Tickmill mt4

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors.

New forex bonuses

Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk. Clients must be at least 18 years old to use the services of tickmill.

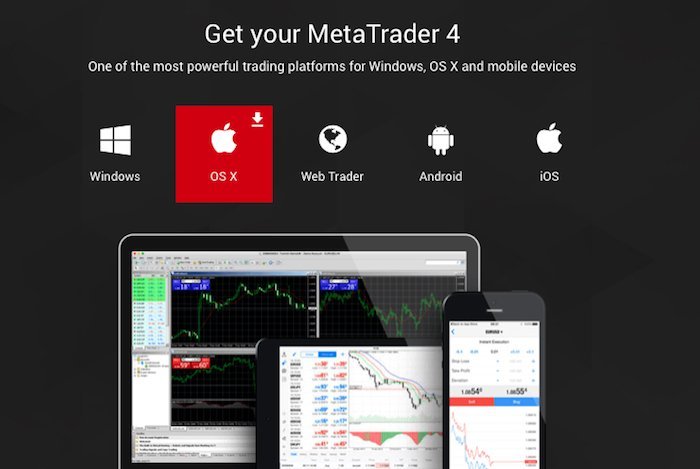

Metatrader 4

(MT4) platform

Tickmill’s MT4 platform is fully customisable and designed to give you that trading edge.

Why trade with tickmill’s

metatrader 4?

Designed specifically for traders, our metatrader 4 platform provides a user-friendly and highly customisable interface, accompanied by sophisticated order management tools help you control your positions quickly and efficiently.

MT4 is widely recognised as the world’s favorite forex trading platform. It offers an easy-to-use user interface, enhanced charting functionality, indicators and supports MQL language. So, you can easily program indicators and expert advisors (eas) to trade the forex market 24/5 with no intervention needed from your side.

Combined with tickmill’s enhanced trading conditions, you’re able to use a globally recognised trading platform accompanied by spreads from 0 pips and 0.20s execution.

Key features of MT4

cfds on forex, stock indices, commodities and bonds. Execute your order with no partial fills, as a result of our huge depth of liquidity. EA trading facilities by using our VPS services. Advanced technical analysis, 50+ indicators and customisable charting… in 39 languages. Trading signals with an advanced notification system.

User manuals

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADE

Launch the platform, enter tickmill’s server name to log in and start trading!

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill review and tutorial

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the metatrader 4 (MT4) trading platform, spreads, bonuses, plus deposit and withdrawal options. Find out whether you should sign up for a tickmill account.

- Tickmill company summary

- Trading platforms

- MT4 platform

- Webtrader platform

- Assets

- Spreads & fees

- Leverage

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- FAQ

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

Tickmill company summary

Tickmill ltd is a member of the global tickmill group, which consists of several trading companies established in the 1980s. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+.

Its headquarters are in london but the company has multiple offices worldwide and its clients can be found everywhere from indonesia, south africa, and tanzania, to vietnam, estonia, australia, and malaysia.

Also part of the tickmill group ltd is tickmill prime and tickmill UK, registered in the isle of man.

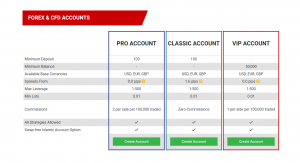

Trading platforms

MT4 platform

Hugely popular due to its ease of navigation, dashboard customization, and a suite of features, MT4 is the leading forex trading platform.

- EA trading

- Charting tools

- 50+ indicators

- Historical data centre

- Order management tools

- Advanced notification system

Webtrader platform

As an online platform, the web-based interface doesn’t require a software download.

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Assets

Clients have access to a range of tradeable instruments:

- Forex – trade on 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD

- Stock indices – access 14+ indices including the FTSE, DAX, dow jones (US30), and NASDAQ (nas100)

- Commodities – trade on WTI oil and precious metals, such as gold (XAUUSD) and silver (XAGUSD)

- Bonds – trade a selection of german bonds

Spreads & fees

The tickmill classic account is commission-free with variable spreads starting from 1.6 pips. For pro and VIP account holders, spreads begin at zero pips with low commissions.

Transaction fees are covered up to $100, but dormant accounts may be charged an inactivity fee. Triple swap charges apply to positions held overnight.

Leverage

The maximum leverage available is 1:500, but varies depending on the asset:

- Stock indices – 1:100

- Metals – 1:500

- Bonds – 1:100

- Oil – 1:100

- FX- 1:500

A margin calculator and detailed information regarding margin requirements can be found on the tickmill website.

