Ethereum broker

Ether is the legal tender of the ethereum platform. Anyone wanting to use or to build upon the ethereum platform will require ether.

New forex bonuses

Many people use the term ethereum for referring to the currency instead of ether, which can cause some confusion. Similar to bitcoin, ether can be traded and mined and can be bought at any of the brokers found on the above chart. Although ether and bitcoin are both cryptocurrencies built on blockchain technology, they are distinct in a number of ways. Most of these differences are related to the refinement of the protocol. Thanks to the way that it is mined, transactions can occur much faster. For instance, the standard “block” time for ethereum is 12 seconds compared to the 10 minutes needed for bitcoin.

Top 10 online brokers to buy ethereum

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

- World's leading social trading platform

- Proven track record of security

- Unlimited daily withdrawals

- Min. Deposit of $200 to get started

- Instant trade execution

With over 30 years of trading experience and trades in over 50 countries, city index is a leader in spread betting, CFD and forex trading. Trade in 12,000+ global markets including bitcoin, indices, shares, forex and much more.

- Trade on 12,000+ markets including bitcoin

- Trade anytime, anywhere. Across all devices

- Risk management & transparent pricing

- Fast execution on every trade

With markets.Com get ZERO commission trading on cryptocurrency, forex and commodity cfds with one of the most sophisticated trading platforms in the industry.

- No commission trading

- Use paypal to trade bitcoin futures

- Advanced innovative trading platforms

Easymarkets was formed by bankers and forex experts and has been serving the forex market for 16 years, with transparent pricing, fixed spreads and no commissions on deposits or withdrawals.

- Demo account is unlimited

- Trade bitcoin with no slippage - ever!

- No commissions or sneaky fees

T&C's apply to each of the offers above, click "visit site" for more details.

Risk warning: users should be aware that all investment markets carry inherent risks, and past performance does not assure future results. Trading of any kind is a high-risk activity, and you could lose more than you initially deposited. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 73-89% of retail investor accounts lose money when trading cfds. Please be sure you thoroughly understand the risks involved and do not invest money you cannot afford to lose. Your capital is at risk. Advertiser disclosure: topbrokers.Trade is an independent professional comparison site funded by referral fees. The compensation topbrokers.Trade receives is derived from the companies and advertisements featured on the site. Due to this compensation, we can provide our users with a free comparison tool. Unfortunately we are unable to list every broker or exchange available, however, we do our best to review as many as possible.

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

With over 30 years of trading experience and trades in over 50 countries, city index is a leader in spread betting, CFD and forex trading. Trade in 12,000+ global markets including bitcoin, indices, shares, forex and much more.

With markets.Com get ZERO commission trading on cryptocurrency, forex and commodity cfds with one of the most sophisticated trading platforms in the industry.

The beginner’s guide to ethereum

What is ethereum?

Ethereum is a blockchain platform with a smart contract functionality and a cryptocurrency. It was invented by vitalik buterin in 2013 and is a decentralized platform created for app developers to build on.

Ethereum can be utilized to decentralize, codify, secure and trade almost anything: voting, financial exchanges, domain names, crowdfunding, company governance, agreements, contracts, as well as intellectual property.

What is ether?

Ether is the legal tender of the ethereum platform. Anyone wanting to use or to build upon the ethereum platform will require ether. Many people use the term ethereum for referring to the currency instead of ether, which can cause some confusion. Similar to bitcoin, ether can be traded and mined and can be bought at any of the brokers found on the above chart.

Ethereum vs. Bitcoin

Although ether and bitcoin are both cryptocurrencies built on blockchain technology, they are distinct in a number of ways. Most of these differences are related to the refinement of the protocol. Thanks to the way that it is mined, transactions can occur much faster. For instance, the standard “block” time for ethereum is 12 seconds compared to the 10 minutes needed for bitcoin.

With ethereum you can pay and clear transactions much quicker than with bitcoin. As well, it does not have the automatic restrictions placed on supply growth that bitcoin does. The limitation is due to the bitcoin block rewards which are halved every four years whereas the amount of ether stays the same and is always available each year.

Additionally, regarding supply, ethereum was crowd-funded whereas bitcoin was released. Because of this, the early bitcoin miners gathered the primary supply and currently own most of the coins in circulation. Ultimately, bitcoin uses a different algorithm to that of ethereum, mitigating against the use of application-specific singular circuits. Ethereum supports a decentralized mining operation for people using their gpus.

How to buy ethereum

The simplest way to buy ethereum (or ether) is through any of the well-known bitcoin exchanges or trading platforms. You can find our top choices above.

The benefits to using ethereum’s decentralized platform

Decentralized applications use the blockchain to run, which they, therefore, benefit from the blockchain’s properties.

Secure

Without any central point of failure and secured by using cryptography, the applications strongly protected against hacking attacks and fraudulent activities.

Immutability

Third parties can’t make any adjustments to the decentralized platform’s data.

Corruption and tamper proof

Based on a network that is established around the consensus principle, these apps make censorship impossible.

Zero downtime

The apps cannot be switched off and can never go down.

The downside to decentralized applications

Regardless of its number of advantages, decentralized applications are not without faults. As a result of smart contract code that humans write, the smart contracts will only be as good as those writing them. Oversights or code bugs can also lead to unintentional unfavourable actions being taken. For example, if there is a mistake or problem in the actual code that gets exploited, there’s no adept and efficient way to stop exploitation or an attack, besides attaining a network consensus and having to re-write the code that’s underlying. It goes against the blockchain’s principle that is supposed to be unchangeable. As well, any action that’s taken by an important party raises key questions concerning the application’s decentralized nature.

Day trading ethereum

If you are only interested in earning on the exchange rate, you can invest in cfds as well. The concept is that rather than having to buy ethereum you can trade according to the exchange rate. The cfds are better suited to experienced traders. However, many beginners are getting into ethereum CFD trading.

Mining ethereum

Proof-of-work is used in mining ethereum. It’s very similar to bitcoin mining because there’s a diminishing block reward earned for each block mined. If you retain a dedicated GPU that’s set up on your computer, then you can start to reap some actual rewards.

Ethereum and ether are largely disruptive technologies that are positioned to alter how the internet inherently works. For now, it is easy to get your piece of “the future of the internet” by following the steps we mentioned above.

How to choose the best platform to buy ethereum

As the trade volumes are reaching billions of dollars a day and the market caps are hitting tens of billions of dollars, it is no wonder that cryptocurrencies fuel the modern day gold rush. Today is an age of digital currencies, with hundreds of cryptocurrencies birthed within the decade. There are already more than a thousand cryptocurrencies in the market, and almost daily a new initial coin offering (ICO) appears.

Because there’s so much competition in the ethereum exchange market as well as having countless brokers and exchanges to choose from, it can be difficult to know which option will work best for you. Here are a few things we suggest keeping in mind before you decide on the right broker for you:

Regulation

Use a regulated ethereum broker or exchange. The regulatory body develops rules and services protect the integrity of the market, as well as traders, and investors. Because of possible safety concerns, you should open accounts exclusively with regulated brokers.

