Claim your bonus

If HMRC are still checking your coronavirus job retention scheme claims, you can still claim the job retention bonus but your payment may be delayed until those checks are completed.

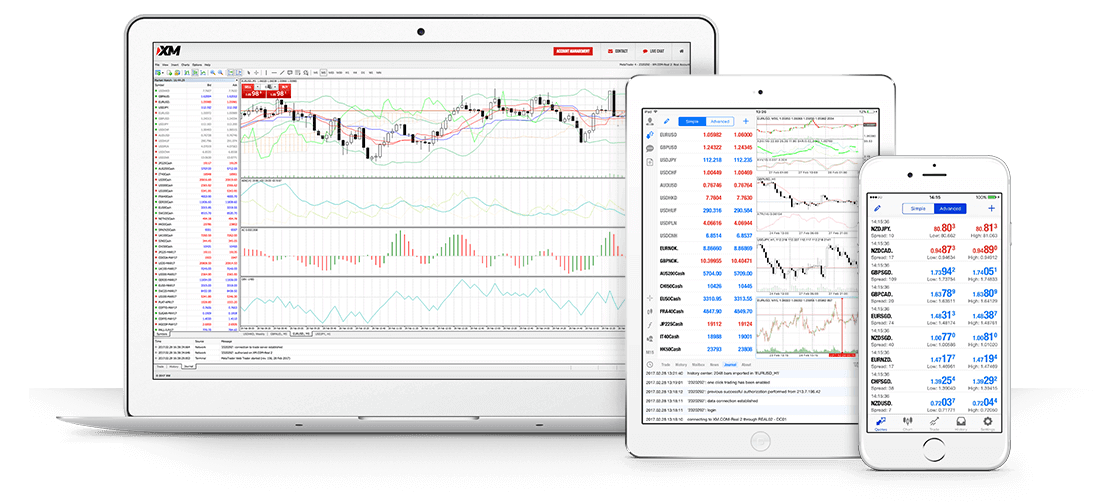

New forex bonuses

You can still claim the bonus if you make a claim for that employee through the job support scheme. Guidance on the job support scheme will be published soon.

Check if you can claim the job retention bonus from 15 february 2021

Find out if you’re eligible to claim the job retention bonus and what you need to do to claim it. You will be able to claim it between 15 february 2021 and 31 march 2021.

This guidance was withdrawn on 5 november 2020

The job retention bonus will no longer be paid in february, as the coronavirus job retention scheme has been extended until the end of march 2021. Further details about the extension are available.

You cannot claim the job retention bonus until 15 february 2021. This guidance will be updated by the end of january 2021 with how to access the online claim service on GOV.UK.

The job retention bonus is a £1,000 one-off taxable payment to you (the employer), for each eligible employee that you furloughed and kept continuously employed until 31 january 2021.

You’ll be able to claim the bonus between 15 february 2021 and 31 march 2021. You do not have to pay this money to your employee.

Who can claim

You can claim the bonus if you’re an employer who has furloughed employees and made an eligible claim for them through the coronavirus job retention scheme. Your employee must have been eligible for the coronavirus job retention scheme grant for you to be eligible for the bonus.

You can still claim the bonus if you make a claim for that employee through the job support scheme. Guidance on the job support scheme will be published soon.

If you have repaid coronavirus job retention scheme grant amounts to HMRC

You cannot claim the bonus for any employees that you have not paid using the coronavirus job retention scheme grant because you have repaid all the grant amounts you claimed for them. This applies regardless of the reason why you repaid the grant amounts.

Employees you can claim for

You can claim for employees that:

- You made an eligible claim for under the coronavirus job retention scheme

- You kept continuously employed from the end of the claim period of your last coronavirus job retention scheme claim for them, until 31 january 2021

- Are not serving a contractual or statutory notice period for you on 31 january 2021 (this includes people serving notice of retirement)

- You paid enough an amount in each relevant tax month and enough to meet the job retention bonus minimum income threshold

If HMRC are still checking your coronavirus job retention scheme claims, you can still claim the job retention bonus but your payment may be delayed until those checks are completed.

HMRC will not pay the bonus if you made an incorrect coronavirus job retention scheme claim and your employee was not eligible for the coronavirus job retention scheme.

Employees who have been transferred to you under TUPE or due to a change in ownership

You may be eligible to claim the job retention bonus for employees of a previous business which were transferred to you if:

- TUPE rules applied

- The PAYE business succession rules applied

- The employees were associated with the transfer of a business from the liquidator of a company in compulsory liquidation where TUPE would have applied if the company was not in compulsory liquidation

To claim the job retention bonus for employees that have been transferred to you, you must have furloughed and successfully claimed for them under the coronavirus job retention scheme, as their new employer. The employees must also meet all the relevant eligibility criteria for the job retention bonus.

This means that you will not be able to claim the job retention bonus for any employees who are transferred to you after the coronavirus job retention scheme closes on 31 october 2020.

Claiming for an individual who’s not an employee

You can claim the job retention bonus for individuals who are not employees, such as office holders or agency workers, as long as you claimed a grant for them under the coronavirus job retention scheme and the other job retention bonus eligibility criteria are met.

The minimum income threshold

To be eligible for the bonus you must make sure that your employees have been paid at least the minimum income threshold.

To meet the minimum income threshold you must pay your employee a total of at least £1,560 (gross) throughout the tax months:

- 6 november to 5 december 2020

- 6 december 2020 to 5 january 2021

- 6 january to 5 february 2021

You must pay your employee at least one payment of taxable earnings (of any amount) in each of the relevant tax months.

The minimum income threshold criteria apply regardless of:

- How often you pay your employees

- Any circumstances that may have reduced your employee’s pay in the relevant tax periods, such as being on statutory leave or unpaid leave

We will check that your employees have been paid at least the minimum income threshold by checking information you’ve submitted through full payment submissions via real time information (RTI).

What payments are included in the minimum income threshold

Only payments recorded as taxable pay will count towards the minimum income threshold. Taxable pay is reported to HMRC as a single figure through full payment submissions via real time information (RTI).

If you are making redundancies

If you make redundancies, you must comply with the normal rules for redundancy, which include using fair redundancy criteria. These rules apply even if this means that fewer of your employees are eligible for the job retention bonus.

Get ready to claim

You cannot claim the bonus until 15 february 2021. This guidance will be updated by the end of january 2021 with details on how to access the online claim service on GOV.UK.

Before you can claim the bonus, you will to need to have reported all payments made to your employee between 6 november 2020 and 5 february 2021 to HMRC through full payment submissions via real time information (RTI).

There are some steps you need to take now to make sure you’re ready to claim.

- Still be enrolled for PAYE online

- Comply with your PAYE obligations to file PAYE accurately and on time under real time information (RTI) reporting for all employees between 6 april 2020 and 5 february 2021

- Keep your payroll up to date and make sure you report the leaving date for any employees that stop working for you before the end of the pay period that they leave in

- Use the irregular payment pattern indicator in real time information (RTI) for any employees not being paid regularly

- Comply with all requests from HMRC to provide any employee data for past coronavirus job retention scheme claims

Using an agent to do PAYE online and claim the job retention bonus

If you use an agent who is authorised to do PAYE online for you, they will be able to claim the job retention bonus on your behalf.

