Hotforex minimum deposit

The different deposit and payment channels include: (risk warning: your capital can be at risk)

New forex bonuses

Hotforex minimum deposit – guide for beginners

Deposit is the process by which traders deposit funds into their hotforex trading accounts. When starting out to trade forex and cfds, there are many things you have to learn and be quite familiar with. These range from actual analysis (fundamental and technical) to how the trading platforms work. You should however be quite knowledgeable of the financing side of your relationship with your online broker.

You must be quite aware of the process of moving funds in and out of your broker account. Most importantly, you should have information such as the minimum deposit required to trade with such a broker. This piece takes you through the minimum deposit required for trading with hotforex.

Official website of hotforex

Facts about the hotforex minimum deposit:

- The minimum deposit is $ 5

- The minimum deposit is depending on the account type

- Micro account $ 5

- Premium account $ 100

- Zero spread account $ 200

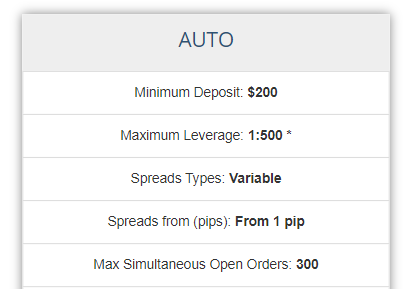

- Auto account $ 200

- PAMM account $ 250

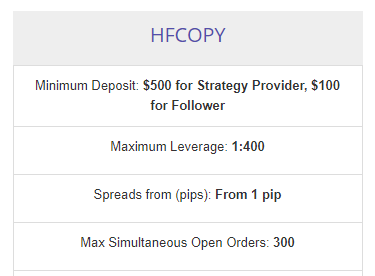

- HFCOPY $ 500 for strategy provide, $ 100 for follower

- Multiple payment methods are available

(risk warning: your capital can be at risk)

How to deposit on hotforex:

There are several methods through which you can deposit funds into your hotforex trading account. The broker actually provides traders with multiple options – and this is quite commendable. With the diverse options provided, traders are free from the restrictions placed by the inaccessibility of certain payment channels in whatever countries they may reside in.

The different deposit and payment channels include:

- Bank wire

- Unionpay

- Credit cards

- Bitpay

- Litecoin

- Ethereum

- Ripple

- Fasapay

- Neteller

- Skrill

- Vload

- Webmoney

Once you created a trading account you can choose the deposit method and invest your money. We recommend verifying the trading account with the requested documents before depositing.

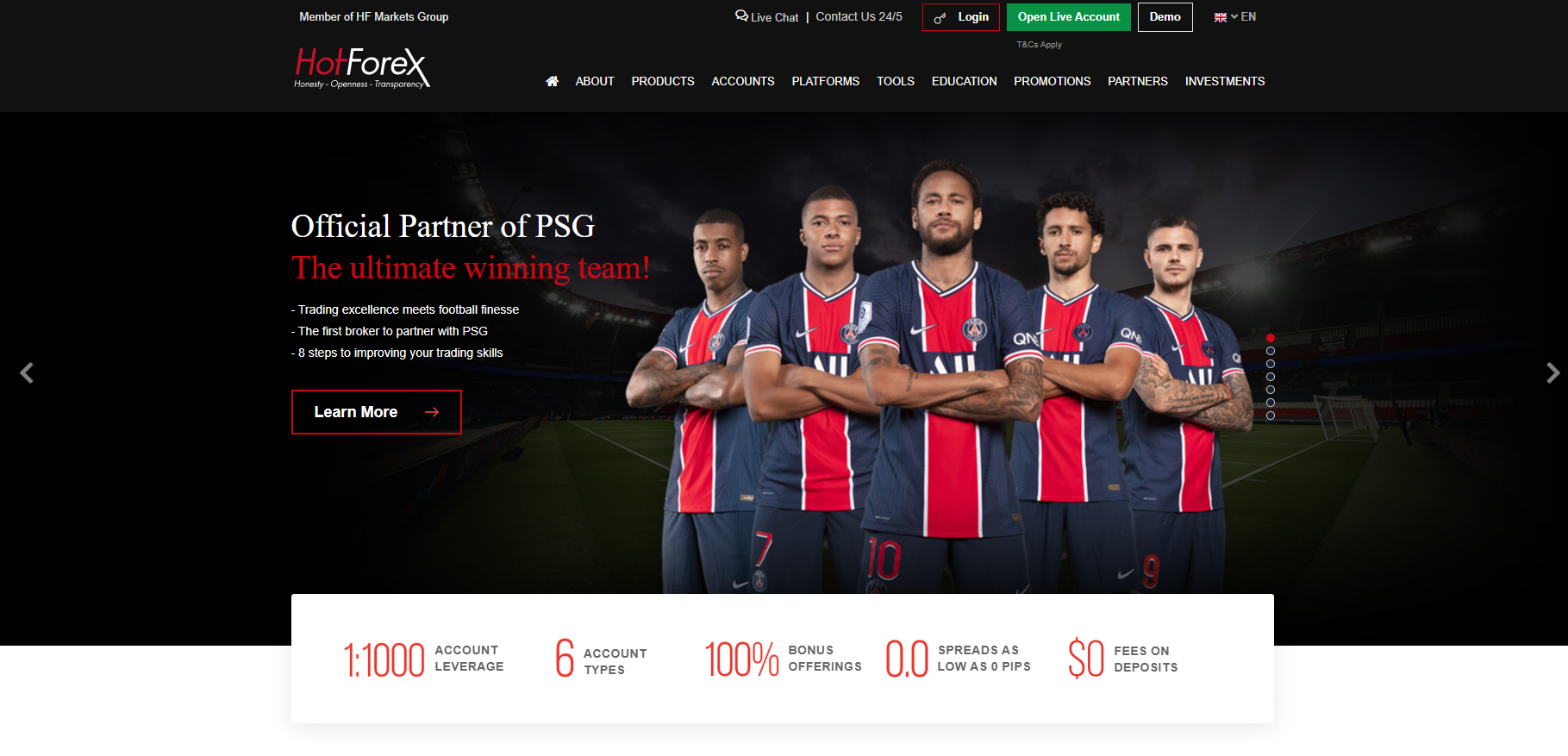

Introduction to hotforex

Hotforex is a globally recognized broker providing forex and CFD trading services to traders all over the world. Currently, it is reportedly present in at least 180 countries and boasts of millions of active traders on its platforms daily. These traders come from asia, africa, and europe, and increasingly, latin america. It has its headquarters in mauritius but with area offices in cyprus, johannesburg (south africa), seychelles, and st vincent and the grenadines.

Hotforex is licensed by multiple reputable regulatory bodies. For one, it is regulated by the dubai financial services authority (DFSA) as well as the highly reputable financial conduct authority (FCA), the financial sector conduct authority (FSCA) of south africa, and the financial services authority (FSA) of seychelles as a securities dealer. Then, it has a license with the financial services commission (FSC) of mauritius. The broker is also registered under the international business companies (amendment and consolidation) of st vincent and the grenadines.

Trading with hot forex

Trading with hot forex is similar to trading with other brokers to some extent. However, there are some unique features provided as well.

Markets and types trading

Hot forex primarily provides forex trading. However, it has now expanded to comprehensive derivatives trading – especially in cfds. Unfortunately, it does not allow for spreadbet trading. Markets available include cryptocurrencies, metals, stocks, indices, and of course, currencies. It offers multiple account types (up to 6, as we will see later) as well as an array of quality trading tools and indicators some of which are proprietary.

One of the most remarkable things to note about hot forex is that it enables trading via a whopping twelve (12) trading platforms. This means that traders can trade from as many platforms as they desire.

Types of accounts in hot forex and minimum deposits

Hotforex, just like most other quality brokers, offers different types of accounts for its traders. Each account type comes with its own features. Usually, what differentiates each account is the minimum deposit that is required to be deposited into the accounts.

The accounts are mainly divided into the demo account and the live account. The demo account is a free account. The live account is that which requires you to deposit funds to be able to trade. There are 5 types of accounts under the live account category. We discuss the account types and their features below:

Demo account (no minimum deposit)

A demo account is a type of trading account containing virtual money. This account is provided by a broker to traders using its platform. With a demo account, you can make trades and do almost every other thing that you do when using a live trading account. However, you cannot withdraw the funds or whatever profits you make with the account. Nevertheless, as you will see, a trading demo account is a must-have.

Uses of a demo account

Listed below are ways in which the demo account has proven invaluable:

- To practice trading skills

For newbie traders, the demo trading account gives you the opportunity to put to practice whatever trading skills you might have learned. Here, you are trading real-life market situations but with fake money, without any risks coming whatsoever on your part.

- To test a trading platform

Before you sign up with a particular broker and commit your capital to it, you may want to test such a broker first.

