Tickmill fx

Clients can choose between four wallet currencies вђ“ USD, EUR, GBP, and PLN. VIP account вђ“ this account, with the same swap-free islamic option, is for high volume professional traders and requires a 50,000 USD minimum deposit.

New forex bonuses

The commission is reduced to 1 USD per side per 100,000 (a standard lot) traded which makes trading even more profitable. This is a very competitive professional account and offers excellent trading conditions.

Tickmill review

- Is tickmill safe?

- Trading conditions

- Account types

- Spreads and commissions

- Deposit and withdrawal fees

- Tickmill for beginners

- Educational material

- Analysis material

- Trading platforms

- Trading tools

- Mobile trading apps

- Evaluation method

- Tickmill risk statement

- Overview

Summary

Built by traders, for traders, tickmill offers low spreads and commission on both ECN and traditional accounts. All accounts feature ultra-fast STP execution (0.15s on average and no requotes) and support for the MT4 platform with all strategies allowed.

Regulated by the FCA in the UK, cysec in europe, and the seychelles FSA internationally вђ“ and a regular winner of trade execution and trading conditions awards вђ“ tickmill also offers 80+ instruments to trade alongside dedicated multi-lingual support and negative balance protection.

Reviews

Account information

Trading conditions

Company details

Deposit & withdrawal methods

Supported platforms for tickmill

Is tickmill safe?

Tickmill ltd is regulated by the seychelles FSA (license: SD 008) and has been regulated by the FCA (license: 717270) since 2016. Cysec has regulated the european entity, tickmill europe ltd (license: 278/15) since 2015.

Tickmillвђ™s quality and popularity amongst traders have been noticed and rewarded by its industry peers; in recent years the company has won awards for best CFD broker asia 2019 (international business magazine), best forex CFD provider 2019 (online personal wealth awards), best forex execution broker 2018 (UK forex awards)В andв best forex trading conditions 2017В (UK forex awards).

More importantly for potential customers, tickmill were recipients of the most trusted broker 2017 (global brands magazine) for a continual focus on keeping pricing competitive and maintaining a fair trading environment.

Trading conditions

All accounts at tickmill offer STP market executed trades in 0.1 seconds on 62 currency pairs in addition to cfds on stock indices, metals, and bonds, without any dealing desk interference. Tickmill does not offer cryptocurrency cfds.

The margin call and stop-out percentage differ for the retail and professional versions of the accounts where the margin call to stop-out for retail clients is 100% to 50%, and professional is 100% to 30%.

Clients can choose between four wallet currencies вђ“ USD, EUR, GBP, and PLN.

Account types

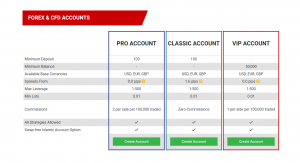

Tickmill offers three different live accounts in addition to the demo account. While trading conditions improve with the account type, the main differentiating factor is the initial deposit required.

Demo account вђ“ A demo account is available for new traders and will remain open until there is no login for seven consecutive days.

Classic account вђ“ this entry-level account requires a minimum deposit of 100 USD, and, like all tickmill accounts, offers a swap-free islamic account option. The spreads start at 1.6 pips and maximum leverage is 1:500 вђ“ note that this is the only account that uses wider spreads instead of charging a commission on each trade.

Pro account вђ“ this account, also with a swap-free islamic option, requires a 100 USD minimum deposit and is the entry-level account for professional traders. Tighter spreads are available in exchange for a commission of 2 USD per side per 100,000 (a standard lot) traded. This commission pricing and structure is an industry-standard and is in line with what other STP brokers offer clients for the same services.

VIP account вђ“ this account, with the same swap-free islamic option, is for high volume professional traders and requires a 50,000 USD minimum deposit. The commission is reduced to 1 USD per side per 100,000 (a standard lot) traded which makes trading even more profitable. This is a very competitive professional account and offers excellent trading conditions.

Spreads and commissions

The minimum spread on the classic account is 1.6 pips with zero commission. The minimum spread on the pro and VIP accounts is 0.0 pips with a commission of 2 USD per side per standard lot trade and 1 USD per side per standard lot traded, respectively.

Deposit and withdrawal fees

Tickmill takes deposits through a variety of global and local methods, under a zero fees policy. They include:

- Visa/mastercard

- Bank transfer

- Neteller/skrill

- STICPAY

- Fasapay

- Unionpay

- Nganluong.Vn

- QIWI

- Webmoney

The zero fees policy means that tickmill will reimburse traders for any fees charged up to 100 USD. If you were charged, submit a copy of the bank statement showing the charge, and the amount will be credited. Should the trading account become inactive, tickmill reserves the right to start reimbursing transfer fees.

