B dollar forex capital

Martin child / getty images now assume you open an account with $500. You can risk up to $5 per trade and buy multiple lots.

New forex bonuses

For example, you can set a stop loss 10 pips away from your entry price and buy five micro lots and still be within your risk limit (because 10 pips x and unlike the stock market, for which the securities and exchange commission requires day traders to maintain an account with $25,000 in assets, there is no legal minimum amount required for forex trading. .10 x 5 micro lots = $5 at risk).

The minimum capital required to start day trading forex

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/486965081-56a22da85f9b58b7d0c784b7.jpg)

Martin child / getty images

It's easy to start day trading currencies because the foreign exchange (forex) market is one of the most accessible financial markets. Some forex brokers require a minimum initial deposit of only $50 to open an account and some accounts can be opened with an initial deposit of $0.

And unlike the stock market, for which the securities and exchange commission requires day traders to maintain an account with $25,000 in assets, there is no legal minimum amount required for forex trading.

But just because you could start with as little as $50 doesn't mean that's the amount you should start with. You may want to consider some scenarios involving the potential risks and rewards of various investment amounts before determining how much money to put in your forex trading account.

Risk management

Day traders shouldn't risk more than 1% of their forex account on a single trade. You should make that a hard and fast rule. That means, if your account contains $1,000, then the most you'll want to risk on a trade is $10. If your account contains $10,000, you shouldn't risk more than $100 per trade.

Even great traders have strings of losses; if you keep the risk on each trade small, a losing streak can't significantly deplete your capital. Risk is determined by the difference between your entry price and the price at which your stop-loss order goes into effect, multiplied by the position size and the pip value.

:max_bytes(150000):strip_icc()/minimum-capital-required-to-start-day-trading-forex-1031370_FINAL1-0fd72348a80a4951b802a7df8b988713.png)

Pip values and trading lots

The forex market moves in pips. Let's say the euro-U.S. Dollar (EUR/USD) currency pair is priced at 1.3025. That means the value of one euro, the first currency in the pair, which is known as the base currency, is $1.3025.

For most currency pairs, a pip is 0.0001, which is equivalent to 1/100th of a percent. If the EUR/USD price changes to 1.3026, that's a one pip move. If it changes to 1.3125, that's a 100 pip move. An exception to the pip value "rule" is made for the japanese yen. A pip for currency pairs in which is the yen is the second currency—called the quote currency—is 0.01, which is equivalent to 1 percent.

Forex pairs trade in units of 1,000, 10,000 or 100,000, called micro, mini, and standard lots.

When USD is listed second in the pair, as in EUR/USD or AUD/USD (australian dollar-U.S. Dollar), and your account is funded with U.S. Dollars, the value of the pip per type of lot is fixed. If you hold a micro lot of 1,000 units, each pip movement is worth $0.10. If you hold a mini lot of 10,000, then each pip move is $1. if you hold a standard lot of 100,000, then each pip move is $10. Pip values can vary by price and pair, so knowing the pip value of the pair you're trading is critical in determining position size and risk.

Stop-loss orders

When trading currencies, it's important to enter a stop-loss order in case the value of the base currency goes in the opposite direction of your bet. A simple stop-loss order would be 10 pips below the current price when you expect the price to rise or 10 pips above the current price when you expect the price to fall.

Capital scenarios

$100 in the account

Assume you open an account for $100. You will want to limit your risk on each trade to $1 (1% of $100).

If you place a trade in EUR/USD, buying or selling one micro lot, your stop-loss order must be within 10 pips of your entry price. Since each pip is worth $0.10, if your stop loss were 11 pips away, your risk would be $1.10 (11 x $0.10), which is more risk than you want.

You can see how opening an account with only $100 severely limits how you can trade. Also, if you are risking a very small dollar amount on each trade, by extension you're going to be making only small gains when you bet correctly. To make bigger gains—and possibly derive a reasonable amount of income from your trading activity—you will require more capital.

$500 in the account

Now assume you open an account with $500. You can risk up to $5 per trade and buy multiple lots. For example, you can set a stop loss 10 pips away from your entry price and buy five micro lots and still be within your risk limit (because 10 pips x $0.10 x 5 micro lots = $5 at risk).

Or if you choose to place a stop loss 25 pips away from the entry price, you can buy two micro lots to keep the risk on the trade below 1% of the account. You would buy only two micro lots because 25 pips x $0.10 x 2 micro lots = $5.

Starting with $500 will provide greater trading flexibility and produce more daily income than starting with $100. But most day traders will still be able to make only $5 to $15 per day off this amount with any regularity.

$5,000 in the account

If you start with $5,000, you have even more flexibility and can trade mini lots as well as micro lots. If you buy the EUR/USD at 1.3025 and place a stop loss at 1.3017 (eight pips of risk), you could buy 6 mini lots and 2 micro lots.

Your maximum risk is $50 (1% of $5,000), and you can trade in mini lots because each pip is worth $1 and you've chosen an 8 pip stop-loss. Divide the risk ($50) by (8 pips x $1) to get 6.25 for the number of mini lots you could buy without exceeding your risk. You would break up 6.25 mini lots into 6 mini lots (6 x $1 x 8 pips = $48) and 2 micro lots (2 x $0.10 x 8 pips = $1.60), which puts a total of only $49.60 at risk.

With this amount of capital and the ability to risk $50 on each trade, the income potential moves up, and traders can potentially make $50 to $150 a day, or more, depending on their forex strategy.

