Real-time virtual fx account

Watch a short video that explains our dual FX display. Currency used to buy/sell the FX pair.

New forex bonuses

FX portfolio - virtual FX position

This section is designed to show activity for currency pair trades for FX traders so that they can track average cost and running P&L on their currency trades. However the "position" value may reflect the sum of trades executed in the FX market along with currency conversions to change non-base funds into your base currency.

Consequently these вђњvirtualвђќ positions do not necessarily reflect an actual cash balance in any currency.

For actual, real-time currency balance, check the total cash field of the market value section.

- To avoid having currency conversions reflected in this panel, use the FXCONV destination on the order line.

- When the FX portfolio panel is displayed, currency positions will also be displayed in the trading window. To remove currency positions from display, condense the FX portfolio panel by clicking the arrow to the left of the panel title.

An exchange on which the pair trades. This may not be the executing exchange for the trade.

The sum of trades executed in the FX market for the selected currency pair.

Unsettled currency trades.

Currency used to buy/sell the FX pair.

(position) x (market price).

Real-time price of the position.

Average price per contract.

The difference between the trade price and the market price times position, including commission.

Example : BUY 20,000 EUR.USD @ 1.54390

Market price (current price) = 1.54385

1.54390 вђ“ 1.54385 = .00005

+ 2.5 commission = -3.50 unrealized P&L

Realized profit & loss for the pair.

Last liquidation "yes" or "no" tag. If set to "yes" this position will be put at the end of the queue to liquidate last in the case of margin requirements. To set, use the right-click menu on the desired position.

Note: while customers have the opportunity to pre-request the order of liquidation in the event of a margin deficiency in their account, such requests are not binding on IB. In the event of a margin deficiency in customerвђ™s account, IB retains the right, in its sole discretion, to determine the assets to be liquidated, the amount of assets liquidated, as well as the order and manner of liquidation. Customers are encouraged to consult the IB customer agreement and the IB disclosure of risks of margin trading for further information.

TWS FX dual presentation

In TWS , IB presents currency/FX position data in two different areas of the account window. We separate out your actual currency values, which may result from FX trades, conversions, or trading products in another currency, from your direct FX pair trading activity.

Market value - real FX balances

Your accountвђ™s actual currency balances are shown in the market value вђ“ real FX balances section of the account window.

FX portfolio - virtual FX position

The FX portfolio section displays your FX trading activity in currency pairs that is helpful for FX traders as it allows tracking of a running P&L and average cost. But, it may also reflect вђњindirectвђќ FX currency conversions designed to close out a non-base currency balance. This view MAY NOT reflect your actual cash balance in any currency. To manage actual currency positions, refer to the market value - real FX balances section of the account window.

Automated FX transaction decision

When you submit an FX order, TWS will attempt to identify whether you want an FX pair trade or a currency conversion, based on your positions and balances, and will ask you how you want the currency trade to be considered. If you elect вђњcurrency conversion,вђќ TWS will create the order to reflect this objective. You submit the order manually, and when the order fills your virtual position in the FX portfolio section will not be affected. Previously, conversions would affect the virtual position and your only option was to manually adjust the position and cost to negate the completed conversion.

If you prefer to let TWS make this determination without displaying the confirmation box, check let TWS make this determination automatically in the future at the bottom of the confirmation box. When you activate this feature, FX trades will display FXCONV as the destination. You can change the destination on a per-order basis by selecting IDEALPRO. To enable the message again, activate it from the messages section of global configuration. Note that the order will not be transmitted automatically.

The account window

The account window lets you monitor every aspect of your account activity. We present "key" account values as the default when you first open the account window (this default view is shown in the illustration below). The account window conveys in real-time values the funds you have available for additional trades and current margin projections.

The account screen is divided into the following sections:

- Balances , which shows your account balances for securities, commodities and in total. These balances don't include margin requirements.

- Margin requirements , which shows your current initial and maintenance margin requirements based on your current positions. Customers under the reg T margin model can compare their current margin to current projected requirements under the portfolio margin model by clicking the try PM icon.

- Available for trading , which tells you what you have for additional trades and cushion before liquidation, based on your balance information and margin requirements.

- Market value - real FX position , which shows the total value of all positions, sorted by currency.

- FX portfolio - virtual FX position , which shows activity for currency pair trades only. The value in the position field only reflects trades executed in the FX market. Please note that these may not reflect real-time FX positions, since non-base currency conversions may also be included.

- Portfolio , which lists all current positions sorted by underlying, and displays the total current market value for each position.

To open the account window

- On the main trading toolbar, click the account icon, or from the account menu select account window .

Advisors and other multi-client account holders will see a drop-down selection on the account and summary tabs to select either an individual account or an account group.

On the account page, elect to display account information for all accounts, any individual account including the master, or a user-defined account group, which includes a subset of accounts (in the image above, group 1 is a user-defined account groups).

On the summary page, choose to view the account summary for all accounts, or for any account group.

Advisors can also print the summary page by selecting print summary from the file menu.

