Forex broker list 2021

The forex brokerage business has undergone a lot of evolution in the last decade.

New forex bonuses

The global financial crisis of 2008 and the events that happened thereafter have reshaped the industry. At about the same time, new technologies came up and also contributed to the evolution of the forex market and forex brokerage business. It is important for traders to understand what forex brokerage is all about and how it will affect their trading ventures. Before we get to meet the best forex brokers for 2021, it is pertinent to identify the role that forex brokers play in a trader’s career and why it is important to go with a forex broker that can match your circumstances and aspirations. Customer support can now be offered using a variety of means that were not in existence 10 years ago. Social media channels such as facebook and twitter, as well as messaging apps such as telegram can now serve as channels for receiving near-immediate responses from a broker’s customer support desk. Choose a broker with a diversified customer support structure which deploys these new means of communication.

Best forex brokers for 2021

Brokerage companies are scattered all over the world and have many differences in trading conditions, products and services. Some companies are regulated, others are not. Some have been around for decades, others are rather young. Certain brokers work as market makers and have fixed spreads, others provide STP or ECN accounts with direct market access and offer a much larger selection of underlying assets for trading. This site was created to help you find the best forex brokers for your specific needs and requirements. There are several sections and filters in the menu on the left. These can be used to create a custom list of entities with preferable parameters and characteristics. If you find a certain broker you are currently trading with or have used before, feel free to share your experience about it in the comments section meant for forex broker reviews.

The forex brokerage business has undergone a lot of evolution in the last decade. The global financial crisis of 2008 and the events that happened thereafter have reshaped the industry. At about the same time, new technologies came up and also contributed to the evolution of the forex market and forex brokerage business. It is important for traders to understand what forex brokerage is all about and how it will affect their trading ventures. Before we get to meet the best forex brokers for 2021, it is pertinent to identify the role that forex brokers play in a trader’s career and why it is important to go with a forex broker that can match your circumstances and aspirations.

Role of forex brokers

Forex brokers have several roles to play in the market. These roles have also evolved over time, as traders demand a lot more from their trading providers. Forex companies now perform the following roles:

A) access to the market

This is the core role of the forex broker. The forex market is a virtual market with no physical location. At the centre of forex market operations is the interbank market, where the big banks offer various currency pairs for sale. Professional and individual traders therefore do not have to proceed to a physical location to trade, but rather have to have a means of accessing the interbank market. They can only gain access to the interbank forex market using software known as platforms. These platforms are provided by the forex brokers. So without the brokers, nobody can get access to the forex interbank market to trade.

Access can be provided directly using the ECN/STP platforms (also known as direct market access platforms), or indirectly using the market maker platforms that route orders to the broker’s dealing desk. Traders should as much as possible, try to understand the implications of getting direct access to the FX market on one hand, and getting indirect access on the other. The type of access granted will determine factors such as amount of capital to start with, as well as the trading styles and processes to be adopted.

B) trader education

This is gradually but surely becoming a very important element of the forex broker’s functions. Research has shown that 90% of retail traders will lose 90% of their accounts in 90 days. This is a well-established market statistic. Majority of the losing traders (if not all) are traders who are uneducated about the market and who do not understand how to trade profitably. These will end falling by the wayside. No broker wants to spend money acquiring clients, only to have them quit the market after decimating their accounts in 90 days. With brokers realizing that such an arrangement is not good for business in the long run, many of them are now investing significantly into trader education. Videos, articles and webinars are the common means by which beginner traders are given an introduction into the forex market.

C) market research

Once traders get established on the platforms using trader educational resources, their trading activities can be sustained via the provision of market research tools, analysis and news feeds. Many brokers have incorporated this into their offerings as well. For the trader, this is a good thing.

Criteria to consider in choosing a forex broker

The criteria for choosing a forex broker have evolved over the years. While there are still some elements that are critical to the choice and which have remained constant over time, there are other parameters which have emerged and which will be considered below.

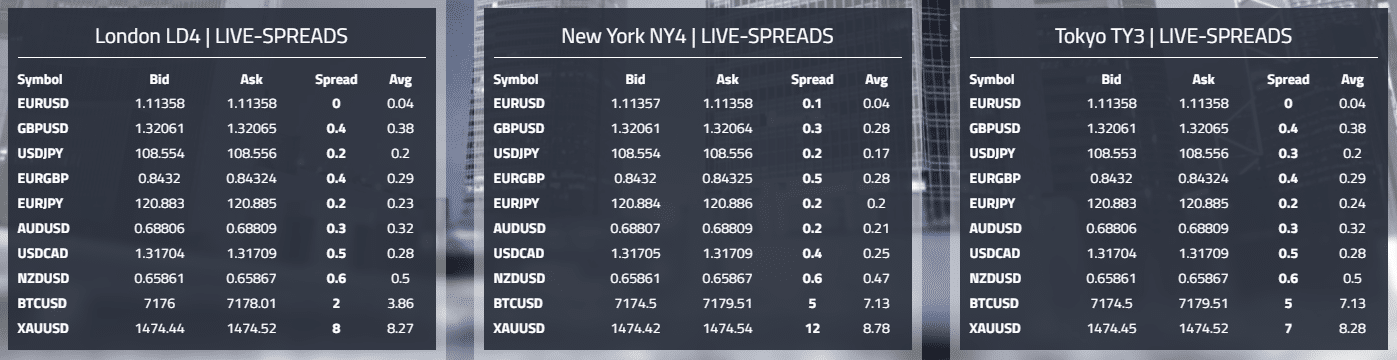

1. Spreads/commissions

Spreads are the primary cost to the trader. Lower costs mean that the trader will have a chance to retain more profits, or at least reduce the losses that may be incurred. Competitive spreads are now a factor used in broker selection. It may not be immediately obvious how much savings on spreads can translate to, but high volume traders such as scalpers know that when up to 300 trades are placed in a month, then savings from reduced spreads can be substantial.

2. Leverage

Leverage in forex is now a big deal. What started off in 2010 when leverage caps were introduced in the US by the commodities and futures trading commission (CFTC), has now been extended into the united kingdom and europe. Retail traders in the UK and EU have seen leverage caps reduced from as high as 1:500, to just 1:30 for major forex pairs. Minor pairs and cfds have even tighter leverage limits. This has increased margin requirements significantly. However, some brokers outside these jurisdictions have continued to maintain the high leverages, thus attracting traders who were caught out by ESMA’s decision. Some of the UK/EU brokers have also opened international divisions, where their international client accounts are being migrated to. So traders now have a choice of operating with the low leverage brokers, or the high leverage ones.

3. Regulation

Regulation will continue to remain a key factor in broker selection. Regulation ensures that traders are protected and that the trading environment is transparent and secure. The brokers presented on this site are regulated in their respective areas of operation, which ensures that traders who open accounts with them are assured of safety of their funds.

