Forex broker free credit

Duration: 20:38. Views: 71000+ if you are looking for fbs vs hotforex you’ve come to the right place.

New forex bonuses

We have 12 tutorials & chords about fbs vs hotforex including images, pictures, photos, wallpapers, and more. In these page, we also have variety of tutorial videos available. Such as chords, tabs, etc. Fbs vs hotforex. Our site gives you recommendations …

Forex broker with free credit

If you are looking for forex broker with free credit you’ve come to the right place. We have 12 tutorials & chords about forex broker with free credit including images, pictures, photos, wallpapers, and more. In these page, we also have variety of tutorial videos available. Such as chords, tabs, etc.

Forex broker with free credit. Our site gives you recommendations for downloading video that fits your interests. You can also share forex brokers $ free money | MT4 program | credit card, paypal, liberty reserve deposit video videos that you like on your facebook account, find more fantastic video from your friends and share your ideas with your friends about the videos that interest you.

Duration: 01:24. Views: 3000+

Duration: 04:25. Views: 7000+

Duration: 01:25. Views: 618

Duration: 09:30. Views: 232

Duration: 06:21. Views: 4000+

Duration: 03:12. Views: 1000+

Duration: 05:21. Views: 447

Duration: 04:15. Views: 964

Duration: 02:33. Views: 3000+

Duration: 20:38. Views: 71000+

Duration: 13:45. Views: 4000+

Don’t forget to bookmark forex broker with free credit using ctrl + D (PC) or command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it’s windows, mac, ios or android, you will be able to download the images using download button.

Related posts

Fbs support

If you are looking for fbs support you’ve come to the right place. We have 12 tutorials & chords about fbs support including images, pictures, photos, wallpapers, and more. In these page, we also have variety of tutorial videos available. Such as chords, tabs, etc. Fbs support. Our site gives you recommendations for downloading video …

Hotforex legal documents

If you are looking for hotforex legal documents you’ve come to the right place. We have 0 tutorials & chords about hotforex legal documents including images, pictures, photos, wallpapers, and more. In these page, we also have variety of tutorial videos available. Such as chords, tabs, etc. Don’t forget to bookmark hotforex legal documents using …

Fbs vs hotforex

If you are looking for fbs vs hotforex you’ve come to the right place. We have 12 tutorials & chords about fbs vs hotforex including images, pictures, photos, wallpapers, and more. In these page, we also have variety of tutorial videos available. Such as chords, tabs, etc. Fbs vs hotforex. Our site gives you recommendations …

Forex calendar

If you are looking for forex calendar you’ve come to the right place. We have 12 tutorials & chords about forex calendar including images, pictures, photos, wallpapers, and more. In these page, we also have variety of tutorial videos available. Such as chords, tabs, etc. Forex calendar. Our site gives you recommendations for downloading video …

Octafx pin

If you are looking for octafx pin you’ve come to the right place. We have 12 tutorials & chords about octafx pin including images, pictures, photos, wallpapers, and more. In these page, we also have variety of tutorial videos available. Such as chords, tabs, etc. Octafx pin. Our site gives you recommendations for downloading video …

Forex no deposit bonus in 2021

Risk warning: losses could exceed deposits.

Haroun kola

Questions?

Risk warning: losses could exceed deposits.

How to trade forex for free

If you always wanted to trade forex, but just don’t have the money to start or you want to try out the live servers instead of demo servers then these brokers have made it possible for you to do just that.

These accounts come with their own terms and conditions and I urge you to read each of them so that you know exactly what to expect from these accounts.

Don’t expect to be able to withdraw this amount, you may be able to withdraw profits, but there WILL be trading volume restrictions and most of them (ALL I think) will want you to make a deposit of your own cash before they make any of the proceeds of this bonus available to you.

Tigerwit

Tigerwit have just announced a new $25 no deposit bonus for ALL new traders to try out their live trading conditions. It could also be a celebration of liverpool winning the EPL after a 30 year wait, but whatever the reason, I’m thrilled they’re doing this.

They have a copy trading solution and in partnership with an EA provider we’re experimenting to see how profitable it could be. More details will be provided to every trader that signs up for this free trading account.

Markets.Com

My favourite broker for this kind of bonus is markets.Com who are offering a R250 in trading credit.

Now I’ve never tried one of these accounts myself, I’d much rather learn with at least a reasonable amount of funds to see me through any consecutive number of losing trades, but I definitely know that other’s are looking for this. So, if you take this up, I’d love to know what your experiences are.

Tickmill

Experience one of the best trading environments in the industry risk-free with tickmills $30 welcome account.

- No need to deposit funds

- No risk of losing your money

- Profits earned can be withdrawn

Trade for free with XM

XM is offering a $30, no deposit bonus to try out their services. Many brokers are now offering this risk free way to give you a taste of their services.

You probably won’t get rich from this free account, you’ll need a decent size account of at least $500 if you want to start making some real money but if you haven’t ever traded before or you want to see what their service is like, sign up with XM.

