Get funding for forex trading

If a trader has 5.0 lots in open positions and has 7.0 lots of pending orders this is a breach of the maximum trade size rules because the aggregate of all open and pending orders is 12.0 lots.

New forex bonuses

Your stop loss order, if triggered, must keep your account balance above your current available drawdown limits, whether that be the weekly loss limit or the trailing maximum loss limit. This is known as a ‘valid stop loss’ order.

Forex t4tcapital trading programme

$25,000 – $50,000 – $100,000

Single signup fee – no subscription!

Unlimited time to reach profit target!

TRADE FOREX, EQUITY INDICES, GOLD & OIL

How it works

Find out how our t4tcapital trading programme can work for you.

Trading rules

The key to success is understanding the rules of engagement.

All your questions answered. Use the webchat at the bottom for support.

Reset account

In the dreaded draw down or breached a limit – you can reset here.

Forex t4tcapital™ trading programme

Anyone can get funded!

GET FUNDED

HOW IT WORKS

Our forex t4tcapital™ trading programme has been created for everyone, whether you are new to trading or a veteran trader that wants to trade the foreign exchange market without risking their own capital. If you have never traded forex before we highly recommend taking our diploma in professional forex trading, our foundation online forex trading courses or one of our in-person fast track forex workshops, where you will get a USD$100,000 practical assessment included and an easy guide to passing the practical assessment. If you are a seasoned forex trader then you simply select the account size you wish to trade and get started straight away.

PROVE YOU CAN TRADE

PROVE YOU CAN TRADE

Prove you can trade by reaching our profit targets without breaking our rules of engagement.

It’s that simple!

TRADE OUR ACCOUNTS

TRADE OUR ACCOUNTS

Once you have passed the practical assessment you will then be allocated one of our accounts to trade and start making up to 80% of your profits.

PROVE YOU CAN TRADE

PROVE YOU CAN TRADE

Account selection and pricing for the assessment stage

Select a suitable evaluation account. This account will be a demo account trading with virtual money. Choose wisely as this account will be the same account you are funded with if you successfully pass the assessment. To pass the assessment you simply need to comply with the ‘rules of engagement’ and reach the specified profit target for the account size chosen. There is no time limit.

No monthly subscription – no time limit to achieve the profit target – no complicated rules

Select your practical assessment:

$100,000 account parameters

| starting balance: | $100,000 |

| profit target: | $10,000 |

| weekly loss limit: | $2,000 |

| maximum loss limit: | $4,000 |

ONE PAYMENT – NO MONTHLY SUBSCRIPTION

USD$350

UNLIMITED TIME TO ACHIEVE YOUR PROFIT TARGET

$50,000 account parameters

ONE PAYMENT

USD$250

$25,000 account parameters

ONE PAYMENT

USD$199

Understand the basic rules

Drawdown limits

Weekly loss limit

At the commencement of your practical assessment, the weekly loss limit is set at:

- $500 for the $25,000 account

- $1,000 for the $50,000 account

- $2,000 for the $100,000 account

The purpose of the weekly loss limit is to protect last week’s profits. The weekly loss limit remains static from the monday open until the friday close of trading. At the end of each trading week, the weekly loss limit is re-calculated on the account balance at 5 pm new york on friday. On the monday open, the weekly loss limit is reset according to your new balance. The weekly loss limit stays in play throughout the lifecycle of the trading account.

If you hit or exceed the weekly loss limit, with either realized or unrealized P/L at any time during the trading week, (monday to friday) your account will be disabled. Any open trades may not be auto-liquidated; however, you will become ineligible for funding. To continue with the opportunity for funding, your practical assessment account requires a reset.

The weekly loss limit stays in play throughout the lifecycle of the trading account.

Maximum loss limit

T the commencement of your practical assessment, the trailing maximum loss limit is set at:

- $1,000 for the $25,000 account

- $2,000 for the $50,000 account

- $4,000 for the $100,000 account

The purpose of the trailing maximum loss limit is to protect your overall profits. The trailing maximum loss limit (as the name implies) trails your highest account balance throughout the practical assessment. If you add profits, the maximum loss limit also moves higher. If you have lost money, the trailing maximum loss limit remains the same as the previous day.

If you hit or exceed the trailing maximum loss limit at any time, with realized or unrealized losses, your account will be disabled. Any open trades may not be auto-liquidated; however, your account will become ineligible for a funding. To continue with the opportunity for funding, your practical assessment account requires a reset.

Trading rules

Maximum aggregate trade size

The maximum ‘aggregate’ trade size is the aggregate of all open positions and all pending orders.

Note: the maximum trade size depends on what account you selected (see table above). You can trade the maximum trade size from the outset.

If you want to leave pending orders and you already have open positions, then you must ensure that the sum of all open positions plus potential pending orders does not breach the maximum position size.

Example: $100K account has maximum trade size of 10.0 lots

If a trader has 5.0 lots in open positions and has 7.0 lots of pending orders this is a breach of the maximum trade size rules because the aggregate of all open and pending orders is 12.0 lots.

A stop-loss order must be attached to every open position or pending order

Every time you open a position or place a pending order in the market it must have a valid stop loss attached to it!

Why pending orders? Because the entry order could be triggered and with no stop loss attached that could result in the entire account being lost.

Your stop-loss orders cannot exceed your available limits

Your stop loss order, if triggered, must keep your account balance above your current available drawdown limits, whether that be the weekly loss limit or the trailing maximum loss limit. This is known as a ‘valid stop loss’ order.

If your stop loss orders on your open positions or pending orders are ‘not valid’ then your account is automatically in breach of the rules.

For example: if you only have $1,000 available on your maximum drawdown limit then opening a position with a stop loss that would generate a $5,000 loss if hit, is not acceptable. It is ‘invalid’ and would be an immediate breach of the rules even if the open position is in profit!

