Forex trading without broker

Sometimes followers can be fabricated. That is why you should critically analyze the followers to ensure that they are real humans.

New forex bonuses

Another reason for this is to ensure that the follower base is consistently growing. If the number of traders copying your potential professional grows and suddenly drops, it may mean a drop in good performance. However, if the followers are ever increasing, you should add that investor to your list. Below are a few tips on how to find a good trader to follow.

Fxdailyreport.Com

For beginners, the forex market can be hard to navigate. There is a lot of jargon that you have to wrap your head around in order to be able to make any reasonable profits. The problem is, it takes a lot of time to master all the crucial skills that are required to qualify as a professional. Often times, many novice traders give up without making a dime.

But do you really have to trade to make money on forex? What if there was a way to invest profitably without actually having to trade? The good news is, there is a way. It is called forex copy trading.

What is copy trading ?

As the name suggests, copy trading is a form of forex trading where you copy or replicate the trading patterns of other traders. This is a trend that emerged in the early 2000’s and has over the years proved to be a real savior for inexperienced traders. With copy trading, also known as mirror trading or sometimes social trading, you can make profits as a forex trader even with minimum skills.

The only skills you require is to understand the whole concept of copy trading, that is mostly, how to choose a good trader to follow. You should, however, keep in mind that forex trading, in general, is risky and high returns are not guaranteed. Although copy trading gives you an opportunity to make profits without investing in research and having to understand the ins and outs of forex, the risk is still there and a lot of caution is required.

In most cases, forex copy trading can backfire because of a poor choice of traders to follow. That is why it is important that you carefully analyze your potential “masters” using the stats provided by the copy trading platform of your interest to make good money.

Below are a few tips on how to find a good trader to follow.

How to find A good trader to follow

The following tips will help you land the perfect trading pro:

- Discover the most followed traders

The number of followers often point to the credibility and prowess of that particular trader. If a potential professional is followed or copied by many traders, it usually means that they have consistently recorded outstanding performance.

- Analyze their followers/copiers

Sometimes followers can be fabricated. That is why you should critically analyze the followers to ensure that they are real humans. Another reason for this is to ensure that the follower base is consistently growing. If the number of traders copying your potential professional grows and suddenly drops, it may mean a drop in good performance. However, if the followers are ever increasing, you should add that investor to your list.

- Should have consistent monthly performance

Your search for the perfect trader should not end with the most followed. Sometimes, they might have a lot of traders copying them, but the balance between profits and losses is not promising. That is why it pays to dig deeper and unearth trading gurus who have posted good and consistent monthly performance.

- Number of trades and time on a platform

Traders who have been on the platform for a long are most preferred. They are usually more experienced and know their way around trading. The number of trades conducted is also another indicator. The person you wish to follow should have done a good number of trades with consistent profits.

You might not find the perfect trader to follow, but as you gain more useful skills, you will be able to make more constructive analysis and choose wisely. The type of copy trading platform you choose also matters. A lot of seasoned traders use credible forex brokers and you will hardly see them on new platforms or those with a bad reputation.

Benefits of forex copy trading

Copy trading presents a lot of good opportunities for both those who copy others and those who are copied.

- You gain invaluable trading skills from professionals you follow

- There is a lot of transparency as the trading history of the trader is publicly disclosed to followers

- You can make passive income without actively trading

- You don’t have to understand all the aspects of forex trading

With forex copy trading, you can make good money without having to actively trade. The point is to choose the right trader to follow by carefully analyzing their profiles and utilizing the stats provided by the various platforms.

Trading in forex without deposit

Posted by: freddie north , march 2, 2020

This post is also available in: indonesia

You can begin your trading forex without deposit or making an actual investment. Top forex brokers are offering free no deposit bonuses, with which you can start trading with a decent lift. It is an undeniable fact that trading with forex is quite a financial risk for even the most seasoned traders and investors.

Is it possible to trade in forex without A deposit

This is even riskier, especially when doing trading short of little experience and the appropriate skills. But what if you are offered a chance to succeed above the risk of losing your money and staying safe?

That's what forex trading is offering at your table with their free, no bonus available via forex brokers. It is unchangeably better to take advantage of such an offer that is currently not so rare. You may not be aware, but even top forex brokers occasionally offer such deals. However, it is always good to preview all settings of the deal where actual money is not used. Therefore, it would be advisable that you check out this offer now for you to lay your hands on a decent and dependable deal.

What if I find that even this offer with no deposit deal is too risky for me? Well, there is always an alternative. You can also use a demo account that allows you to attempt an agreement at trading on the real market with no real money at all. There are many brokers in the forex trading market that you can involve in trying a free demo account, such as templerfx. But if you are looking for a reliable broker that offers services globally, you can try alpari. Are you in the US who is looking for access to forex trading with local brokers? Then you can go to forex.Com. Forex.Com offer their services within the US borders and have a global reputation for being the best brokers.

How to trade with no deposit bonus

Upon opening a trading account, you receive the most attractive bonus of $30. Since templerfx gives you a free initial bonus, you do not need to top up your live account to begin trading. For you to get the no deposit bonus, the first step involves registering with the trading brokers. Each trader has the opportunity to begin trading on forex, but you must verify your account, which takes less time.

In some of the cases, this bonus offer may require SMS verification. Therefore, before applying for this bonus, you should ensure that you have access to the correct phone number. As a new member, you should remember that this bonus is only available or receivable once.

Forex brokers offering bonus

The global forex market is ever-growing, which translates to an increased number of bonuses traders receive. Given this growth, making the right choice on which broker to trade with is becoming more difficult. Any forex broker's trading platform contains indispensable forex bonuses. Often, the no deposit and offered deposit bonuses are the crucial factor during the registration with a new forex broker.

The issue of forex bonuses is not simple and easy. It requires some detailed familiarity to know how bonuses are received and effectuated. Also, you need to know whether, in either case, it seems sensible to register for a forex bonus at all.

