How to take out money from ewallet

Technology has made the financial market convenient for users.

New forex bonuses

One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy. The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

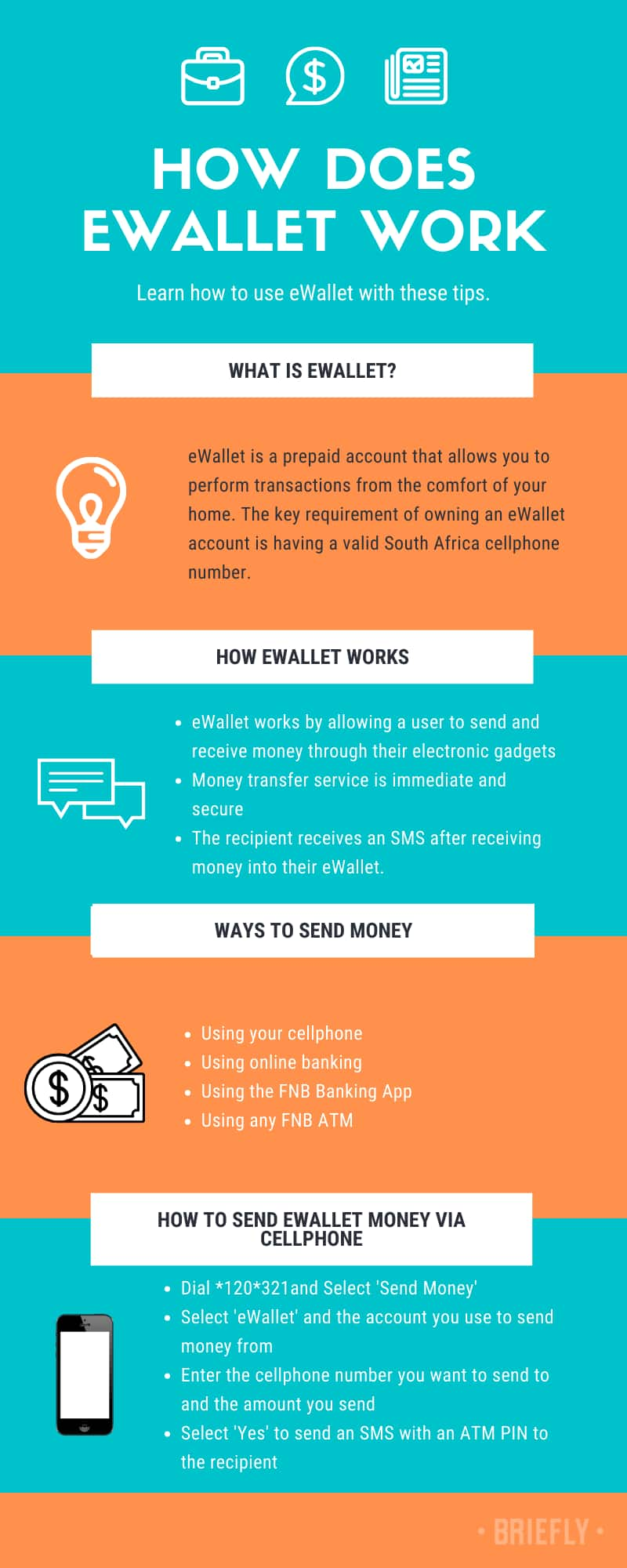

How does ewallet work

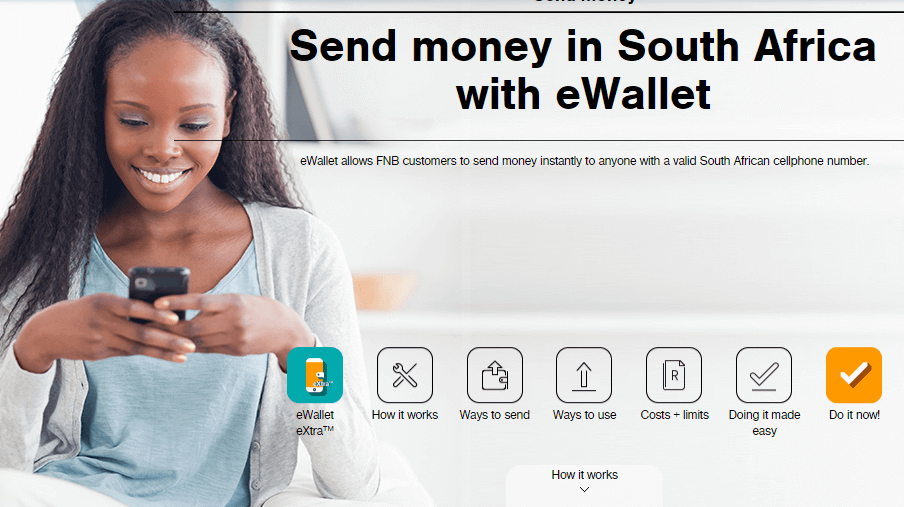

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

Image: canva.Com (modified by author)

source: original

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user's account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user's bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient's account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Image: instagram.Com, @fnbsa

source: UGC

READ ALSO: how to apply and use PEP money transfer

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the 'send money' option and clicking okay

- Selecting the 'ewallet' option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

Image: facebook.Com, @fnbsa

source: UGC

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the "ewallet services" on the screen.

- Enter your valid south african phone number on the keypad and select the "proceed" option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

- Verify that you have completed the transaction before leaving the ATM. In case you do not approve the transaction, you can select the " cancel" option to stop the transaction.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the "get retail PIN" option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the "withdraw cash" at checkout option.

- The following screen will ask you to "withdraw cash from ewallet."

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

READ ALSO: how does standard bank instant money transfer work

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

READ ALSO:

- FNB reverse payment - how can you reverse an EFT payment FNB with ease?

- How to send money to zimbabwe cheap, fast and securely

- How to reverse ewallet payment in 2020?