If you have multiple positions, the cumulative sum of all stop-loss orders must not exceed your current available drawdown limits.

If you do not have a valid stop loss order attached to your open positions your practical assessment will be suspended immediately regardless if your position is in profit or loss and you will need to be reset to be eligible for funding.

If you breach this rule with a live t4tcapital account, your account will be closed immediately, and your outstanding profits will be split according to the profit share.

Example of a valid stop loss order:

Let’s say you have a $2,000 drawdown limit available.

You open a 10 lot position on EURUSD with a 20 point stop loss. If the stop loss is hit the account will lose $2,000.

That’s right on the drawdown limit. That is OK.

Example of an invalid stop loss order with one position:

Let’s say you have a $2,000 drawdown limit available.

You open a 10 lot position on EURUSD with a 25 point stop loss. If the stop loss is hit the account will lose $2,500.

That’s $500 more than the drawdown limit. This is a breach!

Example of an invalid stop loss order with multiple position:

Let’s say you have a $2,000 drawdown limit available.

You have 4 open positions of 2.5 lots on EURUSD with a 30 point stop loss on each. Each stop-loss equates to a $750 loss if it is triggered.

If all stop-loss orders are hit the account will lose $3,000. (4 x $750 = $3,000)

That’s $1,000 more than the drawdown limit. This is a breach!

As soon as our team identifies you have overexposed the account your practical assessment will be suspended immediately.

All open positions must be closed & any pending orders cancelled before 7 pm GMT friday

You are not permitted to hold positions over the weekend. All positions need to be closed out no later than friday 7.00pm GMT/UTC.

If you have an open position over the weekend you will require a reset to continue to be eligible for funding.

You are permitted to trade at all other times except if T4T management halts all trading due to ‘unforeseen highly volatility international events’. In this case, T4T management will notify you directly about the trading halt.

If you breach any rules or drawdown limits you need to pay a reset fee to continue trading

If you breach any rules or drawdown limits, you’ll need to reset your trading account to continue to be eligible for funding. The reset costs $199 and your account will be reset to its starting balance regardless of your account balance at the time of the breach.

We expect our traders to be honest. Once a trader hits a profit target our team will be reviewing all trading activity prior to funding the accounts.

If we find backdated rule breaches your account will be ineligible for funding. So, it makes sense if you breach any rules, notify our team straight away and reset your practical assessment. It will save a lot of heartache by having you make the profit targets only to be informed that your practical assessment account needs to be reset.

Stop trading small accounts

The world’s best subscriptions based FX trading solution. Fundisus provides all participants with funded accounts to access the spot market.

Who are we?

Fundisus is a revolutionary proprietary trading solution. Fundisus has years of industry knowledge and makes use of cutting-edge proprietary trading techology; thus, we are on active trading firm which understands the needs of traders in the market.

We offer $50,000 to start trading forex market with

Traders are compensated on a profit split basis only.

Our funded accounts are EA compatible

Fundisus

Let us tell you more

Your personal liability is limited to your subscription payment.

As all funding is provided by the firm, traders do not risk any of their own trading capital. Even if losses are incurred, the firm will still bear the costs. There are no other trading accounts available that offer this trading opportunity. Use a real account instead of a practice trading account. Preserve your own capital when speculating in FX trading.

Why choose fundisus?

Anyone can trade forex with a capital now.

4 easy steps

Data collection

Total damage has been caused by the civilians arounf the new apple store at wall street.

Guaranteed ROI

Total damage has been caused by the civilians arounf the new apple store at wall street.

Always online

Total damage has been caused by the civilians arounf the new apple store at wall street.

All professional traders start with a $50K trading book, regardless of their background, experience or track record. We give all our traders an equal opportunity to prove themselves as a profitable trader, or have artificial intelligence trading software manage their account hands-free. Profit withdrawals of 5% blocks are independent from the growth targets of 10%.

If you can make a 10% return on your $50K trading book – growing your account to $55k – we will double your initial funding to $100k, or $105k net. The 10% amount of $5k must be maintained in the account and may not be withdrawn. This is independent of any 5% profit withdrawals. Traders have to separately maintain the 10% for the growth target.

If you can make another 10% return on your $100K trading book – growing your account to $115k net – then we will double your account value once again, up to $200k, or $215k net. Again, the $15k amount must be kept in the account.

For the final stage, you must make 10% once again on your $200K trading book, giving you a net of $235k. If you can succeed here we will allocate $1million to you and you will have the opportunity to interview for a fund manager position.

The best funded trader program of 2021

Funded trading accounts offer the best of both worlds. You can make money doing something you love, while at the same time not risking any of your capital. A funded trader program is especially appropriate for beginners. But what is the best funded trader program? Let's go through the list of all providers, their pros and cons.

Transparency: we may get compensated when you click on links in this article.

Best funded trader programs

- Best for trading futures: topsteptrader

- Best for trading forex: topstepfx

- Best newcomer: earn2trade

What makes a good funded trader program?

Good funded trader programs help you to get started by offering education, webinars, and support. At the same time, excellent institutional-grade trading platforms and trustworthy funded trading account partners are important.

Are funded trader accounts worth it?

The main benefit of funded trader accounts is the limited risk factor. There is a small monthly fee for real-time data and the platform. In return, you gain access to a funded account once you proved that you have the right skills needed to be successful. Once you got funded, you keep up to 80% of the profit and request a payout to your checking account.

7 best funded trader programs

1. Topsteptrader

As an industry leader and one of the fastest-growing companies in the united states, topsteptrader has the brand-power and reputation that traders trust. To participate in its funded account program, you first need to complete the trading combine. Here, you enter a real-time simulated futures account with $30,000 to $150,000 of paper currency to test if you're ready for the real thing.