Usually, forex traders reflect bonuses as a way to grow the account balance potentially. It is, at the same time, crucial to know that trading on forex bonuses is linked to some benefits. However, it's also related to the risky features of the currency exchange environment.

Therefore, you should be familiar with the list of brokers recognized for offering the most attractive bonuses in the market.

As we have extensive information and acquaintance about the forex industry for some people, a few queries still can be trendy. We all love making money! This is particularly when we can learn how to earn money without leaving home. If we do not have to capitalize on it our money, it becomes more interesting.

This already sounds and seems fascinating, right? Well, certainly, in the current world, modern tech such as operations may be achieved. However, you still have to be well-versed with specific aspects that will further help you in knowing how to earn your money.

Forex is a globally recognized asset that offers the chance of trading, buying and selling, investing, and benefit to consumers. Forex trading may be complicated, and that is why you need to be conversant and have skills. Many are the benefits that come with this knowledge, such as the ability to start trading without money.

However, you need to attain some more understanding, not risking all of your money, and to stay safe mostly. Best brokers usually give you reliable and cheap openings via which you will have the ability to earn your first multiple dollars.

Additionally, you will increase experience, which will not cost you real money at all. But you definitely will have to invest adequate time in learning. You are being conversant means being equipped. In this article, we will provide you with some data that may turn out valuable for you. Later, it will be totally up to you should you consider it worth to try.

Who can you go to?

While it can sometimes be a little challenging to come across them, several choices for no deposit bonus are obtainable. As stated by the statistics and experience, XM is regarded as the best amongst all. These brokers are successful and are acknowledged mainly for their services globally.

XM has a reputation for being the most loyal and reliable brokers in the industry. Asking how? They are honest with their clients and make genuine and inexpensive offers—the term authentic and cheap means clear terms and conditions as well as practical guidelines.

Still, asking whether it's possible to trade in forex without deposit? Yes, it is, and it's always an option. From bonus options such as no deposit to the demo account, you have these at your disposal. We understand that you may have some anxieties about your safety and security. Worry not!

We are going to provide you with all the structural materials required as a consideration while starting your online money trading. There will be no money-losing risks because none of your real money is being used.

Forex brokers with no deposit bonus

Fxdailyreport.Com

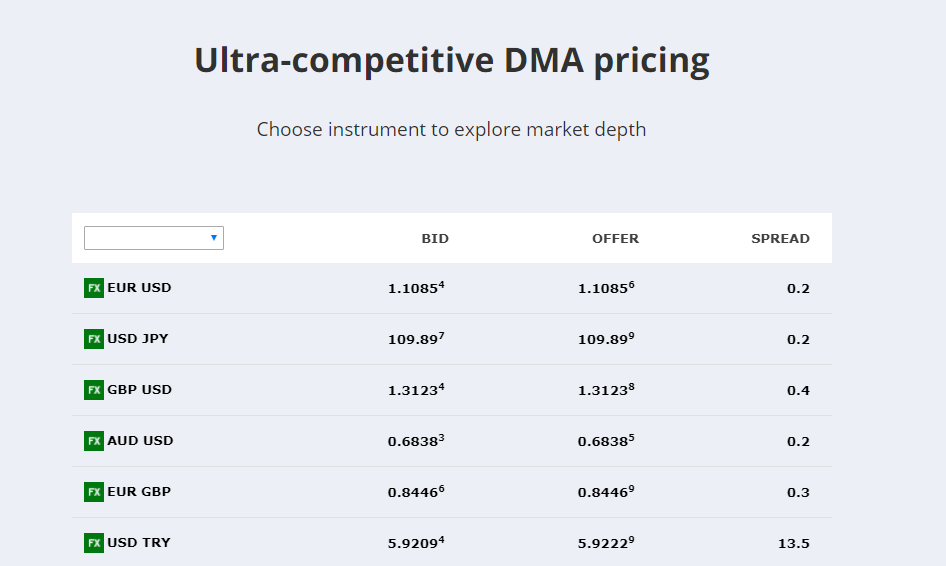

In forex trading, the difference between a bid price and an asking price is known as a spread. Therefore a zero spread account is a type of account that has no difference between bid prices and ask price. A zero spread forex broker is a brokerage firm that offers its traders zero spread accounts. In other words, the spread takes the place of a typical transaction fees, meaning that you don’t have to pay anything.

With this unique account, you as the trader is aware of your entry and exit stages in advance. This means that when you open a trade in a particular position, you automatically know your exit point. This could be an enormous advantage to some traders.

While using a broker that offers this kind of account, it helps to understand that when the spread becomes bigger, the cost of trading rises. On the other hand, when the spread is narrow the cost stays low.

Top forex brokers with starting from 0 pip spreads

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: $100 spread: starting 0 pip leverage: 500:1 regulation: FCA UK, FSA (seychelles), cysec | visit broker | ||

| min deposit: $100 spread: from 0,2 pips leverage: 1:200 regulation: FCA UK (#186171), cysec (#259/14), CIMA (1442313) and DFSA (F000048) | 10% welcome bonus up to $5,000 | visit broker |

Though it may sound like no trader will be charged by a 0 spread forex broker, there is a probability that the broker will charge some traders in one way or another. In fact, there are numerous zero spread brokers that are keen on a particular range. This means that you might get charged, but the charges are not presented as you would expect as they may be in an indirect form.

Zero spread brokers

These types of brokers normally offer an electronic communications network (ECN) or what is termed as a straight through process (STP). They offer a much different approach to the traders in comparison to the typical forex trading brokers. With zero spread brokers, you get direct access to the available financial markets.

It is, however, important to note that the prices are not set by the brokers. Instead, they are set by the market itself.

The pros of zero spread forex brokers

- If you sign up with a zero spread broker, it opens the doors for you to access the market directly.