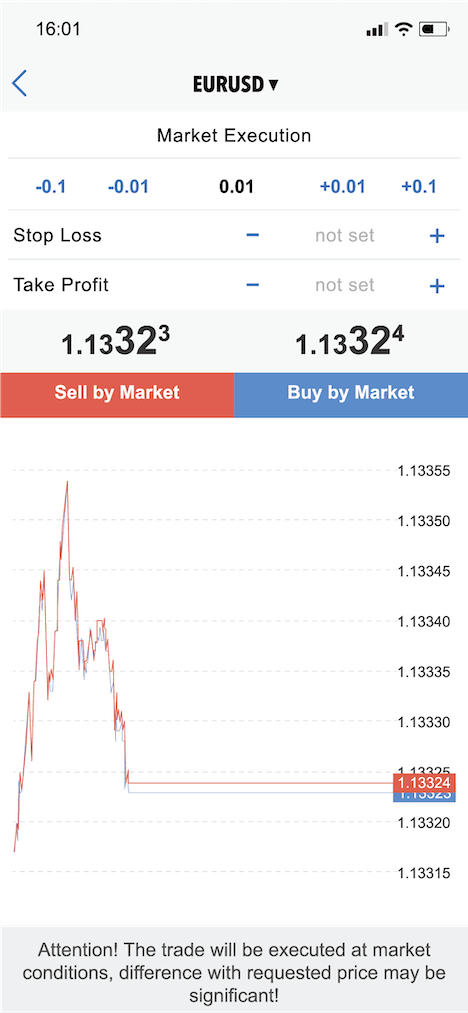

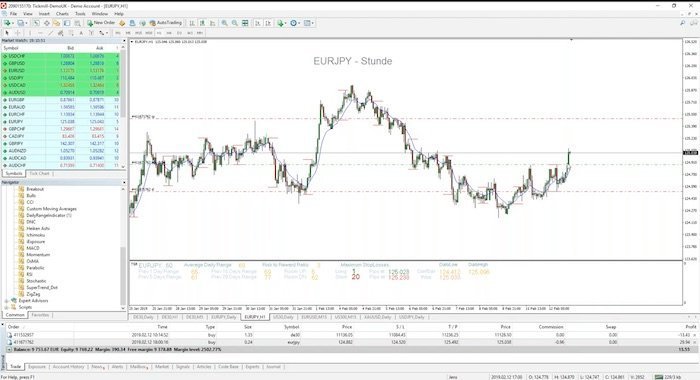

Mobile app

Mobile trading is available on android (APK) and apple (ios) devices and makes trading on the move straightforward while retaining almost all of the desktop features. Users can analyse markets, price trends, and trade directly from charts. Mobile traders can also deposit funds, withdraw profits, and use available bonuses.

Payment methods

Accepted payment methods include bank transfer, visa/mastercard, skrill, neteller and QIWI. The minimum deposit for classic and pro accounts is $100 and for a VIP account, it’s $5,000. The minimum withdrawal is $25. Payments are processed in EUR, GBP, USD and PLN.

To make a deposit or withdrawal, head to the client area. Customer reviews of the payment process are generally positive.

Demo account

The broker offers a forex and CFD demo account. The practice account is a great opportunity to test the MT4 platform, new strategies, and explore additional features, without the risk of losses. You can open a demo account from the broker’s homepage. The demo server also has rich market history data.

Deals & promotions

Four promotional offers are available:

- $30 welcome bonus – set up and login to your account to withdraw your welcome bonus

- Trader of the month – the top-performing trader earns a $1,000 free trading bonus

- Rebate promotion – earn cash rebates on your trades

- Predict the NFP – win $500

For any issues claiming your deposit bonuses, see full bonus terms and conditions under the ‘promotions’ tab. The customer support team can also assist with bonus queries.

Note, deals may not be available to all account holders and in all jurisdictions.

Regulation & licensing

Tickmill ltd is regulated by the seychelles financial services authority (FSA). Tickmill UK ltd is authorised by the financial conduct authority (FCA). Tickmill europe ltd is regulated by the cyprus securities and exchange commission (cysec). These are reputable regulatory agencies and help contribute to the broker’s high trust rating.

Additional features

The broker offers multiple additional features to assist traders, including:

- Free VPS

- News blog

- Copytrade

- Tradingview

- Economic calendar

- One-click (EA) trading

- Video tutorials & seminars

- Forex & pip calculators

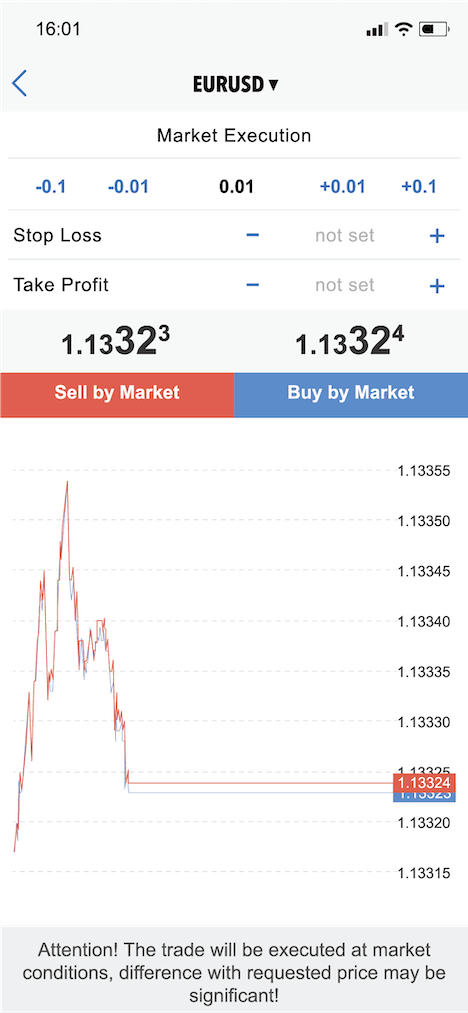

Account types

Tickmill offers three account types:

- Classic – trade cfds on 62 currency pairs, major indices, bonds and commodities. Variable spreads start from 1.6 pips and there are no commissions. A classic account is suitable for both beginners and experienced traders.

- Pro – aimed at experienced traders. Spreads from zero pips, commission payable on 2 currency units per side per lot (0.0020% notional). Stop and limit levels are 0. No commission on stock indices, oil and bonds.

- VIP – an exclusive account for high volume traders. Commission payable on 1 currency unit per side per lot. No commission on cfds, stock indices, oil and bonds. Spreads from zero pips, minimum deposit $50,000.

An islamic trading account is also available.

For issues regarding invalid account requests, check the list of accepted countries below or contact the customer support team.

Benefits

Advantages of trading with tickmill include:

- Demo account

- Hedging & scalping

- Straightforward login

- Multiple promotional offers

- Competitive average spreads

- A good range of educational tools

Drawbacks

Disadvantages of trading with tickmill include:

- No cent or micro account

- Spread betting unavailable

- No metatrader 5 (MT5) platform

- No cryptocurrency and bitcoin trading

- Services not available to clients from the US, japan, or canada

Trading hours

FX trading is available 24 hours, 5 days a week. German bonds can be traded between 00:00 to 23:00 GMT. Gold markets are open from monday to friday, 01:02 to 23:57 GMT and silver monday to thursday from 01:00-24:00 GMT, and friday 01:00 to 23:57 GMT.