4. Broker type

A mention has earlier been made about direct and indirect access to the interbank market. As a trader, you need to know how each type of access will affect you. Market makers provide indirect access because they buy positions from the interbank market and resell them to their clients using a dealing desk. Market makers usually require smaller amounts of starting capital, provide fixed spreads, and tend to have more slippages and requotes. They provide a low barrier for market entry.

ECN brokers on the other hand, provide direct market access. They require large amounts as initial capital, provide variable spreads, but do not have slippages and requotes. However, they charge commissions on trades in addition to spreads. At the end of the day, the trader’s financial capacity will determine if a market maker or an ECN broker will be selected for the trading venture.

5. Trading resources

Trading resources are generally tools that are provided by a broker to enhance the trading experience and potentially improve a trader’s trading outcomes. More is not always better. In this case, it is about finding the broker that has the right mix of trading resources that cover analysis, news and market insight.

6. Customer support

Customer support can now be offered using a variety of means that were not in existence 10 years ago. Social media channels such as facebook and twitter, as well as messaging apps such as telegram can now serve as channels for receiving near-immediate responses from a broker’s customer support desk. Choose a broker with a diversified customer support structure which deploys these new means of communication.

Our list of forex brokers

The list below features best forex brokers selected by us for 2021 year. This list has been prepared after due consideration of all the factors mentioned above. In this list, you will find many brokers that are offshore brokerages with high leverage, or offshore divisions of EU/UK brokerages that can provide high leverage trading platforms to their clients. Feel free to read our forex broker reviews and make an informed choice based on the contents of this website.

Best stock trading forex brokers for 2021

Below you will find a list of forex brokers that offer hundreds and occasionally thousands of stocks for trading. Modern stock market, also known as equity market, connects buyers and sellers of shares with use of electronic networks that spread all around the world. Nowadays, you can purchase some securities without leaving your home or even using a phone to place an order. Most brokers providing specific trading platforms (such as CQG, L2, sterling trader, rhino trader, trading station etc.) offer direct access to US, UK and EU stock markets. Open an account, verify it, deposit some funds and you are all good to start trading.

Who are stock forex brokers? These are forex brokers that offer contracts for difference (cfds) on stocks of companies from around the world. Most stock forex brokers offer stocks that are listed on US exchanges with additions from other major stock indices from around the world, especially from the UK, germany and japan. You may ask: what is the difference between the stocks listed on the platforms of stock forex brokers and stocks that are listed on the platforms of conventional stock brokers? Here are some of them:

- What is traded as stocks on the platforms of stocks forex brokers are actually contracts that mirror the price movements of the underlying stock assets.

- No stocks are exchanged or owned by the trader when trading the shares listed on the platforms of stock forex brokers. In conventional stock exchanges, trades involve actual transfer of stocks from one trader to another.

- In terms of the dealing parties, trading stock cfds involves the trader and the broker/dealer, with the dealer acting as the counterparty to the trader’s positions. In conventional stock exchanges, the brokers do not usually act as counterparties. Rather, they serve to bring together the buyers and sellers of stocks.

- Stock cfds are always traded using leverage, whereas conventional stocks are usually traded using cash only.

Contract specifications for trading stocks on forex broker platforms

Stock cfds are offered by forex brokers all over the world. Therefore, you will see brokers in the UK, EU, australia and offshore locations offering these assets. The only forex brokers who do not offer stocks as a result of regulatory restrictions are US forex brokers. CFD trading on the retail end of the market is prohibited by the CFTC, so you will not see stocks cfds being offered for trading. The location of the forex broker will determine the contract specifications for the listed stocks.

A) leverage

One major specification that will be affected is the leverage. In 2018, the european securities and markets authority (ESMA) reduced the leverage limit for trading of all assets on UK and EU forex brokerages, and stocks cfds were hit with a severe leverage restriction. Presently, cfds on stocks can be traded with a maximum leverage of 1:5, which translates to a margin requirement of 20%. What this means is that if a trader buys 100 units of a stock CFD and this trade costs $2,000 to execute, the trader is expected to come up with a margin of $400 as collateral for the trade. However, some of the offshore brokers listed on our website offer various leverage amounts for stocks cfds. If the trade example mentioned above was to be executed on one of these offshore platforms with a leverage of 1:100 (i.E. 1% margin), then the trader would only need $20 to execute a trade that costs $2000 to execute.

B) spreads

When it comes to spreads, there are differences from one stock forex broker to another. Spreads on stocks cfds, especially those of the big stocks, are usually higher than you would get in major currencies. Therefore, traders need to be aware of the cost implications of trading certain cfds on stocks. Many traders trade stocks on an intraday basis. When day trading stocks CFDS, minute reductions in the spreads on these assets can translate into significant cost savings in the long run.

C) exchanges covered

On most stock forex broker platforms, the stock CFD assets usually featured are pooled from the US exchanges (dow jones, nasdaq100 and S&P500). However, stocks from exchanges in japan, china, UK and eurostoxx may also be featured. As a rule, you would like to choose platforms that feature stocks that you are familiar with.

D) trading hours

Stock markets are not 24-hour markets. They are only open for a few hours a day, and these hours are the only times you can trade stock cfds. The market hours for each national exchange are different and you need to consult the contract specifications page of your preferred broker to know what the trading times for your preferred stock cfds are.

E) minimum tick size and lot size

The minimum tick size will indicate by how many points the stock will move when there is a change in price by a single tick. It is also important to know the monetary value of a single tick move. Obviously, the contracts traded as stock cfds are very different from what obtains in the forex market. In forex, a standard lot trade will cost $100,000 to setup and is expressed as a trade volume of 1.0. In stocks, a standard lot is equivalent to 100 units of a stock, which is actually the value of a full stock CFD contract. However, due to the wide variation in the pricing of the various listed stocks, the monetary cost of a full contract will differ from stock to stock. For instance, the cost of setting up 1 contract for tesla will be different from the cost of setting up 1 contract for alcoa. The only way you can get accustomed to these variations is when you practice trading stocks cfds on demo accounts.

F) rollover fee

If you intend to hold a position on a stock CFD beyond the same trading day, you will incur a fee known as the rollover fee or the swap fee. Traders who hold islamic accounts are exempted from paying this fee. Again, it must be pointed out that the rollover fee differs from one stock CFD to another. You would do well to get this information from any of the brokers in our list.