- As a trader, you know your entry and exit points beforehand as soon the positions are open. If you are into high-frequency scalping, then this kind of brokerage is extremely helpful with calculating non-trading loses. They also help you execute your day trading strategies with precision. Moreover, you can benefit from the speedy execution of your trading moves since you already have direct access to the relevant financial markets.

- Efficiency is another advantage of using 0 pip spread forex brokers. The whole model of trading allows you direct access as well as fast executions; this can be attributed to the fact that there are no interventions from the brokers to your trading decisions. The trading systems are automated, which provides you a great deal of efficiency.

The cons of zero spread forex brokers

While you may think that you will not be charged by this kind of brokerage, some costs might apply in a hidden way. This is detrimental to a trader in that you may end paying various charges without exactly knowing how they came about. Some of these charges are disguised as a huge initial account opening size. Sometimes, you are forced to put with disappointingly low execution speeds.

Also, if you like to make the use of the negative balance protection, it will certainly not help you with a zero spread forex brokers. Dealing directly in the market can be both good and bad. One of the ways in which this can be a disadvantage is that meeting the required liquidity threshold solely rests with you as the trader. For instance, the cost of opening an account is quite high and you have to meet it by yourself.

If you would like to try out a method of currency trading without having to pay hefty transaction costs, the zero spread brokers offer you a perfect opportunity to do so. Nevertheless, zero spread brokerage firms should be looked at more carefully. No trade that promises zero charges on anything really works that way. In fact, if you examine it closely, you may find out that you will be charged by these brokers in subtle ways that aren’t as clear cut as what you would experience with other options.

The 10 best forex broker with zero (no) spread accounts

Do you want to pay less trading fees when investing in currency pairs? – then you should choose zero or no spread forex broker. On this page, we will show you the top 10 companies which are offering trading with starting pips at 0.1. Trading fees can be very expensive when you are doing scalping or high volume trading. By choosing one of our recommended forex brokers you can save a lot of money. In addition, we will provide you detailed information about zero spread trading.

| Broker: | review: | spreads and fees: | regulation: | advantages: | open account: |

|---|---|---|---|---|---|

1. IQ option  | ➜ read the review | starting 0.0 pips + NO COMMISSION ($ 10 deposit) – only on main market hours | cysec (EU) | + leverage up to 1:1000 + personal service + best platform |

Save trading fees by using a low spread forex broker

Overall, we tested more than 50 forex brokers in 7 years of trading time and trading fees are very important to check. Most brokers are offering spread-based account types and a few are offering a zero spread account in addition. Sometimes you can switch between a spread or a zero spread account. If you do a calculation between these two account types you will always see that the zero (no) spread account is cheaper for you. Less trading fees will bring you a higher profit.

Comparison between a spread and zero (no) spread account:

For example, you want to trade 1 lot with the EUR/USD asset. On the spread account, you got a 1.0 pip spread. The pip value is $10. That means you are paying a fee of $10 by opening and closing the trade. The value of the fees is depending on the asset.

Spread account: 1 lot EUR/USD with 1.0 pip spread = $10 spread fee

On a zero (no) spread account you are paying the most of the time $3.5 per 1 lot trading (commission)

Zero spread account: 1 lot EUR/USD with 0.0 pip spread = $3.5 spread fee

In conclusion, the zero spread account is 65% – 50% cheaper than a normal spread account. So you should definitely use a zero spread account to pay fewer fees.

Advantage of a 0.0 pip account:

The calculation above shows us that a zero spread account is cheaper than other accounts. That is the main reason why you should use it. In addition, it is better for certain strategies like scalping where traders only trade small trading movements. The real market prices are traded by the broker. Overall, the trading with a 0.0 pip account is more transparent.

- Payless trading fees

- Better trade execution

- Real market prices

- Transparent trading

- Best for scalping

Disadvantages of a 0.0 pip account:

There is only one disadvantage of a 0.0 pip account. Some forex brokers got no negative balance protection. Forex trading is leveraged trading which implies high risk. There are some market situations where the broker can not close your position (big news event overnight). If you got bad luck and you are trading with a too big trading volume your account balance can become negative. But this is nearly impossible.

Our values to find a good online partner

For traders, it is hard to find a reliable and trusted online forex broker. As experienced traders, we know how to check a partner by certain criteria. Before signing up with a forex broker you should check the homepage to find important information to avoid fraud. There are some fake brokers who are scamming clients all over the world. That should not happen to you so definitely check the regulation of the company. A regulated forex broker is showing the license and regulation on the webpage.

In the following list and video, you will find our full criteria and comparison to find a reliable partner to trade forex. Regulation, the security of funds, and trade execution are very important to us and these are the key factors to trade like a professional.

Criteria for a good forex broker:

- Official regulation

- Official dealer license

- Free demo account

- Low minimum deposit

- Professional support

- Reliable trading platform

- Fast execution

- Low trading fees

How does a 0.0 pip forex spread broker earn money?

In the zero spread account, an additional spread is not charged but the broker will charge a fixed commission. This is depending on the trading volume of the position. Most brokers will show you a commission per 1 lot (100.000) trade. If the commission is $6 per 1 lot trade you will pay a commission of $0.06 if you are trading 0.01 lot.

In conclusion, the forex broker always earns money because of the additional spread or commission. If you are a high volume trader the broker will earn more money and sometimes the company will give you a rebate so that you pay fewer fees because of the high trading volume.