There is no better way to do so than with a demo account. With a demo account, you get to know how trading works with the broker, those instruments that you can get to trade with it, or whatever currency your trading account will be denominated in. With these, you can easily decide if the broker is worth it or not. As such, it is recommended that before you register with hot forex, you first use its demo account for some time.

- To test a strategy or system

Even as an experienced trader, you will still need a demo account. From time to time, you will develop or come across new trading strategies, but you will need to test their effectiveness or profitability before you commit them to your live account. Your demo trading account gives you the best opportunity to do so without incurring any risks. Hot forex provides traders with a $100,000 demo account. This is quite commendable.

(risk warning: your capital can be at risk)

Live accounts:

There is an array of options to pick from when it comes to the live account trading with hot forex.

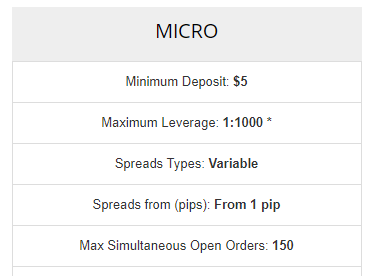

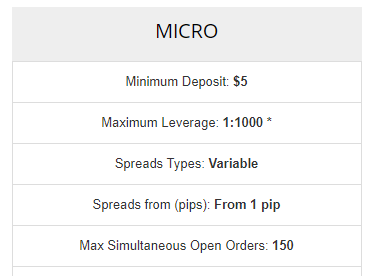

Micro account ($ 5 minimum deposit)

The hotforex micro account is a great option if you want to trade with slightly lower stakes. It is available to traders in cysec, SV, and FSCA areas. The leverage you are allowed on this account also depends on your area. Due to cysec regulations, 1:30 is the limit in the EU, but under SV and FSCA, this limit stretches as far as 1:1000. The trading platforms made available also depend on your location. MT4 is always available, but MT5 is only accessible to those within the range of SV or FSCA bodies.

Zero account (§ 200 minimum deposit)

Everyone with a hotforex and HF markets zero account can benefit from a variable spread that starts from 0 pips on major forex markets. This also has no mark-ups. These accounts are available under cysec, FV, FCA, DFSA, and FSCA regulations. They are known as VIP accounts under DFSA regulation though.

The competitive spread from this account type is marginally balanced by the charging of commission which is generally $6 per round turn on a single lot. These fees can also be paid in your native currency depending on location. Back to leverage where the maximum HF markets leverage in the EU stays at 1:30. This also applies to FCA regulated traders. Under DFSA you can avail of 1:50, and the big leverage is available under SV and FSCA regulation where you can get 1:500 leverage on this account type.

Again, the available trading platforms will also depend on where you are located. MT4 is available on this account type under cysec, SV, DFSA, and FSCA regulations. MT5 is added if you are under FCA in the UK.

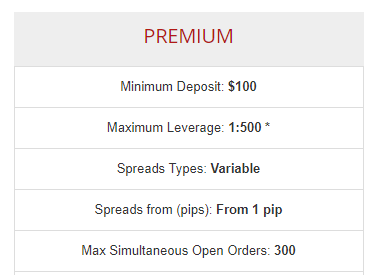

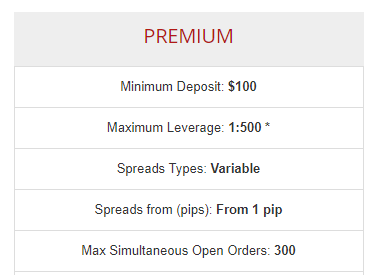

Premium account ($ 100 minimum deposit)

The VIP account obtainable with the hotforex entity is available if you are trading under DFSA regulations and as we described above, it is very similar in nature to the zero account type. There are a few more benefits included. Direct contact with your own hotforex relationship manager is one such benefit.

To open this type of account though, you will need to deposit at least $20,000. Again, however, the variable spread starts at 0 pips and with no markups. Your only costs should be commission which is levied at $12 per round turn on a lot of 44AED per lot. Fees may be higher outside of major currency pairs. Maximum hotforex leverage for this account type is 1:500 and the only trading platform facilitated is MT4.

Hotforex premium account

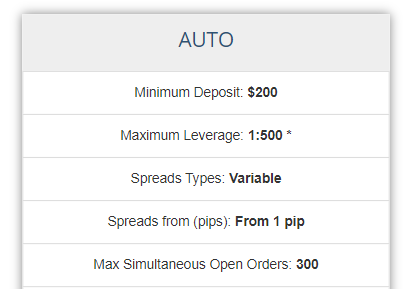

Auto account

This is available under both SV and FSCA regulation and connects with MQL5 to access signals and other benefits from the community. You can access leverage of 1:500 through this account type and the platforms available once again depend on your location. MT4 is available in both areas, but MT5 and HF API are only available to SV registered traders.

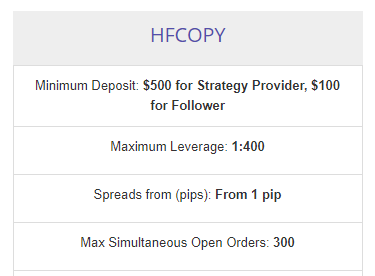

Hfcopy account

The HF copy account is available to traders regulated by cysec or SV bodies and this account allows you to be a copy trader or a provider for others. The social aspect of the account, available on both hotforex and HF markets broker branches, means you can have as many as 400 followers or more if permitted on request. Through this HF copy account, you can only trade in forex, gold, and bitcoin with the leverage restricted to 1:30 under cysec, and 1:400 under SV regulation.

Hotforex hfcopy account

Conclusion on the hotforex minimum deposit

There are many things that can get complicated with dealing with and trading forex. From learning how to trade to knowing how to navigate trading platforms and depositing, the whole process is not always straightforward. The above guide should serve you well for this purpose. Overall, hotforex is a professional broker with good conditions. It is possible to trade with small and big minimum deposits.

(risk warning: your capital can be at risk)

HOW MUCH IS HOTFOREX MINIMUM DEPOSIT?

It might be difficult for beginners or even experienced traders when choosing a broker to work with or to try out new strategies. To help you have an easier option in this problem, we will review one of the most famous brokers in the forex market nowadays, the hotforex broker, about some of the most important factors like hotforex regulation, hotforex minimum deposit, or hotforex spread.

About hotforex

Hotforex is a retail forex brokerage, offering attractive conditions for trading in a wide range of instruments. In order to suit the needs of traders of all preferences and levels of experience, hotforex has a strong connection with liquidity providers and offers its clients a variety of account types to choose from. They use the fundamental MT4 trading platform for their operations. Plus, if you use any operating system that allows web-based, it is also a fine option. They have a very tight spreads policy to improve the rivalry with others, in addition, you can find better leverage on the hotforex website. The assistance service is also a key part to choose this brokerage since it has a nice and abundant team to serve its customers. It is right to say that they have the strongest support service in the market. “trustworthiness, openness, and clarity” is a popular quote we usually see about this intermediary.

How much is hotforex minimum deposit?

Minimum deposit is the required amount of money that a trader has put in the account to start trading. Many traders want a low minimum deposit because they usually want to test the broker first. Some broker can require up to hundreds of dollars while some just need a few bucks.

Hotforex minimum deposit is $5 for the micro account, one of the lowest rates in the market. For other accounts, you can check right here:

For EU clients:

| Min. Deposit | max. Leverage | spread | |

| micro account | $50 | 1:500 | 1 pip |

| premium account | $500 | 1:400 | 1 pip |

| zero account | $100 | 1:200 | 0 pip |

| fixed account | $500 | 1:400 | fixed |

| VIP account | $20,000 | 1:300 | 0.2 pip |

| auto account | $500 | 1:400 | 1 pip |

For clients outside EU:

| Min. Deposit | max. Leverage | spread | |

| micro account | $5 | 1:1000 | 1 pip |

| premium account | $500 | 1:400 | 1 pip |

| zero account | $100 | 1:200 | 0 pip |

| fixed account | $500 | 1:400 | fixed |

| VIP account | $20,000 | 1:300 | 0.2 pip |

| auto account | $500 | 1:400 | 1 pip |

| PAMM account | $250 | 1:300 | 1 pip |

Other extraordinary characteristics of hotforex

We know the basics about hotforex, but what makes them a better choice? There are some attributes that the firm lists out for us:

- Founded in 2010 in mauritius by industry professionals and around 10 years of operation.

- It is registered to the cysec regulations and holds licenses from FSCA. Plus, there are also licenses from FCA, DFSA, and FSA.

- Your fund is safe thanks to the segregation into a large number of accounts in various international banks.

- Over 140 selections in 20 markets to do transactions such as cfds, forex pairs, energies…

- An operating system that permits web-based or MT4 platform can be a tool to work with hotforex

- Many accounts for traders to choose from and they have good benefits: premium, auto, micro, VIP, fix, hfcopy;

- There are particular accounts that have no spread like a zero account or a “swap-free islamic” account. For HF markets clients, there is also a PAMM account.