Instaforex offers A no deposit bonus

Instaforex, asia’s favourite broker also offers a no deposit bonus. There’s is one of the most generous at $1000, but before you get too excited, listen up to what their terms and conditions are.

As soon you reach a 10% profit, ie. $100 in profit, your account won’t allow you to trade any longer until you make a deposit of at least $100.

If you’d like to take advantage of this, then open an account here.

$10 free from fxopen

It’s very easy to apply for the $10 no deposit bonus from fxopen. All you need to do is register an fxopen ewallet. Verify your mobile no and finally, open an STP trading account.

You may withdraw all profits after trading 2 standard lots. The initial $10 USD bonus can’t be withdrawn though, it’s not your money, honey.

I must re-iterate, these trading accounts won’t make you rich for free. You’ll have to make a deposit and trade a certain amount to be able to withdraw either the free deposit amount or

Compare brokers that accept credit cards

For our credit cards comparison, we found 3 brokers that are suitable and accept traders from united kingdom.

We found 3 broker accounts (out of 147) that are suitable for credit cards.

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About IG

Platforms

Funding methods

76% of retail investor accounts lose money when trading spread bets and cfds with this provider

City index

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About city index

Platforms

Funding methods

72% of retail investor accounts lose money when trading cfds with this provider

Admiral markets

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About admiral markets

Platforms

Funding methods

83% of retail investor accounts lose money when trading cfds with this provider

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

Online forex trading account funding: credit cards

Credit cards are one of the safest and easiest methods to fund or make withdrawals from your online trading account. They are widely accepted by most online forex brokers. Brokers that are registered with the financial conduct authority (UK) will only accept credit cards from the forex account owner to prevent money laundering/fraud.

An important consideration to take if you are opening an online trading account is that mastercard do not accept refunds from spread betting or CFD trading companies.

A few things to consider before using a credit card to fund your forex account is:

- If your card accepted by the broker

- Do they charge fees for credit cards

- Do they accept traders from your country

- Are there better alternatives

- What documents do they need

- How long does it take for transactions

Featured forex broker that accept credit cards: ETX capital

ETX capital is a top choice for traders looking for a trusted and regulated forex broker that also accept credit card payments. Why ETX capital?:

- They accept all major credit and debit cards except AMEX.

- They do not charge fees for making payments or withdrawals.

- Payments are processed quickly so you can start trading immediately- 1 working day.

- Accept deposits in several currencies including :GBP, USD, EUR, ZAR, PLN, NOK, DKK, CZK and CHF.

Credit cards accepted by most online brokers:

Credit cards accepted by a minority of online brokers:

Credit card deposit/withdrawal fees

There is a mix of brokers who do not charge the trader any fees for making deposits/withdrawals while others charge a fee, usually around 2%. Some credit cards may also treat payments to forex brokers as cash advances rather than a regular purchase and charge a high interest rate. It would be best advised to check with your credit card provider first to see how they would view the payment. Generally using a debit card will always be free to use and may be the better option.

If you just register your card without making a payment, most brokers will make a pre-authorisation charge of 0.01p from your account. This will be reversed within a week and is only to ensure that it is a real card. This is a usual practice for businesses that require a credit card to make a reservation like hotels.

Making deposits and withdrawals

Before making any withdrawals, the brokers will generally require a few documents to verify who you are and to prevent fraud.

Required documents

- Government issued ID/passport/EU driving licenses

- Utility bill/bank statement/tax assessment showing your full name and physical address

- KYC form

Once registered payments and withdrawals are simple and take only a few days.

Usual payment/withdrawal processing times

Different brokers may have different requirement so it would be best advised to check what your chosen broker requires before you are allowed to make any withdrawals.

Broker debit cards

Some brokers will even offer their own branded mastercard debit cards such as avatrade, hotforex and XM. These cards are directly connected to your trading account and allow you to instantly withdraw funds from your account.

Why choose IG

for credit cards?

IG scored best in our review of the top brokers for credit cards, which takes into account 120+ factors across eight categories. Here are some areas where IG scored highly in:

- 44+ years in business

- Offers 10,000+ instruments

- A range of platform inc. MT4, mac, web trader, L2 dealer, tablet & mobile apps

- 24/7 customer service

- Tight spreads from 0.60pips

- Used by 178,000+ traders.

IG offers four ways to tradeforex, cfds, spread betting, share dealing. If you wanted to trade EURUSD

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

IG have a AAA trust score. This is largely down to them being regulated by financial conduct authority and ASIC, segregating client funds, being segregating client funds, being established for over 44

Trust score comparison

| IG | city index | admiral markets | |

|---|---|---|---|

| trust score | AAA | AAA | A |

| established in | 1974 | 1983 | 2001 |

| regulated by | financial conduct authority and ASIC | financial conduct authority, ASIC and MAS | financial conduct authority, cysec |

| uses tier 1 banks | |||

| company type | private | private | private |

| segregates client funds |

A comparison of IG vs. City index vs. Admiral markets

Want to see how IG stacks up against city index and admiral markets? We’ve compared their spreads, features, and key information below.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

