How much can you earn with forex trading

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders.

New forex bonuses

Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000, this keeps the risk limited to a small portion of the deposited capital. A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

How much money can I make forex day trading?

:strip_icc()/how-much-money-can-i-make-forex-day-trading-1031013_color-332300f659374e4b897904a35b4d64ae.gif)

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

How much can you make from forex trading? (2020)

Last updated on september 8, 2020 by gladice gong leave a comment

DISCLOSURE: THIS POST MAY CONSTAIN AFFILIATE LINKS,MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU. PLEASE READ FULL DISCLOSURE HERE

Are you thinking about making money from trading forex?

Is forex trading really profitable?

Are there forex traders really making money consistently, or even make a living from it?

If yes, then the question becomes, can you make money from forex and how much can you expect to make trading forex?

Now, let’s dive in and help you uncover the answers to these questions.

Is forex trading profitable?

So, is forex trading profitable?

The short answer is yes if you have a profitable forex trading system.

Okay, what is a forex trading system?

Also, how do you tell if a forex trading system is profitable or not?

You probably already know what is a forex trading strategy.

A forex trading strategy tells you ONLY when to enter a trade and when to exit a trade.

Let’s look at a hypothetical example of a forex trading strategy.

You buy the currency pair when the price goes up above the 20-day simple moving average on the 1-hour timeframe, and you sell when the price goes down below it.

On the other hand, a forex trading system tells you not just when to enter and when to exit but also what your trading position size should be and how much you can risk per trade.

Basically, a forex trading system shows you how to trade as well as how to manage your risk, so you can trade profitably in the long run.

Let’s say you have a total trading capital of $1,000.

Whenever you get a buy signal, you risk $500 on every single trade.

If you lose, you lose all of $500.

But, if you win, you will make $1,000 on that trade.

So, does this sound like good risk management to you?

When you lose 50% of your capital, you will have to make a return of 100% JUST to recover your loss.

So, if you want to make money trading forex in the long term, you must manage your risk and money well.

Now, let’s look at some real-life examples of profitable forex traders.

Legendary currency trader, george soros, made more than £1 billion from shorting the pound sterling in 1992.

Bill lipschutz, one of the top currency traders in the world, made hundreds of millions of dollars at the FX department of salomon brothers in the 1980s with no previous experience of the currency markets.

Just like me, you might not feel so relatable to their forex trading success.

So, are there any ordinary people just like you and me who become successful forex traders?

In fact, there are some japanese housewives who are very profitable forex traders.

Yes, you read it right – japanese housewives.

When I first read about their story, I was just as shocked as you are right now.

Here’s an article on the times about a japanese housewife who made 1.7 million trading currency and evaded tax on her currency trading profits.

If you have not read the book called ” millionaire traders”, you should definitely read it.

Inside this book, there are interviews with twelve ordinary individuals who transformed themselves into millionaire traders.

One of them, ashkan bolourals is a retail forex trader who made at least $1 million trading forex.

How much can you make from trading forex?

So, exactly how much can you make with forex trading?

This really depends on these three factors:

- Trading capital

- Leverage

- Profitability of trading system

Now, let’s look at each one of them in detail.

Factor #1: trading capital

First of all, your trading capital determines how much you can make as a forex trader.

Let’s just compare these two scenarios:

Scenario #1: you have a trading capital of $1,000

Scenario #2: you have a trading capital of $100,000

Assuming that you are not using any leverage here and your trading system gives you an average return of 10% a year, you will make a profit of $100 a year (or $8/month) with a trading capital of $1,000.

On the other hand, you will make a profit of $10,000 a year (or $800/month) with a trading capital of $100,000.

So, you see your trading capital can result in a huge difference in how much you can make from trading forex.

Factor #2: leverage

The leverage you get from your forex broker can also determine how much you can make trading forex.

And how does leverage in forex trading work?

In forex trading, leverage means the amount of money you can borrow from your broker to trade forex.

For example, if you have a trading capital of $1,000 and your broker gives you a leverage of 1:50, what that means is that you can initiate a trading position worth up to $50,000.

With leverage, you can significantly increase your rate of return on your capital.

But, it can also make you lose your capital much much faster.

So, if you have a profitable forex trading system, then you can take advantage of the maximum leverage to maximize your return.

If you are just starting out trading forex, then it’s wise not to use high leverage.

Factor #3: profitability of forex trading system

Lastly, the profitability of the forex trading system also determines how much forex traders can make.

When it comes to the profitability of a forex trading system, you have to understand this one simple concept – expectancy.

Expectancy basically means how much money you can expect to win per trade by trading this forex system.

To find out the expectancy of a trading system, you must know three numbers:

- Win/loss ratio (i.E. A forex trader’s number of winning trades relative to the number of losing trades)

- Average size of your win

- Average size of your loss

Let’s say the win/loss ratio is 60/40, the average size of your win is $100 and the average size of your loss is $50, then you can calculate the expectancy like this:

Expectancy = win rate * average win size – loss rate * average loss size

Expectancy = 60% * $100 – 40% * $50

So, what does an expectancy of $20 mean?

It means that for every trade you take based on this forex trading system, you expect to earn a profit of $20.

Basically, the more trades you make, the more you can expect to make from your forex trading.

To help you understand this better, let’s look at an analogy.

This is just like a casino.

You all know that the casino is a very profitable business.

The house has a winning edge.

In fact, the casino designs all its games to make sure that the odds are in its favor, so it can expect a POSITIVE profit from each game played inside the casino.

So, the more bets people make, the more money the house will make.

The same can be said about forex trading.

If you have a forex trading system with a positive expectancy, the higher the expectancy and the more trades you make, the more money you can expect to make.

Can you make money from forex?

So, the most important question is, can you really make money from forex trading?

As a matter of fact, up to 70% of retail forex traders lose money trading forex.

It’s simple to get started trading forex, but it’s going to take hard work to master the forex trading game.

If you want to make money trading forex, you just need to have the following:

- A profitable forex trading system

- Discipline to stick to your forex trading system

The first one is well-understood.

Without a profitable trading system, you are not going to make money in the long run.

The second one is one of the biggest reasons why a lot of forex traders lose money.

Amateur forex traders often let emotions get in the way of their trading.

For example, if the market goes against them, they are likely to revenge trade or refuse to cut their losses.

The difference between a profitable trader and an unprofitable trader is that the former knows the importance of keeping their emotions under control and have the discipline to stick to their trading plan.