Tickmill for beginners

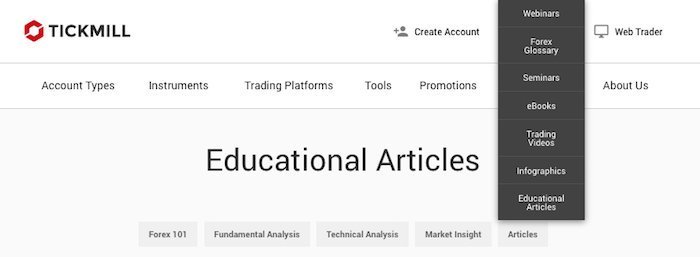

Tickmill does not have a traditional introductory course, but they do publish webinars and seminars to help new traders get their footing. They have also made available a detailed ebook which many new traders will find useful. Additionally, while the analysis blog and tradingview analysis tools do not explain the basics of trading, they do offer new perspectives on currency markets.

Educational material

For new traders, tickmillвђ™s main resource is its downloadable ebook, but the webinars and seminars are also of great assistance.

The 46-page ebook, titled the majors вђ“ insights & strategies, is well illustrated and a suitable replacement for an online course for beginners. The ebook covers forex trading basics and how forex trading works, an introduction to the major currency pairs, trading strategies and the major types of forex analysis. The ebook ends with a section of top tips which will give traders more confidence in their decisions.

Webinars are run in four languages (english, arabic, italian and german), and all previous webinars are available in an archive. The webinar subjects vary from more fundamental concepts like news trading strategies to technical analysis and chart theories like standard elliot wave models.

Tickmill has a schedule of free seminars around the world, which introduce traders to new areas of learning and also allows clients to meet brokers in person and create relationships.

Analysis material

The tickmill research team runs a regular blog which covers topics that relate to both fundamental and technical analysis. Research often covers different currency pairs and encourages traders to learn about market-moving events outside of conventional news sources.

The blog is open to all readers and tickmill allows traders to contact the author with questions about their article. This is unique among brokers, who typically shy away from one-to-one contact with traders when it comes to discussing specific investments.

Tickmill is also active on their tradingview pro account where analysts are continually marking up charts. Even if traders are not going to take advantage of these trading opportunities, they are a great way to learn technical analysis from the pros.

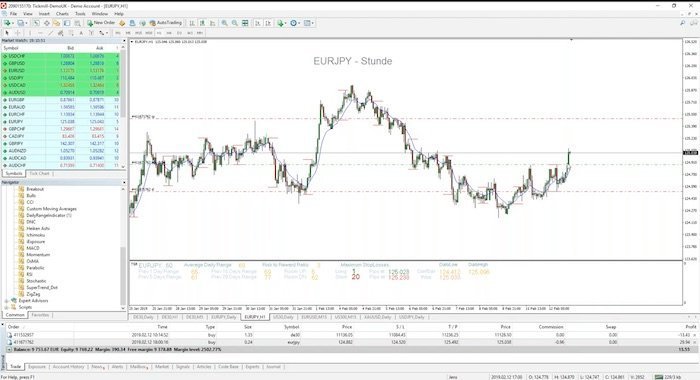

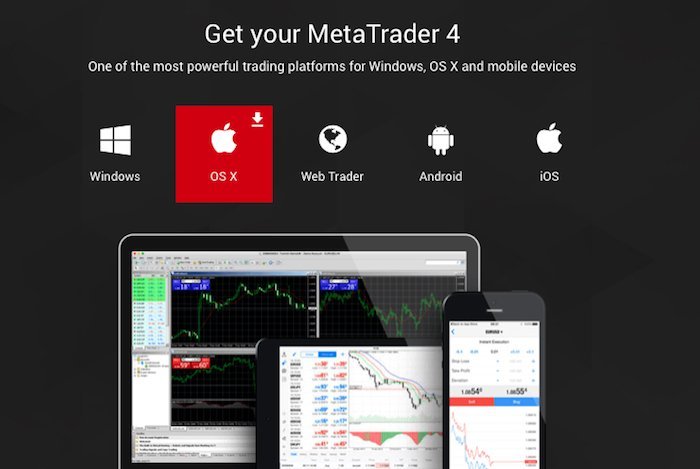

Trading platforms

Tickmill supports metatrader4 (MT4) and the associated web and mobile applications. MT4 is the industry leader and the most common trading platform for CFD traders.

There are many advantages of signing up with an MT4 broker and using MT4 for trading:

- The MT4 community is vast, as is the amount of the text and video resources to support both new and experienced traders.

- The MT4 EA (expert advisor) community of developers is very active, so renting or buying algorithmic trading software is very easy.

- MT4 has very low system requirements, so a new device or computer is not necessary to get started.

Trading tools

Tickmill also provides a number of useful trading tools.

Autochartist is a third-party automated chart analysis tool which scans the markets for volatility and notifies traders of relevant trading opportunities. Since it integrates into MT4, information is available inside the trading view and adds little complication to the platform while providing additional analysis. Autochartist is a common technical analysis tool among traders, so training videos are easy to find online. Tickmill offers autochartist free of charge to all live accounts and the demo account on a delay of five candlesticks.

Another common third-party trading tool available on tickmill is myfxbook autotrade, which is a cross-broker social trading platform that allows for copy trading without the need for additional software.

The one-click trading MT4 expert advisor (EA) is designed to make common trading mechanisms more accessible, which facilitates trading and removes unnecessary navigation between windows and charts. This EA does not overly simplify MT4, but it does make trading on the platform less complicated.