Customer service

Trading happens 24 hrs a day, so customer support should be available at all times. You’ll want to be able to speak with a live support person. The representative’s ability to answer your questions regarding spreads and leverage, as well as company details is very telling.

The details of a good broker should be out in the open for everyone to see, either online or otherwise.

Account types

Your ideal broker to buy ethereum should be able to offer either multiple account options or provide you with an element of customizability. Look for an ethereum broker that offers competitive spreads and easy deposits/withdrawals.

Platform type

The trading platform is the investor’s portal to the markets. So with that in mind, look for a platform that is easy to use, straightforward and offers an advanced collection of analytical and technical and tools, to enhance your trading experience. For more information on selecting the right trading platform for you, please see our tutorial: what to look for when choosing A trading platform

Tradeable assets

While selecting the best trading broker for you, it’s possible just to concentrate on cryptocurrencies if you choose. However, you should keep in mind there are many types of investment alternatives offered as well, such as forex, stocks, cfds, etfs, or trading in options or futures.

Currency pairs

The best brokerages can provide a huge selection of currency pairs. However, it is most important is that they provide the variety of pairs that interest you. While there are many currencies and digital currencies available for trading, there are only a few get the majority of the attention, and as the result, trade with the highest liquidity.

If you want to buy ethereum, it costs money. However, unlike buying stocks or bonds, brokers generally charge a percentage. You may consider looking for a broker that charges a flat rate fee instead of the percentage model.

Liquidity

Because ether is traded in a market where people are both looking to buy or sell the digital currency, it’s crucial to consider the amount of liquidity that an exchange can have. Liquidity is the ability to sell without the price being significantly affected, causing the price to drop.

For more information on cryptocurrencies and cryptocurrency trading, please see our tutorial: the basics of cryptocurrency.

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

Best ethereum trading brokers 2021

In this article, we will look at how to trade ethereum simply online as a CFD. When you trade ethereum with a CFD broker you can use it as a leveraged product, just like forex. You can open a trading account with a recommended broker within just a couple of minutes and start trading immediately. When you trade ethereum, rather than buying it outright you are actually speculating on the price, rather than buying the underlying stock. Let’s explore the benefits inside.

The brokers below represent the best ethereum trading brokers.

FP markets

Regulated by: ASIC, cysec

Headquarters : level 5, exchange house 10 bridge st sydney NSW 2000, australia

Your capital is at risk

This brokerage offers a massive range of tradable assets through forex, CFD, and share trading accounts. FP markets supports the MT4, MT5, and IRESS platforms and offers leverage up to 500:1. You can trade 45 currency pairs with competitive spread or commission pricing.

FP markets was founded in 2005 and is headquartered in sydney, australia. It is regulated by by the ASIC in australia. Demo accounts are available. While it is suitable for beginners, education resources are limited.

What is ethereum?

Many people often confuse ethereum with ether. Ethereum is the network, and ether (ETH) is the cryptocurrency. However, we will use the term interchangeably in order to carry beginners along.

Ethereum is a platform on which smart contracts can be designed, stored and transacted on between two or more parties, without intervention by a central agency. These transactions are stored in blockchain (which is a decentralized ledger) and are available for everyone to see, giving it a peer-to-peer status. These transactions require a digital currency to run on, and ether tokens are the currency that powers this platform.

Ether can be defined as the cryptocurrency of the ethereum network. Ether and ethereum were created by russian programmer vitalik buterin in 2013 as an improvement on the bitcoin technology. Buterin himself has been a bitcoin programmer and in creating ethereum, the following improvements were made:

- The ability to add on blocks of transactions was made easier, enabling them to be added more quickly than is the case with bitcoin. The thinking is that this makes ethereum more efficient as a cryptocurrency.

- The ethereum technology also supports the operation of various computer applications in addition to that of ether. Therefore, other application such as decentralized cloud storage activities could be performed.

- Ethereum was also built to support a number of apps.

- Lately, ethereum is being used as the network to support initial coin offerings (icos), which are mostly crowdfunding efforts by companies who create solutions for all manner of functions within the cryptocurrency space. Ether tokens (and not equity are allocated to those who contribute funds towards the icos.

Ether is now the 2 nd most valuable cryptocurrency after bitcoin. It has gained a massive 2,300% in 2017 alone. This massive surge in price has tickled the interests of traders all over the world, and ether is now available for trading as a cryptocurrency.

Ethereum trading explained

Information available from reliable sources such as etherscan indicates that nearly 5.3 million ether wallets exist. These wallets hold the ethereum currency for individuals and entities. This number indicates a 450% increase from the 1.6 million wallets that were available in may.

What does this indicate? Interest in trading ether has increased substantially. This followed the steady climb of ether from march 2017 till date. The price rise in ether has come as a result of the following:

- Renewed spikes in the price of bitcoin, which fuelled a general interest in cryptocurrencies.

- High profile institutional from large companies such as intel, JP morgan and microsoft. Vladimir putin’s high profile meeting with buterik also spurred rumors of institutional backing from the russian government.

Ether can be obtained either by purchasing it at the exchanges or by “mining” it. Mining, which is a process of solving complex mathematical problems in order to add a block to the existing blockchain and opening a channel for ether to be added to the wallet, gets more difficult as more mining is done. Besides, not everyone is a maths genius. So most people get their ether from a source considered more accessible to the public: the ethereum wallet exchanges.

Interest in trading of ethereum has spurred the growth of another industry; the crypto CFD industry. This is the trading of cryptocurrency contracts as contracts-for-difference (CFD) assets. Trading ether as a CFD is available on selected forex platforms, where ether (ETH) is listed as a tradable asset in pairings with the US dollar, euro and british pound.

Trading of ETH cfds has its peculiar advantages over buying of ETH on exchanges. These advantages are listed below:

- Trading ETH on exchanges can only produce profits when the trader sells his ETH holdings at a much higher price than when they were bought. In contrast, trading ETH as a CFD asset allows the trader to profit from rising and falling prices.

- Those who buy ETH on exchanges are prone to be caught out by sudden price movements on either side because they are essentially trading blind. There are no charts to show possible areas where price will hit support or resistance. However, those who trade ETH as CFD assets usually have access to charts and tools that can enable them to pinpoint areas of support and resistance, thus targeting exact entries and exits.

- All transactions on crypto cfds, including the ETH CFD contract, are executed and settled instantly. This is in contrast to buying ETH on exchanges where there is a time lag as transactions get cross-checked and approved by the peer-to-peer network.

- Platform-traded ETH CFD contracts can be traded using an expert advisor. Better still, these eas can be plugged into remote computers (forex virtual private servers) for round the clock trading, whether the host computer is on or off.

- Ethereum cfds are usually leveraged, so you can control large positions with a smaller amount of your own capital. This can be an advantage if used responsibly.

How to buy and sell ethereum online

Ether is like any other cryptocurrency you will find. They feature largely anonymous trading which is secure against fraudulent activities. When it comes buying and selling ether, you can do so using the following means:

- Exchange your ETH as payment for goods and services either on the ethereum network or on a handful of online shops. Some of these shops also accept ether-based mastercard and visa “cards”.