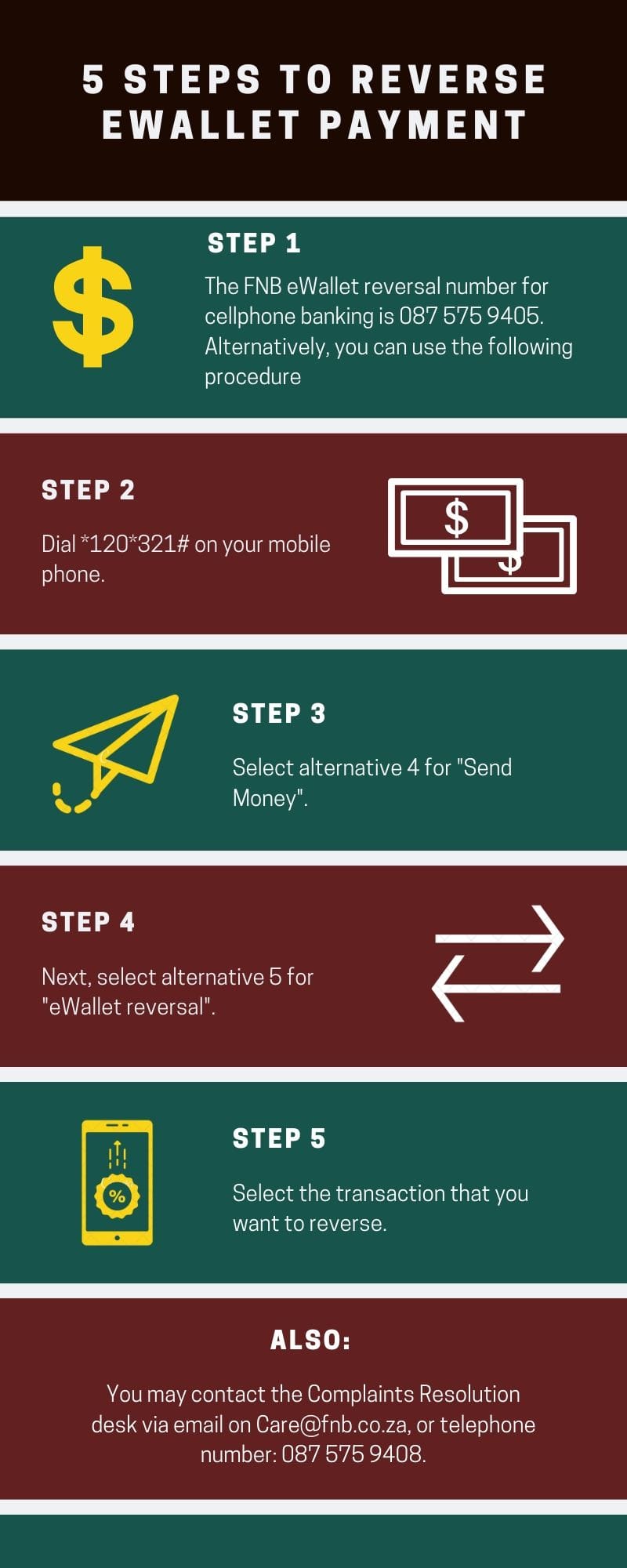

How to reverse ewallet payment in 2021?

In this digital era, sending money across the globe has been made so much easier. Ewallet FNB is one of the simplest, efficient, and cheapest ways to transfer cash to friends and family in south africa. The best part is that you can transfer such funds from your bank account to any registered mobile number all over the country and not necessarily another bank account. In addition, the recipient can access the money instantly at any of the FNB atms. But what happens if you make an error with the recipient's mobile phone or bank information? Here is how to reverse ewallet payment in 2021.

Image: canva.Com (modified by author)

source: UGC

Can I reverse ewallet transaction? In case you send money via this option to the wrong recipient, you need to reverse it and resend it to the right person. Therefore, it is essential to know how to reverse such payments, and here is what you ought to do in case you are caught up in such a situation.

How to reverse ewallet transfer?

How do I reverse FNB ewallet when sent to the wrong recipient? You just noticed that the money has gone to the wrong recipient, and cannot help but panic. Do not worry, as there is an alternative to reversing the transaction. The only way to cancel an already complete transaction is to contact FNB call centre and request for the procedure to be done manually from their end. So, how do you contact FNB call centre on how to reverse ewallet sent to the wrong number manually?

- The FNB ewallet reversal number for cellphone banking is 087 575 9405. Alternatively, you can use the following procedure:

- Dial *120*321# on your mobile phone.

- Select alternative 4 for "send money".

- Next, select alternative 5 for "ewallet reversal".

- Select the transaction that you want to reverse.

- You may also contact the complaints resolution desk via email on care@fnb.Co.Za, or telephone number: 087 575 9408 (option one).

How do I reverse ewallet on FNB app? In case of any inquiries with regards to how to reverse ewallet on app, call 087 575 0362. And for queries on FNB ewallet reversal online, contact 087 575 0000.

Other important details on ewallet reversal

Can you reverse an ewallet transaction? FNB and standard banks permit free money withdrawals at specified retailers. The receiver of the money must know the validity of the ewallet PIN which is normally 30 days for absa and standard bank and 7 days for nedbank. In case the recipient fails to withdraw the cash in the given period, the money is reversed back to the account of the sender.

In case you receive payments wrongly, do not withdraw the cash and the FNB reverse payment will automatically revert to the sender after the PIN expires. The ewallet PIN for FNB is valid for four hours. Upon its expiration, the recipient can opt for FNB ewallet new pin request at any given period by dialing *130*277#.

How long does it take to reverse ewallet?

If you send money to the wrong recipient and call the company's team, the reversal should take up to 4 business days. On the other hand, money is returned to the sender within 15 business days if the recipient's number does not work.

How much does it cost to reverse an ewallet?

Kindly note that you will be charged about R50 as fee to get back the money sent to the wrong number. Also according to FNB, this procedure is not really guaranteed. For a better experience, ensure to double-check the cell phone of the receiver as well as the amount to be sent and this will save you the hassle of making an FNB ewallet reversal. Here is a quick reminder on how to correctly use this platform to send money.

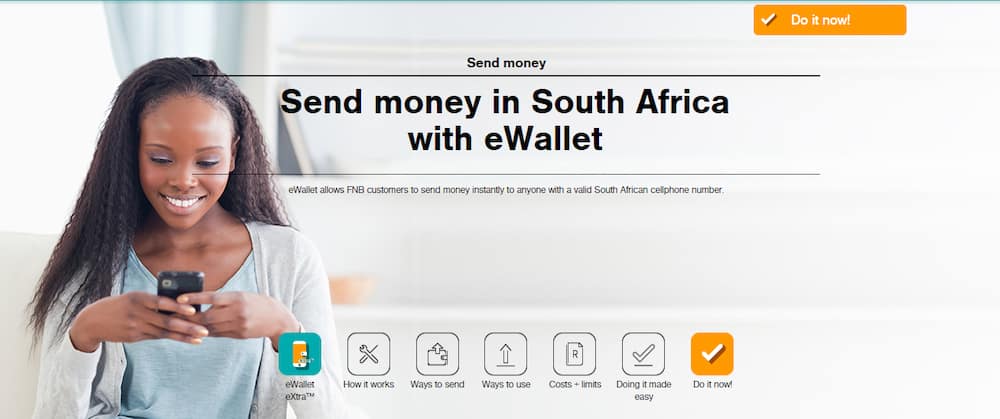

How to correctly send money and avoid reversal inconveniences

Image: fnb.Co.Za

source: UGC

Ewallet FNB is very convenient because one can use it in four different platforms which are mobile banking, ATM, mobile app, or online banking. After selecting your preferred option of making the transfer:

- Select send money then choose ewallet.

- Insert the mobile phone number of the person you wish to make the transfer to. Double-check to ensure that the digits are correct.

- Next, select if the app should offer the recipient a PIN or not, then type in the amount you wish to send.

- Lastly, confirm and submit the transaction.

The recipient gets an instant message after the money has been deposited into their account. To withdraw the cash, go to any of the nearby FBN ATM or selected retailers.

- Select FNB card less services in the screen then tap in the ewallet services.

- Insert your mobile number and press the proceed button.

- Type in the ATM PIN included in the message received and input the amount you wish to withdraw.

- After taking the money, ensure that the transaction has completed, or choose ‘cancel’ before departing from the ATM.

- In case you do not wish to withdraw the money, then you can use your FNB ewallet to purchase airtime, data, and electricity as well as pay for goods and services.

Ewallet account can hold a maximum of R5,000 at any point in time. The limit per day when transferring via the mobile app or online banking is R3,000 while the limit for cellphone banking and atms is R1,500. Additionally, FNB ewallet will only charge you a fee of R10.95 per transaction making it the most affordable way to send money in south africa. Ewallet withdraw fees will vary depending on the amount withdrawn.