This guidance will be updated by the end of january 2021 with details on how agents can claim the bonus for you.

Tax treatment of the job retention bonus

You must include payments you receive under the scheme as income when you calculate your taxable profits for income tax and corporation tax purposes.

Businesses can deduct employment costs as normal when calculating taxable profits for income tax and corporation tax purposes.

Individuals with employees that are not employed as part of a business (such as nannies or other domestic staff) will not have to pay tax on grants received under the scheme.

When the government ends the scheme

You will have until 31 march 2021 to make a job retention bonus claim after which the scheme will close. No further claims will be accepted after this date.

You will not be able to claim until 15 february 2021 and this guidance will be updated by the end of january 2021 with details on how to access the online claim service.

Contacting HMRC

We are receiving very high numbers of calls. Contacting HMRC unnecessarily puts our essential public services at risk during these challenging times.

Get help online

Use HMRC’s digital assistant to find more information about the coronavirus support schemes. You can also contact HMRC if you cannot get the help you need online.

Other help and support

You can watch videos and register for free webinars to learn more about the support available to help you deal with the economic impacts of coronavirus.

Pin-up casino online casino review 2021 - bonuses

Bonuses

Once you join pin-up casino you are off to a good start. You will receive 250 free spins and bonus funds that go as high as $500. The only way to claim this offer is to register for an account at the casino and to make your first deposit. To receive the free spins you need to deposit at least $50. You will get 50 free spins immediately, and 40 free spins per day for the next five consecutive days. You will also receive a 100% match deposit bonus up to $500. The wagering requirements for the free spins and the bonus are 50 times and you have 72 hours to meet them.

Loyalty bonus

The moment you join the casino and start placing real money bets, you will become a part of their loyalty program. The more you play the faster you will climb the level ladder. To make things easier for new members, the casino will give you awards for completed tasks. For instance, you will receive 50 points for just completing your profile and another 50 when you verify your account.

Match bonus

Pin-up casino accepts all kinds of players, both high rollers and those with tight budgets. Each new member at the casino will be rewarded with a 100% match bonus that can go as high as $500. This bonus is only available to new players who create their accounts at the casino and make a deposit. The bonus funds need to be played through 50 times before you can make a withdrawal of your winnings. You have 72 hours to meet the wagering requirements.

Bonus no deposit

At this point, there is no bonus available at the casino but this can change in the future.

Bonus withdrawal rules

When you claim your bonus at the casino, the bonus is credited to your bonus balance and kept separately from your real money balance. You will use your real money first to place bets, and once your balance drops to $0.5 you can use the bonus balance to continue playing. All your winnings and bonus funds can’t be withdrawn until you meet the wagering requirements.

Different games contribute to a different percentage of meeting the wagering requirements. Bets made on video slot games will contribute 100% towards meeting the wagering requirements with some exceptions. These games are excluded from the bonus: the wish master, jekyll, and hyde, blood suckers, robin hood, 888 gold, lucky angler, tree of fortune, secret of the stones, devil's delight, champion of the track, kings of chicago, jackpot 6000, good girl-bad girl, at the copa, after night falls, slots angels, 7th heaven, ned, and his friends, true illusions, sin city nights, whospunit plus, the true sheriff, sugar pop, puppy love plus, pinocchio, simsalabim and gypsy rose, 4 seasons, hot fruits 20, moon princess, cloud quest, energoonz, GEMIX, holiday season, pimped, reactoonz, rise of olympus, royal masquerade, sweet alchemy, viking runecraft, tower quest, wizard of gems, genie jackpots megaways, temple of treasure, wolf legend, vikings unleashed, buffalo rising, legacy of ra, valletta, mustang gold, wolf gold, chillipop, great rhino.

Card games, roulette, keno, virtual sports, and live dealer games will not contribute towards meeting the wagering requirements.

The maximum bet you can place when you play with bonus funds is $5.

Does no claims bonus expire?

Since insurers use information about your driving history to decide on how much you’ll pay for car insurance, having some no claims bonus (NCB) can make a big difference to the amount you’ll pay.

As such, it’s important to understand how your NCB works – and, crucially, whether or not it expires if you don’t have an active vehicle insurance policy running.

Here, we’ll look at everything you need to know about your NCB – including:

- When does a no claims bonus expire?

- Who accepts an expired no claims bonus?

- Whether your NCB will continue if you’re a named driver

With this information, you’ll be able to decide the best way forward if you want to keep your discount in place.

What is a no claims bonus?

A no claims bonus (sometimes also called a ‘no claims discount’) is a perk that all vehicle insurers offer – and it can be transferred from provider to provider.

Every time you drive for one year without making a claim on your insurance, your cover provider will give you a year’s no claims bonus. When you come to renew, you’ll be asked how many years’ bonus you have – and this will usually apply a discount to the price you’re offered.

A no claims bonus is a good way of insurers incentivising careful driving – after all, who doesn’t want cheaper car insurance?

Even if you swap from one provider to another, you’ll be able to take your no claims discount with you. When you tell your new insurer that you’ve got an NCB, they’ll apply your discount and get confirmation from your previous provider.

If you’re expecting a token discount for careful driving, then you might be surprised. Some insurers offer up to 75% for ‘full’ (5 years+) no claims bonus – so it’s well worth being careful and building up those years.

When does a no claims discount expire?

Since a no claims bonus is intended to give an indication of how careful your recent driving has been – if you let it lapse for too long, it will expire.

Don’t worry though – you’ve got 2 years before you lose any bonus you’ve built up – but after that, you’ll start from zero again. If you want to hold on to your bonus, you’ll need to take out another policy before your 2 years is up.

Will my no claims keep running if I’m a named driver?

The good news is, many insurance companies now offer named drivers their own no claims bonus – even if they’re not the main driver or policyholder.

As such, you’ll often be able to keep your no claim’s bonus running, even if you don’t have your own policy. Not all insurers offer this though – so make sure the policyholder has confirmation that this is the case, so your no claim’s discount doesn’t expire.

Do any insurers accept expired no claims discounts?

There are very few insurers that will take expired no claims bonuses into account when they calculate your quote – but you may find some that will. In fact, you may even find insurers who accept NCB that you’ve built in other countries.

Unfortunately, while your insurer might accept claim free driving or an overseas NCB as an equivalent to a no claims bonus – this won’t create any bonus retrospectively, so your NCB will start building again from zero.

Was this answer useful to you?

If you still didn’t find the answer you were looking for and need to speak to an expert, get in touch with us via the methods below

Fault claims and no-claims bonuses

On this page

If you’ve been involved in a motor accident, you may have had a “ fault ” claim put on your insurance record. You might decide to complain because this has affected your no-claims bonus, otherwise known as the no-claims discount.

Different insurers have different approaches to no-claims bonuses and how they’re applied, so we need to look at the individual facts of each case.

What are fault claims and no-claims bonuses?

No-claims bonuses

For every year of driving without making an insurance claim, a policyholder is awarded one year of no-claims bonuses.

For example, if you’ve been driving for 4 years and haven’t made a claim, you’ll have built up 4 years ’ no-claims bonuses.

The more years of no-claims bonus you have , the lower the risk you demonstrate yourself to be to your insurer. This means the insurance quote will be cheaper compared to quotes for other drivers in the same circumstances but with a lower no-claims bonus.