G) the platforms

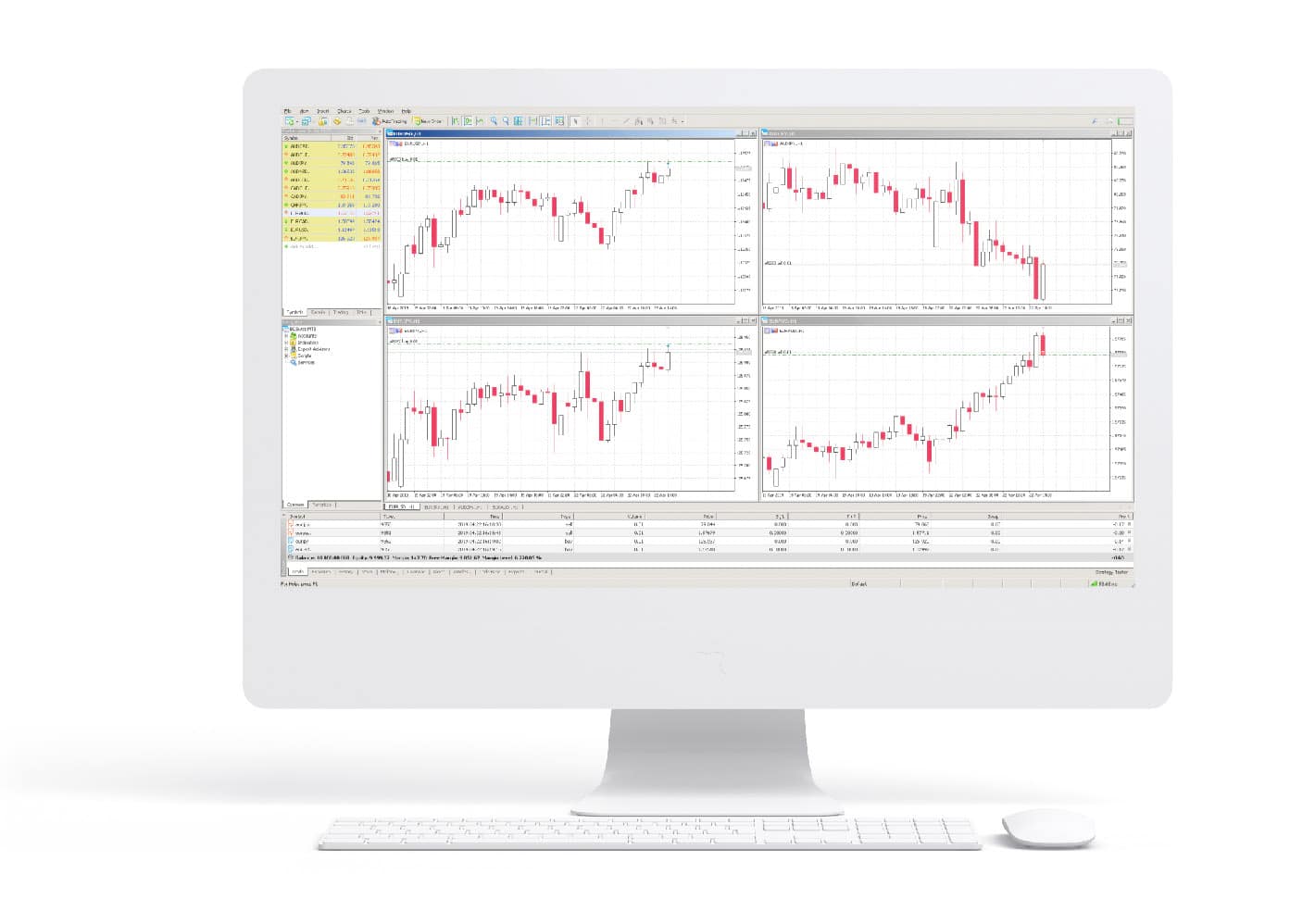

If you scan through the stock forex brokers on our list, you will realize that nearly all of them feature the metatrader 4 or metatrader 5 platforms. A few of the brokers also offer proprietary platforms. You need to study these platforms to understand how to make certain stock CFD assets available or unavailable for trading. There are also certain nuances to get a good grasp of; some of these include how orders are placed, how to set durations for pending orders (good till cancelled or good till day), or how trade sizes are displayed (lot sizes or number of units).

A number of stock forex brokers on our list also offer proprietary platforms which are different from the MT4. If you decide to work with some of these brokers, you should study these proprietary platforms to see how you can get the best out of their stock CFD trading features.

Forex brokers list 2021 – find the top forex brokers

Forex brokers list is the most vital record you will go through while choosing a suitable broker. Forex brokers play the role of the middleman between the liquidity provider & the traders. So, you should choose a trustworthy broker. The top forex brokers list enlists a bunch of reliable brokers. Choosing one from the list will be a wise choice for the transaction. Visit top 10 forex brokers to get the top brokerage list.

Why would you need to trade with best forex brokers?

We have done extensive research to prepare the list. We have gone through individual broker’s profile, trading strategies, forex trading platforms they offer, experience, trader’s satisfaction track record, etc. We have spent our time preparing the list to save your time on brokerage research. We have presented the profile and strategies of the top-notch brokers in a nutshell. Spare a couple of minutes & go through the forex brokers list. We hope you will find a reliable broker to trade from the list.

In the forex market, you exchange money with money. The forex market is even larger than the credit market. The currency values fluctuated throughout the day. As a result, one needs to trade wisely to make a profit. An expert hand will easily be a great help for the inexperienced one in this regard.

The trader needs to understand how the forex market works. A forex broker will guide you to trade in the market. Best forex broker is the best mentor for a novice in this market. You will find the best brokerages on the forex brokers list. All brokers provide sufficient learning materials to learn trading the forex. No way a trader should consider the reliability of the broker. It is always best to choose one from the top forex brokers list.

Forex brokers reviews 2021

15% bonus

100% bonus

100% bonus

Hassle-free access to foreign currency:

If you don’t take a brokerage’s help, you need to be present physically in a currency exchange house. Then you need to wait all day long to receive a good trade opportunity. It will cost you time. The forex market so volatile; you need to make decisions quickly to profit from the trade. A dormant fact about currency exchange is, they charge more than the brokers. So, it is wise to trade with a broker from the top forex brokers list.

Access to a demo account:

The brokerages on the forex broker list would offer to use a demo account on using their website. A demo account would allow you to experience & practice trade without investing real money. Brokers of the top forex brokers list would teach the best forex strategies through the demo account. Using this account, you learn how to trade forex in the market, where & when you should invest money to make maximum profit. If you lose, then it would be your learning to deal with real money. Isn’t it an outstanding opportunity for the beginner to learn forex through hand-on experience?

Saves your time:

Learning forex trade is a long-time procedure. The study says, most entrepreneurs participate in forex trading as a side business. So, learning and then implanting the trading strategies is too much time consuming for most traders. There are chances one may get stuck in the midway of the trade. That’s why to trade with the help of an experienced hand is wise than running the trade solo. And to make this choice, we have already prepared the forex broker list to save your time while choosing.