With the above guide, you now know how to reverse ewallet payments if you incorrectly send the cash. So, if you make the mistake of sending money to the wrong person, do not panic but simply follow the steps and options to reverse the transaction.

DISCLAIMER: this article is intended for general informational purposes only and does not address individual circumstances. It should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility! We are not responsible for any loss, damages, etc. That may occur if the information contained turns out to be inaccurate/incorrect.

How to reverse ewallet payment

In this digital era, sending money across the globe has been made so much easier. Ewallet FNB is one of the simplest, efficient, and cheapest ways to transfer cash to friends and family in south africa. The best part is that you can transfer such funds from your bank account to any registered mobile number all over the country and not necessarily another bank account. In addition, the recipient can access the money instantly at any of the FNB atms. But what happens if you make an error with the recipient’s mobile phone or bank information? Here is how to reverse ewallet payment.

Can I reverse ewallet transaction? In case you send money via this option to the wrong recipient, you need to reverse it and resend it to the right person. Therefore, it is essential to know how to reverse such payments, and here is what you ought to do in case you are caught up in such a situation.

How to reverse ewallet transfer?

How do I reverse FNB ewallet when sent to the wrong recipient? You just noticed that the money has gone to the wrong recipient, and cannot help but panic. Do not worry, as there is an alternative to reversing the transaction. The only way to cancel an already complete transaction is to contact FNB call centre and request for the procedure to be done manually from their end. So, how do you contact FNB call centre on how to reverse ewallet sent to the wrong number manually?

Do the *120*321# cellphone banking thing as if you’re about to send another ewallet. The option for reversal will come up

- The FNB ewallet reversal number for cellphone banking is 087 575 9405. Alternatively, you can use the following procedure:

- Dial *120*321# on your mobile phone.

- Select alternative 4 for “send money”.

- Next, select alternative 5 for “ewallet reversal”.

- Select the transaction that you want to reverse.

Guys pin this for yourselves just in case:

FNB ewallet reversal : *120*321#

choose option 4 (send money)

thereafter option 5 (ewallet reversal)

then choose to high transaction you want to reverse.

It’s cheaper to use cellphone banking than it is to call them.

- You may also contact the complaints resolution desk via email on care@fnb.Co.Za, or telephone number: 087 575 9408 (option one).

How do I reverse ewallet on FNB app? In case of any inquiries with regards to how to reverse ewallet on app, call 087 575 0362. And for queries on FNB ewallet reversal online, contact 087 575 0000.

Other important details on ewallet reversal

Can you reverse an ewallet transaction? FNB and standard banks permit free money withdrawals at specified retailers. The receiver of the money must know the validity of the ewallet PIN which is normally 30 days for absa and standard bank and 7 days for nedbank. In case the recipient fails to withdraw the cash in the given period, the money is reversed back to the account of the sender.

In case you receive payments wrongly, do not withdraw the cash and the FNB reverse payment will automatically revert to the sender after the PIN expires. The ewallet PIN for FNB is valid for four hours. Upon its expiration, the recipient can opt for FNB ewallet new pin request at any given period by dialing *130*277#.

How long does it take to reverse ewallet?

Is there no function though on internet banking that allows one to do this instead of calling the call centre?

You have to phone the ewallet team. The reversal takes 4 working days.

If you send money to the wrong recipient and call the company’s team, the reversal should take up to 4 business days. On the other hand, money is returned to the sender within 15 business days if the recipient’s number does not work.

OK thank u. I will do that! For how long though?

If an ewallet has not been activated within 13 days, the money will be returned to the sender.

How much does it cost to reverse an ewallet?

Kindly note that you will be charged about R50 as fee to get back the money sent to the wrong number. Also according to FNB, this procedure is not really guaranteed. For a better experience, ensure to double-check the cell phone of the receiver as well as the amount to be sent and this will save you the hassle of making an FNB ewallet reversal. Here is a quick reminder on how to correctly use this platform to send money.

How to correctly send money and avoid reversal inconveniences

Ewallet FNB is very convenient because one can use it in four different platforms which are mobile banking, ATM, mobile app, or online banking. After selecting your preferred option of making the transfer:

- Select send money then choose ewallet.

- Insert the mobile phone number of the person you wish to make the transfer to. Double-check to ensure that the digits are correct.

- Next, select if the app should offer the recipient a PIN or not, then type in the amount you wish to send.

- Lastly, confirm and submit the transaction.

The recipient gets an instant message after the money has been deposited into their account. To withdraw the cash, go to any of the nearby FBN ATM or selected retailers.

- Select FNB card less services in the screen then tap in the ewallet services.

- Insert your mobile number and press the proceed button.

- Type in the ATM PIN included in the message received and input the amount you wish to withdraw.

- After taking the money, ensure that the transaction has completed, or choose ‘cancel’ before departing from the ATM.

- In case you do not wish to withdraw the money, then you can use your FNB ewallet to purchase airtime, data, and electricity as well as pay for goods and services.

Ewallet account can hold a maximum of R5,000 at any point in time. The limit per day when transferring via the mobile app or online banking is R3,000 while the limit for cellphone banking and atms is R1,500. Additionally, FNB ewallet will only charge you a fee of R10.95 per transaction making it the most affordable way to send money in south africa. Ewallet withdraw fees will vary depending on the amount withdrawn.

Guys I almost peed on myself today. I mistakenly sent ewallet of R3000 to the wrong number. When I realised, I was like…

Thank god for ewallet reversal, @FNBSA after today I am became a fan.

With the above guide, you now know how to reverse ewallet payments if you incorrectly send the cash. So, if you make the mistake of sending money to the wrong person, do not panic but simply follow the steps and options to reverse the transaction.

DISCLAIMER: this article is intended for general informational purposes only and does not address individual circumstances. It should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility! We are not responsible for any loss, damages, etc. That may occur if the information contained turns out to be inaccurate/incorrect.

How to take out money from ewallet

This is your third and last login attempt available.

Your profile will be blocked if you fail to enter your login details correctly.

Oh no!

We've noticed that you've tried to login more than 3 times.

You might have blocked your online banking profile.

In order to unblock your profile, reset your username and password.

Cellphone banking

- Dial *130*321#

- Select send money

- Select the account you want to send money from

- Key in the cellphone number you want to send to

- Enter the amount you want to send

- Confirm that all is correct (make sure you entered the right cellphone number)

To send money using FNB cellphone banking you need to be registered for cellphone banking.

To register for cellphone banking, dial *130*321#

Online banking

- Log into FNB online banking

- Select the payments tab

- Enter your one time PIN (OTP)

- Select send money

- Select the account you want to send money from

- Select the amount you want to send

- Key in the cellphone number you want to send money to

- Click on finish

You need to register for online banking to send money via the internet

FNB ATM

- Insert your card and enter your PIN

- Select more options

- Select buy it/pay it

- Select send money. Read the terms and conditions and then select proceed

- Key in the cellphone number you want to send money to and select proceed

- Key in the amount you want to send money to and select proceed

- Confirm that all the details are correct and select proceed

- Remember to take your card

No registration or application is necessary if you send money via an FNB ATM

| fee (BWP) | |

|---|---|

| send money | P9.40 |

| withdrawal (you get 1 free withdrawal with every wallet send without exceeding maximum of 4 free withdrawals in the wallet) | FREE |

| dormant ewallet (up to 6 months) | FREE |

| dormant ewallet (after 6 months) | FREE |

Standard network operator rates apply when using your cellphone.