Recommended capital

Starting out with at least $500 gives you flexibility in how you can trade that an account with only $100 in it does not have. Starting with $5,000 or more is even better because it can help you produce a reasonable amount of income that will compensate you for the time you're spending on trading.

Trading GBP/USD: an overview of the pound-dollar forex pair

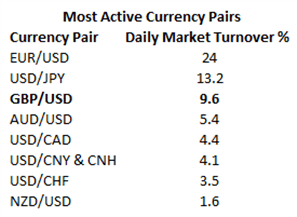

In recent times, the institutional forex market has become the largest financial market in the world. There are also a growing number of retail forex traders. And when it comes to forex, GBP/USD looms large. GBP/USD is the third most traded forex pair in the world and accounts for just under 10% of global foreign exchange turnover. In the most up-to-date report from the bank for international settlements (BIS), GBP/USD also known as “cable” accounts for 9.6% of the volume.

GBP/USD is among the most liquid currency pairs to trade in FX, which can suit traders on shorter time horizons. H igh liquidity means that spreads are tight, while transaction costs are minimal. Many trading strategists believe it is important to stick to highly liquid currencies —such as pound to dollar-- to grasp an understanding of forex trading. It can be easier to learn forex trading with highly liquid currencies before moving to illiquid currency pairs —often targeted by very experienced traders .

This page on pound to dollar forex trading has five sections, each one designed to help the reader understand key concepts. Terminology highlights terms often used in forex trading. The importance of the US dollar talks about the role of the american currency in FX. Best time to T rade touches on some of the most active periods of liquidity and volatility. Market structure covers key participants in forex and GBP/USD including central banks and hedge funds. Tips for fundamental, technical and advanced trading addresses macroeconomic events GBP/USD forex traders watch, charting techniques and correlation analysis.

Terminology

If you are a long, you want to own that asset on the expectation that it will rise in value, while if you are short, you sell something that you do not own, betting that the price will fall. In FX markets, you are simultaneously long and short a currency when taking a position. For example, if you are long or buying GBP/USD, you are expecting the pound to rise in value against the US dollar and vice versa.

Understanding the importance of the US dollar

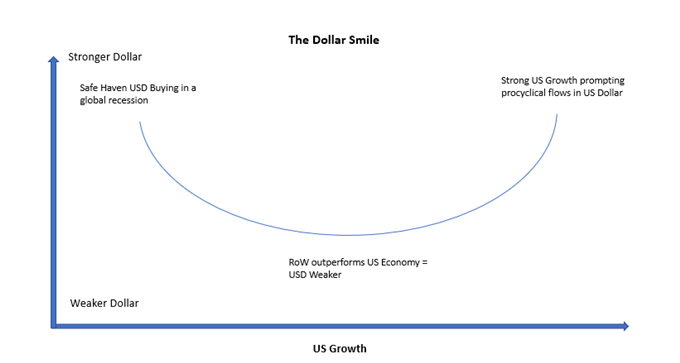

When trading GBP/USD is it also important to understand the US dollar, particularly when the dollar accounts for 88% of all trades in FX. In the early 2000s, an FX strategist from morgan stanley had invented the “dollar smile” theory, whereby the US dollar tends to strengthen when the US dollar is very strong or very weak, while relative growth outperformance in the rest of the world compared to the US leads to a weaker dollar.

Best time to trade GBP/USD

Currency traders must know the most active times of the trading day for liquidity and volatility purposes. Learn more about the importance of currency volatility .

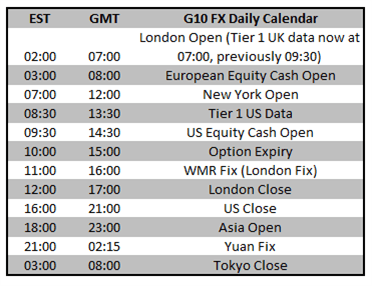

London open (07:00 london time): for GBP/USD, volumes will begin to pick up at the london open as market participants digest the events during the late US and asian market session. Therefore, you will see a pick-up in momentum at this time, which also coincides with the european equity futures open. Alongside this, the ONS have recently have moved tier 1 UK data to this from 09:30 LDN previously.

New york open (07:00 NY time): while pound to dollar is a 24hour market, the most active and liquid time of the day is the LDN/NY crossover, which is generally the best time to trade the most liquid pairs. The crossover can occasionally be associated with a continuation of the moves observed in the european session. That said, it is important to watch closely for possible patterns in the LDN/NY crossover.

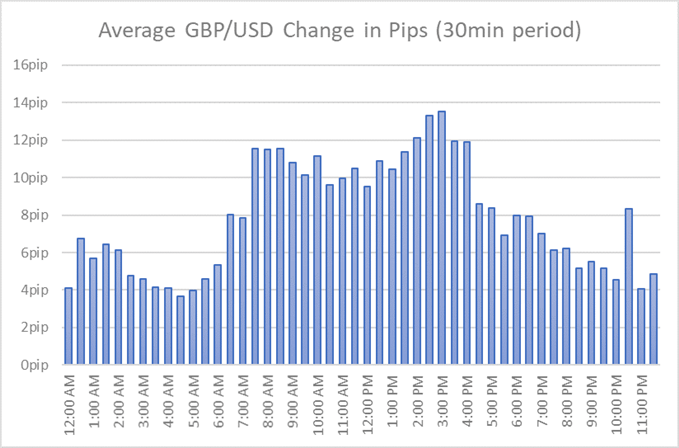

Average GBP/USD intra-day activity over october 2019 to october 2020 (time in GMT)

Tier 1 US data (13:30 london time) : when trading cable, you must be cognizant of the dollar side of the pair thus the tier 1 US data released at this time. Alongside this, other data points include markit and ISM pmis at 14:45 and 15:00 respectively.

