Free forex paper trading

As you look for the best place where to practice your trades, consider paper trading platforms that offer live market feeds before you start with real capital.

New forex bonuses

This is important because you'll want to be able to trade without delayed feeds or processing orders. Finally, paper trading isn’t a one-time-only endeavor. Day traders should regularly use paper trading features on their brokerage accounts to test new and experimental strategies to try their hand in trading markets. Simple mistakes can be incredibly costly for day traders who risk tens of thousands of dollars in hundreds of trades per day. This makes paper trading an integral part of long-term success.

Using paper trading to practice day trading

Day trading has become incredibly competitive with the surge of high-speed trading and algorithmic trading taking place in the markets. The good news is that many online brokers have enabled paper trading accounts to help traders hone their skills before committing any real capital.

Key takeaways

- If you're thinking about becoming a day trader, it makes sense to get some realistic practice in first to test the waters.

- Paper trading is a way to simulate trading strategies and see how they would have paid off, or not, in reality.

- Online brokerage platforms increasingly allow sophisticated paper trading abilities through demo accounts or as a feature for its existing customers.

What is paper trading?

Paper trading is another term for simulated trading, whereby individuals can buy and sell securities without risking real money. While it’s possible to backtest trading strategies, traders may be tempted to use past information to make current trades—known as the look-ahead bias—while the wrong backtesting dataset could involve a survivorship bias. Survivorship bias is the tendency to view the performance of existing funds in the market as a representative sample.

Investors may be able to simulate trading with a simple spreadsheet or even pen-and-paper, but day traders would have quite a difficult time recording hundreds or thousands of transactions per day by hand and calculating their gains and losses. Fortunately, many online brokers and some financial publications offer paper trading accounts for individuals to practice with before committing real capital to the market. This allows them to test out strategies and practice using the software itself.

Setting up a day trading account

Day traders should ideally paper trade with the same day trading broker they plan to use for their live account since it will be as close to reality as possible.

As you look for the best place where to practice your trades, consider paper trading platforms that offer live market feeds before you start with real capital. This is important because you'll want to be able to trade without delayed feeds or processing orders.

Among the most popular brokers are interactive brokers and tradestation, which both have fully-featured simulators that even work using their automated trading rules. Day traders using these platforms will need to open an account to use the simulator, which may mean depositing the minimum funding requirements. The good news is that traders can use the simulator before making live trades with their capital.

Online brokers such as fidelity and TD ameritrade also offer clients paper trade accounts. Investopedia provides a free stock simulator that can be used for paper trading and for those looking to get started with a day trading account, investopedia compiled a list of the best stock brokers for day trading to make the process easier.

It’s important to keep in mind there are still some differences between simulated and live trading. On a technical level, simulators may not account for slippage, spreads or commissions which can have a significant impact on day trading returns. On a psychological level, traders may have an easier time adhering to trading system rules without real money on the line—particularly when the trading system isn’t performing well.

Paper trading tips

Day trading practice depends largely on the strategy that’s being used to trade. For example, some day traders are focused on "feel" and must rely on paper trading accounts alone, while others use automated trading systems and may backtest hundreds of systems before paper trading only the most promising ones. Traders should choose the best broker platform for their needs based on their trading preferences and paper trade on those accounts.

When paper trading, it’s important to keep an accurate record of trading performance and track the strategy over a long enough time horizon. Some strategies may only work in bull markets, which means traders can be caught off-guard when a bear market comes along. It’s important to test enough securities in a variety of market conditions in order to ensure their strategies hold up successfully and generate the highest risk-adjusted returns.

Finally, paper trading isn’t a one-time-only endeavor. Day traders should regularly use paper trading features on their brokerage accounts to test new and experimental strategies to try their hand in trading markets. Simple mistakes can be incredibly costly for day traders who risk tens of thousands of dollars in hundreds of trades per day. This makes paper trading an integral part of long-term success.

Pros of paper trading

Starting out with a paper trading account can help shorten your learning curve. But there are other benefits beyond just educating yourself. First, you have no risk. Because you're not using real money, you don't lose anything. You can analyze what mistakes you've made and help create a winning strategy. This also helps you build your confidence, allows you to practice techniques and strategies needed to be a successful day trader including profit or loss taking and pre-market preparation. Finally, it takes the stress out of trading. You can concentrate on your strategies in a relaxed environment and take the emotion out of trading.

Cons of paper trading

While paper trading will help give you the practice you need, there are a few downfalls. Because it doesn't use real money, you don't get an idea of how fees and commissions factor into your trades. These simulators also don't accurately reflect the reality of the markets, with the lows and highs and the emotion that goes along with trading. Thus, it's important to remember that this is a simulated environment as you get your trading skills in check.

Practice, practice, practice

If you're a first-time investor, take as much time as you can paper trading before you jump ship and begin live trading. Be sure to explore different strategies and new ideas so you can get comfortable. The idea behind using simulators is for you to get comfortable and cut down on your learning curve.

Once you feel as though you've mastered all that you can be using a simulator, try trading with a stock that has had a predictable run—with a lower price and a consistent response to market conditions. If you start trading with a highly volatile stock, it may be a challenge. But if you choose something safer, you can practice what you've learned without taking on too much risk.

The bottom line

Day traders face intense competition when it comes to successfully identifying and executing trade opportunities. Fortunately, most online brokers offer paper trading functionality that empowers day traders to practice their skills before committing real capital. Traders should take advantage of these features to prevent making costly mistakes and maximize their long-term risk-adjusted returns and performance.

Forex trading journal excel template

Are you looking for a forex trading journal excel template? You found it, and you can download it for free!

If you landed on this page, it’s because you decided to kept track of your trades. Keeping a trading journal is the best thing you can do to improve your profits and reduce your losses.

There are many paid trading journal templates, but we believe it is more comfortable and more productive to create your own trading journal excel.

Every trader has different needs, and it must consider this aspect. Some traders need only a simple trading diary to keep track of their ideas without reporting their trades.

Even this simple habit will allow you to improve a lot.

Let’s take an example. You are thinking of opening a trade long on US stock.

Maybe, you have done macroeconomic research and have the belief that that stock price could rise. Also, your favorite technical indicator is signaling you a long entry.

Once you have entered long, everything that pushed you to open the trade will disappear from your memory.

You will think only if to close in profit or loss. If you’ve closed the trade with a profit, your mood will be peaceful. Otherwise, you may be frustrated or angry. We bet it will be hardly rethinking the reasons you entered the market.

When you close the trade, you may have carried out other macroeconomic studies again, and again your favorite indicator may have sent you a signal.

You will end the trade with a profit or a loss, but nothing you have written in your trading diary or trading journal.

The next year these days, you will want to take stock of your trading activity. You will have profits and losses, but they will be only numbers. Regarding the trade that just ended after a year, you cannot remember why you led you to go long.