1. Bdswiss  | ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

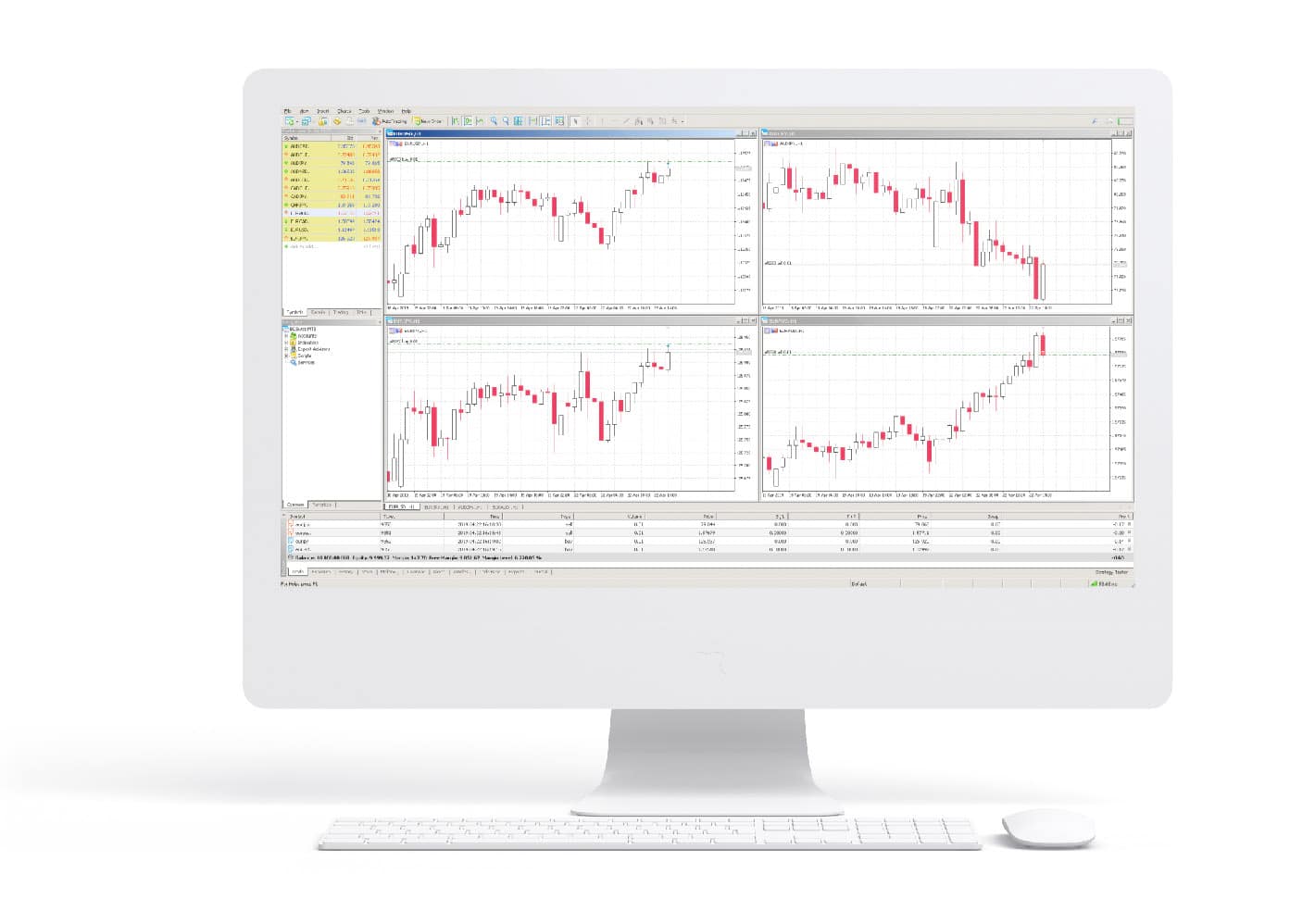

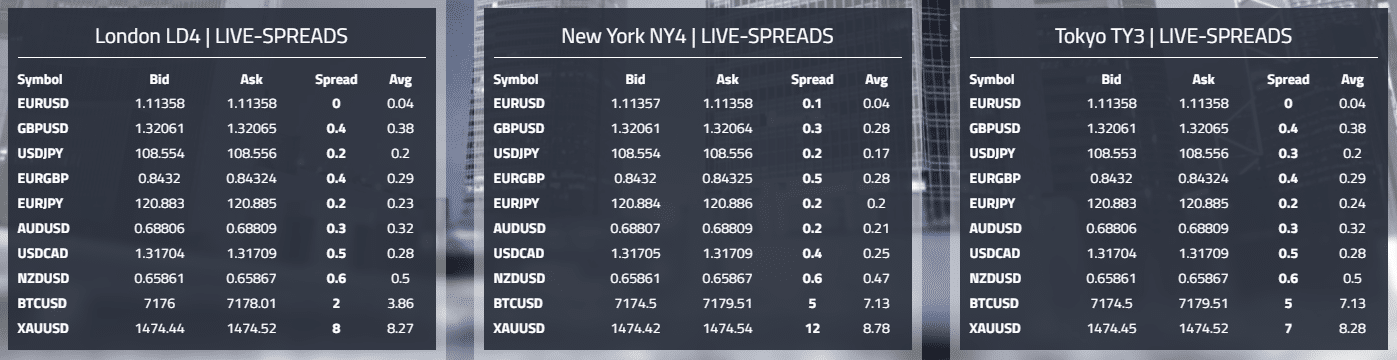

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.