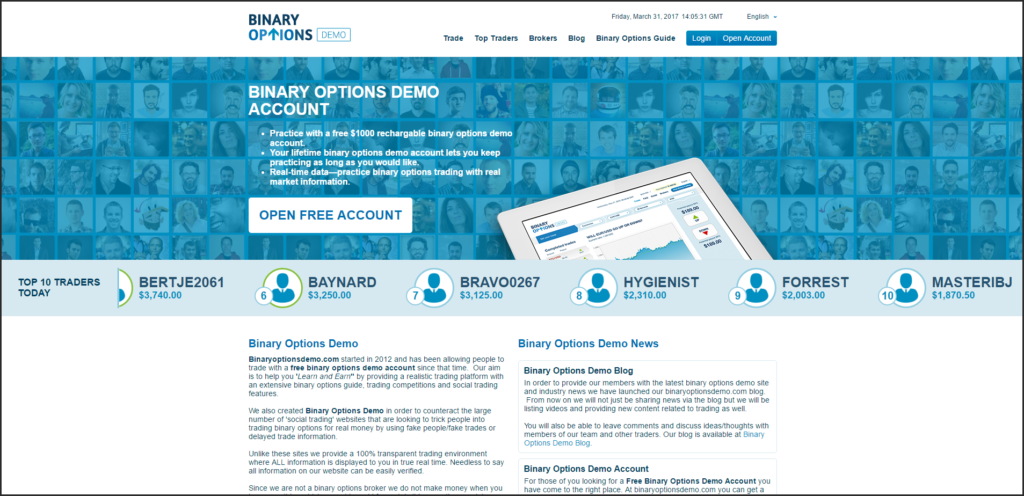

Demo trading account

Develop your trading skills on thousands of markets, and master our award-winning platform for free. 1

Practise trading with £10,000 virtual funds

Get exclusive educational content on IG academy

Test strategies on the go with our free mobile apps

Open a demo trading account

Develop your trading skills on thousands of markets, and master our award-winning platform for free. 1

What is a demo trading account?

A demo account is a simulated market environment offered by a trading provider that aims to recreate the experience of ‘real’ trading as closely as possible. This is so that you can get a feel for how different products and financial markets work. The main difference is you won’t be at risk of losing any money, so you can explore and experiment with confidence.

When you open a demo account with us, you’ll get immediate access to a version of our online platform, along with a pre-set balance of £10,000 in virtual funds to practise with.

Why use a trading simulator?

You can use a trading simulator, such as a demo account, to enable you to get to grips with a platform, build your strategy and grow in confidence, without having to risk any real money.

Trading simulators aren’t just for newcomers. As an experienced trader, you can use demo accounts to try out new strategies, tools or ideas, safe in the knowledge that your experiments won’t result in any real-world losses.

You’ll often see demo accounts described as ‘paper trading’, which is the term to describe simulated securities trading. With an IG demo trading account, you’ll gain access to over 17,000 markets, including:

As well as a range of other markets including bonds, rates and options.

A demo account will enable you to see the financial markets available with IG, and get used to how they behave. You’ll be able to set alerts on markets you want to keep an eye on, so you can react instantly to any price volatility. The demo account will also help you get used to the IG platform, ensuring that you can read and analyse price charts, fill in the deal ticket and monitor open positions.

If you’re interested in using more advanced software, you can also get an MT4 demo account with us. This enables you to build your understanding of the metatrader4 online trading platform in a risk-free environment.

Yes, you can practise stock trading and forex trading for free with an IG demo account. No need to create a separate forex demo account or stock demo account – you can trade both markets via a single login.

With an IG demo account, you can practise CFD trading and spread betting risk-free. These two products both use leverage, which enables you to gain full market exposure for just a small initial deposit. While this can magnify your returns, it can also magnify your risk – so it’s important to get to grips with how they work before you start to trade on live markets.

There is no difference between a demo trading account, trading simulator or paper trading account. All of these terms are just synonyms for the same type of simulated trading platform.

For your country of residence, you may wish to use <

Sorry we cannot open an account for clients with your country of residence through this site. Instead, please visit <

1 awarded ‘best multi platform provider’ and ‘best finance app’ at the ADVFN international financial awards 2020

Markets

IG services

Trading platforms

Learn to trade

Contact us

Spread bets and cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and cfds with this provider. You should consider whether you understand how spread bets and cfds work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, etfs and etcs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG markets ltd, spread betting provided by IG index ltd. IG is a trading name of IG markets ltd (a company registered in england and wales under number 04008957) and IG index ltd (a company registered in england and wales under number 01190902). Registered address at cannon bridge house, 25 dowgate hill, london EC4R 2YA. Both IG markets ltd (register number 195355) and IG index ltd (register number 114059) are authorised and regulated by the financial conduct authority.

The information on this site is not directed at residents of the united states, belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

FX portfolio - virtual FX position

This section is designed to show activity for currency pair trades for FX traders so that they can track average cost and running P&L on their currency trades. However the "position" value may reflect the sum of trades executed in the FX market along with currency conversions to change non-base funds into your base currency.

Consequently these вђњvirtualвђќ positions do not necessarily reflect an actual cash balance in any currency.

For actual, real-time currency balance, check the total cash field of the market value section.

- To avoid having currency conversions reflected in this panel, use the FXCONV destination on the order line.

- When the FX portfolio panel is displayed, currency positions will also be displayed in the trading window. To remove currency positions from display, condense the FX portfolio panel by clicking the arrow to the left of the panel title.

An exchange on which the pair trades. This may not be the executing exchange for the trade.