- A lot of ways to deposit your money;

- Up to 27 languages are provided for clients and the client support is available at every working time.

Spreads & leverage

Like most brokers, hotforex takes a fee from the spread, which is the difference between the buy and sell price of an instrument. The spread it offers is tight and the special fixed spread account is only available for scalpers or automated traders. Leverage differs from each account hotforex provides such as 1:500 for micro, 1:300 for VIP and 1:400 for premium. However, EU traders have the highest leverage rate of 1:30.

Deposits and withdrawals

Don’t worry if you don’t know how to deposit your fund since hotforex supports all debit cards and major currency through services: neteller, fasapay, mybitwallet… same as all international brokerages, you are required to submit legally mandated information whenever you want to take your money back.

Beginner support

Hotforex supports a wide range of languages and support options for its customers. Up to 27 languages can be supported and if you have any problem, feel free to contact them whenever it occurs in trading days. Phone, email, and chat are usually used to help clients. Moreover, there are many educational posts for you to do research and study the market.

Conclusion

We must admit that hotforex deserves to be a top tier broker in the trading forex. After almost 10 years of activity, it has claimed customer’s trust thanks to many factors. There are the MT4 trading platform that suits any operating system, good trading costs, low hotforex minimum deposit, rival leverage and spreads, and significant customer support. For those reasons, we recommend you to choose hotforex to cooperate with.

Looking for the best customer service in FX trading? Read our hotforex review today!

- Website: www.Hotforex.Com

- Phone: +357-24-400561

- Office address:

- Spirou kyprianou 50 irida 3 tower 10th floor,

- Larnaca 6057

- Cyprus

Hotforex is quite new to the forex trading market concerning the popularity and brand awareness, even though the company has been in operation since 2008. The broker has recently re-invented its customer-oriented attitude by offering an excellent customer service platform, which has enabled the company to receive a ton of awards from several recognized institutions from europe, asia, africa, and the middle east. The primary requisite for any broker to achieve recognition in the forex trading industry is to listen to their customers, which is exactly the strategy that hotforex followed to achieve immense success among global retail traders.

Hotforex is also extremely popular among introducing brokers and affiliates, and it is indeed seen as a positive approach by the company to promote its brand among lesser known markets. The company’s prime attention towards ensuring an excellent customer-service oriented brokerage service is one of the key reasons why existing hotforex clients continue to do business with the broker.

Hotforex regulation is also one of the hot topics of discussion among traders, as hotforex is one of the few brokers that have multiple regulatory statuses throughout the world. Hotforex is regulated by the st. Vincent & the grenadines regulatory authority, the cysec in cyprus, and the FSC of the republic of mauritius under the HF markets moniker. It is interesting to note that the broker has based its corporate offices in some of the highly popular tax havens in the world, which can be a bit of an issue with traders from countries such as the US and australia. US-based brokers are required to be regulated by the CFTC and be a member of the NFA to be able to offer their services to US citizens. Nevertheless, almost all the modern regulatory organizations these days are committed to the welfare of traders in general, which is a good thing, considering that the number of scams is increasing on a day-by-day basis.

What are hotforex trading account specifications?

Hotforex has covered a significant part of the financial markets by offering forex, metals, energies, indices, shares, cfds, etfs, and binary options through its different trading accounts. Hotforex certainly understands their clients’ tastes and preferences, which is why they have incorporated a multitude of trading instruments to offer a diverse product portfolio. However, when it comes to choosing an account, hotforex provides nine different types of accounts, which is a lot for the average trader. The minimum deposit required to open an account is $5, while the maximum hotforex leverage is 1:1000. In our opinion, the leverage is too high for a forex trader, but larger accounts have comparatively rational leverage to the tune of 1:400 or lesser margin. The different types of trading accounts are as follows:

EU clients:

- Micro account: $50 deposit, 1:500 leverage, spreads from 1 pip

- Premium account: $500 deposit, 1:400 leverage, spreads from 1 pip

- Zero account: $100 deposit, 1:200 leverage, spread from 0 pip

- Fixed account: $500 deposit, 1:400 leverage, fixed spread

- VIP account: $20,000 deposit, 1:300 leverage, spreads from 0.2 pips

- Auto account: $500 deposit, 1:400 leverage, spread from 1 pip

Non-european clients:

- Micro account: $5 deposit, 1:1000 leverage, spreads from 1 pip

- Premium account: $500 deposit, 1:400 leverage, spreads from 1 pip

- Zero account: $100 deposit, 1:200 leverage, spread from 0 pip

- Fixed account: $500 deposit, 1:400 leverage, fixed spread

- VIP account: $20,000 deposit, 1:300 leverage, spreads from 0.2 pips

- Auto account: $500 deposit, 1:400 leverage, spread from 1 pip

- PAMM account: $250 deposit, 1:300 leverage, spread from 1 pip

European clients cannot receive bonuses and apply for the PAMM account.

The zero account, currenex account, and the VIP account options are ECN platforms that provide tight spreads along with a commission per trade. The auto and HF social accounts are social trading accounts that allow investors to copy trades from other successful traders. Hotforex has excellent trading conditions, and the only problem is that traders can be confused by the sheer number of options available, which can negatively affect the broker’s conversion ratio. On a positive note, hotforex offers an account for every type of trader, which is one of the reasons why hotforex continues to be a popular FX broker among modern traders. The hotforex spreads are also highly competitive, and the spreads starting from 1 pip for the standard accounts are acceptable.

All accounts have access to the full range of trading instruments, and can be traded using the MT4 as the standard hotforex trading platform. Meta trader is the most commonly used and highly popular trading terminal for forex traders, which has prompted hotforex to utilize several versions of the MT4 terminal across its different account offerings. The MT4 mobile apps for ios, android, and windows devices serve as the hotforex mobile trading platform, while the MT4 webtrader can be used for both desktop and mobile trading. The MT4 multiterminal can be used to manage multiple accounts, and is a useful tool for PAMM account holders or for traders who trade on multiple investor accounts.

How can I receive A hotforex bonus?

Deposits are taken care of through credit cards, bank transfers, online payment processors and e-wallets such as skrill and neteller. Traders can make instant deposits and withdrawals. However, withdrawals do take some when compared to the time required for deposits. Accepting a bonus also puts several trading conditions into play, which should be satisfied before making a withdrawal request.

Hotforex has multiple channels for customer support, including live chat, web contact form, active phone numbers, emails, and multi-lingual support. The broker has made it exceptionally clear that dedicate their service towards maintaining an excellent relationship with their traders by keeping their client’s welfare in their mind, and this is the very core principle of the company that is guaranteed to ensure the safety of the traders and keep them secure against broker issues in the highly risk financial markets.

Is hotforex a good broker?

Yes, the hotforex online broker is a very good choice for retail traders. They offer several account types to EU and international clients, are regulated by several bodies including cysec, CFTC and the FSC of mauritius, and offers attractive bonuses to traders in eligible jurisdictions.

Does hotforex have bonus?

Yes, hotforex offers clients in eligible regions a no deposit trading bonus. To claim this offer you must complete the registration process and enter the corresponding sign-up code. Terms and conditions and country restrictions apply.

What type of broker is hotforex?

Hotforex is an online STP/ECN broker which offers its clients several account types across two trading platforms. Most of the account types have STP execution policies, yet you can enjoy ECN trading opportunities by registering for a zero spread account.

What is the minimum deposit at hotforex?

The minimum deposit for an account at hotforex depends on the account type and region you are trading from. For international traders, micro accounts start at $5 deposits. For EU traders, premium accounts start at $100.

How long is hotforex withdrawal?

Hotforex withdrawal times vary depending on which payment method you choose. The broker will process your request within 48 hours, yet transaction times can take between 2-10 business days on credit cards and wire transfers. E-wallets are the fastest withdrawal method, with instant results after processing.

Hotforex broker review – the pros and cons

Hotforex review

Any trader will tell you how important having a good broker is in trading. Hotforex is a reputable forex broker that includes many options and a variety of tools for its user. Read our review to learn more about hotforex and if this forex broker is right for you.

About hotforex

Hotforex has been operational in the industry since 2010. The broker is headquartered in st. Vincent and the grenadines, and has an operational base in cyprus. They have grown substantially in the 9 years since first becoming active. This is exemplified through the number of traders they now accommodate, coupled with their regulation by a varied number of global bodies. This regulation includes within the EU through cysec, and five other global regulatory bodies.

Hotforex account opening

Hotforex offer a total of 6 account types. Three of these, micro, premium, and zero, are suitable for regular traders. This offering is quite similar to the account types offered by FXTM . Auto, PAMM, and hfcopy accounts are also available for those with a more specific nuance in their form of trading.

Ultimately, there are a wide variety of options available for traders wishing to open an account, and there is bound to be something suitable for everyone.