- You can use your ether tokens to invest in icos of companies that will operate in the cryptocurrency space, or companies that provide support services to cryptocurrency networks. Companies such as intel, AMD and nvidia, which supply graphics processing units on which cryptocurrency mining is largely dependent, have already seen their share prices rocket upwards in the last one year due to a surge in demand for their graphics cards by cryptocurrency miners.

- You can decide to store your ETH in online wallets. This strategy depends on being able to buy your ETH at a lower price, then holding them until their value appreciates, before selling off at a higher price to another user.

Where to buy and sell ethereum

Where can ethereum be bought and sold? As mentioned earlier, you can buy and sell ethereum on exchanges as well as trading platforms (CFD contracts on ETH).

Exchanges

In order to buy or sell ethereum on cryptocurrency exchanges, one needs to have a wallet with a unique wallet address. Think of these two items as a bank and a bank account number. You can get your wallet and unique wallet address from the particular exchange you want to use, or you can download a unique wallet from any of the app stores, and link this wallet to the exchange where you want to trade on.

On these exchanges, ether can be traded using fiat currency or use digital currency. Using fiat currency means you use everyday legal tender such US dollars, euros or your local currency to purchase ether from verified sellers. You can also use digital payment methods such as skrill, neteller, webmoney, etc. You can equally purchase ETH with bitcoin, and resell ETH for BTC.

Exchanges usually have a list of verified sellers who will post how much they are selling ether for the various fiat and digital currencies. This allows the buyer to choose from a list of prices and to select the price that will be favorable for the transaction.

Trading platforms

Ether contracts can be traded as cfds on several trading platforms. These platforms basically list the various contracts that feature ether as a paired asset.

If you are using a trading platform which supports the programming and use ofeas, then, by all means, you can use your EA to trade any of the ether pairs. It is important to note that majority of these platforms are owned by market makers. So traders should observe the rules of using market maker platforms, one of which is that not many of them allow eas or scalping techniques.

Payment methods for ethereum trading

To be able to trade ether CFD assets, you need to open a trading account with a broker that supports this activity, after which the trader is expected to fund the account using acceptable payment methods. You can buy ethereum using the following payment methods:

- Credit/debit cards

- Paypal

- Skrill

- Neteller

- Bank wires (SWIFT and SEPA)

- Paycash

- Okpay

- Perfectmoney

Ethereum trading sites, brokers, and software

An ethereum trading exchange is a marketplace where ethereum can be bought or sold in exchange for fiat currency, other digital currencies or other cryptocurrencies. The strategy is to purchase at lower prices, hold for appreciation of price and resell for a profit. The trader can decide to reinvest the initial investment and profit into further trading cycles or may pull the profit and continue investment with the initial sum.

Ethereum trading advantages

- Transactions are not leveraged, which allows the trader purchased ether in quantities they can truly afford and at risk levels, they can manage.

- Transaction costs are lower than in ETH CFD trading.

- Get pricing of ethereum from several sources. This gives you a choice of what prices will benefit you the most. Some sellers simply want money desperately and can sell to you at cheap prices you will not get on CFD platforms.

A major advantage of using exchanges is that many of them now offer mobile apps that can be downloaded from the ios store or from the google play store.

Conclusion

In conclusion, we would like to present our preferred list of the best ethereum trading brokers for 2017. Definitely, there are traders who would prefer to exclusively on exchanges, and others who would like to stick solely to the trading platforms to trade ether cfds. However, you can get the best of both worlds, because the insight you get from the technical analysis tools on the CFD platforms can be used for more informed investments on the ethereum exchanges. So you would have a double advantage when you use both avenues.

For ethereum CFD trading, we selected brokers with:

- Sound regulation. Not regulation in the sense that the assets they offer are regulated, but regulation in terms of having a body look at their trade practices and product offerings to see if they are within the boundaries of the rules.

- Brokers with transparent pricing practices.

- Brokers whose platforms permit the use of the automated trading software.

For ethereum exchange trading, we selected exchanges that offered the following:

Is ethereum halal or haram — we have researched for you

As we are growing digitally and investment options are changing dynamically, it becomes important to keep a check on them. At halal trading brokers, our team reviews all available cryptocurrencies and platforms to bring halal suggestion.

When it comes to ethereum’s popularity, it is among the fastest-growing blockchain technology and cryptocurrency. Millions of people are leveraging this altcoin to diversify their portfolio. If you are also planning to put money into this, you need to read this guide as we have covered ethereum from an islamic and sharia way.

Ethereum is a decentralized online asset like BTC and it functions as a medium of exchange like money that is halal as per pious islamic and sharia laws given by muhammad prophet. When you buy or perform trading in ethereum (in a riba-free way), you are owning a part of that organization by having ethereum’s private key. It makes your ethereum investment halal and sharia-compliant.

Many people confuse cryptocurrency including ethereum with gambling, but it’s not. Gambling is when you put your money in something that you don’t own. With ethereum, you are investing your money into an asset that is operated under a company.

If you want to get started with ethereum trading and not sure where to start, we are here to help. Get in touch with us using the contact form and our team will be happy to help.

What is ethereum? Know the complete system

Ethereum is the second-largest widely used decentralized currency after bitcoin. Ethereum offers more vast applications than bitcoin offers. It is a complete platform where anyone can write code and make applications. Clearing the confusion, ethereum is a vast open-source network and ether is a derived cryptocurrency in which people invest their money.

Talking a little bit about its history, in november 2013, vitalik buterin published an ethereum whitepaper. In the year 2014, the development of the ethereum platform was announced and after a couple of months, ethereum ICO raised $ 18.4 million funding and the company released its test net under the name of olympic. Cutting it short, in the year 2016, the company released its first stable ethereum that went out on block 1,150,000.

After its stable release, this cryptocurrency got a huge spike in popularity and as of now, it holds the market capitalization of $24.80B. Many people just know about cryptocurrency but ethereum is the second-largest and circulated decentralized cryptocurrency. It’s among the safest and fastest transaction platforms also that is used by many companies and organizations.

Millions of people are diversifying their portfolio in a halal way to grow their capital. If you searching for the best platforms to invest in ethereum, we have researched the best halal brokers all around the world for you. Get started with online crypto trading now.

The difference between ethereum and bitcoin explained

It’s a common perception that both ethereum and bitcoins are the same but technically both share some major differences. The ethereum is a full-fledged open-source technology and its coin value is known as ether. As the bitcoins are bought and sold for the transaction and investment purpose, ether serves the same purpose and it’s potentially competing with BTC.

Ethereum is a ledger tech that organizations used to build new applications and programs. Both the BTC and ETH operates on the blockchain technology stack. However, ethereum is more robust and advanced in terms of performing complex operations. To simplify, if bitcoin was the first version in terms of technology, ethereum is the second and more robust version.

A major part of people purchases ETH for investment purposes and its a good option for that. From the past couple of years, this stock has shown strong signs of growth. As it’s getting advanced, the prices are also surging because of its security.

