Forex site

The technical analysis covered by the site actually covers the currencies, valuable metals and other commodities using various other technical tools.

New forex bonuses

Deposit: $10 leverage: 1000:1

List of top forex trading sites

With some of the better forex sites, we have listed here with different collection of sites that is usually at the top of all searches as the top 10 forex blogs list and we hope our readers will benefit a lot.

Deposit: $10 leverage: 1000:1

Deposit: $50 leverage: 1:50

Deposit: $100 leverage: 1:30

Deposit: $50 leverage: 1:1000

Forex factory

This is a forex site which comes along with a predominant forex forum along with a better calendar. Additionally they have a wonderful section that provides updates on the news section for forex

Fxstreet

Fxstreet is a broker who is providing its services featured in multiple languages along with regular outlooks. They do provide aggregated forecasts on the weekly updates and previews for the big events on forex services.

Forexlive

These live sites provides regular and healthy updates on the social platform like over twitter, facebook etc. They are also available for the customers throughout the time. Additionally they bring in the interbank features which impact the forex, regular news updates and many more.

Alphaville

Alphaville is an active blog operated by the financial times that provides excellent analysis into deep mode. They help in understanding the regular and live updates on the forex trading.

Trading NRG

Here they assist in everything to have information that is linked to almost all. Hence it is very important to update the trend of trading commodities like oil, gas, gold and silver. Actually trading energy is the one that performs this works in an excellent way.

Forextv

This is an unusual site that takes part in the growth of the forex trading industry. This also has special provisions of video. Along with this they also provide free video updates on live basis. Hence any forex investments can be made by checking this site.

Netdania

These sites come with an excellent way of interpreting the forex updates. They use charting tools that is being used on many other important sites to provide regular live points on forex trading. Along with fine tuned software, they interpret the active services all over the time.

Currensee

They are the first social network setup for forex that has really made great steps in the year 2010. Along with this, they are experts in providing the regular updates to the forex world in a quick pace now and then.

Fxtechstrategy

The technical analysis covered by the site actually covers the currencies, valuable metals and other commodities using various other technical tools.

Dailyfx blogs

This blog is one of the famous and the widest one that comes with a section for discussion on the forex news and updates.

The 11 best forex websites

Updated 20 january 2021

In this article skip to section

Trading on the foreign exchange market, or forex trading as it is more commonly referred to, takes a considerable amount of skill and knowledge.

For beginner traders, there’s a lot to learn, from basic concepts to trading strategies, risk management and platform familiarisation.

Once you’ve built the confidence to begin trading, you’ll then need to stay on top of market trends, economic news and global events that may impact the market. You’ll also want to continually improve your trading skills, learning how to successfully execute increasingly profitable trades.

Thankfully, there is a huge amount of information available online and it is relatively easy for beginner and experienced traders alike to find all they need to know with a little bit of research.

You’ll want to be sure that the sources you turn to are legitimate and trustworthy. Whether you’re looking for news, technical analysis, strategy guidance or educational resources, it’s vital that the sites you use are reputable.

To help you get started, here is our list of 11 of the best forex websites available.

11 best websites to learn forex trading

The following top forex trading websites include those providing news, education, analysis and trading tools. For a successful trading career, it’s best to use several in conjunction with one another.

1. Etoro trading school

Best for: multi market overview

The one day etoro trading school course covers multiple trading areas including forex, cryptocurrency and stocks.

In-person education is delivered by henry ward, a professional trader with over 10 years’ experience under his belt.

Though the course claims to be suitable for traders of all levels, the content is well suited to beginner traders, or those looking to learn more before dipping their toes into the water.

You’ll have an introduction to the financial markets, learn essential key terms and what they represent, and walk through the fundamental principles of trading.

Perhaps the most useful element of the course for beginners is the introduction of trading personalities. This should help you identify what type of trader you are and determine the most appropriate styles to suit.

In addition to the classroom-based course, held in london’s canary wharf, there’s also a library of webinars and podcasts for those interested in distance learning.

2. Babypips

Best for: beginner education

The first on our list of best forex websites is babypips, a user-friendly site with an easy to navigate layout and a range of tools and features ideal for those new to the world of forex trading.

It posts regular news updates and feature articles in areas such as:

- Technical analysis

- Trade ideas

- Trading psychology

However, it’s through its educational content that babypips really shines.

Its school of pipsology takes a light-hearted approach to what is essentially a highly complex topic. Lesson articles are separated into 11 courses, beginning at pre-school level through to graduation, and are supported with online quizzes and a comprehensive glossary of terms.

There are also several free to use tools, like its position size calculator and gain and loss percentage calculator, designed to help beginner traders mitigate risk and assess the profitability of their trades.

Signing up for an account is free and you can also exchange tips and ideas with fellow traders through its various forums, making babypips perhaps the best website for forex education for beginners.

3. Bloomberg

Best for: financial news and analysis

Bloomberg is the customer-facing website of the international news agency, bloomberg news. It covers just about everything you need to know about events in finance, business and trading.

With stories updated as they unfold from around the globe, it is probably the best website for forex news, as well as providing markets trends, analysis and currency data.

Users are permitted free access to a limited number of articles each month. To get the most from bloomberg’s services, you’ll probably want to consider signing up for either its digital or all-access subscription, which can be paid for monthly or annually. These come with additional benefits including the open and close, bloomberg’s daily newsletter for traders.

4. Dailyfx

Best for: forex calendars

Dailyfx is a free to use website powered by UK-based brokerage, IG. As you would expect from a broker-run site, it provides live market data for major currency pairs, with both simple view and detailed view charts for in-depth technical analysis.

The site provides regularly updated financial news, which is easily filtered by market. You’ll find several articles per day posted under the forex news tab. This is complemented by a separate real-time news feed that pulls in breaking information from accredited sources.

There are plenty of educational resources in dailyfx’s forex university, with courses offered at beginner, intermediate, advanced and expert level. You can also take advantage of its daily live webinars.

There are several useful trading tools including pivot point and trader sentiment charts, but perhaps the most useful tools are the economic and central banks calendars. These provide clear details of upcoming global events and future meetings of each country’s central bank respectively, allowing you to make informed predictions on potential market movement and adjust your positions accordingly.

5. FOREX.Com

Best for: metatrader training

FOREX.Com is a leading UK forex broker that offers a comprehensive library of educational content. As a broker regulated by the financial conduct authority, you can be sure that the guidance provided by FOREX.Com is trustworthy and from a reputable source.

All of the educational materials are free, you do not have to open a trading account with forex.Com to access them.

- Technical analysis

- Trading strategies and concepts

- Managing risk

Resources are separated into the three levels of beginner, intermediate and advanced.

Forex.Com also offers training on trading platforms. This includes its proprietary platform, but perhaps of more value, it also provides several tutorials on the use of the metatrader suite.

As many forex brokers provide this platform, learning how to use it to full effect is well worth your time.

6. Forexfactory

Best for: forex forums

This entry in our list of best forex websites is more geared towards the professional trader and, as its name would suggest, focuses solely on the foreign exchange market.

Information is easily accessible under six simple tabs. Some key ones are:

- The ‘brokers’ tab offers an overview of several forex brokers, including their real-time spreads

- The ‘market’ tab provides a live scanner and customisable forex charts

- A detailed economic calendar sits under the ‘calendar’ tab

Although not comparable with some of our other best forex websites, there’s also a fairly comprehensive news feed.

Forex factory’s best features are probably found under its ‘trades’ and ‘forums’ tabs. The former allows you to see live trades being placed by others in the market, with the latter hosting a wide range of active discussions.

You can use forex factory for free, but you will need to register for an account to take part in its forum threads.

7. Fxstreet

Best for: good all-rounder

A highly popular source of information in the trading community, fxstreet is a good all-round site providing everything you’d expect to find on one of the top forex trading websites.