The amount of discount for a no-claims bonus isn’t set; it varies between insurers.

Fault claims

A “ fault ” claim is recorded when an accident is either:

- The driver’s fault

- Not the driver’s fault, but the cost can’t be claimed from another party – for example, if a parked car is hit and the other driver can’t be found

If a fault claim is recorded, it’s likely to reduce your no-claims bonus if you haven’t protected it. This is normally reduced by 2 years, but insurers should explain in their policy how any reduction in no-claims bonus would be applied.

For example, if you had 4 years unprotected no-claims bonus and you have a fault claim, your no-claims bonus will be reduced to 2 years.

Types of complaint we see

You might decide to complain because:

- You’ve lost your no-claims bonus or had a fault claim recorded, but the accident wasn’t your fault

- You’ve protected your no-claims bonus, but your premiums have increased

- You reported a minor accident without making a claim, but your premiums have increased

We also see complaints involving a misunderstanding about how no-claims bonuses work. For example, we hear from people who:

- Thought their no-claims bonus could be used on more than one policy at the same time

- Didn’t know that their new insurer applies a maximum limit of no-claims bonus and they’ve lost years

- Thought their insurer would accept a no-claims bonus that hasn’t been used for a certain number of years

- Have a no-claims bonus as a named driver, but didn’t realise this couldn’t be transferred to their own policy

- Thought their insurer would accept a commercial no-claims bonus for a private car

- Have built up a no-claims bonus outside the UK, and didn’t know their insurer wouldn’t accept this

What we look at

We look at evidence from both you and your insurer to work out what happened.

If there’s been a misunderstanding or confusion about the policy, we’ll look at its terms. We’ll check whether th e information was clearly explained to you when the policy was sold, and how clear the sales process was.

Here’s a bit more detail on what we look at for specific complaints:

If your insurer has settled a claim, but the accident wasn’t your fault

If your insurer has accepted liability for an accident, it doesn ’ t necessarily mean they think you’re to blame. It may mean they’ve considered the evidence and decided to pay out, rather than fight a claim they think they might lose in court.

Your insurer may have accepted liability for an accident without asking you first. Most policies say the insurer can decide to accept liability. But we often find they haven’t always explained this to the customer.

It ’ s not our role to investigate the accident and decide who ’ s responsible. But we ’ ll look at the evidence available to your insurer at the time and check they made a fair decision. This may include things like:

- Accounts from you and any other drivers involved

- Witness statements

- Engineers' reports

- CCTV footage

When a fault claim has been recorded

If a fault claim has been recorded on your insurance record, you may have lost the no-claims bonus you had, or your premiums may have increased.

Where this has happened, we’ll check that your insurer’s decision was in line with the policy terms and conditions. We’ll then make sure it was clearly explained to you that a no-claims bonus would be affected by a fault claim.

If you’ve reported an accident that wasn’t your fault and you don’t want to make a claim, it shouldn’t be treated as a claim by your insurer. However, your no-claims bonus may be affected if they receive a claim from the other driver.

If you’ve claimed for any damage to your car, your no-claims bonus may be affected until your insurer recovers the money from the other driver’s insurer.

Cases involving insurance fraud

We’ve seen complaints from people who say their insurer has paid out for a made-up or fraudulent claim, and they’re worried that their insurance cost will increase because of it.

If we find that fraud was a possibility, we’ll check whether your insurer investigated further before deciding to pay out. If they didn’t, we may say it was unreasonable for them to pay out.

You can find more information about insurance fraud on the insurance fraud bureau’s website.

If you reported an accident without making a claim

If an accident is reported, but no claim is made

Even if you report a minor accident, the report will normally stay on your insurer ’ s record – f or example, if you reversed into your own garage wall but decided to pay for the repairs yourself. They will also record it on the shared industry central database. But because your insurer didn’t have to pay out anything, this won’t affect your no-claims bonus.

You may have reported a car incident without making a claim, only to find your insurance premiums have gone up when you’ve renewed your policy.

The fact an incident has happened, however minor it may be, signals to an insurer that you’re statistically more likely to make additional claims in future than people who haven’t had any incidents.

So, your insurer may tell you to report any incident you’re involved in, even if you don’t want to make a claim. If you don’t, they might cancel the policy or refuse to pay a claim in the future.

If your premiums have gone up after you’ve reported an incident, we’ll ask your insurer to explain why. We’ll also ask whether there was any other reason for the increase.

If you report an accident, but decide to pay the claim of the other person involved yourself instead of making a claim

You may decide to report an incident without making a claim and pay for any damages yourself. In these cases, the claim should be recorded as “ notification only ” , and there should be no reduction of your no-claims bonus.

Non-fault accidents

You might report an accident, which you say wasn’t your fault and don’t want to claim for . Your insurer should only treat this as a claim if they receive a claim from the other driver – or third party. If they do, it will affect your no-claims bonus until your insurer can work out who’s liable.

If you decide to claim for any damage, it will affect your no-claims bonus until your insurer can recover the costs from the other driver’s insurer.

But a no-claims bonus is only relevant at the annual renewal of the policy. If it’s been found that you weren’t at fault for the accident by the renewal date, your no-claims bonus won’t be affected, regardless of whether the claim is closed or not.

If you’ve made a claim you’re not at fault for during the policy year

An extra year of no-claims bonus is only added if you haven’t had any claims in the policy year. So even if you’re not at fault for a claim, you wouldn’t get a no-claims bonus for that year.

Complaints involving no-claims bonuses when you change insurers

If you insure a second vehicle with a different insurer

We’d expect the premiums on your first vehicle to increase only if your no-claims bonus is transferred to the second vehicle. This is because you will only have one no-claims bonus entitlement, which you can only use on one vehicle at a time.

If you’ve switched insurers mid-way through a policy

Your no-claims bonus will always be a whole number. For example, if you cancelled your policy 11 months into a 12 - month policy, you haven’t gone the full year without being involved in a fault incident. So it would be unfair for your insurer to give you a year of no-claims bonus for this period .

This means you’d leave your insurer with the same no-claims bonus you came to them with – as long as you ha dn ’t had any fault claims.

Proof of no-claims when your no-claims bonus is higher than your new insurer’s maximum

You may go to a new insurer with a higher amount of no-claims bonus than they will accept – f or example, if you have 9 years no-claims bonus, but the maximum they apply is 4 .

We’d still expect your insurer to provide proof of 9 years no-claims bonus at the end of the policy year, unless they’d always made it clear that they wouldn’t.

If your insurer reduces your no-claims bonus to less than you think it should be

If you change insurer and you have a claim, your insurer may decide to “ step-back ” your no-claims bonus. This means they will reduce your no-claims bonus by a set amount of years.

For example, you may have had 9 years no-claims, but your new insurer’s maximum is 4 years. You also have the claim. If their process is to step back to 2 years, they would only provide 2 years ’ no-claims bonus.

We’d normally say this was fair as long as they made this clear when you took the policy out. If they didn’t, we’d need to think about what effect this had on you and your decision to take out the policy.

Most insurers step-back from 5 years even if you have more no-claims bonus than this. So in most cases, this will mean you getting 3 years no-claims bonus.