London WMR fix (1600 london time) : the WMR fix is one of the most widely used benchmarks for FX trading, taking place every day within a 5-minute window around 1600 london time. The fix provides a standard set of currency benchmark rates so that equity and bond investors can compare portfolio valuations and performance with each other.

The WMR fix tends to coincide with a sharp rise in trading volume, prompting a sizeable increase in liquidity. Occasionally, this allows for large real money flows to take place without causing too many distortions. However, flows can also be dominant in one direction (strong buying or strong selling) leading to outsized moves in a very short period of time.

The largest bout of volatility stems from the month-end fix , taking place on the last business, where market extreme moves can often occur in the lead up during 15:00-16:00 london time. These FX flows are derived from mostly equity rebalancing.

As such, if a UK portfolio manager holds US dollar-denominated assets and seeks to hedge FX risk, then a monthly rise in the value of those assets will lead to more dollar hedging (selling the dollar). For example, if equities are FX hedged and US stocks (S&P 500) have risen on the month, while the FTSE 100 (UK stock market) has traded flat, then UK based investors would sell US dollars against the pound to add to their hedge, leading to an appreciation in GBP/USD. The greater the outperformance of US equity market over the UK would be associated with greater selling of the USD against GBP, prompting GBP to rise even higher. Although, extreme moves can often partially revert in the day following the month-end fix. That said, the occurrence of such event in a market as liquid as FX, suggests that the london fix (month-end fix in particular) is important for FX traders to watch for.

Illiquid time zones: even in the most actively traded currencies, there are liquidity risks. Particularly during the early hours of the asia trade as both volumes and liquidity drops off.

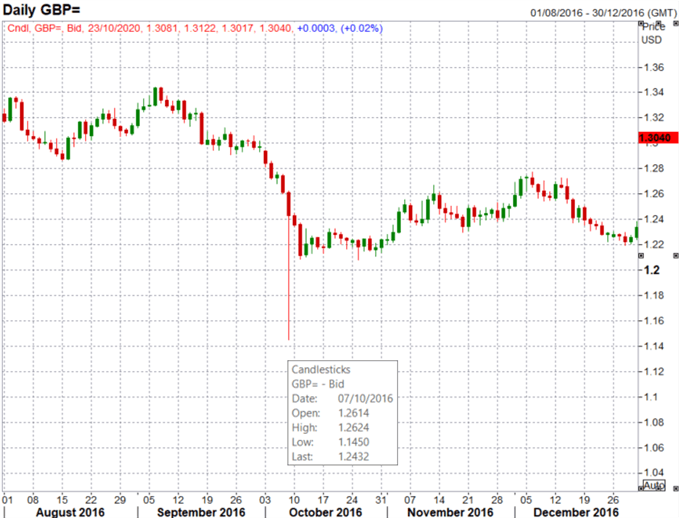

GBP/USD flash crash (october 7 th , 2016) | -6% in 3-minutes

Early in the asian trading session, the pound had depreciated near over 6% in a matter of minutes before quickly retracing much of the losses. While there was a lack of clear catalysts to drive such price action among the major factors that had played a role in the move was the time of day, which is typically associated with lower market volume, making for illiquid trading conditions. Another factor that seemed to have had exacerbated the decline was the surge in demand to sell the pound to hedge options positions, while a GBP negative media report had also added a marginal weight, however, this had not been new information. Consequently, these factors had contributed to a brief halt in futures trading. Learn more about flash crashes .

GBP/USD chart

Market structure andkey market participants

Banks: where most FX trading occurs either through initiation or facilitation.

Hedge fund: this is a private pool of investor capital used to trade in various asset classes equities, commodities, currencies and derivatives to generate superior returns relative to risk. Hedge funds can be classified in several ways:

- Macro funds: using macroeconomic variables to forecast FX trends.

- High-frequency trading (HFT): automated trading systems that use algorithms that can track numerous financial markets and execute vast amounts of orders.

- Real money investor includes mutual funds, pension funds, endowments, insurance companies, and portfolio managers.

FOREX-dollar pokes higher as U.S. Soft data sours mood; china GDP in focus

SINGAPORE, jan 18 (reuters) - the dollar held late-week gains on monday as softening U.S. Economic data and rising coronavirus cases turned investors cautious.

Against a basket of currencies the dollar hovered around a one-month high of 90.887 hit in early trade and the mood also supported the safe-haven yen against other majors.

The euro eased slightly to touch a six-week low of $1.2066 and the risk-sensitive australian dollar slipped 0.3% to a one-week low of $0.7679.

Trade was choppy and moves modest ahead of of a raft of chinese economic data, including GDP numbers due mid-morning, with fourth quarter GDP expected to show a further pickup in growth to 6.1% year-on-year.

The safety bid has added to support for the dollar since the democrats won control of U.S. Congress a fortnight ago, which triggered a surge in U.S. Yields as investors priced in fewer fetters on a borrow-and-spend administration.

The dollar index is up about 1.9% since then and the euro, which surged in 2020, has slipped more than 2% as the dollar’s bounce has coincided with surging virus cases and a political crisis in italy that have cast doubt on the region’s recovery.

Sterling on monday sat at a one-week low of $1.3567 and the yen was steady at 103.83 per dollar, although it advanced to a three-week high of 125.29 per euro.

The new zealand dollar eased 0.1% to a three-week low of $0.7117.