The sum of trades executed in the FX market for the selected currency pair.

Unsettled currency trades.

Currency used to buy/sell the FX pair.

(position) x (market price).

Real-time price of the position.

Average price per contract.

The difference between the trade price and the market price times position, including commission.

Example : BUY 20,000 EUR.USD @ 1.54390

Market price (current price) = 1.54385

1.54390 вђ“ 1.54385 = .00005

+ 2.5 commission = -3.50 unrealized P&L

Realized profit & loss for the pair.

Last liquidation "yes" or "no" tag. If set to "yes" this position will be put at the end of the queue to liquidate last in the case of margin requirements. To set, use the right-click menu on the desired position.

Note: while customers have the opportunity to pre-request the order of liquidation in the event of a margin deficiency in their account, such requests are not binding on IB. In the event of a margin deficiency in customerвђ™s account, IB retains the right, in its sole discretion, to determine the assets to be liquidated, the amount of assets liquidated, as well as the order and manner of liquidation. Customers are encouraged to consult the IB customer agreement and the IB disclosure of risks of margin trading for further information.

TWS FX dual presentation

In TWS , IB presents currency/FX position data in two different areas of the account window. We separate out your actual currency values, which may result from FX trades, conversions, or trading products in another currency, from your direct FX pair trading activity.

Market value - real FX balances

Your accountвђ™s actual currency balances are shown in the market value вђ“ real FX balances section of the account window.

FX portfolio - virtual FX position

The FX portfolio section displays your FX trading activity in currency pairs that is helpful for FX traders as it allows tracking of a running P&L and average cost. But, it may also reflect вђњindirectвђќ FX currency conversions designed to close out a non-base currency balance. This view MAY NOT reflect your actual cash balance in any currency. To manage actual currency positions, refer to the market value - real FX balances section of the account window.

Automated FX transaction decision

When you submit an FX order, TWS will attempt to identify whether you want an FX pair trade or a currency conversion, based on your positions and balances, and will ask you how you want the currency trade to be considered. If you elect вђњcurrency conversion,вђќ TWS will create the order to reflect this objective. You submit the order manually, and when the order fills your virtual position in the FX portfolio section will not be affected. Previously, conversions would affect the virtual position and your only option was to manually adjust the position and cost to negate the completed conversion.

If you prefer to let TWS make this determination without displaying the confirmation box, check let TWS make this determination automatically in the future at the bottom of the confirmation box. When you activate this feature, FX trades will display FXCONV as the destination. You can change the destination on a per-order basis by selecting IDEALPRO. To enable the message again, activate it from the messages section of global configuration. Note that the order will not be transmitted automatically.

Demo trading account

Develop your trading skills on thousands of markets, and master our award-winning platform for free. 1

Practise trading with £10,000 virtual funds

Get exclusive educational content on IG academy

Test strategies on the go with our free mobile apps

Open a demo trading account

Develop your trading skills on thousands of markets, and master our award-winning platform for free. 1

What is a demo trading account?

A demo account is a simulated market environment offered by a trading provider that aims to recreate the experience of ‘real’ trading as closely as possible. This is so that you can get a feel for how different products and financial markets work. The main difference is you won’t be at risk of losing any money, so you can explore and experiment with confidence.

When you open a demo account with us, you’ll get immediate access to a version of our online platform, along with a pre-set balance of £10,000 in virtual funds to practise with.

Why use a trading simulator?

You can use a trading simulator, such as a demo account, to enable you to get to grips with a platform, build your strategy and grow in confidence, without having to risk any real money.

Trading simulators aren’t just for newcomers. As an experienced trader, you can use demo accounts to try out new strategies, tools or ideas, safe in the knowledge that your experiments won’t result in any real-world losses.

You’ll often see demo accounts described as ‘paper trading’, which is the term to describe simulated securities trading. With an IG demo trading account, you’ll gain access to over 17,000 markets, including:

As well as a range of other markets including bonds, rates and options.

A demo account will enable you to see the financial markets available with IG, and get used to how they behave. You’ll be able to set alerts on markets you want to keep an eye on, so you can react instantly to any price volatility. The demo account will also help you get used to the IG platform, ensuring that you can read and analyse price charts, fill in the deal ticket and monitor open positions.

If you’re interested in using more advanced software, you can also get an MT4 demo account with us. This enables you to build your understanding of the metatrader4 online trading platform in a risk-free environment.

Yes, you can practise stock trading and forex trading for free with an IG demo account. No need to create a separate forex demo account or stock demo account – you can trade both markets via a single login.

With an IG demo account, you can practise CFD trading and spread betting risk-free. These two products both use leverage, which enables you to gain full market exposure for just a small initial deposit. While this can magnify your returns, it can also magnify your risk – so it’s important to get to grips with how they work before you start to trade on live markets.

There is no difference between a demo trading account, trading simulator or paper trading account. All of these terms are just synonyms for the same type of simulated trading platform.