When compared with BTC, the applications of ethereum technology is more robust and it’s widely acceptable international technology for developing secure payment and other blockchains applications.

Ethereum is completely a halal cryptocurrency as you are using it as a medium of transaction. On the other side, while you perform trading in ethereum, you own a part of that asset that makes it sharia-compliant.

Start trading with halal ethereum brokers

Online trading is the largest growing investment options available today. Muslims are leveraging this opportunity to grow their capital in a sharia-compliant way. As ethereum is a halal to trade, you can start investing in it using a swap-free account.

A swap-free account is a special islamic account in which your broker won’t deduct any money for holding a stock’s position overnight. It gives you the freedom of performing trading in a riba-free way. We at halal trading brokers connect you with the best halal ethereum broker all around the world.

Coming back to halal ethereum trading, many online third-party brokers claim to offer islamic trading but you need to be careful from them. We review numerous online platforms to suggest you the best halal for trading. As a novice, it becomes overwhelming to decide which is the right one to get started. But, you don’t have to worry about it as we have done the complete research for you. All you need to do is just get in touch with us using the contact form and we will help you get started with halal ethereum trading.

Fxdailyreport.Com

The growth in the popularity of digital currencies is due to the increased public interest in a decentralized economy. The recent political and financial developments have also contributed to the heightened interest in digital currencies. This has encouraged the forex and CFD brokers to join the bandwagon and offer cryptocurrencies for trading. The first retail forex broker to offer trades in ethereum was fxopen.

Top trusted forex brokers offering ethereum trades

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: 0 spread: non-spread, fee 0.1% per trade leverage: non-leverage regulation: - | visit broker | ||

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker | |

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: €100 spread: the spread can be as low as 0.01%” (0.01% = spread for EUR/USD) leverage: 1:294 regulation: ASIC, cysec, FCA (UK) | visit broker | |

| min deposit: $100 spread: starting from 0.9 pips leverage: 400:1 regulation: MIFID, FSB & ASIC | visit broker | ||

| min deposit: $100 spread: from 0,2 pips leverage: 1:200 regulation: FCA UK (#186171), cysec (#259/14), CIMA (1442313) and DFSA (F000048) | 10% welcome bonus up to $5,000 | visit broker | |

| min deposit: $100 spread: fixed and variable leverage: 300:1 regulation: cysec, FSB | visit broker |

What is ethereum ?

Ethereum is a decentralized applications platform. Invented by vitalik buterin, ethereum was announced in 2014 as an alternate blockchain-based system with superior tools for global developers. The beta version of ethereum was launched in july 2015 and in the production version innovation in 2016 introduced turing-complete smart contracts. These applications take into account if-then scenarios when executing specific terms of agreements.

The ethereum blockchain’s value token is referred to as ether and is listed as ETH for trading on cryptocurrency exchanges. Ether’s design is such that it does not function as a global digital currency. It is used for making payments for specified actions that happen on the ethereum network. Users may receive it if they use their computing power for validating transactions and contribute to its development.

Currently, the exchanges and infrastructure that have been developed for bitcoin network support the ether’s market. While the value of bitcoin grew as more people participated in the network, ethereum’s development took place under different circumstances.

Market participants can purchase and sell ether with fiat currency and/or bitcoin. Such transactions can be executed through various exchanges, as a number of organizations are currently offering these trades. The ethereum platform is still in its infancy. As a result, ether has been experiencing sharp fluctuations in price.

Some people might think that trading in ether is not very attractive because of its price volatility. However, the price gyrations do present traders with a lot of opportunities. Sharp volatility in the digital currency’s price allows traders to speculate on its price levels in the future so as to make an attempt to earn a profit. Some others, on the other hand, make use of ether to hedge their bitcoin trades.

Having said this, here are some of the best forex brokers that offer ethereum trading:

Is ethereum halal or haram — we have researched for you

As we are growing digitally and investment options are changing dynamically, it becomes important to keep a check on them. At halal trading brokers, our team reviews all available cryptocurrencies and platforms to bring halal suggestion.

When it comes to ethereum’s popularity, it is among the fastest-growing blockchain technology and cryptocurrency. Millions of people are leveraging this altcoin to diversify their portfolio. If you are also planning to put money into this, you need to read this guide as we have covered ethereum from an islamic and sharia way.

Ethereum is a decentralized online asset like BTC and it functions as a medium of exchange like money that is halal as per pious islamic and sharia laws given by muhammad prophet. When you buy or perform trading in ethereum (in a riba-free way), you are owning a part of that organization by having ethereum’s private key. It makes your ethereum investment halal and sharia-compliant.

Many people confuse cryptocurrency including ethereum with gambling, but it’s not. Gambling is when you put your money in something that you don’t own. With ethereum, you are investing your money into an asset that is operated under a company.

If you want to get started with ethereum trading and not sure where to start, we are here to help. Get in touch with us using the contact form and our team will be happy to help.

What is ethereum? Know the complete system

Ethereum is the second-largest widely used decentralized currency after bitcoin. Ethereum offers more vast applications than bitcoin offers. It is a complete platform where anyone can write code and make applications. Clearing the confusion, ethereum is a vast open-source network and ether is a derived cryptocurrency in which people invest their money.

Talking a little bit about its history, in november 2013, vitalik buterin published an ethereum whitepaper. In the year 2014, the development of the ethereum platform was announced and after a couple of months, ethereum ICO raised $ 18.4 million funding and the company released its test net under the name of olympic. Cutting it short, in the year 2016, the company released its first stable ethereum that went out on block 1,150,000.

After its stable release, this cryptocurrency got a huge spike in popularity and as of now, it holds the market capitalization of $24.80B. Many people just know about cryptocurrency but ethereum is the second-largest and circulated decentralized cryptocurrency. It’s among the safest and fastest transaction platforms also that is used by many companies and organizations.

Millions of people are diversifying their portfolio in a halal way to grow their capital. If you searching for the best platforms to invest in ethereum, we have researched the best halal brokers all around the world for you. Get started with online crypto trading now.

The difference between ethereum and bitcoin explained

It’s a common perception that both ethereum and bitcoins are the same but technically both share some major differences. The ethereum is a full-fledged open-source technology and its coin value is known as ether. As the bitcoins are bought and sold for the transaction and investment purpose, ether serves the same purpose and it’s potentially competing with BTC.

Ethereum is a ledger tech that organizations used to build new applications and programs. Both the BTC and ETH operates on the blockchain technology stack. However, ethereum is more robust and advanced in terms of performing complex operations. To simplify, if bitcoin was the first version in terms of technology, ethereum is the second and more robust version.

A major part of people purchases ETH for investment purposes and its a good option for that. From the past couple of years, this stock has shown strong signs of growth. As it’s getting advanced, the prices are also surging because of its security.

When compared with BTC, the applications of ethereum technology is more robust and it’s widely acceptable international technology for developing secure payment and other blockchains applications.

Ethereum is completely a halal cryptocurrency as you are using it as a medium of transaction. On the other side, while you perform trading in ethereum, you own a part of that asset that makes it sharia-compliant.