Minimum deposit

The minimum deposit to trade with hotforex is variable. This depends on your account type selection and ranges from $5 for a micro account to $200 minimum deposit for a zero account with spreads from 0 pips. Premium accounts are available for a minimum deposit of $100 through the broker.

Availability and ease of opening

Hotforex accounts are widely available for opening to traders around the globe. The only exceptions to this rule apply in the following locations: USA, canada, sudan, syria, and north korea.

Opening a hotforex demo account is a hassle-free process. Simply input your basic personal information and email address to access a range of demo accounts. These include individual, joint, and corporate options. $100,000 is available to virtually trade for an unlimited time when you open a hot forex demo account.

Opening a hotforex live account includes a few more steps, but is equally accessible. Simply upload your ID and residence document verification to get started with real trading.

Hotforex product offerings

Hotforex product offering bridges an extensive range of markets. They manage to feature a total of 49 forex currency pairings. This covers major forex pairs, along with both minor and a range of exotic pairs. This is a large number of markets even when compared with product review of other top brokers .

Offerings also extend into other markets, with more than 100 other cfds offered in indices, metals, commodities, shares, bonds, and 8 cryptocurrency pairs against both the U.S. Dollar and euro.

This should provide a more than adequate range for any trader, regardless of experience level or standing in the industry.

Commissions and fees

Hotforex generally offer commission-free trading to the majority of their users. The exceptions to this are on the PAMM account, where commission is $10 per round turn on every 100,000 units of currency traded, and the zero account where this commission ranges between $8-$12 per 100,000 units. The commission charged on this account is off-set by the more competitive spreads offered.

Non-trading fees

Hotforex is very generous in terms of non-trading fees. This means there are no fees for any deposits or withdrawals to your hotforex trading account. There is also no fee for inactive accounts. This is a coup for the broker, since inactivity fees are typically prevalent through other major brokers.

The broker does charge a swap fee. These are variable depending upon the markets and interest. More information on swap fees and how to obtain an islamic account here.

Hotforex platforms and tools

Hotforex is a metatrader only broker. This means is offers only metatrader platforms. These are widely respected in the industry and still account for several platform variants. This includes MT4 & MT5 for desktop, web, and mobile.

Desktop platform

Hotforex MT4 and MT5 trading platforms line up in much the same manner as with other platforms. As always, they are the leader in terms of charting capability and the volume of technical indicators provided. They also offer the opportunity to employ automated trading strategies through the ever-popular expert advisors function.

In terms of usability, they cut a rudimentary style on the image front. This however makes them very fast and durable thanks to the lack of unnecessary visuals. All functionality is controlled through the side toolbars where up to date news provided by fxstreet can be accessed.

The central console window is also highly customizable, and the added bonus for hotforex users is that they can avail of the premium trader add-on from blue labs. This does significantly enhance the analytics and visual environment of the platform and can be utilized to the benefit of many traders to gain a much greater insight into their trades and potential trades.

Mobile trading platform

The MT4 trading platform is available for both ios and android devices, providing the same excellent range of features and charting prowess in app form. The mobile trading platform is both easy to access and navigate, with only a few simple and clearly labeled screens.

The MT4 trading platform in mobile format focusses on many of the same goals as its desktop counterpart. This is to make trading both accessible, fast, and well-informed. Traders can utilize a wide range of indicators as well as having access to an economic calendar, and the latest news and alerts on the go.

Education and research

Hotforex webinars are second to none when it comes to educational quality and professional delivery. These are regularly delivered by a host of industry experts and when combined with the range of e-courses, guides, and video tutorials offered by the broker, it is clear that hotforex has dedicated both time and effort to creating a lasting educational infrastructure for the benefit of traders.

The broker is also rising strongly in terms of research capabilities which it provides to traders. These include access to autochartist tools, as well as a newly updated HF app which allows traders to track the performance and analytics of their portfolio at all times. The broker also feature their own dedicated research site. This offers in-house analytics, news, and market information compiled by the hotforex team of experts.

Ultimately, these represent strong offerings in both areas which area a major attraction for both new and experienced traders.

Hotforex differentiators

One of the key points which separates hotforex from other brokers in the industry is that of its extensive regulation. They are one broker who do not shy away from being regulated. This sends a very positive message to both current and potential traders.

The wide variety of account types offers convenience to every level of trader which is also not often seen within the industry. The fact that both PAMM and copy trading are also facilitated from the outset is something which is certain to be a welcome also to more experienced traders or those wishing to engage in copy trading.

Hotforex customer service

The broker provides an extensive network of customer support. This is available on a 24/5 basis and includes telephone support contact in 9 countries. Support team members are also available by email in a number of languages, and web-enabled live chat.

Every method of customer support is well reviewed by current traders, and they are also available to those who are yet to open an account who may have questions. The broker website also features a basic FAQ section which highlights some fundamental questions traders may have.

Trustworthiness

Trust is understandable at the core of any trader’s mindset. This is something hotforex caters well for thanks to a variety of provisions.

They have been operating in the sector, to high levels of industry recognition for almost a decade. Added to that, they are regulated via some of the most stringent financial bodies in the financial world. The fact they are regulated by more bodied than most other major brokers, only serves to heighten the feeling of trust among traders.

Looking to the future, they have recently gained approval to operate under the oversight of the dubai financial services authority (DFSA) . This clearly demonstrates their intention to continue fostering global trust in their operations.

Conclusion

Overall, hotforex performs well in all major areas which would be under consideration from new or experienced traders when selecting a broker. This is further highlighted by the fact they have claimed many industry awards. With a growing user base, expanding compliance, and a continually trader-focused outlook on the future, hotforex represents an excellent choice for anyone considering entry to forex trading, or a change of broker.

�� hotforex minimum deposit, account funding methods & withdrawal fees (2020)

Hotforex minimum deposit

Hotforex’s minimum deposit amount to open a real account is US dollar 5 or 70 ZAR.

This minimum deposit amount in ZAR required by hotforex is predetermined and not subjected to the current exchange rate between the US dollar and the south african rand.

Hotforex is a broker which is authorized and regulated by four different regulating entities, namely the cysec, FCA, DFSA, and FSCA, and as a regulated broker, one of the requirements is that client funds be kept in segregated accounts.

In complying with this, amidst several other strict rules and regulations, all client funds must be kept separate from the broker account, and it can only be used by traders to conduct trading activities.

10 best rated forex brokers

MT4, MT5, avatrade social

MT4, MT5, C trader, R trader

You might also like: FXCM MINIMUM DEPOSIT

Deposit fees and deposit methods

Hotforex’s minimum deposit when opening a live account is a lot lower than what other brokers require but traders need to ensure that, before opening positions, they have enough funds to cover the margin requirement.

Traders will need to make sure of fees that may be waived by their payment providers in case there are fees that are charged on transactions when depositing funds into the trader’s hotforex account.

Hotforex offers clients the following ways in which funds can be deposited into the trading account:

- Bank wire transfer

- Credit/debit cards

- Skrill

- Bitcoin cash, and

- Bitcoin

Hotforex supports the following deposit currencies in which traders can fund their accounts:

- USD, and

- ZAR

Step by step guide to deposit the minimum amount

As soon as the trader has registered for a live account with hotforex and the account has been verified and approved, the trader can follow these steps to deposit the minimum amount into the trading account:

- The trader can log in to their hotforex account/client portal/trading platform.

- On the account, the trader can click on ‘deposit’ and select their preferred deposit method.

- The trader can then follow through with paying the minimum amount due using their preferred deposit method.

Traders should take note that depending on the payment method used, some transactions may take a certain amount of time depending on the method, time of the day, and day of the week.

Pros and cons

| PROS | CONS |

| low minimum deposit amount | limited payment methods supported |

| no deposit fees | limited deposit currencies supported |

What is the minimum deposit for hotforex?

How do I make a deposit and withdrawal with hotforex?

Hotforex offers the following popular deposit and withdrawal methods:

- Bank wire transfer

- Credit/debit cards

- Skrill

- Bitcoin cash, and

- Bitcoin

Hotforex prohibits third party payments. Deposits and withdrawals must be to and from the same account that the trader registers when opening a live account.

Does hotforex charge withdrawal fees?

No. There is no mention of withdrawal fees, but traders may be liable for fees waived by their banking institution on some, or all, payment methods and this needs to be verified with the specific preferred payment provider.

How long does it take to make a withdrawal?

This will depend on the method used as some payments may reflect instantly such as credit/debit cards and E-wallets whereas others such as bank wire may take several days.

Home » forex » �� hotforex minimum deposit, account funding methods & withdrawal fees (2020)

Hotforex review

Ranking

Minimum deposit:

Max leverage:

Overview

XM.Com is located in limassol, cyprus and is always at the top of variousranking. They were found in 2009 and have grown into a global industrialgiant with more than 3.5 million customers.