For your country of residence, you may wish to use <

Sorry we cannot open an account for clients with your country of residence through this site. Instead, please visit <

1 awarded ‘best multi platform provider’ and ‘best finance app’ at the ADVFN international financial awards 2020

Markets

IG services

Trading platforms

Learn to trade

Contact us

Spread bets and cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and cfds with this provider. You should consider whether you understand how spread bets and cfds work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, etfs and etcs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG markets ltd, spread betting provided by IG index ltd. IG is a trading name of IG markets ltd (a company registered in england and wales under number 04008957) and IG index ltd (a company registered in england and wales under number 01190902). Registered address at cannon bridge house, 25 dowgate hill, london EC4R 2YA. Both IG markets ltd (register number 195355) and IG index ltd (register number 114059) are authorised and regulated by the financial conduct authority.

The information on this site is not directed at residents of the united states, belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Virtual accounts: real-life benefits in real-time

Proliferation of bank accounts, unreconciled suspense entries and fragmented liquidity are challenges for both domestic and international corporations. Virtual accounts tied with automated liquidity management structures provide a scalable way for treasurers to automate processes and simplify liquidity management whilst concurrently reducing physical bank accounts and streamlining resourcing.

David rego

head of liquidity management and escrow solutions, standard chartered

When asking a treasurer about their business, they typically cite the number of bank accounts as a measure of the scale and complexity of the treasury function. How valid a measure is this, however? Every bank account adds complexity: it needs to be reported on and reconciled, balances managed, and authorised signatories maintained. Every account also has a related cost and represents a potential security risk without adequate oversight over signatories and balances. With virtual accounts and virtual ledger solutions maturing and becoming more interconnected with liquidity management structures, however, we could be seeing a reversal – in which the sophistication and effectiveness of treasury is measured not by how few accounts they have, but by how many virtual accounts they have.

Solutions for every treasury demographic

Treasurers’ desire to reduce the number of physical bank accounts is not new. For example, many larger corporations have set up in-house banks, in which treasury provides banking services such as funding, investment, cash, liquidity and risk management to group companies. As part of an in-house bank, treasurers are increasingly introducing payments on behalf of (POBO) and/or receivables on behalf of (ROBO). Under these arrangements, companies make payments or collect incoming flows ‘on behalf of’ group companies, removing the need for these entities to hold their own bank accounts. These implementations are not frictionless as customers may prefer to pay a local account – while suppliers may challenge or find it difficult to identify and reconcile payments made by an entity different to the one that they invoiced.

The need to simplify and streamline cash and liquidity management is not limited to large multinational businesses. Scalable, accessible solutions are also required by smaller or less mature treasuries that have not yet built sophisticated in-house banking and ‘on behalf of’ structures. Consequently, virtual account solutions emerged, starting with supporting automated reconciliation and moving on to simplifying liquidity management for treasuries of all sizes and levels of sophistication.

Tangible benefits to virtual accounts

Companies can use virtual accounts in a variety of ways to meet their specific needs, whether they operate in one country or many, either as a single solution or in conjunction with solutions such as cash pooling, POBO and ROBO. Virtual accounts are linked to a single physical account. Treasurers and finance managers can set up as many virtual accounts as they need and some banks even provide online account maintenance functions. For example, some companies choose to assign a virtual account to each customer while others may assign a virtual account to their individual subsidiaries or divisions. Customers make payments to the virtual accounts but remittances are automatically routed to a single bank account, typically by currency. The virtual account number is used as a reference field for automatic reconciliation, account posting and reporting purposes.

For both domestic and international companies, virtual accounts offer a range of advantages. The number of physical accounts can be rationalised, reducing cost, risk and administration. Automatic reconciliation rates are higher, and remittances can be posted immediately to customer accounts, freeing up credit lines more quickly.

As companies expand geographically and acquire new entities, their liquidity management needs become more sophisticated, so virtual accounts become part of a broader treasury strategy, potentially also including cash pooling, POBO and ROBO. Treasuries can operate as in-house banks through virtual ledger accounts, combined with automated liquidity management structures that provide intercompany limit tracking and interest settlement. This is a cost-effective way of providing an in-house bank service, with less implementation effort than using physical accounts.

Real-time liquidity management

While reconciliation and reporting are often the reasons companies first choose to implement virtual accounts, there can also be significant liquidity benefits. In particular, by holding a single account rather than multiple accounts, cash is automatically centralised in one location, with balances available for use as soon as remittances are credited to the bank account. With many countries moving to domestic faster payments and the SWIFT gpi (global payments innovation) initiative resulting in faster credit of cross-border payments, the ability to reconcile accounts receivables in real time is critical. This capability allied with solutions like just-in-time cross-border sweeps allow clients to centralise cash and deploy it for payments exactly when needed.

There are inevitably issues to consider when implementing any new cash or liquidity management solution, including regulatory, tax and currency implications. The need to manage the cost of change, such as communicating new settlement instructions to customers and adapting systems, also needs to be factored in. However, as companies continue to expand internationally and adopt new business models, the value proposition of holistic virtual account solutions, combined with automated and increasingly real-time liquidity solutions, is becoming enhanced. Crucially, companies can build in additional services progressively, without disruption, as their needs evolve and new opportunities and demands emerge.

About the author

|

Explore new paradigms, realise new potential with standard chartered. Click here and visit us at sibos stand G02 | 22-25 oct | sydney, australia

This material has been prepared by standard chartered bank (SCB), a firm authorised by the united kingdom’s prudential regulation authority and regulated by the united kingdom’s financial conduct authority and prudential regulation authority. It is not independent research material. This material has been produced for information and discussion purposes only and does not constitute advice or an invitation or recommendation to enter into any transaction.