News, analysis and a range of forex charts are available including live charts, a forecast poll and rates table. Fxstreet’s chart station allows you to track four charts on one page for detailed and comparative analysis.

A lot of fxstreet’s resources and tools are free to use, including its trading signals service, although signal notifications are limited per month and subject to a 15-minute delay.

To make the most of this feature and get access to all signals in real-time, you’ll need to upgrade to fxstreet premium for a monthly fee. This will also give you access to its trading institute, which hosts four live forex webinars per week.

8. Investing.Com

Best for: free trading tools

This free-to-use website provides a wealth of useful trading information and resources including:

- News

- Analysis

- Real-time data

- Educational material

Investing.Com prides itself on catering to beginner traders, with premium features free of charge. Although a US-based website, it provides a localised service.

Investing.Com is also one of the best forex websites when it comes to free tools. Of particular note are its forex volatility and forex correlation calculators. These allow novice traders to get to grips with both the historic volatility and correlation data of a wide range of currency pairs, enabling them to make better-informed trading decisions.

9. Investopedia

Best for: mid-level education and interactive learning

Next on our list of best forex websites is investopedia, a comprehensive resource providing:

- Market news

- Trend analysis

- Trading education

Investopedia has an exceptionally clean layout that is easy to navigate and user-friendly. Its news updates are separated under category tabs including ‘company’, ‘markets’, ‘trading’ and ‘political news’, though its coverage does not compare with the more dedicated news sites like bloomberg.

You’ll find a multitude of educational articles that cover everything from basic terminology to professional trading strategies. These are well structured and informative, but perhaps a little more complex than the educational content found on babypips.

For more in-depth and interactive learning, the investopedia academy is a valuable resource. Courses are available for all levels of experience, each consisting of over 30 individual on-demand video lessons and supporting materials like quizzes and practice exercises. Whilst its onsite articles are free to access, the investopedia academy is a paid-for service.

10. Tradingview

Best for: forex charting

Tradingview is one of the top forex trading websites for charting and social networking. Through cloud-based software, traders of all levels of experience can easily research and track the market with customisable charts set up for specific alerts and indicators.

There are four plans available:

- Basic

- Pro

- Pro+

- Premium

The basic account is free but relatively limited. If you’re new to trading and want to practice charting currency pairs, then the basic account may work for you.

However, to take full advantage of tradingview’s charting software and active social community, you’ll need to upgrade to one of the paid plans. These do all come with a free trial, so you can try them out before making a long-term commitment.

11. Udemy

Best for: on-demand learning

Unlike the other forex websites in this list, udemy is not specifically designed for trading education or information. Rather, it is a global online learning platform that hosts a multitude of courses in almost every subject imaginable.

That said, it has an extensive range of resources for those looking to learn about trading on the foreign exchange market. A simple search for forex brings up over 2,000 courses, from introductory overviews to expert level lectures.

Whilst there are some free-to-access courses, most are paid-for lectures. Prices vary greatly and some can be quite steep, but you’ll often find price promotions that offer a significant discount. Courses are taken through on-demand video and most feature additional resources such as supporting articles or assignments.

Under each course heading, you’ll find an overview of what you’ll learn, a breakdown of each lecture and details on the course instructor. You’ll also see a course star rating and be able to read informative feedback from previous students.

Final thoughts

There are so many websites for forex news and education that it can be difficult to know which ones you can trust, and which ones are best avoided. Hopefully, the above list has provided you with a variety of reputable sources with which to start or progress your forex trading journey.

As mentioned, it’s best to use several of these sites to ensure you’re covering all the basics when it comes to learning about forex trading.

For beginners, it’s advisable to start with basic educational content before moving on to market research and using trading tools. That way, you’ll fully understand how what you’re reading and the tools your using can help you make better-informed trading decisions.

Wikijob does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Trade major US tech stocks this earnings season

Why are traders choosing FOREX.Com?

Global market leader

Connecting traders to the currency markets since 2001

Professional accounts

Discover the FOREX.Com

pro service

Innovative & award-winning

Our new mobile app offers one-swipe trading and lightning fast execution

Financial strength you can depend on

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX.Com.

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

Top stories

The south african reserve bank (SARB) left rates unchanged at.

EUR/USD remains in a longer-term uptrend, with rates finding support.

The biden bounce is expected to continue today, with US.

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

*based on active metatrader servers per broker, apr 2019. **based on CFD spreads and financing competitor comparison on 28/08/19.

Try a demo account

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

It's your world. Trade it.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

The 11 best forex websites

Updated 20 january 2021

In this article skip to section

Trading on the foreign exchange market, or forex trading as it is more commonly referred to, takes a considerable amount of skill and knowledge.

For beginner traders, there’s a lot to learn, from basic concepts to trading strategies, risk management and platform familiarisation.

Once you’ve built the confidence to begin trading, you’ll then need to stay on top of market trends, economic news and global events that may impact the market. You’ll also want to continually improve your trading skills, learning how to successfully execute increasingly profitable trades.

Thankfully, there is a huge amount of information available online and it is relatively easy for beginner and experienced traders alike to find all they need to know with a little bit of research.

You’ll want to be sure that the sources you turn to are legitimate and trustworthy. Whether you’re looking for news, technical analysis, strategy guidance or educational resources, it’s vital that the sites you use are reputable.

To help you get started, here is our list of 11 of the best forex websites available.

11 best websites to learn forex trading

The following top forex trading websites include those providing news, education, analysis and trading tools. For a successful trading career, it’s best to use several in conjunction with one another.

1. Etoro trading school

Best for: multi market overview

The one day etoro trading school course covers multiple trading areas including forex, cryptocurrency and stocks.

In-person education is delivered by henry ward, a professional trader with over 10 years’ experience under his belt.

Though the course claims to be suitable for traders of all levels, the content is well suited to beginner traders, or those looking to learn more before dipping their toes into the water.

You’ll have an introduction to the financial markets, learn essential key terms and what they represent, and walk through the fundamental principles of trading.

Perhaps the most useful element of the course for beginners is the introduction of trading personalities. This should help you identify what type of trader you are and determine the most appropriate styles to suit.

In addition to the classroom-based course, held in london’s canary wharf, there’s also a library of webinars and podcasts for those interested in distance learning.

2. Babypips

Best for: beginner education

The first on our list of best forex websites is babypips, a user-friendly site with an easy to navigate layout and a range of tools and features ideal for those new to the world of forex trading.

It posts regular news updates and feature articles in areas such as:

- Technical analysis

- Trade ideas

- Trading psychology

However, it’s through its educational content that babypips really shines.

Its school of pipsology takes a light-hearted approach to what is essentially a highly complex topic. Lesson articles are separated into 11 courses, beginning at pre-school level through to graduation, and are supported with online quizzes and a comprehensive glossary of terms.

There are also several free to use tools, like its position size calculator and gain and loss percentage calculator, designed to help beginner traders mitigate risk and assess the profitability of their trades.

Signing up for an account is free and you can also exchange tips and ideas with fellow traders through its various forums, making babypips perhaps the best website for forex education for beginners.

3. Bloomberg

Best for: financial news and analysis

Bloomberg is the customer-facing website of the international news agency, bloomberg news. It covers just about everything you need to know about events in finance, business and trading.

With stories updated as they unfold from around the globe, it is probably the best website for forex news, as well as providing markets trends, analysis and currency data.

Users are permitted free access to a limited number of articles each month. To get the most from bloomberg’s services, you’ll probably want to consider signing up for either its digital or all-access subscription, which can be paid for monthly or annually. These come with additional benefits including the open and close, bloomberg’s daily newsletter for traders.

4. Dailyfx

Best for: forex calendars

Dailyfx is a free to use website powered by UK-based brokerage, IG. As you would expect from a broker-run site, it provides live market data for major currency pairs, with both simple view and detailed view charts for in-depth technical analysis.