- You can apply the software, make profits and control against large drawdowns

- You show consistent profitability and manage risk in the process

- Complete steps 1 and 2 in at least 15 days

Other requirements include:

- You meet your accounts profit targets

- You only trade permitted products during permitted times

- You do not hit or exceed the daily loss limit

- You do not hold positions into major economic releases

- You follow topsteptraders scaling plan

So let's assume you have what it takes. Once you complete the trading combine, you enter the funded trader program. Here, the topsteptrader team allocates capital to your account and lets you trade in real-time with zero personal risks.

So what happens when you start trading?

- You keep your first $5,000 in profits and 80% thereafter

- You can expand your asset-base to include trading EUREX products

- You can withdraw your profits at any time, and there is no wire fee for withdrawals over $500

- Your trades have zero commissions and zero clearing fees using tstrader.

Topsteptrader discloses the official company name and address on their website: topsteptrader, LLC, 130 south jefferson suite 200, chicago, illinois 60661.

We recommend starting with the free trial topsteptrader provides.

Limited time offer

- Topsteptrader 20% discount (automatic discount on all account sizes - ignore the popups on their site, my automatic discount is higher)

For a detailed look at the entire service, check out our complete topsteptrader review.

2. Topstepfx

Currency specialists rejoice, this one's for you. As the currency wing of topsteptrader above, topstepfx funded accounts have the same eligibility requirements. First, you need to complete the trading combine and demonstrate you can apply toptrader's software, implement a winning strategy and manage risk at the same time.

It's a necessary step to ensure that toptrader's capital is safe in your hands. Once you start trading, you keep your first $5,000 in profits and take home 80% of your winnings thereafter. You can also withdraw your profits at any time, and there is no wire fee for withdrawals over $500

Now, what separates topstepfx from topsteptrader?

Well, topstepfx funded account balances include buying power of up to $500,000.

And how is this done? In a word - leverage. Currency positions have leverage ratios as high as 100:1. Compared to topsteptrader, the excess leverage with topstepfx is extremely risky. However, as we mentioned, it's not your money.

With topstepfx financing the positions, you can always trade risk-free without worrying about reprisal. Keep in mind, you do need to prove your skills first. If you're a profitable currency trader that lacks the capital to make major moves, a topstepfx funded trader program may be just what you're looking for.

Topstepfx belongs to topsteptrader, and their company name, address and phone are visible on the website: topsteptrader, LLC 130 south jefferson suite 200 chicago, illinois 60661.

Limited time offer

- Topstepfx 20% discount (automatic discount on all account sizes - ignore the popups on their site, my automatic discount is higher)

For a top-to-bottom rundown of all the service has to offer, see our topstepfx review.

3. Earn2trade

Earn2trade offers two different funded trading programs. The gauntlet program and the gauntlet mini program.

The regular gauntlet program is focused on trading the futures market, where you manage a $25,000 virtual account for 60 days. During this time, you have to trade at least 30 calendar days and once per week. Your target is to reach the 10% profit target and never hit the 10% maximum drawdown.

Successful candidates receive a guaranteed funding offer from their partner helios trading partners.

The new gauntlet mini is a program similar to topsteptrader and oneup trader. You pay a monthly fee, and you have to trade according to the rules. Trading lessons, webinars, and access to journalytix (TM) are included in the monthly price.

After completion, you receive an offer for a funded trading account. Both programs come with an 80%/20% profit split, where you keep the 80%.

The company behind is earn2trade LLC, with a registered office in 30 N gould st. STE 4000, sheridan, WY 82801.

Limited time offer

- Earn2trade 50% discount on the 50k account, 20% discount on any other account sizes.

You find all details and a platform walk-through in the comprehensive earn2trade review.

Let's get it straight, the list of the best funded trader programs already ends after the top 3. Topsteptrader, topstepfx and earn2trade programs begin at about $100 per month. All of the following funded trading account providers offer educational packages along with a potential option to let you trade a funded account at some given time.

Those vendors ask you to pay prices from $2,000 all the way up over $15,000, and some of them do not reveal their company address.

If you are looking for a funded trader account with an excellent price-performance ratio, you may focus on the top 3:

- Topsteptrader (futures trading) topsteptrader free trial or 20% off (automatic discount at the checkout - ignore the popups on their site, my automatic discount is higher)

- Topstepfx (forex trading) topstepfx 20% discount (automatic discount at the checkout - ignore the popups on their site, my automatic discount is higher)

- Earn2trade (futures trading) earn2trade 20%-40% discount (discout applied automatically).

4. Oneup trader

Whether if you just starting out or a seasoned professional, onup trader offers a platform where you can showcase your skills and make some money along the way.

There are two steps to get started:

- Get evaluated

- Get funded

The evaluation process begins with oneup's trading evaluation program. The team puts you through a real-time day trading simulator where you can trade, track, measure and showcase your abilities.

Once you pass the evaluation, you get introduced to oneup's funding partners. Once you start trading, the first $8,000 in profits are yours to keep, and after that, you take home 80% of all winnings.

What are some other benefits?

- Choose funding options from $25,000 up to $250,000

- Simplified funding goals with no hidden fees or fine print

- Trade from home, your favorite coffee shop or wherever you want

- Advanced analytics and data that help you become more successful

- Discuss, collaborate and share ideas with one-up trader's community members

- Full transparency and disclosure regarding all services and requirements

Unfortunately, oneup trader does not disclose any information about the company and their address and contact data on the website. Also, there is no information available on what company will fund your account and how many traders got funded so far.

The oneup trader review covers every detail about the funded accounts, but again, the missing information about the company details and ways to contact them should let you become more cautious.

5. Maverick trading

As one of the top prop trading firms out there, maverick trading offers the opportunity to learn from its experts and - if you have what it takes - join the firm as a full-time trader.

Specializing in equities, options and forex, the team offers support, technology and training that help you every step of the way.