Some of the information appearing herein may have been obtained from public sources and while SCB believes such information to be reliable, it has not been independently verified by SCB. Information contained herein is subject to change without notice. Any opinions or views of third parties expressed in this material are those of the third parties identified, and not of SCB or its affiliates.

SCB does not provide accounting, legal, regulatory or tax advice. This material does not provide any investment advice. While all reasonable care has been taken in preparing this material, SCB and its affiliates make no representation or warranty as to its accuracy or completeness, and no responsibility or liability is accepted for any errors of fact, omission or for any opinion expressed herein. You are advised to exercise your own independent judgment (with the advice of your professional advisers as necessary) with respect to the risks and consequences of any matter contained herein. SCB and its affiliates expressly disclaim any liability and responsibility for any damage or losses you may suffer from your use of or reliance on this material.

SCB or its affiliates may not have the necessary licenses to provide services or offer products in all countries or such provision of services or offering of products may be subject to the regulatory requirements of each jurisdiction. This material is not for distribution to any person to which, or any jurisdiction in which, its distribution would be prohibited.

© copyright 2018 standard chartered bank. All rights reserved. All copyrights subsisting and arising out of these materials belong to standard chartered bank and may not be reproduced, distributed, amended, modified, adapted, transmitted in any form, or translated in any way without the prior written consent of standard chartered bank.

Forex training group

Should you practice forex trading using a demo trading account ?

Many of us play sports, and have done so as a child and continue to into our adulthood. And as athletes will attest to, most of the time out on the field or on the court is spent practicing. In fact, 80% or more of the time playing is spent on the practice field, attempting to perfect the process that will eventually hone the necessary skills for the real game.

This scenario plays out in all-types of athletics, as well as in business across the globe. Can you imagine a high-profile lawyer refusing to practice his closing argument without using a mock jury? For those of us that trade the forex markets, we have the luxury of a practice mechanism using real-time data and analysis to test, refine, and improve our strategies.

Signing up for a paper trading account

Setting up a forex paper trading account is quite straightforward and generally requires that you are willing to provide some basic personal information. Most forex dealers, will provide you with a free fx broker practice account, so that you can test drive their platform.

B rokers know that when you become comfortable enough with it, that you may eventually signup for a live account with them. Obviously, the best way for them to achieve this is to provide a demonstration account and trading platform that is nearly identical to a real trading account.

A virtual fx trading platform, provides you with a practice forex trading mechanism, that is easy to use and in many cases, does not require any monetary outlay. When you open a fx practice account, you receive virtual dollars which can be used to gauge your trading performance.

With these types of accounts, you can practice trading forex, without losing real capital. Several brokers provide clients with unlimited virtual funds, which allows you to use a practice trading account, without feeling the pressure of needing to switch over to a real account.

Some forex broker practice accounts never expire. There are also currency trading practice accounts that offer multiple platforms including a downloadable platform, a web based platform and even mobile practice trading accounts. You can even practice forex trading using a using a binary options demo account.

What is paper trading ?

Paper trading in the process of trading an account, without risking “real” capital. A forex paper trading account, allows you to place virtual trades that mimic a real time environment, and determine the accuracy and efficiency of your strategy.

Real-time paper trading can be extremely helpful especially if your strategy relies on specific market conditions to be efficient. For example, if you are a day trader that generates revenue from scalping the market, you might find that when you try to employ your strategy in real-time, it does not perform as well as when you back-tested your strategy.

This could occur for several reasons including that your back-tested results were based on open-close only data points as opposed to real-time tick data. If your back-testing module does not have real-time tick data, which includes every transaction captured by a data provider, then the results that you experience in real-time might be noticeably different from your paper trading results.

Back testing a trading strategy

Back testing a trading strategy is a process that you can use to see if your strategy has made money in the past based on historical data. But remember past results are not a guarantee of future gains. However, back-testing can provide you with confidence that your strategy has merit. The longer your testing period, the more reliable the results. Additionally, a paper trading strategy that is based on daily or weekly changes in the value of a currency pair is more likely to be replicated in real-time, then a strategy that is based on changes to tick data. This is because tick data can be unreliable and sporadic.

A back-test evaluates the profitability of a trading strategy based on historical data. While back-testing a trading-strategy is a great way to generate confidence and find a strategy that works in the past, it is very important to also see if the strategy will continue to work in the future. Forex paper trading can help you avoid some back-testing pitfalls such as curve fitting and over optimization.

Back testing considerations

There are a few assumptions that you should consider when you are back-testing a trading strategy, and attempting to determine if the strategy will work moving forward. First, you want to make sure that your criteria is tested over a broad period as opposed to a limited, specific period. If you design your criteria to only find trades during a year when the market was heading south, then you have targeted a period that is not broad enough to take into account different market situations, rendering your strategy vulnerable during times when a downtrend does not exist.

This type of selection bias can be eliminated by back-testing over multiple periods and then paper trading in a real-time environment.

Trade execution and slippage

Another factor that should be analyzed when evaluating a back tested trading strategy is slippage. Slippage describes the difference between the estimated transaction price and the amount paid for a specific security.