You have access to ewallet

If you are an FNB client with an active transactional account, you already have access to the ewallet service.

Login to online banking, cellphone banking or visit your nearest ATM and select send money to make use of this safe and convenient way to send money to anyone.

Ewallet

Send money anywhere, any time

The ewallet allows FNB customers to send money to anyone with an active cell number. Money is transferred instantly. Recipients can use the money in the ewallet to buy airtime, send money to other cellphones and more.

How it works

Instantly send money or make payments

- You can send money to friends and family members or make a payment to anyone simply and hassle free

- Money can be sent to anyone who has a valid botswana cellphone number and the recipient does not need to have a bank account

- Any GSM cellphone model can be used to send money or to receive money

- Money is instantly available in the ewallet

- Money will be stored in an ewallet. Recipients will be able access the money immediately at an FNB ATM without needing a bank card and without filling in any forms

- Recipients will get all of the money sent as there are no ATM charges to withdraw money

- Recipients don't have to withdraw all the money at once

- Recipients can also check the balance, get a mini statement, buy prepaid airtime, send money on to someone else's cellphone

- You can send money at any time of the day or night via cellphone banking, FNB online banking, FNB app or at an FNB ATM

What's hot

It's for everyone

Send money to anyone with a valid botswana cellphone number

It's simple

The recipient does not need a bank account or bank card

It's convenient

Money can be sent anytime, anywhere, from the comfort and safety of your own home

It's fast

The money is sent immediately and the recipient can access the funds immediately

It's free of bank charges

Pay no bank charges when you send money via ewallet

Ways to send

Send the way you want to

As an FNB customer you can use one of FNB's convenient digital channels to send money to anyone with a valid cellphone number on any network.

Online banking

View how to send money via online banking

Cellphone banking

View how to send money via cellphone banking

View how to send money via FNB ATM

Ways to use

Withdraw, buy + spend

When you receive an SMS notifying you that money has been sent to your cellphone, you can do the following

- Send a portion of the money in the ewallet to another ewallet in exactly the same way

- Withdraw all or some of the money from the ewallet at an FNB ATM without needing a bank card. The rest of the money can be withdrawn at a later stage

- Buy prepaid airtime from the ewallet

- Check the ewallet account balance or get a mini statement

- How to receive money

How to receive money

Turn your phone into a wallet

Once you've received an SMS telling you that you have been sent money

- Dial *130*392# to access the ewallet

- Set a secret 5-digit PIN for the ewallet

- Select 'withdraw cash' and then 'get ATM PIN'

- You'll receive an SMS with an ATM PIN

- Go to an FNB ATM

- At the ATM press the green button (enter/ proceed) and then wallet services

- Key in your cellphone number and ATM PIN

- Choose the amount of money to withdraw. Make sure that either your transaction has ended or that you press 'cancel' before leaving the ATM

If you have been sent money but you have no airtime , dial *103*392# to buy airtime with the money that has been sent to you. Then dial *130*321# .

How to cash out your online casino winnings – 2021 guide

Congratulations on winning the game! So, now you must be looking forward to cashing out the earnings within the account. All the casinos follow separate sets of rules and regulations while taking out their earnings. The rules also differ from one casino to another. But truthfully, most of the gambling houses work in the same fashion. Visit casinoclaw. It happens to be an e-casino which offers amazing cashing out options.

In case the money gets withdrawn slowly, it sends wrong signs to the customers. Reputed casinos pay the earnings the moment a user applies for it. However, certain casinos are a bit shady. They delay the payments. Hence, slow payouts should ring warning bells. Let us find out now in what ways people may take out their earnings from online casinos through this 2021 guide.

Step 1:

Visit an online gambling website that owes you a winning amount. Now, click on the cash payout button. Here you are redirected to the page in which you had initially deposited the money while you started gambling.

Step 2:

Now click over that option of cash withdrawal and then you can select your preferred cash-out option. Another option is that people may take out cash into their gambling wallet implementing a plethora of safe as well as a secure methodology – VISA along with mastercard, neteller, click2pay, skrill, ukash, moneybookers, clickandbuy and paysafecard.

Step 3:

Now fill in your information as well as your home address. After that, click on the “cash withdrawal” button to successfully take out your earnings into cash. This process is quite simple. It is also quite self-explanatory. Reputed casinos aim to ensure that the process is as smooth as possible. However, if you get stuck at any point, contact the casino owner at the earliest.

Various methods to cash out:

1. Via ewallet:

A majority of modern cashing out services like neteller and skrill are together called the ewallet services and you can store the funds in these online wallets. They are convenient for using and the users can safely take out their earnings through these wallets into your banking account. They feature a fast cashing out facility.

Generally, these accounts happen to be connected to the user’s bank account. Hence, when the casino payouts get deposited in these bank accounts, you can easily transfer the amount to the personal bank account. In such a case, you must have at least two to three days’ time in your hand because the process of taking out may require the user to have patience until a few days.

Withdrawal services like these, acts like an amazing buffer in between your bank account as well as an online casino. E-wallets

are the ideal option to cash out considering the safety and the privacy condition.

2. Cashing out in credit cards:

Withdrawing some earnings of a gambling house via credit card is simple. The users are only required to provide the bank with their exact billing information which they provided while depositing the earnings via credit card. They generally take less than seven days for processing.

A credit card brand takes certain precautions. Such precautions also make taking the earnings out of a casino safer. The master card can no longer be used to take out the earnings of a casino. Alternatively, visa cards are commonly used to transfer funds.

3. Taking out money by using wire transfers:

Most of the online gamblers in the USA and canada take out a part of their earnings through wire transfers. They do it because they have few options. However, the action needs them to trust the casinos enough. The reason is they need to share the information related to their bank account with the casinos.

Generally, the transactions done through credit cards ensure that the wire transfers are safe. It is a good idea to transfer the money online, particularly if the banking information used for deposits cannot be used to make withdrawals. The users who use this method generally receive the money within five to ten business days. So much time is taken because the middlemen is removed from the method.

4. Utilizing checks and e-checks:

Checks happen to be the oldest way of taking out the casino earnings. Using checks for taking out the casino earnings is not bound by any limitations. Only a few days are needed to process the earnings and a few more days for the check to get delivered. The best news is that e-checks and wire transfers cannot be forged. E-checks are equally trustworthy as physical checks. However, e-checks help users acquire the money faster than physical checks.

Look out for an online casino that provides excellent facilities for taking out the money from the casino cashier utilizing the very latest encryption technology to ensure the confidential information is always secured. You’ll find many convenient banking options available with major credit cards. They are the popular depositing methods however there are plenty of alternatives too.

Conclusion:

If you ever need assistance when making a deposit, or requesting a payout, contact the casino’s support team. People may contact them at any time, 24 hours a day. It is their duty to ensure that the casino action is as good as it can possibly be. People need to be smart so that they may cash out their earnings fast from online casinos. So, the methods of cashing out need to be reliable too.

There may be a possibility that an online casino might pull down shutters without paying out the winners. Hence, it is important for you to cash out your earnings using any method as soon as possible. The method you select for cashing out your earnings determines how soon you will get paid out. The bank transfer option helps us to cash out faster than a check. The method of ewallet is the most trustworthy. We understand how frustrating it feels when a casino doesn’t pay out people. So, it is in the best interest to retrieve your payment as soon as possible.