Successful forex trading requires a good and reliable broker. In this review, we showed you the top 23 secure forex brokers. Now you can choose your professional trading partner.

Videforex

- High spreads

- Unregulated broker

- Demo account is only available after deposit

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Videforex is a new brokerage company that offers forex and cfds alongside binary options and other products. The scotland-based broker was launched in 2017 and is a subsidiary of the financial group corp (FGC). While FGC owns the rights to the videforex brand, the broker operates as a separate legal entity.

Videforex customers can trade on various assets including binary options, stocks, cfds, forex, and cryptocurrencies. This broker offers bonuses up to 100% on initial deposits. As we will see later in this review, they do not provide industry standard tools such as the MT4. However, this is not to mean that their alternatives are not good.

Trading conditions

Videforex offers three types of trading accounts namely bronze, silver, and gold. The minimum deposit for the bronze account is $250 while that of silver and gold is $1000 and $3000 respectively.

Beginner traders mostly prefer brokers with an affordable minimum deposit requirement. Videforex offers a minimum deposit of $250 which is somehow higher when compared to brokers of its category.

At the time of writing this videforex review, the broker was offering up to 100% bonus on any initial deposit amount. This broker offers leverage of 1:100 which is within the industry average and best for beginner traders. Their spreads are floating and a bit higher than what most brokers provide.

One thing we noted about the broker is that they charge a specific commission to traders who choose to open unleveraged digital currency CFD positions.

Products

Videforex offers over 160 tradable assets which is average compared to a typical broker with their level of experience.

The broker offers over 60 currency pairs to include majors and minors and also popular cryptocurrencies. With videforex, traders can also access major stocks across the globe including IBM, coca-cola, microsoft, facebook, alibaba, and many others.

Major indices provided by this broker include US DOW, S&P 500, nasdaq, DAX, FTSE 100 UK, ISE and many others. The commodities available include silver, platinum, oil, sugar, and coffee.

Regulation

Videforex is a new broker without any regulators yet. Regulation is essential and is among the metrics that traders should use to gauge a given broker reputation. Most importantly, regulatory authorities help keep brokers in check and protect the interests of customers.

From the look of things, videforex appears not to have any regulatory oversight. While the broker might be a credible trading platform, they are closely run by other offshore brokers making them unreliable. Their website does not include any regulatory information. For this reasons, we recommend that you take extra precaution when opening an account with them.

Platforms

We found videforex's trading platform very interesting. Unlike other brokers that offer metatrader4, metatrader5, and extra trading platforms, videforex does not provide any of these.

They operate on a web-based platform where traders can easily carry out their trading activities. In general, we found their unique trading platform easy to navigate. While it does not have stylish and modern tools, we were impressed by its uniqueness as well as its ability to support multiple functionalities.

If simplicity is your thing, we believe that you’ll love videforex’s trading platform. Newbies will have a wonderful time interacting with this trading platform.

Mobile trading

As mentioned above, videforex does not offer the fancy metatrader4 and metatrader5 trading platforms provided by most brokers in the industry.

However, we were surprised to find out that the broker has gone above and beyond to make their web-based trading platform mobile-friendly. Traders can easily access videforex’s web-based platform even when on the go.

Customers can choose to access videforex’s web-based platform via their android and iphone devices. Similarly, the platform is compatible with tablets and ipads. Videforex also has native trading apps that are available for free on play store and app store.

Pricing

Videforex offers fixed spreads with the average for the EUR/USD pair currently standing at two pips.

While there some brokers in the industry with higher fixed spreads, videforex’s spreads are very high. We recommend that you avoid this broker if you are looking for a low-cost option.

Deposits & withdrawals

To open trading accounts with videforex, customers are required to deposit $250. Funds can be deposited through various means including credit card, bank transfer, skrill, neteller, and paypal. Videforex also supports perfect money, altcoins, bitcoin, and litecoin among other widely used cryptocurrencies.

When it comes to withdrawal, traders can use all the major payments methods mentioned above. Videforex imposes a fee of up to $50 for all bank wire transfers.

Additionally, videforex has a minimum withdrawal amount of not less than $50. The best thing about videforex withdrawals is that they are processed within the hour.

Customer support

Videforex has a functional round the clock customer service. What we loved most about videforex’s customer service is their modern video chat feature.

Videforex is one of the first brokerage service providers in the industry to implement the video chat feature. The FGC company is said to be behind videforex’s video chat. Traders report having had a great time interacting with the broker through this feature.

In addition to a functional video chat feature, the broker also offers customer service via phone. Customers can call the brokerage company during the day or night. 24/7.