Start trading with halal ethereum brokers

Online trading is the largest growing investment options available today. Muslims are leveraging this opportunity to grow their capital in a sharia-compliant way. As ethereum is a halal to trade, you can start investing in it using a swap-free account.

A swap-free account is a special islamic account in which your broker won’t deduct any money for holding a stock’s position overnight. It gives you the freedom of performing trading in a riba-free way. We at halal trading brokers connect you with the best halal ethereum broker all around the world.

Coming back to halal ethereum trading, many online third-party brokers claim to offer islamic trading but you need to be careful from them. We review numerous online platforms to suggest you the best halal for trading. As a novice, it becomes overwhelming to decide which is the right one to get started. But, you don’t have to worry about it as we have done the complete research for you. All you need to do is just get in touch with us using the contact form and we will help you get started with halal ethereum trading.

Best ethereum broker to trade ethereum 2020

Ethereum is the second largest cryptocurrency in the world. Ethereum started gaining traction when the price of bitcoin started slumping. Ethereum trade has also picked up and many investors are willing to put their money behind this digital currency. As a result, many ethereum trade brokers have cropped up. Some of the brokers are trustworthy while others are not. You need to ensure that the broker you are dealing with is credible and offers you the best chance of making a profit from your trades. Your broker should offer more than just a trading platform. They should offer you all the tools you need to be able to trade successfully.

We took it upon ourselves to find out which one is the best ethereum broker to trade ethereum 2020. There are many ethereum trade brokers in the industry who claim to offer all sorts of privileges. Our ethereum experts went out to explore the various ethereum brokers available to find out which one is the best. IQ option rose the best ethereum broker to trade ethereum. There are many factors that were put into consideration while coming up with that conclusion. Below we explore these factors and all other aspects of IQ options that make it one of the best, if not the best ethereum broker in the industry.

Now get real account with as little as $10. And start trading the BINARY OPTIONS, FOREX, FX OPTIONS & CRYPTOCURRENCIES at one platform. Click to open free demo account | click to get real account in $10 (april 2020)

My recommended brokers updated january 2020

IQ option

Any person who has been on the online trading space for a while must have heard about IQ option. It is one of the most popular trading platforms. As part of its cryptocurrency trade, it offers ethereum trading. You can trade ethereum on IQ option as pairs with other mainstream currencies. For instance, you can trade with a USD/ETH pair or a EUR/ETH pair. Before we get to how you trade ethereum on IQ option, here is a bit of background information about IQ option.

IQ option has been in operation for almost a decade now. It is operated by a cyprus-based company and the trading platform is regulated by cysec. IQ option is one of the most trustworthy trading platforms in the world. It is available in most countries around the world except the ones listed below.

- Japan

- Turkey

- Israel

- Syria

- Sudan

- Iran

- Russia

- USA

- Canada

- Australia

- Belgium

- France

Its fast growth was informed by its friendly trading environment. To understand how IQ options trading environment looks like let’s explore its trading platforms and accounts.

Trading platform and accounts

IQ option has gone out of its way to ensure its trading platforms are easily accessible. They offer a desktop app, a web-based platform, and a mobile-based platform. You can connect to the platform with any device that has access to the internet. The desktop app and the web-based platform offer the best trading environment. They come with all the tools you need to be able to trade successfully and they are easy to navigate through. The mobile trading platform is accessible from both android and ios systems. It is a very user intuitive platform as well, and it automatically syncs your settings from your desktop or web-based platform.

For ethereum trade, IQ option offers three types of accounts. IQ option also offers a demo account for beginners who are not yet competent enough to engage in the real markets. The cheapest account on IQ options is the entry-level account which requires a minimum deposit of $10. It is a very basic account that allows you to participate in the real markets by placing trades of $1. The other accounts are the top level account and the VIP account. These require minimum deposits of $1000 and $3000 respectively. They come with additional privileges that enable you to trade successfully. The privileges increase as the minimum deposit increases.

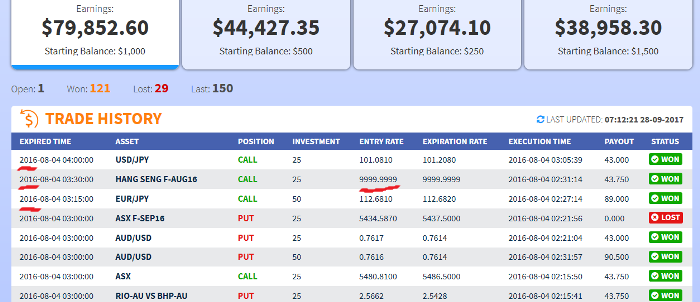

Ethereum code review

The ethereum code is a scam trading software, which promises to make you a lot of money. They claim you will make huge profits of thousands per day, however the truth shows otherwise.

The problem is, that the ethereum code is identical with an old binary options scam software. Before you become the next victim of a classic investing scam, here is what you need to know.

WARNING! Before losing your money at a scam…

The ethereum code scam

The reason why “the ethereum code” is a total scam, has to do with the false claims they make about how you will get rich fast. They display on their website, only 6 copies available, but that is not true because we opened 3 accounts with them today. The goal of their video, is to get you to open a trading account at an unlicensed scam broker.

If you look at the popular crypto trading robots, you will see how they use licensed and regulated crypto brokers, see here.

The ethereum code review

A real automated trading software is supposed to be based on technical indicators and generate trade alerts and place trade for your account.

When we signed up for the software, they simply ask you to deposit money into the brokerage account. There is no ability to see the actual software, how it works, or if there are any settings for it. We can only assume that ethereum code is just a “funnel” to get you to deposit money at some offshore, unlicensed broker.

Real auto trading robots allow you the investors to configure all aspects of the software, before you make a deposit, see here.

Warning about broker scams

It is important for every investor to know, that your money is held at a broker, and if that broker is not licensed, you will never see your money again! When you learn how these scams operate, you will understand why they recommended an unlicensed broker, read this article.

If you are interested in trading CFD’s on ethereum or other crypto currencies, you can see the list of popular brokers here.

Which ethereum code are you using?

This is standard with trading robots, multiple companies use the same name for different products.

Go visit to official software at: ethereum-code-pro.Com.

Please share with other investors which broker the ethereum code scam told you to use, in the comment section below.

Best ethereum exchange reviews & comparison

As ethereum becomes more and more popular, exchanges are including ether (ethereum’s currency) in their currency pairs. In this article I’m going to go over the different ethereum exchanges available and list the various things you need to take into account before choosing an exchange.

Ethereum exchange guide summary

In order to buy or sell ethereum you’ll need to find an ethereum exchange. When choosing an ethereum exchange it’s important to differentiate between 3 different types of exchanges: brokers, trading platforms and P2P marketplaces.

Here are my top 4 picks for the best ethereum exchange by category:

*etoro users: 75% of retail CFD accounts lose money. Your capital is at risk. Etoro US users – cfds are not available for US users. US users can only trade (long) real assets without leverage.