Important details on ABSA ewallet, ABSA cash send, ABSA cardless withdrawal, ABSA online, ABSA internet banking and ABSA branch codes

ABSA cash send is a money transfer platform that allows people to send and receive cash at any ABSA or barclays banks. They provide easy, reliable, and convenient services as it is not a requirement for recipients to be a barclays or ABSA customer. Therefore, it is possible to withdraw ABSA cashsend money without having a bank account or ATM card of the respective banks.

Image: pexels.Com

source: UGC

Customers can send cash using their mobile phones or via ATM. As a result of this flexibility and convenience, they have attracted over 11 customers. This makes ABSA the largest south african retail bank.

How does ABSA cash send work?

ABSA is a fully-owned subsidiary of barclays africa group. ABSA money transfer service facilitates corporate, retail, investment, and business banking, as well as wealth management services and products mainly in south africa and namibia. It is a safe and secure platform to send cash electronically.

ABSA internet banking

ABSA offers banking services that facilitate efficient money transfer across the country to persons with bank accounts or not. Users also develop peace of mind as the intended recipient can only access the funds having the unique 6-digit ABSA access number or code, and 10-digit reference number to verify the transaction.

Image: pexels.Com

source: UGC

ABSA online cash send services

ABSA online payment is easy and quick. Internet banking ABSA allows users to transfer money from their current account, cheque account, or savings through online banking, cellphone banking ABSA, or most ABSA atms. Using online banking, the sending procedure is quite easy:

- Log in to absa online

- Select on ‘payment’

- Now select ‘pay’ then ‘cashsend payment’

- Choose the account you wish to withdraw the funds from, followed by the amount you want to send.

- Type in the phone number of the recipient.

- Create a 6-digit access code, then confirm the payment.

- Remember to share the chosen access code with the recipient.

How to transfer money using ABSA cellphone banking

If you prefer to use your phone, follow this simple procedure:

- Log in to cellphone banking and select ‘cashsend’, followed by ‘cashsend payment’.

- Log off and wait to receive a secure URL that will be sent to you via SMS.

- Open the homepage and enter the amount of money that you wish to send, as well as the recipient’s phone number.

- Create a 6-digit code, then confirm the payment.

- Again, do not fail to share the ABSA cellphone banking code received with the recipient as they will need it to access the money.

Image: pexels.Com

source: UGC

ABSA cardless withdrawal

Cash withdrawal is as easy, simple, and straightforward as sending cash.

- Go to an ATM which offers cashsend ABSA services.

- Select ‘cashsend’ followed by ‘cashsend withdrawal’.

- Enter the 10-digit reference number sent to your phone.

- Enter the 6-digit access code sent by the sender.

- Fill in the total amount sent as only the full amount can be withdrawn.

- Upon verification of the transaction, the money will be handed over to you.

ABSA ewallet and reverse transaction

One recurrent question from many users concerning this service is ‘how do I reverse ABSA cash send transaction?’ this could be as a result of ABSA cash send SMS not received, or other similar ABSA cash send problems.

To make an ABSA reverse transaction, you can log in to the channel used and cancel the transaction. If you have used an ATM, you will find the cancel option under ‘more options’. Reversal is also possible via cellphone banking as well.

READ ALSO: nedbank universal branch code and nedbank branch code 2019

There are other instances that recipients claim to receive an ABSA cash send error 55 notification. This mostly occurs when the withdrawal amount entered is not the same as the amount sent.

Image: pexels.Com

source: UGC

ABSA branch codes

It is important for cash send ABSA customers to be aware of various office addresses depending on their location. These are some of the relevant addresses and office contacts in use today:

Office address: shop no 4, 32 tanner road

- Ithala the gallaria mall – 754226

Office address: shop F73, the gallaria mall

- Ladysmith – 753025

Office address: 118 murchison street

- Moorton agency – 758026

Office address: chatsworth

- Tugela ferry – 753924

Office address: shop no 23, tugela ferry shopping center

- Corporate KZN public sector – 630495

Office address: 4 frosterley park

- Cape town central – 420909

Office address: 48 st georges street

- Centurion center – 630736

Office address: centurion mall

- International banking center JHB – 631805

Office address: ABSA towers north, first floor

- MLS pretoria – 635055

Office address: hadefield building, 1st floor

- Mpumalanga provincial building – 630552

Office address: ABSA provincial head office, paul kruger st.

- Port elizabeth north – 334317

Office address: trust bank center hoof, street 5

- PVT bank cape town – 630615

Office address: ABSA building, 6th floor

- SSC mkuze – 630276

Office address: mkuze center, shop 14/15

Office address: shop 27, westgate mall

Image: pexels.Com

source: UGC

ABSA contact address for general enquiries

READ ALSO: FNB cellphone banking: how to transfer money and register

For other services, contact the following numbers:

- Contact center: +27112764000

- General enquiries: 0860008600

- Action line: 0800414141

- Estatements: telephone – +2711276900 or cellphone – 0860111123

- Fraud hotline: 0860557557

- Internet banking: telephone – +27112767900 or cellphone – 0860008600

- Western union: 0860008600

- Mobile or cellphone banking: 0860111123

- International travel: 0860151151

- Lost and stolen cards: telephone – +27123173000 or cellphone – 0800111155

- Forex-exchange control: 0860151151

ABSA cash send services identified that around 37% of the population in south africa do not have bank accounts. Therefore, this platform has made it possible to reach out to the unbanked sector of the country as well.

READ ALSO: ABSA universal branch code, ABSA branch code and all SA universal branch codes 2019

Playojo withdrawal times

Playojo withdrawal times is important to know. When you win and you want to collect, you probably want the cash in your account as quickly as possible. We get it. So we checked out what the OJO withdrawal time is with the site itself. When it coms to the OJO withdrawal process, know your money is in good hands. They are honest and trustworthy. The OJO online casino is one of the only casinos out there that give you money back even when you lose. They may not have a no deposit bonus but the bonus with that is there are no wagering requirements. That means that any money won is yours. You can take it out whenever you want. We’re going to walk you through all the playojo withdrawal methods. This includes payment options and how to make deposits and withdrawals. The OJO online payments are easy and they work with many systems so you’re sure to be familiar with one of them.

OJO withdrawal methods

You can use a variety of withdrawal methods at the OJO online casino. We know that fast and secure banking systems matter to you. So does OJO, which is why they offer such a wide array of withdrawal options. Credit cards and debit cards allow for instant deposit and also withdrawals. E-wallets of all kinds are at your disposal. They are a great way to get your money quickly and reliably. The ewallet withdrawal times are probably the fastest you’ll experience. The processing times are usually within 24 hours. They are easy to register for as well.

Playojo regulations of withdrawals

The OJO casino is much more relaxed about withdrawals than other casinos. By that, we mean that you’re not having to deal with insane wagering requirements. They have terms and conditions when it comes to OJO withdrawals. Every country has their own rules when it comes to bank and what they can offer. OJO isn’t always able to provide you with all the withdrawal options because they simply aren’t available to them.