Research & education

Videforex offers research & education resources through their parent company. Traders are issued with top trading tools, personal account managers, and advanced market analysis.

Nonetheless, videforex does not offer extra educational resources such as trading signals and trending market news.

With that said, we liked videforex’s informational database and their various research resources. We also noted that only gold and silver account traders receive the best trading resources

Noteworthy points

Although videforex is new in the brokerage industry, they offer many products and their customer service is commendable.

Additionally, the binary options trading platform has some mouth-watering bonus packages. Traders are offered bonuses of up to 100% of their initial deposit. Videforex also holds various promotions regularly.

On tradable assets, videforex customers have access to over 160 assets. We did find videforex’s trading platform pretty impressive and unique. In addition to supporting mobile trading, the platform is simple and comes with many features.

Conclusion

The broker seems to specialize in forex and binary options primarily. However, they also offer a bunch of other products including cfds, stocks, etfs, and market indices.

During our videforex review, we found out that the brokerage provider is not well-regulated. Although they offer frequent promotions and tonnes of bonuses, we advise traders to interact with videforex cautiously.

Dealing with unregulated brokers can be very risky because there isn’t a regulatory authority to hold them accountable. If you have to trade with videforex, you should expect anything. Most importantly, make sure you trade wisely. Otherwise, find another brokerage provider that is well-regulated and adheres to regulatory guidelines.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

Expose what is the meaning of forex no deposit bonus. You gain a real forex trading account with original money on it no deposit required from your side

Youвђ™re probably interested in forex live trading. It is a good way to increase your wealth if you have the right skills and knowledge about the industry as a whole. However, itвђ™s worth to mention that there are a lot of pitfalls in forex trading. If you fail to become an expert in trading before investing large sums of money in it, you may be leading yourself towards financial ruin.

Now, sure, you have read dozens of articles on forex and how to make a profit on it. You have seen dozens of people talk about their immense fortunes earned by trading. What you havenвђ™t seen is thousands of people who only suffered losses when they started trading. Donвђ™t become one of them, trade with skill.

You canвђ™t get experience unless you fail. But how do you get trading skills if you donвђ™t want to lose your own money to learn? The answer is to get a no deposit forex bonus on a forex trading platform.

It is a free bonus (no deposit required) with no deposit required and no strings attached. You just have to register to get anywhere from $30 to $500 for free to get you started in trading. Make sure you don't waste the money and work hard to learn the basics.

Is bonus with no deposit on forex a scam?

While the industry has seen some fraudulent projects, most places that offer trading bonuses with no deposit are trustworthy. The thing is there are so many trading platforms that they have to compete against each other to win new paying customers. Giving away some free money for you to learn how to trade is only beneficial for them.

Profit from their offers. Browse the list of trading platforms that offer no deposit bonuses and chose the most beneficial option fo you.

Forex no deposit bonus is risk free and deposit free bonus. You don’t need any deposit, the broker will give you bonus after opening a new account. Just you need to register with a forex broker and verify your account. Then you can start your live trading.

This how forex broker makes their potential client. Forex broker utilizes no deposit bonuses to pull in new customers, particularly in the event that they are new brokers, to expand their demographic as quickly as conceivable which is the reason they offer such free rewards.

Presently, forex trading becoming more popular, so there are too many traders and they want to start deposit free welcome mean no deposit bonus. Luckily, there is various forex broker offering no deposit bonus for beginners. They offer amazing bonuses, often $5 USD to 100 USD.

How free bonus is important?

Most of the brokers offering bonus. In any case, the greater part of them is unregulated. They are doing it is a great way to find new clients and they can’t find another good way. But regulated forex broker is good they offer some good bonuses for a newbie to familiar with live trading and their trading platform. We reviewed unregulated forex broker offer a free bonus with too many conditions and trading period is very short like 15 days, 20 days maximum 30 days, also you can’t withdraw the bonus, you have to trade required standard lot volume within a short time. Also, you fell trouble with leverage, the maximum amount of withdrawing and withdrawal method and other things. Then?

However, forex free reward is significant for currency traders. A regulated broker always offers a good bonus with some easy conditions to familiar with them. I think finding a trustable broker is important, so a beginner can join with a regulated broker bonus and they have to check some important factors like leverage, speared, fees and commissions and other things. One other thing is a security issue and trading platform.

So you already got it free bonus is important and joining with a regulated broker is better.

In this case, if you are a newbie in this forex trading market, obviously you can start with a free no deposit bonus. Forex is an extremely entangled and professional market, you need some experience to success on trade. In this case, if you are new in the FX market, utilizing a free reward can enable you to make some profit and increase some knowledge on how the market actually work you can make money more.

When you get familiar with your way (strategy, techniques), you don’t need the free reward again. You'd have the option to trade and make plenty of benefits by live trading. Moreover, experience traders, sometime takes a free bonus to multiply their profit and test a new strategy.