Now, if you are serious about trading forex for profits, then you should focus on mastering these two things mentioned above before risking your money.

Related posts:

About gladice gong

Gladice gong is a personal finance writer and stock trader with many years of experience working in the financial industry.

How much can you earn with forex trading

Put an end to your quest of hunting for forex courses or coaches, there will be a new one popping out every other week. If you are looking for the “guru’s guru” “the best in the industry” “one of the world’s best forex trader” – as testified by my students.

Let me ask you a question.

Why do forex traders trade?

I mean how many people who’ve started trading actually love the art of trading and don’t just do it to make money?

I’ll admit I do love trading. The art of trading. The beauty of reading charts especially price action trading and the different forex trading strategies. The satisfaction I get when I see the market moving in the intended direction.

It’s just like playing a game. The main difference is that, when you win this game, you are rewarded in material terms. Not in achievements or kudos, but in actual cash that you can use in the real world.

Would you like to play this game? Working your way through it and ensuring you understand as much as possible on how to win?

If this piques your interest, then, yes, forex trading or trading of any sort may suit you.

Contents

Can you get rich by trading forex?

But ezekiel… I hear, how much money can you make trading forex? Can I become rich from it?

“I would like to put in capital of $1000. And if I trade diligently, is it realistic to make $2k a month from trading… say after one year?”

“if I put in $10,000, can I make $100,000 from it in a year? Or… can I make like $10k a month from it?”

You see, being a forex trading coach and mentor, these are the types of questions I get pretty often.

If you want a straight answer to whether you are able to become rich through forex trading, then the answer is yes.

But… is it simple? Not really.

Can trading make you rich?

How can I turn $10,000 into $100,000?

Want to know a method akin to gambling for how you can get rich through trading?

Take a look at this example:

If, let’s say, you put in $10,000 and you want to grow it to $100,000 in a year.

So that’s 10x growth in 12 months.

Or 1000% growth in 12 months.

Now, do you know of any vehicle that gives you that? Not really.

But is it possible in forex trading? Yes it is.

I mean… you could simply enter a trade with a 100% risk. Meaning you go all-in on one trade risking your entire $10k.

And if that trade runs a risk reward ratio of 1:10.

Then there you go… you just made $100k in a trade.

How can I turn $10,000 into $1 million?

Here’s another example of how to “get rich through forex trading”:

You can go all-in at $10k for one trade.

To put it in simple terms, the chances of you winning are 50% and losing are 50%.

So, if it goes up your way, you could have made (let’s not aim so high… but just a risk reward ratio of 1:1) a 100% profit.

So your $10k becomes $20k.

Now, let’s say you now put in your $20k (at the same 100% risk) and you win your next trade.

And then you put your $40k into the next trade, you make $80k.

Woo-hoo! Three wins in a row and you just turned $10k into $80k.

The fourth win will make you $160k!

And so you went in with high hopes thinking that, in a couple more trades, you will turn that $160k into $320k, then the $320k into $640k and then into $1.28 million!!

Just four more wins and you will be a millionaire! Fantastic!

But of course, things get in the way and fantasies like this are shattered in no time.

Because you lost the next trade and your $80k account is now busted!

Does the above scenario sound familiar? Because it’s stories like this that we hear all too often.

This above scenario is just like gambling isn’t it? The gambler will tell you how much he won and then he’ll lose it all. And then go on to tell you he will make it back and more the next time because he has “learnt” what not to do.

If you follow that specific method, then I’m pretty sure the next set, and the set after that, will turn out the same.

Because you can get lucky in one trade, in two trades, maybe even in three trades… but how long can you stay lucky that way? It’s not really realistic isn’t it.

Now… let me bring you back down to earth. Because that was fantasy island. ;)

So is it not possible to turn $10k into $100k?

But we have to do it the “slow and steady way”.

How much can you make trading forex?

Trading the safer way

Now let’s say we follow the general rules of risking 1-3% a trade. For this example, let’s put it at 3%.

If your risk reward ratio is, on average, at 1:2…

You will win $600 each trade, and, if you lose, you lose $300.

Let’s say you have a win rate of just 50%.

Therefore, out of 20 trades, you lost 10, meaning you lost $300 * 10 = $3000.

And you won 10 trades, 10 * $600 = $6000.

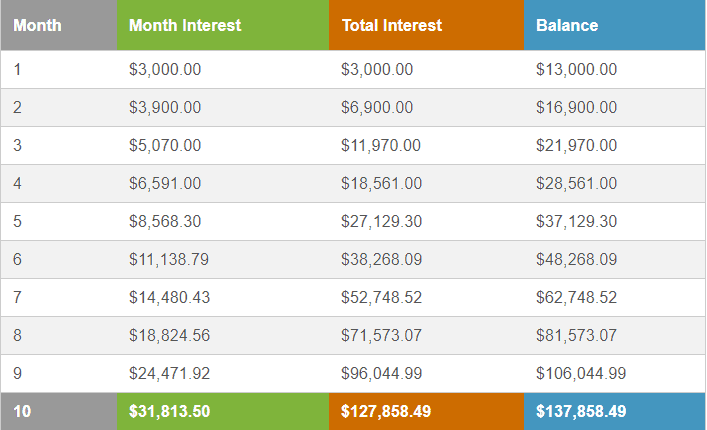

Out of 20 trades, you made $6000 – $300 = $3000.

So now your capital is at $10,000 + $3000 = $13,000.

Meaning your next trade will be 3% of $13,000 = $390.

Now that’s compounding in action.

Let’s put the above scenario into a compounding calculator.

Assuming you take 20 trades a month…

How long do you need to make $100k?

That’s 9 months.

Now of course, it may also seem unrealistic that you are making 30% a month. Because you made $3k out of $10k in a month.

Let’s tone it down a little.

Let’s say out of 10 trades, you won four and lost six. So you have just a win rate of 40%.

And you now only take 10 trades a month, not 20.

Therefore, out of 10 trades, you lost 6, meaning you lost $300 * 6 = $1800.

And you won 4 trades, 4 * $600 = $2400.

Out of 10 trades, you made $2400 – $1800 = $600.

So now your capital is at $10,000 + $600 = $10,600.

Meaning your next trade will be 3% of $10,600 = $318.

Let’s put it into compounding…

You will reach $100k at month 40. Which is around 3 year 4 months.

Now it may seem way longer. But turning $10k into $100k in 3+ years is still really good, right?