So how do you get funded?

- Submit your application

- Improve your skills using maverick's trading simulators, tests and strategy courses

- Prove your skills by showing you can implement the trading plan, manage risk and produce profits

- Receive a funded account where you keep 70-80% of your profits and get paid every month.

Through its dedicated team, maverick trading promotes diversity, respect and transparency.

Before officially joining the firm, the team will outline all expectations as well as discuss the inherent risks of day trading.

Compared to the top three above, the pricing is significantly higher since they include more extensive education in their program costs. You need about $6,000 to get started and you need to put $5,000 of your own funds at risk once you get funded.

For more information on what all that means, see the maverick trading review.

6. Try day trading

Trydaytrading can cost you more than $15,000! When you first begin the try day trading funded trader program, the team starts by outlining the two most important ways to reduce risk:

- They assign a professional trading coach that teaches you how to trade

- They provide access to try day trading's proprietary leading indicator software

They also offer a 30-day trial. Anyway, the 30-day trial costs you more than $400. A bit hefty for a trial period! And more than $15,000 for their main service seems to be too expensive. Remember, for that money, you could use topsteptrader's trading combine about 150 times!

There is no company name mentioned on their website, only the address in utah. The google reviews seem to be good at first, but clicking on the details you notice that a curious pattern.

The detailed try day trading review covers all of the bells and whistles.

7. Tradenet

Tradenet is not available to residents in the united states. With four pricing options, you can decide which tradenet funded trader program is right for you. Led by meir barak, the site states that it has educated over 30,000 students worldwide on how to become better traders.

All of the funded account programs come with a 14-day money-back guarantee. That way, you can test out the service risk-free before deciding if you want to continue on. The costs are relatively high compared to the competitors mentioned in this best funded trader program comparison.

Please, also keep in mind that tradenet does not offer those funded accounts themself. Instead, they connect you with investment firms once you purchased one of their educational packages.

I found various addresses; one is limassol cyprus, one in israel and the united kingdom.

If you're interested in learning more about tradenet's funded trader programs as well as its education courses and live trading chat room, check out our tradenet review.

Funded trader program summary

There's no doubt funded trader programs have plenty of benefits. Many providers offer exceptional service and can be a great addition to your trading toolkit. Whether it's access to advanced software or the idea of using someone else's money to trade - funded accounts offer a risk-free way to compete against the best.

More importantly, the knowledge you obtain is invaluable. Considering their own money is at stake, providers will do everything in their power to ensure you succeed. They don't want you draining their bankroll, right?

So what this means for you is:

- Greater guidance,

- Mentorship and

- Coaching compared to other services.

As well, when competing in the arena, you're surrounded by other advanced traders. This will help you increase your skill-set and have you climbing up the ladder in no time.

When deciding between the options above, you really can't go wrong with most of them.

Topsteptrader is the market leader and receives our highest rating, followed by topstepfx, and earn2trade.

I am a bit undecided about maverick trading, tradenet, oneup trader and try day trading. The reason is that for some you have to pay between 2,000 and $16,000 to join their programs, some do not disclose any contact and company details.

Their prices are higher because they included extensive trading education courses in their funded trader programs. So it depends on you what you want to trade and what your focus is. If you are looking purely for a funded trader account, then topsteptrader and earn2trade are the best choices.

If you are looking for excellent education, then I recommend you to read my comprehensive best trading courses blog post. And if you really consider joining the expensive funded trader programs, then make sure to read the detailed reviews first.

Get loan for forex trading: social funding offering financial help to forex investors

Trading in forex market offers a big opportunity for those who would want to make money in this trillion dollar market. If you want a loan to start forex trading, there are a few social funding options you can consider. This article gives you information on where you can find a loan to trade in forex market.

There are many kinds of loan facilities you can get but one area that has not been explored is lending people money to trade in forex. Lenders consider forex trading to be a high-risk market and they try to keep off from this kind of lending. However, through a social funding platform, you can become a member and be able to access loan facilities to start trading in forex.

Forex trading is a lucrative business and people are making a lot of money through this trade. What you need to do is understand the market, read more about trading strategies and market analysis then start trading. It is important to use the free demo accounts provided by many brokers to practice on how to trade. This will give you a hint on how you are likely to fair when you start the real thing.

One big problem that people have when they want to trade in forex is the capital. If you do not have money, it means you cannot trade. However, with the forex trading loans, you can be able to starting trading in this market and get a share of this trillion-dollar market. The good thing about forex trading is that it has been made easy for traders.

You do not have to invest a lot of money in this market. With a couple of tens of dollars, you can trade. All you need is identify the best brokers such as etoro and then register. After registration, you can start practicing with a demo account as you look for the money. Once you have got the money, you can now begin trading.

When trading in forex market, you should understand that there are substantial gains and risks involved. You can earn as well as lose your money. Try to follow the market analysis and move with the trend. There are a lot of resources offering information pertaining to successful forex trading. You can access that information online and learn more about trading in this market.

When you are trading, avoid using a large proportion of your amount. If you have $100 dollars, you can trade with $20 dollars in order to minimize the risks. You can only use a large amount in case you are sure about a particular trade. Nonetheless, it is easy to make money with this trading. Even better, you do not have to trade yourself; you can copy other traders who are succeeding in the trade.

With the copy trader strategy offered by forex brokers, it is helping many people even the inexperienced ones to start making money. If you want to get a forex trading loan

How to get funding for your trading strategy?

So, it’s been some time since you’ve been thinking of making more money out of your successful trading strategy. And why should you not? After all, you’ve worked hard for it and there is only a small % of people who are successful in this business. The idea is to add more funds to your trading strategy and get more profits.

So how do you go about finding more money? Do you ask your family, your friends or vcs? Well, you can do that but it’s slightly more complicated than that. I will try to cover the various options, their intricate nature and all the things you would need apart from your trading strategy to make someone finance your trading.