Terms and conditions for free forex bonuses

The different broker set different terms and conditions. There are a lot of terms and conditions in a free bonus, some terms and conditions are really hard. Like you have to trade a certain number of standard lot volume to withdraw profit. But there have also some good trader they regularly making money with this free bonuses. They use tricky techniques, they always hunt bonus presenting a website to choose an amazing bonus. The choose bonus then joins, start trading make some money, and build up their special strategy.

On the other hand, some other brokers will give you one time to withdraw conditions. Some will ask to deposit for withdrawing and some will say to start live trading and internal transfer your amount.

Discover more about the free bonuses

You have learned a lot already from here, but sometimes beginner asks some question us this like:

Is forex free bonus is a welcome bonus?

Actually, most of the time broker gives the bonus after joining with them so you can say it is forex welcome bonus.

Also, some reputed broker gives a bonus to their old clients and new clients, its deposit bonus like a 20% deposit bonus. Example: a trader after deposit $100 the broker will give $20 and the trader will able to trade with $100.

Does forex broker give no deposit bonus without verification?

Yes! Usually, a broker doesn’t provide the free bonus without verification. First things you need to fill-up at least your name and email, you have to confirm your email id for the complete creation of account.

Usually, the broker wants some individual data like ID card, passport or utility document after opening or before withdrawing profit.

But sometimes it happens that forex broker offers no deposit bonus without any verification.

Can I make money with a free bonus?

Why not? The broker gives the bonus to trade on the real market. It totally depends on you, if you can make some profit it’s obviously yours. But we suggest free bonus for newbie and learn something and for familiar with real market trading and for preparing themselves for the future.

So you can make with free bonus and withdraw it after meeting the terms and conditions.

What is the best thing in a free bonus?

The best thing is if you have a no fund you can start live trading, you can learn new thing and if you can make some profit further you can trade it with a forex deposit bonus that will boost your trading capital.

So you have to start with a free bonus wisely.

Conclusion

Forex no deposit or deposit free trading bonus is a kind of blessing for a newbie, they can start live trading with it easily. Here is some good opportunity will help you to take a decision to choose a free bonus.

- You can start live trading without any deposit

- You can change your broker platform of a broker

- You can earn some money and grow your confidence

You can change your trading instruments (currency pair, stocks, indices, share, commodities, and crypto currency)

You can start trade without pressure and risk free

You can develop your trading plan, strategy, and pattern

So you may say the free bonus is a really good opportunity to learn real forex trading, familiar with live trading environment and prepare yourself to take the challenge (forex trading contest)

Forex bonus – no deposit required!

Current no-deposit bonus promotions:

AGEA – $5 account – no deposit required – verified

Caesar trade – up to $100,000 bonus – no deposit required. Service fee is to be paid in order to receive the bonus.

Forexcent – $5 account – no deposit required

Fort FS – $5 account – no deposit required

FW markets – $10 account – no deposit required

Fxgiants – $35 account – no deposit required – verified

Fxlider – $50 account – no deposit required

Fxopen – $10 account – no deposit required – verified

Fxplayer – $100 account – no deposit required – – beta platform

Fxprivate – $30-$50+ account (amounts vary for different countries) – no deposit required

Hirose financial UK – $10 + $20 account – no deposit required – verified

IK trust – $69 account – no deposit required

Instaforex – $30-$50+ account (amounts vary for different countries) – no deposit required

Paxforex – $7 account – no deposit required – verified

Paxforex – up to $20-$40 account – no deposit required – for forex blog owners

Plus500 – $25 account – no deposit required – verified

Roboforex – $15 account – no deposit required – verified

Stforex – $10 account – no deposit required

Vertical markets – $100 account – no deposit required

XM – $30 no-deposit bonus – verified

Find the full list of bonuses at: bestforexbonus.Com – forex no-deposit bonuses

Affiliate links, affiliate self-promotions and other bonuses that don’t come directly from forex brokers will not be published.

What exactly is a FREE no deposit bonus?

A vigorous competition for new clients among forex brokers has created a new trend – no-deposit forex bonuses, which is certainly going to benefit many novice investors when starting to trade the forex market.

A so called “no-deposit bonus” is a totally free, broker sponsored funding of trader’s new live forex account.

All you have to do is fill in an application for opening a live trading account with a broker, and your new forex account will be credited with real USD – the bonus money to start trading in the real market immediately. No deposit is required on your side!

How cool is that?! It is, in fact, a real value deal:

– you get to try out broker’s platform

– you get to test your trading skills & get some experience

– you can make money on top or, if it goes wrong – lose nothing

However, there are also few other facts to know about no deposit bonuses:

– while the profits you make in trading are withdrawable, the bonus money itself, as a rule, can’t be withdrawn without meeting certain conditions (trading volume, further account funding etc.).

– no deposit bonuses are known to be quite small, around $25-50, which is good for a micro account. Traders should understand that their trading experience on a micro level might significantly differ from trading with a larger portfolio due to higher financial risks involved. Proper money management of each: micro, mini and standard accounts require additional experience.