It is essential to keep the update of the changing currency rate. The forex brokers on the top forex brokers list keep this update of the market on your behalf and run the trade at a suitable time to make maximum profit.

Use of technology:

Brokerages you find on the forex broker list use versatile technology to run the trade. They use the technologies to keep pace with the changing market. They use intelligent tools to analyze the market & can identify risk on a transaction. The brokers on the top forex brokers list keep track of the previous and current records. They interpret these data to predict the future market. The best broker would give you precise analysis and would suggest your best trading strategies. So, hire a top-notch broker to maximize profit on minimizing loss.

Many forex brokers offer an opening bonus on signing up an account on their website. They usually offer these bonuses to encourage traders to trade with them. But there are imposters too! You need to be very conscious about whom you deal with. We suggest you to choose a broker from our forex broker list to get an authentic broker.

Checklist before choosing the forex broker

You will find thousands of forex provider’s names once you search on the web. The success in trading largely depends on the forex broker’s trading strategy. Choosing the right and loyal broker from the forex broker list will lead you to succeed in trading.

You will invest your hard-earned money in the forex market. So proper research before trading with a forex broker is a must. There are some features to check while choosing the broker. Consider the following factors before you hire the broker.

Regulatory agency of the broker:

The regulatory agency is the best yardstick to differentiate the authenticate brokerage from a fraud one. The regulatory agency supervises the activities of the forex broker. They keep a close eye on the brokerages and ensure discipline in trade. An authentic broker would always receive a trading license from the concerned regulatory agency of its region. Here we present the name of regulatory bodies from around the world.

- United states of america: national futures association (NFA), commodity futures trading commission (CFTC)

- United kingdom: financial conduct authority (FCA), prudential regulation authority (PRA)

- British virgin islands: BVI financial services commission (FSC of BVI)

- Canada: investment information regulatory organization of canada (IIROC)

- Australia: australian securities and investment commission (ASIC)

- Germany: bundesanstalt für finanzdienstleistungsaufsicht (bafin)

- France: autorité des marchés financiers (AMF)

- Switzerland: swiss federal banking commission (SFBC)

- South africa: financial services conduct authority (FSCA)

- Mauritius: financial services commission of mauritius (FSC mauritius)

- UAE (dubai): dubai financial services authority

- Cyprus: cyprus securities and exchange commission (cysec)

Brokers form the top forex brokers list are under the supervision of the regulators. So, trading with them is always safe.

Privacy of the trader

You genuinely expect your data to be safe with the broker. When you open an account on a broker’s website from the forex broker list, you need to give information like credit card detail, bank account information, passport information & utility bill, etc. The broker you will choose must ensure your information privacy. Clarify if you have any doubts about their data preservation strategy before you trade with them.

Product range

In the forex market, you don’t only exchange currency. You can trade in precious metals(gold), commodities (oil), stock indices, cryptocurrency, bonds through the brokerage as well. The best broker will provide an extensive range of products to trade in the market. The broad range of products increases the ground to earn profit & advance in the market as well.

Trading platform

The trader would get access to the forex market through the trading platform. The brokers on the top forex brokers list offer multiple forex trading platforms (tool). Some brokers provide the proprietary platform; their unique features make them different from others. Before choosing the broker from the forex broker list, make sure your broker would offer you the platform with

- User-friendly news feed

- Varieties of charting tools

- Educational & learning materials

- Multiple trading ways (web trading, social and mobile trading, etc.)

- Personalize trading screen

Trading cost

The transaction charge is the broker’s way of making money. The trader will pay the transaction cost, commission, or payment asked by the forex broker. Spread and commission are the two standard fee style. An honest broker will inform you about their charge before the trade. There should be no hidden charge.

The trader would like to go for a broker with a low charge. But it is not always possible to get the best forex broker at a low cost. You should then sacrifice your budget to get better service. Do your intensive research on how the broker’s charge before you trade with one from the forex broker list.

While choosing the broker from the forex broker list, you need to decide by keeping a balance among service, security, learning materials, tools & transaction cost. The broker on top forex brokers list offers fantastic deals and services to their clients. Trading with them will help you to earn maximum profit. You would learn different strategies too, which will help you to make your mark in the forex market in the long run.

Best stock trading forex brokers for 2021

Below you will find a list of forex brokers that offer hundreds and occasionally thousands of stocks for trading. Modern stock market, also known as equity market, connects buyers and sellers of shares with use of electronic networks that spread all around the world. Nowadays, you can purchase some securities without leaving your home or even using a phone to place an order. Most brokers providing specific trading platforms (such as CQG, L2, sterling trader, rhino trader, trading station etc.) offer direct access to US, UK and EU stock markets. Open an account, verify it, deposit some funds and you are all good to start trading.

Who are stock forex brokers? These are forex brokers that offer contracts for difference (cfds) on stocks of companies from around the world. Most stock forex brokers offer stocks that are listed on US exchanges with additions from other major stock indices from around the world, especially from the UK, germany and japan. You may ask: what is the difference between the stocks listed on the platforms of stock forex brokers and stocks that are listed on the platforms of conventional stock brokers? Here are some of them:

- What is traded as stocks on the platforms of stocks forex brokers are actually contracts that mirror the price movements of the underlying stock assets.

- No stocks are exchanged or owned by the trader when trading the shares listed on the platforms of stock forex brokers. In conventional stock exchanges, trades involve actual transfer of stocks from one trader to another.

- In terms of the dealing parties, trading stock cfds involves the trader and the broker/dealer, with the dealer acting as the counterparty to the trader’s positions. In conventional stock exchanges, the brokers do not usually act as counterparties. Rather, they serve to bring together the buyers and sellers of stocks.

- Stock cfds are always traded using leverage, whereas conventional stocks are usually traded using cash only.

Contract specifications for trading stocks on forex broker platforms

Stock cfds are offered by forex brokers all over the world. Therefore, you will see brokers in the UK, EU, australia and offshore locations offering these assets. The only forex brokers who do not offer stocks as a result of regulatory restrictions are US forex brokers. CFD trading on the retail end of the market is prohibited by the CFTC, so you will not see stocks cfds being offered for trading. The location of the forex broker will determine the contract specifications for the listed stocks.