Account types

Micro accounts: are a perfect for beginner traders, who doesn’t want to risk a lot of money. It has minimal deposit of 5$ and 100 lot restricted contract size, with 1 lot being 1,000. This account type is also commission free and costs are only the spreads.

Trading platform

XM.Com does not have their own trading platform; instead, they use meta-trader. On the one hand, MT4 and MT5 are the most popular platforms in the world, on the other – an outdated design and the absenceof price warnings. However, the intuitive interface and access to programming make meta-trader very popular.

- Max levarge – 1:400

- Minimum deposit – $100

- Spreads from – spreads from – 0 PIPS

- Hotforex

- Overview

- Account types

- Trading platform

- Deposit & withdraws

- Markets

- Customer support

- Safety

- Final thoughts

Overview:

HF markets is an award winning forex broker with 10 years market presence. They have over 2 million live opened accounts. HF markets are highly regulated by different authorities and provide their customers different account options, trading platforms, tools and services. The company is actively participating in different charity organizations like recross, sos children villages mauritius, UNICEF and other.

Account types:

There are four customer account types: premium account has $100 minimum deposit, variable spreads from 1 PIP and maximum 300 simultaneous open orders. Zero spread account with minimal deposit of $200, close to 0 PIP spreads and 500 allowed at the same time open orders. HFCOPY account has social trading functions where clients can copy professional trades’ transactions. There is €1000 minimum deposit for strategy provider and €300 for follower. Premium pro account has $500 minimum deposit, 1:400 maximum leverage and variable spreads from 1 PIP.

Trading platform:

HF markets provides the metatrader4 platform. MT4 is one of the most popular trading platforms in the world and is used by most forex brokers. The advantages of MT4 are that it is very easy to use and allows you to access custom scripts. There is also a mobile application and a web browser version. However, there are some disadvantages. Meta trader has a very outdated user interface.

Deposit & withdraws:

HF markets offers a wide variety of deposit and withdrawal options. A big advantage is the lack of commissions. A deposit can be made using bank transfer, credit cards and online payments. The minimum deposit is 50 dollars, except for bank transfer (250 dollars). Online payment options are neteller, skrill and sofort banking. The minimum withdrawal is $5 and $150 for a bank transfer.

Markets:

HF markets provide access to wide range of trading instruments. Cryptocurrencies like bitcoin, etherium, litcoin and ripple are available for leverage trading 24/7; large number of currency pairs is available with almost 0 pips spread; variety of precious metals like gold; the world leading indices cfds

Customer support:

HF markets provide a customer support via life chat, email and phone. They have also an additional phone numbers for their spanish and german customers and another one for a global support. Polish customers can use separate email address for polish speakers poland@hfeu.Com.

Safety:

HF markets are regulated by cyprus securities and exchange commission (cysec), UK financial conduct authority (FCA), dubai financial services authority (DFSA), south african financial sector conduct authority (FSCA) and seychelles financial services authority (FSA). HF markets provides insurance without additional costs their clients. Civil liability insurance program with €5,000,000 limit safe clients against company liabilities and market coverage against errors, omissions, negligence, fraud and various other risks that may lead to financial loss. Addition to that HF market are using segregation of funds, when clients’ funds held in separate accounts from those used by the company. These funds cannot be used to pay back creditors in the unlikely event of the default of the company.

Final thoughts:

HF market is highly respectable financial service provider, which put a lot of efforts to safeguard their clients’ funds. The company provides different account types and a wide range of trading instruments. Within the last 10 years HF markets has become one of the market leaders with a certain amount of influence.

Visit site

Hotforex

- Trading instruments somewhat limited

- Banking options limited

- No real promotions

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Hotforex has been around since 2010 when it was started in mauritius. They are a leader when it comes to providing forex services online, as well as being a worldwide CFD broker. They place an emphasis on their customer.

Currently, there are a number of jurisdictions in which the broker is regulated in, including the cyprus securities and exchange commission (cysec), the financial service provider from the financial sector conduct authority (FSCA) in south africa, and the financial services commission (FSC) in mauritius.

They have won numerous awards since they started their business operations, including being part of the top 100 companies list that was compiled by the world finance magazine in 2017.

On the hotforex platform, there are 27 different languages catered for.

- Founded in 2010 in mauritius

- Regulated by numerous respected bodies

- Winner of many esteemed awards

Trading conditions

One of the key components of hotforex as a broker is to cater for all of the potential needs their customer may have. This is why they have a massively diverse range of account types available for you to choose from, with seven different options on offer, which is extremely high in this sector.

The options available to you are the micro, premium, zero, VIP, auto, hfcopy , PMAA, and premium pro accounts. Each of them has their own strengths and weaknesses, so you need to ensure that in opening an account, you choose an option that best suits your specific needs.

With the micro account, it is suitable for beginners, with a minimum deposit of $50 required, with spreads starting from 1 pips and variable spreads in general. For those looking to minimise fees and spreads, the zero account has raw spreads with 0 mark-up.

This means that you will be dealing with very tight spreads and low commissions. If you are a high roller, the VIP account could be for you as a result of the minimal fees associated with its use and very competitive spreads.

There is a minimum required deposit of $20,000 on this account type. The auto account allows you to copy automatically the advice given by the signals and indicators which are provided from expert analysis systems that have been created at hotforex.

Leverage is going to change depending on the type of account and the type of instrument you are looking to trade.

While often times hotforex has interesting bonuses and promotions running, at the moment they do not having anything of note on offer. In the past for example, if a client deposited 250 USD into his/her approved bonus scheme account he could receive a 100 % supercharge bonus credit of 250 USD. The rescue bonus applied to deposits over 50 USD. If a client deposited 100 USD, he/she could receive 30 USD as part of a rescue program. The rescue program could be used as a stop loss as there is was no limitation in using it for trading. Users were able to receive the rescue bonus after a loss cut. Unfortunately this is not a current promotion, but it may be worth looking out for such bonuses in the future.

- 6 different account types to choose from

- Competitive spreads

- Flexibility of options

Products

In terms of the trading instruments offered by hotforex, you can deal with everything from cryptocurrencies, forex, metals, indices, shares, energies, commodities and bonds.

There are more than 50 different currency pairs available and they currently have 53 different shares available as part of their offering.

- 53 shares available to be traded

- Over 50 currency pars to be traded

Regulation

Under their official name of HF market group, they are regulated in a number of different territories.

They are a cypriot investment firm (CIF) and are regulated by the cysec (license number: 183/12). They are regulated by the FSC of the republic of mauritius (license number: C110008214) as well as being incorporated in st. Vincent and the grenadine as an international business company (license number 22747 IBC 2015), they are authorised by the FSCA in south africa (authorisation number 46632), as well as being regulated by the seychelles FSA (license number SD015).

With such wide ranging regulatory bodies approving of hotforex, you can sleep well at night knowing your funds will be kept safe.

- Regulated by numerous respected bodies

Platforms

Like a lot of forex brokers, hotforex utilises metatrader as their trading platform. This is ideal for those traders who are well used to using this trading platform and it is quite easy to pick up for those who don’t have any experience using it.

There are many different features and tools available to you as part of this platform which helps to enhance the ability of the trader.

There are many different version of metatrader 4 available with hotforex, including their desktop, multi-terminal, web browser, iphone, ipad, android and general smartphone versions of the trading software.

There is also a proprietary hotforex rapidtrader API available to users which allow traders to get direct market access, as well as being able to conduct automated trading without needing to use the metatrader 4 platform.

- Variety of metatrader platforms to choose from

- Proprietary trading platform option

Mobile trading

As a result of being a metatrader only platform, you will able to utilise the platforms on ios and android devices, through the metatrader 4 (MT4) app which can be downloaded straight away from either the app store or the android play store. There is also a version for general smartphones that do not fall under the android or iphone categories.

There are 30 trading charting indicators available on the mobile apps and you have the full range of trading instruments to choose from with these apps.

- Quality mobile offering

Pricing

With hotforex, the amount of fees and commission that you have to pay will be dependent on what sort of account you have with them. There are seven different account types in total.

For the most part, there are variable tight spreads offered at hotforex in addition to their specialised account for scalpers that are fixed spread and the automated trading account which has the same spread prices as interbank.

For their zero account in which there are no spreads, commission is charged at a tiered rate. Generally, for trades sized up to 1,000 there will be $0.08 charged per round turn, $0.80 charged per round turn for a trade size of up to 10,000 and $8 per round turn for trades sized up to 100,000.

- The typical spread you can expect for EURUSD is 1.2 pips

- Competitive spreads

- Variety of pricing models depending on account type

Deposits & withdrawals

There are many different deposit and withdrawal options available for users of the hotforex platform. Mastercard and visa cards are of course catered for in addition to the likes of skrill, american express, neteller, mybitwallet, webmoney and bank transfers.

The minimum required deposit for a bank wire transfer is $250, with the minimum required deposit for all other options being set at $50. Hotforex do not charge any fees for these payment options.