The site provides regularly updated financial news, which is easily filtered by market. You’ll find several articles per day posted under the forex news tab. This is complemented by a separate real-time news feed that pulls in breaking information from accredited sources.

There are plenty of educational resources in dailyfx’s forex university, with courses offered at beginner, intermediate, advanced and expert level. You can also take advantage of its daily live webinars.

There are several useful trading tools including pivot point and trader sentiment charts, but perhaps the most useful tools are the economic and central banks calendars. These provide clear details of upcoming global events and future meetings of each country’s central bank respectively, allowing you to make informed predictions on potential market movement and adjust your positions accordingly.

5. FOREX.Com

Best for: metatrader training

FOREX.Com is a leading UK forex broker that offers a comprehensive library of educational content. As a broker regulated by the financial conduct authority, you can be sure that the guidance provided by FOREX.Com is trustworthy and from a reputable source.

All of the educational materials are free, you do not have to open a trading account with forex.Com to access them.

- Technical analysis

- Trading strategies and concepts

- Managing risk

Resources are separated into the three levels of beginner, intermediate and advanced.

Forex.Com also offers training on trading platforms. This includes its proprietary platform, but perhaps of more value, it also provides several tutorials on the use of the metatrader suite.

As many forex brokers provide this platform, learning how to use it to full effect is well worth your time.

6. Forexfactory

Best for: forex forums

This entry in our list of best forex websites is more geared towards the professional trader and, as its name would suggest, focuses solely on the foreign exchange market.

Information is easily accessible under six simple tabs. Some key ones are:

- The ‘brokers’ tab offers an overview of several forex brokers, including their real-time spreads

- The ‘market’ tab provides a live scanner and customisable forex charts

- A detailed economic calendar sits under the ‘calendar’ tab

Although not comparable with some of our other best forex websites, there’s also a fairly comprehensive news feed.

Forex factory’s best features are probably found under its ‘trades’ and ‘forums’ tabs. The former allows you to see live trades being placed by others in the market, with the latter hosting a wide range of active discussions.

You can use forex factory for free, but you will need to register for an account to take part in its forum threads.

7. Fxstreet

Best for: good all-rounder

A highly popular source of information in the trading community, fxstreet is a good all-round site providing everything you’d expect to find on one of the top forex trading websites.

News, analysis and a range of forex charts are available including live charts, a forecast poll and rates table. Fxstreet’s chart station allows you to track four charts on one page for detailed and comparative analysis.

A lot of fxstreet’s resources and tools are free to use, including its trading signals service, although signal notifications are limited per month and subject to a 15-minute delay.

To make the most of this feature and get access to all signals in real-time, you’ll need to upgrade to fxstreet premium for a monthly fee. This will also give you access to its trading institute, which hosts four live forex webinars per week.

8. Investing.Com

Best for: free trading tools

This free-to-use website provides a wealth of useful trading information and resources including:

- News

- Analysis

- Real-time data

- Educational material

Investing.Com prides itself on catering to beginner traders, with premium features free of charge. Although a US-based website, it provides a localised service.

Investing.Com is also one of the best forex websites when it comes to free tools. Of particular note are its forex volatility and forex correlation calculators. These allow novice traders to get to grips with both the historic volatility and correlation data of a wide range of currency pairs, enabling them to make better-informed trading decisions.

9. Investopedia

Best for: mid-level education and interactive learning

Next on our list of best forex websites is investopedia, a comprehensive resource providing:

- Market news

- Trend analysis

- Trading education

Investopedia has an exceptionally clean layout that is easy to navigate and user-friendly. Its news updates are separated under category tabs including ‘company’, ‘markets’, ‘trading’ and ‘political news’, though its coverage does not compare with the more dedicated news sites like bloomberg.

You’ll find a multitude of educational articles that cover everything from basic terminology to professional trading strategies. These are well structured and informative, but perhaps a little more complex than the educational content found on babypips.

For more in-depth and interactive learning, the investopedia academy is a valuable resource. Courses are available for all levels of experience, each consisting of over 30 individual on-demand video lessons and supporting materials like quizzes and practice exercises. Whilst its onsite articles are free to access, the investopedia academy is a paid-for service.

10. Tradingview

Best for: forex charting

Tradingview is one of the top forex trading websites for charting and social networking. Through cloud-based software, traders of all levels of experience can easily research and track the market with customisable charts set up for specific alerts and indicators.

There are four plans available:

- Basic

- Pro

- Pro+

- Premium

The basic account is free but relatively limited. If you’re new to trading and want to practice charting currency pairs, then the basic account may work for you.

However, to take full advantage of tradingview’s charting software and active social community, you’ll need to upgrade to one of the paid plans. These do all come with a free trial, so you can try them out before making a long-term commitment.

11. Udemy

Best for: on-demand learning

Unlike the other forex websites in this list, udemy is not specifically designed for trading education or information. Rather, it is a global online learning platform that hosts a multitude of courses in almost every subject imaginable.

That said, it has an extensive range of resources for those looking to learn about trading on the foreign exchange market. A simple search for forex brings up over 2,000 courses, from introductory overviews to expert level lectures.

Whilst there are some free-to-access courses, most are paid-for lectures. Prices vary greatly and some can be quite steep, but you’ll often find price promotions that offer a significant discount. Courses are taken through on-demand video and most feature additional resources such as supporting articles or assignments.

Under each course heading, you’ll find an overview of what you’ll learn, a breakdown of each lecture and details on the course instructor. You’ll also see a course star rating and be able to read informative feedback from previous students.

Final thoughts

There are so many websites for forex news and education that it can be difficult to know which ones you can trust, and which ones are best avoided. Hopefully, the above list has provided you with a variety of reputable sources with which to start or progress your forex trading journey.

As mentioned, it’s best to use several of these sites to ensure you’re covering all the basics when it comes to learning about forex trading.

For beginners, it’s advisable to start with basic educational content before moving on to market research and using trading tools. That way, you’ll fully understand how what you’re reading and the tools your using can help you make better-informed trading decisions.

Wikijob does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Trade with the global forex trading specialist

Why FOREX.Com?

Metatrader

Trade over 500 markets including equities, indices, FX and commodities on the new and improved MT5

Competitive pricing

Maximize your potential with straightforward pricing choices to suit your trading style

Active trader

Earn rebates and one-on-one professional support when you qualify for our active trader program

Financial strength you can depend on

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX.Com.

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Not sure where to start?

Take our short quiz and get matched resources that fit your trading style.