We’d usually say it was reasonable for your insurer to give you a letter – if you asked for it – that sets out:

- The amount of no-claims bonus you started the policy with

- Their business maximum

- How that’s affected the your no-claims bonus after a claim

How long a no-claims bonus lasts

Each insurer will have their own rules about how long you have had a no-claims bonus for.

Most will accept a no-claims bonus that’s less than 2 years old, but others may accept less than 3 years. However, they may only accept 3 years if they were the last insurer. Some commercial insurers will only accept no-claims bonuses that are less than a year old.

How long an insurer can withhold confirmation of a no-claims bonus if a claim is ongoing

You can cancel a policy and set up a new policy with another insurer whenever you want, even if a claim is ongoing. But the claim will have an effect on the no-claims bonus if:

- The claim is settled in your favour – the reduction should only last until the claim is settled

- The outcome of the claim is that you’re at fault – your insurer should release proof of no-claims bonus, taking off a loss of discount for the claim

We don’t think it’s fair for your insurer to withhold a no-claims bonus you’ve earned. But we might not interfere if they’ve done this because you owe them money.

Complaints involving protected no-claims bonuses

If you’ve made a claim, you may find that your insurance premiums have increased, even though you have “ protected ” no-claims bonus.

Different insurers have different rules about how the protection applies. In a lot of policies, a protected no-claims bonus means the amount of your no-claims bonus won’t change if a fault claim is recorded. However, this doesn’t mean the price is protected, so you may still see your premiums increase when you renew the policy.

We’ll check the policy terms and conditions to make sure they’ve been applied fairly. If they haven’t, we’ll probably tell your insurer to refund any extra money you paid.

How to complain

Talk to the business first. They need to have the chance to put things right. They have to give you their final response within 8 weeks for most types of complaint. If you’re unhappy with their response, or if they don’t respond, let us know.

Putting things right

If we think it was unreasonable for your insurer to settle a claim, we’re likely to tell them to change your record to a non-fault claim instead. If we find you’ve been unfairly paying more for your insurance, we’ll also tell them to refund you the extra money.

If we think the insurer’s customer service has been poor, or you’ve suffered any unnecessary trouble and upset, we may also award additional compensation.

Georges reviews

Internet marketing product reviews by george eeken

How to claim your bonuses and bonus FAQ

Probably you read one of my reviews and want to buy a product (or already did). Awesome!

Of course, I want to reward you with special bonuses..

What kind of bonuses?

There are four categories of bonuses:

- [always] bonus points to use on selectyourbonus.Com

- [often] extra bonus: choose one or more products for free on georgesdeals.Com

- [often] special bonus packages on special bonus pages.

- [optional] instead of bonus points and bonuses, you can (often) opt for a 12,5% cash rebate.

Selectyourbonus.Com

To give you a choice to select your bonuses yourself, I created my special membership site selectyourbonus.Com where you can change bonus points for great WP plugins, courses, and other information products.

For each and every product in the funnel you’ll buy, you’ll always get bonus points. The number of points is based upon the price level of the product and is usually a value between 40 and 200 points. As the products on selectyourbonus are each “valued” with 5 or 10 points, you can choose at least 4 products for free (for each product you’ll buy).

You can use your points whenever you want. For every download, your points will be deducted and the remaining points will be valid “for life” in your members’ area. (hence, no need to tell me which products you want, you can select them yourself).

And there is no need to create your membership account on selectyourbonus.Com. This will be done for you (after you’ve sent your bonus request as described below).

Free products on georgesdeals.Com

For most of the upsells or specific higher priced front-end products, you can select one or more free high-end products on my special deal site georgesdeals.Com.

How do you know if you can select a free product on georgesdeals?

There is no specific rule, for each product I decide if and how many products you are allowed to choose. Just read about the bonus details on each review or on the new offers overview page.

Please, don’t buy the products directly on georgesdeals.Com if you can select one or more products for free. Instead, just send an email to [email protected] and tell which product(s) you want.

(of course, if you are not allowed to select a free product on georgesdeals, you can always buy these deals as a regular purchase)

Special bonus pages

Often the vendor allows their affiliates to give away special bonuses. Of course, if this is the case, you’ll get these bonuses as well. Most of the times, these bonuses are delivered inside the members/download area of the product itself. In other cases, I have to send these bonuses to you via email.

Besides these “standard” bonuses, some vendors do give me (semi-)exclusive bonuses to give away, or I added my own extra bonuses.

For all these kind of special bonuses, I did create a special bonus page or mention the individual bonuses in my review.

Cash rebate bonus

Instead of applying for your bonuses and bonus points, most of the times (if the seller allows it) you can opt for a cash rebate of 12,5% of the purchase price (for each product you’ve bought). To get your rebate, please read about the terms & conditions, and use the ticket system on georgesrebates.Com.

How to claim your bonus points and bonuses?

As you’ll get a different number of bonus points for each individual purchase, I have to add your bonus points manually (and in case you are a first-time buyer, I have to manually set up your membership on selectyourbonus as well).

Furthermore, you can often select one or more free products on georgesdeals.Com, and as I don’t know which one(s) you prefer, you have to tell me which product(s) you want!

Anyway, to get your bonuses, I have to do some things manually.

That’s why I can’t automate your bonus delivery.

So, please send an email to [email protected] with your purchase details. And if applicable, let me know which free product(s) on georgesdeals.Com you want.

You can expect your bonus delivery within 24 hours (during business days).

Other FAQ

How to be sure you’ll use my affiliate link?

No worries, follow this link to see how you can check that you’ll use my affiliate link.

Can’t find my review but still want to buy a product and get my special bonuses?

First check out if you can find them on one of these pages: new products or the latest jvzoo picks of the day. Still not found? Send me an email ([email protected]) and tell me which product you want to buy. And I’ll reply with the affiliate link you can use.

Do I need to create an account on selectyourbonus.Com?

No, our support will create your account and send you the login details.

Do I need to buy the (free) bonus products on georgesdeals.Com?

No, just send an email to [email protected] and tell which free product(s) you want.

Thanks again. Enjoy your new product(s) and keep following your dreams.

No-claim bonus explained: the ultimate guide

There’s no claims bonus, no claim discount, no claims bonus protection, a whole load of rules and exclusions – do you find it all rather confusing?

Fortunately we’re here to help you out. In this article, we explain what a no claims bonus is, how you can earn your bonus, and whether it’s worth paying extra to protect it.

What is a no-claim bonus?

For every year that you’re insured to drive a car but you don’t make a claim on your insurance, an insurer gives you a no claims bonus. You could see it as a way of rewarding you for good and safe driving.

In fact, it’s a useful way for insurance companies to build your record as a driver into their pricing scheme.

You must pay attention to the small print because even if a claim isn’t your fault, it could lose you your bonus.

These bonuses are also called no claim discounts (NCD) – you’ll be given a discount against the insurance premium that you would otherwise pay.

How does no-claim bonus work?

Every year, your insurer will notify you (usually on the renewal letter) how many years’ bonus you have.

When they calculate the renewal premium, they’ll work out the price and then take off a percentage discount depending on how many years you have.

If you get a quote from another insurer, you tell them how many years no claims bonus you have and they will also give you a discount. How much discount they give for how many years is up to them and depends on each provider’s own criteria.

Note that you may not be able to get a no claims bonus on third party cover.