How about if we wait a bit longer…

By month 80, you would have turned it into $1 million dollars!

So is forex really profitable?

Can you get rich by trading forex?

This is the power of compounding put into trading.

Can you make a living trading forex?

As much as it’s possible to do. I don’t want any new traders to be jumping into this game thinking that they can get rich instantly.

The fact is that most new forex traders leave the game after just two years.

And only 10% of traders make money.

It’s because successful trading takes discipline that is incorporated into a solid forex trading system to put the above into action.

Few forex traders want to put in the hard work but only want to get rich.

That’s why there are always gimmicks out there and get-rich-quick schemes which people will always fall into.

Final thoughts

After trading for two decades and seeing the stories of thousands of traders, I can say that I know quite a lot on this subject matter.

So here’s my take away if you want to become successful in this field.

Don’t go into trading with a mindset of wanting to make a million out of a thousand. Instead, go in with the mindset that you are here to learn and hone this skill into a finely crafted tool. Mastering any skill takes time, and nothing is ever achieved without a lot of hard work and practice.

Most people jump into the game and put in loads of money right at the start. On the contrary, in the first six months to a year, you should spend your time learning and practicing with very little money involved. Only when you are ready, and by being ready, I mean that your account is growing steadily, can you then decide to put in more capital.

Try picking up any new sport, e.G. Soccer, basketball, badminton, etc. Were you good at it right from the start? No, everyone who has ever become good at anything has put countless hours into practicing and honing their craft. Working on their weakness and strengthening their game.

The same goes for forex trading. Don’t expect to make big bucks within the first few months of trading. If you somehow manage this, it’s pure luck. Instead, spend time practising and working on your trading game. And this time and effort you put into honing trading into an art will reward you going forward.

Questions:

How much do forex traders make a day?

This will depend on the number of trades you take in a trade. If your trading style is scalping, then you can probably take 20 trades a day. And by scalping, I mean that you are trading in a timeframe such as one minute.

And if that is your preferred way of trading, the math formula will be:

Your win rate: e.G. You win 6 out of 10 trades = 60% win rate.

Your risk reward ratio: e.G. 1:2.

Your risk percentage: e.G. 2%.

So 20 trades * 60% win rate = 12 wins.

Risk per trade is: 2% * $1k = $200.

12 wins * $400 (risk reward ratio 1:2) = $4800.

Total profit: $4800 – $1600 = $3200.

And the above estimation is based on the above scenario.

But what if scalping is not your style and you prefer mid- to longer-term trading?

So perhaps, you will have just one to three trades a day.

Do the math and you will have the answer.

How much to invest in forex trading to make a living?

Using the formula of calculating your win rate, your risk percentage, your risk reward ratio – the number of trades will give you an estimate of how much you can make a month.

And if your living expenses are $3.2k a month, and if you trade 20 trades a month based on the above example, then $10k capital is needed.

Can you make a living day trading forex?

Yes, aside from your daily trades with wins that have a risk reward ratio of 1:2, there are also trades that can go as high as 1:15 or 1:25. These are what I call a bonus for us forex traders.

Imagine you have a trade with a risk percentage of 3%. And you made a successful trade with a risk reward ratio of 1:25.

You’ve just made a 75% gain of your capital in a single trade with just a risk of 3%.

If your capital is $10k, you would have made $7.5k in a single trade…

And if your capital is $100k, you made $75k profit on that trade.

So apart from your day-to-day trades with the standard risk to reward ratio – these are our salary –the big trades are our big payday. Our bonus.

How much money can you make from forex trading – 2020 guide

Millions of people across the globe are trading to earn higher profits. If you are a trader, then forex trading is a common term for you. It is the best way to make vast amounts of money by trading in foreign exchange. The most significant advantage of forex is low fees as compared to others. Both beginners and experienced traders can buy or sell currencies with high profits.

No doubt that you can earn an ample amount of money through trading forex. It is important to learn how to make it. If you want to achieve significantly, then you must trade hard. Check out forexstore to start forex trading. In the following write-up, know the amount of money you can earn via trading forex exchange. There are many factors to earn and calculate money won in trading forex. Let’s begin.

1. Trade more

Many individuals are addicted to trading, like gambling. They buy and sell foreign exchange frequently to earn profits. If you think of trading once and get plenty of amounts, then you are wrong. You have to trade more to collect a significant amount. Now, you might be thinking that there are also chances of failure. Is it best to invest money repeatedly? You must invest more to trade more.

Due to higher chances of wins, you can risk your shares again and again in trading forex. When you trade more, the winning probability is quite high. A beginner can risk with time and circumstances, but an experienced trader must not lose the opportunity at all.

2. Managing risk

Risking huge amounts is one of the trading schemes to get high returns. Remember one thing that there are also possibilities of losing massive amounts. You must trade carefully because it eventually affects your account of trading. Before trading forex, you need to create a strategy with positive output.

Suppose if you are getting $10,000 in your account per year by trading $1000, then it will not be the same each year. You can earn more considerably than expected. Try to trade more in some years to get higher profits. It will not affect your account, and in the end, a trader can count on his massive earned money.

3. Money extraction from your trader’s account

You can operate your trading account for buying or selling foreign exchange. The amount will be stored in your account, and you can either trade more, withdraw or keep it there for adding more interest. Every person earns money to enjoy a satisfying life with luxuries and comfort. Make sure that you debit the required money from your account.

It is essential to keep a certain amount as savings for more trading. The added compound will generate more amount, and later, you can get more money out of it. Therefore, it is a good deal of saving amount for the future. Many traders prefer to do such things for better money management.

4. Determine your expectancy

Trading is about risking money. You can determine the expectancy factor by analyzing your performance while trading. Suppose if you are continuously risking your money, and you are getting profits 2 or 3 times, then you are not a good trader. But sometimes, you have an excellent winning rate by getting profits in the initial trading session.

You need to join the winning and losing rate together to know about your future profits and loss. You can easily create different methods for trading if you determine your rate of expectancy. It will help you in earning money via forex trading efficiently.

5. Trading risk is dependent on currency pairs

An experienced trader is aware of different currency pairs. You can lose some amount while trading a currency pair. A trader must know the current currency rate and then buy or sell it. You need to estimate the winning and losing trade to get enough profits. If we calculate the win rate of the trader, then you must find out the difference between the profitable and loser trades.

The win rate is quite less in case of no or fewer commissions. There is a considerable return on the profit without affecting any previous records. The profit from trading on various currency pairs is different. Make sure that you analyze the current rate before investing your money.