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

Go to content for my region

Try a demo account

It's your world. Trade it.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

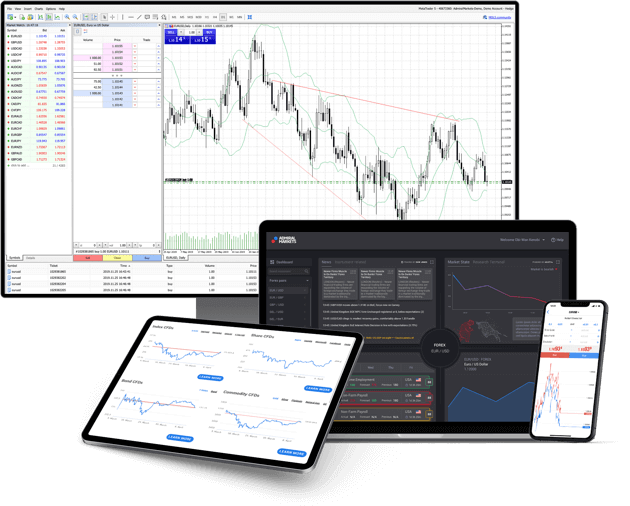

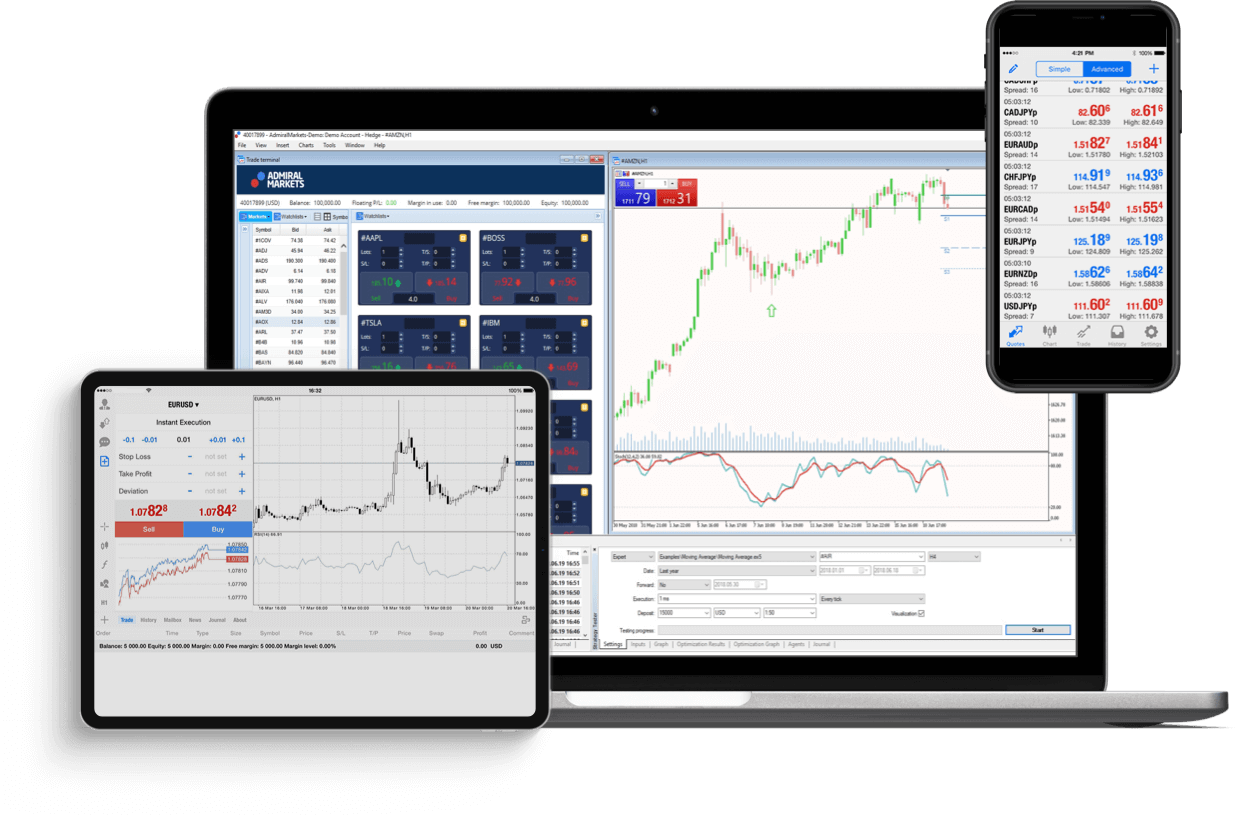

Trade with comfort on any device

Whether it`s windows or mac, android or ios, it doesn`t matter – we`ve got you covered!

Invest from just €1

Sign up for unlimited access to 4,000+ stocks from the new york stock exchange, nasdaq, FTSE and more - all without paying markups, rollovers, management or ticket fees.*

Some of the trademarks reflected on this page might be under trademark protection. Admiral markets does not have any direct relationship with the owners of these trademarks.

How it works

Register

Sign up with your name and email address to start trading

Start investing from €1, and start trading from just €100

Trade

Log in and start trading more than 8,000 instruments!