You’ll also usually be able to get a no claim discount only if you’re the main driver of the car. Only a few insurers offer a no claim discount for named drivers.

How do I build my NCB?

You build your no claim discount through having insured your car without making a claim. Each year that you continue without making a claim, another year’s bonus is added.

If you make a claim, but the insurer is able to recover its payout from someone else, you’ll usually keep your NCB. For instance, if you are involved in an accident that’s someone else’s fault, and their insurer pays to repair your car, you won’t lose your NCB.

However, if your car is stolen, and your insurer pays out, you will lose your NCB. The same could happen if you’re involved in an accident but the other driver isn’t insured and can’t afford to pay for the damage.

The no claim bonus belongs to you as a driver. It doesn’t belong to your car. But you can only use it on one vehicle at a time. If you decide to change car, you transfer your NCB to the insurance on the new car.

But if a named driver on your policy crashes your car, you could still lose your NCB.

How much can no claims bonus reduce my car insurance?

No claims bonus can have a big impact on the cost of your car insurance, because it’s the best way an insurer has of determining whether you’re a good risk for them to insure.

That’s particularly the case in the early years. Some insurers will offer 30% off after one year’s NCB, but the extra discount levels off after three or four years. For many insurers, the maximum NCB they’ll take into account is 5. The savings tend to tail off after year 3 or 4.

But every insurer makes their own decisions about how much NCB to offer for each year. So we can’t say “one year equals a third off,” but the table below gives typical ranges of no claims discount that you might expect to see.

| Number of years NCB | potential discount |

|---|---|

| 1 | 10-30% |

| 2 | 20-40% |

| 3 | 25-45% |

| 4 | 30-50% |

You should also note that if you have an accident, even if you don’t make a claim, insurers might put your premium up. The no claims bonus isn’t the only factor that’s used when calculating your premium.

Compare best no claims discount

Some of the best promises and discount rates are explained in the table below.

| Insurance company | when you won’t lose your NCB | discounts available |

|---|---|---|

| uninsured driver promise – if you’re hit by an uninsured drive you won’t forfeit your NCB you won’t lose your NCB for claims if the car is vandalised | up to 65% NCB | |

| you won’t lose your NCB for accidents caused by potholes or flood, for theft or damage while the car is parked | – | |

| uninsured driver promise | 30% for one year NCB 60% after 5 years | |

| uninsured driver promise | 80% discount for 9 years NCB (drivers over 25 only) | |

| uninsured driver promise | 75% discount for 10 years NCB | |

| windscreen, window and sunroof claims don’t affect NCB | – | |

| uninsured driver promise | up to 37% for 9 years NCB | |

| windscreen and window claims don’t affect NCB (but sunroof claims do) | up to 50% for 5 years NCB | |

| uninsured driver promise | up to 80% for 4 years NCB |

Do all insurers offer no claims bonus?

Yes, all insurers offer no claims bonus. But all of them have different rules.

For instance some won’t offer a discount to drivers under a certain age. Others don’t offer a discount till you get to your second year of NCB. Some will accept claim-free years built up as a named driver or driving a company car, and others won’t.

You really need to make sure you know the exact terms and conditions. Fortunately, we can help take a lot of the work out of doing the comparison.

What happens to my NCB if I make a claim?

Your NCB basically reflects whether the insurer had to pay out or not. If an accident’s not your fault, your insurer will usually get their money back from the other driver’s insurance, so you keep your NCB. If your insurer loses money (typically, if an accident’s your fault or the perpetrator can’t be traced), you’ll lose your NCB. But there are exceptions.

If you’re hit by a driver who’s not insured, your insurer won’t get paid – and you’ll lose your NCB, unless your policy gives you an uninsured driver promise. It’s worth looking for an insurance policy with this feature.

If the accident is your fault – well, sorry, but your NCB is gone. Serves you right.

Unfortunately, you’ll also lose your NCB if your car is stolen. And that’s tough, but that’s the way it is – because your insurer will pay out for a new car.

Some insurers let you make certain types of claim without affecting your NCB. For instance, LV= doesn’t take your NCB away if you claim for a chipped windscreen – though you’ll have to pay an excess of £95 on your claim.

By the way, if you’re in an accident and lose your NCB, but later on, it’s found that it wasn’t your fault after all, your NCB will be restated. Insurers may be tough, but they’re also fair.

Is protecting my NCB worth it?

Some insurers including admiral and diamond offer NCD protection, a kind of NCD insurance. This allows you a certain number of claims without losing your NCB, but it’s an added extra on your policy so you have to pay for it.

Is it worth the price? It’s difficult to tell. Remember that the impact of your no claims bonus is greatest in the early years, so it could only take you two years after an accident to get back to a high level of no claims discount.

You also need to factor in that while you might not lose your discount, the insurer might increase the basic premium because you’ve had an accident, so you’d still get a discount but on a higher base cost. It’s difficult to give a hard and fast answer, so you need to compare quotes with and without NCB protection.

No claims bonus protection – how many claims can you make without losing your no claims bonus?

| Insurer | no-claim bonus protection |

|---|---|

| 2 claims in 3 years | |

| unlimited | |

| 1 claim in a single year | |

| unlimited | |

| 1 claim in 3 years | |

| 2 claims in 3 years | |

| 2 claims in 3 years | |

| 2 claims in 3 years | |

| 2 claims in 3 years | |

| 2 claims in 3 years |

Can named drivers get no claims bonus?

Some policies allow a named driver as well as the main driver on a car to build up a no claims bonus.

A second driver no claims bonus can be particularly useful for youngsters who’ve been driving their parent’s car for a while before buying (and insuring) their own. It can also be useful if you’ve been driving a company vehicle, though to transfer the NCB you need to be replacing the company car with your own – you can’t have the NCB on both.

No claims bonus for named drivers is more difficult to transfer than if you’re a main driver. You might find you can only use your named driver no claims bonus on your own car, when you buy one, if you take out a policy with the same insurer.

Can I use my NCB on several cars?

No. You can only use your NCB on one car. If you own a second car, your NCB won’t be available for insurance on it.

However, you may be able to secure savings by getting a multi-car insurance.

How can I get proof of my no claims bonus?

Many insurers (like drive like A girl, direct line and tesco bank) will show your no claims bonus on your renewal letter. But not all of them.

If you switch insurer, you’ll have to ask your previous insurer to send you separate no claims bonus proof. That might involve a telephone call, but increasingly, insurers will let you download your proof of no claims bonus from the self-service customer portal.

Can I transfer my NCB if I switch insurer?

You should be able to transfer your NCB if you switch insurer.

You’ll need to have a no claims bonus proof to show your new insurer. In many cases the proof of no claims will be on your renewal letter. If not, you may have to ask your insurer to provide you with a letter.

There are a few cases in which you might not be able to transfer your NCB, for instance:

- If you’re using a named driver no claim on someone else’s car

- If you have an accelerated NCD.

Some, but not all, insurance companies will allow you to transfer NCB in these circumstances. Even so, a named driver no claims discount is worth having – you’ll be ahead of the curve, and after you’ve had your NCB on your own car for a year you’ll be able to transfer elsewhere.

Can I transfer a no claims bonus from abroad?

Unfortunately, no insurer will allow you to transfer a no claims discount from abroad. You’ll have to start from scratch.

Can I transfer my company car NCB?