Opening times for cfds will depend on their respective market. Head to the official tickmill website for more information. Trading hours can also be viewed in the MT4 terminal.

Customer support

Customer support is available monday to friday 7:00 – 16:00 GMT via:

- Phone – +852 5808 2921

- Email –[email protected]

- Live chat – chat logo on the right of the homepage

The support team can help with a range of queries, from registration and verification documents to swap-free conditions, forgotten passwords, and account faqs.

Additional information can be found on tickmill’s linkedin and youtube platforms.

Security

Their internal systems are FSA compliant, so client funds are held in segregated accounts. The broker adheres to industry safety standards and only offers secure deposit and withdrawal options. Negative balance protection is available to all clients.

Tickmill verdict

Tickmill is a regulated broker offering the MT4 trading platform, a suite of additional resources, plus multiple account options. Take tickmill’s services vs pepperstone, XM, zulutrade, or IC markets, and traders benefit from competitive fees but sacrifice such a diverse product list.

Accepted countries

Tickmill accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

But traders from united states, canada, japan, bangladesh, nigeria, pakistan, kenya are not allowed by the broker.

Does tickmill offer an islamic account?

Yes, tickmill offers a swap-free account, compliant with sharia law. See the broker’s website for instructions on how to open an account.

Is tickmill a true ECN broker?

Yes, tickmill is an ECN broker and not a market maker. This arguably means clients benefit from lower fees and operate in a more transparent trading environment.

Is tickmill available to US clients?

No, services are not available to those from the US. Traders from canada, japan and some other countries are also unable to open real-money trading accounts.

Is tickmill a good broker?

Tickmill is a highly regulated and well-established broker, offering the popular MT4 platform. With decent welcome bonuses and customer support also available, tickmill a solid online broker.

Does tickmill have the NASDAQ?

Yes, clients can trade on the NASDAQ. Tickmill traders also have access to a dozen or so other stock indices, plus 62 currency pairs, commodities, and german bonds.

| Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities |

Axi offers forex and CFD trading to retail and professional traders. Our review includes all you need to know, from read more

The last twenty years have seen US-headquartered oanda, grow into an established player on the global online broker stage. Today read more

Eaglefx offers FX and CFD trading on the MT4 platform, including indices and cryptocurrencies. Follow this review for a breakdown read more

Liteforex limited is an established CFD and forex broker. Clients can trade on the metatrader 4 (MT4) and metatrader 5 read more

Vincent nyagaka is a professional trader, analyst &. He has been actively engaged in market analysis for the past 7 years. He has a monthly readership of 100,000+ traders and has taught over 1,000 students since 2014. Vincent is also an experienced instructor and public speaker. Checkout vincent’s professional trading course here.

Platform

metatrader 4 (MT4)

Platform MT4 tickmill sepenuhnya dapat disesuaikan dan dirancang untuk memberikan keunggulan dalam trading anda.

Mengapa trading dengan tickmill

metatrader 4?

Dirancang khusus untuk para trader, platform metatrader 4 kami menyediakan antarmuka yang ramah pengguna dan sangat dapat disesuaikan, disertai dengan alat manajemen order yang canggih membantu anda mengontrol posisi anda dengan cepat dan efisien.

MT4 secara luas diakui sebagai platform trading forex favorit di dunia. Ini menawarkan antarmuka pengguna yang mudah digunakan, fungsi chart yang disempurnakan, indikator dan mendukung bahasa MQL. Jadi, anda dapat dengan mudah memprogram indikator dan expert advisors (EA) untuk memperdagangkan pasar forex 24/5 tanpa intervensi dari pihak anda.

Dikombinasikan dengan kondisi trading tickmill yang ditingkatkan, anda dapat menggunakan platform trading yang diakui secara global disertai dengan spread dari 0 pips dan eksekusi 0,20 detik.

Fitur utama dari MT4

CFD pada forex, indeks saham, komoditas dan obligasi. Eksekusi order anda tanpa pemenuhan order secara parsial, sebagai hasil dari kedalaman likuiditas kami yang sangat besar. Fasilitas trading EA dengan menggunakan layanan VPS kami. Analisis teknikal canggih, 50+ indikator dan chart yang dapat disesuaikan. Dalam 39 bahasa. Signal trading dengan sistem notifikasi canggih.

Panduan pengguna

MULAI TRADING dengan tickmill

Mudah dan cepat untuk bergabung!

REGISTER

Selesaikan registrasi, login ke area klien anda dan upload dokumen yang diperlukan.

BUAT AKUN

Setelah dokumen anda disetujui, buat akun live trading.

BUAT DEPOSIT

Pilih metode pembayaran, danai akun trading anda dan mulai trading.

TRADING

Jalankan platform, masukkan nama server tickmill untuk login dan mulai trading!

INSTRUMEN TRADING

KONDISI TRADING

AKUN TRADING

PLATFORM

EDUKASI

KEMITRAAN

PROMO

TENTANG KAMI

SUPPORT

Tickmill adalah nama dagang grup perusahaan tickmill.

Tickmill.Com dimiliki dan dioperasikan dalam grup perusahaan tickmill. Tickmill group terdiri dari: tickmill UK ltd, teregulasi oleh financial conduct authority (kantor terdaftar: lantai 3, 27 - 32 old jewry, london EC2R 8DQ, inggris), tickmill europe ltd, teregulasi oleh cyprus securities and exchange commission (kantor terdaftar: kedron 9, mesa geitonia, 4004 limassol, siprus), tickmill south africa (PTY) LTD, FSP 49464, teregulasi oleh financial sector conduct authority (FSCA) (kantor terdaftar: the colosseum, lantai 1, century way, office 10, century city, 7441, cape town), tickmill ltd, teregulasi oleh financial services authority of seychelles dan anak perusahaannya yang 100% dimiliki procard global ltd, nomor registrasi UK 09369927 (kantor terdaftar: lantai 3, 27-32 old jewry, london EC2R 8DQ, inggris), tickmill asia ltd - teregulasi oleh financial services authority of labuan malaysia (nomor lisensi: MB/18/0028 dan kantor terdaftar: unit B, lot 49, lantai 1, blok F, gudang lazenda 3, jalan ranca-ranca, 87000 FT labuan, malaysia).