What you’d need to be ready with?

Before you go asking for money, I'd like you to be ready with some things that will make you look like a serious trader who means business.

1. A good track record

Your strategy has been making money for you. But since when? 3 months? 6 months? And how have you been tracking the performance? What format? Excel sheet? Your handbook? On your broker’s software?. If you’re looking to get serious money from anyone, you’ll need to have at least 2 year’s worth of consistent profitable track record. This is because many people get lucky and are able to have profits for a few months, this doesn’t guarantee that their strategy will work for a longer period.

Anyone who’s going to invest money into something will always be extra cautious. So your track record has to be from a trusted source, here are some online services that you can make use of for keeping a journal of your trades.

Easy to use, trusted by many traders and provides good analytics for your trades and their performance.

Supports a wide variety of brokers based on MT4 platform. Offers decent analytics.

2. Tune it!

If your strategy has made a lot of profits in a relatively short time then probably it also means that your strategy has a larger risk appetite. This is something investors try to avoid, they like to have their money in relatively stable assets. So you’re good, even if you’re able to get consistent single digit % profit year on year with relatively low risk. So tune your strategy to reduce the risk as much as possible.

It is possible that the core or nature of your strategy doesn’t allow you to reduce the risk, that’s also fine, but in this case, it’s a little difficult to get external funding, you’re better off on your own money.

Funding avenues

Now that you have a good track record and have tuned your strategy to get the investment, where do you get your funds from? Here are some ways

Social trading

A lot of social networks related to trading have started in recent years. Many of these networks have functionality to let other people follow you and invest in your trading strategy, what you get out of it is part of the profit or fees from the platform. This could be a good way for you to earn more money out of your successful trading strategy. Here are some of the famous social trading platforms,

Etoro is a global investor community with a significant number of active people. This is like a facebook but for traders. Etoro offers something called as ‘copy people’ , this feature lets other people copy your trading strategy, the platform automatically executes trades for your followers same as your trades just the proportion of position size varies based on the amount of money your followers have put in, the platform also manages risk and exposure based on your strategy.

Here’s a screenshot of how the copy people interface looks like.

Your followers can see all the information they’d require to make an informed decision on whether to follow you or not. This information includes your account’s month of month performance, the average risk taken, the total number of people who copy your strategy, total trades, your portfolio of instruments, average holding time, trades per week etc.

Etoro pays you a certain fee for every follower (or copier in this case) you have.

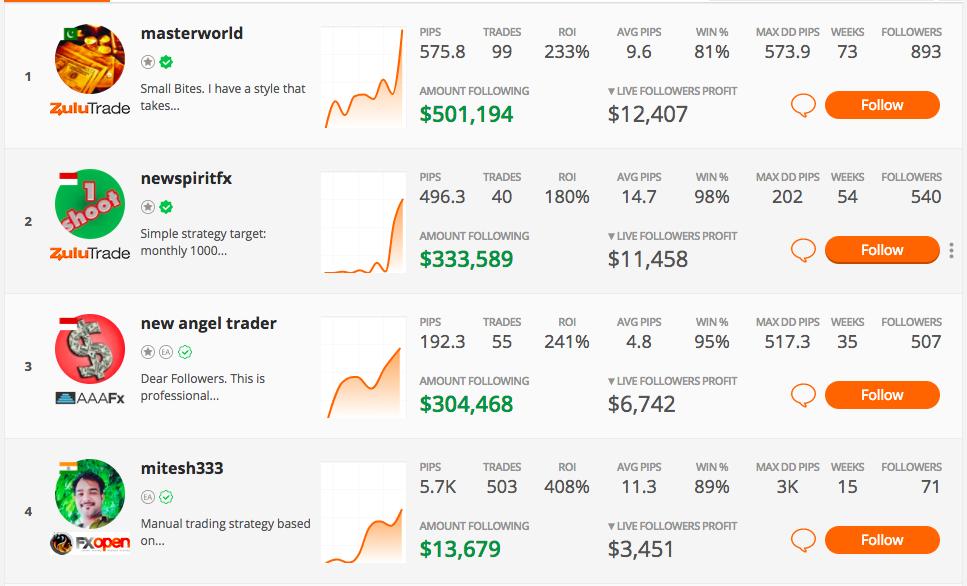

Started in 2007, zulutrade has always put emphasis on social trading, especially in forex social trading. Equipped with thousands of signal providers with a professional and advanced search tool, your followers can analyze your strategy in minute detail, and they can replicate your performance. The best feature would be the ability to customize risk and money management.

Here’s how their social trading platform looks like. It provides all sorts of details one would require to make a trading decision.

The idea is to get as many live followers as you can and when they trade using your strategy you get a cut from zulutrade. The commission starts from $5 per $100k traded in total by your live followers. Pretty decent, eh? Here are more details on their partner program, if you wish to know.

Other benefits of social trading is that you become popular. And popularity has its own value that you can monetize. A popular trader is also an influencer who can tie up with brokers, data-providers, exchanges and other trading services to help these organizations reach out to more people and in turn help you make money outside of your trading. Becoming an influencer is a whole different ballgame maybe we’ll cover that topic separately.

Here are some other social trading platforms - alpari, ayondo, tradeo, darwinex etc. They all offer similar services with similar fees structure. Go ahead, explore!

Compete and win!

If you’re not too keen on social trading, you can look at participating in competitions that allocate huge capital to top performing strategies. Let’s look at some,

Quantiacs holds a competition worth $2.25 million every quarter. Quantiacs is a marketplace for user-generated trading algorithms. They connect trading systems with external capital from institutional investors. Quantiacs is quite well-known in quant community and winning a competition here will surely make you famous. Quantiacs offers toolbox for python and MATLAB to create and backtest your trading systems.