“optimism is being challenged as the reality of a tough few months is upon us,” ANZ analysts wrote in a note to clients. “the near-term outlook for consumption, the main driver of economic growth, is poor.”

U.S. Retail sales fell for a third straight month in december, data showed on friday, as renewed measures to slow the spread of COVID-19 triggered job losses.

The worldwide coronavirus death toll surpassed 2 million on friday and the world health organization has warned the worst could be ahead.

Later in the week, U.S. President-elect joe biden is due to be inaugurated in a heavily-guarded washington against the risk of more mob violence, with investors also beginning to doubt how much of his stimulus plans can make it through congress.

Biden’s pick for treasury secretary, janet yellen, is expected to rule out seeking a weaker dollar when testifying on capital hill on tuesday, the wall street journal reported.

Reporting by tom westbrook editing by shri navaratnam

Forex business boon for zim capital markets

Tawanda musarurwa

Senior business reporter

Zimbabwe’s capital markets are likely to see a spike in US dollar-denominated assets after government last year allowed insurance companies and pension funds to collect premiums and contributions in foreign currency.

And because these entities typically need to grow these funds and pay them back in the currency of collection, demand for foreign currency denominated investment assets in the country will rise.

Statutory instrument 280 of 2020, which was promulgated last november, amended the exchange control (exclusive use of zimbabwe dollar for domestic transactions) regulations to allow insurance companies and pension funds to transact in foreign currency.

Association of investment managers of zimbabwe chairman mr jubelah magutakuona, said the move will boost the local capital markets.

“the markets are still developing. The question is there demand for US dollar-products? I believe that over time that demand will be able to create markets.

“as long as regulators have allowed for the collection of contributions in US dollars, there is going to be a demand for US dollar assets,” he told a zimbabwe association of pension funds (ZAPF) virtual meeting recently.

He said some of the possible US dollar denominated assets that insurers and pensions funds could consider include fixed income assets, the reserve bank of zimbabwe (RBZ)’s US dollar savings bond, equities on the victoria falls stock exchange (VFEX), as well as investments in the energy and property sectors.

In developed economies, capital markets investments cover a wide range of products, but locally the capital market is not that well developed and is dominated by shares although retails investors can invest in collective investment schemes or unit trusts and other privately sold funds.

The anticipated growth of foreign currency denominated investment classes will likely broaden both local and foreign investor participation on the capital markets.

Zimbabwe’s fiscal and monetary authorities are driving financial inclusion, which is a key enabler to the achievement of the sustainable development goals (sdgs).

The inclusion rates for retail investors on zimbabwe’s capital markets currently stands at about 1 percent.

But with zimbabwe currently using a dual currency system, there are a number of issues that need to be addressed to improve the efficiency of some these US dollar denominated assets in the country.

“the first investment class is in the fixed income space, which is ideally the safest and lowest risk asset class. In the present circumstances, the credit market infrastructure is in place, banks are able to take your money, they are able to extend credit to specific US dollar generating sectors like the mining sector or the tobacco sector, or the horticultural sector.

“but we see a bit of reluctance from the US dollar borrowers because of the impact of inflation on the zimbabwe dollar, so people will be playing two currencies against each other,” said mr magutakuona.

“the exporter is actually generating US dollars and you would imagine that someone earning US dollars would be comfortable to borrow in US dollars, but they would rather borrow in zimbabwe dollars and then convert it into US dollars to do their business and then hold zimbabwe dollar obligations.

“but if you are borrowing on a fixed rate arrangement in zimbabwe dollars and then there is currency depreciation, one tends to make huge profits just on playing currencies alone.

“because of that reason, we have seen reluctance on the part of US dollar borrowers, which is hindering the fixed income space from generating traction although the infrastructure is already in place.”

In weeks following the promulgation of SI-280 of 2020, a number of players in the industry were lamenting the limited availability of appropriate assets to invest in.

The insurance and pensions commission (IPEC) has said its role is to provide oversight, not instruct insurers or pension funds on where to invest their monies.

“it is not the role of IPEC to direct pension funds to where or how to invest their funds. It is up to trustees to engage experts to guide them on the appropriate investments, and for them (trustees) to exercise due diligence,” said IPEC pensions manager tariro mateisanwa.

Meanwhile, some investment advisors have indicated that there are significant opportunities in the private equity space, especially with regards to exporting companies.

ZAPF director general sandra musevenzo, said there is need for some level of regulation with regards to private equity investments.

“although there is need for due diligence on the part of trustees, we have highlighted that the securities and exchange commission of zimbabwe (SECZ) should come up with some guidelines on investments into private equity, which is mostly done by pension funds.”

FOREX-dollar drops on democrat gains in U.S. Senate election

* dollar index hits lowest since april 2018

* euro hits new 2018 high versus dollar

* bitcoin trades above $35,000

* graphic: world FX rates in 2020 tmsnrt.Rs/2RBWI5E

LONDON, jan 6 (reuters) - the dollar hit its lowest level in nearly three years on wednesday with markets pricing in a democrat win in the U.S. Senate election in georgia that would pave the way for a larger fiscal stimulus package and fuel currency market risk appetite.

Democrats had won one hotly contested U.S. Senate race in georgia and pulled ahead in the second by 0900 GMT, edging closer to control of the chamber.

Analysts generally assume a democrat-controlled senate would be positive for economic growth globally and thus for most riskier assets, but negative for bonds and the dollar as the U.S. Budget and trade deficits swell even further.

The dollar index hit its lowest since april 2018 as european markets opened, having slipped gradually overnight. At 0901 GMT it was at 89.387, down 0.1% on the day.