After a year, your skills could be improved, but you won’t be able to judge the past if you don’t remember it.

You may have attended a trading course and learned that the indicator you liked so much doesn’t work.

Remember that the human mind always remembers with a filter, and this filter is enhanced when emotions come into play.

Trading is all about emotions, sometimes powerful, such as disappointment, frustration, hope.

Writing your every trade in a trading diary or a trading journal will help you remember and judge your every trade with a rational mind.

At the end of this page, you will find a forex trading journal excel download for free.

However, we believe that the best thing is to create your own trading journal or trading diary by adapting it to your needs.

Why you need a trading journal

The best way to improve in trading is to keep a trading diary.

It is like a paper diary, but above all, in spreadsheets where we record the trades, we performed during the day.

By reviewing your trades, you can learn a lot because you can draw many fundamental indications.

Time passes, you can’t remember..

Let’s take an example. You are thinking of opening a trade long on US stock.

Maybe, you have done macroeconomic research and have the belief that that stock price could rise. Also, your favorite technical indicator is signaling you a long entry.

Once you have entered long, everything that pushed you to open the trade will disappear from your memory.

You will think only if to close in profit or loss. If the trade is successful, your mood will be peaceful. Otherwise, you may be frustrated or angry. We bet it will be hardly rethinking the reasons you entered the market.

When you close the trade, you may have carried out other macroeconomic studies again, and again your favorite indicator may have sent you a signal.

The trade will be ended with a profit or a loss, but nothing you have written in your trading diary or trading journal.

The next year these days, you will want to take stock of your trading activity. You will have profits and losses, but they will be only numbers. Regarding the trade that just ended after a year, you cannot remember why you led you to go long.

After a year, your skills could be improved, but you won’t be able to judge the past if you don’t remember it.

You may have attended a trading course and learned that the indicator you liked so much doesn’t work.

Remember that the human mind always remembers with a filter, and this filter is enhanced when emotions come into play.

Trading is all about emotions, sometimes robust, such as disappointment, frustration, hope.

Writing your every trade in a trading diary or a trading journal will help you remember and judge your every trade with a rational mind.

At the end of this page you will find a forex trading journal excel download for free.

However, we believe that the best thing is to create your own trading journal or trading diary by adapting it to your needs.

We learn from our mistakes.

Why you need the forex trading journal excel template

Having a diary allows you to record the trades and review them, thus pushing you to think about the trades and don’t forget about them.

Therefore, it is essential to take time every day to review your trades and try to analyze if there are errors or recurring positive factors to eliminate the former and strengthen the latter.

Building a trading journal is relatively simple for anyone with the necessary computer skills to create an excel worksheet: the columns will contain the categories. In contrast, the rows will contain the trades.

The essential items of your trading diary

- Trade opening time

- Currency pair

- Long / short

- Entry price

- Stop loss

- Target

- Closing price

- Gain / loss (in pips)

- Notes

This will eventually allow you to find the trades in the chart and go to review them.

In the notes, it is important to be brief and write critical comments such as emotions at the time of opening the trade, the reasons for opening, closing, obstacles, doubts, etc.).

Some questions that the diary can answer

Winning percentage of the strategy.

An idea of our system’s success rate can be useful to calculate the size of the position and estimate the profit targets.

Average stop-loss and take-profit.

Helps determine the optimal size of positions to meet money management criteria

Times of the day more profitable.

Depending on the answer, we may decide not to trade at a particular time of the day or improve in that period, where perhaps the trading conditions are different.

Short or long?

Are shorts or longs usually more profitable? How much? We could only look for short or long entries or investigate the reasons for any difference in performance.

Preferred currency pairs

Each currency moves differently from the others; some couples respect more technical levels, others less. Any cross is more volatile; some continue in lasting trends; others consolidate.

Do I get excellent results in EUR / USD but not in GBP / USD? This information can help us better select which couples we can trade better with our style.

We could abandon the less productive cross or try to improve the results on those.

Do you come out of time?

We may find that we come in too early and waiting for an extra candle; we may get better results.

Prices to the target?

We may close positions prematurely, but the diary tells us that prices, on average, reach the target we set ourselves.

Recurring patterns

Especially with the screenshots’ help, we can notice that a particular price formation consistently brings positive or negative results. The next time we see a similar pattern, we will know how to behave.

Forex trading journal template first version

In the image below, you can see our first template version, developed 3 years ago:

As you can see, it provides a lot of useful information such as the average trade and the average risk-reward ratio.

The only thing you will have to do is enter the trades you have executed and the relevant result.

With this forex trading journal excel template, you can finally keep track of your every trade.

You can improve by reviewing your trades and understand what your real statistics are.

The simple trading diary

A trading diary will have a straightforward template, and you will not need to enter all the information.

The principal purpose of a trading diary is to remember the reasons we opened the trade.

It will be handy for those who use fundamental analysis or diversified trading systems.

For example, if you are a trader who only uses overbought levels or oversold levels to enter a trade, you will not need to remember your motivations.

If instead, you buy shares based on the fundamental analysis, you will want to remember which analysis led you to open the trade or which economic indicators you analyzed.

To make a trading diary, we will use microsoft word and organize each trade in a single word page.

We will place the word page thus created and named in a different folder for each month of the year.

We can write something like this:

Trading diary of 02.04.2020

We are approaching an economic recession. I found this interesting analysis of apple on seeking alpha.

The RSI indicator I’m following tells me that apple is in an oversold zone, so I buy the $ 10,000 amount. I will close the trade when the RSI indicator returns to overbought.

Trading diary of 15.03.2020

I found this analysis on zerohedge and decided not to wait for the RSI indicator but to close within this week.

As you can see, it is effortless and does not require a big effort, but imagine after a year how much useful information you could have by looking at your track record.

How to create a trading journal excel

An excel trading journal requires entering much more data. We will use excel because it will be necessary to perform some calculations automatically.

Our advice is to use a spreadsheet for each strategy.

For example, if I carry out operations on the US market shares using an RSI indicator, I will dedicate a particular trading journal excel to this strategy.

This sheet is elementary to create, and you can add the items you will need.

As you can see, everything is straightforward. All you need to do is enter your initial capital and only some details of the transaction in the excel trading journal.

If you always use the same stocks, you can create a drop-down list to speed up the insertion with an automatic selection.

How to take a screenshot of a chart

In each note, we should add a photo of the chart used with your indicators. We should do the screenshot of the chart at the exact moment we open the trade.

We shouldn’t wait because future price movements would change the view of your trade.

If you use metatrader4, you can use a function already present on the platform to extract a chart’s screenshot.

Once you click on “OK” to automatically open a web page with screenshots, you can click on the photo and save it on your hard disk or share it online through the links.