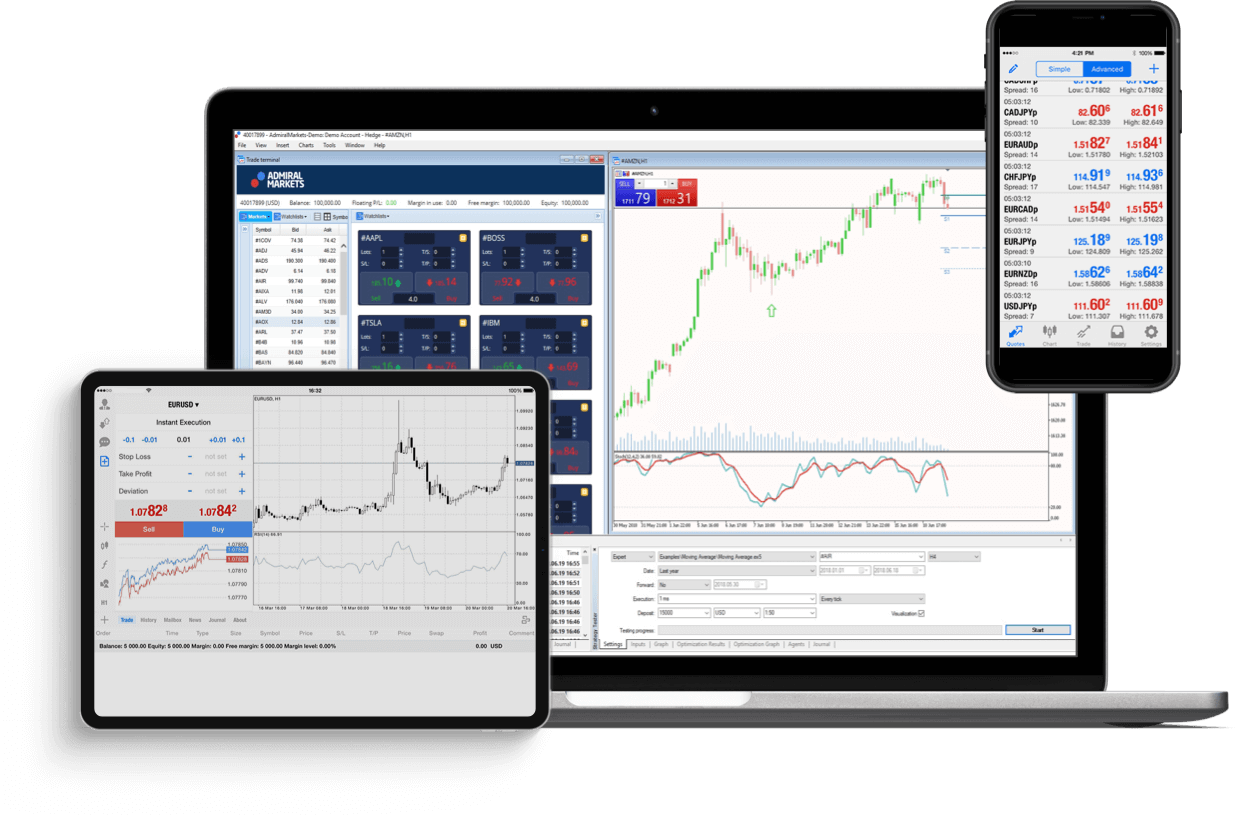

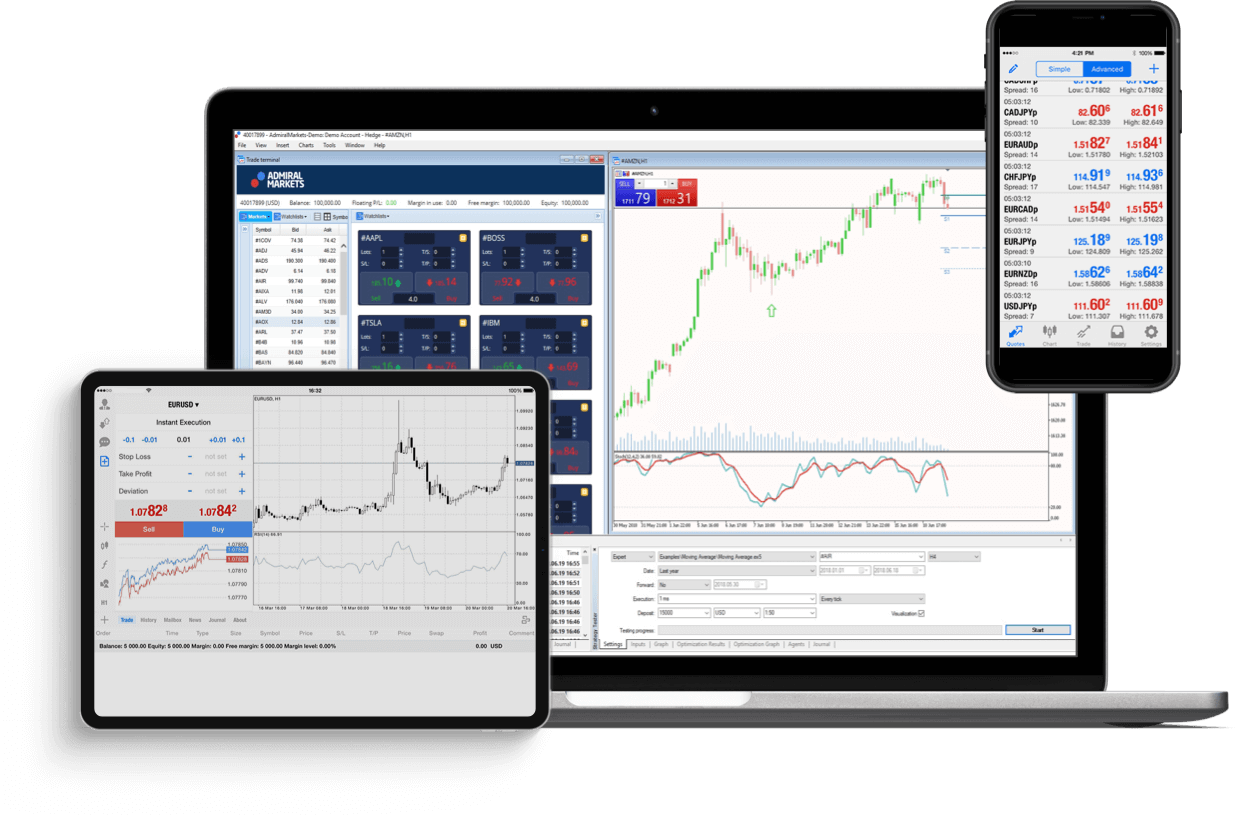

Trading

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs, bonds, or cryptocurrencies. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