The dollar also fell to its lowest in six years versus the swiss franc, at 0.8761.

The euro was up 0.2% at $1.2326, having rose past major resistance to hit as high as $1.2346 in early european trading .

“we had not assumed democrat victories in these elections and hence some revisions weaker to the extent of USD weakness we expect this year may be warranted,” derek halpenny, head of research at MUFG, wrote in a note to clients.

“we currently tentatively are targeting 1.2800 for EUR/USD by year-end,” he added.

But elsa lignos, global head of FX strategy at RBC capital markets said that she disagreed with the market consensus that U.S. Fiscal stimulus is “risk-on” and therefore dollar-negative.

Instead, she said, big infrastructure spending in the U.S. Would strengthen the dollar, particular against non-commodity producing developed market currencies.

Riskier currencies also surged, with the new zealand dollar and australian dollar hitting their highest since 2018 and holding onto these gains in the european session .

The move was helped by a range of surveys overnight showing that manufacturing globally had proved resilient in december, despite escalating virus cases.

A decisive outcome in georgia could arrive as soon as wednesday morning in the united states, although the tightness of the count suggests an official result may take longer.

“the current quiet on the FX market might just be the quiet before the storm,” wrote ulrich leuchtmann, head of FX and commodity research at commerzbank. He said that market participants will have learned from the presidential election in november that it can take a few days to get the final result.

“USD side is not going to provide any momentum until the result is sufficiently clear,” he said.

“as soon as first market participants begin betting on one side or the other (republican USD positive or democrat USD negative) others are likely to jump on the bandwaggon.”

Elsewhere, U.S. President donald trump escalated tensions with beijing by signing an executive order banning U.S. Transactions with eight chinese software applications.

After surging on monday and tuesday, the yuan softened, after china’s central bank appeared to signal a preference for a more moderate pace of intervention.

The yuan has gained around 10% on the dollar since last may as china’s economic rebound has led the world’s pandemic recovery .

Bitcoin traded above $35,000 for the first time, rising to $35,879 in the asian session and extending a rally that has seen it rise more the 800% since mid-march.

These gains waned as european markets opened, with bitcoin at $34,156.11 at 0915 GMT.

Reporting by elizabeth howcroft; editing by alexander smith

How much trading capital do forex traders need?

Accessibility in the forms of leverage accounts—global brokers within your reach—and the proliferation of trading systems have promoted forex trading from a niche trading audience to an accessible, global system.

However, the amount of capital traders have at their disposal will greatly affect their ability to make a living. A trader's ability to put more capital to work and replicate advantageous trades is what separates professional traders from novices. Just how much capital a trader needs, however, differs vastly.

Key takeaways

- Traders often enter the market undercapitalized, which means they take on excessive risk to capitalize on returns or salvage losses.

- Leverage can provide a trader with a means to participate in an otherwise high capital requirement market.

- The leverage a trader requires varies, but if a trader is making consistent trades, the leverage required is simply enough that the trader is able to profit without taking unnecessary risks.

Considering leverage in forex trading

Leverage offers a high level of both reward and risk. Unfortunately, the benefits of leverage are rarely seen. Leverage allows the trader to take on larger positions than they could with their own capital alone, but impose additional risk for traders that do not properly consider its role in the context of their overall trading strategy.

Best practices would indicate that traders should not risk more than 1% of their own money on a given trade. While leverage can magnify returns, it's prudent for less-experienced traders to adhere to the 1% rule. Leverage can be used recklessly by traders who are undercapitalized, and in no place is this more prevalent than the foreign exchange market, where traders can be leveraged by 50 to 400 times their invested capital.

A trader who deposits $1,000 can use $100,000 (with 100 to 1 leverage) in the market, which can greatly magnify returns and losses. This is considered acceptable as long as only 1% (or less) of the trader's capital is risked on each trade. This means that with an account size of $1,000, only $10 (1% of $1,000) should be risked on each trade.

While difficult in practice, traders should avoid the temptation of trying to turn their $1,000 into $2,000 quickly. It may happen, but in the long run, the trader is better off building the account slowly by properly managing risk.

Respectable performance for forex traders

Every trader dreams of becoming a millionaire by making intelligent bets off of a small amount of capital. The reality of forex trading is that it is unlikely to make millions in a short timeframe from trading a small account.

While profits can accumulate and compound over time, traders with small accounts often feel pressured to use large amounts of leverage or take on excessive risk in order to build up their accounts quickly. When factoring fees, commissions and/or spreads into return expectations, a trader must exhibit skill just to break even.

Simply being profitable is an admirable outcome when fees are taken into account. However, if an edge can be found, those fees can be covered and a profit will be realized. A trader that averages one tick per trade erases fees, covers slippage and produces a profit that would beat most benchmarks.

Are you undercapitalized for making a living in forex trading?

The high failure rate of making one tick on average shows that trading is quite difficult. Otherwise, a trader could simply increase their bets to five lots per trade and make 15% per month on a $50,000 account. Unfortunately, a small account is significantly impacted by the commissions and potential costs mentioned in the section above. I

N contrast, a larger account is not as significantly affected and has the advantage of taking larger positions to magnify the benefits of day trading. A small account by definition cannot make such big trades, and even taking on a larger position than the account can withstand is a risky proposition due to margin calls.

If the goal of day traders is to make a living off their activities, trading one contract 10 times per day while averaging a one-tick profit may provide an income, but is not a livable wage when factoring other expenses.

There are no set rules on forex trading—each trader must look at their average profit per contract or trade to understand how many are needed to meet a given income expectation, and take a proportional amount of risk to curb significant losses.