For example, if you want to write a post on forexfactory.Com, paste the post’s link, and it will autoload the image.

Another straightforward method to take a screenshot of a chart is to use a free tool already present in windows.

We are talking about the snipping tool. If you have never used it or don’t know it, write the search bar’s snipping tool.

If you want to add effects or shapes or writings to your screenshot, you can use the free software microsoft paint. For more professional work, there are paid tools such as snagit from the manufacturer of camtasia that allows you to make cutouts like the snipping tool but has advanced editing functions.

To edit your graphic you can use photoshop or an interesting free alternative: GIMP.

The best free and online platform to find charts is tradingview.

Tradingview is a free site with many useful functions and technical analysis indicators; you can also find trading ideas and sentiment indicators.

How to create a drop-down list in excel

Select all cells and click on “data” and “data validation”.

Choose “list” and enter all the equity securities you need separated by a comma.

As you can see, it will be very easy and fast to select your favorite titles.

Paper trading simulator

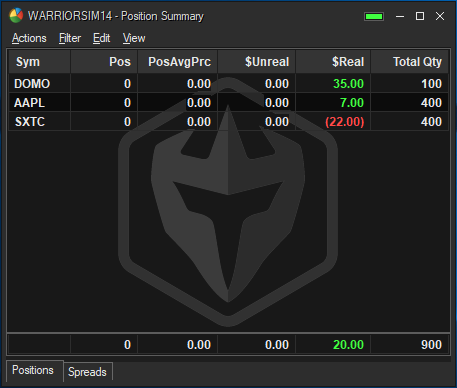

The warrior trading paper trading simulator allows students to practice trading using virtual currency. You will have the ability to trade USA equities markets as well as the US options market. Students gain experience without risk, and can learn to minimize losses.

Real-time level 2

Replicate reality

Advanced reporting

Start with $200k in buying power

Ready to get started?

The warrior trading paper trading simulator is available as an add-on to warrior pro and warrior starter students.

The warrior trading simulator

View a quick walkthrough of the paper trading simulator:

Already using the paper trading simulator? See the support guide:

The warrior trading simulator runs on windows pcs. For more information, please read the system requirements.

Warrior trading is building a robust trading simulator platform to provide our students with the most realistic trading simulator environment. This unique platform offers REAL-TIME data from NYSE and NASDAQ. The data feeds include level 2, time & sales, and charts. Unlike simulators based on historical data, real-time data allows you to practice trading the markets side by side with our instructors and mentors in our chat rooms.

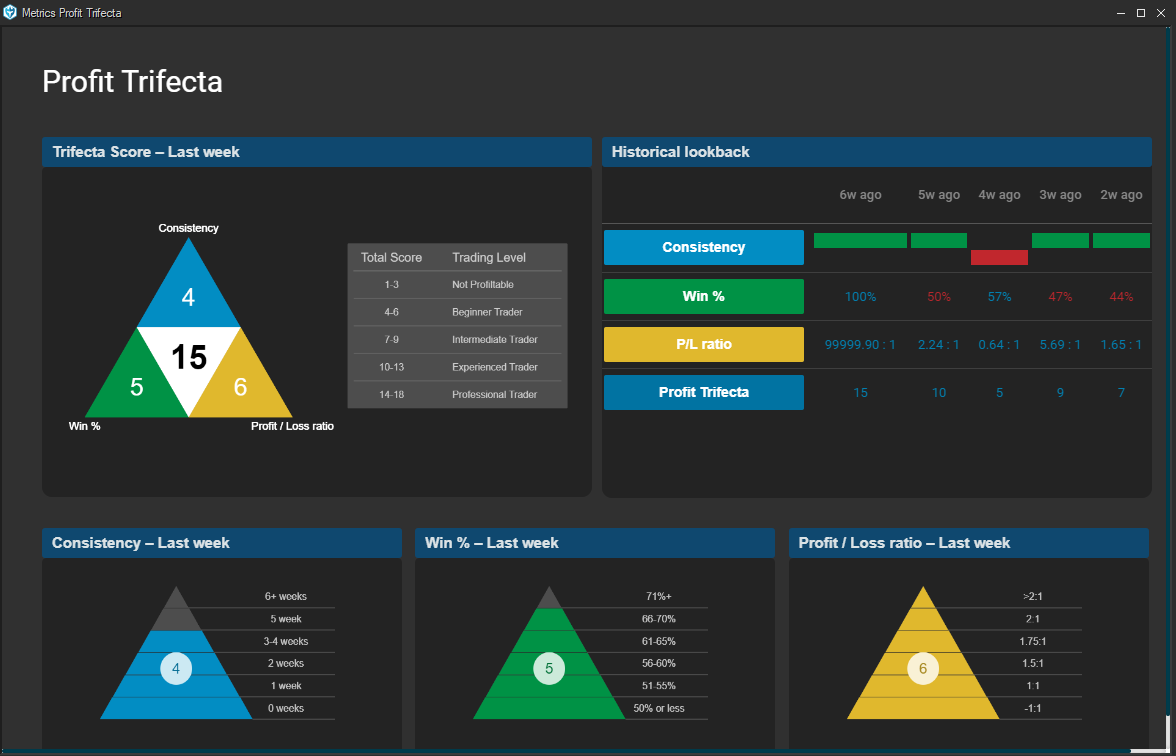

The warrior trading simulator platform allows paper trading students to see their metrics and performance. As students use the platform, we monitor trades our students are making, aggregate the data, and provide metrics to help improve their performance.

Trading in a simulator allows for learning and mistakes. Most new traders make mistakes (ross lost more than $30k in beginner mistakes) and learning to trade in a simulator prevents losing real money. During the first month of using the simulator, students can test various trading strategies and get a feel for the market.

After the first month, a student should be able to focus on 1 or 2 strategies that are best suited for their personality and their risk preferences. Warrior trading encourages students to develop their own strategy as part of their trading education.

While there are many paper trading platforms, the warrior trading paper trading simulator offers advantages that many others don't. It allows students to practice the same hot keys and strategies they can expect to use while trading on the live market. You'll be able to make hotkeys for going long or short, create stop orders and profit targets, set a stop at breakeven, and cancel all orders with the ability to use an offset to guarantee fills in a fast moving market.

The paper trading simulator prepares students to trade live with brokers like lightspeed or capital markets elite group.

Billing & general support – [email protected]

Warrior trading, PO box 330, great barrington, MA 01230

1-530-723-5499

If you do not agree with any term of provision of our terms and conditions you should not use our site, services, content or information. Please be advised that your continued use of the site, services, content, or information provided shall indicate your consent and agreement to our terms and conditions.

Warrior trading may publish testimonials or descriptions of past performance but these results are NOT typical, are not indicative of future results or performance, and are not intended to be a representation, warranty or guarantee that similar results will be obtained by you.