Klien harus minimal 18 tahun untuk menggunakan layanan tickmill.

Peringatan risiko tinggi: trading contracts for difference (CFD) dengan margin memiliki tingkat risiko yang tinggi dan mungkin tidak cocok untuk semua investor. Sebelum memutuskan untuk berdagang contracts for difference (CFD), anda harus mempertimbangkan tujuan perdagangan, tingkat pengalaman, dan selera risiko anda dengan cermat. Adalah mungkin bagi anda untuk mengalami kerugian yang melebihi modal yang anda investasikan dan karena itu anda tidak perlu menyetor uang yang anda tidak mampu kehilangannya. Pastikan anda benar-benar memahami risiko dan berhati-hati untuk mengelola risiko anda.

Situs ini juga berisi link ke website yang dikendalikan atau ditawarkan oleh pihak ketiga. Tickmill belum meninjau dan dengan ini tidak bertanggung jawab untuk setiap informasi atau materi yang diposting di salah satu situs yang terhubung ke situs ini. Dengan membuat link ke situs pihak ketiga, tickmill tidak mendukung atau merekomendasikan produk atau jasa yang ditawarkan di website tersebut. Informasi yang terkandung di situs ini dimaksudkan untuk tujuan informasi saja. Oleh karena itu, tidak boleh dianggap sebagai tawaran atau ajakan untuk setiap orang dalam setiap yurisdiksi yang mana tawaran atau ajakan seperti itu tidak diizinkan atau kepada orang yang dia akan melanggar hukum untuk membuat tawaran atau ajakan seperti itu, atau dianggap sebagai rekomendasi untuk membeli, menjual atau berurusan dengan perdagangan mata uang atau logam mulia tertentu. Jika anda tidak yakin tentang peraturan lokal perdagangan mata uang dan spot logam anda maka anda harus meninggalkan situs ini segera.

Anda sangat disarankan untuk mendapatkan saran finansial, hukum dan pajak independen sebelum melanjutkan dengan perdagangan mata uang atau spot logam. Tidak ada dalam situs ini yang harus dibaca atau ditafsirkan sebagai saran dari pihak tickmill atau afiliasi, direktur, staf atau karyawannya.

Layanan tickmill dan informasi di situs ini tidak ditujukan untuk warga negara/penduduk amerika serikat, dan tidak dimaksudkan untuk distribusi, atau digunakan oleh, siapa pun di negara atau yurisdiksi mana pun jika distribusi atau penggunaan tersebut bertentangan dengan hukum atau peraturan setempat.

Tickmill review and tutorial

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the metatrader 4 (MT4) trading platform, spreads, bonuses, plus deposit and withdrawal options. Find out whether you should sign up for a tickmill account.

- Tickmill company summary

- Trading platforms

- MT4 platform

- Webtrader platform

- Assets

- Spreads & fees

- Leverage

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- FAQ

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

Tickmill company summary

Tickmill ltd is a member of the global tickmill group, which consists of several trading companies established in the 1980s. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+.

Its headquarters are in london but the company has multiple offices worldwide and its clients can be found everywhere from indonesia, south africa, and tanzania, to vietnam, estonia, australia, and malaysia.

Also part of the tickmill group ltd is tickmill prime and tickmill UK, registered in the isle of man.

Trading platforms

MT4 platform

Hugely popular due to its ease of navigation, dashboard customization, and a suite of features, MT4 is the leading forex trading platform.

- EA trading

- Charting tools

- 50+ indicators

- Historical data centre

- Order management tools

- Advanced notification system

Webtrader platform

As an online platform, the web-based interface doesn’t require a software download.

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Assets

Clients have access to a range of tradeable instruments:

- Forex – trade on 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD

- Stock indices – access 14+ indices including the FTSE, DAX, dow jones (US30), and NASDAQ (nas100)

- Commodities – trade on WTI oil and precious metals, such as gold (XAUUSD) and silver (XAGUSD)

- Bonds – trade a selection of german bonds

Spreads & fees

The tickmill classic account is commission-free with variable spreads starting from 1.6 pips. For pro and VIP account holders, spreads begin at zero pips with low commissions.

Transaction fees are covered up to $100, but dormant accounts may be charged an inactivity fee. Triple swap charges apply to positions held overnight.

Leverage

The maximum leverage available is 1:500, but varies depending on the asset:

- Stock indices – 1:100

- Metals – 1:500

- Bonds – 1:100

- Oil – 1:100

- FX- 1:500

A margin calculator and detailed information regarding margin requirements can be found on the tickmill website.

Mobile app

Mobile trading is available on android (APK) and apple (ios) devices and makes trading on the move straightforward while retaining almost all of the desktop features. Users can analyse markets, price trends, and trade directly from charts. Mobile traders can also deposit funds, withdraw profits, and use available bonuses.

Payment methods

Accepted payment methods include bank transfer, visa/mastercard, skrill, neteller and QIWI. The minimum deposit for classic and pro accounts is $100 and for a VIP account, it’s $5,000. The minimum withdrawal is $25. Payments are processed in EUR, GBP, USD and PLN.

To make a deposit or withdrawal, head to the client area. Customer reviews of the payment process are generally positive.

Demo account

The broker offers a forex and CFD demo account. The practice account is a great opportunity to test the MT4 platform, new strategies, and explore additional features, without the risk of losses. You can open a demo account from the broker’s homepage. The demo server also has rich market history data.

Deals & promotions

Four promotional offers are available:

- $30 welcome bonus – set up and login to your account to withdraw your welcome bonus

- Trader of the month – the top-performing trader earns a $1,000 free trading bonus

- Rebate promotion – earn cash rebates on your trades

- Predict the NFP – win $500

For any issues claiming your deposit bonuses, see full bonus terms and conditions under the ‘promotions’ tab. The customer support team can also assist with bonus queries.