Proof of identification for OJO withdrawal

Sometimes, there is the OJO withdrawal player pending that can slow down the process of your withdrawal. As a customer at OJO, you’ll have to provide your ID, show proof of address, and ownership of the payment method. This is to prevent fraudulent activity and is one way that OJO keeps the site secure for all legit players. This can slow down the withdrawal process. Make sure you upload documents as soon as you can so you can get your withdrawal processed.

How fast is the playojo withdrawal time?

As a wage free casino, you have the right to take your winnings out whenever you want. When you want your money, the OJO casino does their best to get it to you right away. At the casino’s end, they process the request right away. This is what will get the payment process going. There are a variety of steps to get you your money. Playojo casino does their best to speed up the process on their end.

If they could, they would give you’re your cash same day. Sadly, that’s not really in their hands.

It’s the financial institution that is the deciding factor on how fast you’ll get your money. It really depends on the fund transfer you choose. Banks process things at different speed. There are a few factors that dictate the length of time it’s going to take.

Getting your OJO withdrawal fast

If you’ve done everything necessary to have the withdrawal validated, you’re on your way to a fast withdrawal process. To make it even faster you can use an ewallet like paypal. They are known to be one of the fastest ways to get your money. An ewallet usually takes less than 24 hours to be processed. On the flipside, a bank transfer is going to take up to 7 working days to process.

An OJO withdrawal time has to do with two levels of processing. Firstly, you have the casino withdrawal verifying process. This take a bit of time as the casino needs to validate your request. You make the withdrawal through the cashier online. The processing time is going to take less than 24 hours. From there, the funds transfer process will begin when the casino releases the funds. This is now in the hands of your bank or the financial institution you’re working with.

Credit/debit cards – 2-7 business days

ewallets – 0-24 hours

bank transfer – 2- 7 business days

The OJO withdrawal process

The OJO withdrawal process is easy. Once you get yourself some winnings, it’s time to get that money put into your account. First, you want to choose a withdrawal option. Hopefully we’ve made it easy to figure out what option OJO offers that is best for you. We recommend you use the method you used when you deposited money in your casino account.

When you select a method, you can follow the easy steps OJO has to withdraw those funds. There isn’t a minimum so you can take even the smallest amount out. Withdraw the amount you wish to take out and wait for the money to come back into your account. That’s it.

OJO withdrawal options

You can use all the most reputable methods for deposits. Then you can easily have the money put back onto your card or into your bank account. When you use a credit card like visa, mastercard, or maestro, there is a minimum of £10 with a 0% fee. Trustly, instat banking, and sofort offer the same configuration in their withdrawal. It costs you nothing to process your funds through these methods. Paypal, eco, and skrill, and netteller are other methods.

OJO has really made sure they’re offering the most effortless payment systems. This allows you to get your money withdrawn easily with very little hassle. It should be easy to figure out what banking method you’ll want to use. If you’ve already been using a certain ewallet for making purchases online, use that. Same goes for your credit card. We found that playojo makes withdrawals easy and with the no minimum withdrawal on their end, you are free to take money out whenever.

How to reverse FNB ewallet payment?

How to reverse ewallet FNB south africa. The purpose of this article is to show people how to reverse ewallet. Ewallet FNB is one of the most popular ways to send money to friends and family in south africa. Ewallet allows FNB customers to send money instantly to anyone with a valid south african cellphone number.

Do the *120*321# cellphone banking thing as if you’re about to send another ewallet. The option for reversal will come up

Ewallet FNB is an affordable, easy and instant cash transfer service that allows you to send money to anyone. In the 2018 financial year, helloyouth.Co.Za reported that about R26 billion was sent via FNB ewallet. But what happens when you accidentally send money to the wrong cellphone number? Here is how to reverse ewallet payment. We focus on the below steps.

How to reverse ewallet transfer?

Two ways to reverse an ewallet payment

Cellphone banking

- Dial *120*321# on your mobile phone [USSD]

- Select option 4 for “send money”

- Next, select option 5 for “ewallet reversal”

- Select the transaction that you want to reverse

Call centre

The FNB ewallet reversal contact number for cellphone banking is 087 575 9405. Call this number to request a send money transaction reversal. Reversals may incur a fee and are not guaranteed. FNB charges R50 for requesting a reversal.

How long does it take to reverse ewallet?

The FNB ewallet reversals take between 4 to 15 working days to process.

@sswazi1 you have to phone the ewallet team. The reversal takes 4 working days. RB

How ewallet works

- Send money from your FNB account

- Cash is transferred immediately and securely

- Recipient receives an SMS after receiving cash into the ewallet

FNB ewallet service allows you to instantly send money to anyone as long as their phone number is active. Dial *130*321# and try it out pic.Twitter.Com/sqcpwsaq5v

— first national bank (@fnb_botswana) july 28, 2017

How does the recipient get ewallet money?

- Dial dial *120*277# and select 1 for ‘get cash’

- You will receive an SMS with a temporary ATM PIN

- At the FNB ATM, you need to press ‘proceed’ or ‘enter’, then select ‘ewallet services’

- You must enter your cellphone number and the temporary ATM PIN sent via SMS and select the amount of money you would like to withdraw

That’s it about how to reverse an ewallet.

Ewallet reviews 2021

Detailed expert review

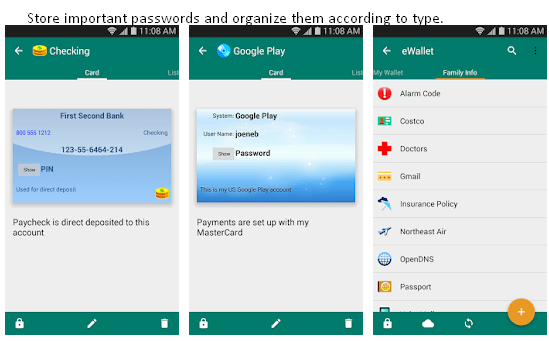

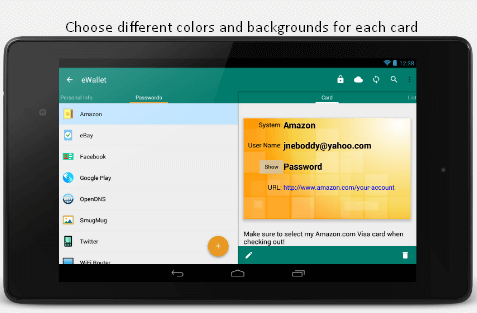

Ilium takes pride in its “simple software,” especially its password manager, ewallet — but is it really as easy to use as the company claims? Ewallet certainly runs smoothly, and it’s jam-packed with useful features like unlimited password storage, a random password generator, cloud sync, and more. In fact, its functionality is super solid. But there’s no free version, which means that its features need to be worth the money you’re paying.

I’ve reviewed nearly 70 password managers in order to give you the low-down on whether ewallet is worth your time and money. Here’s what I found out.