Depositing via bank transfer will take between 2 and 7 working days whereas the other options will have their deposits processed almost instantly. In terms of withdrawals, they will start to be processed within 24 hours after the request has been submitted.

The minimum withdrawal amount is $5 for all options except the bank transfer, with the minimum withdrawal being $150. It will take the bank transfer and credit cards between 2 and 10 working days for withdrawals to be fully processed. Withdrawals made through the likes of neteller and skrill will be processed almost instantly.

- Processing times are average

- Payment options somewhat limited

Customer support

You can get in touch with a member of the hotforex customer support team 24 hours a day. You have the option of sending an email, talking to a representative via live chat or ringing them over the phone. There are different numbers you need to ring depending on the specific region you are located in.

There are more than a dozen languages catered for through the customer support team and the support is available five days per week. They also have a comprehensive FAQ section in which you will very likely find answers to your questions.

- Customer support available 24/5

- Comprehensive FAQ section

Research & education

Hotforex have an extensive education section as part of their platform to help their traders as much as possible. They have everything from live webinars to market analysis, general training videos and step by step courses.

All of these resources are available to anyone and they are ideal for those trading out their trading journey and more experienced traders alike.

Noteworthy points

Hotforex has a VPS hosting service if you need it and they have a whole host of trading tools, calculators and market analysis all in one place that will fit all of your needs.

It really is a one stop shop for all of your trading needs, as they look after the needs of their users from start to finish.

They are well respected in the industry and this is reflected by the numerous awards they win each and every year. They are involved with numerous charities, including the likes of unicef and red cross, as well as sponsoring numerous events over the years, such as the 2017 carrera cup.

The platform is easy to use and with more than 27 languages catered for, they cover most of the bases.

- Support of numerous charitable organisations

- Over 27 languages

- VPS hosting service

Conclusion

Hotforex is a one stop shop for all of your trading needs, whether you are new to trading or have many years of experience

They have a great education centre which will allow you to educate yourself on all manners of training, as well as keeping up to date with the latest market analysis.

Their customer support team is always available to help and they have tried and trusted banking options which keep your funds safe and sound. They’re regulated by numerous respected bodies across the world and have competitive pricing across the board through their various account types.

Overall, hotforex is one of the best brokers on the scene today and are definitely a great option if you are looking for a new broker.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

Deposit minimum hotforex – panduan untuk pemula

Deposit adalah proses di mana pedagang mendepositkan dana ke dalam akaun dagangan hotforex mereka. Apabila mula berdagang forex dan CFD, terdapat banyak perkara yang anda perlu belajar dan agak akrab dengan. Ini terdiri daripada analisis sebenar (asas dan teknikal) untuk bagaimana platform dagangan berfungsi. Walau bagaimanapun, anda harus berpengetahuan tentang sisi pembiayaan hubungan anda dengan broker dalam talian anda.

Anda mesti sedar proses memindahkan dana masuk dan keluar dari akaun broker anda. Yang paling penting, anda perlu mempunyai maklumat seperti deposit minimum yang diperlukan untuk berdagang dengan broker sedemikian. Sekeping ini membawa anda melalui deposit minimum yang diperlukan untuk berdagang dengan hotforex.

Laman web rasmi hotforex

Fakta mengenai deposit minimum hotforex:

- Deposit minimum ialah $5

- Deposit minimum bergantung kepada jenis akaun

- Akaun mikro $ 5

- Akaun premium $ 100

- Akaun zero spread $ 200

- Akaun auto $ 200

- Akaun PAMM $ 250

- HFCOPY $ 500 untuk strategi menyediakan, $ 100 untuk pengikut

- Pelbagai kaedah pembayaran tersedia

(amaran risiko: modal anda boleh berisiko)

Bagaimana untuk mendeposit di hotforex:

Terdapat beberapa kaedah di mana anda boleh mendepositkan dana ke dalam akaun dagangan hotforex anda. Broker sebenarnya menyediakan pedagang dengan pelbagai pilihan – dan ini agak terpuji. Dengan pelbagai pilihan yang disediakan, peniaga bebas daripada sekatan yang diletakkan oleh ketidakupayaan saluran pembayaran tertentu di mana-mana negara yang mereka mungkin tinggal di.

Saluran deposit dan pembayaran yang berbeza termasuk:

- Pindahan bank

- Unionpay

- Kad kredit

- Bitpay

- Litecoin

- Ethereum

- Riak

- Fasapay

- Neteller

- Skrill

- Vload

- Webmoney

Sebaik sahaja anda membuat akaun dagangan, anda boleh memilih kaedah deposit dan melabur wang anda. Kami mengesyorkan mengesahkan akaun dagangan dengan dokumen yang diminta sebelum mendepositkan.

Pengenalan kepada hotforex

Hotforex adalah broker yang diiktiraf di seluruh dunia yang menyediakan perkhidmatan dagangan forex dan CFD kepada pedagang di seluruh dunia. Pada masa ini, ia dilaporkan hadir di sekurang-kurangnya 180 negara dan mempunyai berjuta-juta peniaga aktif di platformnya setiap hari. Peniaga-peniaga ini berasal dari asia, afrika, dan eropah, dan semakin, amerika latin. Ia mempunyai ibu pejabatnya di mauritius tetapi dengan pejabat kawasan di cyprus, johannesburg (afrika selatan), seychelles, dan st vincent dan grenadines.

Hotforex dilesenkan oleh pelbagai badan pengawalseliaan yang bereputasi baik. Untuk satu, ia dikawal selia oleh lembaga perkhidmatan kewangan dubai (DFSA) serta pihak berkuasa kelakuan kewangan (FCA) yang bereputasi baik, lembaga kelakuan sektor kewangan (FSCA) afrika selatan, dan lembaga perkhidmatan kewangan (FSA) seychelles sebagai peniaga sekuriti. Kemudian, ia mempunyai lesen dengan suruhanjaya perkhidmatan kewangan (FSC) mauritius. Broker juga didaftarkan di bawah syarikat perniagaan antarabangsa (pindaan dan penyatuan) st vincent dan grenadines.

Berdagang dengan hot forex

Berdagang dengan hot forex adalah serupa dengan perdagangan dengan broker lain sedikit sebanyak. Walau bagaimanapun, terdapat beberapa ciri unik yang disediakan juga.

Perdagangan pasaran dan jenis

Hot forex terutamanya menyediakan perdagangan forex. Walau bagaimanapun, ia kini telah berkembang kepada perdagangan derivatif yang komprehensif – terutamanya dalam CFD. Malangnya, ia tidak membenarkan perdagangan spreadbet. Pasaran yang tersedia termasuk mata wang kripto, logam, saham, indeks, dan tentu saja, mata wang. Ia menawarkan pelbagai jenis akaun (sehingga 6, seperti yang akan kita lihat kemudian) serta pelbagai alat perdagangan yang berkualiti dan penunjuk beberapa yang proprietari.

Salah satu perkara yang paling luar biasa untuk diperhatikan mengenai hot forex adalah bahawa ia membolehkan perdagangan melalui platform dagangan dua belas (12). Ini bermakna bahawa peniaga boleh berdagang dari seberapa banyak platform yang mereka inginkan.

Jenis akaun dalam hot forex dan deposit minimum

Hotforex, sama seperti kebanyakan broker berkualiti lain, menawarkan pelbagai jenis akaun untuk pedagang. Setiap jenis akaun dilengkapi dengan ciri-cirinya sendiri. Biasanya, apa yang membezakan setiap akaun adalah deposit minimum yang perlu didepositkan ke dalam akaun.

Akaun terutamanya dibahagikan kepada akaun demo dan akaun nyata. Akaun demo adalah akaun percuma. Akaun nyata adalah yang memerlukan anda mendepositkan dana untuk dapat berdagang. Terdapat 5 jenis akaun di bawah kategori akaun nyata. Kami membincangkan jenis akaun dan ciri-ciri mereka di bawah:

Akaun demo (tiada deposit minimum)

Akaun demo adalah sejenis akaun dagangan yang mengandungi wang maya. Akaun ini disediakan oleh broker kepada pedagang yang menggunakan platformnya. Dengan akaun demo, anda boleh membuat dagangan dan melakukan hampir setiap perkara lain yang anda lakukan apabila menggunakan akaun dagangan langsung. Walau bagaimanapun, anda tidak boleh mengeluarkan dana atau apa sahaja keuntungan yang anda buat dengan akaun. Walau bagaimanapun, seperti yang anda lihat, akaun demo perdagangan adalah mesti ada.

Kegunaan akaun demo

Disenaraikan di bawah adalah cara-cara di mana akaun demo telah terbukti tidak ternilai:

- Mengamalkan kemahiran perdagangan

Bagi pedagang baru, akaun dagangan demo memberi anda peluang untuk mengamalkan apa sahaja kemahiran perdagangan yang mungkin anda pelajari. Di sini, anda berdagang situasi pasaran kehidupan sebenar tetapi dengan wang palsu, tanpa sebarang risiko yang datang apa pun di pihak anda.