Note, deals may not be available to all account holders and in all jurisdictions.

Regulation & licensing

Tickmill ltd is regulated by the seychelles financial services authority (FSA). Tickmill UK ltd is authorised by the financial conduct authority (FCA). Tickmill europe ltd is regulated by the cyprus securities and exchange commission (cysec). These are reputable regulatory agencies and help contribute to the broker’s high trust rating.

Additional features

The broker offers multiple additional features to assist traders, including:

- Free VPS

- News blog

- Copytrade

- Tradingview

- Economic calendar

- One-click (EA) trading

- Video tutorials & seminars

- Forex & pip calculators

Account types

Tickmill offers three account types:

- Classic – trade cfds on 62 currency pairs, major indices, bonds and commodities. Variable spreads start from 1.6 pips and there are no commissions. A classic account is suitable for both beginners and experienced traders.

- Pro – aimed at experienced traders. Spreads from zero pips, commission payable on 2 currency units per side per lot (0.0020% notional). Stop and limit levels are 0. No commission on stock indices, oil and bonds.

- VIP – an exclusive account for high volume traders. Commission payable on 1 currency unit per side per lot. No commission on cfds, stock indices, oil and bonds. Spreads from zero pips, minimum deposit $50,000.

An islamic trading account is also available.

For issues regarding invalid account requests, check the list of accepted countries below or contact the customer support team.

Benefits

Advantages of trading with tickmill include:

- Demo account

- Hedging & scalping

- Straightforward login

- Multiple promotional offers

- Competitive average spreads

- A good range of educational tools

Drawbacks

Disadvantages of trading with tickmill include:

- No cent or micro account

- Spread betting unavailable

- No metatrader 5 (MT5) platform

- No cryptocurrency and bitcoin trading

- Services not available to clients from the US, japan, or canada

Trading hours

FX trading is available 24 hours, 5 days a week. German bonds can be traded between 00:00 to 23:00 GMT. Gold markets are open from monday to friday, 01:02 to 23:57 GMT and silver monday to thursday from 01:00-24:00 GMT, and friday 01:00 to 23:57 GMT.

Opening times for cfds will depend on their respective market. Head to the official tickmill website for more information. Trading hours can also be viewed in the MT4 terminal.

Customer support

Customer support is available monday to friday 7:00 – 16:00 GMT via:

- Phone – +852 5808 2921

- Email –[email protected]

- Live chat – chat logo on the right of the homepage

The support team can help with a range of queries, from registration and verification documents to swap-free conditions, forgotten passwords, and account faqs.

Additional information can be found on tickmill’s linkedin and youtube platforms.

Security

Their internal systems are FSA compliant, so client funds are held in segregated accounts. The broker adheres to industry safety standards and only offers secure deposit and withdrawal options. Negative balance protection is available to all clients.

Tickmill verdict

Tickmill is a regulated broker offering the MT4 trading platform, a suite of additional resources, plus multiple account options. Take tickmill’s services vs pepperstone, XM, zulutrade, or IC markets, and traders benefit from competitive fees but sacrifice such a diverse product list.

Accepted countries

Tickmill accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

But traders from united states, canada, japan, bangladesh, nigeria, pakistan, kenya are not allowed by the broker.

Does tickmill offer an islamic account?

Yes, tickmill offers a swap-free account, compliant with sharia law. See the broker’s website for instructions on how to open an account.

Is tickmill a true ECN broker?

Yes, tickmill is an ECN broker and not a market maker. This arguably means clients benefit from lower fees and operate in a more transparent trading environment.

Is tickmill available to US clients?

No, services are not available to those from the US. Traders from canada, japan and some other countries are also unable to open real-money trading accounts.

Is tickmill a good broker?

Tickmill is a highly regulated and well-established broker, offering the popular MT4 platform. With decent welcome bonuses and customer support also available, tickmill a solid online broker.

Does tickmill have the NASDAQ?

Yes, clients can trade on the NASDAQ. Tickmill traders also have access to a dozen or so other stock indices, plus 62 currency pairs, commodities, and german bonds.

| Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities |

Axi offers forex and CFD trading to retail and professional traders. Our review includes all you need to know, from read more

The last twenty years have seen US-headquartered oanda, grow into an established player on the global online broker stage. Today read more

Eaglefx offers FX and CFD trading on the MT4 platform, including indices and cryptocurrencies. Follow this review for a breakdown read more

Liteforex limited is an established CFD and forex broker. Clients can trade on the metatrader 4 (MT4) and metatrader 5 read more

Vincent nyagaka is a professional trader, analyst &. He has been actively engaged in market analysis for the past 7 years. He has a monthly readership of 100,000+ traders and has taught over 1,000 students since 2014. Vincent is also an experienced instructor and public speaker. Checkout vincent’s professional trading course here.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Visit broker

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill review and tutorial

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the metatrader 4 (MT4) trading platform, spreads, bonuses, plus deposit and withdrawal options. Find out whether you should sign up for a tickmill account.

- Tickmill company summary

- Trading platforms

- MT4 platform

- Webtrader platform

- Assets

- Spreads & fees

- Leverage

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- FAQ

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

Tickmill company summary

Tickmill ltd is a member of the global tickmill group, which consists of several trading companies established in the 1980s. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+.

Its headquarters are in london but the company has multiple offices worldwide and its clients can be found everywhere from indonesia, south africa, and tanzania, to vietnam, estonia, australia, and malaysia.

Also part of the tickmill group ltd is tickmill prime and tickmill UK, registered in the isle of man.

Trading platforms

MT4 platform

Hugely popular due to its ease of navigation, dashboard customization, and a suite of features, MT4 is the leading forex trading platform.

- EA trading

- Charting tools

- 50+ indicators

- Historical data centre

- Order management tools

- Advanced notification system

Webtrader platform

As an online platform, the web-based interface doesn’t require a software download.