If you are the only driver of a company car, you might be able to use your years of claim-free driving to get a discount when you buy and insure your own car.

It’s not, strictly, a no-claim bonus but it will have the same effect on your premium.

Not all insurers will let you do this. You’ll need a letter from the insurer of your company car confirming:

- That you had sole use of the car,

- That you could use it for your own domestic and leisure driving as well as for commuting, and

- The number of years you’ve been driving without making a claim.

You’ll also need to confirm that you have given up the company car.

You cannot claim any discount if you have been driving a commercial vehicle like a van, or if you’ve been using a car pool.

Does my NCB expire?

An NCB will eventually expire if you do not have an insure a car for some time, generally, two years.

So for instance if you spend a year on a round-the-world trip, or just sell your old car and don’t get round to buying a new one for six months or so, you’ll still be able to use your NCB from your last car. Most insurers will recognise a NCB up to 24 months old; some insurers will even recognise an NCB that’s up to three years old.

But if you leave it longer than that, your NCB will expire for good, and you’ll have to build it up all over again from the beginning.

What is a no claims bonus accelerator?

To get a no claims bonus you usually have to complete a whole twelve months’ insurance without making a claim, and you’ll get it at the end of that year. With a no claims bonus accelerator, you’ll get it after 10 months.

That’s really useful for new drivers who can build up their NCB more quickly.

However, you might find it difficult to switch insurer, as not all insurers will accept an accelerated no claims bonus. So it might be more cost effective to stick with a regular policy and wait the extra couple of months. You’ll need to do a proper comparison of quotes to work out whether it’s worth your while.

XM 30 USD no deposit bonus – claim here

Platform

Min. Volume

Action

XM no deposit bonus is a great opportunity for the beginners or the traders that have not had any trading experience with the company. The broker has proved its excellence many times during its 10 years presence on the forex trading market and is widely known as a reliable broker around the globe. Currently, XM is offering a no deposit bonus to its new clients all around the world. Customers who are willing to start trading with XM can get $30 trading bonus after creating the real trading account with them. The bonus is available for anyone, but people who want to claim it should meet certain criteria. In this XM no deposit bonus review we will explain how can you get your no deposit bonus 30 USD and what are the terms and conditions of using it.

Who can get XM $30 no deposit bonus?

XM no deposit bonus is offered to all the new clients of the XM broker who wants to experience the trading process with XM on their platform to ensure themselves that the broker and the platform is the right choice. Although the newly register customer must be eligible and meet all the criteria to receive their bonus. Generally, the only restrictions are to the people who are under 18 years old or are otherwise under legal age in their countries of residence. The customers who fall under the category of “minors” do not have the right to trade and therefore cannot receive the money.

The customer should not have any history containing the events of violations of the broker regulations. In addition to that, if XM suspects that the user is violating or has an attempt to abuse the promotion or the fair rules of the trading bonus, XM broker reserves the right to deny, withhold or withdraw the trading bonus, or any other offered promotions for the user. Each and every customer can only get the trading bonus once. According to XM no deposit bonus terms and conditions the bonus is attached to the uniques IP address, therefore the user can hold only one trading bonus. Once the new customer creates the real trading account he or she has a 30-day limit to claim the free 30 USD, after that the promotion is no longer valid for this user.

How to get XM no deposit bonus

The process of getting XM global $30 bonus is very easy and takes several steps only. Once you go the XM website promotional section you will see that all the needed information and instructions are displayed in a way that even a beginner trader can understand it without any complication. Moreover, the website has a user-friendly design which makes it even easier to navigate there.

On the sections of promotions, you will see several offering that is currently active for the new users or current customers of the brokers.

To get your bonus you need to choose the trading bonus. Click here to claim your bonus, you will be landed to the 30 USD free bonus section directly.

*clients registered under the EU regulated entity of the group are not eligible for the bonus

Once you are on the page, you are one click away from getting your XM welcoming bonus.

In order to get it, you need to have the real trading account where you will be using 30 USD. Therefore the button for claiming your bonus will direct you to the registration of the real account. Creating the real account with XM consists from two steps and takes 2 minutes only. Let us go through the process of the registration process.

- To create the real account and get you free XM 30 USD bonus you need to fill the first part of the registration application. You need to fill your personal information. XM requires for the first and last name you enter in the registration form to be as it is written in your identity document. You should also indicate your country of residence, phone number (you will need a phone number later for the SMS verification) and an E-mail address, where you will get your ID for accessing the trading account. Also, you need to choose a preferred language for yourself. XM offers a wide range of 25 languages to choose including english, spanish, german, italian, french, russian, chinese and more.

- After filling up your personal information the registration form asks you to choose a trading platform type, currently available platforms with XM broker is metatrader 5 and metatrader 4. If you do not know how to choose between them, do not get confused. Here are the differences between these two platforms. Generally, you can access your trading account on MT4 and MT5 with pretty much all devices such as PC, MAC, IOS and android. However, metatrader 5 additionally includes XM webtrader, meaning that you will not have to install any software, as you can have access to the trading platform online. The second difference between the platforms is that metatrader 5 offers its users to trade in stocks, stocks indices, and precious metals, while metatrader 4 is predominately a forex trading platform. To sum up, metatrader 5 is an upgraded version of the MT4 and has two main features added – XM webtrader and trading possibilities for stock indices and precious metals. It is completely up to you which platform you will go with, both of them is highly recommended by the traders all around the world and you can get your XM no deposit bonus does not matter which platform you choose.

- Once you have made up your mind on which platform you will start trading you should choose the account type you want to start with. In the registration form, you are given 5 options that are currently available for XM customers. These accounts are micro, standard, XM zero, XM ultra low micro, and XM ultra-low standard. We will not give in the depth of differences between the accounts here, you can check the XM website account section where all related information is displayed.

One step away from getting XM free bonus

- Once you submit the first part of the questionnaire, the second part of the registration will be. At this point, you are one step away from getting your XM free $30. The next part of the questionnaire is designed in a way to finalize your trading account details and for XM to simply determine the purpose of the client. This part of the registration is pretty small as well. You will be asked if you are a US citizen or not, this question is solely for tax purposes.

- Next, you need to fill up your trading account details such as – account base currency, account bonus, and leverage. The last part of the registration is to provide information about your investment amount in USD currency, your employment status and intended purpose and nature of transactions.

After the questionnaire is completed the website will ask you to set a password on your account.

XM bonus transaction confirmation

Congratulations, you now have completed the registration process and are about to get your 30 USD. After submitting the registration form you will receive an email asking for confirmation on receiving the XM bonus 30 USD. An email will be sent on an address you have indicated while registering. Alongside with it, you will receive an ID for your trading account. You need to use this account number and the password you have indicated while registering to enter the members area.

Getting XM no deposit bonus on your account

After all the steps explained above are successfully completed you need to activate the bonus to get it on your trading account. You should successfully complete the verification procedure with SMS and/or voice verification. In a result, you will receive free 30 USD for trading on your account. The transaction might take up to 24 hours, but usually, the money appears on the user’s account in less than one hour. The XM forex no deposit bonus is solely for trading purposes, meaning that you cannot withdraw the initial $30, you can only withdraw the profit you will make from the trading. As we got to the point of withdrawal lets see what are the withdrawal restrictions and instructions.