Forex - dollar weakens; economic recovery in doubt

Investing.Com - the dollar sold off sharply in early european trade monday, weighed by doubts about the strength of the U.S. Economic recovery ahead of the federal reserve's policy meeting later this week.

At 3:10 AM ET (0710 GMT), the dollar index, which tracks the greenback against a basket of six other currencies, was down 0.5% at 93.907, trading at levels not seen since may 2018.

Elsewhere, USD/JPY was down 0.6% at 105.53, falling to a four-month low, GBP/USD was up 0.3% at 1.2820, reaching a four month high, while EUR/USD was up 0.5% at 1.1708, having earlier reached a 22-month high.

The dollar is weighed down by a number of factors, including a worsening row with china and the uncertainty surrounding november’s presidential election. However, of prime concern are doubts about the strength of the U.S. Economic recovery as the country struggles to cope with covid-19’s second wave.

The U.S. Reported on thursday its first rise in employment claims since march, largely as a result of a number of populous states having to roll back reopenings because of the pandemic.

“high frequency data already pointed to a stalling of the US recovery in recent weeks,” said analysts at danske bank, in a research note. “july's U.S. Pmis confirmed this picture with the services PMI showing further improvement but remaining in contraction territory in contrast to its european counterpart.”

The commerce department is due to give its first take on second-quarter U.S. GDP on thursday, with analysts forecasting a bruising 34% annualized decline during the three-month period. Ahead of that, durable goods orders for the month of june are due later monday.

The federal reserve meets this week, with its two-day meeting ending wednesday, amid growing expectations that the U.S. Central bank will have to support the economy once more.

The emergency phase when the corona crisis was at its peak is over, and “now comes the next phase of supporting the recovery – a recovery, which several fed members over the past weeks have said will take several years,” said analyst morten lund, at nordea, in a research note. “as [fed board member lael] brainard therefore put it in her recent speech, the focus of monetary policy will now shift from stabilization to accommodation. What those ‘accommodation tools might look like will be the focal point” of the FOMC meeting.

Capital flight

What is capital flight?

Capital flight is a large-scale exodus of financial assets and capital from a nation due to events such as political or economic instability, currency devaluation or the imposition of capital controls. Capital flight may be legal, as is the case when foreign investors repatriate capital back to their home country, or illegal, which occurs in economies with capital controls that restrict the transfer of assets out of the country. Capital flight can impose a severe burden on poorer nations since the lack of capital impedes economic growth and may lead to lower living standards. Paradoxically, the most open economies are the least vulnerable to capital flight, since transparency and openness improve investors’ confidence in the long-term prospects for such economies.

Understanding capital flight

The term “capital flight” encompasses a number of situations. It can refer to an exodus of capital either from one nation, from an entire region or a group of countries with similar fundamentals. It can be triggered by a country-specific event, or by a macroeconomic development that causes a large-scale shift in investor preferences. It can also be short-lived or carry on for decades.

Currency devaluation is often the trigger for large-scale – and legal – capital flight, as foreign investors flee from such nations before their assets lose too much value. This phenomenon was evident in the asian crisis of 1997, although foreign investors returned to these countries before long as their currencies stabilized and economic growth resumed.

Because of the specter of capital flight, most nations prefer foreign direct investment (FDI) rather than foreign portfolio investment (FPI). After all, FDI involves long-term investments in factories and enterprises in a country, and can be exceedingly difficult to liquidate at short notice. On the other hand, portfolio investments can be liquidated and the proceeds repatriated in a matter of minutes, leading to this capital source often being regarded as “hot money.”

Capital flight can also be instigated by resident investors fearful of government policies that will bring down the economy. For example, they might begin investing in foreign markets, if a populist leader with well-worn rhetoric about protectionism is elected, or if the local currency is in danger of being devalued abruptly. Unlike the previous case, in which foreign capital finds its way back when the economy opens up again, this type of flight may result in capital remaining abroad for prolonged stretches. Outflows of the chinese yuan, when the government devalued its currency, occurred several times after 2015.

In a low-interest rate environment, “carry trades” – which involve borrowing in low-interest rate currencies and investing in potentially higher-return assets such as emerging market equities and junk bonds – can also trigger capital flight. This would occur if interest rates look like they may head higher, which causes speculators to engage in large-scale selling of emerging market and other speculative assets, as was seen in the late spring of 2013.

During periods of market volatility, it is not uncommon to see the expressions capital flight and flight to quality used interchangeably. Whereas capital flight might best represent the outright withdrawal of capital, flight to quality usually speaks to investors shifting from higher yielding risky assets to more secure and less risky alternatives.

Key takeaways

- Capital flight is the outflow of capital from a country due to negative monetary policies, such as currency depreciation, or carry trades in which low interest rate currencies are exchanged for higher-return assets.

- Governments adopt various strategies, from raising interest rates to signing tax treaties, to deal with capital flight.

How do governments deal with capital flight

The effects of capital flight can vary based on the level and type of dependency that governments have on foreign capital. The asian crisis of 1997 is an example of a more severe effect due to capital flight. During the crisis, rapid currency devaluations by the asian tigers triggered a capital flight which, in turn, resulted in a domino effect of collapsing stock prices across the world.

According to some accounts, international stocks fell by as much as 60 percent due to the crisis. The IMF intervened and provided bridge loans to the affected economies. To shore up their economies, the countries also purchased US treasuries. In contrast to the asian financial crisis, the purported effect of a 2015 devaluation in the chinese yuan that resulted in capital outflows was relatively milder, with a reported decline of only 8 percent at the shanghai stock market.