Most of us experience slippage when we attempt to stop out of a position when the market is volatile. For example, we may hold a long position and place a stop loss at 1.2010 but our broker stops us out at 1.2005, causing 5 pips of slippage.

So there will be instances when a trader does not transact at the exact price generated by the strategy, which needs to be incorporated into the profit and loss calculations. For example, a system might be tested and look successful on certain exotic currency pairs, but when a trader attempts to purchase these same currency pairs in live trading, the bid/offer spread might eat up a significant portion of the potential profits. If the liquidity of an asset is weak, the back tested trading strategy needs to incorporate this issue into the profit and loss generated from the back test.

Using a virtual trading platform to paper trade can help spot these types of instances. Once you have back-tested your results, you can see if they work in real-time. Slippage can be harmful to your strategy if you are attempting to generate small gains from many transactions. So, if you are only trying to make 10 pips from each trade, and you initially account for 2-pips of slippage, but you find out that your strategy averages 5-pips of slippage, then you will most likely need to go back to the drawing board. Many novice traders forget that you can experience slippage on your entry and exit. You need to incorporate this information into your back-test, but if you forget to do this, a paper trading routine should bring this information to light.

Forex broker commissions

As opposed to slippage costs, commission costs are the fees charged by your broker and the clearing house. Most forex brokers do no charge a specific commission, but instead factor that cost into their bid offer spread. This spread, is the difference between where a market maker is willing to purchase a currency pair, relative to where they are willing to sell a currency pair. The bid-ask disparity needs to be incorporated into your back-testing results, otherwise, without factoring this in, you will be underestimating the actual cost of trading your strategy.

Trading in different time zones

One of the issues of trading a currency pair around the clock is that the liquidity can vary from one time zone to another. Most major currency pairs see their best liquidity during the european/american time zone overlap. The yen and australian dollar will experience robust liquidity during asian hours, while the canadian dollar will see strong liquidity during the north american hours. When you are back testing your strategy, you should be cognizant of these tendencies.

Back testing software and historical data

There are some forex brokers that provide back-testing software. Typically, to use the software, you need to provide them with some basic personal information, and then they will allow you to download the software and perform back tests using their data. Some may even allow you to upload your own historical data. You can also attempt to back-test a trading strategy using excel or a paid service.

You should analyze the data you use carefully to ensure that the quality is acceptable. This is especially important if you are day trading. Forex data can be “dirty” and in many instances, it needs to be cleaned and filtered. This means that bad data points could be prevalent throughout your time series, and if your strategy is looking for quick spikes or drops, then the data might generate inaccurate testing results.

Another step you want to take when running a back test on a strategy is to perform in sample and out of sample testing. This helps reduce curve fitting and allows you to generate a trading strategy that is robust and more likely to perform in varying market environments.

An example of in sample and out of sample testing would be to pick a 10-year period to back test your results. You can start by using the 4-middle years to back-test and determine if the strategy works well. Your next step would be to test the strategy on the first 3-years, and if that is successful, you would then test the strategy on the last 3-years. In each case, you would want the results to look similar. You would prefer to see, that the win to loss ratio is correlated, along with the amount that you win or lose or average. You also want to make sure that the equity curves and drawdown numbers are relatively stable over each testing period. If the strategy works in all-three periods, you can then move on to forward testing using a virtual account.

Forward testing on a demo account

Forward testing allows you to further bolster your backtested results by applying it in a real-time environment and evaluating the performance of the system without risking real capital.

The forward test allows you to evaluate your backtested results going forward into the future after the back test is complete. One of the benefits of forward testing on a virtual account is that it will help you determine whether your strategy has merit using forward data.

When you analyze your strategy, you need to be honest with yourself. You should look at the trades in aggregate and not cherry pick trades to determine if your process works as intended.

In addition, if a trade occurred in a forward test environment, that is abnormal or unexpected, it should not immediately be discarded, if at all. Instead you must analyze that data point carefully and determine if additional tweaks may be needed in your strategy to compensate for similar risk occurrences in the future.

One issue that can occur which can affect the accuracy of your results are spikes in real-time data. This may produce transactions at a level that is unrealistic. Be sure to monitor your paper trading, and do a post analysis on your trades to see if the forward tests are being accurate reflected.

Discretionary trading using a virtual forex account

Whether you are using a systematic approach or a discretionary approach, paper trading will help you discover any pitfalls in your methodology or processes. If you are using technical analysis, a paper trading approach will test your decision-making processes similar to a real capital trading environment. You will be making decisions about your entry and exit levels in real time, and practicing these techniques to see if they are working as intended.

For example, one common question you will face is whether you should wait for a bar to close to generate a transaction, or trade prior to the close of the bar. Many times, break outs or break downs, occur, only to reverse later in the trading session.

The technical analysis studies that you plan to use might look different in real-time, as compared to after a bar closes. You will need to address and make decisions around these matters.

One important facet that a virtual account does not always address is the use of margin and margin calls. A margin call is a situation where the real funds that you have in your account falls below the required minimum set by your broker to cover your open positions.

Most of the time, if you cannot add funds to your real capital account, you will need to exit some of your positions or they will be liquidated automatically.

In fact, most brokers tell you that they have the right to liquidate your position at their discretion if there is a margin call that you cannot fund.