It’s NOT a no-deposit bonus, when:

– in order to start trading with free bonus money you’re asked to deposit own money;

– when profits made during trading are not withdrawable. To be able to withdraw the bonus money itself, you can be asked to meet certain conditions (trading volume, further account funding etc.), but this should not be the case, when you wan to withdraw profits only.

The good and the bad: brokers learn from mistakes

As practice shows, offering a no-deposit bonus is a fast and 200% times efficient strategy to promote your brokerage: within several days to a week everyone knows your name, even if the company is brand new. However, it’s not that simple as it may look – a badly planned/executed promotion can backfire and ultimately start building a negative reputation around the company. Therefore, we recommend that brokers carefully study pros and cons of running a no-deposit bonus promotion in order to not repeat mistakes made by others.

We’ve prepared a few suggestions to help brokers plan their no-deposit promotions with a positive outcome:

1. Make sure you call your promotion by its name, see the paragraph above “it’s NOT a no-deposit bonus, when”. If you want traders to make a deposit in the end before any withdrawal, call it a “deposit bonus”. This way you won’t be accused in running a wrong non-useful promo.

2. Define the circle of traders who is eligible to receive a no-deposit bonus in advance: decide whether it’s going to be a worldwide promo, or an offer for certain countries. Again, this sets clear rules and cuts out any negative feedback from traders who are ineligible for a no-deposit bonus.

3. Don’t change your no-deposit bonus rules after the promo has began. News about the bonus spread fast, and once traders start discussing it, you don’t want them to rave about new (often more complex/tight rules) that has been added midway.

We wish you success in running your next no-deposit bonus promotion!

Compare brokers that accept credit cards

For our credit cards comparison, we found 3 brokers that are suitable and accept traders from united kingdom.

We found 3 broker accounts (out of 147) that are suitable for credit cards.

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About IG

Platforms

Funding methods

76% of retail investor accounts lose money when trading spread bets and cfds with this provider

City index

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About city index

Platforms

Funding methods

72% of retail investor accounts lose money when trading cfds with this provider

Admiral markets

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About admiral markets

Platforms

Funding methods

83% of retail investor accounts lose money when trading cfds with this provider

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

Online forex trading account funding: credit cards

Credit cards are one of the safest and easiest methods to fund or make withdrawals from your online trading account. They are widely accepted by most online forex brokers. Brokers that are registered with the financial conduct authority (UK) will only accept credit cards from the forex account owner to prevent money laundering/fraud.

An important consideration to take if you are opening an online trading account is that mastercard do not accept refunds from spread betting or CFD trading companies.

A few things to consider before using a credit card to fund your forex account is:

- If your card accepted by the broker

- Do they charge fees for credit cards

- Do they accept traders from your country

- Are there better alternatives

- What documents do they need

- How long does it take for transactions

Featured forex broker that accept credit cards: ETX capital

ETX capital is a top choice for traders looking for a trusted and regulated forex broker that also accept credit card payments. Why ETX capital?:

- They accept all major credit and debit cards except AMEX.

- They do not charge fees for making payments or withdrawals.

- Payments are processed quickly so you can start trading immediately- 1 working day.

- Accept deposits in several currencies including :GBP, USD, EUR, ZAR, PLN, NOK, DKK, CZK and CHF.

Credit cards accepted by most online brokers:

Credit cards accepted by a minority of online brokers:

Credit card deposit/withdrawal fees

There is a mix of brokers who do not charge the trader any fees for making deposits/withdrawals while others charge a fee, usually around 2%. Some credit cards may also treat payments to forex brokers as cash advances rather than a regular purchase and charge a high interest rate. It would be best advised to check with your credit card provider first to see how they would view the payment. Generally using a debit card will always be free to use and may be the better option.

If you just register your card without making a payment, most brokers will make a pre-authorisation charge of 0.01p from your account. This will be reversed within a week and is only to ensure that it is a real card. This is a usual practice for businesses that require a credit card to make a reservation like hotels.

Making deposits and withdrawals

Before making any withdrawals, the brokers will generally require a few documents to verify who you are and to prevent fraud.

Required documents

- Government issued ID/passport/EU driving licenses

- Utility bill/bank statement/tax assessment showing your full name and physical address

- KYC form

Once registered payments and withdrawals are simple and take only a few days.

Usual payment/withdrawal processing times

Different brokers may have different requirement so it would be best advised to check what your chosen broker requires before you are allowed to make any withdrawals.

Broker debit cards

Some brokers will even offer their own branded mastercard debit cards such as avatrade, hotforex and XM. These cards are directly connected to your trading account and allow you to instantly withdraw funds from your account.

Why choose IG

for credit cards?

IG scored best in our review of the top brokers for credit cards, which takes into account 120+ factors across eight categories. Here are some areas where IG scored highly in:

- 44+ years in business

- Offers 10,000+ instruments

- A range of platform inc. MT4, mac, web trader, L2 dealer, tablet & mobile apps

- 24/7 customer service

- Tight spreads from 0.60pips

- Used by 178,000+ traders.