- Untuk menguji platform dagangan

Sebelum anda mendaftar dengan broker tertentu dan melakukan modal anda kepadanya, anda mungkin mahu menguji broker sedemikian terlebih dahulu.

Tidak ada cara yang lebih baik untuk berbuat demikian daripada dengan akaun demo. Dengan akaun demo, anda dapat mengetahui bagaimana perdagangan berfungsi dengan broker, instrumen yang anda boleh dapat berdagang dengannya, atau apa sahaja mata wang akaun dagangan anda akan disebutkan. Dengan ini, anda boleh dengan mudah memutuskan jika broker berbaloi atau tidak. Oleh itu, adalah disyorkan bahawa sebelum anda mendaftar dengan hot forex, anda mula-mula menggunakan akaun demo untuk beberapa waktu.

- Untuk menguji strategi atau sistem

Walaupun sebagai pedagang yang berpengalaman, anda masih memerlukan akaun demo. Dari semasa ke semasa, anda akan membangunkan atau mencari strategi perdagangan baru, tetapi anda perlu menguji keberkesanan atau keuntungan mereka sebelum anda melakukannya ke akaun langsung anda. Akaun dagangan demo anda memberi anda peluang terbaik untuk berbuat demikian tanpa menanggung sebarang risiko. Hot forex menyediakan pedagang dengan akaun demo $ 100,000. Ini agak memang terpuji.

(amaran risiko: modal anda boleh berisiko)

Akaun langsung:

Terdapat pelbagai pilihan untuk dipilih apabila ia datang kepada perdagangan akaun nyata dengan hot forex.

Akaun mikro (deposit minimum $ 5)

Akaun mikro hotforex adalah pilihan yang hebat jika anda ingin berdagang dengan kepentingan yang sedikit lebih rendah. Ia boleh didapati untuk peniaga-peniaga di kawasan cysec, SV, dan FSCA. Leverage yang anda dibenarkan pada akaun ini juga bergantung pada kawasan anda. Oleh kerana peraturan cysec, 1:30 adalah had di EU, tetapi di bawah SV dan FSCA, had ini terbentang sejauh 1:1000. Platform dagangan yang disediakan juga bergantung pada lokasi anda. MT4 sentiasa tersedia, tetapi MT5 hanya boleh diakses oleh mereka yang berada dalam lingkungan SV atau badan FSCA.

Akaun sifar (§ 200 deposit minimum)

Semua orang dengan akaun sifar pasaran hotforex dan HF boleh mendapat manfaat daripada spread berubah-ubah yang bermula dari 0 pips di pasaran forex utama. Ini juga tidak mempunyai mark-up. Akaun ini boleh didapati di bawah peraturan cysec, FV, FCA, DFSA, dan FSCA. Mereka dikenali sebagai akaun VIP di bawah peraturan DFSA walaupun.

Spread yang kompetitif dari jenis akaun ini sedikit seimbang dengan pengecasan komisen yang secara amnya $ 6 setiap pusingan menghidupkan satu lot. Yuran ini juga boleh dibayar dalam mata wang asli anda bergantung pada lokasi. Kembali ke leverage di mana leverage pasaran HF maksimum di EU kekal pada 1:30. Ini juga terpakai kepada peniaga-peniaga yang dikawal selia FCA. Di bawah DFSA anda boleh memanfaatkan 1:50, dan leverage besar boleh didapati di bawah peraturan SV dan FSCA di mana anda boleh mendapatkan leverage 1:500 pada jenis akaun ini.

Sekali lagi, platform dagangan yang ada juga bergantung kepada tempat anda berada. MT4 boleh didapati di jenis akaun ini di bawah peraturan cysec, SV, DFSA, dan FSCA. MT5 ditambah jika anda berada di bawah FCA di UK.

Akaun premium (deposit minimum $ 100)

Akaun VIP yang boleh didapati dengan entiti hotforex boleh didapati jika anda berdagang di bawah peraturan DFSA dan seperti yang kami terangkan di atas, ia adalah sangat serupa dengan jenis akaun sifar. Terdapat beberapa faedah lagi yang disertakan. Hubungan langsung dengan pengurus perhubungan hotforex anda sendiri adalah salah satu manfaat tersebut.

Untuk membuka akaun jenis ini walaupun, anda perlu mendepositkan sekurang-kurangnya $20,000. Sekali lagi, bagaimanapun, penyebaran pembolehubah bermula pada 0 pips dan tanpa markup. Satu-satunya kos anda harus komisen yang dikenakan pada $ 12 setiap pusingan menghidupkan banyak 44AED setiap lot. Yuran mungkin lebih tinggi di luar pasangan mata wang utama. Leverage hotforex maksimum untuk jenis akaun ini ialah 1:500 dan satu-satunya platform dagangan yang dipermudahkan ialah MT4.

Akaun auto

Ini boleh didapati di bawah peraturan SV dan FSCA dan berhubung dengan MQL5 untuk mengakses isyarat dan faedah-faedah lain daripada masyarakat. Anda boleh mengakses leverage 1:500 melalui jenis akaun ini dan platform yang tersedia sekali lagi bergantung pada lokasi anda. MT4 boleh didapati di kedua-dua kawasan, tetapi MT5 dan API HF hanya tersedia untuk peniaga berdaftar SV.

Akaun hfcopy

Akaun salinan HF tersedia untuk pedagang yang dikawal selia oleh cysec atau badan SV dan akaun ini membolehkan anda menjadi pedagang salinan atau pembekal untuk orang lain. Aspek sosial akaun, yang boleh didapati di kedua-dua cawangan broker hotforex dan HF markets, bermakna anda boleh mempunyai seramai 400 pengikut atau lebih jika dibenarkan atas permintaan. Melalui akaun salinan HF ini, anda hanya boleh berdagang dalam forex, emas, dan bitcoin dengan leverage terhad kepada 1:30 di bawah cysec, dan 1:400 di bawah peraturan SV.

Kesimpulan mengenai deposit minimum hotforex

Terdapat banyak perkara yang boleh menjadi rumit dengan berurusan dengan dan perdagangan forex. Dari belajar bagaimana untuk berdagang untuk mengetahui bagaimana untuk menavigasi platform perdagangan dan mendepositkan, keseluruhan proses tidak selalunya mudah. Panduan di atas harus memberi perkhidmatan yang baik untuk tujuan ini. Secara keseluruhan, hotforex adalah broker profesional dengan keadaan yang baik. Ia adalah mungkin untuk berdagang dengan deposit minimum yang kecil dan besar.

Hotforex minimum deposit

Low minimum deposit forex brokers

After spending weeks of examining and reviewing many brokers, I found some of the best low minimum deposit forex brokers with micro accounts below $10.

Here’s a list of the best legit and regulated low minimum deposit forex brokers with small micro accounts:

You can find reviews and more brokers with micro accounts in the table at the bottom of this post.

You'll see in this article:

Why forex micro accounts?

There are a few reasons that people look for the forex brokers with low minimum deposit or forex micro accounts but I think the main reason is that you are a new trader and you want to get your feet wet before plunging into the ocean.

Well, that’s a wise thing to do and fortunately, there are several forex brokers offering low minimum deposit accounts so not only do you have a chance to begin with a few bucks but also you have a wide range of brokers that you can pick from.

There are some factors that you can pay heed to when choosing a low minimum deposit account. Some of them might not be as important while picking brokers for a larger size account, like educational material, and some should be treated differently such as leverage.

There might be other reasons for the traders to search for the forex brokers with low minimum deposits like having a strategy, especially a scalping one, with aggressive money management or dividing your capital into several small portions and keeping it out of your account for psychology issues or any other reasons.

Either way, you are probably interested in knowing some information about the brokers in this category so that you can make a more reliable decision.

What to search in low minimum deposit forex brokers?

There are several sections that I’ve designed for the table but some of them are more important especially if you are new to trading so I’ll explain them to some extent.

These are some of the factors that I think are important to consider when searching for low minimum deposit forex brokers.

I looked into these metrics precisely when I was searching for micro accounts brokers so that I can write a fair review and provide useful information for everyone that reads this post.

Ok, now let’s see what you should look at when seeking brokers with small accounts.

Regulation

Brokers’ regulation is always important however it’s crucial when you trade with large size accounts. With a low minimum deposit, you don’t need to scout out for a highly regulated broker with the authorization of several financial bodies in different parts of the world.

On the other hand, choosing a broker with no regulation is not a wise decision either because they have no obligatory conditions that watch their probable wrongdoings and make them accountable if they do something illegal.

Not regulated brokers have tempting conditions in some cases such as lower spreads but you can find those situations, and even better, in some regulated brokers as well — you just need to dig deeper.