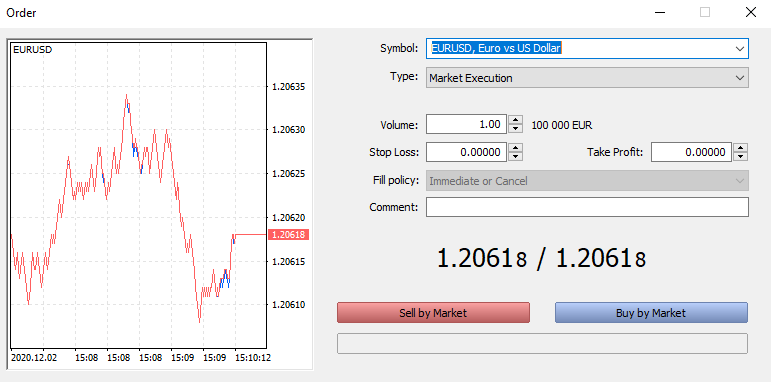

See the picture of 0.0 pips spread in EUR/USD trading here:

How does the no spread account really work?

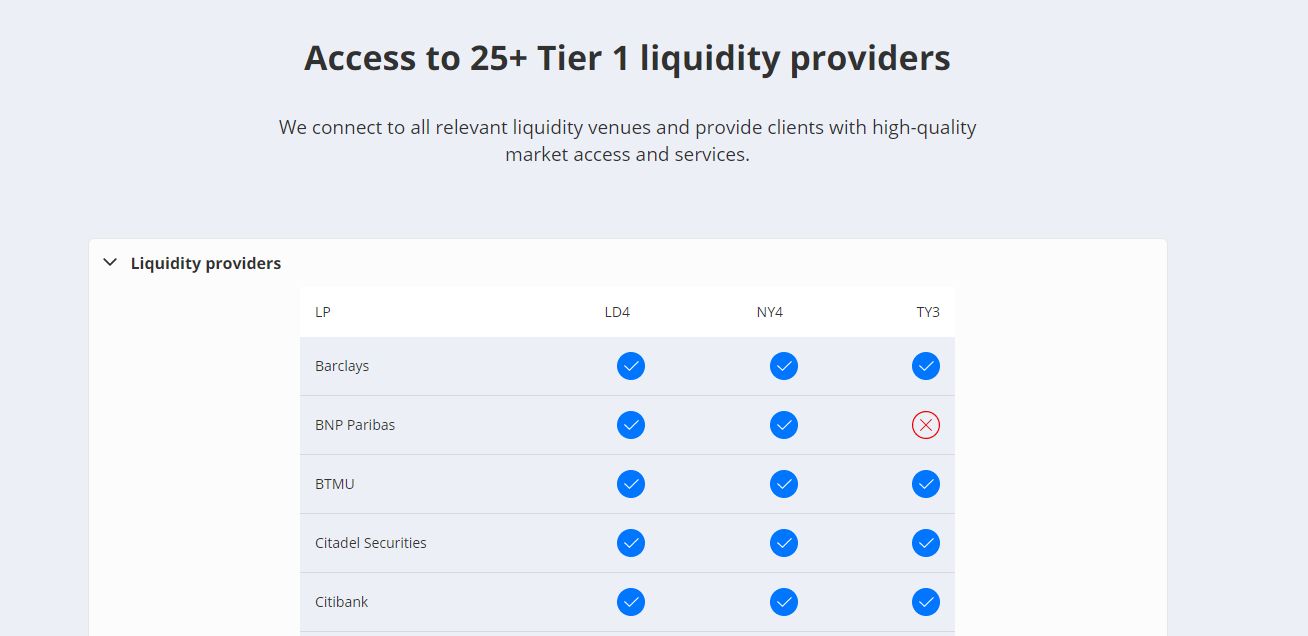

In the following, we will show you exactly how it works behind the scenes. The most forex brokers getting liquidity by a “market maker” called “liquidity provider” and some companies are making it by themself. Around the world, there are big liquidity providers like banks (goldman sachs, barclays, citibank, and more). These banks are giving direct market liquidity to the forex brokers.

Forex broker liquidity providers

The orders are matched by the “spot market” and not traded on a real stock exchange like stocks or futures.

Get direct market spreads

With a zero spread account, you get direct market access and real original prices. Most forex brokers show you the liquidity in the trading platform. You can see the market depth and how much liquidity is there. In our opinion, no spread accounts are more transparent than spread accounts.

Direct spreads from liquidity providers

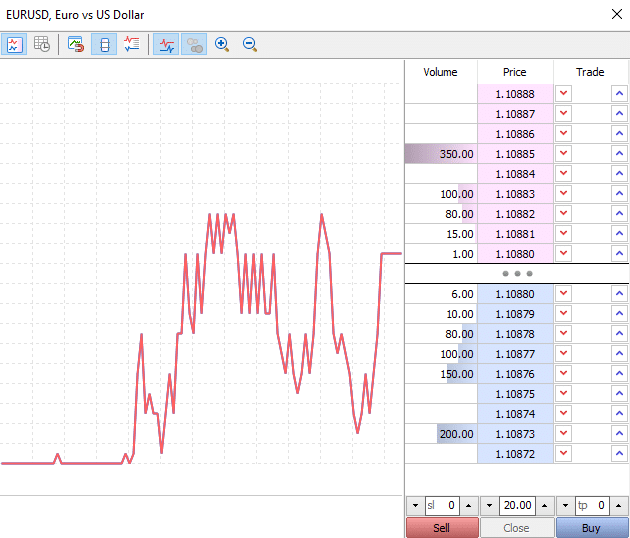

See the market liquidity

The most no spread brokers are ECN or no dealing desk brokers. You can see the market liquidity in your trading platform. The most popular platform is metatrader. If you click on “depth on market” you will see the order book (picture below).

Orderbook for no spread accounts

On the prices, you see the lots based on the liquidity. Liquidity can change very millisecond. We do not recommend trade with order book strategies in the forex market because the numbers are changing too fast.

No conflict of interest

There is no conflict of interest between the forex broker and the trader. It does not matter if you make a loss or winning trades. The broker earns only money by the commissions. Successful traders are welcome because the broker will earn more money in the long run. You can be sure that your funds and investments are safe when the broker got an official dealer license.