Ross cameron’s experience with trading is not typical, nor is the experience of students featured in testimonials. They are experienced traders. Becoming an experienced trader takes hard work, dedication and a significant amount of time.

Your results may differ materially from those expressed or utilized by warrior trading due to a number of factors. We do not track the typical results of our current or past students. As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers.

Available research data suggests that most day traders are NOT profitable.

In a research paper published in 2014 titled “do day traders rationally learn about their ability?”, professors from the university of california studied 3.7 billion trades from the taiwan stock exchange between 1992-2006 and found that only 9.81% of day trading volume was generated by predictably profitable traders and that these predictably profitable traders constitute less than 3% of all day traders on an average day.

In a 2005 article published in the journal of applied finance titled “the profitability of active stock traders” professors at the university of oxford and the university college dublin found that out of 1,146 brokerage accounts day trading the U.S. Markets between march 8, 2000 and june 13, 2000, only 50% were profitable with an average net profit of $16,619.

In a 2003 article published in the financial analysts journal titled “the profitability of day traders”, professors at the university of texas found that out of 334 brokerage accounts day trading the U.S. Markets between february 1998 and october 1999, only 35% were profitable and only 14% generated profits in excess of than $10,000.

The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable. This reiterates that consistently making money trading stocks is not easy. Day trading is a high risk activity and can result in the loss of your entire investment. Any trade or investment is at your own risk.

Any and all information discussed is for educational and informational purposes only and should not be considered tax, legal or investment advice. A referral to a stock or commodity is not an indication to buy or sell that stock or commodity.

This does not represent our full disclaimer. Please read our complete disclaimer.

Citations for disclaimer

Barber, brad & lee, yong-ill & liu, yu-jane & odean, terrance. (2014). Do day traders rationally learn about their ability?. SSRN electronic journal. Https://papers.Ssrn.Com/sol3/papers.Cfm?Abstract_id=2535636

Garvey, ryan and murphy, anthony, the profitability of active stock traders. Journal of applied finance , vol. 15, no. 2, fall/winter 2005. Available at SSRN: https://ssrn.Com/abstract=908615

Douglas J. Jordan & J. David diltz (2003) the profitability of day traders, financial analysts journal, 59:6, 85-94, DOI: https://www.Tandfonline.Com/doi/abs/10.2469/faj.V59.N6.2578

Copyright © 2020 warrior trading™ all rights reserved.

Paper trading

What is paper trading?

Paper trading is more commonly used in an institutional setting. It is what we in the forex trading or CFD industry call demo trading. The term ‘paper trading’ comes from the stock market, where investors who wanted to practise would write their investment ideas on paper and follow the market movements, to see if their ideas panned out.

There are many types of traders, including more short-term and those who keep positions open for the longer term. Common to all new traders is hesitation when it comes to placing trades and of course, concern at losing money from their trading.

Whilst all types of trading come with risks, brokers offer a variety of tools to help first time traders to improve their trading skills before committing real funds. One of these tools is called “paper trading”, although as mentioned you are less likely to hear the term, since we use the term demo trading.

Click here to open a demo account and master your trading skills! Ready for the real action?

Advantages and disadvantages of paper trading

Trading without the risk

demo accounts come with many benefits and are widely used by first time traders who want to practice and learn how to trade before they trade with real money. More experienced traders use demo accounts to test out their strategies or to test-drive a new platform they haven’t used before. For new traders it is an excellent way to learn about the market, and most importantly to learn about yourself as a trader. Needless to say, this is a very useful tool in the trading world.

On the downside though, for a new trader, trading in a simulated environment without committing real funds, feels very different from a real account scenario where real money is at stake. With demo trading, the psychological aspects of trading don’t come into play, like fear and greed.

How it works

using a demo account allows first time traders to experience and trade with an account that looks and acts similarly to the real online trading accounts traders use. Demo account users receive an amount of virtual money in the beginning, and can start trading by opening selling and buying positions. Just like a real account, the demo account shows market movements on the traders’ screens, so they can decide if they should continue their trade or get out. This all contributes to assessing their actions, learning from them and getting ready to start trading in their real account.

For demo account users it is not only important to practise on demo accounts, but also to look back at their actions and learn from them. This is also important for more experienced traders, who want to practise on the demo account. They need to check if their trades and strategies proved to be as successful as they had hoped, and of course, they will use this knowledge to optimise their performance on the back of it.

Disadvantages of paper trading

However, there are some risks to paper trading which should not be ignored. Some people would suggest not to begin with a demo account for a number of reasons.

Euphoria trading

the main one, according to them, is the sense of euphoria paper trading can give. Since there is no real money being used, traders can take risks that they otherwise wouldn’t, thus expanding their profits. A case of money loss, on the other hand, is often not taken very seriously since it’s not real money that’s being lost. There is another disadvantage; since it’s not their money they are trading with, they won’t always follow the market and respond as they would if it was their own money.

Delayed data

some demo accounts do not use up-to-date information, but delay it by 15-20 minutes, so competitors do not use the data. Others display fake data, but the main goal remains the same – to get traders ready for the forex market. On the avatrade demo account, the information displayed is in real-time and projects the accurate rates. The tool is very common and used worldwide by brokers on stocks, bonds, commodities etc. Due to the fact that there is not real money that’s been put in, it’s often called “paper money”, “monopoly money” etc.

Should you use paper trading?

Should you as a first-time trader use paper trading? Should you open a demo account before trading in the real market?

The answer is yes, as long as you remember how to use it to its best effect. A few simple guidelines can dramatically increase the effectiveness of a demo account.

Here are a few simple guidelines that would dramatically increase the effectiveness of a demo account.

Treat it as a proper real account

this will not only overcome the main obstacle of demo accounts, but will ease the transition from demo account to real accounts. Paper trading might seem easy, but there is an important component missing.

As mentioned briefly earlier, real trading involves a lot of emotions, which can be a plus since traders are more invested emotionally. But this can lead to negative consequences – emotional trading, with no real thought or research and ending with money loss. Again, with demo trading you may feel the adrenaline rush and the fear or the greed. So as long as you factor this in, the transition from demo to real will be more successful for you.

Learn as much as possible

it is highly recommended to practise on a demo account, whilst simultaneously educating yourself on the market. There are so many free blogs and education portals you can use. Don’t underestimate the importance of a strong understanding of the trading platform and the markets you wish to trade on. Preparation is key. We recommend using the demo account for at least a few days, before switching over.

Finally, remember that trading does not suit everyone. Those people that rush to trade without considering the intricacies of the platform or the market may end up disappointed, not to mention ending up with lighter pockets.

Use paper trading as a mirror to yourself, in order to answer the following questions – am I ready to trade? Is this market suitable for me? If the answers are yes, it is time to open a real account!