If you want a detailed explanation about the different types of exchanges and to read summarized reviews of the different exchanges keep on reading. Here’s what I’ll cover:

1. How do I buy ethereum?

In order to buy ethereum you’ll need to:

- Find an ethereum exchange

- Open an account

- Deposit funds

- Exchange your funds for ethereum

- Withdraw the ethereum to your own wallet (optional but recommended)

2. Ethereum exchange types

Before you choose an ethereum exchange it’s important to get familiar with the different exchange types out there.

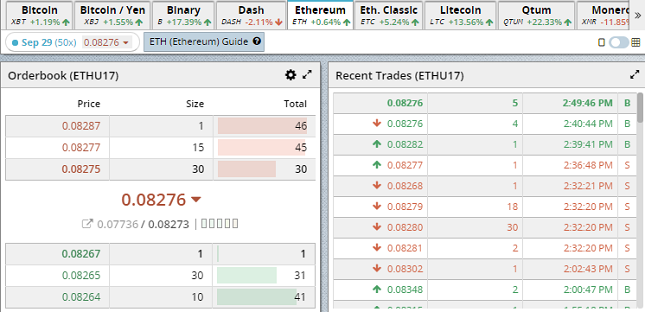

Trading platforms

Connect buyers and sellers automatically through an online website. The buyer states the requested price and the platform finds a seller that meets the bid. No direct communication is done between the buyer and seller. Trading platforms are usually the cheapest option when it comes to fees but are also much more complicated than other options.

Brokers

A website that sells you ethereum directly for a premium. Brokers are usually the easiest way to buy ethereum but are also more expensive.

P2p marketplaces

Websites that connect buyers and sellers directly so they can negotiate on a price. While these sites usually allow for a wider array of options (payment methods, supported countries, etc.) they also hold a large amount of risk since you’re buying from an anonymous individual.

3. How to choose an ethereum exchange?

When examining an exchange you should take into account several factors:

- Fees – what are the deposit, withdrawal and transaction fees the exchange collects?

- Countries supported – is the exchange supported in your country?

- Payment methods accepted – does the exchange accept credit cards, wire transfers or even paypal?

- Exchange reputation – how long has the exchange been around? Is it transparent about its business?

- Level of verification needed – is there a long verification process or can you buy ethereum right away?

- Reliable support – how responsive is the exchange support? Can you chat with them or just email them?

Keep in mind that no exchange is perfect and usually an exchange will excel in one field and lag behind in another.

4. Best ethereum broker exchanges

CEX.Io

CEX.Io is a fincen registered bitcoin and ethereum broker that also supplies a complete trading platform. The exchange accepts credit cards, wire transfers and SEPA transfers if you live in the eurozone. The site has a very easy to use and intuitive interface that allows you to buy ETH relatively quick. If you feel comfortable using the site’s trading platform instead of the brokerage service you can save a lot in fees. You can read my full CEX.Io review here.

Coinmama

Coinmama has been around since 2013 and supplies a brokerage service to both bitcoin, ethereum and a variety of other cryptocurrencies. The exchange will buy or sell ethereum directly at a premium. They also put an emphasis on quality customer support. Coinmama accepts credit and debit cards, as well as SEPA transfers for ethereum purchases. If you have the option to pay via SEPA you’ll decrease fees dramatically. You can read my full coinmama review here.

Coinbase

Coinbase is one of the most popular methods for buying ethereum. The exchange is one of the oldest around and has been active since 2012. Coinbase supports 100+ different countries including the US, canada, UK, and australia.

Coinbase can act as a broker through its direct and easy buying service, or you can use the coinbase pro exchange if you’re a more experienced user. You can read my full coinbase review here.

Bitpanda

Bitpanda is a bitcoin broker that also specializes in buying and selling ethereum within the eurozone. The company was founded in late 2014 and since has grown to become one of the more popular options to purchase bitcoins around europe. The company has many payment options and delivers coins to your wallet in a fast and secure manner. You can read my full bitpanda review here.

5. Best ethereum trading platforms

Etoro

Etoro is a trading platform that allows trading in several cryptocurrencies such as ethereum, bitcoin, ripple, bitcoin cash, dash and more. It is very well suited for people who are looking to make money from changes in ethereum’s price but not so much for people who want to actually hold their ether in their own wallet.

The reason for that is that withdrawing your coins to your private wallet involves sending it first to your etoro wallet, which may take up to 3 days.

Important:

Keep in mind that cryptocurrencies can widely fluctuate in prices and are not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework. So keep in mind that your capital is at risk. US users – cfds are not available for US users. US users can only trade (long) real assets without leverage.

Bitstamp

Bitstamp has added the ethereum trading pair in late 2017. The exchange has been around since 2011 and is one of the oldest and most respectable exchanges around. The platform supplies two options for buying ethereum – using the trading platform or using the brokerage service. The trading platform is cheaper but harder to use for inexperienced users, while the brokerage service is a more expensive “one click” solution. You can read my full bitstamp review here.

Binance

Binance is a crypto to crypto trading platform that also supplies a brokerage service for buying cryptos with a credit card. This means that you can either use your credit card to buy ethereum or you can deposit any other cryptocurrency and exchange it for ethereum. The fees for using the brokerage service are of course much higher than the 1% transaction fee the trading platform charges. You can read my full binance review here.

Changelly

Changelly was established on 2016 and within a year has managed to attract over 100,000 users which is pretty impressive. The exchange allows you to trade one cryptocurrency for the other. If you own bitcoin you can almost instantly trade it for ethereum.

From personal experience it takes around 30 minutes to get a coin traded from one type to another and the interface is very clean and intuitive. However don’t use the exchange to buy ethereum with fiat currency since the fees are extremely high. You can read my full changelly review here.

6. Best ethereum P2P exchanges

Localcryptos

Localcryptos is a P2P marketplace where buyers and sellers of ETH can meet online and trade similiar to localbitcoins. Although this platform gives a wide variety of payment methods it’s important to remember that you’re dealing with individuals and not corporations.

This means that the chance a deal can go wrong is higher and it’s important to take that into account. As a general rule it’s best to keep this option for when all other options fail.

7. Conclusion

As ethereum becomes more popular the options for buying it increase dramatically. The main thing when choosing an exchange would be to make sure your country and payment method are supported. For beginners it’s better to use brokerage services and pay a bit of a premium while more advanced users should trade on trading platforms and save on fees.

If you have additional comments or questions feel free to leave them in the comment section below.

Free bitcoin crash course

Learn everything you need to know about bitcoin in just 7 days. Daily videos sent straight to your inbox.

Best cryptocurrency brokers for 2021

Daniel ‘harris’ major

I have tested 40+ crypto brokers. You can find the best cryptocurrency brokers below. This is by far the easiest way to get started with cryptocurrencies.

Cryptocurrency trading has become really popular in the past years. It’s growing more ever year.

Many big trading brokers have already added some of these cryptocurrencies. Everybody can sign up and start trading bitcoin or other crypto coins. This is the easiest and probably the simplest way to invest in cryptocurrency.

After trying out most brokers, here are the best cryptocurrency brokers:

Best cryptocurrency brokers (non-US traders only)

Plus500 – top rated trading platform

Plus500 is a big name in the trading industry. They have a really low minimum deposit requirement and a great trading site.