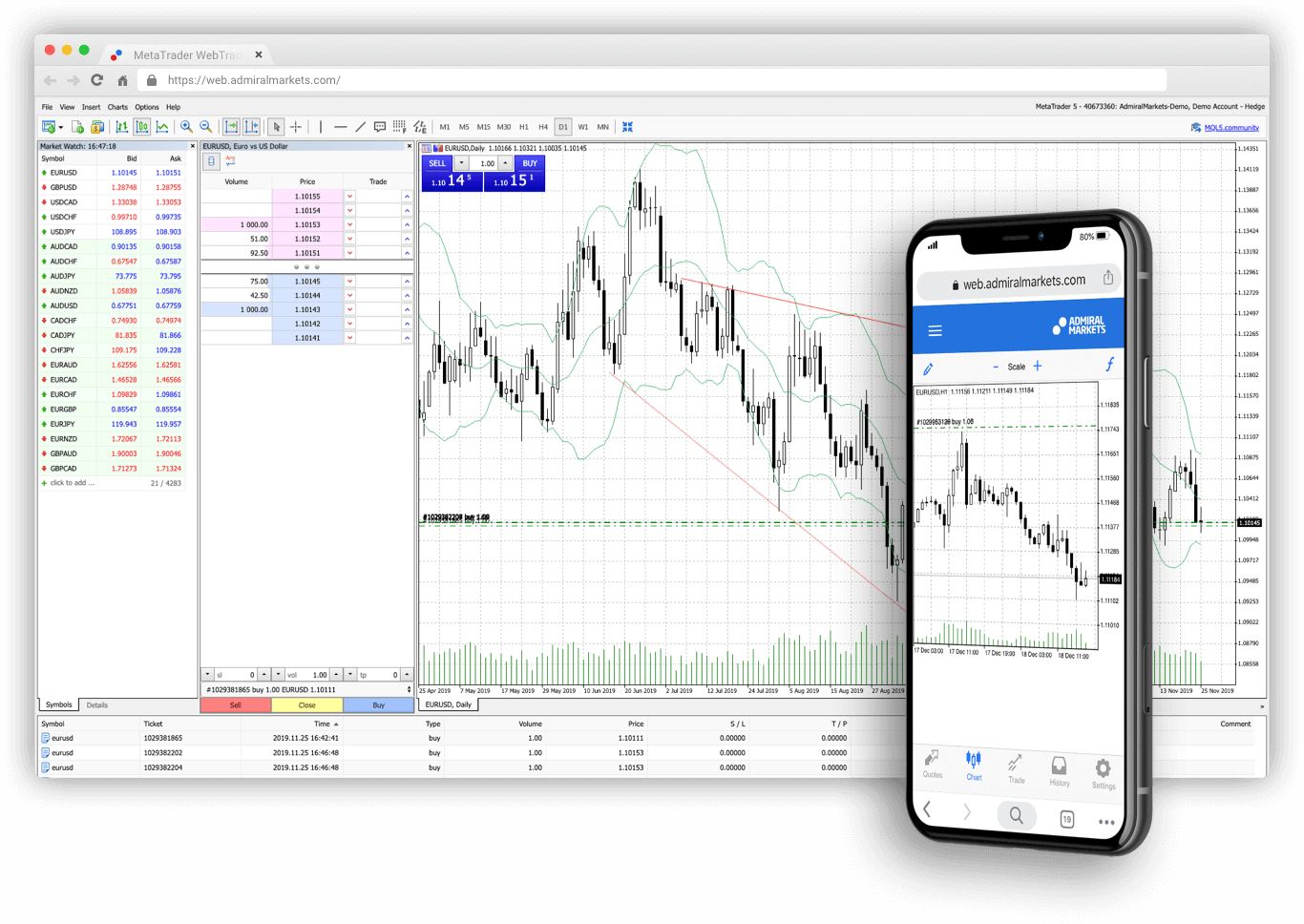

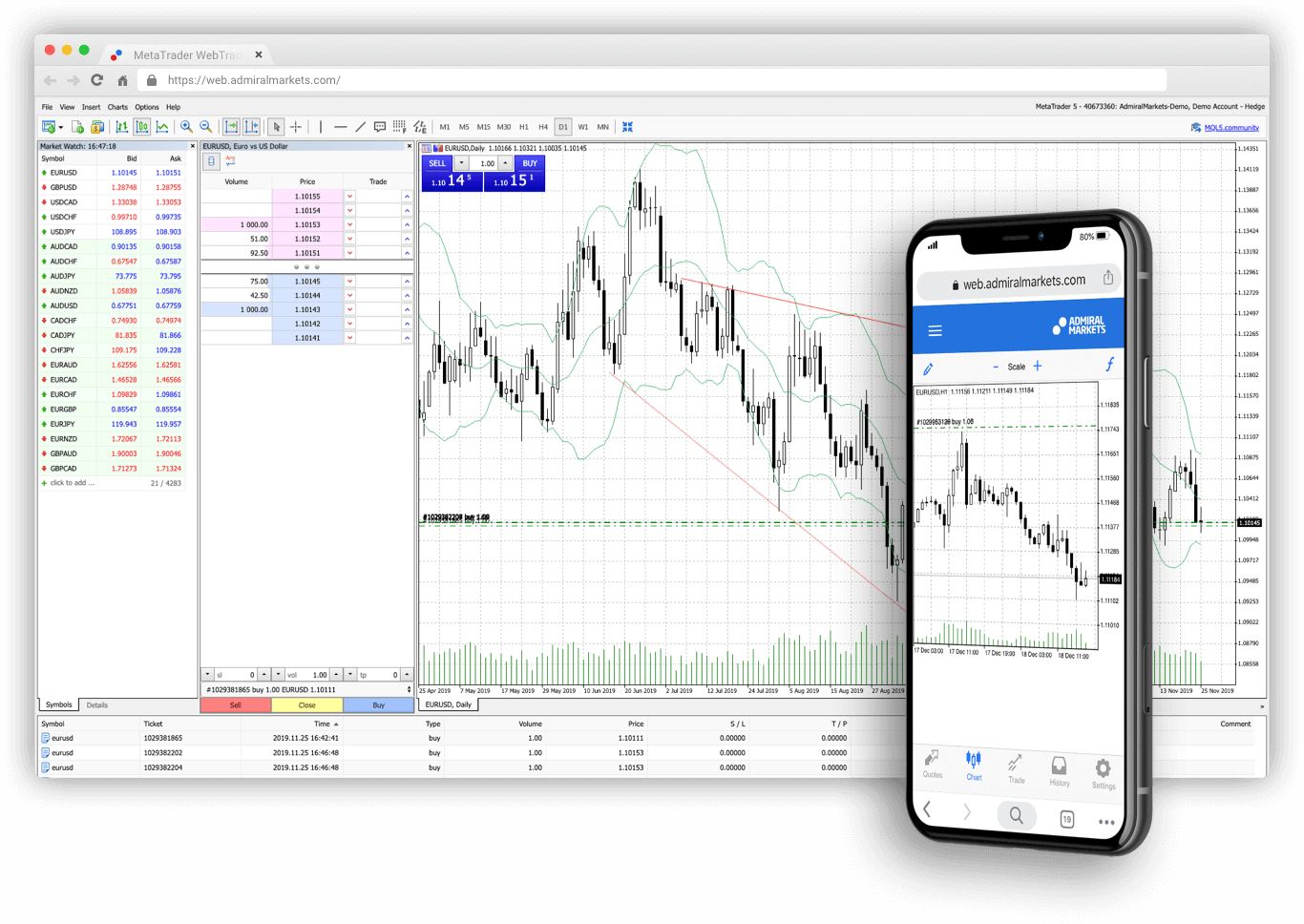

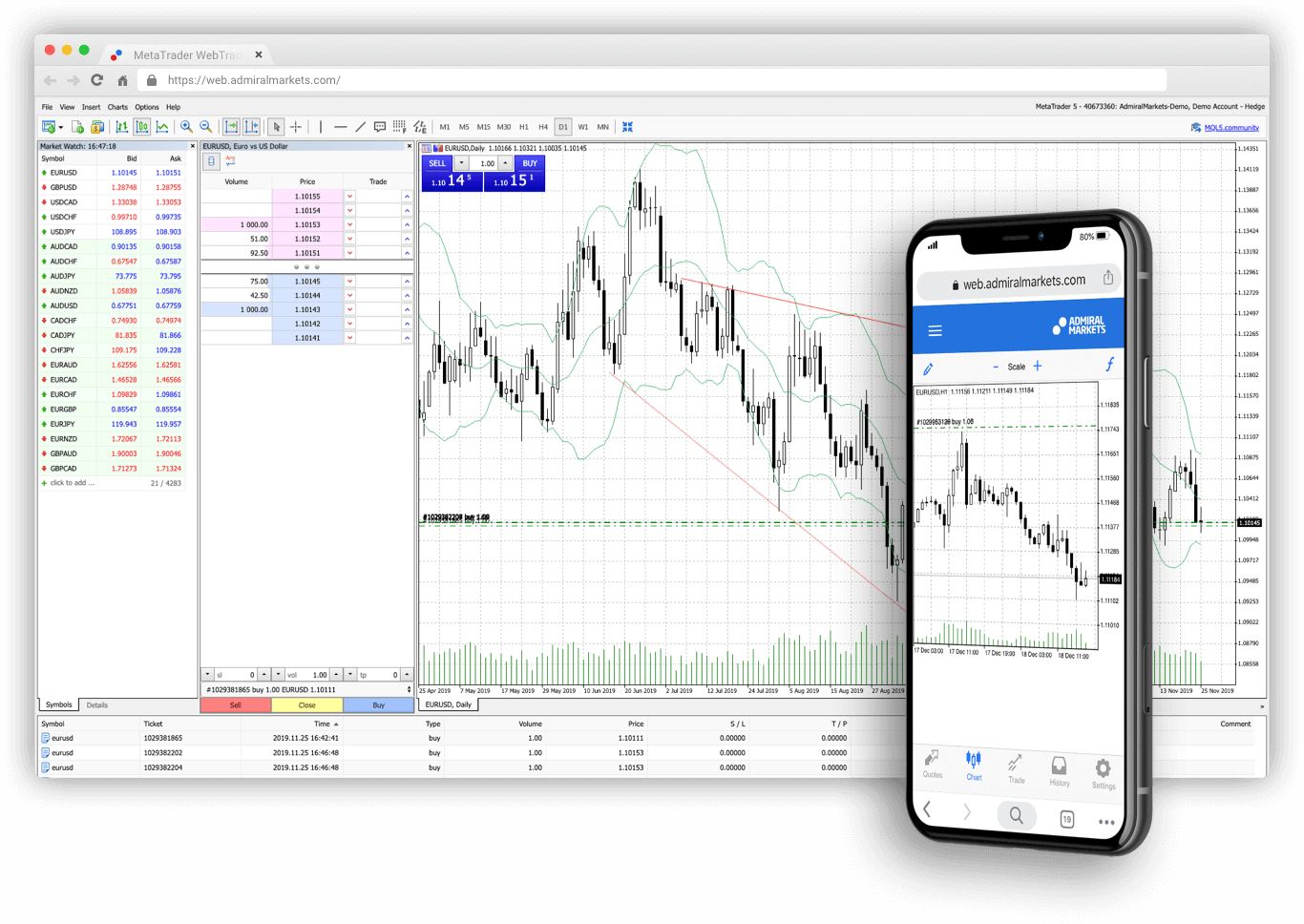

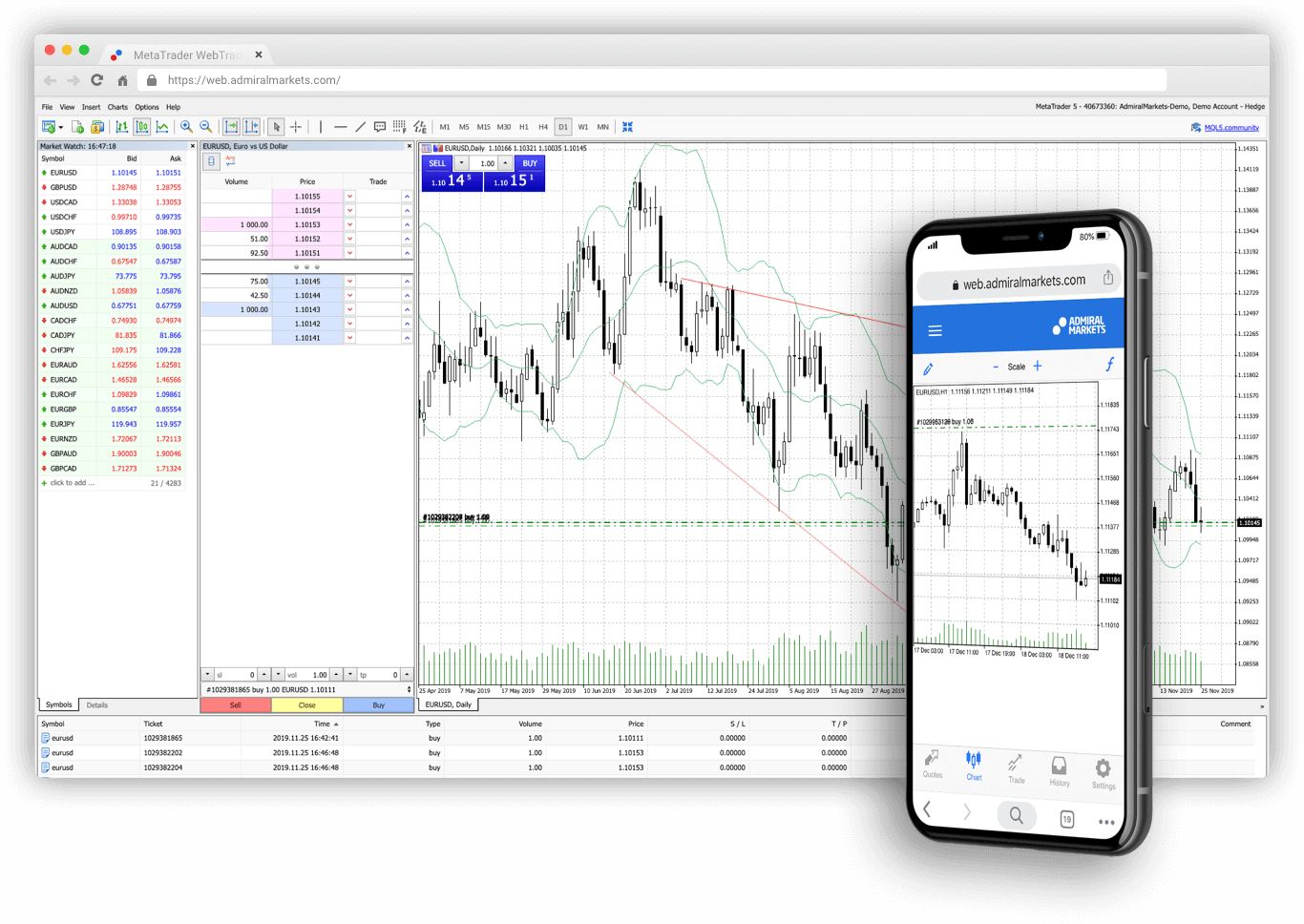

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs, bonds, or cryptocurrencies. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Trade and invest in 8,000+ markets today

Forex

47 cfds on currency pairs

Indices

20 index cfds, including cash cfds and index futures

Shares

3000+ share cfds, as well as the ability to invest in thousands of shares

Commodities

Cfds on metals, energies and agriculture commodities

Bonds

US treasuries and germany bund cfds

380+ ETF cfds, plus hundreds of etfs available through invest.MT5

Cryptocurrencies

Cfds on bitcoin, dash, ether, litecoin, monero and more

Top trading conditions

Trade our best conditions yet, including some of the market`s most competitive spreads!

- Leverage up to:

- Retail clients: 1:30 - 1:20

- Professional clients: 1:500 - 1:10

- Forex typical spreads from 0.5 pips (EURUSD), micro lots and fractional shares

- Commission-free stocks and funds via cfds

- Free real-time charts, market news and research

- 4,000+ cfds on currencies, energies, metals, indices, stocks & digital currencies

- 4,500+ single shares and etfs

try it on demo

Why choose admiral markets?

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

Try demo trading

Not sure how to start? We`ve got you! Start practicing trading with virtual funds on the admiral markets demo trading account.

Get in touch

More questions? Contact us today!

- Account types

- Deposits & withdrawals

- Admiral markets pro

- Professional trading terms

- Demo account

- Stocks and etfs cfds

- Islamic forex account

- Trading calculator

- Fees

- Documents & policies

- Trading app

- Forex

- Commodities

- Indices

- Shares

- Etfs

- Bonds

- Digital currencies cfds

- Contract specifications

- Margin requirements

- Volatility protection

- Pro.Cashback

- Invest.MT5

- Admiral markets card

- Forex & CFD webinars

- FAQ

- Trader`s glossary

- Forex & CFD seminars

- Risk management

- Articles & tutorials

- Zero to hero

- Forex 101

- Trading videos

- E-books

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets cyprus ltd or admiral markets PTY ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

All references on this site to ‘admiral markets’ refer jointly to admiral markets UK ltd, admiral markets cyprus ltd and admiral markets PTY ltd. Admiral markets’ investment firms are fully owned by admiral markets group AS.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Forex site

So, how do you find out which forex pair and time frame is best to trade?

It uses no indicators, but the trend is determined by pure price action.

Avoid struggling with the erratic market chaos when the trend direction is unclear. Take only confident trades in the best markets at the current time.

You would be the one knowing which one particular (even exotic) pair is trending while other traders wouldn't notice it without this tool. Knowledge is power!