6. Calculate profit from forex trading

There is one way to know the amount of earning money by trading forex. You can calculate all the potential earnings. Before that, you must know certain things about your yearly profits, trading amount, earnings, buying, and selling currency assumptions. It is easy to evaluate the profits if you know how exactly you trade and what strategies you must adopt.

Determining all the factors and calculating profits are the best ways to know the amount of money you can make through trading forex. You can also calculate the average rate of profit that you will earn in an entire year.

The bottom line

Trading forex exchange is not a one-day task to earn a considerable amount. You need to invest and experiment a lot to become a good forex trader. There is no doubt that you can make much money from forex trading. But you have to focus on your performance to prevent yourself from massive loss.

Make sure that you come up with highly-effective trading strategies to get profits frequently. Millions of people worldwide are trading, but not everyone is getting the same results. You must calculate everything from your trading performance to future profits from forex. It will ensure that you are on the correct path or not. After analyzing everything, there will be a scope of improvement in your trading performance.

Make sure that you keep the above things in your mind for better results. Try to start trading by investing a small amount to prevent huge losses. It is better to understand your skills before trading enough money on different exchange currencies.

You can earn A lot of money by trading forex

The most important indicators in shopping and promoting a career

You can reward with 1 to 2 risks in the transaction. However, if you simply win 20% of the time, you will be a stable loser.

Now, obviously, the threat you want to praise is not a solution. What is your winning price?

Maybe you have 90% of the winning price. However, if every time you take a risk, you lose $ 0.90 and you lose $ 5, you will always be a loser.

So, what is the answer?

- Absolutely, the risk of your praise and win rate itself is meaningless.

- Well, the secret is this …

- You need to consider your chances of winning and receiving praise in order to finalize your profitability.

- This is what you expect.

- Your expectations will give you the opportunity to keep your expectations for every dollar.

Mathematically speaking, it can be expressed as:

- W is close to the scale of your extraordinary victory

- L is close to your average loss scale

- P-entry winning price

The correct example is as follows:

You have made 10 transactions. 6 winning transactions and 4 falling transactions. This means that your win percentage is 6/10 or 60%. If your six transactions increase your profit by $ 3,000, then your joint profit is $ 3,000 / 6 = $ 500. If the most effective loss is $ 1,600, then your extraordinary loss is $ 1,600 / $ 4 = $ 400.

Subsequently, these figures are applied to the intended system:

In this case, the expected value of your way of buying and selling is 35% (very good expectation). This means that your way of buying and selling will fall by 35 cents per dollar in every long-term transaction.

- The flow of permits

- Why must play bigger to win bigger

- Are you sure?

- Most people in the casino work 24 hours a day, 365 days every 12 months. Why?

- Due to reality, the more they play, the more money they earn-the same is true for trading.

You may be surprised:

“what does this have to do with purchases and promotions?”

This indicates how often you trade. The more transactions you make, the more money you can make (although expectations are high).

Let’s imagine:

- You can win foreign exchange shopping and promote technology 70% of the time, of which 1-3 risks are commendable.

- But right here

- It has only 2 trading indicators in 12 months.

- How much unusual transaction money can you make through this foreign exchange trading method?

- No more people, right? Heck, when you consider the risk of a continuous 9% decline, you might even lose in that year.

- Do you have the ability to see how important this is?

Right now:

The frequency of your transactions is critical, but it is not enough to determine how much cash you can earn in foreign exchange shopping and promotions.

Why cash is your lifeblood for buying and promoting foreign exchange in commercial enterprises

you may have heard the story that a trader spent a small amount of money and then replaced it in piles in a short period of time.

- However, you do not need to be aware that for every trader trying to do this, thousands of other traders blow up their accounts.

- Thanks to a short, rich plan, allow no longer needs shopping and promotions. Or, gradually develop it as the enterprise you are looking for.

- Now, the license says, you may generate 20% of the profits (together) within 12 months.

- With an account of $ 1,000, you need an average of 12 months to get $ 200 in income.

- In a $ 1 million account, the median you see is $ 100,000, which is consistent with the year.

- For accounts with an annual income of $ 10 million, the average amount you want to search is $ 2 million.

Now, not to mention that you can make 20% of your income every year, because, in fact, this percentage may be better for an afternoon or swing traders (because you have more trading opportunities).

The best difference is your betting period (or a chance to match your bet). The greater the threat, the higher your return.

Will you refund or increase revenue?

If you use a USD 10,000 account with an average annual income of 20%, it might be worth … 383,376.00 USD after 20 years.

If you are a daily traveler, trading is your easiest source of income. You need to withdraw funds from your account to meet your life needs.

However, if you have a full-time task and are trading, then you really should not make any withdrawals and may increase your account earnings.

This is not right or wrong. Ultimately, you must understand the needs of your trading employer-and recognize that withdrawals may have a long-term impact on your returns.

How much money you can earn by forex trading?

The average daily turnover on the worldwide foreign exchange markets was estimated at USD 5 trillion in 2016. Traders don’t dream of having financial independence and self-employment by helping themselves by successful online FX trading. Because of the leverage offered by forex brokers, the forex market needs the least amount of money to begin trading, trades 24 hours a day (in the week) and provides more potential. The main question is how much money can trader make by fx trading?

Probably, when it comes to FX trading, there is a huge array of revenue potential. Some people may still need to work another job, but they manage to pull a little money out of the market every month by trading. There are those that can comfortably live with what they earn from forex trading and there’s the small minority who can make a lot. There is also a big community of forex traders wanting to be struggling, and never making any profits.

Every trader dreams to take a small amount of money out of it and become a millionaire off it. The truth is that trading a small account would unlikely to occur. Although profits can collect and compound over time, small-account traders often feel forced to use huge amounts of leverage or take on extreme risk to rapidly build up their accounts. Not knowing that skilled fund managers frequently earn less than 10-15 percent a year, traders with small accounts frequently believe that they can earn double, triple, or even 10 times their money in a single year.

The sum of money you earn by forex market depends on your trading experience, determination, and attention to detail. You need to do the following to be a good fx trader read everything you can about how the market operates, build a trading strategy that produces reliable results, pay attention to market expert analyzes, carry out your own through analysis before making a trade, know when to lock your gains and decrease your losses, be patient and diligent, don’t let your emotions overpower your common sense.

