriting for exceptional brokers

Our expanded selection of MGA solutions are designed to provide our brokers with the competitive edge. We provide exclusive underwriting capacity for a wide range of markets. Our enhanced variety of products and attractive rates of commission are all designed to help you win and retain more business. Welcome to XO.

What we do

XO is one of the longest established insurance portals, providing specialist underwriting services and solutions to brokers nationwide.

- Over 30 products and schemes available

- Competitive commissions

- Online quote, buy, MTA & renewals

- Secure login

- Simplified question sets

- Offline facilities

- Supported by an experienced in house team

- Single point of contact for all facilities

- Only available to fully authorised brokers

Let’s talk commercial products

Real flexibility with XO commercial products

Providing peace of mind for on the road business needs

Your clients will benefit from our unique scheme with our insurance partners.

Whether your clients are builders or plumbers, we work closely with our insurance partners to bring you bespoke underwriting solutions.

We work with our established insurance partners to offer comprehensive cover at competitive prices to non-trade risks.

Competitive cover solutions for goods and tools in transit.

Domestic or business, we have capacity to offer insurance solutions for both options.

Our turnover product offers no restrictions on the number of employees or labour only subcontractors, which will provide your clients with more flexibility.

Working with our underwriters, we can offer tailor-made CAR policies designed to meet the needs of your clients; from small to medium sized contractors covering various building and civil engineering risks.

Address

2-3 sir alfred owen way, barclay house, caerphilly, CF83 3HU

XO, xbroker, constructaquote.Com and black and white are trading names of moorhouse group limited, registered in england and wales, company number: 3825233, data protection number: Z481498X, registered address: barclay house, 2-3 sir alfred owen way, caerphilly, CF83 3HU.

Authorised and regulated by the financial conduct authority under firm reference number 308035. This can be checked on the financial services register at www.Fca.Org.Uk/register.

Copyright © 2021 moorhouse group ltd. All rights reserved.

So, let's see, what we have: find out what types of accounts and accounts are available in XM indonesia login. What are the features and benefits of accounts and which traders are best suited for them? At xm broker login

Contents of the article

- New forex bonuses

- XM indonesia login - types of accounts and...

- Types of accounts for beginners

- Stock trading XM indonesia

- XM account login

- XM broker singapore login: fund protection

- XM broker login and registration

- Trading conditions

- Xm broker login

- Metatrader 4 (MT4)

- Why XM MT4 is better?

- XM MT4, faster and better.

- How can I find my server name on MT4 (PC/mac)?

- How can I gain access to the MT4 platform?

- Can I use my MT5 account ID to access MT4?

- How do I get my MT4 account validated?

- Can I trade stock cfds with my existing MT4...

- What instruments can I trade on MT4?

- How MT4 developed

- Usage of metatrader (MT4)

- MT4 and automated trading

- Automated trading and MQL

- Mobile trading and MT4

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- XM broker

- XM broker review

- XM broker account types

- XM.Com broker zero account

- XM broker micro trading account

- XM.Com broker standard trading account

- XM.Com broker managed forex accounts

- XM broker islamic account

- XM broker demo account

- XM broker deposit and withdrawal methods

- XM broker login

- Akses ke member area

- Baru di XM?

- Xm broker login

- Extraordinary underwriting for exceptional brokers

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.