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Assets

Clients have access to a range of tradeable instruments:

- Forex – trade on 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD

- Stock indices – access 14+ indices including the FTSE, DAX, dow jones (US30), and NASDAQ (nas100)

- Commodities – trade on WTI oil and precious metals, such as gold (XAUUSD) and silver (XAGUSD)

- Bonds – trade a selection of german bonds

Spreads & fees

The tickmill classic account is commission-free with variable spreads starting from 1.6 pips. For pro and VIP account holders, spreads begin at zero pips with low commissions.

Transaction fees are covered up to $100, but dormant accounts may be charged an inactivity fee. Triple swap charges apply to positions held overnight.

Leverage

The maximum leverage available is 1:500, but varies depending on the asset:

- Stock indices – 1:100

- Metals – 1:500

- Bonds – 1:100

- Oil – 1:100

- FX- 1:500

A margin calculator and detailed information regarding margin requirements can be found on the tickmill website.

Mobile app

Mobile trading is available on android (APK) and apple (ios) devices and makes trading on the move straightforward while retaining almost all of the desktop features. Users can analyse markets, price trends, and trade directly from charts. Mobile traders can also deposit funds, withdraw profits, and use available bonuses.

Payment methods

Accepted payment methods include bank transfer, visa/mastercard, skrill, neteller and QIWI. The minimum deposit for classic and pro accounts is $100 and for a VIP account, it’s $5,000. The minimum withdrawal is $25. Payments are processed in EUR, GBP, USD and PLN.

To make a deposit or withdrawal, head to the client area. Customer reviews of the payment process are generally positive.

Demo account

The broker offers a forex and CFD demo account. The practice account is a great opportunity to test the MT4 platform, new strategies, and explore additional features, without the risk of losses. You can open a demo account from the broker’s homepage. The demo server also has rich market history data.

Deals & promotions

Four promotional offers are available:

- $30 welcome bonus – set up and login to your account to withdraw your welcome bonus

- Trader of the month – the top-performing trader earns a $1,000 free trading bonus

- Rebate promotion – earn cash rebates on your trades

- Predict the NFP – win $500

For any issues claiming your deposit bonuses, see full bonus terms and conditions under the ‘promotions’ tab. The customer support team can also assist with bonus queries.

Note, deals may not be available to all account holders and in all jurisdictions.

Regulation & licensing

Tickmill ltd is regulated by the seychelles financial services authority (FSA). Tickmill UK ltd is authorised by the financial conduct authority (FCA). Tickmill europe ltd is regulated by the cyprus securities and exchange commission (cysec). These are reputable regulatory agencies and help contribute to the broker’s high trust rating.

Additional features

The broker offers multiple additional features to assist traders, including:

- Free VPS

- News blog

- Copytrade

- Tradingview

- Economic calendar

- One-click (EA) trading

- Video tutorials & seminars

- Forex & pip calculators

Account types

Tickmill offers three account types:

- Classic – trade cfds on 62 currency pairs, major indices, bonds and commodities. Variable spreads start from 1.6 pips and there are no commissions. A classic account is suitable for both beginners and experienced traders.

- Pro – aimed at experienced traders. Spreads from zero pips, commission payable on 2 currency units per side per lot (0.0020% notional). Stop and limit levels are 0. No commission on stock indices, oil and bonds.

- VIP – an exclusive account for high volume traders. Commission payable on 1 currency unit per side per lot. No commission on cfds, stock indices, oil and bonds. Spreads from zero pips, minimum deposit $50,000.

An islamic trading account is also available.

For issues regarding invalid account requests, check the list of accepted countries below or contact the customer support team.

Benefits

Advantages of trading with tickmill include:

- Demo account

- Hedging & scalping

- Straightforward login

- Multiple promotional offers

- Competitive average spreads

- A good range of educational tools

Drawbacks

Disadvantages of trading with tickmill include:

- No cent or micro account

- Spread betting unavailable

- No metatrader 5 (MT5) platform

- No cryptocurrency and bitcoin trading

- Services not available to clients from the US, japan, or canada

Trading hours

FX trading is available 24 hours, 5 days a week. German bonds can be traded between 00:00 to 23:00 GMT. Gold markets are open from monday to friday, 01:02 to 23:57 GMT and silver monday to thursday from 01:00-24:00 GMT, and friday 01:00 to 23:57 GMT.

Opening times for cfds will depend on their respective market. Head to the official tickmill website for more information. Trading hours can also be viewed in the MT4 terminal.

Customer support

Customer support is available monday to friday 7:00 – 16:00 GMT via:

- Phone – +852 5808 2921

- Email –[email protected]

- Live chat – chat logo on the right of the homepage

The support team can help with a range of queries, from registration and verification documents to swap-free conditions, forgotten passwords, and account faqs.

Additional information can be found on tickmill’s linkedin and youtube platforms.

Security

Their internal systems are FSA compliant, so client funds are held in segregated accounts. The broker adheres to industry safety standards and only offers secure deposit and withdrawal options. Negative balance protection is available to all clients.

Tickmill verdict

Tickmill is a regulated broker offering the MT4 trading platform, a suite of additional resources, plus multiple account options. Take tickmill’s services vs pepperstone, XM, zulutrade, or IC markets, and traders benefit from competitive fees but sacrifice such a diverse product list.

Accepted countries

Tickmill accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

But traders from united states, canada, japan, bangladesh, nigeria, pakistan, kenya are not allowed by the broker.

Does tickmill offer an islamic account?

Yes, tickmill offers a swap-free account, compliant with sharia law. See the broker’s website for instructions on how to open an account.

Is tickmill a true ECN broker?

Yes, tickmill is an ECN broker and not a market maker. This arguably means clients benefit from lower fees and operate in a more transparent trading environment.

Is tickmill available to US clients?

No, services are not available to those from the US. Traders from canada, japan and some other countries are also unable to open real-money trading accounts.

Is tickmill a good broker?