A) leverage

One major specification that will be affected is the leverage. In 2018, the european securities and markets authority (ESMA) reduced the leverage limit for trading of all assets on UK and EU forex brokerages, and stocks cfds were hit with a severe leverage restriction. Presently, cfds on stocks can be traded with a maximum leverage of 1:5, which translates to a margin requirement of 20%. What this means is that if a trader buys 100 units of a stock CFD and this trade costs $2,000 to execute, the trader is expected to come up with a margin of $400 as collateral for the trade. However, some of the offshore brokers listed on our website offer various leverage amounts for stocks cfds. If the trade example mentioned above was to be executed on one of these offshore platforms with a leverage of 1:100 (i.E. 1% margin), then the trader would only need $20 to execute a trade that costs $2000 to execute.

B) spreads

When it comes to spreads, there are differences from one stock forex broker to another. Spreads on stocks cfds, especially those of the big stocks, are usually higher than you would get in major currencies. Therefore, traders need to be aware of the cost implications of trading certain cfds on stocks. Many traders trade stocks on an intraday basis. When day trading stocks CFDS, minute reductions in the spreads on these assets can translate into significant cost savings in the long run.

C) exchanges covered

On most stock forex broker platforms, the stock CFD assets usually featured are pooled from the US exchanges (dow jones, nasdaq100 and S&P500). However, stocks from exchanges in japan, china, UK and eurostoxx may also be featured. As a rule, you would like to choose platforms that feature stocks that you are familiar with.

D) trading hours

Stock markets are not 24-hour markets. They are only open for a few hours a day, and these hours are the only times you can trade stock cfds. The market hours for each national exchange are different and you need to consult the contract specifications page of your preferred broker to know what the trading times for your preferred stock cfds are.

E) minimum tick size and lot size

The minimum tick size will indicate by how many points the stock will move when there is a change in price by a single tick. It is also important to know the monetary value of a single tick move. Obviously, the contracts traded as stock cfds are very different from what obtains in the forex market. In forex, a standard lot trade will cost $100,000 to setup and is expressed as a trade volume of 1.0. In stocks, a standard lot is equivalent to 100 units of a stock, which is actually the value of a full stock CFD contract. However, due to the wide variation in the pricing of the various listed stocks, the monetary cost of a full contract will differ from stock to stock. For instance, the cost of setting up 1 contract for tesla will be different from the cost of setting up 1 contract for alcoa. The only way you can get accustomed to these variations is when you practice trading stocks cfds on demo accounts.

F) rollover fee

If you intend to hold a position on a stock CFD beyond the same trading day, you will incur a fee known as the rollover fee or the swap fee. Traders who hold islamic accounts are exempted from paying this fee. Again, it must be pointed out that the rollover fee differs from one stock CFD to another. You would do well to get this information from any of the brokers in our list.

G) the platforms

If you scan through the stock forex brokers on our list, you will realize that nearly all of them feature the metatrader 4 or metatrader 5 platforms. A few of the brokers also offer proprietary platforms. You need to study these platforms to understand how to make certain stock CFD assets available or unavailable for trading. There are also certain nuances to get a good grasp of; some of these include how orders are placed, how to set durations for pending orders (good till cancelled or good till day), or how trade sizes are displayed (lot sizes or number of units).

A number of stock forex brokers on our list also offer proprietary platforms which are different from the MT4. If you decide to work with some of these brokers, you should study these proprietary platforms to see how you can get the best out of their stock CFD trading features.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

1. Bdswiss  | ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.

Successful forex trading requires a good and reliable broker. In this review, we showed you the top 23 secure forex brokers. Now you can choose your professional trading partner.

Best CFD forex brokers for 2021

Below you will find a list of forex brokers that offer a wide range of various cfds (contracts for difference) for trading. Basically, the CFD provides an opportunity to benefit from the difference between entry and exit market price of a certain underlying asset. That kind of trading isn't actually accompanied by a transfer of ownership rights on the asset, it’s more like a bet between buyer and seller. Depending on the price movement, one takes profits and other takes losses. Most popular cfds are based on currencies, indices, commodities and stocks, although some forex brokers also offer bonds, etfs and even interest rate contracts for difference.

Forex brokers now offer a wide variety of assets from different asset classes. These assets are offered as contract-for-difference assets or cfds. This is a contract between a dealer and a trader to settle the difference between the entry price at the time of contract commencement, and the exit price on contract expiration, without physical exchange of the underlying asset in question.

To put it in another way, a CFD is a trade contract based on an underlying asset between a buyer and a seller, in which both agree that the price differential of the asset between the start and end of the trade contract will be paid by one party to the other. The physical asset is not owned or exchanged by any of the two parties.

The fact that there is no physical ownership or exchange of the physical asset between both parties makes this form of trading easy to offer on trading platforms, following the same principles of online forex trading where the traders do not physically exchange the currencies being traded. Also, traders can go long or short on the CFD, enabling profits to be made with long orders on rising prices, and short orders on falling prices.

What assets are traded as cfds?

Unlike a decade ago when cfds were restricted to stocks and a few indices, it is now possible to trade a wide variety of assets as cfds. The CFD forex brokers in our list offer the following asset classes as cfds:

- Cryptocurrencies

- Commodities (metals, energies, softs)

- Indices

- Stocks

- Bonds

- Etfs

- Interest rates

Types of CFD brokers

Just like in the forex market, there are two types of CFD forex brokers. We have the market makers, who operate a dealing desk and offer CFD trading in-house, and we have the direct market access providers, who pool pricing from several liquidity providers and offer same to their clients without passing these through a dealing desk. There are also hybrid brokers, who offer both models to different categories of clients.

Dealing desk brokers operate in two ways. For a majority of clients, pricing and order fulfilment is done at the dealing desk, where wholesale positions obtained from the interbank market are chopped down into smaller bits that their clients can trade. Orders which are too large or which may constitute counterparty risk are sent to the interbank market.

Direct market access (DMA) brokers deal with clients who have wholesale capacity. As the interbank market requires large volume trades, only clients with the financial muscle to operate at this level are taken. Pricing is aggregated from several providers and routed to the trader, who selects a set of bid-ask prices and place orders based on these prices. Orders are then sent to the interbank market, or to other prime brokers who can perform fulfilment.

Criteria for choosing a CFD broker

In selecting the CFD brokers listed on this site, certain criteria were used. The ultimate aim was to present brokers that would guarantee CFD traders the best possible deals with great user experience. Factors used in the determination of the best CFD forex brokers include: regulation, trading software type, types of accounts provided (with features) and contract specifications (commissions and spreads).

A) regulatory status

Regulation is a key factor in consumer protection. It ensures that there are laid down rules by which brokers must abide, for the safety of their clients. Regulatory protocols are enforced by the regulatory agencies. If anything goes wrong, relief or arbitration can be sought by the consumer.

Some of the requirements for running a CFD forex brokerage, as enforced by regulators are as follows:

- A physical location which can be accessed at any time.

- Qualified personnel, including a management team that can be identified.

- Financial reporting.

- Anti-money laundering procedures.