IG offers four ways to tradeforex, cfds, spread betting, share dealing. If you wanted to trade EURUSD

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

IG have a AAA trust score. This is largely down to them being regulated by financial conduct authority and ASIC, segregating client funds, being segregating client funds, being established for over 44

Trust score comparison

| IG | city index | admiral markets | |

|---|---|---|---|

| trust score | AAA | AAA | A |

| established in | 1974 | 1983 | 2001 |

| regulated by | financial conduct authority and ASIC | financial conduct authority, ASIC and MAS | financial conduct authority, cysec |

| uses tier 1 banks | |||

| company type | private | private | private |

| segregates client funds |

A comparison of IG vs. City index vs. Admiral markets

Want to see how IG stacks up against city index and admiral markets? We’ve compared their spreads, features, and key information below.

Civil liability insurance programme

CFD’s are complex instruments, and there is a high risk of losing money.

FOREX, cfds & commodities

Start trading with ICM capital

Key features

Very tight spreads trading

ECN spreads from 0.0 pips

Ultra-fast execution with no re-quotes

Liquidity from tier-1 banks

Leverage up to 1:30 on major currency pairs

Forex, commodities & cfds in one account

Award-winning client services team*

SMS, live streaming and trading central reports

Market leading insurance

Civil liability insurance cover up to £5,000,000**

Smartphone, tablet

& PC trading

Trade anywhere, any time at

a place convenient for you.

Economic calendar 19 january 2021

Online quotes

ICM capital

mastercard*

ICM capital mastercard*

ICM capital has launched its very own mastercard ® . We believe the main advantage for you is that it enables the transfer of funds between your trading account and your ICM capital mastercard. Now you can easily withdraw your any trading profits you have made, wherever they are in the world!

* mastercard is a registered trademark of mastercard international incorporated. The card is issued by wirecard card solutions ltd (“WDCS”) pursuant to license by mastercard international inc. WDCS is authorized by the financial conduct authority to conduct electronic money service activities under the electronic money regulations2011 (ref: 900051)” all transfers of funds are processed by intercash partner banks using the approved intercash "prepaidgate" technology

Why ICM capital?

Why we believe traders choose ICM capital

Leading investment house since 2009

Ultimate safety of clients’ funds

segregated client accounts

Award-winning broker

20+ global awards

ICM access

client account management system

Competitive trading account types

Support

ECN spreads from 0.0 pips

Award-winning ECN technology

Deep liquidity directly from tier-1 banks

Free ECN demo available with ICM direct

Ultra-fast market execution with no re-quotes

Subscribe now to receive our

FREE DAILY MARKET REPORT

Receive major news updates including: key support & resistance levels, market summaries and charts

so, let's see, what we have: if you are looking for forex broker with free credit you've come to the right place. We have 12 tutorials & chords about forex broker with free credit at forex broker free credit

Contents of the article

- New forex bonuses

- Forex broker with free credit

- Forex no deposit bonus in 2021

- Questions?

- How to trade forex for free

- Tigerwit

- Markets.Com

- Tickmill

- Trade for free with XM

- Instaforex offers A no deposit bonus

- $10 free from fxopen

- Compare brokers that accept credit cards

- We found 3 broker accounts (out of 147)...

- City index

- Admiral markets

- Online forex trading account funding: credit cards

- Featured forex broker that accept credit cards:...

- Credit cards accepted by most online brokers:

- Credit cards accepted by a minority of online...

- Credit card deposit/withdrawal fees

- Making deposits and withdrawals

- Broker debit cards

- Why choose IG for credit cards?

- A comparison of IG vs. City index vs. Admiral...

- List of the best 23 forex brokers | trusted...

- Strict criteria for the forex broker review

- How does a forex broker work?

- Warning: only trade with regulated and...

- How risky is forex trading?

- How to deposit and withdrawal money:

- Not every country is available for forex trading

- Review conclusion: start trading with a reliable...

- Videforex

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- Expose what is the meaning of forex no deposit...

- How free bonus is important?

- Terms and conditions for free forex bonuses

- Discover more about the free bonuses

- Is forex free bonus is a welcome bonus?

- Does forex broker give no deposit bonus without...

- Can I make money with a free bonus?

- What is the best thing in a free bonus?

- Conclusion

- Forex bonus – no deposit required!

- Current no-deposit bonus promotions:

- What exactly is a FREE no deposit bonus?

- It’s NOT a no-deposit bonus, when:

- The good and the bad: brokers learn from mistakes

- Compare brokers that accept credit cards

- We found 3 broker accounts (out of 147)...

- City index

- Admiral markets

- Online forex trading account funding: credit cards

- Featured forex broker that accept credit cards:...

- Credit cards accepted by most online brokers:

- Credit cards accepted by a minority of online...

- Credit card deposit/withdrawal fees

- Making deposits and withdrawals

- Broker debit cards

- Why choose IG for credit cards?

- A comparison of IG vs. City index vs. Admiral...

- Civil liability insurance programme

- FOREX, cfds & commodities

- Key features

- Smartphone, tablet & PC trading

- Economic calendar 19 january 2021

- Online quotes

- ICM capital mastercard*

- ICM capital mastercard*

- Why ICM capital?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.