Join the forex scalper community. We have included instant access to our dedicated community of over 2500 members worldwide.

How much can a private individual earn on forex?

Forex trading is booming around the world, but how much money can you realistically make?

Forex trading is becoming more popular, and people don’t necessarily have to be experts to get involved. The rise in the number of web-based trading platforms makes it possible to create an account and get trading in no time at all. For all those people moving into the sector, one question burns above all others: how much money might I make?

Around $5.3 trillion is traded on the forex market every day and the total trading volume is four times the size of global GDP and it’s 53 times the size of the new york stock exchange.

Online forex trading platforms have opened up the sector to all sorts of people who might not have considered trading financial instruments. These provide help and support in the form of online training and extensive customer service support, as well as an accessible and intuitive interface which enables you to make trades with just a few clicks.

How much can you make?

So, if you’re one of the people thinking about jumping into the forex market, the question is: how much money might you make? The disappointing, but realistic answer, is that it all depends.

There is no guarantee of success in the forex market, and even on a good day the chances are that you will make a string of losses. The secret is to try and make sure the number of positive trades is higher than negative and that you make more money on good trades than you lose on bad.

For that you need to aim for certain targets. One of the first metric forex traders look for is win rate. A rate of 55%, for example, would mean the trader is successful 55% of the time. Most of all they need to make sure that their wins are more profitable than their losses. So, if you lose 10 pips on one trade but gain 15 on another, you’ll be pretty happy with life.

The amount you earn also predictably depends on how much you invest. A 5% yield on $1,000 might not look very good, but if that’s on $100,000, your profits look much healthier. Most platforms will also try to encourage you to make large investments by reducing the amount of commission they take.

The trading platform ROFX, for example, starts with a trial account of $1,000 rising to more professional levels of $100,000. Higher investments hold out the prospect of higher returns, but also increased risk.

Of course, wins aren’t guaranteed, but traders can reduce their risk by using a stop loss order which sells up when losses reach a certain amount. This means that the losses you incur are limited while the gains are not.

So, if you invest $5,000 of capital, with a win rate of 55% but risk only 1% of your capital, your gains should be considerable. You might use a stop loss order five pips away from the entry price and have a target of an eight-pip gain which means you’ll sell up once you’ve gained eight pips. This means your potential gain is 1.6 times higher than your risk. The amount you win, of course, also depends on the number of trades you make, but let’s take the theoretical scenario that you win 55 trades in a month gaining $80 on each one, against 45 trades in which you lose $50. The results would work out like this.

One leading analytical tool, pyfolio, for example, offers an open source tool which can evaluate a portfolio while taking into account a degree of uncertainty and offer a number of visualisations.

These figures discount commission rates but give you an idea of how much you might make if you are successful and employ the right strategies. The one thing to remember, though, is that not all trading platforms offer the same quality of service or the same prices. It pays to do your research, work out how much they charge and what strategies they employ.

How much trading capital do forex traders need?

Accessibility in the forms of leverage accounts—global brokers within your reach—and the proliferation of trading systems have promoted forex trading from a niche trading audience to an accessible, global system.

However, the amount of capital traders have at their disposal will greatly affect their ability to make a living. A trader's ability to put more capital to work and replicate advantageous trades is what separates professional traders from novices. Just how much capital a trader needs, however, differs vastly.

Key takeaways

- Traders often enter the market undercapitalized, which means they take on excessive risk to capitalize on returns or salvage losses.

- Leverage can provide a trader with a means to participate in an otherwise high capital requirement market.

- The leverage a trader requires varies, but if a trader is making consistent trades, the leverage required is simply enough that the trader is able to profit without taking unnecessary risks.

Considering leverage in forex trading

Leverage offers a high level of both reward and risk. Unfortunately, the benefits of leverage are rarely seen. Leverage allows the trader to take on larger positions than they could with their own capital alone, but impose additional risk for traders that do not properly consider its role in the context of their overall trading strategy.

Best practices would indicate that traders should not risk more than 1% of their own money on a given trade. While leverage can magnify returns, it's prudent for less-experienced traders to adhere to the 1% rule. Leverage can be used recklessly by traders who are undercapitalized, and in no place is this more prevalent than the foreign exchange market, where traders can be leveraged by 50 to 400 times their invested capital.

A trader who deposits $1,000 can use $100,000 (with 100 to 1 leverage) in the market, which can greatly magnify returns and losses. This is considered acceptable as long as only 1% (or less) of the trader's capital is risked on each trade. This means that with an account size of $1,000, only $10 (1% of $1,000) should be risked on each trade.

While difficult in practice, traders should avoid the temptation of trying to turn their $1,000 into $2,000 quickly. It may happen, but in the long run, the trader is better off building the account slowly by properly managing risk.

Respectable performance for forex traders

Every trader dreams of becoming a millionaire by making intelligent bets off of a small amount of capital. The reality of forex trading is that it is unlikely to make millions in a short timeframe from trading a small account.

While profits can accumulate and compound over time, traders with small accounts often feel pressured to use large amounts of leverage or take on excessive risk in order to build up their accounts quickly. When factoring fees, commissions and/or spreads into return expectations, a trader must exhibit skill just to break even.

Simply being profitable is an admirable outcome when fees are taken into account. However, if an edge can be found, those fees can be covered and a profit will be realized. A trader that averages one tick per trade erases fees, covers slippage and produces a profit that would beat most benchmarks.

Are you undercapitalized for making a living in forex trading?

The high failure rate of making one tick on average shows that trading is quite difficult. Otherwise, a trader could simply increase their bets to five lots per trade and make 15% per month on a $50,000 account. Unfortunately, a small account is significantly impacted by the commissions and potential costs mentioned in the section above. I

N contrast, a larger account is not as significantly affected and has the advantage of taking larger positions to magnify the benefits of day trading. A small account by definition cannot make such big trades, and even taking on a larger position than the account can withstand is a risky proposition due to margin calls.

If the goal of day traders is to make a living off their activities, trading one contract 10 times per day while averaging a one-tick profit may provide an income, but is not a livable wage when factoring other expenses.

There are no set rules on forex trading—each trader must look at their average profit per contract or trade to understand how many are needed to meet a given income expectation, and take a proportional amount of risk to curb significant losses.

How much do forex traders make per month?

How much do forex traders make per month? What is the monthly earnings potential of the average forex trader? If you’re reading this article, you’re probably fairly new to forex trading, so I don’t want to misguide you.