Forex trendy is a much more sophisticated application capable of recognizing the most reliable continuation chart patterns. It scans through all the charts, on all time frames and analyzes every potential breakout . After considering the reliability of the pattern it tells you something like this:

And you see the chart with the trend lines forming the triangle and the breakout point – all that clearly drawn for you . The trend line looks solid with many touching points, so you are prepared for the massive breakout. Something you would miss unless you have supernatural powers to watch and analyze all the charts! Such events happen very rarely in one single chart. It's not just drawing trendlines, but it's actually looking for reliable patterns formed by strong trendlines having more than two touching points at a certain distance.

Not familiar with chart patterns and these fancy names? You will get the 30-page ebook with tons of real examples "understanding the myths of market trends and patterns" right after subscribing!

Trade with comfort on any device

Whether it`s windows or mac, android or ios, it doesn`t matter – we`ve got you covered!

Invest from just €1

Sign up for unlimited access to 4,000+ stocks from the new york stock exchange, nasdaq, FTSE and more - all without paying markups, rollovers, management or ticket fees.*

Some of the trademarks reflected on this page might be under trademark protection. Admiral markets does not have any direct relationship with the owners of these trademarks.

How it works

Register

Sign up with your name and email address to start trading

Start investing from €1, and start trading from just €100

Trade

Log in and start trading more than 8,000 instruments!

Trading

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs, bonds, or cryptocurrencies. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs, bonds, or cryptocurrencies. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Trade and invest in 8,000+ markets today

Forex

47 cfds on currency pairs

Indices

20 index cfds, including cash cfds and index futures

Shares

3000+ share cfds, as well as the ability to invest in thousands of shares

Commodities

Cfds on metals, energies and agriculture commodities

Bonds

US treasuries and germany bund cfds

380+ ETF cfds, plus hundreds of etfs available through invest.MT5

Cryptocurrencies

Cfds on bitcoin, dash, ether, litecoin, monero and more

Top trading conditions

Trade our best conditions yet, including some of the market`s most competitive spreads!

- Leverage up to:

- Retail clients: 1:30 - 1:20

- Professional clients: 1:500 - 1:10

- Forex typical spreads from 0.5 pips (EURUSD), micro lots and fractional shares

- Commission-free stocks and funds via cfds

- Free real-time charts, market news and research

- 4,000+ cfds on currencies, energies, metals, indices, stocks & digital currencies

- 4,500+ single shares and etfs

try it on demo

Why choose admiral markets?

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

Try demo trading

Not sure how to start? We`ve got you! Start practicing trading with virtual funds on the admiral markets demo trading account.

Get in touch

More questions? Contact us today!