Tickmill is a highly regulated and well-established broker, offering the popular MT4 platform. With decent welcome bonuses and customer support also available, tickmill a solid online broker.

Does tickmill have the NASDAQ?

Yes, clients can trade on the NASDAQ. Tickmill traders also have access to a dozen or so other stock indices, plus 62 currency pairs, commodities, and german bonds.

| Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities |

Axi offers forex and CFD trading to retail and professional traders. Our review includes all you need to know, from read more

The last twenty years have seen US-headquartered oanda, grow into an established player on the global online broker stage. Today read more

Eaglefx offers FX and CFD trading on the MT4 platform, including indices and cryptocurrencies. Follow this review for a breakdown read more

Liteforex limited is an established CFD and forex broker. Clients can trade on the metatrader 4 (MT4) and metatrader 5 read more

Vincent nyagaka is a professional trader, analyst &. He has been actively engaged in market analysis for the past 7 years. He has a monthly readership of 100,000+ traders and has taught over 1,000 students since 2014. Vincent is also an experienced instructor and public speaker. Checkout vincent’s professional trading course here.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill review

- Is tickmill safe?

- Trading conditions

- Account types

- Spreads and commissions

- Deposit and withdrawal fees

- Tickmill for beginners

- Educational material

- Analysis material

- Trading platforms

- Trading tools

- Mobile trading apps

- Evaluation method

- Tickmill risk statement

- Overview

Summary

Built by traders, for traders, tickmill offers low spreads and commission on both ECN and traditional accounts. All accounts feature ultra-fast STP execution (0.15s on average and no requotes) and support for the MT4 platform with all strategies allowed.

Regulated by the FCA in the UK, cysec in europe, and the seychelles FSA internationally вђ“ and a regular winner of trade execution and trading conditions awards вђ“ tickmill also offers 80+ instruments to trade alongside dedicated multi-lingual support and negative balance protection.

Reviews

Account information

Trading conditions

Company details

Deposit & withdrawal methods

Supported platforms for tickmill

Is tickmill safe?

Tickmill ltd is regulated by the seychelles FSA (license: SD 008) and has been regulated by the FCA (license: 717270) since 2016. Cysec has regulated the european entity, tickmill europe ltd (license: 278/15) since 2015.

Tickmillвђ™s quality and popularity amongst traders have been noticed and rewarded by its industry peers; in recent years the company has won awards for best CFD broker asia 2019 (international business magazine), best forex CFD provider 2019 (online personal wealth awards), best forex execution broker 2018 (UK forex awards)В andв best forex trading conditions 2017В (UK forex awards).

More importantly for potential customers, tickmill were recipients of the most trusted broker 2017 (global brands magazine) for a continual focus on keeping pricing competitive and maintaining a fair trading environment.

Trading conditions

All accounts at tickmill offer STP market executed trades in 0.1 seconds on 62 currency pairs in addition to cfds on stock indices, metals, and bonds, without any dealing desk interference. Tickmill does not offer cryptocurrency cfds.

The margin call and stop-out percentage differ for the retail and professional versions of the accounts where the margin call to stop-out for retail clients is 100% to 50%, and professional is 100% to 30%.

Clients can choose between four wallet currencies вђ“ USD, EUR, GBP, and PLN.

Account types

Tickmill offers three different live accounts in addition to the demo account. While trading conditions improve with the account type, the main differentiating factor is the initial deposit required.

Demo account вђ“ A demo account is available for new traders and will remain open until there is no login for seven consecutive days.

Classic account вђ“ this entry-level account requires a minimum deposit of 100 USD, and, like all tickmill accounts, offers a swap-free islamic account option. The spreads start at 1.6 pips and maximum leverage is 1:500 вђ“ note that this is the only account that uses wider spreads instead of charging a commission on each trade.

Pro account вђ“ this account, also with a swap-free islamic option, requires a 100 USD minimum deposit and is the entry-level account for professional traders. Tighter spreads are available in exchange for a commission of 2 USD per side per 100,000 (a standard lot) traded. This commission pricing and structure is an industry-standard and is in line with what other STP brokers offer clients for the same services.

VIP account вђ“ this account, with the same swap-free islamic option, is for high volume professional traders and requires a 50,000 USD minimum deposit. The commission is reduced to 1 USD per side per 100,000 (a standard lot) traded which makes trading even more profitable. This is a very competitive professional account and offers excellent trading conditions.

Spreads and commissions

The minimum spread on the classic account is 1.6 pips with zero commission. The minimum spread on the pro and VIP accounts is 0.0 pips with a commission of 2 USD per side per standard lot trade and 1 USD per side per standard lot traded, respectively.

Deposit and withdrawal fees

Tickmill takes deposits through a variety of global and local methods, under a zero fees policy. They include:

- Visa/mastercard

- Bank transfer

- Neteller/skrill

- STICPAY

- Fasapay

- Unionpay

- Nganluong.Vn

- QIWI

- Webmoney

The zero fees policy means that tickmill will reimburse traders for any fees charged up to 100 USD. If you were charged, submit a copy of the bank statement showing the charge, and the amount will be credited. Should the trading account become inactive, tickmill reserves the right to start reimbursing transfer fees.

Tickmill for beginners

Tickmill does not have a traditional introductory course, but they do publish webinars and seminars to help new traders get their footing. They have also made available a detailed ebook which many new traders will find useful. Additionally, while the analysis blog and tradingview analysis tools do not explain the basics of trading, they do offer new perspectives on currency markets.

Educational material

For new traders, tickmillвђ™s main resource is its downloadable ebook, but the webinars and seminars are also of great assistance.

The 46-page ebook, titled the majors вђ“ insights & strategies, is well illustrated and a suitable replacement for an online course for beginners. The ebook covers forex trading basics and how forex trading works, an introduction to the major currency pairs, trading strategies and the major types of forex analysis. The ebook ends with a section of top tips which will give traders more confidence in their decisions.

Webinars are run in four languages (english, arabic, italian and german), and all previous webinars are available in an archive. The webinar subjects vary from more fundamental concepts like news trading strategies to technical analysis and chart theories like standard elliot wave models.