In fact, I’m going to tell you some hard truths that you probably don’t want to hear, but they are absolutely necessary to learn if you ever want to become a successful forex trader. Your initial reaction may be discouragement, but there is a light at the end of the tunnel.

Please fight the urge to roll your eyes and move on to something more uplifting. Sometimes the truth hurts, but I will absolutely guarantee that if you don’t listen to what I’m about to tell you, you will NEVER be a successful, long-term forex trader.

So how much do forex traders really make per month?

This question is a little misleading for a couple of reasons:

- Most forex traders are not profitable

- No profitable trader in any market makes the same percentage of profit each month

These are the questions you NEED to ask:

Why are most forex traders unprofitable?

Despite what you may have heard about how easy it is to make money in the forex market, the truth is that most traders fail. It is also true that you will probably fail at trading, but you don’t have to. The real reason traders fail is probably not what you think.

This is why traders actually fail:

Greed

Most new forex traders have unrealistic profit expectations. They think it will be possible to make 25% – 50% or more month to month. They have dreams of turning their small account into a very large account in just a few years.

This is totally unrealistic. If it were possible we would all be doing it. Most successful traders make a much lower average monthly profit (3%-7% is common). If you’ve averaged 10% or better for more than a year, you’re a rockstar in the trading world.

Take this into consideration:

If you could sustain a 10% average monthly gain, you would more than triple your account every year.

By averaging 6%, you would more than double your account every year.

Starting with $5,000, and averaging only 3% per month, your account would grow to over $170,000 in 10 years.

Warren buffet became a billionaire trader averaging only 30% per YEAR!

I’m not saying it’s impossible to make 25% or more in a month. I’ve done it, and many others have done it. I’m saying its impossible to MAINTAIN such a high average monthly gain. In order to shoot for such a high goal, you will be pressured to take bad trades, overtrade, and overleverage (which brings me to my next point).

Overleveraging

Poor money management is one of the worst account killers for new traders. This goes back to greed, because traders typically overleverage while shooting for unrealistic profit targets.

You should be risking a small percentage of your account on each trade, and you should be risking the same amount on each trade. I recommend never risking more than 2% per trade. Many successful forex traders risk 1% or less per trade, and some very successful and experienced traders risk 3%.

Risking more than a small amount per trade is a death sentence for your trading account because all trading systems go through periods of drawdown. If you’re risking too much during one of these periods, you will, at least, wipe out much of your progress, if not completely wipe out your account.

Consider these two examples:

If you lost 10 consecutive trades, risking 2% per trade, your account would be down about 18%. You would need to earn about 22% of the remaining account just to get back to your starting balance.

If you lost 10 consecutive trades, risking 10% per trade, your account would be down by more than 65%. You would need to earn nearly triple the remaining account (187%) just to get back to your starting balance.

Not only does responsible money management help preserve your capital during losing streaks, it also helps to keep you trading your edge mechanically. That’s because losing 1% or 2% on a trade does not sting nearly as much as losing 5%, 10%, etc….

It’s easier to deal with the losses, psychologically speaking. You’re more likely to pull the trigger on the next trade, and let your edge work itself out over time. And that’s exactly what you need to do, if you know you have a profitable trading method working for you.

Insufficient testing

I cannot stress this point enough. Testing is the backbone of a successful trading program. Most new traders are too impatient and undisciplined to thoroughly test new strategies. I think this, again, goes back to greed, because we all want to fire our bosses as soon as possible. You want to get that account snowballing quickly, but this is a costly, rookie mistake.

The problem is that, without sufficient testing of your trading system or any new trading setup, you’re not going to know how it will hold up during changing market conditions. You need to know if your trading system can stay profitable through increasing/decreasing volatility, growing/shrinking average daily range, impactful news events, etc….

I would not even consider a new trading strategy unless it had proven itself to be profitable after, at least, a couple hundred backtesting trades – either through my trading platform or using a backtesting software, such as forex tester 3.

Next, I would forward test (with a demo or micro account) the new strategy for, at least, a few months. The more time you spend doing this the better off you will be down the road because you will have absolute confidence in a system that has proven to be profitable over time.

Knowing exactly what your system is capable of, and proving to yourself that your trading system is profitable over months or (preferably) years worth of different market conditions will go a long way in helping you to mechanically trade the edge that your system gives you – even when you’re experiencing a losing streak.

Lack of discipline

I’ve mentioned discipline a few times already, and it’s an import factor in profitable trading. It’s another psychological aspect of trading that can either make you or break you. Most new traders lack discipline in every aspect of their trading, from testing to execution.

It takes discipline, as well as patience, to properly test a new trading strategy. Most traders don’t have the discipline to do any manual backtesting at all. They simply learn a new trading method, and demo trade it for a week or two, or worse, they go straight to live trading.

It takes discipline to keep trading when you’re losing. If you’ve done your due diligence, then you already know for sure that you’re trading a consistently profitable trading system. With discipline, you will be able to keep pulling the trigger on the next trade and let your edge play out over time.

Sometimes you just have a bad feeling about a trade, although it meets your criteria. It takes discipline to mechanically trade every setup that comes along, but it’s a must. As soon as you start trading subjectively, you’ve abandoned your edge and you’re gambling.

Note: there is limited room for some subjectivity in some aspects of trading when you become much more experienced, but you should strive to trade as mechanically as possible even then.

Lack of discipline can also lead you into catastrophic behaviors, such as overleveraging (which I mentioned above) and revenge trading. Revenge trading is when you re-enter the market because you’re trying to earn back money that you’ve just lost – not because your trading system has provided another quality entry trigger.

Overtrading could be mentioned in the same breath. Successful, disciplined traders trade less, because they only take the best trade setups. They have the discipline to wait for the market and their trading system(s) to provide them with quality setups, rather than trying to force bad setups to meet some unrealistic profit target.

System hopping

If you’re a new forex trader, it’s absolutely necessary to find a consistently profitable trading system to start testing. As of right now, there are three profitable trading systems reviewed on this website that I have personally traded and recommend. However, I mostly use day trading forex live now.

Note: read my full reviews of these trading systems to see which one will fit your trading style and schedule, as each of these systems are completely different.

If you’ve been trading for a year or two, the truth is that you’ve probably already traded a few profitable trading systems. You just were not confident enough in them, or disciplined enough to let their edge play out over time.

You probably didn’t test long enough, started trading your hard earned money, lost a bunch of it, blamed the trading system you were using, and moved on to the next system. This is a constant, destructive cycle that a large majority of unsuccessful traders are trapped in.