Be careful: slippage can happen on market events

Always be careful by trading forex. The 0.0 pip spreads are not fixed. On market events, there can be slippage and you get a bad execution. This also applies to normal spread accounts. It means the market is too fast and there is low liquidity. A lot of traders are closing their limit orders when a market news event happens. So the liquidity is small.

We do not recommend to trade on market news because of the high risk. The volatility can be very high and the movements are not predictable. So be careful when you trade forex. It is not without risk. On the economic calendar, you can see the market events for your forex pairs.

Conclusion: you should use a 0.0 pip forex trading account

On this page, we showed you detailed information about the zero spread account for forex trading. Nowadays, a lot of brokers are offering this account type. The minimum deposit is different from broker to broker. Sometimes you have to invest more than $1,000 into your account to get 0.0 pips spread.

The forex broker is earning money by an additional trading commission fee which you are paying each trade. Bdswiss is an exception with the monthly fee account. The commission is depending on your trading platform and trading asset. As you saw in our calculation you can save more than 60% of trading fees if you are switching to a no spread account.

With a regulated broker, you can be sure that there is no scam or fraud. The companies which we present on this page are tested with real money. To get a closer look at a forex broker you can read the full and detailed reviews. The winner is clearly tickmill because the commissions are the lowest.

Our reviews:

- IQ option

- IC markets

- Tickmill

- XTB

- Bdswiss

- XM

- Roboforex

- Vantage FX

- Admiral markets

- Blackbull markets

The zero (no) spread account is the best way for traders to save trading fees. It is cheap trading with direct market liquidity.

Forex trading without broker

Trading is an integral part of the world for pushing commerce and trade. It channelises economies which in the end meets the pangs of hunger and quenches the thirst for various things including food and essential beverages. So, the efforts go into them are inevitable and vital for sustaining lives. Forex trading is one such form that lives in proximity to international trades.

Market players indulge in forex trading for multiple reasons, including the business point of view and exchanging the currency while going overseas. But can you imagine earning money through forex without trading? It sounds quite indifferent when we hear or read, but there are ways.

Forex without trading: become a forex broker

Not many market players or forex investors think of becoming a broker in their wildest of dreams; it is because they focus only on booking profits directly and not passively. But they should know that brokers who indulge in brokering are no short of money or gains.

Brokers get their share of commission on both bidding, buying and selling the instrument or underlying assets. These middlemen do not need to invest their money in the forex market. Instead, they can act as a helper and guide traders through to purchase currencies.

Becoming a forex broker means you are the bridge between buyers and sellers. Today, when almost every work and transaction is transiting online, forex trading has become more comfortable. In earlier days, people had to use a pen, pencil and a notebook to write down about all bureau of tradings. Now, a panel of computer networks powered by algorithms do it.

What does a forex broker need?

A forex broker should know about data, pattern, evolution, most prominent investors, time for investment, highs and lows of the market, triggering points and above all should have the ability for predicting what does the future unfold.

However, the competition is hyperactive in the tantalising market of uncertainties and volatility. But do you know, for a broker, fluctuations in the financial markets are like best friends? They ensure volumes of traders flocking at the door for claiming opportunities that come knocking the door.

Now, helping traders to lock their luck is the job of a broker. And for this, the individual doing so should have a conviction rate of hundred per cent. If you, as a broker are not convinced that a deal can draw profits, then no one can convince your client aka an investor.

So, as a broker, you must get yourself convinced about buying or selling a specific currency pair in a time. You know the competition is stiff between brokerage firms, they all are investing a lot in getting the infrastructure of IT and marketing in place for drawing right, quick information that can translate into voluminous clients. So, for attracting the attention of interested participants, a broker should be well-read.

Also, you have to make efforts to crack codes of deals that can prove advantageous for your clients. Their gains would translate in word of mouth, and your earning will elevate accordingly.

Forex without trading: think innovatively as a broker

Trading platforms like global trade ATF and roinvesting have such a team of brokers that bargain the most lucrative deals for their clients, which hold them firmly. You have to think that way to be a representative of your own brand of forex brokerage.

Plus, a broker, it is your duty that your client or investor does not meet with any losses. Offering them clever tips is important to win their trust over.

Even during the non-eventful days, you must get some investments by investors. It is your duty to introduce them to tools and charts that can create opportunities for them in the bearish market.

Forex without trading: affiliate program

Affiliation is the next big thing and already growing at a quick pace across the world. It has become an alternative career, and in terms of forex trading, it is playing a major role in passive income. A trader can put aside the trading business and can make money alternatively. Isn’t that interesting?

You can create your platform by getting on board different brokerage firms at a single place. However, it may sound easy, but requires loads of efforts. You have to speak with renowned and budding brokers, explain your business plans and then generate an affiliate link.

Also, as you know, tradings are happening on online platforms; you have to be presentable. Some people create their websites and get it done. So, you do not have direct trading involvement in the forex trading, but you offer clients, several brokers, for choosing.

Application on websites

After receiving affiliate links from your associate brokerage platforms, you apply them on your website. Any client or customer who chooses one of the brokers for trading and makes a deposit, you receive a fixed amount of commission. However, it may range from smaller to bigger, depending upon the investment by your lead.

Moreover, on every transaction that takes place between the broker and the trader, you receive a percentage of benefit. So, more number of people selecting brokers from your place and choosing to invest is benefitting you. So, you do not have to touch forex trading, but use your acumen and execute in the right direction knowing about the market.

You can also choose to promote the broker of your choice, whichever invites your benefits. Social media or digital marketing are some of the best options you can utilize to your advantage. Also, put out the affiliate links there, reach out to the targeted people and get them to trade with your following associates.

Track those who have the penchant for forex trading and understand the market and how it enacts during different time zones. Anyone who has that clarity in mind can garner profits for him/her, and of course, you have the cherry going by your side. Precisely, forex trading affiliate marketing can make you a millionaire provided you can market the valuable content to traders and investors.