Paper trading main faqs

Paper trading gives you something approaching hands-on experience, which is far more valuable than simply theoretical knowledge. You can be a genius with theoretical knowledge, but when faced with the pace of movement in real market trading environments you could freeze-up and fail miserably. So, paper trading can teach you valuable lessons about real-world trading that you can’t learn from other sources. And while paper trading won’t fill in all your learning needs it is one zero-risk method for improving on your trading.

Paper trading is considered to be very useful for new traders, but in truth it can benefit anyone, even professionals use paper trading when they are developing a new strategy. And while you might be impatient to get to trading with real money, the benefits to be gained from paper trading are incalculable. Taking the time to test your trading strategy with paper trading could mean the difference between a profitable trading career, and a huge disappointment. Paper trading can also help remove the emotions from your trading since you aren’t risking real money.

Paper trading without a plan isn’t going to help you much in the long-run. You have to treat your paper trading just as carefully as you would handle real money trading. That means instead of starting with the $1 million demo account you’ll likely be faced with, you should start with a realistic amount of money in your demo account. That might be $10,000 or it might be $1,000. Then you need to record everything about your trades. Why you took the trade. What your exit target is and why. What actually happened with the trade. Afterwards you can go back to determine how you might have made the trade more profitable, or less of a loss.

Paper trading account

So now it’s time for you to open a paper trading account. Start testing out the different trading strategies and techniques we talk about in our education section. You can start by identifying trends and then using simple moving averages, before moving up. Try and spot your own emotional reactions to different trade outcomes, as understanding how this affects your trades will be a massive advantage in improving your skill level prior to risking real money.

Click here to open a demo account now!

We recommend you to visit our trading for beginners section for more articles on how to trade forex and cfds.

Paper trading

What is paper trading?

Paper trading is more commonly used in an institutional setting. It is what we in the forex trading or CFD industry call demo trading. The term ‘paper trading’ comes from the stock market, where investors who wanted to practise would write their investment ideas on paper and follow the market movements, to see if their ideas panned out.

There are many types of traders, including more short-term and those who keep positions open for the longer term. Common to all new traders is hesitation when it comes to placing trades and of course, concern at losing money from their trading.

Whilst all types of trading come with risks, brokers offer a variety of tools to help first time traders to improve their trading skills before committing real funds. One of these tools is called “paper trading”, although as mentioned you are less likely to hear the term, since we use the term demo trading.

Click here to open a demo account and master your trading skills! Ready for the real action?

Advantages and disadvantages of paper trading

Trading without the risk

demo accounts come with many benefits and are widely used by first time traders who want to practice and learn how to trade before they trade with real money. More experienced traders use demo accounts to test out their strategies or to test-drive a new platform they haven’t used before. For new traders it is an excellent way to learn about the market, and most importantly to learn about yourself as a trader. Needless to say, this is a very useful tool in the trading world.

On the downside though, for a new trader, trading in a simulated environment without committing real funds, feels very different from a real account scenario where real money is at stake. With demo trading, the psychological aspects of trading don’t come into play, like fear and greed.

How it works

using a demo account allows first time traders to experience and trade with an account that looks and acts similarly to the real online trading accounts traders use. Demo account users receive an amount of virtual money in the beginning, and can start trading by opening selling and buying positions. Just like a real account, the demo account shows market movements on the traders’ screens, so they can decide if they should continue their trade or get out. This all contributes to assessing their actions, learning from them and getting ready to start trading in their real account.

For demo account users it is not only important to practise on demo accounts, but also to look back at their actions and learn from them. This is also important for more experienced traders, who want to practise on the demo account. They need to check if their trades and strategies proved to be as successful as they had hoped, and of course, they will use this knowledge to optimise their performance on the back of it.

Disadvantages of paper trading

However, there are some risks to paper trading which should not be ignored. Some people would suggest not to begin with a demo account for a number of reasons.

Euphoria trading

the main one, according to them, is the sense of euphoria paper trading can give. Since there is no real money being used, traders can take risks that they otherwise wouldn’t, thus expanding their profits. A case of money loss, on the other hand, is often not taken very seriously since it’s not real money that’s being lost. There is another disadvantage; since it’s not their money they are trading with, they won’t always follow the market and respond as they would if it was their own money.

Delayed data

some demo accounts do not use up-to-date information, but delay it by 15-20 minutes, so competitors do not use the data. Others display fake data, but the main goal remains the same – to get traders ready for the forex market. On the avatrade demo account, the information displayed is in real-time and projects the accurate rates. The tool is very common and used worldwide by brokers on stocks, bonds, commodities etc. Due to the fact that there is not real money that’s been put in, it’s often called “paper money”, “monopoly money” etc.

Should you use paper trading?

Should you as a first-time trader use paper trading? Should you open a demo account before trading in the real market?

The answer is yes, as long as you remember how to use it to its best effect. A few simple guidelines can dramatically increase the effectiveness of a demo account.

Here are a few simple guidelines that would dramatically increase the effectiveness of a demo account.

Treat it as a proper real account

this will not only overcome the main obstacle of demo accounts, but will ease the transition from demo account to real accounts. Paper trading might seem easy, but there is an important component missing.

As mentioned briefly earlier, real trading involves a lot of emotions, which can be a plus since traders are more invested emotionally. But this can lead to negative consequences – emotional trading, with no real thought or research and ending with money loss. Again, with demo trading you may feel the adrenaline rush and the fear or the greed. So as long as you factor this in, the transition from demo to real will be more successful for you.

Learn as much as possible

it is highly recommended to practise on a demo account, whilst simultaneously educating yourself on the market. There are so many free blogs and education portals you can use. Don’t underestimate the importance of a strong understanding of the trading platform and the markets you wish to trade on. Preparation is key. We recommend using the demo account for at least a few days, before switching over.

Finally, remember that trading does not suit everyone. Those people that rush to trade without considering the intricacies of the platform or the market may end up disappointed, not to mention ending up with lighter pockets.

Use paper trading as a mirror to yourself, in order to answer the following questions – am I ready to trade? Is this market suitable for me? If the answers are yes, it is time to open a real account!

Paper trading main faqs

Paper trading gives you something approaching hands-on experience, which is far more valuable than simply theoretical knowledge. You can be a genius with theoretical knowledge, but when faced with the pace of movement in real market trading environments you could freeze-up and fail miserably. So, paper trading can teach you valuable lessons about real-world trading that you can’t learn from other sources. And while paper trading won’t fill in all your learning needs it is one zero-risk method for improving on your trading.

Paper trading is considered to be very useful for new traders, but in truth it can benefit anyone, even professionals use paper trading when they are developing a new strategy. And while you might be impatient to get to trading with real money, the benefits to be gained from paper trading are incalculable. Taking the time to test your trading strategy with paper trading could mean the difference between a profitable trading career, and a huge disappointment. Paper trading can also help remove the emotions from your trading since you aren’t risking real money.