Buy/sell cfds on bitcoin in addition to buying stocks, commodities, forex etc (traded only through cfds). Plus500 is the most complete trading platform.

- Trade cfds on bitcoin & many other cryptos

- Minimum deposit is only $100

- Regulated and trusted platform

- Very fast signup process

- Live chat

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Plus500 disclaimer: 76.4% of retail CFD accounts lose money.

IQ option – lowest minimum deposit ($10)

If you don’t want to make a huge initial investment, then IQ option is the best broker for you. The minimum deposit requirement is only $10. This is by far the lowest in the industry.

- You can trade many cryptocurrencies

- Minimum deposit is only $10

- Best trading platform

- Multiple account currencies

- Free demo account

- Regulated by CYSEC (#247/14)

Etoro – top crypto broker

Etoro is a really popular trading site. They have been around since 2006. Etoro is regulated by CYSEC, FCA and ASIC.

Buy/sell bitcoin on etoro in addition to buying stocks, commodities, forex etc. Etoro is the most complete trading platform.

- Trade bitcoin & many other cryptos

- Minimum deposit is $200

- Regulated and trusted platform

- Australian traders are also accepted

- Great support team

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Etoro disclaimer: 71% of retail CFD accounts lose money.

Highlow – best all-round crypto broker

Due to regulation highlow stopped accepting traders from the EU and UK.

Highlow is an australian trading broker (AFSL no.364264). What I like most about this broker is the intuitive platform. It is so easy to use. Especially new traders will like the clean layout.

I’ve been using highlow for a few years now and I never had a problem. Highlow publishes their number of trades on the homepage. There are millions of trades on this broker each month.

I use the main platform which is web based. This means, that you don’t have to download any software. This platform is stable and safe (they use SSL).

I have also tried the ios app and the android app. They are great, but I just don’t like trading on smartphones in general.

The payouts on highlow are amazing (up to 200%, which is more than on other brokers).

Highlow is a great broker for cryptocurrencies (but only if you are not from EU,UK, US). They have a good reputation, great support team and awesome promotions for new traders.

- Trade bitcoin & other cryptos

- Minimum deposit is only $50

- Regulated and trusted platform

- Fastest signup process (no questionnaires)

- Multiple account currencies

- Free demo account (no registration needed)

Nadex – US traders welcome

Nadex is a CFTC regulated broker. In fact, this is probably the only US broker that has this regulation.

Only US traders are allowed on nadex. Non-US traders check out the next broker.

Update OCTOBER 2019: looks like nadex removed crypto trading. After contacting them I found out that they will add it back soon. Register on nadex now and get updated when they add it.

Recently, nadex started offering bitcoin trading.

- Trade bitcoin, forex or binary options

- Minimum deposit is $250

- CFTC regulated broker

- Great support team

- Many payment methods (even paypal)

Crypto brokers with most cryptocurrencies

Here are the most popular cryptocurrencies offered by cryptocurrency brokers:

- Etoro – bitcoin, ethereum, litecoin, dash, ethereum classic, NEO and ripple.

- Plus500 – bitcoin, ethereum, litecoin, bitcoin cash, ripple, IOTA.

- Avatrade – bitcoin, ethereum, ethereum classic, ripple, dash, bitcoin cash litecoin, monero and NEO.

Lowest minimum deposit brokers

These are the best brokers with low minimum deposit requirements:

- Etoro – $200

- Plus500 – $100

- Avatrade – $100

This is really important because the crypto market itself is unregulated. Depositing on a regulated broker means that your money is safe.

We’ve also looked at the support team and the payment methods. You can deposit easily using multiple payment methods on the brokers below.

Top rated brokers that have cryptocurrencies

While we are all familiar with the broad definition of a broker, is there something more to it when it comes to cryptocurrencies?

Simply put, a cryptocurrency broker refers to a website that traders will visit to trade cryptocurrencies at a set price. In many ways, they are similar to forex brokers whose services are a lot more familiar to the general public.

Etoro disclaimer: 71% of retail CFD accounts lose money.

You still can’t decide which broker is best for you?

How to choose your cryptocurrency broker

Is leverage really necessary? Cryptocurrency markets are volatile in nature with prices fluctuating immensely thereby generating high profits even in the absence of leverage. But for some traders, the desire for more earnings justifies the use of leverage.

Before choosing your broker, settle yourself on whether the already immense profits that come from a cryptocurrency market are enough for you or you would like to use leverage to enhance them even further, bearing in mind, of course, that will also significantly increase the risk factor to your funds.

Negative balance protection: it is always advisable to trade with a broker that affords the negative balance protection facility. That way, you will never be at risk of losing more than what you invested in case you sustain very heavy losses.

How suitable is the required capital for you? This is another subjective part to your decision. Do you prefer trading with a small capital or bigger one to help you zero in on bigger returns? Find out what size trades your broker is offering before you open an account.

Narrow spreads for the win: let us be honest, it is only fair that your broker gets a cut from the money you generated having provided you with the essential facilities for it and all. But let us be honest, you definitely want every last dime for yourself.

A spread refers to the difference between the buying price and selling price of a trade and it varies with each broker. The spread is what counts as fees for your broker so the smaller it is, the lower the cost will be on your part.

Lets go into what aspects you as a trader must consider when choosing a broker to trade cryptocurrencies.

Which cryptocurrencies are you interested in trading?

Make sure you have decided on which cryptocurrencies you want to trade in before signing up with your broker.

If your choice is a prominent cryptocurrency like bitcoin (official site), litecoin (official site), or ethereum(official site), there will be a relatively broad availability of brokers that have trading options for those. However, less prevalent examples like monero, IOTA, or zcash may be a little harder to come by.

So study the cryptocurrencies being offered by a broker before you sign up for an account.

Pros and cons of cryptocurrency brokers

Here are some features that these broker have or don’t:

pros

- Signup up with a crypto broker is probably the fastest way to get started with cryptocurrency trading

- If you are less tech-savvy then a broker is safer for you

- You can start buying cryptocurrency while traditional exchanges don’t always accept this payment method

- Most of the time you can’t withdraw cryptocurrencies from a broker. You have to exchange it back to fiat money (USD/EUR etc.)

Cryptocurrency brokers – what to look for

Here are some of the more understated details about your cryptocurrency broker that could make your trading experiences so much more efficient and successful.

1. What are the weekend hours like?

This is a key detail that distinguishes cryptocurrencies from other prominent trading markets like forex, futures, and equity. Cryptocurrency brokers operate during the weekends as well.

There is virtually no difference in purchasing bitcoin at the end of the week as opposed to the middle of the week during peak hours.

But there is a catch. While digital currency exchanges are available during the weekend, your broker may not (why is the stock market closed on the weekend?). So in effect, if there is considerable movement within your relevant cryptocurrency market during a weekend when your broker is not operating, you may not have the ability to respond in any way.

2. How is it hedging?

Your broker is probably not keen on revealing if it is hedging cryptocurrency traders but it is important information for you to know.

Why is it so important for you to know?