- Segregation of clients’ accounts, and in some jurisdictions, access to investor compensation insurance.

The CFD forex brokers in our list conform to these requirements and this list is updated regularly as new information on regulation becomes available.

B) CFD trading platforms

Many of the brokers in our list offer the MT4 and MT5, which have excellent facilities for CFD trading. Indeed, the MT4 has become the mainstay of CFD trading in the retail segment of the market, as it has great asset listings, and charting/analytical tools to enable multi-asset technical analysis.

C) CFD account types

No two traders are created the same. That is why compartmentalization of traders using an account differentiation system is gradually becoming the norm. Creating separate accounts for beginners, advanced traders or professional level traders ensures that each category of traders are provided with tools they can work with, suitable for their level of expertise. The needs of advanced traders will differ greatly from those of beginners, so it is vital to provide accounts that meet the demands of each trader class.

D) contract specifications

In terms of contract specifications, it is important for traders to know the conditions under which a CFD asset is traded. Trading an ETF CFD is not the same as trading a CFD on crude oil. In the same vein, what a trader pays in commissions or spreads on a crypto CFD will be different from what the trader will pay when trading the nasdaq100 index CFD. Therefore, the best CFD forex brokers will ensure that their clients know clearly what they are getting into whenever they decide to trade a particular asset.

It must also be mentioned that some brokers will charge commissions and spreads on certain cfds, while others may only charge spreads. The only way for a trader to get this information is for a broker to spell out the conditions of trading on each asset very clearly. This is usually done using a contract specifications table on the individual broker websites.

The contract specifications include information on the following:

- Minimum order: it is pertinent to know if you can trade micro-lots on particularly volatile assets, or whether you can only place a minimum of 0.1 lots.

- Leverage/margin requirement: what is the leverage/margin requirement for every CFD traded on a CFD forex platform?

- Commission: are there commissions to be paid? If yes, how much?

- Tick size and increment: how many points is one tick worth, and by how many ticks/points does an asset fluctuate?

- Trading hours: when is an asset open for trading?

- Expiration of contract: are contracts continuous, or do they expire? If they expire, what is the expiration period: one month or three months?

For currency pairs, each metric is probably the same from one currency to another. But for cfds which cover several asset classes, the information will be totally different from one asset class to another. As a trader, access to this information is absolutely crucial to be able to plan your trades and risk management strategies. All the CFD forex brokers in our list have pages with contract specification tables that clearly spell out what you can expect to encounter when you trade a CFD asset.

Best forex broker for 2021

Best forex broker for 2021

Are you looking for a the best and serious forex broker in 2021?

Then this page is the right place for you.

We are happy to provide all traders with this special service so that you can find the best forex broker to meet your needs.

Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, find out in the following texts how to select a security provider and which online broker offers the best conditions.

| Broker rating | account type | min deposit | min lot | typical spread pips | max leverage | trading platform | year of foundation | registration |

|---|---|---|---|---|---|---|---|---|

| IC markets | standard raw spread raw spread (ctrader) | $200 | 0.01 | 1.1 |

Definitions:

Account type – an account type name. Basic account types include cent (balance in US cents), micro (usually having minimum lot from 0.01 (1,000 reference currency units), standard (classic accounts normally having ultimate functionality), pro accounts intended for use by professional traders, usually having reduced spread, ECN (electronic communications network) – accounts having access to one of electronic stock exchange systems, NDD (no dealing desk) – accounts with execution without the dealer’s participation, STP (sraight through processing).

Min. Deposit – minimum deposit necessary for opening this type of account.

Min. Lot – minimum position amount where 1 lot = 100,000 reference currency units.

Typical spread – difference between the bid and ask prices for the selected instrument. For account types with fixed spread constant value is specified. For account types with floating spread normally average daily spread is specified. If the broker doesn’t specify this value, the typical spread is calculated by forex wiki trading as average daily value.

Max. Lev. – maximum size of broker leverage.

Trading platform – MT4 – metatrader 4, MT5 – metatrader 5, web – web trading platform.

Year of found. – year of the company foundation.

Reg. – regulating organization.

Regulation in europe – brokers registered and regulated in the european union

STRICT CRITERIA FOR THE FOREX BROKER REVIEW

In contrast to many other comparison sites, we present you on this website really the safest providers with the best conditions for traders. As traders with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided with this comparison. In addition, one would like to save fees as a trader, because the costs for the trade reduce of course the actual profits. Also, the security of customer money is of high priority. A regulation or license, for example, is urgently needed for secure trading with european brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers 2020.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- Safety of customer funds

- Good markets execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

Your browser does not support the video tag.

Your browser does not support the video tag.

Best forex broker for 2021 ( ECN brokers)

The forex market deals with the trading of forex currency. It trades a volume of around $5 trillion every day. In forex, trading with the best forex broker will generate maximum profit in the transaction. We have done thorough research on the forex market. You will get information about top forex brokers on our website. We will provide all information to choose the best forex brokers for beginners as well.

What is forex trading?

Forex is simply exchanging one currency with another one. The buyer & seller exchange foreign currency with each other at a specific price. The national currencies of the different countries are traded in this market. The forex market has no central hub. It’s a global digital(electronic) platform with end nodes in brokerage houses, financial firms, & central banks. Trading takes place 24 hours in the forex market.

Like other businesses, forex trading aims to earn a profit on investment. Currency conversions make the price movement of some currencies immensely volatile. This volatility makes the trading captivating. The volatility of the market increases the chance of making a profit. On the other hand, an increase in volatility escalates the risk too. The best forex broker would give you the advice to trade for increased profit minimizing the loss.

Best forex broker (ECN brokers)

15% bonus

100% bonus

100% bonus

What is the forex broker?

You need to get access to the trading platform for exchanging currency pairs, i.E., buying & selling the currency. The forex broker is the financial service organization that will give you this access to the trading platform. Investors for a large organization, currency speculator, are the broker’s client. An individual brokerage firm contributes a small portion to the total foreign exchange market.

Top forex brokers trade with outstanding trading plans & strategies. On buying the currency pair, the trader opens the trade. He sells the same currency pair & thus closes the deal. Through the best forex broker, the trader closes the transaction on a high exchange rate & makes the profit.

For example, a trader wants to trade the EUR/USD pair. He buys the euro using the US dollar. He would close the trade on selling the pair. The sale price is equivalent to the buying price of US dollars with euros. Now about the profit & loss, the trader will make a profit if the exchange rate is higher while selling, i.E., on closing the trade. If the rate is low, he incurs the loss.

Forex terminology

To get complete guidance about the forex market, first, let us introduce some important forex terms.

Currency pair

Two different currencies form a currency pair, i.E., base currency & counter currency. For example, EUR/USD. You will buy euro & sell the US dollar when buying the pair. While selling, you sell US dollars & buy euro.