Governments employ multiple strategies to deal with the aftermath of capital flight. For example, they institute capital controls restricting the flow of their currency outside the country. But this may not always be an optimal solution as it could further depress the economy and result in greater panic about the state of affairs. Besides this, the development of supranational technological innovations, such as bitcoin, may help circumvent such controls.

The other commonly-used tactic by governments is signing of tax treaties with other jurisdictions. One of the main reasons why capital flight is an attractive option is because transferring funds does not result in tax penalties. By making it expensive to transfer large sums of cash across borders, countries can take away some of the benefits gained from such transactions.

Governments also raise interest rates to make local currency attractive for investors. The overall effect is an increase in the currency's valuation. But a rise in interest rates also makes imports expensive and pumps up the overall cost of doing business. Another knock-on effect of higher interest rates is more inflation.

Example of illegal capital flight

Illegal capital flight generally takes place in nations that have strict capital and currency controls. For example, india’s capital flight amounted to billions of dollars in the 1970s and 1980s due to stringent currency controls. The country liberalized its economy in the 1990s, reversing this capital flight as foreign capital flooded into the resurgent economy.

Capital flight can also occur in smaller nations beset by political turmoil or economic problems. Argentina, for instance, has endured capital flight for years due to a high inflation rate and a sliding domestic currency.

Forex - dollar gains; german data disappoints

Investing.Com - the dollar edged higher in early european trade tuesday, reversing earlier losses as traders sided with the safe haven as the recovery in german industrial production was less impressive than expected in may.

At 3:10 AM ET (0710 GMT), the dollar index , which tracks the greenback against a basket of six other currencies, was up 0.2% at 96.896.

EUR/USD was down 0.2% at 1.1290, GBP/USD dropped 0.1% to 1.2477, while USD/JPY was up 0.2% at 107.54.

Germany's industrial production rebounded in may, rising by 7.8% on the month after falling by a revised 17.5% in april. However, this recovery was more modest than the 10% rise widely expected.

Despite the recovery, production is still well below the levels recorded before the onset of the coronavirus crisis. May output was down 19% in calendar- and season-adjusted terms compared with february, the month before lockdown measures were imposed.

Also adding to the demand for the safe-haven greenback has been the ever-increasing number of covid-19 cases, with over 11.5 million cases having been reported globally as of july 7, according to johns hopkins university data.

The dollar had fallen sharply on monday as better-than-expected U.S. Services data strengthened investor expectations for speedier economic recovery.

There are a number of federal reserve speakers due later tuesday, including raphael bostic, mary daly and thomas barkin. The market will pick up on comments with respect to the fed's plans for QE and forward guidance.

Elsewhere, AUD/USD fell 0.4% to 0.6943, after australia’s second-most populous state announced a six-week lockdown across metropolitan melbourne after a coronavirus outbreak.

As expected, the reserve bank of australia held its cash rate at 0.25% and made no changes to policy at tuesday's board meeting.

“we expect the RBA to reiterate the australian economy is performing better than feared, and any move higher in the cash rate is some years away,” commonwealth bank of australia (OTC: CMWAY ) analyst joe capurso told CNBC.

But he added, “the main downside risks for AUD/USD are an escalation in U.S.-china tensions and the risk partial lockdowns become more widespread."

Also, USD/CNY rose 0.1% to 7.0207, with the dollar rebounding after the yuan hit its highest level in nearly four months after the sharp gains seen in the chinese share markets.

The canadian dollar: what every forex trader needs to know

Foreign exchange, or forex, trading is an increasingly popular option for speculators. Ads boast of "commission-free" trading, 24-hour market access and huge potential gains, and it is easy to set up simulated trading accounts to practice trading techniques.

With such easy access comes risk. Forex trading is a huge market, but every forex trader is competing with thousands of professional analysts and other knowledgeable professionals many of who work for major banks and funds. The foreign exchange market is a 24-hour market, and there is no exchange – trades take place between individual banks, brokers, fund managers, and other market participants. Artificial intelligence has also changed the forex market in recent years with the introduction of predictive analytics models and machine-learning capabilities, all of which help forex traders to gain a huge advantage.

Forex is not a market for the unprepared, and investors should do thorough homework before entering the market. In particular, would-be traders need to understand the economic underpinnings of the major currencies in the market and the special or unique drivers that influence their value.

The canadian dollar

Just eight currencies account for over 80% of the volume of the forex market, and the canadian dollar (often called the "loonie" because of the appearance of a loon on the back of the C$1 coin) is one of these major currencies, and is the sixth-most held currency as a reserve. for more information of currency trading, see top 7 questions about currency trading answered.)

The canadian dollar's currency ranking is somewhat of an anomaly as canada's economy (in terms of U.S. Dollars of GDP) is actually 10th in the world. canada is also relatively low on the list of major economies in terms of population, but it is the 12th largest export economy in the world, according to the observatory of economic complexity hosted by MIT. after the bretton woods system was put into place, canada allowed their currency to float freely from 1950 to 1962 when extensive depreciation toppled a government, and canada then adopted a fixed rate until 1970 when high inflation prompted the government to move back to a floating system.

All of the major currencies in the forex market are supported by central banks. For the canadian dollar it is the bank of canada. As with all central banks, the bank of canada tries to find a balance between policies that will promote employment and economic growth while containing inflation. Despite the significance of foreign trade to canada's economy (and the influence that currency can have on trade), the bank of canada does not intervene in the currency – the last intervention was in 1998 when the government decided that intervention was ineffective and pointless. (for more, see get to know the major central banks.)