XM bonus withdrawal

As mentioned above you are not able to withdraw the initial bonus money. Although you are free to withdraw the money which you will make from your successful trading. As per as XM withdrawal procedure any withdrawal of funds will result in the proportional removal of the initial trading bonus. You can see how it works on the picture below.

Why XM 30 USD no deposit bonus

Why should you go with XM forex free trading bonus? XM has a reputation that is beyond any suspicion. The company is cyprus based and is fully regulated by the cyprus regulator cysec. The company has 10+ years experience and throughout his presentation of the market, they have strongly established their name as a frontier of the trading industry. The broker has many advantages for the experienced brokers and the beginners. The main advantage, especially for the newcomers in the industry is a highly innovative platform and an interface that helps you navigate and easily understand the system. Besides that FX broker offers 24/5 professional customer support in 25 languages. This can be especially helpful for the new traders. This is why we advise starting with the XM 30$ bonus, as the advantages that the broker is offering to its customers can be a great start of a successful trading career.

*30 USD non-deposit bonus is not available to EU clients registered under the EU regulated entity of the group.

Car insurance no-claims bonuses explained

All you need to know about your car insurance no-claims bonus or no-claims discount - from how they work to whether it's worth paying out to protect it.

What is a 'no-claims' bonus or discount?

A no-claims bonus - also known as a no-claims discount - is a percentage discount your insurer shaves off your insurance premium to reward you for not having made a car insurance claim in the previous year.

So if, for example, you had a no-claims bonus of 30%, you’d pay £700 where you would otherwise have paid £1,000.

For each consecutive year that you don’t make any claims, the discount increases. So where your insurer might award you 30% for one year without claims, five claims-free years under your belt might net you 60%.

What’s the maximum no-claims bonus I can get?

As you build up more claims-free years, you progress along a no-claims bonus scale, which might look something like the example below.

Eventually, you’ll reach the number of claims-free years required to net the maximum discount your insurer will offer.

| Number of years with no claims | possible discount on your premiums |

|---|---|

| 1 year | 30% |

| 2 years | 35% |

| 3 years | 40% |

| 4 years | 50% |

| 5 years | 60% |

| 6 years | 70% |

| 7 years | 72% |

| 8 years | 73% |

| 9 years | 75% |

Each insurer's no-claims bonus scheme is different - from the size of discounts to the number of claims-free years it takes to achieve them.

Maximum discounts range from around 40% to 80%, while the number of claims free-years you need before you’re at the top of the scale ranges from around five to 15 years.

What is a no-claims bonus worth?

By itself, a no-claims bonus doesn’t really tell you much about what you’ll pay - you need to know what the premium is to work out how much of a saving it represents.

Suppose you have two insurers. Both have a base premium of £1,000, to which the discount is applied. With insurer A, your no-claims bonus is 75%, and with insurer B, 60%. In this case, insurer A is clearly the cheapest.

But where the base premiums are different - as they’re likely to be in the real world - then the comparison changes. If insurer A’s base premium is £1,500 and insurer B’s, £900, for instance - then insurer B is cheaper.

| Insurer A | insurer B | |

|---|---|---|

| no-claims discount | 75% | 60% |

| base premium | £1,000 | £1,000 |

| premium with discount | £250 | £400 |

| base premium | £1,500 | £900 |

| premium with discount | £375 | £360 |

Some insurers will make a point of awarding generous no-claims bonuses in their marketing, but it's important to compare the final quote - with any discounts included - to determine which is the best deal.

The reason it’s worth keeping your no-claims bonus in mind is that you can lose it if you make a claim, meaning you'll pay higher premiums than you otherwise would have.

How can a claim affect my no-claims bonus?

If you make a car insurance claim, you may lose some of your no-claims bonus according to where you are on the insurer’s ‘step-back’ scale.

This basically bumps down the discount back to what it was in previous years. Insurers have different step-back scales.

In the example below, the driver has spent five years building their no-claims bonus up to 60%.

When they make a claim, that five-year discount reduces to a three-year discount - so at renewal they only get 40% off, and have to spend two years building their no-claims bonus back to what it was.

What claims don't affect my no-claims bonus?

There are certain kinds of claim that won't erode your no-claims bonus. Generally, insurers will leave your no-claims bonus alone if your claim was not a 'fault' claim.

This means they were able to recover their repair costs in full from the party at fault. Similarly, many insurers will disregard non-fault claims where the other driver was uninsured.

It's also quite common for insurers to make exceptions with glass damage claims.

Should I protect my no-claims bonus?

No-claims bonus protection is an added extra that you can buy with your insurance.

It will prevent a limited number of claims (two or three claims over a three-year period is common) from having an impact on your no-claims bonus.

No-claims bonus protection will certainly save you money if you make a claim. However, you'll need to pay extra for it (around £60 is fairly typical), so its value depends on how much discount you’d stand to lose by claiming.

Insurers don’t make this easy to find out - but they do have to show how much discount, on average, their customers were awarded for each year of no claims.

So this should give you a starting point in working out whether to buy no-claims bonus protection.

As a general rule of thumb, the bigger your no-claims bonus, the more you stand to lose through making a claim, and therefore the greater the value of the protection.

How does no-claims bonus protection work?

A fairly common misconception about bonus protection is that it stops your premiums from rising because of a claim.

Unfortunately, this isn’t true. If you make a claim and, as a result, the insurer thinks you’re more likely to make future claims, it will increase your premium. After this, it will apply whatever discount you have.

So, suppose your discount is 60%, you’re paying £400 instead of the base premium of £1,000. Then you make a claim - protected under the added extra you've paid for.

The following renewal your insurer could then increase that base premium to £1,300. With the same 60% discount in place, you’d now be paying £520.

Which? Collects data on no-claims bonus protection. The table below shows the policies of dozens of insurers we rate.

| Car insurer | number of claims you can make with a protected no-claims discount |

|---|---|

| AA insurance | 2 claims in 3 years |

| admiral | 2 claims in 3 years |

| age co | 2 claims in 3 years |

| ageas | 2 claims in 3 years |

| aviva plus (regular) | 1 claim in 1 year |

| AXA | 2 claims in 3 years |

| budget | 2 claims in 3 years |

| by miles | unlimited |

| churchill | 2 claims in 3 years |

| co-op insurance | 3 claims in 3 years |

| diamond | 2 claims in 3 years |

| direct line | 2 claims in 3 years |

| elephant | 2 claims in 3 years |

| esure | unlimited |

| hastings direct | 2 claims in 3 years |

| insurepink | 2 claims in 3 years |

| john lewis finance | 2 claims in 3 years |

| LV= | unlimited |

| M&S bank | 2 claims in 3 years |

| mercedes-benz | varies by underwriter |

| more than | unlimited |

| NFU mutual | 2 claims in 5 years |

| people's choice | 2 claims in 3 years |

| privilege | 2 claims in 3 years |

| provident | 2 claims in 5 years |

| quote me happy | 2 claims in 3 years |

| RAC | 2 claims in 3 years |

| rias | 2 claims in 3 years |

| saga | 2 claims in 3 years |

| sainsbury's bank | 2 claims in 3 years |

| santander | 2 claims in 3 years |

| sheilas' wheels | unlimited |

| swiftcover | 2 claims in 3 years |

| swinton classic | 2 claims in 5 years |

| tesco bank | 2 claims in 3 years |

Can I transfer my no-claims bonus to a new policy?