Because, as a trader, you want to be absolutely in the clear regarding the policies for risk management being followed by your broker. Let us not forget that cryptocurrency markets are extremely volatile and an unhedged broker is more easily prone to major losses incurred by its clients. Naturally, those costs will warrant compensation via fatter spreads and additional costs for traders. It will be best to sign up with a broker that will not withhold the relevant information from you.

More great features you could be interested in

Commissions and trading on margin – an important thing to note while trading cryptocurrencies is that their prices tend to be more similar to equities than they are to real currencies. So your broker could be charging you commissions in addition to a wide spread on each trade. That, of course, raises the cost probably a bit much for your liking.

Another similarity with equities is that the margin conditions with cryptocurrencies are significantly more than they are with forex or cfds. Consequently, leverage is usually up to 10x. How considerable the margin rate will be for traders is down to what trading strategies and risk management they subscribe to.

Authenticity of market data – aside from merely evaluating how it influences spreads, market data for cryptocurrency CFD prices can be a good indicator of how the quality of the product will be in the future.

One of the more recent examples of this is BTC-e which was an immensely popular platform for trading bitcoin before it was shut down by feds. BTC-e was the first bitcoin exchange to incorporate forex trades and so made their exchange accessible via MT4 and supplied cryptocurrency liquidity for brokers.

But once it was shut down, every broker that depended squarely upon BTC-e was left with no hedging options or market data to put a price on its crypto cfds.

Are short sales available? For many traders, shorting is a crucial strategy option, the lack of which can be a deal breaker with a potential broker. Many brokers tend to offer ‘long’ only since there are only a few hedging solutions when opening short trades.

As you see, investing in cryptocurrencies can be a truly lucrative venture for you but only if you get it right.

And a lot of that is down to which broker you decide to trade with.

Ready to start trading?

Trade with the cryptocurrency brokers listed above to make sure that your money is safe, you pick a broker with a stellar reputation and you keep the fees low. Excel at trading bitcoin by creating your own trading strategy.

These cryptocurrency brokers make it really easy to trade bitcoin and other coins. You don’t have to be a trading expert. It helps if you know what a blockchain is or how the ledger and transactions work, but this is all optional.

Sign up now and see for yourself how easy it is to get started.

ETH/USD: turbulent trading conditions ahead for ethereum

Latest news

Stocks rally on new administration's measures

USD/ARS: relentless bullish trend shows no mercy for peso

EUR/USD forecast: back and forth market ahead

NASDAQ 100 forecast: breaking towards new records again

After doubling its value since the start of the holiday season, ETH/USD has produced rough trading conditions the past few days with a spike in selling.

Ethereum has produced turbulent trading conditions the past few days after achieving record high values. A wave of selling has taken place within ETH/USD, and a spike lower from the highs of the 10 th of january until the 11 th essentially wiped out 25% of the cryptocurrency's value. However, this move lower followed an incredible run higher, which saw ETH/USD more than double its value since the 23 rd of december.

ETH/USD has followed in the footsteps of other cryptocurrencies and demonstrated an ability to produce a roller coaster ride for traders who are brave enough to participate within the digital currency markets. Trading the past three weeks has seen a rush of buying, and the recent surge downward may merely be short-term profit-taking by traders and funds who decided now is a good time to cash in some winnings.

The past few weeks of trading are a reminder of the volatile conditions which have been experienced by cryptocurrencies in the past. Speculative highs and devastating lows have been a hallmark of the marketplace since its initiation. However, the past year has seen a rather reliable bullish trend emerge, and one which was able to take place without the frenzied fanfare of previous years. The past few weeks, though, are a stark reminder that ETH/USD is an asset which can be highly speculative and needs to be treated with care by traders.

The rapid price fluctuations of ETH/USD make choosing nearby support and resistance levels difficult, which means traders should enter the market after consideration of their goals and ability to withstand the potential of volatility. Support near the 1005.00 to 995.00 junctures should be monitored closely; if ETH/USD should penetrate the 1000.00 mark lower, it may set off a psychological test of existing sentiment and propel the market lower.

Resistance near the 1125.00 mark should also be watched. If ETH/USD is able to muster more buying and challenge this higher mark, it may wake up buyers who believe that another leg up can be sustained. ETH/USD has proven to be highly speculative the past few weeks, and trading in january has produced rapid fire results. Traders need to be diligent when taking positions of ETH/USD and monitor their positions with finesse.

So, let's see, what we have: don't miss out on the hype! Find the best places to buy ethereum online and compare fees, commissions, promotions and features all in one place! At ethereum broker

Contents of the article

- New forex bonuses

- Top 10 online brokers to buy ethereum

- The beginner’s guide to ethereum

- What is ethereum?

- What is ether?

- Ethereum vs. Bitcoin

- How to buy ethereum

- The benefits to using ethereum’s decentralized...

- The downside to decentralized applications

- Day trading ethereum

- Mining ethereum

- How to choose the best platform to buy ethereum

- Best ethereum trading brokers 2021

- FP markets

- What is ethereum?

- Ethereum trading explained

- How to buy and sell ethereum online

- Where to buy and sell ethereum

- Payment methods for ethereum trading

- Ethereum trading sites, brokers, and software

- Ethereum trading advantages

- Conclusion

- Is ethereum halal or haram — we have researched...

- What is ethereum? Know the complete system

- The difference between ethereum and bitcoin...

- Start trading with halal ethereum brokers

- Fxdailyreport.Com

- Top trusted forex brokers offering ethereum trades

- Is ethereum halal or haram — we have researched...

- What is ethereum? Know the complete system

- The difference between ethereum and bitcoin...

- Start trading with halal ethereum brokers

- Best ethereum broker to trade ethereum 2020

- Ethereum code review

- The ethereum code scam

- The ethereum code review

- Warning about broker scams

- Which ethereum code are you using?

- Best ethereum exchange reviews & comparison

- Ethereum exchange guide summary

- 1. How do I buy ethereum?

- 2. Ethereum exchange types

- 3. How to choose an ethereum exchange?

- 4. Best ethereum broker exchanges

- 5. Best ethereum trading platforms

- 6. Best ethereum P2P exchanges

- 7. Conclusion

- Best cryptocurrency brokers for 2021

- Best cryptocurrency brokers (non-US traders only)

- Plus500 – top rated trading platform

- IQ option – lowest minimum deposit ($10)

- Etoro – top crypto broker

- Highlow – best all-round crypto broker

- Nadex – US traders welcome

- Crypto brokers with most cryptocurrencies

- Lowest minimum deposit brokers

- Top rated brokers that have cryptocurrencies

- How to choose your cryptocurrency broker

- Which cryptocurrencies are you interested in...

- Pros and cons of cryptocurrency brokers

- Cryptocurrency brokers – what to look for

- More great features you could be interested in

- Ready to start trading?

- ETH/USD: turbulent trading conditions ahead for...

- Latest news

- Stocks rally on new administration's measures

- USD/ARS: relentless bullish trend shows no mercy...

- EUR/USD forecast: back and forth market ahead

- NASDAQ 100 forecast: breaking towards new records...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.