The important thing in affiliate marketing

Reputation management is something that everyone knows is the backbone of promoting a business. While promoting a business or a broker for affiliate marketing, you should build up hype around your portal through significant work in the field and tempting offers. If you can play around these two games, then traffic will begin to mount, and benefits will walk your way.

Become a forex consultant

Consultancy firms are close to beating any other service providing market. Their valuable inputs and direction can assist you in becoming a rich person and cast away perils that may cause losses in the fluctuating market of the foreign currency exchange. Hence, several trader and investors look forward to hiring an agency or seek a consultant’s advice.

Now, here lies your favourite portion, without spending a penny or depositing any amount in a forex broker’s account you earn hefty checks. However, it comes at the cost of learning the forex market at the back of hands. You should have answers to all queries that your trader may expect.

As a forex consultant, it is your job to assist clients in helping capitalizing and consolidating the market. You have to offer information that is not available to common people or in a magazine, that’s how you’ll justify the payment you receive from the client.

Also, you have to offer such insights that have significance in the international market as far as forex trading is concerned.

Requirements for becoming a forex consultant

A forex consultant is deemed as an expert who holds benchmark records in foreign as well as the regional market. One who can guide a novice to experienced campaigners of forex trade for investment and see them through difficult times of the foreign exchange trading is the duty of a consultant.

The better the advice, the higher are the charges and earning. So, you have to guard your information exclusively for the ones who deserve and pays for it, that is how you earn without forex trading.

If we talk about the salary package, as per the BLS, the average annual salary received by a financial analyst and consultant was $85,660 as of may 2018.

Going by the current salary packages, and earnings, that’s a huge income without forex trading.

Some notable anecdotes for becoming a successful gainer without trading forex

If you wish to earn passive income through forex or the foreign exchange market, it is imperative to know the fundamentals of top currencies. One should know the reasons that cause highs and lows. There are political scenarios, civil wars, policies and miscellaneous interruptions like the ongoing pandemic that can lead to stirring in the prices of currencies and trades.

Conclusion:

There is a life beyond a well, and of course, people can earn without trading foreign exchange currency directly but by associating and directing other people who are willingly doing it. You can charge others for offering them your valuable guidance or work for them as an astute broker.

How to start forex trading without investment

If you don’t have an initial investment for starting forex I believe it better to know how to start forex trading without investment. But if you expect high returns without investment, it will never happen. To get high returns you have to deposit a lot of money.

Of course, it is possible to engage in foreign exchange transactions without investment but not make a lot of money at once. For one thing, without investment, you get money not from the foreign exchange market but from brokers.

This will allow you to not only trade without investment but also have a good experience in the forex market. If you do not have a large or small amount of money to invest in forex trading, you can do so by studying this carefully.

I have given you some important facts about it below, check it out and get an understanding of how to start forex trading without investment and make a profit.

Actually how to start forex trading without investment.

- Choosing a free forex trading account

- Affiliate program

- Contestsprogram

Choosing a free forex trading account

You have the opportunity to get a free account and engage in foreign exchange transactions. You can open a free account by choosing a broker who offers bonuses as well as special offers.

XM

Founded in 2009 and it is regulated by cysec and it is great for beginners because they provide good educational videos and demo account facilities. In addition, you can trade over 700 instruments and also gives special bonus offers for new clients.

Nordfx

Founded in 2008 and it is regulated by cysec and VFSC. Nordfx gives MT4 and MT5 facilities and also they offer 30 currency pairs, the other one is provided special offers for new clients.

Affiliate program

If you want to make money in foreign exchange without any investment, you can do so through the affiliate program.

This method is becoming very popular nowadays. You can do this successfully without using your money and you can make money without trading.

All you have to do is advise new traders on how to choose a good broker to deal with the forex market. This will allow you to earn a bonus. You can do this by doing a good review of brokers for new traders.

You will get a fee from the brokers if traders registered under the referral link, and you can use that money to make trading if you want. To do this, you must first connect with a broker and open an account.

So if you run affiliate programs like this, you will have the opportunity to earn money without any investment. It will be easier for you if you do this on your own website or blog.

Contests

Most brokers hold open contests for real and demo accounts for everyone. The nature of this competition is to give a real account to the people who earn the most in a short period of time.

Then you will be able to get the amount of money you earned. In addition, you can get some more benefits from this. You will not get real money first but the person who wins at the end of the competition will get real money.

You can use this money to invest in foreign exchange transactions. Because you do not need to risk money.

Fxdailyreport.Com

In forex trading, the difference between a bid price and an asking price is known as a spread. Therefore a zero spread account is a type of account that has no difference between bid prices and ask price. A zero spread forex broker is a brokerage firm that offers its traders zero spread accounts. In other words, the spread takes the place of a typical transaction fees, meaning that you don’t have to pay anything.

With this unique account, you as the trader is aware of your entry and exit stages in advance. This means that when you open a trade in a particular position, you automatically know your exit point. This could be an enormous advantage to some traders.

While using a broker that offers this kind of account, it helps to understand that when the spread becomes bigger, the cost of trading rises. On the other hand, when the spread is narrow the cost stays low.

Top forex brokers with starting from 0 pip spreads

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: $100 spread: starting 0 pip leverage: 500:1 regulation: FCA UK, FSA (seychelles), cysec | visit broker | ||

| min deposit: $100 spread: from 0,2 pips leverage: 1:200 regulation: FCA UK (#186171), cysec (#259/14), CIMA (1442313) and DFSA (F000048) | 10% welcome bonus up to $5,000 | visit broker |

Though it may sound like no trader will be charged by a 0 spread forex broker, there is a probability that the broker will charge some traders in one way or another. In fact, there are numerous zero spread brokers that are keen on a particular range. This means that you might get charged, but the charges are not presented as you would expect as they may be in an indirect form.