The economy behind the canadian dollar

Ranked tenth in terms of GDP (measured in U.S. Dollars) in 2017, canada has enjoyed relatively strong growth over the last 20 years with two relatively brief periods of recession in the early 1990s and 2009. canada has had persistently high inflation rates, but better fiscal policy and an improved current account balance have led to lower budget deficits, lower inflation and lower inflation rates.

In analyzing the economic situation in canada, it is also important to consider canada's exposure to commodities. Canada is a meaningful producer of petroleum, minerals, wood products and grains, and the trade flows from those exports can influence investor sentiment regarding the loonie. As is the case for virtually all developed economies, this data can be readily found on the internet through sources like the agriculture and agri-food canada website. (for related reading, see economic factors that affect the forex market.)

Although the average age of canada's population is high compared to global standards, canada is younger than most other developed economies. canada has a liberal immigration policy, however, and its demographics are not particularly troubling for the long-term economic outlook.

Because of the tight trading relationship between canada and the united states (they both are at or near the top of each other's import/export markets), traders of the canadian dollar watch the events in the united states. while canada has pursued very different economic policies, the reality is that conditions in the united states inevitably spill over into canada to some extent. (these conditions also influence other economic phenomena such as inflation. For more, see how the U.S. Government formulates monetary policy.)

What is particularly interesting about the U.S.-canada relationship is how conditions can diverge. The structure of canada's financial market helped the country avoid many of the problems with bad mortgages that affected the united states. On the other hand, technology companies are less significant to canada's economy, and this led to relative weakness in the canadian dollar during the tech boom in the united states in the 1990s. Also, the commodity boom of the 2000s (particularly in oil) led to an outperforming loonie. (for more, see 5 steps of A bubble.)

Drivers of the canadian dollar

Economic models designed to calculate the "right" foreign currency exchange rates are notoriously inaccurate when compared to real market rates partly because economic models are typically based on a small number of economic variables (sometimes just a single variable such as interest rates). Traders, however, incorporate a much larger range of economic data into their trading decisions, and their speculative outlooks can move rates just as investor optimism or pessimism can move a stock above or below the value its fundamentals suggest. (for more, see 4 ways to forecast currency changes.)

Major economic data includes the release of GDP, retail sales, industrial production, inflation, and trade balances. This information is released at regular intervals, and many brokers as well as many financial information sources like the wall street journal and bloomberg make this information freely available. Investors also take note of employment, interest rates (including scheduled meetings of the central bank), and the daily news flow – natural disasters, elections, and new government policies can all have significant impacts on exchange rates.

As is often the case with countries that rely on commodities for a sizable portion of their exports, performance of the canadian dollar is often related to the movement of commodity prices. In the case of canada, the price of oil is particularly significant for currency moves, and investors tend to go long on loonies and short on oil importers (such as japan, for instance) when oil prices are moving up. Similarly, there is some impact on the loonie fiscal and trade policy in countries like china – countries that are major importers of canadian materials. (for more, see canada's commodity currency: oil and the loonie.)

Capital inflows can also drive action in the loonie. During periods of higher commodity prices, there is often increased interest in investing in canadian assets, and that influx of capital can impact exchange rates. That said, the carry trade is not so significant for the canadian dollar.

Unique factors for the canadian dollar

Given the relative economic health of canada, the country has a somewhat high interest rate among developed economies. Canada also enjoys a newly-won reputation for balanced fiscal management and finding a workable middle path between a state-dominated economy and a more hands-off approach. This is relevant during periods of global economic uncertainty – though not a reserve currency like the U.S. Dollar, the canadian dollar is considered a global safe haven. (for more, see the U.S. Dollar's unofficial status as world currency.)

While the canadian dollar is not a reserve currency at the level of the U.S. Dollar, this is changing. Canada is now the sixth most commonly held reserve currency and those holdings are increasing.

The canadian dollar is also uniquely tied to the health of the U.S. Economy. Though it would be a mistake for traders to assume a one-to-one relationship, the united states is a huge trade partner for canada, and U.S. Policies can have significant influence over the course of trading in the canadian dollar.

The bottom line

Currency rates are notoriously difficult to predict, and most models seldom work for more than brief periods. While economics-based models are seldom useful to short-term traders, economic conditions do shape long-term trends.

So, let's see, what we have: what is the recommended minimum capital required for day trading forex based on various trading styles and desired income? At b dollar forex capital

Contents of the article

- New forex bonuses

- The minimum capital required to start day trading...

- Risk management

- Pip values and trading lots

- Stop-loss orders

- Capital scenarios

- Recommended capital

- Trading GBP/USD: an overview of the pound-dollar...

- Terminology

- Understanding the importance of the US dollar

- Best time to trade GBP/USD

- GBP/USD chart

- Market structure andkey market participants

- FOREX-dollar pokes higher as U.S. Soft data sours...

- Forex business boon for zim capital markets

- FOREX-dollar drops on democrat gains in U.S....

- How much trading capital do forex traders need?

- Considering leverage in forex trading

- Respectable performance for forex traders

- Are you undercapitalized for making a living in...

- Forex - dollar weakens; economic recovery in doubt

- Capital flight

- What is capital flight?

- Understanding capital flight

- How do governments deal with capital flight

- Example of illegal capital flight

- Forex - dollar gains; german data disappoints

- The canadian dollar: what every forex trader...

- The canadian dollar

- The economy behind the canadian dollar

- Drivers of the canadian dollar

- Unique factors for the canadian dollar

- The bottom line

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.