Paper trading without a plan isn’t going to help you much in the long-run. You have to treat your paper trading just as carefully as you would handle real money trading. That means instead of starting with the $1 million demo account you’ll likely be faced with, you should start with a realistic amount of money in your demo account. That might be $10,000 or it might be $1,000. Then you need to record everything about your trades. Why you took the trade. What your exit target is and why. What actually happened with the trade. Afterwards you can go back to determine how you might have made the trade more profitable, or less of a loss.

Paper trading account

So now it’s time for you to open a paper trading account. Start testing out the different trading strategies and techniques we talk about in our education section. You can start by identifying trends and then using simple moving averages, before moving up. Try and spot your own emotional reactions to different trade outcomes, as understanding how this affects your trades will be a massive advantage in improving your skill level prior to risking real money.

Click here to open a demo account now!

We recommend you to visit our trading for beginners section for more articles on how to trade forex and cfds.

Forex trading journal excel template

Are you looking for a forex trading journal excel template? You found it, and you can download it for free!

If you landed on this page, it’s because you decided to kept track of your trades. Keeping a trading journal is the best thing you can do to improve your profits and reduce your losses.

There are many paid trading journal templates, but we believe it is more comfortable and more productive to create your own trading journal excel.

Every trader has different needs, and it must consider this aspect. Some traders need only a simple trading diary to keep track of their ideas without reporting their trades.

Even this simple habit will allow you to improve a lot.

Let’s take an example. You are thinking of opening a trade long on US stock.

Maybe, you have done macroeconomic research and have the belief that that stock price could rise. Also, your favorite technical indicator is signaling you a long entry.

Once you have entered long, everything that pushed you to open the trade will disappear from your memory.

You will think only if to close in profit or loss. If you’ve closed the trade with a profit, your mood will be peaceful. Otherwise, you may be frustrated or angry. We bet it will be hardly rethinking the reasons you entered the market.

When you close the trade, you may have carried out other macroeconomic studies again, and again your favorite indicator may have sent you a signal.

You will end the trade with a profit or a loss, but nothing you have written in your trading diary or trading journal.

The next year these days, you will want to take stock of your trading activity. You will have profits and losses, but they will be only numbers. Regarding the trade that just ended after a year, you cannot remember why you led you to go long.

After a year, your skills could be improved, but you won’t be able to judge the past if you don’t remember it.

You may have attended a trading course and learned that the indicator you liked so much doesn’t work.

Remember that the human mind always remembers with a filter, and this filter is enhanced when emotions come into play.

Trading is all about emotions, sometimes powerful, such as disappointment, frustration, hope.

Writing your every trade in a trading diary or a trading journal will help you remember and judge your every trade with a rational mind.

At the end of this page, you will find a forex trading journal excel download for free.

However, we believe that the best thing is to create your own trading journal or trading diary by adapting it to your needs.

Why you need a trading journal

The best way to improve in trading is to keep a trading diary.

It is like a paper diary, but above all, in spreadsheets where we record the trades, we performed during the day.

By reviewing your trades, you can learn a lot because you can draw many fundamental indications.

Time passes, you can’t remember..

Let’s take an example. You are thinking of opening a trade long on US stock.

Maybe, you have done macroeconomic research and have the belief that that stock price could rise. Also, your favorite technical indicator is signaling you a long entry.

Once you have entered long, everything that pushed you to open the trade will disappear from your memory.

You will think only if to close in profit or loss. If the trade is successful, your mood will be peaceful. Otherwise, you may be frustrated or angry. We bet it will be hardly rethinking the reasons you entered the market.

When you close the trade, you may have carried out other macroeconomic studies again, and again your favorite indicator may have sent you a signal.

The trade will be ended with a profit or a loss, but nothing you have written in your trading diary or trading journal.

The next year these days, you will want to take stock of your trading activity. You will have profits and losses, but they will be only numbers. Regarding the trade that just ended after a year, you cannot remember why you led you to go long.

After a year, your skills could be improved, but you won’t be able to judge the past if you don’t remember it.

You may have attended a trading course and learned that the indicator you liked so much doesn’t work.

Remember that the human mind always remembers with a filter, and this filter is enhanced when emotions come into play.

Trading is all about emotions, sometimes robust, such as disappointment, frustration, hope.

Writing your every trade in a trading diary or a trading journal will help you remember and judge your every trade with a rational mind.

At the end of this page you will find a forex trading journal excel download for free.

However, we believe that the best thing is to create your own trading journal or trading diary by adapting it to your needs.

We learn from our mistakes.

Why you need the forex trading journal excel template

Having a diary allows you to record the trades and review them, thus pushing you to think about the trades and don’t forget about them.

Therefore, it is essential to take time every day to review your trades and try to analyze if there are errors or recurring positive factors to eliminate the former and strengthen the latter.

Building a trading journal is relatively simple for anyone with the necessary computer skills to create an excel worksheet: the columns will contain the categories. In contrast, the rows will contain the trades.

The essential items of your trading diary

- Trade opening time

- Currency pair

- Long / short

- Entry price

- Stop loss

- Target

- Closing price

- Gain / loss (in pips)

- Notes

This will eventually allow you to find the trades in the chart and go to review them.

In the notes, it is important to be brief and write critical comments such as emotions at the time of opening the trade, the reasons for opening, closing, obstacles, doubts, etc.).

Some questions that the diary can answer

Winning percentage of the strategy.

An idea of our system’s success rate can be useful to calculate the size of the position and estimate the profit targets.

Average stop-loss and take-profit.

Helps determine the optimal size of positions to meet money management criteria

Times of the day more profitable.

Depending on the answer, we may decide not to trade at a particular time of the day or improve in that period, where perhaps the trading conditions are different.

Short or long?

Are shorts or longs usually more profitable? How much? We could only look for short or long entries or investigate the reasons for any difference in performance.

Preferred currency pairs

Each currency moves differently from the others; some couples respect more technical levels, others less. Any cross is more volatile; some continue in lasting trends; others consolidate.

Do I get excellent results in EUR / USD but not in GBP / USD? This information can help us better select which couples we can trade better with our style.

We could abandon the less productive cross or try to improve the results on those.

Do you come out of time?

We may find that we come in too early and waiting for an extra candle; we may get better results.

Prices to the target?

We may close positions prematurely, but the diary tells us that prices, on average, reach the target we set ourselves.

Recurring patterns

Especially with the screenshots’ help, we can notice that a particular price formation consistently brings positive or negative results. The next time we see a similar pattern, we will know how to behave.

Forex trading journal template first version

In the image below, you can see our first template version, developed 3 years ago:

As you can see, it provides a lot of useful information such as the average trade and the average risk-reward ratio.