Ewallet features

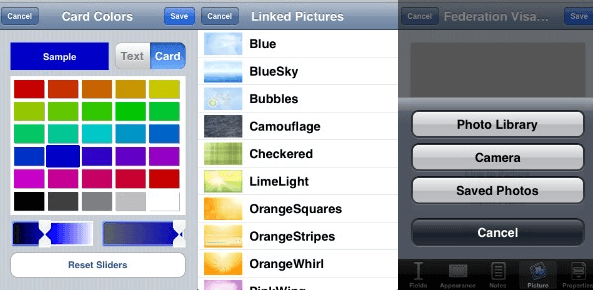

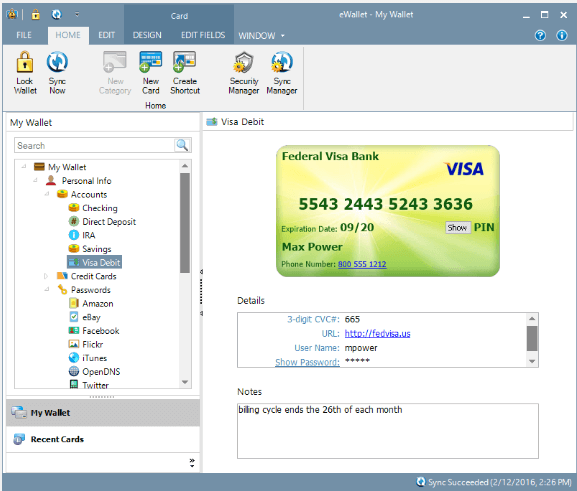

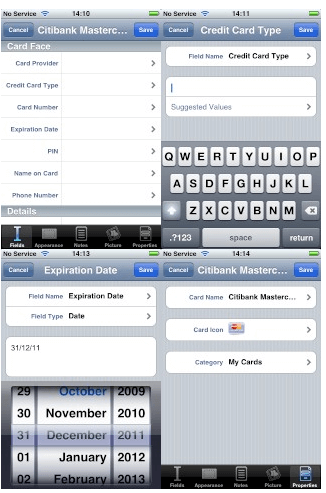

While the technology behind ewallet is pretty sophisticated, the platform itself is simple and easy to use. Features include unlimited password storage, multiple device support, automatic password entering, random password generator, fingerprint scanner, auto-lock, data backup, 256-bit AES encryption, and seamless sync between devices.

While other password managers (lastpass, truekey) offer some of these features, ewallet is one of the only ones that offers such a complete package. For example, many free password managers (like dashlane’s free version) offer password storage and good security, but the number of passwords you can store is limited, or sync and backup is not included. If you want those extras, you will usually have to get a paid version that in many cases will be more expensive than ewallet.

There’s only one small downside when it comes to ewallet: the features are not totally uniform across platforms. For example, the import wizard is only available on desktop, and sync options differ depending on the device. The iphone/ipad version seem to be the most advanced; they offer face ID support and autofill provider for safari and other apps, whereas the android version doesn’t. Lastpass, this isn’t.

Password storage

Storage of passwords and other important information is the bread and butter of any password manager, and ewallet excels in this area. You can store all kinds of info, including credit card numbers, bank accounts, web passwords, driver’s licenses, clothing sizes, even voter registration numbers. There’s also autopass automatic password entering, so when you visit a site on your desktop or mobile, your password is automatically filled in.

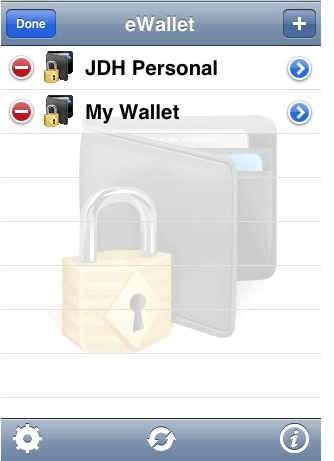

Ewallet provides highly-organized password storage. As opposed to other password managers that lump all your information together, ewallet offers multiple wallets, which can have their own passwords (or not). So you can keep all your financial information in one place, all your online shopping details in another, your insurance info in another, etc.

Each wallet has its own security settings, so you can choose to activate automatic lock, intruder lockout, number of invalid password attempts, and more.

Syncpro

If you download ewallet to multiple devices, you’ll naturally want to sync them. Syncpro is ewallet’s syncing system, and it works via cloud and direct sync (similar to how myki works). There are different methods of sync depending on the devices you use, but the gist is that cloud sync automatically syncs your devices without the need for a direct connection, and direct sync works via wifi.

Syncpro also lets you backup your information; if you want further backup, ewallet also offers an email and restore option.

Customization

A standout feature of ewallet is its high level of aesthetic customization. Each password you store has its own card, and you can choose the background and colors for each one. While this isn’t integral to the functionality, it can be super-fun. And if you’re planning to use ewallet for your kids, this special feature makes ewallet an attractive choice.

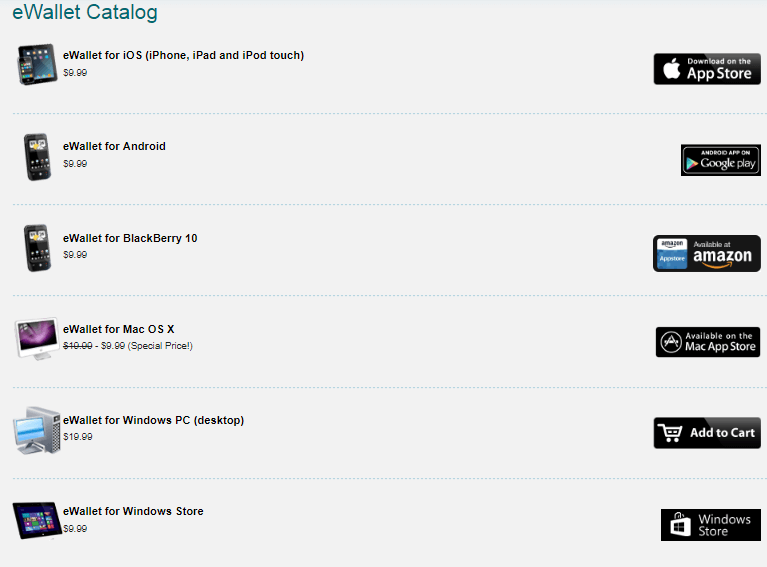

Ewallet plans and pricing

I’ll be honest—I’m disappointed with ewallet’s payment system, which is why I’m giving it a rating of 3/5. As opposed to selling one version that can be downloaded to desktop and smartphone, ilium sells ewallet as totally different products for

- Windows PC

- Windows store

- Mac OS X

- Android

- Blackberry

- Iphone/ipad/ipod touch

So if you want to use it on desktop and mobile, you’ll have to pay separately for each product. And if you want to use it for your entire family, it can get really costly. For android, an ewallet license can’t work on multiple store accounts, which means if your kids have their own play store accounts, you have to buy ewallet separately for each one. Iphone is more advanced and supports family sharing, which means that up to 6 family members can use the app.

But before you write off ewallet as too expensive, let’s quickly review what’s included:

- Unlimited password storage

- Cloud and direct sync

- Auto-locking feature

- Autopass automatic password entering

- Individual password security settings

- Random password generator

- Wallet customization

- 256-bit military grade AES encryption

- Fingerprint scanner (and facial ID on iphones)

The fact is, ewallet’s standard package comes with all the features of a high-quality password manager, and it’s made by ilium, a respected name in the software industry. It’s up to you to decide whether a high-qualty product (and the peace of mind that comes with it) is worth the cost.

If you’re not sure you want to buy it, you can try out any ewallet product for 30 days. If it suits your needs, you can go ahead and buy it. If not, you’re not obligated in any way.

Ewallet ease of use and setup

Ewallet is really easy to use; if you have any familiarity at all with computers or smartphones, you’ll be able to use it with no trouble at all. As opposed to storing all of your info in one unsorted mess, ewallet allows for a high level of organization. This includes creating multiple wallets for different categories (personal, finance, work, etc.). Within each wallet you can create folders to further sort your info. And finally, each password or financial detail gets its own card, and you decide which wallet/folder to store it in.