Here’s a screenshot of the currently on-going competition.

There are other similar projects as well, quantconnect and quantopian are such examples. Quantopian has a strong community of quants, a lot of useful discussions happen on the community forum.

All of these sites will offer you a platform either supported by python or MATLAB to help you get your strategy on-board. These platforms will also equip you with historical data, bevy of indicators and economical data to get you started with. You can check them out here quantopian & quantconnect.

Prove your strategy and get funds, simple!

If you think, getting people to follow you and copy your strategy isn’t your cup of tea and you’d rather prefer a direct platform where you just throw numbers and get direct funding. Or you just don’t want to reveal your strategy/trades because it’s the holy grail, well, then that’s possible too.

Here are some platforms that are direct and would be happy to fund your strategy -

Since there are so many of them, I will just focus on the most prominent ones, you can explore the rest in your own sweet off market hours.

Oneup trader focuses on simplifying the funding process. A good platform to connect with investors who are looking to put their money in traders who have proved their worth. Oneup trader works on a monthly fees basis along with profit sharing scheme with investors. State of the art analytics, a community of traders, free data fees and vast funding network are some of their selling points.

With more than 27,000 trading accounts, psyquation has become popular among traders who are looking to step up their game. With its wide investor network, the available capital for funding is quite huge. They have also tied up with a large pool of brokers to provide a seamless trading interface.

Psyquation boasts about their analytics platform that gives you a research based advice. Here’s an overlook of their leaderboard.

Other fundraising platforms:

Next steps

In case you are not looking to get funding for your trading strategy but want to venture as an entrepreneur in this field we have the perfect success story to inspire you. This case study talks about derek and maxime, finance experts from two different nationalities who were connected during quantinsti’s executive programme in algorithmic trading and started their own firm in algorithmic trading domain. Click here to read the story.

INSTANT FUNDING FOR FOREX TRADERS

Take our capital,

Accelerate your funded account up to $1.28 million dollars

What is your trading personality?

LOW RISK

Apply risk measures in your trading to receive a low target for more funding.

AGGRESSIVE

Take the freedom to trade your style with no restrictions.

Trade with high leverage and no mandatory stop orders.

ARE YOU NEW TO THE FUNDING TRADERS' PROGRAM?

Choose your funded account model

Profit target is determined by the profit goal for the current stage, from which the5ers will increase your trading capital responsibility.

Profit is the sum of all realized and unrealized positions including commission and swap charges. Once the target is hit, the trader is requested to close all running trades, and report the achievement to the fund.

It is only for the first stage of the program, the profit target is lower, 6% for the low-risk plans, and 12% for the aggressive programs. With all the rest of the stages, the profit target is 10% for the low risk, and 25% for the aggressive programs.

The equity stopout level is the lowest value of the account allowed. Once the account equity value is below this level, the fund will close all running trades, and disable trading and access.

The stopout level is a fixed value of loss allowance measured from the starting balance account of each level. As much the trader profit in the account, so his/hers loss allowance increases. Example: the starting balance is $10,000, the account is with $200 profit, the equity stopout level is $9,600; this gives the trader $600 loss allowance, if the profit increases to $500, the loss allowance is now $900.

The leverage applied for the trading account. The trader is allowed to utilize the full leverage applied for the account with no further enforcement.

Aggressive programs are set to 1:30 leverage, powers by 30 times the market buying allowance. Low risk programs are set at 1:6 leverage, powers by 6 times the market buying required.

Setting a stoploss for every trade is required when participating in the low risk programs. Only in the low risk plans, each and every position must consist of a proper stoploss at value not greater of 1.5%. The fund risk monitor, allows up to 2 whole minutes for placing a proper stoploss.

Failing to maintain stoploss discipline will result by switching the program to aggressive mode.

The maximum time required to complete the profit target for the first level of the program. To be clear, the maximum expiry time is applied ONLY for the very FIRST stage of the program. In all other progressed levels, there will be NO expiration time limit for active traders.

The maximum number of calendar days is set for 180 for the low risk plans, and 60 calendar days for the aggressive plans.

Once hitting the profit target alone with the rest of the qualification objectives, the5ers will increase your capital responsibility, with all the objectives increased proportionally.

At the first stage accomplishment, you will be receiving 4 times greater from initial capital of your first account. For every other steps (but the first one) the growth upscaling is twice of the last initial capital.

The deal with the5ers is that you bring the trading and we bring all the trading capital, we take the full risk for trading loss - but the profits will be shared with you. We will pay you a commission of 50% of the trading profits.

Payout is issued every month starting the second level of the program. Only at the first stage payout is paid once the stage is fully completed.

Good to know, receiving payouts is never being deducted from your forward progression toward the next milestone. With the5ers you get both the growth and the payouts. No need to decide.

A thought about percentage. Some may say a better percentage offer could be found elsewhere. We say, don’t judge by the percentage - judge by the potential money you actually receive. With our fast growth plan, you are increasing your actual money profit potential much faster than anywhere else.

The5ers guarantees maximum trading capital in funding, which is currently a 1.28 million dollars real funded account.

1.28 million is a big account to manage, however, this is not our final offer for you. Once you accomplish your goal on the 1.28 M account, we will discuss with you further growth and targets.

By signing up for the5ers programs you receive an instant funded account right away, with trading access to the fund’s pool account. We give a fair opportunity for every trader to present his/her trading skills on a real-capital-funded account. We take full responsibility to handle potential trading losses, which should be secured by a one-time participation fee.

Your participation fee is not trading securities. We are not a broker, not representing any financial institutes. Your once-off fee is paying you into the most rewarding funding program experience in the industry.

The fee is not refundable once you had made your first action in the funded account. Remember, you are being assigned to a real funded account from the very beginning. Any profits you will be making will be shared with you eventually.