The only thing you will have to do is enter the trades you have executed and the relevant result.

With this forex trading journal excel template, you can finally keep track of your every trade.

You can improve by reviewing your trades and understand what your real statistics are.

The simple trading diary

A trading diary will have a straightforward template, and you will not need to enter all the information.

The principal purpose of a trading diary is to remember the reasons we opened the trade.

It will be handy for those who use fundamental analysis or diversified trading systems.

For example, if you are a trader who only uses overbought levels or oversold levels to enter a trade, you will not need to remember your motivations.

If instead, you buy shares based on the fundamental analysis, you will want to remember which analysis led you to open the trade or which economic indicators you analyzed.

To make a trading diary, we will use microsoft word and organize each trade in a single word page.

We will place the word page thus created and named in a different folder for each month of the year.

We can write something like this:

Trading diary of 02.04.2020

We are approaching an economic recession. I found this interesting analysis of apple on seeking alpha.

The RSI indicator I’m following tells me that apple is in an oversold zone, so I buy the $ 10,000 amount. I will close the trade when the RSI indicator returns to overbought.

Trading diary of 15.03.2020

I found this analysis on zerohedge and decided not to wait for the RSI indicator but to close within this week.

As you can see, it is effortless and does not require a big effort, but imagine after a year how much useful information you could have by looking at your track record.

How to create a trading journal excel

An excel trading journal requires entering much more data. We will use excel because it will be necessary to perform some calculations automatically.

Our advice is to use a spreadsheet for each strategy.

For example, if I carry out operations on the US market shares using an RSI indicator, I will dedicate a particular trading journal excel to this strategy.

This sheet is elementary to create, and you can add the items you will need.

As you can see, everything is straightforward. All you need to do is enter your initial capital and only some details of the transaction in the excel trading journal.

If you always use the same stocks, you can create a drop-down list to speed up the insertion with an automatic selection.

How to take a screenshot of a chart

In each note, we should add a photo of the chart used with your indicators. We should do the screenshot of the chart at the exact moment we open the trade.

We shouldn’t wait because future price movements would change the view of your trade.

If you use metatrader4, you can use a function already present on the platform to extract a chart’s screenshot.

Once you click on “OK” to automatically open a web page with screenshots, you can click on the photo and save it on your hard disk or share it online through the links.

For example, if you want to write a post on forexfactory.Com, paste the post’s link, and it will autoload the image.

Another straightforward method to take a screenshot of a chart is to use a free tool already present in windows.

We are talking about the snipping tool. If you have never used it or don’t know it, write the search bar’s snipping tool.

If you want to add effects or shapes or writings to your screenshot, you can use the free software microsoft paint. For more professional work, there are paid tools such as snagit from the manufacturer of camtasia that allows you to make cutouts like the snipping tool but has advanced editing functions.

To edit your graphic you can use photoshop or an interesting free alternative: GIMP.

The best free and online platform to find charts is tradingview.

Tradingview is a free site with many useful functions and technical analysis indicators; you can also find trading ideas and sentiment indicators.

How to create a drop-down list in excel

Select all cells and click on “data” and “data validation”.

Choose “list” and enter all the equity securities you need separated by a comma.

As you can see, it will be very easy and fast to select your favorite titles.

Paper trading forex using practice or demo accounts

Perhaps one of the most useful features offered by online forex brokers for the novice forex trader consists of the demo or practice account.

Before the advent of this type of online account, new traders would often enter their trades on paper rather than executing them in the market. This activity gave rise to the term paper trading.

Benefits of practice or demo accounts

Such practice or demo forex trading accounts now effectively allow you to paper trade in a virtual account using virtual money. Practice or demo accounts consist of simulated trading accounts where no actual money is placed at risk. Also, trades can be initiated and liquidated, but no real funds are actually exchanged.

Forex brokers typically offer demo accounts in the hope of attracting more business. From a trader’s perspective, demo accounts allow traders to practice trading while not actually producing any tangible results in terms of actual profits or losses, which means you can test out your trading systems or strategies.

Overall, such practice accounts can offer trading novices a great way to learn about how to trade forex, as long as they do their best to avoid trading errors that might allow them to develop poor habits.

Learn how to trade forex using demo accounts

Those new to forex trading can also use practice or demo accounts to help themselves get a better handle on how the forex market trades without putting any money on the line.

For trading novices, it can really pay to learn as much as possible about the forex market during a demo trading experience before graduating to live trading.

Also, depending on their psychological makeup as a trader, many people ultimately find that trading forex is just not right for them. Unfortunately, this often happens after they lose a large amount of money and blow out their funded trading accounts.

Basically, losing a large amount of virtual money in a demo account can be a lot less painful if the market eventually gives you the clear signal that trading the forex market is not exactly your cup of tea.

Demo trading success may not indicate live trading success

The lack of actual money being placed at risk in demo accounts can result in significant differences between the performances achieved by forex traders in demo trading and live trading environments.

Such a variation can come from pricing or order execution differences on the part of the forex broker, as well as a platform switch or performance change.

In addition, they might arise as a result of a different set of emotional responses on the part of the trader when nothing is at stake versus when they have substantial amounts of money on the line.

Irrespective of the source of the potential performance difference, it will need to be taken into account when traders are either learning how to trade forex or are evaluating trading plans and strategies.

Demo trading helps you know yourself as a trader

Once you have satisfied yourself that you are cut out for trading forex and that you have a decent trading plan by paper trading using a practice or demo trading account, you have probably gained considerable information about yourself, your trading needs and how you respond to pressures that might arise when trading.

Armed with this very helpful self knowledge gained from demo trading, you can then move on to selecting a funded trading account with a retail forex broker that will best meet your needs.

Moving on to a live trading account

Basically, choosing the right type of live forex trading account to graduate to after demo trading the forex market involves having a good knowledge of your personal trading needs.

Next step: what type of account to open first?

Free forex paper trading

Welcome to IQ forex, a simple and easy trading game to learn how to trade with binary options on forex and cryptocurrency. You are free from financial risks and legal risks while enjoying binary options trading. Here you can check your winning rates and your rank among others. The best part is the chart is based on real market signals.

The easiest way

IQ forex provides the easiest way to experience forex margin trading .

Real market data

The chart in IQ forex is generated from real-time tick data of real market .

IQ coin

IQ coin is a cyber money only available within this app. IQ coin is not interchangeable with real currency .

Risk-free sandbox

IQ forex is a sandbox for forex margin trading. Free from financial risks and legal risks .

About binary options trading

Currencies are a popular investment class that allow for speculation on price movements, just like bets on other asset classes. Foreign exchange, or forex in short, is a decentralized global market where currency pairs are traded.

Binary options trading is an investment that works more like a prediction that can be either right or wrong, but nowhere in between. An investor bets that a given asset will be above or below a certain point after a fixed amount of time. That time can vary greatly, but it can be as quick a turnaround as 60 seconds.