There is no “holy grail” in trading. The point is to find a system that makes sense to you, and test it to see if it actually works. Just as importantly, you need to test it to prove to yourself that it will be profitable in the long term.

You’re looking for something that will provide you a verified edge in the market. You need to have an unwavering belief in the trading system that you are using. Once you do, you simply have to continue to trade the edge that your system provides for you with discipline.

Many traders unwittingly give up on profitable trading systems because they don’t trade them long enough, or with enough discipline, to let the edge work out for them. Even the best traders in the world lose lots of trades, but they have the discipline to let their edge play out.

What is a realistic average monthly profit expectation for a successful trader?

This question is more in line with the way you should be thinking, although its answer may be just as discouraging: it depends on the trader, their trading system, the market, etc….

Successful traders simply trade the edge that their trading system(s) give them, and take what they can get. They don’t set goals and they don’t force trades to meet those goals.

A really good year for a successful trader might look like this:

January +5%

february -2%

march +9%

april +12%

may +3%

june +9%

july +15%

august +20%

september +7%

october -4%

november +5%

december +5%

A trader with this record, if no money was withdrawn from the account along the way, would have earned over 120% – more than doubling their starting balance! Their average monthly profit percentage would be 7%.

Even as I’m writing this I can picture the amateur traders saying to themselves, “that’s not enough! I’ll never be able to do this for a living at that rate.” that is greed and impatience doing what they do to every inexperienced trader.

You could make more than what is depicted in the example above, but if you don’t change your attitude and expectations, you will most likely make much less. Instead of asking yourself, “how much can I make per month as a forex trader?” you should be asking yourself, “am I willing to do what it takes to become a successful forex trader?”

Still looking for a profitable trading system? I've tested 10+ systems. Only 3 were profitable! Learn more about my #1 recommended trading system, day trading forex live.

How much money can you make trading forex?

Posted april 30th, 2020 by TSFX & filed under blog.

The internet is full of stories about supposedly brilliant forex traders making millions by day-trading the markets, making it seem easy, glamorous and the road to instant riches.

The vast majority of such tales are highly dubious however and are normally accompanied by efforts to sell you expensive trading courses or complex software – which then turn out to be duds of course.

So being realistic about it – how much money can you really expect to make trading forex?

The unpopular but undeniably accurate answer – much like to the question “how long is a piece of string” – is it depends. How much you make depends on how often you trade, in what volumes and how successful you are. Indeed, the cold hard truth of the matter is: there’s no guarantee you’re going to make anything at all. In fact, around 70-80% of traders actually lose money overall.

Even so, with reasonable volumes and good advice it is possible to realise some healthy returns. Understanding all the different factors that go into making a successful trader are crucial though. Let’s take a look at these now.

Beyond the headlines

Reading the headlines it is easy to get roped in by tales of vast fortunes being made from trading. Famous traders like lawrie inman and paul redmond supposedly make millions from their trading and reading their stories makes trading the markets sound like a path to overnight riches and the kind of exotic lifestyle most people can only dream of.

At the very top end, it is possible to make significant amounts of money from trading. However, top traders like inman and redmond are able to make such huge sums because they work for investment banks and have massive kitties to play with. If they were starting out on their own with just a few grand in the bank, the story would be very different. They would probably be happy to scratch out a few grand of profit per year, just like most other non-professional traders who don’t have millions of dollars to play with.

So it’s important to look beyond the headlines when considering how much money you might make from forex trading. How much capital you have to start with is crucial and will ultimately determine the bounds of what’s possible for you.

It’s also important not to compare apples with pears and to not measure yourself against the city and wall street big boys who have the backing of investment banks. Pick a target that’s achievable and be happy with any profit generated over a year. Remember, the vast majority of traders lose money overall.

Requirement #1 – having a winning strategy

OK, so now we’ve established the importance of setting some realistic goals and not getting carried away with the headlines, it’s time to look at what factors will affect how much money you can make trading the forex markets.

Obviously the first requirement to making money from your forex trading is to have a strategy that works and can consistently beat the market. Without that you are just relying on pot luck, which is never a good strategy in any form of investing!

The good news though is that we are here to assist you in your efforts to find a winning strategy, with our reviews of forex trading services, establishing which ones can make a profit under a live trial and which ones can’t.

If you can find a profitable strategy that’s a good start, but is by no means the end of the story however. There are a number of other factors which will determine how much money you make from your forex trading.

Establishing the baseline – win rates and profit/loss ratios

There is no way to be certain about how much you will make from forex trading, but there are factors which can help you establish a baseline for how much you could expect to make with your strategies. These factors include your win rate and profit/loss ratio:

- Win rate: your win rate will be the number of successful trades you make. For example, if you win 60 out of 100 trades, your win rate will be 60%. In an ideal world, a win rate of more than 50% will mean you’re earning money, although this will depend on the size of the wins and losses. Most people would view a rate of 55% as being both realistic and sufficient to generate a reasonable return.

- Profit/versus loss: what that win rate translates to in terms of money will depend on your profit versus loss ratio. For example, if you’re making more on your wins than you’re losing on your losses, you’ll have more leeway when it comes to performance. Someone whose wins are considerably bigger than their losses could be making money even if their win ratio is lower than 50%. Likewise, it’s no good having a high win rate if your wins are small, but your losses big.

So having a good idea of your winning trade percentage and profit/loss ratio should give you a rough guide to the kind of returns you might expect from your trading.

Risk management

One of the other crucial factors that will influence how much profit your trading generates is how you manage your risk.

You can limit your downside risk by using a stop loss order. This gets you out of a position if things start to go against you and limits the scale of your losses – if using a guaranteed stop loss that is. This will set a low point which exits a trade once a certain point is reached.

For example, if you buy the EUR/USD pair at 1.1015, with the expectation that the market is going to rise, you can put a stop loss order at 1.1005, ten pips below the start price to limit your losses. This is a safeguard in case the market moves against you and you’re unable to execute a trade in time.

You can combine your risk/reward figure to set an expectancy for how much you might earn. For example, let’s say you make ten trades and win six. If your six wins earned $3,000, your average win rate is 3,000/6 which amounts to $500. Alternatively, if your losses are only $1,200 then your loss rate can be calculated as 1,200/4 which comes to $300.

By combining these numbers, you can identify how much you should expect to earn for every dollar invested. Ideally, this rate should be above zero which should mean you would expect to see a positive return.