- Account types

- Deposits & withdrawals

- Admiral markets pro

- Professional trading terms

- Demo account

- Stocks and etfs cfds

- Islamic forex account

- Trading calculator

- Fees

- Documents & policies

- Trading app

- Forex

- Commodities

- Indices

- Shares

- Etfs

- Bonds

- Digital currencies cfds

- Contract specifications

- Margin requirements

- Volatility protection

- Pro.Cashback

- Invest.MT5

- Admiral markets card

- Forex & CFD webinars

- FAQ

- Trader`s glossary

- Forex & CFD seminars

- Risk management

- Articles & tutorials

- Zero to hero

- Forex 101

- Trading videos

- E-books

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets cyprus ltd or admiral markets PTY ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

All references on this site to ‘admiral markets’ refer jointly to admiral markets UK ltd, admiral markets cyprus ltd and admiral markets PTY ltd. Admiral markets’ investment firms are fully owned by admiral markets group AS.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Compare forex brokers

Forex brokers are the connection between you and forex trading. By using a broker, you can trade currency pairs on one of the most popular trading markets in the world. While there are many available to choose from, all offering many different features, it can be daunting when it comes to choosing the right one to invest with.

The hardest part can be negotiating the sheer number of brokers offering their services across the world. With many based in one country and licensed in another, and offering many different languages, you can spend much of your time just searching through the information available. It can be hard to know where to start, which is why we are here to help.

From checking that a broker has licensing from a legitimate source to checking what features each one offers, there are many factors to consider. Starting with a checklist of what is important to you can be an excellent place to begin. You can then use our extensive research, reviews and recommendations to help you draw up a shortlist of brokers before you decide on the one for you.

In this article, you will learn:

The various features offered by a forex broker what welcome and deposit bonuses are offered how to choose the right broker site for you

Top rated forex sites

Risk warning: the products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad disclosure: some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

What makes a great broker

First and foremost, the critical requirement for a broker is that they invoke trust. As an online service, this is not always easy. How do you know that you can trust a forex broker with your money? There are several ways to find a company that you can rely on:

Licensing and regulation

This is one of the best ways to assess if a broker can be trusted. A licensed and regulated broker has to adhere to standards and regulations to be allowed to offer their services in a particular country. There are many types of licensing to look out for including cysec (cyprus), FCA (UK) and ASIC (australia).

Ease of using the platform

Is the platform easy to use? Ease of use is high on the list of criteria when choosing a broker. You need to ascertain if they offer an excellent mobile trading experience and that this extends to all types of devices. Look for a compatible app or at least a superb mobile enhanced website.

Bonuses and incentives

If you are new to forex trading, a welcome bonus is an excellent incentive offered by many brokers. Sometimes it takes the form of a no deposit bonus giving you free money to trade with. Other bonuses offered include a deposit bonus which matches up to 100% of the funds that you deposit. This is an excellent way to build your capital or try new assets or trade types.

Free demo accounts

The demo account is high on the list for many traders as it allows you to get to grips with a trading platform before you continue any funds. While trading takes place in a virtual environment with virtual funds, it is a great way to find your way around and learn the ropes.

The terms and conditions, the number of currency pairs available and the education tools are also high on many traders list of requirements. When looking for a great broker, you are looking to ensure that they tick all of these boxes. In addition to this transparency is vital. Sometimes it can be hard to find the information that you are looking for. A good broker will ensure that all the information, including customer support, is easy to find and displayed on their website.

I'll find you an awesome forex site in seconds. Ready to go?

What type of device do you trade on?

What style of financial bonus suits you best?

How fast do you want to withdraw profits?

What amount are you thinking to deposit?

I'm checking 75+ sites to find your best match.

Risk warning: the products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad disclosure: some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

Bonus and welcome deals

While a bonus or welcome incentive is an essential factor for many traders, you need to consider if this is important to you? Are you likely to choose your broker based on the bonus that they offer? Now many forex brokers offer bonuses to incentivise people to open an account and make an initial deposit. Once you make a deposit they will often match this or offer a percentage of your deposit as a bonus.

Some brokers go one step further and give you a bonus before you deposit any funds. These bonuses vary significantly between brokers with some not offering one. While some may provide a flat bonus based on a minimum deposit, others will offer a percentage ranging from 10% to 100% of your deposit. A welcome bonus is an excellent way to get to grips with trading as it allows you to trade without risk.

Having these usable funds means that you can get used to trading on the website and make your early mistakes (if any) without risking losing your own money. It is important to note though that once you have received your welcome bonus, you can't just withdraw it. Often you need to trade it a minimum number of times before you can remove it. After the first deposit bonus, many brokers will offer deposit bonuses to incentivise you to keep on trading.

Ideal broker features

The best forex broker sites are all competing for your business in a very competitive market place. Therefore they need to ensure that they offer the best features and incentives for you to trade with them.

For many, the biggest draw is a deposit bonus while for others, it is the analytical tools or whether the platform offers a virtual demo account. Not all brokers offer a free demo account, some will offer them once you have made a deposit, but this is a common feature of a broker as it allows you to get used to trading on the platform with virtual money before you make a deposit.

If you are looking for a broker that offers the best trading platform, then you should check that they offer mobile trading and that you can trade on any device. For many, it is essential to be able to trade on the move whether that be on a smartphone or tablet.

So what are the most popular broker features that most traders look for?

Licensing and regulation from a reputable source good mobile trading experience on ios and android across multiple devices ease of use of the platform forex analytical and education tools demo trading platform with virtual funds automated trading so that you can trade without being online welcome or deposit bonus good customer support

You will have your list of criteria when it comes to making your choice, and once you have made this list, you can shortlist those that offer the features that you are looking for. We provide you with information with a list of criteria already researched and analysed to make the information more straightforward for you to filter.

So what are the most popular broker features that most traders look for?

Finding the best brokers

Whether you are new to forex trading or have a little more experience, finding the right broker can often be the hardest part of your trading experience. Before you even get to grips with spread betting, currency pairs, the various analytical tools, and how to get the best out of trading you are faced with the finding the best broker. There are lots of good brokers, all who offer multiple benefits.

First, you need to decide which of the available features are essential to you. Are you more interested in the bonus than the trading experience for example? While it may all seem like a lot of time and effort to spend researching the various brokers; help is at hand. We have done all of the hard work for you with our team of experts spending their time studying and analysing every single broker. They carry out this research by using their own trading experience to trade with each broker.

In addition to this, our experience of the financial markets allows us to ensure that the brokers we recommend are trustworthy, licensed and regulated and a safe place to invest your money. If we put our name to a broker then it is because we have thoroughly vetted every aspect of trading with them. We then share this information with you enabling you to put together a shortlist before deciding which one to conduct your forex trading with.

So, let's see, what we have: list of forex trading websites for this year by top10forex. Find the list of best forex trading sites and online trading options. At forex site

Contents of the article

- New forex bonuses

- List of top forex trading sites

- Forex factory

- Fxstreet

- Forexlive

- Alphaville

- Trading NRG

- Forextv

- Netdania

- Currensee

- Fxtechstrategy

- Dailyfx blogs

- The 11 best forex websites

- 11 best websites to learn forex trading

- 1. Etoro trading school

- 2. Babypips

- 3. Bloomberg

- 4. Dailyfx

- 5. FOREX.Com

- 6. Forexfactory

- 7. Fxstreet

- 8. Investing.Com

- 9. Investopedia

- 10. Tradingview

- 11. Udemy

- Final thoughts

- Trade major US tech stocks this earnings season

- Why are traders choosing FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Open an account in as little as 5 minutes

- Try a demo account

- The 11 best forex websites

- 11 best websites to learn forex trading

- 1. Etoro trading school

- 2. Babypips

- 3. Bloomberg

- 4. Dailyfx

- 5. FOREX.Com

- 6. Forexfactory

- 7. Fxstreet

- 8. Investing.Com

- 9. Investopedia

- 10. Tradingview

- 11. Udemy

- Final thoughts

- Trade with the global forex trading specialist

- Why FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Not sure where to start?

- Open an account in as little as 5 minutes

- Try a demo account

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- Trade with comfort on any device

- Invest from just €1

- How it works

- Register

- Trade

- Trading

- Metatrader: the #1 tool for traders and investors...

- Trade with admiral markets mobile app

- Metatrader webtrader platform

- Metatrader: the #1 tool for traders and investors...