Summary

Using a paper trading account is a viable way to test out new and existing strategies. Just as if you were practicing sports, you can try out new techniques and see how they perform in real-time. Most brokers offer demonstration accounts, that have unlimited virtual funds, and provide access to their trading platform including downloaded platforms, web based platforms and mobile platforms.

A virtual account can help expose many of the inaccurate assumptions you might have made that were not captured by “in and out” of sample testing.

If you are trading a discretionary account, a real-time demo account will provide you with specific circumstances that you might not normally see, and allow you to test your trading skill, along with your ability to implement your techniques.

Listen UP.

Take your trading to the next level, accelerate your learning curve with my free forex training program.

Virtual accounts: real-life benefits in real-time

Proliferation of bank accounts, unreconciled suspense entries and fragmented liquidity are challenges for both domestic and international corporations. Virtual accounts tied with automated liquidity management structures provide a scalable way for treasurers to automate processes and simplify liquidity management whilst concurrently reducing physical bank accounts and streamlining resourcing.

When asking a treasurer about their business, they typically cite the number of bank accounts as a measure of the scale and complexity of the treasury function. How valid a measure is this, however? Every bank account adds complexity: it needs to be reported on and reconciled, balances managed, and authorised signatories maintained. Every account also has a related cost and represents a potential security risk without adequate oversight over signatories and balances. With virtual accounts and virtual ledger solutions maturing and becoming more interconnected with liquidity management structures however, we could we be seeing a reversal – in which the sophistication and effectiveness of treasury is measured not by how few accounts they have, but by how many virtual accounts they have.

Solutions for every treasury demographic

Treasurers’ desire to reduce the number of physical bank accounts is not new. For example, many larger corporations have set-up in-house banks, in which treasury provides banking services such as funding, investment, cash, liquidity and risk management to group companies. As part of an in-house bank, treasurers are increasingly introducing payments on behalf of (POBO) and/or receivables on behalf of (ROBO). Under these arrangements, companies make payments or collect incoming flows ‘on behalf of’ group companies, removing the need for these entities to hold their own bank accounts. These implementations are not frictionless as customers may prefer to pay a local account – while suppliers may challenge, or find it difficult to identify and reconcile payments made by an entity different to the one that they invoiced.

The need to simplify and streamline cash and liquidity management is not limited to large multinational businesses. Scalable, accessible solutions are also required by smaller or less mature treasuries that have not yet built sophisticated in-house banking and ‘on behalf of’ structures. Consequently, virtual account solutions emerged, starting with supporting automated reconciliation and moving on to simplifying liquidity management for treasuries of all sizes and levels of sophistication.

Tangible benefits to virtual accounts

Companies can use virtual accounts in a variety of ways to meet their specific needs, whether they operate in one country or many, either as a single solution or in conjunction with solutions such as cash pooling, POBO and ROBO. Virtual accounts are linked to a single physical account. Treasurers and finance managers can set up as many virtual accounts as they need and some banks even provide online account maintenance functions. For example, some companies choose to assign a virtual account to each customer while others may assign a virtual account to their individual subsidiaries or divisions. Customers make payments to the virtual accounts but remittances are automatically routed to a single bank account, typically by currency. The virtual account number is used as a reference field for automatic reconciliation, account posting and reporting purposes.

For both domestic and international companies, virtual accounts offer a range of advantages. The number of physical accounts can be rationalised, reducing cost, risk and administration. Automatic reconciliation rates are higher, and remittances can be posted immediately to customer accounts, freeing up credit lines more quickly.

As companies expand geographically and acquire new entities, their liquidity management needs become more sophisticated, so virtual accounts become part of a broader treasury strategy, potentially also including cash pooling, POBO and ROBO. Treasuries can operate as in-house banks through virtual ledger accounts, combined with automated liquidity management structures that provide intercompany limit tracking and interest settlement. This is a cost-effective way of providing an in-house bank service, with less implementation effort than using physical accounts.

Real-time liquidity management

While reconciliation and reporting are often the reasons companies first choose to implement virtual accounts, there can also be significant liquidity benefits. In particular, by holding a single account rather than multiple accounts, cash is automatically centralised in one location, with balances available for use as soon as remittances are credited to the bank account. With many countries moving to domestic faster payments and the SWIFT gpi (global payments innovation) initiative resulting in faster credit of cross-border payments, the ability to reconcile accounts receivables in real time is critical. This capability allied with solutions like just-in-time cross-border sweeps allow clients to centralise cash and deploy it for payments exactly when needed.

There are inevitably issues to consider when implementing any new cash or liquidity management solution, including regulatory, tax and currency implications. The need to manage the cost of change, such as communicating new settlement instructions to customers and adapting systems also needs to be factored in. However, as companies continue to expand internationally and adopt new business models, the value proposition of holistic virtual account solutions, combined with automated and increasingly real-time liquidity solutions, is enhancing. Crucially, companies can build-in additional services progressively, without disruption, as their needs evolve and new opportunities and demands emerge.

Virtual accounts: real-life benefits in real-time

By embracing virtual accounts, corporations can automate treasury processes and simplify liquidity management at the same time

David rego

Head of global liquidity, deposits and escrow solutions

Ask a treasurer about their business and they will typically cite ‘number of bank accounts’ as a measure of the scale and complexity of a treasury function. But how valid a measure is this?