Zero spread brokers

These types of brokers normally offer an electronic communications network (ECN) or what is termed as a straight through process (STP). They offer a much different approach to the traders in comparison to the typical forex trading brokers. With zero spread brokers, you get direct access to the available financial markets.

It is, however, important to note that the prices are not set by the brokers. Instead, they are set by the market itself.

The pros of zero spread forex brokers

- If you sign up with a zero spread broker, it opens the doors for you to access the market directly.

- As a trader, you know your entry and exit points beforehand as soon the positions are open. If you are into high-frequency scalping, then this kind of brokerage is extremely helpful with calculating non-trading loses. They also help you execute your day trading strategies with precision. Moreover, you can benefit from the speedy execution of your trading moves since you already have direct access to the relevant financial markets.

- Efficiency is another advantage of using 0 pip spread forex brokers. The whole model of trading allows you direct access as well as fast executions; this can be attributed to the fact that there are no interventions from the brokers to your trading decisions. The trading systems are automated, which provides you a great deal of efficiency.

The cons of zero spread forex brokers

While you may think that you will not be charged by this kind of brokerage, some costs might apply in a hidden way. This is detrimental to a trader in that you may end paying various charges without exactly knowing how they came about. Some of these charges are disguised as a huge initial account opening size. Sometimes, you are forced to put with disappointingly low execution speeds.

Also, if you like to make the use of the negative balance protection, it will certainly not help you with a zero spread forex brokers. Dealing directly in the market can be both good and bad. One of the ways in which this can be a disadvantage is that meeting the required liquidity threshold solely rests with you as the trader. For instance, the cost of opening an account is quite high and you have to meet it by yourself.

If you would like to try out a method of currency trading without having to pay hefty transaction costs, the zero spread brokers offer you a perfect opportunity to do so. Nevertheless, zero spread brokerage firms should be looked at more carefully. No trade that promises zero charges on anything really works that way. In fact, if you examine it closely, you may find out that you will be charged by these brokers in subtle ways that aren’t as clear cut as what you would experience with other options.

How to start trading forex (4 steps)

Welcome to the world of forex. There might be many reasons why you are reading this article. It could be that your friend or acquaintance mentioned about how they trade and perhaps even make a living by trading forex. Whatever your reasons may be; this article will give you an overview of the forex markets and how to start trading forex … and perhaps make money for yourself.

Step 1. What is forex?

Step 2. Learn forex basics

Step 3: find a forex broker

Step 4: start trading

Step 1. What is forex?

Forex, or foreign exchange is an unregulated market, also known as OTC (over-the-counter) and is the biggest market with average daily turn-over that runs into billions. It is even bigger than the US stock markets. Although due to its OTC nature, no one can really give the correct numbers as to the forex turnover. But nonetheless, forex is indeed a big market and thus allows many market participants. From your neighborhood bank to specialized investment companies, to your friend; the forex markets always offers a piece of the action whoever you are and wherever you are (even from your home).

The basic concept of trading forex is very simple. You trade or speculate against other traders on the direction of a currency.

So, if you believe that the euro is going to rise, you would BUY the euro, or SELL the euro if you think the euro would fall. It’s as simple as that.

Step 2. Learn forex basics

Before you get ready to deposit your funds and start trading there are some important points you must understand, each of which are outlined below.

Forex brokers: in order to start trading forex, you will need to trade with the help of a forex broker. There are many forex brokers out there today who allow you to open a forex trading account for as little as $5. The forex broker is the one who facilitates your buy and sell orders and also allows you to research into the markets (also known as technical or fundamental analysis) to help you make more informed decisions… and of course allows you deposit more funds or withdraw your profits when you want to. ( click here to see our forex brokers rating )

Trading platform:you need a trading platform from which you can place your trades, which are then sent to the broker for settlement. Also, a trading platform is essential for you to conduct your technical analysis and also to see the current market prices. Most retail brokers offer the MT4 (short for metatrader 4) trading platform, which is free of cost. You can also open a demo trading account and practice trading with virtual money to gain the experience required before trading with real money.

Forex trading hours:while you might have heard that the forex markets never sleeps, it actually does. Firstly, you won’t be able to trade on weekends (saturday and sundays). But for the rest of the week, the forex market operates 24 hours a day. This is due to the fact that forex trading is global. At any point in time, you will always find an overlap of a new market session while the previous market closes. What time of the day or which market session you trade plays a big role if you are an intra-day trader or a scalper. This is another vast topic, which we will cover at a later stage. ( click here to learn more about forex trading hours . )

Now that you have a basic overview of the forex markets, here are some final pointers to remember before you start trading for yourself.

What is a pip?:pip is a measure of change in a currency pair’s value and is the 5 th decimal. For example, if EURUSD changes from 1.31428 to 1.31429, the change is denoted as 1pip (1.31428 – 1.31429 = 0.00001). When you trade, the more pips you make, the more profit you have. Ex: buying EURUSD at 1.31428 and selling (or closing your trade) at 1.31528 would give you 100pips in profit. ( read more about forex PIP )

Reading quotes: forex quotes are presented in a bid and ask price (both of which vary by a few pips and from one broker to another). The bid price is the price at which you can buy and the ask price is the price as which you can sell. So, a EURUSD quote would look like this 1.31428(bid)/1.31420(ask).

What is a spread?: spread is nothing but the difference between the bid and ask price. So in the above example, for 1.31428/1.31420, the spread would be 8 pips. ( read more about forex spread)

What is a leverage?: leverage is the amount by which you can request your broker to magnify (or increase) your trade value. Leverage is often quoted in ratios such as 1:50, which means that when trading on a 1:50 leverage, your $100 is magnified to $50000. Leverage is a big topic in itself and it is recommended to read this article to learn more. Leverage is important both in terms of making profits as well as managing risks and therefore, your trades.