Tickmill VPS has partnered with beeksfx to provide discounted VPS services to clients. While many brokers will include VPS as a free service for active traders, VPS has chosen to partner with a leading 3rd party provider and asks clients to take on the additional cost.

Mobile trading apps

Metatrader4 (MT4) is also available on IOS, android and windows mobile phone and tablets. The app will connect to the same account as the desktop software, keeping the trading experience synchronised, and traders mobile.

Evaluation method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the tickmill offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Tickmill risk statement

Trading forex is risky, and each broker is required to detail how risky the trading of forex cfds is to clients. Tickmill would like you to know that: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with tickmill ltd.

Overview

Tickmill is an award-winning and trustworthy STP broker that relies heavily on industry-standard platforms to enable fast execution. With a strong education section, additional premium tools offered to traders for no extra cost, and good trading conditions, tickmill should be a top choice in forex brokerage.

Tickmill review

In a FAST-MOVING market, choose a STABLE BROKER

Table of contents

Introduction

Tickmill is one of the most credible and reliable forex brokers in the market. Founded in 2014 with its headquarters in london – UK, this company has been providing quality brokerage services to users across the world from the past six years. Users of this broker get to access various financial markets like forex, soft/hard commodities, indices, bonds, etc.

Compared to other brokers with the level of tickmill’s market experience, this broker proved to be heavily regulated with some of the top tier financial regulators. Tickmill offers four types of well curated accounts and users get to pick the ones that is most appropriate to them. Demo trading facility is also available for users which could help novice traders to get the hang of the platform they are going to use.

This broker offers their services on the MT4 trading platform which is highly accepted by traders across the world. Using this platform, users get to trade on both desktops (windows/mac), and smartphones (android/ios). Apart from these, there are various other services this broker provides for their users like trading bot services called autochartist, VPS and many more.

The unique selling proposition of this broker is the lowest fees they offer. When compared to other regulated brokers, tickmill charges very less commissions and trading fees. Options to deposit and withdrawal are also many and are typically not charged. On the flip side, users get to access limited number of asset classes when compared to other brokers of this range.

Tickmill is now in position to claim that it possesses way above 100,000 traders which have jointly opened more than 250,000 active accounts.

Tickmill.Com is owned and operated within the tickmill group of companies.

– tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 – 32 old jewry, london EC2R 8DQ, england),

– tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),

– tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA)

– tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927

– tickmill asia ltd – regulated by the financial services authority of labuan malaysia (license number: MB/18/0028).

Addresses and phones

Addresses:

tickmill UK ltd, registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england

tickmill europe ltd, registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus

tickmill south africa (pty) ltd, registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town

tickmill ltd, registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england

tickmill asia ltd, registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia

Phones:

+852 5808 2921

+6087-504 565

+44 203 608 6100

+357 25041710

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill UK review 2021

| tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities. | ||

| Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities. | ||

Tickmill is a multiple award-winning broker that provides access to forex, cfds, indices, commodities, bonds. Tickmill allows traders to use the metatrader4 trading platform, but unfortunately not metatrader5 at this point.

Careful traders will be reassured knowing that tickmill is licensed to offer trading services by several regulators, 4 in fact, including the FCA.

Tickmill summary

Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities.

Ratings

CFD trading

Trade on 80+ CFD instruments across FX, stock indices, & commodities.

| FTSE spread | 0.9 |

|---|---|

| GBPUSD spread | 0.3 |

| oil spread | 0.4 |

| stocks spread | N/A |

Forex trading

Trade on majors, minors and exotics with up to 1:500 leverage.

| GBPUSD spread | 0.3 |

|---|---|

| EURUSD spread | 0.1 |

| EURGBP spread | 0.4 |

| assets | 62 |

Payment methods

Tickmill accepts the following payment methods:

- Skrill

- Neteller

- Visa

- Webmoney

- QIWI

- Wire transfer

- Fasapay

- Rapid transfer

- Perfect money

- Swift

- Sticpay

- Paysafecard

Awards

Tickmill is an award-winning broker, with 5 awards received so far.

- Best commodities broker 2020 - rankia markets experience expo

- Best trading experience 2020 - forex brokers award

- Best forex execution broker 2019 - CFI.Co awards

- Best CFD broker asia 2019 - international business magazine

- Best forex CFD provider 2019 - online personal wealth awards

Tickmill vs other brokers

If you want to compare tickmill with other brokers, use the detailed comparisons below.

So, let's see, what we have: considering trading with tickmill? Is it safe? Learn about their trading conditions, pros and cons before you place your money with tickmill. At tickmill fx

Contents of the article

- New forex bonuses

- Tickmill review

- Summary

- Reviews

- Account information

- Trading conditions

- Company details

- Deposit & withdrawal methods

- Supported platforms for tickmill

- Is tickmill safe?

- Trading conditions

- Tickmill for beginners

- Trading platforms

- Evaluation method

- Overview

- Tickmill review

- Introduction

- Tickmill UK review 2021

- Tickmill summary

- CFD trading

- Forex trading

- Payment methods

- Awards

- Tickmill vs other brokers

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.