Every bank account brings complexity: it needs to be reported on and reconciled, balances managed, and authorised signatories maintained. Every account also has a related cost and represents a potential security risk without adequate oversight over signatories and balances.

With virtual accounts and virtual ledger solutions maturing and becoming more interconnected with liquidity management structures, however, this is changing. The sophistication of treasury can increasingly be measured not by how many accounts they have, but by how many virtual accounts they have.

One solution set to fit all sizes

Treasurers’ desire to reduce the number of physical bank accounts is not new. As a way of combatting the complexity of new physical accounts, many larger corporations have set up in-house banks, in which treasury provides banking services such as funding, investment and risk management to group companies. Treasurers are increasingly introducing payments-on-behalf-of (POBO) and/or receivables-on-behalf-of (ROBO) as part of an in-house bank. Under these arrangements, companies make payments or collect incoming flows ‘on behalf of’ group companies, removing the need for these entities to hold their own bank accounts. But the system is not frictionless – for example, suppliers may find it difficult to reconcile payments made by an entity different to the one they invoiced.

"reconciliation and reporting are often the reasons companies choose to implement virtual accounts, but there can also be significant liquidity benefits"

The need to simplify and streamline cash and liquidity management is not limited to large multinational businesses. Scalable, accessible solutions are also required by smaller or less mature treasuries that have not yet built sophisticated in-house banking structures.

Consequently, virtual account solutions emerged, initially as a way of supporting automated reconciliation and then as a means of simplifying liquidity management for treasuries of all sizes and levels of sophistication.

Tangible benefits of virtual accounts

Companies can use virtual accounts in a variety of ways to meet their specific needs. Virtual accounts are linked to a single physical account. Treasurers and finance managers can set up as many of these accounts as they need and some banks even provide online account maintenance functions. For example, some companies choose to assign a virtual account to each customer, while others may assign them to their individual subsidiaries or divisions. Customers make payments to the virtual accounts but remittances are automatically routed to a single bank account, typically by currency. The account number is used as a reference field for automatic reconciliation, account posting and reporting purposes.

For both domestic and international companies, virtual accounts offer a range of advantages. The number of physical accounts can be rationalised, reducing cost, risk and administration. Automatic reconciliation rates are higher, and remittances can be posted immediately to customer accounts, freeing up credit lines more quickly.

"as companies expand and adopt new business models, the value proposition of holistic virtual account solutions is growing"

As companies expand geographically and acquire new entities, their liquidity management needs become more sophisticated, so virtual accounts become part of a broader treasury strategy, potentially also including cash pooling, POBO and ROBO. Treasuries can operate as in-house banks through virtual ledger accounts, combined with automated liquidity management structures that provide intercompany limit tracking and interest settlement. This is a cost-effective way of providing an in-house bank service, with less implementation effort than using physical accounts.

Real-time liquidity management

While reconciliation and reporting are often the reasons companies first choose to implement virtual accounts, there can also be significant liquidity benefits. In particular, by holding a single account rather than multiple accounts, cash is automatically centralised in one location, with balances available for use as soon as remittances are credited to the bank account. With many countries moving to domestic FAST (fast and secure payments) and the SWIFT gpi (global payments innovation) initiative resulting in faster credit of cross-border payments, the ability to reconcile accounts receivables in real time is critical. This capability, allied with solutions like just-in-time cross-border sweeps, allows clients to centralise cash and deploy it for payments exactly when needed.

There are inevitably issues to consider when implementing any new cash or liquidity management solution, including regulatory, tax and currency implications. The need to manage the cost of change, such as communicating new settlement instructions to customers and adapting systems also needs to be factored in.

However, as companies continue to expand internationally and adopt new business models, the value proposition of holistic virtual account solutions, combined with automated and increasingly real-time liquidity solutions, is growing.

Crucially, companies can build in additional services progressively, without disruption, as their needs evolve and new opportunities and demands emerge.

So, let's see, what we have: FX portfolio - virtual FX position this section is designed to show activity for currency pair trades for FX traders so that they can track average cost and running P&L on their currency trades. At real-time virtual fx account

Contents of the article

- New forex bonuses

- FX portfolio - virtual FX position

- The account window

- Demo trading account

- Open a demo trading account

- What is a demo trading account?

- Why use a trading simulator?

- FX portfolio - virtual FX position

- Demo trading account

- Open a demo trading account

- What is a demo trading account?

- Why use a trading simulator?

- Virtual accounts: real-life benefits in real-time

- Proliferation of bank accounts, unreconciled...

- Forex training group

- Should you practice forex trading using a demo...

- Signing up for a paper trading account

- What is paper trading ?

- Back testing a trading strategy

- Back testing considerations

- Trade execution and slippage

- Forex broker commissions

- Trading in different time zones

- Back testing software and historical data

- Forward testing on a demo account

- Discretionary trading using a virtual forex...

- Summary

- Listen UP.

- Virtual accounts: real-life benefits in real-time

- Solutions for every treasury demographic

- Tangible benefits to virtual accounts

- Real-time liquidity management

- Virtual accounts: real-life benefits in real-time

- By embracing virtual accounts, corporations can...

- David rego

- One solution set to fit all sizes

- Tangible benefits of virtual accounts

- Real-time liquidity management

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.