What is a lot?: A lot is a unit by which you place your trade. In financial terms, a lot is also referred to as a contract. There are preset lots (or contract sizes) that you can trade. For example a standard lot is nothing but 100,000 units (known as 1 lot). ( read more about lot)

Reading charts: the ability to understand and read the charts is very essential to trading. Depending on your approach, you can choose between a line, bar or candlestick charts and trade accordingly (for example trading based on candlestick patterns). ( read more how to read forex charts)

Placing orders (how to buy and sell): in forex trading, it is possible to either buy or sell any currency pair. Most trading platforms, give you this option. You buy when you think that price will go up and you sell when you think that price will fall. There is a common terminology used in forex trading, which is buy low, sell high; which is an important point to remember. ( read more how to place orders with MT4 )

Order types: besides buy and sell, another point to remember the types of orders. There are two basic order types: market orders and pending orders. When you click on ‘buy’ or ‘sell’ you are basically buying (or selling) at the current market price. A limit order on the other hand tells the broker that you want to buy or sell only at a particular price. ( read more about types of forex orders)

Step 3. Find a forex broker

As mentioned, there are many forex brokers today and therefore it can get confusing on how to choose the forex broker that is right for you. To briefly summarize, remember the following points while choosing a forex broker:

- Look for a forex broker that is regulated

- See if the forex broker offers a minimum deposit amount

- What is the leverage that the broker offers

- What is the minimum contract size that you can trade

- Bonuses and the terms and conditions (see on our site list of forex deposit bonuses and forex no deposit bonuses)

- Deposit and withdrawal types as well as the terms and conditions

- Trading methods that are allowed by the broker

We can also help you choose a forex broker by reading our article how to choose forex broker

Step 4. Start trading

Finally, now that you have selected a forex broker to trade with it is recommended to first open a demo trading or a practice account. Most forex brokers offer unlimited demo trading account (but will be deactivated if not used for 30 days). This is a good way to get acquainted with the forex markets and also help you to understand your trading style (scalper or intra day trading, swing trading, etc) and approach (fundamental or technical analysis). You can search for various trading methods and systems or you can develop one yourself when you have a good understanding of technical or fundamental indicators.

Conclusion:

Forex trading is one of the most active and dynamic ways to trade the financial markets. At the heart of everything, it is the basic fluctuations in currency values which drives everything else. Learning to trade forex and understanding the forex markets can give a good foundation to trading other markets such as derivatives or equities.

Forex trading with or without a broker

There is a myth making the rounds in the forex universe. This rumor that’s whispered and spread from keyboard to keyboard over cyberspace states that in order to take part in forex trading, you must have a broker.

A rumor is all this is because there’s no truth in the must part of the rumor. You can do your forex trading with a broker if you choose to do so, but it certainly isn’t a must. Many traders act without a broker and conduct their trading business successfully.

Even if you don’t have the first clue about how forex trading is done, and you’ve never done it, you still don’t have to have a broker if you don’t want one. Can you gain from having a forex broker in your corner?

Yes and no. It depends on whether or not your forex broker is smart about trading and whether or not he’s going to be smart about trading for you. Some forex brokers look at those who want to partake of trading currencies as another zero on their own paycheck and they will actually work against you in a practice known as sniping.

Sniping is a practice committed by some forex brokers who in effect cheat you out of profits. Yes, it’s dishonest and no, you have no recourse whatsoever to protect yourself from sniping done by a forex broker bent on taking advantage of you.

There are decent forex brokers who do help those are involved with forex trading or want to get involved with forex trading. These are professionals in the trading world who value both their customers and their own reputations.

They would no more think of cheating you than they would themselves. Most forex brokers are legitimate in the trading world but it’s the actions of a few bad apples that tend to spoil the bushel.

You can learn about forex trading and you can trade without going through a broker if you’re afraid you might encounter one who isn’t what he claims to be. But on the other hand, an honest broker brings to the table his expertise with the forex.

While forex trading with a broker has the advantage of using his expertise to aid you in making trades, sometimes this leads to a tendency on the part of the trader to ignore getting a forex knowledge on his own. If you’re not knowledgeable about forex trading, then you won’t know if the moves your broker are making are for your good or his.

So, let's see, what we have: fxdailyreport.Com for beginners, the forex market can be hard to navigate. There is a lot of jargon that you have to wrap your head around in order to be able to make any reasonable profits. At forex trading without broker

Contents of the article

- New forex bonuses

- Fxdailyreport.Com

- What is copy trading ?

- Trading in forex without deposit

- Is it possible to trade in forex without...

- How to trade with no deposit bonus

- Fxdailyreport.Com

- Top forex brokers with starting from 0 pip spreads

- The 10 best forex broker with zero (no) spread...

- Save trading fees by using a low spread forex...

- Comparison between a spread and zero (no) spread...

- Advantage of a 0.0 pip account:

- Disadvantages of a 0.0 pip account:

- Our values to find a good online partner

- How does a 0.0 pip forex spread broker earn money?

- How does the no spread account really work?

- Get direct market spreads

- See the market liquidity

- No conflict of interest

- Be careful: slippage can happen on market events

- Conclusion: you should use a 0.0 pip forex...

- Forex trading without broker

- Forex without trading: become a forex...

- What does a forex broker need?

- Forex without trading: think innovatively as a...

- Forex without trading: affiliate program

- The important thing in affiliate marketing

- Become a forex consultant

- Requirements for becoming a forex...

- Some notable anecdotes for becoming a...

- Conclusion:

- How to start forex trading without investment

- Actually how to start forex trading...

- Fxdailyreport.Com

- Top forex brokers with starting from 0 pip spreads

- How to start trading forex (4 steps)

- Step 1. What is forex?

- Step 2. Learn forex basics

- Step 3. Find a forex broker

- Step 4. Start trading

- Conclusion:

- Forex trading with or without a broker

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.