The only thing that I would like to see added is a manual search option; at this point, ewallet doesn’t offer it. But because the level of organization is so high, it’s easy to find what you’re looking for even without it.

As you can see below, each card includes plenty of details — and you get to decide what to include.

Another convenient feature is autopass, which automatically fills in your information for various sites. So when you visit amazon, ebay, your bank, etc., your sign-in information will appear in the appropriate fields and you can log in immediately.

Installation and set up take just a few minutes; the only disappointment is that the desktop version requires a .NET framework if it’s not already installed on your computer. That adds about five minutes to installation, not really a big deal. Once everything is installed on your desktop, the platform runs smoothly. Same goes for ios and android.

I’d say this is all impressive, just not as impressive as other simple (or even one-click) installation processes, like lastpass.

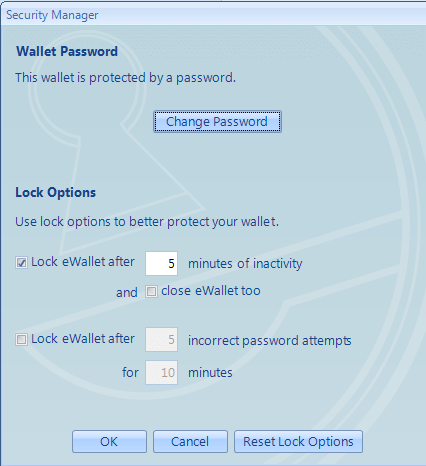

Ewallet security

Ewallet allows you to create passwords for different wallets; it also includes a password generator to create passwords that are not easily guessable by others. You don’t have to create passwords for each wallet, but the option is there. Of course, you need one password to log into your account, but android and iphone offer fingerprint access as well. Iphone also offers facial ID access. I’m still more impressed by truekey’s 15 types of two-factor authentication though.

You can easily edit, change, or delete your passwords.

Other security settings in each wallet are:

- Limit password attempts

- Lock after 5 attempts

- Lock for 30 minutes

- Lock when inactive

Ewallet uses 256-bit military grade AES encryption to protect your data, which makes it virtually impossible to hack. However, there’s no 2-step verification, which is why I didn’t give a 5/5 rating.

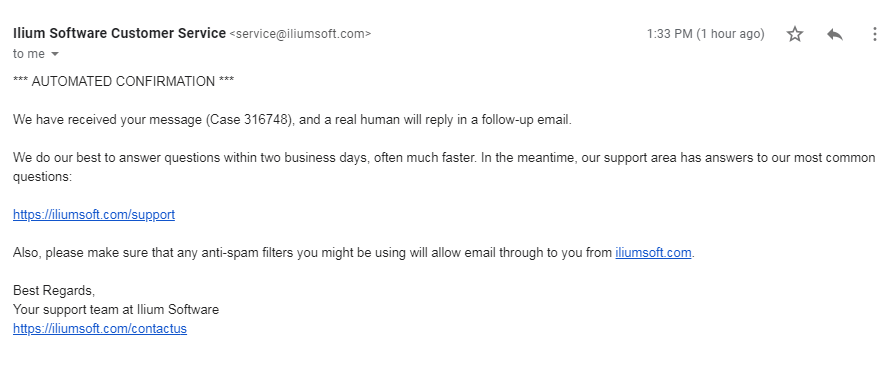

Ewallet customer support

For such an impressive software company, ilium’s ewallet support leaves something to be desired. You can contact only contact them by email, not phone or live chat. When I sent them a test email, the automatic response said I’d receive an answer within 2 business days. I wasn’t too happy about that, since 2 business days is a pretty long time to wait. It reminded me of how slow dashlane were to get back to me.

However, in reality, I received a response within a few hours. I sent a few more emails to judge the response time, and consistently received responses within a few hours from a friendly support rep.

The FAQ pages are not the clear and neat pages that I’m used to; yes, they contain information, but many articles date back to 2016 and the look itself is a bit old-fashioned. Don’t get me wrong — there is information, it’s just not as easy to read or find as most modern websites. Or other password managers – like bitdefender’s very active forums.

As for refunds, ewallet accepts returns made within 30 days of your purchase of the software. However, this is only for products purchased directly from ewallet; the play store and app store each have their own refund policies.

Ewallet products & pricing

Ewallet is a comprehensive password manager that comes with lots of features, including unlimited password storage, cloud and direct sync, a password generator, high-level customization, and more. It’s also really easy to use, so you don’t have to break your head trying to figure out how to make it work.

My main gripe is that it sells its desktop and mobile products separately. If you’re the only one who needs it, you’re still getting really good value for your money, even with the separate products. But if you want it for your whole family, it can get really costly buying different licenses for multiple smartphones and desktops.

As with any product, it’s up to you to decide whether what you’re getting is worth the cost. The one thing you can be sure about is that when it comes to features and ease of use, there’s no question that ewallet is superb. I’d still recommend a more solid all-rounder like lastpass though.

So, let's see, what we have: have you tried using ewallet? Do you know⭐HOW DOES EWALLET WORK⭐? These simple tips will be beneficial in going about the service. Read the info about ewallet. At how to take out money from ewallet

Contents of the article

- New forex bonuses

- How does ewallet work

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How to reverse ewallet payment in 2021?

- How to reverse ewallet transfer?

- Other important details on ewallet reversal

- How long does it take to reverse ewallet?

- How much does it cost to reverse an ewallet?

- How to correctly send money and avoid reversal...

- How to reverse ewallet payment

- How to reverse ewallet transfer?

- Other important details on ewallet reversal

- How long does it take to reverse ewallet?

- How much does it cost to reverse an ewallet?

- How to correctly send money and avoid reversal...

- How to take out money from ewallet

- Cellphone banking

- Online banking

- FNB ATM

- You have access to ewallet

- Send money anywhere, any time

- Instantly send money or make payments

- What's hot

- Send the way you want to

- Withdraw, buy + spend

- Turn your phone into a wallet

- How to cash out your online casino winnings –...

- Various methods to cash out:

- 1. Via ewallet:

- 2. Cashing out in credit cards:

- 3. Taking out money by using wire transfers:

- 4. Utilizing checks and e-checks:

- Conclusion:

- Important details on ABSA ewallet, ABSA cash...

- How does ABSA cash send work?

- ABSA internet banking

- ABSA online cash send services

- How to transfer money using ABSA cellphone banking

- ABSA cardless withdrawal

- ABSA ewallet and reverse transaction

- ABSA branch codes

- Playojo withdrawal times

- OJO withdrawal methods

- Playojo regulations of withdrawals

- Proof of identification for OJO withdrawal

- How fast is the playojo withdrawal time?

- Getting your OJO withdrawal fast

- The OJO withdrawal process

- OJO withdrawal options

- How to reverse FNB ewallet payment?

- How to reverse ewallet transfer?

- How long does it take to reverse ewallet?

- How ewallet works

- How does the recipient get ewallet money?

- Ewallet reviews 2021

- Detailed expert review

- Ewallet features

- Ewallet plans and pricing

- Ewallet ease of use and setup

- Ewallet security

- Ewallet customer support

- Ewallet features

- Ewallet products & pricing

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.