For example, if you have an expectancy of 0.35, that means that for every dollar invested you might expect to see a return of 35 cents. This is also known as “return on investment” or ROI – usually expressed as a percentage, in this case it would be an ROI of 35%.

If your expectancy is relatively stable, using your preferred strategies, it stands to reason that a higher volume of trades will lead to higher returns – presuming of course your strategy stands up to a higher volume of trading.

Even the most effective trading strategy can suffer a string of losses however and it is almost inevitable at some stage. Being able to handle these losing streaks and not trying to chase your losses or over-trade is an important part of being a successful trader.

Money management

This then leads us on to another key factor in determining how much money you might make trading – how you manage your money. Making sure you have a sufficient bank to cover the inevitable losing streaks is crucial and not risking more than you can afford to lose on any trade is a key part of successful trading.

For example, a sensible rule of thumb would be to only risk 1-2% of your starting bank on each trade. So if your starting bank was $10,000, you would only risk $100-$200 per trade. You could set your stop losses to this amount, thus giving clear parameters for each trade and not over-exposing yourself.

The biggest mistake most traders make is risking too much on trades, blowing their bank and not being able to recover. Let’s be honest, we’ve probably all done it at one stage or another! Having the right approach to money management though will make a big difference to how much money you end up making from your trading.

Leverage amount

As discussed earlier, ultimately the capital available to you will determine the bounds of what’s possible to achieve with your trading. In turn, the amount of capital you have available to trade with will also be affected by the leverage offered by your broker.

When trading on a cash basis you will only trade what you can actually afford to buy. In other words, if you want to trade $15,000 worth of stocks, you must have $15,000 on hand. However, forex brokers usually offer leverage which means you only need to have a small percentage of the amount you want to trade.

A common rate in the UK is 30:1 which means that a $5,000 allows you to take $150,000 worth of positions. In other countries this can be much higher though – up to 100:1 or in some cases even a massive 500:1.

This sounds great in theory but bear in mind if a position moves sharply against you, your broker will ask you to cover it. If you don’t have enough money in your account then the broker will close out your position, potentially leaving you with a hefty loss. Or in extreme circumstances, you may owe the broker a considerable amount of money – see the swiss franc/euro debacle of january 2015 for example, which bankrupted both traders and forex brokers alike.

A factor to keep in mind in these scenarios is slippage, which refers to losses which are greater than expected even with stop losses in place, thanks to fast moving markets. On such occasions the stop losses will not cover the move of the market (unless you have utilised guaranteed stop losses), leaving you to cover the full amount the market has moved by.

So ultimately the lesson here is on the one hand to recognise that leverage provides you with more capital to trade with (and potentially more profit), whilst on the other understanding it can go the other way and leave you with bigger losses.

It’s best to be cautious with leverage and think “how much could I actually lose if there was a really big market move against me?” using guaranteed stop losses can help to mitigate these risks (although you have to pay a premium for these and it’s important to check your broker’s T&cs to be sure they actually provide the security you want).

Conclusion – how much money can you make trading forex?

Whilst there are widespread claims of people amassing huge fortunes from forex trading, the stark reality is that the vast majority of forex traders lose money – around 70-80% in fact. Even some of those paid to do it on wall street and in the city lose money!

Making any money at all from forex trading is actually a considerable achievement. How much you make will depend on a range of factors including your win rate, profit/loss ratio, money management, initial capital and leverage amount.

Here’s a hypothetical example taking these factors into account:

- Having $10,000 to start with;

- A win ratio of 55%;

- An even profit/loss ratio (i.E. $100 won per trade versus $100 lost);

- Making one trade per day;

- Risking 1% on each trade;

- Using stop losses;

- Using sensible money management and leverage;

- Returns could be approximately: $2,600 profit.

So this fairly simple example would provide a return of around $2,600 from a starting capital of $10,000. That would be a very respectable return and any aspiring trader should be happy with this kind of result.

Ultimately of course whether you are able to make any money at all will depend on whether you have a successful strategy to start with. Here at trade stocks & forex we aim to help you do that by providing in-depth reviews of forex products and identifying the systems that work and those that don’t. Check out our winning systems page for an up-to-date list.

Good luck with your trading whether you use one of the systems on our list or your own!

The contents of this website are intended for educational and information purposes only and do not constitute any form of advice or recommendation and are not intended to be relied upon by you in making (or refraining to make) any specific investment or other decisions. Appropriate expert independent advice should be obtained before making any such decision. We cannot and do not offer individual investment advice.

So, let's see, what we have: here is a scenario for how much money a simple and risk-controlled forex day trading strategy can make, and guidance on how to achieve that level of success. At how much can you earn with forex trading

Contents of the article

- New forex bonuses

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- How much can you make from forex trading? (2020)

- Is forex trading profitable?

- How much can you make from trading forex?

- Can you make money from forex?

- How much can you earn with forex trading

- Contents

- Can you get rich by trading forex?

- How can I turn $10,000 into $100,000?

- How can I turn $10,000 into $1 million?

- How much can you make trading forex?

- Can you make a living trading forex?

- Final thoughts

- How much do forex traders make a day?

- How much to invest in forex trading to make a...

- Can you make a living day trading forex?

- How much money can you make from forex trading –...

- 1. Trade more

- 2. Managing risk

- 3. Money extraction from your trader’s account

- 4. Determine your expectancy

- 5. Trading risk is dependent on currency pairs

- 6. Calculate profit from forex trading

- The bottom line

- You can earn A lot of money by trading forex

- The most important indicators in shopping and...

- So, what is the answer?

- Mathematically speaking, it can be expressed as:

- The correct example is as follows:

- Will you refund or increase revenue?

- How much money you can earn by forex trading?

- How much can a private individual earn on forex?

- How much can you make?

- How much trading capital do forex traders need?

- Considering leverage in forex trading

- Respectable performance for forex traders

- Are you undercapitalized for making a living in...

- How much do forex traders make per month?

- So how much do forex traders really make per...

- Why are most forex traders unprofitable?

- Greed

- Overleveraging

- Insufficient testing

- Lack of discipline

- System hopping

- What is a realistic average monthly profit...

- How much money can you make trading forex?

- Beyond the headlines

- Requirement #1 – having a winning strategy

- Establishing the baseline – win rates and...

- Risk management

- Money management

- Leverage amount

- Conclusion – how much money can you make trading...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.