Of course, we provide much more than just funded accounts. Trading with the5ers is a whole trading experience, including funding, accelerated growth with extreme income potential, full dedicated team of professionals ready to cater to your professional and administrative requirements, we provide education, and trading events, a live trading room, and extensive performance statistics dashboard.

Double capital at profit milestone up to 1.28 million guaranteed!

The5ers offer the most extreme and accelerated growth rate. At every milestone you are acquiring, the5ers will double your initial capital handling, also doubling the trading objectives, in terms of maximum loss allowance (aka equity stop out level), leverage, and stoploss (for applicable programs).

Milestones for the low-risk programs are set to 10% net profit, for the aggressive plans, a 25% target is set.

Trader funding

The 5%ers offer one of the most flexible, rewarding, and lucrative forex trader funding programs in the industry with NO evaluation, instant funding, and low-cost, one-time fees, and the freedom to trade as you wish - because you know how you best trade, and you should not be forced to conform, they tailor your progression based on your profile, whether you are a lower risk or more aggressive trader*

The process

- Quick signup with a one-time fee

- Instant funding, NO evaluation

- Opportunity to QUADRUPLE initial funding with target achievement

- Guaranteed monthly payout

- 50/50 profit share agreement from day 1

- Profit payouts DO NOT affect account growth progression, ever.

- Double funding each time your target is achieved

- 10%/25% targets, depending on risk profile

- Guaranteed up to $1.28 million USD

Why trade with the 5%ers?

Always trade with real money

Everything is done with real money - because there is NO demo trading at any point, it means you can begin earning from day one

Zero risk

There is zero risk to you - you bring the talent, they bring the capital, you both share in the success

Low-cost entry

There are no subscription fees or hidden fees of any kind. Just a one-time fee is all it takes to get started

All traders welcome

Easily achieved milestone targets and flexible trading conditions make the 5%ers an excellent choice for all traders

All trading system/styles

No restrictions are placed on strategy or style. Ever. You know how you trade best - why would they try to change that?

24/7 access

The FX trades 24/5, but the 5%ers also allow you to hold over the weekend, not just overnight, giving you 24/7 access

Monthly payouts

Your profit share is paid out to you monthly, guaranteed, with no minimum threshold and account doubling for every target achievement

Ongoing support

The 5%ers provide excellent support through live chats, email, telephone and forms and even have an on-staff trade psychologist

Metatrader4

The 5%ers use metatrader4 (MT4) - the world's most popular trade-execution platform - exclusively, making it convenient for any trader

Browse all available accounts from the 5%ers below.

Use the toggle to switch between their low-risk account parameters and their aggressive-risk account parameters. Remember, you have the freedom and the flexibility to trade as you wish and they simply tailor your parameters to your style – determined through your actual trading performance. Pretty cool.

A low-risk trader is defined as someone who actively employs risk management techniques in their trading, such as use of stop/losses and lower leverage. These traders benefit from lower targets to achieve fund doubling, but of course, are mandated by consistent use of risk management techniques.

Low-risk funded trader account 1 – $24,000 USD | start with $6,000 USD

Low-risk funded trader account 2 – $40,000 USD | start with $10,000 USD

Low-risk funded trader account 3 – $52,000 USD | start with $13,000 USD

Low-risk funded trader account 4 – $80,000 USD | start with $20,000 USD

An aggressive trader is defined as someone who trades freely, someone who doesn't necessarily follow a strict guide of risk management principles. Benefit from the freedom the 5%ers allow, and trade with total autonomy with an aggressive funded trader account

Can forex trading make you rich?

Can forex trading make you rich? Although our instinctive reaction to that question would be an unequivocal "no,” we should qualify that response. Forex trading may make you rich if you are a hedge fund with deep pockets or an unusually skilled currency trader. But for the average retail trader, rather than being an easy road to riches, forex trading can be a rocky highway to enormous losses and potential penury.

But first, the stats. A bloomberg article in nov. 2014 noted that based on reports to their clients by two of the biggest forex companies at the time—gain capital holdings inc. (GCAP) and FXCM inc.—68% of investors had net losses from trading currencies in the prior year. While this could be interpreted to mean that about one in three traders does not lose money trading currencies, that's not the same as getting rich trading forex.

Key takeaways

- Many retail traders turn to the forex market in search of fast profits.

- Statistics show that most aspiring forex traders fail, and some even lose large amounts of money.

- Leverage is a double-edged sword, as it can lead to outsized profits but also substantial losses.

- Counterparty risks, platform malfunctions, and sudden bursts of volatility also pose challenges to would-be forex traders.

- Unlike stocks and futures that trade on exchanges, forex pairs trade in the over-the-counter market with no central clearing firm.

Note that the bloomberg numbers were cited just two months before an unexpected seismic shock in the currency markets highlighted the risks of forex trading. On jan. 15, 2015, the swiss national bank abandoned the swiss franc's cap of 1.20 against the euro that it had in place for three years. as a result, the swiss franc soared as much as 41% against the euro on that day.

The surprise move from switzerland's central bank inflicted losses running into the hundreds of millions of dollars on innumerable participants in forex trading, from small retail investors to large banks. Losses in retail trading accounts wiped out the capital of at least three brokerages, rendering them insolvent, and took FXCM, then the largest retail forex brokerage in the united states, to the verge of bankruptcy.

Unexpected one time events are not the only risk facing forex traders. Here are seven other reasons why the odds are stacked against the retail trader who wants to get rich trading the forex market.

Excessive leverage

Although currencies can be volatile, violent gyrations like that of the aforementioned swiss franc are not that common. For example, a substantial move that takes the euro from 1.20 to 1.10 versus the U.S. Dollar over a week is still a change of less than 10%. Stocks, on the other hand, can easily trade up or down 20% or more in a single day. But the allure of forex trading lies in the huge leverage provided by forex brokerages, which can magnify gains (and losses).