The 195 countries use around 180 authorized currencies. The currency pairs are divided into three different categories. They are,

Major pair: you will find the US dollar in the major pair. The other currency of this pair is one from the EUR, AUD, NZD, JPY, CAD, GBP, CHF. For example, EUR/USD, GBP/USD, USD/JPY. The best forex brokers for beginners suggest trading with major pair.

Cross pair: in cross pair, any two currency except the US dollar form the pair. Example – EUR/CAD, NZD/CAD.

Exotic pair: the least popular currencies make this pair. Though less popular, such a pair can be extremely volatile. Rand (south africa), peso (mexica), lira (turkey), forint (hungary), koruna (czech republic), or zloty (poland) form such a pair.

The best forex broker would give the option to trade all categories of currency pairs.

Forex terminology – top forex brokers – best forex brokers for beginners ( ECN )

Exchange rate

The price at which the trader trades one currency for another one is the exchange rate. For example,

Let us take 5 $/€ as the exchange price between the dollar & the euro. You will buy one euro spending 5 dollars. Exchange rates are mostly 1. Floating & 2. Fixed.

Floating exchange rate: the exchange price of currencies is flexible. The rate changes with the market condition (like interest rate, price level, future market expectation, etc.). Top forex brokers trade at a favourable floating price to make the profit.

Fixed exchange rate: in this case, the government fixes the currency price with another currency price. Such an exchange rate doesn’t change.

Bid price

The selling price of base currency (or a product) is the bid price. For example, in the quote USD/AUD 1.5/20, the bid price is 1.5. It means one can sell 1 US dollar for 20 australian dollars.

Ask/offer price

The buying price of base currency (or product) is the ask/offer price. For example, in the quote USD/AUD 2.75/20, the ask price is 2.75. It means one can buy 1 US dollar for 2.75 australian dollars.

Spread is the best forex broker‘s ‘no commission’ way of making the profit. The difference between bid & ask(offer) price is the spread. The spread is measured in pip (the smallest unit). Spreads are of two kinds- fixed & variable.

Fixed spread: fixed spread remains the same regardless of market condition. Brokerages that operate the trade as ‘dealing desk’ or market maker offer fixed spread.

Variable spread: this spread changes continuously. The bid and ask price changes too with the variable spread . ‘non-dealing desk’ model operator brokers offer variable spread.

Percentage in point (pip)

Percentage in point (pip) is the 4 th decimal value on a price quote. Example- the price quote of USD/JPY is .0625. It means, 1 US dollar enables you to buy around.0625 japanese yen.

The initial capital the investor uses to open a position is the margin. The best forex broker reviews that, the margin may lead to both profit & loss apart from opening the leveraged trade

The size of trade or position that you would open is the lot. On standard measurement, one lot= 100,000 units of the base currency (of the pair). Euro is the base currency in the EUR/USD. You open the trade in the US dollar means the trade size is $100,000.

Leverage

The ratio of the trader’s fund to the broker’s credit size is the trade leverage. One borrows an amount of capital to increase the return. This borrowed capital is leverage. The leverage is variable. Brokers decide the amount based on market conditions. Usually, the top forex brokers prefer to trade with high leverage.

Let us give an example. A trader would require around $130,000.00 to trade the GBP/USD pair without leverage. The costs reduce to only $260.00 ($130,000.00/500= $260) using 1:500 leverage.

Long & short

The trader can go long or short. When you go long, you buy the first part(currency) of the pair and sell the second part. And, you expect the price will rise. Going short means you sell the first part and buy the second currency. You expect the price will reduce.

Forex market categories

There are three types of forex market. The best forex broker would keep the option open to trade in whichever you feel comfortable.

Forward forex market

It is the OTC (over the counter) market where the price is decided for future delivery. The price is determined on the interest rate discrepancies basis. Top forex brokers usually trade on EUR/USD, USD/JPY, and GBP/USD currency pairs. There is no restriction on date & quantity. So, they generally meet investor’s expectations more precisely. You can trade in a forward contract on a public exchange.

Future forex market

In the future market, the price, quantity are defined for a specified period. It has less flexibility compared to forward future market. Such a market usually has an expiration date & contracted amount. Future contracts are not traded on the exchange.

Spot forex market

In the spot market, assets & currency are delivered immediately after the transaction. It is also called the ‘cash market’ or ‘physical market.’ the exchange price at which trading takes place in the market is termed as the spot exchange rate.

The forex market provides equal opportunities for level investors from beginners to experts. It is true, like every other business, you may find difficulty in trading at the beginning. In that such a case, we suggest you trade with the best forex brokers for beginners. They will provide significant educational resources & materials. Going through the resources, you will learn how you should trade forex to earn the profit.

How the forex broker makes a profit?

The best forex broker will surely make his profit from the trade. As you will invest your hard-earned money in this business, you should know how your money will work as a profit to the brokerage.

The top forex brokers make money in two ways – through spread & commission.

The broker may not offer you a charge for the currency exchange. Do you think they will compromise with their benefit in this case? Of course not! They sometimes widen the spread & take a portion of the money as their profit. The forex market is extremely volatile. So in the case of variable spread, you may end up with a large amount of money. Be always careful about how the brokerage would ask you their fee.

There is some broker who asks for an amount of commission on the trade. This transaction charge is their profit from work.

While choosing the broker, don’t forget to pay attention to how you will pay the brokerage charge?

Advantages of trading forex – best forex brokers for beginners ( ECN )

Advantages of trading forex

Trading with the best forex broker brings lots of benefits. Some of the trade benefits are,

High liquidity

By liquidity we understand, the ability of a product/ item to get converted in cash. The forex market offers high liquidity. That is, a large volume of currency can be transferred in the money and vice versa.

Low transaction cost

Typically spread is the transaction cost in the forex market. Or, the broker may ask for commission. In both ways, top forex brokers make their profit. The charge of currency exchange is comparatively less with other uprising business.

Use of leverage

The best forex brokers offer a significant amount of leverage on trade. Using leverage, the investor can trade with a higher amount of money than they have in the account. For example, trading at the 50:1 leverage, using only $1000 (as capital), you can control $50,000 trade.

Make your profit from the rise and fall of currency price

Directional trading is absent in the forex market. There is no particular period for the transaction. You can buy the currency pair when you think the price is going to increase. When you feel the pair value would decrease, you can sell it.

As the price is continuously changing, adapting different forex strategies will help you to trade better. If you are new in this business, then look for the best forex brokers for beginners. They will teach you to trade in this volatile market.

Trade using the demo account

You can learn forex trading using a demo account before trading with real money. Using a demo account is free. It is safe because you invest ‘play money’ & not the real money to test the trading trend. Ultimately the entire capital is kept intact. The best forex broker would always offer a demo account.