Tickmill has a schedule of free seminars around the world, which introduce traders to new areas of learning and also allows clients to meet brokers in person and create relationships.

Analysis material

The tickmill research team runs a regular blog which covers topics that relate to both fundamental and technical analysis. Research often covers different currency pairs and encourages traders to learn about market-moving events outside of conventional news sources.

The blog is open to all readers and tickmill allows traders to contact the author with questions about their article. This is unique among brokers, who typically shy away from one-to-one contact with traders when it comes to discussing specific investments.

Tickmill is also active on their tradingview pro account where analysts are continually marking up charts. Even if traders are not going to take advantage of these trading opportunities, they are a great way to learn technical analysis from the pros.

Trading platforms

Tickmill supports metatrader4 (MT4) and the associated web and mobile applications. MT4 is the industry leader and the most common trading platform for CFD traders.

There are many advantages of signing up with an MT4 broker and using MT4 for trading:

- The MT4 community is vast, as is the amount of the text and video resources to support both new and experienced traders.

- The MT4 EA (expert advisor) community of developers is very active, so renting or buying algorithmic trading software is very easy.

- MT4 has very low system requirements, so a new device or computer is not necessary to get started.

Trading tools

Tickmill also provides a number of useful trading tools.

Autochartist is a third-party automated chart analysis tool which scans the markets for volatility and notifies traders of relevant trading opportunities. Since it integrates into MT4, information is available inside the trading view and adds little complication to the platform while providing additional analysis. Autochartist is a common technical analysis tool among traders, so training videos are easy to find online. Tickmill offers autochartist free of charge to all live accounts and the demo account on a delay of five candlesticks.

Another common third-party trading tool available on tickmill is myfxbook autotrade, which is a cross-broker social trading platform that allows for copy trading without the need for additional software.

The one-click trading MT4 expert advisor (EA) is designed to make common trading mechanisms more accessible, which facilitates trading and removes unnecessary navigation between windows and charts. This EA does not overly simplify MT4, but it does make trading on the platform less complicated.

Tickmill VPS has partnered with beeksfx to provide discounted VPS services to clients. While many brokers will include VPS as a free service for active traders, VPS has chosen to partner with a leading 3rd party provider and asks clients to take on the additional cost.

Mobile trading apps

Metatrader4 (MT4) is also available on IOS, android and windows mobile phone and tablets. The app will connect to the same account as the desktop software, keeping the trading experience synchronised, and traders mobile.

Evaluation method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the tickmill offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Tickmill risk statement

Trading forex is risky, and each broker is required to detail how risky the trading of forex cfds is to clients. Tickmill would like you to know that: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with tickmill ltd.

Overview

Tickmill is an award-winning and trustworthy STP broker that relies heavily on industry-standard platforms to enable fast execution. With a strong education section, additional premium tools offered to traders for no extra cost, and good trading conditions, tickmill should be a top choice in forex brokerage.

Tickmill review and tutorial

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the metatrader 4 (MT4) trading platform, spreads, bonuses, plus deposit and withdrawal options. Find out whether you should sign up for a tickmill account.

- Tickmill company summary

- Trading platforms

- MT4 platform

- Webtrader platform

- Assets

- Spreads & fees

- Leverage

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- FAQ

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

Tickmill company summary

Tickmill ltd is a member of the global tickmill group, which consists of several trading companies established in the 1980s. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+.

Its headquarters are in london but the company has multiple offices worldwide and its clients can be found everywhere from indonesia, south africa, and tanzania, to vietnam, estonia, australia, and malaysia.

Also part of the tickmill group ltd is tickmill prime and tickmill UK, registered in the isle of man.

Trading platforms

MT4 platform

Hugely popular due to its ease of navigation, dashboard customization, and a suite of features, MT4 is the leading forex trading platform.

- EA trading

- Charting tools

- 50+ indicators

- Historical data centre

- Order management tools

- Advanced notification system

Webtrader platform

As an online platform, the web-based interface doesn’t require a software download.

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Assets

Clients have access to a range of tradeable instruments:

- Forex – trade on 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD

- Stock indices – access 14+ indices including the FTSE, DAX, dow jones (US30), and NASDAQ (nas100)

- Commodities – trade on WTI oil and precious metals, such as gold (XAUUSD) and silver (XAGUSD)

- Bonds – trade a selection of german bonds

Spreads & fees

The tickmill classic account is commission-free with variable spreads starting from 1.6 pips. For pro and VIP account holders, spreads begin at zero pips with low commissions.

Transaction fees are covered up to $100, but dormant accounts may be charged an inactivity fee. Triple swap charges apply to positions held overnight.

Leverage

The maximum leverage available is 1:500, but varies depending on the asset:

- Stock indices – 1:100

- Metals – 1:500

- Bonds – 1:100

- Oil – 1:100

- FX- 1:500

A margin calculator and detailed information regarding margin requirements can be found on the tickmill website.

Mobile app

Mobile trading is available on android (APK) and apple (ios) devices and makes trading on the move straightforward while retaining almost all of the desktop features. Users can analyse markets, price trends, and trade directly from charts. Mobile traders can also deposit funds, withdraw profits, and use available bonuses.

Payment methods

Accepted payment methods include bank transfer, visa/mastercard, skrill, neteller and QIWI. The minimum deposit for classic and pro accounts is $100 and for a VIP account, it’s $5,000. The minimum withdrawal is $25. Payments are processed in EUR, GBP, USD and PLN.

To make a deposit or withdrawal, head to the client area. Customer reviews of the payment process are generally positive.

Demo account

The broker offers a forex and CFD demo account. The practice account is a great opportunity to test the MT4 platform, new strategies, and explore additional features, without the risk of losses. You can open a demo account from the broker’s homepage. The demo server also has rich market history data.

Deals & promotions

Four promotional offers are available:

- $30 welcome bonus – set up and login to your account to withdraw your welcome bonus