Yes. When you apply for car insurance, the insurer will ask and check how much no-claims bonus you’re entitled to.

In some cases, you’ll be asked to supply evidence from your previous insurer to back this up. This allows you to carry over the benefits of your accumulated claims record without having to start from scratch each time you switch insurer.

You’ll not always see perfect continuity, though - as insurers each have their own no-claims bonus schemes and will apply their own rules.

For example, some insurers may not recognise no-claims bonus you’ve accrued as a named driver on someone else’s policy, and if you’ve not been insured for a few years, the old no-claims bonus will lapse.

Do I need proof of my no-claims bonus?

In many cases, you won’t be asked for proof of your no-claims bonus, but you should always assume that you will and have it in order. Insurers will often check online databases first to corroborate your no-claims bonus entitlement stated in your application.

Your no-claims bonus should also be stated in your paperwork from the insurer you’re leaving.

Where this isn’t available, you can write to your insurer and ask them to supply you with a letter detailing your number of claim-free years.

How to get proof of your no claims bonus

If you’ve built up a no claims bonus (NCB), you’ll want to take advantage of the discount it gives you when you switch insurance providers. To do this, you’ll need to get proof of no claims. Here’s how.

If you’ve built up a no claims bonus (NCB), you’ll want to take advantage of the discount it gives you when you switch insurance providers. To do this, you’ll need to get proof of no claims. Here’s how.

Why your no claims bonus matters

Your no claims discount (NCD) accrues for each year you’re on the road without making a claim on your car insurance. The longer you drive without a claim, the more discount you can potentially get – although insurance providers often cap bonuses at around five years.

Your no claims bonus plays an important role in how your car insurance premium is calculated. Although potential discounts vary depending on the provider, the association of british insurers says that one claim-free year could net you up to 30% off, and up to 60% if you manage five years without making a claim.

If you’ve switched to a new provider and stated your no claims bonus (NCB) when you were quoted, you’ll need to give proof of the NCB – typically within seven to 21 days. If you can’t provide it by then, your insurance may be cancelled or your premium could go up.

Related articles

How car insurance providers give proof of no claims

Getting proof of no claims isn’t always straightforward, as insurance providers give (and accept) proof in different ways.

When you switch, it’s a good idea to check what proof of no claims your new car insurance provider will need. Ask them what they want to see on the document – for example, the registration number of the car the discount applies to – and whether they’ll accept a copy or scan.

If they need the original, make sure you keep a copy for your own records.

How to get proof of no claims

Your provider won’t always send you proof of no claims automatically. And some new providers will ask your old provider for the proof of no claims discount themselves, but they’ll let you know if they’re going to do this.

Your no claims discount may be on your renewal letter. If it’s not on there, it might be on the cancellation notice you’ll receive if you’re switching.

If you can’t find it yourself, contact your provider and ask them to send you the required proof.

Once you’ve forwarded proof to your new provider, you should get a letter from them, confirming they’ve received it. If you don’t hear anything, follow up to make sure they have it.

Protecting your no claims discount

Claiming for an accident where you’re at fault can mean you lose your no claims discount. So some drivers choose to pay a fee, on top of their insurance premium, to protect it.

It’s worth knowing, however, that this doesn’t necessarily mean your premiums won’t rise. Providers look at your driving history when they calculate your premium, so an accident could have an impact on how much you pay for your car insurance, even if you have a NCB.

Ready to compare car insurance?

Compare car insurance from a range of UK car insurance providers.

Looking for a quote?

Compare car insurance in minutes to see if you can save

Like this?

2021 comparethemarket.Com. All rights reserved. Comparethemarket.com is a trading name of compare the market limited. Registered in england no. 10636682. Registered office: pegasus house, bakewell road, orton southgate, peterborough, PE2 6YS. Compare the market limited is authorised and regulated by the financial conduct authority for insurance distribution (firm reference number: 778488) and is registered with the financial conduct authority under the payment services regulations 2017 (FRN: 911617) for the provision of payment services. Energy and digital products are not regulated by the FCA.

This website uses cookies. Continuing to use this website gives consent to cookies being used. For information on how to disable them see our cookie policy.

*to obtain a reward a qualifying purchase must be made. Rewards T&cs apply.

Meerkat meals: participating restaurants. 1 membership per 12 months.

Pizza delivery & collection: 50% off pizzas, 7 days a week. £30 min spend. Order via the app with your membership. Exc. N.I. In restaurant: 2 for 1 on selected food, cheapest free. Sun-thurs. Max 6 people. Exc certain days & kid’s meals. App only.

Meerkat movies: participating cinemas. Tues or weds. 2 standard tickets only, cheapest free.

Apple and the apple logo are trademarks of apple inc., registered in the U.S. And other countries and regions. App store is a service mark of apple inc.Google

Play and the google play logo are trademarks of google LLC.

^for the period 1st september to 30th november 2020, 12,477 people responded to the recommend question. 11,706 responded with a score of 6 or above, therefore 93.8% are likely to recommend.

Comparethemarket.Com uses cookies to offer you the best experience online. By continuing to use our website, you agree to the use of cookies. If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.

Trade forex and cfds on stock indices,

oil and gold.

78.04% of retail investor accounts lose money when trading cfds with this provider.

You should consider whether you can afford to take the high risk of losing your money. Risk disclosure

- Trade with a regulated broker

- Zero commissions

- Trade on desktop, mobile and tablet

- No hidden fees

Trade on 16 platforms from 1 account

MT4 and MT5, both available for desktop, tablet and mobile devices

78.04% of retail investor accounts lose money when trading cfds with this provider.

You should consider whether you can afford to take the high risk of losing your money. Risk disclosure

Why choose XM?

There is a reason why over 3.5 million clients have chosen XM for trading forex and cfds on stocks

stock indices, commodities, metals and energies.

Licensed and regulated

Trading with XM means trading with a licensed and regulated broker.

Up to 30:1 leverage

XM offers its clients up to 30:1 leverage with negative balance protection and no changes in margin overnight or at weekends.

24-hour support

At XM you can enjoy 24/5 support in over 30 languages by live chat, email and phone.

Over 1000 instruments

XM offers trading in over 1000 instruments ranging from forex and cfds on stock indices, oil and gold.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

XM live chat

By clicking the "enter" button, you agree for your personal data provided via live chat to be processed by trading point of financial instruments limited, as per the company's privacy policy, which serves the purpose of you receiving assistance from our customer support department.

If you do not give your consent to the above, you may alternatively contact us via the members area or at support@xm.Com.

All incoming and outgoing telephone conversations, as well as other electronic communications (including chat messages or emails) between you and us will be recorded and stored for quality monitoring, training and regulatory purposes.

Please enter your contact information. If you already have an XM account, please state your account ID so that our support team can provide you with the best service possible.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

So, let's see, what we have: find out if you’re eligible to claim the job retention bonus and what you need to do to claim it. You will be able to claim it between 15 february 2021 and 31 march 2021. At claim your bonus

Contents of the article

- New forex bonuses

- Check if you can claim the job retention bonus...

- This guidance was withdrawn on 5 november 2020

- Who can claim

- Employees you can claim for