A 24/5 market

The market is open for 24 hours. Forex trading is available five days a week. You will trade at a suitable time. The forex market runs trade in three major time zone varying the region (country). You can trade according to your time zone.

The forex market is such a place where you should invest wisely. Learning forex is not a matter of one single day. The newcomer in this business should trade with the best forex brokers for beginners. You will find hundreds of brokerages once you look for the one. The top 10 ecn forex brokers would be the one who meets your trading requirement.

ALL TYPES OF FOREX BROKERS IN 2021. SEE FULL LIST NOW!

Before choosing the best forex brokers, you must know all the types of forex brokers out there. Why do you need to know that? Because each type of forex broker is suitable for different levels of traders. You need to choose the right type in order to succeed in this market.

There are two main types of forex brokers in the market:

- Dealing desk

- No dealing desk

Dealing desk brokers are also called market makers. No dealing desk brokers are divided into two types: straight through processing (STP) and electronic communication network + straight through processing (ECN+STP). Read more for the details of each type.

WHAT IS DEALING DESK?

Dealing desk brokers are those who make money from spreads and the service of providing traders with liquidity. We can call them market makers.

Dealing desk brokers create markets for their clients, meaning they often trade against their clients. Do you think it is a conflict of interest? It's not really like that. Dealing desk brokers provide liquidity for both buying and selling sides, which means that they buy and sell your trades at the same time.

For example: you place an order to buy 1 lot (100,000) EUR/USD with dealing desk broker. To match your trading volume, that dealing desk broker will find suitable sales volume from other customers or they will switch to other liquidity providers.

This way they will minimize risks, as they make money from spreads, without having to confront clients. However, if they can’t find the same liquidity as your transaction, they will have to confront your trade.

Different forex brokers will have different risk management policies, so make sure you check the policies before deciding to open a forex account with best forex broker.

WHAT IS NO DEALING DESK?

No dealing desk brokers don’t create markets like dealing desk brokers. This type of forex brokers earn money by charging commission or raising the spreads a little bit. No dealing desk brokers can be STP or STP + ECN.

What is STP?

The STP forex broker will direct clients' transactions straight to liquidity providers and interbank markets. This type of forex brokers usually has multiple liquidity providers, each of whom would offer different bid/ask prices (spread).

For example: your STP broker has 3 liquidity providers, each of whom will offer different bid and ask prices. The broker’s exchange system will arrange the prices and request the best price. In this case, the best bid price is 1.3000 (you want to sell high price) and the best ask price is 1.3001 (you want to buy low price). The bid/ask price is now 1.3000/1.3001.

Will this quote appear on your trading platform?

No! Your forex broker is not a charity. To compensate for their risks and operational costs, your forex broker will vary slightly. The quotes you’ll see on the trading platform will be 1.2999/1.3002.

When you decide to buy 100,000 EUR/USD at 1.3002, your transaction is sent through your broker to either liquidity provider A or B. If your transaction is accepted, liquidity provider A or B will sell 100,000 EUR/USD at 1.3001 and you have an order to buy 100,000 units of EUR/USD at 1.3002. Your forex broker has earned 1 pip of revenue.

The bid/ask quotes often change which is why most STP brokers offer flat spreads.

What is ECN?

A true forex ECN broker will allow their clients' trading orders to interact with other trading orders participating in the ECN system. ECN participants can be banks, retail investors, hedge funds and even forex brokers. Basically, participants exchange with each other by providing their best bid/ask price.

ECN also allows its customers to see "depth of market". Depth of market displays the buy and sell orders of participants. Due to the nature of ECN, it is difficult to increase spreads to gain income, so ECN forex brokers often earn income through a commission. They charge commission for their service.

WHICH TYPES OF FOREX BROKERS ARE SUITABLE FOR YOU?

Obviously, there is no better type of forex broker. Each type is just suitable for different type of traders, so let’s see which type of forex brokers is suitable for you:

- If you are a new trader or you have traded forex for less than 6 months, you should trade with dealing desk brokers (regular accounts).

- If you have experience in forex trading (more than a year of trading), you can trade with no dealing desk brokers (ECN or zero spread accounts)

TYPES OF FOREX BROKERS AND SUITABLE STRATEGIES

Just like I have said in many other articles, there are many forex trading strategies used in the market. Just like traders, each strategy is the most effective when you use it with the suitable type of forex brokers.

Dealing desk brokers obviously have wider spreads than no dealing desk, so traders who need tight spreads should trade with STP or ECN brokers. On the other hand, dealing desk brokers hardly charge commission or charge less than no dealing desk. So, if your strategy is long term, consider trading with dealing desk brokers.

So, let's see, what we have: list of the best forex brokers for 2021 providing access to foreign exchange markets. Explore forex broker reviews, ratings, and trading conditions. At forex broker list 2021

Contents of the article

- New forex bonuses

- Best forex brokers for 2021

- Role of forex brokers

- Criteria to consider in choosing a forex broker

- 1. Spreads/commissions

- 2. Leverage

- 3. Regulation

- 4. Broker type

- 5. Trading resources

- 6. Customer support

- Our list of forex brokers

- Best stock trading forex brokers for 2021

- Contract specifications for trading stocks on...

- A) leverage

- B) spreads

- C) exchanges covered

- D) trading hours

- E) minimum tick size and lot size

- F) rollover fee

- G) the platforms

- Forex brokers list 2021 – find the top forex...

- Best stock trading forex brokers for 2021

- Contract specifications for trading stocks on...

- A) leverage

- B) spreads

- C) exchanges covered

- D) trading hours

- E) minimum tick size and lot size

- F) rollover fee

- G) the platforms

- List of the best 23 forex brokers | trusted...

- Strict criteria for the forex broker review

- How does a forex broker work?

- Warning: only trade with regulated and...

- How risky is forex trading?

- How to deposit and withdrawal money:

- Not every country is available for forex trading

- Review conclusion: start trading with a reliable...

- Best CFD forex brokers for 2021

- What assets are traded as cfds?

- Types of CFD brokers

- Criteria for choosing a CFD broker

- Best forex broker for 2021

- Best forex broker for 2021

- Are you looking for a the best and...

- Then this page is the right place for you.

- STRICT CRITERIA FOR THE FOREX BROKER REVIEW

- Best forex broker for 2021 ( ECN brokers)

- What is forex trading?

- ALL TYPES OF FOREX BROKERS IN 2021. SEE FULL LIST...

- WHAT IS DEALING DESK?

- WHAT IS NO DEALING DESK?

- WHICH TYPES OF FOREX BROKERS ARE SUITABLE...

- TYPES OF FOREX BROKERS AND SUITABLE...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.