Not all unregulated brokers are scam and you may find a good one every now and then but I prefer to look for the best ones among regulated brokers.

I think having one regulation in this case suffices. That’s why I’ve chosen the brokers in this list from the ones that are authorized by one regulatory body at the least.

If you want to know more about the method that I used for scoring them, you can see this post that I explain about that.

Spread

With low minimum deposit accounts, you get the worst spreads of brokers most of the time. This is definitely not the strong suit of micro or mini accounts but if this is your priority, for example if you are a scalper, there are still some brokers in the list that have lower spreads.

You will defiantly have problems if you’re a scalper with a 3 to 4 pip tp/sl unless you have an impressive win rate.

On the other hand, there are plenty of options to pick from if you have something like a 10-pip target or stop loss.

If you are a longer-term trader like a day trader, the condition is better and you can pay attention to the other aspect of the brokers as well.

The spread section of the list is based on the lowest spread (from) you get for EUR/USD, which normally has the lowest spread among all the available currency pairs.

If you trade a specific pair or pairs or even other trading instruments like metals, cfds, cryptocurrencies, and etc; you can find the typical or minimum spreads for them on the website of the brokers.

Another good side of regulated brokers is that they publish some information like their spreads on their websites, however, according to my experience, the information released by high regulated brokers are more reliable.

Leverage

This is probably the most important factor for micro accounts. It makes it possible to trade with a low budget in general. Without that there’s no such a thing as a low minimum deposit account.

As a general rule, the higher leverage in small size accounts the better and the lower in large-size accounts the safer, so it’s kind of a double-edged sword.

It’s very hard to trade with as low as 5 or 10 dollars normally even with high leverage like 1.2000, now imagine you have to trade when you have 1:300 with min lot size of 0.01 — it’s kind of impossible to open more than one trade at a time.

In a nutshell, with a 1:300 leverage and 0.01 lot size and a $10 account, we can have roughly 2 trades at a time so if you have a strategy that generates lots of signals, you should pick the highest leverage or larger lot size or even both.

For example, with a lot size of 0.001, you can have 20 trades with the same leverage (1:300) and even larger tp/sl.

If you just open one trade at a time even 1:200 will be enough. In this case, you can put stress on other aspects of the broker you want to pick.

Min lot size

Minimum lot size is the next crucial factor for minimum deposit accounts. The combination of this and the leverage determines your freedom in trading with micro accounts.

As we saw, the larger leverage the better for micro accounts. It’s the opposite for min lot size, the smaller the better.

One standard size for example for EUR/USD is worth $10. 0.1 lots are worth $1 and 0.01 lots are worth 10 cents.

With a $10 account, considering you use a large leverage like 1:1000, you almost have 100 pips which makes it possible to have lots of small trades with a for example 5-pip tp/sl.

Imagine how many trades you can have with 0.001 or even 0.00001 lot size. It’s very helpful for scalpers with a lot of simultaneous trades.

There are some brokers in the list that provides such lot sizes, so if opening lots of positions at the same time is in your trading style, they would be a great fit for you.

Education

This section is not necessarily important if you are not new to trading but it’s a helpful element to consider if you are a newbie.

You have to be well-equipped before even think of trading a small account, but since micro accounts can be an alternative to the demo accounts, you can start with a few dollars right away instead of fake money.

There are some advantages to that. First of all, there are some differences between demo and live accounts.

For example, you may not see problems like slippage (getting a worse price than the one you order), or at least not as frequent, in demo accounts.

So when you trade with a live account especially if you rip a few number of pips like scalpers, you might get into trouble and stumble upon situations you’ve never seen before.

Another issue that you might come across when trading with live accounts is psychology. You can trade with fake money and win or lose big amounts but nothing changes inside you.

You trade fearlessly and don’t care about your trades so you wouldn’t get back and analyze them to find the flaws. It’s different in real money even if it’s not much.

Anyway, if you’re a complete beginner, choosing a broker with educational material can serve you well in the early stage of your trading career.

You’ll probably need more, especially in terms of experience, but even basics can prevent you from jumping into many unreasonable trades or losing your money soon.

I went through all the educational materials of the brokers listed here so that I can be a better reviewer. I didn’t want to just see the headlines of education sections on the brokers’ websites to figure out if they have any material but I examined each of them thoroughly so that I can give meaningful scores.

The scores are from A+ which includes the educations that have useful articles, videos webinars, seminars with high-standard quality, to B which means the broker only provides some basics.

If you are a rather experienced trader, you can skip this section and pay attention to other parts but if you are a beginner, consider this factor as one of your choosing criteria.

Bonus

I chose this factor for the brokers with low minimum deposit because it can increase your initial money so that you can trade with a chubbier account, however, it might not be beneficial to you if you don’t know these kinds of bonuses well.

First of all, you should know that there’s nothing like free money in this case. It means no broker gives you a bonus with no string attached. You need to trade and redeem the bonus.

In other words, the brokers take back their money when you trade and give them spreads or commission which are the revenue stream of the legit brokers.

For example, for withdrawing a bonus, you need to trade a rather high number of lots compare to the size of your account. It’s even worse when they give you no deposit bonus.

For example, if you get a $50 bonus, you need to trade 50 standard lots so that you can withdraw that $50. In other words, you have to be a hell of a trader with lots of trades in a day because in most cases you have a limited time for redeeming the money too.

It can lead to overtrading and growing other bad trading habits which are fatal to the future of your trading especially if you are a newbie.

If you decide to use these types of bonuses, you can find them on the table or on this post that I wrote about them here.

Just make sure to read the terms and conditions of the bonus so you don’t break the bonus’ rules and waste your time.

There are reviews both on the above link and on the links inside the table that explain the conditions thoroughly.

Support

Since online trading creates an opportunity for people from all over the world, brokers try to provide service in different languages.

It comes in handy for the traders who don’t speak english or english is not their native language because there might be some terms and conditions that people ignore because they don’t understand them correctly.

Brokers’ website is the primary source of the clients to find everything they need to know about their brokers and become more familiar with different parts of them.

Moreover, it’s very helpful for those who want to take advantage of educational materials. If the broker’s website offers their languages, the learning process becomes more productive.

Supporting different languages on a website doesn’t necessarily mean that they have customer service or support in those languages.

Some websites support lots of languages but they only have english customer service agents. On the other hand, there are some brokers in the list that have agents for most of the languages that their site supports.

Hotforex, FXTM, FBS, robo forex are some of them.

You can find whether they speak in your language or not by either having a look at their contact page or asking them via online chat.

So, let's see, what we have: what is the hotforex minimum deposit in 2021? ✅ introduction guide for new traders ✔ payment methods ➔ read more at hotforex minimum deposit

Contents of the article

- New forex bonuses

- Hotforex minimum deposit – guide for beginners

- How to deposit on hotforex:

- Introduction to hotforex

- Trading with hot forex

- Markets and types trading

- Types of accounts in hot forex and minimum...

- Demo account (no minimum deposit)

- Live accounts:

- Micro account ($ 5 minimum deposit)

- Zero account (§ 200 minimum deposit)

- Premium account ($ 100 minimum deposit)

- Auto account

- Hfcopy account

- Conclusion on the hotforex minimum deposit

- HOW MUCH IS HOTFOREX MINIMUM DEPOSIT?

- About hotforex

- How much is hotforex minimum deposit?

- Other extraordinary characteristics of hotforex

- Spreads & leverage

- Deposits and withdrawals

- Beginner support

- Conclusion

- Looking for the best customer service in FX...

- What are hotforex trading account specifications?

- Hotforex broker review – the pros and cons

- About hotforex

- Hotforex account opening

- Hotforex product offerings

- Commissions and fees

- Hotforex platforms and tools

- Education and research

- Hotforex differentiators

- Hotforex customer service

- Trustworthiness

- Conclusion

- �� hotforex minimum deposit, account funding...

- Hotforex minimum deposit

- Deposit fees and deposit methods

- Pros and cons

- Does hotforex charge withdrawal...

- How long does it take to make a...

- Hotforex review

- Overview:

- Account types:

- Trading platform:

- Deposit & withdraws:

- Markets:

- Customer support:

- Safety:

- Final thoughts:

- Hotforex

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- Deposit minimum hotforex – panduan untuk pemula

- Bagaimana untuk mendeposit di hotforex:

- Pengenalan kepada hotforex

- Berdagang dengan hot forex

- Perdagangan pasaran dan jenis

- Jenis akaun dalam hot forex dan deposit minimum

- Akaun demo (tiada deposit minimum)

- Akaun langsung:

- Akaun mikro (deposit minimum $ 5)

- Akaun sifar (§ 200 deposit minimum)

- Akaun premium (deposit minimum $ 100)

- Akaun auto

- Akaun hfcopy

- Kesimpulan mengenai deposit minimum hotforex

- Hotforex minimum deposit

- Low minimum deposit forex brokers

- Why forex micro accounts?