A trader who shorts $5,000 worth of euros against the U.S. Dollar at 1.20 and then covers the short position at 1.10 would make a tidy profit of $500 or 8.33%. If the trader used the maximum leverage of 50:1 permitted in the U.S. (ignoring trading costs and commissions) the profit is $25,000, or 416.67%.

Of course, had the trader been long euro at 1.20, used 50:1 leverage, and exited the trade at 1.10, the potential loss would have been $25,000. In some overseas jurisdictions, leverage can be as much as 200:1 or even higher. Because excessive leverage is the single biggest risk factor in retail forex trading, regulators in a number of nations are clamping down on it.

Asymmetric risk to reward

Seasoned forex traders keep their losses small and offset these with sizable gains when their currency call proves to be correct. Most retail traders, however, do it the other way around, making small profits on a number of positions but then holding on to a losing trade for too long and incurring a substantial loss. This can also result in losing more than your initial investment.

Platform or system malfunction

Imagine your plight if you have a large position and are unable to close a trade because of a platform malfunction or system failure, which could be anything from a power outage to an internet overload or computer crash. This category would also include exceptionally volatile times when orders such as stop-losses do not work. For instance, many traders had tight stop-losses in place on their short swiss franc positions before the currency surged on jan. 15, 2015. However, these proved ineffective because liquidity dried up even as everyone stampeded to close their short franc positions.

Get loan for forex trading: social funding offering financial help to forex investors

Trading in forex market offers a big opportunity for those who would want to make money in this trillion dollar market. If you want a loan to start forex trading, there are a few social funding options you can consider. This article gives you information on where you can find a loan to trade in forex market.

There are many kinds of loan facilities you can get but one area that has not been explored is lending people money to trade in forex. Lenders consider forex trading to be a high-risk market and they try to keep off from this kind of lending. However, through a social funding platform, you can become a member and be able to access loan facilities to start trading in forex.

Forex trading is a lucrative business and people are making a lot of money through this trade. What you need to do is understand the market, read more about trading strategies and market analysis then start trading. It is important to use the free demo accounts provided by many brokers to practice on how to trade. This will give you a hint on how you are likely to fair when you start the real thing.

One big problem that people have when they want to trade in forex is the capital. If you do not have money, it means you cannot trade. However, with the forex trading loans, you can be able to starting trading in this market and get a share of this trillion-dollar market. The good thing about forex trading is that it has been made easy for traders.

You do not have to invest a lot of money in this market. With a couple of tens of dollars, you can trade. All you need is identify the best brokers such as etoro and then register. After registration, you can start practicing with a demo account as you look for the money. Once you have got the money, you can now begin trading.

When trading in forex market, you should understand that there are substantial gains and risks involved. You can earn as well as lose your money. Try to follow the market analysis and move with the trend. There are a lot of resources offering information pertaining to successful forex trading. You can access that information online and learn more about trading in this market.

When you are trading, avoid using a large proportion of your amount. If you have $100 dollars, you can trade with $20 dollars in order to minimize the risks. You can only use a large amount in case you are sure about a particular trade. Nonetheless, it is easy to make money with this trading. Even better, you do not have to trade yourself; you can copy other traders who are succeeding in the trade.

With the copy trader strategy offered by forex brokers, it is helping many people even the inexperienced ones to start making money. If you want to get a forex trading loan

So, let's see, what we have: get funded. Prove you can trade, no monthly payments, an unlimited time to achieve the profit target with simple rules and a profit share of up to 80%. At get funding for forex trading

Contents of the article

- New forex bonuses

- Forex t4tcapital trading programme

- Forex t4tcapital™ trading programme

- Anyone can get funded!

- GET FUNDED HOW IT WORKS

- Account selection and pricing for the assessment...

- No monthly subscription – no time limit to...

- Select your practical assessment:

- $100,000 account parameters

- USD$350

- $50,000 account parameters

- USD$250

- $25,000 account parameters

- USD$199

- Understand the basic rules

- Drawdown limits

- Weekly loss limit

- Maximum loss limit

- Trading rules

- Maximum aggregate trade size

- A stop-loss order must be attached to every open...

- Your stop-loss orders cannot exceed your...

- All open positions must be closed & any pending...

- If you breach any rules or drawdown limits you...

- Stop trading small accounts

- Let us tell you more

- The best funded trader program of 2021

- Best funded trader programs

- What makes a good funded trader program?

- Are funded trader accounts worth it?

- 7 best funded trader programs

- 1. Topsteptrader

- 2. Topstepfx

- 3. Earn2trade

- 4. Oneup trader

- 5. Maverick trading

- 6. Try day trading

- 7. Tradenet

- Funded trader program summary

- Get loan for forex trading: social funding...

- How to get funding for your trading strategy?

- INSTANT FUNDING FOR FOREX TRADERS

- What is your trading personality?

- ARE YOU NEW TO THE FUNDING TRADERS' PROGRAM?

- Choose your funded account model

- Trader funding

- The 5%ers offer one of the most flexible,...

- The process

- Why trade with the 5%ers?

- Always trade with real money

- Zero risk

- Low-cost entry

- All traders welcome

- All trading system/styles

- 24/7 access

- Monthly payouts

- Ongoing support

- Metatrader4

- Browse all available accounts from the 5%ers...

- A low-risk trader is defined as someone who...

- Low-risk funded trader account 1 – $24,000 USD |...

- Low-risk funded trader account 2 – $40,000 USD |...

- Low-risk funded trader account 3 – $52,000 USD |...

- Low-risk funded trader account 4 – $80,000 USD |...

- An aggressive trader is defined as someone who...

- Can forex trading make you rich?

- Excessive leverage

- Asymmetric risk to reward

- Platform or system malfunction

- Get loan for forex trading: social funding...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.