If the prediction is correct, the investor will recoup his or her investment plus a bonus on top—if they’re wrong, the investor loses the entire amount put into the venture.

Paper trading

Considering upping your game by adding a new strategy? Or maybe you'd like to try your hand at options. With papermoney ® , a trading simulator from TD ameritrade, you can trade without risking a dime, in a real-time environment.

The place where trading risk doesn't exist.

You have nothing to lose when playing with papermoney® 2 min read

Trading or investment idea? Consider some simulation 2 min read

All done paper trading. Now what? Experiment for real 2 min read

Three option trading hang-ups you can dump in the new year 5 min read

Can too much trading practice knock you off your game? 2 min read

Why social media is now essential for individual investors 6 min read

Gold for best print magazine overall

Financial communications society 2016

Best content-driven website

Content marketing awards 2016

Content intended for educational/informational purposes only. Not investment advice, or a recommendation of any security, strategy, or account type.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Market volatility, volume, and system availability may delay account access and trade executions.

Past performance of a security or strategy does not guarantee future results or success.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options trading subject to TD ameritrade review and approval. Please read characteristics and risks of standardized options before investing in options.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in australia, canada, hong kong, japan, saudi arabia, singapore, UK, and the countries of the european union.

TD ameritrade, inc., member FINRA/SIPC, a subsidiary of the charles schwab corporation. TD ameritrade is a trademark jointly owned by TD ameritrade IP company, inc. And the toronto-dominion bank. © 2021 charles schwab & co. Inc. All rights reserved.

Demo trading account

Develop your trading skills on thousands of markets, and master our award-winning platform for free. 1

Practise trading with £10,000 virtual funds

Get exclusive educational content on IG academy

Test strategies on the go with our free mobile apps

Open a demo trading account

Develop your trading skills on thousands of markets, and master our award-winning platform for free. 1

What is a demo trading account?

A demo account is a simulated market environment offered by a trading provider that aims to recreate the experience of ‘real’ trading as closely as possible. This is so that you can get a feel for how different products and financial markets work. The main difference is you won’t be at risk of losing any money, so you can explore and experiment with confidence.

When you open a demo account with us, you’ll get immediate access to a version of our online platform, along with a pre-set balance of £10,000 in virtual funds to practise with.

Why use a trading simulator?

You can use a trading simulator, such as a demo account, to enable you to get to grips with a platform, build your strategy and grow in confidence, without having to risk any real money.

Trading simulators aren’t just for newcomers. As an experienced trader, you can use demo accounts to try out new strategies, tools or ideas, safe in the knowledge that your experiments won’t result in any real-world losses.

You’ll often see demo accounts described as ‘paper trading’, which is the term to describe simulated securities trading. With an IG demo trading account, you’ll gain access to over 17,000 markets, including:

As well as a range of other markets including bonds, rates and options.

A demo account will enable you to see the financial markets available with IG, and get used to how they behave. You’ll be able to set alerts on markets you want to keep an eye on, so you can react instantly to any price volatility. The demo account will also help you get used to the IG platform, ensuring that you can read and analyse price charts, fill in the deal ticket and monitor open positions.

If you’re interested in using more advanced software, you can also get an MT4 demo account with us. This enables you to build your understanding of the metatrader4 online trading platform in a risk-free environment.

Yes, you can practise stock trading and forex trading for free with an IG demo account. No need to create a separate forex demo account or stock demo account – you can trade both markets via a single login.

With an IG demo account, you can practise CFD trading and spread betting risk-free. These two products both use leverage, which enables you to gain full market exposure for just a small initial deposit. While this can magnify your returns, it can also magnify your risk – so it’s important to get to grips with how they work before you start to trade on live markets.

There is no difference between a demo trading account, trading simulator or paper trading account. All of these terms are just synonyms for the same type of simulated trading platform.

For your country of residence, you may wish to use <

Sorry we cannot open an account for clients with your country of residence through this site. Instead, please visit <

1 awarded ‘best multi platform provider’ and ‘best finance app’ at the ADVFN international financial awards 2020

Markets

IG services

Trading platforms

Learn to trade

Contact us

Spread bets and cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and cfds with this provider. You should consider whether you understand how spread bets and cfds work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, etfs and etcs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG markets ltd, spread betting provided by IG index ltd. IG is a trading name of IG markets ltd (a company registered in england and wales under number 04008957) and IG index ltd (a company registered in england and wales under number 01190902). Registered address at cannon bridge house, 25 dowgate hill, london EC4R 2YA. Both IG markets ltd (register number 195355) and IG index ltd (register number 114059) are authorised and regulated by the financial conduct authority.

The information on this site is not directed at residents of the united states, belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

So, let's see, what we have: day traders face intense competition in today's market. Paper trading practice is more important than ever for getting above-market risk-adjusted returns. At free forex paper trading

Contents of the article

- New forex bonuses

- Using paper trading to practice day trading

- What is paper trading?

- Setting up a day trading account

- Paper trading tips

- Pros of paper trading

- Cons of paper trading

- Practice, practice, practice

- The bottom line

- Forex trading journal excel template

- Why you need a trading journal

- Time passes, you can’t remember..

- We learn from our mistakes.

- The essential items of your trading diary

- Some questions that the diary can answer

- Forex trading journal template first version

- The simple trading diary

- How to create a trading journal excel

- Paper trading simulator

- The warrior trading paper trading simulator...

- Ready to get started?

- The warrior trading simulator

- Paper trading

- What is paper trading?

- Advantages and disadvantages of paper trading

- Disadvantages of paper trading

- Should you use paper trading?

- Paper trading

- What is paper trading?

- Advantages and disadvantages of paper trading

- Disadvantages of paper trading

- Should you use paper trading?

- Forex trading journal excel template

- Why you need a trading journal

- Time passes, you can’t remember..

- We learn from our mistakes.

- The essential items of your trading diary

- Some questions that the diary can answer

- Forex trading journal template first version

- The simple trading diary

- How to create a trading journal excel

- Paper trading forex using practice or demo...

- Benefits of practice or demo accounts

- Learn how to trade forex using demo accounts

- Demo trading success may not indicate live...

- Demo trading helps you know yourself as a trader

- Moving on to a live trading account

- Free forex paper trading

- About binary options trading

- Paper trading

- The place where trading risk doesn't exist.

- You have nothing to lose when playing with...

- Trading or investment idea? Consider some...

- All done paper trading. Now what? Experiment for...

- Three option trading hang-ups you can dump in the...

- Can too much trading practice knock you off your...

- Why social media is now essential for individual...

- Gold for best print magazine overall

- Best content-driven website

- Demo trading account

- Open a demo trading account

- What is a demo trading account?

- Why use a trading simulator?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.